Capital Small Finance Bank Ltd is a recently listed micro-cap small finance bank with a market cap of 1365 Cr (09th June, 2025). The bank is headquartered in Jalandhar and does most of its business in the states of Punjab and Haryana.

Capital Small Finance Bank has a differentiated business model, though localized in a few parts of the country. While the numbers speak for themselves, possibilities of geographical expansion while staying consistent on the client profile and the nature of the asset book are the real differentiators for this small finance bank. With a focus on driving fee income as a proportion of revenue much higher from the current level, Capital Small Finance bank has a good lever to increase ROA and ROW from a combination of operating leverage & cross selling from the newer branches. Given where the interest rate regime in India is, this fits into our preferred template of operating cost optimization leading to higher ROA for a lender, as opposed to increasing yield by serving newer client segments that are unproven. Investors should continue to watch Capital Small Finance Bank and evaluate if the foray into newer regions and the increased focus on cross selling can improve numbers from the current level without increasing the lending risk for the business.

Capital Small Finance Bank Ltd Company Summary

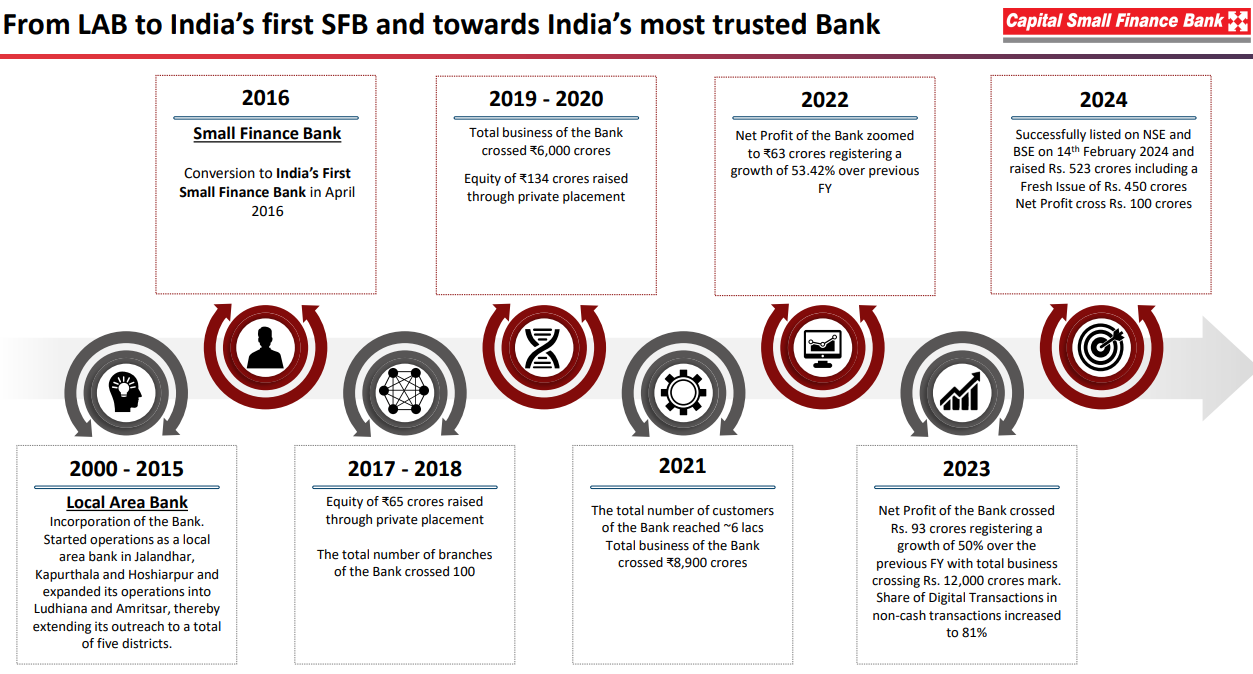

Capital Small Finance Bank Ltd was incorporated in May, 1999 as “Capital Local Area Bank Limited” in Kapurthala, Punjab. Capital Small Finance Bank Ltd was incorporated as a Local Area Bank under RBI. Local Area Bank (LAB) was a specific micro-regional banking license that RBI used to issue in the late 1990s and early 2000s. Under a LAB license, a bank was allowed to operate in 3 to 5 contiguous districts of a particular state only and it was allowed to open only 1 urban branch per district, the rest being rural and semi-urban. Capital Small Finance Bank Ltd continued to operate as a Local Area Bank from 1999 to 2016. In April 2016, the bank was awarded a small finance bank license by RBI along with other applicants like AU Small Finance Bank. In fact, Capital Small Finance Bank Ltd was the first bank in India to receive a small finance bank license. Since 2016, Capital Small Finance Bank Ltd has continued to operate as a successful small finance bank in its home state of Punjab. It has also expanded operations to neighbouring states such as Haryana, Rajasthan, NCR, Himachal Pradesh etc. After Punjab, Capital Small Finance Bank Ltd’s next focus state is Haryana where it wants to create a franchise like Punjab in the coming years.

Capital Small Finance Bank Ltd Management Details

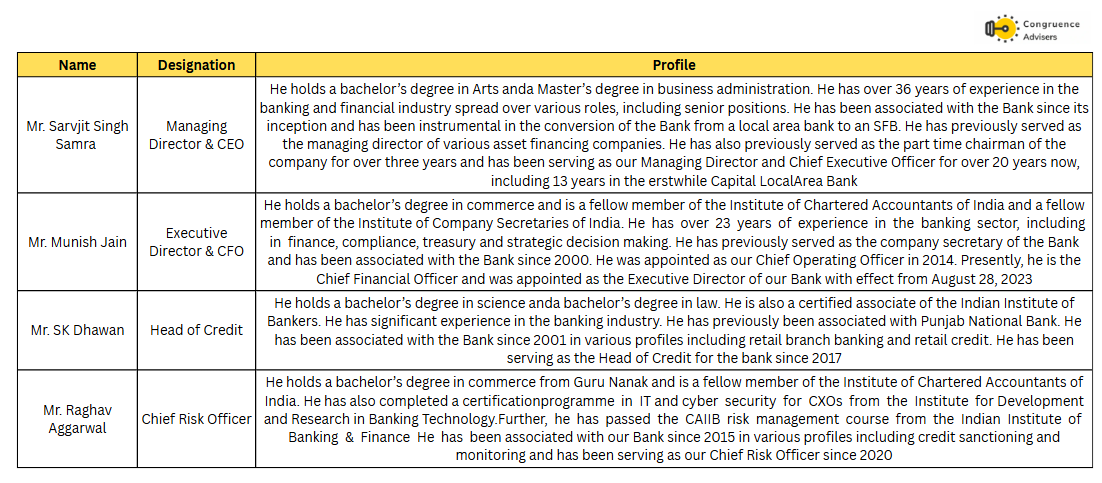

The promoter family of Capital Small Finance Bank Ltd is the Simra family from Punjab. Mr. Sarvjit Singh Simra is the Managing Director and Chief Executive Officer of Capital Small Finance Bank Ltd. Mr. Munish Jain, who joined Capital Small Finance Bank Ltd in 2000, is the Executive Director and seems to be the key executive managing day to day affairs of Capital Small Finance Bank Ltd along with Mr. Simra.

Capital Small Finance Bank Ltd – Industry Landscape

Why were small finance banks created?

Small Finance Bank as a construct was envisaged by the RBI in the 2010s with a view to creating specialised small-bank like institutions which would focus on rural and semi urban populations which were credit deprived. The intent was to create a category of lending institutions which could help deepen credit penetration outside urban areas without overstretching universal banks. The small finance banks were meant to extend credit to the unorganized sector, small and micro business units and industries and farmers. This segment of the population was often deprived of formal credit and had to depend on informal sources of credit which were often usurious.

After inviting applications in 2014, the RBI approved 11 out of the 72 applications received. Most of the approved applicants were micro finance institutions with the exception of Capital Small Finance Bank Ltd, which was a local area bank. The first SFB licenses were rolled out by the RBI in the year 2016.

How are they different from scheduled commercial banks?

Small finance banks differ from universal banks in a few key parameters. Lets understand the differences

- Small finance banks are mandated to have at least 75% proportion of priority sector lending (PSL) on their books whereas the requirement for scheduled commercial banks is only 40%. This restriction is in place to ensure that SFBs fulfill the mandate they were created for.

Priority sector loans refer to loans made to 8 specific sectors which were historically credit deprived such as agriculture, MSME, education, housing, social infrastructure etc.

- At least 50% of the loans extended by Small finance banks must be < INR 25 Lakhs in size. This is to ensure that SFBs focus on micro-credit needs of the underserved segments of society. No such restrictions are placed on scheduled commercial banks

- For an institution to be eligible to apply for an SFB license, its minimum net worth should be INR 200 Cr, whereas the same for a scheduled commercial banking license is INR 500 Cr. This is to encourage more institutions to come forward to take SFB licenses and grow rural and semi-urban credit penetration

- The capital adequacy ratio (CRAR) for SFBs has been set at 15% whereas for scheduled commercial banks, the CRAR ratio has been set at 9% + 2.5% capital conservation buffer (effectively 11.5%). The higher CRAR requirement for SFBs reflects the riskier nature of their lending operations compared to SCBs

- At least 25% of all outstanding branches should be located in unbanked areas at all times

Industry size and AUM composition trends

Today, the total AUM (assets under management) of the small finance bank industry is ~INR 2.8 Lakh Cr in FY25. This comprises ~1.5% of the overall credit outstanding in India. Hence SFBs are still a very small part of the Indian lending ecosystem with scheduled commercial banks dominating the industry. Historically, the SFB industry AUM has grown rapidly at > 25% CAGR per annum. The total share of deposits of SFBs in the Indian lending ecosystem is ~1.2%

While most SFBs had started off as microfinance lending institutions, the share of MFI loans and unsecured loans has been steadily coming down in the portfolios of SFBs over the years. SFBs have progressively diversified into other secured lending practices such as home loans, loan against properties, vehicle loans, MSME loans, gold loans etc. The mix of MFI loans in SFB portfolios has reduced from 40% in FY20 to 32% by FY23. As per latest reports, ~65% of the entire outstanding AUM of small finance banks is now secured in nature.

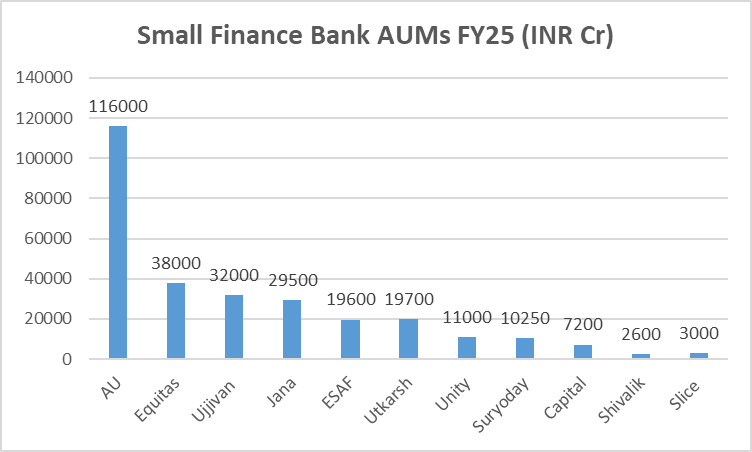

As on date there are 11 small finance banks registered in India. The largest by far is AU Small Finance Bank Ltd. The combined AUM in FY25 is ~INR 2.9 Lakh Cr.

Transition to universal banks

- At least 5 years of successful operation as an SFB

- Listed in the public markets

- A minimum net worth of INR 1000 Cr

- The SFB is required to have profitable and stable operations over the last few years with GNPA < 3% and NNPA < 1%

- SFBs with a diversified loan portfolio will be preferred by RBI

Having recognized that the larger SFBs may outgrow the “small-bank” restrictions placed on them, the RBI has provided a transition mechanism for SFBs to apply for universal banking licenses and transition to becoming universal banks like HDFC Bank or ICICI Bank. An SFB needs to fulfill certain criteria to be eligible for becoming a universal bank

There are several benefits for an SFB in transitioning to a universal bank which would get them interested, primarily

- Transitioning from a “small finance bank” to a regular bank has a positive impact on customers with respect to brand perception. Customers may trust a regular bank more with their savings than a “small finance bank”

- Transitioning to becoming a regular bank removes the restrictions placed on SFBs with respect to minimum 70% PSL lending and having at least 50% of the customer base with Average Transaction Size > INR 25 Lakhs. This can free up the bank to offer a varied product portfolio and expand more into urban locales and tap more profitable customers with larger pockets

- Transitioning to a regular bank may allow SFBs to price their liabilities more aggressively. At present the savings bank and fixed deposit interest rates offered by SFBs tend to be higher than their universal banking counterparts. The higher rates are required to incentivize customers who otherwise may not choose a “small finance bank” vs a regular bank. This could improve the bank’s cost of funds and help expand NIMs

As on date, AU Small Finance Bank Ltd and Ujjivan Small Finance Bank Ltd have submitted their applications to RBI and the applications are under process. AU Small Finance Bank Ltd is highly likely to receive the universal banking license. Jana Small Finance Bank Ltd’s application is also impending and is expected to be filed in CY25. Equitas Small Finance Bank Ltd is expected to file after FY26. The rest of the Small Finance Banks are not close to filing yet as they are yet to fulfill the filing criteria.

Capital Small Finance Bank Ltd Business Details

Core lending Philosophy

Capital Small Finance Bank Ltd is uniquely positioned within the small finance banks and has a very different customer cohort and business model to most of its peers. Let’s take a deeper look into the elements of Capital Small Finance Bank Ltd’s lending philosophy

- Middle income lender: Unlike its peers, Capital Small Finance Bank Ltd does not lend to the low income segment. Instead, it lends to middle income customers whose average annual income ranges between INR 4-50 Lakhs

- 100% secured lending book: Capital Small Finance Bank Ltd believes in extending secured loans to its customers .Therefore it does not have any exposure to riskier, unsecured segments like MFI. This separates it from most of its MFI peers who still have significant MFI exposure

- Become a one-stop shop for the customer: Capital Small Finance Bank Ltd wants to become the primary banker for its customers on the asset and liability sides. The bank believes that this approach will help them build a sticky customer portfolio.

- Believe in extending income generation loans: Capital Small Finance Bank Ltd believes in providing income generation loans rather than consumption loans like gold loans or personal loans. The reason the bank has a small portfolio of consumption loans is to service the demand of their existing customers. They don’t believe in using consumption loan products like gold loans etc. to bring in new customers for the bank

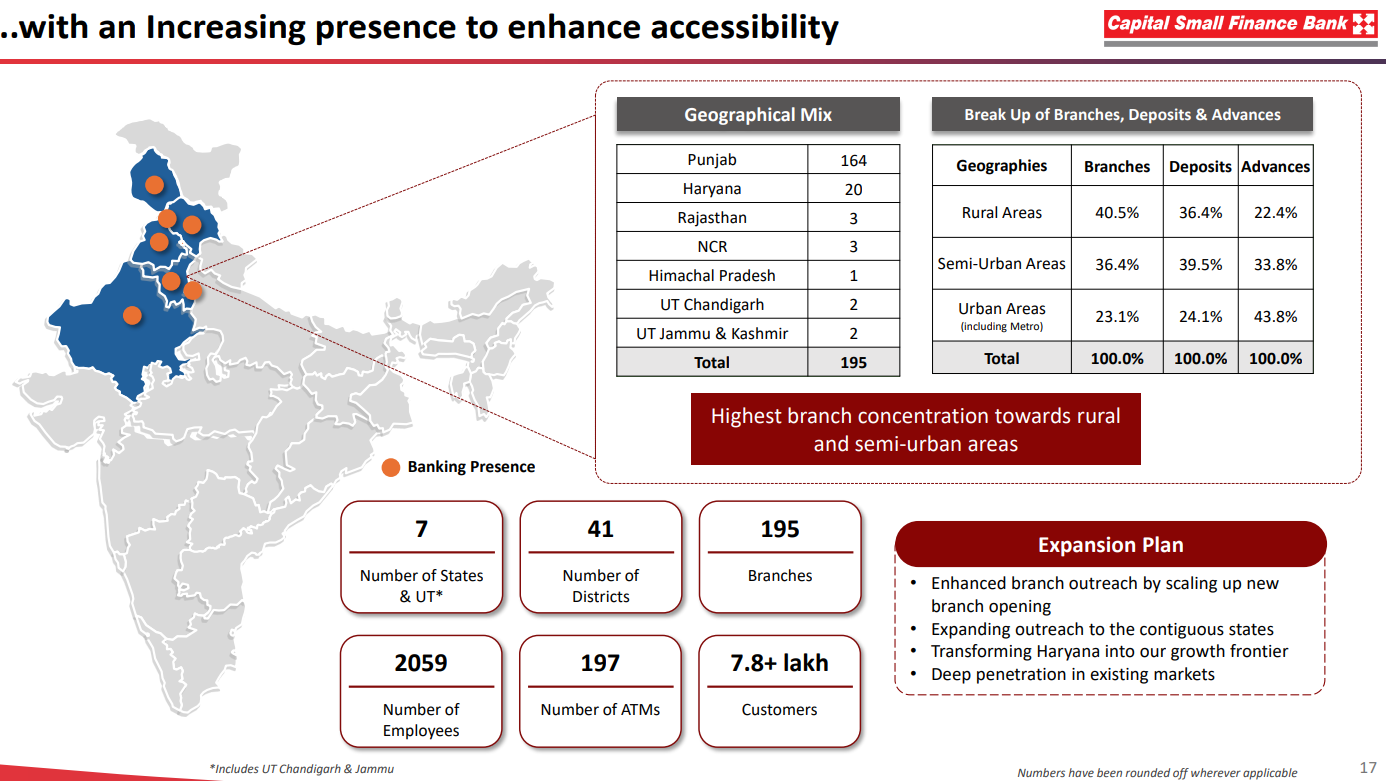

- Contiguous geographical expansion: Capital Small Finance Bank Ltd’s home state is Punjab where an overwhelming majority of its deposits and advances come from. Over the last few years, Capital Small Finance Bank Ltd has opened several branches in Haryana and wants to create a Punjab like franchise in Haryana next, as they believe the customer base in both states share many similarities. The next set of growth states for them after Haryana could be Rajasthan, NCR, Himachal Pradesh etc.

Advance and liability profile

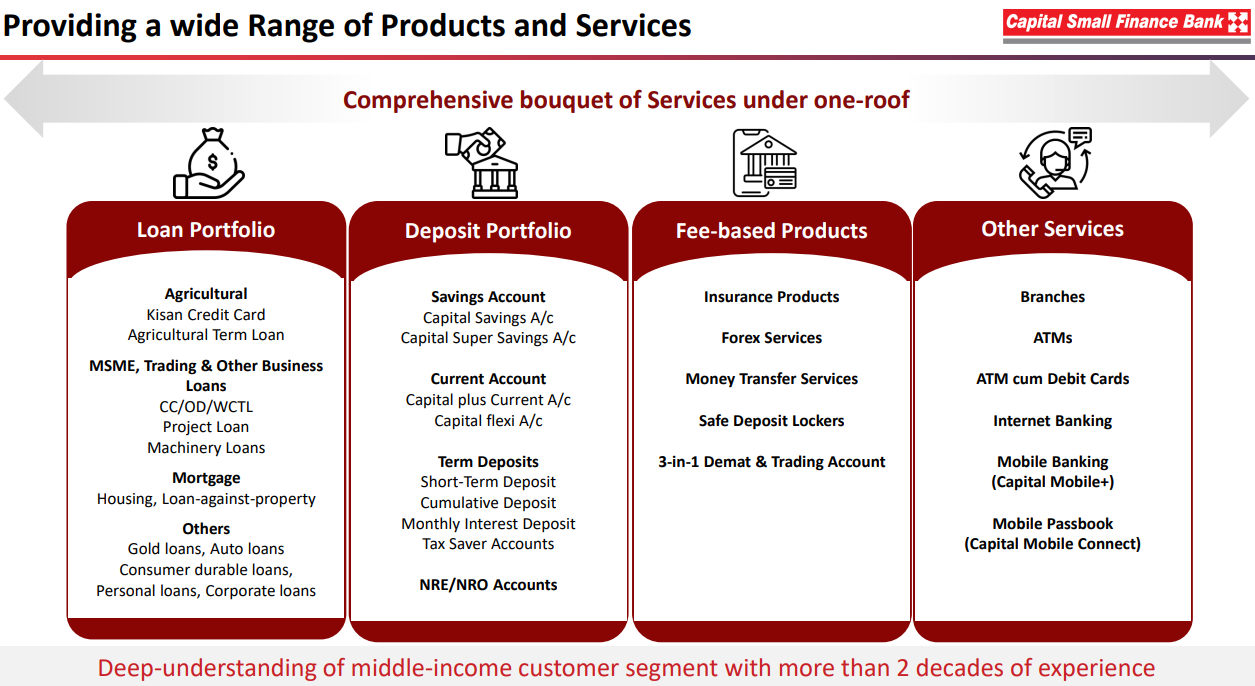

The gamut of services provided by Capital Small Finance Bank is summarised in the chart below

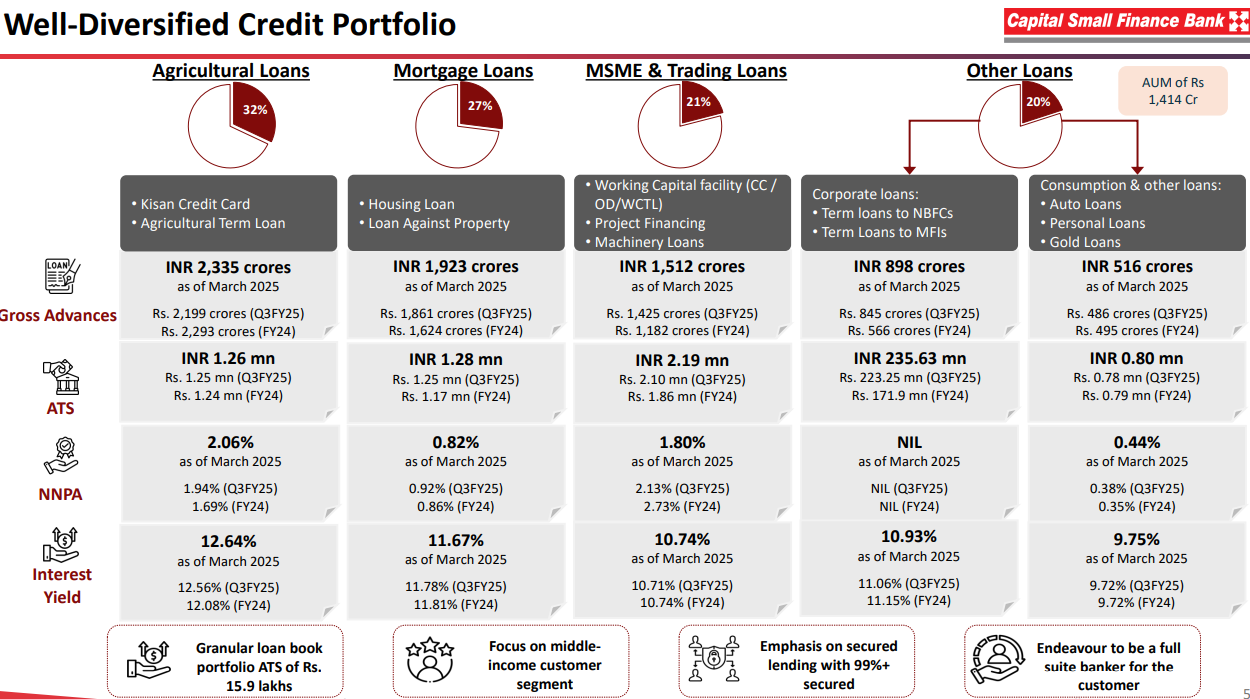

Capital Small Finance Bank Ltd offers 5 major loan products as listed below in the chart

- Agricultural loans – These are a mix of short term Kisan Credit Card (KCC) working capital loans of duration < 1Y and longer term agricultural term loans which have a tenure of 5-7 years. While underwriting agri loans, the farmer’s paying capacity is assessed based on land size and cropping patterns. The land should be able to bear at least 2 crops in a year, with the bank preferring 3 crops with one MSP crop. The loan-to-value ratio is usually 50% and the collateral is agricultural land. Average ticket size is INR 12-13 Lakhs.

- Housing loans and LAP – The book here is split evenly between housing loans and loan-against-property (LAP). The loan-to-value ratio for LAP is 50-65% and the loan-to-value ratio for HF is 67-78%. Average ticket size is INR 12-13 Lakhs

- MSME and trading loans – These comprise a variety of secured loans for working capital, machinery financing or project financing. The loan-to-value ratio is between 75-82% and average transaction size is ~INR 12 Lakhs

- Corporate loans – These are wholesale loans made usually to other NBFCs. Most of the book is made up on NBFCs who are in the business of secured onward lending with < 10% of the book lent to NBFC MFIs. The average ticket size here is ~INR 24 Cr and there are only 40-45 clients in all. The bank does not lend to customers who have a below-investment-grade credit rating and is trying to build a book consisting of A- to A+ rated clients only. All loans made to financial institutions with a credit rating below A- are protected via first-loss-default-guarantee (FLDG). The underwriting of these corporate loans are based on the corporate’s leverage ratio, capital adequacy, historical write off track record and lending profile (% secured book).

- Consumption loans – As mentioned above, these loans are not a core product of Capital SFB, but are included to service existing customers who demand gold, auto or personal loans. Therefore, this is an ancillary offering by the bank to ensure provision of full-suite services to its clients. The average ticket size here is INR 8 Lakhs.

Overall, ~80% of the advances book is collateralised using either property or fixed deposits kept with the bank. Due to Capital Small Finance Bank Ltd’s heavy presence in agricultural pockets of India, Capital Small Finance Bank Ltd’s business is seasonal. Q1 and Q3 are usually weak in terms of advances and strong in terms of collections and deposits, reflecting harvesting periods. On the other hand, Q2 and Q4 are strong for advances and weak for deposits, reflecting loan demand in preparation for sowing season

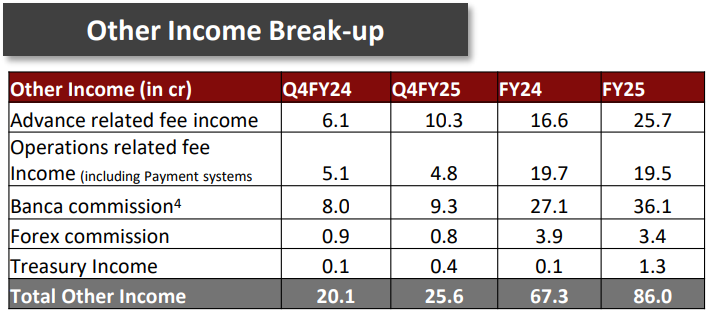

Capital Small Finance Bank Ltd also has a sticky fee income franchise, primarily driven by Banca commissions earned from distributing medical and life insurance policies and advances related commissions. Other income as % average assets has inched up over the years to 0.9% but still has a long way to go in comparison to SFB peers who report 1.5-2%.

Capital Small Finance Bank Ltd has a strong retail-deposit focused liability franchise. ~82% of the bank’s funding is raised via deposits, with an impressive 37% CASA ratio. About ~93% of Capital Small Finance Bank Ltd’s deposit base comes from retail deposits vs wholesale deposits. The liability book is granular with an average savings account balance of INR 42000 per customer.

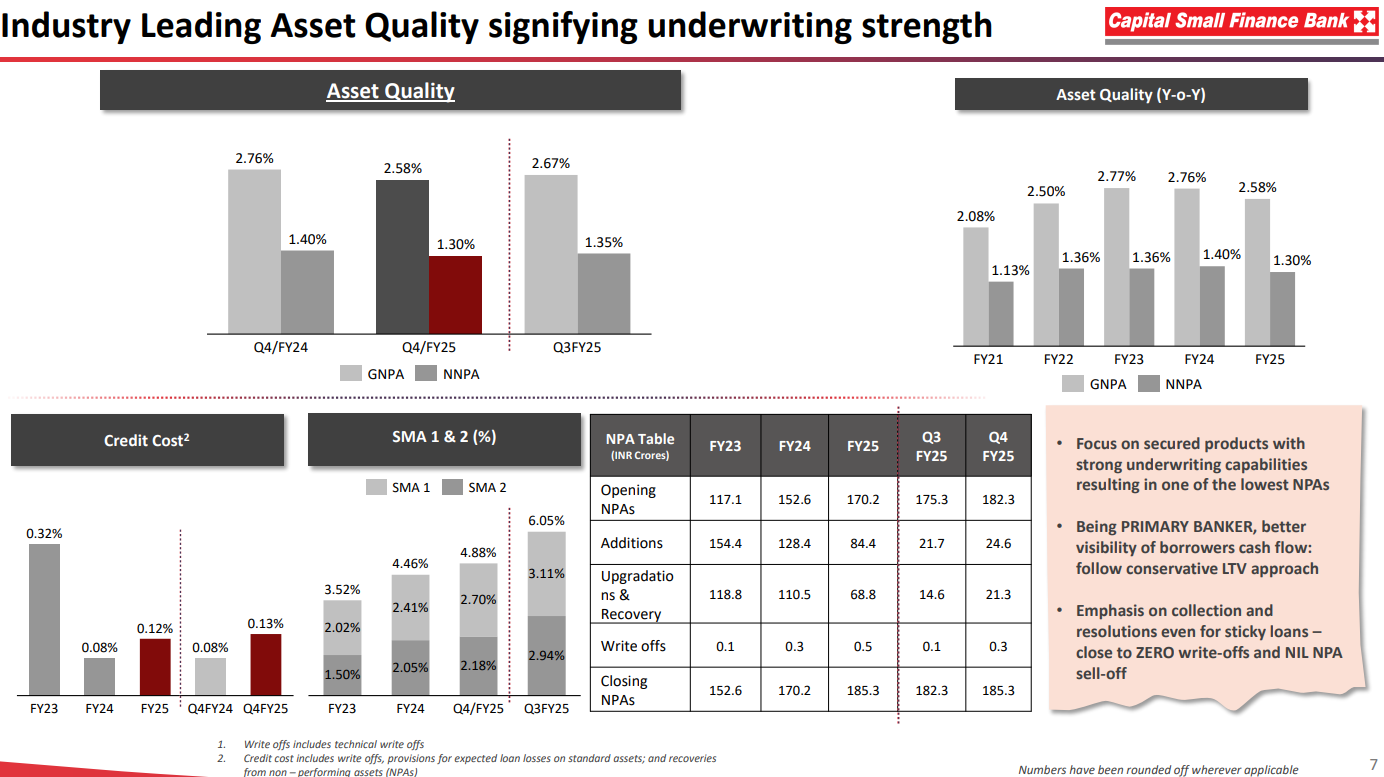

Capital Small Finance Bank Ltd has always managed to keep good credit discipline. This is reflected in its 5Y average GNPA, NNPA, PCR and credit cost ratios of 2.55%, 1.31%, 49% and 0.3%. By virtue of its conservative lending model, Capital Small Finance Bank Ltd has the lowest credit costs amongst its SFB peers by a distance. Capital Small Finance Bank Ltd does not focus on the SMA-0 bucket (0-30 days overdue) but chooses to focus on SMA-1 and SMA-2 buckets (31-90 days overdue), as customers often pay EMIs at the end of the month rather than on the exact day of the month they are due. Capital Small Finance Bank Ltd has consistently managed to recover overdue loans keeping credit costs low in spite of not-so-low SMA buckets.

Capital Small Finance Bank Ltd prides itself on its record of near-zero write-offs and zero ARC sales. Capital Small Finance Bank Ltd tries to maintain an overall provision coverage ratio of 50%+. An unsecured loan which is NPA for more than 1Y+ is fully provided for whereas a secured loan which is NPA for 4Y+ is fully provided for.

Branch network and geographies

Capital Small Finance Bank Ltd has a branch network of 195 branches with most of them being in the home state of Punjab. Haryana has the next highest number of branches with 20. Punjab contributes ~79% of the bank’s advances and ~90% of the bank’s deposits. In FY26, Capital Small Finance Bank Ltd plans to open 20-25 branches with 10 new branches being planned for Haryana. This signals their intent to focus on Haryana as the next growth state after Punjab.

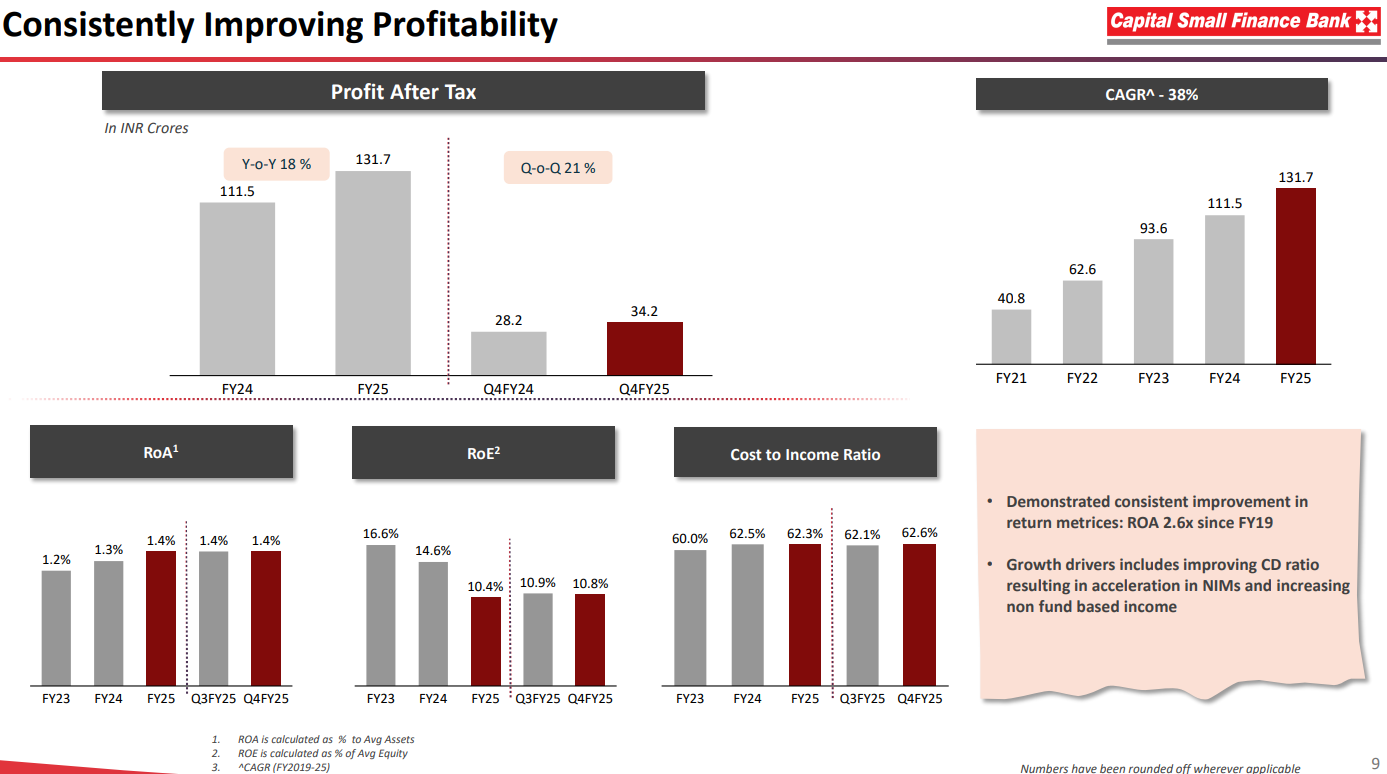

Capital Small Finance Bank Ltd’s robust advances and liabilities operations have ensured rapid growth in profit after tax and healthy return on capital metrics. Between FY21-FY25, Capital Small Finance Bank Ltd has compounded PAT at a CAGR of 34% with an average RoA of 1.1% and an average RoE of 12.8%. Over the last 3 years the RoA has consistently improved by 10bps each year, reaching 1.4% in FY25. The RoE at 10.4% for FY25 appears to be depressed due to the IPO equity raise. This is expected to normalise to mid-teens in the next 2-3 years. Capital Small Finance Bank Ltd does not anticipate an equity capital raise for the next 2-3 years. This should expand leverage ratios and ROEs significantly.

Capital Small Finance Bank Ltd Corporate Governance Analysis

- Board Composition – Capital Small Finance Bank Ltd has a large Board comprising 12 members, with 7 Independent Directors, 2 Nominee Directors and 2 Executive Directors. The Chairman of the Board is an Independent Director. The Board of Directors have relevant experience across banking, finance, law and agriculture.

- Promoter remuneration – The total remuneration paid to promoters and executive leadership amounted to ~INR 6.5Cr in FY24, comprising salary, rental payments and interest payments. This amounted to ~6% of FY24 PAT.

- Related Party Transactions – There are no significant related party transactions to note apart from borrowings/deposits received from promoters and their related parties amounting to INR ~11.4 Cr and interest payments to promoters and their related parties to the tune of INR ~2.28 Cr.

- Contingent Liabilities – The total contingent liabilities of Capital Small Finance Bank Ltd amounted to ~INR 9.2 Cr which amounted to < 1% of the book value of equity of Capital Small Finance Bank Ltd in FY24.

- Dividend Policy – Capital Small Finance Bank Ltd has been consistently paying dividends over the last several years. In FY24 Capital Small Finance Bank Ltd paid a dividend of INR 1.2/share and in FY25 Capital Small Finance Bank Ltd paid a dividend of INR 4.1/share.

Capital Small Finance Bank Ltd Financial Performance

Between FY21 and FY25, Capital Small Finance Bank Ltd has grown its AUM from INR 3763 Cr to INR 7184 Cr, at a CAGR of 18%. In the same period, Capital Small Finance Bank Ltd’s PAT has grown at a CAGR of 34%.

Capital Small Finance Bank Ltd Yields, cost of funds and interest spreads have been relatively consistent and range bound over the last 5Ys at 10.8-11.3%, 5.1-6.0% and 5.2-5.7% levels respectively. Capital Small Finance Bank Ltd NIM has expanded significantly, presumably due to an expanding credit-deposit ratio over the years and lower leverage in FY25 as the IPO equity has flown into the balance sheet. Operating costs as % of assets has also remained stable in the range of around 2.9-3.2%. Credit costs have steadily declined from 0.5% in FY21 to 0.1% in FY25.

During this period, Capital Small Finance Bank Ltd RoA has steadily increased from sub 1% to 1.4% in FY25. RoE was also tracking the trajectory of RoAs till FY24, it has dipped in FY25 due to the leverage ratio coming down thanks to IPO. Capital Small Finance Bank Ltd has delivered these return metrics while keeping provision coverage ratio at acceptable levels of 50% and GNPA at ~2.5%.

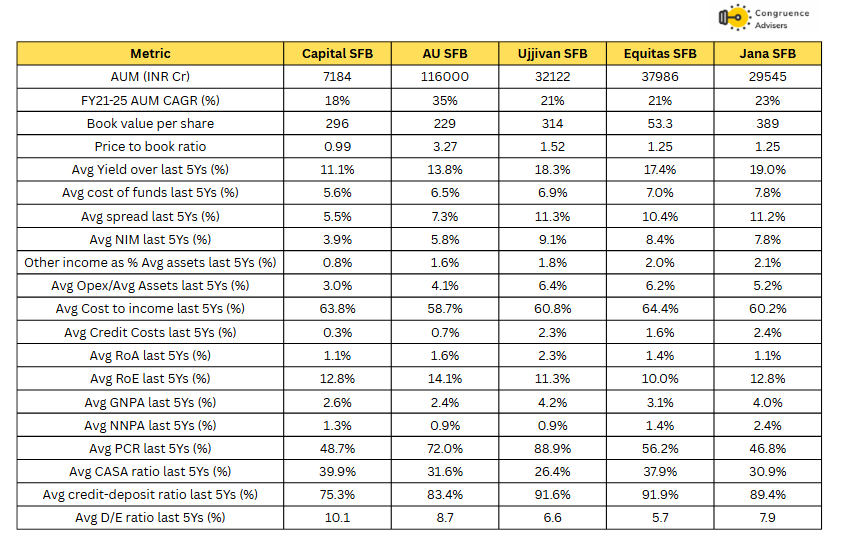

Overall, Capital Small Finance Bank Ltd has performed quite well in terms of return metrics. The growth CAGR of 18% while good in general, is much lower than other SFB peers. But then as we will see in the rest of this note, Capital Small Finance Bank Ltd is not your typical Small Finance Bank and chooses to operate with a very different business model. Hence the growth rates have to be considered in that context.

Capital Small Finance Bank Ltd Comparative Analysis

To understand Capital Small Finance Bank Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Capital Small Finance Bank Ltd to its competitors (peer comparison) on various fundamental parameters and Capital Small Finance Bank Ltd share performance relative to relevant benchmark and sector indices.

Capital Small Finance Bank Ltd Peer Comparison

Let’s compare Capital Small Finance Bank Ltd’s performance with its larger Small Finance Bank peers.

Capital Small Finance Bank Ltd is clearly the smallest Small Finance Bank amongst the peers compared, by a distance. It is also Capital Small Finance Bank Ltd which has grown its AUM at the slowest rate compared to its peers. The vast difference in Capital Small Finance Bank Ltd’s model compared to its peers is evident in the gulf in its average NIM of 3.9% with the average NIM of the other 4 peers at 7.8%. That’s compensated to a large extent via its very low credit cost of 0.3% vs the average credit cost of the other 4 peers at 1.8%. Capital Small Finance Bank Ltd’s RoA is also the joint lowest in its peer group, at 1.1%, a result of the low NIMs it chooses to operate with. Historically, it has had a significantly high leverage ratio of 10.1x, presumably due to its conservative lending model which allowed it to lever up more than its peers. Since the IPO, the leverage has come down, impacting the ROE in FY25, but one expects that it will go up over the next 2-3 years as they lever up again.

As stated earlier, Capital Small Finance Bank Ltd’s unique model amongst the Small Finance Banks peer group clearly stands out in this table. Hence, as an investor, one really cannot afford to assess Capital Small Finance Bank Ltd with the same lens that one applies to the Small Finance Bank Ltd pack in general.

Capital Small Finance Bank Ltd Index comparison

Capital Small Finance Bank Ltd share performance vs S&P BSE Small cap Index as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why you should consider investing in Capital Small Finance Bank Ltd ?

Capital Small Finance Bank Ltd offers some compelling reasons to track closely and to consider investing in banking sector

Small finance banks have a long runway of growth – Small finance banks have a combined AUM of ~3L Cr today which is a tiny portion of India’s total credit market (<2%) and it is growing at 20%+, much faster than overall credit market growth due to the segments of the market it targets. Hence, SFBs as an industry, offer high growth rates and a long runway as a value proposition.

Long experience in its home market – Long before it became an SFB in 2016, Capital Small Finance Bank Ltd had been operating in its home market of Punjab since 1999 as a Local Area bank. Hence, Capital Small Finance Bank Ltd has a deep understanding of its customer base and credit dynamics in the agricultural belts of Punjab and Haryana. This should give us reasonable confidence about their ability to navigate credit cycles in the region robustly.

Unique lending characteristics in the SFB universe – Capital Small Finance Bank Ltd, while part of the SFB universe, stands out against its SFB peers across several metrics. Unlike its peers, Capital Small Finance Bank Ltd targets middle income customers and not low-income customers. The average yield on its book is ~11%, significantly lower than its peers which operate at 16-20% yields. Its cost of funds at 6% is also the lowest in its peer group. Thus, compared to other SFBs, Capital Small Finance Bank Ltd offers a differentiated, more conservative value proposition which may be preferred by many investors.

100% secured book and history of very low credit costs – Capital Small Finance Bank Ltd has a 100% secured book and historically has managed to have credit costs in a very low range, below 0.5% per annum. This should give investors confidence about the quality of their underwriting.

What are the Risks of investing in Capital Small Finance Bank Ltd ?

Question marks on growth and terminal value in the long term – Capital Small Finance Bank Ltd has a model based on lending to middle income customers at comparatively low yields (~11%), piggybacking on its low cost of funds (~6%). Today, Capital Small Finance Bank Ltd is able to raise low cost deposits from Punjab due to its two-and-a-half decade presence in the state and the trust that it has built with its customer base.

However, at these rates of deposits (3.35% savings account rate, 7.5% fixed deposit rate), it starts competing with much larger commercial banks to win customers. The sustainability of this deposit model might come into question when they have to start raising deposits from outside their home markets in order to grow. If they are not able to raise deposits at the present low rates, then they will have to increase their yields from 11% and potentially get into riskier segments such as unsecured lending, where they have no experience.

Hence the terminal value of their present business model can be called into question. This doubt might potentially cap their PB valuation ratios.

Geographical concentration – A large proportion of their current lending book is based in Punjab (~79%) with smaller amounts in Haryana, Rajasthan, NCR and surrounding geographies. Greater than 90% of their deposits are raised from liability customers in Punjab. Hence, Capital Small Finance Bank Ltd is significantly geographically concentrated in the state of Punjab and is thus exposed to state specific risks. With the recent military escalations between India and its erratic neighbour to the West, this adds a geo-political risk factor for the bank in addition to local political and climactic risk factors

Deposit franchise in SURU (semi-urban and rural) areas whereas advances customers in urban areas – Capital Small Finance Bank Ltd bank has ~75% of its branches in SURU areas, 76% of its deposits come from SURU branches, whereas only 56% of its advances are made in SURU branches with 44% being made in urban branches. ThusCapital Small Finance Bank Ltd’s strategy seems to be to raise liabilities from its core customer base in the hinterland of Punjab and use them to make advances in urban areas in Punjab, Haryana and Rajasthan. This mismatch in assets and liabilities means that Capital Small Finance Bank Ltd’s performance in SURU branches and urban branches are linked to each other even though logically they ought not to be. If for some reason, liability growth in the SURU branches slows down then that will affect advances in urban branches and if advances in urban areas slows down, then Capital Small Finance Bank Ltd will have to expand its customer base in SURU branches to compensate.

One hopes that over time, as Capital Small Finance Bank Ltd gains trust and visibility in urban centers, its deposit franchise in urban centers will increase to match the urban share of advances.

Capital Small Finance Bank Ltd Future Outlook

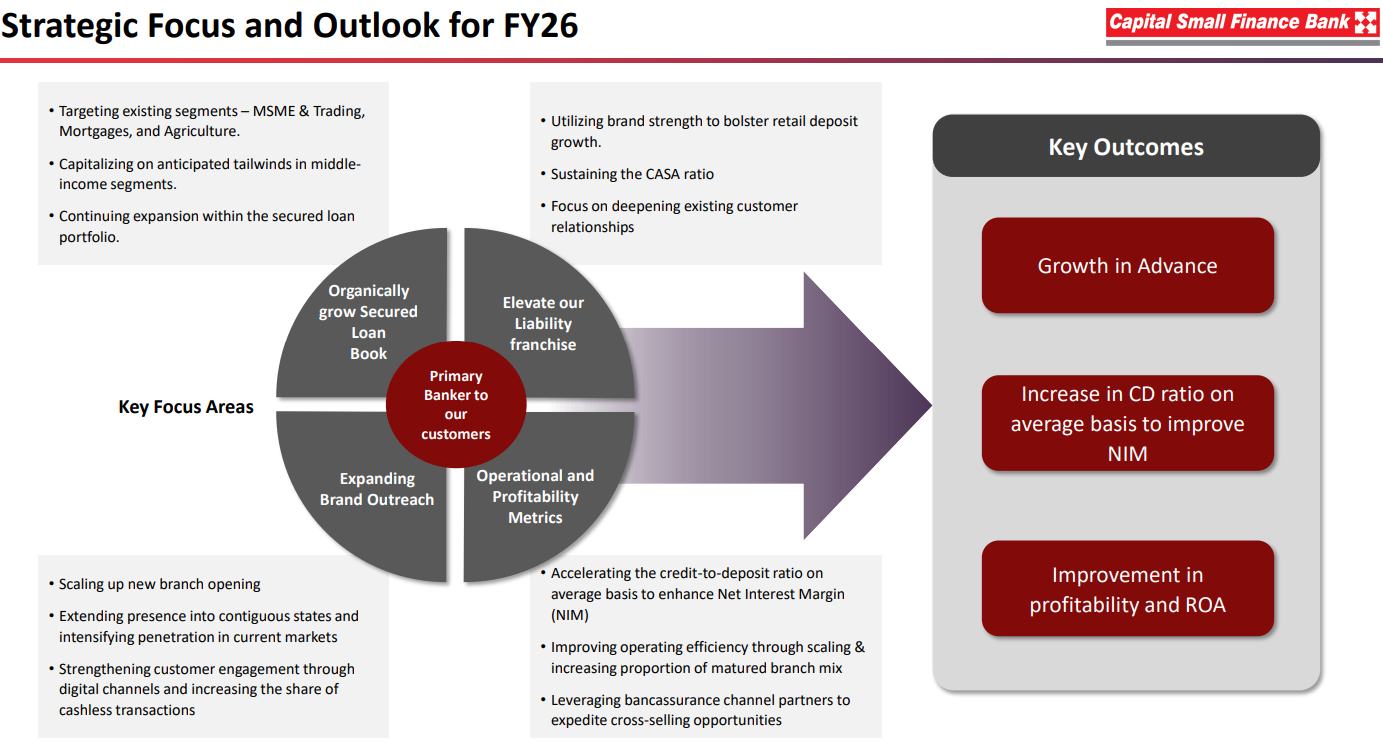

Capital Small Finance Bank Ltd management shies away from giving any specific guidance as any prudent banking management should. Banking after all is a commodity industry affected by a myriad of economic factors which cannot be predicted. Even so, the management is targeting a loan book growth in excess of 20% for FY26. The deposit growth is expected to be > 11% reported in FY25. Management is confident of RoA expansion over the next 2-3 years primarily due to the following factors

- Increase in the CD ratio – Capital Small Finance Bank Ltd intends to increase the credit-deposit ratio from 81.4% to the late 80s. For every 100bps increase in the CD ratio, the management expects a 4bps expansion in NIM which flows through directly to the RoA

- Optimisation of other income as % of average assets – Capital Small Finance Bank Ltd intends to increase its other income as % of average assets to bring it more in line with its Small Finance Bank peers. At present this ratio is ~0.9% for Capital SFB whereas its > 1.5% for its Small Finance Bank peers. Increased cross sell and focus on driving the fee income franchise should help them achieve this goal

- Operating leverage as branches mature – In our opinion, this is the weakest lever for the near term. As Capital Small Finance Bank Ltd builds out its branch network outside of Punjab, we expect new branches to take time to break even and become profitable. Thus, this lever is unlikely to contribute to an increase in RoA in the next 2-3 years. This may be a medium term lever which will kick in 3-4 years down the line when their brand presence and franchise in Haryana matures significantly.

Capital Small Finance Bank Ltd bank has indicated its intention to file for a universal banking license in the next couple of fiscal years. At present it appears to meet all eligibility parameters apart from the requirement of NNPA being < 1% for 2 consecutive years. We believe Capital Small Finance Bank Ltd should not be in too much of a hurry to gain the universal banking license at this stage of its journey. In a bid to compress NNPAs to gain the license, the bank may be forced to increase the PCR ratio and recognize higher credit costs which will affect its RoA metric. Capital Small Finance Bank Ltd has been on a nice upward RoA trajectory over the last 3 years and we believe at this early stage of its listed journey in public markets, it should continue to build on that track record to develop confidence in the investor fraternity. Of course, given its low NIM and low yield franchise, transitioning to a universal banking license is likely to strengthen its business model by enhancing its ability to raise low cost liabilities. But we believe the license will come in due course of time in a few years and there is no need to force it.

Capital Small Finance Bank Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Capital Small Finance Bank Ltd Price Charts

Since Capital Small Finance Bank Ltd listed just about a year ago, it makes sense to only look at its daily chart.

Capital Small Finance Bank Ltd stock listed at a price of 433 and went on to make a high of 467 a few days later. But since then it has been a downhill story. Along with the rest of the financial sector, Capital Small Finance Bank Ltd also got derated from 1.6x BV to < 1x BV steadily over the course of the next few months. Capital Small Finance Bank Ltd stock seemed to have found a bottom around 271 in early 2025 from where it reversed to 317, but the markets sent it back to 255 levels to form a new all time low. April and May were incredibly volatile for Indian markets following the Trump tariff tantrums and the India-Pak skirmishes on the border. Since the crises got over, Capital Small Finance Bank Ltd stock has recovered a bit and is consolidating in the 280-300 range over the last few weeks.

The immediate support level for Capital Small Finance Bank Ltd stock is 271, followed by the all time low levels of 250-255. On the upside, Capital Small Finance Bank Ltd stock faces strong resistance at 318. The next resistance level is at 362. Considering that Capital Small Finance Bank Ltd stock seems conservatively valued at < 1x BV at present, we see no imminent danger of Capital Small Finance Bank Ltd stock testing its support levels (Unless of course a new “crisis” crops up). Any sharp falls from current levels, maybe accumulation opportunities. On the upside, the resistance levels should progressively get taken out once Capital Small Finance Bank Ltd starts showing 20% growth in its book and mid teens ROE. If management delivers on its guidance, both of those outcomes should be achieved in FY26.

Capital Small Finance Bank Ltd Latest Latest Result, News and Updates

Capital Small Finance Bank Ltd Quarterly Results

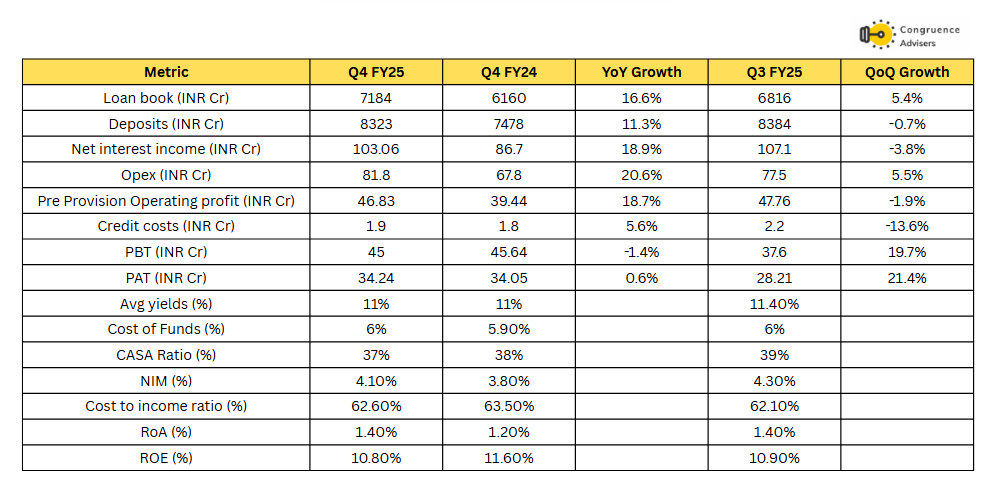

Capital Small Finance Bank Ltd reported steady results in Q4 FY25 with the loan book growing at 17% YoY and deposits growing at 11% YoY. PAT increased by 21% YoY, RoA for the quarter came in at 1.4% and ROE for the quarter came in at 10.8%. Credit cost was very low at 0.13% for the quarter.

Capital Small Finance Bank Ltd Yield on advances for the quarter came in at 11% against cost of funds of 6%, leading to an interest spread of 5% and a net interest margin (NIM) of 4.1%. For the full year FY25, yields on advances came in at 11.2%, cost of funds at 6%, NIM at 4.2% and RoA and RoE at 1.4% and 10.4% respectively.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this to a general audience. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will continue/be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.