Arvind Fashions Ltd is one of India’s leading branded apparel players with a sharp focus on premium and casual wear. Arvind Fashions Ltd has five brands i.e USPA, Tommy Hilfiger, Calvin Klein, Arrow, and Flying Machine. Arvind Fashions Ltd also has executed category extensions into footwear, kidswear, innerwear, and a few other adjacencies.

Arvind Fashions Ltd today is structurally stronger, more focused, and better positioned than ever before. With a sharpened portfolio of five brands and adjacencies that are scaling backed by disciplined capital allocation, we believe the Arvind Fashions Ltd is entering a phase of profitable compounding, with risk-reward firmly skewed towards sustained rerating if growth comes in as expected.

Arvind Fashions Ltd Company Summary

Arvind Fashions Ltd is part of the Sanjay Lalbhai Group and is one of India’s leading branded apparel and lifestyle companies with a sharp focus on casualwear, denim and premium fashion. Incorporated in 2016 (as Arvind J&M Ltd.) and spun off from Arvind Ltd. in March 2019 through an NCLT-approved demerger, Arvind Fashions Ltd today stands as a pure play branded fashion player. The separation unlocked strategic autonomy which enabled sharper capital allocation and brand led growth.

Arvind Fashions Ltd operates a multi-channel distribution network spanning exclusive brand outlets (EBOs), large format stores (LFS), multi-brand outlets (MBOs), its own e-commerce platform (NNNOW), and leading online marketplaces. Arvind Fashions Ltd designs, sources, markets, and sells across a broad lifestyle spectrum including apparel, footwear, innerwear, accessories.

Arvind Fashions Ltd has consolidated its portfolio around five “power brands”, which drive the bulk of revenue and profitability:

- U.S. Polo Assn. (USPA) – India’s leading casualwear brand, with strong multi category play in apparel, footwear, and accessories.

- Arrow – Premium formalwear label with deep heritage and product innovations; now repositioned to appeal to younger professionals. Also has a sportswear and casual wear range of products now.

- Tommy Hilfiger & Calvin Klein – Premium lifestyle and fashion icons under the PVH Arvind JV, Both brands benefit from global brand equity and rising premiumisation trends in India.

- Flying Machine – India’s first jeans brand, now positioned as a youth centric, digital first label; Flipkart holds a minority stake in its subsidiary Arvind Youth Brands Pvt. Ltd.

Arvind Fashions Ltd’s brand strategy is anchored around four structural pillars –

- International & Aspirational – Global names with strong recall among India’s urban middle class.

- Young Demographic Focus – Core target audience of millennials and Gen-Z, aligning with India’s consumption demographics.

- Casualisation of Fashion – Focus on casualwear and denim, the fastest growing apparel categories in India.

- Category expansion – Leveraging brand strength to expand into footwear, innerwear, womenswear, and kidswear, which offer higher growth and margin accretion.

Restructuring Phase – Strategic Portfolio Rationalisation

At its peak, Arvind Fashions Ltd housed more than a dozen international and domestic brands across categories. The strategy gave it scale and presence but also stretched capital, inflated royalty outflows and diluted management focus. Many of these brands turned into loss making or dormant operations which weighed heavily on the balance sheet and led to suppressed returns.

Learning from this phase, management pivoted towards a profitability first framework with an emphasis on ROCE improvement and disciplined capital allocation. Beginning FY20, Arvind Fashions Ltd undertook a multi year restructuring to prune the portfolio and build a leaner, more scalable business model.

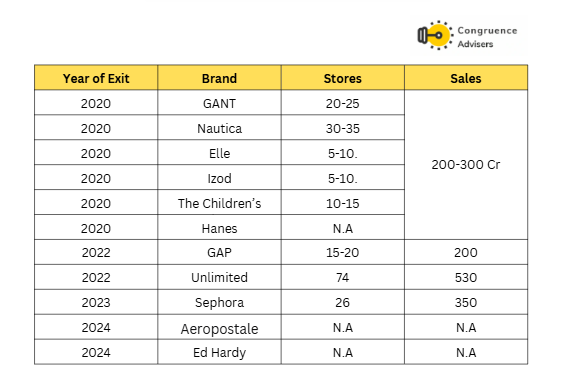

Post COVID, Arvind Fashions Ltd accelerated its portfolio clean up and started exiting multiple sub-scale and loss making brands such as Gant, Nautica, Elle, IZOD, GAP, TCP, Hanes, Newport, and Ruf & Tuf. These exits collectively freed up ~₹150 crore of capital employed which improved cash efficiency and reduced royalty drag. Of the larger businesses, Arvind Fashions Ltd also monetised two verticals i.e the sale of its value retail chain Unlimited to V-Mart ( at ₹180 Cr in FY22) and the divestment of Sephora India to Reliance Luxe Beauty ( at ₹216 Cr in FY24). Together, Unlimited and Sephora accounted for ~32% of Arvind Fashions Ltd’s revenue in FY20.

Despite pruning nearly one-third of its portfolio by revenue contribution, Arvind Fashions Ltd’s overall revenue remained broadly flat between FY20-FY24. Growth from this core portfolio offset the drag from exits. Alongside exits, Arvind Fashions Ltd also shut down unviable stores, liquidated aged inventory through controlled channels such as Megamart and moved brands to a secondary sales model to enhance cash flow discipline.

This restructuring has fundamentally reshaped Arvind Fashions Ltd into a focused branded fashion play anchored around five high conviction “power brands” i.e U.S. Polo Assn., Tommy Hilfiger, Calvin Klein, Flying Machine and Arrow. These labels enjoy high brand equity, scalability and category adjacency opportunities (footwear, womenswear, kidswear, innerwear).

Today, Arvind Fashions Ltd is leaner, margin accretive and capital-efficient with an improved ROCE profile and stronger balance sheet flexibility. Management has clearly stated that the priority is profitable growth, premiumisation and returns discipline rather than chasing new brands, a good example of learning from the past and focusing on building high quality franchises.

Arvind Fashions Ltd Corporate structure

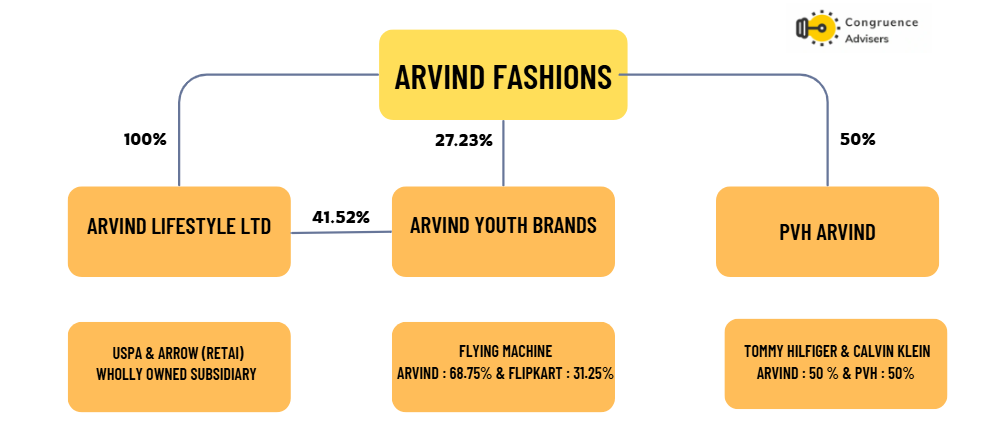

On a standalone basis, Arvind Fashions Ltd primarily houses the wholesale business of Arrow. The largest subsidiary, Arvind Lifestyle Brands Ltd. (ALBL), is 100% owned and managed U.S. Polo Assn. (the single largest contributor to revenue) along with the retail operations of Arrow.

Arvind Youth Brands Pvt. Ltd. (AYB), which owns Flying Machine, is effectively 68.75% controlled by Arvind Fashions Ltd through a combination of direct and indirect holdings (AFL + ALBL). Flipkart holds the balance 31.25% stake, which provides a strong digital partner for this youth focused and online heavy brand.

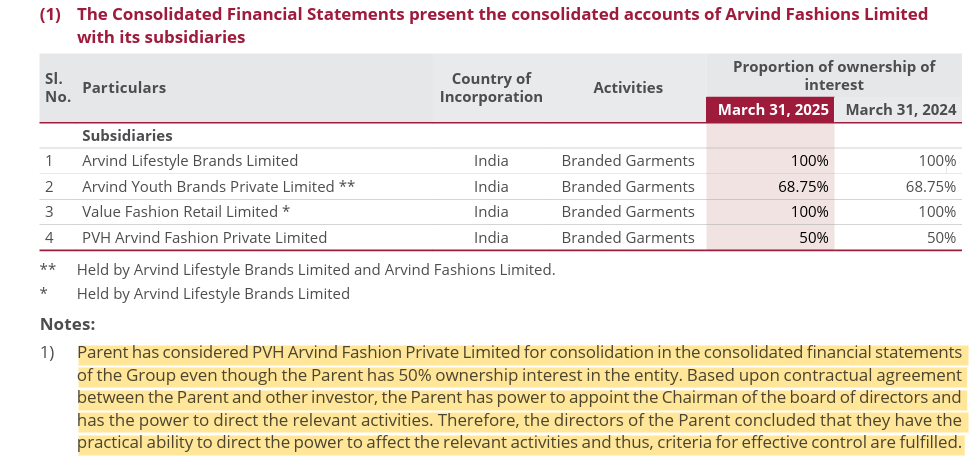

In the premium lifestyle segment, Arvind Fashions Ltd operates PVH Arvind Fashion Pvt. Ltd., a 50:50 joint venture with PVH Corp., which owns and operates Tommy Hilfiger and Calvin Klein in India. This JV is consolidated into Arvind Fashions Ltd’s financials.

Additionally, Arvind Fashions Ltd has historically used Value Fashion Retail Ltd. to house its outlet and liquidation formats such as Megamart, which provides an efficient off price channel for old season inventory.

History of Labhai Group – Arvind Fashion Ltd’s promoter

The Lalbhai Group traces its roots to the founding of Arvind Mills in 1931, in response to Mahatma Gandhi’s Swadeshi movement. The ambition from inception was clear to build a textile enterprise that could compete globally. By the mid-1930s, Arvind was already exporting butta voiles to Switzerland and the UK, signalling its international aspirations.

The group’s modern arc began under Kasturbhai Lalbhai (1894-1980), who assumed leadership at just 17 after his father’s passing. Kasturbhai built Arvind into an industrial powerhouse and emerged as a statesman industrialist, co-founding institutions such as IIM Ahmedabad with Vikram Sarabhai. He also laid the foundation for diversification, instilling a culture of education, philanthropy and long-term vision.

The third generation saw Siddharth Lalbhai (1923-1998) and Shrenik Kasturbhai Lalbhai (1925-2014) carry the legacy forward. Siddharth contributed to expanding textiles but later spearheaded the group’s foray into chemicals through Atul Ltd. (founded in 1947 by Kasturbhai), which his branch of the family continues to lead today. Shrenik, meanwhile, modernised Arvind Mills through the 1970s-80s, laying the groundwork for denim manufacturing that would transform Arvind into one of the world’s largest denim producers.

The third generation’s pivotal figure, Sanjay Lalbhai, joined Arvind in 1977 during a turbulent phase when power looms threatened the large mill model. His strategic reinvention was backward integration into denim, which not only revived the company but also created a new growth engine. Under his watch, Arvind became synonymous with denim and launched Flying Machine, India’s first homegrown jeans brand.

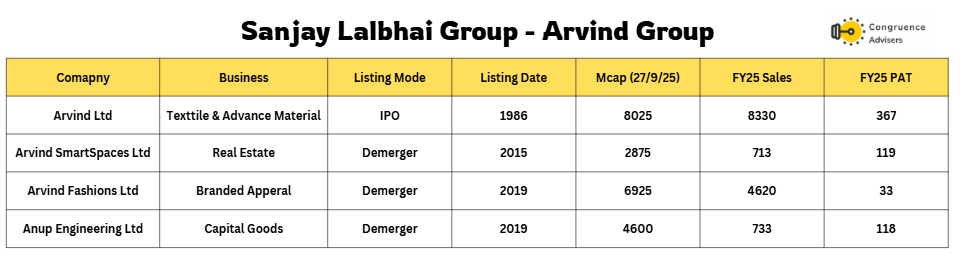

Diversification & Demerger – Over the past three decades, Arvind diversified beyond textiles through licensing partnerships with global fashion brands such as US Polo Assn., Tommy Hilfiger, and Calvin Klein, while also building homegrown labels and expanding into other businesses like real estate, capital goods and water solutions. In 2015-16, the group carved out its real estate business, Arvind SmartSpaces, and listed it as a separate entity. In 2019, to unlock value and improve capital allocation efficiency, Arvind executed a three-way demerger:

- Arvind Limited – Legacy textiles and advanced materials

- Arvind Fashions Ltd. – Branded apparel and retail portfolio

- Anup Engineering – Engineering solutions and process equipment manufacturing

Today, under the fifth generation of leadership, the group operates through four listed entities with distinct mandates:

- Arvind Ltd. – Textiles and advanced materials.

- Arvind Fashions Ltd. – Branded apparel and retail.

- Arvind SmartSpaces Ltd. – Real estate development.

- Anup Engineering Ltd. – Engineering solutions and process equipment.

Leadership is clearly demarcated: Punit Lalbhai drives Arvind Ltd, Anup Engineering Ltd and new-age verticals like advanced materials and water solutions (Arvind Envisol).

Kulin Lalbhai, meanwhile, leads Arvind Fashions Ltd. and Arvind SmartSpaces, steering consumer-facing businesses, premiumisation and digital expansion.

Collectively, the Sanjay Lalbhai led group has transformed into a multi vertical conglomerate with four listed companies generating over ₹14,600 crore in FY25 revenue and a combined market cap of more than ₹22,500 crore. The journey from commodity textiles to a diversified, capital efficient portfolio across fashion, advanced materials, real estate, and engineering reflects the group’s ability to adapt, reinvent and stay relevant across five generations.

Arvind Fashions Ltd Management Details

Arvind Fashions Ltd is preparing for a leadership transition with Ms. Amisha Jain has joined as Managing Director & CEO effective August 13, 2025, succeeding Mr. Shailesh Chaturvedi.

Amisha brings 25+ years of diverse global experience across retail, consumer, and technology sectors. Most recently, she served as Managing Director & SVP at Levi Strauss for South Asia, Middle East, Africa, and Eastern Europe, where she drove double-digit growth, consolidated Levi’s market leadership in denim, and strengthened its omni-channel presence. Before Levi’s, she was CEO of Zivame where she transformed the brand into a consumer centric intimatewear and loungewear brand and enhancing its D2C play.

Her earlier stints include COO roles within the Arvind Group (Arvind Sports Lifestyle, Arvind Digital) where she led digital commerce and brand incubation and Nike India, where she transformed retail distribution as Head of Sales and Director of Marketplace Transformation. She started her career at McKinsey & Company as Engagement Manager, advising consumer-facing clients on corporate growth, channel strategy, retail transformation and shopper experience innovation. An alumna of INSEAD, Amisha’s background uniquely blends strategy consulting, brand building, digital execution, and consumer engagement aligning well with Arvind Fashions Ltd’s ongoing premiumisation, omni-channel, and asset-light growth strategy.

Mr. Shailesh Chaturvedi, who led Arvind Fashions Ltd for nearly two decades, leaves behind a legacy of transformation. He orchestrated the portfolio rationalisation, sharpened capital allocation, and delivered profitable growth after years of drag from underperforming brands. His stewardship scaled Tommy Hilfiger and Calvin Klein into India’s leading premium brands, rejuvenated Arrow, and reinforced USPA’s leadership in casualwear.

The baton now passes to Amisha, whose digital-first orientation, omni-channel expertise, and proven record in scaling consumer brands will be critical in unlocking the next phase of growth for Arvind Fashions Ltd’s five “power brands.”

Arvind Fashions Ltd’s strong second line of management provides both depth and continuity, ensuring seamless operational execution and strategic consistency through the leadership transition

Arvind Fashions Ltd – Industry Landscape

Apparel Industry

The apparel industry comprises companies that design and sell clothes. Within this, the readymade garments (RMG) or apparel segment includes shirts, trousers, T-shirts and jeans. It also comprises ethnic wear, such as kurtas, salwar kameez, lehengas and sarees.

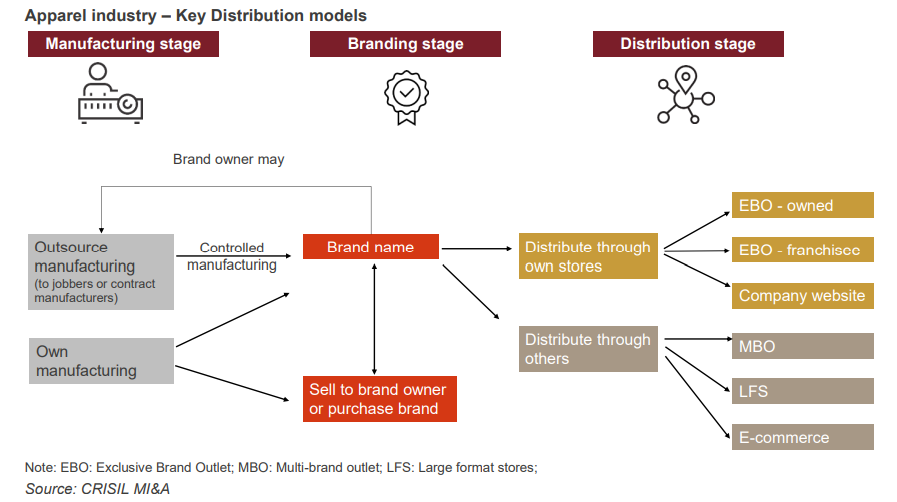

Overview of various distribution models in the industry

The Indian apparel industry operates across three critical stages i.e manufacturing, branding, and distribution with each shaping the economics and scalability of players in the sector.

On the manufacturing side, companies either pursue in-house manufacturing, which ensures greater control but is working capital intensive or outsourced/contract manufacturing, which provides flexibility and reduces capital intensity. At the branding stage, the core value lies in building aspirational and differentiated identities that can command pricing power across categories. Finally, in distribution, brands leverage a mix of channels to reach consumers i.e exclusive brand outlets (EBOs, both company-owned and franchisee), large-format stores (LFS), multi-brand outlets (MBOs), company websites, and third-party e-commerce platforms.

The choice of distribution strategy is a key determinant of capital employed and return ratios. Company owned stores (COCO), while margin accretive, require higher upfront investments, whereas franchise-operated models (FOFO/FOCO) allow faster asset light expansion with limited balance sheet impact. Online platforms provide scalable reach and lower overheads but require sharper discounting and marketing spends. Players that successfully balance these models driving premiumisation through COCO, scale through FOFO, and velocity through e-commerce tend to generate superior operating leverage and cash conversion.

To summarise, the structure of these models underscores the trade-off between control, scalability, and capital efficiency.

Distribution Channels – Key Driver of Profitability

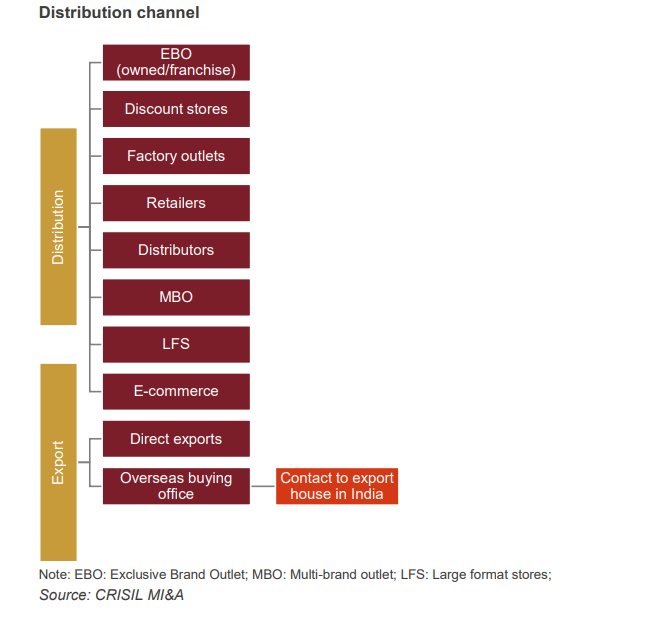

In the apparel industry, distribution strategy is as critical as brand positioning which directly influences revenue growth, margins, and working capital efficiency. Players typically deploy a mix of channels i.e Exclusive Brand Outlets (EBOs), Multi-Brand Outlets (MBOs), Large Format Stores (LFS), factory outlets, e-commerce and exports. each with distinct economics and consumer touchpoints.

Exclusive Brand Outlets (EBOs)

EBOs, whether company-owned (COCO) or franchisee operated (FOFO), are the most effective medium to deliver brand identity and maximize consumer connect. The model bypasses multiple intermediaries, ensuring higher realisations, tighter inventory control, and consistent consumer experience. It not only helps a brand to manage inventory better, but also enables it in customising inventory to suit the needs of customers and create a balance across product portfolios.

Multi-Brand Outlets (MBOs) & Large Format Stores (LFS)

This distribution channel is gaining momentum in India. In this channel, apparel is sold by an RMG player to multibrand outlets (MBOs) and large-format stores (LFS) that sell apparel of several brands through large retail spaces, located in prime locations of cities and towns. Usually, the MBOs/LFSs are present in shopping-mall chains or are standalone stores with a presence in more than one location, e.g., Shoppers Stop, Pantaloons Retail, Westside (Trent), Globus, Lifestyle and Pyramid. Realisations from this channel are lower than those earned by selling to retailers, as MBOs/LFS keep higher margins than retailers while purchasing garments, with their costs being higher. In terms of distribution, players can also sell garments through distributors, which, in turn, sell them either to retailers or MBOs/LFSs. The retailers or MBOs/LFSs sell the apparel to end-users. Since two middle agencies figure between the seller and end-users, realisations from this channel are lower than those earned by selling through retailers, because in this case both the distributor and retailer or MBO/LFS provide for their costs and profits while purchasing an apparel.

Factory Outlets & Discount Stores

Factory outlets and discount stores are essential for liquidation of old inventory at controlled margins. This channel allows players to accelerate cash conversion cycles while protecting full-price channels from dilution. Arvind Fashion Ltd’s Megamart is a key example of an outlet-driven format designed to clear old-season stock.

E-commerce & Digital

Digital has emerged as a structural growth driver. Marketplaces like Flipkart, Myntra, and Amazon not only deliver incremental reach but also serve as discovery platforms for younger consumers. Increasingly, players are pivoting towards omnichannel models, integrating brand.com platforms (NNNOW for Arvind Fashion Ltd) with marketplaces to optimise consumer access and inventory flow

Exports

Garments are exported either directly to companies or through overseas buying offices. In the case of overseas buying offices, export orders are forwarded to domestic textile manufacturing units. These units manage the manufacturing part and strictly adhere to buyers’ requirements. After final checking for quality and performance, the consignment is dispatched to the overseas customers.

In conclusion, the profitability and growth trajectory of apparel players hinge on how effectively they balance their channel mix. Premiumisation and direct to consumer expansion via EBOs and digital are margin accretive, while MBOs and factory outlets ensure volume growth.

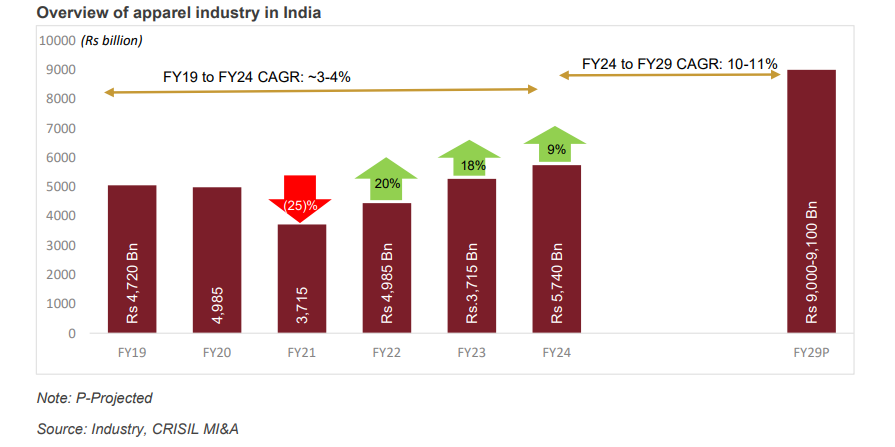

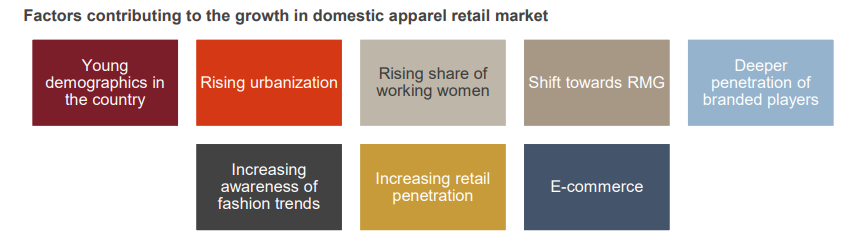

Overview of apparel industry in India

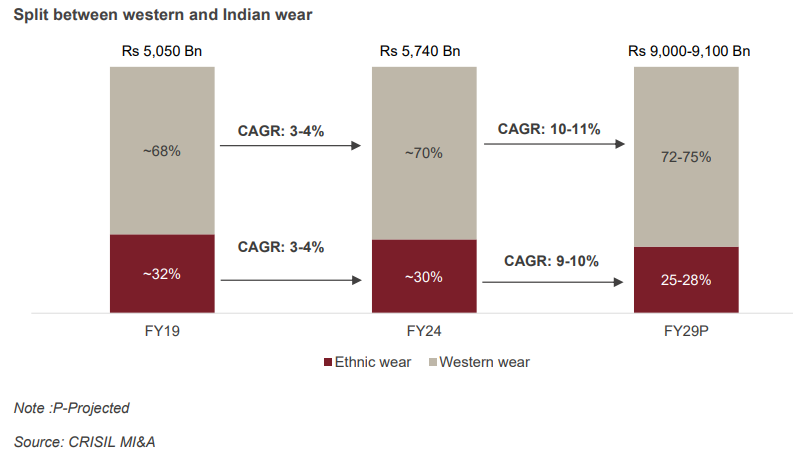

The Indian apparel market has witnessed a volatile yet transformative journey over the past few years. Between FY19 and FY24, the industry clocked a muted CAGR of ~3–4% as growth was disrupted by pandemic-induced stress, with FY21 seeing a steep ~25% contraction due to mall shutdowns, supply-chain bottlenecks, and weak discretionary spending. However, the market bounced back with double-digit recovery in FY22 (+20%) and FY23 (+18%) as consumers returned to retail outlets, aided by festive demand and normalization of mobility. FY24 further consolidated this uptrend with a healthy ~9% YoY growth, taking industry sales to ~₹5.7 trillion.

Looking forward, the apparel market is poised for a stronger trajectory, projected to compound at 10-11% CAGR through FY29, potentially reaching ₹9.0-9.1 trillion. Growth drivers include sustained demand recovery, revival of international trade, higher disposable income, urbanization-led consumption, and increased penetration of organized retail and e-commerce.

Recent Trends – FY25 Slowdown

While the apparel market staged a strong recovery in FY22–24 (CAGR ~9%), FY25 has ended on a softer note. Industry checks point to materially slower than trajectory seen in FY22-24. The moderation is largely driven by subdued discretionary spending in value and mass fashion, muted wedding/occasion demand and an unfavourable base effect. Premium brands, however, continue to outperform, aided by structural premiumisation and urban demand resilience.

Management commentaries across leading players suggest that FY25 is the year of consolidation rather than breakout growth, with revenue growth lower than projected.

That said, the long-term demand drivers for the industry remain intact. Rising disposable income, shift to branded wear, and category extensions into womenswear, kidswear, footwear, and accessories.

Ethnic vs. Western Wear Dynamics

Ethnic wear currently accounts for ~30% of India’s apparel industry, largely driven by casual and celebration/wedding categories for both men and women. However, with evolving consumer preferences, ethnic wear has been increasingly relegated to festive and ceremonial occasions, while western wear continues to capture everyday and aspirational demand. Consequently, the share of ethnic wear in the overall apparel market is projected to decline to ~25–28% by FY2029 from ~32% in FY2019 and ~30% in FY2024.

The western wear is expected to expand at a faster clip, growing at a CAGR of ~10–11% over FY2024–29, compared to ~9–10% for ethnic wear. By FY2029, western wear is likely to comprise ~72–75% of the overall apparel industry, underscoring a structural shift towards global fashion trends and lifestyle changes. This transition is being driven by rising disposable incomes, increasing urbanisation, proliferation of fast-fashion formats, and greater adoption of western styles among younger consumers.

For branded apparel players such as Arvind Fashions Ltd this structural tailwind in western wear provides a favourable backdrop, given their strong positioning across leading international and homegrown western brands.

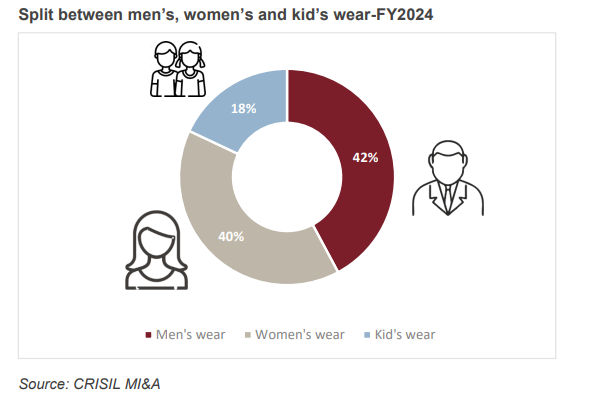

Men’s wear is the biggest contributor of apparel industry in India

The Indian apparel market remains dominated by men’s wear, which accounted for ~42% of the overall industry in FY2024. This underscores the strong demand visibility and entrenched preference for men’s clothing categories, particularly casualwear and denim, where global and domestic brands have built deep consumer equity.

Women’s wear follows closely with ~40% share, reflecting the rising fashion consciousness among female consumers and increasing wallet allocation towards apparel categories. Kid’s wear, while structurally smaller at ~18% share, remains a fast-growing segment driven by demographic tailwinds, rising nuclear families, and premiumisation in children’s fashion.

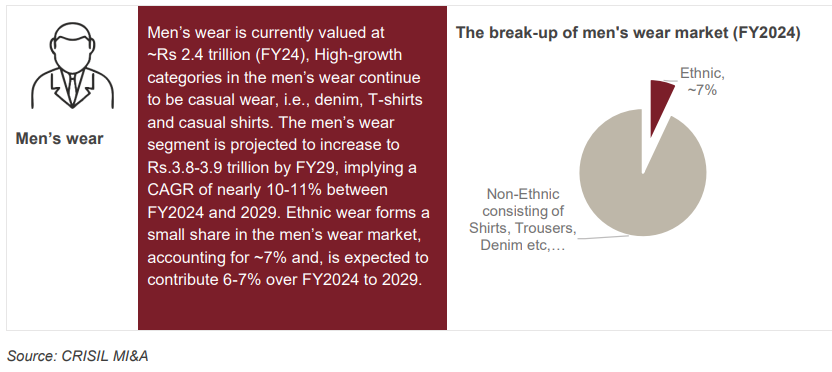

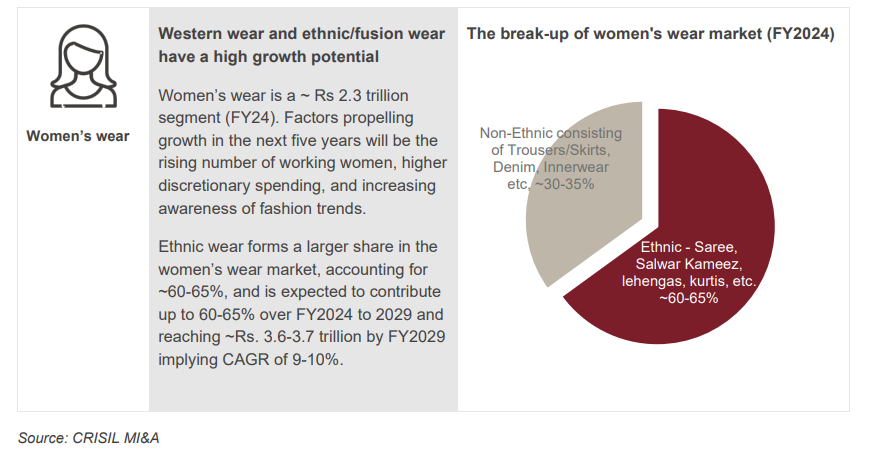

Split of Men’s, Women’s and Kids category in to ethnic and western wear

Men’s wear, currently valued at ~₹2.4 trillion (FY24), remains the largest segment with a 42% market share. Growth is being driven by casualisation trends i,e denim, T-shirts, and casual shirts. while ethnic wear forms only ~7% of men’s wear. Men’s wear is projected to grow at a 10–11% CAGR through FY29, reaching ₹3.8-3.9 trillion.

Women’s wear is valued at ~₹2.3 trillion (FY24), accounting for ~40% of the market. Unlike men’s wear, the segment retains a high skew towards ethnic apparel (~60–65%) such as sarees, salwar kameez, lehengas, and kurtis. That said, non-ethnic categories like trousers, skirts, denim, and innerwear are gaining share, reflecting lifestyle changes and rising workforce participation among women. The women’s wear segment is expected to expand to ₹3.6-3.7 trillion by FY29, implying a 9–10% CAGR.

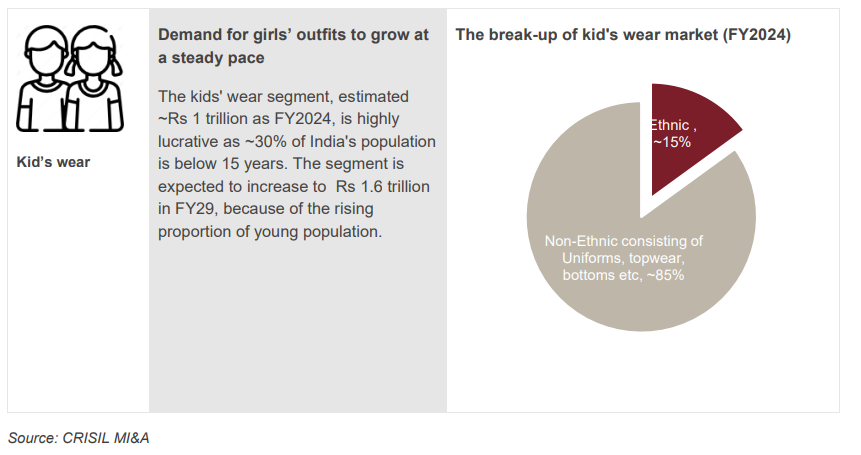

Kid’s wear, estimated at ~₹1 trillion (FY24), represents ~18% of the market and is underpinned by India’s demographic advantage i.e nearly 30% of the population is below 15 years. Ethnic wear accounts for ~15% of the category, while non-ethnic segments (uniforms, topwear, bottoms) dominate. The kid’s wear market is projected to grow steadily to ₹1.6 trillion by FY29, driven by rising young population and increasing spending on children’s apparel.

From a structural standpoint, western wear is steadily gaining share across categories. Men’s (already >90%), women’s (gradually rising from ~35–40%), and kids (already ~85%). This shift towards casual and western wear, coupled with the scaling of organised retail and e-commerce, underpins long-term growth visibility for branded apparel players like Arvind Fashions.

Organised vs. Unorganised Market

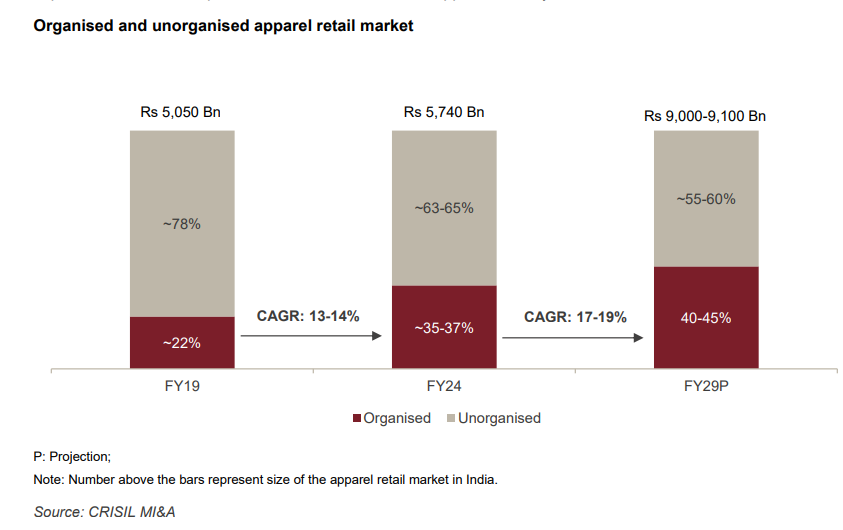

The Indian apparel industry continues to undergo structural consolidation, with the organised segment steadily gaining share from the unorganised market. In FY2019, organised retail accounted for just ~22% of the industry, reflecting the dominance of fragmented mom-and-pop stores. By FY2024, the share of organised players had already expanded to ~35–37% on the back of rising brand penetration, mall expansion, improved supply chains, and accelerating adoption of e-commerce platforms.

The trend is expected to accelerate further, with the organised segment projected to reach ~40–45% share of the market by FY2029, growing at a faster clip (17–19% CAGR) versus the overall industry growth. This shift will be supported by increasing consumer preference for quality, standardised products, aspirational brands, and omnichannel shopping experiences.

Organised players are also expanding beyond apparel into accessories and lifestyle adjacencies, offering a full stack brand experience and thereby increasing both visibility and basket size.

Arvind Fashions Ltd – Business Details

Arvind Fashions Ltd runs a concentrated “power-brand” play anchored on five labels U.S. Polo Assn. (USPA), Tommy Hilfiger (TH), Calvin Klein (CK), Arrow and Flying Machine (FM) with each scaled across apparel, footwear, innerwear, kids and women’s lines and sold through EBOs, LFS/MBOs and D2C (NNNOW + marketplaces).

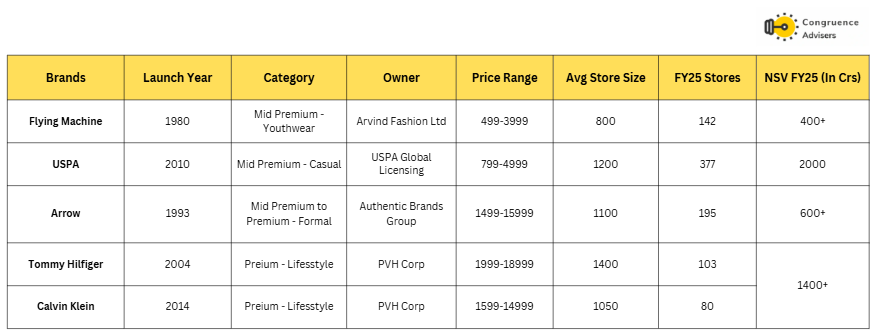

Arvind Fashions Ltd brand portfolio is now sharply streamlined into five high-conviction “power brands,” each targeting distinct consumer segments and price points. U.S. Polo Assn. is the flagship growth engine, commanding ~₹2,000 cr in FY25E NSV with the widest footprint (377 stores, ~1,200 sq. ft. average size) and strong casualwear positioning. Tommy Hilfiger and Calvin Klein anchor the premium lifestyle segment, together contributing ~₹1400 cr NSV with smaller but more productive store networks (183 stores combined).

Arrow remains the key play in premium formalwear with ~₹600+ cr NSV, while Flying Machine continues to scale as a youth-focused, digital-first label (~₹400+ cr NSV).

U.S. Polo Association (USPA)

U.S. Polo Association (USPA) is Arvind Fashions Ltd’s flagship and largest revenue contributing brand and firmly positioned as India’s #1 casualwear label with strong recall and aspirational brand in the mid premium to premium price segment. Since its launch in 2009, the brand has scaled rapidly, crossing ₹1,000 Cr NSV in FY19 and ₹2,000 Cr in FY25 a milestone unmatched by any other single apparel brand in India.

The brand enjoys a multi category presence spanning menswear, womenswear, kidswear, footwear, innerwear, and accessories, which is enabling wallet share expansion and cross-selling opportunities. Adjacent categories now contribute over 25% of USPA sales, with womenswear growing >50%, kidswear clocking >30% growth and innerwear scaling rapidly. These adjacencies coupled with premiumisation efforts (e.g., Liquid Cotton Polo, winterwear upgrades and bottom-wear expansion), have reinforced USPA’s differentiation.

Large-format flagship stores in Bangalore, Hyderabad, Goa, and Jodhpur are now showcasing the full portfolio including footwear, womenswear, and innerwear, improving category salience and store productivity

Its distribution footprint is equally formidable – 377 EBOs across 161 cities (average size ~1,200 sq. ft.), robust presence in MBOs and large format stores and a sharply growing online channel. USPA’s franchise led model also makes it highly attractive for long term partners, operating with strong unit economics and consistent profitability.

USPA has maintained a steady ~370–400 store base over FY19-25 with its footprint expanding from 155 cities in FY19 to 173 cities in FY23 before rationalising to 161 cities in FY25. Management in multiple concalls highlighted that USPA’s network expansion is now highly curated with exits of underperforming stores and sharper focus on franchisee profitability and Tier-II/III penetration, rather than chasing headline store count.

Management commentary has repeatedly highlighted USPA’s double-digit pre-IndAS EBITDA margins and strong ROCE, making it a “cash cow” for Arvind Fashions Ltd. We believe USPA is a structural compounder for Arvind Fashions Ltd i.e tight price architecture, broad category adjacencies, and a deep asset light retail network drive scale, margin and cash flow with limited execution risk.

Tommy Hilfiger (TH) & Calvin Klein (CK)

Tommy Hilfiger and Calvin Klein are housed under PVH Arvind Fashions Pvt. Ltd., a 50:50 JV with PVH Corp. that Arvind Fashions Ltd consolidates in its numbers.

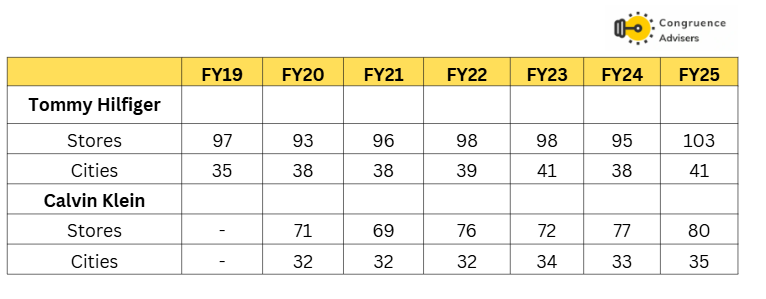

Tommy Hilfiger, launched in India in 2004, has established itself as one of the most recognisable premium lifestyle brands. With 103 EBOs across 41 cities (avg ~1,400 sq ft) and a price architecture of ₹1,999–₹18,999, it delivers strong gross margins, aided by tight discount controls and a rising full-price mix. The brand has compounded at ~15% CAGR over the past five years, scaling to ~₹750 Cr revenue in FY24, with adjacencies in women’s wear, kidswear, innerwear, accessories and footwear. Growth drivers are selective new stores in premium catchments, omni-channel scale, and adjacencies that lift ATV and throughput per sq. ft.

Calvin Klein, introduced in 2015, plays in the super-premium bridge to luxury segment, with 80 EBOs across 35 cities (avg ~1,050 sq ft) and pricing between ₹1,599-₹14,999. Calvin Klein has compounded at ~19% CAGR, reaching ~₹500 Cr revenue in FY24 with strong traction in innerwear, jeans and tees. supported by celebrity-led marketing and sharp brand positioning. Innerwear and accessories are emerging as key growth engines.

The relatively low store growth for Tommy Hilfiger and Calvin Klein is by design, not demand led. Management has said they’re prioritising productivity and profitability per store i.e upgrading to larger, experiential flagships in key metros and shutting borderline/long-tail outlets, especially post-COVID.

Together, Tommy Hilfiger and Calvin Klein are Arvind Fashions Ltd’s premiumisation engine, they carry clear pricing power, generate superior cash conversion, and structurally earn the highest ROCE in the portfolio. In FY25, the PVH Arvind JV (TH+CK) did ~₹1424 cr revenue with approx EBITDA% of ~19-20% and ~₹151 cr PAT, making it Arvind Fashions Ltd’s most profitable block; management also attributes a rising share of consolidated profit to this JV as premium demand outperformed the company average.

Arrow

Arrow, launched in India in 1993, was the first premium international menswear brand to enter the market and remains one of Arvind Fashions Ltd’s most established labels. Positioned in the mid-premium to premium formalwear segment, Arrow offers a wide range of formal, semi-formal, and smart casual apparel. Its product innovation history includes detachable collars, auto-press shirts, anti-UV fabrics, stain-resistant materials and adjustable waistband trousers catering to evolving workplace and lifestyle needs.

Post Covid Arrow has faced two structural drags : (1) an over indexed wholesale/MBO model that ran ahead of secondary sell through and (2) low margin institutional sales that the company has now exited. These issues suppressed profitability and locked up working capital.

Management then undertook a clean-up, matched primary to secondary in wholesale, tightened credit cycles, liquidated legacy stock, and pivoted the brand to full price sell through with lower discounting. As this one time MBO correction rolled off, the team called out improving sell through/LTL and a return to normal growth trajectory.

On the demand side, Arrow has been “re-energised” with product and retail upgrades like Auto-Press shirts, Auto-Flex trousers, the “1851” line, a refreshed store identity and NY design pov plus a move to a demand pull supply chain and stronger omni.

Management path to margin lift is clear: scale back to peak and beyond, improve channel mix (more retail vs wholesale), push higher ticket suits/blazers/1851, keep discounting low, and drive operating leverage. Management has publicly framed the journey: first mid-single-digit EBITDA, then march toward ~10%.

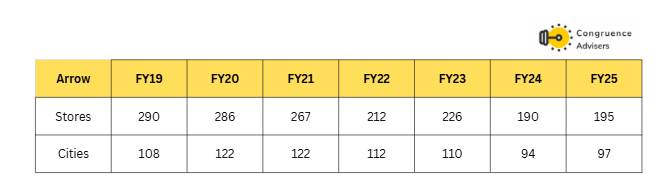

Arrow has ~195 EBOs across ~97 cities; avg EBO ~1,100 sq ft; ASP bands ₹1,499–₹15,999.

We believe with the clean-up done and the mix tilting to full price retail, Arrow should compound on a healthier base while releasing working capital pressure and rebuilding profitability.

Flying Machine (FM)

Flying Machine is Arvind Fashions Ltd’s homegrown denim brand launched in 1980, is one of India’s oldest youthwear labels and continues to rank among the top three denim players. Despite its 40+ year heritage, the brand has retained a digital-first DNA with a large share of revenues historically driven through Flipkart and Myntra.

Two things held it back recently: (1) channel concentration in online B2B that later saw deliberate de-stocking and discount control by Arvind Fashions Ltd and (2) brand fatigue, which showed up as flattish revenues despite scale.

This over reliance on online B2B channels coupled with some brand fatigue, led to stagnation in recent years with sales plateauing around ₹400 Cr.

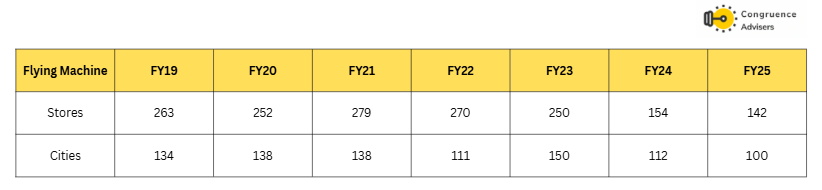

Store count has been rationalised from a FY19 peak of 263 to ~142 EBOs in FY25 (avg ~800 sq. ft.), reflecting a sharper focus on productivity per sq. ft. and ROCE rather than sheer footprint expansion.

Management responded with a full reset revamping the logo and retail identity, reworking product architecture and improving channel discipline to reduce discounting and improve sales.

The brand is now in a “season behind Arrow” recovery mode, showing early green shoots of improved sell through and reduced markdowns. Aided by Flipkart’s significant minority stake in Arvind Youth Brands, Flying Machine is leveraging digital scale while aggressively expanding offline to de-risk channel concentration. Adjacent categories like footwear, innerwear, and kidswear are being scaled up, broadening the revenue base.

Management has emphasised that while Flying Machine may take time to fully reaccelerate, the groundwork brand refresh, channel recalibration, and category extensions sets up the brand for a healthier growth trajectory, with improving margins and stronger capital efficiency over the medium term.

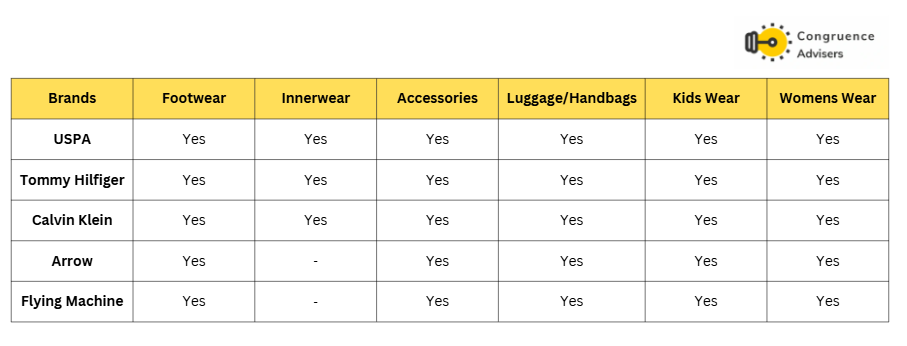

Adjacent categories

Arvind Fashion Ltd has consciously built out a portfolio of adjacent categories beyond core apparel i.e in footwear, innerwear, accessories, luggage/handbags and women’s & kidswear. These extensions allow Arvind Fashions Ltd to deepen customer engagement, expand wallet share and create higher-margin, repeat-purchase businesses that complement its power brands.

Management commentary across concalls highlights that these businesses are margin-accretive, capital-light, and scalable, making them an important growth lever. Arvind Fashion Ltd’s strategy has been to use its existing brand equity to launch extensions like the U.S. Polo footwear and innerwear or Calvin Klein handbags.

As of FY25, adjacent categories contributed over 20% of Arvind Fashion Ltd’s revenues. Within this, footwear crossed ₹300 crore in sales (management is targeting ₹500 crore in the medium term), while kidware scaled ~₹200 crore with strong traction in the U.S. Polo and Tommy . Women’s wear has been another standout, with the U.S. Polo women’s doubling revenues post-COVID. Accessories, handbags, and luggage are also scaling steadily, benefiting from cross-brand synergies and omni-channel distribution.

New Format Expansion – Club A & Stride

Arvind Fashions Ltd is actively piloting and scaling new retail formats i.e Club A and Stride, and Megamart to strengthen brand equity, accelerate premiumisation, and improve inventory productivity. All formats are rolled out under an asset light FOFO model, enabling faster scale up without straining the balance sheet.

Club A – Multi-Brand Premium Experience

Club A is Arvind Fashions Ltd’s curated “all brands under one roof” format and positioned as a super-premium, full price retail destination. The concept targets occasionwear and lifestyle shoppers by offering expanded categories (including women’s and kids’ wear) in high-visibility high-street and travel retail hubs. Unlike discount driven models, Club A operates strictly on a full price architecture to reinforce premium positioning.

As of FY25, Arvind Fashions Ltd has opened 4-5 stores (Indiranagar – Bangalore, Surat, Lucknow Airport, Hyderabad, Gurgaon) and is still in the pilot phase, with management emphasizing proof of concept before scale up. Club A is expected to contribute 10-15% of incremental net square footage in coming years, complementing mono brand expansion. The format is viewed as a long-term play in Arvind Fashions Ltd’s premiumisation journey .

Stride – Footwear & Accessories Growth Engine

Stride is Arvind Fashions Ltd’s dedicated multi brand footwear and accessories format, housing categories like U.S. Polo footwear and handbags. The format capitalises on the structurally higher-margin footwear segment, where Arvind Fashions Ltd already enjoys online leadership.

With ~11 stores operational, Arvind Fashions Ltd targets doubling footwear revenues in 3 years. Growth was temporarily impacted by BIS compliance on footwear inventory, but management highlighted this as a short-term headwind, with normalization expected to unlock faster rollout. Stride also reinforces Arvind Fashions Ltd’s ambition to scale adjacencies and reduce reliance on apparel driven topline .

Megamart – Outlet-Driven Inventory Liquidation

Megamart functions as Arvind Fashions Ltd’s factory outlet chain, designed to liquidate old-season merchandise of marquee brands via a controlled offline channel. Positioned in outlet-heavy, high-street catchments, Megamart stores (~4,000+ sq. ft.) operate with upfront discounts from day one, offering wider assortment availability and better conversion. From zero stores three years ago, Megamart has scaled to 50+ outlets.

Arvind Fashions Ltd Manufacturing

Arvind Fashions Ltd follows a fully outsourced production model. Manufacturing is done through a network of 100+ suppliers which allows Arvind Fashions Ltd to stay asset-light, flexible, and focus on brand, design, and retail execution rather than capital-heavy production. This is consistent across all its five core brands (USPA, Tommy Hilfiger, Calvin Klein, Arrow, Flying Machine).

Arvind Fashions Ltd Distribution Network

Arvind Fashions Ltd has built a well diversified retail distribution network that balances scale with capital efficiency. Arvind Fashions Ltd operates a large base of 977 Exclusive Brand Outlets (EBOs) spread across 475+ cities and towns, covering ~11.9 million sq. ft. of retail space as of FY25. Within EBOs, the bulk of the expansion is driven by the FOFO. The COCO format, while contributing a smaller share of the network (~25% of the overall retail business), continues to play a strategic role in high-potential clusters and in premium formats like Tommy Hilfiger where brand control and consumer experience are critical. Importantly, Arvind Fashions Ltd has rationalised its COCO presence in recent years, pruning underperforming stores and only committing fresh capital to outlets that can deliver >15% IRR which reflects a sharper capital allocation discipline.

Beyond EBOs, Arvind Fashions Ltd has a strong presence in 9,000+ Multi Brand Outlets (MBOs) and department store shop-in-shops, providing visibility in high-traffic retail destinations such as Shoppers Stop, Lifestyle, and Pantaloons. Arvind Fashions Ltd also leverages Large Format Stores (LFS) as an additional channel to extend reach across urban India.

On the digital side, Arvind Fashions Ltd has an integrated strategy with its own NNNow.com platform, alongside leading marketplaces like Myntra, Flipkart and Amazon which ensure omnichannel visibility and capture India’s accelerating shift towards online fashion consumption.

Arvind Fashions Ltd Fund Raising

Coming out of COVID and the portfolio clean up, Arvind Fashions Ltd needed balance sheet strength to (1) absorb restructuring costs/royalty settlements from brand exits, (2) normalise working capital and (3) fund selective growth while keeping leverage in check.

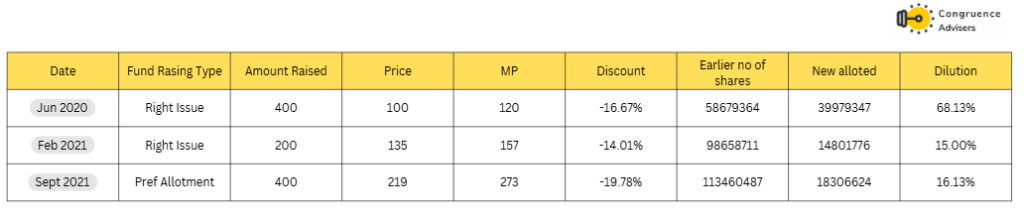

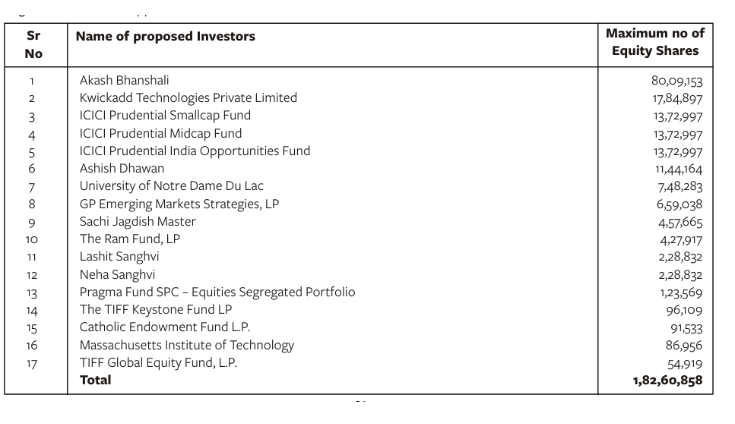

Arvind Fashion Ltd has raised capital to strengthen its balance sheet and reduce debt. Between FY20-FY21, Arvind Fashion Ltd undertook two rights issues (₹400 Cr in June 2020 and ₹200 Cr in Feb 2021) followed by a preferential allotment of ₹400 Cr in Sept 2021, alongside monetisation of a ₹260 Cr stake in Arvind Youth Brands to Flipkart. These steps, though dilutive but were crucial in navigating the pandemic, funding brand rationalisation, and bringing down net debt.

As highlighted in recent concalls, Arvind Fashion Ltd is now generating strong free cash flows and has set a medium term aspiration of becoming debt-free.

List of investors participated in Arvind Fashion Ltd preferential allotment and Most of them have already exited their positions after generating attractive IRRs

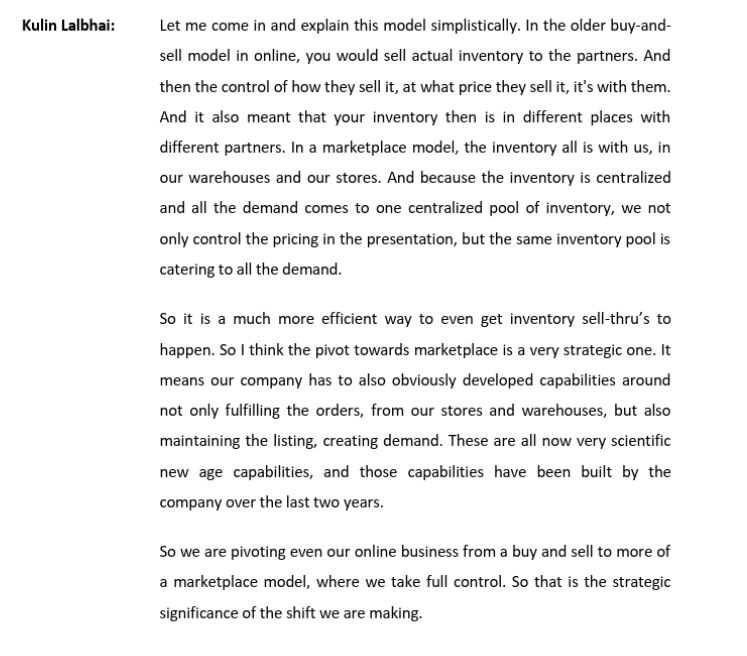

Arvind Fashions Ltd Change in model

One of the most significant structural pivots at Arvind Fashions Ltd has been the transformation of its sales and inventory model post-COVID. Earlier, Arvind Fashions Ltd. followed a sell-in model, where revenues were booked at the time goods were sold to channel partners or franchisees. The inventory was effectively offloaded to trade partners, While this drove short term revenue recognition, it created multiple pain points like elongated credit cycles, high working capital, excess channel stock, and heavy discounting to clear old inventory. This eroded margins, stressed the balance sheet and diluted brand equity.

Recognising these structural flaws, management transitioned from FY21 onwards to a direct sales model. Under this model, inventory is aligned with actual consumer demand, supported by real time sell out data. Rather than pushing excess stock into the channel, Arvind Fashions Ltd now keeps inventory on its books by tightly controlling supply, assortment planning, and liquidation cycles. Franchisees largely operate on a FOFO model, while Arvind Fashions Ltd ensures discipline through – Centralised inventory planning with sharper demand forecasting, Buyback of aged stock and liquidation through formats like Megamart and Stronger compliance and training for franchise partners to maintain brand standards

This transition has been a game-changer in financial terms:

- Working Capital Efficiency – Inventory turns improved to 4x+, debtor days reduced sharply, and free cash flow generation strengthened.

- Margin Expansion – Controlled discounting and higher full-price sell-through added 300-400 bps in EBITDA margins over FY22-FY25.

- Balance Sheet Deleveraging – Stronger cash flows enabled net debt reduction, with management targeting a near debt-free balance sheet in the medium term.

Arvind Fashions Ltd Financial Performance

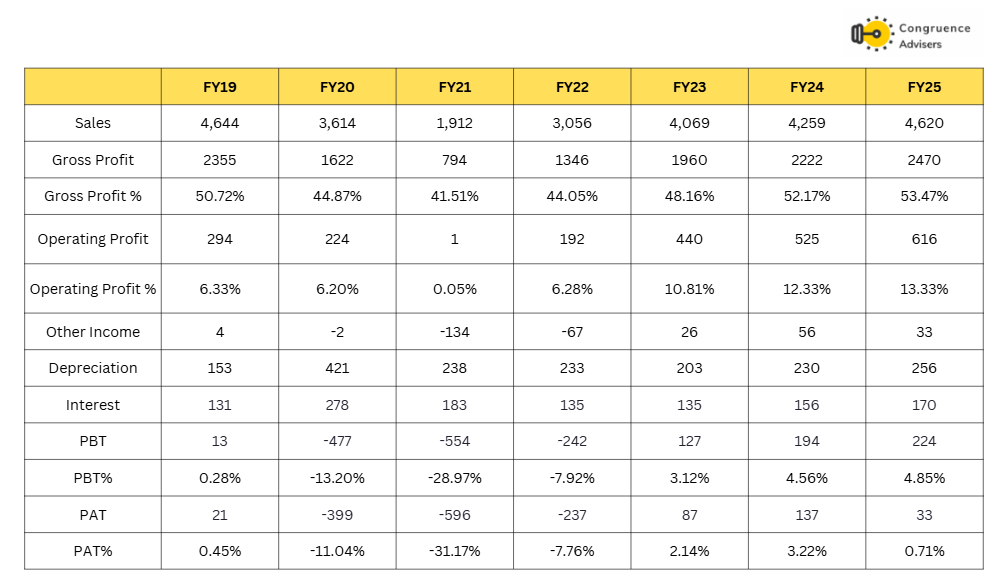

Arvind Fashions Ltd’s financial journey reflects a clear turnaround story. Between FY19-FY22, performance was weak due to portfolio rationalisation, COVID disruptions and brand closures, which led to sharp revenue declines, margin pressures, and heavy losses. However, the restructuring phase set the stage for recovery. From FY23 onwards, Arvind Fashions Ltd returned to growth, with topline recovery, steady margin expansion, and profitability improvement driven by premium brands and tighter discount control. FY25 consolidated this progress, with sales growing 8.5% YoY to ₹4,620 Cr, gross margins improving to 53.5%, and EBITDA margins reaching 13.3%. While reported PAT was muted at ₹33 Cr due to a one-off DTA charge, adjusted PAT stood at ₹85 Cr, up 70% YoY.

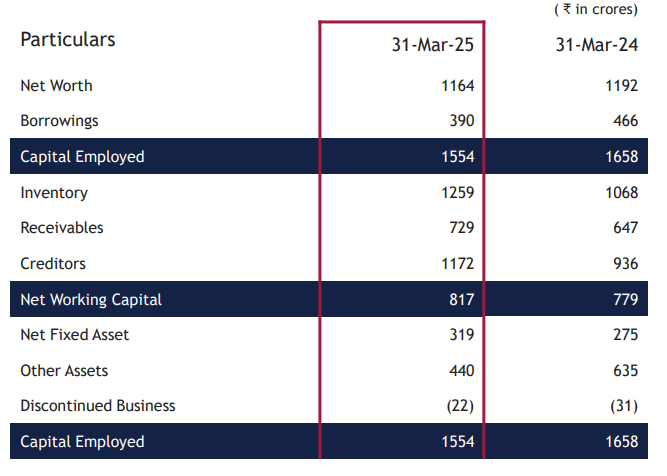

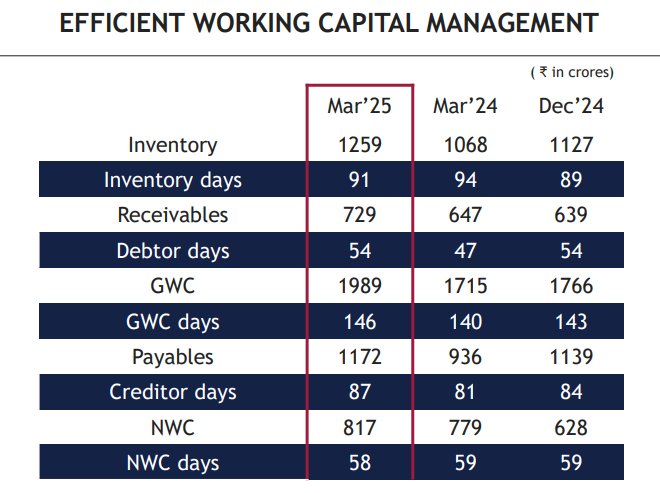

Arvind Fashions Ltd Capital Employed and Working Capital Management

Arvind Fashions Ltd has continued to improve its balance sheet health in FY25, reducing borrowings to ₹390 Cr vs ₹466 Cr in FY24. Capital employed declined marginally to ₹1554 Cr as Arvind Fashions Ltd tightened working capital and optimized assets. NWC stood at ₹817 Cr vs ₹779 Cr last year, translating into 58 days, broadly stable YoY despite higher sales. Inventory levels rose to ₹1259 Cr but inventory days improved to 91 from 94 which showcased stronger supply chain discipline. Receivables increased to ₹729 Cr with debtor days at 54 (vs. 47 last year), while creditors grew sharply to ₹1172 Cr, pushing creditor days up to 87 (vs. 81 in FY24). Importantly, gross working capital days remained steady at 146 despite revenue acceleration, indicating consistent inventory turns at ~4x.

Management, in the FY25 concall, highlighted that tight control on working capital, improved full price sell through and better discounting discipline have supported free cash flow generation, enabling debt reduction of nearly ₹75 crore in FY25. They emphasized that working capital efficiency is central to sustaining >20% ROCE and expect future improvements to come from a richer retail channel mix, premiumization, and sharper sourcing practices

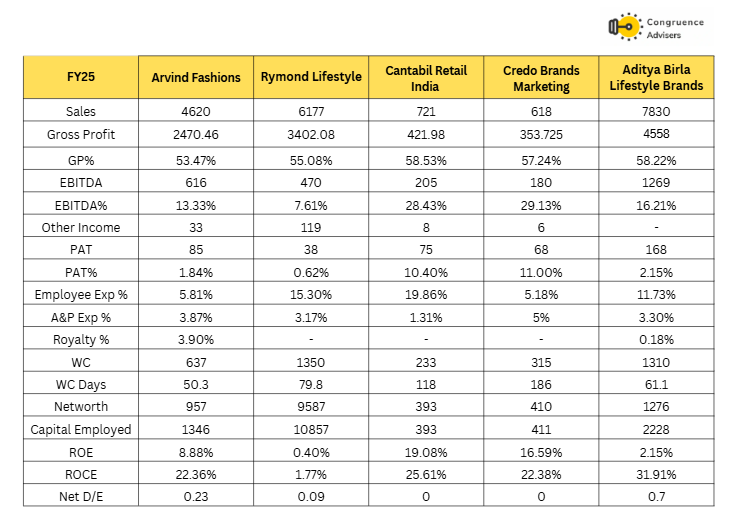

Arvind Fashions Ltd Comparative Analysis

To understand Arvind Fashions Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Arvind Fashions Ltd to its competitors (peer comparison) on various fundamental parameters and Arvind Fashions Ltd share performance relative to relevant benchmark and sector indices.

Arvind Fashions Ltd Peer Comparison

In the listed universe of branded apparel we have compared Arvind Fashions Ltd with both focused single brand companies like Cantabil Retail and Credo Brands, as well as diversified players such as Raymond Lifestyle and Aditya Birla Lifestyle Brands.

Cantabil and Credo operate with a more focused single-brand approach, but their distribution strategies differ. Cantabil relies almost entirely on the EBO route, largely operating through COCO stores, which gives it tight control over pricing, product mix, and customer experience, translating into superior EBITDA margins of ~28%. On the other hand, Credo (Mufti) operates with ~55% of its footprint in EBOs, while the balance comes from MBOs and LFS formats.However, their smaller scale restricts their ability to drive efficiencies and premiumisation across multiple consumer segments. Raymond Lifestyle, recently demerged, carries a strong legacy in ethnic wear and formal suits but struggles with weak return ratios weighed down by a heavier working capital structure (WC days at ~80). Aditya Birla Lifestyle, the closest peer to Arvind Fashions Ltd in terms of diversified portfolio play, enjoys scale with revenues of ₹7,830 crore and higher EBITDA margins (~16.2%), but being a recent listing under the Aditya Birla umbrella, its capital allocation strategy remains a watchpoint, especially given the risk of inorganic expansion that could dilute returns.

Arvind Fashions Ltd today stands out in the branded apparel landscape because of its sharp restructuring journey exiting loss making brands, unlocking capital, and pivoting to just five power brands that dominate their categories. Unlike peers that still juggle broader or single brand portfolios, Arvind Fashions Ltd has become extremely focused on scaling only high-conviction, high-margin brands like USPA, Tommy Hilfiger, and Calvin Klein. Its disciplined control on discounting, strong working capital efficiency, and steady ROCE improvement (>20%) further differentiate it in an industry prone to capital drag. This combination of portfolio clarity, premiumisation focus, and financial discipline gives Arvind Fashions Ltd a structurally stronger footing compared to peers.

Arvind Fashions Ltd Index Comparison

Arvind Fashions Ltd share performance vs S&P BSE Small Cap Index, as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why you should consider investing in Arvind Fashions Ltd ?

Arvind Fashions Ltd offers some compelling reasons to track closely and to consider investing in India’s premium branded apparel market, offering a focused brand portfolio, improving profitability and a structurally stronger balance sheet.

Powerful and Focused Brand Portfolio – Arvind Fashions Ltd today operates with one of the most focused brand portfolios in Indian apparel retail, having exited loss making and subscale businesses. Its five power brands are USPA (already above ₹2,000 Cr NSV), Tommy Hilfiger, Calvin Klein, Arrow, and Flying Machine. Which is span across casualwear, denim, formalwear, and premium lifestyle segments. The international labels Tommy Hilfiger and Calvin Klein continue to capture India’s premiumisation trend with industry leading growth and margins, while USPA remains the dominant casualwear franchise. At the same time, legacy brands are on a turnaround path. Arrow has swung back to profitability with sharper positioning and Flying Machine is being re-energised with a Gen Z-focused identity and offline expansion to reduce online dependence. With three brands already acting as profit engines and two brands undergoing a clear revival, Arvind Fashions Ltd has built a scalable, high-margin portfolio that positions it strongly for margin expansion and improved ROCE in the coming growth cycle.

Category Extensions Driving Growth – Arvind Fashions Ltd strategy of scaling its core brands through category extensions is bearing visible results. Adjacencies like footwear, kidswear, innerwear, activewear, and women’s wear together accounted for ~20% of consolidated revenues in FY25 (~₹1,500 Cr+), compared to ~15% in FY24. Footwear continues to be the standout adjacency, now an annualized ~₹300 Cr+ revenue business, led by U.S. Polo Assn. and Tommy Hilfiger and has emerged as the largest and fastest growing segment. Kidswear, primarily through USPA and TH has scaled to ~₹200 crore+ and is growing at mid teens CAGR, while innerwear and activewear are smaller but high potential plays. This adjacency led growth not only diversifies the portfolio but also supports margin expansion, as many of these categories carry structurally better unit economics.

Omnichannel presence – Arvind Fashions Ltd runs a tightly integrated, “direct-first” network spanning EBOs, MBOs/LFS, and online (brand.com/NNNOW plus marketplaces like Myntra, Flipkart, Amazon). The EBO footprint is scaling rapidly with most new doors opened under FOFO for asset-light expansion, while select COCO stores are retained in premium clusters where IRR is high. Department stores and MBOs provide breadth and discovery, and the online rails (own site + marketplaces) drive incremental reach and data led merchandising. Together, this mix lifts sell through, lowers discounting, and improves inventory turns, with EBOs and D2C increasingly contributing a higher share of revenues for Arvind Fashions Ltd.

Strong Financial Turnaround and Profitability – Arvind Fashions Ltd has delivered a remarkable financial turnaround, shifting from deep losses to sustained profitability. The company swung from a net loss of ₹267 crore in FY22 to a PAT of ₹87 crore in FY23, with profits compounding further in FY25, where comparable PAT (ex-DTA charge) grew by over 70% YoY. This recovery has been delivered by consistent margin expansion; EBITDA margins rose from 6% in FY22 to 13%+ in FY25. which is driven by improved channel mix, tighter discounting discipline, sourcing efficiencies, and operating leverage. Equally important, ROCE improved sharply from negative in FY22 to ~14% in FY23, >16% in FY24, and crossed 20% in FY25, underscoring efficient capital allocation and balance sheet discipline. With management confident of sustaining 50-100 bps annual margin gains, Arvind Fashions Ltd is now firmly positioned as a structurally profitable, capital efficient play in India’s branded apparel space.

Asset Light Model – Arvind Fashion Ltd operates on a capital light strategy designed to scale growth while minimising capex intensity. Arvind Fashion Ltd sources its entire product range from apparel to footwear and accessories through a network of long-standing third-party vendors. This outsourced model not only de-risks manufacturing exposure but also provides flexibility in design, assortment, and replenishment cycles. Arvind Fashion Ltd leverages its scale to negotiate favourable sourcing terms and improve gross margins.

On the distribution side, the growth engine is the FOFO model, under which the majority of new stores are being rolled out. FOFO enables aggressive nationwide expansion without straining the balance sheet, as franchisees bear the capex. Management commentary highlights that 90%+ of store additions are FOFO based, in line with the asset-light approach.

Importantly, by combining an asset light retail expansion with strong vendor partnerships, Arvind Fashion Ltd has created a scalable, high ROCE business model that allows reinvestment into brand building and category extensions without compromising balance sheet strength.

Strengthened Balance Sheet and Shareholder Value – Arvind Fashions Ltd. has significantly strengthened its balance sheet which provides the financial flexibility to support sustainable growth and enhance shareholder value. Over the past few years, Arvind Fashions Ltd has deleveraged meaningfully, with gross debt reducing steadily from 1050 Cr in FY20 to 380 Cr in FY25.

Management has articulated a clear medium term aspiration to become net debt free, a target well supported by its improving cash conversion cycle. Working capital discipline remains a key enabler as inventory turns have consistently stayed above 4x, while debtor days have reduced, ensuring leaner operations and robust cash flow generation. Reflecting its healthier financial profile and improved earnings visibility, Arvind Fashions Ltd has also resumed shareholder payouts, recommending a dividend of ₹1.60 per share in FY25.

This combination of deleveraging, efficient working capital management and capital return marks a step change in Arvind Fashions Ltd’s journey toward building a sustainable, value accretive business model.

What are the Risks of Investing in Arvind Fashions Ltd?

Investors need to keep the following risks in mind if they choose to invest into this business. Risks needs to be weighed in combination with the advantages listed above to arrive at a decision that is optimal for your portfolio construct

Competition and Discounting Pressure – The Indian apparel industry remains intensely competitive with both global and domestic players vying aggressively for market share. This competitive intensity often translates into deep discounting across channels, which, if not managed prudently, risks eroding brand equity and compressing margins.

Arvind Fashions Ltd has adopted a calibrated approach to reduce discount dependence and focus on full price sales. This has already translated into margin gains on the back of tighter discount control and sharper retail execution. Management also highlighted LTL growth of 8.1% in retail and 30%+ growth in online D2C achieved with controlled discounting, underscoring the strength of its brand portfolio.

Going ahead, Arvind Fashions Ltd aims to sustain profitability through a sharper channel mix, inventory discipline and greater reliance on COCO/FOCO stores and brand.com rather than chasing volumes through heavy promotions.

Franchisee and Partner Risk – Arvind Fashions Ltd’s retail network expansion is predominantly driven by the FOFO model, which allows the Arvind Fashions Ltd to remain asset light while scaling rapidly across high streets, malls, and emerging consumption clusters. While this model provides speed and capital efficiency, it also introduces execution risk. Variability in franchisee capabilities could result in inconsistent service quality or brand experience.

Management has acknowledged this risk and instituted multiple safeguards. Arvind Fashions Ltd runs detailed training programs for franchise partners, enforces strict compliance audits, and provides structured operational support to ensure alignment with brand standards. Arvind Fashions Ltd has also highlighted that its franchisee pool comprises motivated, high quality entrepreneurs, many of whom bring strong local relationships with landlords and communities which helps Arvind Fashions Ltd secure prime retail spaces at better terms.

Muted Consumer and Discretionary Demand – The broader Indian discretionary consumption environment has been subdued for several quarters with commentary across apparel, footwear and lifestyle peers echoing the same trend. Arvind Fashions Ltd has consistently highlighted that consumer demand remains soft which directly impacts sales velocity and full-price sell-through. This softness poses a risk to sustained growth, Arvind Fashions Ltd’s performance resilience has largely come from brand equity, channel rationalisation, and tighter discounting discipline, but broad based industry demand revival remains critical for sustaining this growth.

On the policy front, recent government measures such as income tax relief and GST rationalisation are expected to provide a boost to disposable incomes and improve consumer sentiment. These initiatives could act as catalysts for a discretionary demand uptick.

Dependence on Third-Party Vendors and Supply Chain Disruptions – Arvind Fashions Ltd. follows a capital light operating model i.e sourcing its entire merchandise from an established network of third party vendors. While this strategy optimises return ratios and reduces inventory/working capital intensity, it creates an inherent dependency on supplier reliability. Risks include potential supply chain disruptions, longer lead times, cost inflation, or lapses in quality control, which could impact product availability and margins.

To mitigate this, Arvind Fashions Ltd works with a diversified vendor base across geographies and categories which has reduced concentration risk. Arvind Fashions Ltd maintains stringent quality control standards and audits, while also leveraging long standing vendor relationships to secure better terms and priority supply. Arvind Fashions Ltd has also invested in digital supply chain systems and demand forecasting to improve visibility and agility, helping it manage inventory turns and maintain consistent service levels.

Brand Concentration and Performance of Laggard Brands – A substantial portion of Arvind Fashions Ltd profitability is driven by the premium brands Tommy Hilfiger and Calvin Klein (PVH brands) and the power brand USPA. While brands like Arrow and Flying Machine have historically been a drag on profitability.

Management has been executing turnaround strategies: Arrow has been repositioned with sharper product innovation (Arrow New York, occasion wear lines), stricter credit discipline, and improved sell through. Flying Machine is being de-risked from overdependence on online by EBO expansion and sharpening its youth positioning. While early signs are visible in channel rationalisation and better retail performance, the success of these turnarounds is critical for overall margin expansion.

Inability to Renew Brand Licenses – Arvind Fashions Ltd’s portfolio is heavily dependent on marquee international labels such as Tommy Hilfiger, Calvin Klein, and U.S. Polo Assn., which operates under long term licensing agreements. The sustainability of these partnerships is critical, as they contribute a significant portion of Arvind Fashions Ltd’s revenues and profitability. The key risk lies in the potential non-renewal of licenses whether due to failure to meet performance benchmarks, contractual non compliance or strategic decisions by the brand principals. Such an outcome could materially impact Arvind Fashions Ltd’s earnings visibility and valuation, given the high margin nature and aspirational positioning of these brands.

Arvind Fashions Ltd has historically maintained strong relationships with global brand owners backed by consistent execution and category leadership in India. Management commentary across concalls has repeatedly highlighted that long-dated licenses are in place with built-in renewal mechanisms, and Arvind Fashions Ltd has demonstrated its ability to deliver sustained growth, thereby reducing counterparty risk.

Counterfeit Products – The sale of counterfeit versions of Arvind Fashions Ltd’s popular brands can harm brand reputation, erode customer trust, and impact legitimate sales. Arvind Fashions Ltd actively monitors for and takes enforcement action against counterfeit activity

The biggest risk at CMP arises from lower than anticipated growth over the next 12-18 months. If the resurgence of consumer spending does not materialize on anticipated lines, the market may continue to view this business with skepticism since the improvement in the balance sheet is already well acknowledged.

Arvind Fashions Ltd Future Outlook

Targets for FY26 and Beyond –

- Management has guided for 12–15% revenue growth in FY26, led by acceleration in adjacent categories and continued expansion of direct channels.

- EBITDA margins are expected to expand by 50–100 bps annually, with corresponding PAT margin gains, driven by operating leverage, tighter discounting discipline, and sourcing/scale efficiencies.

- ~150 new stores are planned in FY26, largely via the FOFO route, with higher net square footage addition versus FY25.

- Direct to consumer channels (EBOs + online B2C) are targeted to increase their share by 100–200 bps, aiding inventory efficiency.

- Working capital discipline will continue to drive strong free cash flow, with a clear medium-term aspiration to remain debt-light and ROCE-accretive (20%+ levels).

Brand wise Growth Path –

- U.S. Polo Assn. (USPA): With a NSV of over ₹2000 Cr and healthy EBITDA margins of 13-14%, USPA remains the flagship growth engine. Expansion will be driven not only by core casualwear but also by high growth adjacencies like footwear, kidswear, etc. which already contribute 25%+ of brand revenues.

- Tommy Hilfiger & Calvin Klein (TH & CK): Together, these premium international brands are expected to deliver 12-15% topline CAGR with EBITDA margins of 19-20%. Their strong positioning in the aspirational consumption segment makes them critical to driving margin accretion.

- Arrow & Flying Machine: Both brands are in turnaround mode. Arrow has returned to profitability with a sharper product mix and reduced discounting, while Flying Machine is being re-energised through a Gen Z-focused identity and omni-channel push. Their margin recovery is likely to provide incremental upside.

Adjacencies such as footwear, kidswear, innerwear, and women’s wear now contribute ~20% of consolidated revenues and continue to scale at 15-20% CAGR. Footwear has already crossed ₹300 Cr in size, followed by kidswear at ~₹200 Cr, with innerwear around ₹200 cr. These categories will be key levers for growth and premiumisation.

Arvind Fashions Ltd has undergone a sharp transformation over the past few years by exiting non core and unprofitable brands, tightening supply chain discipline, and focusing exclusively on five core brands. The business today stands on a leaner, more profitable base with well defined brand strategies, strong working capital discipline and a scalable, asset light FOFO led retail model. Arvind Fashions Ltd is now geared to deliver consistent, profitable growth.

Arvind Fashions Ltd’s outlook is anchored around (1) scaling power brands with profitable adjacencies, (2) steady 12-15% topline growth with margin expansion, (3) rising contribution of direct channels and digital, and (4) continued improvement in ROCE and FCF generation.

On the demand side, the consumer environment remains somewhat soft, but recent government measures including personal income tax relief and GST rationalisation are expected to improve disposable incomes and revive discretionary spending. These initiatives, combined with premiumisation trends and urban consumption recovery, can act as catalysts for growth.

Arvind Fashions Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Arvind Fashions Ltd Price charts

On the weekly chart, Arvind Fashions shows an important support level around 365 where the price took strong support in the April 2025 tariff tantrum. The base of the rising trendline was not violated barring the steep selloff seen on April 7th. This price point is a culmination of two long term trends and hence a very important milestone in our assessment.

Any price correction closer to the rising trendline can be viewed as an accumulation opportunity in the future – if your assessment of the fundamentals indicates a steady earnings growth over the next 12-18 months. The price will need decent (if not good) earnings for the trend line to sustain from here.

On the daily chart, we believe that the current range bound movement since August beginning is in line with the small cap index trend. Any breakdown below a level of 510 will make the current trend into a neutral one from positive; while sustained move above the level of 570 would imply that the market is confident about the ability of the business to deliver healthy revenue and PAT growth over the next 5-6 quarters. Q2 FY26 results could turn out to be decisive in setting a trend.

Arvind Fashions Ltd Latest Latest Result, News and Updates

Arvind Fashions Ltd Quarterly Results

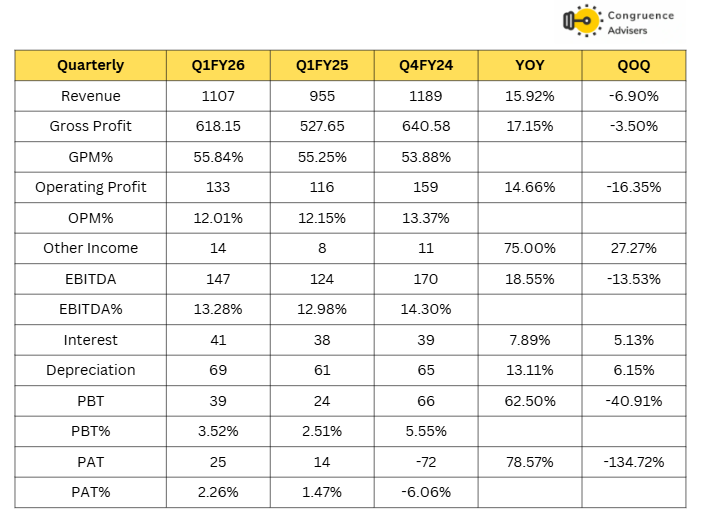

Arvind Fashions Ltd printed a strong revenue growth of 15.9% YoY in Q1FY26 driven by broad-based growth across all channels retail, online B2C, and wholesale. However, revenues moderated 6.9% QoQ due to seasonality. Gross profit up 17.2% YoY, translating into a gross margin of 55.8% (+60 bps YoY, +200 bps QoQ). The expansion was aided by reduced discounting and superior channel mix. EBITDA growth is supported by operating leverage and lower discounting. Despite higher marketing spends (+140 bps).

Channel & Business Highlights

- Retail channel: Grew ~15% YoY, led by strong like-to-like (LTL) growth of 8.1% and lower discounting.

- Online B2C (D2C) channel: Delivered >30% YoY growth, continuing its trajectory of outperformance.

- Wholesale channel: Grew >10% YoY, rebounding from last year’s weak base.

- Store network: Arvind Fashions Ltd added 29 EBOs during the quarter, taking the count to 987 EBOs, spanning ~12.3 lakh sq. ft. of retail space.

- Working capital: NWC days remained stable, with inventory turns at ~4x, which reflects disciplined inventory management.

- Category performance: Adjacent categories (women’s wear, footwear & accessories, kids’ wear) witnessed >20% growth

Final Thoughts on Arvind Fashions Ltd

Arvind Fashions Ltd can turn out to be a very interesting business if the consumption trajectory revives in FY26. The management has done excellent work on the balance sheet and capital allocation fronts over the past 5 years, a good run of revenue growth can put the business into the next orbit. The business quality is much better than most peers and the current valuation multiple reflects the same. Arrow and Flying Machine brands starting to print 6%+ EBITDA margin (pre IND AS) can move the needle by 100bps for the overall EBITDA margin over the next 2-3 years.

To reiterate, FY26 could turn out to be a decisive year. Investors will need to monitor the business like a hawk over the next 2-3 quarters to be able to bet with conviction, if they choose to.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this to a general audience. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will continue/be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.