Why entry valuation should matter to most investors and most businesses

A popular narrative today is that entry valuation does not matter if you buy a proven high-quality business and are willing to hold the stock for 10 years or higher.

The question is how many investors can execute on this well? Let us ask a few basic questions and see how the answers stack up.

How many proven high-quality businesses exist in India where you can take a 10-year view?

Maybe thirty at best. A behemoth like Reliance Industries did not make the cut till 3 years ago.

How many investors have the ability to recognize a high-quality business for what it is?

Not many, else investing wouldn’t just be simple but would also be easy.

How many investors can hold stocks for 10 years and more?

Very few if you actually take the time to go through hundreds of broking account statements, as I have.

For those who don’t fall into this bucket (holding a proven high-quality business for 10 years and higher), entry valuation matters a lot. Much more than we think it does.

This note looks at the stock price and valuation history of a few consumer businesses that are widely acknowledged to be good or promising businesses today. We will see that if one had bought these at the higher end of the valuation range, the return would have suffered for years together though the earnings kept growing. The reason we’ve chosen businesses from the consumer sector is that they have low cyclicality and secular growth prospects. If entry valuation matters in such businesses, it should matter even more for other businesses.

The trick is to track the valuation at which one buys and not just the stock price at which one buys

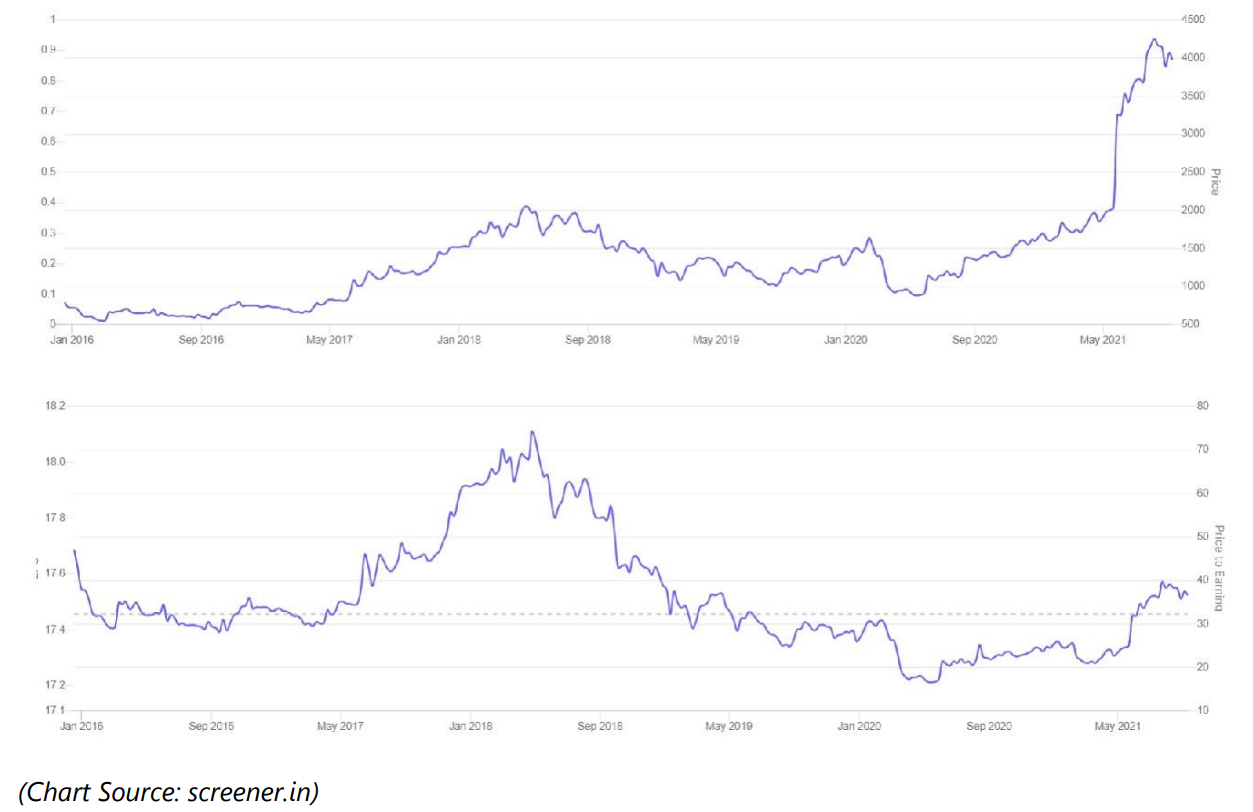

Exhibit 1 - Lux Industries

Let us see the stock price and PE multiple charts, shall we?

If you had bought this once the trailing PE multiple crossed 30 in May 2017, you would have bought a business that generated PAT of 60 Cr in FY2017. It took almost 3 years for the stock price to come back to the same level but the more interesting chart here is the second one. The stock still hasn’t come back to the PE multiple range it was trading at from May 2017 till Sep 2018.

Between FY17 and FY19 the PAT for the business went up from 60 Cr to 101 Cr, that is a 66% increase in earnings but this was accompanied by a near stagnant stock price during the period.

Eventually the stock did make money for investors. However, by being a bit prudent with entry valuation investors could have made better returns from the same stock. This isn’t market timing (which is difficult to do), this is more of choosing what valuation range to buy the business at.

Why buy a business at 45 PE when you can see that it is trading at the higher end of its historical valuation range?

Exhibit 2 - Page Industries

I don’t think there is much of a debate that this is one of the better businesses in India. It still remains the best managed business within the innerwear segment, if anything Lux Industries is still some distance away in terms of business quality.

Once again, we should see the stock price chart in combination with the PE multiple chart.

For FY17 the PAT was 266 Cr

For FY19 the PAT was 394 Cr

Observe the stock price trend though there was very good growth in earnings. The reason for this underperformance was that valuation much higher than was warranted for the business even after accounting for the quality and growth visibility. The stock price is yet to get past its 2018 high, the current high PE is an anomaly due to the COVID situation that should correct itself in a couple ofquarters.

You can always shove the Asian Paints stock chart in my face as a counterpoint to this. However, the odd exception to a rule does not make the rule irrelevant.

All principles have to be seen on a balance of probabilities. If something works more than 60% of the time, it is a very useful rule to follow.

Exhibit 3 - Britannia Industries

FY18 PAT was 1,004 Cr

FY21 PAT was 1,864 Cr

I don’t think anyone will have a problem with the earnings growth the business has shown over this period.

How has the story panned out for investors who bought at elevated valuation in 2018? Here we go.

A few counter points can be made here as well.

“Let us wait and watch how this does 5 years now, this will surely make you eat humble pie”

“Investors haven’t lost money here in spite of buying at high valuation, at least this hasn’t been a DHFL”

Why can’t we accept the simple data backed thesis that when you buy at elevated valuation (compared to historical averages over the past 5 years), the return expectation should be lower than the historical average?

Why buy something at 60 PE when the 5-year average tells you that the business does trade at 40 PE sometimes? Following this simple rule would have netted you an incremental 30% return in Marico Ltd over the past 18 months

Why come up with intellectual reasons to rationalize your inability to be choosy about the entry valuation?

Why be at the market’s mercy rather than strive to improve the probability of your own success by displaying a higher amount of emotional control?

Why can’t one be a good long-term investor who is also choosy about entry valuation? It is not an either-or scenario here

I can foresee a few more debates coming up.

“PE multiple is a superficial measure, what really matters is the rate at which free cash flow grows for a business”

I agree, I am big fan of doing a reverse DCF to decipher the expectations baked into stock prices for free cash flow businesses. But if most of the market tracks PE, does that not make it a relevant measure in a Keynesian beauty contest like investing? A tad too simple maybe; but surely not irrelevant. It does have its uses.

What the “PE doesn’t matter” line of thinking fails to take into account is that looking at a stock price chart with the benefit of hindsight is different from experiencing price stagnation real time.

The ITC stock price trend has become a meme today.

I know some “long term” investors who cashed out of Britannia and Page Industries between 2018 and 2020. These were the very same folks who had invested into these stocks fooling themselves that they planned to hold for 10 years.

This year I have hit the 10-year holding mark for some businesses. While the journey does look fruitful when I look back, what transpired in real time for some of the stocks was this –

- Cera Sanitaryware made a peak of 2,700 in May 2015 and then fell to 1,600 over the next 12 months though PAT went from 101 Cr in FY15 to 130 Cr in FY16. PE multiple fell from 54 to 28 during this period.

- Kajaria Ceramics peaked out at 700+ in 2017 and then fell 50% over the next 8 months. The PE multiple fell from 50 to 26 in this period.

- APL Apollo fell from 2,400 in Jan 2018 to 1,200 by the mid of 2019. PE multiple went from 36 to 21 during this time accompanied by a stagnation in PAT for 4-5 Quarters. For the record I added to my existing position when this happened, not when the TTM PE was above 30.

Almost every single error of commission I made over the past 5-6 years came down to paying a valuation higher than warranted for the specific business after accounting for the business quality. A few businesses (Asian Paints, Pidilite etc) might always keep me waiting for a reasonable valuation but those are the exceptions to the rule. There is nothing set in stone that says you HAVE to invest into these exceptions. So long as your portfolio delivers 20% p.a. should you really care if you hold Asian Paints or not?

You should not ignore a rule that works because of a few exceptions to the rule.

Investors who invest based on probabilities instead of possibilities have a higher chance of good outcomes over the long run.

The only buy and hold investors who should completely ignore this note are those whose existential fear is errors of omission. These folks are usually hell bent on buying only the best businesses for whatever reasons they have. If you have already concluded that is the best style for you and you can actually hold stocks for a long time, this note shouldn’t affect you too much.

For all of the others, entry valuation should matter a lot.

Disclaimer

The document expresses some views on specific business to better illustrate certain concepts. This does not constitute either investment advice or a recommendation to BUY/SELL/HOLD any of the businesses being discussed.

The purpose of this publication is not to express views on the valuation of the business or the sector being discussed. Most of the content here is an exercise in inferential reasoning and the mental models involved in thinking about businesses in general. Effective learning calls for specific examples to drive home the core concepts and that, precisely, is the endeavour here.

While utmost care has been exercised in preparing this document, www.congruenceadvisers.com does not warrant

the completeness or accuracy of the information contained and disclaims all liabilities, losses damages arising out of the use of this information. Some statements and opinions contained in the document may include future expectations and forward-looking statements that are based on current views and involve assumptions and other risks which may cause actual results to be materially different from the views/expectations expressed. Readers shall be fully responsible for any decision taken based on this document.

We sincerely suggest that you view this as a learning exercise and nothing more. Please consult a qualified and registered investment professional before taking any investment decision.