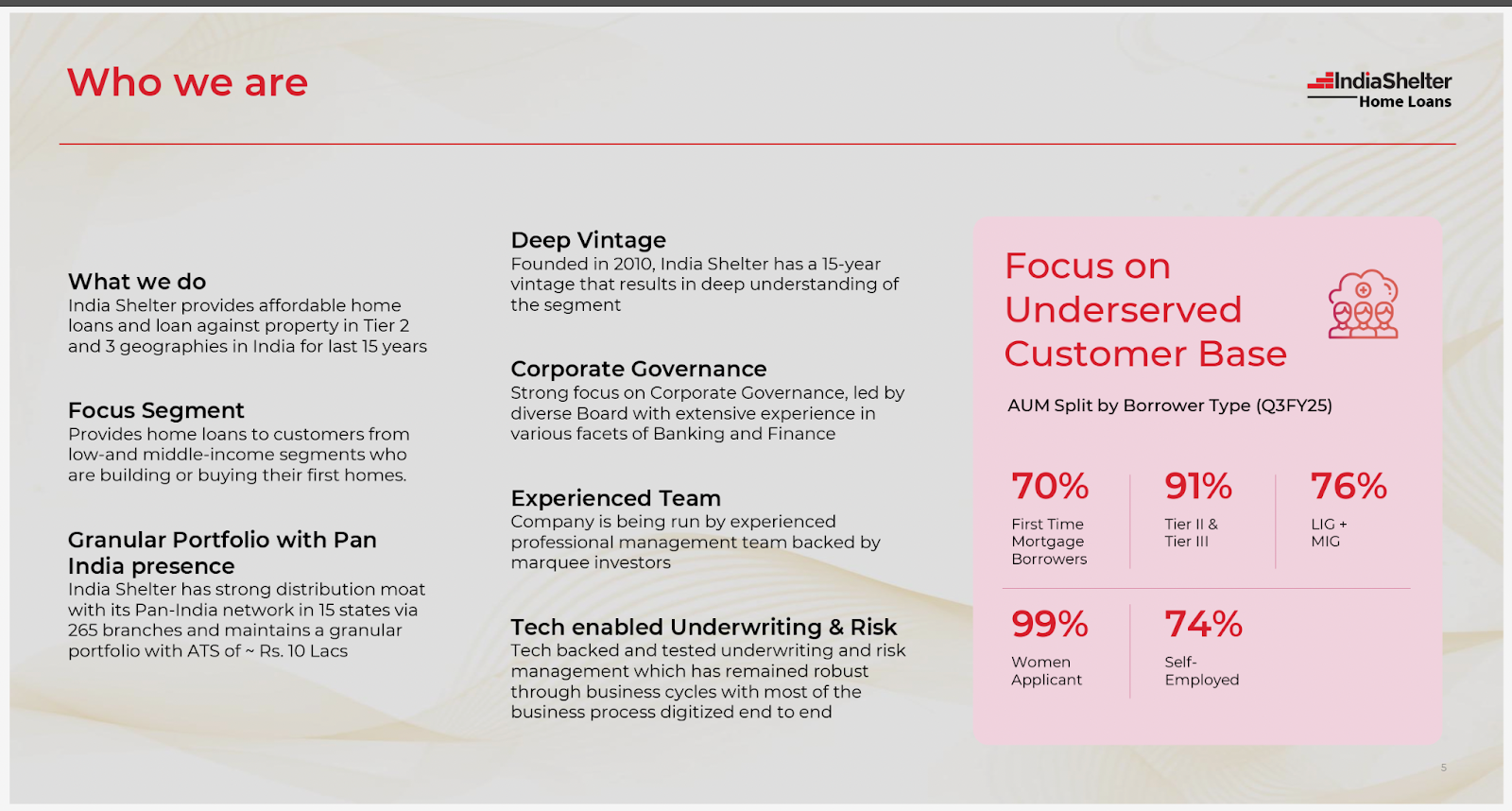

India Shelter Finance Corporation Ltd (ISFCL) is a housing finance company incorporated in 1998 as Satyaprakash Housing Finance. The company was acquired by the current investors in September 2009. It is focused on the low-cost and affordable housing segment, targeting self-employed customers in the informal low- and middle-income segment. As of December 31, 2024, the company had a managed AUM of Rs. 7,619 crore spread across 15 states/Union Territories. It offers loans to customers for home improvement, home extension, construction of dwelling units on an owned plot of land, home purchase, and loans against property.

India Shelter Finance is expected to be one of the fastest growing affordable housing finance companies in the listed equity segment. With a proven track record of geographical diversification, asset quality and improving operational efficiency, it can turn out to be an interesting bet within the housing finance industry. With a business model that is heavy on the self employed segment, we believe that India Shelter Finance is better shielded from disruption compared to the salaried segment.

India Shelter Finance Corporation Ltd Company Summary

India Shelter Finance Corporation Ltd (India Shelter/the company) was originally incorporated as “Satyaprakash Housing Finance India Ltd.” in 1998. In 2002, the National Housing Board (NHB) granted the company a certificate to operate as a housing finance institution without accepting public deposits. In 2009, the company was taken over by Mr. Anil Mehta and Mr. Sanjay Gupta. Both Mr. Mehta and Mr. Gupta come from a banking background, having worked with ANZ Grindlays, ADB, Bank of America, and HDFC. The company was rebranded as “India Shelter Finance Corporation Ltd.” in 2010. Since then Westbridge has taken over the majority stake and now they are promoters holding 47%. It was granted a banking certificate by NHB in the same year. India Shelter Finance Corporation Ltd commenced its lending operations in 2010, by opening its first branch in Rajasthan and disbursing loans of Rs. 0.1 Mn with an LTV (Loan to Value Ratio) of 10-12%.

Recent updates

• AUM crossed Rs. 7,600 crores & Networth crossed Rs. 2,500 crores in 9MFY25.

• India Shelter continues to source internally with 97% to 98% in-house sourcing.

• India Shelter 100% of the book is secured.

• LTV on the book stands at 52%.

• Average ticket size continues to range from Rs. 10 lakhs.

Guidance

• Branch addition of around 40-45 for the year.

• Maintain margins at around 6%.

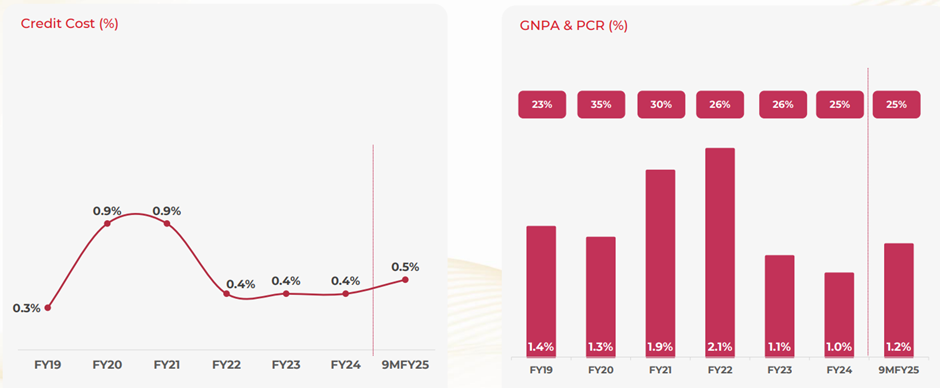

• Credit cost in a range of 40 to 50 bps.

• Loan growth in a range of 30% to 35%.

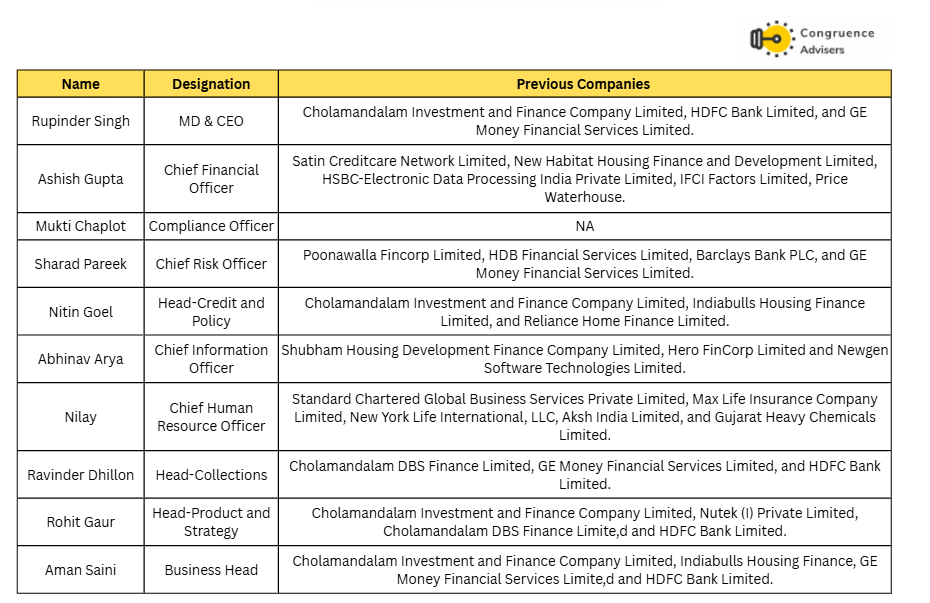

India Shelter Finance Corporation Ltd Management Details

Mr. Mehta stepped back from day-to-day operations and management in 2020, and India Shelter Finance Corporation Ltd was handed over to Mr. Rupinder Singh (Mr. Singh), who joined India Shelter Finance Corporation Ltd the same year. Mr. Singh took over operations and is leading the next leg of growth for the company. Mr. Sudhin Choksey, the Chairman, adds further credibility with his prior experience as the head of Gruh Finance, a renowned institution in the housing finance sector.

Founding Team

India Shelter Finance Corporation Ltd – Industry Overview

Affordable Housing Finance Sector

There is a lot of data in the public domain on the sector. In this report, we will highlight the key factors that are important to our investment thesis

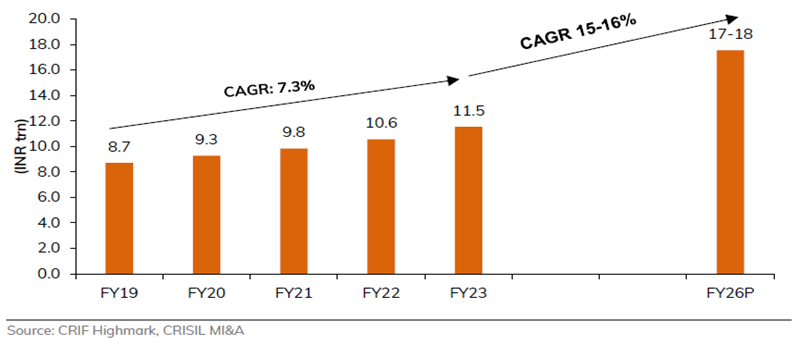

The affordable housing market is expected to grow in the range of 15-16% between FY23 and FY26 as the Indian market started coming out of the COVID fallout in the FY20-23 period.

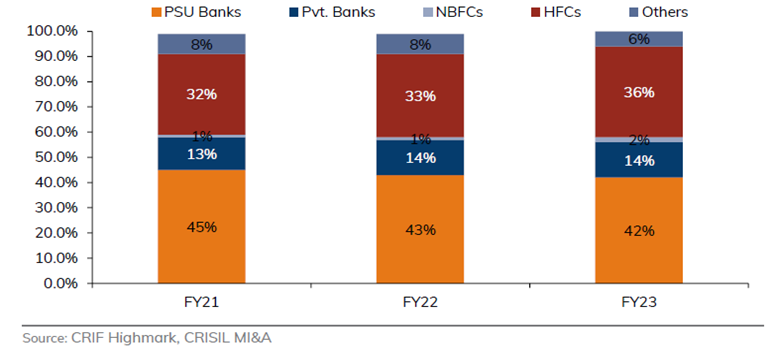

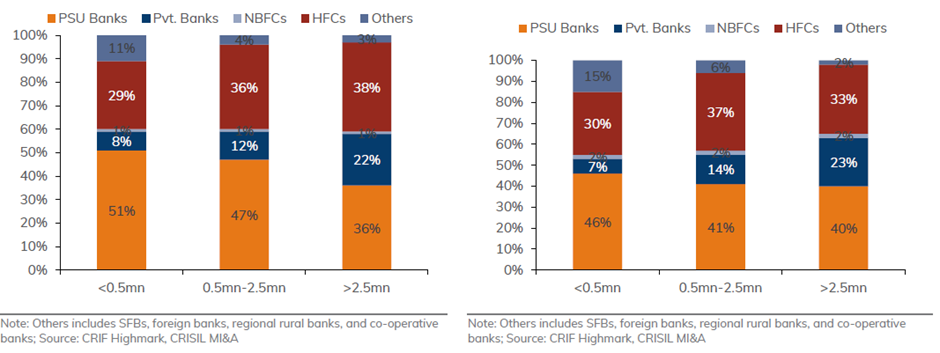

Market share within this segment has been steadily slipping away from PSU Banks in favour of HFC’s

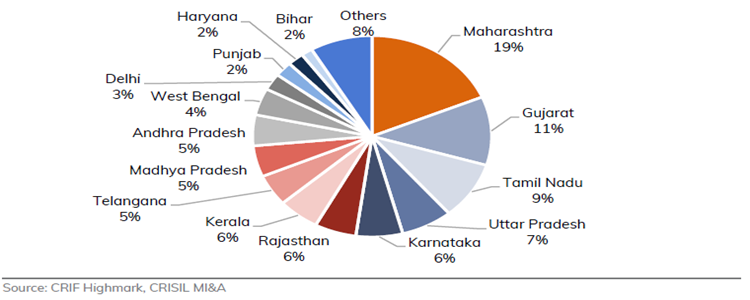

State wise share of the affordable housing sector

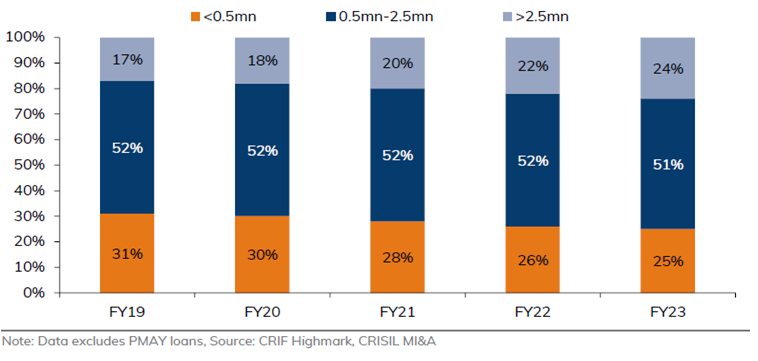

Segment Dynamics within the overall housing market

Share in FY19 Share in FY23

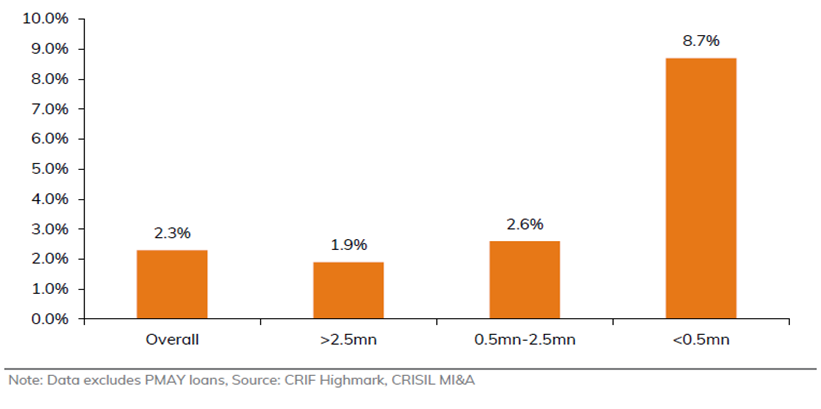

GNPA% based on ticket size

Summarizing these data points –

- HFC’s likely to continue to win market share in the affordable housing market

- Many of the potential AHFC customers are New to Credit, this calls for good risk assessment and ongoing risk management. The underbanked segment is also the riskiest.

- The risk of bad loans rises significantly in the below 5 lakhs segment. While the 5-25 lakh segment is definitely riskier than the > 25 lakhs segment, the increase in risk is not disproportionate and offers a healthy spread for those willing to make the investments. This grey area can offer spreads that can compensate a lender for the higher risk involved.

- This segment calls for significant primary, qualitative work to build a good business. The ideal business will have a deep understanding of each customer, high engagement effort and a standardized technology layer that can help keep operating expenditure low over a period of time. Last mile reach and service are extremely important to customers, unlike the Tier-1 and urban markets where customers are much more technology savvy

- The risk of disruption is much higher in the customer segments that are already credit profiled and well discovered. The salaried segment is easier to assess & underwrite than the self-employed segment for obvious reasons. As a thumb rule, cash flow-based underwriting can be easily replicated by any lender while asset based (non-quoted and illiquid assets) underwriting has entry barriers due to the subjectivity, skills and the last mile effort needed.

If you wish to read more about the sector, please search in the public domain for ICICI Securities’ Initiating coverage reports on India Shelter Finance & Aadhaar Housing Finance from 2024.

The charts used are from these reports while the above summary and conclusions are ours.

India Shelter Finance Corporation Ltd Business Overview

India Shelter Finance Corporation Ltd (India Shelter/the company) was originally incorporated as “Satyaprakash Housing Finance India Ltd.” in 1998. In 2002, the National Housing Board (NHB) granted the company a certificate to operate as a housing finance institution without accepting public deposits. In 2009, the company was taken over by Mr. Anil Mehta and Mr. Sanjay Gupta. Both Mr. Mehta and Mr. Gupta come from a banking background, having worked with ANZ Grindlays, ADB, Bank of America, and HDFC.

The company was rebranded as “India Shelter Finance Corporation Ltd.” in 2010. It was granted a banking certificate by NHB in the same year. It commenced its lending operations in 2010, by opening its first branch in Rajasthan and disbursing loans of Rs. 0.1 Mn with an LTV (Loan to Value Ratio) of 10-12%.

India Shelter Finance Corporation Ltd initially focused on EWS (Economically Weaker Section) and LIG (Low-Income Group) individuals in India at a time when the concept of affordable housing had not received much attention. It maintained lower LTV (10-20%) lending in the initial years until it built a robust framework for assessing borrower creditworthiness. Post the initial funding rounds, India Shelter Finance Corporation Ltd expanded beyond Rajasthan. Between FY11 and FY20, India Shelter Finance Corporation Ltd delivered an AUM (Assets Under Management) CAGR growth of 80%, mostly owing to its low base and a large untapped and unserved section of the population.

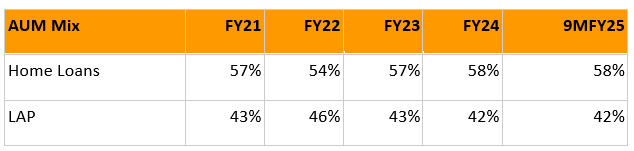

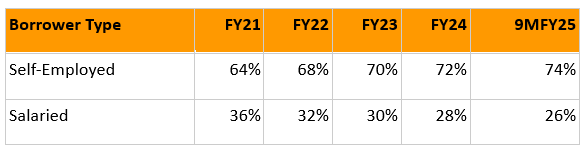

India Shelter Finance Corporation Ltd is engaged in the business of lending for housing and business. It has two major product verticals of: Home Loans & Loans against Properties (LAP). Currently, it runs a loan book with ~61% (on Balance Sheet) exposure to Housing Loans (HLs), which is close to the minimum amount (60%) required for NBFCs to qualify as a housing finance company as per the RBI directive.

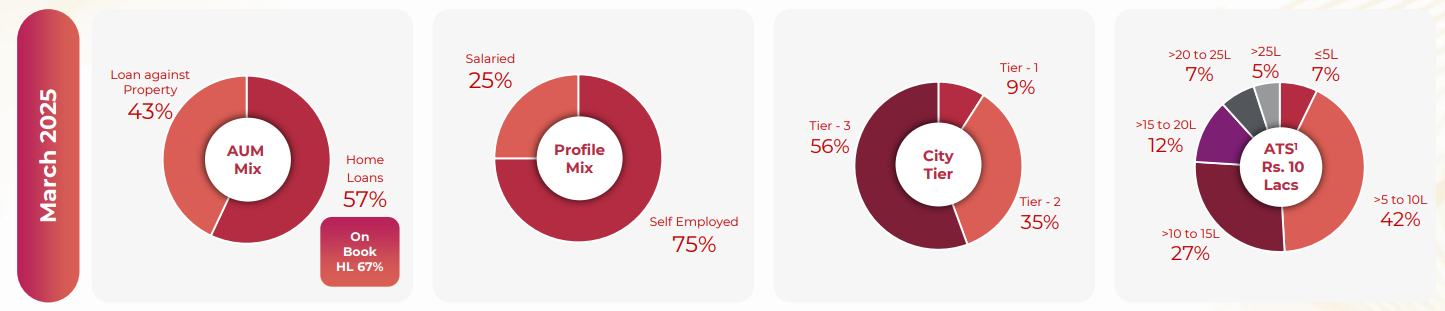

AUM Mix

Borrower Mix in AUM

Ticket Size Mix in AUM

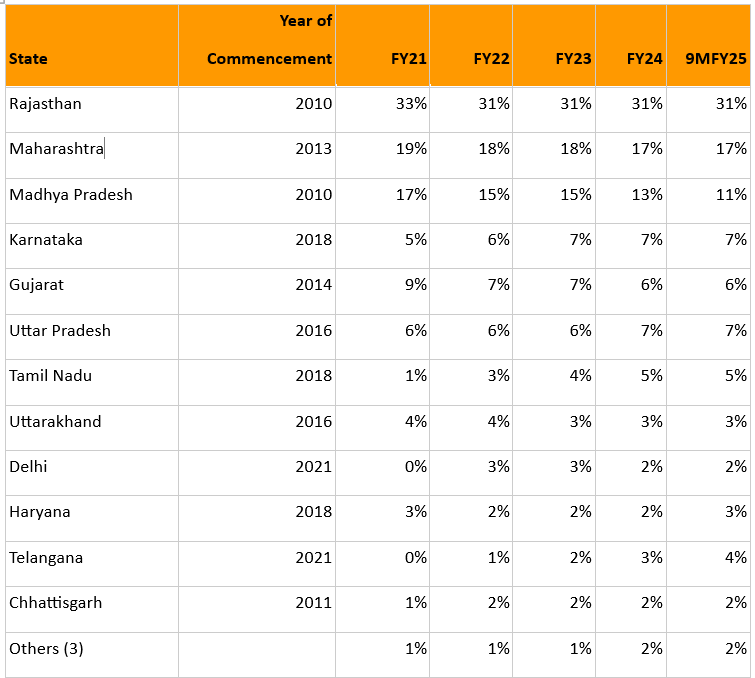

State-Wise Exposure & Branch Expansion Strategy

India Shelter Finance Corporation Ltd has built a robust distribution network with a pan-India presence across 15 states, operating through 265 branches. India Shelter Finance Corporation Ltd maintains a granular loan portfolio, with an average ticket size (ATS) of approximately ₹1 million, reflecting its focus on affordable housing:

- Annual Expansion Plan: Targeting the addition of 40–45 branches each year

- Zonal Structure: The branch network is organized into six operational zones in Rajasthan & Gujarat, South India, Maharashtra, Madhya Pradesh, North (including Delhi NCR & Uttar Pradesh), Punjab, Haryana, Chandigarh & Uttarakhand

- FY30 Outlook: The branch network is projected to scale to 500 branches by FY30, with an expected vintage mix as follows:

- 9%: Branches less than 1 year old

- 29%: Branches aged between 1–3 years

- 62%: Branches older than 3 years

- Branch-Level Efficiency: Each branch typically services a catchment area covering 50–60 km of AUM

- Operational Staffing: An operations executive is appointed from Day 1 of branch launch, with primary responsibility for customer service

India Shelter Corporation Ltd currently does not operate in North-East India, Jammu & Kashmir, and Kerala, which collectively account for only 5–7% of the total market opportunity. As such, India Shelter Finance Corporation Ltd plans to consolidate within its existing 15-state footprint without expanding into new geographies.

The LTV in HLs is close to 55%, while the LTV for LAPs stands at 45%. India Shelter Finance Corporation Ltd, as stated earlier, serves the LIG segment (it started operations with EWS and LIG both but shifted focus to LIG) of the population and as a result runs a 74% self-employed borrower book. Tier-wise India Shelter Finance Corporation Ltd has the bulk of its exposure in Tier 3 (T3) Cities, followed by T2 and T1.

Over the years, India Shelter Finance Corporation Ltd has witnessed its AUM moving towards T3 cities. From a ticket size standpoint, the Rs. 0.5-1.5 Mn segment accounts for ~70% of AUM. The current average ticket size (ATS) for the blended book is Rs. ~10 lakhs. India Shelter Finance Corporation Ltd underwrites loans under two models, namely: On-book AUM and Off-Book (DA) underwriting. HLs are underwritten as On-Book assets, while LAPs are written under both on and off-book assets. Every month, the company will conduct the securitization of the LAP portfolio. Direct Assignments (DA) accounts for ~13% of total income as of Q3FY25. India Shelter Finance Corporation Ltd sources almost all loans through in house sourcing mechanism, reliance on DSA and external leads is minimal. This is one of the reasons why the business was able to navigate the COVID crisis in a manner that was better than anticipated (though the business wasn’t listed then)

While asset quality has been steady once the peak of the COVID crisis was behind them, the in house client sourcing model introduces high opex in the initial few years of opening new branches. This is similar to the trend one sees in large bank branches too, the profitability of seasoned branches is much higher even for an HDFC or ICICI Bank. This is also one of the reasons why an IDFC First bank operates at a higher Cost to Income ratio compared to any bank that has been slow on branch expansion.

Due to this, the business model opens up the possibility of operating leverage –

- As the new branch season, one can expect the assets/branch to trend up

- As more branches season, the Opex to Assets ratio should normalize from elevated levels

- Over a period of time, one will see AUM/Branch and AUM/Employee rise.

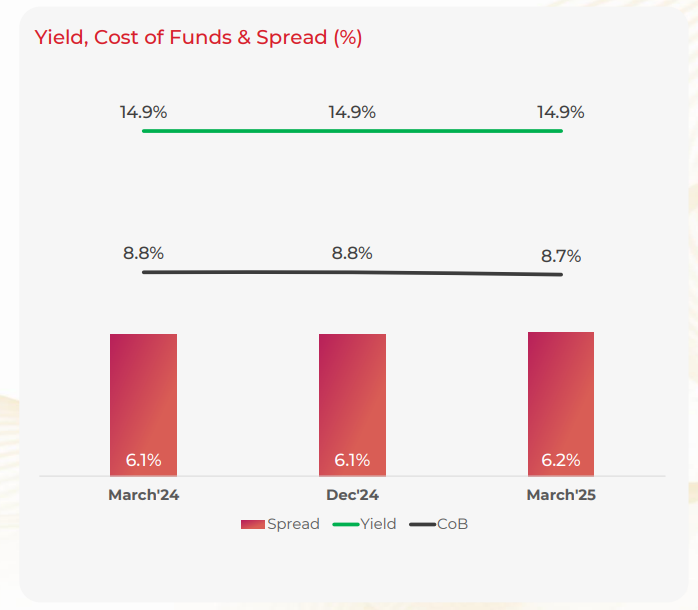

The key is to manage expansion without any deterioration in asset quality or in the spread the lender makes between the Yield on Advances & the cost of funds.

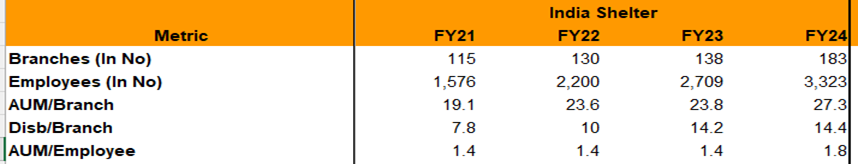

On these parameters, one can observe that India Shelter Finance Corporation Ltd has been steadily making progress

While spread and NIM have been holding up within a healthy range

The ICICI Securities report has this interesting chart which indicates that as a branch crosses the 3-year mark, the rise in AUM can be disproportionate until it stabilizes at the average level

While the addition of further new branches will obviously continue to place a cap on how much these parameters can improve, a steady improvement in the following bodes well for higher ROA over the medium term –

- Assets per branch increasing to the industry average of 35-40 Cr

- Opex to AUM reducing by 50-60 bps over the next 3 years

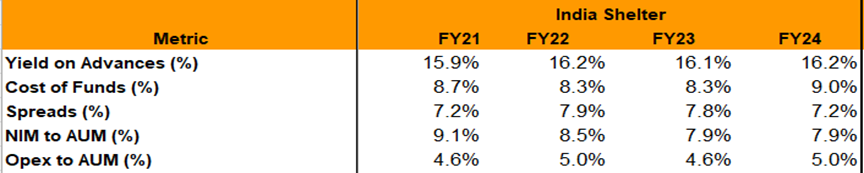

Over the past many quarters, India Shelter Finance Corporation Ltd management team has been reducing the interest rate risk in the book by shifting incremental disbursements in favour of a floating regime from a fixed regime. From the Q3 FY25 investor presentation

This pivot is expected to bring down the volatility in interest rate spreads over time, even if sticking to a fixed rate regime works in favour of the business in a falling interest rate regime (as we are in now). This gives us comfort that the management team is as focused on asset liability and risk management as it is on growth. Most accidents in lending happen when growth is prioritized over risk management when the going is good, only for the cycle to reverse in a few years.

Given the moves the management is making, if asset quality can be managed well over the next few years, the improvements in ROA can be considerable due to the operating leverage inherent in the business right now.

With credit rating upgrades likely due to scale improvement, the cost of funds can further trend down more than the interest rate cuts. A lower cost of funds allows the management team the comfort of minimizing balance transfers in the future. BT can be a significant drain on lenders since the cost of acquisition gets loaded upfront to some extent, while BT compromises the customer lifetime value.

India Shelter Finance Corporation Ltd is already well placed on the BT front, with scale, this should further reduce and improve the business quality compared to lenders like Home First Finance, where the reliance on DSA sourcing is much higher. Both the Westbridge Capital-backed entities (Aptus & India Shelter Finance) are doing far better on this front up to FY24.

India Shelter Finance Corporation Ltd Underwriting Process

The credit process is designed with a dual-layer structure combining fieldwork and centralized checks. Field officers handle most of the initial customer engagement, while central operations primarily manage verification under a maker-checker framework.

The underwriting workflow spans approximately three days:

- Day 1: The loan officer initiates the application through a mobile platform, leveraging the Account Aggregator system to access the applicant’s bank statements.

- Days 2–3: Notifications are triggered via Salesforce to the technical, credit, and legal teams for further assessment of the application.

Collateral valuation is managed by a dedicated team of about 150 members. Roughly 75% of property valuations are conducted internally. External valuation is reserved for select scenarios—typically for high-value loans exceeding ₹1.5 million or applications from newly established branches.

At a national level, about 45% of applications are rejected, with approval rates around 55%. The most common reasons for rejection include inadequate collateral or insufficient cash flow on the applicant’s part.

Loan processing fees average around 2-3% plus GST. However, rates vary slightly—home loans generally attract a lower fee, while loans against property (LAP) tend to be higher.

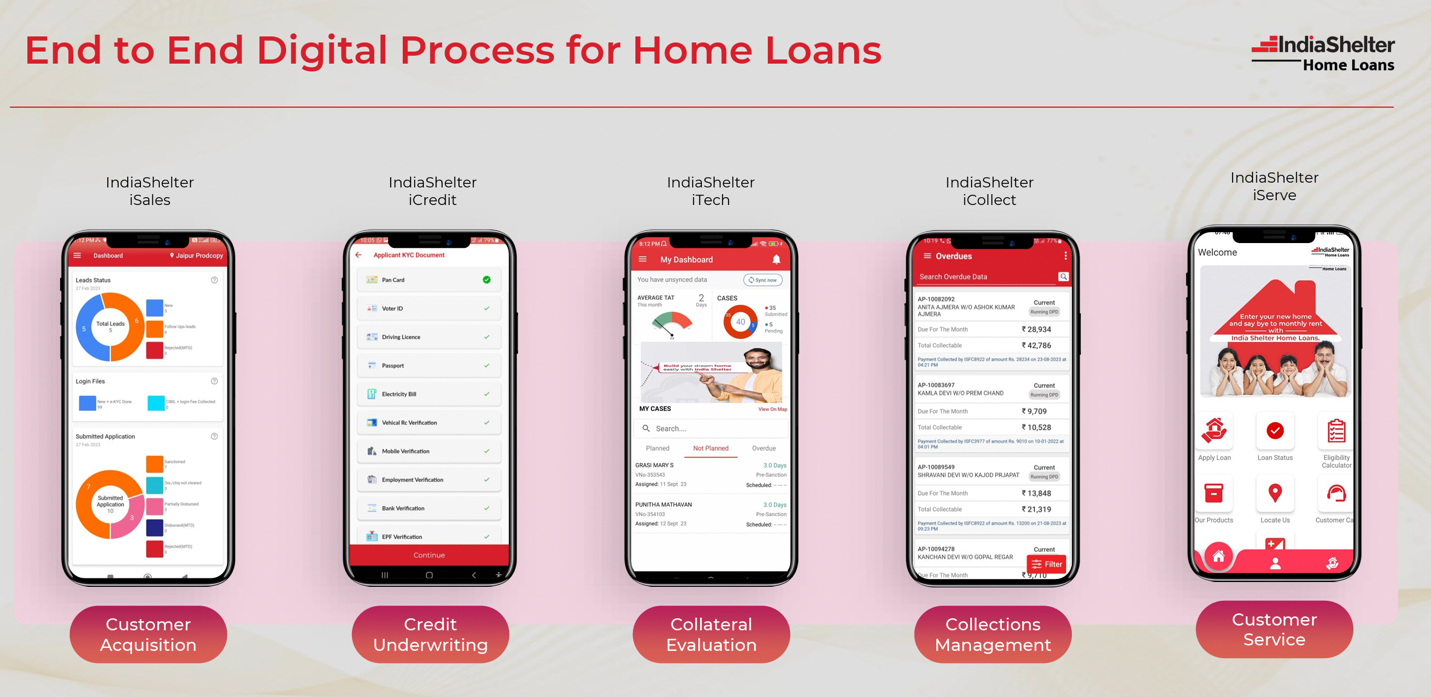

India Shelter Finance Corporation Ltd has established a robust, technology-first business model and was among the pioneers in adopting Salesforce, implementing it as early as FY13. This positioned India Shelter Finance Corporation Ltd as one of the first in the affordable housing segment to leverage such technology at scale.

Technology plays a central role across India Shelter Finance Corporation Ltd operations—from lead generation to collections—through a suite of proprietary in-house applications. Key platforms include:

- iSales – for customer acquisition and lead management

- iCredit – to streamline the credit underwriting process

- iTech – for efficient and accurate collateral valuation

- iCollect – to enhance and track collection efforts

- iServe – to manage and improve customer service

Each of these applications is seamlessly integrated with Salesforce, ensuring end-to-end visibility, operational efficiency, and data consistency across all stages of the customer lifecycle.

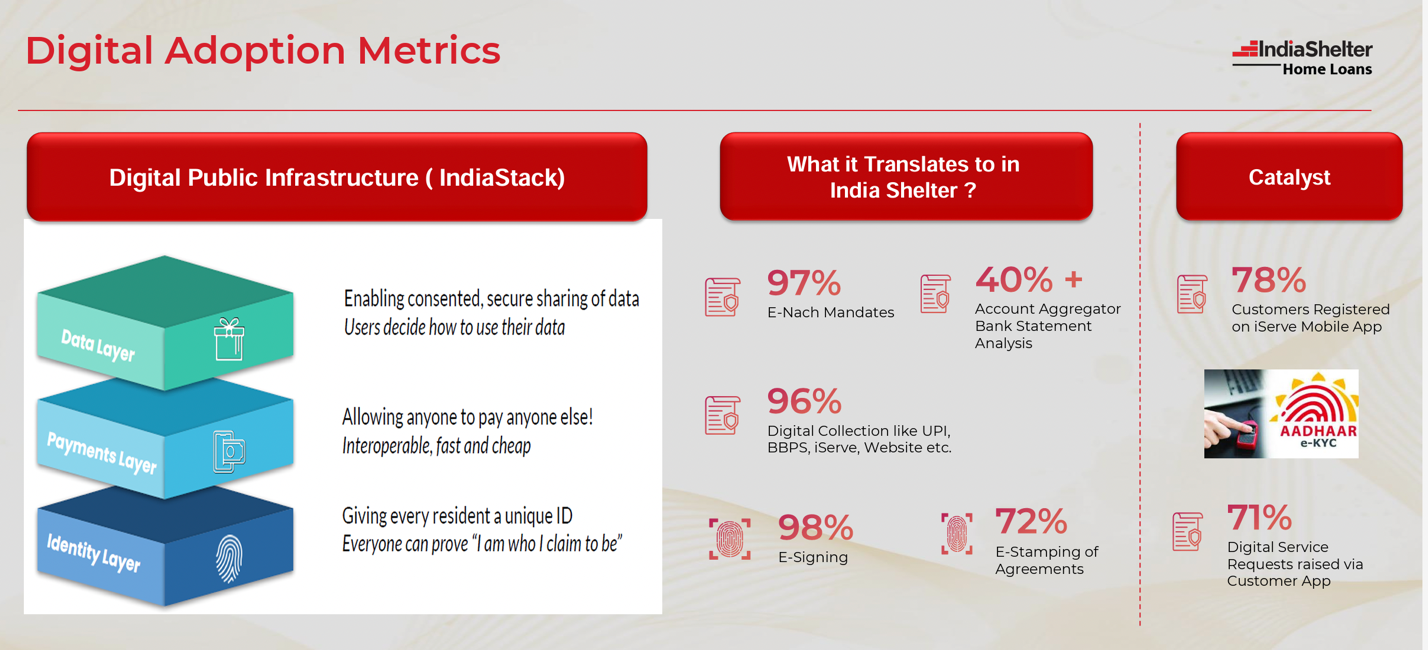

Strong Digital Adoption

India Shelter Finance Corporation Ltd strong technology foundation has led to impressive digital adoption across its customer base. As of the latest metrics:

- 97% of customers are enrolled under the E-NACH mandate

- 96% of collections are processed through digital channels such as UPI, BBPS, the iServe app, and the company’s website

- ~98% of documentation is now executed via e-signatures, a significant leap from just ~5% in FY22

- 78% of customers are actively registered on the iServe mobile application

India Shelter Finance Corporation Ltd was among the early movers in the affordable housing finance segment to adopt Salesforce, implementing it in 2013 when its AUM were still below ₹100 Cr. Salesforce serves as India Shelter Finance Corporation Ltd’s core loan origination system and is seamlessly integrated with both upstream and downstream applications, including mobile platforms, an in-house business rule engine, and a predictive dialer.

This deep integration has enabled India Shelter Finance Corporation Ltd to establish a fully paperless, end-to-end loan journey for its customers, enhancing both operational efficiency and customer experience

India Shelter Finance Corporation Ltd Corporate Governance

Board Composition – The Board of Directors for India Shelter Finance Corporation Ltd comprises 7 directors, of whom 4 are Independent and 3 are Nominee Directors. Mr. Sudin Chokesey is the Chairman, & The nominee Directors are Sumir Chanda and Shalesh Mehta on the board, bringing diverse and relevant experience to the company in the domains of the Housing sector.

Promoter Remuneration – The total remuneration to KMP for FY24 amounted to INR 4.05 Cr. Total KMP remuneration as % of PAT amounted to ~1.6% in FY24.

Related Party Transactions – India Shelter Finance Corporation Ltd had no significant related party transactions in FY24.

Contingent Liabilities – According to the annual report for FY24, the total amount of contingent liabilities amounts to ~INR 6.7 Cr, related to income and service tax.

India Shelter Finance Corporation Ltd Financial Performance

India Shelter Finance Corporation Ltd is a relatively young business in a young sector. While historical financials are important to study, there is no indication of what can transpire in the future, especially as scale improves from here.

Nevertheless, the historical financials indicate that the business is on the right path and that the story is credible –

- Initial investments into building branch and underwriting infrastructure kept operating costs high

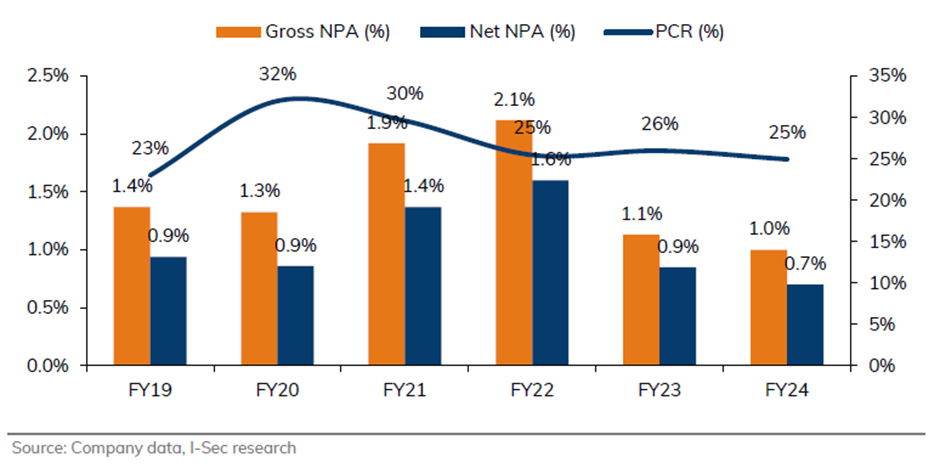

- While the spread & NIM profile were always healthy, higher Opex kept ROA depressed till the business crossed the threshold of 2,000 Cr AUM. Improvement in ROA & ROE has been excellent from FY22 as the management team brought the NPA profile under control and continued to grow the business at an excellent rate

- Leverage has been kept within a reasonable limit, as the spread offers the possibility of building a highly profitable business without excessive leverage. Many large banks have been operating at a leverage of > 7x since their NIM profile is much lower, though the cost of funds is way lower than a HFC business model.

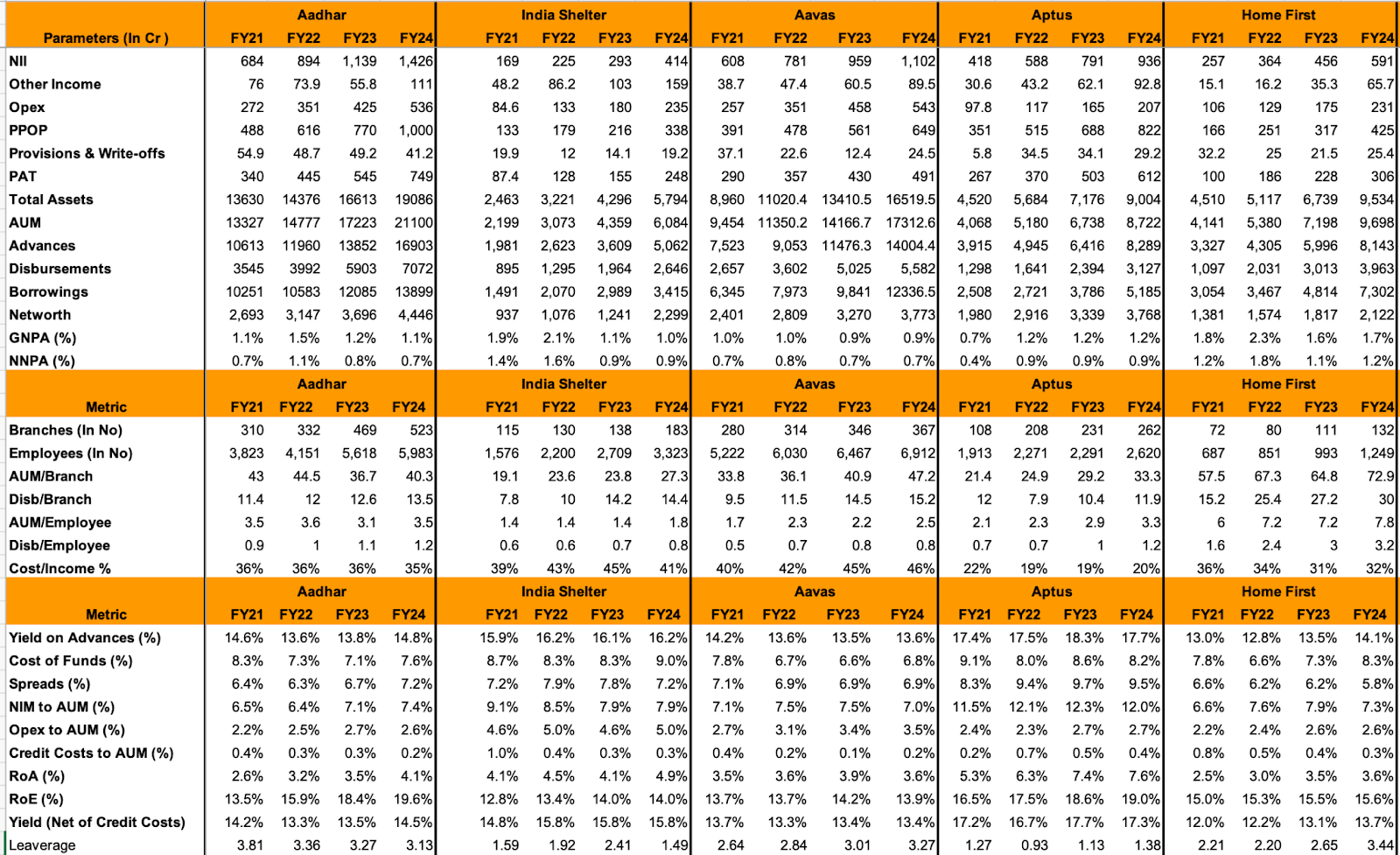

India Shelter Finance Corporation Ltd Comparative Analysis

To understand India Shelter Finance Corporation Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparing to India Shelter Finance Corporation Ltd its competitors (peer comparison), comparing a benchmark index, and comparing sector performance.

India Shelter Finance Corporation Ltd Peer Comparison

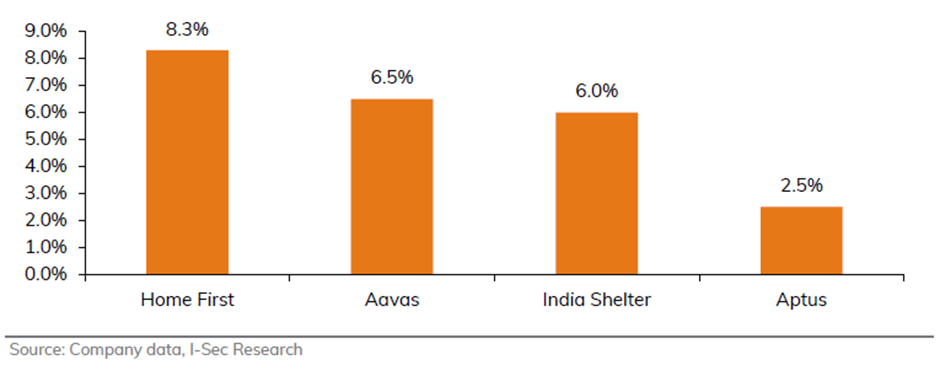

The closest peers of India Shelter Finance Corporation Ltd in terms of lending profile seem to be Home First Finance Ltd, Aptus Value Housing Finance India Ltd, AAVAS Financiers Ltd, and Aadhar. All of them posted 15 %+ 3 years AUM CAGR, while India Shelter Finance Corporation Ltd has shown strong growth at 42% 3 years AUM CAGR.

Aptus Value Housing Finance India Ltd has the highest yield at 17.7% for FY24, AAVAS Financiers Ltd and Home First Finance Ltd have moderate yields at 15% and 13.60%, India Shelter Finance Corporation Ltd second highest at 16.2%.

All five players have a similar 6-9% range of cost of funds. AAVAS Financiers Ltd has the best asset quality, with the lowest GNPA of 0.94% and NNPA of 0.7%, indicating strong risk management and healthy loan performance. In contrast, India Shelter Finance Corporation Ltd is slightly higher at 1% GNPA and NNPA at 0.9%. Home first has the highest at 1.7% GNPA and NNPA 1.2%.

Aptus Value Housing Finance India Ltd outperforms in return ratios with the highest ROA (8%) and ROE (19%), while India Shelter Finance Corporation Ltd is similar in line with ROE at 19% and a lower ROA of 5%.

In FY24, AAVAS Financiers Ltd had the most extensive network with 367 branches and 6,912 employees. Indian Shelter Finance Corporation Ltd has a setup with 183 branches and 3023 employees.

India Shelter Finance Corporation Ltd and Aadhar Housing finance have steadily increased their exposure to non-salaried borrowers, with India Shelter Finance Corporation Ltd reaching a high of 72% in FY24, helped business model geared toward higher-yield, self-employed customers. This contrasts with Home First, which has progressively shifted toward salaried customers to 68% in FY24, indicating a focus on lower-risk, more predictable income profiles.

In terms of product mix, companies like Home First and Aavas maintain a strong emphasis on home loans, with Home First consistently above 85% over the years. Meanwhile, India Shelter Finance Corporation Ltd continues to allocate a substantial portion of its book (42–45%) to Loan Against Property (LAP)—a higher-risk, higher-yield product. On the distribution front, there’s a distinct divergence as well: India Shelter Finance Corporation Ltd, Aavas, and Aptus now rely almost entirely on in-house sourcing, which can improve loan quality and cost efficiency over time

State-wise AUM distribution for four housing finance companies—Aadhar, India Shelter Finance Corporation Ltd, Aptus, and Home First—along with the branch distribution percentage of Aavas. Aadhar has a well spread AUM across major states like Maharashtra, 14%, Uttar Pradesh, 13,% and Rajasthan, 13.1%. India Shelter Finance Corporation Ltd has its highest exposure in Rajasthan (31.1%) and Maharashtra (16.9%). Aptus is highly concentrated in Andhra Pradesh (42%) and Tamil Nadu (34%), clearly a regional play. Home First has a big presence in Gujarat (29.8%) and Maharashtra (13.3%). Aavas has a wide spread, with major presence in Rajasthan (29.3%) and Madhya Pradesh (13.7%), as per its regional expansion plan. Overall Aptus and Home First are more regional, while Aadhar and Aavas are more balanced across multiple states.

India Shelter Finance Corporation Ltd Index Comparison

India Shelter Finance Corporation Ltd share performance vs S&P BSE Small cap Index as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why You Should Consider Investing in India Shelter Finance Corporation Ltd

Strong Growth Outlook Ahead of Industry Average – Healthy growth rate of > 1.5x the industry growth rate of 15% p.a. over the next 3–5 years. Management guidance is at 30–35% p.a. growth over the next few years.

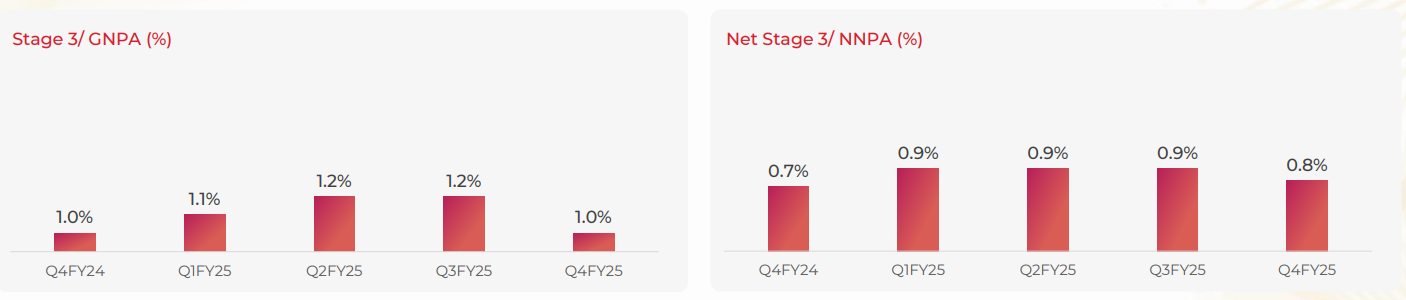

Stable Asset Quality with Controlled Credit Cost – Asset quality is likely to stay good, and the business is unlikely to exceed the high credit cost years of FY21 and FY22. Credit cost is likely to stay in the range of 0.4–0.5% of the book.

Operating Leverage to Improve Cost Efficiency – Cost to cost-to-income ratio is expected to steadily trend lower over the next 3–5 years. Opex to AUM has improvement potential of 75–100bps over the next few years as the business scales past the 10,000 Cr mark on advances.

Limited Upside in NIM Despite Potential Fluctuations – Further sustained improvement in NIM is unlikely, though there can be quarters where there is sequential improvement.

Expanding Geographical Reach to Reduce Concentration Risk

Geographical diversification across customer segments is expected to bring down the Top 3 states’ weightage well below the current level of ~60%.

Credit Rating Upgrade to Support Cost of Funds Reduction – Credit rating improvement to play out over the next 3 years. The business was upgraded to AA in August 2024 from A+. Cost of funds should see an improvement over the next few years.

What are the Risks of Investing in India Shelter Finance Corporation Ltd

Regulatory Pressure Likely to Impact NIMs Over Time – Lending continues to be a highly regulated business where the RBI wants high-yield lenders to bring down lending rates over time. There is every possibility that the regulator may push HFCs to operate at lower NIMs as the scale of business grows at a high rate.

Sustaining High Growth May Require Strategic Shifts – It is very difficult to sustain a high growth rate without moving away from the current growth template; at some point in time, the business will have to look at newer verticals, which could increase the risk compared to the current level.

Intensifying Bank Competition Could Pressure Yields and Growth – Large Banks becoming aggressive in the core areas of HFCs could lead to higher competition, lower yields and lower growth rates & valuation eventually. Though we assign this a low probability over the next 5 years, a tangible slowdown in growth rates will need to be treated with high seriousness. Banks have become aggressive on gold loans in the past 24 months, this situation may eventually play out in the AHFC segment too.

Delayed Rural Revival May Affect Sector Valuations – There are hopes of a rural and semi-urban India revival in FY26, especially on the back of the election spending of FY25 and higher cash handouts as a government policy since FY24. If this improvement fails to materialize for whatever reason, the valuation multiple accorded to HFCs may suffer going forward.

Global Macroeconomic Volatility a Key Risk to Profitability – The current macro volatility at a global level may percolate into Indian interest rates if the US Govt loses control of the bond markets. Interest rate volatility when a good chunk of the current advances is at fixed rates can lead to a sudden drop in profitability for lenders.

Promoter Sell-Off Risk Remains Elevated in PE-Owned HFCs – The promoter coming to the market with a bulk sell order is always a possibility in PE-owned companies, especially when the global macro environment is hazy. Many AHFCs are owned by PE companies (Aptus, Home First, Aadhaar, Aavas, India Shelter), and the entire segment has this risk at any point of time. This risk is higher for India Shelter Finance & Aadhar Housing Finance since they listed only recently.

India Shelter Finance Corporation Ltd Future Outlook

India Shelter Finance Corporation Ltd aims for to reach an AUM size of INR 30,000 Cr implying a >25% CAGR till FY30 with RoE of >17%. It plans to add 40–45 new branches every year to take the total branch count to ~500 by FY30, from the current level of 265. While pursuing Vision 2030, it would continue to follow the same strategy of focusing on the high-yielding self-employed segment (~75% of its customer base) in Tier 2/3 cities (~91% of customers in these markets), maintain credit cost at 40–50bps, spread at ~6% and cost/asset at 4% vs. 4.6% currently.

India Shelter Finance Corporation Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time, price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers, we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

India Shelter Finance Corporation Ltd Price charts

Since the India Shelter Finance Corporation Ltd stock has a trading history of only ~1 year, we will only be looking at the daily chart.

On a Daily Chart, positioning in India Shelter Finance is very strong as the stock has made a new ATH while the rest of the market has been struggling. Fundamentally the business has been the fastest grower and the valuation multiple (Price to Book) still falls within the reasonable range

India Shelter Finance Corporation Ltd Latest Result, News, and Updates

India Shelter Finance Corporation Ltd Quarterly Results

India Shelter Finance continued its run of good quarterly results in the recently announced Q4 FY25 results. Disbursement rose 25% YoY and 6% QoQ while AUM rose 35% YoY and 7% QoQ to 8,189 Cr. PAT rose 39% YoY to 108 Cr in Q4 FY25 and to 378 Cr in FY25. Asset quality improved marginally QoQ, GNPA fell from 1.2% in Q3 FY25 to 1% in Q4 FY25

Management guidance of ~30% growth in AUM over the medium term continues.

Credit costs are expected to stay within a healthy range as guided.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this to a general audience. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will continue/be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.

Disclosure – The stock is currently (May 2025) part of one of our research offerings, our view may be biased for this reason. Please do an independent evaluation of the business and do not depend only on this note for initiating/closing out positions.