Tara Chand Infralogistic Solutions Ltd was established in 2012 to acquire the traditional business of M/s Tara Chand and Sons, founded in 1989. Tara Chand Infralogistic Solutions Ltd operates in three main areas: a) construction equipment rental; b) cargo handling and logistic services, including warehousing and transportation, mainly for steel; and c) steel processing. TCISL provides its fleet of equipment for use in various sectors, such as power, oil and gas, steel, cement, renewable energy, and urban and rural infrastructure development, including roads, bridges, highways, airports, metros, irrigation projects, and water pipelines. Tara Chand Infralogistic Solutions Ltd caters to 52 diverse customers, spanning PSUs to large Indian multinationals, operating in 21 states and even internationally in Mauritius.

We believe that Tarachand Infra Logistics Solutions Ltd provides a unique opportunity to play the capital formation boom in India’s infrastructure sector due to its strong position in Indian infrastructure and steel logistics sectors. With a proven track record, experienced management, and a robust balance sheet, Tarachand Infra Logistics Solutions Ltd is well-positioned to benefit from the ongoing government-led capex cycle. High growth guidance across segments & expectation of operating and financial leverage in FY25 further solidify the investment thesis. Additionally, a Potential foray into EPC operations adds another avenue for growth and diversification. Although numerous EPC companies are listed in the Indian markets, only a handful of equipment rental companies are listed, potentially giving Tarachand Infra Logistics Solutions Ltd a scarcity premium.

Tara Chand Infralogistic Solutions Fundamental Analysis

The Fundamental analysis of Tarachand Infralogistics Solutions Ltd. aims to analyze parameters such as revenue, gross profit, EBITDA, net profit, and more.

Tarachand Infralogistics Solutions Ltd.’s financial performance has rebounded strongly since a dip in FY 21-22, with revenue and net profit growing at 11% and 19% CAGR, respectively (FY19-23). Decreasing employee costs has evidently improved efficiency and EBITDA margins have also improved, reaching 34% in FY24. Overall, the company shows a solid growth trajectory. Tarachand Infralogistics Solutions Ltd sees the momentum continuing & expects to grow 30% for FY25

| Profit & Loss | FY20 | FY21 | FY22 | FY23 | FY24 | CAGR(FY19-23) |

| Revenue | 115 | 110 | 128 | 141 | 172 | 11% |

| Gross Profit | 104 | 98 | 117 | 127 | 159 | 11% |

| Gross Profit % | 91% | 89% | 91% | 90% | 92% | |

| Employee Cost | 20% | 18% | 18% | 15% | 14% | |

| EBITDA Margin | 31% | 31% | 28% | 30% | 34% | |

| Other Income | 0.4 | 0.3 | 5.6 | 4.5 | 2.8 | |

| Depreciation | 17 | 22 | 23 | 22 | 29 | |

| Interest | 8 | 9 | 10 | 8 | 7 | |

| Profit before tax (PBT) | 11 | 3 | 3 | 13 | 22 | 20% |

| PBT % | 9% | 3% | 3% | 9% | 13% | |

| Net profit (PAT) | 8 | 3 | 2 | 9 | 16 | 19% |

| Net Profit % | 7% | 2% | 2% | 7% | 9% | |

| No. of Equity Shares | 1.36 | 1.36 | 1.36 | 1.36 | 1.41 | |

| EPS | 5.8 | 1.9 | 1.7 | 6.9 | 11.4 |

Tara Chand Infralogistic Solutions Company Summary

Tara Chand InfraLogistics Solutions Ltd. is a microcap (Market Cap INR 625 Cr) that is in the logistics and infrastructure sectors of the economy. Tarachand InfraLogistics Solutions Ltd. operates primarily in three segments – steel logistics and transportation, steel processing and distribution, and heavy equipment rental services for infrastructure construction. The company was incorporated in 2012 by acquiring the proprietary business of Tarachand and Sons, which had been in existence since 1989. Initially, the company was known as Tarachand Logistic Solutions Limited, but it changed its name to Tara Chand Infralogistics Solutions Ltd. in Sep 2022. Tara Chand Infralogistics Solution Ltd. was started by Mr. Vinay Kumar and his brother Ajay Kumar. Tara Chand Infralogistics Solution Ltd has been in the steel logistics and transportation business since the 80s, while the equipment rental division was added more recently. Tara Chand Infralogistics Solution Ltd was listed as an SME in March 2018. In April 2024, Tara Chand Infralogistics Solutions Ltd. moved to the main board of NSE.

The equipment rentals division is Tarachand Infra Logistics Solutions Ltd.’s primary growth driver, and hence, most of our analysis will focus on this segment. The steel logistics and transportation segment is a capital-light segment that provides steady revenues and cash flows. It gives a solid base for Tarachand Intralogistics Solutions Ltd. to grow its equipment rental division. The steel processing and distribution segment is the smallest segment, with limited growth over the last few years.

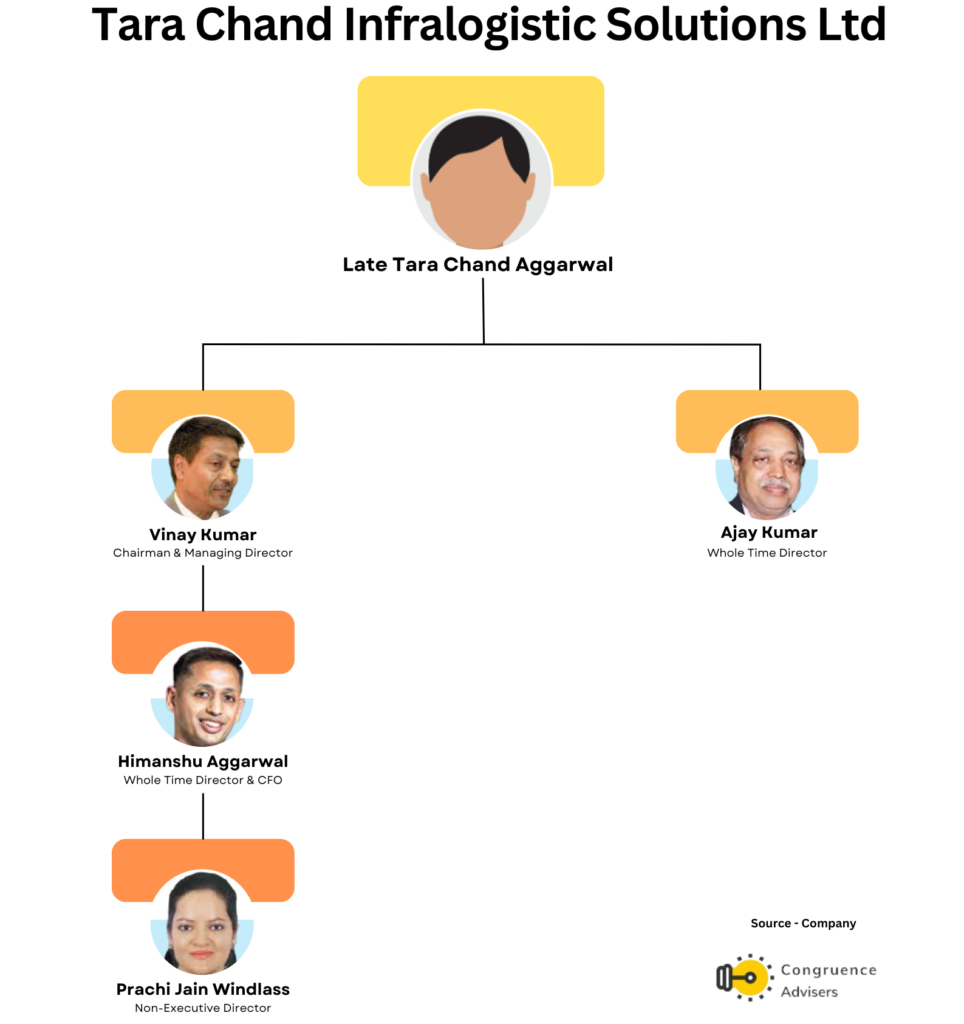

Tara Chand Infralogistic Solutions Ltd – Promoter Family Structure

Tara Chand Infralogistic Solutions Ltd is a promoter-run and Promoter-Driven company. Vinay Kumar (60 years old) is the Chairman and Managing Director of Tarachand Infra Logistics Solutions Ltd. His brother, Ajay Kumar (57 years old), is the Whole-Time Director. Vinay Kumar’s son, Himanshu Aggarwal (37 years old), is the Executive Director and Chief Financial Officer. Himanshu Aggarwal’s wife, Prerna Sandeep Aggarwal (37 years old), is a Non-Executive Director of Tarachand Infra Logistics Solutions Ltd.

Tara Chand Infralogistic Solutions Ltd Management Details

Management Details spotlight the significant role of the Tara Chand Infralogistic Solutions Ltd promoter family and the profile of its management members in various functions.

| Name | Designation | Profile |

| Mr. Vinay Kumar | Chairman & Managing Director | Graduated from Guru Nanak Dev University, Amritsar, Punjab, As the promoter and a first-generation entrepreneur, he has been with the company since its inception. Renowned for his business insight and execution capability, he has pioneered numerous innovative features in the steel logistics segment |

| Mr. Ajay Kumar | Whole Time Director | As the Whole Time Director and Promoter of our company, he has been with us since inception. 30 years of industry experience building the company, nurturing client relationships, and managing finances. He excels in cost control and profitability. |

| Himanshu Aggarwal | Whole Time Director & CFO | Associated since November 1, 2017. He holds a Bachelor of Science in Biomedical Engineering from Northwestern University, Chicago. He focuses on finance, commerce, and accounts, providing leadership in business development, operational execution, and strategic decision-making |

| Mr. Sant Kumar Joshi | Non-executive Independent Director | Appointed as an Additional Director on April 22, 2019. A retired IAS officer, he has over 37 years of experience in public administration, specializing in people management, process improvement, problem-solving, and enhancing organizational performance within the Government of Haryana. |

| Mr. Divakar Hebbar | Non-executive independent Director |

Appointed as an Additional Director on August 18, 2022. Holding a Diploma in Mechanical Engineering, he was associated with L&T’s Construction group from March 1982 until his retirement as Senior Deputy General Manager on July 1, 2019. He has extensive experience in equipment management, repairs and maintenance, equipment hiring, vendor evaluation, and staff training. |

Tara Chand Infralogistics Solutions Ltd Industry Landscape

Indian crane rental industry

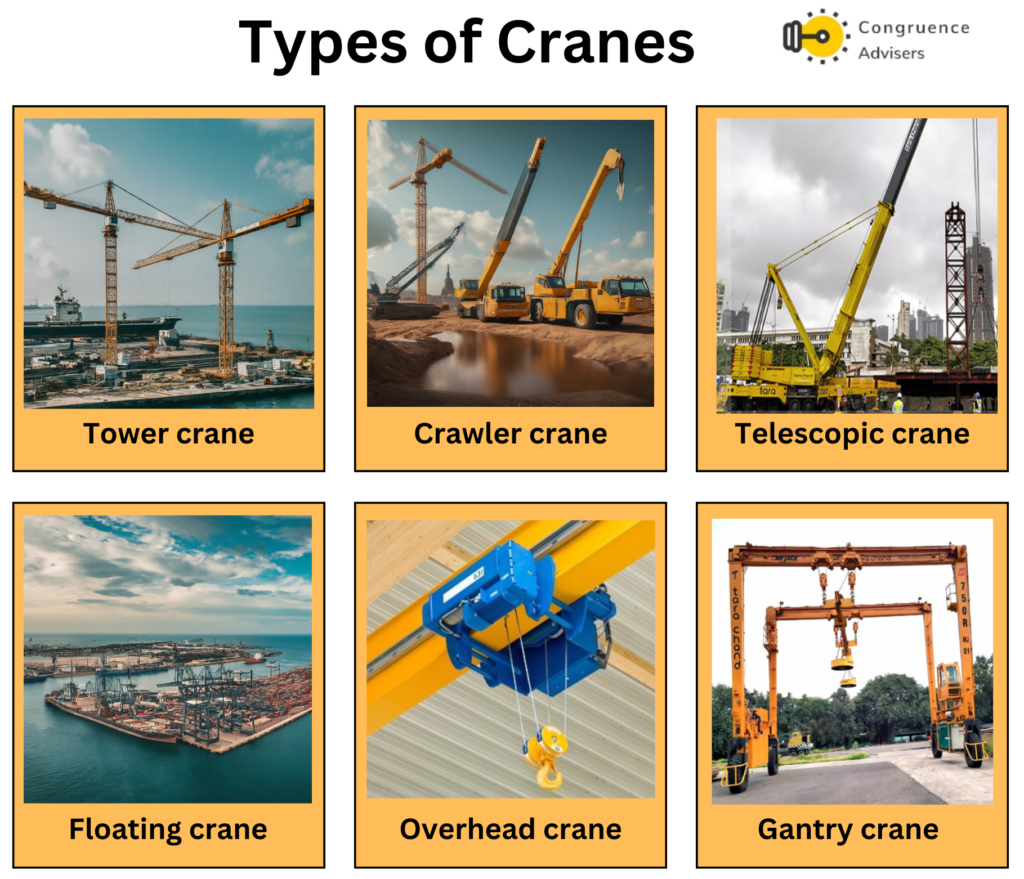

Since cranes are used by end-users for short periods when they are undergoing a capital expansion, many end-users choose to rent cranes for the required period rather than outright buying them. Thus, crane rental companies play a significant role in the crane industry. crane rental companies buy cranes from crane OEMs and lease them out to end users on a need basis. The overall global annual crane rental demand is estimated to be between USD 45-55bn, growing at ~5% CAGR per annum, according to Fact.MR’s research reports. While there are no reliable estimates of the size of the Indian crane rental market, applying India’s share of global GDP of 3-4% to the worldwide demand number, we may estimate India’s annual crane rental demand to be in the region of USD 1.5-2bn. This is also the ballpark number industry participants have estimated. As India embarks on a journey of building more infrastructure and factories, the usage of heavy-duty cranes such as tower cranes, crawler cranes, telescopic cranes, and floating cranes is expected to grow at a much faster pace than the smaller-sized cranes. Government programs in infrastructure and manufacturing, such as Make in India, Bharatmala Pariyojna, and thrust on renewables have spurred capital investments to decadal highs in recent years. A long-awaited private capex cycle starting up soon can further energize this infrastructure spending and thus drive demand for cranes in India.

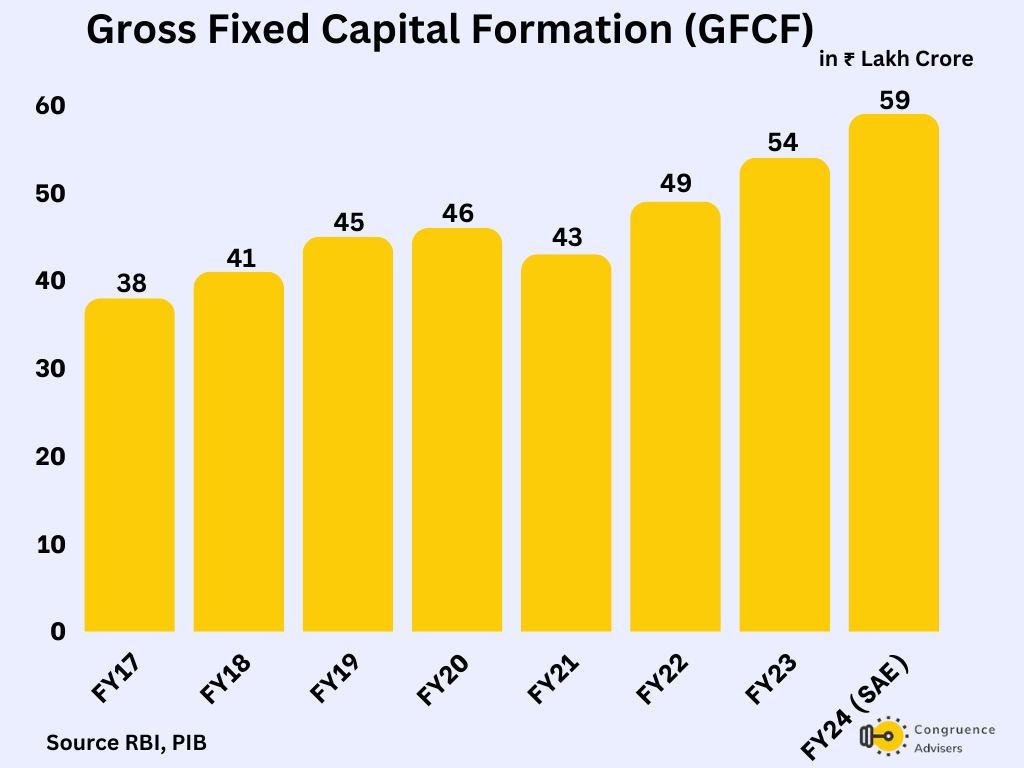

Gross Fixed Capital Formation (GFCF) Trends in India

Gross Fixed Capital Formation (GFCF) in the Indian economy has increased from Rs. 37.88 lakh crore (constant 2011-12 prices) in FY17 to Rs. 54.35 lakh crore in FY23. This growth is due to govt-led infrastructure projects and gradual recovery in private sector investment. Gross Fixed Capital Formation (GFCF) as a percentage of GDP reached 34.10% in FY24 vs 33.3% in FY23 & Expected to increase to 36% in FY27

Types of cranes

Many types of cranes are used across the industry. To get a more holistic understanding of the industry landscape, let’s briefly understand the various types of cranes used.

- Tower cranes – Tower cranes have a horizontal boom balanced on a tall, vertical tower. They are used primarily for the construction of tall residential or commercial buildings.

- Crawler cranes – Crawler cranes have a track instead of wheels to navigate uneven terrain. They have a telescopic or lattice boom that can lift heavy loads. They are used for heavy-duty infrastructure projects such as wind turbine installation, steel plant erection, cement plant erection, downstream oil and gas plants, etc.

- Telescopic cranes – Telescopic cranes are truck-mounted cranes with a telescoping boom that can extend and retract. They are also used for heavy-duty infrastructure projects.

- Floating cranes – Floating cranes are Ship—or barge-mounted heavy-duty cranes used for port operations or offshore construction.

- Overhead cranes – Overhead cranes are fitted in factories and warehouses to lift objects. They usually move horizontally with the help of supporting channels mounted on ceilings. They are much smaller in size compared to the other types of cranes.

- Gantry cranes – Similar to overhead cranes, gantry cranes are mainly used in yards and warehouses. They are equipped with wheels that allow them to move along a fixed path.

The most significant player by far in the Indian crane rental industry is Sanghvi Movers Ltd, which was ranked as the 6th largest globally by capacity by the International Cranes Magazine in its June 2023 issue. Its fleet comprises crawler-mounted cranes with lattice booms and truck-mounted cranes with telescopic booms, about 400 in number. Apart from Sanghvi, the two other listed crane rental companies in India are Tarachand Infralogistics Solutions Ltd. and Crown Lifters Ltd. They both have heavy-duty cranes in their equipment lists, which are capable of undertaking large-scale infrastructure works, and both of them earn large chunks of revenues from the wind energy sector. A few companies in the unlisted space with similar heavy lifting capacities are Amrik Singh and Sons Crane Services Pvt. Ltd. Barkat Cranes; apart from these, there are a number of smaller, unlisted crane rental companies in India who mainly operate in the lower load bearing segments of the market.

Indian Steel logistics and transportation industry

Indian steel production in FY24 was 143 mn MT, an annual growth rate of 7% from FY19. As per the National Steel Policy of 2017, India aims to be able to produce 300 mn MT of finished steel by 2030, implying a steep annual growth rate of 13% from here on. We feel that the target may be too ambitious, but it’s clear that the Indian Government is encouraging the industry to increase its output of finished steel. India’s domestic finished steel consumption was 136 mn MT in FY24, a growth of 13% over FY23. India is the 2nd largest producer of finished steel in the world after China. As China’s construction sector slows down and India’s capital formation trends are higher, the gap between India and China in steel production and consumption is expected to narrow in the coming years.

Steel logistics and transportation are part of the steel industry operations and are not treated as a separate industrial segment as such. Hence, only a few data related to steel handling and transportation costs are available. However, according to data available from industry sources, steel logistics costs can amount to as much as ~20% of the final price of finished steel in India. Steel logistics costs would include raw material transportation costs, raw material, WIP, and finished goods handling costs, as well as finished steel transportation costs. Most private steel manufacturers do steel handling operations in-house while outsourcing transportation. Public sector steel companies such as Steel Authority of India Limited (SAIL) and Rashtriya Ispat Nigam Limited (RINL) often outsource steel handling operations at their warehouses and stockyards to 3rd party companies, such as Tarachand Intralogistics Solutions Ltd., via 4-5 year contracts through a tendering process. The steel logistics and transportation industry is likely to grow at the same pace as steel consumption and production, which may be in the range of 7-10% per year for the foreseeable future.

Tara Chand Infralogistic Solutions Ltd Product Details

Tarachand Infralogistics Solutions Ltd. classifies its business into 3 verticals.

- Segment A (Infra work, tangible goods and services segment) – This segment is the equipment rentals division

- Segment B (Transportation and handling segment) – This segment deals with steel logistics, handling and transportation

- Segment C (Processing and distribution of goods segment) – This segment deals with processing finished steel into various shapes and sizes for use in the construction industry.

Segment A – Infra work, tangible goods and services segment

Segment A is the equipment rental division for Tarachand InfraLogistics Solutions Ltd. The company has been in this business segment since 2003. The business model under this segment is as follows – Tarachand InfraLogistics Solutions Ltd. buys construction equipment such as cranes, aerial working platforms, and piling rigs from OEMs such as SANY, Zoomlion, and Liebherr and leases them out to clients across various sectors such as infrastructure, cement, petrochemicals, steel, renewable energy, etc. The leases are wet leases, which means Tarachand InfraLogistics Solutions Ltd provides not only the equipment but also the trained manpower required to operate the equipment. The lease period can vary from 2 months to even 2 years, depending on the nature of the requirement for a client. For example, clients hiring equipment for a new plant construction may employ it for more than a year’s duration, whereas a client hiring a crane to effect a plant shutdown may need it only for a few weeks or months.

Tarachand Infralogistics Solutions Ltd. has a fleet of 350+ cranes and other equipment, such as piling rigs, aerial working platforms, trailers, and pullers. The crane capacities range from small ones below 50MT used for stockyard work to huge telescopic and crawler cranes of capacity > 500 MT used in infrastructure construction projects. Tarachand InfraLogistics Solutions Ltd’s fleet is relatively new, with an average age of 5-6 years.

| Type of equipment | Nos. | Total lifting capacity (MT) |

| All-terrain telescopic cranes (110-800 MT) | 20 | 4840 |

| Telescopic truck-mounted cranes (25-80 MT) | 41 | 2095 |

| Crawler cranes (40-500 MT) | 31 | 4430 |

| Rubber Tyre gantry cranes (20-50 MT) | 10 | 200 |

| Pic-n-carry cranes (14-23 MT) | 56 | 1676 |

| Piling rigs | 25 | |

| Aerial working platforms | 10 | |

| Trailers 30-55 MT (For transportation) | 80 |

Image: Zoomlion crawler crane 500 MT (L) and Liebherr Telescoping crane 800MT (R) from Tarachand Infralogistics Solutions Ltd.’s fleet

Since FY20, Segment A revenues, and EBITs have grown at a CAGR of 7.5% and 4.7%, respectively, for Tarachand InfraLogistics Solutions Ltd. ROEs for equipment rental companies are highest when the average age of their fleet is high, and assets are heavily depreciated on the book. The high ROEs for Tarachand InfraLogistics Solutions Ltd in its equipment rental division in FY20-21 probably reflect that. They have bought a lot of heavy equipment recently, which has depressed the ROEs from the high levels. However, as the new equipment keeps getting utilized and aging, the ROEs will sequentially keep improving.

| Segment A – Revenue, EBIT, ROCE Trends FY20-FY24 | FY20 | FY21 | FY22 | FY23 | FY24 | CAGR |

| Seg A revenues | 57 | 66 | 72 | 65 | 76 | 7.5% |

| Seg A EBIT | 12.8 | 12.1 | 2.9 | 6.9 | 15.4 | 4.7% |

| Seg A EBIT margin | 22.5% | 18.3% | 4.0% | 10.6% | 20.3% | |

| Seg A Equity capital employed | 27 | 26 | 19 | 45 | 81 | 31.7% |

| Seg A return on capital | 47.4% | 46.5% | 15.3% | 15.3% | 18.9% |

The rental yield earned by Tarachand Infralogistics Solutions Ltd. on the equipment lease depends on the demand-supply dynamics of construction equipment at that point in time. Demand for heavy construction equipment can be deeply cyclical in an economy. In a phase where fixed capital expansion is happening, there will be a lot of new construction, leading to a lot of demand for rental equipment and very healthy yields. The opposite happens when the appetite for capital expansion is low in an economy. Right now, there is a strong momentum for fixed capital formation in India, with a lot of Government-financed infrastructure thrusts in highways, ports, railways, renewable energy, etc. At the same time, capacity utilization in the manufacturing sector is touching 75%, typically a point where the likelihood of a new private capex cycle becomes high in the near future. De-leveraged balance sheets of Indian companies and banks and a strong GDP growth outlook for the years will aid this possibility even more. Tarachand Infralogistics Solutions Ltd. started FY23 with monthly yields of 2.5%. By the end of the financial year, the average monthly yield for Segment A for the year was 2.85%, suggesting that monthly yields in Q4 may have been over 3%+. If the yield trajectory remains strong, Tarachand Infralogistics Solutions Ltd. will benefit from healthy operating leverage.

Yields for Tarachand Infralogistics Solutions Ltd. have also improved significantly over time because of a change in the mix of its clients. Tarachand Infralogistics Solutions Ltd. was earlier leasing out its equipment for a lot of infrastructure projects such as road and rail construction. They were essentially working as subcontractors for EPC players such as Larsen & Toubro Ltd (L&T), ITD Cementation India Ltd, Afcons Infrastructure Ltd, etc. These Infrastructure projects are Government financed and tender-based and hence operate under strict budgetary control, capping the yields. Over the last couple of years, Tarachand Infralogistics Solutions Ltd. has consciously moved away from such projects and towards capacity expansion projects in the cement, steel, and petrochemical industries. It’s also entering the renewable energy segment in FY25. These projects involve the erection of new plants and are self-funded by clients such as UltraTech Cement Ltd, Jindal Steel & Power Ltd, Reliance Petrochemicals, and Suzlon Energy Ltd. The yields possible in this segment are much higher.

Change in sectoral mix for Tarachand Infralogistics Solutions Ltd. from FY23 to FY24

| Sector | FY24 | FY23 |

| Rural & Urban Infrastructure | 39% | 66% |

| Metals & Minerals | 32% | 21% |

| cement | 18% | 4% |

| Petrochemicals | 10% | 6% |

| Others | 1% | 2% |

Construction equipment typically has a life of 15-20 years, but it is depreciated much faster than that on the company’s books. Tarachand Infralogistics Solutions Ltd. has been depreciating its equipment for 6-7 years, for example. This causes an outsized optical impact on the P&L but doesn’t affect cash flows as much. Hence, for companies like Tarachand Infralogistics Solutions Ltd., it may also be useful to look at a metric called Cash PAT = PAT + depreciation.

| PAT vs Cash PAT FY20-FY24 | FY20 | FY21 | FY22 | FY23 | FY24 |

| Revenue | 115 | 110 | 128 | 141 | 172 |

| PAT | 8 | 3 | 2 | 9 | 16 |

| Depreciation | 17 | 22 | 23 | 22 | 29 |

| Cash PAT = PAT + Depreciation | 25 | 25 | 25 | 31 | 45 |

| PAT % | 7.0% | 2.7% | 1.6% | 6.4% | 9.3% |

| Cash PAT % | 21.7% | 22.7% | 19.5% | 22.0% | 26.2% |

Construction equipment typically has a resale value of 60% of the gross block even after 8-9 years of its life. So often, they can be sold at or above book value. Tarachand Infralogistics Solutions Ltd. tends to churn its equipment after reaching the age of 8-9 years to keep its fleet fresh. While the rental yields commanded by slightly older equipment are not necessarily very different from new equipment, the repair and maintenance costs do go up with age, and certain clients may demand deployment of newer equipment, so this churn out makes economic sense. Thus, a bulk of the funds required to purchase new equipment are unlocked from the sale of old equipment.

Gauging the upcoming demand, Tarachand Infralogistics Solutions Ltd. has recently signed a 160Cr purchase plan with Zoomlion India Pvt. Ltd. for heavy-duty cranes and aerial working platforms. This capex is to be executed over FY25 and FY26 as per the flow of actual orders being received from clients. The capex will be funded by a mix of internal accruals and suppliers’ credit. The terms of the suppliers’ credit are such that the debt won’t come on the books of Tarachand Infralogistics Solutions Ltd. for a few years, and thus, there won’t be a hike in interest costs for a few years even while the netblock doubles from INR 160 Cr to INR 320 Cr. When the suppliers’ credit gets converted to debt on the books, hopefully, Tarachand Infralogistics Solutions Ltd. will have earned enough cash to repay the loans smoothly. This favorable mode of financing, most likely brought about by Chinese crane OEM’s eagerness to grow their business in India as Chinese construction has slowed down, gives an additional fillip to the balance sheet while not compromising growth.

The current order book in Seg A to be executed by FY25 is INR 62 Cr. The company expects to grow this segment’s revenues by 30% in FY25, reaching ~INR 100 Cr. The segment’s revenues are H2 heavy as construction work slows down in the monsoons. Starting Q4, Tarachand Infralogistics Solutions Ltd depreciation run-rate has slowed down as heavier cranes with higher usable lives have come into the balance sheet. This lower run rate is expected to give a bump to the EBIT margin next year, leading to a higher segmental ROCE. Here’s how we think Segment A nos could play out in FY25 if management is able to deliver the 30% top-line growth it is guiding for

| Seg A – FY24 nos and expected FY25 nos (INR Cr) | |

| FY24 Revenues for Seg A | 76 |

| FY24 EBIT for Seg A | 15 |

| FY24 average Gross Block for Seg A (Estimated) | 214 |

| FY24 ROCE Seg A | 7.2% |

| FY25 Revenues estimated for Seg A | 99 |

| FY25 estimated EBIT for Seg A | 27-32 |

| FY25 estimated average Gross Block for Seg A | 258 |

| FY25 estimated ROCE for Seg A | 10.5%-12.5% |

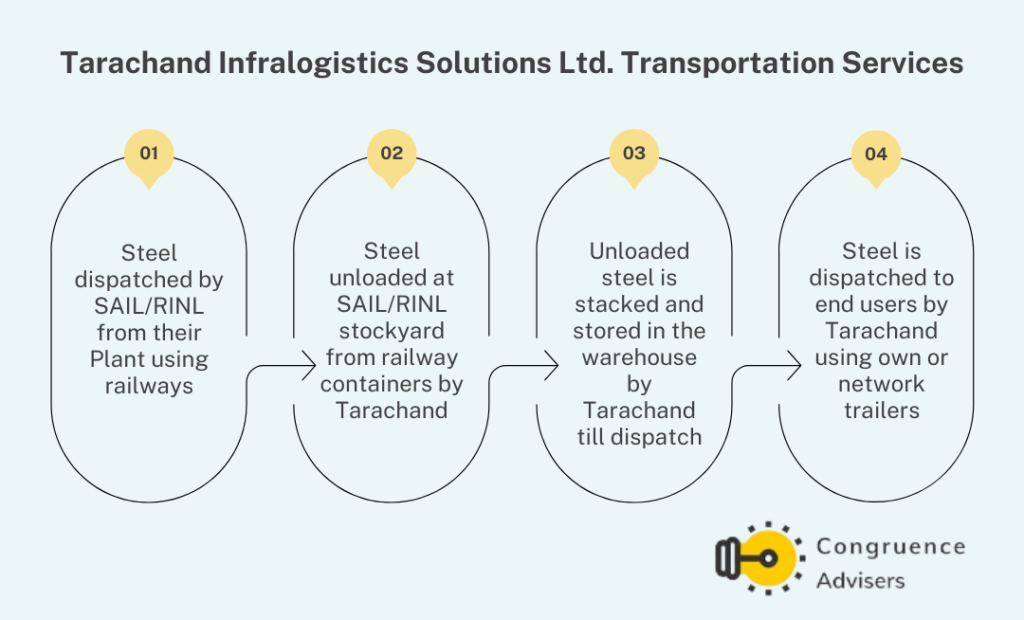

Segment B – Transportation and handling

Segment B is the division wherein Tarachand Infralogistics Solutions Ltd. handles and transports steel for its clients. Tarachand Infralogistics Solutions Ltd. has two major clients in this segment – Steel Authority of India Limited (SAIL) and Rashtriya Ispat Nigam Limited (RINL). Tarachand Infralogistics Solutions Ltd.’s primary responsibility in this segment involves handling steel at the stockyards or depots of its PSU clients. When steel reaches the stockyard from the client’s plants, Tarachand Infralogistics Solutions Ltd. manpower at the stockyard is responsible for unloading the steel, storing it in the stockyard, and then also loading it on trucks and trailers for dispatch to the client’s end customers. For stockyard operations, Tarachand Infralogistics Solutions Ltd. employs manpower and machines such as rubber tyred gantry cranes. Tarachand Infralogistics Solutions Ltd gets paid per metric tonne of steel handled. The contracts are awarded for multiple years together – 4 to 7 years typically – and the awarding happens through a tendering process. The contracted per Metric Tonne rate for steel handled has a price revision clause based on inflation, which comes into force every 6 months. Tarachand Infralogistics Solutions Ltd. has 40 years of experience in handling steel and thus claims to be in an advantageous position while bidding for tenders of Steel Authority of India Limited (SAIL) and Rashtriya Ispat Nigam Limited (RINL). This is borne out by the fact that Tarachand Infralogistics Solutions Ltd has managed to win repeat orders from both clients on several occasions. Tarachand Infralogistics Solutions Ltd also claims to be the only operator of RTG cranes outside of steel manufacturers themselves. These cranes help reduce manpower and increase the efficiency of handling operations at the stockyards.

Image: A rubber tyred gantry crane belonging to Tarachand Infralogistics Solutions Ltd.

Apart from handling steel at the stockyard, Tarachand also provides transportation services to its clients to transport steel to end users. The company owns a network of ~80 trailers and pullers and has a total network of 500 trailers and pullers at its disposal through transportation partners.

Over the last 4 years, Segment B revenues have increased at a CAGR of 16.6%, and EBIT has increased at an impressive CAGR of 35.5%. The interesting thing to note is that the business has grown without any need for additional capital injection, leading to a very high return on capital. Unlike Segment A, this segment’s operations are not assets, and there is no need for incremental asset deployment to scale revenues. EBIT margins in this segment have come down by ~400 bps YoY in FY24. According to management, this is because a new, large contract has started in FY24, and the initial stages of a contract, asset mobilization is high, and throughput is low. The EBIT is expected to come back to FY23 levels in FY25. The present order book in this segment, which is executable by FY25, amounts to INR 76 Cr. Management expects to grow this segment also by 30% in FY25, hoping to deliver ~INR 108 Cr in revenues.

| Segment B – Revenue, EBIT, ROCE Trends FY20-FY24 | FY20 | FY21 | FY22 | FY23 | FY24 | CAGR |

| Seg B revenues | 44.7 | 32.1 | 44 | 61.8 | 82.6 | 16.6% |

| Seg B EBIT | 3.5 | -0.3 | 5.6 | 11.1 | 11.8 | 35.5% |

| Seg B EBIT margin | 7.8% | -0.9% | 12.7% | 18.0% | 14.3% | |

| Seg B Equity capital employed | 19.6 | 19.8 | 26.4 | 26.2 | 22 | 2.3% |

| Seg B return on capital | 17.9% | -1.5% | 21.2% | 42.4% | 54.9% |

Segment C – Steel Processing and distribution of goods

This is the smallest business segment for Tarachand Infralogistics Solutions Ltd., with segmental revenues contributing ~8% of the overall FY24 revenues. In this segment, Tarachand Infralogistics Solutions Ltd. converts finished steel rebars into the required shapes and sizes using steel processing machines and supplies for infrastructure and construction companies. These machines are usually installed at client sites and warehouses. Tarachand Infralogistics Solutions Ltd. also supplies processed steel from its plant in Taloja. The plant has machines such as automatic shear lines, robotmaster, twinmaster, manual benders, arc benders, etc.

Image: Processed steel SKUs supplied by Tarachand Infralogistics Solutions Ltd.

Over the last 4 years, revenue in this segment has increased at a rate of 5.4% CAGR, and EBIT has increased at a rate of 13.3% CAGR. The segment earns less than INR 1 Cr EBIT and is thus inconsequential in the larger scheme of things for Tarachand Infralogistics Solutions Ltd.

| Segment C – Revenue, EBIT, ROCE Trends FY20-FY24 | FY20 | FY21 | FY22 | FY23 | FY24 | CAGR |

| Seg C Revenues | 11.2 | 11.6 | 12.5 | 14.2 | 13.8 | 5.4% |

| Seg C EBIT | 0.4 | -0.68 | 0.78 | 0.43 | 0.66 | 13.3% |

| Seg C EBIT margin | 3.6% | -5.9% | 6.2% | 3.0% | 4.8% | |

| Seg C Equity capital employed | 10.66 | 11.45 | 11.8 | 8.8 | 2.7 | -29.1% |

| Seg C return on capital | 3.8% | -5.9% | 6.6% | 4.9% | 24.4% |

Tara Chand Infralogistic Solutions Ltd Financial Analysis

In this section, we present a detailed financial analysis of Tarachand Infralogistics Solutions Ltd, which has demonstrated strong financial performance in recent years, with consistent revenue and profit growth. Tarachand Infralogistics Solutions Ltd boasts a healthy balance sheet and robust cash generation, further solidifying its positive outlook.

Over the last 5 years, Tarachand Infralogistics Solutions Ltd. has grown revenues and PAT at a CAGR of 10.6% and 18.9% while delivering an average ROCE of 12%. During this period, Tarachand Infralogistics Solutions Ltd has converted ~70% of its EBITDA into cash while significantly improving its interest coverage ratio and reducing working capital days appreciably. Tarachand Infralogistics Solutions Ltd has 730 permanent employees and works in 50+ sites across India. Tarachand Infralogistics Solutions Ltd has a current order book of INR 138 Cr and expects to grow its topline by 30% in FY25. Tarachand Infralogistics Solutions Ltd sees the momentum continuing into FY26 and beyond if policy continuity remains. The balance sheet of Tarachand Infralogistics Solutions Ltd has remained robust throughout, and with growth kicking in now, this microcap stock looks like an interesting case study from an investment point of view.

| Tarachand InfraLogistics Solutions – Key Metrics FY20-FY24 | FY20 | FY21 | FY22 | FY23 | FY24 | CAGR |

| Revenues | 115 | 110 | 128 | 141 | 172 | 10.6% |

| EBITDA (Incl Other income) | 35 | 34 | 36 | 42 | 58 | 13.5% |

| PAT | 8 | 3 | 2 | 9 | 16 | 18.9% |

| PAT % | 7.0% | 2.7% | 1.6% | 6.4% | 9.3% | |

| Capital employed | 139 | 160 | 152 | 156 | 180 | 6.7% |

| ROCE | 14% | 8% | 9% | 13% | 16% | |

| ROE | 15% | 5% | 3% | 13% | 17% | |

| CFO/EBITDA | 117% | 35% | 90% | 58% | 44% | |

| D/E | 1.6 | 1.9 | 1.6 | 1.3 | 0.9 | |

| Interest coverage ratio | 4.4 | 3.8 | 3.0 | 4.8 | 7.9 | |

| Gross fixed asset turns | 0.7 | 0.6 | 0.6 | 0.6 | 0.6 | |

| Days of Working capital | 133 | 202 | 174 | 135 | 110 |

Tara Chand Infralogistic Solutions Ltd Corporate Governance

In this section, we have examined Tarachand Infralogistics’ corporate governance, focusing on board composition, promoter remuneration, related party transactions, and depreciation policy. We have highlighted areas that require continuous monitoring, such as related party transactions and depreciation rates.

Board Constitution – There are 8 Directors on the Board of Tarachand Infralogistics Solutions Ltd. The Managing Director chairs the Board, and 50% of the Directors are independent. One of the Independent Directors, Mr Diwakar Hebbar Kapoli, has relevant experience by virtue of having retired as a senior manager at Larsen & Toubro Limited. The other independent directors are ex-IAS officers or bankers who bring relevant experience to the table for the business. Independent Directors chair the Audit and Remuneration Committees.

Promoter remuneration – The total outflow towards promoters and their relatives in the form of salaries, interest, rent, etc., totalled INR 1.07Cr in FY23, amounting to ~11.5% of the FY23 PAT, which is well within recommended limits.

Related Party Transactions – There are two related companies where Executive Directors or relatives of the Executive Directors have considerable influence and where material related party transactions have taken place – M/s. Phonex Infracon Solution and M/s. Tarachand Industries Limited. Both companies seem to be in similar fields of EPC and construction business, and therefore, related party transactions with them must be monitored closely. As of FY23, the related party transactions are not of major concern. Tarachand Industries Limited, a privately held company, has also grown its revenues strongly in the last couple of years. Monitoring their growth vis-à-vis Tarachand Infralogistics Solution Ltd.’s growth is advisable.

Depreciation policy – The rate of depreciation for assets seems to have come down in Q4 FY24 compared to historical depreciation rates. Management explained on the Q4 FY24 investor call that this is because the new cranes that have recently come into the balance sheet are much larger and thus have a much longer depreciable life. The Q4 depreciation figure was published after consultation with the auditors. While this is a satisfactory explanation, we will continue to monitor the company’s depreciation policy in the future, as depreciation is a major P&L line item for Tarachand Infralogistics Solutions Ltd

Tara Chand Infralogistic Solutions Ltd Peer Comparison

Sanghvi Movers Ltd., India’s largest crane rental company, serves as the closest comparison for Tarachand Infralogistics Solutions Ltd., despite key differences in revenue composition (Almost 90%+ of Sanghvi Movers Ltd’s revenues come from equipment rental). Despite this distinction, Sanghvi Movers is the closest benchmark for Tarachand Infralogistics Solutions Ltd

Almost 50% of Sanghvi Movers Ltd’s revenues come from the wind energy sector, and they command a 75% share of total wind turbine installations in India. The wind energy sector has seen a strong turnaround starting FY23 after 6 years of pain, giving Sanghvi a major boost in business. The rest of the business comes from the steel, cement, petrochemical, and infrastructure sectors. Sanghvi Movers has recently purchased a 1600 MT crane from Sany Heavy Industry India Pvt Ltd, which might be the heaviest land crane operating in India.

Below is the analysis of Tarachand Infralogistics Solutions Ltd and its peer Sanghvi Movers Ltd Ltd based on Revenue, EBITDA margins, CFO/EBITDA conversion, working capital days W(C days), Return on Equity (ROE), Return on capital employed (ROCE), average yield on equipment rentals & other Financial parameters

| Competitor benchmarking | Sanghvi Movers | Tarachand Infra |

| FY24 Revenue (INR Cr) | 619 | 172 |

| FY24 Revenue growth (%) | 27% | 22% |

| FY24 EBITDA (INR Cr) | 381 | 55 |

| FY24 EBITDA margin (%) | 62% | 32% |

| FY24 ROCE (%) | 24% | 17% |

| FY24 average yield on equipment rentals (%) | 2.20% | 2.85% |

| Gross block (INR Cr) | 2490 | 298 |

| No. of large cranes | 353 | 79 |

| Total lifting capacity (MT) | 81,288 MT | 3000 MT+ |

| Avg age of crane fleet | 20-21 years | 5-6 years |

| Avg 5Y ROCE (%) | 8.94% | 10.20% |

| Avg 5Y CFO/EBITDA (%) | 103% | 83% |

| 5Y Net Capex (INR Cr) | 505 | 154 |

| Debt/Equity ratio | 0.28x | 0.9x |

| Interest coverage ratio | 16.40x | 8x |

Tarachand Infralogistics Solutions Ltd.’s metrics compare quite favorably with that of the industry leader – Sanghvi Movers Ltd, Both companies delivered very strong revenue growth and ROCE numbers in FY24. Tarachand Infralogistics Solutions Ltd. comfortably outdid Sanghvi Movers Ltd. in gross yield numbers of 2.85% vs 2.2%. This is surprising considering the mix of wind energy in Sanghvi Movers’ topline. Perhaps Tarachand Infralogistics Solutions Ltd is able to command better yields due to its fleet of cranes being much, much younger than Sanghvi Movers’ Ltd, but this is only a guess on our part. Both Tarachand Infralogistics Solutions Ltd & Sanghvi Movers Ltd have had very good EBITDA to CFO conversion ratios over the years, and have very comfortable interest coverage ratios, which indicates the strength of their balance sheets. Over 5 years, Tarachand Infralogistics Solutions Ltd has better average ROCEs, presumably due to the stable nature of the steel logistics and handling business, which acts as an excellent buffer to the more cyclical equipment rental vertical.

Tara Chand Infralogistic Solutions Ltd Index Comparison

Tarachand Infralogistics Solutions Ltd share performance vs. S&P BSE Small cap Index as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Tara Chand Infralogistic Solutions Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGMs.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

On daily charts, Tarachand Infralogistics Solutions Ltd stock consolidated between 160-200 levels for 4 months between December 2023 and March 2024. In early April, Tarachand Infralogistics Solutions Ltd stock broke out of the range and made a parabolic move towards 320 in just a few trading sessions. After consolidating for a week, Tarachand Infralogistics Solutions Ltd’s stock made another parabolic move towards 430 levels. There are early signs of consolidation at this level. As long as election results are in favor of policy continuity and the earnings trajectory continues to be bullish, the stock should respect the 20 DMA level, which is currently at 365.

On weekly charts, one can see that Tarachand Infralogistics Solutions Ltd stock has tended to consolidate in horizontal bands for months together before giving a strong breakout and moving up strongly. After the consolidation from Feb-Aug 2023, Tarachand Infralogistics Solutions Ltd stock almost doubled in the next 3 months. Then, it entered another horizontal consolidation phase for 4 months before breaking out violently and moving up 60% in a couple of weeks.

Why You Should Consider Investing in Tara Chand Infralogistic Ltd Solutions

We should consider investing in Tarachand Infralogistics Solutions Ltd due to its strong position in the rapidly growing Indian infrastructure and steel logistics sectors. With a proven track record, experienced management, and a robust balance sheet, Tarachand Infra Logistics Solutions Ltd is well-positioned to benefit from the ongoing government-led capex cycle. High growth guidance across segments & expectation of operating and financial leverage in FY25 further solidify the investment thesis. Additionally, a Potential foray into EPC operations adds another avenue for growth and diversification.

- Tailwinds in the industry – There is a significant Government-financed capex program going on across sectors of the economy, such as roads, railways, ports, renewables, etc. Manufacturing capacity utilization in the private sector is also at ~75%, and sooner or later, this will result in a private capex cycle. All this infrastructure build-out will generate a lot of demand for cranes and is likely to keep equipment rental yields healthy. 4-7-year contracts drive the steel logistics segment, and Tarachand Infralogistics Solutions Ltd. is one of the rare 3rd party companies with deep experience and capabilities in steel handling, so there is no imminent threat of loss of business from the sector in the near future.

- Experienced management – Tarachand Infralogistics Solutions Ltd.’s management has 40 years of experience in steel logistics and handling and 20 years of experience in heavy equipment rental. The management has managed the balance sheet very well while growing the company over the years. In spite of being a micro-cap and an SME stock until April 2024, the management organizes regular conference calls with investors, demonstrating their commitment to shareholders.

- Strong balance sheet and cash generation—Tarachand Infralogistics Solutions Ltd. has a very robust balance sheet with a debt-to-equity ratio of 0.9x and an interest coverage ratio of 8x. Over the last five years, Tarachand Infralogistics Solutions Ltd has converted more than 70% of its EBITDA into cash flow from operations, thus demonstrating its working capital discipline. Days of working capital have also decreased by 17% from 133 days to 110 days since FY20.

- High growth guidance across segments – The management is confident of delivering 30% topline growth in FY25 owing to the INR 138 Cr order book in hand and indications received from its clients about imminent capex programs. If policy continuity regarding infrastructure build-out continues after the 2024 general elections, then the robust demand scenario may last for several more years.

- Potential for operating and financial leverage – A 30% topline growth can lead to disproportionately high PAT growth in FY25 due to the twin levers of operating leverage and financial leverage. Employee costs and other fixed costs won’t increase in line with revenues. Generous suppliers’ credit terms for new crane capex means that finance costs are unlikely to increase significantly in FY25 while the asset base increases. With larger cranes coming into the books, the depreciation rate will also decrease as they have longer lives. So, there is significant potential for financial leverage to play out below EBITDA levels.

- Expansion into EPC operations—Tarachand Infralogistics Solutions Ltd has signaled its intent to enter selective EPC operations. This is most likely going to be a forward integration in the same projects where their cranes and other equipment are deployed on a rental basis. While the EPC segment margins will be lower than rental margins, absolute revenues and EBITDA will increase.

What are the Risks of Investing in Tara Chand Infralogistic Solutions Ltd

We have outlined the significant risks associated with investing in Tarachand Infralogistics Solutions Ltd. These include unfavorable policy shifts away from infrastructure spending, interest rate hikes impacting project demand, potential missteps in its EPC venture, and conflicts of interest with related parties.

Change in policy environment – A change in the policy environment that de-emphasizes infrastructure build-out can significantly hamper the demand environment for Tarachand Infralogistics Solutions Ltd. Such a policy change can also impact the private sector’s confidence and delay the private sector capex cycle even more. This is a risk that must be keenly tracked.

Unfavorable policy action by the Reserve Bank of India – Any further hike in interest rates by the RBI to combat inflation, prevent currency depreciation, or mandate significantly higher provisioning for banks for infrastructure lending can slow down capex projects, thus impacting demand.

EPC foray gone wrong – If the company commits too many resources towards its EPC foray and ends up choosing unremunerative projects or faces delays in execution, it can lead to capital drain and stress on the balance sheet

Related parties – There are related party companies owned by promoters or relatives of promoters that operate in similar areas of EPC works or equipment rental. Any potential conflict of interest needs to be monitored closely through related party transactions and comparative growth of the listed and unlisted entities.

Tara Chand Infralogistic Solutions Results

Tarachand Infralogistics Solutions Ltd’s latest Quarterly Results highlight excellent performance on parameters like Revenue, EBITDA, and Profit on both QoQ and YoY basis

Tarachand Infralogistics Solutions Ltd. reported solid Q4FY24 results, with revenues increasing 20% YoY, operating profits increasing 55% YoY, and PAT increasing a whopping 140% YoY. The disproportionate increase in profits compared to revenues nicely demonstrated the twin effects of operating leverage and financial leverage playing out. The operating leverage resulted from higher revenues over the same asset base, whereas financial leverage resulted from stable interest costs and reduced depreciation costs, as discussed in the corporate governance section. Most of the revenue and profit growth was driven by the Equipment Rental vertical, which reported a YoY revenue growth of 35% and an operating profit growth of 330%. The company has guided for a strong FY25, where it expects to grow revenues by 30%. We expect the bottom line to grow much faster than revenue growth, as management has indicated that interest costs are unlikely to increase much next year due to suppliers’ credit arrangements with crane OEMs.

| Q4FY24 | Q4FY23 | Q3FY24 | QoQ | YoY | |

| Revenue | 46.49 | 38.84 | 44.36 | 5% | 20% |

| Operating Profit | 16.52 | 10.68 | 14.04 | 18% | 55% |

| Other Income | 0.41 | 1.59 | 0.49 | ||

| EBITDA % | 36% | 27% | 32% | ||

| Depreciation | 5.85 | 6.65 | 8.2 | ||

| Interest | 1.86 | 1.95 | 1.69 | ||

| Profit before tax (PBT) | 9.22 | 3.67 | 4.64 | 99% | 151% |

| PBT % | 20% | 9% | 10% | ||

| Net profit (PAT) | 6.3 | 2.62 | 3.35 | 88% | 140% |

| Net Profit % | 14% | 7% | 8% |

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.

Disclosure (Updated as of Sep 30, 2024) – Hold a tracking allocation that is less than 1% of overall equity allocation in personal portfolio