Leave the swinging deliveries outside the off stump and duck the bouncers

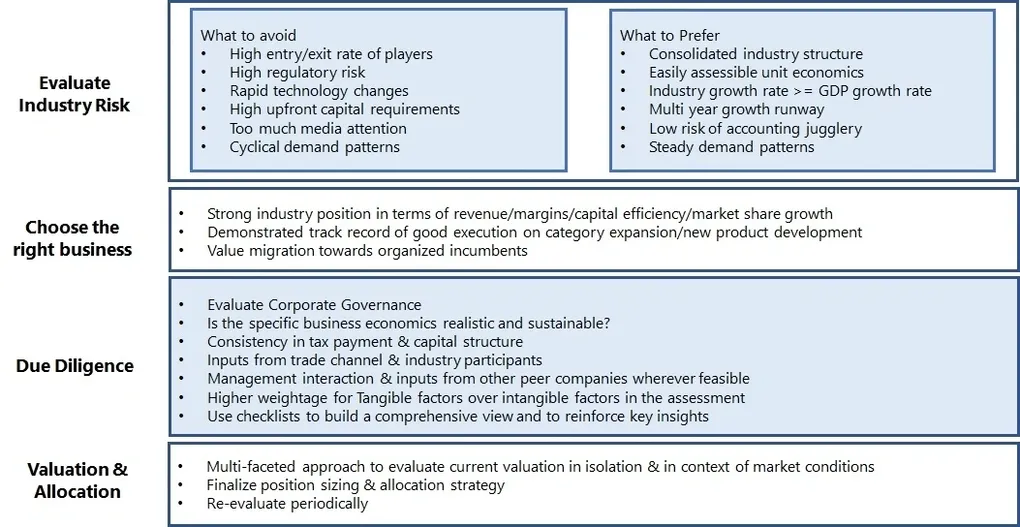

As a rule, define the kind of businesses you will consider and the kind you will not consider. Without a clearly defined rejection process in place, investors run the risk of being all over the place. Use principles of reduction to eliminate most avoidable mistakes

Obsessively focus on the fundamentals

The process works because it starts from first principles and not with questions like

- “What is the capital efficiency?”

- “What is the earnings growth rate”?

The process instead answers why the growth rate and capital efficiency are what they are and for what possible reasons they might change going forward. Fundamentals reveal the method behind the madness

Understand the nuances of the game

Making money in the market comes down to the following sequence more often that not

- Having a view that differs from the prevalent market consensus on a business

- Your view turning out to be the correct one

- The market eventually coming around to your view and pricing the business likewise

Rinse and repeat with a good strike rate (> 70%) over a long period of time

Play the asymmetric odds

What also matters is how much money you make when you are right and how much do you lose when you are wrong. This asymmetry in outcomes is a very important aspect of compounding wealth.

Do not underestimate behavioral aspects

The process is incremental, iterative, drives off inferential reasoning and can be unbelievably boring for most people. Investing was never meant to be entertaining. It is simple but never easy.

There is no holy grail in investing

There are multiple ways to succeed but there is no holy grail. Find an approach that you can consistently and reliably execute over time and stick to that. Any other answer is a plain old sales pitch. The Fundamental Vs Technical debate is like asking who is a better batsman – Dravid or Sehwag? The bigger question is who can you be? Not who is better