Incorporated in 2018, Entero Healthcare Solutions Ltd is in the business of distribution and marketing of pharmaceutical and surgical products and allied services.

We believe Entero Healthcare is a pure-play investment on the massive consolidation of India’s highly fragmented pharma distribution industry. The company is executing a proven M&A roll-up strategy using its tech enabled platform to acquire and integrate smaller players, which is driving 30%+ revenue growth. The near term catalyst is the inflection from cash burn to cash generation with management guiding to >4% EBITDA and positive OCF in FY26. which, if delivered, validates the scalability of the model. Success hinges on continued deal discipline, fast integrations and working capital discipline.

Entero Healthcare Solutions Ltd Company Summary

Entero Healthcare Solutions Ltd was founded in 2018 by Prabhat Agrawal MD & CEO (ex-CEO of Alkem Labs) and Prem Sethi Whole-time Director & COO (ex-Director, Offering Development and Product Management with IQVIA). From day one their thesis was simple that India’s pharma distribution was highly fragmented i.e over 65,000 distributors and 900,000+ retailers, was (and largely remains) dominated by small, regional players, with organized distributors holding only an 8-10% share. So they decided to build a pan India, tech driven, integrated distribution platform that could serve both sides of the market i.e brands (with reach, data and commercial services) and buyers (retail chemists, hospitals) with dependable supply and service.

Backed by initial investment from healthcare focused PE firm OrbiMed Asia, Entero Healthcare Solutions Ltd’s origin is distinctive. It was not conceived as a single city wholesaler to be scaled slowly; it was designed from inception as a national platform. The strategy was built on acquiring strong regional distributors and integrating them into a single, centralized technology stack and standardized operating playbook.

Phase 1: Building the Playbook (2018-2023)

Through its first five years, Entero Healthcare Solutions Ltd focused on three repeatable building blocks

- Network reach – Add warehouses and cities which have deepened access to retailers and hospitals.

- Category breadth – widen SKUs to become a one stop procurement partner.

- Tech & process – stitch everything with ERP/BI and a digital ordering front end so fill rates, visibility and working capital control get better with scale.

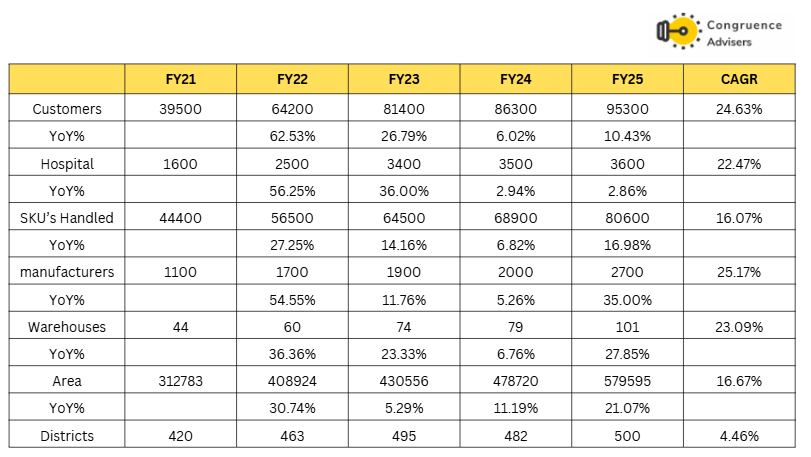

By December 31, 2023, Entero Healthcare Solutions Ltd had 78 warehouses across 38 cities, supplying ~79,400 pharmacies (1 in 10 in India) and 3,300+ hospitals with ~67,100 SKUs. and became one of India’s largest distribution platforms. That footprint was assembled in part through a deliberate M&A program: ~34 acquisitions since inception, with a clear post-deal playbook (expand SKUs, extend territory, plug into central procurement and tech, standardize processes).

Phase 2 : IPO and growth acceleration (FY24-FY25)

February 2024 was a milestone: Entero Healthcare Solutions Ltd listed on the stock exchanges raising ₹1,000 Cr through a fresh issue + 400 Cr OFS. To be deployed for working capital, inorganic growth and debt repayment (fuel for the same strategy that worked in the first five years)

Operationally, FY24 closed with ₹3,922 Cr (+19% YoY, outpacing IPM) with an EBITDA margin 2.9% (up 91 bps YoY) and this a clean inflection point for profitability. This wasn’t a one-off, the margin lift came from procurement efficiencies and a richer mix (more value added services and better categories), themes management said would continue.

FY25 – Revenue ₹5,095.8 cr (+30% YoY), GP ₹486.3 cr (9.5%, +50 bps), EBITDA ₹171.5 cr (3.4%, +50 bps), PAT ₹107.4 cr (+170% YoY). Led by procurement efficiencies, richer mix (devices/diagnostics/surgical) and operating leverage as scale kicked in.

Acquisitions (FY25): Management closed 10 deals through the year contributing Rs. 792 crores in annualized revenue. The acquired assets were margin accretive (blended 6-8% EBITDA) a crucial part of the story as consolidated margins step up.

Since then, Entero Healthcare Solutions Ltd has become one of the largest and fastest-growing pharmaceutical distribution platforms in the highly fragmented Indian pharma market and has a track record of ~50 acquisitions, seamlessly integrated into a centralized, tech enabled supply chain that ensures efficiency, transparency and nationwide reach.

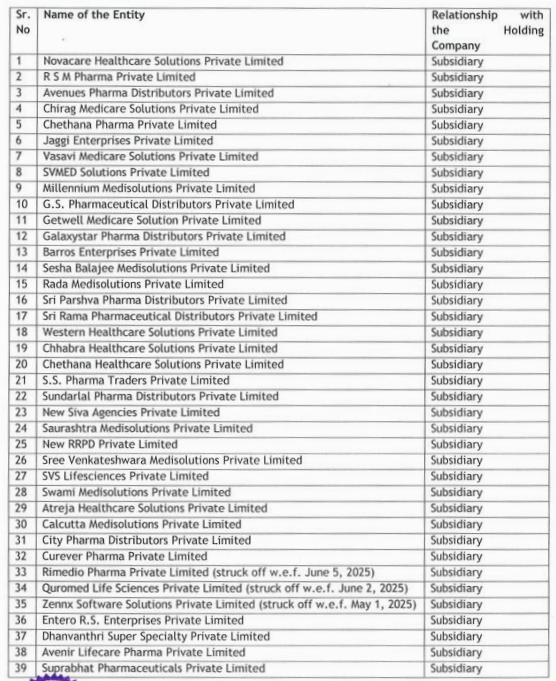

Entero Healthcare Solutions Ltd Corporate structure

Entero Healthcare Solutions Ltd operates as a parent company with a large number of operating subsidiaries because its model is built around acquisitions. Since 2018, Entero Healthcare Solutions Ltd has completed dozens of acquisitions across multiple geographies and product categories and Instead of immediately collapsing these acquisitions into the parent, Entero Healthcare Solutions Ltd keeps most of them as separate subsidiaries in the first few years. Management’s view is that these local companies come with strong regional goodwill, relationships, and positioning in their micro markets and that value is worth preserving initially. At the same time, these subsidiaries are not standalone or unmanaged within roughly three months of closing a deal, Entero Healthcare Solutions Ltd plugs them into its own systems: ERP, procurement, tech stack, banking relationships, and vendor access. That gives the acquired business a bigger portfolio to sell, better buying terms, and the benefit of Entero Healthcare Solutions Ltd’s scale, while letting it hold on to its local identity and customer stickiness.

Entero Healthcare Solutions Ltd does acknowledge that carrying 48+ subsidiaries increases compliance overhead and is operationally a hassle and longer term they’ve said they will definitely look at merging entities. But in the current phase, this structure is intentional. It lets Entero Healthcare Solutions Ltd expand faster across geographies and product adjacencies, protect the local brand and relationships it is buying and still centralise the economics and systems under the parent

Entero Healthcare Solutions Ltd Management Details

Entero Healthcare Solutions Ltd was founded by professional management, not by legacy distributors inheriting a regional network. The CEO, Prabhat Agrawal has previously led a large listed pharma company (ex-CEO of Alkem Laboratories) and has global finance experience as Group CFO at Metalfrio in Brazil and he runs strategy, market positioning, and long term scale. The COO and co-founder, Prem Sethi comes from IQVIA and is an ISB trained operator who runs core execution levers like supply chain, retail pharma, business development and field operations. Group CFO, Balakrishnan Natesan Kaushik, is a Chartered Accountant and CFA, part of the founding team, and is responsible for strategic finance, treasury, investor communication, compliance, and controls.

The people who founded the company are the same people running it, but they are not first generation local wholesalers; they are professionally qualified operators and institutional grade managers who think in terms of systems, integration, EBITDA quality, working capital, governance and capital discipline.

Entero Healthcare Solutions Ltd – Industry Landscape

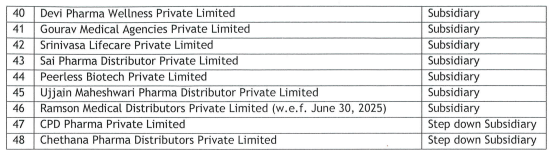

The Indian healthcare ecosystem is basically a network of multiple players that all sit between the manufacturer and the patient. On the supply side you have pharma companies, medical device makers, surgical consumables players, diagnostic consumables/equipment suppliers. On the demand side you have hospitals/clinics, retail pharmacies, standalone diagnostics chains, and even the hospital in house labs and in house pharmacies.

Sitting in the middle of this entire flow is the distributor, the pharma and healthcare product distributor is the physical and commercial bridge that moves product from the manufacturer to every point of care where the patient actually touches the system.

Hospitals and clinics are where patients go for treatment (IPD/inpatient and OPD/outpatient). Diagnostics can either sit inside hospitals or as standalone labs that patients walk into directly. Medical devices and consumables largely sit inside hospitals and diagnostic centres, where they’re used as part of the procedure and billed into the service. On the retail side, pharmacies are the front end for both prescription drugs (Rx) and OTC products; they are also the outlet for things like thermometers, BP monitors, bandages, etc. In IPD cases (admitted patients), hospitals usually have their own captive pharmacy and dispense directly. In OPD (walk-in/consult cases), the patient is free to buy from outside chemists.Insurance has one role in this system: it unlocks access to hospitals by paying for care, but it doesn’t move product physically.

The actual physical movement of drugs, devices, consumables and diagnostic products and the availability of the right SKU in the right hospital/pharmacy/lab at the right time is driven by the distributor layer. That distributor layer is what companies like Entero Healthcare Solutions Ltd are trying to organise at national scale.

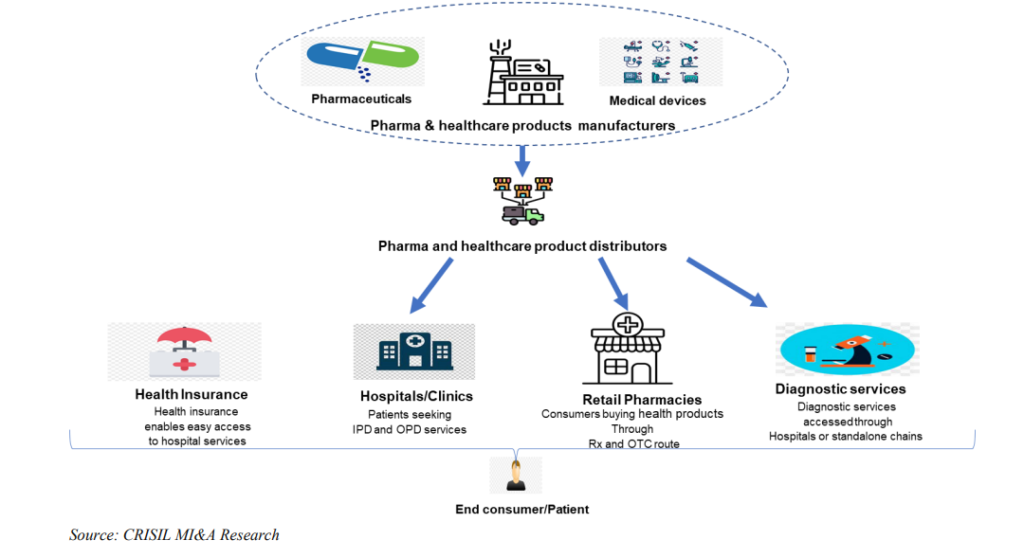

Penetration of health services in the country to support growth of healthcare value chain

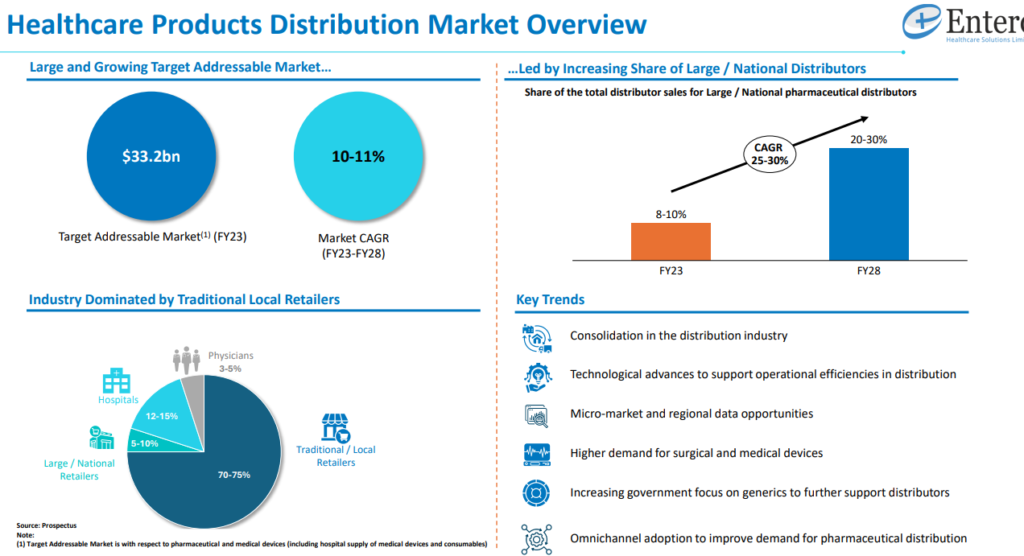

India’s healthcare value chain is big, broad, and still growing fast. In FY23 the total healthcare market (pharma, hospitals, medical devices, diagnostics, health insurance) was about ₹10 trillion in size and it’s projected to move towards ~₹16.5-17.5 trillion by FY28. The growth isn’t coming from one pocket, it’s across the board. Hospitals are the largest piece at ~₹5.7T in FY23 and have been compounding at ~12% (FY18-FY23), with an expected ~11-12% going forward. Pharmaceuticals is ~₹1.9T with ~9-10% growth expected. Medical devices is already a ₹0.8T category and is growing ~11-12%, which is important because that’s what the higher-margin adjacency distributors like Entero Healthcare Solutions Ltd keep talking about. Diagnostics is a ₹0.8T space growing ~9-10%, and health insurance at ~₹0.9T is actually growing the fastest structurally (historically ~17% CAGR and likely ~19-20%).

India is a global hub for pharmaceutical manufacturing

India is not just a consumption market, it’s also a production hub. The Indian pharma industry is one of the largest in the world by volume, valued at roughly ₹3.6-3.8 trillion (Domestic 54% & Exports 46%) as of FY23 when you include both domestic sales and exports. India supplies roughly 3-3.5% of total global drug and medicine exports and ships into 200+ countries, including highly regulated markets like the US, EU, UK, and Canada. The ecosystem is set up for scale i.e strong technical talent, regulated manufacturing, and deep experience in both formulations and bulk drugs. A lot of India’s exports are still low cost generics, but the infrastructure (GMP compliant plants, regulatory familiarity, trained pharma talent, etc.) is already in place. The healthcare demand in India is compounding at double-digit rates across hospitals, devices, diagnostics and insured access, and India is simultaneously a credible global manufacturing base.

Domestic Pharmaceutical supply chain

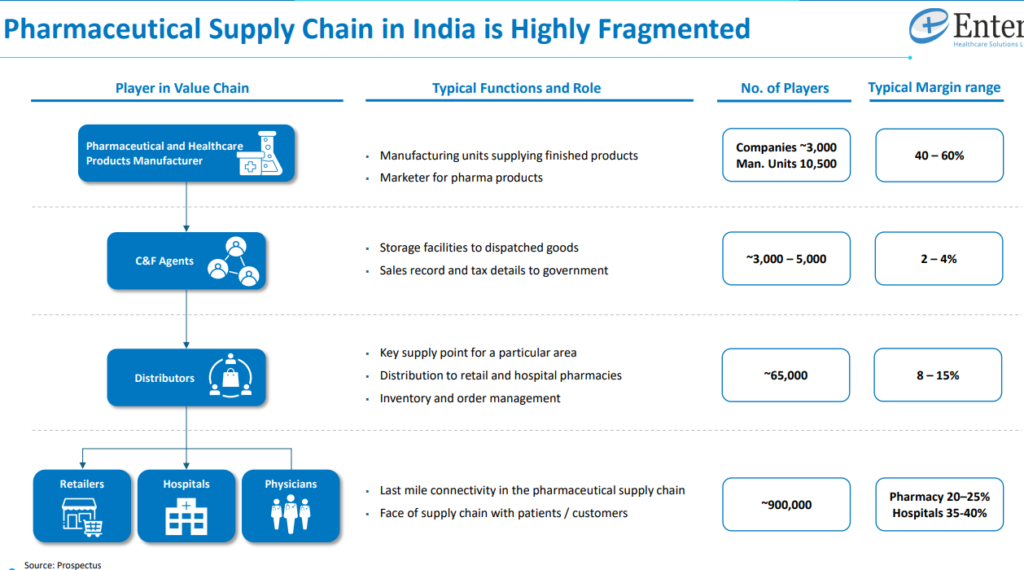

The pharma supply chain in India is basically a stacked system that starts at the manufacturer and ends at the patient with multiple layers in between and historically it’s been extremely fragmented. Pharma and healthcare product manufacturers (drugs, consumables, medical devices) either produce or market the product but they don’t directly reach every pharmacy or hospital themselves. They typically appoint C&F agents. These C&F agents act as state/region hubs; they store stock coming in from different manufacturing sites, handle dispatch, keep records and handle tax reporting. From there, distributors place orders on these C&F locations and lift material. The distributor is the real commercial node in the chain. Distributors run inventory, manage orders and supply into retail pharmacies, hospital pharmacies and sometimes directly to physicians.

Downstream, retailers, hospitals and physicians are the last mile interface for the patient. Retailers dispense prescriptions and OTC, hospitals dispense to in-patients through their own in house pharmacies (IPD) and in many cases also serve out patient traffic (OPD) and in some cases doctors/clinics themselves dispense medicines. Most demand in India still flows through traditional retail pharmacies (around 80-85% of total demand), while hospitals are 12-15% and direct physician dispensing is the balance (3-5%).

Historically, every layer of this chain used to be hyper local i.e thousands of independent distributors, local chemists, single city hospital suppliers, etc. The slide shows ~3,000 manufacturers (10,500+ manufacturing units), ~3,000–5,000 C&F agents, ~65,000 distributors, and ~900,000 retailer / hospital / physician outlets. Margins are split across the chain: manufacturers keep ~40-60%, C&F agents earn ~2-4%, distributors earn ~8-15%, and retailers earn ~20-25% on pharma. In devices and consumables, the total channel margin (distributor + retailer) is even richer 1.5-2.0x pharma because the doctor’s prescription lock-in is weaker, so the supply chain players have more pricing power. This is exactly why distributors are now leaning harder into medical devices, surgical consumables, diagnostics consumables, etc. not just pure Rx.

What’s changing is who controls this chain. The market is gradually moving from thousands of standalones to larger/national players on both distribution and retail. A “national distributor” in this context means someone present in multiple states (3-4+ states), not just one city. A “national retailer” means a branded pharmacy chain operating across multiple states, not just a neighbourhood chemist. At the same time, the role of the distributor is no longer just “move boxes.” The supply chain is adding services personalised support to pharmacies/hospitals, category management, structured hospital supply and in some cases direct digital ordering, inventory visibility, demand-supply analytics, and order tracking. Earlier, most of this was manual. Now the system is getting more tech-enabled; live stock visibility, credit tracking, scheme visibility, delivery tracking, ageing control and hospital / retail account management are becoming standard. So the broad industry direction is still very fragmented in absolute numbers, but consolidating into multi state distributors and pharmacy chains, higher channel value in non pharma SKUs like consumables and devices, and a steady shift from manual, relationship-only distribution to tech led, data visible, service led distribution. This is the environment companies like Entero Healthcare Solutions Ltd are operating in.

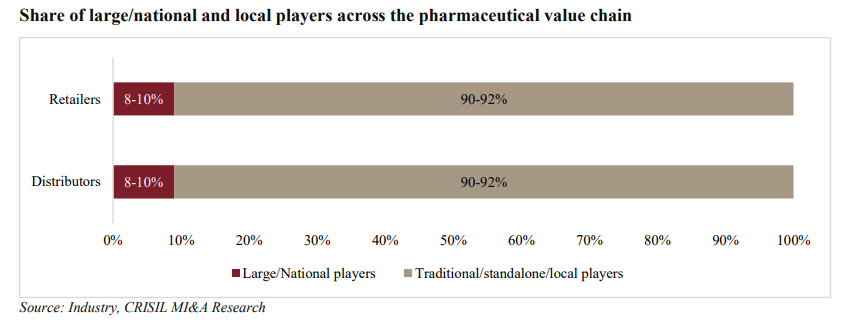

The Indian pharma supply chain is still massively fragmented and mostly local. There are ~65,000 distributors and 900,000+ retailers in the system and 90-92% of that is still controlled by traditional standalone players rather than any national platform. Only about 8-10% of the market is with large or multi state distributors, and the same 8-10% range applies on the retail side for national pharmacy chains and e-pharmacies. Everyone else is still a small, single city or single state.

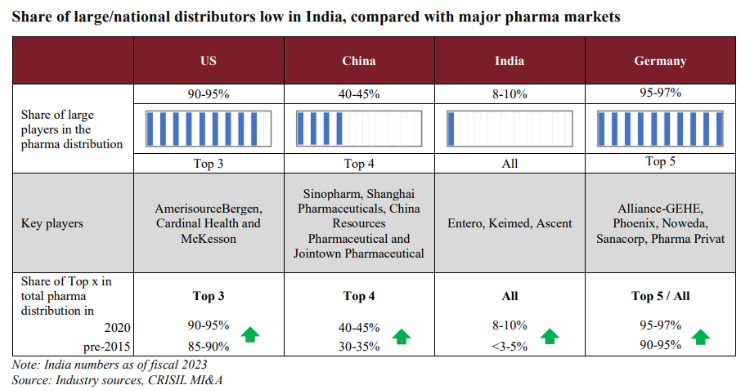

When compared with other global developed pharmaceutical markets, India’s market is highly fragmented. The distribution of pharmaceutical products in India is extremely fragmented, with ~65,000 distributors as of March 31, 2023. These generally only service limited local areas, unlike developed markets where large nationwide distributors occupy a dominant market position. As a result, in India, healthcare brands and product manufacturers need to work with a large number of small wholesalers and distributors to make products available to end consumers. In these developed markets, established pharmaceutical distributors have focused on consolidation. They account for an over 90-95% market share of the overall pharmaceutical distribution market in the US and ~95-97% in Germany. The penetration of large/national distributors in the Indian market is lower compared with these developed markets, presenting an opportunity for large/national players to consolidate in the market and tap the growth potential from consolidation.

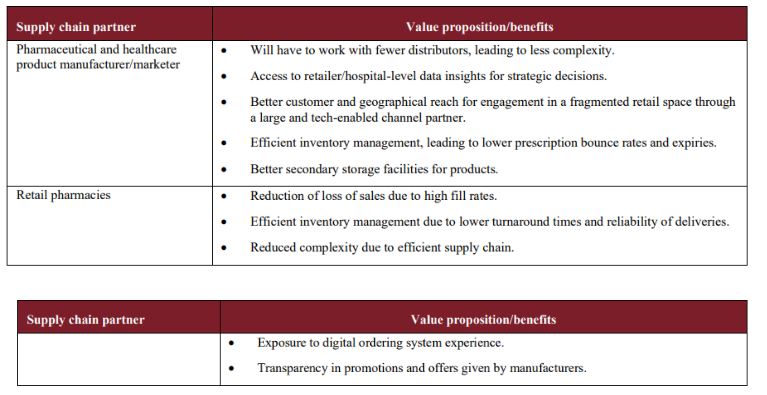

Benefits of large/national distributors to the pharmaceutical supply chain

Large national distributors create value for all stakeholders by acting as a One Stop Shop for retailers and hospitals, ensuring higher fill rates and better inventory management. This efficiency provides manufacturers with a wider reach and access to real-time data, which ultimately helps patients get better access to medicines at a lower cost

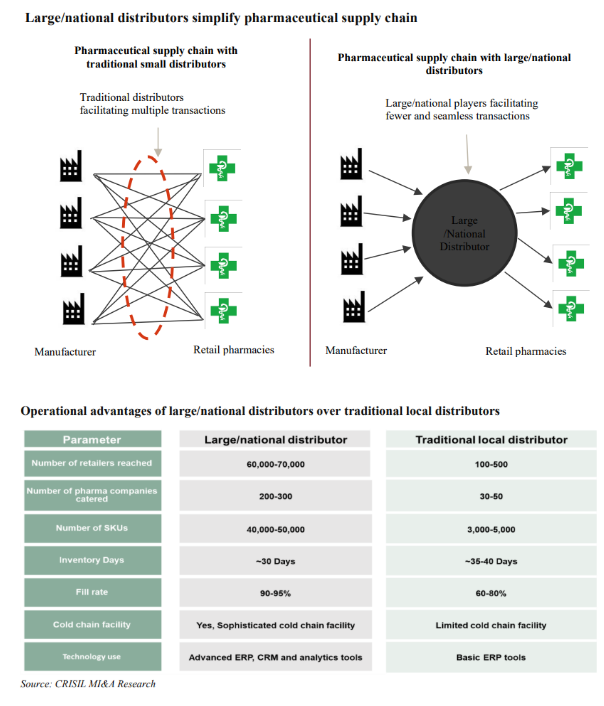

Large/national distributors collapse a web of many to many transactions into a single counterparty for manufacturers and pharmacies, cutting complexity and leakage. Vs local players, they also reach far more retailers (60k-70k vs 100-500) and principals (200-300 vs 30-50), carry deeper catalogs (40k-60k SKUs), and run with lower inventory days (~30 vs ~35-40) and higher fill rates (90-95% vs 60-80%). They also bring validated cold chain and advanced ERP/CRM/analytics, which lift service quality and compliance and support scale economics.

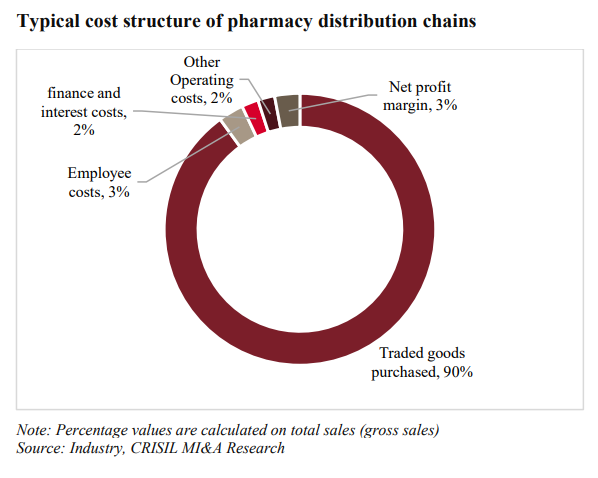

Pharmacy distribution is a high volume, thin margin, pass through business i.e~90% of gross sales is the cost of traded goods, with only ~3% employee, ~2% finance and ~2% other opex left to cover before a ~3% net profit. This cost shape explains why scale, procurement programs, mix and working-capital discipline are the real levers.

We see there is a huge TAM for organised players Entero Healthcare Solutions Ltd and what’s changing is that the bigger players are now acquiring these traditional local distributors to get wider reach and to run the network more efficiently. Exactly the same thing is starting to happen in retail i.e large pharmacy chains and e-pharmacies are beginning to formalize what used to be purely mom and pop chemists. The implication is straightforward the opportunity is consolidation. Today, distribution and last mile retail are still mostly in the hands of local operators, but structurally the market is already moving toward scaled, multi state platforms that can use better systems, compliance, and purchasing power to take share.

Entero Healthcare Solutions Ltd Business Details

Entero Healthcare Solutions Ltd’s business model is structured around two key services. The primary engine is Demand Fulfilment, its core, large scale distribution business This traditional distribution operation currently accounts for the vast majority of the company’s revenue; other is Demand Generation, a smaller but higher margin, value added service. In this segment, Entero Healthcare Solutions Ltd acts as a commercial partner for manufacturers where it deploys its own medical representatives to promote their brands. This also includes the development of its own private label products such as medical devices and surgical consumables.

Demand fulfilment (national distribution to pharmacies/hospitals) – On the fulfilment side, Entero Healthcare Solutions Ltd acts as a national healthcare products distributor and positions itself as a one stop procurement partner for pharmacies, hospitals and clinics. Entero Healthcare Solutions Ltd runs a scaled distribution network across 20 states and 500 districts (FY25), with 101 warehouse locations totaling ~5.75 lakh sq. ft. as of March 31, 2025. Through this network Entero Healthcare Solutions Ltd services more than 95,300 retail pharmacies and 3,600+ hospital customers and sources from 2,700+ healthcare product manufacturers.

The product basket is intentionally broad, it includes prescription pharmaceuticals, OTC medicines, nutraceuticals, surgical consumables, vaccines, and medical devices / diagnostic consumables and equipment. This breadth allows Entero Healthcare Solutions Ltd to drive high availability and fill rates for its customers, including critical items that require compliance heavy handling such as temperature controlled products. The physical layer covers imports, central warehousing, redistribution and last mile delivery, including cold chain logistics where required. Alongside third party brands, Entero Healthcare Solutions Ltd also sells its own private label products under the Entero Surgicals umbrella in categories like homecare medical devices, surgical consumables, rehabilitation products, gloves, PPE, nebulisers, etc. These are non pharma categories where it can participate in higher margin, specification led demand.

Demand Generation

The Demand Generation model is Entero Healthcare Solutions Ltd’s second, smaller business pillar and represents its high margin and value added services business. In this segment, Entero Healthcare Solutions Ltd moves beyond simple logistics to act as a strategic commercial partner for healthcare product manufacturers. Entero Healthcare Solutions Ltd offers manufacturers a turnkey go to market layer by deploying its own team of medical representatives to detail products to doctors; running brand/launch programs (channel strategy, pricing/pack, territory roll-outs) and chemist engagement to drive repeat orders, promotions and loyalty.

This is already proven with named relationships e.g., the ongoing collaboration with Roche (since 2020) for promotion, marketing and distribution of nephrology therapies and management also cites Abbott and Servier among commercial solutions clients.

The primary advantage of this business is its superior profitability. Management explicitly stated that the promotion margins are higher. This makes the entire Demand Generation segment EBITDA margin accretive and it is a key lever in management’s strategy to enhance overall margins. Therefore, while it is a much smaller contributor to the top line (less than 5% as per the Q4FY25 call), its main strategic advantage is its critical role in lifting Entero Healthcare Solutions Ltd’s overall profitability.

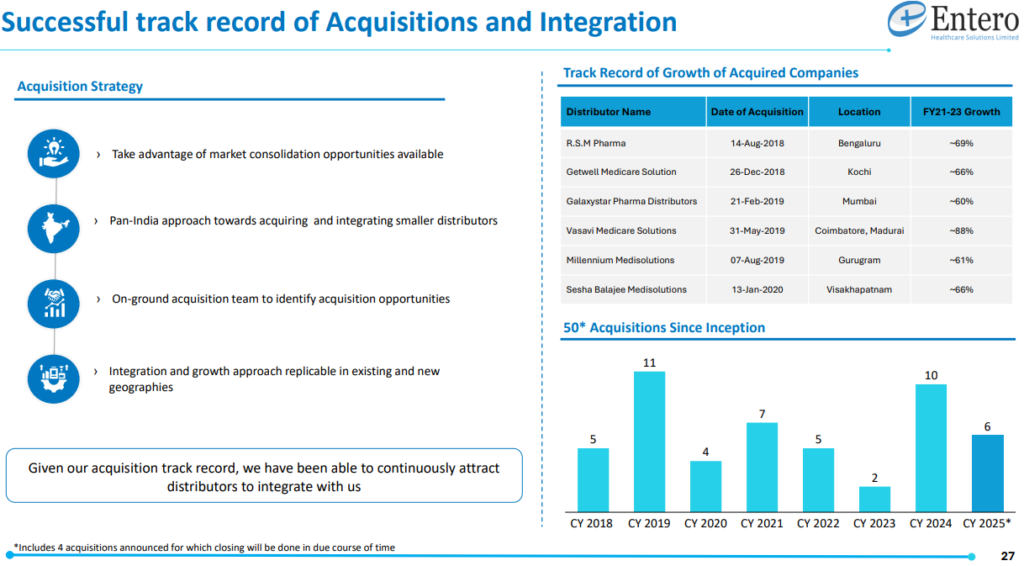

Acquisitions “The Core Growth Engine”

Entero Healthcare Solutions Ltd’s growth strategy has consistently leaned on inorganic expansion as a core pillar alongside organic execution. Since inception in 2018, Entero Healthcare Solutions Ltd has maintained a dedicated on ground M&A team and a clear playbook for identifying diligence and integrating targets.

Through FY25, Entero Healthcare Solutions Ltd completed and integrated 10 strategic acquisitions that together contributed an annualised revenue run rate of about ₹792 Cr. Management also announced a further 6 acquisitions expected to add over ₹400 crore on an annualised basis. Looking ahead, the FY26 pipeline is framed around transactions that would contribute roughly ₹500 crore of recognised revenue on Entero Healthcare Solutions Ltd’s books as they annualise. Across this period, management has emphasised a disciplined approach, focusing on margin accretive assets and clean integration timelines.

The strategic rationale behind these deals is threefold. First, Entero Healthcare Solutions Ltd uses acquisitions to enter or deepen presence in specific geographies; examples include markets such as Jaipur, Ujjain, Trivandrum, Khammam, Bijapur, and Ahmedabad thereby broadening distribution density and local relationships. Second, acquisitions expand the product portfolio toward structurally higher margin adjacencies such as specialty pharma, medical devices, surgical consumables and trade generics. The Peerless Biotech acquisition, for instance, added manufacturing capability and widened the devices/diagnostics offering. Third, Entero Healthcare Solutions Ltd consolidates share in existing strongholds, supporting double digit local market shares in cities like Bangalore, Vizag, Cochin and Goa.

Integration is treated as a 90 day process. Newly acquired entities are plugged into Entero Healthcare Solutions Ltd’s policies, processes, ERP and operating systems within roughly 3 months. This standardisation aligns buying patterns, unlocks procurement efficiencies and connects local teams to central technology and analytics which enables the acquired businesses to scale faster and improve unit economics under Entero Healthcare Solutions Ltd’s umbrella.

On valuation, management indicates a preference for single digit EV/EBITDA multiples; typical transactions have been cited in the ~5-7× EV/EBITDA range, with tight filters on quality and fit. Target selection weighs market size, customer base quality, supplier relationships, portfolio alignment, synergy potential, historical financials and forward growth prospects with a payback horizon generally aimed at 2-3 years.

On margins, management has clarified the gap between the 6-8% standalone EBITDA typical of acquisition targets and the consolidated margin reported at group level (3.4% in FY25). The primary diluter is corporate overhead centralised at the parent, which does not sit in subsidiary P&Ls.

Beyond overhead, Integration and growth investments (talent, process, tech) temporarily weigh on consolidated margins as businesses are scaled. Finally, the group figure is a blended average of higher margin acquired units and lower margin legacy/organic operations; as more high margin assets are added and fully integrated, the consolidated margin should drift up.

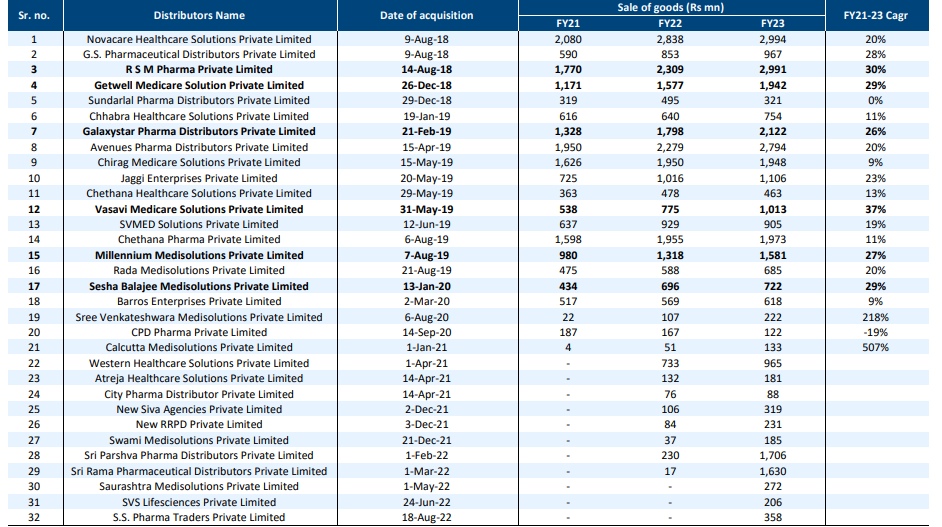

Performance of some old acquisitions

Management has also been explicit about walking away when better options appear. A notable example is the cancelled acquisition of Radha Medisolutions Private Limited. The deal was shelved after a superior target surfaced in the same market with a stronger revenue profile and better margins fully consistent with Entero Healthcare Solutions Ltd’s selective, accretive M&A stance.

Private Label

Entero Healthcare Solutions Ltd’s private label strategy is a small, adjacency led extension of its core distribution model which is useful but not central to growth or margin expansion. Operating under Entero Surgicals with sub brands like Carent (homecare devices), Entros (mobility), Entair (nebulisers), Safent (PPE, hygiene, surgical consumables) and Glovent (gloves), the focus sits squarely on non pharma categories homecare devices, surgical consumables and rehabilitation products. where conflict with principal manufacturers is minimal. Manufacturing is outsourced to third-party contract players who make Entero Healthcare Solutions Ltd’s brand/pack specs, and distribution runs both through Entero Healthcare Solutions Ltd’s network and select external channels into pharmacies, hospitals, and nursing homes.

Strategically, the private label broadens the basket and leverages Entero Healthcare Solutions Ltd’s existing reach, but management is clear: it is not the main driver of margin. The heavy lifting on gross margin comes from procurement scale and mix shift into inherently higher margin categories (devices/diagnostics/surgical consumables often earning 1.5-2x pharma margins). Private labels can help at the margin especially in hospital accounts where Entero Healthcare Solutions Ltd controls more of the procurement but it remains small % of revenue and management doesn’t expect it to become a huge part Maintaining even a 1% share would require private labels to grow in line with the broader, fast growing base.

Curever

Entero Healthcare Solutions Ltd’s Curever was its private label generic medicines line contract manufactured and sold under Entero’s brand to monetize distribution reach but it faced relentless price competition, weak brand pull without costly MR/promo spend, channel conflict with principal manufacturers and higher working capital/expiry risk. As a result, unit economics were poor (losses at low revenue scale in FY23), so management has scaled it down.

The strategic pivot is to confine private labels to non-pharma adjacency devices and consumables under Entero Surgicals where there’s less supplier conflict, better gross margins (often 1.5 -2× pharma distribution) and lower expiry risk.

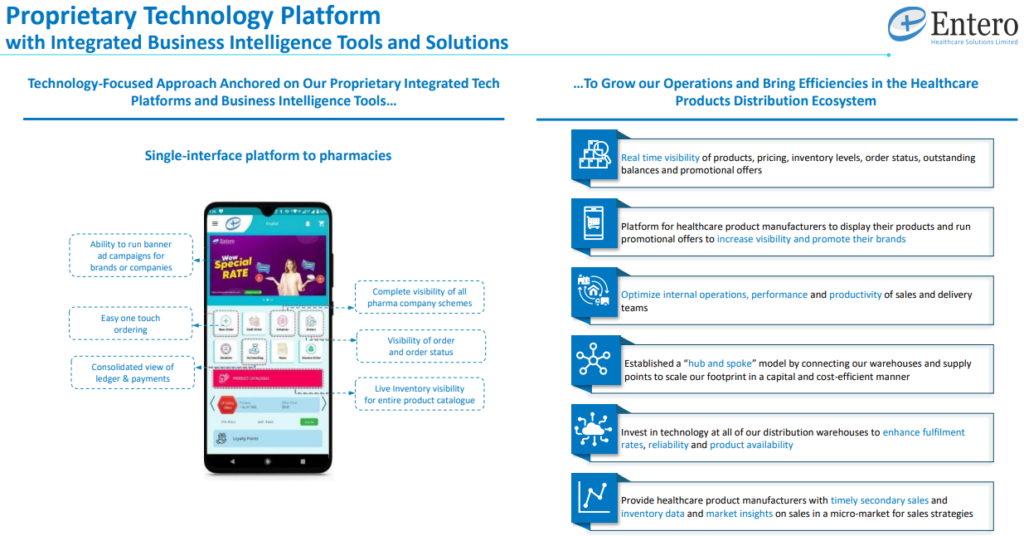

Entero Healthcare Solutions Ltd Tech Stack

Entero Healthcare Solutions Ltd has adopted a technology focused approach to grow its operations and improve efficiency within the healthcare products distribution ecosystem. Entero Healthcare Solutions Ltd’s strategy is anchored on its proprietary integrated technology platforms and business intelligence tools.

Entero Healthcare Solutions Ltd management believes technology plays a significant role in driving efficiencies in the healthcare supply chain. The aim is to digitise supply chain processes to reduce inefficiencies and redundancies in areas like product ordering, sales, payments, returns and inventory management, which benefits the entire healthcare ecosystem.

Entero Direct

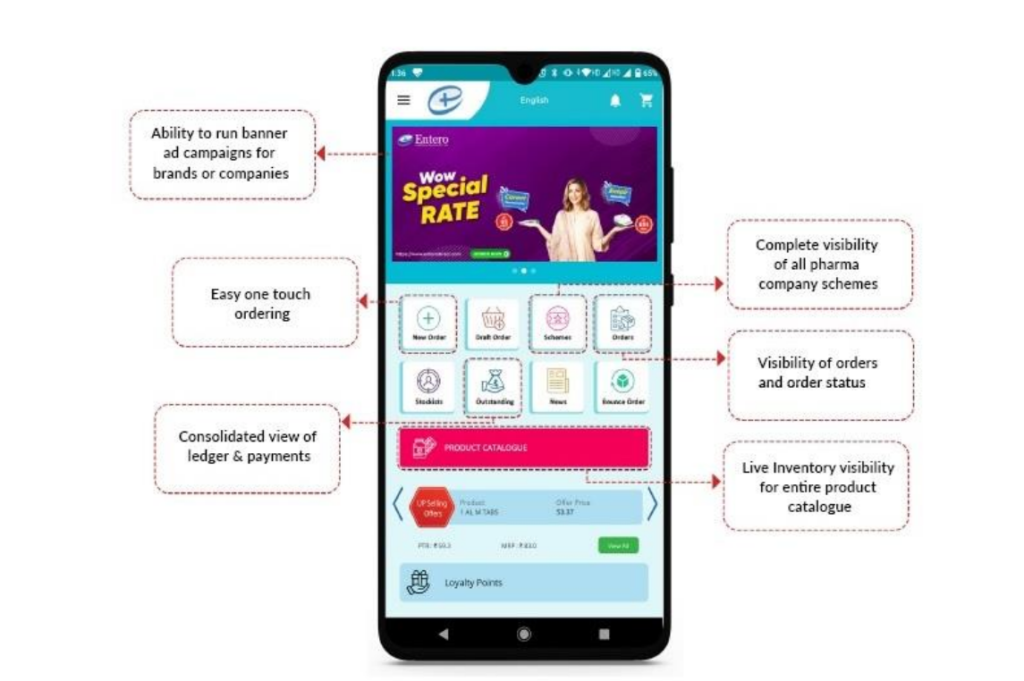

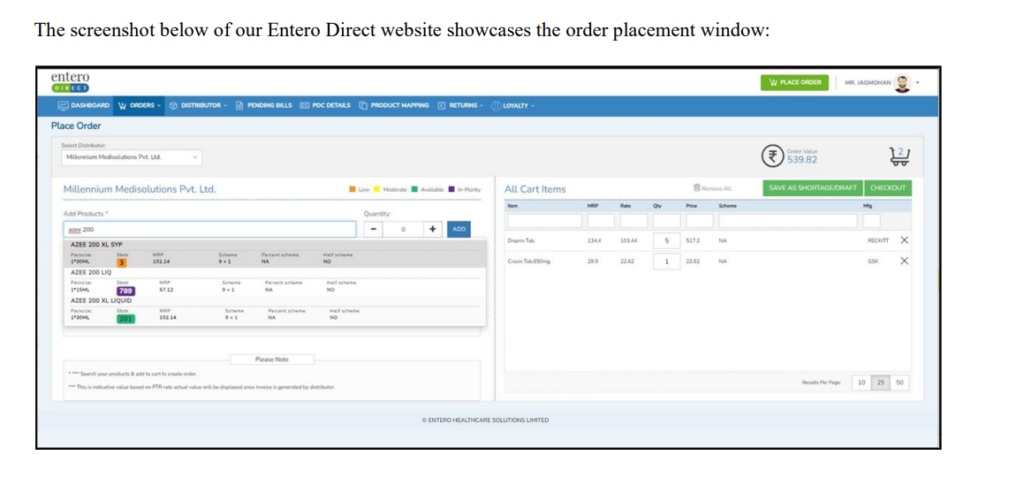

Entero Direct is Entero’s B2B ordering app/portal for pharmacies and hospitals, it gives customers real time visibility of product range, pricing, inventory levels, order status, outstanding balances and promotional offers and supports 24×7 order management.

Entero Direct platform is a cloud-based software as a service solution that allows retailers to order their procurement needs from Entero Healthcare Solutions Ltd. Retailers can use the platform for placing orders, tracking and making payments on the go. The platform provides retailers with order management and tracking, as well as returns and claims settlement processing. This enables retailers to have visibility of the inventory in real-time, as well as check the status of their orders in real-time. The platform also includes loyalty programs for better retention of retailers.

Through the platform, Entero Healthcare Solutions Ltd also drove new retailer expansion with limited in-person sales force deployment. Further, through Entero Direct, their sales force are also able to plan their customer visits, access live inventory levels, view running offers, promotions and other relevant customer information before assisting customers to place an order. Our delivery fleet can also use Entero Direct to plan their deliveries and update delivery status on the application

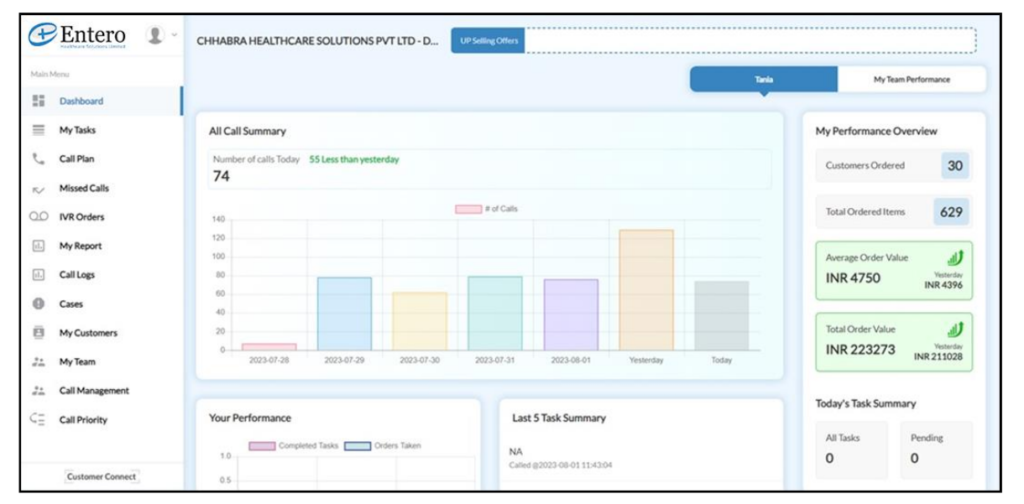

Entero CRM

Entero CRM application is a customer relationship management tool that manages and analyses interactions with customers, in order to increase customer retention and wallet share. Through Entero CRM, entero call centre executives are able to access customer information such as past billings and outstanding payments while communicating with customers. Entero CRM also keeps track of all customer calling schedules (including any missed calls) made on their CRM platform, to ensure robust customer management.

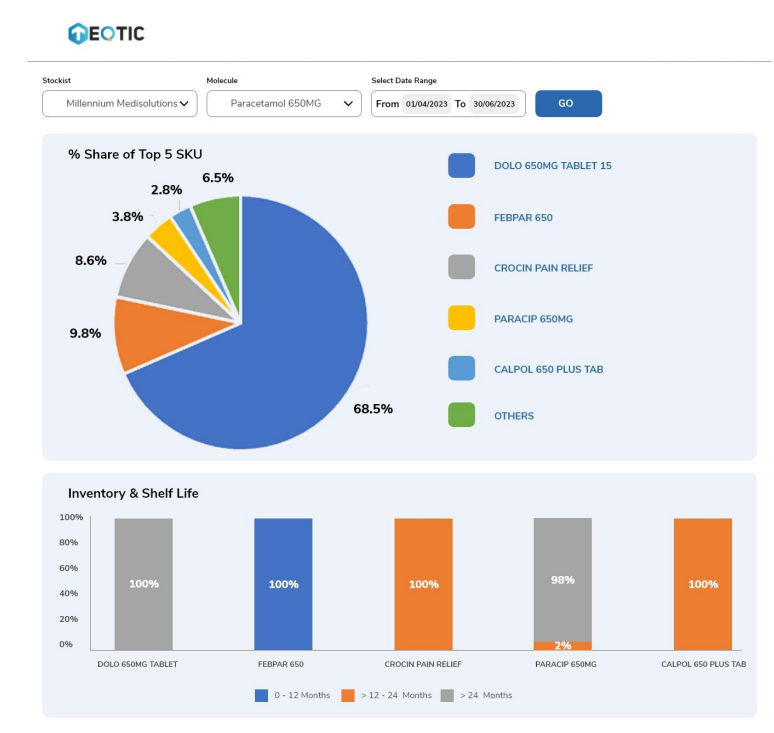

The image below showcases a screenshot of our Entero Direct CRM tool

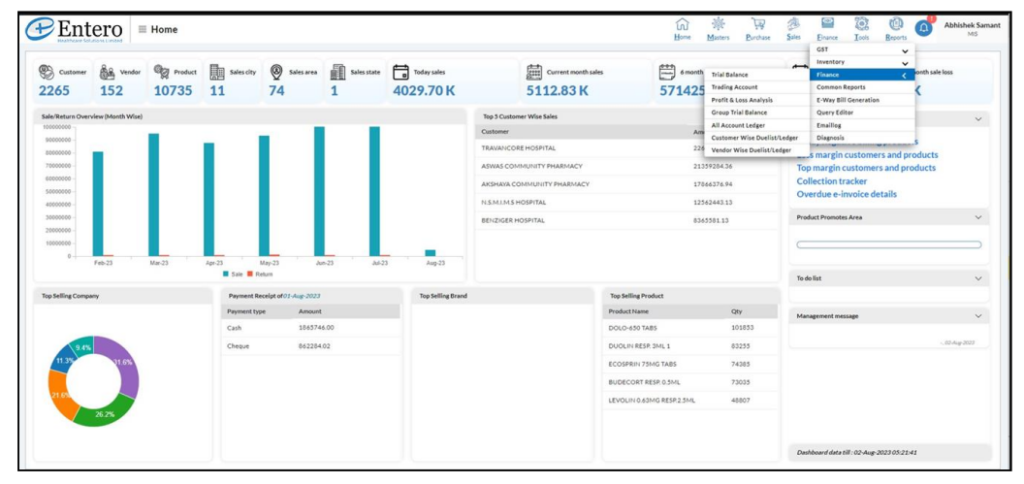

Entero ERP

Developed in-house Entero ERP system, which has been implemented across multiple locations in India. Entero ERP system is a cloud-based ERP tool.

Some of the key benefits of Entero ERP system includes (i) seamless integration of data across locations; (ii) complete control over product and customer masters; (iii) enhanced security features such as web application firewalls; (iv) better centralized controls; and (v) lower risk of data loss.

Teqtic data warehouse and business intelligence tool

Entero has developed Teqtic as a data warehouse business intelligence and data analytics tool to generate customized reports by using past customer transactional data and records. Teqtic is a cloud based system which makes it easy for them to roll out updates and new features to all users. Entero Healthcare Solutions Ltd utilises Teqtic to generate customized reports to monitor, among others, sales, purchases and inventory levels at all of our distributors and warehouses across India.

Teqtic is utilized by both Entero Healthcare Solutions Ltd and their external customers.

They provide identity based access control to our customers. Among the reports that they provide to external customers (mainly pharmaceutical companies) include:

Account wise product wise sales; Real-time inventory visibility at warehouse locations; Sales by company division, geography, customer & salesperson and proof of delivery reports.

These reports generated by Teqtic can be customized based on customer requirements. Entero Healthcare Solutions Ltd business teams work with customers to understand their requirements and thereafter customize the reports accordingly.

HealthEdge

HealthEdge is Entero Healthcare Solutions Ltd’s recently launched, membership-based digital program to upgrade neighbourhood chemists. To speed it up, Entero Healthcare Solutions Ltd bought the Aayu Chemist app and Medcords platform from Medcords Healthcare Solutions and folded them into HealthEdge. For retailers, it’s a practical toolkit: set up a personalised online e-store/website, run promotions, manage inventory better (including faster expiry settlements) and tap special procurement offers that lift margins. It also lets chemists add value added services like booking doctor consults or in store lab tests. so they deepen customer relationships while improving day to day efficiency and profitability.

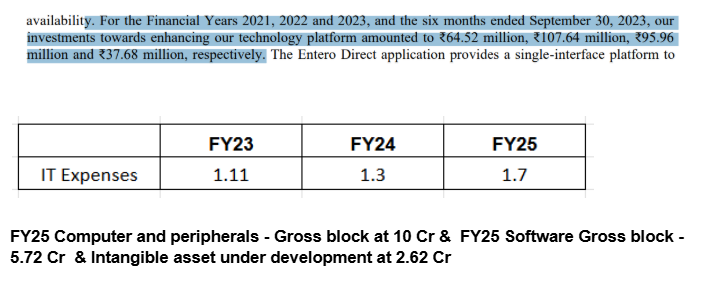

We believe while Entero Healthcare Solutions Ltd has successfully developed a comprehensive, proprietary tech stack. This technology is table stakes for any modern, large-scale distributor. It is a crucial and necessary tool for achieving operational efficiency, scaling the business and rapidly integrating new acquisitions. However, the tech itself is not a deep, defensible moat. This is confirmed by looking at Entero Healthcare Solutions Ltd’s own spending. The investment is not an insurmountable financial barrier. Well-capitalized competitors, such as Keimed (backed by Advent and Apollo) and API Holdings (PharmEasy) has also built the similar platforms.

In fact, management themselves confirmed in the Q1FY26 earnings call that all these tech investments have been made in the past” and they don’t see much significant investments in tech going forward. Therefore, the technology is best viewed as a critical enabler of the real strategy. The true competitive edge is not the tech itself, but Entero Healthcare Solutions Ltd’s proven ability to use this platform to execute its high-speed, on the ground M&A and integration playbook more efficiently than others.

Entero Healthcare Solutions Ltd Financial Performance

Entero Healthcare Solutions Ltd’s financials show a classic high growth scaling story that is now translating into profitability. Revenue has scaled impressively to ₹5096 cr in FY25 since its inception in FY18 driven by a dual engine of steady organic growth and a successful M&A strategy. More importantly, what’s key here is that the profitability is scaling alongside the revenue; gross profit grew even faster at a ~36% CAGR i.e Gross margins expanded from 8% to 9.5% as Entero Healthcare Solutions Ltd gained procurement power and shifted its product mix toward higher margin non pharma products. This revenue and gross margin improvement has fueled significant operating leverage, with EBITDA margins expanding from just 1.2% to 3.4% as operational efficiencies from integrations were realized and corporate overheads were spread over a larger sales base. Which led to a powerful swing on the bottom line, with Entero Healthcare Solutions Ltd turning from a net loss of -₹15.4 cr in FY21 to a net profit of ₹107.4 cr in FY25. Going forward management guides for further margin expansion to over 4% in FY26.

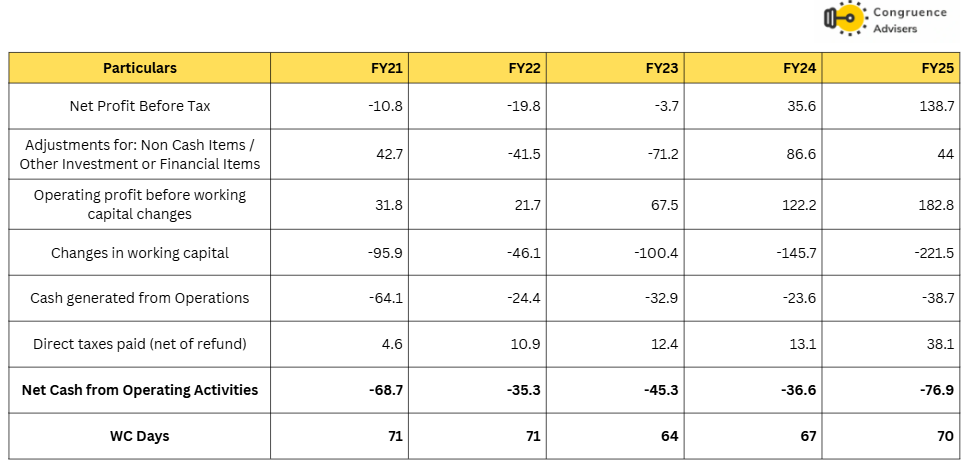

Entero Healthcare Solutions Ltd Cashflow & Working capital

This cash burn is a standard feature of a high growth M&A model which constantly needs to invest in working capital to fund its M&A “acquisition engine” and strong organic growth.

However, the full-year FY25 figure of -₹76.9 Cr obscures a critical inflection point. Management confirmed in its Q4FY25 earnings call that Entero Healthcare Solutions Ltd successfully turned OCF positive in H2FY25 (by approx. ₹50 Cr). The full year figure was negative only because the H1FY25 was negative. This H2 performance is the first major proof point that the model can become self sustaining.

Management is guiding to full year OCF positive in FY26 on two levers: (a) EBITDA >4% (mix/procurement/ops) and (b) net working capital days optimization (already improved from 71 to 66 days in FY25 with a firm 60 day target by FY26 end). If delivered, CFO/EBITDA conversion should improve which will reduce reliance on external funding for M&A.

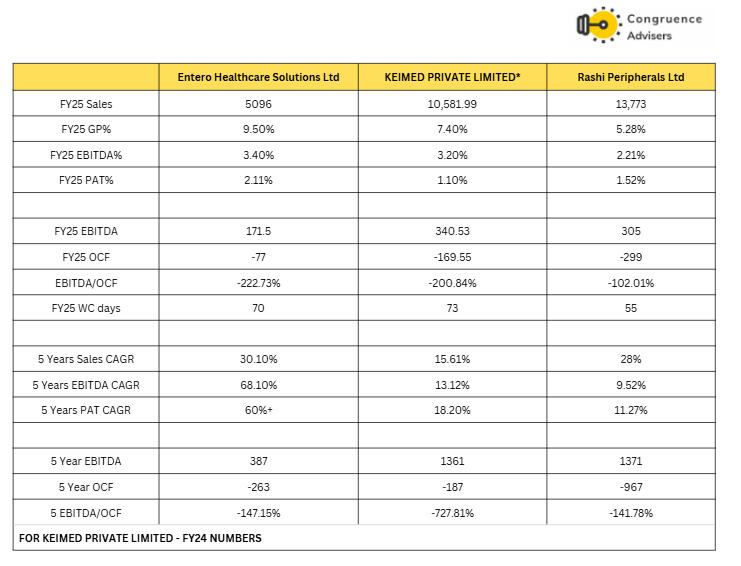

Entero Healthcare Solutions Ltd Comparative Analysis

To understand Entero Healthcare Solutions Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Entero Healthcare Solutions Ltd to its competitors (peer comparison) on various fundamental parameters and Entero Healthcare Solutions Ltd share performance relative to relevant benchmark and sector indices.

Entero Healthcare Solutions Ltd Peer Comparison

A direct peer comparison for Entero Healthcare Solutions Ltd is difficult because its main competitors are not publicly listed. The true competition comes from the captive distribution arms of larger healthcare ecosystems. This includes players like Keimed Ltd, which was acquired by Apollo Hospitals and Advent International and from the Apollo promoters and is reportedly set to be merged with Apollo 24×7 for a future listing. Other major unlisted players are Ascent Wellness and Akna Medical, which are owned by API Holdings (PharmEasy) and Udaan is also into pharma distribution but not able to scale well. Medplus has subsidiaries that are into pharma distribution but they do only captive business.

Since there are no pure-play listed peers, we have compared Entero to its direct (but unlisted) competitor Keimed Pvt Ltd and to Rashi Peripherals Ltd (an IT distributor) to get a sense of the business model’s economics.

- Entero Healthcare Solutions Ltd vs. Rashi Peripherals (IT Distributor) – While Rashi’s revenue is more than double Entero Healthcare Solutions Ltd’s, their profitability is very similar, with an EBITDA margin of 3.1% for Rashi vs. 3.4% forEntero Healthcare Solutions Ltd. What’s highly favorable for Entero Healthcare Solutions Ltd is that its gross margin at 9.5% is nearly three times Rashi’s 3.3%, suggesting pharma distribution is a structurally more attractive business at the gross level.

- Entero Healthcare Solutions Ltd vs. Keimed Pvt Ltd – This is the most direct comparison. Although Keimed is larger in revenue ₹8,683 Cr (FY24) vs. Entero Healthcare Solutions Ltd’s ₹5,096 Cr, Entero Healthcare Solutions Ltd’s financial profile appears significantly stronger. Entero operates at a 9.5% gross margin compared to Keimed’s 6.1%, and this superior profitability flows down to the EBITDA margin (3.4% vs. Keimed’s 2.8%) and PAT margin (2.1% vs. Keimed’s 1.8%). A key reason for this difference is that Keimed is a quasi captive player with an estimated 50% of its revenue coming from the Apollo group, which is why its profitability looks optically weak relatively.

Ultimately, the investment thesis isn’t just about beating peers; it’s about the huge TAM. as the pharma distribution market is highly fragmented with organized players accounting for less than 10%. This is in stark contrast to a consolidated market like the US, where 3 players have 90%, giving Entero Healthcare Solutions Ltd a massive, multi decade runway to grow simply by acquiring and consolidating the other 90% of the market.

Entero Healthcare Solutions Ltd Index Comparison

Entero Healthcare Solutions Ltd share performance vs S&P BSE Small Cap Index, as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why you should consider investing in Entero Healthcare Solutions Ltd ?

Entero Healthcare Solutions Ltd offers some compelling reasons to track closely and to consider investing in India’s pharma distribution consolidation play.

Huge TAM – Entero Healthcare Solutions Ltd is a market share compounding story in a highly fragmented market where organized distributors control <10% of the pie. It already runs a pan India, tech led platform across ~500 districts, serving 95,300+ pharmacies (~1 in 10 nationally) and 3,600+ hospitals on unified rails a scale that confers a clear right to win via stronger procurement terms, higher fill rates, faster brand roll outs and cross sell of higher margin adjacencies (devices/diagnostics/surgical) alongside pharma. For manufacturers, Entero Healthcare Solutions Ltd is a single national counterparty with execution at scale; this translates into high growth and visible market share gains as consolidation accelerates.

A Proven & Disciplined M&A model – Entero Healthcare Solutions Ltd has executed 50+ acquisitions since 2018, building a national footprint through repeatable, playbook driven M&A.Targets are screened for strategic fit (new geography, new category/capability) and economics (typically 6-8% standalone EBITDA, margin accretive to the group). Deal discipline is visible in paid multiples i.e around single-digit EV/EBITDA (5–7x) or ~0.6–0.7x sales with a stated payback of ~2-3 years. Integration is fast within ~90 days, acquired entities are migrated onto Entero Healthcare Solutions Ltd’s ERP/WMS, procurement rails, credit policies, and tech stack which unlock procurement benefits, mix upgrades (devices/diagnostics/surgical), and WC control. Management has also shown selectivity walking away or switching to better targets when economics/fit improve.

Consistent growth organic engine – Beyond M&A, the core franchise is compounding on its own. management guides to ~1.5-2x IPM through steady account onboarding (pharmacies/hospitals), wallet share gains in existing accounts and a mix shift toward higher margin adjacencies (devices/diagnostics/surgical). Importantly, acquired entities don’t just add run rate they typically reaccelerate post integration once migrated onto Entero Healthcare Solutions Ltd’s systems which standardises buying, improves scheme capture, better WC and enables cross-sell/attach of higher margin categories, lifting both throughput and unit economics versus pre deal baselines.

The Inflection to Positive Cash Flow – This is the most critical catalyst after achieving positive OCF in H2FY25, Management has guided to be OCF positive for the full financial year FY26. This will be achieved by the combination of higher margins and a sharp focus on improving working capital management. Net working capital days are already down from 71 to 66 with a target to reach 60 days by the end of FY26.

Technology Enabled Platform & Scalability – Tech advancements are a key benefit of the ongoing consolidation and Entero Healthcare Solutions Ltd has successfully leveraged its technology platforms to support and streamline the business. Entero Healthcare Solutions Ltd’s solutions include:

- Entero Direct – A cloud based SaaS solution that allows retailers to manage their procurement needs, make payments and get access to live inventory levels, promotional offers and loyalty programs with minimal interaction.

- Entero CRM – This platform helps Entero Healthcare Solutions Ltd analyze customer interactions and maintain relationships.

- Proprietary ERP System – This system ensures a smooth flow of operations across its vast network.

What are the Risks of Investing in Entero Healthcare Solutions Ltd ?

Investors need to keep the following risks in mind if they choose to invest into this business. Risks needs to be weighed in combination with the advantages listed above to arrive at a decision that is optimal for your portfolio construct

Acquisition Pipeline – A core risk to Entero Healthcare Solutions Ltd’s investment case is its heavy reliance on its acquisition engine.This high growth strategy is not guaranteed, as Entero Healthcare Solutions Ltd may struggle to find a steady pipeline of suitable targets or fail to negotiate attractive terms, especially as competition for these assets could drive valuations higher. The greatest danger is a loss of management discipline, if the team under pressure to deliver growth, abandons its stated guidance of buying assets in the 5-7x EV/EBITDA range and pays up at multiples closer to its own, the “valuation arbitrage” at the heart of the investment thesis breaks and future acquisitions would become highly dilutive to shareholders.

Integration Execution Risk – Buying a company is the easy part; integrating it is complex, and this remains a substantial operational risk. Entero Healthcare Solutions Ltd’s model promises a rapid, approximately 3 month operational integration (covering ERP, procurement, credit, and processes). Any slippage here risks delayed synergy realization, leakage on vendor schemes, fractured controls and cultural pushback from local teams. If this integration playbook fumbles, the expected synergies, procurement efficiencies, and margin improvements will not materialize.

Terminal Value Risk – Terminal value of this business cannot be too high once unorganized share in the pharma distribution market starts falling aggressively. An oligopoly market structure will bring down PE multiples to less than 20 eventually. This is a paradox for this business that needs to be watched; more successful the business, lower can be terminal value multiple. However the risk of this over the next 4-5 years is low since there is a long runway of growth

Retail Pharmacy consolidation Risk – Entero Healthcare Solutions Ltd’s scale advantage is derived from its fragmented customer base of 95,300+ pharmacies, which gives it bargaining power. The primary risk here is that the retail side of the supply chain organizes at a much faster rate than it is currently. If large, organized chains or e-pharmacy players aggressively consolidate the market, Entero Healthcare Solutions Ltd’s customer base would shift from thousands of small buyers to a few powerful corporate accounts. This concentration would give customers immense bargaining power to demand lower prices and better credit terms which can severely compress Entero Healthcare Solutions Ltd’s margins for example Medplus has subsidiaries that are into pharma distribution but they do only captive business. They also haven’t invested into the distribution business for many years now. This risk isn’t high but needs to be watched

High Working Capital & Negative OCF Risk – The most critical financial risk for Entero Healthcare Solutions Ltd’s consistent history of negative OCF. This cash burn is a direct result of its high growth model, which requires investments in working capital (inventory and receivables) to fund its numerous acquisitions and organic expansion.

Management has explicitly guided that their focus would be on improving working capital management (targeting 60 days) and to finally generate positive OCF in FY26. This guidance is an important catalyst to track but it introduces a second critical question that even if OCF turns positive, will it be sufficient to self fund the guided 30% revenue growth? This growth target is heavily dependent on continuous, capital-intensive acquisitions. If the positive OCF is not large enough to fund this M&A pipeline internally, Entero Healthcare Solutions Ltd will still be forced to raise external capital.

Industry Growth Slowdown – Management guides its organic growth relative to the IPM i.e targeting 1.5-2.0x IPM growth. However, the market is anchored to a 30%+ narrative for overall revenue growth. If the industry softness persists, even meeting the high end of their guidance (i.e 2x of IPM) would only yield lower organic growth. Which will be far below the 30% absolute growth which investors expect which will lead to raising the operational bar for management to offset this slowdown through aggressive M&A. If it fails to do so, Entero Healthcare Solutions Ltd’s reported growth could drift below the 30% narrative, even if it technically meets its relative guidance.

Entero Healthcare Solutions Ltd Future Outlook

Entero Healthcare Solutions Ltd management has guided for an aggressive FY26 targeting revenue growth of 30%+ (in line with FY25) and for the first time aiming for a full year EBITDA% exceeding 4%. Most critically, Entero Healthcare Solutions Ltd is guiding for positive OCF for the full year.

This outlook is built on a three pillar strategy, though it remains heavily dependent on its M&A led consolidation model.

The Acquisition Engine (Inorganic Growth) – This remains the core of Entero Healthcare Solutions Ltd’s high growth narrative. The business model is effectively an “acquisition engine” designed to consolidate India’s fragmented pharma distribution market.

In FY25, Entero Healthcare Solutions Ltd successfully acquired and integrated 10 companies, adding ₹792 crores in annualized revenue, The momentum continues with 6 new strategic acquisitions already announced. These are expected to add over ₹400 Cr in annualized revenue and will be funded from existing IPO proceeds, Management is being selective and targeting acquisitions that are EBITDA% accretive and expand its presence in high value segments like trade generics, specialty pharma and medical devices.

Steady Organic Growth – Entero Healthcare Solutions Ltd aims to grow its base business by onboarding new pharmacies and hospitals while increasing its “wallet share” with existing customers.

Management is confident it can maintain an organic growth rate of 1.5-2x the Indian Pharmaceutical Market (IPM) growth, This strategy faces headwinds from a general slowdown in the IPM, which has decelerated from historical double digit growth to a 7-8% rate. Therefore, organic growth alone will not be sufficient to meet the 30% growth the M&A remains essential.

Focus on Profitability and Efficiency – The third pillar is a clear focus on margin expansion and cash generation. The target of exceeding a 4% EBITDA% and achieving positive OCF hinges on increasing the revenue share from higher margin categories and driving procurement efficiencies and improving working capital management as the company scales.

In our view, Entero Healthcare Solutions Ltd’s story is best understood as a consolidation play executing a valuation arbitrage. Entero Healthcare Solutions Ltd is leveraging institutional capital to acquire smaller, regional players at attractive multiples (0.6-0.7x sales) while the public market values Entero Healthcare Solutions Ltd at a higher multiple (0.9-1x sales).

The market is unlikely to be satisfied with organic growth alone; the 25%+ growth story depends on the M&A engine continuing to fire. The primary risk, therefore, is future funding. Entero Healthcare Solutions Ltd has sufficient IPO proceeds to fund its FY26 acquisition targets. However, the business is currently operating cash flow negative and the management’s guidance for achieving positive OCF by the end of FY26 is the single most critical catalyst to monitor.

Entero Healthcare Solutions Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Entero Healthcare Solutions Ltd Price charts

Since Entero Healthcare Solutions Ltd was listed in 2024, the stock trading history is limited to less than two years, we have just the daily chart to go by. On a Daily chart, Entero Healthcare Solutions Ltd has exhibited pronounced post IPO volatility since its listing in late 2024, surging from an initial price to a peak of approximately ₹1,500 levels. From Mid 2025 Entero Healthcare Solutions Ltd stock has subsequently entered a clear downtrend. Key support levels to watch out for are ₹1078 and ₹ 976. Resistance level above the downtrend line in a short time frame.

Entero Healthcare Solutions Ltd Latest Latest Result, News and Updates

Entero Healthcare Solutions Ltd Quarterly Results

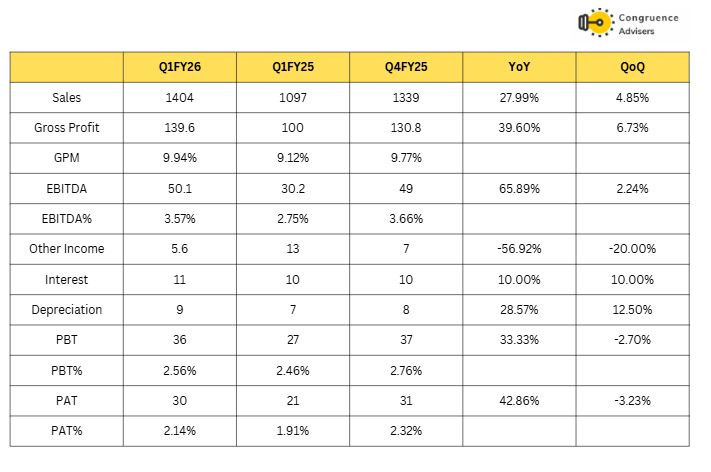

Entero Healthcare Solutions Ltd began FY26 on a strong note, reporting 28% YoY revenue growth to ₹1,404 Cr significantly outperforming IPM growth of 9%, while PAT rose 47% YoY to ₹30 Cr. Performance was driven by continued execution on its strategy to consolidate India’s fragmented healthcare supply chain through both organic expansion and disciplined acquisitions. Growth was broad based supported by customer additions, partnerships with healthcare brands and diversification into new categories such as medical devices, diagnostics, and trade generics.

Margins expanded in tandem with topline growth, Gross margin improved to 9.9% (vs 9.1% YoY) and EBITDA margin rose to 3.6% (vs 2.8%), aided by a richer product mix, higher value-added services and procurement efficiencies. The modest QoQ decline in profitability was due to the impact of annual salary hikes implemented at the start of the year, with management expecting operating leverage benefits to flow through in subsequent quarters.

Management reiterated its focus on technology led productivity gains, expanding its customer base and maintaining cost efficiency. Overall, We believe Entero Healthcare Solutions Ltd remains well positioned to deliver sustained double digit growth with gradual margin improvement through FY26.

Final Thoughts on Entero Healthcare Solutions Ltd

This is one business where growth appears to be a given, however what will make or break the stock is how management executes on growth without diluting the unit economics, capital structure and ownership over time.

While the management team appears confident of turning Operating cash flow positive in FY26 and developing the ability to drive future acquisitions based on internal cash flows, one will need to see if the management team is able to balance the fine line between debt and equity capital raising in a manner that can maximize shareholder value.

It is easy to get excited about the obvious growth but at current valuation the market will want to see > 25% p.a. Growth over the medium term. While the business may be able to deliver ~15% p.a. Growth organically from the existing portfolio, the remaining 10%+ p.a. Growth will need to come from acquisitions. Till the time the business becomes self-sustaining on cash flows (both for organic growth & acquisition led growth), lower valuation multiple given by the market to the business can constrain their acquisition plans. If the market were to derate the business down to ~0.6x price to sales, the ability of the management to acquire small distributors at < 0.5x price to sales may get constrained.

There will also be the comparison with Medplus who is the 2nd largest pharmacy store chain that has already gotten to a self-sustaining growth level. Medplus generated 265 Cr of operating cash flows (pre IND AS reporting) with capex of ~60 Cr in FY25, giving it a very healthy level of cash flow that it can use to drive growth. On a pre IND AS level, operating margins of Medplus are at ~4.5% and the price to sales multiple at > 1.5x as of date. Though Medplus and Entero Health occupy different parts of the value chain, investors will always compare such stories and choose for themselves.

Investors will need to have a clear view on the sustainability of the growth of Entero Healthcare and the terminal value for the business in 10 years time, since their ability to deliver aggressive growth is linked to how well they can improve margins, cash flow and raise capital (equity, debt or a combination of the two).

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this to a general audience. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will continue/be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.