Allied Blenders & Distillers Ltd is the largest Indian-owned Indian-made foreign liquor (IMFL) company and the third-largest IMFL company in India, in terms of annual sales volume over FY2014 and FY2024

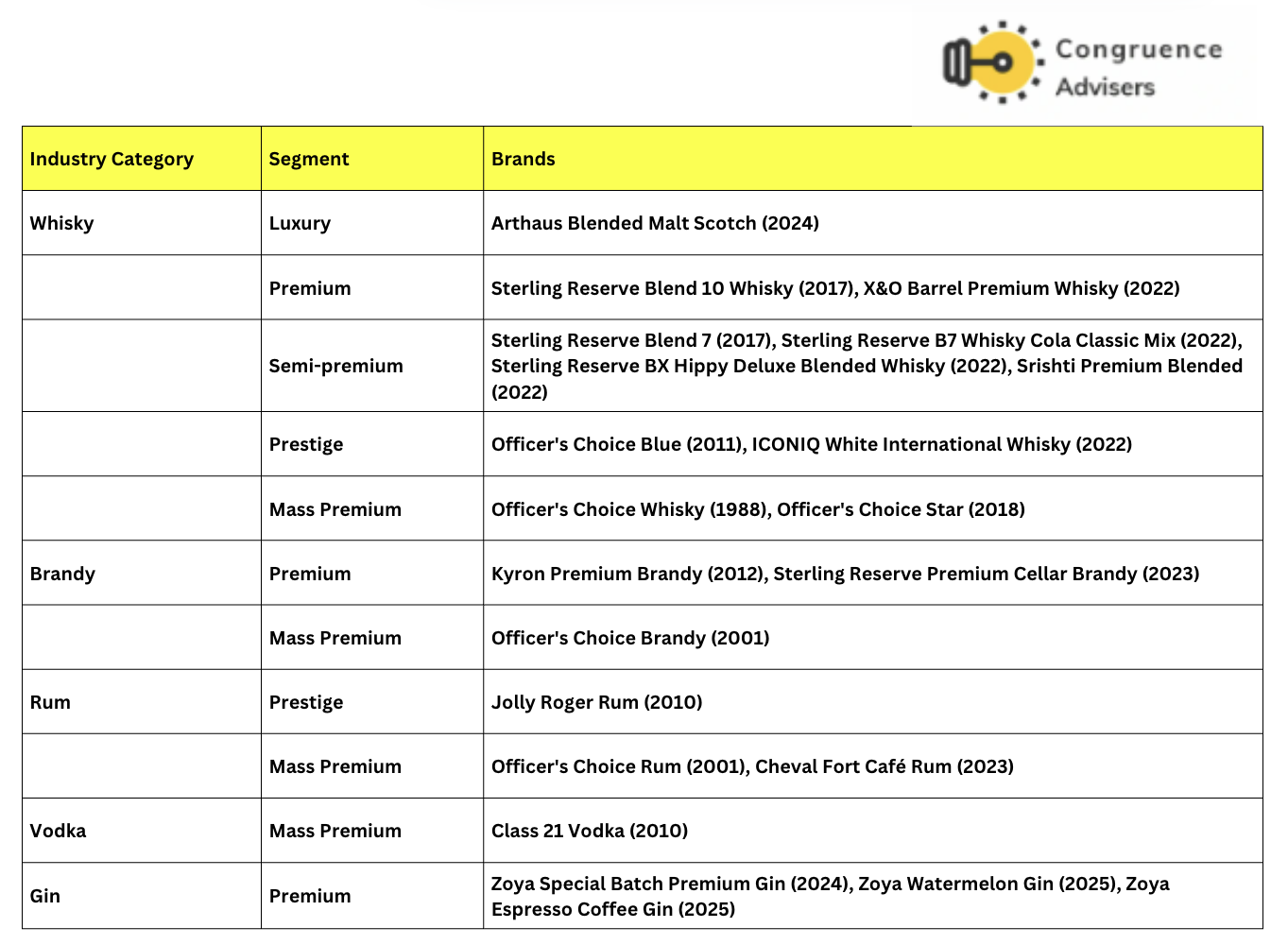

It is one of the only four spirits companies in India with a pan-India sales and distribution footprint, and a leading exporter of IMFL. It had an estimated market share (in terms of sales volume) of 11.8% in the Indian whisky market for FY2023. Allied Blenders & Distillers Ltd’s product range includes five main categories of IMFL, i.e., whisky, brandy, rum, vodka, and gin. Officer’s Choice Whisky is their flagship brand and was launched in 1988 with entry into the mass premium whisky segment. Its other whisky brands include Officers Choice Blue, ICONiQ White, and Sterling Reserve, among others.

Allied Blenders & Distillers Ltd Company Summary

Allied Blenders & Distillers Ltd is India’s largest homegrown IMFL company by volume and one of only four spirits players with a pan-India distribution network. Allied Blenders & Distillers Ltd boasts a diverse brand portfolio, led by Officer’s Choice, the world’s third-largest whisky brand, along with ICONiQ White, its newest millionaire brand and the fastest-growing whisky globally. With a strengthened balance sheet post-IPO and enhanced financial flexibility, Allied Blenders & Distillers Ltd is entering a new phase of growth. It is undergoing a strategic shift towards premiumisation, underpinned by supply-chain efficiencies and disciplined cost management, positioning it to deliver volume-led expansion and sustained margin accretion.

Allied Blenders & Distillers Ltd Management Details

Allied Blenders & Distillers Ltd was started and is owned by Kishore Chhabria, a well-known name in the Indian alcohol industry. His elder brother Manu Chhabria was one of India’s first corporate raiders who made a name for himself through a series of hostile takeovers in the 1980’s. The family’s takeover of Shaw Wallace and the subsequent business feud with Vijay Mallya is a very interesting footnote in corporate India. Kishore eventually had a fallout with his elder brother and subsequently joined hands with Vijay Mallya, only to have a bitter fight with him. The saga culminated with the United group taking over Shaw Wallace and Kishore exiting with his own brand Officers Choice Whisky after a series of high-profile legal maneuvers in the mid part of the 2000-10 decade.

Kishore Chhabria was involved operationally until 2023 when he stepped away to leave the operational control in the hands of a professional management team that is currently in charge. It is interesting to note that Kishore has traditionally hired operating managers from the UB group to help him scale up Allied Blenders & Distillers Ltd (from one flagship brand to 17 brands today). His current management team has been with him for many years. Kishore wanted to list Allied Blenders & Distillers Ltd much earlier in the 2016-21 period, only to miss the bus twice due to deteriorating stock market conditions. There was a time when Allied Blenders & Distillers Ltd was interested in taking over Tilaknagar Industries, but the deal did not go through.

The primary takeaway from the history of the business and the promoter is that the business is helmed by an owner-operator team who are veterans at navigating the complex alcohol market in India, characterized by a maze of state-level policies and extensive Government involvement in both distribution and pricing. Building up to become a pan-India player with manufacturing & distribution across multiple locations and managing complex pricing arrangements with each state calls for significant management bandwidth & skill.

Allied Blenders & Distillers Ltd – Industry Overview

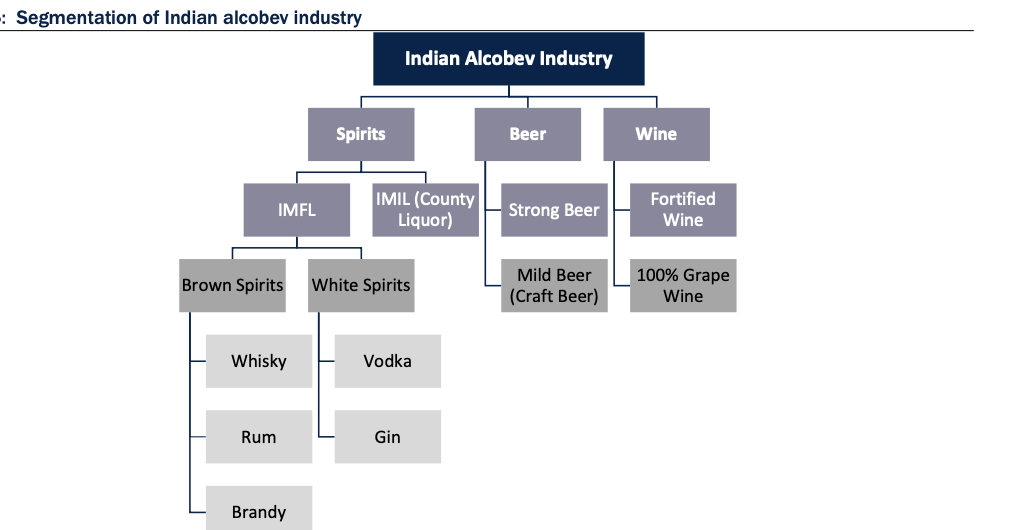

INDIAN ALCOBEV INDUSTRY

Source: Company, DAM Capital Research

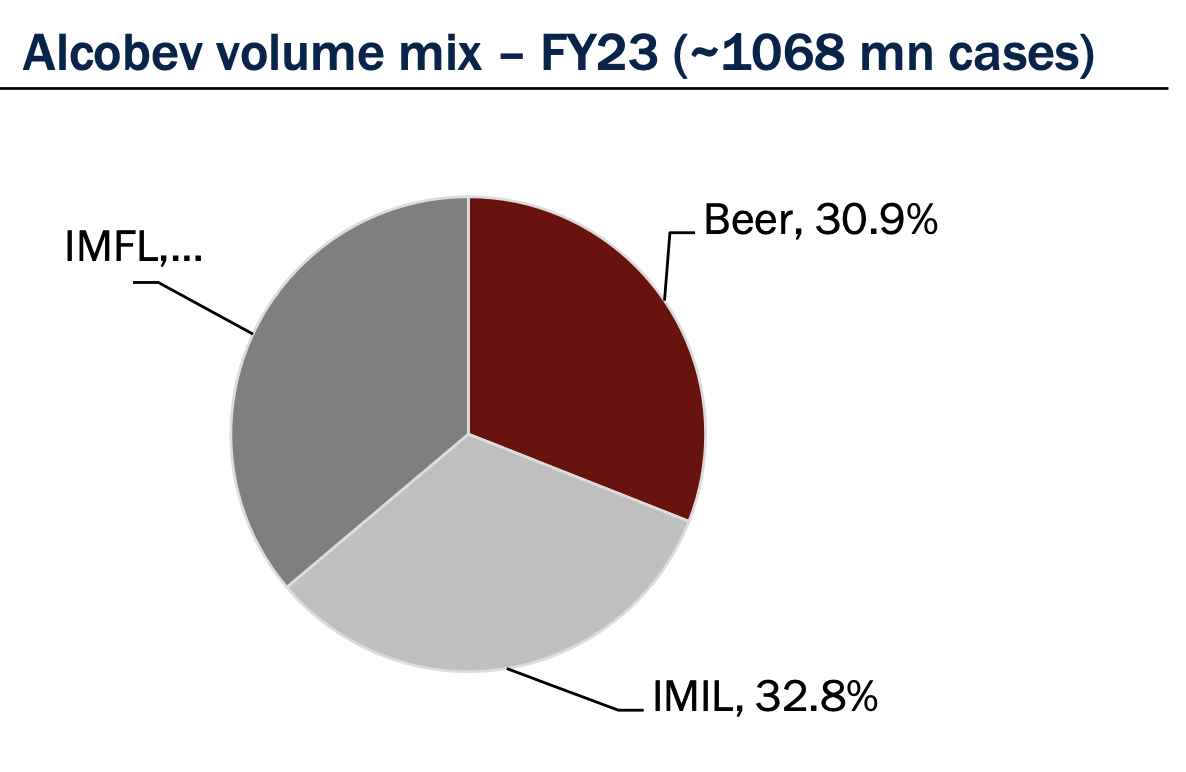

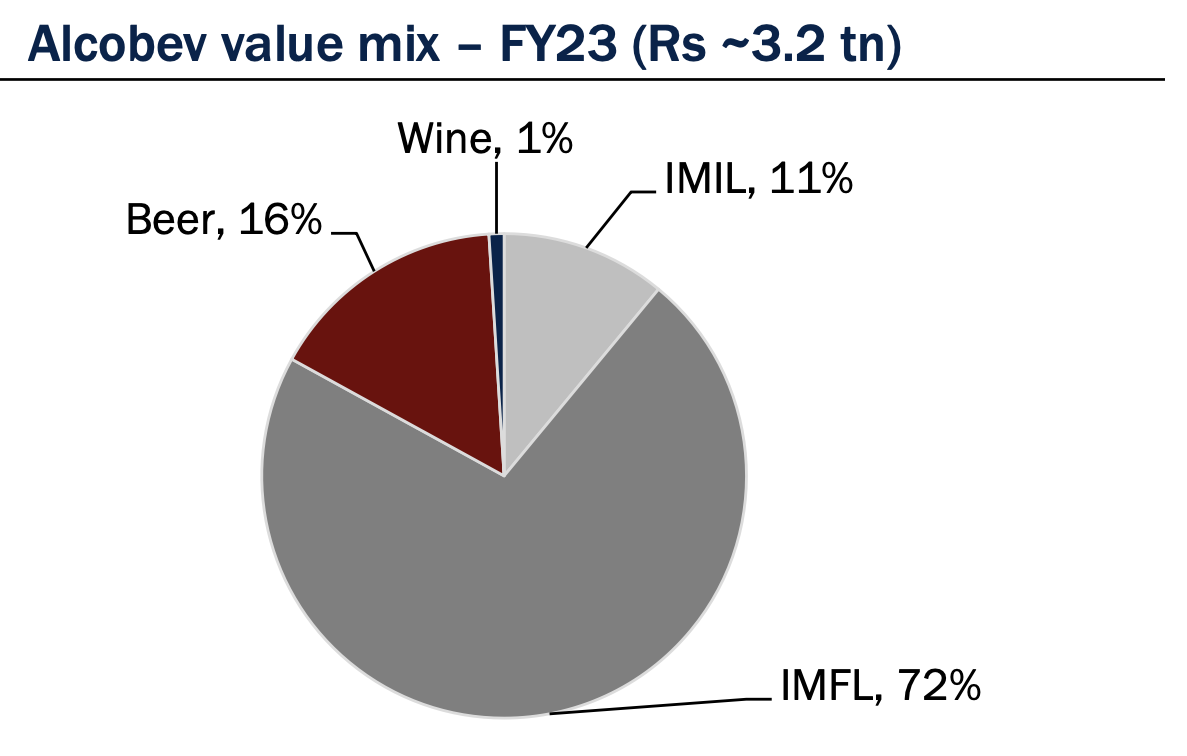

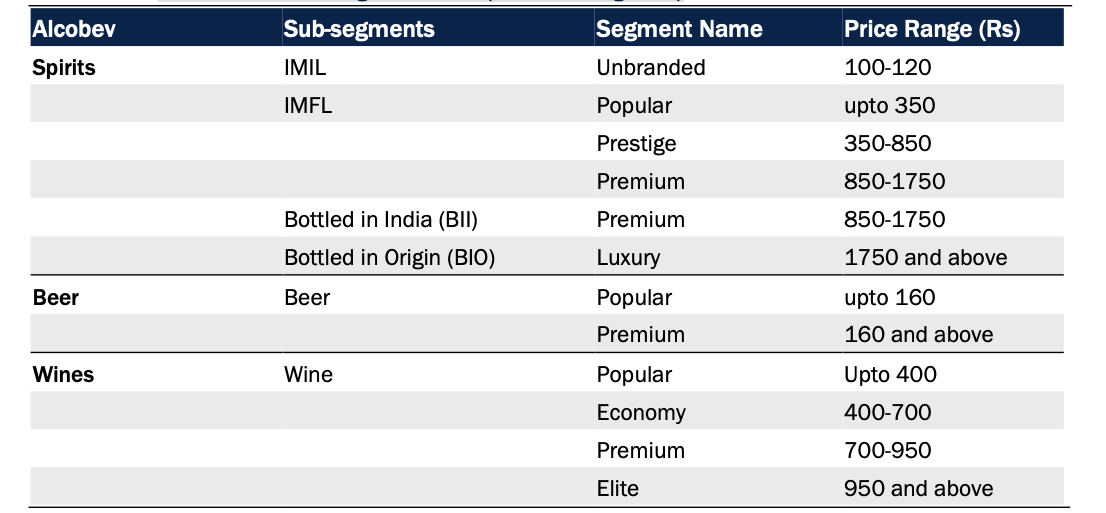

Indian-made Foreign Liquor (IMFL) is the largest segment of the Indian alcohol beverage market, both in volume (~36%) and value terms (~72%). Beer, being a bulky product, accounts for ~31% by volume but only ~16% by value. Indian-made Indian Liquor (IMIL)/country liquor accounts for ~33%/~11% in value/volume terms and is expected to grow at a modest rate, with consumers upgrading to premium spirits. Wine is a niche category, accounting for less than 1% of the market, but is estimated to grow at the fastest pace.

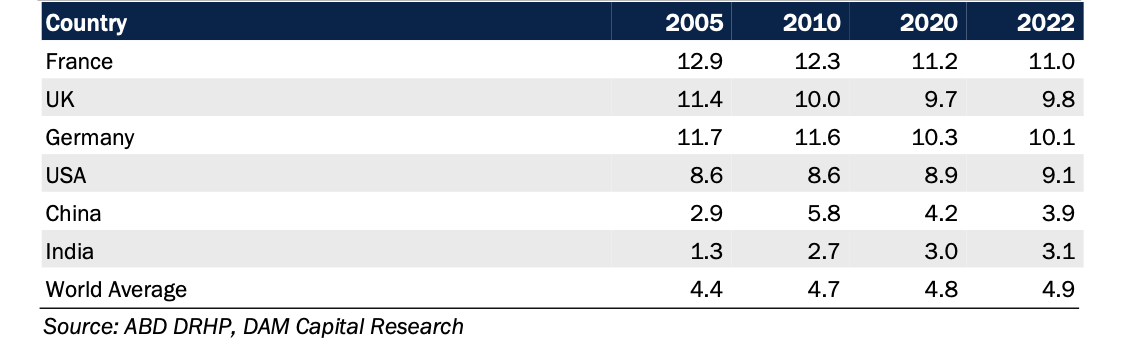

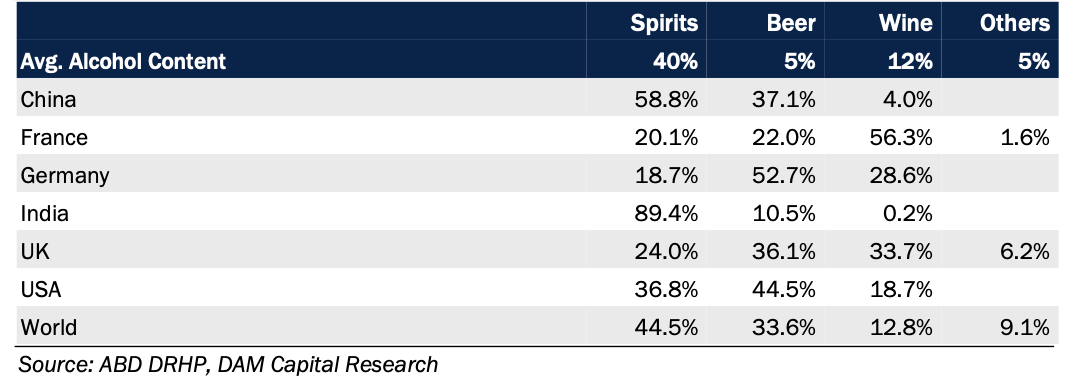

Per capita consumption of pure alcohol

Contribution of alcoholic beverages in 100% alcohol in 2022 (in %)

Source: Company, DAM Capital Research

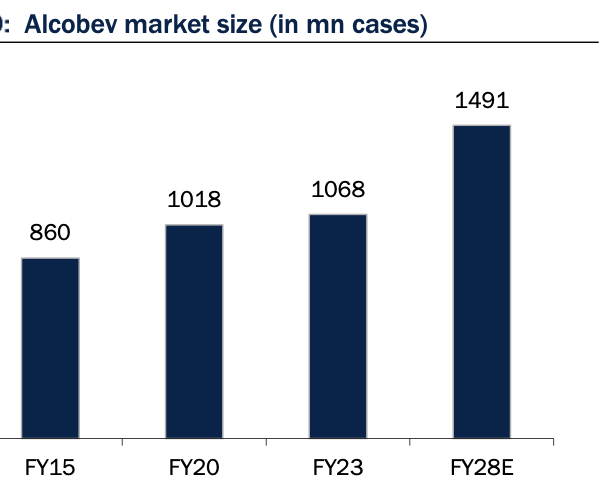

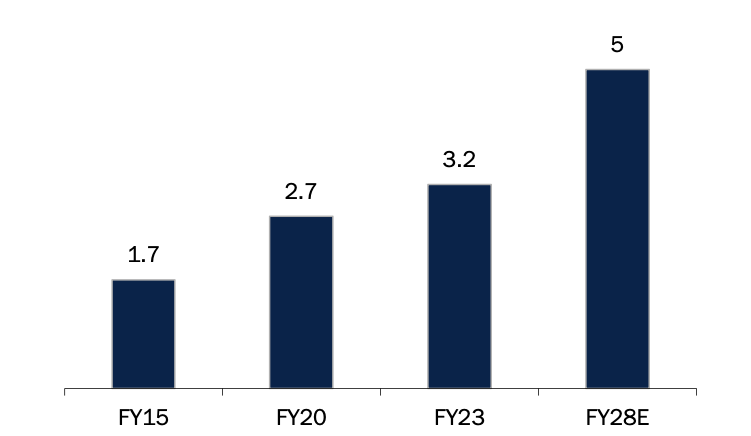

The Indian alcobev market is estimated to be worth Rs 3.2 tn as of FY23 and to grow at ~11.3%/~14% in volume/value terms over FY23-FY28E.

Alcoholic beverage market size (in mn cases)

Source: Company, DAM Capital Research

Alcoholic beverage market size (in Rs tn)

Source: Company, DAM Capital Research

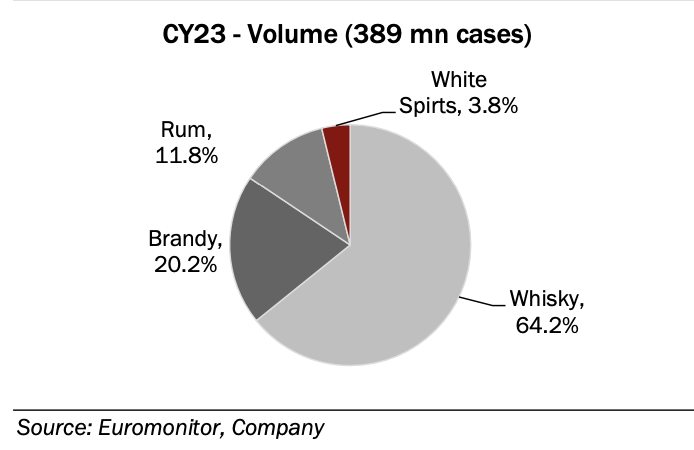

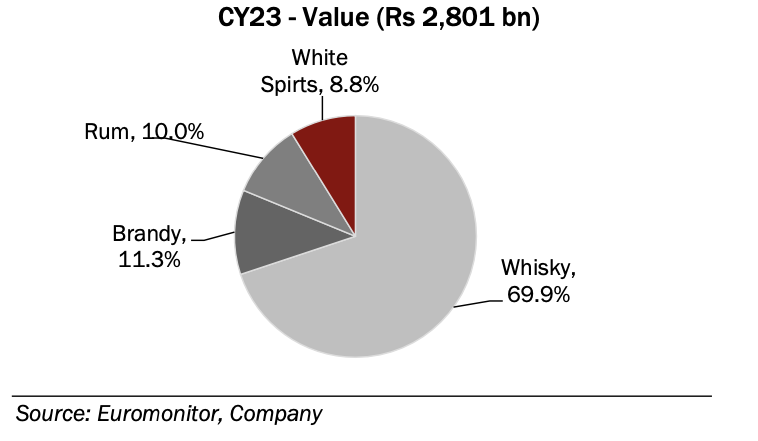

Within IMFL, brown spirits, which include whisky, brandy, and dark rum, have been major contributors, accounting for more than 90% of overall IMFL sales volume.

During CY23, whisky constituted the largest segment with ~64% of the sales volume and ~70% of value. White spirits such\ as vodka and gin accounted for ~3.8% of the total IMFL volume and ~9% of value.

Brandy is the second-largest selling brown spirit with a volume/value contribution of ~20%/~11 in CY23.

IMFL Category Mix (Volumes)

IMFL Category Mix (Value)

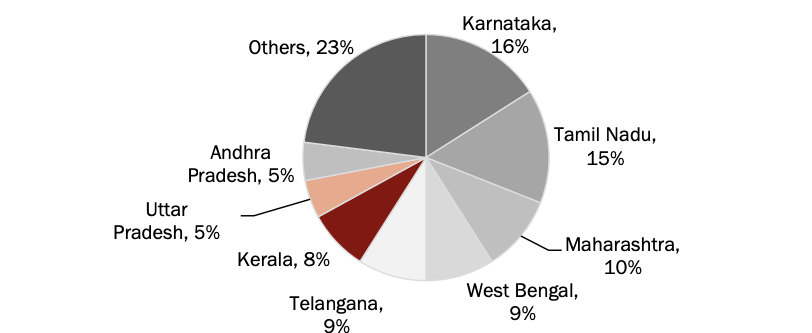

South India contributes to higher volumes, whereas North and West contribute to higher profitability

The IMFL market is dominated by southern states, with five states contributing close to half of the overall volume of the market. This is on account of county liquor being banned in the South. Tamil Nadu and Karnataka are the top two markets in the south. The South India market has the higher contribution of the popular segment, whereas North and West lead in the P&A segment.

Region-wise IMFL volume split

Source: Company, DAM Capital Research

State-wise IMFL volume split

Source: Company, DAM Capital Research

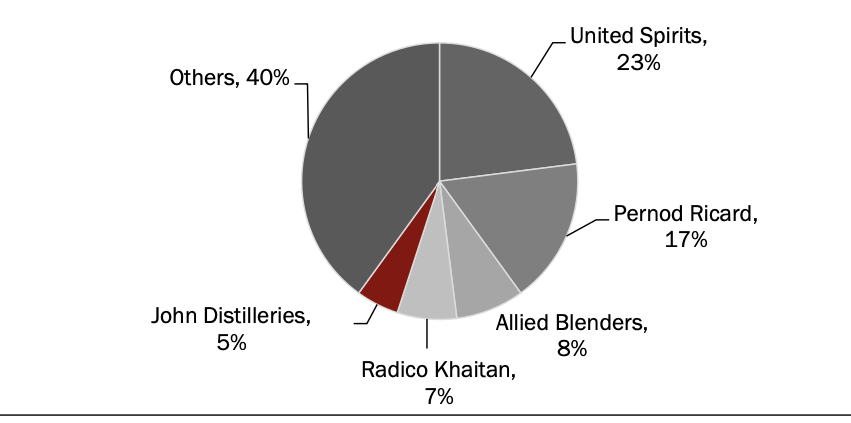

Key players in the IMFL market

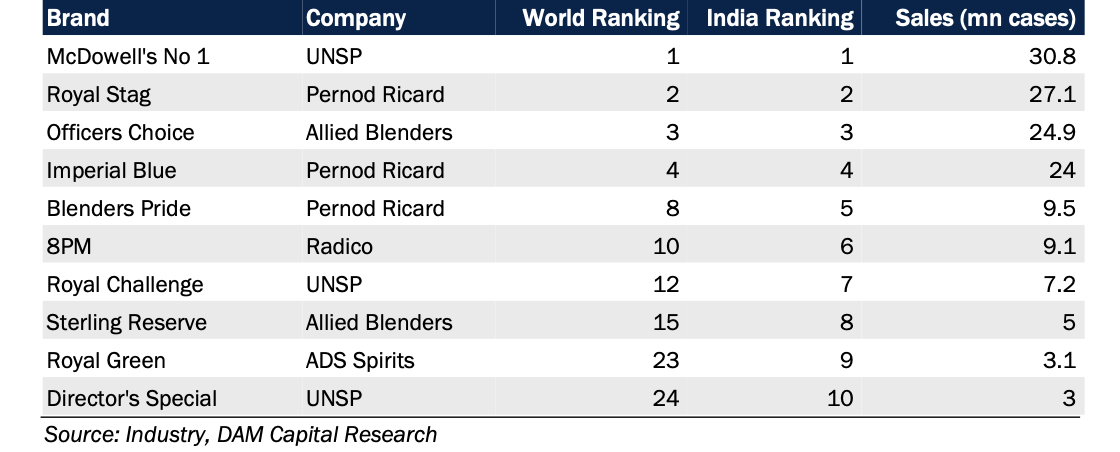

The Indian IMFL market is dominated by four major players controlling nearly half the market volume. United Spirits Ltd., a Diageo subsidiary, leads with seven millionaire whisky brands, including McDowell’s No. 1, the world’s top-selling whisky by volume. Pernod Ricard India, a subsidiary of Pernod Ricard SA, ranks second and drives premiumization in the whisky segment. Allied Blenders and Distillers, the largest Indian-owned IMFL company, is third, followed closely by Radico Khaitan.

IMFL volume market share (FY23) – 385 mn cases

Source: Company, DAM Capital Research

India’s top-selling whiskies (2022)

The beer market is oligopolistic in India

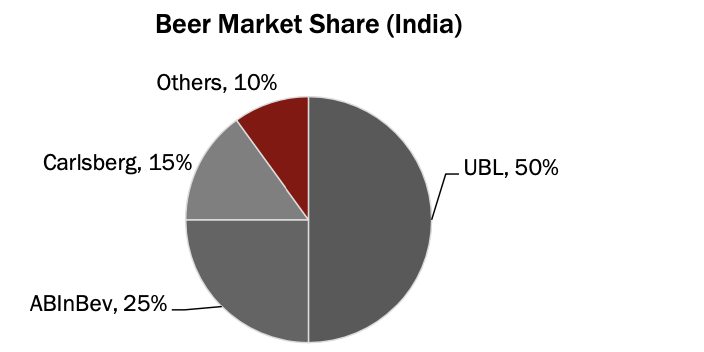

The Indian beer market has grown from 200 mn cases in FY10 to 330 mn cases in FY23. UBL is the market leader in the beer segment with ~50% market share in volume terms, with its flagship Kingfisher brand accounting for a major chunk of volumes. UBL, along with AB-InBev and Carlsberg, accounts for ~80% of India’s beer volumes.

Strong beer (with ~5-8% of alcohol) dominates the market, accounting for nearly 85% of the total beer consumption

Beer market share (India)

Per capita consumption of beer in India at ~2 liters is significantly lower than the global average of ~30 liters (Source: UBL FY23 Annual Report). Beer consumption is higher in coastal states, but players have been successfully tapping in other regions as well. Additionally, beer in India is largely an urban-oriented drink.

According to IMARC, the five southern states (Telangana, Tamil Nadu, Karnataka, Kerala, and Andhra Pradesh) account for ~20% of India’s population but ~36% of India’s beer consumption, indicating a higher per capita consumption in southern India.

Maharashtra (~9% of India’s population) is one of the biggest markets for beer, accounting for ~13% of the Indian

beer market.

Given that, only six Indian states account for ~50% of India’s beer consumption

Indian Beer Market – state-mix (value terms)

Volatility in taxation and state-to-state variation in route-to-market add to the complexity

Alcoholic beverages in India are a state subject, with production, distribution, and sale of alcohol being the responsibility of the state. Understanding the route-to-market is critical in each state due to varying and often complex structures. Every state has its own model of distribution ─ there are multiple modes being used in the country, ranging from complete control of the distribution network through state-run Wholesaling and retailing to varying degrees of control over either wholesaling or retailing, and in some cases, both. In some states, both wholesaling and retailing are carried out by private players.

Different types of market structures

Liquor Distribution Policies in India: State-wise Analysis

With the consumption of liquor in India being under the jurisdiction of states, it has multi-layered excise duty structures. Like petrol and diesel, liquor is out of the purview of GST. Liquor has historically been a significant contributor to state tax revenues, ranking among the top three revenue streams. When a state’s revenue faces challenges or needs to compensate for the cost of freebies, it often resorts to increasing levies on alcohol.

Alcohol’s contribution to state tax revenue (for key states)

Source: Company, DAM Capital Research

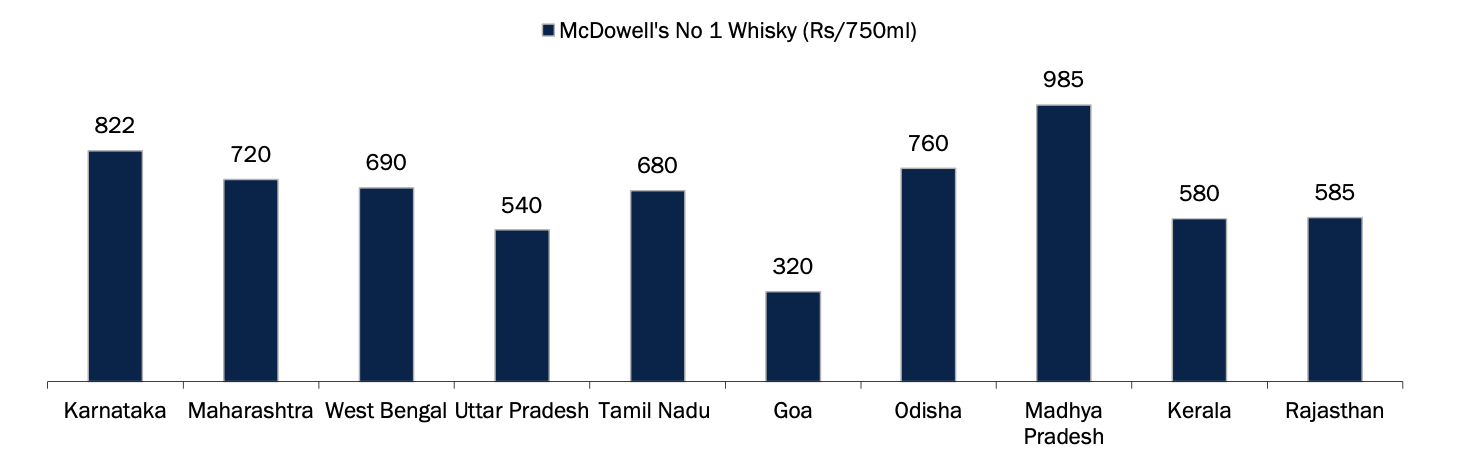

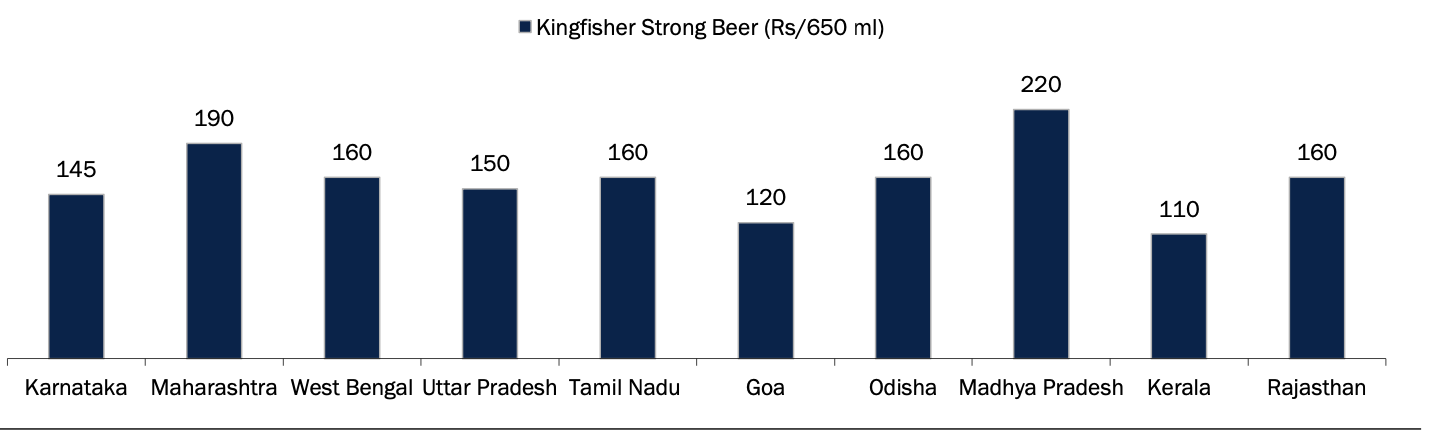

Different tax structures lead to large variances in pricing across states

Source: Company, DAM Capital Research

Kingfisher Strong Beer Prices (Rs/650 ml) in various states

Source: Company, DAM Capital Research

More than 60% of the gross revenue of the leading alcoholic beverage companies in India is comprised of excise duty paid directly to state governments. The share of excise duties in the total gross revenues of the leading alcoholic beverage companies in India has shown an increasing trend. In addition to excise, some states also charge sales tax. Apart from these taxes, there are one-time or annual fees for label registration and related activities.

Pricing is controlled by state governments

Each state has its own formula for deciding the prices of alcoholic beverages. Price is determined by two key factors, including EDP (Ex-Distillery Price), which covers the cost of production, and state excise policies, which specify duties, license fees, cess, surcharges, wholesale margin, and retail margin. Taxes and margins are calculated as a percentage of EDP. The contribution of taxes progressively decreases as the EDP moves up, as per the category of the product.

One of the key challenges in the Indian alcobev industry is a revision of MRPs with the increasing cost of production. MRP revisions need to be approved by the states, as it is the prerogative of the respective excise departments. While the window to revise MRPs in many states is annual in nature, in some states like Kerala and Telangana, revision of MRPs can take three to four years, even though the price of raw materials may increase or decrease throughout the year. There are exceptions like Maharashtra, where MRPs can be revised throughout the year.

In India, the premiumisation of the IMFL market has a strong bias towards up-trading from popular to prestige, and similarly, prestige to premium segment.

The premiumization trend has been a standout feature of the recent resurgence in the alcobev space. After facing challenging times, the industry has seen a remarkable recovery and exceeded pre-pandemic levels, with growth being led by the P&A segment. Companies are fully capitalizing on this trend through innovation and significant portfolio expansion in the value plus and premium segments. Trends such as occasion-based drinking, where experience sits at the heart of the occasion, are also leading to growth in the premium segment

In India, the premiumization of the IMFL market has a strong bias towards up-trading from popular to prestige, and similarly, prestige to premium segment. For United Spirits, the proportion of P&A volumes to its overall volumes has risen from ~47% in FY18 to ~82% in FY24, boosted by the strategy to reduce focus on the “regular” category and drive growth in the P&A one.

Similarly, Radico Khaitan has shown strong execution, with the proportion of P&A improving from ~26% in FY18 to ~46% in FY24.

Alcoholic Beverages Market Segmentation (across categories)

Source: Company, DAM Capital Research

Export

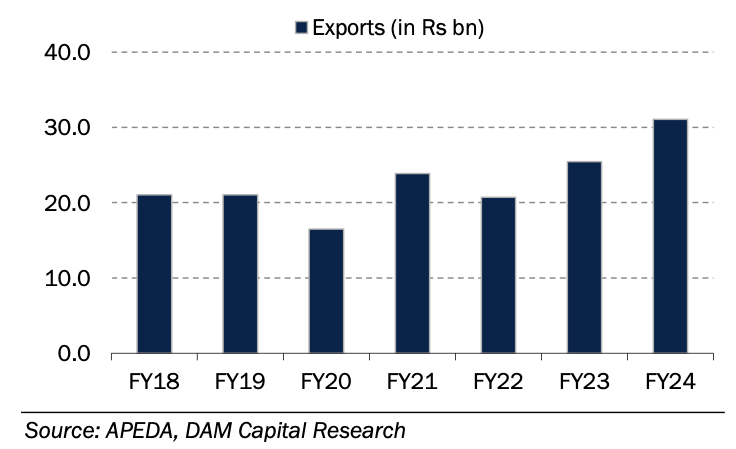

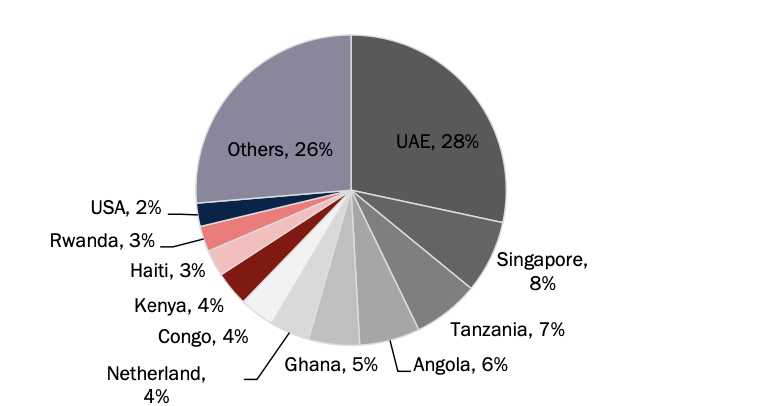

The export of Indian alcoholic beverages is limited as Indian whisky does not conform to specifications listed for whisky in major markets of the world. Indian whisky is popular in countries with a large Indian diaspora, with the Middle East being the largest market for Indian whisky. India’s alcobev exports for FY24 stood at ~Rs31 bn (up ~22% YoY). UAE accounted for ~28% of India’s imports in FY24

APEDA (Agricultural & Processed Food Products Export Development Authority) has set a target of exporting alcohol worth ~USD1 bn over the next few years.

Exports of alcobev from India

Source: Company, DAM Capital Research

Exports from India – geographical mix (FY24)

Source: Company, DAM Capital Research

India’s Distilled Spirits Imports by Category (in USD mn)

Imported alcoholic beverages (beers, wines, spirits, liqueurs) attract customs duties in India. At the port of entry, along with customs duties, certain levies and surcharges are also applicable. When a particular alcoholic beverage product is further distributed inland, excise and VAT for that specific State/Union Territory are applicable in addition to the import duties. Thus, state excise is calculated on a compounded tax structure (i.e., tax on the center’s import duty and manufacturing price)

Imported alcoholic beverages (beers, wines, spirits, liqueurs) attract customs duties in India. At the port of entry, along with customs duties, certain levies and surcharges are also applicable. When a particular alcoholic beverage product is further distributed inland, excise and VAT for that specific State/Union Territory is applicable in addition to the import duties. Thus, state excise is calculated on a compounded tax structure (i.e., tax on the center’s import duty and manufacturing price).

Source: Company, DAM Capital Research

Raw material

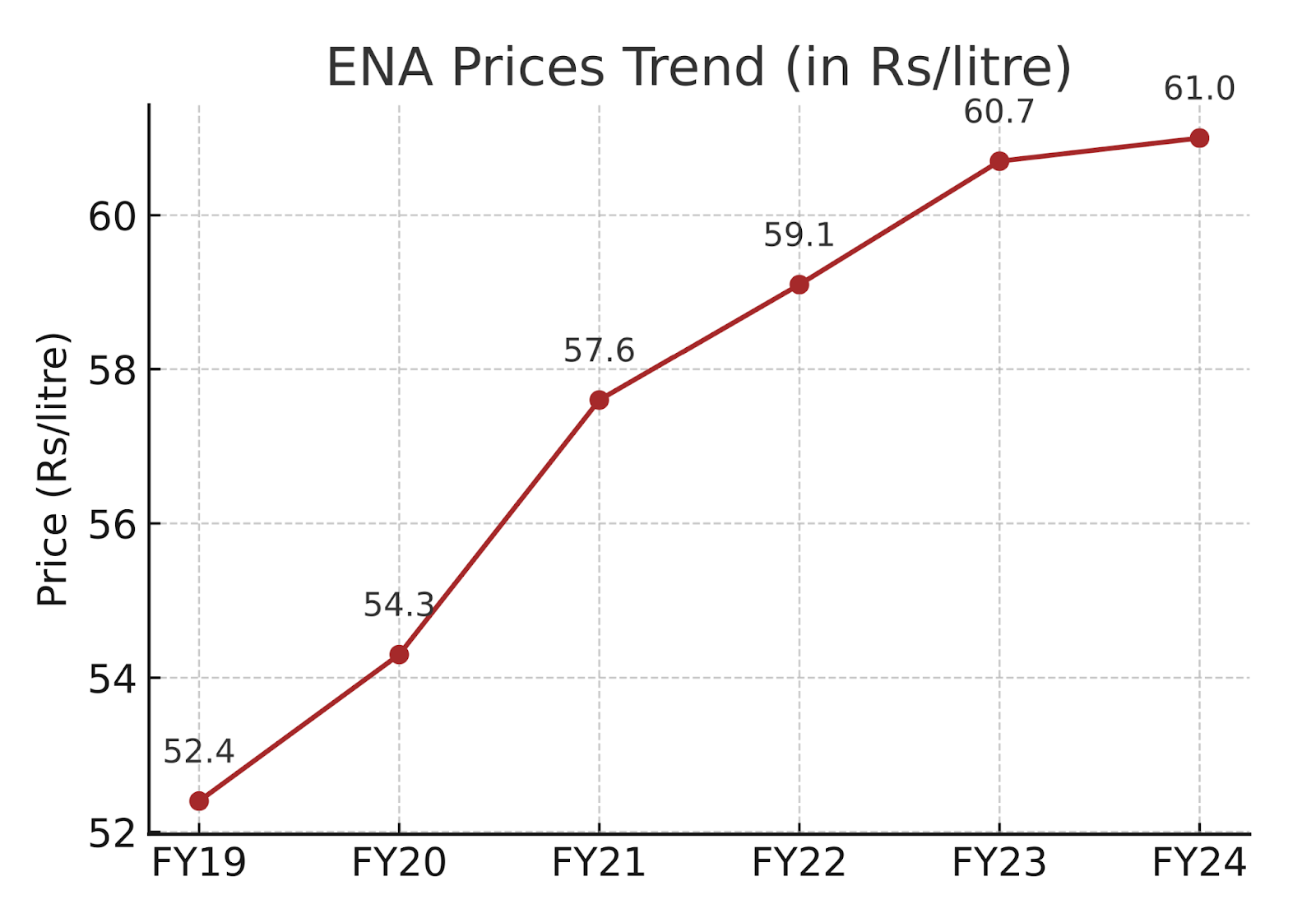

The alcoholic beverage industry faces challenges in passing on rising raw material costs due to state-regulated pricing, making operating margins sensitive to price fluctuations.

ENA (~50% of IMFL CoGS): ENA, derived from molasses or grains, is a key raw material for IMFL. Prices are rising due to government support for ethanol blending. Radico benefits from captive distillation, meeting its ENA needs and reducing vulnerability to price hikes. UNSP lacks significant captive capacity but is securing ENA through third-party agreements to mitigate margin impacts. Recent policy changes allowing ethanol production from FCI rice, B-heavy molasses, and sugarcane syrup/juice should stabilize ENA prices.

ENA stands for Extra Neutral Alcohol It is a highly distilled, neutral spirit used as a key raw material in the production of Indian Made Foreign Liquor (IMFL)

Barley (~20% of Beer CoGS): Barley, the primary malting ingredient, affects beer costs. UBL imports and procures barley locally, but prices doubled from May 2021 to May 2022, worsened by UBL’s short-term procurement strategy. This led to a gross margin drop to ~42.5% (Q1FY24-Q1FY25) from 54.4% (FY12-22). Other beer inputs include rice, maize, sugar, and hops.

Glass Bottles (~20-25% of IMFL CoGS, ~40% of Beer CoGS): Glass bottles, made from soda ash, sand, and cullet, are affected by energy costs and supply-demand imbalances. Beer relies heavily on bottles (~40% of CoGS), while spirits use ~20%. UBL uses 45% recycled bottles, but new bottles cost 1.5-2.5x more. High bottle prices persist due to supply shortages.

Other Packaging: Costs of cans, mono cartons, and lids are tied to aluminium and paper prices. UNSP began phasing out mono cartons in 2022 for premium Scotch brands, followed by Pernod Ricard in 2023, removing them across its portfolio for cost control and ESG goals.

Source: Company, DAM Capital Research

Source: Company, DAM Capital Research

Source: Company, DAM Capital Research

Allied Blenders & Distillers Ltd Business Overview

Allied Blenders & Distillers Ltd is the largest Indian-owned Indian-made foreign liquor (IMFL) company and the third largest IMFL company in India, in terms of annual sales volume over FY2014 and FY2024

It is one of the only four spirits companies in India with a pan-India sales and distribution footprint, and a leading exporter of IMFL. It had an estimated market share (in terms of sales volume) of 11.8% in the Indian whisky market for FY2023. Allied Blenders & Distillers Ltd’s product range includes five main categories of IMFL, i.e., whisky, brandy, rum, vodka, and gin. Officer’s Choice Whisky is their flagship brand and was launched in 1988 with entry into the mass premium whisky segment. Its other whisky brands include Officers Choice Blue, ICONiQ White, and Sterling Reserve, among others.

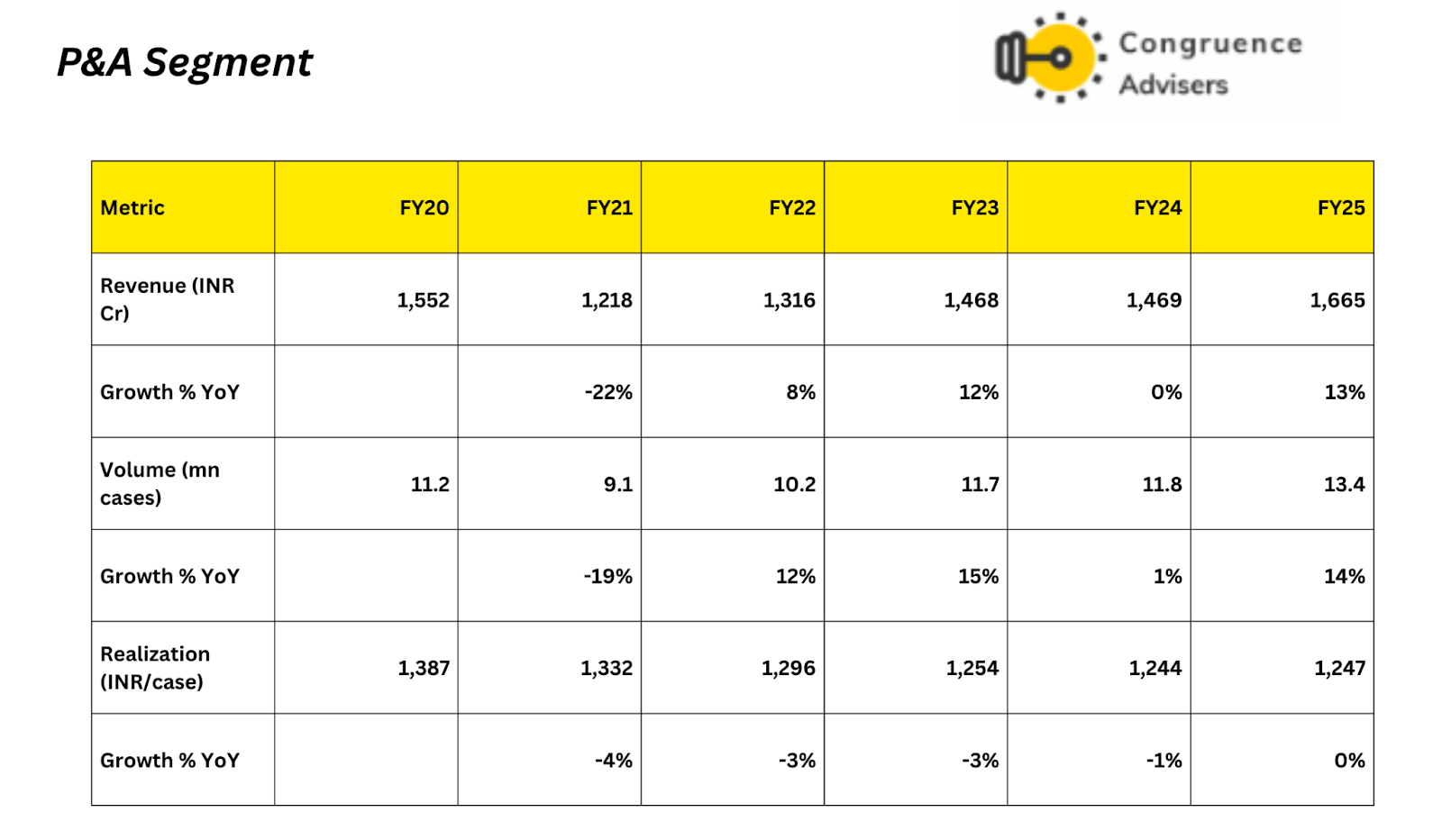

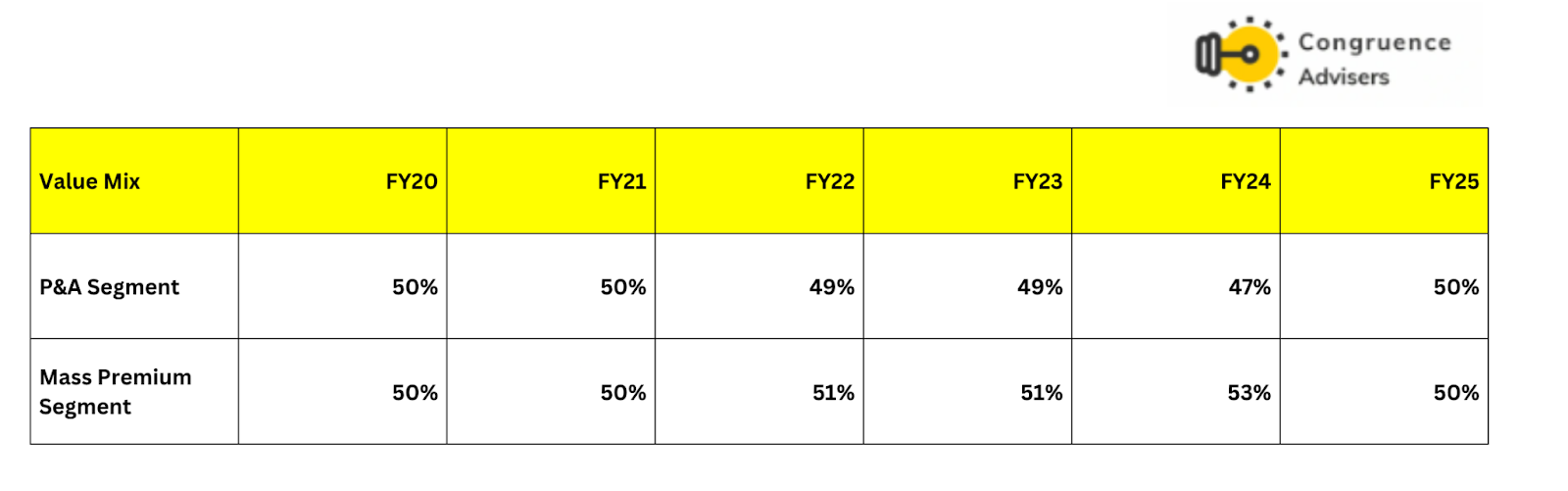

Segment-wise Revenue (P&A and Mass Premium)

Note;P&A stands for Prestige & Above

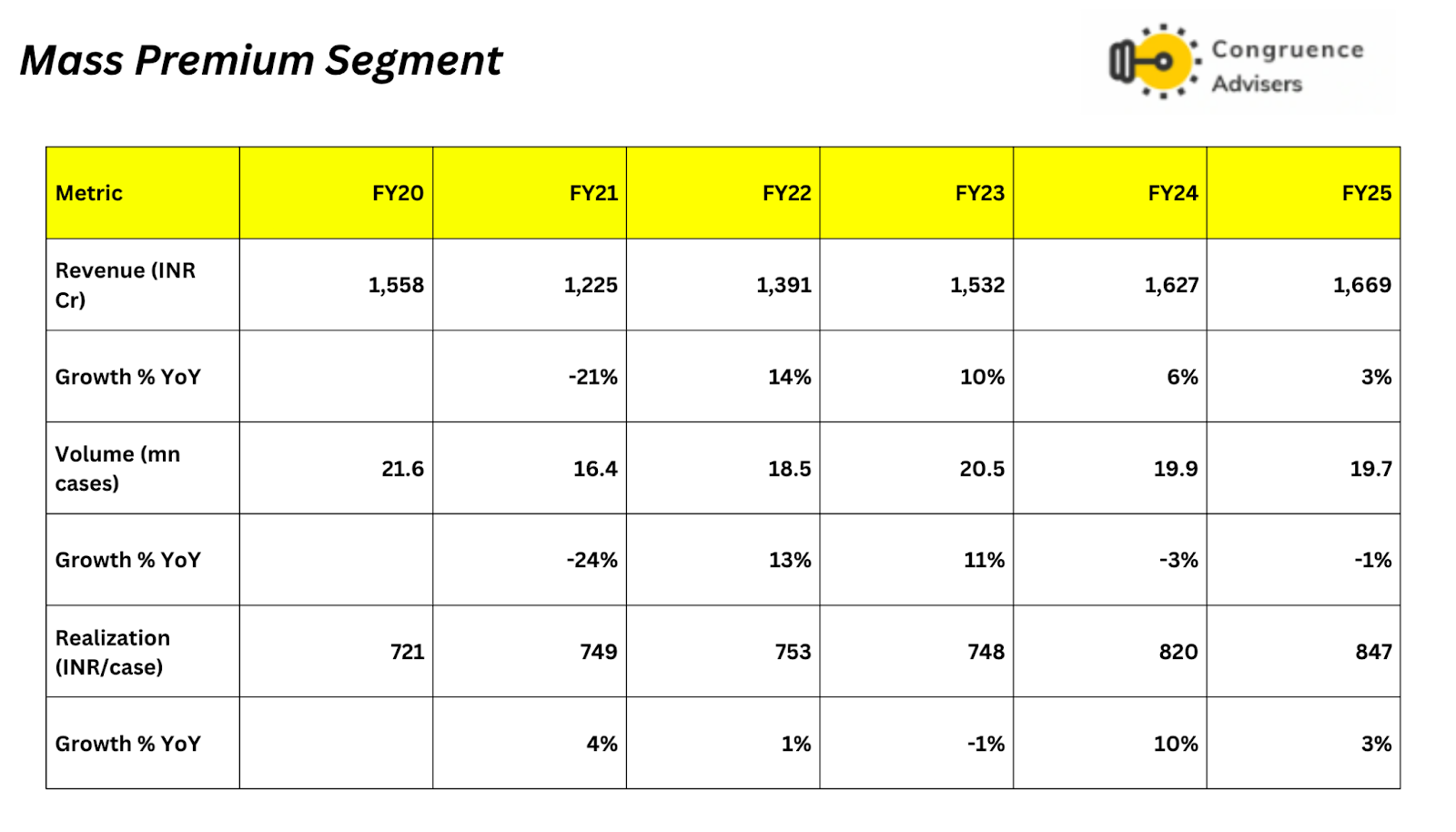

Premiumization of portfolio – The new focus area, Allied Blenders & Distillers Ltd, has been traditionally concentrated on the mass market segment, which represents over 60% of the company’s total volumes. Allied Blenders & Distillers Ltd intends to enhance its contribution from the P&A segment by expanding its existing brands and introducing new products in the premium and luxury segments, and in categories outside of whisky.

Over time, Allied Blenders & Distillers Ltd has built a well-known range of products, evolving from a single-brand company into a multi-brand and multi-product entity, with a presence in various categories and segments of India’s IMFL sector. Officer’s Choice serves as Allied Blenders & Distillers Ltd’s flagship brand, with its range (including Officer’s Choice Blue) contributing 75-80% to Allied Blenders & Distillers Ltd’s total volumes. It ranks as the third best-selling whisky brand globally and in India. Additionally, Sterling Reserve and ICONIQ are two other millionaire brands in Allied Blenders & Distillers Ltd’s product lineup.

P&A segment to post double-digit volume growth: Allied Blenders & Distillers Ltd has lower representation in its premium portfolio compared to major competitors. In FY25, P&A comprised 40% of its total volume. Allied Blenders & Distillers Ltd boasts of three millionaire labels within the P&A category – Officer’s Choice Blue and ICONIQ White in the prestige segment, and Sterling Reserve Blend 7 in the semi-premium segment. The P&A segment has grown faster compared to the popular category. Management expects the P&A segment to post double-digit volume growth in the future. Additionally, Allied Blenders & Distillers Ltd plans to enhance its position in the high-margin luxury segment and explore non-whisky categories by launching new brands through both its own labels and through partnerships. The latest products are expected to feature blended malt Scotch (Arthaus), single malt Scotch, blended Scotch whisky, vodka, and rum.

Launch of Zoya Gin – In FY24, Allied Blenders & Distillers Ltd introduced Zoya, its inaugural luxury gin in the markets of Haryana, Maharashtra, Rajasthan, and Goa. In FY25, the product will already be available in the top 10-12 gin markets throughout India. Additionally, Allied Blenders & Distillers Ltd is concentrating on exporting Zoya and has already initiated shipments to Dubai. Allied Blenders & Distillers Ltd is also working to enhance the brand’s presence in duty-free markets. Management’s strategy for Zoya and the entire luxury portfolio is to target four channels – domestic, duty-free, export, and the defense sector, which includes approvals from paramilitary forces and CSD. The gin market in India currently accounts for 4-5 lakh cases, although the category is relatively small, profit margins are significantly higher, with Zoya’s gross margin of about 70%.

Partnered with a Russian vodka brand, Allied Blenders & Distillers Ltd is collaborating on distributing products that are bottled at the place of origin (BIO). In October 2024, Allied Blenders & Distillers Ltd entered into a strategic alliance with Roust Corporation to distribute Russian Standard vodka within India. This premium vodka will be available in three versions – original, gold, and platinum – with prices set at Rs 2,200, Rs 2,600, and Rs 5,000, respectively, in Maharashtra.

Russian Standard currently leads the premium vodka segment in Russia with 30% market share and is sold in over 85 countries. This partnership seeks to take advantage of the rapidly growing vodka market in India, which is presently around 13 million cases and is growing at over 20% each year.

Allied Blenders & Distillers Ltd unveiled ICONIQ White Whisky in September 2022, and the brand achieved sales of over 1mn cases in the very first year. Sales surged to 2.3mn cases by the end of FY24, and are now on the path to an annual run rate (ARR) of 4.5- 5mn cases in FY25. A major factor behind ICONIQ’s success is its strategic placement between the semi-premium and deluxe market segments, enabling it to draw in customers moving up from lower-priced whiskies like McDowells No.1 and Imperial Blue, as well as those opting for less expensive options from higher-priced brands like Royal Stag. This segment pertains to roughly 120mn cases, and its price range attracts consumers from both the semi-premium and deluxe segments, thereby fueling growth. Allied Blenders & Distillers Ltd’s strategic positioning, along with creative packaging and marketing tactics, including the introduction of unconventional whisky colors, has played a significant role in ICONIQ’s swift acceptance and expansion in the marketplace.

Pricing-wise Officer’s Choice whisky, Officer’s Choice Blue, ICONIQ Blue, Sterling Reserve Blend 7 Classic, and Sterling Reserve Blend 7 fall under the price of Rs 1000; Kyron Brandy, Sterling Reserve Blend 10, Zoya Gin are in the price range of Rs 1000- 2,500 while Arthaus whisky is available in the range of Rs 2,500- Rs 5,000.

Manufacturing Facilities

Allied Blenders & Distillers Ltd distillery at Rangapur, Telangana, has an annual capacity of ~71mn liters. Allied Blenders & Distillers Ltd intends to establish or acquire additional distilleries in leading states to increase its internal sourcing of ENA. Allied Blenders & Distillers Ltd has a nationwide network of bottlers that constitutes a balanced combination of owned and partner bottling operations. As of 31 March 2025, Allied Blenders & Distillers Ltd owned and operated 9 bottling plants and entered into agreements with 6 third-party bottling facilities to utilize their entire licensed capacity for production. It has also secured 18 non-exclusive bottling agreements with various third-party facilities. Its extensive nationwide network of bottling sites guarantees the availability of locally produced products at competitive prices, thereby circumventing the additional tariffs that come with interstate transportation. Allied Blenders & Distillers Ltd had a retail presence of 79,329 outlets as of 31 March 2025.

Allied Blenders & Distillers Ltd’s exports to 14 nations until March 2024 surged to 23 nations by the end of March 2025. Management hopes to achieve robust double-digit growth in its exports business, which currently hovers at ~1.5-2 mn cases currently. Allied Blenders & Distillers Ltd has a solid foothold in the international markets, particularly in the Middle East, Latin America, Africa, and Southeast Asia. Leveraging its luxury portfolio, Allied Blenders & Distillers Ltd aims to enhance its presence in Europe and the US in the coming quarters. This luxury portfolio would also provide opportunities to Allied Blenders & Distillers Ltd in the global duty-free markets, where it intends to participate by FY26.

Currently, Allied Blenders & Distillers Ltd derives ~90% of its revenue from the domestic markets, with the international markets roughly contributing 10%. Allied Blenders & Distillers Ltd intends to enlarge this ratio to 85:15 in the next 2-3 years. The margins in the export business are comparatively higher than domestic. Also, Allied Blenders & Distillers Ltd aims to expand its exports from 22 to 30 countries over the next 2-3 years.

Backward integration to improve supply chain and profitability Enhancing supply chain efficiency and profitability through backward integration.

Allied Blenders & Distillers plans to invest Rs 525 crore in capital expenditure over the next three years, with allocations of Rs 185 crore in the first year, Rs 220 crore in the second year, and approximately Rs 120 crore in the third year. This expenditure will be financed through a combination of internal accruals and debt, with the anticipated benefits expected to start accruing from FY27 onwards. The primary objective of this capital outlay is to strengthen the company’s backward integration capabilities, particularly in the areas of Extra Neutral Alcohol (ENA), malt production, and PET bottle manufacturing. As part of this strategy, the company acquired Minakshi Agro Industries in Maharashtra for around Rs 75 Cr. This facility currently has a production capacity of 1.1 crore liters of grain spirit, which the company intends to expand by an additional 5 crore liters through a further investment of approximately Rs 250 Cr, targeting operational readiness by FY26-27.

Presently, the company meets 30% of its ENA requirements through captive production and aims to increase this share by setting up or acquiring distilleries in strategic states. This move toward complete internal ENA sourcing is expected to deliver substantial cost savings, given that each case of whisky (9 litres) requires about 4 liters of ENA, and the cost difference between owned and purchased ENA remains at Rs 10–15 per litre despite inflationary pressures on both.

Cost reduction measures to enhance profitability

Cost efficiency in packaging – Allied Blenders & Distillers Ltd has moved from glass to PET bottles for packaging Officer’s Choice in multiple states. PET bottles are much less expensive compared to glass bottles. It is presently collaborating with the governments of other states to obtain approval for PET conversion. At present, glass bottles make up just 10% of Officer’s Choice whisky’s total volumes, while PET and tetra pack account for 80% and 10%, respectively.

Introduction of Tetra Pack – Allied Blenders & Distillers Ltd has introduced Tetra packs for Officer’s Choice whisky in three states, utilizing a small package and aiming to transition two additional states to Tetra packs each year. The cost of a Tetra Pack is considerably lower compared to both PET and glass bottles.

Removal of mono carton – Allied Blenders & Distillers Ltd has ceased using mono cartons for Officer’s Choice whisky and is incrementally in the process of doing the same for brands like Officer’s Choice Blue and Sterling Reserve. Similarly, Allied Blenders & Distillers Ltd has plans to gradually eliminate mono cartons for ICONIQ White once it reaches a specific threshold in particular states.

Market bottle utilization – Allied Blenders & Distillers Ltd aims to increase the utilization of returned bottles from 13% in FY24 to 20% in the short term, leading to enhanced cost efficiency.

UK Free Trade Agreement – The recent UK Free Trade Agreement is expected to boost margins for Allied Blenders & Distillers Ltd, the largest importer of bulk Scotch, with annual duty savings of Rs 75-80 crore, potentially driving a 175-200 basis point increase in EBITDA margins. These savings will also enhance the affordability of the company’s super-premium and luxury portfolio.

Telangana payment difficulties are expected to normalize by the coming Quarters

Telangana has been Allied Blenders & Distillers Ltd largest market, accounting for ~30% of its revenue. According to media reports, the state government owes liquor companies Rs 4,800 Cr in overdue payments, which includes payment for goods sold to Telangana State Beverages Corporation Ltd and advance excise duty paid by liquor companies when supplying liquor stocks. Allied Blenders & Distillers Ltd faced significant working capital challenges due to the delay in receivables from the state of Telangana, which increased from ~60 days to over 150 days, hindering its ability to meet demand and consequently, volume growth, especially in 2HFY24 and 1QFY25. Allied Blenders & Distillers Ltd has Rs 400 crore in outstanding receivables from Telangana. Management expects the payment cycle to normalize in the coming quarters.

In Q4FY25, Telangana had significant overdue amounts until September but has been paying on time since October. While some increase in receivables at year-end was noted in other government-controlled markets, those are being paid in April and May.

Privatization policy for liquor in Andhra Pradesh to accelerate growth

Allied Blenders & Distillers Ltd reached its highest sales of 40 lakh cases in Andhra Pradesh during FY16. In FY24, the company recorded sales of approximately 17 lakh cases in Andhra Pradesh. The new annual run rate will be 30 lakh cases in the state post-implementation of the new liquor policy, which permits private retailers to sell alcohol.

Fundraising efforts helped reduce debt and substantially save interest expenses

As of 31 March 2024, Allied Blenders & Distillers Ltd’s total gross debt was Rs 820 crore, which included Rs 630 crore of short-term debt. In July 2024, Allied Blenders & Distillers Ltd successfully completed an IPO of Rs 1,500 crore, comprising a fresh issue of Rs 1,000 crore. The funds raised from the IPO were used to settle the debt. In addition to repaying debt, the company also settled all overdue VAT obligations. Allied Blenders & Distillers Ltd has since secured Rs 325 crore in working capital debt at a lower borrowing rate of 8.5%, down from 11–11.5% earlier, for FY24 /FY25. Allied Blenders & Distillers Ltd’s interest expenses were approximately Rs 170 crore / Rs 125 crore.

Allied Blenders & Distillers Ltd Corporate governance

Board Composition – Allied Blenders & Distillers Ltd Board of Directors comprises 16 members, including 7 independent directors and 3 women directors, no of independent directors is less than 50% ensuring a well-diversified and compliant board structure.

Related Party Transactions – Allied Blenders & Distillers Ltd reported related party transactions amounting to ₹62 crore in FY25, with KMP-related companies primarily related to purchases and services received, which is 1.78% of total revenue.

Dividend Payout – Allied Blenders & Distillers Ltd has paid a dividend only in FY25, its first profitable year in the recent past. This is a positive development.

Contingent Liabilities – Allied Blenders & Distillers Ltd contingent liabilities are 202 crore in FY25, which relate to government or statutory authorities and are tax-related. This amounts to ~13% of the Allied Blenders & Distillers Ltd’s consolidated net worth as of FY25.

Remuneration Payout – Key Managerial Personnel drew a total compensation of ~₹24 crore in FY25 i.e., including salaries and performance-linked bonuses. This represents ~12% of PAT, still a high number. However, the number used to be much, much higher in previous years, when Mr. Kishore Chhabria used to draw an inordinately high annual salary of INR 40Cr+ till FY23. This tapered down to INR 10Cr in FY24 and has since been eliminated as Mr. Chhabria has moved to a non-executive role.

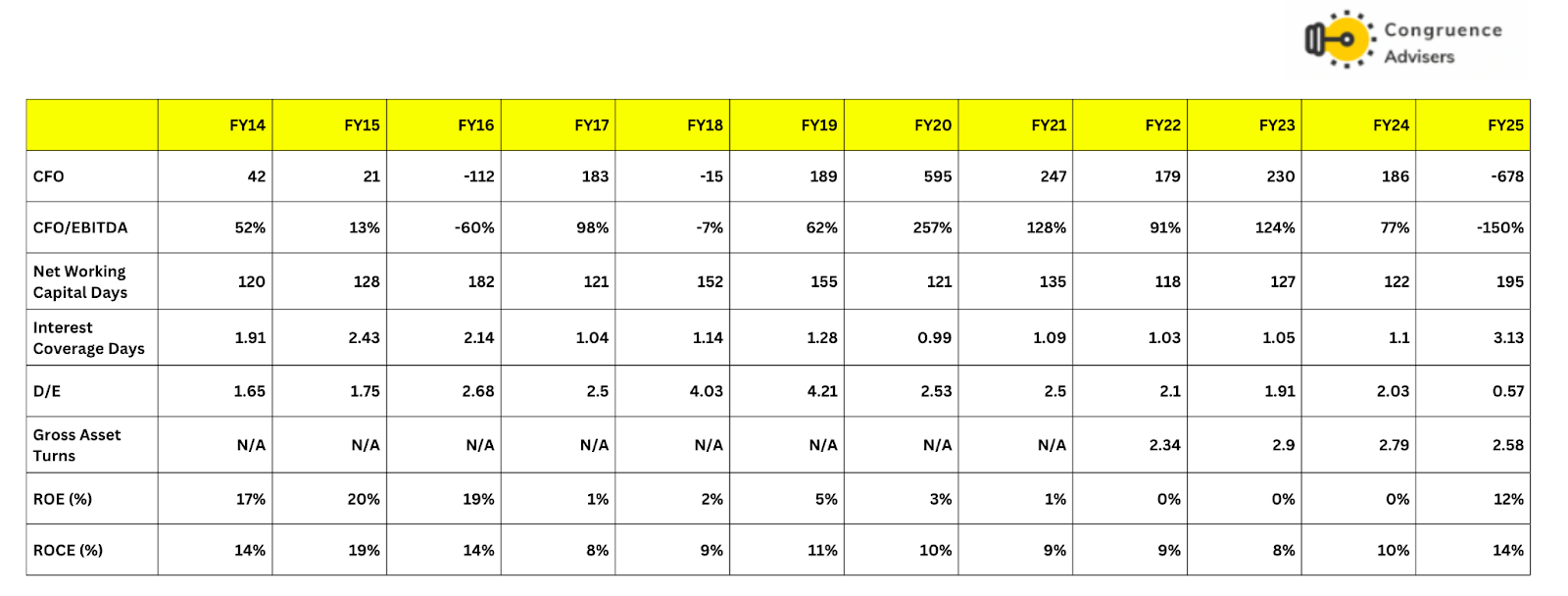

Allied Blenders & Distillers Ltd Financial Performance

Over the last 5 years, Allied Blenders & Distillers Ltd has grown revenues at a CAGR of 3%, EBITDA at a CAGR of 13%, and PAT at a CAGR of 72%, with revenue growth muted in the last 5 years. During this period, EBITDA and PAT margins have been volatile, staying between 16–13% and 0%-2%, respectively. Over the 3 years, Allied Blenders & Distillers Ltd revenues have grown at a CAGR of 9%, EBITDA at a CAGR of 30%, and PAT at a CAGR of 480%.

Allied Blenders & Distillers Ltd – Working capital, Debt, and cash flow analysis

Allied Blenders & Distillers Ltd total gross debt stood at ~₹820 Cr as of 31 March 2024, including short-term debt of ~₹630 Cr. In June 2024, Allied Blenders & Distillers Ltd completed the IPO of ~₹1,500 crore, including a fresh issue of ~₹1,000 crore. The IPO proceeds were utilized to pay off the debt.

Besides the debt repayment, Allied Blenders & Distillers Ltd also cleared all outstanding VAT liabilities. The company has now raised ~₹325 crore in working capital debt at a reduced borrowing cost of 8.5%, compared to the previous 10–11%.

Allied Blenders & Distillers Ltd’s interest expense for FY24 stood at ~₹170 Cr, which came down to ~₹125 crore in FY25. Net debt as on 31 March 2025 was ₹658 crore. Notably, Allied Blenders & Distillers Ltd has ~₹400 crore due from Telangana, which management is hopeful of receiving in the near future.

Allied Blenders & Distillers Ltd Comparative Analysis

To understand Allied Blenders & Distillers Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Allied Blenders & Distillers Ltd to its competitors (peer comparison) on various fundamental parameters and Allied Blenders & Distillers Ltd share performance relative to the relevant benchmark and sector indices.

Allied Blenders & Distillers Ltd Peer Comparison

We have compared Allied Blenders & Distillers Ltd with three key players in the Alcobev Industry: Radico Khaitan, United Spirits, and Tilaknagar Industries.

Allied Blenders & Distillers Ltd is on a turnaround path, showing improved profitability in FY25 after several years of underperformance. From FY20 to FY24, Allied Blenders & Distillers Ltd lagged behind industry benchmarks in both gross margins and overall profitability, but recent results indicate a positive shift.

United Spirits is the clear industry giant; it’s over three times the size of Allied Blenders & Distillers Ltd in terms of revenue, and it’s also far ahead in profitability and efficiency. With stronger margins, better returns, and very low debt, it’s the gold standard for financial strength and consistency.

Radico Khaitan sits somewhere in the middle. It’s more profitable and efficient than Allied Blenders & Distillers Ltd right now, with decent margins and a healthier balance sheet. But when it comes to growth, Allied Blenders & Distillers Ltd is pulling ahead. It’s growing faster on both the EBITDA and PAT fronts, showing that it’s quickly gaining ground.

Tilaknagar Industries is the smallest of the lot, but arguably the most agile. Despite its size, it delivers the highest profit margins and returns, along with strong cash flows. It’s lean, focused, and very efficient. Compared to Allied Blenders & Distillers Ltd, Tilaknagar is already in the sweet spot of profitability, but Allied Blenders has more scope to improve.

Allied Blenders & Distillers Ltd Index Comparison

Allied Blenders & Distillers Ltd share performance vs S&P BSE Small Cap Index, as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why You Should Consider Investing in Allied Blenders & Distillers Ltd

Strong Industry Position – Allied Blenders & Distillers Ltd is already one of the Top 4 and best-known businesses in the alcoholic beverage sector, with retail touchpoints at ~80,000 outlets. Though Allied Blenders & Distillers Ltd is a small cap at a market cap of 12,000 Cr, it already displays many of the intangible characteristics needed to become a mid-cap over time (proven promoter, good management, good product development roadmap & good financial management).

Potential for Re-Rating & Favorable Industry Dynamics – The alcohol beverage industry is one of high terminal value in the Indian market, and we will be fishing in an area where the base rate of success is high over the medium term. Radico Khaitan has been a spectacular success story in the stock market over the past 5 years, delivering a 48% CAGR to become a mid-cap from a small-cap.

Margin Expansion Roadmap & Product Success – ICONiQ White – Clear roadmap to increase margins over time through a combination of backward integration, premiumization (new launches are all P&A category), and better cost management. Their new launch, ICONiQ White, is already India’s fastest-growing whisky brand with a very steep 100%+ scale in volume through FY25. Within 30 months of launch, the product has crossed a volume of 5mn cases, which indicates that the premiumization journey already has its first tangible success. The business had been building a portfolio of super premium and luxury offerings, which could pay dividends over the next few years. Focus on the on-premise channel with investment in a 50-member team.

Capex – The business spent 72 Cr in acquiring a distillery from MAILLP in December 2024, which enhanced the in-house ENA capacity to > 30% of the business needs, which led to an improved gross margin in Q4 FY25. With further expansion planned, gross margins are expected to see a further leg up through FY26 and FY27.

Working Capital Disruption and Recovery – FY24 saw muted revenue growth due to working capital stuck with the Telangana Govt (their largest market), which was a pan-Industry issue. Starting from September 2024, the working capital issue started getting resolved, which allowed the business to print healthy revenue growth of 19% YoY after some muted quarters

What are the Risks of Investing in Allied Blenders & Distillers Ltd

Volatility in RM prices – ENA and packaging materials, including glass, paper, PET, etc., are all key raw materials for the company. ENA (~50% of CoGS) remains volatile and continues to compress gross margins. Any further hikes in prices would be detrimental to maintaining the guidance on the operational performance front.

Government Control and Revenue Dependence – Alcohol is too important a revenue generator for state governments to be left to the free markets. While some states like Andhra and UP have seen reformist policies, many other states are likely to treat the revenue as a cash cow to be milked (at the expense of both consumers and brands) to make up for the social benefits spending schemes that have become the mainstay of Indian politics since 2023. Working capital issues may resurface if cash-strapped governments start acting up to preserve their treasury buffers.

Valuation Risk – Valuation is not cheap, there is always the possibility that, as consumption spending revives in India, the alcohol sector may see a minor derating as the scarcity premium within consumer stocks dissipates away. While business risk and execution risk aren’t high in this story, we are carrying some amount of valuation risk at the current price.

Safety Risk – Distilleries are susceptible to health & hygiene concerns. Any mistake in production that leads to health issues for consumers within a particular batch can have severe legal ramifications and costs. While this risk is not high, we have seen regulatory testing pick up a notch across the Food & Beverages categories in India.

Promoter Risk – Given the history of the promoter, one can never rule out a resurgence of the corporate raider avatar if an interesting business were to be up for sale. The promoter was also taking a huge salary till 2023 (> 90 Cr per year), which was a significant drain on the P&L of the business. While this has been regularized post the IPO, there is always the tendency of the promoter to cash in if the business were to see spectacularly good times in the future.

Promoter Holding and Supply Overhang – At promoter holding of ~80%, one large block coming to the market to comply with regulatory guidelines is a matter of time. This could put supply pressure on the stock price at the wrong time and interfere with the organic stock price journey if this were not the case.

Allied Blenders & Distillers Ltd Future Outlook

The management has listed out multiple levers and triggers for investors to track progress, including higher export growth, where the margin is much higher.

Allied Blenders & Distillers Ltd is targeting double-digit revenue growth by focusing on premiumization, optimizing its state-mix, and expanding across categories. Allied Blenders & Distillers Ltd aims to increase the volume contribution from its Prestige & Above (P&A) portfolio to over 50%, building on the success of ICONiQ White, Sterling Reserve, and other emerging brands. The recent launch of ABD Maestro Pvt Ltd is expected further to drive growth in the super-premium and luxury segments.

Allied Blenders & Distillers Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time, price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Allied Blenders & Distillers Ltd Price charts

Allied Blenders & Distillers Ltd was listed in August 2024, hence we can only examine the day chart. The price saw a steep climb in the run-up to the Q4 FY25 results and has held above 390 since then, after a consolidation. The current price trend is hovering near its ATH with a tight consolidation looming with an upper sloping lower trend line. The current RSI is well within the normal range of ~60, which indicates that the market has digested the steep gain from 310 odd to 400+, and the price appears to be waiting for Q1 FY26 numbers to chart out the next leg of the journey.

Allied Blenders & Distillers Ltd Latest Result, News and Updates

Allied Blenders & Distillers Ltd Quarterly Results

FY25 was a breakout year for Allied Blenders & Distillers Ltd, its first year as a listed entity marked by good financial performance, strategic execution, and margin expansion. Allied Blenders & Distillers Ltd delivered strong top-line growth of 6.2% YoY in FY25, but more importantly, EBITDA surged 81.7% to its highest-ever level, and PAT rose sharply to ₹195 Cr, a dramatic turnaround from just ₹2 crore in FY24. Q4 FY25 was particularly strong, with revenue up 21% YoY and EBITDA margin more than doubling to 16.1%. Much of this improvement was driven by better gross margins (up 436 bps), improved due to softer grain prices, cost control, packaging efficiencies, and strategic rate resets.

Strategically, Allied Blenders & Distillers Ltd is executing well on multiple fronts. Its premiumization drive is clearly paying off, with strong volume growth in Prestige & Above (P&A) and Super-Premium/Luxury segments. Backward integration projects, including ENA, malt, and PET facilities, are expected to drive an additional 300bps EBITDA margin expansion by FY27. At the same time, the balance sheet is strengthening, with net debt/EBITDA improving to 1.7x despite ongoing CAPEX.

Allied Blenders & Distillers Ltd is taking a disciplined approach to profitability, trimming low-margin state-brand combinations and maintaining gross margins above 40% in the Mass Premium segment. While challenges like receivables from Telangana remain, management has been proactive, and the outlook remains optimistic with clear growth levers including international expansion, new product development, and the strategic push into higher-margin categories

Final thoughts on Allied Blenders & Distillers Ltd

Alcohol is one of the rare consumption pockets in India which is expected to grow significantly faster than nominal GDP. The sector is recession proof to a large extent and there is a clear trend of premiumisation amongst younger consumers. Allied Blenders & Distillers Limited is one of the strongest plays on this theme in India, ranking amongst the top 4 large players in India with established brands, a country wide distribution and manufacturing network and decades of experience in navigating the heavily regulated marketscape of the Indian alcohol industry.

Allied Blenders and Distillers Limited has long remained an IMFL player selling whisky in the value segment, which is now turning its attention seriously towards premiumisation. Its stated focus on increasing the value and volume salience of the P&A segment, intent to launch several luxury brands across its portfolio and increasing their portfolio’s salience in the on-trade segment (bars, restaurants) are all credible signs towards this premiumisation journey. This coupled with their backward integration initiatives in PET bottle manufacturing and enhancing ENA and malt manufacturing capacities, could give a serious fillip to their margins in the coming years. While, they have a favourable base for delivering YoY revenue growth till H1 FY26 due to the uptick in Andhra Pradesh demand starting from H2 FY25, it needs to be seen whether they can sustain a double digit volume growth path subsequently. Another thing to watch for is their success in launching luxury brands and tapping into on-trade channels. If they can achieve these two goals, margin levers are very likely to play out and they should be able to print 15%+ EBITDA margins after a few years.

Valuations for the company are not cheap. However, valuations for credible players in the alcohol industry are unlikely to be cheap because of reasons stated above. On a 2Y forward basis, the company may be trading at 38-40x PE. If the company delivers double digit growth and expands EBITDA margins to 15%+ over the next few years, the stock can look interesting based on the specific investor’s investing style and portfolio construction methodology. Sure a business to regularly track, even if one chooses not invest.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this to a general audience. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will continue/be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.