Goldiam International Ltd is a listed micro-cap company headquartered in Mumbai, Maharashtra. Goldiam International Ltd manufactures gold jewellery studded with natural and lab-grown diamonds and exports them, primarily to the USA. In recent months,Goldiam International Ltd has also ventured into lab-grown diamond jewellery retail business in India.

Goldiam International Ltd Company Summary

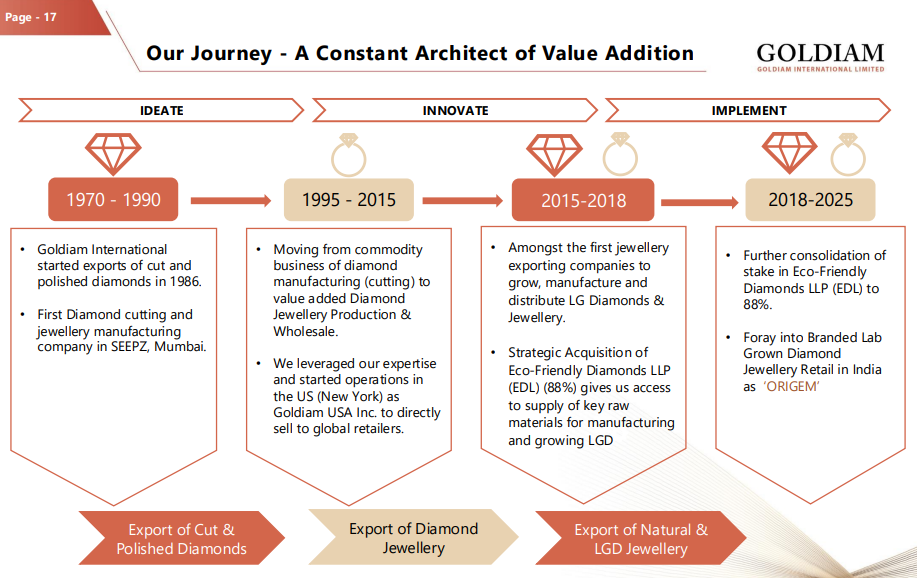

Goldiam International Ltd began its journey as Goldiam (International) Pvt. Ltd., incorporated in 1986. The company was founded by M. R. Bhansali and K. R. Bhansali, who started by exporting cut & polished diamonds and plain/studded gold jewellery. From early on, the company aimed for forward integration handling diamond cutting, polishing, and jewellery manufacturing all under one roof. Today, Goldiam International Ltd is led by Mr. Rashesh M. Bhansali as Executive Chairman and Mr. Anmol Bhansali as Managing Director. Mr. Rashesh M. Bhansali is the son of the founder Late Mr. M.R. Bhansali and Mr. Anmol Bhansali is his son.

For several decades since its inception, Goldiam International Ltd was one of the many manufacturers and exporters of natural diamond studded gold jewellery. Lab-grown diamonds became a viable product in the jewellery industry starting mid-2010s. Goldiam International Ltd was able to grasp the huge demand potential of lab-grown diamond jewellery in the USA early on and went on to become an early mover in this space in India. Goldiam International Ltd pivoted its B2B export business away from natural diamond jewellery towards lab-grown diamond jewellery around the turn of the last decade (2018-2020). This enabled them to leapfrog larger peers and become one of the largest exporters of lab-grown diamond jewellery from India in the space of a few years.

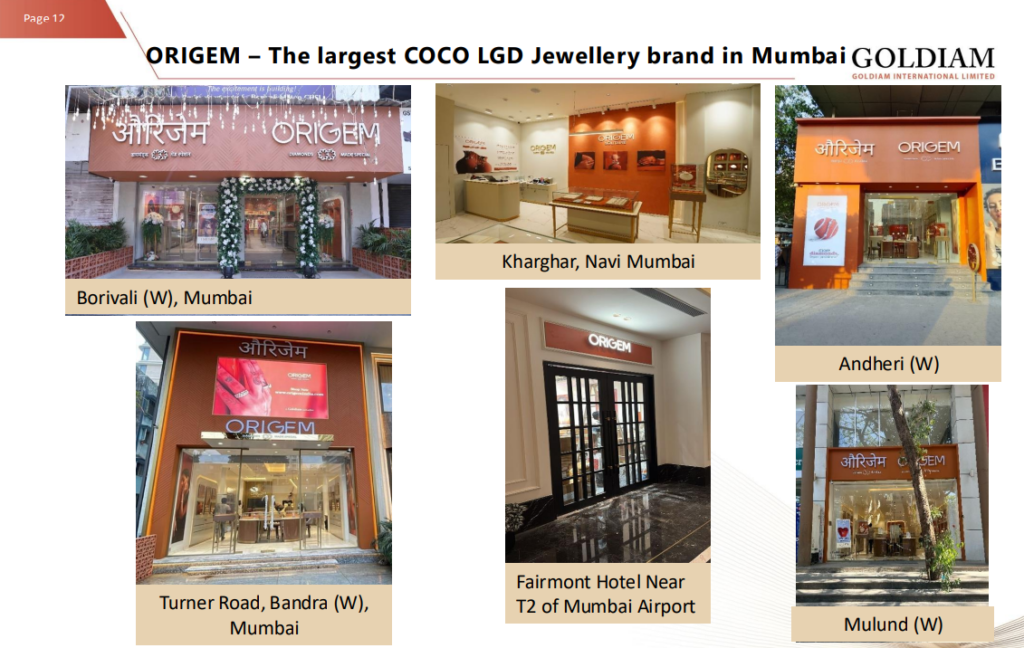

In recent months, Goldiam International Ltd has ventured into its own lab-grown diamond jewellery retail business in India by the name of Origem. Goldiam International Ltd believes that the demand for lab-grown diamond jewellery that has played out in the USA over the past 10 years, will play out in India as well. Goldiam International Ltd wants to capitalise on this demand by becoming one of the largest lab-grown diamond jewellery retail companies in India. Goldiam International Ltd has already opened 8 Origem stores in Mumbai, Bangalore and Delhi NCR and plans to open between 70-90 stores pan-India in the next 18-24 months.

Goldiam International Ltd Management Details

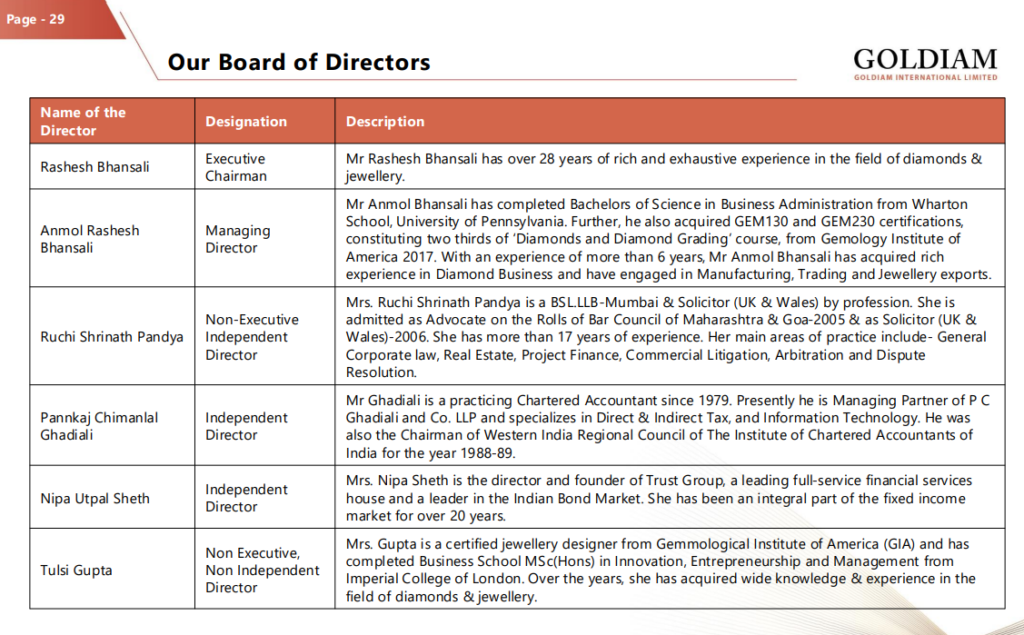

Goldiam International Ltd is a promoter owned and operated company. The Bhansali family owns 59% of Goldiam International Ltd and runs the day to day operations of Goldiam International Ltd. Mr. Rashesh Bhansali serves as the Executive Chairman of Goldiam International Ltd and his son, Mr. Anmol Bhansali serves as the Managing Director of Goldiam International Ltd.

Goldiam International Ltd – Industry Landscape

The global natural diamond studded jewellery market is estimated to be in the range of US$ 90-100bn at retail value. The global lab-grown diamond studded jewellery market is estimated to be about 15-18% of the natural diamond market i.e. between US$ 14-18bn. Put together, the total diamond studded jewellery market globally is estimated to be between US$ 105-118bn. A bulk of this jewellery is studded in gold with smaller amounts in platinum and silver.

The natural diamond jewellery market is estimated to grow at 3-4% CAGR going forward whereas the lab-grown-diamond jewellery market is estimated to grow at ~10% CAGR. Lab grown diamonds have grown remarkably over the last decade or so and have made a significant dent in demand for natural diamond jewellery. Lab grown diamond jewellery is still in the early stages of adoption in the world. This is reflected in LGD jewellery’s expected CAGR being more than twice that of natural diamond jewellery.

USA is the single largest market for lab-grown diamond jewellery, accounting for ~70% of global demand. Uptake of LGD in the rest of the world has been more tepid, however it is expected to start penetrating ex-USA global demand in the coming years.

Rise of lab grown diamonds and LGD jewellery

Lab grown diamonds have existed for several decades. The first lab grown or synthetic diamond was made by the high pressure high temperature (HPHT) route as far back as 1954. In parallel, scientists evolved the Chemical Vapour Deposition (CVD) process for making synthetic diamonds. By the 1990-2000s, both technologies had matured enough to start producing gem quality lab-grown diamonds.

Let’s understand the two different techniques for making lab-grown diamonds

– HPHT – This process grows diamonds by dissolving carbon in a metal flux (Fe-Ni-Co) under extreme pressure and temperature, crystallizing onto a seed. It’s capital-intensive but excels at bulk output. Most HPHT capacity is in China.

– CVD – CVD uses a microwave plasma to activate methane/hydrogen gases so carbon deposits atom-by-atom on a seed. It runs at lower pressure and temperature than HPHT which enables high-purity type IIa crystals and large single-crystal plates which are suitable for use as gems. India (Gujarat) has a significant chunk of global CVD capacity.

Overall it is estimated that China has ~50% of global market share in manufacturing LGDs while India has about ~15-20%. The relatively low capital expenditure involved in CVD manufacturing, coupled with the existing diamond cutting, polishing and setting supply chain in India has spurred the rise of CVD manufacturing in India.

Two events in the late 2010s helped mainstream lab-grown-diamond jewellery. The first was the US Federal Trade Commission Jewellery Guides revision which stated that lab created stones were indeed diamonds. The second was the largest natural diamond company, De Beers’s, 2018 launch of Lightbox – a lab grown diamond jewellery brand. Lightbox sought to position LGD jewellery as fashion/value in contrast to heirloom natural diamond jewellery. However, over time, lab grown diamond jewellery has penetrated not only fashion but also bridal jewellery, especially engagement rings. The lower cost of lab grown diamonds has allowed customers to buy larger carat diamond engagement rings for lower prices. Today it is estimated that ~50% of all engagement rings sold in the USA are made of lab grown diamonds.

As lab grown diamonds became mainstream, there was an explosion of reactor capacity. Manufacturers put up capacity in the hopes of capturing a very high return on capital. However, as supply exploded, inevitably the wholesale prices of lab grown diamonds started correcting. Since 2018, lab grown diamond supply has grown 10x+ while wholesale prices have dropped by more than 90%. Over the last couple of years it is believed that wholesale LGD prices have reached a level which barely covers marginal costs for LGD manufacturers. Therefore the steep price declines in LGD is believed to be over and going forward LGD pricing is expected to be much more stable. Of course further technological breakthroughs which make LGD manufacturing even cheaper, can cause a further slide in LGD prices in the future. As of 2025, at retail level, an LGD trades at 80-90% discount to its equivalent natural diamond counterpart.

Lab grown diamonds supply chain

- LGD manufacturing – Most lab grown diamonds are grown in China and India. China dominates HPHT diamonds while India has a sizable share of the CVD market

- LGD cutting and polishing – Just like in natural diamonds, the cutting and polishing hub for rough LGD is entirely located in India. This is due to the availability of deep, skilled labour pools, cost advantages wrt other countries and co-location of the accompanying supply chain. It is estimated that 9 out of 10 rough diamonds in the world are cut and polished in India

- LGD studded jewellery manufacturing and export – India is once again the largest studded jewellery manufacturing and export center of the world. SEEPZ, Mumbai is the largest hub for studded jewellery exports from India. Apart from India, Thailand is also a large hub for studded jewellery manufacturing and exports. Turkey is another country with a large manufacturing and export presence followed by Vietnam as an emerging country.

Indian jewellery industry and export trends

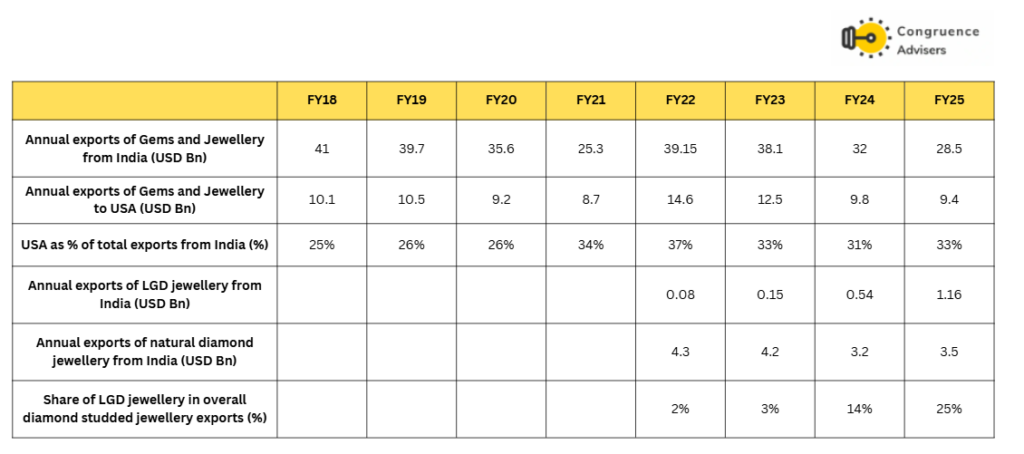

As one can see from the table below, the annual exports of gems and jewellery from India is about USD 28.5bn in FY25. This is down from USD 41bn in FY18. A significant part of the export decline is due to the reduction in volume and prices of natural diamonds since 2018.

Of the total exports, about 33% in FY25 was to the USA, which is the single largest importer of Indian jewellery. Over the last decade, the US share of Indian gems and jewellery exports has crept up from 25% to 33%.

It is very interesting to see how lab grown diamond jewellery exports started out with very modest numbers in FY22 and have since exploded 15x in 3 years. In FY25, LGD jewellery exports amounted to USD 1.16bn, accounting for 25% of all diamond studded jewellery exports from India. At the same time, one can see that export values of natural diamond studded jewellery has gradually crept down from USD 4.3bn in FY22 to USD 3.5bn in FY25. This clearly illustrates the shift in demand away from natural diamond jewellery into lab grown diamond jewellery. A bulk of these LGD jewellery exports are to the USA.

The hub for Indian diamond studded jewellery exports is SEEPZ, Mumbai. Some of the largest Indian exporters of natural and LGD studded jewellery are companies such as Jewelex, Jewel One, Goldiam International Ltd, Uni Design, KBS Creations, HK Designs, Renaissance Global etc.

Goldiam International Ltd Business Details

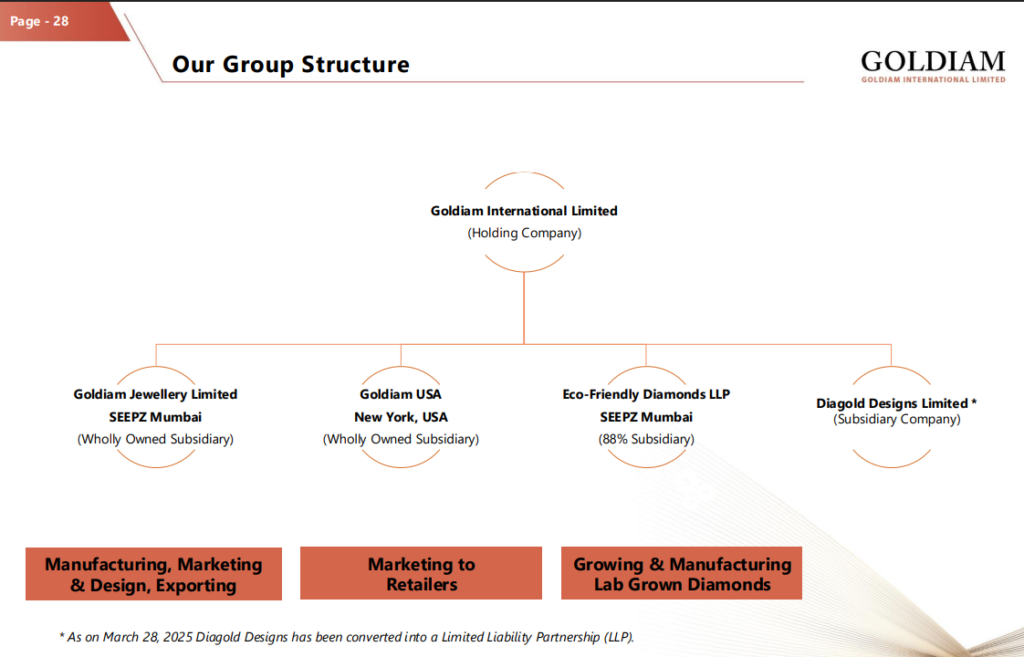

Goldiam International Ltd has two main business segments – the traditional B2B jewellery exports business and Origem, the new India focused LGD jewellery retail venture.

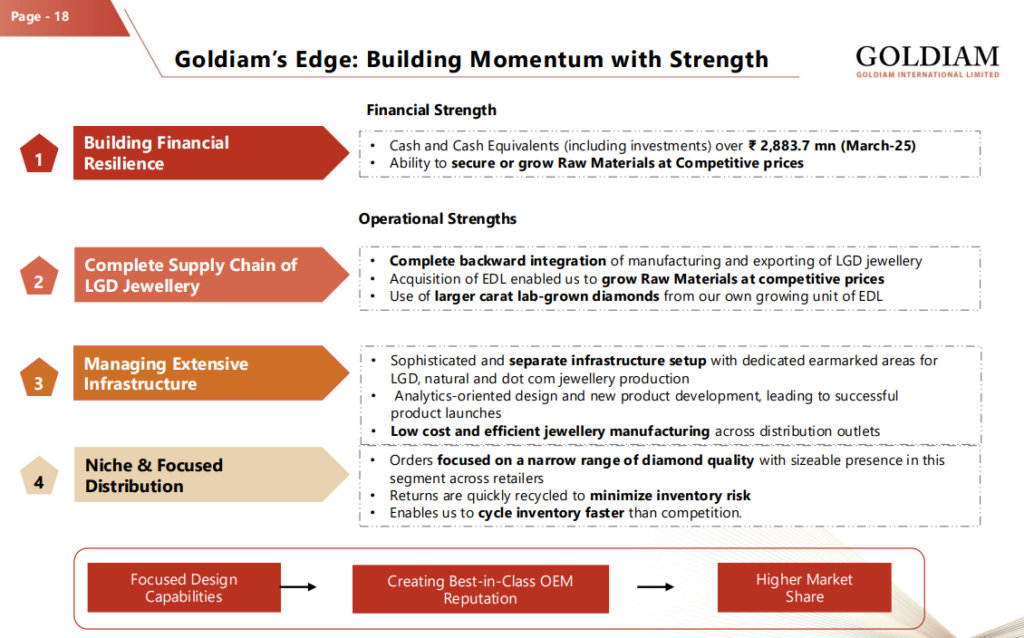

Goldiam International Ltd acquired an 88% stake in an LGD manufacturing company called Eco Friendly Diamonds LLP in 2021 for INR 21 Cr. Subsequently, in FY22, they invested INR 10Cr to increase the facility’s LGD manufacturing capacity by 40%. Today, this manufacturing unit can make 630 carats of CVD diamonds per month and satisfies a part of Goldiam International Ltd’s LGD requirements. The vast majority of LGD consumed by Goldiam International Ltd are still sourced by the company from independent manufacturers. Having a captive manufacturing gives them a good understanding of the manufacturing process which helps them in better sourcing as well. In the unlikely event that market prices of LGDs start going up, this captive manufacturing facility can give them a cost advantage for a part of their business.

Let’s take a detailed look at the nuances of the B2B and B2C business segments separately.

B2B Business

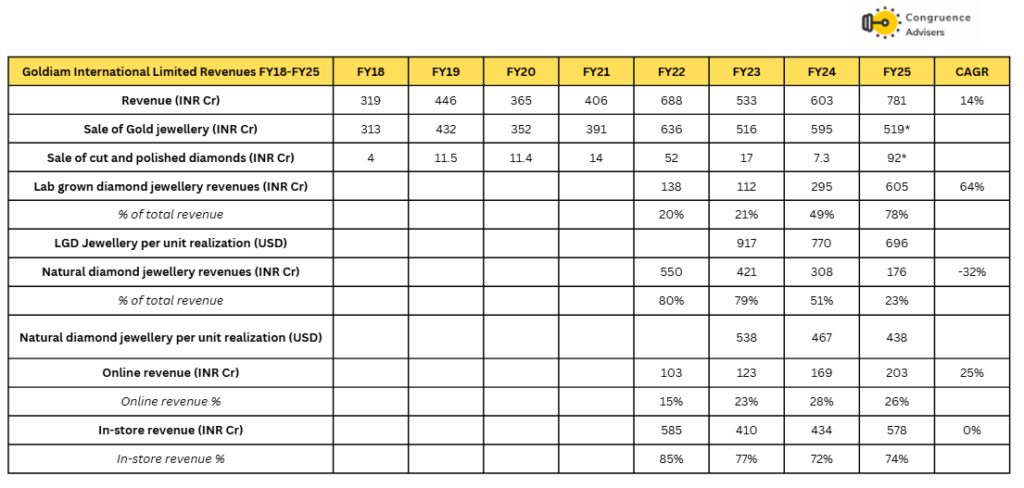

Till FY25, the entire revenues of Goldiam International Ltd came from the B2B jewellery exports business. Since FY18, the B2B business has grown at a CAGR of 13.6%. Lab grown diamond jewellery sales started picking up around FY20 – Goldiam International Ltd started reporting LGD jewellery revenue separately from FY22.

Between FY22-25, LGD jewellery sales have grown massively, at a CAGR of 64%, from INR 138Cr to INR 605Cr. In FY22, LGD jewellery constituted only 20% of Goldiam International Ltd’s overall sales. By FY25 this number had gone up to 78%. During the same period, natural diamond jewellery sales dropped from INR 550Cr in FY22 to INR 176Cr in FY25. Thus, in the last 5 or so years, Goldiam International Ltd has pivoted its B2B exports business from a natural diamond jewellery business to a lab-grown-diamond jewellery business.

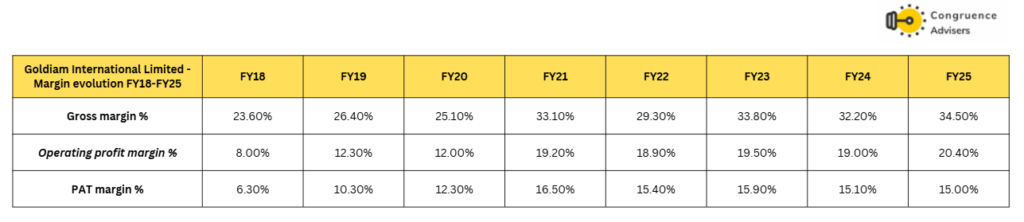

The increase in proportion of LGD jewellery sales vs natural diamond jewellery sales has helped increase gross margins for Goldiam International Ltd.

You can read why LGD jewellery has higher gross margins than natural diamond jewellery in the words of management below

Another transformation that has happened in the B2B business is the increasing proportion of online sales vs in-store sales. Online sales as a % of total revenue has grown from 15% in FY22 to 26% in FY25. The online model is less working capital intensive for Goldiam International Ltd and hence a higher proportion of online orders is beneficial for Goldiam International Ltd.

About 90% of Goldiam International Ltd’s B2B business is in the USA with 10% split between regions such as Europe, Australia and the Middle East. Goldiam International Ltd exports diamond and LGD jewellery to various cohorts – Large jewellery retailers such as Signet Jewellers Ltd., department-store chains such as JC Penney and individual mom and pop stores. Mom and pop stores are serviced by Goldiam International Ltd via wholesalers. Signet is Goldiam International Ltd’s largest customer, accounting for about 1/3rd of Goldiam International Ltd’s FY25 sales. The mom and pop stores business via wholesalers accounts for about 10% of Goldiam International Ltd’s topline.

B2B Business model

Under the B2B business model, Goldiam International Ltd places two kinds of inventory at the stores of large jewellery retailers such as Signet. The first is regular inventory for jewellery SKUs which Signet has already approved. For sales of these SKUs, Goldiam gets paid in 60-90 days.

The other kind of inventory is for new jewellery SKUs that Goldiam International Ltd has developed which retailers like Signet are yet to include in their regular offerings. This kind of inventory is called “memo sales” and the inventory is placed on consignment basis with the US retailer i.e. while the inventory is physically located with the retailer in the USA, it continues to remain on the books of Goldiam International Ltd. As and when the SKUs actually sell-through to end customers from the retail stores of the retailer, Goldiam International Ltd gets paid for the sold SKUs. Over time, SKUs that have satisfactory sell-through rates at the retail stores are confirmed by the retailer as regular SKUs and subsequent purchase orders are placed on Goldiam International Ltd under regular business terms (non-consignment sales with 60-90 days of credit).

At any point of time, about 20-25% of overall sales to jewellery retailers is on “memo basis”, the rest is on regular business terms. SKUs placed on a “memo” basis that don’t have a satisfactory sell-through rate even after 12-15 months, are taken back as returns by Goldiam International Ltd. The gold is then melted and the diamonds are re-purposed for other SKUs. The typical returns rate on “memo” inventory is about 20%. For “memo” inventory that gets returned, the labour cost involved in making the jewellery, typically 10-12% of the B2B sales value, is a loss for Goldiam International Ltd.

Placing the right “memo” inventory with US retailers and ensuring high sell-through rates of their memo SKUs is the way for jewellery manufacturers like Goldiam International Ltd to increase wallet share with large US jewellery retailers such as Signet. Therefore the working capital and returns related costs involved in managing “memo” inventory is nothing but a business development cost for Goldiam International Ltd. Therefore the merchandising and new product team of Goldiam International Ltd is a very important element in driving success in “memo” sales which pave the way for winning higher wallet share with key customers.

Under the online sales model, Goldiam International Ltd’s customers such as Signet accept end-customer orders via their websites and e-commerce platforms. These individual customer orders are passed on to Goldiam International Ltd. Goldiam manufactures the order and ships it directly to the individual customers under a drop-ship model. Compared to the in-store offline model, the online model is very light on working capital for Goldiam International Ltd. Therefore, increasing online exports % is a good thing for Goldiam International Ltd.

The exports to mom and pop jewellers is done via large wholesalers. The wholesalers get higher credit terms from Goldiam International Ltd compared to jewellery retailers – about 150-180 days.

The key determinants of success in the B2B studded jewellery exports business are

- A strong merchandising and new products team which can innovate and come up with new products continuously. For this, the company needs to have a good pulse of evolving trends in end jewellery markets

- Having a strong presence in the USA and a strong face-to-face personal relationship with key buyers at the likes of Signet, JC Penney etc. With tariffs in play, the wherewithal to manufacture castings in the USA is another key capability.

The below excerpt from one of the investor conference calls should help illustrate points #1 and #2

- Financial and operational capability to deliver orders on time and as per the desired specifications

- Strong sourcing and manufacturing capabilities in natural and lab-grown diamonds. With the proliferation of LGD manufacturing units in India, sourcing capabilities are proving to be more important than in-house manufacturing. Being able to source the right SKUs at the right prices, taking advantage of periodic price corrections, can result in appreciable advantages in cost of operations.

As of FY25, Goldiam International Ltd. appears to be the 2nd largest LGD jewellery exporter from India and is amongst the top 5 largest diamond studded jewellery exporters from India. Jewelex, Jewel One, HK Designs, KBS Creations, Uni Design are some of the other large exporters of diamond studded jewellery from India. They compete directly with Goldiam International Ltd in this space.

Goldiam International Ltd’s growth in LGD jewellery exports in the last 3 years has been remarkable. The LGD jewellery exports spike has catapulted Goldiam International Ltd into one of the top Indian exporters of studded jewellery from being one of the also-rans in the industry.

B2C Business

Goldiam International Ltd. has recently launched its B2C LGD jewellery venture, Origem, in India. They intend to sell everyday-wear, fine jewellery in Origem in the price range of INR 40-50k per unit. With their rich experience in LGD jewellery exports and having seen the explosion of LGD jewellery demand in the USA, Goldiam International Ltd management is quite confident that a similar trend will play out in India. Indians have a penchant for gold and diamond jewellery. While natural diamond jewellery was unaffordable for most Indians, the advent of LGDs has brought diamond jewellery within the grasp of many Indians. Through Origem, Goldiam intends to capture a large share of this upcoming LGD jewellery demand in India.

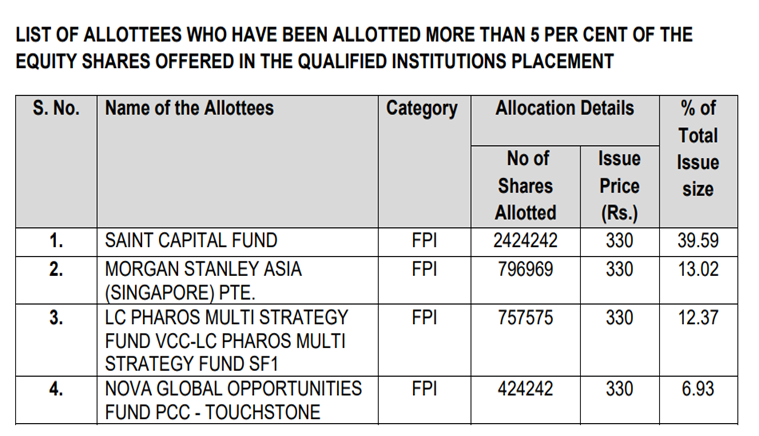

Goldiam International Ltd. has already opened 8 COCO stores in India as of Sep 2025 – 6 in Mumbai, 1 in Bangalore and 1 in Noida. Goldiam International Ltd has recently raised ~INR 200 Cr of equity capital via a Qualified Institutional Placement by diluting ~5% of total equity. Goldiam International Ltd intends to use the funds to rapidly scale Origem to 80-90 stores pan India in the next 18-24 months.

Presently the LGD jewellery market is nascent in India with the largest player operating with < 50 stores pan India and doing < INR 100Cr of revenues. There are no publicly listed companies retailing LGD jewellery, all the competitors are privately funded. In such an environment, capital could be a significant barrier to scaling. By doing the QIP and with almost ~INR 300Cr of cash and investments on their books, Goldiam International Ltd seems to have taken care of the capital needed to scale Origem to a pan India brand.

The management has spoken about the unit economics of an average Origem store in its investor calls. Some of the points mentioned by management are as follows

- They expect the average store to breakeven at INR 25-30 Lakhs of monthly sales (INR 3.5Cr annual sales). Given that unit realizations are around INR 40-50k, this implies an average Origem store could break even when sales hit ~2-3 numbers per day. If consumers like their collections, this is not a very big number to achieve. Therefore good stores can be expected to exceed the breakeven sales numbers comfortably

- The total investment needed per store would be to the tune of ~INR 3.5Cr.

- INR 2.5 Cr towards inventory

- ~INR 50 Lakhs towards capital fitouts of the store

- ~INR 50 Lakhs towards rental deposits

At an average investment of ~3.5Cr, their present cash war-chest of ~INR 500Cr (INR 200Cr from QIP + INR 300Cr of cash in balance sheet) should suffice for 140 stores. Beyond 200 stores, a jewellery brand in India can be legitimately considered to be a pan-India presence, so Goldiam is well on that path in terms of capital availability

- The average retail price per unit of jewellery is expected to be in the range of INR 40k-50k. The company expects to have gross margins north of 40% in this business.

Putting all of this data about store unit economics together, it would seem that this is a fairly lucrative retail business model on paper which can deliver 20%+ ROCE at the store level. The proof of the pudding will lie in execution which is far from easy, especially considering Goldiam International Ltd. has had no prior B2C experience.

The opportunity definitely looks quite exciting, especially if management is right about India being at the cusp of adopting LGD jewellery as mainstream. Right now, there isn’t too much credible competition in the space, with the largest competitors being privately funded players such as Limelight Diamonds and Aukera Jewellery. However, the behemoths of the Indian jewellery retail industry such as Tanishq, Malabar Gold & Diamonds, Kalyan Jewellers etc. may decide to enter this market if they believe LGD jewellery is here to stay and is not just a passing fad.

Since these incumbents have large natural diamond jewellery businesses, they will be a little wary of committing to LGD jewellery initially for fear of cannibalizing their natural diamond sales. This could provide Goldiam International Ltd with a window of opportunity of 2-3 years in which it can establish itself as a premier national brand for lab-grown diamond jewellery. If it is able to do so, then Goldiam International Ltd’s terminal value will expand dramatically and investors in the stock are in for a good time. But as we have said before, it is easier said than done. Investors should track retail execution by Goldiam International Ltd and emerging competition in the space, quarter by quarter.

Presently, Goldiam International Ltd is experimenting with various store formats (small vs large) and collections (premium vs affordable) across its stores to gauge what the sweet spot could be for LGD jewellery retail. Here are details of 3 different kinds of stores it has opened in Mumbai recently

- Borivali – 900-1000 sft size, rent 800 Rs/sft, Avg jewellery ticket size INR 50k per unit (Mid premium)

- Turner road – 1300sft size, rent higher than premium store, Avg jewellery ticket size 90k per unit (Premium)

- Kharghar – 700-800sft size, lower rent than premium store, Avg jewellery ticket size INR 25-35k per item (Affordable)

All the stores are company owned and company operated (COCO) and Goldiam International Ltd plans to keep it that way in the first few years of its existence in order to ensure that there is a consistent brand experience delivered across all stores, pan India. We like this strategy – this shows that Goldiam International Ltd is keen to get things right from the get-go to establish Origem as the premier LGD jewellery brand in India instead of taking capital light shortcuts for growth by adopting FOFO (Franchise owned, franchise operated) or FOCO (Franchise owned, company operated) models from the start.

Goldiam International Ltd Corporate Governance

Board Composition – Goldiam International Ltd board comprises 6 Directors with 3 Independent Directors, satisfying the 50% independent Directors’ criteria. Mr. Rashesh Bhansali is the Executive Chairman of the Board

Promoter remuneration – The total payout to promoters’ and their relatives in the form of remuneration and professional charges amounted to ~INR 16Cr in FY25. This amounts to about ~14% of Goldiam International Ltd’s consolidated PAT, which is on the higher side. Investors should keep an eye on how this amount grows with growth in Goldiam International Ltd’s bottomline.

Related Party Transactions – There is about ~INR 10Cr of payables to promoters outstanding. The context of these payables are not mentioned in the annual report. Normally these pertain to loans given by promoters to the company.

Contingent Liabilities – The total contingent liability amount is ~INR 20Cr pertaining to a property tax demand from MCGM. This amounts to < 3% of Goldiam International Ltd’s net worth and hence isn’t really material.

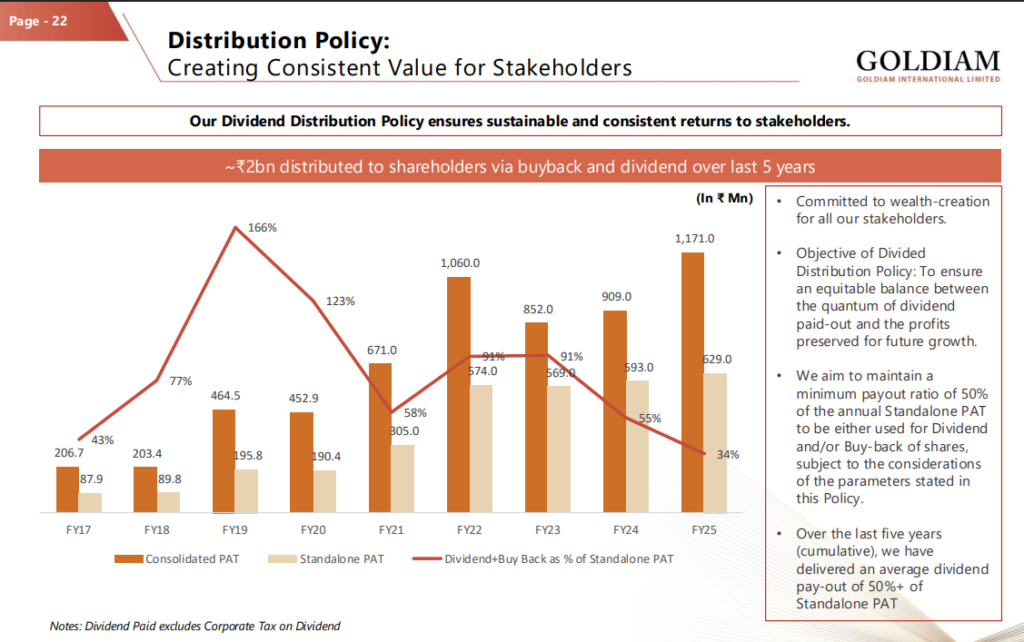

Dividend Policy – Goldiam International Ltd has consistently paid between 15-30% of the consolidated PAT as dividends to shareholders over the last 10 or more years.

Goldiam International Ltd Financial Performance

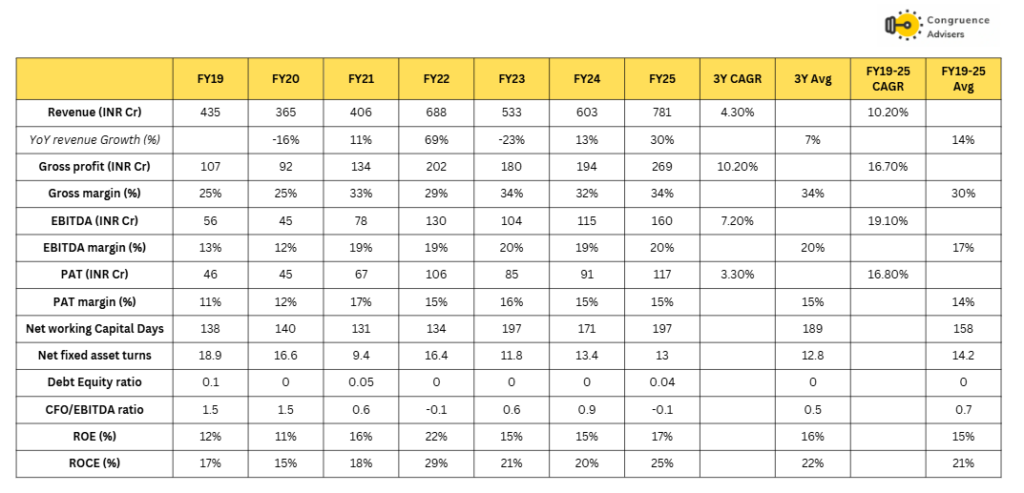

Goldiam International Ltd has grown revenues at a steady CAGR of 10% since FY19. It has done so with very respectable average ROE and average ROCE numbers of 15% and 21% respectively over this period. Goldiam International Ltd.’s operations are asset light as evident from the average net-fixed-asset-turns ratio of 14x. Working capital days are on the higher side at an average of ~160 days, this is to be expected in an export facing B2B business with a high number of SKUs. Goldiam International Ltd has never had any significant debt on its balance sheet and has generated good cash flows. This has resulted in Goldiam International Ltd having a cash and investment balance of ~INR 300 Cr as of FY25. Goldiam International Ltd proposes to use this cash to grow its retail business in India.

What is interesting to note in the above table is what has happened to Goldiam International Ltd’s metrics since the turn of the decade, when it started increasing the proportion of its lab-grown-diamond jewellery exports at the expense of natural diamond jewellery exports. The 3Y average gross margin of Goldiam International Ltd is 400bps higher than the FY19-FY25 average and the 3Y average EBITDA margin is 300 bps higher than the FY19-25 margins, highlighting superior unit economics in the LGD jewellery export business. While net working capital days in the 3Y period has spiked to ~190 days from the earlier ~160 days, the higher margins have more than compensated for this rise, as seen from a 100bps increase in the Goldiam International Ltd’s average ROE and average ROCE in the 3Y period over the FY19-FY25 period.

Goldiam International Ltd Comparative Analysis

To understand Goldiam International Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Goldiam International Ltd to its competitors (peer comparison) on various fundamental parameters and Goldiam International Ltd share performance relative to relevant benchmark and sector indices.

Goldiam International Ltd Peer Comparison

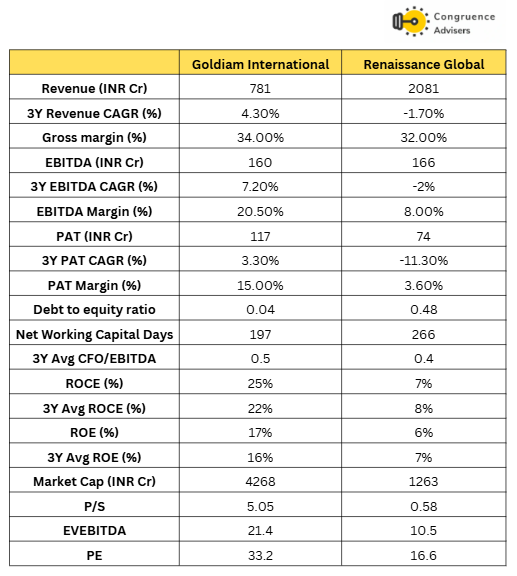

Goldiam International Ltd. has one exact listed peer Renaissance Global Ltd. In addition to manufacturing and exporting diamonds and diamond studded gold jewellery, Renaissance also derives 10% of its revenues from D2C jewellery sales.

Renaissance Global, a 3x larger company than Goldiam in terms of topline, has clearly lagged behind Goldiam International in the last 3 years. While Goldiam International Ltd has grown its PAT at a 15% CAGR in this period, Renaissance’s PAT has reduced at a CAGR of 11%. While Goldiam International Ltd is touching high teens ROEs, Renaissance is still stuck at 6-7% levels.

This disparity in growth as well as return metrics is well reflected in the difference in valuations of the two companies.

Goldiam International Ltd Index Comparison

Goldiam International Ltd share performance vs S&P BSE Small Cap Index, as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market.

Why you should consider investing in Goldiam International Ltd ?

Goldiam International Ltd offers some compelling reasons to track closely and to consider investing in Jewellery sector

Steady B2B business history with sound metrics – As discussed in detail above in the article, Goldiam International Ltd has run its B2B jewellery export business very well, growing at a steady CAGR of 10% while being asset light and generating enough free cash flows to amass an INR 300Cr cash balance in FY25. This provides a very strong and time-tested base on which to build new business avenues such as LGD jewellery retail

B2B studded jewellery exports to the USA has a large TAM – Goldiam International Ltd’s base business of B2B studded gold jewellery exports to the USA has a large total addressable market size of which Goldiam International Ltd is barely capturing ~1% or so if one were to hazard an educated guess. The market is still growing at a ~4% CAGR. In addition to the market growth, Goldiam International Ltd. has the opportunity to expand its wallet share with US buyers by taking share away from other incumbents. This would need constant innovation in merchandising and successful relationship management with large US retail chains on their part.

Management has shown the ability to capitalise on new business opportunities – Pre 2018, Goldiam International Limited was one of the smaller exporters of natural diamond studded jewellery from India. However, when LGD jewellery started taking off in the USA, the company recognized the opportunity and became an early-mover in capturing that export market. Consequently, today it is one of the largest LGD jewellery exporters in India. This ability to quickly pivot into emerging business areas and capture share, bodes well for shareholders.

LGD jewellery retail in India is an exciting opportunity – If India follows in the footsteps of the USA in terms of widely adopting LGD gold jewellery, then a retail play in this segment will have long legs. LGDs offer good value while maintaining the same aesthetics of natural diamond in jewellery, which should attract India’s customers. The traditional pan-India jewellery chains in India such as Tanishq, Malabar, Kalyan etc. have large natural diamond studded jewellery businesses and hence may prefer to wait for LGD jewellery to become established as a category in India, before entering with their own offerings. This window of a few years (hopefully) can prove to be a great opportunity for Origem to establish a pan India footprint via Origem.

Good mix of young and experienced management at the helm – The father-son duo of Mr. Rashesh Bhansali (Executive Chairman) and Mr. Anmol Bhansali (Managing Director) brings a nice mix of experience and youth to the table for Goldiam International Ltd’s shareholders. One can be reasonably certain that the recent bold steps taken by the company to pivot its B2B business towards LGD jewellery first and then to venture into its own LGD jewellery retail business in India, would have been significantly influenced by the younger generation in Mr. Anmol Bhansali. LGD jewellery is a young product which is

What are the Risks of investing in Goldiam International Ltd ?

Investors need to keep the following risks in mind if they choose to invest into this business. Risks needs to be weighed in combination with the advantages listed above to arrive at a decision that is optimal for your portfolio construct

Immediate risk from Trump tariffs – USA has imposed 50% tariffs on Indian exports as of now. While this may come down to 25% eventually, it is still a substantial number for Indian exporters. For now, Goldiam International Ltd has publicly announced that it has managed to avert US tariffs by importing US made gold castings for its jewellery via its US subsidiary and then doing value addition in India to produce the finished articles of jewellery. As per US customs rules, for all products with a minimum threshold of US made content, the products are exempt from tariffs. On paper this workaround seems tenable but it remains to be seen whether there is any impact on Goldiam International Ltd’s B2B business margins as a result. There is also the remote possibility that the Trump administration sees this as a loophole and attempts to plug it. Investors must keep a close eye on developments here – this is a big near term risk to keep in mind.

Retail is not an easy business to crack for a traditional B2B player – Retail is not an easy business to crack for a company which has traditionally been a B2B player only. This has been proven across various industry contexts in India and other markets. The skillsets required to win in retail are very different from the skillsets required to win in B2B. So far, Origem seems to have made a steady start – opening the right kind of stores in the right kind of locales in urban metros. The store unit economics claimed by management also seem lucrative with the possibility of generating 20% ROCE. But only time will tell whether the store format, product assortment, pricing and the brand itself comes together well enough to generate enough excitement amongst buyers.

Latent threat of LGD jewellery entry by traditional pan-Indian retailers – While today the traditional Indian gold jewellery brands are staying away from LGD gold jewellery, there is no certainty that things will continue to remain the same in years to come. If the likes of Tanishq feel that LGD gold jewellery is a serious new category worth pursuing, then they make a substantial play in this space. While such an entry by the bigwigs will prove Goldiam International Ltd right in taking a big bet on this space, it can also challenge Origem’s terminal value in the long run. Investors ought to keep an eye out on emerging dynamics in this space.

Further LGD price erosion risk remains albeit at a lower level – Although management has said multiple times that the sharp price erosion of LGDs is a thing of the past, more benign price corrections are likely to continue. This can result in inventory losses for Goldiam International Ltd, depressing their gross margins.

In the long run, continued price erosion of LGDs has the potential to keep buyers away as they feel they are buying a sharply depreciation asset or paying for a stone that has no intrinsic value. However, with the pace of sharp price corrections in LGDs hopefully behind us and wide acceptance of LGD jewellery in the USA, that category risk seems to be diminishing every day.

Customer concentration risk – Signet, the largest jewellery retail company in the USA, is a large customer for Goldiam International Ltd., likely contributing more than 30% of their FY25 topline. This introduces a degree of customer concentration risk for Goldiam International Ltd.

Gold price risk – Any company in the gold jewellery value chain has to deal with gold price risk. While gold has been on a tearaway rally in recent years and seems on course for a structural bull market for a few years, any unexpected adverse movement in the price of gold has the potential to cause inventory losses for Goldiam International Ltd and impact their gross margins.

Goldiam International Ltd Future Outlook

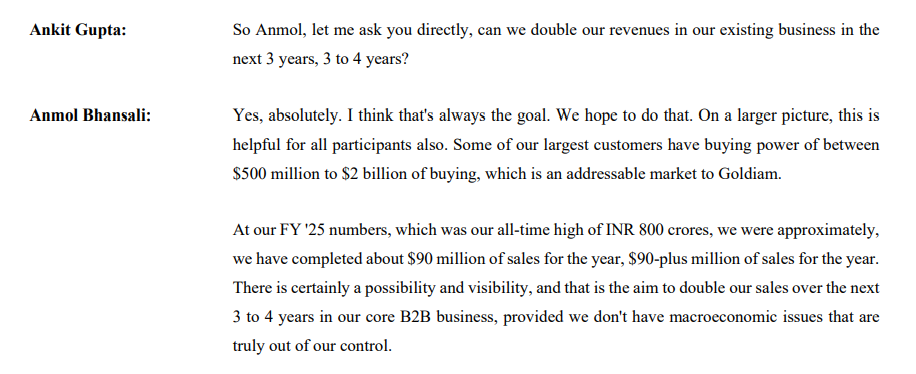

Goldiam International Ltd management is reasonably confident of growing the B2B export business at a CAGR of 15% (5Y revenue CAGR is 16%). In fact in the Q4 FY25 investor conference call, in answer to a question by a participant, management said the B2B business could double in 3-4 years (20-25% CAGR) provided there were no big macro-economic setbacks. We feel underwriting a 15% growth in the B2B is realistic. Anything more than that will depend on Goldiam International Ltd’s ability to gain wallet share with its largest customers.

If the Origem stores click with customers and their collections are well liked and price points well accepted, then it is quite likely that the retail business can scale to INR 300Cr in 3 years (~100 stores). The capital to scale to 100 stores is available as discussed earlier. If store unit economics work out, management will surely press the pedal on growth.

If Origem is a success and starts contributing 20-25% of overall revenues by FY28, there is a good possibility that Goldiam International Ltd’s valuation multiples will expand as the market starts underwriting higher terminal values for the company. For reference, Bluestone is a recently listed, fast growing, everyday-wear fine jewellery retail company, trading at ~5x Price to Sales.

The bull-case for Goldiam International Ltd. is that it is able to keep growing its B2B exports business at 10-15% CAGR for the medium term while seeding and scaling up its retail business to an INR 300-400Cr enterprise over the next 3 years with healthy ROCEs around 20%. Lab grown diamond jewellery demand should have long legs in India and if Origem is able to grab and maintain a significant share of the LGD jewellery retail market in India, then investors are likely to value the stock at a premium. The management is smartly utilising B2B cash flows to build out a B2C business in a sunrise jewellery category. Their execution remains to be soon and that will decide how the stock performs over the medium term.

Goldiam International Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Goldiam International Ltd Price charts

On the daily chart, over the last 1 year, Goldiam International Ltd stock has been in consolidation mode after a sharp up move just prior to this period. On the downside Goldiam International Ltd stock has taken support at roughly 307 levels, thrice during this period. At the peak of the Trump tariff tantrums Goldiam International Ltd stock broke this support for a short period but quickly bounced back. The 305-310 zone should continue to act as a strong support zone which is unlikely to be decisively breached unless there is an unexpected setback in the business trajectory. On the upside, Goldiam International Ltd stock needs to clear the 435-455 zone with good volumes to potentially start a new trend in the stock price. Till such time Goldiam International Ltd stock may consolidate between these two zones.

On the weekly chart spanning 5 years, one can see a long 3 year period of horizontal consolidation sandwiched between two strong up moves. Goldiam International Ltd stock first entered the 120-205 consolidation band in Sep 2021 after a strong up move on the back of solid quarterly numbers in H1 FY22. From there Goldiam International Ltd stock remained in that band for nearly 3 years during which it formed a rough inverse head and shoulders pattern. Goldiam International Ltd stock decisively broke out of this zone in Aug 2024 on the back of large buying volumes. This presumably happened as earnings started growing strongly again after 2 years of consolidation. Also the market had likely already started discounting Goldiam International Ltd’s entry into LGD jewellery retailing. Goldiam International Ltd stock quickly doubled, reaching 400 levels within a couple of months. Since then Goldiam International Ltd stock has once again found itself in a consolidation zone after creating short-lived highs above 550 as the broader market topped out in Jan-Feb 2025

Goldiam International Ltd Latest Latest Result, News and Updates

Goldiam International Ltd Quarterly Results

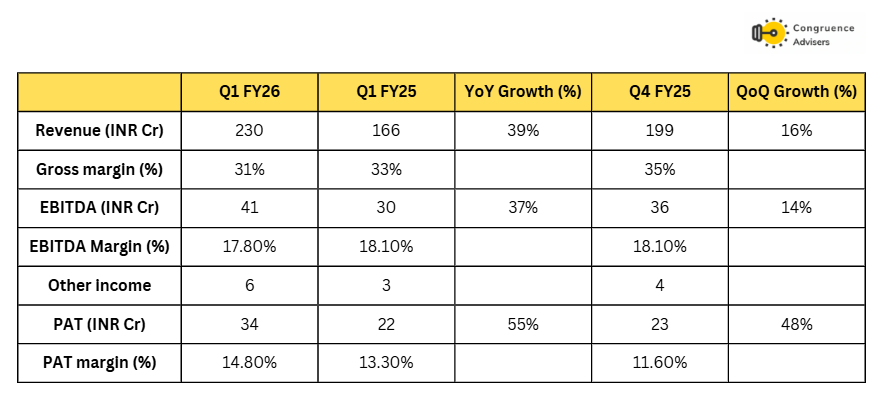

Goldiam International Ltd reported a strong start to the financial year FY26 with a 39% YoY sales growth in Q1 FY26. EBITDA grew by 37% YoY and PAT grew by 55% YoY. Soon after Q1 results, Goldiam International Ltd raised INR 202 Cr via QIP from Institutional investors. This resulted in 5.7% dilution in Goldiam International Ltd’s shareholding. The funds will be used for expansion of Origem stores across India.

Final thoughts on Goldiam International

The potential of the business is obvious, given the proven capability in the export market. However the future of the business appears to be intricately tied to how successful the B2C foray will be in the domestic LGD market. Pivoting from a B2B model to executing a successful jewelry EBO foray is much easier said than done. While the QIP has secured growth capital to aggressively open stores, it remains to be seen how the store unit economics will fall into place through FY26 and FY27.

Every large jewelry retail chain must be keenly watching Goldiam International’s foray into the domestic LGD market, it is highly likely that some of them were throw their hat into the ring once the model gets proven. While this is a risk 2-3 years into the future, Goldiam’s commitment to cracking the domestic LGD retail market is respectable. It is one of those situations where one needs to either go big or go home, being conservative will mean that the fruits of risk taking can accrue to others while Goldiam is the player trying and fine tuning the model.

The tariff overhang is keeping the current price muted. However, it will be too much to expect the price to stay muted for long if the management team can execute the EBO foray well and start showcasing early signs of success. FY26 and FY27 could turn out to be pivotal years for Goldiam International. Investors should track this story closely and take an independent view on valuation; valuing such stories is as much an art as it is a science.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this to a general audience. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will continue/be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.