Incorporated in 1996, Tatva Chintan Pharma Chem Ltd manufactures Structure Directing Agents, Phase Transfer Catalysts, Electrolyte Salts for Super Capacitor Batteries and Pharma & Agro Intermediates and Specialty Chemicals.

Tatva Chintan Pharma Chem Ltd stands at a very interesting juncture as its core SDA segment is rebounding strongly after a reset phase, while new engines like electrolyte additives and advanced intermediates is expected begin meaningful scale-up in FY27. The semiconductor chemicals vertical holds promising optionality if successfully executed. With capacity already in place, a credible track record of innovation, and early signs of operating leverage playing out, Tatva Chintan Pharma Chem Ltd is well positioned to deliver 20%+ growth from here.

Tatva Chintan Pharma Chem Ltd Company Summary

Tatva Chintan Pharma Chem Ltd incorporated in 1996, is a leading integrated specialty chemicals manufacturer headquartered in Vadodara, Gujarat, with two state of the art manufacturing facilities located at Ankleshwar and Dahej SEZ. Tatva Chintan Pharma Chem Ltd has steadily evolved from a niche catalyst manufacturer to a globally recognised supplier of high value and complex chemicals serving diversified industries.

Tatva Chintan Pharma Chem Ltd operates across four major product segments –

- Structure Directing Agents (SDAs)

- Phase Transfer Catalysts (PTCs)

- Electrolyte Salts & Solutions for supercapacitors and energy storage applications (ESS)

- Pharmaceutical, Agrochemical Intermediates and other Specialty Chemicals (PASC)

As of FY25, Tatva Chintan Pharma Chem Ltd manufactured 226 products across these categories, catering to ~500 customers across 30+ countries. Tatva Chintan Pharma Chem Ltd employs 679 people and maintains warehouses in the USA and the Netherlands, supported by wholly owned subsidiaries in both regions to ensure global distribution and client proximity.

Tatva Chintan Pharma Chem Ltd remains the largest and only commercial manufacturer of SDAs for zeolites in India and ranks second globally in this niche category. It is also among the leading global producers of PTCs which is a critical class of catalysts used across the chemical value chain. Its R&D centre in Vadodara is spread across 36,000 sq. ft. and approved by the Department of Scientific & Industrial Research (DSIR) and employs over 50 scientists. The R&D centre focuses on process innovation, green chemistry, and development of next generation high purity chemicals.

Tatva Chintan Pharma Chem Ltd’s FY25 installed capacity stood at 552 KL across 39 assembly lines with a reactor utilization of 64.1% and assembly utilization of 30.5%. Exports contributed ~61.5% of FY25 revenue.

Tatva Chintan Pharma Chem Ltd’s clientele includes leading global and domestic names such as Merck, Bayer AG, Laurus Labs, Asian Paints, Tosoh Asia, Navin Fluorine, Atul Ltd, SRF Ltd, Divi’s Laboratories, Firmenich Aromatics, and Otsuka Chemical, among others. Tatva Chintan Pharma Chem Ltd’s products find applications across automotive (emission control catalysts, EURO VI and upcoming EURO VII standards), petroleum refining, pharmaceuticals, agrochemicals, paints & coatings, flavours & fragrances, and electronics industries.

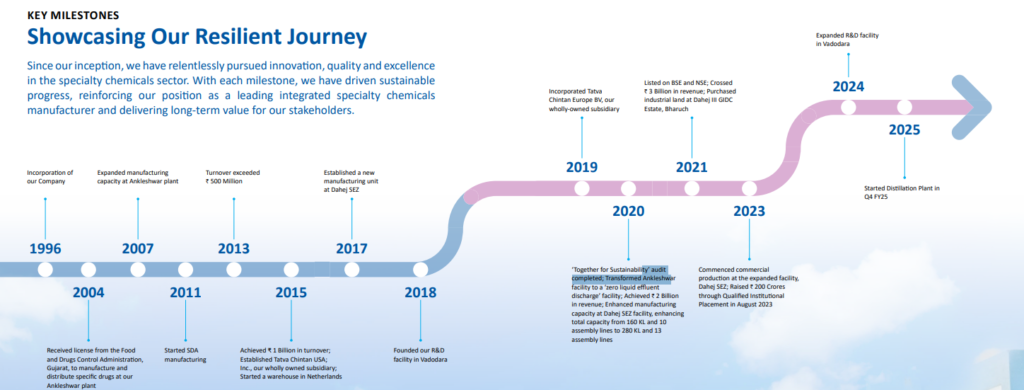

Tatva Chintan Pharma Chem Ltd History and Evolution

Tatva Chintan Pharma Chem Ltd founded in 1996 by first generation technocrats, has evolved into a differentiated play on high barrier, application specific specialty chemicals. Initially focused on catalysts and chemical intermediates i.e PTC, Tatva Chintan Pharma Chem Ltd laid its foundation at Ankleshwar, which later became home to its first scaled manufacturing unit.

Tatva Chintan Pharma Chem Ltd’s breakthrough came in 2011 with its foray into Structure Directing Agents (SDAs) which is a highly specialized class of quaternary salts critical to zeolite manufacturing. This pivot marked a strategic transition from general intermediates to chemistries with significant global entry barriers that is driven by technical formulation and purity requirements. Tatva Chintan Pharma Chem Ltd was early to identify this white space, and today stands as India’s only commercial SDA manufacturer and a global No. 2 player.

Post 2013, as annual turnover crossed ₹50 crore, Tatva Chintan Pharma Chem Ltd began establishing international ground. By 2015, it had set up Tatva Chintan USA Inc. and a Netherlands warehouse, supporting a growing international customer base. The Dahej SEZ plant was commissioned in 2017 which lifted export capacity, followed by an R&D facility in Vadodara (2018) that enabled internal development of IP intensive, process driven chemistries.

The next major inflection point came in 2021, when Tatva Chintan Pharma Chem Ltd launched a successful ₹500 crore IPO and listed on the NSE and BSE. The issue was a combination of ₹225 crore fresh issuance and ₹275 crore Offer for Sale (OFS). The company used the fresh capital to fund expansion at its Dahej manufacturing facility (~₹147 crore), upgrade its Ankleshwar plant (~₹20 crore) and invest in a dedicated R&D center at Vadodara (~₹23 crore). These initiatives were focused on scaling SDA and PTC production and driving new product development.During the same period, Tatva Chintan Pharma Chem Ltd also upgraded its Ankleshwar site to a Zero Liquid Discharge facility i.e aligning with tightening global environmental norms and improving its positioning with multinational customers who increasingly prioritize sustainable supply chains.

In 2023, Tatva Chintan Pharma Chem Ltd reinforced its balance sheet through a ₹200 crore QIP, and acquired land at Dahej III GIDC for capacity-linked expansion. A dedicated SDA block was commissioned at Dahej with 316 KL of reactor capacity, while assembly lines increased to 31. Which has set the stage for batch based scalability.

By FY25, Tatva Chintan Pharma Chem Ltd had expanded Dahej capacity to 461 KL and 36 lines, and commissioned a distillation plant to boost solvent recovery which has further improved gross margin resilience. R&D focus continues to deepen across new platforms including electrolyte chemistries, flow chemistry, and semiconductor materials, supporting its transition toward multi vertical global leadership in niche and high purity chemicals.

Tatva Chintan Pharma Chem Ltd Management Details

Tatva Chintan Pharma Chem Ltd is a founder-led company, built from the ground up by three first generation technocrats i.e Chintan Shah, Ajaykumar Patel, and Shekhar Somani. who have remained deeply involved since its inception in 1996. Interestingly, all three founders are alumni of Maharaja Sayajirao University of Baroda, likely batchmates from different technical streams and appear to have started the company directly after completing their education.

Mr. Chintan Shah, the Chairman and Managing Director, is the strategic face of Tatva Chintan Pharma Chem Ltd and leads R&D, global partnerships, and the innovation roadmap. A computer science engineer by training, he combines technical depth with commercial sharpness and has played a pivotal role in driving Tatva Chintan Pharma Chem Ltd’s global positioning. Mr. Ajay Patel, a chemical engineer, has been the force behind building the Tatva Chintan Pharma Chem Ltd’s manufacturing backbone, including Dahej and Ankleshwar, and is the go-to leader for project execution and process improvement. Mr. Shekhar Somani, with a pharmacy background, anchors the operational core, managing domestic sales, quality systems, and customer service.

Among the three co-founders, Chintan Shah is the sole active participant in investor calls. While Ajay Patel and Shekhar Somani remain operationally involved, they do not participate directly in earnings calls.

Tatva Chintan Pharma Chem Ltd – Industry Landscape

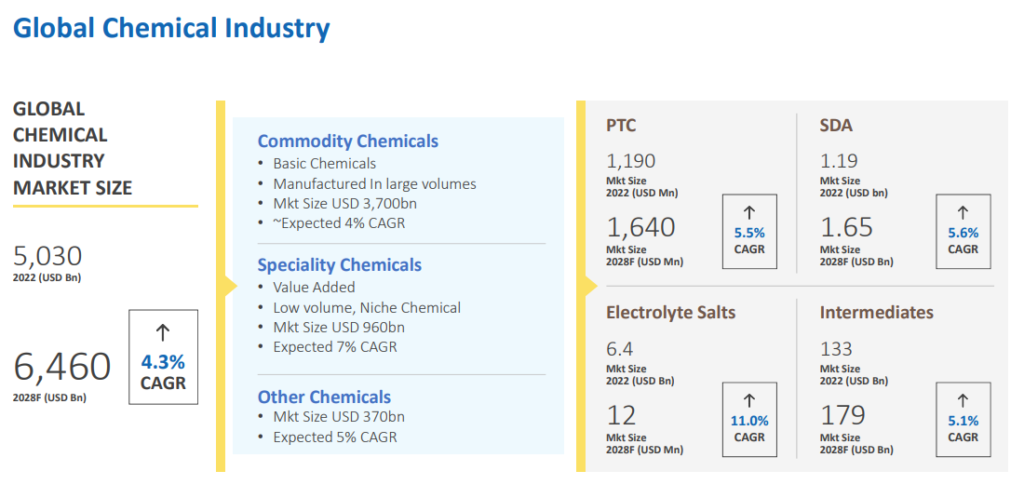

The global chemical industry, valued at USD 5.03 trillion in 2022 is projected to expand at a CAGR of 4.3%, reaching USD 6.46 trillion by 2028. Within this massive umbrella, the Specialty Chemicals segment is the most exciting pocket of value, owing to its high entry barriers, low volumes, and customized application base.

Specialty Chemicals – Specialty chemicals, with an addressable market size of USD 960 billion, are expected to grow at a 7% CAGR. These are typically low-volume, high-value formulations with very specific applications.

Several macro trends are accelerating demand for these value-added chemistries:

- Sustainability Push – Governments and corporations worldwide are increasingly shifting toward greener, more sustainable chemical processes, which often require tailor-made specialty formulations.

- Outsourcing of High-Purity Manufacturing – Global chemical and life sciences companies are outsourcing the production of complex intermediates and ultra-pure materials to specialized players, particularly in cost-competitive countries like India and China.

- Innovation-Driven Demand – Rising R&D investment in electric vehicles (EVs), pharmaceuticals, agrochemicals, electronics, and semiconductors is creating newer use-cases and increasing the complexity of chemical inputs — a space specialty chemicals are uniquely positioned to serve.

This dynamic ecosystem creates ample opportunities for focused players with deep chemistry know-how, high process control, and strong compliance credentials.

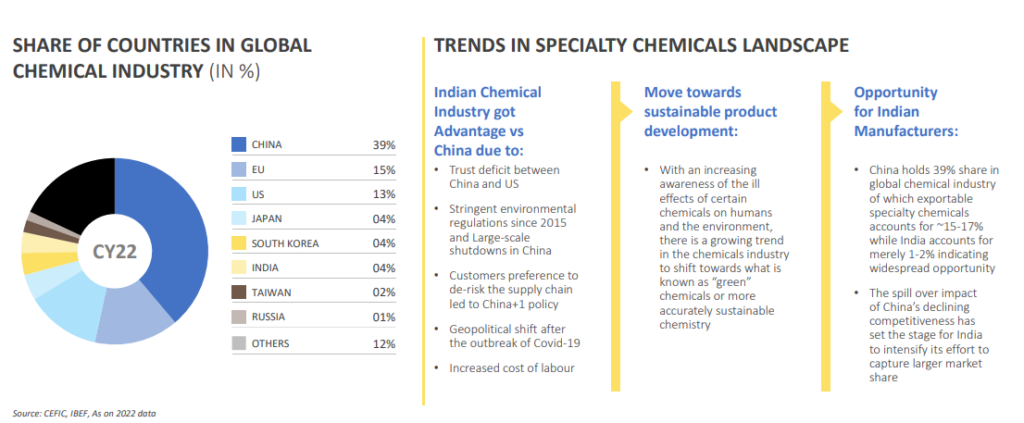

India’s rapidly expanding footprint in Global Chemical Market

India, which currently accounts for just ~4% of the global chemical industry output (CY22), is increasingly being seen as a structurally advantaged alternative to China. Particularly in the export-oriented specialty chemicals space. While China commands a dominant 39% share, India’s current ~1-2% share in global exportable specialty chemicals suggests massive headroom for growth.

This shift is driven by a combination of long term structural and geopolitical factors. Stringent environmental regulations in China since 2015, coupled with rising labor costs and large-scale plant shutdowns, have led global customers to seek diversified, de-risked supply chains. i.e giving rise to the “China+1” strategy. The post-Covid geopolitical realignment has only accelerated this transition.

India is well positioned to benefit from this trend, thanks to its strong technical talent, cost efficient manufacturing, and improving regulatory compliance. The growing global push towards sustainable or “green” chemistry also plays to India’s strength, especially with companies like Tatva Chintan Pharma Chem Ltd that are deeply aligned with clean chemistries, process innovation, and zero-liquid discharge practices.

With many Indian players already establishing global customer linkages and moving up the value chain through high purity and multi step synthesis capabilities, the country stands poised to expand its footprint meaningfully in the global specialty chemicals arena over the next decade.

Phase Transfer Catalysts (PTCs)

- Market Size: USD 1.19 billion (2022)

- Expected Size by 2028: USD 1.64 billion

- CAGR: 5.5%

What are Phase Transfer Catalysts (PTCs)?

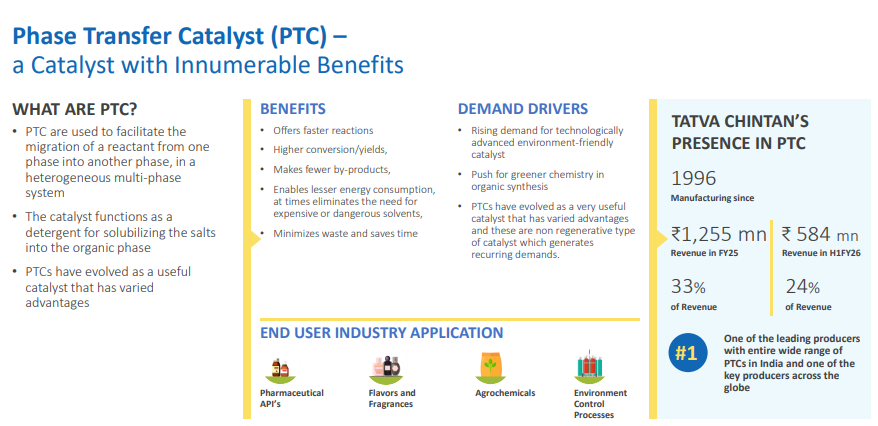

Phase Transfer Catalysts (PTCs) are specialty chemical compounds that enable a chemical reaction to occur between two substances located in different phases typically one in water and the other in an organic solvent by “transferring” one of the reactants into the phase where the reaction takes place. Think of them as chemical couriers that allow two otherwise immiscible substances to interact efficiently.

From an industrial chemistry standpoint, PTCs function like surfactants or detergents, helping solubilize inorganic salts into the organic phase where the core reaction happens. This eliminates the need for harsh, expensive, or toxic solvents that would otherwise be required to bring all reactants into a single phase.

Why Are PTCs Important?

PTCs have evolved into one of the most valuable workhorse catalysts across fine and specialty chemicals. Their benefits are compelling:

- Higher reaction efficiency – Faster reaction times and better conversion rates.

- Cleaner chemistry – Fewer by-products and less solvent use.

- Green alignment – They help reduce energy consumption and waste generation which is key for sustainability mandates.

Because PTCs are typically non-regenerative, they are consumed in the reaction process. This creates steady recurring demand from customers which makes it a highly sticky business.

Where Are PTCs Used?

PTCs are used in a variety of downstream industries where complex organic reactions are involved, such as – Pharmaceutical APIs (e.g., synthesis of drug intermediates), Agrochemicals Flavours and Fragrances and Environmental control processes (e.g., wastewater treatment catalysts)

PTCs enable reactions between chemically immiscible phases, reducing the need for harsh solvents. With increased regulatory focus on green chemistry and cleaner industrial processes, demand for PTCs is rising. Tatva Chintan Pharma Chem Ltd is a top global supplier across the full spectrum of PTCs and has established sticky relationships with major pharma and agrochemical players.

Structure Directing Agents (SDAs)

- Market Size: USD 1.19 billion (2022)

- Expected Size by 2028: USD 1.65 billion

- CAGR: 5.6%

SDAs are critical to the production of zeolites, used extensively in automotive emission control (SCR catalysts), petrochemicals, and increasingly in plastic recycling and green chemistry applications. Tatva Chintan Pharma Chem Ltd is India’s only commercial SDA manufacturer and second largest globally, providing strong export-led leverage. As SCR adoption rises globally, the SDA demand is expected to sustain robust growth.

SDAs are quaternary ammonium salts that serve as molecular scaffolds during the synthesis of zeolites. crystalline materials used as catalysts and adsorbents. By dictating the pore structure and channel architecture of the resulting zeolite, the SDA determines whether the crystal will be suited for cracking crude oil, reducing vehicle emissions, or enabling fine chemical synthesis. Once the zeolite is formed, the SDA is typically removed (burnt off), but its job of templating the structure is what makes the entire catalytic system viable.

This makes SDAs mission critical in industries where precision and performance matter. Their biggest industrial use case lies in automotive emission control. especially diesel vehicles that use SCR (Selective Catalytic Reduction) systems. Here, zeolites are promoted with copper or iron trap and convert NOx emissions, and the specific pore geometry needed for this catalytic activity is achievable only through precise SDAs. They also power processes in refining and petrochemicals (e.g., FCC, hydrocracking, dewaxing), methanol to olefins and advanced organic synthesis, each of which demands a distinct zeolite structure and hence a customized SDA.

What makes this space attractive is that although SDAs are used in small quantities by weight, they are absolutely irreplaceable from a functionality standpoint. A mismatch in SDA can derail the crystallization process, resulting in the wrong zeolite phase, poor performance, or outright process failure. This makes SDA supply sticky and high-margin once a customer locks into a formulation. Thus giving the segment a small input, high dependency characteristic that favors specialty players over bulk suppliers.

From a structural standpoint, the global SDA market is niche but highly value-added, growing in line with new emission regulations, refinery modernization, and green chemistry initiatives. What further compounds entry barriers is the purity requirement: trace impurities can interfere with zeolite nucleation, and only a few global players including Tatva Chintan Pharma Chem Ltd have the process technology to consistently deliver the required quality.

Customers include global catalyst manufacturers and material science firms who undergo long validation cycles before onboarding a supplier — creating natural stickiness and reducing the risk of commoditization.

All in, SDAs may be a sub-segment of specialty chemicals by market size, but they punch well above their weight in strategic importance. Their role in enabling clean emissions, fuel optimization, and advanced chemistry makes them an important of modern catalytic processes and players like Tatva Chintan Pharma Chem Ltd, who’ve cracked the quality consistency-sustainability trifecta are well-positioned to benefit from the long-term industry shift toward tighter regulations and greener chemistry.

Electrolyte Salts for Supercapacitor Batteries

- Market Size: USD 6.4 billion (2022)

- Expected Size by 2028: USD 12 billion

- CAGR: 11%

This is one of the fastest growing segments globally, driven by trends in energy storage, electric vehicles, and consumer electronics. Tatva Chintan Pharma Chem Ltd has entered this high-purity space, supplying glymes and other custom electrolytes to international clients, particularly in China and Japan. The company expects meaningful scale-up as design wins mature over the next 2-3 years.

Pharma & Agrochemical Intermediates

- Market Size: USD 133 billion (2022)

- Expected Size by 2028: USD 179 billion

- CAGR: 5.1%

Tatva Chintan Pharma Chem Ltd continues to supply key intermediates for APIs, pigments, and fragrance chemicals. Although this is a more commoditized segment compared to SDAs/PTCs, it adds volume leverage to fixed assets and improves utilization.

Tatva Chintan Pharma Chem Ltd Business Details

Phase Transfer Catalyst (PTC) – PTCs are used to facilitate the migration of a reactant from one phase into another phase where the reaction occurs, in a heterogeneous multi-phase system. PTCs are used for a variety of industrial processes. Phase transfer catalysts are a type of catalyst that allows a reactant to be migrated from one phase to another where the reaction takes place eliminating the need for costly and unsafe solvents that can dissolve all reactants in one phase, and costly raw materials minimizing the issue of waste. Phase transfer catalysts are widely used in green chemistry applications. Therefore, the increasing global focus of the chemical industry on reducing residual waste and reducing the use of organic solvents is boosting the market for catalysts for phase transfer

Tatva Chintan Pharma Chem Ltd’s Phase Transfer Catalyst segment is a strategic cornerstone of its business model. Which is serving as a consistent and resilient revenue stream across cycles. Tatva Chintan Pharma Chem Ltd is recognized as one of the leading producers of PTCs in India and a prominent global player, with a strong reputation for high-purity and quality-focused production. PTCs are essential in multiple industries from pharmaceuticals to agrochemicals and this broad applicability ensures diversified demand and lower cyclicality compared to more concentrated product lines.

Tatva Chintan Pharma Chem Ltd has built deep relationships with both Indian and global customers, particularly in regulated markets, by offering specialized and tailored PTCs suited to exacting process needs. Its consistent performance has allowed Tatva Chintan Pharma Chem Ltd to maintain preferred-supplier status with multinational clients, and recent onboarding of new large customers reflects its continued market penetration.

Strategically, Tatva Chintan Pharma Chem Ltd’s success in PTC is rooted in its technical capabilities, R&D-driven product customization, and reliable global delivery. Tatva Chintan Pharma Chem Ltd has used its deep know-how in quaternary chemistry to evolve into a specialist provider, enabling more efficient, greener chemical synthesis for customers. PTCs often serve as enablers of green chemistry, aligning with broader sustainability trends in global manufacturing.

Operationally, the PTC segment plays a balancing role in Tatva Chintan Pharma Chem Ltd’s portfolio. During downturns in more volatile segments (like SDAs, which are tied to auto markets), PTC has provided stability and helped cover fixed costs. It is not only a revenue driver but also a buffer against sector-specific shocks.Tatva Chintan Pharma Chem Ltd has also built flexibility into its operations by being able to switch PTCs between internal use and external sale depending on demand scenarios.

While PTC margins are solid, they are more moderate compared to ultra premium segments. However, the business remains robust even in price pressured environments, aided by Tatva Chintan Pharma Chem Ltd’s scale, process efficiency, and ability to absorb fluctuations better than smaller or less specialized competitors. Volatility in the segment is mainly due to pricing pressure and destocking cycles, but volume demand has shown sustained growth, which reinforces customer stickiness and market depth.

Looking forward, Tatva Chintan Pharma Chem Ltd expects the PTC business to continue growing organically and steadily, driven by new customer wins, global capacity readiness, and rising industry adoption of efficient catalytic systems. It sees this segment as a long-term growth engine not as hyper-explosive, but dependable, resilient, and well aligned with evolving global needs.

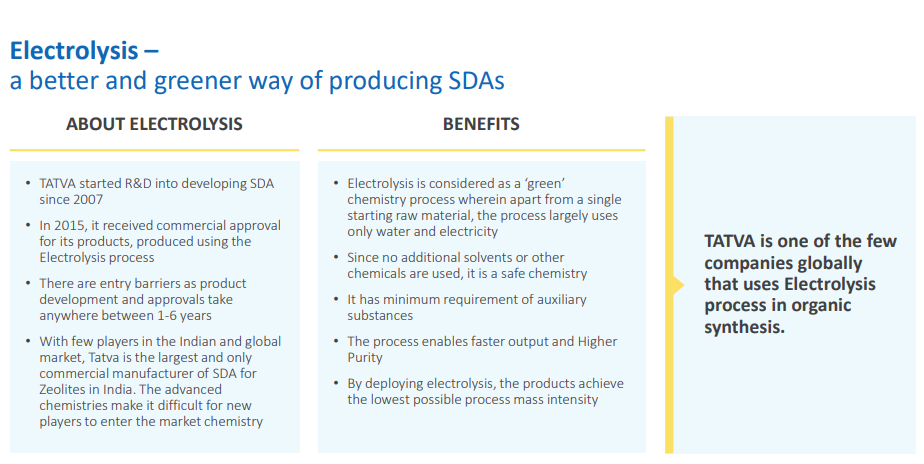

Structure Directing Agents (SDA) – Tatva Chintan Pharma Chem Ltd’s SDA business wasn’t built overnight; it’s a classic case of technical compounding over nearly 2 decades. After starting out in 1996 with Phase Transfer Catalysts, Tatva Chintan Pharma Chem Ltd gradually built foundational expertise in quaternary chemistry through the early 2000s. It wasn’t until around 2008-2010 that Tatva Chintan Pharma Chem Ltd began serious R&D on SDAs at the lab scale. The real turning point came between 2010-2015, when they cracked the code on purity and batch consistency (the two biggest bottlenecks in SDA commercialization). By 2015-16, the first full scale SDA orders began flowing in, following multi-year molecule validations with global customers. What makes this segment hard to replicate is not just the chemistry, but the process. Tatva Chintan Pharma Chem Ltd developed a proprietary electrochemical synthesis route and refined it over time to ensure ultra-high purity and reproducibility. That became the Tatva Chintan Pharma Chem Ltd’s moat. Over the years, Tatva Chintan Pharma Chem Ltd also co-developed application-specific SDAs for niche catalyst and emission control applications, which made relationships even stickier. By the time of the IPO in FY21, the SDA business had transformed into a high-barrier, high-margin franchise with Tatva Chintan Pharma Chem Ltd emerging as the only commercial manufacturer in India and the 2nd largest globally.

Tatva Chintan Pharma Chem Ltd’s SDA business serves a highly technical and global customer base which mainly consists of catalyst manufacturers supplying the automotive emissions and refining sectors. Customers include large global chemical, pharma, and material companies, with sales spread across over 25 international markets. While names aren’t disclosed specifically for SDAs, the broader customer list includes players from Tier-1 global buyers. For SDAs specifically, the two core end-use verticals are (1) automotive emission-control catalysts (for diesel vehicles and heavy-duty engines) and (2) refinery/petrochemical catalysts, both of which rely on zeolite-based chemistry. Smaller offtake also comes from research institutions, advanced materials, and emerging applications like polymer recycling (but these are still evolving).What makes this business attractive is the stickiness. SDA customers don’t switch suppliers casually because qualification cycles are long, risk of failure is high, and SDAs are mission critical to the performance of the final catalyst. A formulation change could disrupt yield, consistency, or regulatory compliance (especially in emissions), making supplier replacement costly and risky. Once qualified, Tatva Chintan Pharma Chem Ltd typically supplies for the entire lifecycle of that catalyst product i.e creating repeat and annuity-like revenue streams. Additionally, demand is a mix of steady consumption (linked to ongoing production campaigns) and project-based surges tied to new catalyst development cycles, especially when emission standards tighten (Euro 7, BS6+, etc.)

Tatva Chintan Pharma Chem Ltd has strengthened retention further through highly consistent purity, reliable global logistics (including a European warehouse), and customer-first commercial practices. All of this creates high switching costs and positions the SDA vertical as a sticky, recurring, high entry barrier B2B chemistry business rather than a transactional commodity line.

Over time, SDA revenue has grown to become the Tatva Chintan Pharma Chem Ltd’s largest and highest-margin segment i.e accounting for ~52% of total revenue at its peak in FY22, with segment gross margins well above the company average. However, this growth has not been linear. The segment is inherently cyclical and tightly linked to regulatory cycles and drivetrain transitions, particularly in the automotive catalyst space. FY22 was a breakout year, as tightening emission norms (BS-VI, Euro VI, and China VI), a post-COVID industrial rebound, and advance stocking by catalyst manufacturers especially in China drove an exceptional surge in demand. At peak, China alone contributed over 40% of Tatva Chintan Pharma Chem Ltd’s SDA revenues, fueled by last-minute buying ahead of the China VI rollout and strong demand from diesel truck OEMs. But In FY23, SDA revenues fell sharply as customers destocked and Chinese demand collapsed not due to competitive loss, but due to a structural shift. China’s commercial vehicle fleet started moving from diesel SCR to LNG/CNG platforms, driven by favorable gas economics (lower gas prices due to war) Since these platforms need simpler or alternate catalytic systems, SDA of the type Tatva supplies saw its demand crater.

By FY24, Tatva Chintan Pharma Chem Ltd’s SDA exports to China had fallen to near zero. In response, Tatva Chintan Pharma Chem Ltd proactively diversified its SDA customer base by onboarding new accounts in Japan, US, and Europe, and even co-developing new SDA molecules tailored to their chemistries. These new customers have gone through validation and started ramping volumes, making the export mix more balanced and less China dependent. FY24 marked a transition year with subdued topline but improving exit run-rates. FY25 has seen a decisive rebound i.e normalized ordering, slower than expected EV displacement in heavy transport, and early Euro 7 stocking have brought SDA volumes back, with quarterly revenues more than doubling YoY and margins recovering toward 20-22%. Going forward, while lumpiness will remain around emission cycles, Tatva Chintan Pharma Chem Ltd’s deep process expertise, high customer stickiness, and diversification away from China position the SDA business for structurally stronger, more stable growth.

Tatva Chintan Pharma Chem Ltd operates in a tightly controlled, high entry barrier niche where global competition is extremely limited. The SDA market for zeolite catalysts is effectively a duopoly with SACHEM (US) as the long-standing leader and Tatva Chintan Pharma Chem Ltd emerging as the clear global No. 2, and the only commercial-scale producer in India. Outside these two, the landscape consists of small regional suppliers or captive in-house production by certain catalyst manufacturers.but none with the proven scale, portfolio depth, or validation credentials to compete meaningfully. Entry barriers are steep i.e manufacturing SDAs requires deep process know how, multi-step synthesis routes, and extremely tight purity control. where even ppm level impurities can derail zeolite crystallization outcomes. Beyond chemistry, the biggest moat is customer qualification i.e any new supplier must undergo 12-36 months of sampling, trials, and regulatory validation before being approved, making switching highly unlikely once a supplier is locked in. Reputation, long service history, and consistent global supply only strengthen incumbency.

Tatva Chintan Pharma Chem Ltd’s proprietary electrolysis based production technology, DSIR approved R&D capability, multipurpose manufacturing assets, global logistics footprint, and broad SDA catalogue (50+ products) further widen the gap versus would be entrants. Environmental compliance, hazardous chemical handling capability, and capex intensive scale also discourage new players. Put together, the SDA industry structure strongly favors incumbents, and Tatva Chintan Pharma Chem Ltd’s positioning as a trusted, validated supplier gives it durable pricing power, stickiness, and a structurally advantaged moat in a market where displacement risk remains low.

Looking ahead, the SDA business appears poised for a strong multi-year upcycle driven by regulatory catalysts, delayed EV substitution, and Tatva Chintan Pharma Chem Ltd’s expanded commercial footprint. Management has clearly articulated that the much anticipated disruption from electric mobility isn’t unfolding as fast particularly in the heavy commercial vehicle segment where diesel remains dominant and emission catalysts remain non-negotiable. As a result, demand for zeolite based emission control systems and by extension, SDAs continues to remain structurally relevant.

The Euro 7 regulatory rollout in Europe (targeted for CY26-27) is emerging as the next big trigger, and Tatva Chintan Pharma Chem Ltd has already begun aligning its SDA portfolio to the reformulated catalyst chemistries expected under these new standards. Similar regulatory tightening is anticipated in India and possibly China (depending on LNG-diesel policy shifts), setting the stage for another demand wave. Concurrently, Tatva Chintan Pharma Chem Ltd has used the downturn of FY23 and early FY24 to meaningfully diversify its SDA book ie onboarded marquee customers across Japan, the US, and Europe, and sharply cutting dependence on China (which once contributed 40%+ of SDA revenue, now near zero). This customer expansion is already visible in the commercial scale-up, with Tatva Chintan Pharma Chem Ltd reporting blockbuster SDA revenue growth for the last two quarters of FY25, supported by exit run-rates well above FY24 levels.

Beyond emissions, Tatva Chintan Pharma Chem Ltd is also developing high purity and next gen SDA molecules for advanced applications like continuous flow chemistry, polymer recycling, and new age materials. Which is indicating a push to widen the scope beyond the auto catalyst cycle. Capacity, which was once a constraint, is now future ready. The Dahej expansion gives Tatva Chintan Pharma Chem Ltd ample near term headroom, and incremental investments are already underway to future proof supply as fresh programs scale.

Management commentary across the last two earnings calls (Q1 and Q2 FY26) has remained decisively optimistic, with indications that the SDA business has moved from bottoming out to early stage growth. While risks such as sudden EV-led diesel displacement or unexpected regulatory delays are worth monitoring, the probability weighted scenario remains favorable. Net net, SDA is set to remain Tatva Chintan Pharma Chem Ltd’s strategic growth pillar and its core margin engine supported by its global duopoly status, expanding client base, and rising regulatory complexity that makes product replacement difficult.

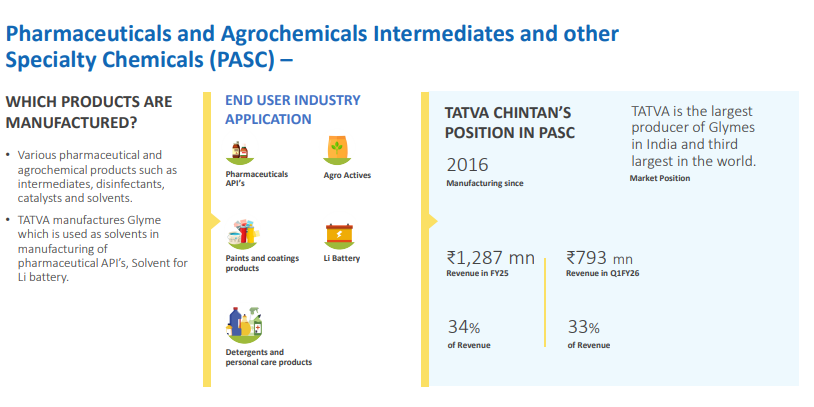

Pharmaceutical & Agrochemical Intermediates and Other Specialty Chemicals (PASC)

Tatva Chintan Pharma Chem Ltd’s Pharma, Agrochemical Intermediates & Specialty Chemicals (PASC) vertical comprises a diversified product mix spanning pharmaceutical intermediates, agrochemical intermediates, and specialty reagents, and is increasingly aligned toward higher value and higher complexity chemistry.

On the pharma side, the portfolio includes intermediates used as upstream building blocks for APIs with Tatva Chintan Pharma Chem Ltd typically handling one or more sophisticated multi step sequences in the precursor chain. The current development pipeline is notably oncology oriented with 3-4 new intermediates linked to anti cancer drug synthesis. Which indicates a clear strategic focus on niche chemistries rather than commoditized generics.

In agrochemicals, Tatva Chintan Pharma Chem Ltd has progressed from development to commercialization i.e one large scale agro intermediate has already entered continuous production backed by a meaningful order in FY25-26, a second molecule has received customer approval and will begin commercial supply in H2FY26, and a third high-potential molecule which is approved by a major domestic client and under sampling with another is positioned for scale-up at the upcoming Jolva greenfield facility due to its volume potential.

Beyond pure intermediates, the portfolio includes other specialty chemicals such as quaternary ammonium compounds (benzalkonium chloride), solvents (like mono/tetraglyme ethers), biocides, catalysts, and functional additives that find applications across pharmaceuticals, home-care, paints and coatings, textiles, dyes & pigments, batteries, and flavor & fragrance industries. Thus, the end-use footprint of PASC is inherently broad, diversified, and geared towards high-value and critical demand sectors.

The segment’s evolution has been rapid and recent. Before the IPO (FY21), PASC existed mainly as a basket of smaller specialty chemicals with limited commercial scale. Post-IPO, Tatva Chintan Pharma Chem Ltd strategically deepened investments in R&D infrastructure, scale-up pipelines and dedicated multipurpose production blocks. By FY24-FY26, this investment translated into tangible progress as multiple pharma and agro intermediates moved from lab development to validation batches to commercial supply, while customer onboarding included both global pharma players and large domestic agrochemical manufacturers.

Now Tatva Chintan Pharma Chem Ltd PASC segment is entering a scale-up phase. Over the next 18 months, the segment is positioned to transition from early commercialization into meaningful revenue and earnings contribution.Near-term growth momentum is supported by a clear commercialization pipeline. Tatva Chintan Pharma Chem Ltd expects 3 pharma intermediates and at least 2 agro intermediates to be commercialized between late 2025 and mid 2026, with revenue ramp-up commencing from Q3 FY26 onwards. Management has explicitly guided that both approved agro intermediates will record revenues starting from H2FY26, while pharma intermediates should meaningfully contribute from the same period as validation batches conclude. This implies that FY27 will be the first full year reflecting scaled contribution from the new portfolio.

A key enabler of this growth is the removal of capacity constraints. The upcoming Jolva facility (operational Jan 2026) will provide dedicated multipurpose manufacturing space for high-volume pharma and agro intermediates. This will not only ease current bottlenecks but also improve operational efficiency, batch cycle economics, and scale linked cost absorption. With Jolva facility handling the high volume domestic agro molecule, existing Dahej and Ankleshwar blocks will be freed to focus on other intermediates and specialty chemicals which will smoothen production planning and reduce volatility. The early customer feedback and ongoing discussions indicate that Tatva Chintan Pharma Chem Ltd may be able to add additional molecules (including a potential 4 or 5 pharma product) without incremental strategic capex thanks to this new capacity.

Demand conditions are also turning favorable. Industry-wide destocking that weighed on orders in 2023 has normalized, and customers are now restocking with greater forward visibility. In pharma, global oncology demand remains structurally strong, while multinational formulators continue diversifying supply chains toward India. In agrochemicals, both secular crop-protection demand and India’s push toward import substitution of key intermediates support a shift toward domestic suppliers like Tatva Chintan Pharma Chem Ltd. Additionally, Tatva Chintan Pharma Chem Ltd’s emphasis on cleaner catalytic synthesis fits well with tightening global sustainability requirements across pharma and agrochem chains, potentially strengthening its qualification edge and pricing justification. Customer traction is expected to compound as execution credibility builds. Tatva Chintan Pharma Chem Ltd has already secured one marquee agro customer, with a second in onboarding stages. In pharma, intermediates tied to regulated filings offer multi-year recurring visibility, since supplier switching is difficult once validated. Management has highlighted growing customer interest and expects wallet share expansion within existing accounts as volumes stabilize and trust deepens particularly for molecules where Tatva Chintan Pharma Chem Ltd is one of few experienced commercial scale suppliers globally.

Financially, the PASC segment is already becoming a meaningful revenue contributor, accounting for ~25-30% of total revenues in FY25-26, with H1 FY26 PASC revenue at ~₹76 Cr despite timing-driven deferrals (including ~₹26 crore of goods in transit). Growth should accelerate through FY27 as commercialized molecules scale and new capacity is utilized. The opportunity size remains large as management indicated that individual molecules in the portfolio have the potential to scale to levels comparable to Tatva Chintan Pharma Chem Ltd’s current enterprise revenue base if adopted widely. Which can lead to a steep scalability curve ahead.

Margin trajectory is expected to improve as scale builds. While current profitability is temporarily depressed by underutilized capacity and multi-stage chemistry overhead, management expects comparable to its broader specialty chemical profile. As plant utilization rises and customer recall stabilizes, fixed-cost absorption will improve and product mix will tilt toward higher-value intermediates.

Electrolyte Salts & Solutions (ESS) – Tatva Chintan Pharma Chem Ltd’s electrolyte additives business, while still a small part of its overall revenue base, represents a high-potential strategic segment that aligns well with long-term trends in battery technology and clean energy.

Tatva Chintan Pharma Chem Ltd began developing specialized electrolyte salts several years ago by leveraging its core strength in quaternary ammonium chemistry and process integration. These products are used in supercapacitor and sodium-ion batteries for applications like stationary energy storage and hybrid vehicles i.e require high purity, tight process control, and customized formulations, all of which play to Tatva Chintan Pharma Chem Ltd’s R&D and manufacturing capabilities. Tatva Chintan Pharma Chem Ltd is supplying electrolyte additives to a mix of global supercapacitor makers, sodium-ion battery innovators, and emerging Indian energy storage companies.

Over time, Tatva Chintan Pharma Chem Ltd moved from lab-scale R&D to small-scale commercial shipments, and as of FY25, began consistently supplying to customers across both energy storage and hybrid battery verticals. Revenue from the segment remained modest in FY25 (~₹6 crore), but management has guided for a significant ramp-up in FY26 (~₹15 crore), with expectations that electrolyte additives could contribute 10% of overall sales by FY27.

Tatva Chintan Pharma Chem Ltd has backward integrated production and now delivers not just salts but full electrolyte solutions to select clients, which positioned Tatva Chintan Pharma Chem Ltd as a high-value partner rather than just a raw material supplier. While Tatva Chintan Pharma Chem Ltd has so far avoided the crowded lithium-ion battery materials market, it is focused on niche applications like sodium-ion and hybrid battery chemistries where it faces limited global competition. Management has indicated strong customer traction, validated performance, and regular dispatches now underway, with commercialization timelines accelerating. If executed well, this business could scale rapidly in coming years and contribute meaningfully to both growth and margin expansion. Importantly, segment level EBITDA margins are expected to be healthy, potentially on par with or even exceeding PTC levels though not quite as high as SDAs due to solution based blending.

Tatva Chintan Pharma Chem Ltd Manufacturing Facility

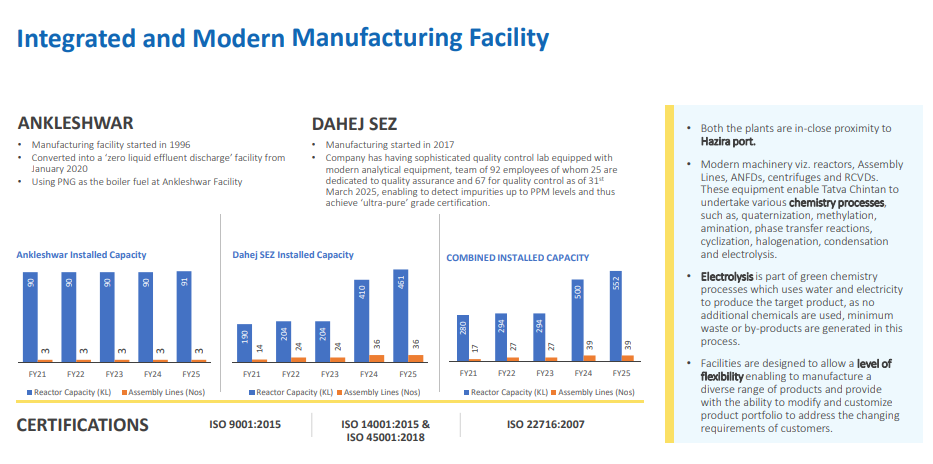

Tatva Chintan Pharma Chem Ltd operates two integrated manufacturing facilities i.e Ankleshwar and Dahej SEZ designed for flexibility, regulatory compliance, and process innovation.

The Ankleshwar unit, operational since 1996, has been converted into a ‘zero liquid effluent discharge’ facility since 2020 and uses PNG as boiler fuel, reinforcing its green chemistry ethos. The Dahej SEZ plant, started in 2017, features advanced quality control labs and modern equipment including reactors, centrifuges, and RCVDs. With over 60 employees dedicated to QC and product validation, the Dahej facility achieved ultra pure grade certification in FY25, with control over impurity levels in parts per million.

Combined, these two plants offer a total reactor capacity of 551 KL as of FY25, with 39 assembly lines. Both facilities support complex chemistries such as methylation, quaternization, halogenation, and electrolysis which enables Tatva Chintan Pharma Chem Ltd to manufacture a broad spectrum of specialized intermediates and additives. Their proximity to Hazira port ensures logistical efficiency for exports.

In addition to these, Tatva Chintan Pharma Chem Ltd is setting up a new greenfield facility at Jolva, scheduled for commissioning by January 2026. This site will focus on high-purity applications including semiconductor chemicals, agrochemical blocks, and further expansion in SDAs and electrolyte additives.

Tatva Chintan Pharma Chem Ltd R&D

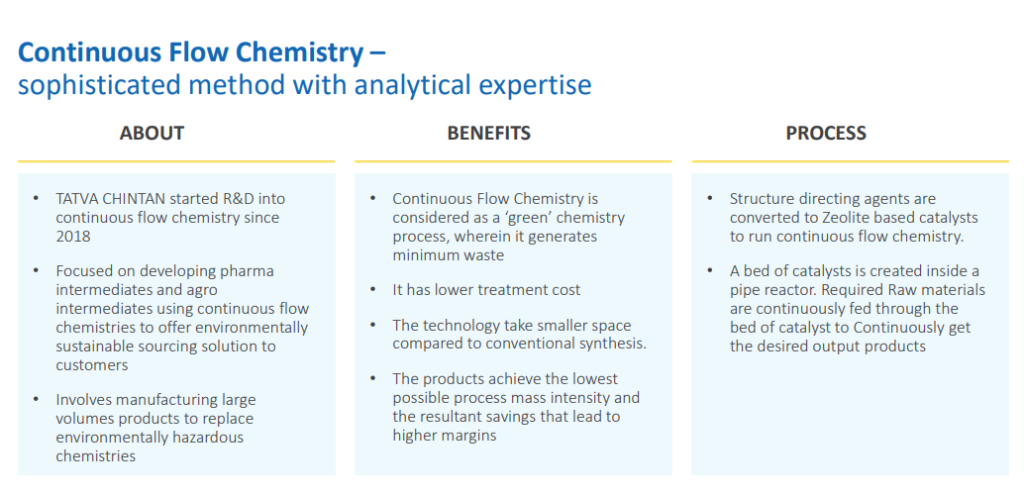

Tatva Chintan Pharma Chem Ltd’s R&D ecosystem in Vadodara. The facility is equipped with advanced infrastructure including continuous flow reactors, high-pressure autoclaves (capable of handling up to 100 bar), and temperature range setups from -10°C to 300°C enabling complex, multi-step synthesis. The lab is functionally segmented into four key areas – Organic Synthesis, Electrolysis, Catalyst & Continuous Flow Chemistry, and Analytical Method Development.

As of September 30, 2025, the R&D team comprises 56 scientists, including 29 senior experts. R&D spending has consistently been strong.

Tatva Chintan Pharma Chem Ltd has embedded green chemistry deeply into its operations by using eco-friendly processes like electrolysis and continuous flow chemistry, minimizing waste and solvent usage.

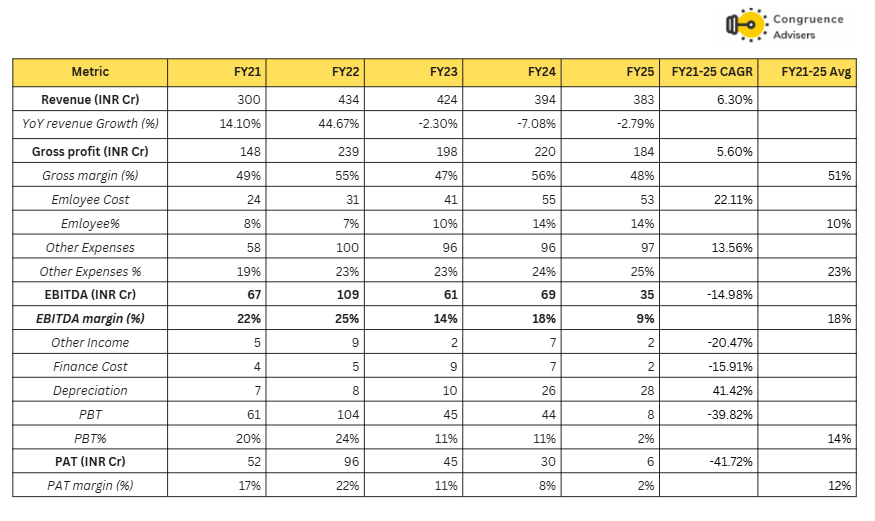

Tatva Chintan Pharma Chem Ltd Financial Performance

Tatva Chintan Pharma Chem Ltd revenue grew at a CAGR of ~6.3% over this period with FY22 standing out as a peak year where revenue jumped 44.7% YoY which is driven by strong SDA offtake linked to emission regulation stocking and a China led pre-buy cycle. This surge also lifted gross margins to 55% and EBITDA margins to 25%. However, FY23 marked the beginning of a downturn where revenue declined marginally and margins eroded sharply as customer destocking and a demand reset particularly in the SDA segment. EBITDA margins fell to 14%, and PAT nearly halved. The weakness continued into FY24 and FY25, with EBITDA shrinking to just ₹35 Cr in FY25, and PAT decreased to ₹6 Cr due indicating under absorption of fixed costs amid lower utilization. Employee costs and overheads stayed elevated due to capacity expansion which further depressed the margins. While Tatva Chintan Pharma Chem Ltd remained profitable, the FY23-FY25 phase reflects the pain of a cyclical downturn of SDA.

However, FY26 has marked a visible turnaround as in Q2FY26 Tatva Chintan Pharma Chem Ltd printed double-digit revenue growth and an 18% EBITDA% which led by recovery in SDA volumes, new product commercializations and improved plant utilization. Management now expects 25% YoY revenue growth in FY26 and normalized 20%+ EBITDA margins as operating leverage kicks in.

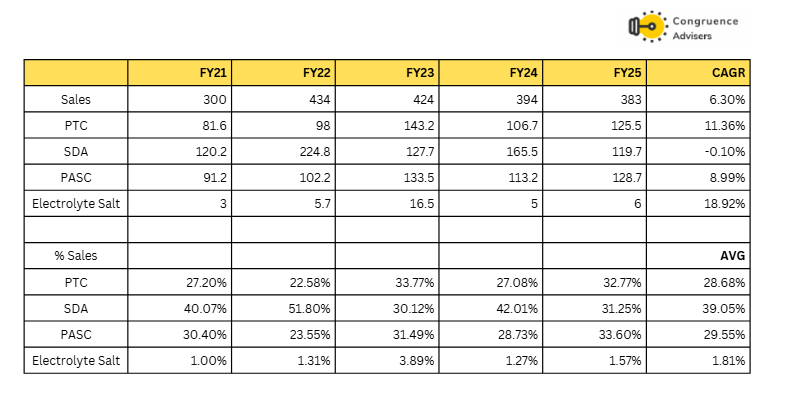

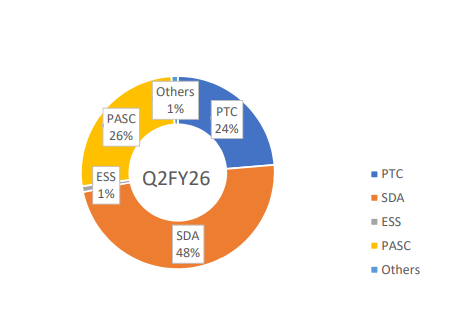

Tatva Chintan Pharma Chem Ltd Segmental mix

Over FY21-25, Tatva Chintan Pharma Chem Ltd’s segmental revenue mix reflects a balanced contribution across SDA, PTC, and PASC, with strong growth in PTC (11.4% CAGR) and PASC (9% CAGR). SDA, while historically the largest contributor, saw cyclicality with a flat 5-year CAGR due to demand normalization post-FY22. Electrolyte additives remain nascent (~1–2% of sales), but show strong early momentum with ~19% CAGR.

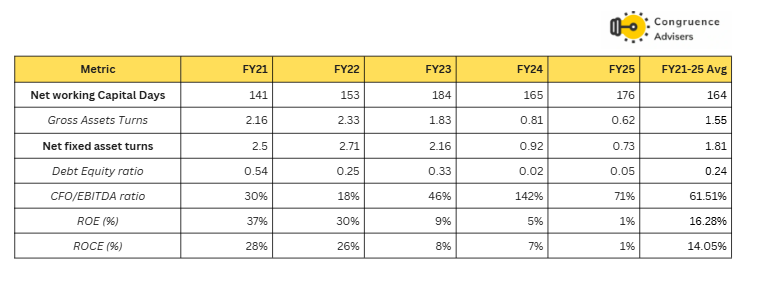

Tatva Chintan Pharma Chem Ltd Working Capital, Debt, Return and Cash Flow Analysis

Between FY21 and FY25, Tatva Chintan Pharma Chem Ltd’s balance sheet and return metrics showed visible strain primarily due to the capex and prolonged underutilization. Net working capital days stretched from 141 to 176 due to sluggish sales, elevated inventories particularly during the SDA and PASC downcycles. Asset turnover ratios deteriorated sharply due to lower sales growth and underutilized capacities (especially at Dahej). ROE fell from a high of 37% in FY21 to just 1% in FY25, while ROCE followed suit (28% to 1%). Management acknowledged this fall was a function of under absorbed costs and lumpy sales over a bloated capital base. On a positive note, cash generation remained healthy, with average CFO/EBITDA conversion over 60% which validated the underlying earnings quality.

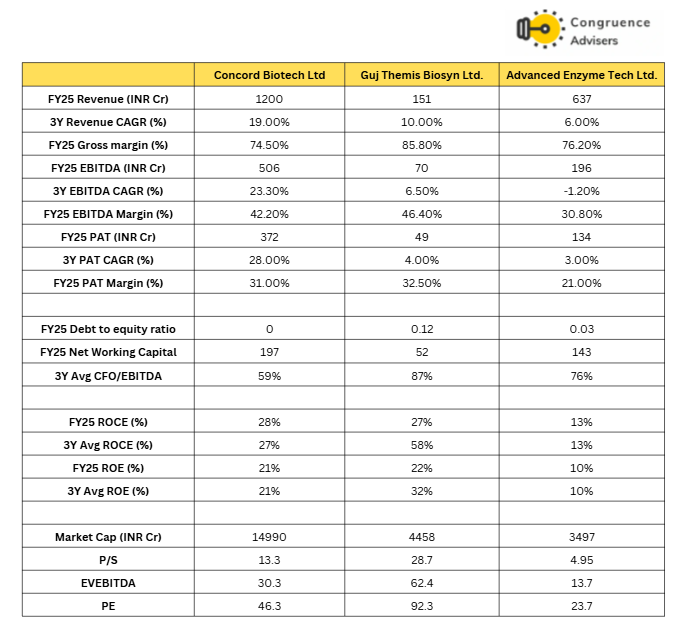

Tatva Chintan Pharma Chem Ltd Comparative Analysis

To understand Tatva Chintan Pharma Chem Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Tatva Chintan Pharma Chem Ltd to its competitors (peer comparison) on various fundamental parameters and Tatva Chintan Pharma Chem Ltd share performance relative to relevant benchmark and sector indices.

Tatva Chintan Pharma Chem Ltd Peer Comparison

Tatva Chintan Pharma Chem Ltd operates in a niche, high entry barrier segment with no direct listed peer in India. Its product portfolio is centered around high-purity SDAs , Phase PTCs and specialty intermediates for green chemistry applications. Which is unique in the Indian chemical space. The only comparable player globally is SACHEM Inc U.S based company regarded as the global leader in SDAs.

SACHEM and Tatva Chintan Pharma Chem Ltd together form a virtual duopoly in the SDA market, particularly for zeolite-based catalyst applications used in emission control, petrochemicals, and advanced materials. Both companies have core competencies in quaternary ammonium chemistry and are known for their deep R&D capabilities, stringent process controls, and ability to meet ultra-high purity specifications required by global catalyst and semiconductor clients.Outside of Tatva Chintan Pharma Chem Ltd and SACHEM, the landscape is fragmented and non competitive. Some small-scale regional players exist, often with limited portfolios and no global reach. A few catalyst manufacturers produce SDAs in house for captive use, but very few attempt 3rd party commercial sales due to the steep regulatory and technical requirements. Management has acknowledged that they don’t see meaningful global competition apart from SACHEM. Instead, the focus is on deepening wallet share with existing clients, commercializing new SDA variants tailored to evolving emission norms (like Euro 7), and expanding applications in adjacent segments like semiconductors and polymer upcycling.

While Tatva Chintan Pharma Chem Ltd has no direct listed peer operating at scale in its core SDA (Structure Directing Agent) business, we have benchmark it against a set of high quality specialty chemical names like Vinati Organics, Vishnu Chemicals, and Clean Science & Technology ltd.

- Vinati Organics Ltd is comparable in terms of long-cycle molecule development, global client relationships, and product-level dominance (like its global leadership in IBB and ATBS).

- Vishnu Chemicals Ltd has also built scale in niche chemistries (like chromium derivatives). However, its business is more commoditized in parts and doesn’t carry the same level of technical or purity intensive differentiation.

- Clean Science & Technology Ltd which went public around the same time as Tatva Chintan Pharma Chem Ltd. Clean Science & Technology Ltd operates with a sharp focus on green chemistry and clean manufacturing processes. While they have dominated in certain fine chemical segments (like MEHQ, BHA), it doesn’t directly compete in Tatva Chintan Pharma Chem Ltd’s quaternary ammonium or SDA spaces.

Tatva Chintan Pharma Chem Ltd Index Comparison

Tatva Chintan Pharma Chem Ltd share performance vs the S&P BSE Small Cap Index, as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why You Should Consider Investing in Tatva Chintan Pharma Chem Ltd

Cycle Turn is Underway – FY24 was a transitional year for Tatva Chintan Pharma Chem Ltd marked by post-COVID inventory correction, subdued ordering from key SDA and agrochemical customers and margin compression due to under absorption of newly added capacity. This was less about structural weakness and more about digestion of the previous demand surge, coupled with macro softness in China and global chemical cycles.

However, signs of an upturn are now clearly visible. By H1FY26, Tatva Chintan Pharma Chem Ltd had already printed healthy double digit revenue growth with Q2FY26 EBITDA margins recovering to ~18% up meaningfully from prior year levels. Management commentary across calls points to rising order visibility, customer re-engagement, and improving plant utilizations across core segments like SDAs and pharma intermediates.

Multiple tailwinds are aligning. First, restocking is now underway across several customer accounts that had run lean post FY23. Second, the global push for tighter emission norms (Euro 7, Bharat Stage VII, etc.) is driving fresh demand for zeolite-based catalysts, which directly supports Tatva Chintan Pharma Chem Ltd’s SDA portfolio. Third, demand for complex intermediates in pharma and agro is rebounding, supported by supply chain diversification and outsourcing from global innovators. And finally, with geopolitical risk and concentration concerns rising, large global buyers are de-risking supply chains away from China i.e opening up wallet share for credible, high-quality Indian suppliers like Tatva Chintan Pharma Chem Ltd. it looks like the beginning of a new demand cycle, where volume normalization, margin recovery, and capacity headroom are set to converge.

Capacity Headroom Ready to Support Growth – One of Tatva Chintan Pharma Chem Ltd’s underappreciated levers is the significant capacity headroom it has already built into the system. The recent Dahej SEZ expansion has been fully commissioned by adding both reactor volume and downstream assembly lines, while the upcoming Jolva greenfield facility is targeted to go live by January 2026 which is designed to support the ramp-up in pharma & agro, and electrolyte linked products. This means Tatva Chintan Pharma Chem Ltd is well positioned to scale across segments without any near term capex bottlenecks. Management has also indicated that EBITDA margins, currently weighed down by upfront costs and underutilized capacity, are expected to improve as volumes scale. Which will lead to operating leverage and driving both growth and profitability.

Diversified Product & Customer Base – Tatva Chintan Pharma Chem Ltd has a well diversified portfolio across products, geographies, and end-use industries. Tatva Chintan Pharma Chem Ltd currently manufactures over 150 product SKUs, spanning core segments like SDAs, Phase PTCs, pharma and agro intermediates and electrolyte additives used in advanced batteries. These products find application across a wide range of industries including pharmaceuticals, agrochemicals, automotive emission control, coatings, dyes, batteries and fragrances.In addition to its established segments, Tatva Chintan Pharma Chem Ltd is also entering the high purity semiconductor chemicals space, an optionality that could evolve into a strategic growth pillar over the medium to long term. This segment holds the potential to open up a new growth vector, with attractive margins similar to SDAs. Tatva Chintan Pharma Chem Ltd’s export to diversify customers across 25+ countries, with marquee clients such as Merck, Bayer, Divi’s Labs, Laurus Labs, Firmenich, and SRF, among others.

R&D Led Culture with a Green Chemistry Edge – Tatva Chintan Pharma Chem Ltd is a company shaped by decades of R&D led compounding. Starting with quaternary ammonium chemistry, it has steadily built depth across SDAs, PTCs, glymes and intermediates. The core strength lies not just in molecules, but in engineering clean, scalable, and high-purity processes around them. What really sets Tatva Chintan Pharma Chem Ltd apart is its strong alignment with the principles of “Green Chemistry.” Tatva Chintan Pharma Chem Ltd has invested in solvent free manufacturing routes, electrolysis based synthesis (especially for SDAs and PTCs), and high recovery distillation systems. I.e all aimed at reducing waste, avoiding hazardous by products and minimizing environmental load. Its flagship Ankleshwar facility is a Zero Liquid Discharge plant and the newer facilities have also been designed around sustainability norms.

In an era where global MNCs and customers are sharply focused on ESG metrics and supply chain sustainability, Tatva Chintan Pharma Chem Ltd’s green positioning has started to gain serious traction. Tatva Chintan Pharma Chem Ltd is increasingly viewed not just as a low-cost supplier from India, but as a high-tech, environmentally aligned partner capable of meeting Western audit standards and sustainability mandates.

Established market presence backed by the experience of the promoters – Tatva Chintan Pharma Chem Ltd enjoys a well established position in the niche but high value specialty chemicals space led by its deep expertise in quaternary ammonium chemistry and its status as India’s largest and among the world’s top manufacturers of SDAs for zeolites. it’s the outcome of over two decades of sustained technical work, long qualification cycles, and strong customer trust. Beyond SDAs, Tatva Chintan Pharma Chem Ltd has carved out leading positions in key verticals such as Phase Transfer Catalysts, electrolyte additives and select agro pharma intermediates often being among the very few globally approved vendors in each niche.

Much of this strength stems from its promoter team, led by first generation technocrats who’ve been hands on since inception. Their combined experience of 25-30 years across process development, engineering, and customer engagement gives.

What are the Risks of Investing in Tatva Chintan Pharma Chem Ltd

Customer & Product Concentration Risk – Despite its diversified product portfolio, Tatva Chintan Pharma Chem Ltd’s SDA segment accounts for 45-50% of revenue and is heavily linked to global emission catalyst demand. Within that, a few large customers have historically driven a significant share of sales. Any scale down, delay, or de-stocking from these accounts can cause disproportionate revenue and margin volatility, as seen in FY23.

Regulatory & End-Market Cyclicality – Tatva Chintan Pharma Chem Ltd’s key segments (especially SDAs) are tied to regulatory cycles, particularly automotive emission norms (Euro VI, BS-VI, Euro VII, etc). While regulations offer tailwinds the demand is inherently lumpy and driven by factors like catalyst prebuys, transitions and destocking. Which creates earnings volatility. A delay or softening in upcoming standards (e.g., Euro 7 rollout) or faster than expected EV adoption could hurt demand for SDA linked catalysts.

EV Risk Is Real but Limited in near term – While electric vehicle adoption poses a potential long term headwind for zeolite based catalysts. management has repeatedly clarified in concalls that the risk is limited in the near to medium term, especially in the commercial vehicle segment. Heavy duty trucks and buses, where SCR (Selective Catalytic Reduction) systems using zeolite catalysts are standard, have seen slower EV transition due to infrastructure, cost, and performance limitations. As per management commentary, diesel powered CVs are expected to remain the dominant drivetrain for at least the next 5-7 years, particularly in India and emerging markets. This gives Tatva Chintan Pharma Chem Ltd a long enough runway to monetize upcoming SDA programs aligned to Euro 7 and equivalent norms before any material volume risk from EV substitution arises.

Execution Risk in New Segments – Tatva Chintan Pharma Chem Ltd is expanding into new areas like semiconductor chemicals and battery electrolytes, which involve long validation cycles, ultra high purity standards, and significant upfront investment. There’s no guarantee that pilot projects will scale to commercial revenue. Any delay or failure in these bets may strain returns on capital or delay margin improvement.

Input Cost & RM Dependence – Tatva Chintan Pharma Chem Ltd is exposed to volatility in key raw materials including quaternary ammonium compounds and solvents. While some procurement is backward integrated the prices are still influenced by global supply demand swings and crude linked pricing. FY23 margin compression was partly due to cost inflation and under absorption of fixed costs during weak volume phases.

Forex & Export Dependency – Tatva Chintan Pharma Chem Ltd exports accounts for 70%+ revenue. Hence Tatva Chintan Pharma Chem Ltd is exposed to currency fluctuations, especially USD and Euro. A sharp appreciation in INR or volatility in forex markets may impact realizations. While Tatva Chintan Pharma Chem Ltd does hedge selectively, some risk remains. Also the global trade disruptions or tariff changes could impact the growth

Tatva Chintan Pharma Chem Ltd Future Outlook

Tatva Chintan Pharma Chem Ltd stands at an interesting strategic juncture. As it is transitioning from a period of cyclical reset to one of renewed growth momentum. After navigating margin pressures and demand volatility across FY23-FY24, Tatva Chintan Pharma Chem Ltd is now structurally better positioned across all key levers i.e products, capacity, customer diversification, and margin trajectory. SDA, Tatva Chintan Pharma Chem Ltd’s flagship and highest margin segment (~50% of revenue) is firmly back in an upcycle, supported by regulatory tailwinds (Euro 7), slower than expected EV substitution in commercial vehicles, and fresh order conversions across the US, Europe and Japan. Management remains bullish on this momentum, and Q2FY26 results already reflected a visible turnaround, with double digit revenue growth and 18% EBITDA margin.

The PTC segment continues to be a stable and profitable pillar. Tatva Chintan Pharma Chem Ltd is one of the few global players offering high purity quaternary ammonium based PTCs, which are used across pharma, fine chemical, and polymer industries. PTC segment benefit from consistent off take and long standing customer relationships and offers a base load of steady cash flows Tatva Chintan Pharma Chem Ltd

In the PASC segment, multiple molecules are in advanced stages of development. Management has indicated that at least 2 new products will be commercialized in FY26, with more in the pipeline. A dedicated block is being built to support this growth. Tatva Chintan Pharma Chem Ltd is adding new high value molecules and deepening relationships across APIs, fungicides, and high-purity building blocks. Recent wins in regulated markets and increased wallet share from anchor clients are expected to drive this segment meaningfully over the next 2-3 years.

In electrolytes and glymes (for lithium-ion batteries), they are serving both domestic and export accounts with customized chemistries (a clear play on EV and energy storage tailwinds). Management expects Electrolyte Additives to reach ₹15-20 Cr in revenue in FY26 and contribute up to 10% of total revenue by FY27 with profitability is also anticipated to improve gradually as volumes ramp up.

Another key optionality is semiconductor chemicals. In semiconductors, Tatva Chintan Pharma Chem Ltd has already completed pilot batches and is now headed toward plant scale trials with global customers. Commercial scale up is expected by FY28, with ₹50-100 Cr opportunity per molecule.

For FY26E, Tatva Chintan Pharma Chem Ltd has guided for ~25% YoY revenue growth, with a further 20-25% expected in FY27E, driven by broader product scale-up and new customer additions with recent Dahej expansion already commissioned and the Jolva greenfield plant expected to go live by Jan 2026, Tatva Chintan Pharma Chem Ltd has built significant capacity headroom across product lines. Current utilization is sub optimal, but this provides embedded operating leverage. As volumes ramp up, EBITDA margins are expected to expand from the current ~18% toward historical 22-24% range.

Management remains optimistic yet prudent regarding FY26-27 guidance. Their credibility is high which can be validated by their foresight during the Q2 FY23 earnings call when they correctly signaled headwinds in the SDA segment despite the prevailing strength at the time. However the stock has already seen a sharp rerating from ₹800 to over 1400+ levels, which means the next leg of rerating will likely be driven by management execution.

Tatva Chintan Pharma Chem Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Tatva Chintan Pharma Chem Ltd Price charts

On a weekly Chart, Tatva Chintan Pharma Chem Ltd has completed a long, multi‑month falling channel and has clearly broken out with strong momentum, turning the primary trend up from mid‑2025. The prior resistance zone around Rs 1100-1150 has been taken out convincingly and now acts as the first meaningful support, with a deeper demand zone visible near 880. The overall structure suggests the downtrend is over and the stock has transitioned into a new uptrend.

On the daily timeframe, Tatva Chintan Pharma Chem Ltd is undergoing a pullback from the recent swing high, with the price slipping below the short EMAs and approaching the rising 50-DMA zone near Rs 1,350, which serves as the immediate reference support. The prior horizontal resistance near Rs 1140 remains a strong positional support, while Rs 880 is a major line in the sand for the current uptrend.

Tatva Chintan Pharma Chem Ltd Latest Latest Result, News and Updates

Tatva Chintan Pharma Chem Ltd Quarterly Results

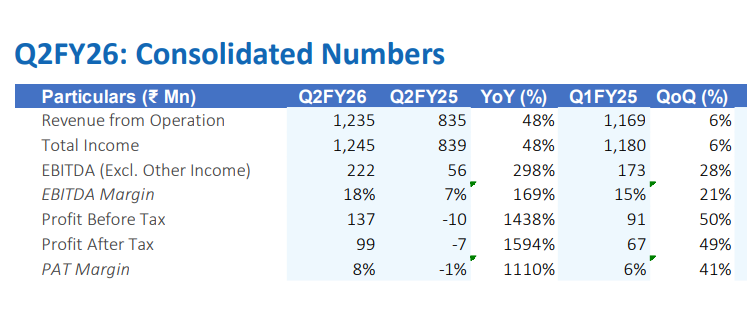

Tatva Chintan Pharma Chem Ltd delivered a robust set of numbers for the quarter ended Q2 FY26 and printed Revenue growth of 48% YoY and 6% QoQ. Growth was primarily fueled by a sharp recovery in the SDA segment.EBITDA took a massive jump of 298%YoY and 28% QoQ, EBITDA% expanded to 18% (up from 7% in Q2 FY25 and 15% in Q1 FY26). (Management expects margins to stabilize in the 20-22% range over the next two quarters as plant occupancy levels increase).

The growth story this quarter was uneven across segments, with SDA doing the heavy lifting while PASC faced temporary logistical headwinds. Management highlighted that almost none of their products are currently subject to reciprocal tariffs (US tariffs), providing a layer of insulation against trade volatility.

SDA – Revenue up 119% YoY and 51% QoQ. SDA is witnessing a strong revival. The demand is being driven by the upcoming implementation of Euro 7 emission standards and a macro shift in the automotive sector towards hybrid vehicles (rather than just pure EVs). Management noted that the China market demand remains negligible; growth is driven by the Rest of the World. Plant occupancy for SDA is currently around 50% which leaves significant headroom for operating leverage.

PTC – Performance: Revenue up 7% YoY and remained flat QoQ (+1%). This remains a mature cash cow for the company. While the segment faces intense competition (growing from 2 to nearly 10 players domestically), Tatva Chintan maintains market leadership through organic growth.

PASC – Revenue up 19% YoY but down 31% QoQ. The sequential dip is attributed to the campaign based nature of production and revenue recognition timing i.e Goods in transit increased significantly to 26 Crores (vs. 16-17 Crores previously), deferring revenue recognition to Q3, Commercialization of new large-scale agro intermediates has commenced, with revenue expected to reflect from Q3 onwards.

Electrolyte Salts – Revenue down 5% YoY but showing strong sequential traction with 47% QoQ growth. While the base is small, this is a key strategic focus. The company is seeing demand traction in Energy Storage Systems (ESS) and supercapacitors for hybrid batteries. Management is targeting ~INR 15 Crores in revenue from this segment for the full fiscal year.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this to a general audience. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will continue/be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.