We will reach out to you over email within 24 hours with links to digitally sign (Aadhar OTP based) the T&C and make the payment

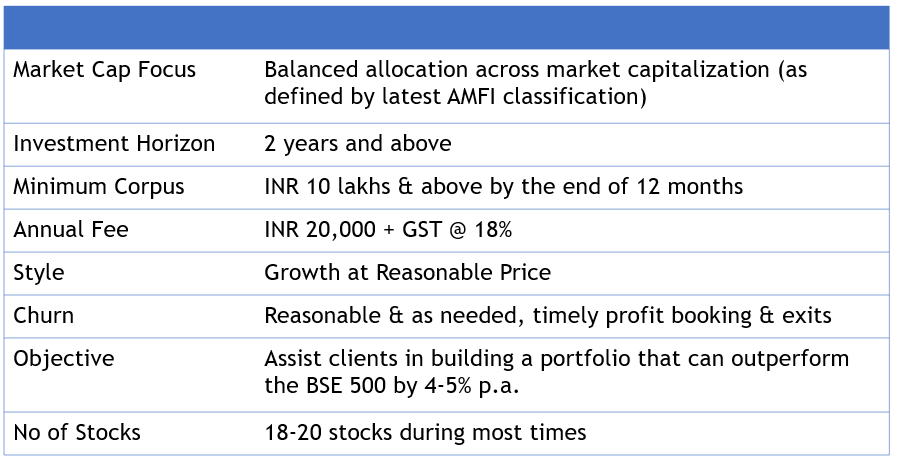

A flexicap equity portfolio offering that

Do read the FAQ section below for more details

We will reach out to you over email within 24 hours with links to digitally sign (Aadhar OTP based) the T&C and make the payment

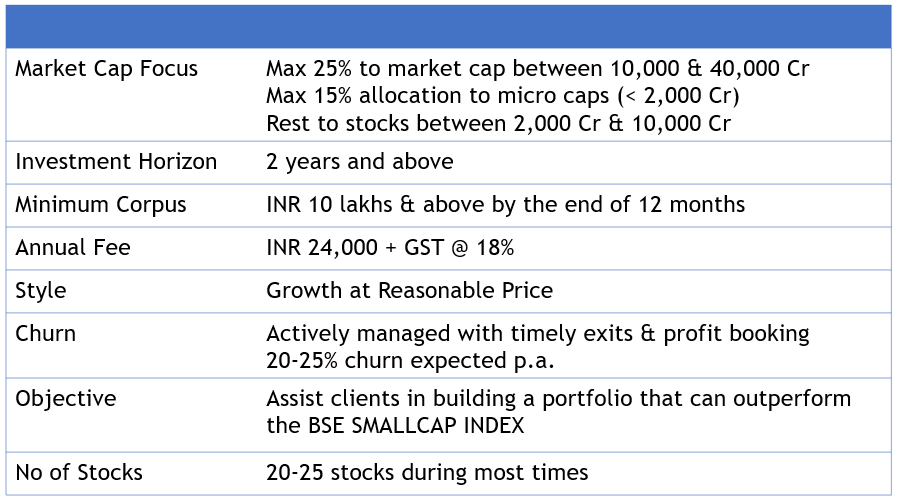

Mix of emerging businesses with these characteristics

Do read the FAQ section below for more details

We will reach out to you over email within 24 hours with links to digitally sign (Aadhar OTP based) the T&C and make the payment

We research the universe of listed stocks, and communicate our view on the chosen stocks at regular intervals and you can take decisions accordingly. We will be updating the model portfolio based on how prices move and the individual businesses execute, we charge you an annual fee for this. Please note that giving views on stocks outside of our coverage universe is outside the scope of engagement.

You perform the transactions through any online trading account of your choice. Your portfolio is completely under your control all the time, we do not manage your funds. This is a DIY (Do it Yourself) model of managing your own equity portfolio. We will provide research backed inputs on the individual stocks with the decision on portfolio actions being up to the subscribers.

You will need to commit some time (a few transactions a month at the maximum) to execute the transactions. Else, this model may not add value to you.

A T&C document as per SEBI guidelines that you need to e-sign using Aadhar OTP

Since you will be making the transactions yourself, routine KYC updates with your broker as and when applicable. We have no role to play in this process. We will only check if you are KYC complaint basis your PAN search

We will charge you an annual fixed fee + applicable taxes as per current SEBI guidelines for fees and billing schedule for Research Analyst firms.

Our annual fee structure will make commercial sense to subscribers who can invest at least INR 12 lakhs into the equity market based on our research. Higher the corpus, lower will be your annual expense as a % of the corpus invested.

A pertinent question, one can make well-reasoned arguments favoring either side. Our take on this is very simple – unless the portfolio is differentiated, refrain from paying high fees to active managers, instead reduce expenses by investing in index funds and ETF’s.

Our suggestion is to stick to passive funds for large cap investing, active investing should be for differentiated portfolios that focus on businesses outside the NIFTY 50.

If only things were that simple. We are more inclined towards investing in growth companies that meet our criteria where we do not have to overpay. We do not follow the “quality at any price” philosophy. What we do is well captured in the Investment Process section.

We are a Research Analyst firm whose primary skill set is a deep understanding of businesses and expressing a view on valuation. The objective of the model portfolios we offer is to outperform the S&P BSE 500 by 4-5% p.a. over the investment horizon (3-5 years). Please note that there are no guaranteed returns on offer, the equity market is a fickle beast that can reward you well if you can play the game right.

We have a bigger focus on managing risks than on managing returns. This way we endeavor to smoothen out the investing experience and focus on durability rather than short term return maximization. There has been no shortage of stocks in our portfolio that have turned out to be multi-baggers but that was never the sole objective we started out with.

Good things take time to build, so do good portfolios. Please don’t expect earth shattering returns within a short span of time. It is very difficult to separate luck from skill in the short term.

We will send you a detailed FAQ note on this process. This is why we started with a limited set of like-minded investors and fine-tuned the approach before launching this service online.

Wrong question, we build a durable equity portfolio for you; we do not recommend stocks. The offering is the equity portfolio and not individual stock recommendations.

We are not a tactical stock recommendation service where we commit to a specific number of stock ideas every year. We want investors to sign up if they are looking for a professional who can build an equity portfolio that can perform well across market cycles rather than chasing the elusive multibagger all the time.

You should expect to receive communication on the following lines

Yes, you can.

There is no guarantee of positive returns in equity investing. However, if you stay the course (3-5 years) and execute well enough based on our communication & research, the possibility of losing money reduces considerably. The risk of investing in equities goes down as the holding period goes up, we hope this is common knowledge by now.

Please express your interest by clicking on the Subscribe to Equity Portfolio Service button at the top of this page. It will ask you for details we need to initiate the onboarding process.

We will reach out to you with the necessary documentation and details on the on boarding process.