Is IPO good or bad – My dislike explained

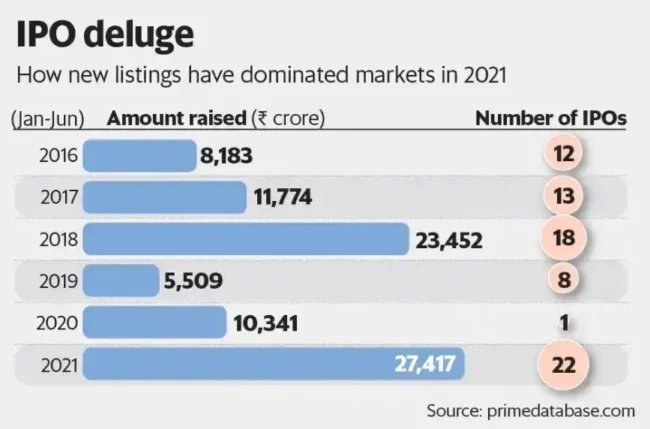

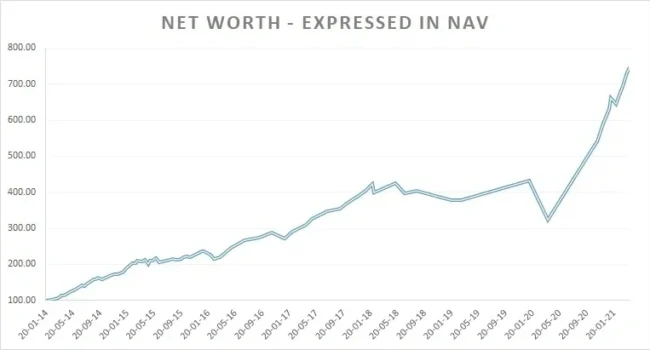

Investment bankers focusing on public markets have their swagger back after a hiatus of three years. They have an important role to play in the capital markets ecosystem, they are the folks who facilitate liquidity events for corporate India. Those who provide risk capital (PE, VC, other investors) to entrepreneurs when they need it the…