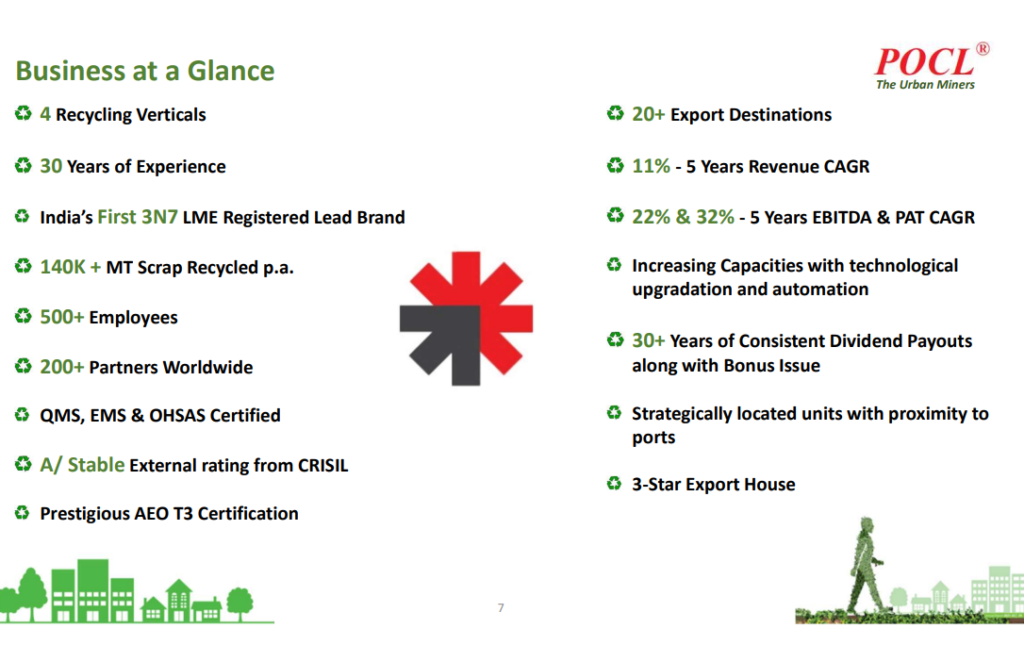

Incorporated in March 1995, Pondy Oxides and Chemicals Ltd manufactures lead and lead alloys, which are supplied to customers that produce batteries. Pondy Oxides and Chemicals Ltd’s core product is lead and lead alloys, which are mainly used in making lead-acid batteries. The company has smelting facilities and can manufacture various types of lead metal, lead alloys and other nonferrous metals as per customer needs.

We believe Pondy Oxides and Chemicals Ltd represents an attractive opportunity amid rising global awareness and regulatory support for metal recycling. In the lead segment, Pondy Oxides and Chemicals Ltd is transitioning from pure volume growth to margin-led expansion. This shift is powered by a structural “Super Cycle” which is further supported by aggressive capacity additions (targeting 204 ktpa), increasing value-added product mix (71%) and strong regulatory tailwinds via BWMR. Other segments like copper are also poised for healthy growth supported by capacity ramp-up and forward integration. With a debt-free balance sheet and disciplined capital allocation, Pondy Oxides and Chemicals Ltd stands out as one of the rare stories capable of sustaining 20%+ growth over the medium term.

Pondy Oxides and Chemicals Ltd Company Summary

Pondy Oxides and Chemicals Ltd stands as one of India’s foremost non-ferrous recycling companies and is widely recognized as one of the country’s largest secondary lead manufacturers. Pondy Oxides and Chemicals Ltd operates with a strong commitment to the circular economy by leveraging its metallurgical capabilities to transform end-of-life industrial scrap into high purity refined metals, specialized alloys, and engineered materials.

Through its multi-vertical recycling platform, Pondy Oxides and Chemicals Ltd plays a crucial role in reducing import dependency and supporting domestic manufacturing and promoting sustainable resource use. Headquartered in Chennai, Tamil Nadu, Pondy Oxides and Chemicals Ltd has built a robust track record over the past three decades under the strategic leadership of Mr. Anil Kumar Bansal and Mr. Ashish Bansal (Managing Director). The promoters bring deep experience in metal recycling and international sourcing and have successfully scaled Pondy Oxides and Chemicals Ltd from a lead-based player into a diversified recycler with operations spanning multiple material streams.

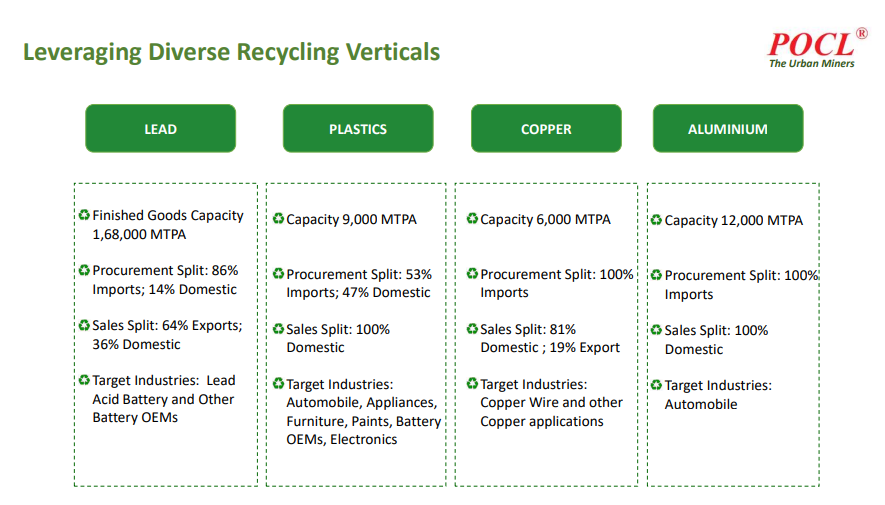

As of FY25, Pondy Oxides and Chemicals Ltd operates across four primary recycling verticals –

- Lead and Lead Alloys – the core and most mature vertical, accounting for over 90% of revenue. Pondy Oxides and Chemicals Ltd operates three large lead smelters (SMD-I in Tamil Nadu, SMD-II in Andhra Pradesh, and the recently acquired Thervoykandigai unit) with a combined capacity of 1,68,000 MTPA ( with additional of 36,000 MTPA coming in H2FY26). Pondy Oxides and Chemicals Ltd produces more than 100 custom lead alloys, with Value-Added Products (VAPs) comprising ~60% of its lead portfolio.

- Copper Recycling – currently a nascent vertical with 6,000 MTPA capacity (FY25 production at 741 MT), focused on high-conductivity copper for OEM applications in automotive, paints, and electronics. Capacity expansion to 24,000 MTPA is under consideration.

- Aluminium Recycling – Pondy Oxides and Chemicals Ltd commissioned its aluminium melting and alloying facility in FY24, with a capacity of 12,000 MTPA, manufacturing die-cast alloys (ADC, LM series) largely for the automobile sector. FY24 turnover for the division was approximately ₹42 crore on a standalone basis.

- Engineering Plastics – built around a 9,000 MTPA capacity for industrial plastics such as PPCP, ABS, HDPE, Nylon 6 and 66, the segment sources raw material from captive plastic scrap generated during battery imports. It primarily targets customers in India’s automotive and electronics manufacturing hubs.

Pondy Oxides and Chemicals Ltd has developed strong global sourcing and distribution linkages. It procures raw materials from over 70 countries, typically under annual contracts with reliable scrap suppliers and exports to 20+ countries, with Southeast Asia, Korea, the Middle East, and Europe among its key markets.Pondy Oxides and Chemicals Ltd’s high-quality standards are validated by its London Metal Exchange (LME) registration for its 3N7 Lead brand, which certifies 99.97% purity, which we think is a key differentiator in global markets.

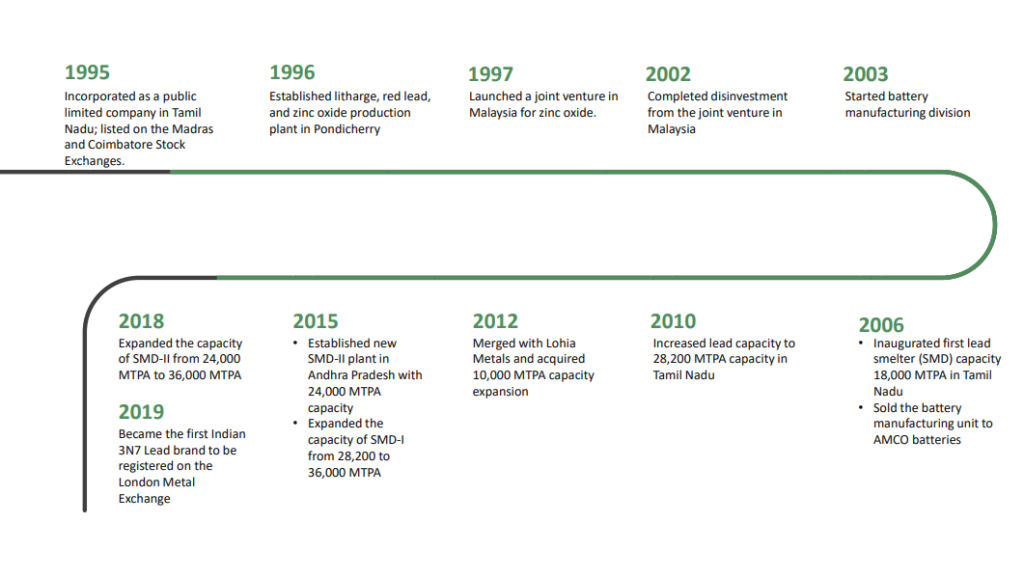

Pondy Oxides and Chemicals Ltd History and Evolution

Pondy Oxides and Chemicals Ltd has evolved over three decades from a niche chemicals manufacturer into circular economy enterprises. Pondy Oxides and Chemicals Ltd’s transformation has been marked by deliberate strategic pivots, capacity expansions.

1995-2003 – Early Capabilities & Strategic Foundation

- 1995: Incorporated as a public limited company in Tamil Nadu; listed on the Madras and Coimbatore Stock Exchanges.

- 1996: Commissioned its first plant in Pondicherry to manufacture litharge, red lead, and zinc oxide. establishing its core competency in lead chemistry.

- 1997: Entered an international joint venture in Malaysia for zinc oxide manufacturing.

- 2002: Divested from the Malaysian JV and realigned the business toward domestic integration.

- 2003: Commissioned a new lead-acid battery manufacturing unit in Tamil Nadu, marking early vertical integration.

2004-2012: Pivot to Recycling & Capacity Building

- 2006: Commissioned the first lead smelter (SMD-I) in Tamil Nadu with 18,000 MTPA capacity and exited the battery division via sale to AMCO Batteries.

- 2010: Expanded lead smelting capacity at SMD-I to 28,200 MTPA.

- 2012: Merged with Lohia Metals, which added 10,000 MTPA of lead recycling capacity.

2013-2019: Multi-Plant Expansion & Listing on LME

- 2015: Commissioned SMD-II in Andhra Pradesh with 24,000 MTPA capacity and Simultaneously expanded SMD-I to 36,000 MTPA.

- 2018: Scaled SMD-II to 36,000 MTPA.

- 2019: Achieved a major milestone by becoming the first Indian company with a 3N7 purity lead brand registered on the London Metal Exchange (LME) which helped in global brand recognition and stronger export market access.

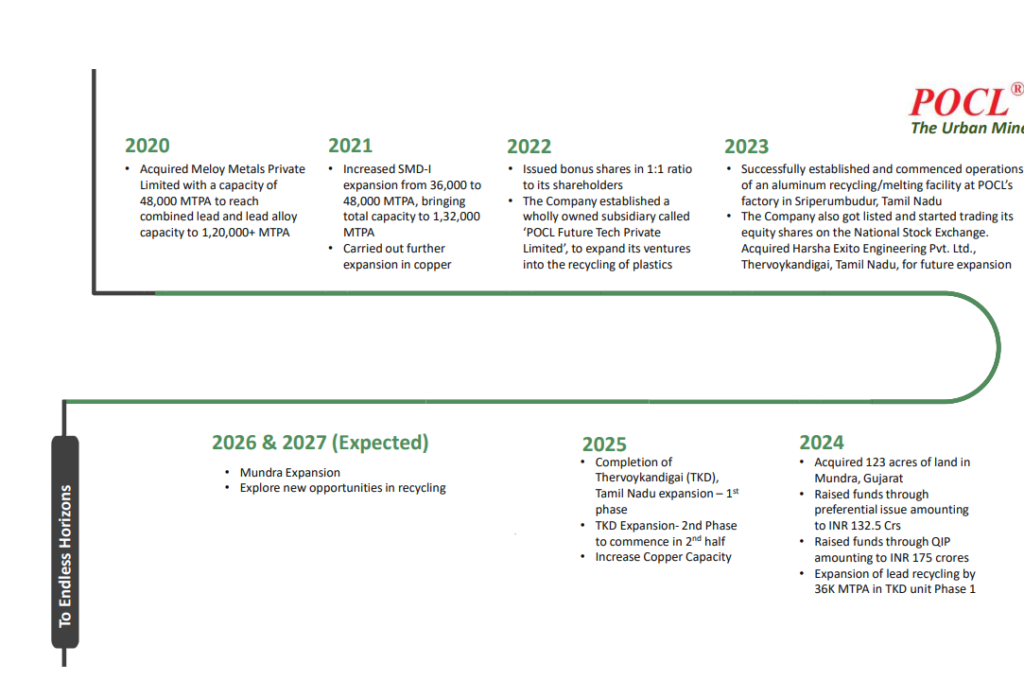

2020-2023: Diversification and Scale

- 2020: Acquired Meloy Metals Pvt Ltd, adding 48,000 MTPA and taking total smelting capacity beyond 1,20,000 MTPA.

- 2021: Expanded SMD-I further to 48,000 MTPA, consolidating total lead capacity at 1,32,000 MTPA and Initiated incremental expansion in copper recycling.

- 2022: Launched POCL Future Tech Pvt Ltd, a wholly owned subsidiary, to enter the plastics recycling space.

- 2023: Commenced operations at the aluminium recycling and alloying facility in Sriperumbudur, Tamil Nadu, Listed on the National Stock Exchange (NSE). and Acquired Harsha Exito Engineering Pvt Ltd, providing land and infrastructure that later became the Thervoykandigai (TKD) unit.

2024: Strategic Land Bank & Capital Infusion

- Acquired 123 acres of industrial land in Mundra, Gujarat, located ~16 km from port, to build a coastal recycling and export-oriented industrial base.

- Raised fresh capital via: ₹132.5 crore through preferential allotment and ₹175 crore through QIP

- Deployed funds for capex and working capital with focus on scaling the new TKD facility.

2025: Commissioning of India’s First Fully Automated Lead Recycling Plant

- Commissioned Phase I of the Thervoykandigai (TKD) Unit, adding 36,000 MTPA of lead capacity.

- Designed with full automation and process control, the unit represents a major technology leap in India’s recycling sector, with higher operational efficiency and better margin profile.

2026-2027: Next Growth Wave (Forward Looking)

- TKD Phase II (additional 36,000 MTPA) targeted for commissioning in H2 FY26.

- Copper recycling to be scaled up from 6,000 to 24,000 MTPA.

- Development of the Mundra project expected to commence by end-2026:

- Envisioned as a multi-metal recycling hub,

- Offering geographic/logistics advantage,

- With the potential to incubate new verticals like lithium-ion battery recycling, depending on feasibility.

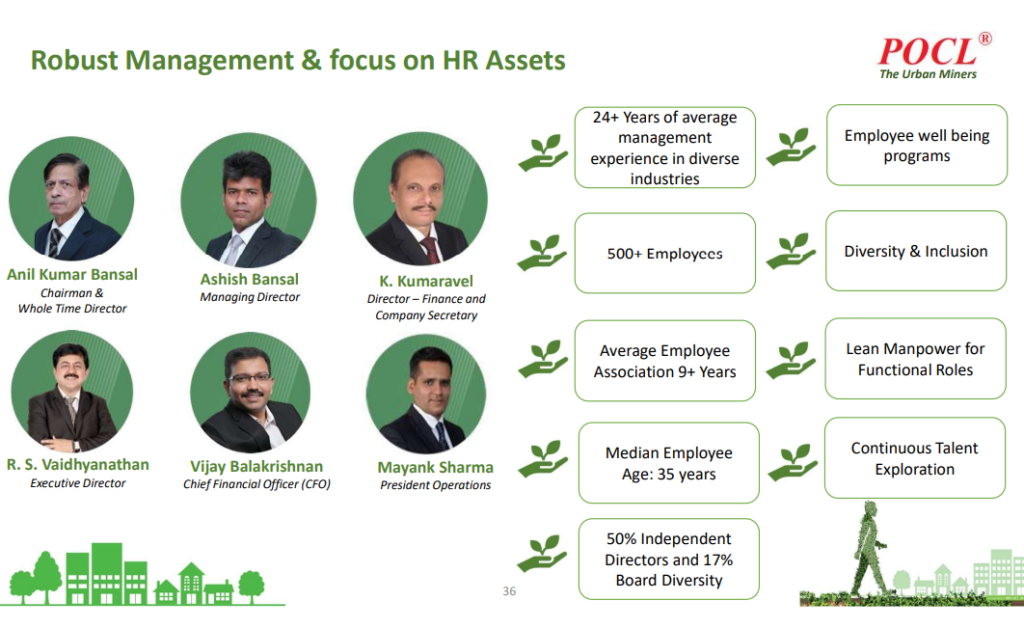

Pondy Oxides and Chemicals Ltd Management details

Pondy Oxides and Chemicals Ltd is a promoter led and promoter driven company led by Bansal family. At the helm is Mr. Anil Kumar Bansal, Executive Chairman and a first-generation entrepreneur, who founded Pondy Oxides and Chemicals Ltd and brings over 35 years of experience in the non-ferrous metals industry. He has been instrumental in guiding Pondy Oxides and Chemicals Ltd’s evolution from a niche chemical manufacturer into a vertically integrated multi-metal recycling player. His strengths lie in strategic direction, capital raising, and building international sourcing relationships particularly across Asia and the Middle East. Mr. Bansal continues to anchor the Pondy Oxides and Chemicals Ltd’s long-term roadmap, overseeing land acquisition, financial structuring and incubation of new recycling verticals.

Carrying this legacy forward is Mr. Ashish Bansal, Managing Director and a second-generation promoter. A qualified engineer, he has played a pivotal role in scaling up Pondy Oxides and Chemicals Ltd’s operations, institutionalizing automation and process discipline, and driving compliance-led growth. He leads day-to-day execution across facilities, oversees global scrap procurement, and has spearheaded the development of new business lines such as plastics and aluminium recycling. Under his leadership, Pondy Oxides and Chemicals Ltd has deepened its global export footprint, ramped up its LME-aligned lead business, and commissioned India’s first fully automated lead recycling plant at Thervoykandigai.

We view Pondy Oxides and Chemicals Ltd’s management as disciplined, execution focused, and capital efficient with a clear preference for steady and modular growth over aggressive scaling. The leadership team including Managing Director Mr. Ashish Bansal, CFO Mr. Vijay Balakrishnan, and President (Operations) Mr. Mayank Sharma has been consistently present in quarterly investor calls.

Pondy Oxides and Chemicals Ltd Industry Landscape

Global Non Ferrous Recycling Industry Overview

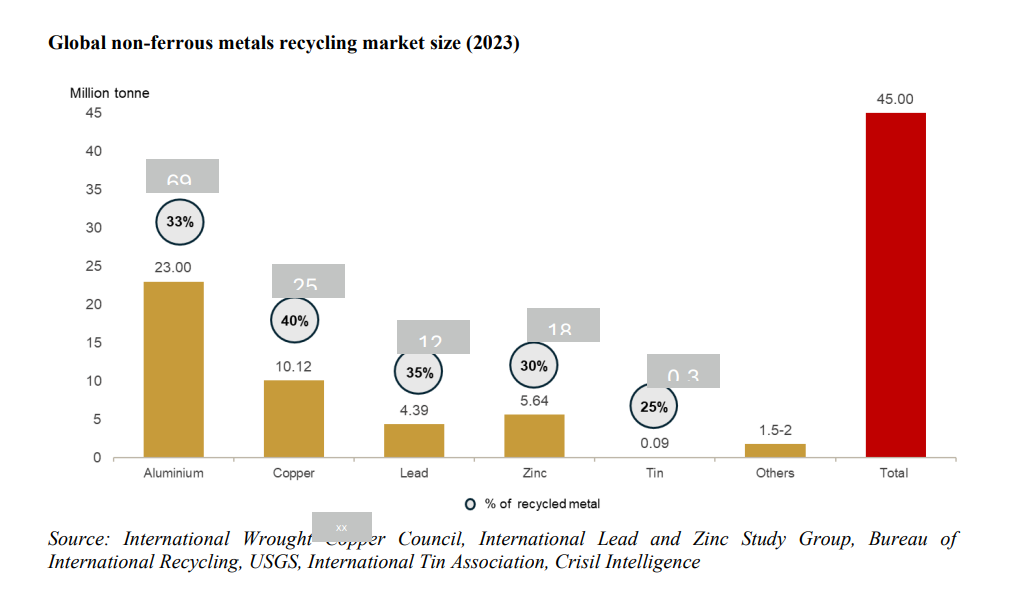

The global non ferrous metals recycling industry is an important pillar of the circular economy as it conserves natural resources, reduces carbon emissions, and supports sustainable industrial growth. In 2023, the total recycled volume of non-ferrous metals was estimated at 45 million tonnes. Aluminium dominated with 23 mn tonnes, followed by copper with 10.1 mn tonnes and lead with 4.4 mn tonnes, according to industry data from USGS, ILZSG, and Crisil Intelligence.

Non-ferrous metals are particularly well suited for recycling due to their inherent property of infinite recyclability without quality degradation. The relatively high energy intensity and environmental cost of primary production make recycling an economically and ecologically compelling alternative.

Material wise Recycling Efficiency and Environmental Impact

Aluminium

- Aluminium recycling has a significant positive impact on the environment. One tonne of aluminium recycled can save up to 8 tonne of bauxite, 14,000 kWh of energy, 40 barrels (6,300 litre) of oil and 7.6 cubic metre of landfill space

- The aluminium recycling process consumes up to 95% less energy than producing aluminium from virgin raw material

- The recycling of one aluminium can is sufficient to power a 100-watt bulb for almost four hours, highlighting the energy efficiency of the recycling process

- Aluminium drink cans account for almost 100% of recycling rate in some countries, demonstrating the success of its recycling effort

Copper

- Copper has a high recycling value, with premium-grade scrap holding at least 95% of the value of primary metal from newly mined ore

- Recycling copper is an energy-efficient process and saves up to 85% of the energy used in its primary production

- Replacing the primary production method with copper scrap reduces carbon dioxide (CO2) emissions by ~65%, making recycling a more environmentally friendly option

Lead

- The lead industry has a high recycling rate, with 50% of the lead produced and used each year having been used before in other products.

- From 1960 to 2022, the total usage of refined lead stood at 422.1 million tonne, with 47% attributable to the recycling industry

- According to the International Lead Association, 80% of modern lead is used in the production of batteries, of which more than 99% are recycled

- Using secondary lead instead of ore reduces CO2 emissions by 99%

Tin

- Primary production of tin requires 99% more energy than secondary production

- In the use of refined tin, solder accounts for almost half of the total, followed by others, including chemicals, tinplate, lead-acid batteries and copper alloys. The use of recycled tin as a proportion of total tin use is ~32%

Zinc

- According to the International Zinc Association, 60% of total zinc production is still in use, while the global end-of-life recycling rate for zinc is ~45%

- Secondary zinc production is more energy-efficient and uses 76% less energy than primary production

- Old zinc scrap mainly comprises die-cast parts, brass objects, end-of-life vehicles, household appliances, old air-conditioning ducts, obsolete highway barriers and street lighting, which reflect the diverse sources of recyclable zinc materials

Geo wise Regulatory & Infrastructure Trends

North America: The North American market is well established with the United States (US) and Canada as key players. The region has a mature recycling infrastructure, aided by technological advancements and sustainability regulations. Aluminum recycling is particularly strong in the US owing to its widespread use in the packaging, construction and 1automotive sectors. North America has the world’s highest Recycling Input Rate (RIR) with 57 per cent of the metal produced in the region originating from scrap.

Europe: Europe leads in regulatory support for metal recycling, promoting an advanced recycling ecosystem across the European Union (EU). The EU Green Deal and various waste management frameworks encourage high recycling rates for non-ferrous metals, especially in automotive and industrial manufacturing. Europe has the highest Recycling Efficiency Rate (RER) in the world, recovering 81 per cent of aluminium scrap available in the region.

Asia: Asia leads the global market for non-ferrous metal recycling, with China, Japan and India driving substantial growth, owing to expanding industrial and infrastructure development. Rapid urbanisation and industrialisation coupled with significant demand for metals such as aluminium and copper in the construction, electronics and automotive sectors, have bolstered recycling efforts. India’s recycling market is growing, especially with governmental support for sustainable development and resource efficiency. In addition, investments in recycling infrastructure and advancements in technology contribute to higher recycling rates across the region.

South America: Led by Brazil and Chile, the South American market mainly focuses on copper recycling owing to its vast mining resources. However, the region is gradually diversifying into the recycling of other non-ferrous metals to meet growing local demand and support global supply chains.

Rest of the world: Other regions, including parts of Africa and the Middle East, are increasingly recognising the economic benefits of recycling but face infrastructure challenges. Investments and partnerships from global recycling firms are helping to foster growth in these regions.

India’s non-ferrous metal recycling ecosystem

India’s non-ferrous metal recycling ecosystem is evolving steadily, with varying degrees of maturity across different metals.

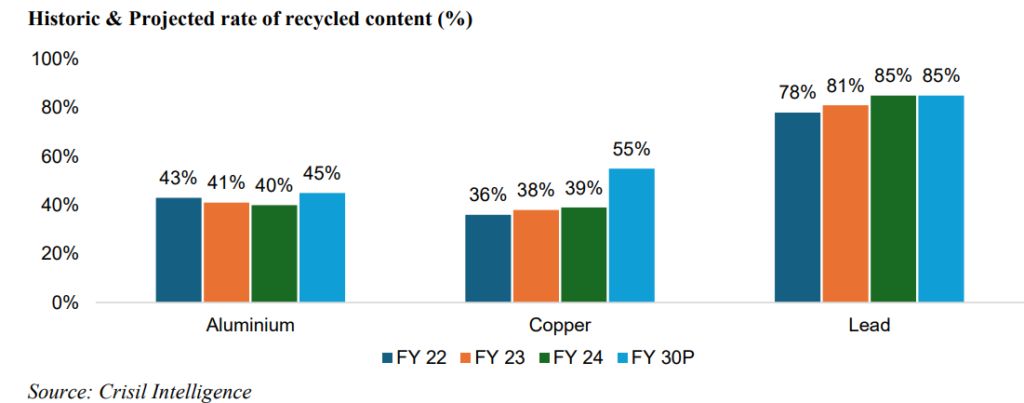

- Lead is India’s most successfully recycled non-ferrous metal. The recycled content has increased from 78% in FY22 to 85% by FY24 and is expected to hold steady at that level through FY30. This reflects a well-established reverse supply chain for lead-acid batteries, driven by regulatory mandates and high collection efficiency.

- Copper recycling is on an upward trajectory, with recycled content improving from 36% in FY22 to 39% in FY24. By FY30, it is projected to reach 55% as demand from power transmission, EVs, and electronics rises, and more scrap processing capacity comes online.

- Aluminium recycling remains crucial due to its energy-saving benefits, though India’s recycled content declined marginally from 43% in FY22 to 40% in FY24 due to primary demand outpacing scrap availability. However, this is expected to recover to 45% by FY30 as scrap flows improve and recycling investments scale up.

Lead Industry in India

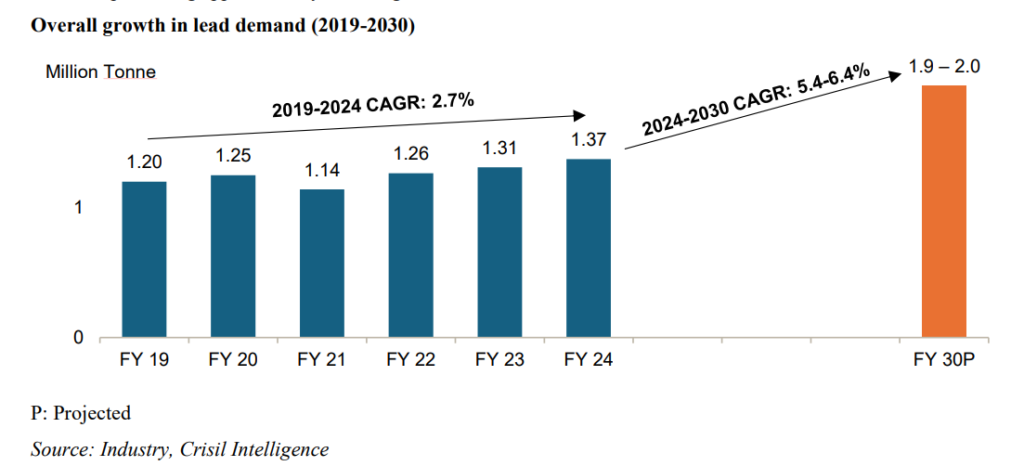

India’s lead demand is on a steady upward trajectory primarily driven by automotive, industrial and backup power applications all of which rely heavily on lead-acid batteries. According to Crisil Intelligence, overall lead demand in India grew from 1.20 mn tonnes in FY19 to 1.37 mn tonnes in FY24, clocking a modest 2.7% CAGR during this period. However, growth is expected to accelerate significantly over the next six years, with demand projected to reach 1.9-2.0 mn tonnes by FY30, translating to a 5.4-6.4% CAGR between FY24 and FY30.

Lead Recycling Industry in India

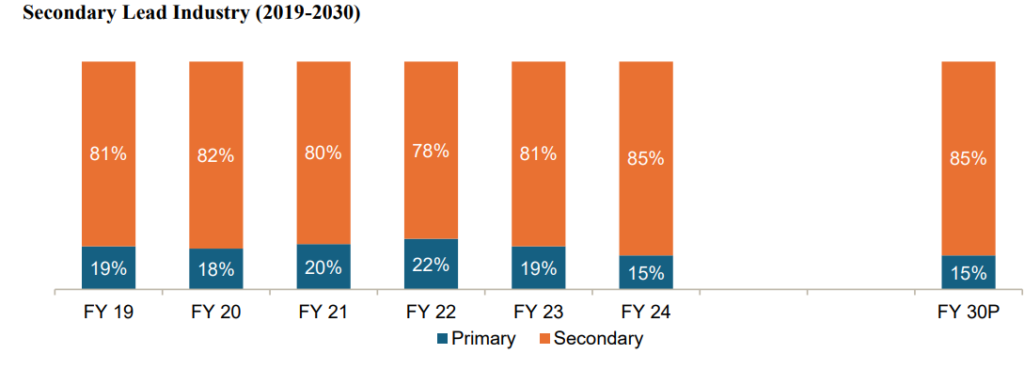

India’s lead industry is dominated by secondary (recycled) lead, which has emerged as the preferred supply route due to its economic and environmental benefits. As of FY24, nearly 85% of India’s lead production is derived from recycled sources, a figure projected to sustain through FY30, which clearly reflects a mature and efficient recycling ecosystem.

Between FY19 and FY24, the share of secondary lead has remained consistently high, rising from 81% to 85%, while primary lead production has gradually declined to just 15%. This structural shift is supported by regulatory incentives, increased domestic availability of used batteries, and strong economics of secondary smelting.

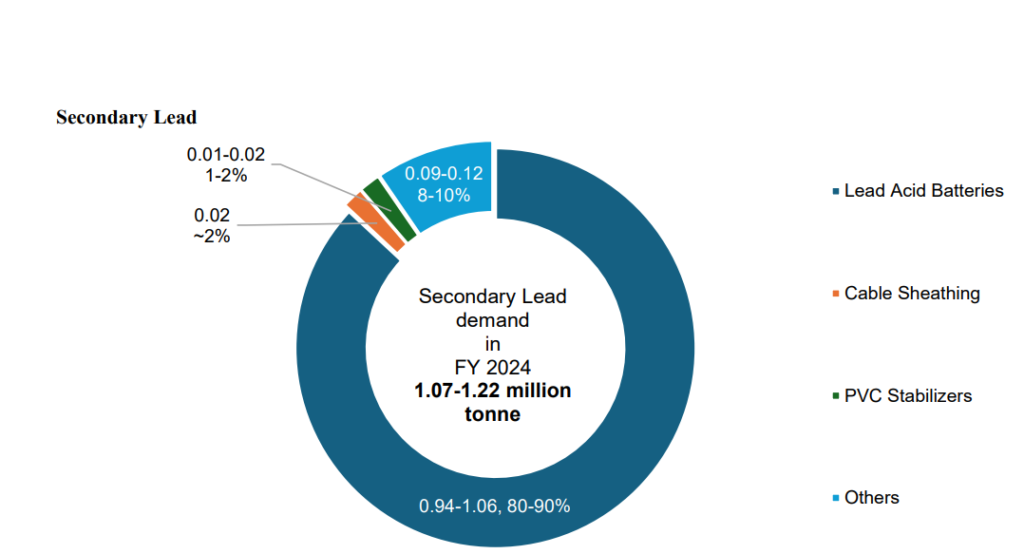

Of the total secondary lead demand in FY24, 80–90% (0.94–1.06 million tonnes) is attributable to lead-acid batteries, underscoring the battery sector’s dominance. Other downstream applications include cable sheathing (~2%), PVC stabilizers (~2%), and miscellaneous industrial uses (~8–10%).

This shift signals a structural growth phase for the industry, led by:

- Rising vehicle penetration, including demand from the replacement battery market;

- Increased industrialisation and grid storage requirements;

- And strong policy tailwinds for formal recycling under India’s Extended Producer Responsibility (EPR) and environmental compliance frameworks.

Value Chain of Secondary Lead

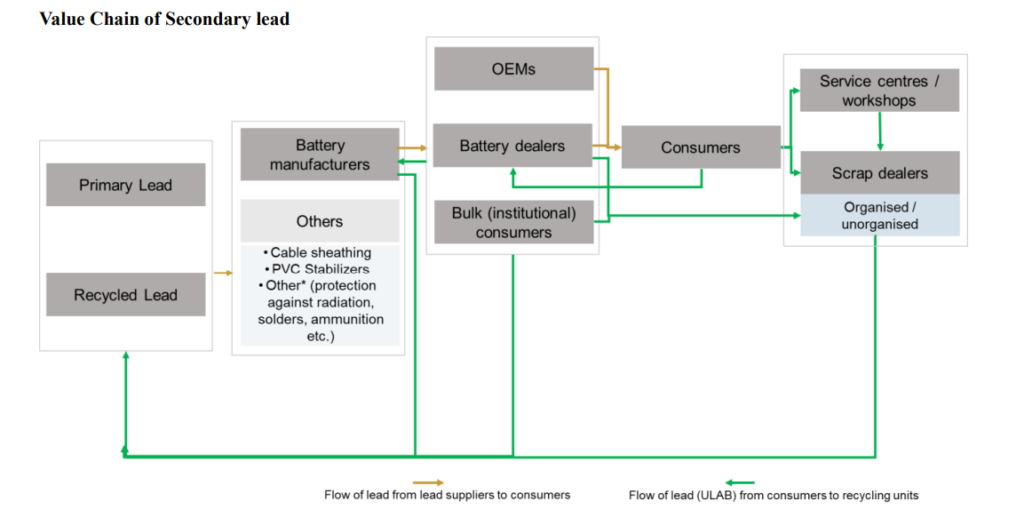

The secondary lead ecosystem in India is a closed-loop value chain centered on the recycling of used lead-acid batteries (ULABs). It begins with the generation of recyclable lead and ends with the reuse of refined lead in batteries and industrial products:

- Input Sources

- Recycled Lead is primarily recovered from used batteries collected by scrap dealers (both organized and unorganized), service centers, workshops, and institutional users.

- Primary Lead, though still present, plays a marginal role (15%) in overall supply.

- Collection & Recycling

- ULABs are funneled from consumers and industrial users to scrap dealers, who act as aggregators. This collected scrap is then routed to recyclers like Pondy Oxides and Chemicals Ltd, Gravita India Ltd, etc.

- Formal and compliant recyclers extract and purify lead through smelting processes.

- End-Use Applications

- The refined recycled lead is primarily consumed by battery manufacturers, who produce batteries for various downstream users.

- A smaller share of recycled lead is also used in PVC stabilizers, cable sheathing, and specialty applications (e.g., radiation shielding, ammunition).

- Downstream Distribution

- From battery makers, products flow to OEMs, bulk institutional consumers, battery dealers, and end consumers.

- Once spent, these batteries re-enter the cycle through scrap collection, enabling a circular economy.

This integrated value chain not only supports the sustainability narrative but also provides cost advantages and regulatory tailwinds to organized players like Pondy Oxides and Chemicals Ltd, Gravita India Ltd, etc, who operate across procurement, processing, and end-customer channels.

Secondary Lead Industry Structure & Regional Concentration

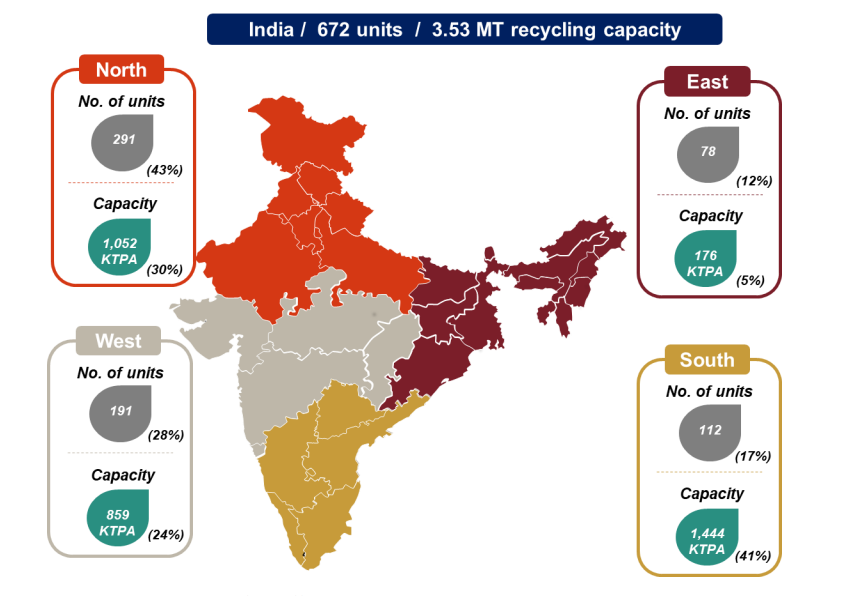

India’s secondary lead industry is highly fragmented, comprising 672 units registered with the Central Pollution Control Board (CPCB), with a cumulative recycling capacity of 3.53 million tonnes per annum (MTPA). These units primarily process used lead acid batteries (ULABs) and other forms of lead-containing waste.

However, despite the regulatory framework, 30-35% of lead recycling still occurs in the unorganized segment, posing challenges around environmental compliance and quality consistency. This makes the case stronger for well-capitalized, compliant recyclers like POCL, which benefit from regulatory adherence, traceable supply chains, and ESG-conscious customers.

The CPCB has introduced an online portal for battery importer registration to promote regulatory visibility and accountability in the value chain. But enforcement remains uneven, especially outside the organized ecosystem.

From a regional lens:

- Southern India, with only 17% of registered units, accounts for the highest capacity share at 41% (1,444 KTPA), driven by scale players like POCL and proximity to ports.

- Northern India has the largest number of units (291; 43%), contributing 30% of the total capacity.

- Western India holds 28% of units and 24% capacity, while

- Eastern India remains underdeveloped, with just 12% of units and a mere 5% share in capacity.

Favorable Government Initiatives & Incentives

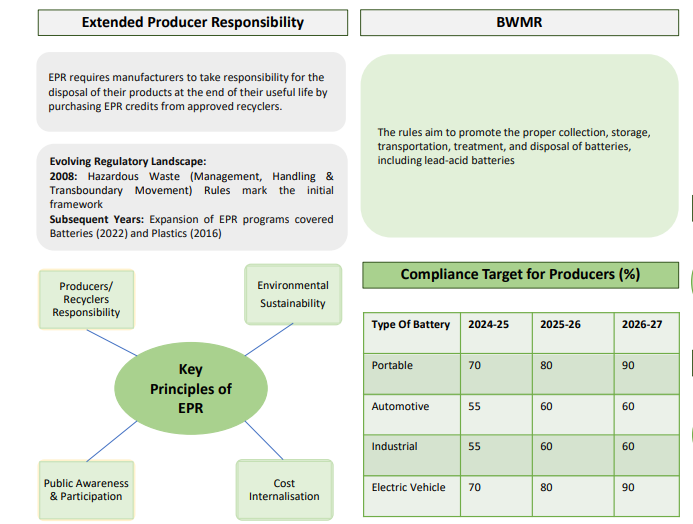

The Battery Waste Management Rules (BWMR) – The Battery Waste Management Rules (BWMR) have evolved significantly from the original Batteries (Management and Handling) Rules, 2001, with the most recent versions (2022-2025 drafts) introducing far-reaching structural reforms

The 2001 Rules focused mainly on ensuring used lead-acid batteries (ULABs) were returned by consumers and bulk users to dealers and recycled by registered recyclers. Responsibilities were split among manufacturers, assemblers, importers, and recyclers, but the enforcement mechanisms were limited. There was little emphasis on tracking, transparency, or newer chemistries like lithium-ion.

The 2022–2025 BWMR framework represents a structural shift. The rules are now chemistry agnostic and digitally enforced. Some of the major enhancements include:

1. Introduction of Extended Producer Responsibility (EPR)

- EPR mandates that battery producers are responsible for the collection and recycling of end of life batteries.

- They must meet annual collection and recycling targets, failing which they face penalties.

- Obligations are calculated based on production/import volumes, and must be fulfilled through formal recyclers listed on a national portal.

- This directly incentivizes partnerships with organized recyclers as only registered and traceable recyclers can help producers meet their targets.

2. Digital Tracking & Transparency (Battery EPR Portal)

- A centralized online EPR portal has been introduced (MoEFCC/CPCB administered), where:

- Producers and recyclers must register and file real-time returns.

- Battery collection, recycling, and material recovery certificates (EPR credits) are tracked.

- This brings traceability and formalization to a previously opaque industry. Due to this a registered and compliant recycler stands to gain share from the unorganized sector, which will struggle with compliance.

3. Mandatory Recycling Targets and Recovery Benchmarks

- Producers must ensure minimum levels of material recovery (e.g., lead, cobalt, nickel, lithium) from the batteries they collect.

- Recovery targets increase annually, which ensures that higher-efficiency recyclers become preferred partners.

- Example: The 2024-25 rules mandate minimum 75-80% recovery of key metals in lead and lithium-ion batteries.

.

4. Inclusion of Lithium-ion and New Chemistries

- Unlike the 2001 Rules (which were limited to lead-acid batteries), the latest BWMR also covers Lithium-ion, Nickel-cadmium and Zinc-based batteries, among others.

- The new rules also ban landfilling or incineration of used batteries which has created mandatory feedstock flow into formal recyclers.

5. Market-Based Mechanism – EPR Certificate Trading

- Producers who exceed their obligations can trade excess EPR credits to those who fall short.

- This market mechanism introduces a monetizable incentive for recyclers if they process more batteries, it earns more tradable credits.

- Early mover recyclers gain both volume and financial upside.

6. Import Restrictions and Registration Discipline

- All importers and recyclers must be registered with CPCB, and failure to meet collection/recycling targets leads to suspension or cancellation.

- Imported batteries (including assembled EV packs) must have pre-registered compliance documentation.

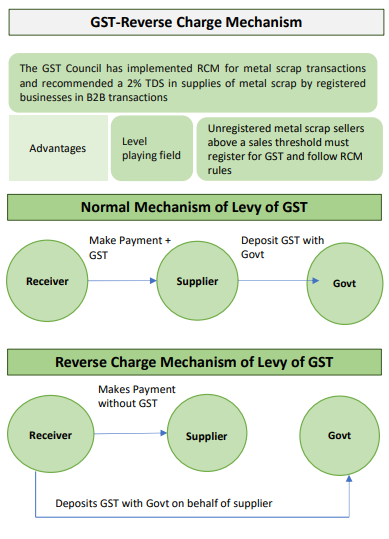

GST-Reverse Charge Mechanism

The implementation of the GST Reverse Charge Mechanism (RCM) for metal scrap transactions has significantly strengthened formalization in the recycling industry. As this framework mandates that the buyer (not the seller) deposit GST directly with the government on behalf of metal scrap vendors.

This has two major effects: first, it ensures better tax compliance and tracking of scrap movement; second, it deters informal players who previously operated outside the tax net.

Pondy Oxides and Chemicals Ltd’s management has pointed out that the RCM, coupled with a 2% TDS on B2B scrap transactions, is leveling the playing field. By requiring GST registration for sellers crossing a certain turnover threshold, the regulation forces informal scrap aggregators to either formalize or exit. This benefits organized recyclers by reducing procurement friction, widening access to GST-compliant scrap, and further tilting the ecosystem toward traceable and compliant sourcing. Over time, this trend could reduce dependence on imported scrap, lower working capital cycles (by cutting lead times), and improve margins due to better negotiation power with compliant domestic vendors.

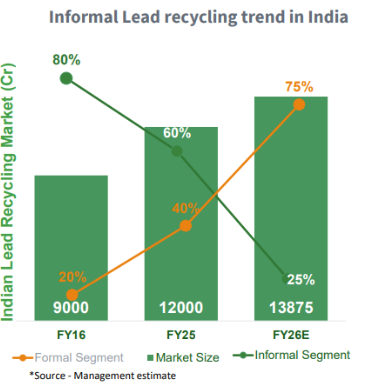

These regulatory shifts, especially the implementation of EPR, rising recovery targets, and digital traceability are driving a structural transformation in India’s battery recycling landscape. As the chart illustrates, the formal segment has already grown from just 20% of the market in FY16 to a projected 75% by FY26 marking a decisive pivot away from the informal ecosystem. This formalization is not just regulatory it’s economic, as OEMs and importers are now obligated to channel scrap through CPCB-registered players. For organized recyclers this shift represents a multi-year tailwind which will expand both addressable market share and margin potential

Pondy Oxides and Chemicals Ltd Business Details

Pondy Oxides and Chemicals Ltd operates four key business segments.

- Lead and Lead Alloys Recycling

- Engineering Plastics

- Aluminium Recycling

- Copper Recycling

Lead and Lead Alloys is the core vertical which contributes the majority of revenues. Aluminium recycling focuses on die-cast alloys for the auto sector. Copper recycling is a growing vertical with planned capacity expansion. The Engineering Plastics division converts battery-derived plastics into industrial-grade compounds.

Lead and Lead Alloys Recycling – The Lead and Lead Alloys segment is Pondy Oxides and Chemicals Ltd’s primary revenue and cash flow generator and consistently contributes around 93-95% of standalone revenues. While management has articulated a long-term vision to diversify into copper, aluminium and plastics by 2030, lead remains the cornerstone of operations in the medium term. Over the years, Pondy Oxides and Chemicals Ltd has evolved from a pure play commodity recycler to a specialty alloy producer which enables it to command pricing premiums over LME linked benchmarks. Pondy Oxides and Chemicals Ltd is currently in the midst of its largest ever expansion cycle at Thervoykandigai (TKD), aimed at doubling down on scale, which will result in margin uplift and supply chain depth in the Asia Pacific battery value chain.

Pondy Oxides and Chemicals Ltd operates an end to end closed loop recycling system that begins with the dismantling of used lead-acid batteries (ULABs) using automated battery breakers. These systems separate plastic, electrolytes, and lead-bearing components like grids and pastes. The extracted lead materials are then smelted in rotary furnaces equipped with environmental controls, and the molten lead is transferred to refining kettles where impurities are removed with precise chemical additives. At this stage, Pondy Oxides and Chemicals Ltd customizes the metal by adding alloying elements such as calcium, antimony, tin, and selenium to manufacture over 100 different lead-based products. These include pure (soft) lead (3N7 grade), lead-calcium alloys, lead-antimony alloys, lead-selenium alloys, and proprietary high-performance blends tailored to battery OEM requirements. The finished products are cast into ingots, tested, and annealed to ensure mechanical strength and purity before shipment. By shifting its portfolio toward value-added products (VAPs), which now form nearly 70% of the lead segment, Pondy Oxides and Chemicals Ltd has enhanced its pricing power and customer stickiness. Pondy Oxides and Chemicals Ltd has secured long-term contracts with Tier-1 clients across Southeast Asia, Japan, and South Korea.

Pondy Oxides and Chemicals Ltd’s lead smelting and refining footprint has scaled meaningfully through acquisitions and brownfield expansions. Historically operating at ~132,000 MTPA capacity across Tamil Nadu and Andhra Pradesh, Pondy Oxides and Chemicals Ltd initiated a two-phase expansion of 72,000 MTPA at the TKD facility:

- Phase I (36,000 MTPA) commenced in April 2025, becoming India’s first fully automated lead recycling plant with advanced process control and real time traceability. It achieved ~50% utilization in Q2 FY26 and is expected to ramp to 70-80% in the coming quarters.

- Phase II (36,000 MTPA) is under development and slated for commissioning in H2 FY26.

Post expansion, lead processing capacity will reach 204,000 MTPA, Pondy Oxides and Chemicals Ltd has incurred total capex of ₹105 Cr across both phases which is funded through QIP and internal accruals.

To de-risk from LME-linked commodity cycles and drive better margin realization, Pondy Oxides and Chemicals Ltd has strategically shifted its product mix toward high margin and customer-specific alloys. As of H1 FY26, ~70% of the segment’s volume comprised value added products including Lead-Calcium, Lead-Antimony, and Lead-Tin alloys. These alloys are developed in close consultation with global and domestic battery OEMs by locking in formulation stickiness and recurring demand. Pondy Oxides and Chemicals Ltd is the only Indian company exporting certain alloy types to Japan which we believe is a testament to its quality adherence and technical credentials. Pondy Oxides and Chemicals Ltd’s LME-registered 3N7 (99.97% purity) brand allows participation in global spot and contract markets, while providing hedging flexibility.

Pondy Oxides and Chemicals Ltd has entrenched its position as a reliable supplier across the Asian battery ecosystem. In H1 FY26, 64% of lead revenues came from exports, primarily to South Korea, Japan, Vietnam, Indonesia, and Thailand. The remaining 36% were domestic with Amara Raja being the largest client (~25–30% share of domestic revenues). Management has clarified that Amara Raja’s own captive recycling setup will likely be self-consumption focused and Pondy Oxides and Chemicals Ltd will continue to supply high-grade alloys.

Pondy Oxides and Chemicals Ltd operates on long-term contracts with 90-95% of sales are annualized agreements with pricing linked to prior month LME averages plus alloying premiums.

Pondy Oxides and Chemicals Ltd employs a Hub and Spoke model with a deep and globally diversified scrap sourcing network. In H1 FY26, 86% of scrap was imported which is sourced from over 70 countries through 270+ supplier relationships. Pondy Oxides and Chemicals Ltd plans to reduce import dependence to 65% over time by leveraging India’s maturing reverse logistics market which will be supported by regulatory support as new regulations have been acting as strong tailwinds. I.e Battery Waste Management Rules (BWMR) and EPR mandates are formalizing the scrap ecosystem and Reverse charge mechanism (RCM) and TDS provisions on scrap procurement are reducing the informal sector’s competitiveness.

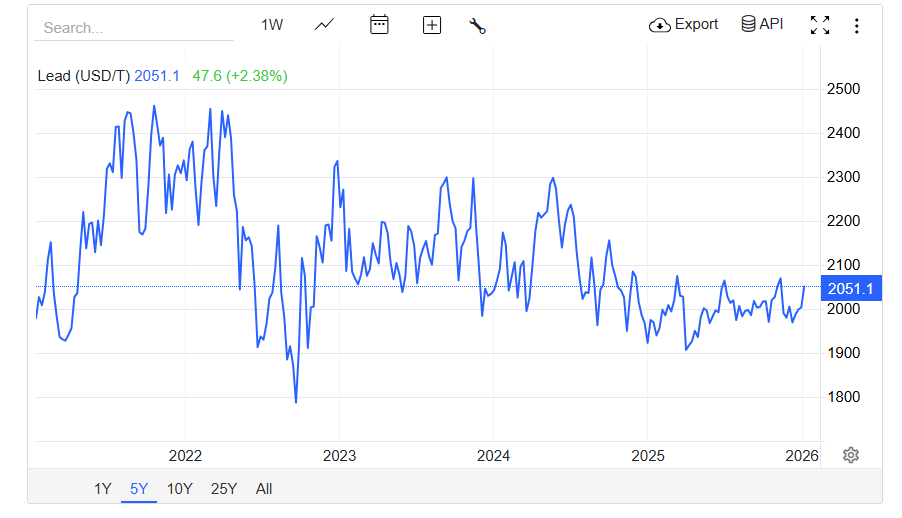

Despite being a base metal the lead has historically shown relatively lower volatility compared to other non ferrous commodities as evident from its 5 year price chart where it has largely traded within a narrow band of USD 1,900-2,300 per tonne.

However, to safeguard against price fluctuations Pondy Oxides and Chemicals Ltd follows a prudent back to back hedging strategy. Under this model, Pondy Oxides and Chemicals Ltd simultaneously books its raw material purchases and finished goods sales based on prevailing London Metal Exchange (LME) prices. As soon as a sales order is confirmed, Pondy Oxides and Chemicals Ltd locks in a corresponding procurement contract, which ensures that any movement in LME prices has a neutral effect on its operating margins. Also the pass through pricing mechanism is reinforced through long-term contracts, where the final price is computed as: LME monthly average + conversion premium (which includes processing costs and negotiated margins). Pondy Oxides and Chemicals Ltd uses LME-registered brands like its own 3N7-grade lead for delivery liquidity and hedging efficiency which allows it to both physically and financially hedge inventory risks.

As a registered recycler under India’s Battery Waste Management Rules (BWMR), Pondy Oxides and Chemicals Ltd is eligible to generate Extended Producer Responsibility (EPR) certificates for the responsible recycling of used lead-acid batteries. These certificates are not traded in an open market but are issued to fulfill compliance obligations of battery producers and importers. While the monetary value of these certificates is not market determined (price is regulated or compliance-linked) hence not a revenue stream in the open market sense like carbon credits or plastic EPR which can be traded more freely, they still offer a compliance-based economic benefit. For Pondy Oxides and Chemicals Ltd, this strengthens customer stickiness with OEMs (who are obligated to meet EPR quotas) and reinforces its role as a compliant and preferred partner and thus indirectly supporting margins, even if it doesn’t add high-margin revenue in the traditional sense.

Engineering Plastics – The Engineering Plastics division marks Pondy Oxides and Chemicals Ltd’s evolution into a more integrated model. Historically, when Pondy Oxides and Chemicals Ltd recycled lead acid batteries it sold the leftover plastic scrap (mainly polypropylene) to third parties.

Recognizing the opportunity to capture more value from its own waste stream, Pondy Oxides and Chemicals Ltd set up a plastics recycling and compounding unit under its wholly-owned subsidiary, POCL Future Tech Pvt Ltd. This vertical has since grown into a small but fast-scaling business and contribution was ₹21 crore in FY24 and ₹31.5 crore in H1FY26. Pondy Oxides and Chemicals Ltd is now targeting ₹50-60 crore in FY26 revenue and sees long-term potential to scale this business to ₹200-300 crore annually over the next few years.

The raw material used in this business primarily comes from the Pondy Oxides and Chemicals Ltd’s own battery recycling process, where about 7% of each battery comprises plastic. Instead of disposing of it, Pondy Oxides and Chemicals Ltd processes this plastic in-house through washing, grinding, and extrusion to make polypropylene granules. It also procures additional plastic scrap both domestically and internationally (with a 46:54 domestic-to-import mix in H1 FY26) to feed its 9,000 MTPA installed capacity. Production volumes are ramping up steadily with Q1 FY26 output at ~808 metric tonnes, and management targeting monthly volumes of 600-700 tonnes in the near term.

What makes this segment especially promising is Pondy Oxides and Chemicals Ltd’s shift from basic recycled granules to value-added products, where additives and fillers are blended with base polymers to create high performance plastics. The current product range includes ABS, Nylon 6 and 66, Polycarbonate, HDPE, and LDPE materials used in sectors such as automotive interiors, bumpers, appliances, electronics, and paint containers. While basic recycling yields 6-8% EBITDA margins, the value-added products are expected to raise margins to 10-12% over time. However, one major drag on profitability has been high rental overheads, as the unit currently operates from a leased facility costing about ₹2 crore per year. To resolve this, Pondy Oxides and Chemicals Ltd is relocating the plastics unit to its own premises in Thervoykandigai (TKD), which is expected to be completed by Q3-Q4 FY26. This move should eliminate rent costs and push the business into EBIT positive territory.

The business also stands to benefit from regulatory support. Under India’s updated Plastic Waste Management Rules the manufacturers must use a certain percentage of recycled plastic and Pondy Oxides and Chemicals Ltd being a registered recycler is eligible to generate and sell EPR (Extended Producer Responsibility) credits, which offer an additional profit stream. Though it is still evolving, this mechanism has the potential to significantly boost margins once credit trading becomes more mainstream.

On the capex front, Pondy Oxides and Chemicals Ltd has earmarked around ₹30-40 crore over the next two years as part of its broader ₹75 crore investment program for improving machinery, scaling up compounding capabilities, and completing the relocating. Pondy Oxides and Chemicals Ltd ultimately plans to raise monthly production capacity from ~1,000 MT to 2,000-3,000 MT in phases. Which we believe will lead to a once overlooked byproduct into a high-margin and scalable business.

Copper Recycling – Pondy Oxides and Chemicals Ltd’s Copper segment is rapidly emerging as its most ambitious growth engine and reflecting Pondy Oxides and Chemicals Ltd’s strategic shift toward diversification from Lead. While Lead still contributes over 90% of revenue, the management has explicitly outlined the copper as a core vertical that could rival or even surpass the Lead in terms of revenue over a 7-8 year horizon. Which is backed by a clearly defined roadmap involving a 4x capacity expansion with potential of 20x revenue scale-up, and a product evolution strategy that pivots the segment from basic recycling to manufacturing of value-added copper products.

As of FY25, Pondy Oxides and Chemicals Ltd’s copper processing capacity stood at 6,000 MTPA and revenue contributing was at ₹55 crore. However, the business has seen an inflection point in FY26 with the first half alone (H1FY26) generating ₹172 crore in revenue and management is guiding for full year guidance at ₹400 crore. To support this trajectory, Pondy Oxides and Chemicals Ltd is implementing a product centric rather than phase centric expansion model. The capacity is expected to reach 12,000 MTPA by the end of FY26 and scale to 24,000 MTPA by FY27. This expansion will be driven by a planned capital investment of ₹100-110 crore which is split into ₹35 crore in H2FY26 and another ₹55-60 crore in FY27.

Pondy Oxides and Chemicals Ltd is also evolving its operating model from being a basic scrap processor to a full fledged manufacturer of specialized copper products. Traditionally, the segment focused on simple scrap recycling i.e converting imported copper grades such as Clove, Cobra, Mill Berry and Barley into commodity grade outputs. EBITDA Margins here were thin at 5-5.5% and resembled trading activity. Pondy Oxides and Chemicals Ltd is now installing electric induction furnaces and machinery for producing Copper Billets, Ingots, and in later phases Foils and Coils, which will offer significantly higher value realization and better operating leverage. This forward integration is expected to push segment-level EBITDA margins up to 7-8% in the medium term.

The current sales mix is largely domestic (~81% in H1 FY26) and focused on industrial customers such as copper wire manufacturers and component makers. The entire raw material basket (100%) is currently sourced through imports which exposes Pondy Oxides and Chemicals Ltd to global scrap pricing dynamics. However, this also provides an opportunity to build scale and eventually tap international customers once the VAP portfolio is fully operational. The risk here lies in volatility and availability of global scrap, which will need to be actively managed as volumes scale.

According to Ashish Bansal (Managing Director), “In over 7 to 8 years view, I would rather put it that copper could generate even more revenues than lead.”

Aluminium Recycling – The Aluminium segment marks the Pondy Oxides and Chemicals Ltd’s fourth non ferrous recycling vertical, it was strategically launched to diversify its portfolio beyond lead, copper and plastics. While the segment initially showed promise, it has since entered a deliberate pause phase as part of a broader business recalibration.

Unlike the lead division which benefits from a deep market, price transparency via the LME, and a high-margin alloy strategy the aluminium business was launched with a commoditized product mix centered around standard die cast alloys like ADC12 and LM series. These products, though widely used in the automotive and industrial casting industries often suffer from intense price-based competition, low entry barriers, and, critically, the absence of an effective hedging mechanism. This left Pondy Oxides and Chemicals Ltd vulnerable to raw material price swings particularly in a market where procurement (scrap grades like Taint Tabor and Zorba) is 100% import-dependent. Management prudently chose to pause operations rather than continue operating at sub economic margins.

Pondy Oxides and Chemicals Ltd’s Sriperumbudur facility in Tamil Nadu, which houses the aluminium division, has an installed capacity of 12,000 MTPA. However, as of H1 FY26, production has been suspended, and the facility remains underutilized. Break-even utilization was previously estimated at 500-600 tonnes per month, but the current model could not support even that volume sustainably. The crux of the issue was that unlike Pondy Oxides and Chemicals Ltd’s lead and copper segments the aluminium alloys such as ADC12 are not directly quoted on the LME or any major commodity exchange. This eliminates the ability to hedge either raw material or finished goods prices, which forces the company to absorb any volatility in input costs or selling prices. Despite an attempt to manage these risks through back to back procurement and sales, the timing lags and freight risks further compressed margins.

In FY24, the aluminium segment contributed approximately ₹42 crore in revenue, with marginally positive utilization in Q3 FY24 before being suspended. No top-line or EBIT contribution has been recorded since, but importantly, Pondy Oxides and Chemicals Ltd was able to contain further losses before deciding to restructure the vertical. Rather than incurring recurring losses, Pondy Oxides and Chemicals Ltd is taking time to reassess the market dynamics and identify a more suitable, value-added product mix that would allow margin recovery and growth without speculative exposure.

In a promising development for its aluminium vertical, Pondy Oxides and Chemicals Ltd is actively engaging with regulatory and exchange authorities to address one of the core structural challenges in the secondary aluminium industry i.e lack of a standardized hedging platform. Pondy Oxides and Chemicals Ltd has confirmed in investor interactions that it is in discussions with the Multi Commodity Exchange to develop and introduce a futures contract for aluminium alloys, particularly for widely used grades like ADC12. This initiative, if successful, would allow players like Pondy Oxides and Chemicals Ltd to hedge both input and output price risks, thus stabilizing margins in a market otherwise characterized by high volatility and low pricing transparency. Crucially, the effort to create a tradable contract has received preliminary support from relevant regulatory bodies. The Ministry of Mines has reportedly shown a positive stance toward formalizing trading and risk management tools for the aluminium alloy market, in line with its broader policy focus on formalizing and deepening India’s non-ferrous metals ecosystem. While the MCX contract is still in the conceptual stage, Pondy Oxides and Chemicals Ltd’s role in shaping this structure could offer a first-mover advantage, especially as Pondy Oxides and Chemicals Ltd prepares to re-enter the aluminium market with a restructured product mix. And we believe the outcome of this initiative will be pivotal.

Looking ahead, management has made it clear that it does not intend to exit the aluminium business. Instead, it views the current pause as a strategic opportunity to rethink the business model. Pondy Oxides and Chemicals Ltd plans to re-enter the segment by targeting custom or niche aluminium alloys that are less commoditized and may be sold through long term contracts with better margin protection. The installed capacity itself remains a dormant asset that can be scaled up quickly once the product market fit is reestablished. If successful, Pondy Oxides and Chemicals Ltd estimates the current infrastructure has the potential to generate revenues in the range of ₹250 crore annually. Initial signs of revival are expected in CY26 by starting with small volume batches as part of the learning cycle before full commercial ramp-up.

Investors should monitor for developments on product selection, procurement realignment, and volume ramp-up beginning late FY26.

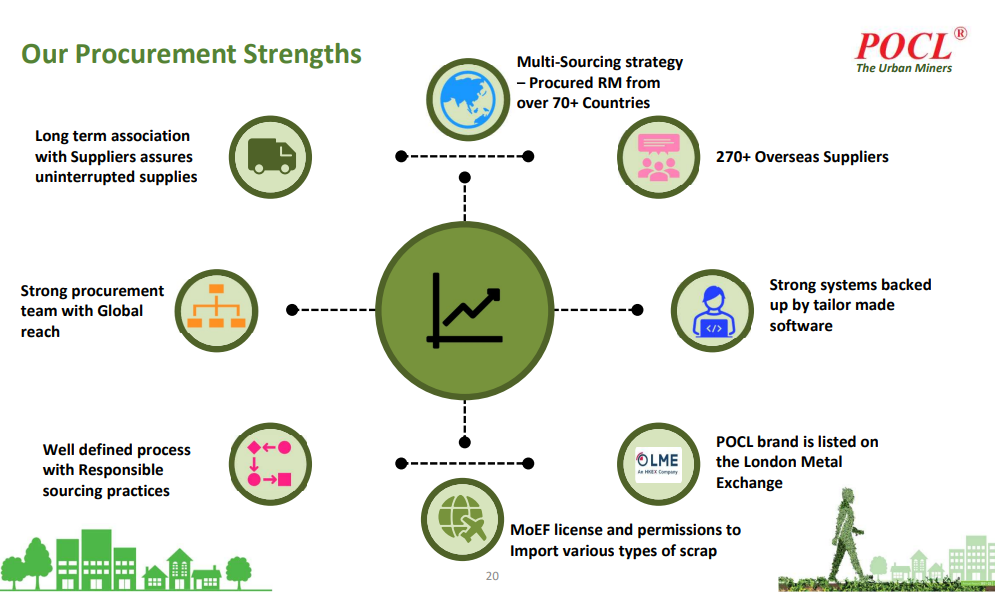

Pondy Oxides and Chemicals Ltd Procurement Strengths

Pondy Oxides and Chemicals Ltd has built a robust global procurement ecosystem. It sourced raw materials from over 70 countries through a network of 270+ overseas suppliers. Pondy Oxides and Chemicals Ltd has a very strong global procurement team which is supported by customized digital systems and responsible sourcing practices which ensures reliable and ethical supply chains. Pondy Oxides and Chemicals Ltd is listed on the London Metal Exchange (LME) and holds MoEF licenses for diverse scrap imports.

Pondy Oxides and Chemicals Ltd has established a strong global supply chain by partnering with some of the most reputable names in the metal and recycling industry. Its supplier base includes leading firms like Glencore, Trafigura, EMR, Sims Metal, and Pan American Zinc which reinforces reliability and quality in raw material sourcing.

On demand side Pondy Oxides and Chemicals Ltd has built enduring relationships with a wide range of marquee clients across the battery, auto, and industrial sectors. Its clientele includes global giants like Panasonic, Amara Raja, GS Yuasa, Clarios, 3M, and Hyundai, Tata Green Batteries, TVS, and Nilkamal.

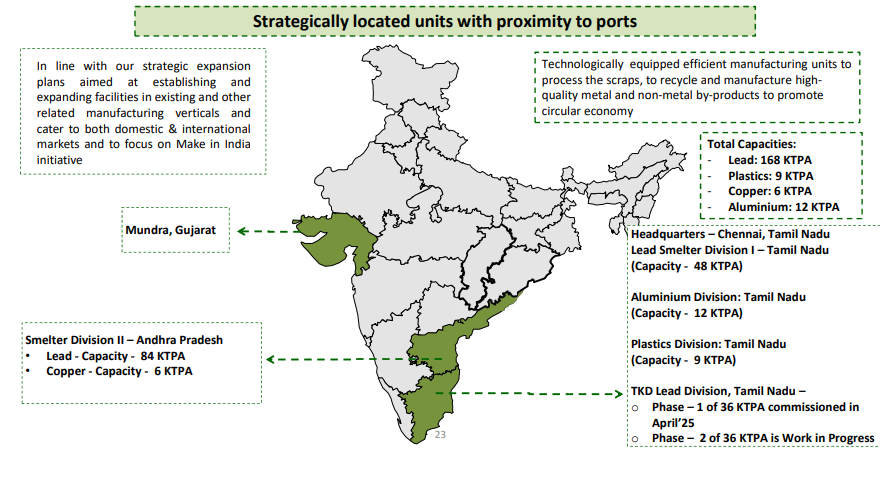

Pondy Oxides and Chemicals Ltd Manufacturing Facilities

Pondy Oxides and Chemicals Ltd’s manufacturing footprint is concentrated in South India with facilities located in Tamil Nadu and Andhra Pradesh. Its core smelting units Lead Smelter Division I (48 KTPA), Aluminium Division (12 KTPA), and Plastics Division (9 KTPA) are all located in Tamil Nadu and are company-owned. The TKD Lead Division (72 KTPA across two phases) is also situated in Tamil Nadu, with Phase 1 already commissioned and Phase 2 underway both Plants are located with proximity to Chennai Port. In Andhra Pradesh, Pondy Oxides and Chemicals Ltd operates Smelter Division II, with 84 KTPA of lead and 6 KTPA of copper capacity which is rented. The Andhra Pradesh plant is located near the Amara Raja plant.

Additionally, Pondy Oxides and Chemicals Ltd has acquired a 123-acre land parcel in Mundra, Gujarat, for future expansion across lead, copper, aluminium, and plastics with its intent to diversify beyond the South and tap into global logistics advantages via port proximity.

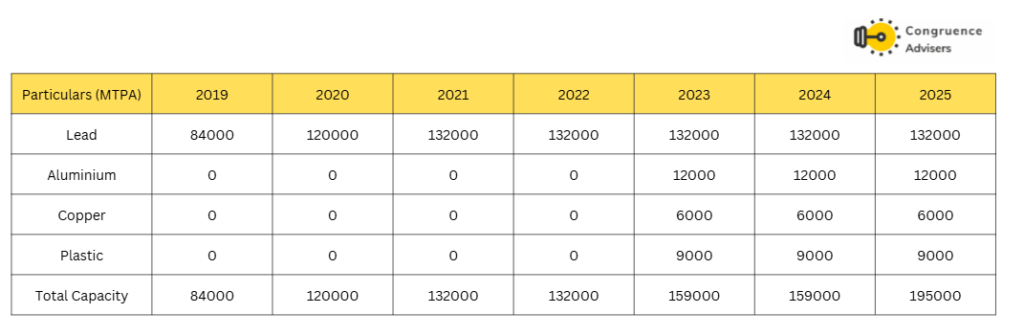

Pondy Oxides and Chemicals Ltd’s total installed capacity has risen sharply from 84,000 MTPA in FY19 to 195,000 MTPA in FY25, driven by multi expansions. Recently 36,000 MTPA lead capacity was added at TKD Phase-1 commissioned in H1FY26 with another 36,000 MTPA set to come online in H2FY26 which will take total lead capacity to 204000 MTPA. In copper, Pondy Oxides and Chemicals Ltd has embarked on a doubling program which will expand from 6,000 to 12,000 MTPA by end-FY26. These expansions lay the groundwork for strong growth over the next few years.

Pondy Oxides and Chemicals Ltd Corporate Governance Analysis.

Board Composition – The Board of Directors of Pondy Oxides and Chemicals Ltd comprises 6 members, out of which 3 are Independent Directors. The Board is chaired by the promoter Mr. Ashish Bansal .

KMP Remuneration – Total remuneration paid to KMP during FY25 was ₹4.97 Cr, representing approximately 7% of Pondy Oxides and Chemicals Ltd’s consolidated PAT .

Related Party Transactions – Other than promoter remuneration, the report includes standard business related transactions (e.g. rent paid to related entities), all of which are disclosed transparently and appear to be conducted at arm’s length .

Contingent Liabilities – Total outstanding contingent liabilities for FY25 were ₹0.92 Cr, which is negligible.

Dividend Policy – Pondy Oxides and Chemicals Ltd has a track record of over 29 years of consistent dividend payments.

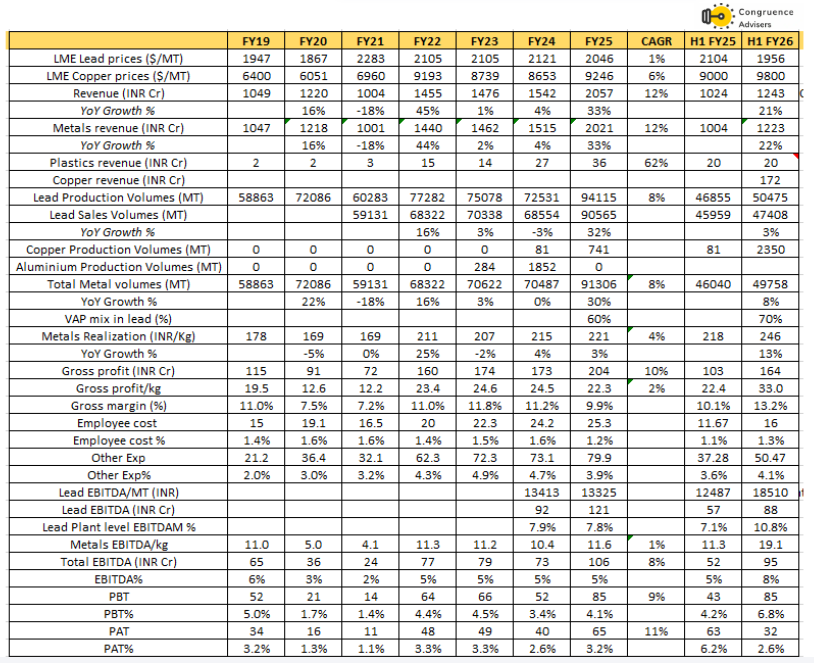

Pondy Oxides and Chemicals Ltd Financial Performance

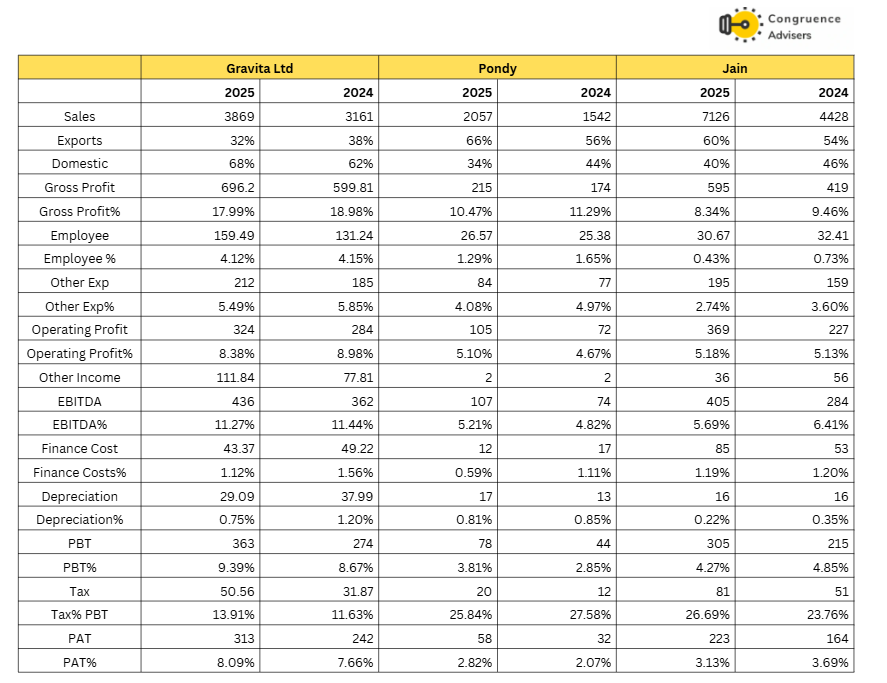

Over the past five years, Pondy Oxides and Chemicals Ltd has shown steady and consistent growth by transforming from a basic lead recycler to a value added diversified player. Revenue has grown at a CAGR of 12%, while EBITDA and PAT have compounded at 14% and 18% respectively led by strong operating leverage and value added products. Interestingly H1FY26 alone delivered ₹1004 Cr in revenue and ₹82 Cr in PAT over 80% of FY25’s net profit. The key driver of this profitability surge is the rising contribution from value-added products, which now make up 70% of the lead mix (up from just 30% in FY19). This shift has led to margin expansion, with lead EBITDA/ton nearly doubling from ₹9,000–10,000 levels pre-FY22 to ₹18,500+ in H1 FY26. Copper, which was negligible until FY24, has also become a meaningful contributor, generating ₹172 Cr in H1 FY26 revenue, with 2,350 MT in volumes and is on track for >₹400 Cr annual run rate.

Despite modest growth in tonnage (8% CAGR), Pondy Oxides and Chemicals Ltd has extracted higher value per ton due to better realizations and product mix. Gross profit per kg has climbed to ₹13.6 in H1 FY26, with gross margins exceeding 11%. Pondy Oxides and Chemicals Ltd has maintained healthy cost discipline which further helped consistent margin delivery.

Pondy Oxides and Chemicals Ltd Comparative Analysis

To understand Pondy Oxides and Chemicals Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Pondy Oxides and Chemicals Ltd to its competitors (peer comparison) on various fundamental parameters and Pondy Oxides and Chemicals Ltd share performance relative to relevant benchmark and sector indices.

Pondy Oxides and Chemicals Ltd Peer Comparison

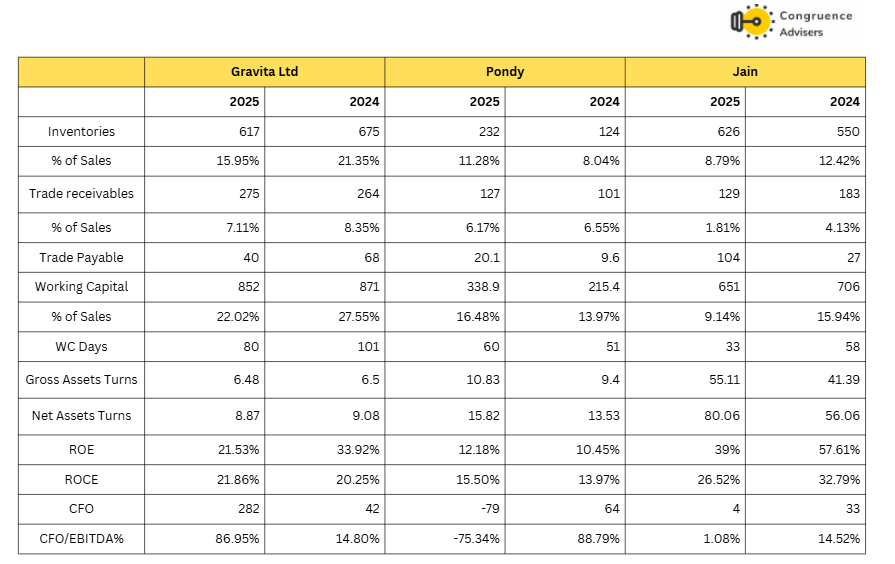

We have compared Pondy Oxides and Chemicals Ltd with domestic listed peers such as Gravita India Ltd and the recently listed Jain Resource Recycling Ltd, both operating in the metal recycling and circular economy space. On a global scale, competitors like Ecobat Technologies, Campine NV, and Korea Zinc operate at very heavy cost structures and have lower profitability, while Indian players benefit from structurally lower operating costs allowing them to maintain leaner operating structures and attractive asset turns. This cost advantage, combined with favorable domestic regulations positions Indian recyclers much more attractive vs global peers.

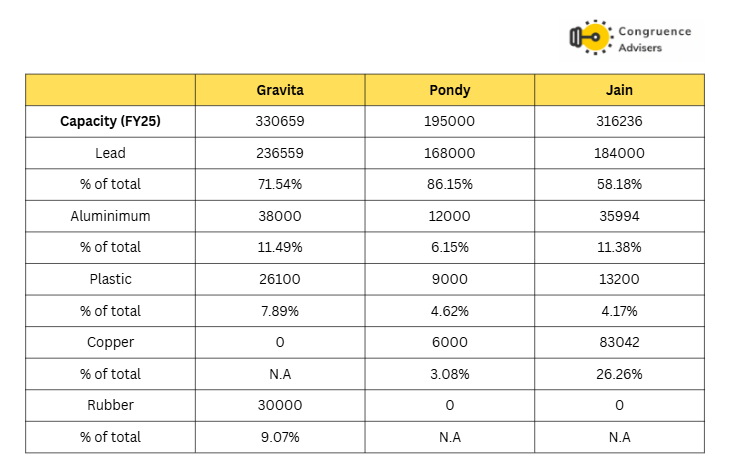

Gravita India Ltd leads in overall scale with the highest installed capacity at over 3.3 lakh MTPA, followed by Jain Resource Recycling Ltd and then Pondy Oxides and Chemicals Ltd. However, in terms of business diversification, Gravita India Ltd and Jain Resource Recycling Ltd are far ahead in the race having established significant capacities across Aluminium, Plastics, and in Jain Resource Recycling Ltd’s case, Copper as well. Pondy Oxides and Chemicals Ltd remains primarily Lead focused with 86% of its capacity tied to this single metal. That said, Pondy Oxides and Chemicals Ltd is actively addressing this concentration by aggressively ramping up its Copper vertical and targeting a 4x capacity expansion by FY27, which will gradually reduce its reliance on Lead and diversify its revenue streams.

Gravita India Ltd is the most profitable of the three with strong margins (EBITDA ~11%, PAT ~8%) as It has a global manufacturing presence (Africa/Central America) with more diversified sourcing, own scrapyards and highest capacity that supports strong profitability While Pondy Oxides and Chemicals Ltd is in a scaling-up phase. While it has lower margins at EBITDA ~5%, PAT ~3% vs Gravita India Ltd. its profitability is improving as it now focuses more on value-added products. It has a strong export share (66%), and rising EBITDA per ton. For H1 they have already surpassed 8%+ EBITDA%. Jain Resource Recycling Ltd is the largest by revenue (~₹7,100 Cr in FY25) but has the lowest margins at EBITDA ~5%, PAT ~3% due to its commodity heavy copper and aluminum business. While it has more scale relatively, profitability is lower and it remains more exposed to price volatility.

Gravita India Ltd has higher working capital intensity compared to peers, primarily due to its global operations and ownership of scrap yards across geographies, which necessitates higher inventory holdings. Gravita India Ltd has relatively lower asset turns due to its global manufacturing setup. While Pondy Oxides and Chemicals Ltd manages a leaner working capital cycle with just 60 days and high asset turns. Jain Resource Recycling Ltd stands out with the highest asset turns likely driven by its diversified portfolio, which are typically high volume and lower-margin segments with quicker working capital cycles. While both Gravita India Ltd and Jain Resource Recycling Ltd deliver robust return ratios. Jain Resource Recycling Ltd’s relatively weak CFO/EBITDA conversion.

We believe Gravita India Ltd is much superior compared to other peers as it enjoys a strategic moat through its global footprint, operating more than 12 plants across Asia, Africa (Senegal, Togo, Ghana), and Central America. This global hedge enables Gravita India Ltd to source scrap from less regulated and cost-efficient regions, particularly in Africa which allows it to secure higher margins due to favorable input costs and localized recycling. In contrast,Pondy Oxides and Chemicals Ltd’s operations are entirely south India centric i.e Tamil Nadu and Andhra Pradesh.

Pondy Oxides and Chemicals Ltd Index Comparison

Pondy Oxides and Chemicals Ltd share performance vs S&P BSE Small Cap Index, as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why You Should Consider Investing in Pondy Oxides and Chemicals Ltd ?

Pondy Oxides and Chemicals Ltd offers some compelling reasons to track closely and to consider investing in India’s recycling ecosystem.

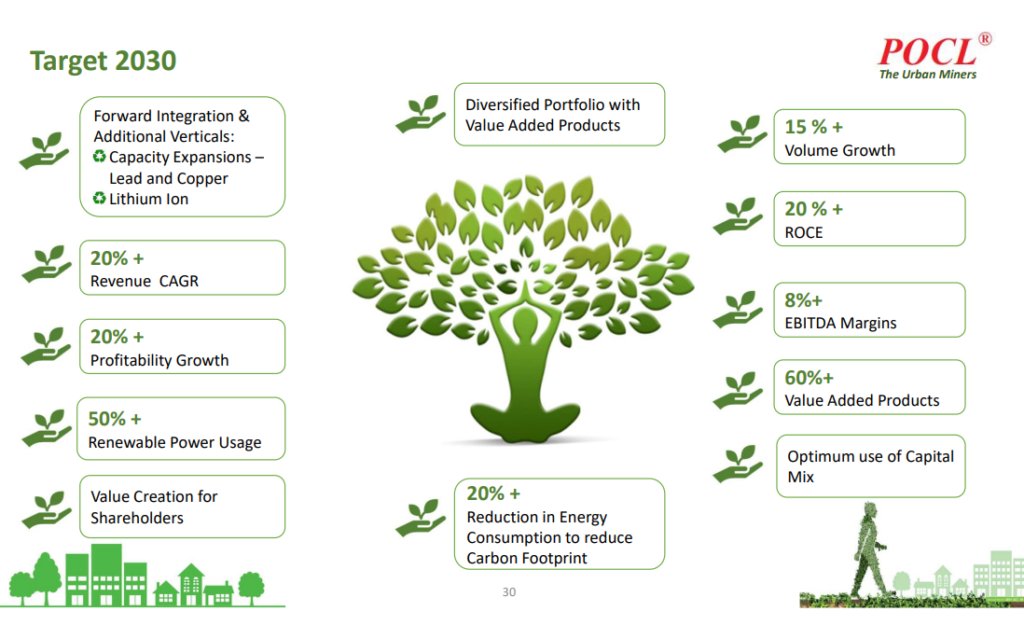

- A Clear Path to High Growth (Target 2030) – Pondy Oxides and Chemicals Ltd’s “Target 2030” roadmap has been laid out by management over the past two fiscal years, which is a comprehensive strategy to transform the company from a single segment recycler into a multi vertical circular economy player. The plan aims for a 20%+ revenue CAGR and 15%+ annual volume growth, while structurally improving profitability with EBITDA margins exceeding 8% and ROCE above 20%. Currently, early execution has exceeded expectations. By H1 FY26, Pondy Oxides and Chemicals Ltd had already breached the 8% EBITDA margin milestone which is well ahead of its medium term targets. The scale-up in Copper, the turnaround in Plastics, and the operating leverage from Phase 1 of the lead expansion at Thervoy Kandigai (TKD) are all compounding margin momentum. The roadmap also aligns well with broader industry tailwinds. With organized recycling expected to grow at a 15-20% CAGR over the next 5-7 years driven by stricter regulation, rising demand for clean input materials, and circularity mandates from OEMs. Even peers like Gravita India are guiding for similar growth numbers which underscore the structural opportunity in this space. Pondy Oxides and Chemicals Ltd’s early traction in delivering on its Target 2030 metrics gives it a credible edge in a rapidly formalizing industry.

- Focusing toward Value Added and High Margin Products – One of the major reasons for Pondy Oxides and Chemicals Ltd’s structural re-rating is its deliberate pivot toward value added products i.e. moving away from commoditized pure metal sales. This pivot particularly within the Lead segment has had a profound impact on margins and customer retention. As of H1 FY26, VAP made up nearly 70% of the segment’s sales mix. These products not only command a premium over base LME-linked pricing but also embed Pondy Oxides and Chemicals Ltd more deeply in OEM supply chains through technical validation cycles that are hard to replicate. The margin impact is already visible. EBITDA per ton surged by 62% YoY to ₹19,970 in Q2 FY26 well above the Pondy Oxides and Chemicals Ltd’s historical average of ₹10,000-12,000. This VAP-led strategy is now being replicated in the Copper segment as well. Pondy Oxides and Chemicals Ltd is moving away from basic scrap to rod conversion and scaling toward copper billets, ingots, foils, and flat products through the installation of advanced electric induction furnaces. These product upgrades are expected to lift EBITDA margins from the current 5-5.5% range to 7-8% over the next 12-18 months. In our view, this value centric approach will strengthen Pondy Oxides and Chemicals Ltd’s competitive moat and position it well for sustained and high value growth.

- Favorable Regulatory Tailwinds – India’s regulatory environment is undergoing a structural shift that significantly favors organized and compliant recyclers. The implementation of the Battery Waste Management Rules (BWMR) mandates that battery manufacturers source a specific percentage of their lead requirement from recycled materials. This not only guarantees consistent demand for companies like Pondy Oxides and Chemicals Ltd but also systematically disadvantages unorganized and non-compliant players (many of whom are unable to meet the environmental and legal standards now required). Complementing this is the Extended Producer Responsibility (EPR) framework, under which Pondy Oxides and Chemicals Ltd, as a registered recycler, generates EPR certificates. These credits can be sold to manufacturers who are unable to meet their mandated recycling targets. Although monetization is still evolving, management expects EPR trading to become a meaningful profit lever, particularly in segments like Plastics and Lead. Additionally, recent tax reforms such as the Reverse Charge Mechanism (RCM) under GST and mandatory TDS on metal scrap transactions are formalizing the domestic scrap supply chain. These policies discourage cash-based operations in the informal sector and drive more scrap toward compliant, traceable channels. Which we believe will further strengthen Pondy Oxides and Chemicals Ltd access to domestic raw materials and improve operating leverage.

- Diversified Business Model Across Customers, Suppliers, and Products – Pondy Oxides and Chemicals Ltd operates a well-diversified model that reduces dependency risks across the value chain. On the customer side, Pondy Oxides and Chemicals Ltd supplies to over 20 countries including marquee Tier-1 battery OEMs in Southeast Asia and Japan, while maintaining domestic partnerships with leading domestic players and Its supplier network is equally broad i.e sourcing non-ferrous scrap from 70+ countries and 270+ partners which ensures raw material security. Product-wise, Pondy Oxides and Chemicals Ltd has expanded beyond Lead into Copper, Plastics with a strategic focus on value-added applications thus it makes the business resilient across geographies, commodities, and end user industries.

- Aggressive Capacity Expansion Across Verticals – Pondy Oxides and Chemicals Ltd is executing a well calibrated capex plan across verticals i.e Lead capacity is being scaled from 132,000 to 204,000 MTPA, with Phase 1 (36,000 MTPA) already commercialized in Q1 FY26. Phase 2 is on track for H2 FY26, strengthening its dominant position in the segment. Copper capacity will rise from 6,000 to 24,000 MTPA by FY27, targeting INR 900-1,000 Cr revenue from value-added copper products. Shift to owned premises at TKD and transition to engineering plastics will drive margin expansion. Revenue target: INR 200-300 Cr in the next few years. Importantly, all new expansion is geared toward VAP that command higher margins and customer stickiness with these expansions either commissioned or already funded. This creates a strong case for good medium term earning visibility.

- Future Optionality – Pondy Oxides and Chemicals Ltd is strategically laying the groundwork for long-term growth beyond its ongoing expansion cycle by creating multiple levers for future value unlocking. The acquisition of 123 acres of industrial land in Mundra, Gujarat which is close to a major port and which positions Pondy Oxides and Chemicals Ltd to build a large-scale integrated facility catering to western India and export markets. Additionally, Pondy Oxides and Chemicals Ltd is actively exploring entry into lithium-ion battery recycling and e-waste recycling which is backed by internal R&D and feasibility studies with a potential commercial foray targeted around FY27. The aluminium segment, currently paused due to margin headwinds and lack of effective hedging is also slated for a structured re-entry. Management is re-evaluating the product mix toward higher-margin, value-added alloys, with the intent to restart operations under a more sustainable and hedged model. Together, these initiatives represent asymmetric upside as none of these are priced into current earnings but could unlock significant value over the medium to long term.

- Strong balance sheet – Pondy Oxides and Chemicals Ltd has recently turned net cash positive with net cash balance of ₹71 Crores as of H1 FY26. Management has indicated that it intends to maintain a similar financial posture going forward. In parallel, the company delivered its best ever half yearly performance, with Revenue up 22%, EBITDA up 83%, and PAT up 98% YoY. Also Pondy Oxides and Chemicals Ltd has a track record of over 29 years of consistent dividend payments

What are the Risks of Investing in Pondy Oxides and Chemicals Ltd ?

Investors need to keep the following risks in mind if they choose to invest into this business. Risks needs to be weighed in combination with the advantages listed above to arrive at a decision that is optimal for your portfolio construct

- Supply Chain and Import Dependency – A significant portion of Pondy Oxides and Chemicals Ltd’s raw material sourcing is import driven which makes its operations inherently sensitive to global supply chain dynamics. As per H1FY26 disclosures, approximately 86% of the Pondy Oxides and Chemicals Ltd’s lead scrap and 100% of its copper scrap were sourced from international markets i.e involving over 270 suppliers across 70+ countries. While this broad supplier base helps in mitigating concentration risk, it simultaneously increases the Pondy Oxides and Chemicals Ltd’s exposure to external disruptions. Geopolitical tensions, such as the Russia-Ukraine conflict or Red Sea disruptions, can impact container availability, extend shipping timelines, and inflate ocean freight costs which ultimately affect procurement efficiency and working capital cycles. While management is proactively working to shift the import mix in favor of more domestic sourcing (targeting a 65:35 Import:Domestic mix for lead in the coming years), the current high reliance on global sourcing remains a key operational risk that investors should closely monitor.

- Competitive and Market Risks – Pondy Oxides and Chemicals Ltd operates in a dynamic market where customer behavior and regulatory enforcement can materially influence its competitive positioning. One emerging risk is the backward integration by large OEM clients (Amara Raja), which is in the process of establishing its own captive lead recycling capacity. While Pondy Oxides and Chemicals Ltd management has clarified that such moves are aimed at processing internal scrap and will not significantly affect 3rd party alloy procurement in the near term, this trend signals a potential structural shift. If more OEMs follow suit, Pondy Oxides and Chemicals Ltd may face pressure on future volumes. Additionally, the persistent presence of the unorganized sector poses a challenge, particularly in the domestic scrap procurement ecosystem. Despite regulatory advancements like the Battery Waste Management Rules (BWMR) and Extended Producer Responsibility (EPR), enforcement remains patchy in some regions. Unregistered recyclers often operate with lower compliance and environmental costs which enable them to offer higher prices for scrap.

- Execution Risk – Pondy Oxides and Chemicals Ltd’s ongoing transformation under its Target 2030 vision involves large-scale capital expenditure across its Lead, Copper, and Plastics businesses, with a strong emphasis on value added products. While this expansion positions Pondy Oxides and Chemicals Ltd for long-term growth and margin improvement, it also introduces execution risks that investors must monitor. New verticals especially Plastics and Aluminium have historically gone through extended gestation periods. For example, the Plastics segment was EBITDA+ but incurred EBIT losses in its early stages due to high rental costs at its leased facility. Only after shifting operations to its owned Thervoykandigai (TKD) premises did it begin to approach breakeven. Similarly, the Aluminium division faced structural headwinds due to lack of effective hedging and commoditized margins which led to a strategic pause in operations. These cases highlight the risks of new vertical ramp-ups dragging on profitability until operational scale is achieved. Pondy Oxides and Chemicals Ltd has been in the middle of few capex projects including critical projects such as the Phase-2 Lead expansion and Phase-1/2 Copper scaling. Any execution delays whether due to regulatory bottlenecks, equipment installation, or labor/resource constraints could impact growth and impact operating leverage and affect medium-term growth projections. While management has demonstrated strong project discipline in Phase-1 lead commissioning, the continued execution agility will be essential as the Pondy Oxides and Chemicals Ltd juggles multiple large projects simultaneously.

- Regulatory and Policy Risks – Pondy Oxides and Chemicals Ltd’s business model is closely linked with government regulations, which presents both opportunities and vulnerabilities. One key area of uncertainty is the monetization of Extended Producer Responsibility (EPR) credits. While Pondy Oxides and Chemicals Ltd is a registered recycler and well-positioned to benefit from EPR frameworks, the commercial trading of these credits remains in a nascent stage. The absence of a fully developed pricing mechanism and secondary market means that the timing, volume, and margins from EPR monetization are still unpredictable. In addition, Pondy Oxides and Chemicals Ltd’s core business especially in lead recycling involves the handling of hazardous materials, placing it under stringent environmental scrutiny. Any lapses in compliance or tightening of norms could result in operational interruptions, penalties, or increased compliance costs. While Pondy Oxides and Chemicals Ltd emphasizes its proactive investments in pollution control systems and zero-emission technologies, regulatory risk remains an ever-present factor in the recycling industry, particularly as sustainability standards continue to evolve globally.

- Commodity Price and Operational Cost Volatility – While Pondy Oxides and Chemicals Ltd actively hedges its primary raw materials such as lead and copper against international benchmarks like the LME, certain operational costs remain inherently unhedged. These include smelting, refining, and utility expenses (power and furnace oil), which are subject to fluctuations based on regional energy prices and broader macroeconomic factors. Although Pondy Oxides and Chemicals Ltd’s pricing model allows for partial pass-through of these costs, any sudden spikes may temporarily compress margins. Additionally, in the Aluminium segment, Pondy Oxides and Chemicals Ltd previously faced challenges due to the absence of an effective exchange based hedging mechanism for secondary alloys like ADC12. This lack of protection contributed to margin pressures and ultimately led Pondy Oxides and Chemicals Ltd to pause operations in that vertical to reassess its product strategy. On the currency front, while Pondy Oxides and Chemicals Ltd is exposed to forex fluctuations due to its import-heavy procurement model (especially for copper and lead scrap), its significant export revenue base provides a natural hedge. This balanced exposure helps mitigate currency risk over the medium term.

Pondy Oxides and Chemicals Ltd Future Outlook ?

Pondy Oxides and Chemicals Ltd has entered FY26 with strong momentum, reporting a 22% year-on-year revenue growth in H1 and a significant improvement in margins. Most importantly, Pondy Oxides and Chemicals Ltd crossed the 8% consolidated EBITDA margin threshold much ahead of its 2030 vision.:

Lead Recycling – Lead remains Pondy Oxides and Chemicals Ltd’s major segment, contributing the majority of volumes and profits. Pondy Oxides and Chemicals Ltd is undergoing a two-phase expansion of its Thervoy Kandigai (TKD) smelter to add 72,000 tonnes per annum (tpa) capacity. Phase-1 (36 ktpa) started in Q1 FY26 and is ramping up steadily, with Phase-2 set to commission in H2 FY26. Once both phases are operational, total lead capacity could exceed 168 ktpa by FY27 and it will potentially double revenue from the segment. Value addition is also improving: ~70% of current lead sales are now specialty alloys, up from ~50% a year ago. This shift has driven a sharp margin expansion, with lead EBITDA/tonne rising 48% YoY to ₹19,970 in Q2 FY26. Management expects to maintain high single-digit margins even as newer capacity dilutes mix initially.

Given India’s high recycling efficiency in lead (with ~85% recycled content as of FY24), the bulk of this incremental demand is expected to be met through organized secondary recycling. Which further reinforces the importance of players like Pondy Oxides and Chemicals Ltd who bring scale, compliance and technology to the sector and the segment offers high visibility on earnings growth for FY26 and FY27.

Copper Recycling – Copper, a relatively new business for Pondy Oxides and Chemicals Ltd, is being aggressively scaled. Capacity is being doubled from 6 ktpa to 12 ktpa by FY26 end, and FY26 copper revenue is already tracking toward ₹400 Cr. The long-term ambition is for copper to potentially overtake lead in revenue given global demand and product diversification. Currently, copper margins are modest (~3-4%) as Pondy Oxides and Chemicals Ltd is only doing basic smelting. However, Pondy Oxides and Chemicals Ltd plans to move into value-added copper compounds and alloys, which should meaningfully lift margins over the next 12-18 months. Once integration is complete, copper is expected to be a significant growth and profitability lever in the overall portfolio.

Plastics Recycling – The plastics business, though small (~9 ktpa capacity), has been a drag on margins due to operating from a leased facility and lower volumes. Pondy Oxides and Chemicals Ltd is shifting this division to its own TKD site, which should reduce fixed overheads and enable the launch of ABS compounding and engineering plastics. Management expects breakeven in H2 FY26 and margin recovery starting FY27. While plastics may remain a smaller contributor, successful restructuring will help improve overall ROCE and reduce segmental losses.

New Recycling Verticals (Lithium-Ion and Aluminium) – Pondy Oxides and Chemicals Ltd is actively building optionality in future-facing segments

- Lithium-Ion Recycling: Pondy Oxides and Chemicals Ltd has taken a strategic stake in an R&D venture (ACE Green) to build expertise, with commercial operations expected around FY27-28.

- Aluminium Recycling: After pausing operations earlier, Pondy Oxides and Chemicals Ltd is re-entering this space through a planned 12 ktpa facility at its Mundra plant. This site will also house expanded capacities for copper, plastics, and lead. Aluminium could add 4-5% to revenue over time with commissioning expected after FY27.

Pondy Oxides and Chemicals Ltd, though listed for several years, has only recently begun to see meaningful recognition from the market. Which we believe is driven primarily by its sharp operational and financial turnaround in the last two quarters i.e Pondy Oxides and Chemicals Ltd’s ability to scale while delivering 8%+ EBITDA margins well ahead of its 2030 vision and along with The Battery Waste Management Rules (BWMR) and sector formalization are acting as long term structural tailwinds

Interestingly amid a weak broader market environment Pondy Oxides and Chemicals Ltd’s stock price has remained very strong and consistently sustaining above the ₹1400 level which is a clear indication that investors are beginning to price in not just the recent performance but also the likelihood of its sustainability. While we believe a first leg of valuation rerating has already played out and the ability of Pondy Oxides and Chemicals Ltd to deliver the continued consistency in margin delivery and capital efficiency makes it a credible medium-term compounder and its well on track to meet its Target 2030.

Pondy Oxides and Chemicals Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Pondy Oxides and Chemicals Ltd Price charts

The weekly chart indicates that a structural uptrend is intact in the stock in spite of the current broader market weakness. The stock has shown the tendency to see a sudden spurt only to be followed by a long consolidation twice in the past three years. We believe that this has to do with the market’s perception of low value addition, this perception has been changing in recent times with the announced diversification of the business into multiple verticals. The stock saw a steep run up from June 2024 to Sep 2024, the interim low since then was made in April 2025 during the first tariff tantrum. Our overall takeaway is that the market is giving credence to the structural nature of the story, this reflects in the price surpassing the previous peak of Sep 2024 while the broader market small cap stock has seen a ~30% fall since then. The strong H1 FY26 results have an obvious role to play in this changed perception where gross margin has surprised positively.

The day chart indicates that the horizontal level of 1200-1220 is critical for the stock since this level was crossed after a long consolidation of more than a year. The stock has taken a minor beating over the past week or so but continues to hover close to the 50 DMA even after the correction, something many large cap stocks have failed to do in recent times.

Q3 FY26 earnings are important to keep the short term buoyancy intact in this counter. Until the numbers are clear, we believe that this is one of the stronger small cap counters in the face of the broader market carnage we have seen since Sep 2024.

Pondy Oxides and Chemicals Ltd Latest Latest Result, News and Updates

Pondy Oxides and Chemicals Ltd Quarterly Results

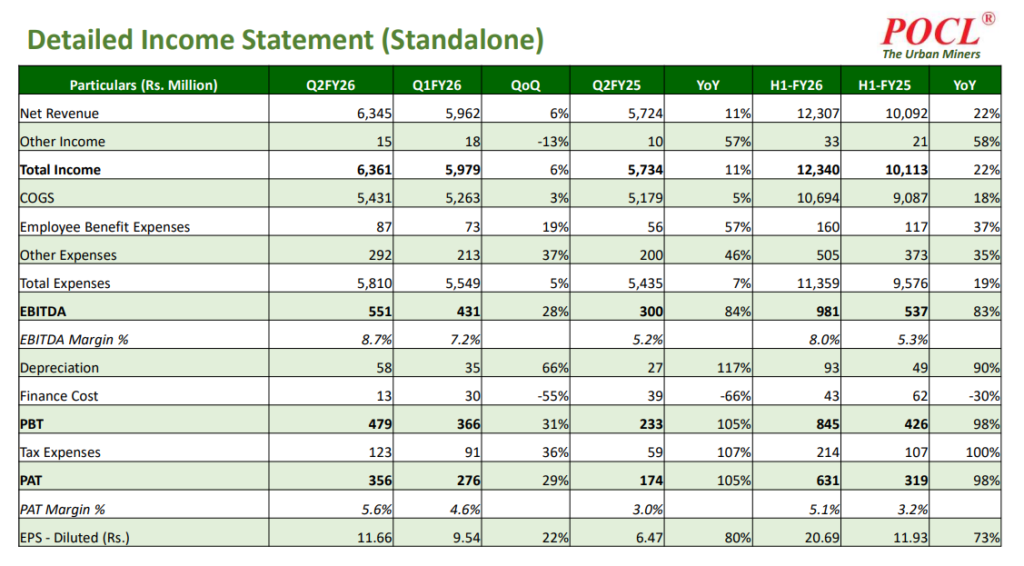

In Q2 FY26, Pondy Oxides and Chemicals Ltd reported a strong set of numbers with revenue of ₹634.5 Cr (up 11% YoY, 6% QoQ) and has delivered a sharp margin expansion over the last two quarters with EBITDA margins improving from 5.2% in Q2 FY25 to 7.2% in Q1 FY26 and further to 8.7% in Q2 FY26. This margin uplift is driven by structural shifts across business segments: the Lead division benefited from a higher share of alloys (~70%) and scale ramp-up at the new TKD plant; Copper saw operating leverage from higher volumes and initial value-added production; and the Plastics business moved closer to EBIT breakeven as administrative costs declined. Additionally, finance costs dropped 66% YoY as the Pondy Oxides and Chemicals Ltd utilized internal accruals and QIP funds efficiently to reduce debt and fund capex.

The management, in its Q2 FY26 concall, emphasized that this margin trajectory is sustainable, backed by structural business pivots rather than commodity tailwinds.