Vishnu Chemicals Ltd is a niche chemical company which manufactures Chromium and Barium chemicals. Vishnu Chemicals Ltd has established presence in the domestic and international market. Vishnu Chemicals Ltd has presence in 50+ countries and sells majorly in markets including Brazil, USA, Mexico, South Korea, Italy, Germany, Australia, Bangladesh, Argentina and Egypt among others.

The extent to which Chromium and Barium chemicals are used in the production of everyday products and are a critical ingredient across the pharmaceuticals, consumers, industrial sector and building material segment. We believe Vishnu Chemicals Ltd appears well-positioned to deliver sustained growth over the next few years, backed by its market leadership, integrated operations and continuous efforts to diversify its product portfolio.

Vishnu Chemicals Ltd Company Summary

Incorporated as Vishnu Chemicals Pvt Ltd in 1989 and commenced its business as a manufacturer of chromium based specialty chemicals in the year 1990. Vishnu acquired a Bhilai-based peer company: Keystone Industries Ltd in 1999. Pursuant to the scheme of amalgamation between erstwhile Keystone Industries Limited and Vishnu Chemicals Private Limited in FY05, it was listed in India. Subsequently, the name of the Company was changed to Vishnu Chemicals Ltd with effect from January 2, 2006.

In fiscal 2016, Vishnu Chemicals Ltd acquired the entire shareholding of Solvay Vishnu Barium Private Limited from Solvay group (Belgium Chemical Group) and it became a wholly owned subsidiary of Vishnu Chemicals Ltd, subsequent to which its name was changed to Vishnu Barium Private Limited.

With Vishnu Chemicals Ltd established track record of operations of three decades, they have established a market position of being a preferred vendor for global customers in some of key products across chromium and barium chemicals.

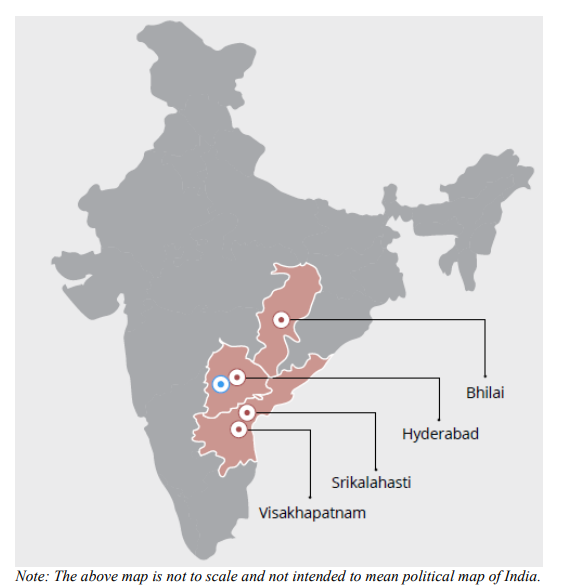

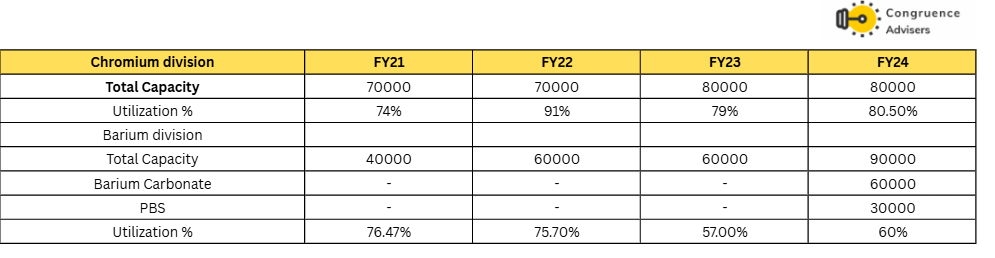

Over the years Vishnu Chemicals Ltd has both backward and forward integrated and Its product portfolio comprises 10 primary and derivative products having over 12 application industries across various industries in India and globally. Serving over 12 industries in more than 50 countries, Vishnu Chemicals Ltd operates four manufacturing units: one in Telangana, two in Andhra Pradesh, and one in Chhattisgarh, with a combined capacity of 170ktpa (80ktpa for chromium and 90ktpa for barium).

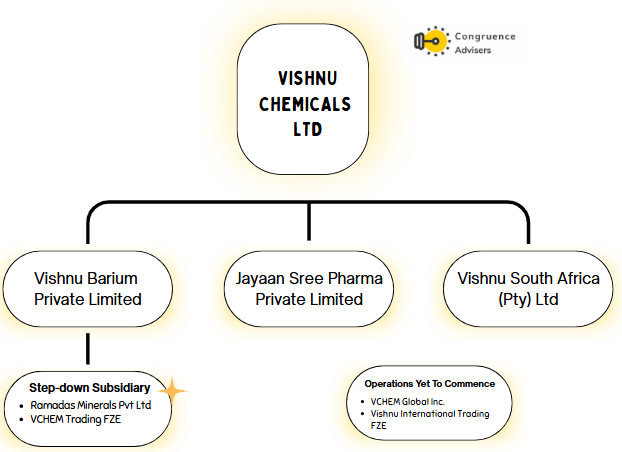

Vishnu Chemicals Ltd Company Structure

Vishnu Chemicals Ltd primarily operates through its flagship entity for the production and sale of chromium chemicals. For its barium chemicals business, it operates through a wholly owned subsidiary, Vishnu Barium Private Limited. To support backward integration for the barium segment, Vishnu Barium also holds step-down subsidiaries, namely Ramadas Minerals Pvt Ltd.

In recent strategic moves, Vishnu Chemicals Ltd has expanded its footprint through new ventures and acquisitions. It has acquired Jayaan Sree Pharma Pvt Ltd as part of its entry into strontium-based chemistry. Additionally, the incorporation of Vishnu South Africa (Pty) Ltd for backward integration into chrome mining operations in South Africa.

Vishnu Chemicals Ltd has also established a few entities i.e VCHEM Global Inc. and Vishnu International Trading FZE whose operations are yet to commence.

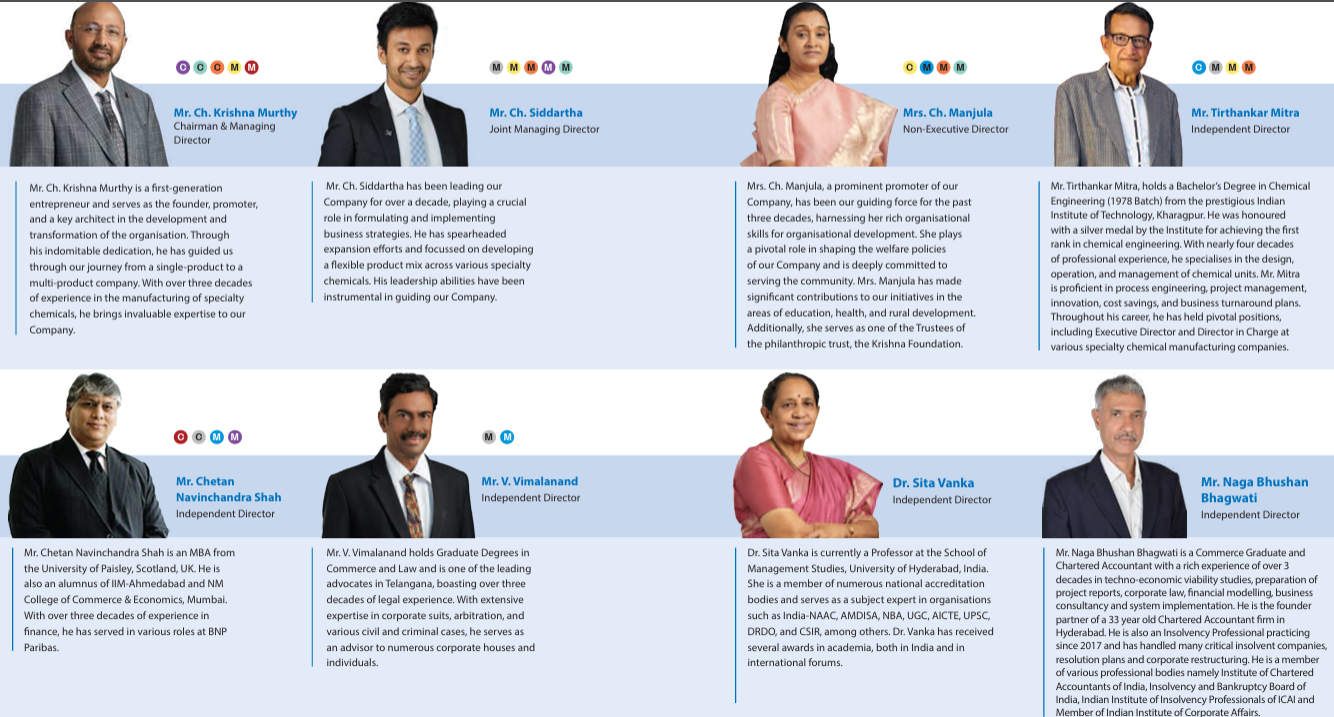

Vishnu Chemicals Ltd Management Details

Vishnu Chemicals Ltd is a promoter run and promoter driven company. Vishnu Chemicals Ltd is led by Mr. Krishna Murthy Cherukuri, a technocrat and first-generation entrepreneur who serves as Chairman and Managing Director. As the founder and driving force behind Vishnu Chemicals Ltd, Mr. Cherukuri has played a pivotal role in Vishnu Chemicals Ltd’s evolution from a single-product business to a diversified specialty chemicals manufacturer. With over 30 years of experience in the industry, he brings deep domain expertise and strategic vision to the organisation.

Mr. Siddartha Cherukuri, son of Mr. Krishna Murthy, holds the position of Joint Managing Director. With over a decade of leadership experience at Vishnu Chemicals, he has been instrumental in formulating and executing growth strategies. Under his leadership, Vishnu Chemicals Ltd has expanded its footprint and diversified its product portfolio across various specialty chemical segments.

The promoter group’s commitment is reflected in continued financial support and strategic leadership. They have pledged a portion of their shareholding and extended personal guarantees to facilitate business expansion. Also, in the past, the promoters voluntarily chose to forego their entitled preference dividends entirely in FY20 and FY21 and partially in other years. This reflects their long-term orientation and deep-rooted belief in the future potential of the business.

INDUSTRY

Global Chemical Industry

Global Chemical market is estimated at USD 5,614 Bn in FY24, Expanded at 8–9% CAGR from FY19-FY23, Going Forward growth is expected to remain in the high single digits at 7-8%. China accounts for 40%+ share in the global chemical space, followed by the US and the EU at 13-15% each (but declining). India accounts for 4% share and is expected to go up significantly, as derisking of the global supply chain continues.

Since the past few decades, China has become a behemoth in global manufacturing. Its chemical production capacity rose 8-fold post 2000. However, over the past few years, due to increasing environmental compliance of chemical facilities, trade war with the US and, recently, COVID-19 supply chain issues, global companies are adopting the ‘China+1’ strategy. With supply chain disruption and uncertainty in China, global players are looking at diversifying their sourcing and India offers a strong alternative with comparable scale, technology, raw materials and supportive government policies.

After a sharp jump in global commodity prices over CY21-22, global chemical prices have fallen sharply over CY23-24 but have largely stabilized over the past six months, possibly due to the impending cost curve. Given China’s aggressive capacity additions historically and pricing strategy, Chemical prices are expected to be largely range bound over the next two to three years, as underutilized capacities will see a pick-up in production on every price increase.

India Chemical Industry

Indian Chemical market is estimated at USD 220 Bn in FY24, Expanded at 10-12% CAGR from FY19-FY24, Going Forward Indian Chemical market is projected to reach 300 Bn by FY28

Unlike China where most growth has been driven at the cost of margin, balance sheet. India growth was better vs Chinese and European peers led by disciplined capacity expansion over the past decade largely funded with internal accruals and stable working capital Along with focus on Specialized chemistries, capital efficiency, lower labour costs and strong engineering capabilities.

The Indian chemical sector saw a dream run through FY17-22 when it rallied at 48% CAGR against Nifty’s 14% and Nifty 500’s 13% rise in the same period. However, over the last couple of years, the sector has come under pressure and has seen a sharp correction. This has been mainly due to:

(a) global customers reducing inventory levels (channel destocking),

(b) higher raw material costs coupled with weaker pricing power due to the destocking trend

(c) increased freight costs driven by global supply chain disruptions.

(d) China Dumping

Indian players are expanding their R&D teams, as they expand into new chemistries and products, expanding their addressable market.

Overall, the Indian chemical sector is poised for continued growth, driven by a combination of favorable market conditions, government support, and technological advancements. While challenges exist, the industry is well-positioned to capitalize on opportunities and become a major global player.

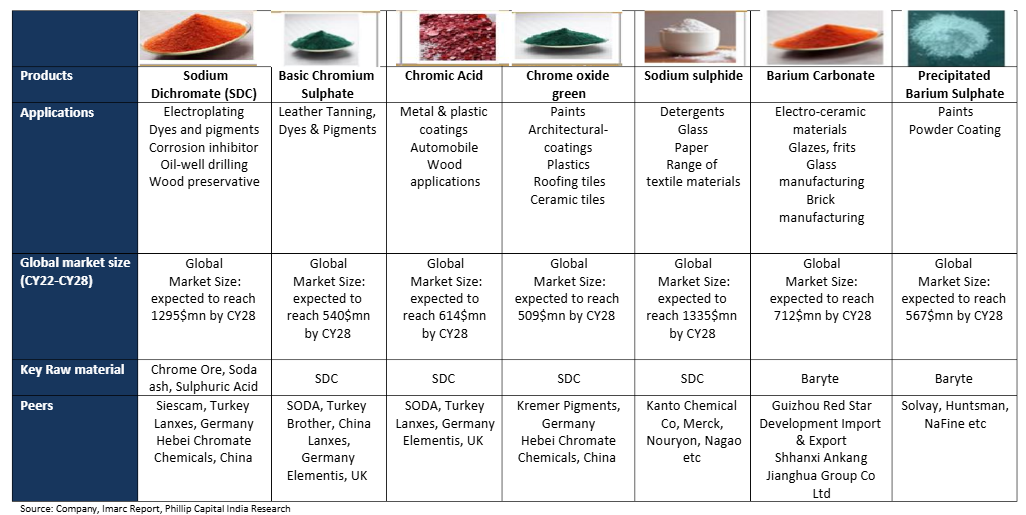

Vishnu Chemicals Ltd Product Market Size

The Chromium chemical industry consists of four major products; viz, Sodium Dichromate having a current market size of US$ 912 million, Chromic Acid having a current market size of US$ 476 million, Chrome Oxide Green having a current market size of US$ 379 million and Chrome Sulphate having a current market size of US$ 425 million. These products are expected to grow at a CAGR of 6.0%, 4.3%, 5.0% and 4.0%, respectively between 2022-2028.

Barium Carbonate current market size is US$ 503 million and is expected to grow at a CAGR of 6.0% between 2022-2028. Further, precipitated barium sulphate has a current market size of US$ 429 million and is expected to grow at a CAGR of 4.7% between 2022-2028.

Our Take on Chemical Sector

Our big learning from investing in the chemical sector is that there are very few secular plays here that can deliver healthy growth at 20%+ ROCE over the medium term. There are just too many moving parts, too many things that can go wrong in a hyper competitive industry with one clear big daddy – China. Most of the businesses here are tactical investments where one plays the cycle right, pockets profits and moves onto something more predictable.

At gross asset turns < 2x and EBITDA margin less than 20% for most businesses, a working capital cycle in excess of 90 days will always keep ROCE below 18% across a full cycle. Tracking the RM and finished goods prices on a quarterly basis is just too much of a hassle for the average investor, especially with institutions having this database in place. There simply is no edge in such a sector for a retail investor, unless one has done real in depth work and understands the business segments well enough.

In this context, Vishnu Chemicals stands out due to its business model of focusing on niche areas where margin volatility over the past decade has been minimal even in the face of large supply chain dislocations since 2016. The business model has also seen low disruption from the big daddy of the chemicals sector – China due to the geographies from where the raw materials of the business are sourced.

The business has been printing an operating margin of 15%+ reliably over the entire cycle from 2015-24, which prompted us to take a deeper look at this business.

Vishnu Chemicals Ltd Business Details

Vishnu Chemicals Ltd business is divided into two major product categories :

(1) Chromium Chemicals

(2) Barium Chemicals (through our wholly owned Subsidiary, Vishnu Barium Private Limited).

(3) Strontium carbonate – Upcoming product

Chromium Chemicals

Most people are familiar with chrome as an alloying element in stainless steel, but since the discovery of chrome ore in 1798, chrome has also been widely used in the chemical, leather tanning, and pigment industries. The principal product containing chrome in the chemical industry is sodium dichromate, which is used both as a feed material for the production of other chrome chemicals, and as a process material for the surface treatment of metals. Chemicals made from sodium dichromate and which, along with sodium dichromate, are industrial products, include chromic acid, chrome oxide, and potassium dichromate. The uses of chrome chemical products are quite diverse and include metal finishing, leather tanning, pigment production, wood preservation, and chrome metal.

Chromium chemicals are highly valued due to properties such as high corrosion resistance, vibrant colour, uniformity, durability, resilience to extreme temperatures, lustrous appearance, and low coefficiency against friction. They play a pivotal role in improving both the aesthetics and durability of various products, thereby improving the performance and life of industrial components, timber treatment, pharmaceuticals, pigments and dyes.

The global Chromium Chemicals in terms of sodium dichromate market is estimated at approximately 800,000 metric tons, growing steadily at a CAGR of 3–6%. Vishnu Chemicals Ltd, with an annual capacity of 80,000 metric tons, currently holds a global market share of about 8–10%. Within India, Vishnu Chemicals Ltd commands a market share of 50-60% market share in chromium chemicals. Chromium chemical manufacturers are predominantly located in countries with abundant chrome ore reserves—namely South Africa, Kazakhstan, Turkey, and India. Vishnu Chemicals Ltd aims to expand this share to 12–13% over the next 3–4 years, driven by capacity expansion and increased penetration in key export markets.

Vishnu Chemicals Ltd manufactures a variety of chromium-based chemicals with sodium dichromate being the primary product which largely finds application in industries such as pharmaceuticals, pigments & dyes and to manufacture other chromium chemicals, which are derivatives of sodium dichromate.

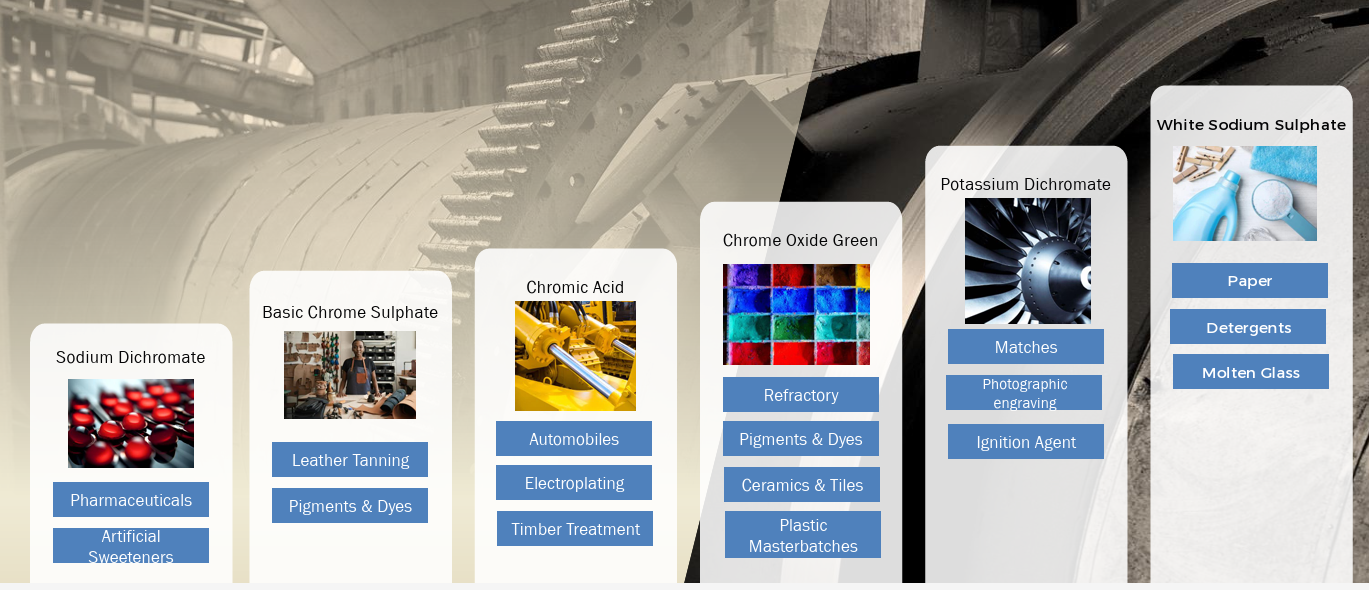

Chromium Chemicals Products

Sodium Dichromate – Also known as bichromate of soda, disodium dichromate, or sodium dichromate (VI), is an inorganic compound and is a source in preparing chromium based derivatives and has various applications such as screen printing & photographic engraving, Electroplating, Pyrotechnics and explosives, Pigment preparation like chrome oxide green and lead chromate, wood preservative for protection from termites and fungi and Metal treating and as a corrosion inhibitor.

End Use of Sodium Dichromate – largely used for producing chromium derivatives 60%, Pharma 18%, Pigments & Dies 14% and other at 4%

In CY23, China accounted for the largest share of global SDC consumption at 45%, Eurasia at 20%, while both North America and South Asia at 8%. Western Europe at 5% of the and Eastern Europe, Central/South America, and the Middle East/Africa at 2%. Japan and other at 1% share.

Basic Chromium Sulphate – Chromium Sulphate is mainly used for tanning and processing in the leather industry and for synthesis of other chromium based re-tanning agents and production of chromic compounds. It is also used in dyeing of khaki cloth and in manufacture of chrome-based dyestuffs.

In CY23, South America led the consumption with a 27% share, China at 22%, Asia Pacific at 21%. Europe at 11%, North America at 7%. Both Turkey and Africa & ME at 6% each.

Chromic Acid – Chromic Acid is an intermediate in chromium plating and is also used in ceramic glazes, and colored glass. It can be used to clean laboratory glass ware, particularly of otherwise insoluble organic residues. Chromic Acid has also been widely used in the band instrument repair industry, due to its ability to “brighten” raw brass. It is also used as a wood preservative and as a strong oxidizing agent finding application in organic synthesis and for preparation of other chrome chemicals of analytical grades.

End Use – 80.3% of chromic acid was used for metal plating, Wood preservatives accounted for 14.9%, while others made up 4.8%.

In CY23, China accounted for 36% consumption, North America and Asia Pacific at 19%,

Europe at 13%, South America 8%, Africa & ME 4% and Turkey at 1%.

Chrome Oxide Green – Chrome Oxide is an inorganic compound with an additional chromium molecule, along with chromium trioxide and is used as an ingredient in the refractories and brake linings and as a raw material for the manufacture of chromium metal. It is a green-colored pigment that is used in a wide range of applications, including ceramics, plastics, coatings, and paints. Due to its durability and weather-resistance properties, it is used in industrial paints and automotive coatings (largely Defence).

End Use – 66.1% of chrome oxide green is used in pigments, Ceramics account for 15.7%, and others make up 18.2%. North America dominates the global chrome oxide green market with a 60% share, Europe follows with 25%, while Asia Pacific, South America, and Middle East & Africa each hold 5%.

Potassium Dichromate – Potassium Dichromate is used for chromium source in preparing chromium compounds, leather tanning and screen printing, electroplating, pyrotechnics and explosives, pigment preparation, wood preservative, metal treating and corrosion inhibitor, oil drilling & silver testing, catalyst for the chromium metal production, photographic engraving, preparation of “chromic acid”, which can be used for etching materials

Chrome metal – (upcoming product in chromium chemicals)

Vishnu Chemicals Ltd is preparing to enter high-value, import-substitute products such as chrome metal. Chrome metal is a critical material used in defence, aerospace, medical alloys, turbo reactors, nuclear energy, welding electrodes, and other high-performance industries, owing to its non-corrosive properties. India currently imports the entire domestic demand of ~2,000 tonnes per year, mainly from Europe, China, and Russia. With no domestic manufacturer, Vishnu Chemicals Ltd’s entry into this segment would make it the only chrome metal producer in India.

Chrome metal is a derivative of Chromium Oxide Green, which in turn is derived from Sodium Dichromat. So Vishnu Chemicals Ltd is expanding its Sodium Dichromate by 12,000 metric tonnes. Vishnu Chemicals Ltd plans to commence chrome metal production by Q3 FY26, and management expects it to be both value-accretive and margin-enhancing, strengthening the Chromium segment further while improving self-reliance in a critical strategic material for the country.

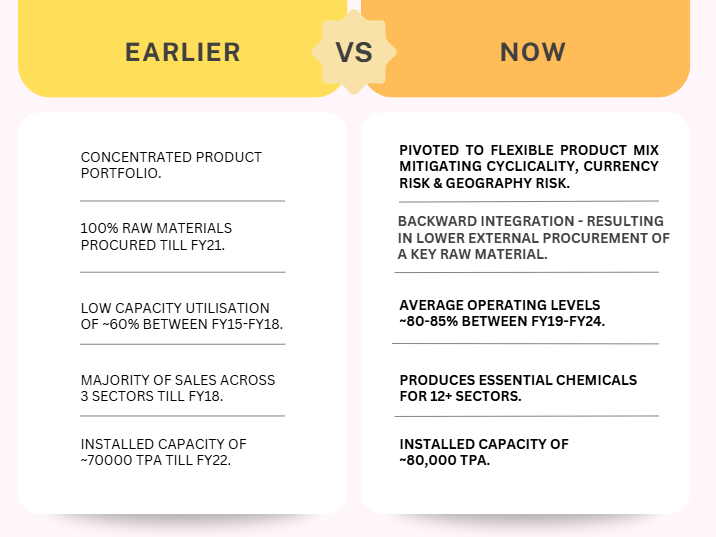

Piviot

Until FY18, Vishnu Chemicals Ltd was primarily focused on two products—Sodium Dichromate and Basic Chromium Sulphate. However, over the past few years, Vishnu Chemicals Ltd has strategically diversified into a broader range of chromium-based derivatives and value-added products. This pivot has allowed Vishnu Chemicals Ltd to expand its customer base, reduce product concentration risk, and mitigate cyclicality linked to end-user industries.

Today, Vishnu Chemicals Ltd is present across the entire Chromium Chemicals value chain and continues to be one of India’s largest integrated producers in this space. Through this expansion, the company has emerged as one of the top 3–4 global players in the Chromium Chemicals space

Vishnu Chemicals Ltd manufactures nearly 90% of global products in the Chromium chemicals chain, although margins and realizations vary across the portfolio.

In the domestic market,Vishnu Chemicals Ltd already commands over 50% market share across most of its product categories and aims to further consolidate its leadership position. Internationally, Vishnu Chemicals Ltd is strategically focused on becoming the leading global producer of Sodium Dichromate over the medium term.

Backward integration

Soda Ash Plant

Key raw materials for Vishnu Chemicals Ltd’s chromium chemicals business include chrome ore, soda ash, and sulphuric acid. Vishnu Chemicals Ltd imports chrome ore from South Africa through 6–12 month contracts and sources soda ash both domestically and internationally.

Rising soda ash prices post FY18 has led the management to pursue backward integration to enhance cost efficiency and de-risk input volatility. As part of this strategy, Vishnu Chemicals Ltd commissioned its in-house soda ash plant in January 2022, with a capital outlay of ₹140 crore. This plant uses carbon dioxide (CO₂) as a feedstock i.e a rare and innovative approach globally. to produce soda ash. Currently, the plant caters to 40–50% of the Vishnu Chemicals Ltd’s internal soda ash requirement.

This initiative has not only strengthened Vishnu Chemicals Ltd’s cost structure, but also contributed significantly to gross margin stability.

Chrome Ore Mine Acquisition

Vishnu Chemicals Ltd has signed a definitive agreement to acquire a chrome ore mine and beneficiation plant in South Africa for USD 10 million on a debt-free, cash-free basis. The mine holds ~10 million metric tons of chrome ore reserves, enough to meet Vishnu Chemicals Ltd’s for the next 30–40 years. current requirement of ~100 KTPA.

Chrome ore accounts for nearly 45% of Vishnu Chemicals Ltd’s input costs, and global prices have remained firm (averaging ~USD 270/t, with current spot prices at USD 350/t).

Under South African law, 26% of the mine must be owned by a local partner. While Vishnu Chemicals Ltd will retain 100% ownership of the processing plant and 74% of the mine.

Operational integration is expected in a phased manner over the next 1–2 years, with approvals and clearances likely to take 2–3 quarters. Once fully integrated, the management expects the mine to cater to 100% of its chrome ore requirement, improving EBITDA% by 200–300 bps due to lower input costs and better operating leverage.

As per management commentary, the beneficiation plant is already in working condition and well-suited to the ore specifications Vishnu Chemicals Ltd currently sources, reducing the commissioning risk and enabling faster ramp-up. Vishnu Chemicals Ltd views this backward integration as a key strategic move to ensure long-term margin sustainability and secure critical raw material amid rising global demand (with global mining at ~40 mmt/year and reserves at ~500 mmt).

We believe this acquisition is expected to materially improve cost competitiveness, especially in the Chromium derivatives business, where Vishnu Chemicals Ltd aims to emerge as the lowest-cost producer globally.

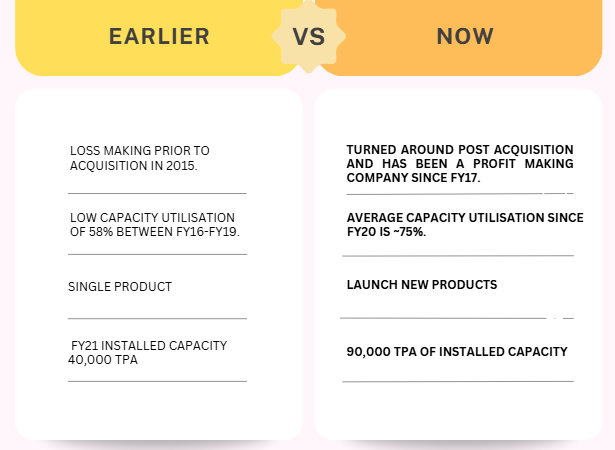

Barium Chemicals

Vishnu Chemicals Ltd initially entered the Barium Chemicals business in May 2001 through a joint venture with Solvay Group. However, after five years of operational losses, Solvay took full control of the business. Vishnu Chemicals Ltd used the proceeds from the exit to establish a greenfield chromium chemicals plant in Vizag.

In July 2015, Vishnu Chemicals Ltd reacquired 100% stake in the Barium entity, which now operates as Vishnu Barium Private Ltd (VBPL), a wholly-owned subsidiary. Since then, the company has executed a strong turnaround strategy, significantly improving profitability by increasing the export share from 15% in FY16 to 50% in FY24, thereby enhancing scale, margin profile, and diversification of end markets.

Vishnu Chemicals Ltd started with barium carbonate and expanded its product portfolio to manufacture Precipitated Barium Sulfate (import substitution product) in Q2FY24, with a capacity of 30ktpa. The capex was completed in 15 months. Vishnu Chemicals Ltd total capacity stands at 90ktpa across barium chemistry.

Vishnu Chemicals Ltd currently commands a ~40% market share in the Barium Chemicals segment.

Vishnu Barium Private Ltd is strategically focused on two key products both of which cater to distinct end-user segments. I.e Barium Carbonate and Precipitated Barium Sulfate (PBS)

Barium Carbonate – Barium carbonate, a white crystalline powder is odorless and water insoluble compound, which naturally occurs as the mineral witherite, found in hydrothermal veins and as a secondary mineral in certain sedimentary rocks. It is also formed as a byproduct of the mining and refining of ores, such as lead and zinc.

Barium Carbonate, primarily used in glass, ceramics, tiles, building materials, bricks, water treatment, and the caustic soda industry, is a well-established product for Vishnu Barium Private Ltd. Also, it is used in further downstream barium compounds like barium chloride, barium nitrate, barium sulfate, and other barium salts

Barium carbonate global market is estimated at 1mmt as of FY22, which is expected to grow at 3.5% CAGR Till FY30.

End use – Specialty Glass is the largest application of barium carbonate at 31%, Bricks & Tiles at 26.5%, Chemical Compounds at 14.5%. Glazes & Enamels account for 10.3%, and ElectroCeramic Material for 8.8%. The Caustic Soda Industry uses 5.3%, while Others make up 3.7%.

Vishnu Barium Private Ltd is the largest domestic producer with ~40% market share and has recently gained traction in international markets like the U.S. (capitalizing on supply disruptions from a competitor). Vishnu Chemicals Ltd expects to maintain strong volumes here, supported by customer stickiness and rising exports.

Precipitated Barium Sulfate – Precipitated Barium Sulfate, on the other hand, is a high-performance filler used in powder coatings, paints, and lead-acid batteries. Vishnu Chemicals Ltd is the sole domestic manufacturer, with its market share rising from 15% to 30% in FY24, driven by strong import substitution and approvals from major MNCs and mid-sized powder coating companies. Vishnu Chemicals Ltd plans to gradually expand exports.

Precipitated barium sulfate is substituting titanium dioxide as Precipitated barium sulfate is half the price of TiO2. Currently, only few customers are using this route due to technological challenges and availability concerns.

Precipitated Barium Sulfate has the highest EBITDA% (almost 2x) compared to core business.

End Use – Paints & Coatings at 70.2%, Plastic at 23.4%, Ink Pigment 3.2% and paper at 1%.

Precipitated Barium Sulfate global market is estimated at ~700ktpa as of FY22, which is expected to grow at 3.6% CAGR Till FY30E. China is the largest exporter of PBS at ~120-140ktpa. With domestic demand for PBS growing at ~15% CAGR, and India’s annual consumption doubling from 15,000 tons in 2018 to ~30,000 tons today, Vishnu Barium Private Ltd is already operating at ~80% utilization and is preparing to double PBS capacity from 30 KTPA to ~60 KTPA by FY27.

Despite current headwinds in the global construction and building materials sector key end-use markets for Barium chemicals. Vishnu Chemicals Ltd has strategically entered into newer territories vs FY24 and now they have started marketing more in developed countries. Which will support volume stability and gradual improvement in realizations over the medium term.

Furthermore,Vishnu Chemicals Ltd is actively exploring value-added opportunities within its Barium portfolio with development of an organic solvent-based product that could open up new end-use applications. As this is very early stage management has restrained from giving further details

Backward Integration in Barium Chemicals

Vishnu Chemicals Ltd has acquired Ramadas Minerals Pvt Ltd in FY24 for 26 Cr. Ramadas operates a barite beneficiation plant located in Srikalahasti, Andhra Pradesh, in close proximity to Vishnu Barium Private Ltd’s own Barium Chemicals manufacturing unit. Which lead to logistics advantage between the raw material source, beneficiation facility, and the final production plant.

Barite is a critical raw material for manufacturing barium-based compounds such as Barium Carbonate and Precipitated Barium Sulfate. At optimal plant utilization, Vishnu Chemicals Ltd requires ~130,000–140,000 MTPA of barite. Ramadas’s beneficiation plant is expected to cater to approximately 30–35% of this requirement. While the plant does not extract barite directly, it converts lower-grade barite feedstock into higher-grade material which is sourced from the mine that is owned by the state government

This in-house beneficiation capability has already started delivering economic benefits. As of January 2025, the company had recovered nearly 40% of its investment in Ramadas Minerals within just five quarters of acquisition. The remaining investment is expected to be recouped within 2.5 years from the transaction date, implying a strong internal rate of return.

Strategically, this acquisition marks a key step in backward integration for the Barium business. It enhances raw material security, lowers input costs, and improves consistency and quality of feedstock. In addition, since the beneficiation plant was already operational at the time of acquisition, the company avoided significant time and capital expenditure that would have been involved in setting up a greenfield facility. The move also reduces exposure to fluctuations in barite prices and supports long-term operating margins.

Strontium Chemistry – New Product Foray

Vishnu Chemicals Ltd has announced its strategic foray into Strontium Chemistry through the acquisition of Jayansree Pharma, an inorganic chemicals manufacturing company. The acquisition was executed at an enterprise value of ₹52 Cr, which has led to gross block addition of ₹80 Cr and net block of ₹50 Cr, making it a value-accretive inorganic expansion. The acquired unit will be used to manufacture Strontium Carbonate, which is a chemistry where Vishnu Chemicals Ltd has already built sufficient expertise i.e to convert minerals coming out from the planet into different chemicals.

Strontium Carbonate, derived from the mineral Celestite, has a global demand of approximately 250,000 tonnes and caters to high-growth sectors such as electronics, ferrites (used in EVs and motors), magnets, and the ceramics industry. Importantly, it is a complete import substitute in India, with no domestic production currently, and is largely sourced from Mexico and Germany, which together account for over 75% of Indian imports. Commercial production is expected to commence in Q1 FY26, following necessary upgrades to plant and equipment.

At peak capacity of 10,000 tonnes, Vishnu Chemicals Ltd expects to generate revenues of ₹140–150 Cr annually from this segment within two years of commencement. The Strontium product line will further diversify the Vishnu Chemicals Ltd ’s inorganic chemicals portfolio and leverage its existing market presence in ceramics and specialty chemical applications.

Vishnu Chemical Ltd Manufacturing Plants

Vishnu Chemicals Ltd has four integrated and strategically located manufacturing facilities in India, situated at (1) Visakhapatnam, Andhra Pradesh (2) Bhilai, Chhattisgarh (3) Hyderabad, Telangana, and (4) Srikalahasti, Andhra Pradesh (owned by wholly-owned subsidiary, Vishnu Barium Private Limited).

As of March 31, 2024, Vishnu Chemicals Ltd manufacturing facilities had an installed capacity of 80,000 MT and 90,000 MT for Chromium Chemicals and Barium Chemicals respectively.

Vishnu Chemicals Ltd manufacturing facilities are equipped with modern machinery and equipment which enables Vishnu Chemicals Ltd to undertake various chemistry processes. Vishnu Chemicals Ltd manufacturing facilities are multi-purpose whereby the same plant is able to produce different products to meet customer demand, with significant backward and forward integration linkages, providing Vishnu Chemicals Ltd flexibility to change the product mix to cater to market requirements.

Vishnu Chemicals Ltd Corporate governance

Board Composition – Vishnu Chemicals Ltd’s Board of Directors is composed of 7 members, including 4 independent directors and 2 women directors. They bring together a wealth of experience, diverse expertise, and visionary leadership with backgrounds spanning chemical, technology, finance, Law and management

Related Party Transactions – In FY24, Vishnu Chemicals Ltd reported related party transactions of approx ₹32 Cr which 2.6% of FY24 Sales. A significant portion of this was with Vasantha Transport Corporation, a promoter-owned entity. The nature of transactions involved transportation, hire services, and customs house agent (CHA) services, primarily to support the logistics and supply chain operations of the company. These services are mainly for the movement of raw material and finished goods from the port to the factory and from the factory to the customer site

Contingent Liabilities – According to the annual report of FY24, the total amount of contingent liabilities amounts to 6-7 Cr which is > than 1% of net worth

KMP Remuneration – KMP Remuneration for FY24 is around INR 3.17 Cr vs 2.93 Cr YoY (up 8.2%), which is 3.1% of FY24 net profit

Audit Committee – Independent director chairs the audit committee, While the promoter is part of the audit committee. Having a fully independent audit committee is seen as a better corporate governance practice.

Dividend – Vishnu Chemicals Ltd has shown a consistent commitment to shareholder returns through regular dividend payments since many years. The promoters have shown a shareholder-friendly approach by voluntarily forgoing higher the entire 7% on preference shares resulting in a waiver of ₹5.36 Cr. Similarly, in FY23, promoters opted for a lower rate of 4.5% instead of the entitled 7%, foregoing approximately ₹1.9 crore.

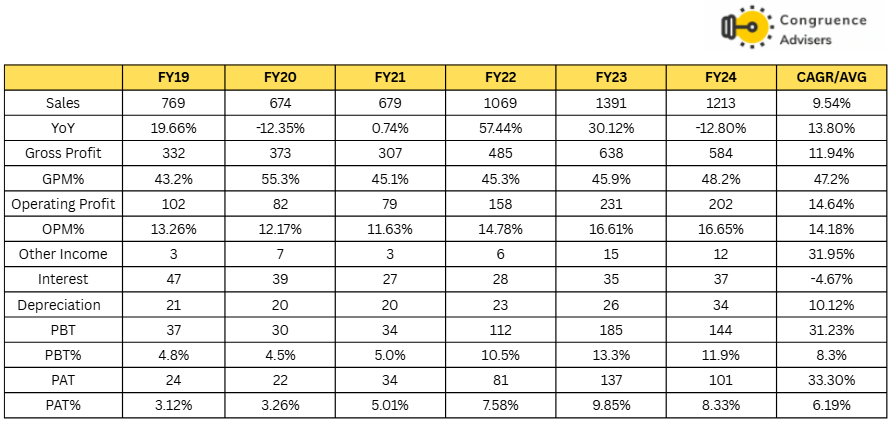

Vishnu Chemicals Ltd Financial Performance

Vishnu chemicals Ltd posted 10% CAGR from FY19-FY24, Vishnu Chemicals Ltd revenue declined in FY24 entirely due to lower realizations led by falling sea freight rates and softening prices for most raw materials. The FY22 and FY23 were clear outlier years marked by surge in demand, raw material inflation and logistics cost escalation.

FY24 was a clear normalization year, where sea freight corrected but demand, especially from export markets, declined considerably. Vishnu chemicals Ltd’s decision to prioritize customer retention over aggressive price hikes helped mitigate volume loss and maintain long-term relationships.

Gross Profit margin & EBITDA margin expansion was driven by disciplined focus across both value addition and backward integration initiatives vs many global peers that experienced sharp margin compression.

Exports account for 50% for Vishnu chemicals Ltd. Exports offer a 3–5% price premium over domestic sales, with U.S. markets offering an even higher premium of 8–9%. However, export sales come with a longer receivables cycle of 45–60 days compared to quicker domestic collections.

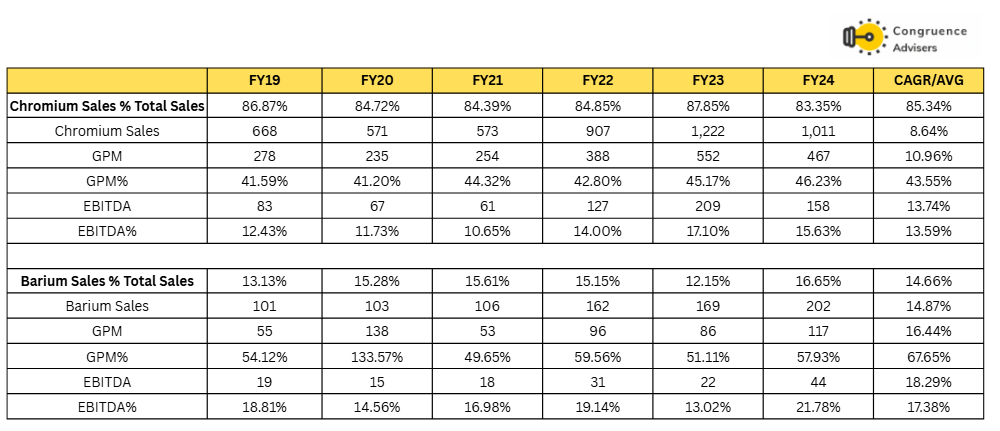

Vishnu Chemicals Ltd Segmental Performance

Chromium chemicals remain Vishnu chemicals Ltd’s core business accounting 85% of total revenue with a CAGR of 8.6% over FY19–24. Despite a dip in FY24 due to lower realizations, EBITDA margins improved to 15.6% supported by better cost controls and backward integration. Capacity utilization has steadily improved to over 80%, and upcoming chrome metal capacity is expected to further aid volume and margin expansion.

The Barium segment has scaled well, with sales growing at a 14.9% CAGR and margins improving significantly to 21.8% in FY24. Backed by backward integration through Ramdas Minerals and robust export demand, the Barium segment has become a high-margin vertical. Recent capacity expansion to 90,000 MTPA, including PBS, positions the segment for sustained growth and operational leverage.

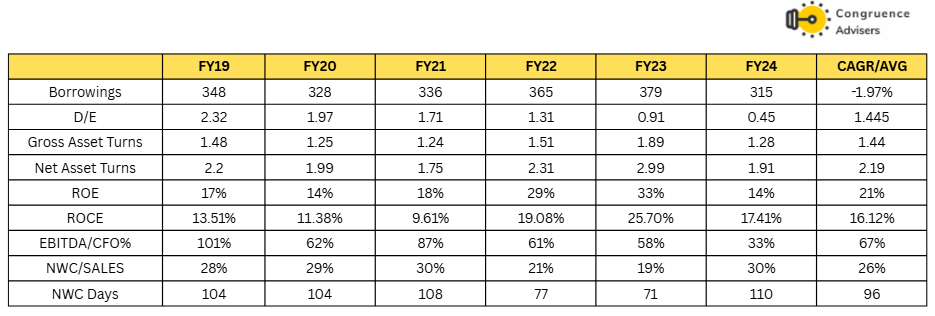

Vishnu Chemicals Ltd Return Ratio, Cash Flow, Working Capital and Debt Analysis

In FY24, Vishnu Chemicals Ltd has improved its balance sheet strength by reducing borrowings by 90 Cr resulting in debt-to-equity at 0.45x. Net working capital days increased to 110 due to higher inventories and receivables expect it normalize to around 90 days. Avg EBITDA/CFO for 5 years at 67% which is good for a chemical company. Both ROE & ROCE in is impacted by subdued performance in FY24

Vishnu Chemicals Ltd invested 120 Cr for capex in FY24 – 53 Cr in Chromium (including capacity expansion and modernization) and 67 Cr in Barium (mainly to upgrade Ramadas Minerals’ plant and commission the PBS facility).

Vishnu Chemicals Ltd Comparative Analysis

To understand Vishnu Chemicals Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Vishnu Chemicals Ltd to its competitors (peer comparison) on various fundamental parameters and Vishnu Chemicals Ltd share performance relative to relevant benchmark and sector indices.

Vishnu Chemicals Ltd Peer Comparison

In the Chromium division, Vishnu Chemicals Ltd operates in a competitive global landscape with peers such as Sisecam (Turkey), Elementis (US), Lanxess (Germany), and Chinese players like Sichuan Yinhe and Hubei Zhenhua.

However, the industry is undergoing significant consolidation. Elementis recently sold its chromium business to Turkey’s Yildirim Group, and Lanxess exited by divesting its South African operations to China’s Brothers Group. Moreover, while Chinese producers are present, they do not pose a major threat as China is a net importer of chromium chemicals.

Barium division, the global market is heavily dominated by China, which controls around 70% of global production due to its abundant barite reserves, low-cost processing, and large domestic demand. China is the largest exporter of barium products, followed by India, with both nations collectively contributing 85–90% of global exports. The Indian PBS market has been historically dependent on Chinese imports, while global markets like the US, Japan, and Brazil also import significant volumes from China. In recent concall vishnu chemical ltd management has mentioned that they don’t see China as a competition even in the barium business now. With the kind of backward integration Vishnu Chemicals Ltd has done with Ramdas Minerals, it gives us a much better position to Vishnu Chemicals Ltd

TABLE

Vishnu Chemicals Ltd Index comparison

Vishnu Chemicals Ltd share performance vs S&P BSE Small cap Index as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why you should consider investing in Vishnu Chemicals Ltd ?

Vishnu Chemicals Ltd offers some compelling reasons to track closely and to consider investing in niche specialty chemicals business

Market Leader in Chromium & Barium Chemicals – Vishnu Chemicals Ltd stands as the largest manufacturer of chromium chemicals in India, commanding a dominant 55–60% market share and 8–10% share globally. In the barium chemicals space, Vishnu Chemicals Ltd 40% market share, making it a key player in both segments. This leadership coupled with an integrated business model and a dynamic product mix, offers investors a high degree of visibility, margin stability, and long-term growth potential.

Diversified Product Portfolio – Over the years, Vishnu Chemicals Ltd has significantly broadened its product portfolio, evolving from just 2 chromium-based products to over 6, with several more currently under development. Similarly, in the barium chemicals segment,Vishnu Chemicals Ltd has expanded from 1 to 3 products, again with additional offerings in the pipeline.

New Product Forway – In FY24, Vishnu Chemicals strategically entered the strontium chemicals space through the acquisition of Jayansree Pharma. Which results in a new revenue stream (Starting from Q1FY26) and will tap into growing demand from sectors like electronics, magnets, ceramics, and electric mobility.

Manufacturing facilities are multi-purpose whereby the same plant is able to produce different products which enables Vishnu Chemicals Ltd to dynamically allocate resources toward higher-margin products based on real-time market demand and pricing trends which ensures margin stability even during cyclical downturns.

Strong Backward and Forward Integration – Vishnu Chemicals Ltd has built a highly integrated value chain, enabling it to optimize costs, ensure raw material security, and operate with high efficiency. All manufacturing units are strategically located close to raw material sources, key customers, or seaports. On the backward integration front, Vishnu Chemicals Ltd has made investments into soda ash plant, Recent acquisition of chrome ore mine in south africa and Ramadas Minerals (barite beneficiation plant). Which will reduce dependence on external vendors, improve feedstock quality and lower input costs. Vishnu Chemicals Ltd has also invested into modernising its facilities to capture flue gases through a unique, in-house developed reverse engineering process and use the recovered element as a raw material for our manufacturing process

On the forward integration side, Vishnu Chemicals Ltd’s diverse product portfolio and flexible manufacturing setup enables it to adjust its product mix based on market trends, improve capacity utilization, and mitigate risks related to cyclicality, currency fluctuations, and geographical demand shifts.

Less hyped stock – Despite being the largest manufacturer of chromium chemicals in India with a 55–60% domestic market share and 8–10% global market share and a 40% market share in barium chemicals, Vishnu Chemicals Ltd remains relatively under the radar compared to other chemical sector stocks that are heavily discussed across social media and retail platforms.

Vishnu Chemicals Ltd can print decent growth with higher EBITDA margins compared to other chemicals plays. For investors looking beyond hype and focusing on fundamentals, Vishnu Chemicals Ltd offers a compelling opportunity.

What are the Risks of Investing in Vishnu Chemicals Ltd ?

Investors need to keep the following risks in mind if they choose to invest into this business. Risks needs to be weighed in combination with the advantages listed above to arrive at a decision that is optimal for your portfolio construct

Exchange Rate Volatility – Vishnu Chemicals Ltd derives approximately 50% of its revenue from exports and it also imports a portion of its key raw materials both of which are exposed to foreign currency fluctuations, particularly the U.S. Dollar and Euro. Although Vishnu Chemicals Ltd uses hedging strategies to partially manage this exposure, sharp currency movements can impact both realization and input costs.

Raw Material Price Volatility – A significant portion of Vishnu Chemicals Ltd’s input costs is linked to commodities such as soda ash, chrome ore, barite, and other key minerals. While Vishnu Chemicals Ltd has made meaningful strides in backward integration including in-house soda ash production and recent ore mine acquisitions. Still a large share of raw materials is still sourced both domestically and internationally.

Although Vishnu Chemicals Ltd generally has the pricing power to pass on cost increases to customers, this ability is dependent on prevailing demand conditions and product realisations. Any sudden spike in global raw material prices, especially due to supply disruptions or geopolitical constraints can impact gross margins.

Geopolitical Risks and Global Uncertainty – with nearly 50% of Vishnu Chemicals Ltd revenues coming from exports and an expanding footprint in developed markets, Vishnu Chemicals Ltd is inherently exposed to global geopolitical risks. Tensions such as trade wars, sanctions, import/export restrictions, and regional conflicts can disrupt supply chains, impact customer demand, or lead to regulatory uncertainties. These events could potentially delay shipments, increase compliance costs, or reduce market access.

Execution Risks – Vishnu Chemicals Ltd is undertaking several forward-looking initiatives, including backward integration through captive mines, forward integration into Chrome metal, Developing new products in the barium segment and Foray into Strontium chemicals. While these projects hold strong potential, delays in execution, cost overruns or failure to scale as expected could affect the Vishnu Chemicals Ltd’s growth trajectory and returns on capital employed.

Demand slowdown in end user industry – Any demand slowdown in end user applications like pharmaceuticals, electroplating,refractories, wood preservatives, ceramics, and paints at any point in time or due to macro headwinds can potentially drag volumes/realization for Vishnu Chemicals Ltd

Vishnu Chemicals Ltd Future Outlook

Vishnu Chemicals Ltd management has hinted for 15–20% CAGR growth, supported by both volume expansion and value-added product introductions across its Chromium, Barium, and newly entered Strontium verticals.

On the Chromium Chemicals front, Vishnu Chemicals Ltd operates with an installed capacity of 80,000 tonnes, with potential to generate revenues in the range of ₹1,100–1,250 crore at optimal utilization, depending on realizations and freight economics. Additionally, the commencement of chrome metal production by Q3 FY26 is expected to boost volumes by another 10%, and act as a margin accretive product, further improving EBITDA performance in H2 FY26.

In the Barium segment, the growth will be supported by volume and benefit of backward integration through Ramdas Minerals; Vishnu Chemicals Ltd is already witnessing robust traction, particularly from developed markets like the U.S. and Europe, where demand is shifting toward non-China alternatives. Management is guiding for 15–20% volume growth in FY26, with potential revenue in the ₹300–400 crore range at peak utilization. .Vishnu Chemicals Ltd also plans to double to PEB capacity by FY27

Further, Vishnu Chemicals Ltd is set to foray into Strontium chemistry via its acquisition of Jayasree Pharma. (to go live by Q1FY26) This diversification is expected to contribute ₹140–150 crore in annual revenues within two years of commercial operations, adding another growth lever and deepening Vishnu Chemical Ltd’s presence in ceramics, magnets, and electronics sectors.

From a margin perspective, Vishnu Chemicals Ltd has demonstrated consistent improvement. EBITDA margins have increased from 12-15% historically to 16–17% currently, and Vishnu Chemicals Ltd aims to reach 17.5-18% in the near term, with a long-term goal of 20% EBITDA% with the support from recently acquired chrome ore mines.

Chrome Metal, Strontium chemicals and progress on mining are expected to start contributing meaningfully by H2 FY26. However, execution needs to be tracked closely. Management is still in the process of finalizing its Capex roadmap for FY26

We believe few things need to fall into place like Favorable end-product realizations and raw material price, Timely ramp-up and scalability of new product lines, Successful execution of backward integration projects, Operationalization of acquired assets along with Macroeconomic stability to deliver the strong performance.

Vishnu Chemicals Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Vishnu Chemicals Ltd Price charts

On the weekly timeframe, the Vishnu Chemicals Ltd stock has been in a consolidation phase for more than 3 years now since March 2022. While CY22 signified the peak for many chemicals stocks which went on to fall > 40% from there, Vishnu Chemicals stock price trend has been relatively healthy. In the recent mania of Tariffs and the small cap meltdown in India, the price found support at the long term trendline and is now consolidating near the upper end of the price range.

On a daily chart, Vishnu Chemicals Ltd is currently trading near the upper end of its sideways consolidation range between ₹384 and ₹478. Vishnu Chemicals Ltd stock recently bounced from the lower support zone around ₹384 and is now showing bullish momentum with higher lows and closing above short-term moving averages. Volume on up days suggests accumulation, and a breakout above ₹478 could trigger a fresh rally, and both ₹384 and ₹478 act as key support and resistance levels.

Vishnu Chemicals Ltd Latest Latest Result, News and Updates

Vishnu Chemicals Ltd Quarterly Results

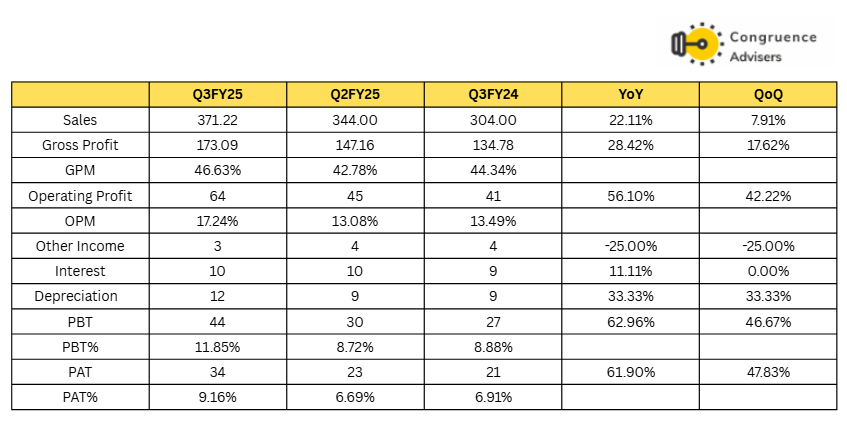

Vishnu Chemical Ltd posted strong consolidated Q3FY25 results at 22% YoY & 7.9% QoQ, Growth is led by both value and volume growth in barium division and value growth in chromium division. Both EBITDA & PAT is led by the barium division due higher utilization and operating leverage. Segmental mix at chromium:barium at 75.4%:24.6% vs 82.9%:17.1% YoY vs 76.7%:23.3% QoQ

Domestic market performance significantly outpaced that in export markets. Domestic to export sales mix shifted to 61:39 in Q3 FY25 vs to 57:43 in Q2 FY25. Barium business is outperforming particularly in the export market.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this to a general audience. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will continue/be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.