Disruption – Thinking Deeper

Disruption – Radical change to an existing industry or market due to technological innovation

The key words here are “radical change” and “technological innovation”.

In the first decade of this millennium, disruption was spoken of only in certain technology circles. Starting with 2010, it has become a buzzword that almost every investor considers while evaluating prospective investments. The rise of the data economy has more or less cemented the “threat of disruption” as one of the more important risk factors to be evaluated while evaluating the quality of a business.

In the context of Indian investing, the rise of the new age businesses only commenced in the latter part of the 2001-2010 decade. We did not really have great data infrastructure till the beginning of the next decade, once that took off, so did the adoption of these new age businesses.

Make no mistake, the threat of disruption is real. But is the threat equally potent across industries or are there some industries that are more susceptible to disruption?

In this note, we look at a couple of industries to see if/how disruption has affected them. The objective is to consider a few examples and use them to see if one can abstract learnings at a higher level and make them generic enough to use in the business analysis framework.

Example 1 – The Retail Equity Broking Industry

https://forum.valuepickr.com/t/financialisation-tsunami-expected-in-amc-insurance/4753/34 (rather than replicate that entire post here which by itself will take up 2-3 pages)

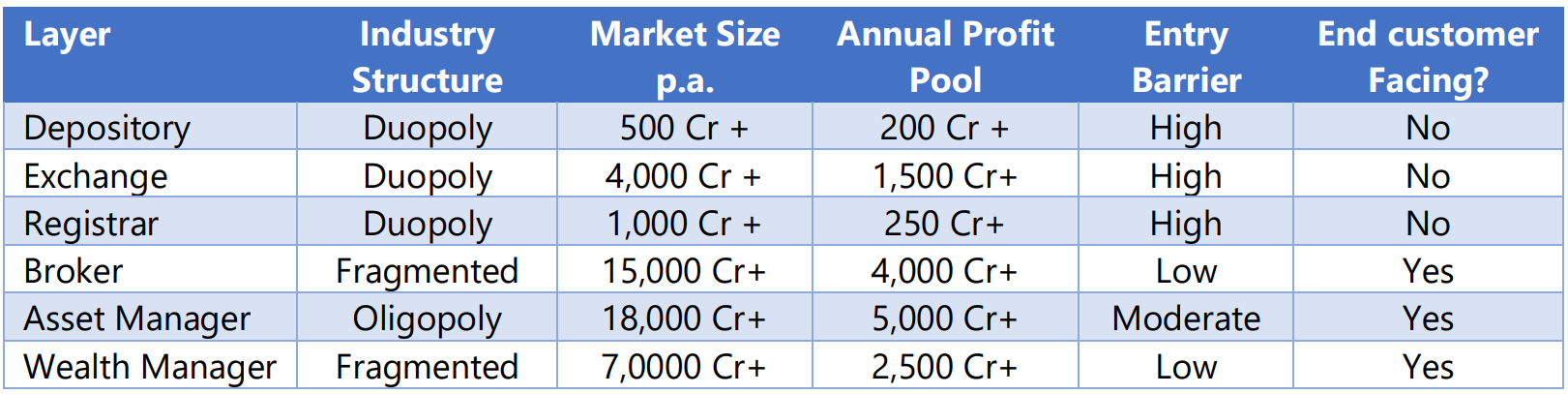

Let us make some notes about the characteristics of each of the layers in the value chain

Which is the layer that has gotten disrupted? Broking

Which is the layer that is likely to get disrupted next? Wealth Manager

Reasons – Large enough profit pool, low entry barriers, customer facing segment, presence of homogeneous customer segments that can be targeted with better technology & lower price. More importantly, the value addition by these segments was debatable.

Note that Depositories, exchanges and registrars are the layers that assure transaction integrity and reliability in exchange for a nominal fee per transaction. This combined with the fact that the profit pool is lower, there is just no incentive for a new entrant to try and disrupt the status quo.

As for wealth managers and asset managers, the thought process is already articulated in my detailed note on Asset Management & Wealth Management. Reproducing the relevant slides on disruption from that note for easy reference

Disruption - How & Who first?

- Pivot to a new philosophy of investing (Also trading, Hybrid approach etc) – this needs to build critical mass in HNI+ before it gets democratized to retail category

- Efficient/cheaper ways of getting the same return (Indexing, ETF) – this will take off once the alpha generation tapers down. For this point above need to take of first and then fail over a cycle so that people see the value of low cost indexing!

- Operationally easier model of investing – this target areas where value addition is minimal and technology can help save costs and ensure better discipline.

Who? Asset allocators masquerading as knowledgeable people get taken out first by technology advisory platforms. If 20% to large cap equity, 30% to mid and small cap equity and 50% to fixed income is all there is to investment advice, technology can do it far better in the long run

When? 5+ years time frame

Technology engine becomes the advisory layer that not only monitors but also executes transactions, customer acquisition too will be dominated by technology. Super HNI will still work with Wealth managers but for structured solutions & Estate planning while the investment advisory piece will get commoditized for much lower fees

Impending Disruption - Summary & key insights

Technology driven disruption tends to first target the mass market with low hanging fruits where you have a large homogenous customer segment

PayTM money, ET Money, Flipkart, Groww, Scripbox are all investing to capture mass & affluant segment

Ease of investing & Participating in a growing market are the early themes that will play out

Reducing expenses & Better way of investing will only follow at a later point of time

Within the same overall industry, we have some segments that are getting disrupted while there are some others that are unlikely to get disrupted any time soon.

Thinking in terms of industries or sectors may not be the right construct in the context of disruption, one always needs to look deeper and identify segments which are more prone to getting disrupted

Example 2 – Innerwear Industry

Change in colour – No

Change in material – Minimal

The notable change that has happened is that the industry has shifted towards the organized segment. Innerwear has now become a lifestyle decision and not just a utilitarian decision. At most, the channel through which customers buy might change over the next decade but there is not going to be much of technology led change in the industry. This is a characteristic of the industry itself and rubs off onto the industry players.

As long as an incumbent ensures presence across channels and manages to build a respectable brand, the risk of the business model getting disrupted is not high in this industry.

Food for thought

Now ask yourself why does Page Industries (market leader in innerwear) command a PE multiple of 55+ while ICICI Direct (one of the leaders in equity broking) trades at less than half that multiple?

There is always a method to the madness, valuation multiples always reflect the longevity profile of the particular industry/business. Higher the longevity, more the willingness of investors to accord a higher terminal value for the business. All other things (market position, growth, capital efficiency) remaining the same, a higher longevity means a higher valuation multiple and vice versa.

Pick any business in India that trades at earnings multiple higher than 55 today, chances are that the longevity profile of that business is equally impressive.

I am not in the business of content generation, neither am I a strategy consultant who has an incentive to write 20-page case studies covering multiple industries. The primary objective of whatever content I produce is to enhance the business analysis framework that I have and to make it more comprehensive over time. My objective (and I guess of anyone reading this) is to become a better investor, for this reason inferences matter more than the details of each specific case.

One can consider more industries to see what the impact and source of disruption has been. I would accord more importance to identifying some common trends that can help evaluate the risk of disruption when one gets down to analysing individual businesses.

With this context in mind, one can make the following observations

- There needs to be a good enough incentive for someone to make the effort of disrupting the status quo. You will rarely see a 500 Cr annual market get disrupted, the juice has to be worth the squeeze. No sensible investor will help fund disruption when the addressable market size and the profit pool aren’t large enough to justify the effort involved.

- Information based economies/business models are more likely to get disrupted than are brick and mortar-driven businesses. This is obvious to anyone who observes the world closely. The risk of rapid technology obsolescence is highest in information-based economies. An information economy business that gets disrupted dies out in a few years’ time. Network effect-based businesses are tough to disrupt but once disrupted, they rarely survive.

- It is much easier to acquire market share through freebies and discounts in industries where the decision making is completely in the hands of the end consumer. It is not as easy to acquire market share where influencers are present (like advisors, contractors, carpenters etc) and there is a substantial installation/service component to the product. A standalone plug and play product is more likely to get disrupted than a product that has dependencies.

- Emergence of concentrated buying centres is a serious threat that can eventually disrupt indirectly. For all the noise that e-commerce players have made in India, they just offered a more convenient way of buying existing goods and services initially. But once they owned a captive customer base and the distribution network, they launched private labels which can eat into the profit pool of the incumbent brands. If not anything else, the power balance between the brand and the channel partner has been changing. Malls did the same to brands before the e-commerce hit the street.

- The most dangerous kind of disruption (from the point of view of an incumbent) is when the disruptor has a radically different cost structure compared to the incumbent. Once the market tips, the incumbent just cannot compete with the newer model unless they adopt the same model; this is easier said than done. The wealth management industry, especially at the retail and emerging affluent segments is at a serious threat of disruption from robo advisers over the next few years for this very reason. The cost to income ratio for a robo adviser beyond a threshold scale can keep falling for decades. Once they have enough organic cash flows to fund their customer acquisition cost, it is game over for the traditional model.

- Emergence of concentrated buying centres is a serious threat that can eventually disrupt indirectly. For all the noise that e-commerce players have made in India, they just offered a more convenient way of buying existing goods and services initially. But once they owned a captive customer base and the distribution network, they launched private labels which can eat into the profit pool of the incumbent brands. If not anything else, the power balance between the brand and the channel partner has been changing. Malls did the same to brands before the e-commerce hit the street.

True disruption is one that incumbents struggle to cope with even if they have good managers. A lala company losing the race to a contemporary company is not disruption, it is more likely a case of lazy/bad management.

Of all the combinations, a network effect prone business model that gets disrupted is most likely to be a disaster for the incumbent. See what Facebook did to other budding social networks like Orkut.

What Zerodha did to incumbent equity brokers in India is commendable but not mortally wounding, incumbent brokers are still growing profitably and are able to adapt. They are also able to wean business away from the smaller brokers and are trying to pivot into digital financial marts going forward. If you have an incumbent customer base that has lakhs of rupees in demat with you, why not sell them loans and other products in exchange for a fee at minimal incremental balance sheet risk? You have some new age businesses who are paying astronomical customer acquisition costs to build a base of affluent Indians while those who have ready access to them have been twiddling their thumbs for a while.

While Amazon is obviously the rage all around, Walmart is very much around and competing. They have been wounded no doubt but they aren’t dead by any means yet, contrary to what some were saying in 2015. One can’t say the same about the marginal players in the industry though.

The threat of disruption is real but it can sometimes be over rated and over hyped. Some industries and segments are prone to disruption while some others rarely get disrupted. The ability to make this distinction and to identify the reasons for the same is an important skill in business analysis and valuation.

Marginal players dying out is part of the capitalism cycle, but when the incumbent market leader starts looking irrelevant in a short span of time, that is true disruption.

A careful look at the unit economics of the incumbent and disruptor should be able to reveal the game that is going on. Unless a disruptor starts changing the unit economics of the incumbent for the worse, it rarely causes mortal wounds.

It eventually comes down to industry structure, entry barriers, profit pools and unit economics. The best VC’s never get carried away by technology that looks good and sounds swanky unless that solves a real customer problem and can address a large market. They start by estimating the size of the pond and then get down to evaluating how well the team can execute in scaling the business, once the concept gets proven.

Disruption by itself does not mean anything unless one can see the $ it can bring in as a result.

Disclaimer

The document expresses some views on specific business to better illustrate certain concepts. This does not constitute either investment advice or a recommendation to BUY/SELL/HOLD any of the businesses being discussed.

The purpose of this publication is not to express views on the valuation of the business or the sector being discussed. Most of the content here is an exercise in inferential reasoning and the mental models involved in thinking about businesses in general. Effective learning calls for specific examples to drive home the core concepts and that, precisely, is the endeavour here.

While utmost care has been exercised in preparing this document, www.congruenceadvisers.com does not warrant the completeness or accuracy of the information contained and disclaims all liabilities, losses damages arising out of the use of this information. Some statements and opinions contained in the document may include future expectations and forward-looking statements that are based on current views and involve assumptions and other risks which may cause actual results to be materially different from the views/expectations expressed. Readers shall be fully responsible for any decision taken based on this document.

We sincerely suggest that you view this as a learning exercise and nothing more. Please consult a qualified and registered investment professional before taking any investment decision.