Rolex Rings Ltd is engaged in manufacturing (forging and machining) of bearing rings and auto components like engine parts, transmission parts, exhaust system parts, and chassis parts, etc. Rolex Rings Ltd caters primarily to the requirement of the automobile sector and has a reputed clientele comprising global and domestic auto component manufacturers.

The missing piece in the Rolex Rings Ltd story over the past few years has been growth. While the stock was a market favorite till 2021 due to the business quality, market leading margins and strong cash flow generation, the lack of healthy growth has led to a valuation multiple derating over the past two years. While management indicates healthy orders in hand, the tariff situation has led to a good degree of uncertainty on when the anticipated growth can materialize. If the management is successful in driving growth over the next few years, the market may start giving weightage to the intrinsic advantages of the business model again. Rolex Rings Ltd is interestingly poised due to the very reasonable valuation adjusted for the unit economics, if only growth can revert to a healthy range from here.

Rolex Rings Ltd Company Summary

Rolex Rings Ltd is one of the top five forging companies in India in terms of installed capacity and a manufacturer and global supplier of hot rolled forged and machined bearing rings, and automotive components for segments of vehicles, including two-wheelers, passenger vehicles, commercial vehicles, off-highway vehicles, electric vehicles, industrial machinery, wind turbines, and railways, amongst other segments. It is one of the key manufacturers of bearing rings in India, catering to most of the leading bearing companies in the country.

Its product portfolio includes a wide range of bearing rings, gearbox components, and automotive components. Manufacturing capabilities are complemented by tool design, engineering, and product development capabilities.

- Rolex Rings Ltd operates 594 spindles, which are machines used in manufacturing.

- 24 forging lines, representing separate production lines where metal parts are shaped by forging

- Total forging capacity is 165,000 metric tons per annum (MTPA), meaning they can process up to 165,000 tons of metal through forging each year.

- The machining facility can make more than 75 million parts every year, showing its large-scale capability to produce finished machined components.

- Other machinery includes heat treatment furnaces, cold rolling machines, and other infrastructure.

In FY25, Rolex Rings Ltd reported sales of INR 1155 Cr, EBITDA of INR 269 Cr, and profit after tax of INR 174 Cr. The operations of Rolex Rings Ltd can be broadly classified under two business divisions: a) Bearing Rings – 45%, b) Auto Components – 55%.

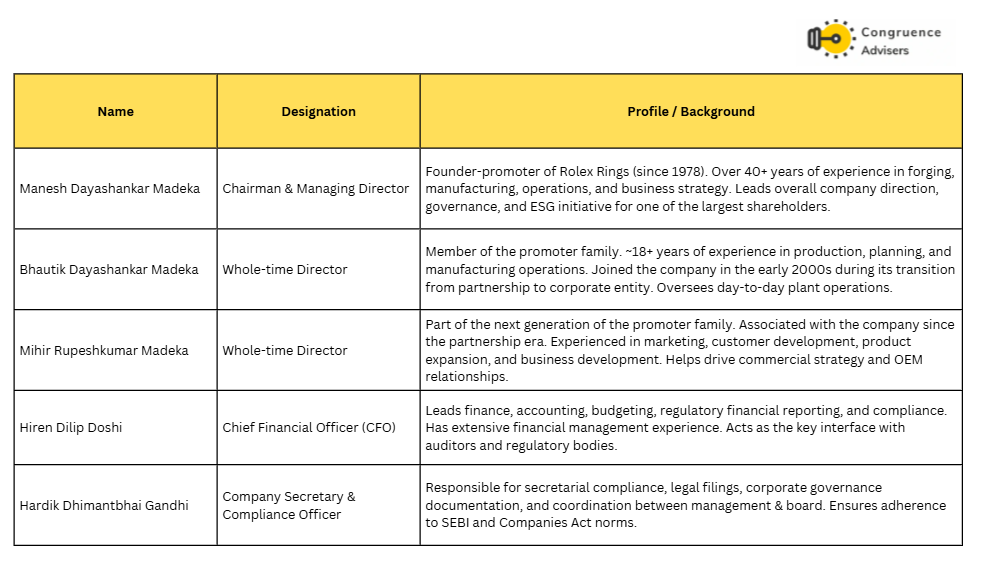

Rolex Rings Ltd Management Details

Members of the Madeka family established Rolex Rings Ltd, with the business originally starting under the name “Rolex Industries” in 1977-78 as a partnership firm in Rajkot, Gujarat. The key promoters are Manesh Dayashankar Madeka and Rupesh Dayashankar Madeka, who were pivotal in forming and growing Rolex Rings Ltd. Manesh D. Madeka, in particular, serves as the Chairman and Managing Director, having accumulated over four decades of experience across marketing, production, and finance.

Other members of the Madeka family, such as Bhautik Dayashankar Madeka (Whole-Time Director) and Mihir Rupeshkumar Madeka (Whole-Time Director), are actively involved in management.

The business began as a family and has stayed under close promoter management, gradually evolving from a partnership firm into a major manufacturer of forged and machined components, particularly bearing rings and automotive parts. Several members of the Madeka family continue to play a crucial role in the day to day management and strategic direction of the firm.

Rolex Rings Ltd – Industry Overview

Global Metal & Steel Industry

The global metals industry, foundational to all industrial sectors, is set to grow from $8.43 trillion in 2024 to $8.95 trillion in 2025 and $10.7 trillion by 2029, underscoring its pivotal role in infrastructure, manufacturing, energy, and consumer goods. Key sectoral themes:

- Steel: Global crude steel output rose 2.9% YoY, with India and Southeast Asia driving growth even as global consumption for steel is set to decline marginally by 1% in 2025. Environmental concerns have led to rising demand for low-carbon “green steel,” and industrial metals (copper, aluminum, nickel) are pivotal for the EV and renewable energy boom.

- Technological Advancements: The industry is experiencing transformative change with rapid digitization, robotics adoption, and advanced recycling, boosting efficiency, transparency, and sustainability.

- Circular Economy: Increasingly, metals are processed and reused as part of closed-loop systems, reducing carbon footprint and raw material dependency.

Indian Metals and Forging Sector

India’s entire metal ecosystem mining, refining, value-added processing is experiencing a generational upsurge, thanks to surging infrastructure spend, automotive/EV production, and government manufacturing push. The country’s forging market is valued at $7.7 billion in 2025, projected to reach $12.8 billion by 2032 (CAGR 7.4%).

- Automotive Demand: The vehicle sector, especially EVs and hybrids, is the main engine, demanding stronger yet lighter components (aluminum, titanium). Materials innovation is critical for fuel efficiency and safety.

- Aerospace & Defense: “Make in India” and indigenization norms are steering premium demand for high-precision parts.

- Exports: Indian forging’s global appeal has grown, with exports capturing increased share as Western clients diversify away from China.

- Regional Leadership: South India leads the domestic forging market, bolstered by automotive and heavy engineering hubs.

Automotive and Advanced Industrial Forgings

Forging underpins the advanced manufacturing economy— engine, transmission, suspension, and drive-train components, as well as critical structural and safety parts for automotive, wind, and industrial machinery. The rapid evolution of EV platforms, aerospace needs, and global environmental standards are accelerating technology upgrades, automation, and lean/smart factory adoption across the industry. Demand for digital traceability, green credentials, and high-tolerance machining are now ubiquitous requirements.

Government Initiatives

Transformational Policies

- Production-Linked Incentives (PLI): Financial incentives foster capex, localization, and world-class quality. For Rolex Rings, this enables expansion into value-added, exportready products.

- National Manufacturing Mission: Strategic roadmap to boost India’s GDP share from manufacturing (now 13-14%), augments Rolex’s core business through policy support for scaling, R&D, and skills.

- Make in India / Atmanirbhar Bharat: Encourages local sourcing and value addition—opening defence, railways, and e-mobility verticals to qualified forgers. Rolex Rings’ adherence to ESG and high-quality standards positions it as a supplier of choice.

- Green Manufacturing & ESG Compliance: Mandatory ESG disclosures, incentives for renewable energy use, and a clear regulatory preference for companies with transparent governance, favour sustainability leaders like Rolex Rings. Internal investments in solar/wind and optimized processes are directly aligned.

- Skill India, Digital India, and R&D: Funding for technology upgradation, workforce upskilling, and advanced manufacturing adoption supports Rolex’s human capital and innovation agenda.

How Government Initiatives Empower Rolex Rings

- Accelerated client acquisition as domestic and global customers prioritise “local for global” and ESG-compliant suppliers.

- Access to capital and lower cost of compliance for new capacity and green technology i.e improving margins and resilience.

- Enhanced opportunities in complex, high-margin sectors (aerospace, EV, defence) opened by policy-induced market creation.

- Participation and leadership in new-age manufacturing and export clusters via government-enabled networks and sharing best practices.

Rolex Rings Ltd Business Overview

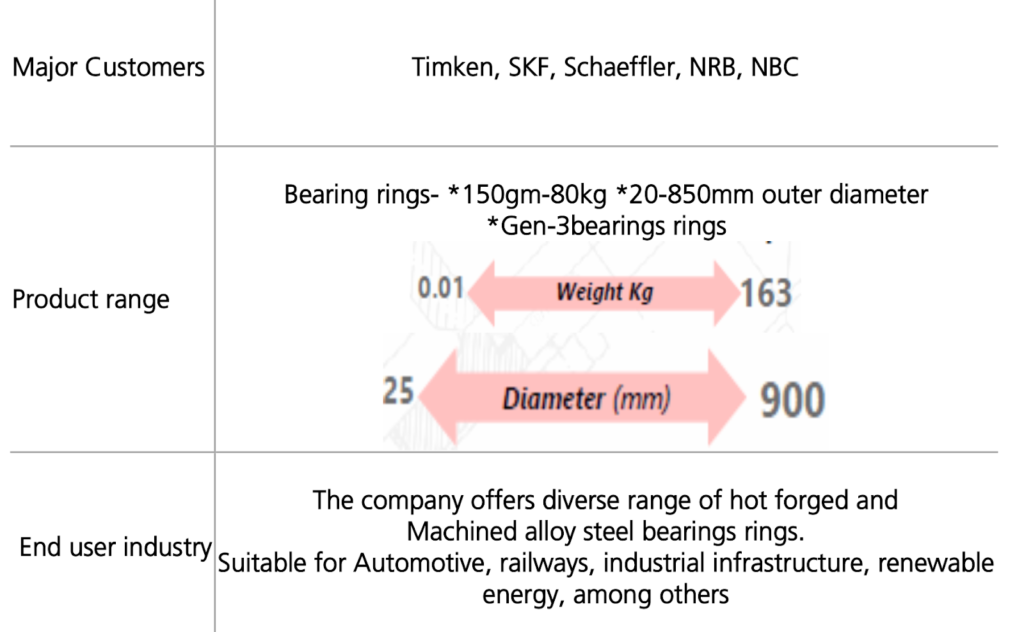

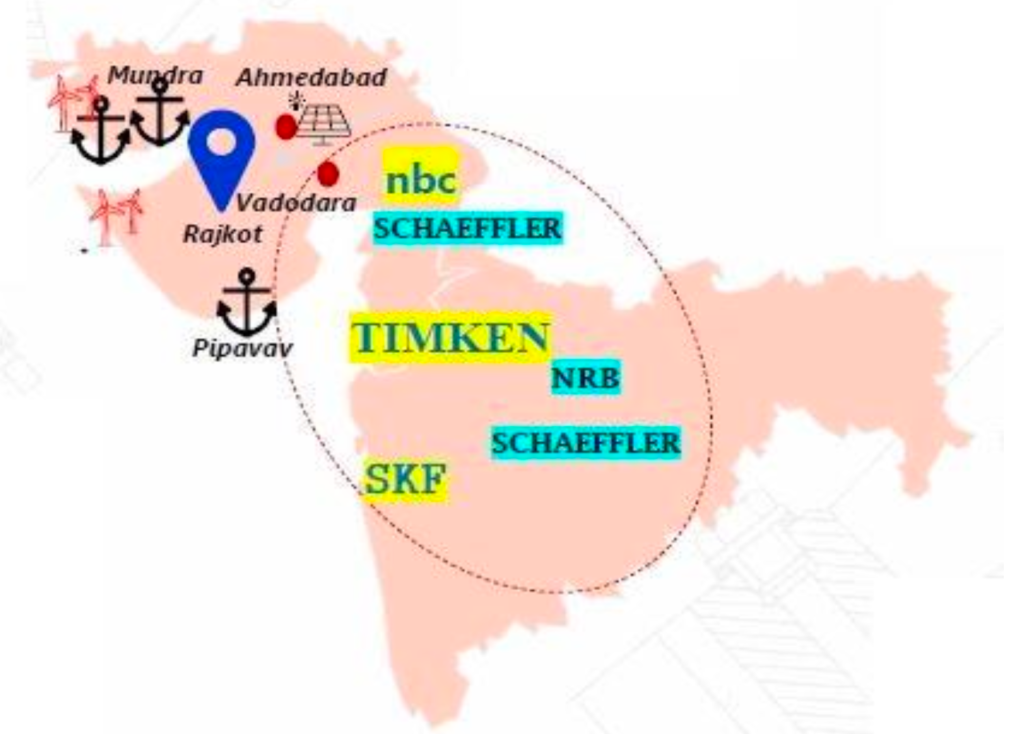

Rolex Rings Ltd is one of the key manufacturers of Bearing Rings in India, focused on hot-rolled and machined bearing rings. Caters to most leading bearing companies in India. Major customers include Timken, Schaeffler, SKF, NRB, and NBC. To date, Rolex Rings Ltd has offered a diverse range of hot forged and machined alloy steel bearing rings ranging from 10 gm to 163 kg in weight and 25 mm to 900 mm in diameter. Its bearing rings are suitable for a wide range of end-user industries such as Automotive, railways, industrial infrastructure, and renewable energy, among others. Rolex Rings Ltd has the capabilities to cater to bigger rings’ requirements, which have higher value and relatively lower competitive intensity.

Rolex Rings Product Portfolio

The development of an array of products over the years has helped Rolex Rings Ltd become one of the leading manufacturers of forged products and suppliers of bearing rings and automotive components. Rolex Rings Ltd has a diverse range of hot forged and machined alloy steel bearing rings weighing from 0.01 kilograms to over 163 kilograms, and with an inner diameter of 25 mm to an outer diameter of 900 mm.

This makes its products suitable for a wide range of end-user industries such as automotive, railways, industrial infrastructure, and renewable energy, among others. Rolex Rings Ltd also offers a wide set of auto components such as wheel hubs, shafts and spindles, gears, etc. An expanded product portfolio has helped the company to garner a higher share of business from existing customers and also reduced dependence on a single product category.

Bearing Rings – Long standing relationship with key customers

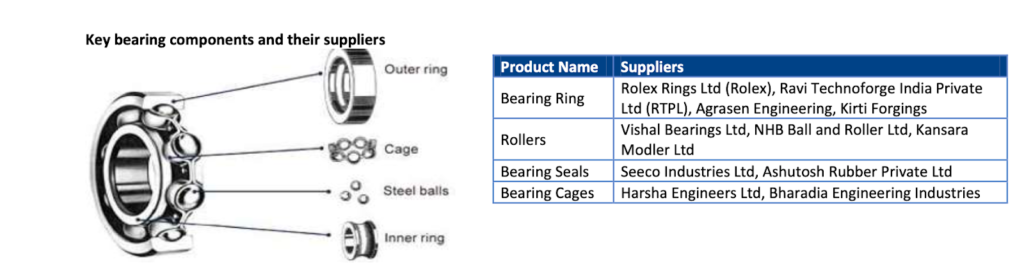

The main components for bearings include five basic parts, i.e., inner ring, outer ring, rolling element, cage, and seals. The inner and outer rings are commonly referred to as bearing rings/races.

Bearing rings are an essential part, so bearing manufacturers limit the number of suppliers and prefer to work with approved vendors. This leads to customer loyalty and customer stickiness in this sector, as evidenced by 7 of the top 10 customers having been with the company for over a decade. Rolex Rings Ltd has established solid partnerships with reputable manufacturers like Timken, Schaeffler, SKF, and NBC.

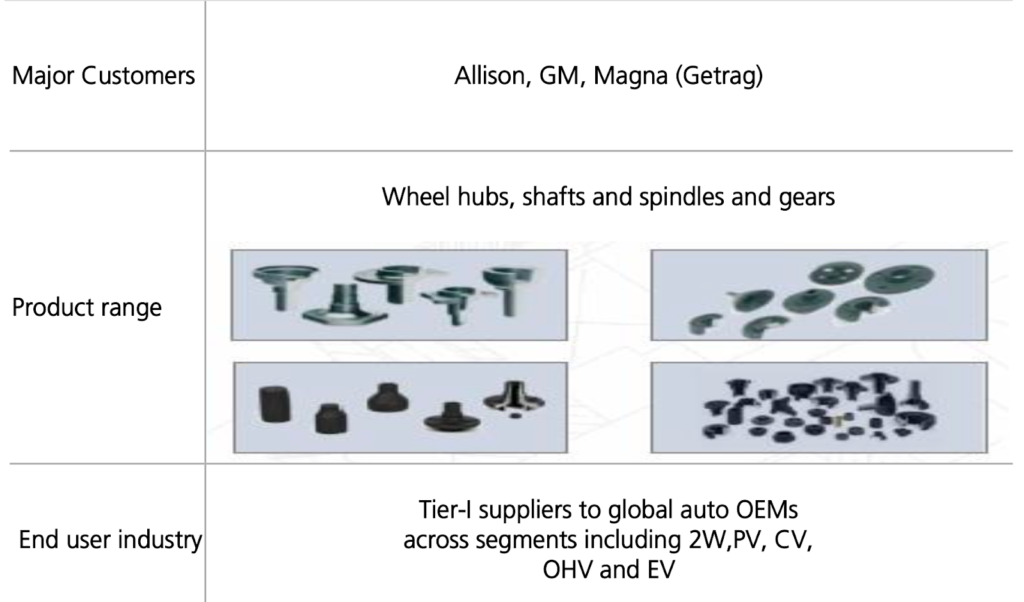

Automotive components – complex engineering creates a high entry barrier

Rolex Rings Ltd primarily manufactures transmission and wheel parts, which require higher precision and machining. Margins are comparatively higher in this segment as compared to the bearing segment, as 90-95% of the products are machined. In the segment, Rolex Rings Ltd has continuously added products to increase its wallet share with existing customers. Key customers in the segment are Allison Transmission, GM, and Magna (Getrag).

The segment has high entry barriers, and it is difficult to onboard new customers due to a long customer conversion cycle and stringent qualification parameters.

Post acceptance of the product, it takes a long period (of 1-1.5 years) for validation and testing. E.g., the company started with a single component for a single plant 10 years back with one of the PV manufacturing Companies in the US; now, it is supplying more than 30 different auto components to the same client.

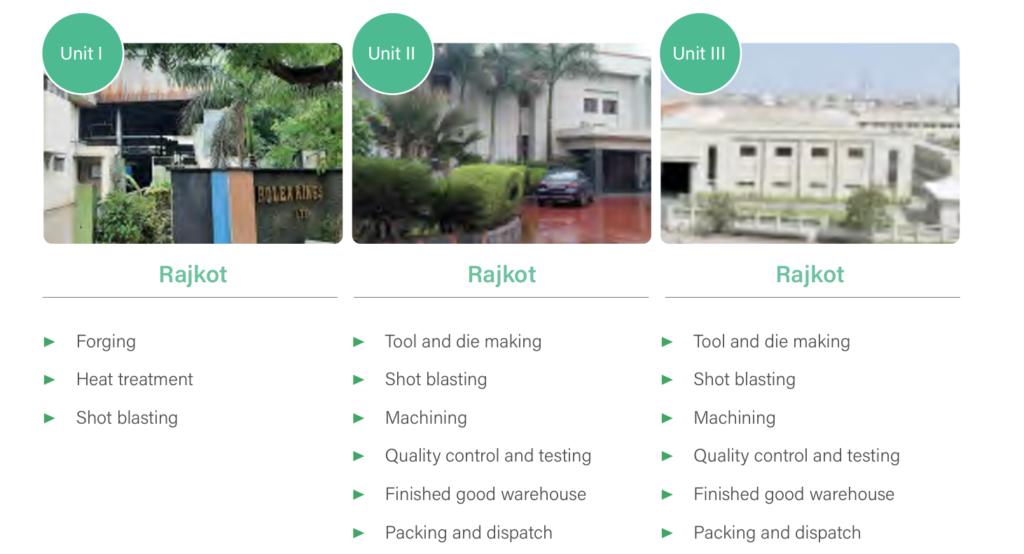

Operational Facilities

Rolex Rings Ltd has three manufacturing units in Rajkot. The proximity of its manufacturing units to the ports of Kandla, Mundra, and Pipavav allows it to serve export markets as well as numerous automotive clusters in North, West, and South India.

The location of manufacturing facilities at Rajkot gives Rolex Rings Ltd access to automotive clusters in North India, West India, and South India, and also caters to export markets through its close proximity to the ports of Kandla, Mundra, and Pipavav. Further, the Rolex Rings Ltd outsources some pre-machining operations to take advantage of lower costs offered by vendors, while it balances work in-house, allowing it to respond quickly and efficiently to any customer requirements or change in product specifications without the need to depend on delivery schedules.

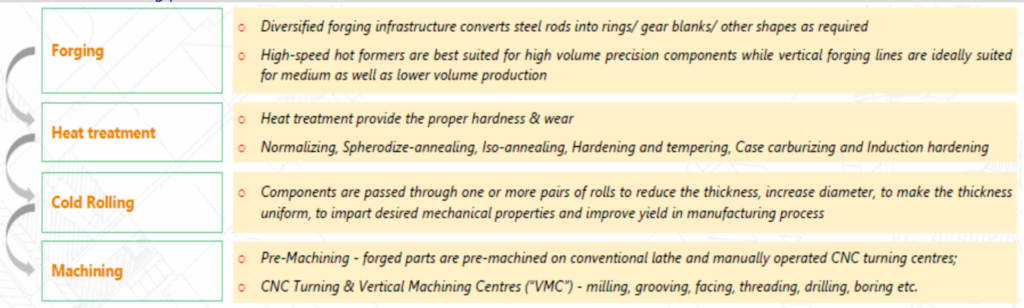

Manufacturing Process

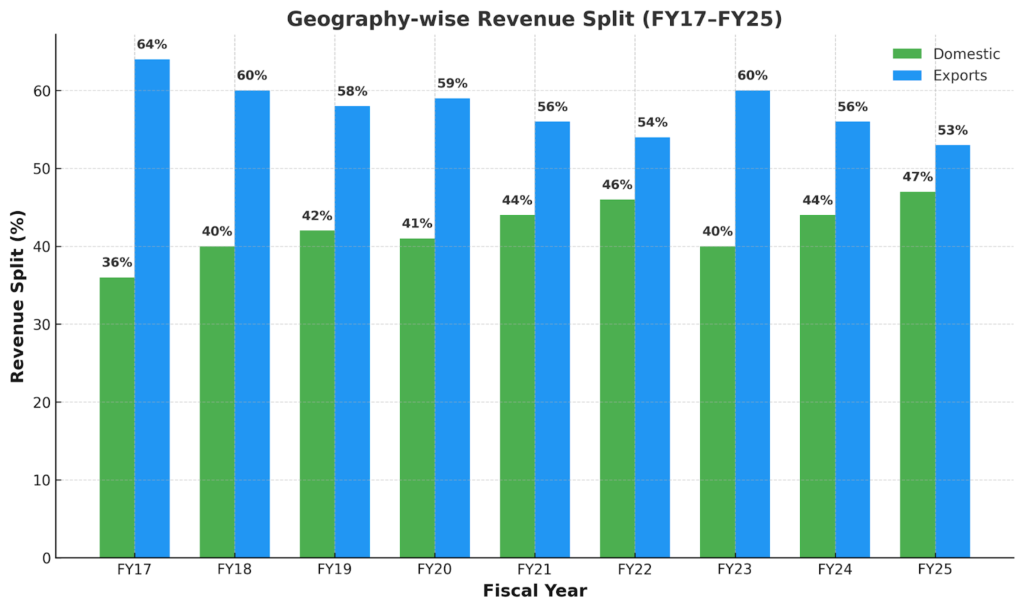

Geography-Wise Revenue Split

Rolex Rings Ltd offers bearing rings and automotive components to domestic and catering to the US, Canada, Mexico and the European continents. As of Q1FY26, the US accounts for 25% of export revenue and 20% revenue contribution from the European side. Overall, geography-wise revenue split of exports is at 53% in FY25, which declined when compared to 64% in FY17. Domestic business revenue mix improved 47% in FY25 when compared to 36% in FY16.

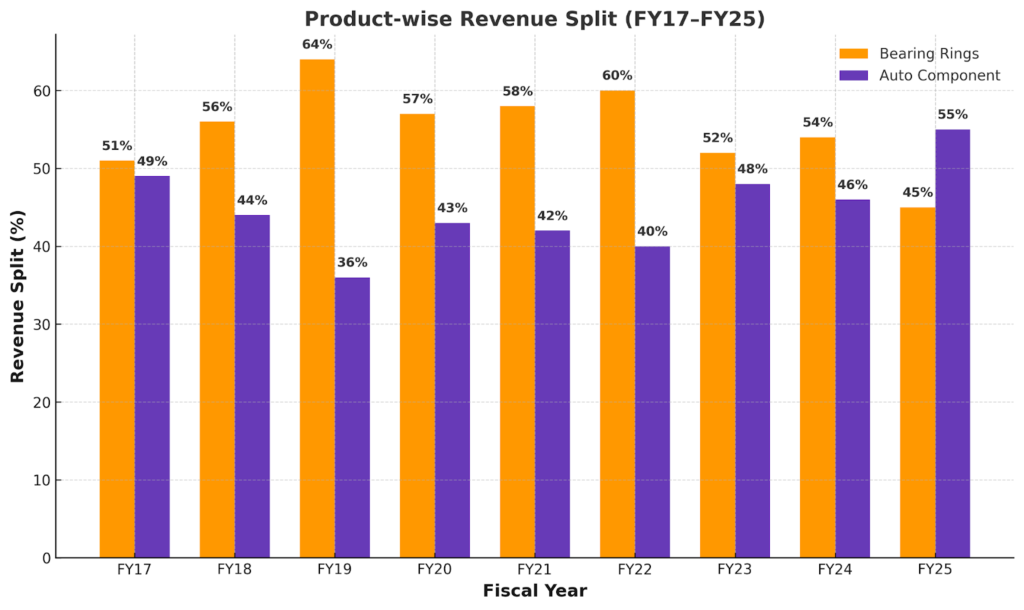

Bearings Rings revenue mix has declined from 45% in FY25, when compared to 51% in FY17. Auto Components revenue mix has increased from 55% in FY25 when compared to 49% in FY19.

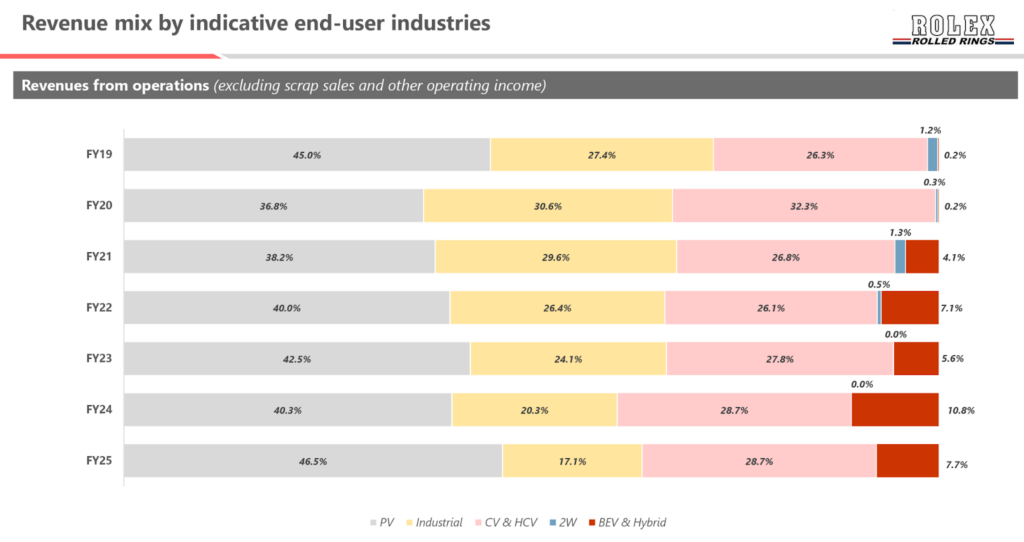

Industry-Wise Revenue Split

- Passenger Vehicles – Cars and SUVs used by individuals or families.

- Industrial – Products or services used in general industries (like manufacturing, construction, etc.).

- Commercial Vehicles – Vehicles used for business purposes, like trucks, vans, and buses.

- Heavy Commercial Vehicles – The largest trucks and buses, mainly used for long-distance transport or heavy-duty tasks.

- Two-Wheelers – Motorcycles, scooters, and mopeds.

- Battery Electric Vehicle – Vehicles powered only by batteries (no petrol or diesel engine), like electric cars or scooters.

- Hybrid Vehicles – Vehicles powered by both a conventional engine (petrol/diesel) and an electric motor.

Margin Across The Geography and Products

The Rolex Rings Ltd EBITDA margins have consistently ranged around 22% to 25% over the last few years.

- High Value Added Products (Internal/Product Focus):

- Products with multiple processes/critical operations are associated with better margins.

- Critical bearing rings supplied to some US suppliers are noted to have margins of more than 25%.

- Auto components broadly range between 22% to 25% EBITDA margin.

- EV and Hybrid Components are confirmed to command better margins compared to regular products. Components for EV/Hybrid vehicles require more precision and additional processes, leading to more profit.

- Export vs. Domestic Sales (Geographical/Channel Focus):

- The overseas business generally has a marginal benefit from export incentives.

- The majority of export products typically involve value-added processes and critical operations, contributing to better margins compared to domestic sales.

- In the export auto component market, specifically for high-premium cars and EVs, the transmission components involve critical operations and good value additions, making the margins quite lucrative (higher by 15% to 20% compared to bearing rings).

- Specific Applications (End-User Focus):

- Rolex Rings Ltd noted that the passenger vehicle segment and the hybrid vehicle segment are two areas where high-value, high-precision components are prioritised. Rolex Rings Ltd focuses on expanding products in the EV and hybrid segments, as demand for these high-value products would yield better margins.

Other – Achieving higher capacity utilisation, targeting more than 70% to 75%, is also expected to improve margins due to better absorption of fixed costs.

Raw Material Cost

The primary raw material for Rolex Rings Ltd is steel and its alloys, specifically various grades of alloy steel used in manufacturing bearing rings and automotive components.

Raw materials are sourced from customer-approved domestic and international steel sources.

- For bearing rings, Rolex Rings Ltd generally does not import steel, but for auto components, steel is imported from Japan. Overall, imported steel constitutes approximately 18% to 20% of total purchases in FY22.

- The majority of input material is sourced directly from within India (90% in FY25, up from 89% in FY24).

- The percentage of input material sourced directly from MSMEs/small producers was 2.70% in FY25, compared to 2.56% in FY24.

Pricing revisions based on commodity costs occur quarterly for overseas customers and on a monthly basis for domestic customers.

Order Book & Capacity Utilisation

For FY26 – The order book for Rolex Rings Ltd stands at Rs110-120 Cr Per Month, of which Rs 60-65 Cr is sourced from the auto-components business and the rest comes from the bearings business.

Looking ahead, management has confirmed approximately ₹175 Cr worth of new orders in the pipeline, with the majority to commence from Q2FY26. However, it’s crucial to note that about 25% of these new orders are from the US and are currently on hold due to tariff uncertainties.

Despite this, the company’s proactive efforts in domestic and European markets are expected to compensate for any short-term US slowdown.

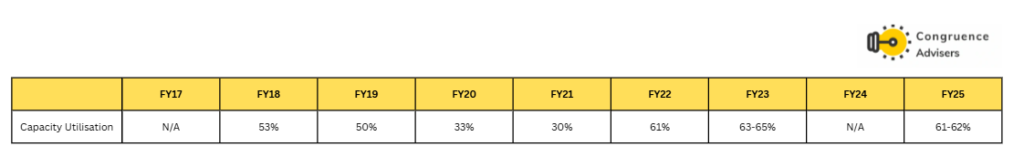

Capacity Utilization

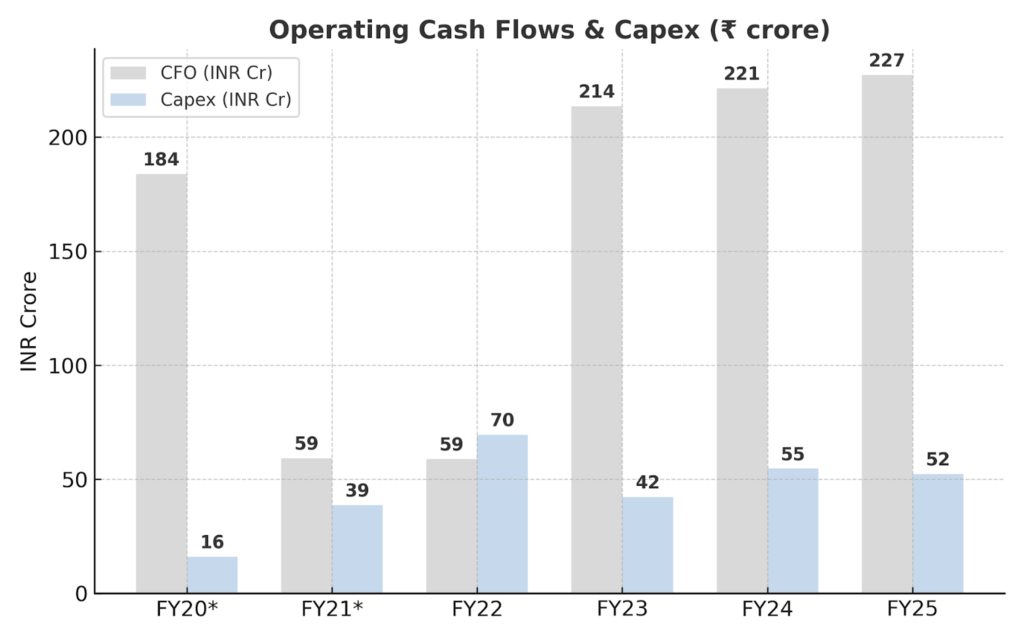

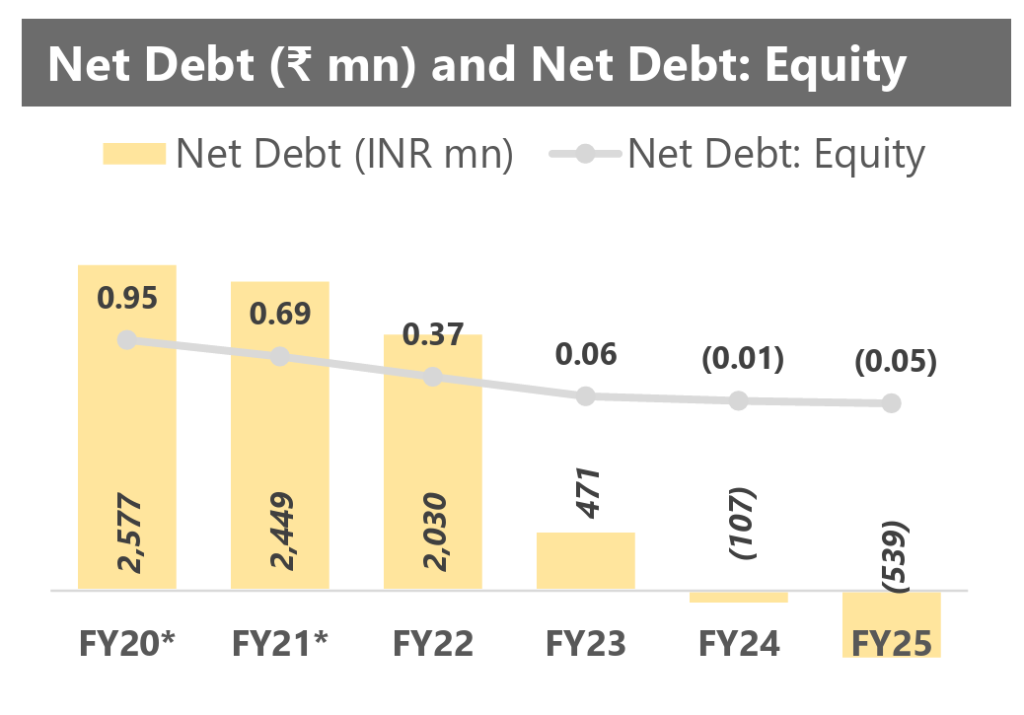

The consistent generation of operating cash flow over the years has enabled Rolex Rings Ltd to drastically improve its balance sheet status. The strong cash flow generation has been crucial in significantly reducing the debt, resulting in Rolex Rings Ltd becomin net debt-free.

Capex for FY26 is at ₹40–50 Cr, primarily for the installation of two additional vertical forging lines to support confirmed growth in the auto components segment. About 10% of this outlay will be allocated toward maintenance capex. For FY27, planned capex is expected to be ₹20–30 Cr.

Historical Expansion and Crisis Impact

In 2007, Rolex Rings Ltd invested approximately Rs 400 Cr in capacity expansion, partially funded by a Rs 150 Cr private equity infusion from NSR, but the new factory’s commissioning in 2009-10 coincided with the Global Financial Crisis, causing widespread order cancellations from Europe, which then accounted for over 60% of revenues. Pre-GFC, exports dominated sales, but the crisis severely impacted European automotive demand, leading to sales and profitability declines that strained debt servicing for the expansion-funded borrowings. This vulnerability stemmed from Rolex Rings Ltd heavy reliance on cyclical auto components like bearing rings supplied to Tier-I manufacturers.

CDR Restructuring in 2013

Unable to service debts amid deteriorating conditions, Rolex Rings Ltd invoked Corporate Debt Restructuring in January 2013, restructuring term debt of Rs 487 Cr (Rs 136 Cr due by March 2020 and Rs 351 Cr by March 2022), with working capital limits estimated at Rs 82 crore for FY13 and Rs 94 crore for FY14. The CDR package included lender rights like Right of Recompense (RoR) for sacrifices made, imposing restrictions on dividends, asset pledges, and banking ties until closure. Consortium banks led by Union Bank of India enforced these terms, highlighting Rolex Rings Ltd high leverage from pre-crisis capex.

From FY15, Rolex Rings Ltd generated robust free cash flows, enabling accelerated repayment of CDR loans, fully closed by FY22, with net debt/equity dropping from 2.3x pre-turnaround to 0.40x in FY22, 0.08x in FY23, and 0.00x by FY25. This deleveraging reflected sound management, including cost savings, diversified customer onboarding during slowdowns (offsetting European losses, now ~20% of topline), and operational efficiencies, boosting EBITDA margins to ~23% in recent years. Capacity utilization stabilized around 60%, supported by repeat orders from approved global clients like bearing majors.

In Feb 2025, Rolex Rings Ltd received a demand from Union Bank of India for a Right of Recompense (RoR) amounting to ₹228 Cr related to a 2013 Corporate Debt Restructuring agreement. Rolex Rings Ltd disputes the bank’s calculation of RoR, claiming it does not align with contractual agreements and has communicated its objections to the involved banks. Rolex Rings Ltd is actively engaging with the consortium to resolve the issue.

Rolex Rings Ltd has provisioned ₹50.60 Cr for the RoR liability as of Q3FY25 and maintains sufficient liquidity through unutilized credit lines and liquid investments.

Rolex Rings Ltd Corporate Governance

Board Composition – As of FY25, the Board of Rolex Rings Ltd. had 6 members: 3 Independent Directors, 2 Whole-Time Directors who are from the promoter family, and Manesh Dayashankar Madeka, who is the Chairman and the Managing Director of Rolex Rings Ltd.

Promoter Remuneration – The total remuneration paid to promoters via salaries and rents paid in FY25 was Rs 8.2 Cr, which is approximately 2% of Rolex Rings Ltd reported PAT.

Contingent Liabilities – The total contingent liabilities outstanding for Rolex Rings Ltd as of FY25 amounted to ₹20 Cr, primarily of Income Tax and Service tax-related demands from the Government. The total contingent liabilities are less than 2% of the book value of equity of Rolex Rings Ltd, and hence not material. But The Consortium of banks issued a demand notice to the company for ₹228 Cr. If the management’s assessment turns out to be wrong and the banks successfully enforce the full demand, including compounded interest, the company faces a significant unprovided liability.

Related Party Transactions – There are scrap sales and subcontracting payments worth Rs 2.5Cr in FY25 with related parties, but the amounts are not material

Dividend Track Record – Rolex Rings Ltd has not paid a dividend in the last ten years, during which Rolex Rings Ltd prioritised repaying debt and reinvesting funds into its own business. Given that the business seems to be on auto-pilot and no inorganic acquisitions seem to be on the horizon, it would be good corporate governance practice on part of the management to start considering a dividend payment.

Rolex Rings Ltd Financial Performance

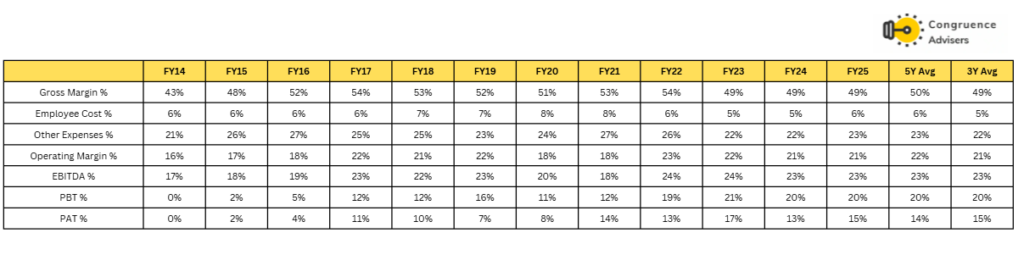

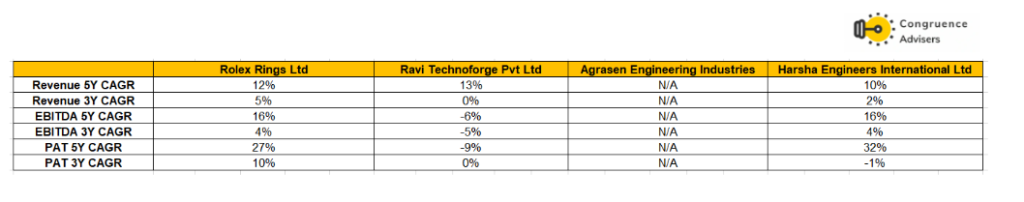

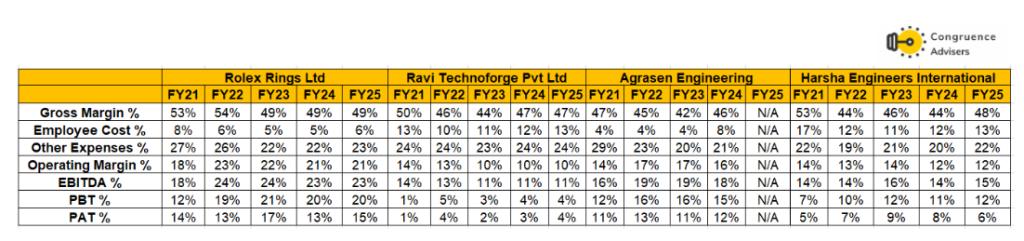

Over the last 5 years, Rolex Rings Ltd has grown revenues at a CAGR of 12%, EBITDA at a CAGR of 16%, and PAT at a CAGR of 17%, with revenue growth above double-digit in the last 5 years. During this period, EBITDA margins have been stable around 23-24% apart from FY21, which was impacted by Covid, and PAT has stayed between 13–17%, respectively. Over the 3 years, Rolex Rings Ltd revenues have grown at a CAGR of 5%, EBITDA at a CAGR of 4%, and PAT at a CAGR of 10%.

In FY20 & FY21, Overall reduction in Domestic and Export sales due to the recession caused by the Automobile industry and by the effects of COVID-19 starting in January 2020.

In FY22 – Covid recovery and Strong momentum were driven by demand across domestic and export markets, especially in industrial rings and automotive exports.

FY23 – Pickup in demand from existing customers and addition of new customers, resulting in an increase in the quantum of sales, along with improved sales realisation across product categories.

FY24- Remained largely stable despite global inflationary pressure and moderate demand schedules in the European and US markets (resulting in lower manufacturing activity at the consumer end).

FY25 – Impacted due to subdued demand in the bearing ring business, especially in overseas markets, and supplies to European customers coming in weaker than expected.

Rolex Rings Ltd Working Capital, Debt, Return and Cash Flow Analysis

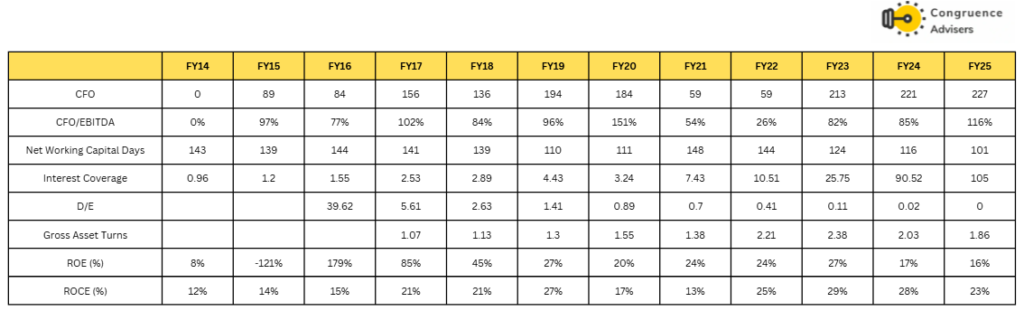

Rolex Rings Ltd looks much stronger position now when compared to early years, The Cash Flow from Operations shows a consistent uptrend, growing from ₹89 Cr in FY15 to ₹227 Cr in FY25 and the CFO/EBITDA conversion ratio improved , indicating strong cash generation relative to profitability. Working Capital management has been efficient with Net Working Capital Days declining from a peak of 148 days in FY21 to just 101 days by FY25, reflecting improved cash conversion and operational efficiency.

Most notably, the Rolex Rings Ltd interest coverage ratio has strengthened dramatically from 0.96x in FY14 to 105x by FY25, while the Debt-to-Equity ratio has de-leveraged from 39x in FY16 to near zero by FY25, signifying complete deleveraging and financial strength.

Rolex Rings Ltd Comparative Analysis

To understand Rolex Rings Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Rolex Rings Ltd to its competitors (peer comparison) on various fundamental parameters and Rolex Rings Ltd share performance relative to relevant benchmark and sector indices.

Rolex Rings Ltd Peer Comparison

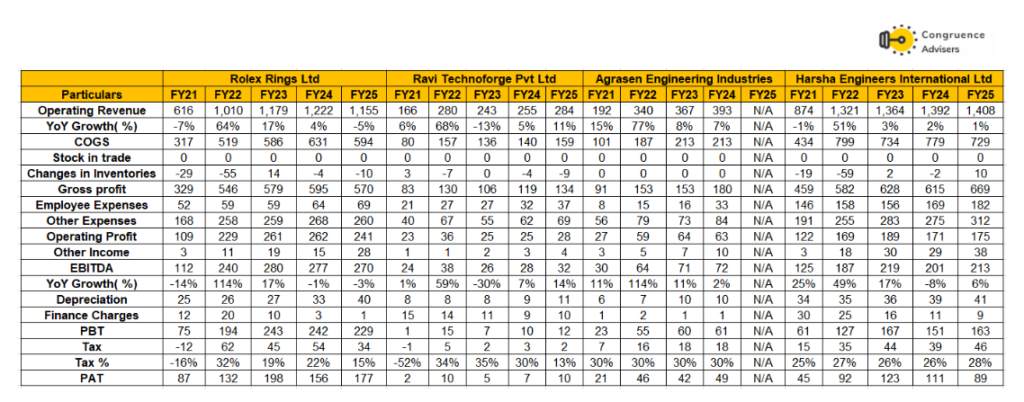

Rolex Rings Ltd nearest competitor, private players are Ravi Technoforge, Agrasen Engineering Industries and public listed players are Harsha Engineers Ltd. Both private players are significantly smaller compared to Rolex Rings Ltd. Further, it enjoys higher margins and a better return ratio profile.

With a 5-year revenue CAGR of 12% indicating a strong growth trajectory versus Ravi Technoforge’s declining 13% and Harsha Engineers’ modest 10%. Most significantly, Rolex Rings Ltd profitability margins are industry leading, with an Operating Margin of 21% in FY25 substantially outpacing Ravi Technoforge’s 10% and Agrasen Engineering’s 16%, while the EBITDA margin of 23% ranks among the highest peers.

Gross margins remain resilient at 49% in FY25, comparable to peers, indicating stable pricing power. Rolex Rings Ltd’s 5-year PAT CAGR of 27% is exceptional and demonstrates superior profit growth conversion relative to peers, driven by operational efficiency with Employee Costs at only 6% of sales and Other Expenses at 23%, reflecting lean operations and better cost control compared to Ravi Technoforge (13% and 24% respectively).

Rolex Rings Ltd Index Comparison

Rolex Rings Ltd share performance vs the S&P BSE Small Cap Index, as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why You Should Consider Investing in Rolex Rings Ltd

Experienced promoters with an established track record of operations: The promoters of Rolex Ring Ltd, the Madeka family, are well-qualified and possess extensive experience in the auto components industry, reflected in the Rolex Ring Ltd’s strong and sustained performance for over four decades. Established in 1980, Rolex Rings Ltd has evolved into one of the leading suppliers of forged bearing rings and a wide range of automobile components, including engine, transmission, chassis, and exhaust system parts, thereby demonstrating a long-standing and proven track record in the auto-components industry.

Approved supplier to marquee clients with diversified geographic revenue streams: Rolex Rings Ltd primarily serves the automobile sector and enjoys a strong customer base comprising leading bearing and auto component manufacturers. Its long-standing relationships and status as an approved vendor for various parts enable the company to secure consistent repeat orders. Additionally, Rolex Rings Ltd benefits from a geographically diversified revenue profile, with exports contributing around 52% of its turnover in FY25, supported by its association with global customers operating across multiple countries, particularly in the US and Europe.

Strong Balance Sheet & Stable Margins: Rolex Rings Ltd has successfully repaid its long-term debts and is currently “Net Debt Negative” (carrying cash surpluses). Despite volatility in raw material prices and ocean freight costs, Rolex Rings has maintained consistent EBITDA margins in the range of 22% to 24% over the last few fiscal years.

Diversified Product Portfolio and reduced dependency: Rolex Rings Ltd revenue split is balanced between Bearing Rings and Automotive Components. In recent quarters, the Auto Component segment contributed 54%, while Bearing Rings contributed 46%, showing a healthy shift toward higher value-added auto components. Rolex Rings Ltd caters to diverse sectors, including passenger vehicles, commercial vehicles, industrial machinery, railways, wind turbines, and electric vehicles (EVs). This reduces dependency on the cyclicality of any single industry.

EV and Hybrid Transition: Revenue from EV and Hybrid vehicles has grown to approximately 8-10% of revenue. Rolex Rings Ltd has secured new programs from US and European auto component majors for EV and hybrid vehicle components. This includes transmission parts and wheel hubs for EVs, which command better margins due to higher precision requirements.

What are the Risks of Investing in Rolex Rings Ltd

Liability on account of Right of Recompense: Rolex Rings Ltd has received a demand notice from a consortium of banks led by Union Bank of India for a Right of Recompense (RoR) liability arising from its 2013 debt restructuring. Rolex Ring Ltd has disputed the claim and is currently in active negotiations with the lenders. Both Rolex Ring Ltd and the consortium have agreed to seek a legal opinion on the matter, and a final settlement is still pending. Rolex Ring Ltd has recognised a provision of ₹50.60 cr based on its best estimate of the potential liability up to FY25. Rolex Ring Ltd also maintains adequate liquidity through an unutilised line of credit and unencumbered cash and liquid investments, which are expected to be sufficient to meet the potential liability.

Presence in a competitive and cyclical industry, though demand remains stable: Rolex Rings Ltd operates in a highly competitive auto-component industry, whose performance is closely linked to end-user sectors such as automobiles, engineering goods, capital goods, and railways. The industry’s demand profile is cyclical and influenced by broader economic conditions. In FY25, the Indian automotive components industry was valued at US$137.06 billion, with growth primarily driven by domestic demand. Recessionary conditions in key Western markets, including the US and Europe, dampened demand from both international and domestic customers. Nonetheless, aftermarket sales remained robust at around US$20 billion, supporting the overall demand environment.

Customer Concentration Risk: Rolex Rings Ltd faces significant customer concentration, with its top 10 customer groups contributing around 84% of total sales in FY25 (compared with 80% in FY24). However, this risk is partly mitigated by Rolex Ring Ltd long-standing relationships with most of these customers, many of whom it has been associated with for over a decade. Being a Tier-II supplier in the auto component value chain, Rolex Ring Ltd supplies bearing rings and other components to Tier-I manufacturers who serve major OEMs in the automobile sector. This positioning limits Rolex Ring Ltd’s bargaining power, as its customers are relatively large and influential industry players.

Vulnerability of profit margins to raw material and foreign exchange fluctuations: Steel and its alloys constitute the primary raw materials required for manufacturing bearing rings and auto components, and their commodity-linked prices are inherently volatile. Moreover, Rolex Ring Ltd does not have long-term supply contracts with steel vendors, exposing its profitability to fluctuations in input prices. While quarterly revisions in sales contracts with most customers help partially offset adverse movements, Rolex Ring Ltd remains vulnerable. With exports contributing about 52% of its revenue in FY25 (56% in the previous year), Rolex Ring Ltd is also exposed to foreign exchange risks. However, it benefits from a partial natural hedge through imports and mitigates the remaining exposure using foreign currency working capital borrowings and forward contracts.

Rolex Rings Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time, price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers, we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Rolex Rings Ltd Price charts

On a Daily chart Rolex Rings Ltd in a sustained downtrend, with the price recently rebounding slightly from the strong support zone near ₹100-101 and around the IPO price. Until it breaks above the immediate resistance around ₹122, upside momentum may remain limited. A decisive move above that level could signal recovery, while slipping below ₹100 may invite further weakness.

On a Weekly chart, Rolex Rings Ltd is in a well‑defined multi‑month downtrend, with successive lower highs from the 260-280 region and a clean breakdown below the earlier demand zone around 122–123, which now acts as strong overhead resistance. Price has drifted down to the psychologically important 100 area, close to the recent low and IPO price, where the candles show hesitation and small lower wicks, hinting at some value buying but not yet a confirmed reversal.

Rolex Rings Ltd Latest Result, News and Updates

Rolex Rings Ltd Quarterly Results

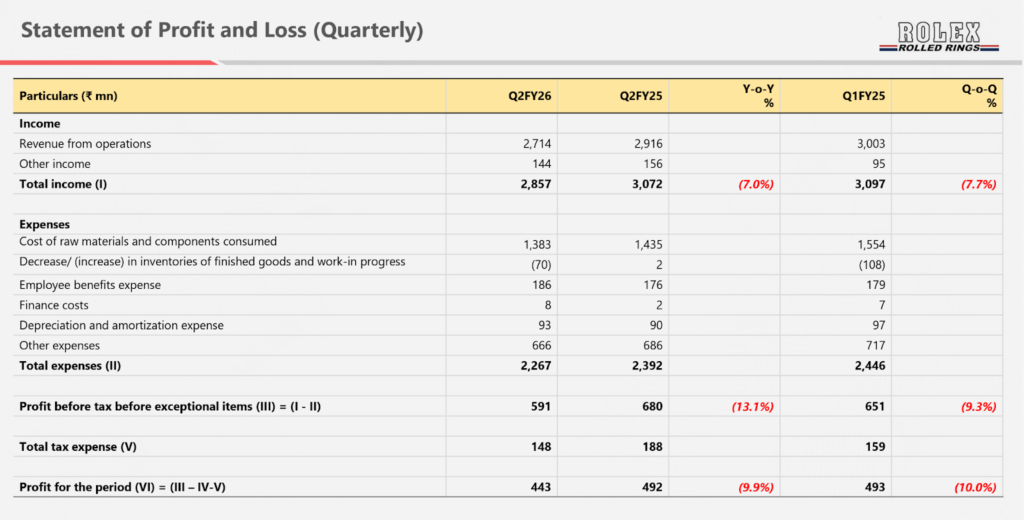

Q2 FY26 for Rolex Rings Ltd was weak on revenue due to US tariff disruption, but margins held up well and domestic/Europe showed healthy traction.

Q2 FY26 revenue from operations at ₹271 Cr vs ₹292 Cr in Q1 FY26 and ₹300 Cr in Q2 FY25, a decline of 7% QoQ and 9% YoY, primarily due to US export slowdown. Despite lower revenue, the company maintained strong profitability with EBITDA of ₹69 Cr (vs ₹77 crore in Q1 and ₹75 crore in Q2 FY25) and PAT of ~₹44 Cr (vs ₹49 crore in Q1 and similar to Q2 FY25).

Product mix in Q2: bearing rings contributed 58% of revenue and auto components 42%, supported by incremental domestic and European bearing-ring demand.

Geographic mix shifted towards India/Europe: exports dropped to ~43% and domestic rose to 57%; US share of revenue fell while Europe’s share increased, with Europe already at ~₹118 crore in H1 FY26 vs ~₹190 crore in all of FY25.

US import duty on relevant components spiked to ~53% on shipments arriving from mid‑September through October, leading US customers to defer orders and sharply reduce imports from India. A mid October proclamation cut duty on key auto parts to about 28% effective for consignments cleared at US ports from 1 November, giving relief but with customers still waiting for final trade‑deal clarity before ramping volumes.

Rolex Rings Ltd generated positive operating cash flow of ~₹87 crore in H1, spent ~₹13 crore on capex for value‑added processes, remains net-debt-free, and is commissioning a 9 MW solar power plant expected to be operational by December 2025.

Final thoughts on Rolex Rings Ltd

Rolex Rings Ltd. seems to be one of those stable companies in the industrial/auto-ancillary space which print good margins, generate great return on capital and are free cash flow generating machines. The only missing piece of the equation in such plays is often revenue growth. The other missing piece often is lack of management hunger for pursuing inorganic growth. Both of these features apply to Rolex Rings Ltd as well. Since getting out of CDR issues, Rolex Rings Ltd has generated ~INR 250Cr+ of free cash flow. But instead of paying dividends or considering growth avenues, Rolex Rings Ltd has so far chosen to accumulate the cash on its balance sheet via financial investments. We can only hope that management realizes that the Indian market does not reward great unit economics in stories where growth is missing. Rolex Rings Ltd is presently available at very cheap valuations of 15x TTM PE. If the market gets any confidence of even 10% revenue growth for 2-3 years, this story is ripe for a re-rating. But we have often seen that such companies in the auto ancillary space are happy to go with their product cycles and keep accumulating cash on the balance sheet without looking to pursue alternative growth avenues. We can only hope Rolex Rings Ltd management reconsiders this approach. Otherwise this could be another auto ancillary/industrial play which will remain purely cyclical.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this to a general audience. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will continue/be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.