Dharmaj Crop Guard Limited, incorporated in 2015, is a microcap agrochemical company; Dharmaj Crop Guard Limited manufactures, distributes and markets a wide range of agrochemical formulations from its facility in Ahmedabad, Gujarat and active ingredients and intermediates at Saykha GIDC, Bharuch, Gujarat. Dharmaj Crop Guard Limited was listed on the BSE & NSE on 8 Dec 22. Dharmaj Crop Guard Limited’s business is categorised into 3 verticals: – Branded Formulation (B2C), Institutional Formulation (B2B), & recently launched Active Ingredients.

Dharmaj Crop Guard Limited: A High-Growth Play in Domestic Agrochemical Sector

We believe Dharmaj Crop Guard Limited is poised for significant growth, with the potential to achieve a 25% sales CAGR for next few years. While FY25 may see subdued profitability due to new capex, The real upside is expected over FY26-27, driven by margin improvements and optimal utilisation of new capacity. Favourable domestic agrochemical market conditions and management’s focus on controlling working capital & Cash Flow make it very interesting play on agrochemical sector

Dharmaj Crop Guard Limited Company Overview

Dharmaj Crop Guard Limited is a relatively new player in the agrochemical industry. Dharmaj Crop Guard Limited was incorporated in 2015 by first-generation promoters with extensive experience in various agrochemical companies, including the likes of Coromandel, Sumitomo, Cheminova, UPL, etc. Dharmaj Crop Guard Limited began operations in 2016 with a formulation manufacturing unit in Kerala GIDC on the periphery of Ahmedabad in Gujarat. Dharmaj Crop Guard Limited is into manufacturing, distributing, and marketing a wide range of agrochemical formulations such as insecticides, fungicides, herbicides, plant growth regulators, micro fertilisers, and antibiotics.

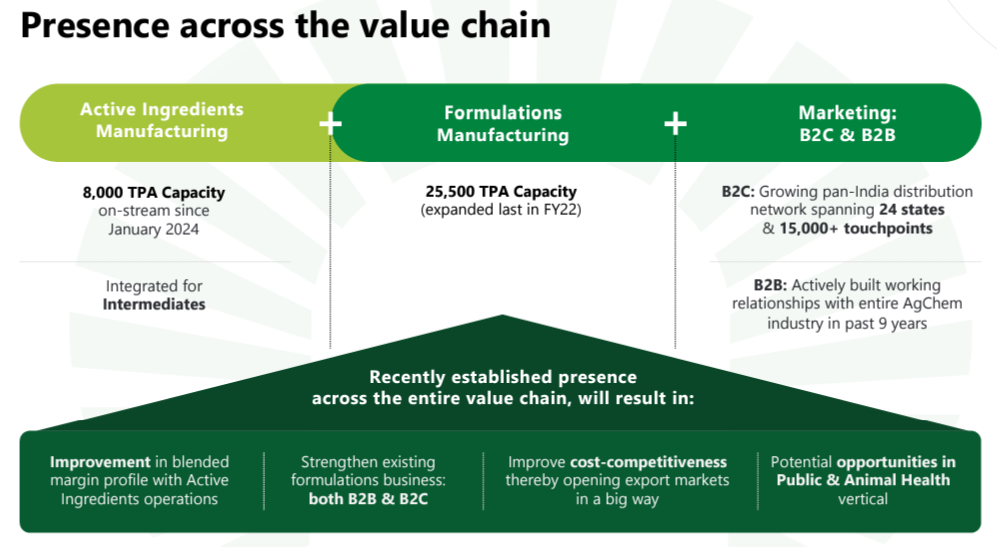

Dharmaj Crop Guard Limited’s business is broadly categorised into 3 verticals – Branded Formulation (B2C), Institutional Formulation B2B & recently forayed vertical Active Ingredients (B2B). Over the last 8 years, Dharmaj Crop Guard Limited has built a distribution network of 16,000 plus touch points with 5,000 plus dealers and distributors in 24 states supported by 20 stock depots. On the institutional side, Dharmaj Crop Guard Limited has built a customer base of 730+ clients. They actively engaged with customers of all sizes, i.e., MNCs, domestic majors, and smaller firms.

Dharmaj Crop Guard Limited has recently commissioned an active ingredients & intermediates manufacturing facility located in Saykha GIDC, Bharuch. This plant has a cumulative production capacity of 8,000 TPA.

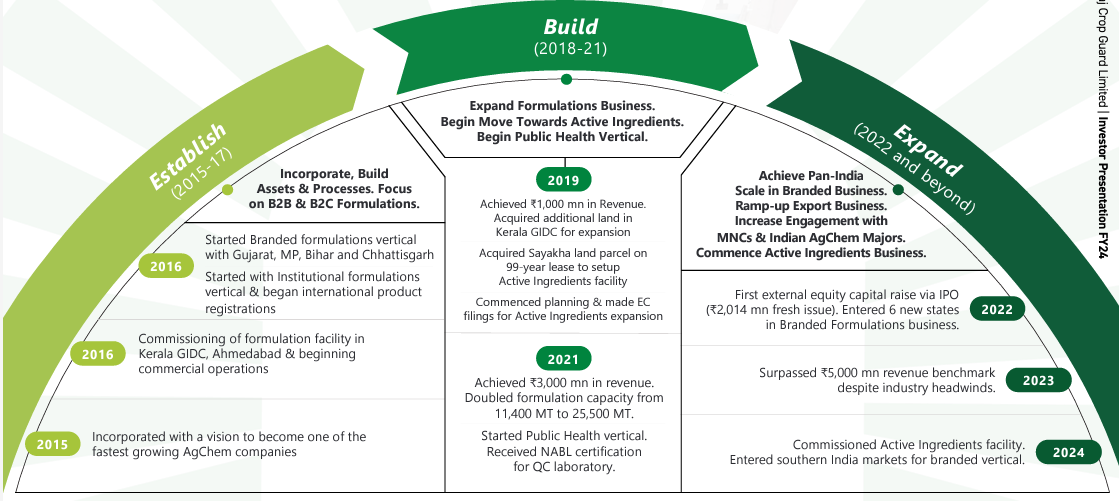

A Quick Glimpse of Dharmaj Crop Guard Limited Evolution

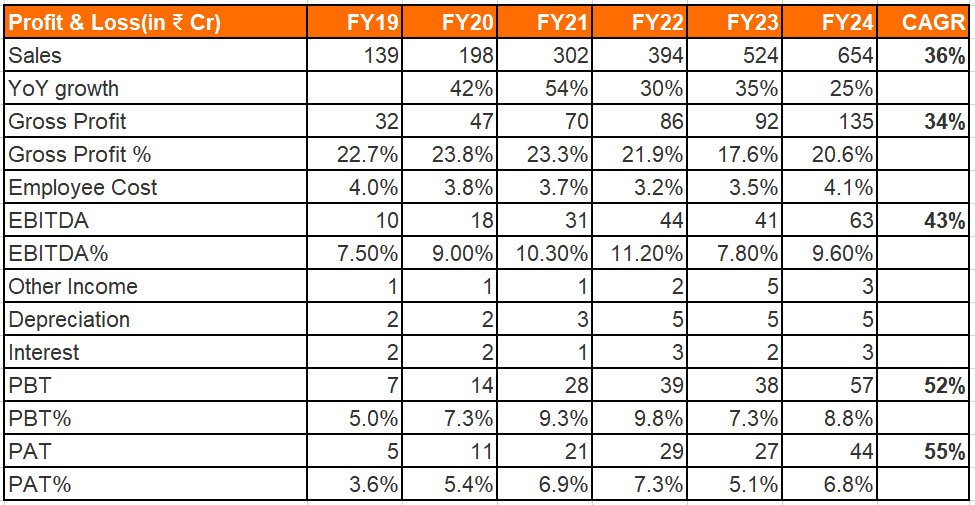

It’s noteworthy that since commencing operations in 2016, Dharmaj Crop Guard Limited has rapidly scaled its revenue to ₹654 Cr in FY24 (₹756 Cr on a TTM basis), making it one of India’s fastest-growing agrochemical companies with the last 5 years Sales & PAT CAGR at 36% & 55%

IPO and objective of IPO

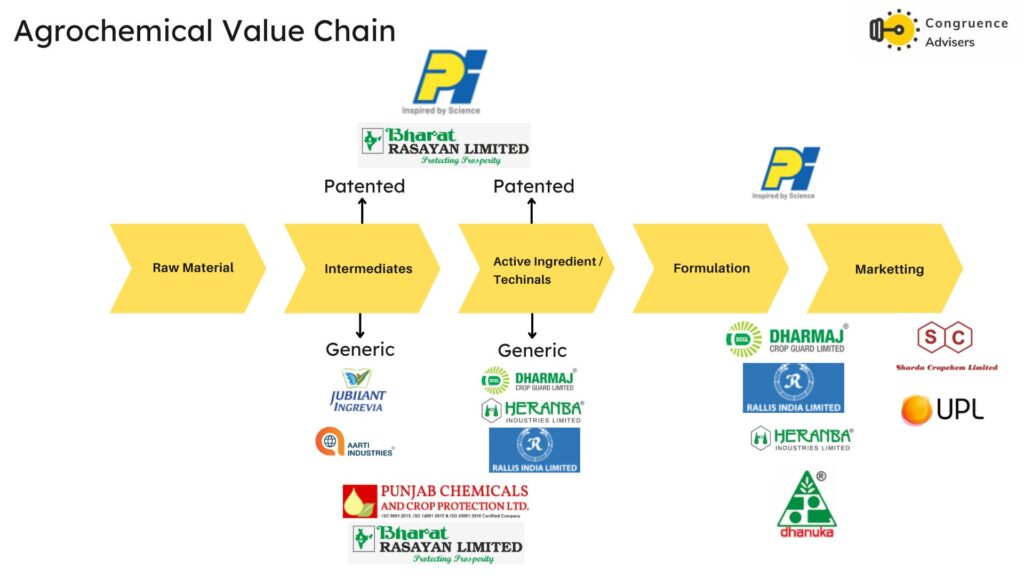

Dharmaj Crop Guard Limited launched an IPO worth ₹251 Cr, with ₹216 Cr as the fresh issue of equity shares. The primary objective of the IPO was to partially fund the construction of a new plant in Sayakha, Gujarat, for backward integration into agrochemical technicals and its intermediates, which will be used for internal consumption and sales in the domestic & international markets, i.e., expanding the presence of Dharmaj Crop Guard Limited across the value chain.

Dharmaj Crop Guard Limited Management details

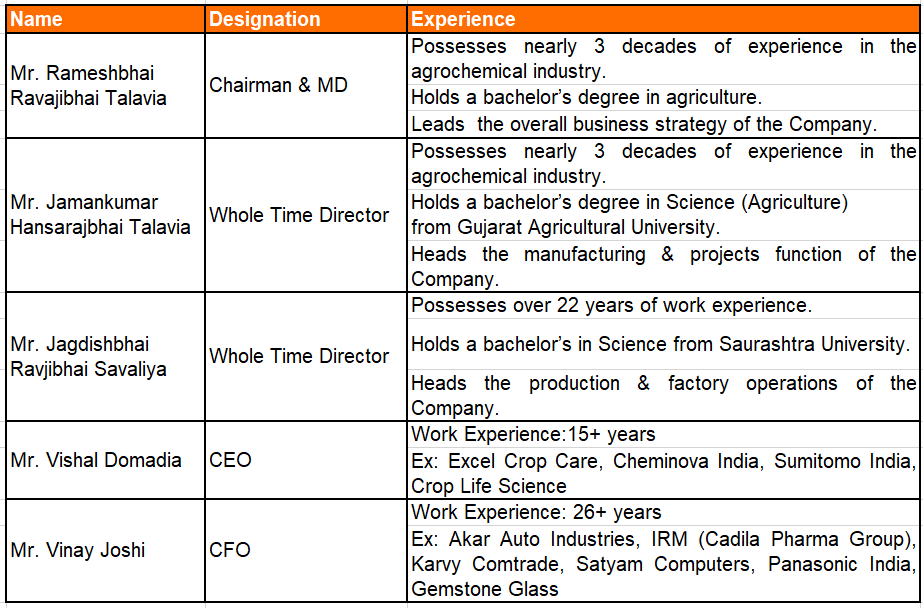

Dharmaj Crop Guard Limited is led by a team of first-generation entrepreneurs with deep roots in the agrochemical industry. Rameshbhai Talavia (54 years), the Managing Director, founded Dharmaj Crop Guard Limited in 2015 after his impactful career at various agrochemical companies. His cousin, Jamankumar Talavia (54 years), a Whole-Time Director, has been instrumental in driving Dharmaj Crop Guard Limited’s manufacturing and procurement strategies. Jagdishbhai Savaliya (45 years), Whole-Time Director, ensures the highest standards in product quality. Vishal Domadia (37), the CEO, joined Dharmaj Crop Guard Limited in 2016, specialising in brand management and sales & marketing, significantly enhancing Dharmaj Crop Guard Limited’s market presence. Together, these leaders have vast experience and have built Dharmaj Crop Guard Limited into a formidable player in the agrochemical sector.

The promoters are backed by a management team & core technical team that has vast experience in manufacturing with the required technical know-how to manufacture the products that Dharmaj Crop Guard Limited offers

Dharmaj Crop Guard Limited Industry Overview

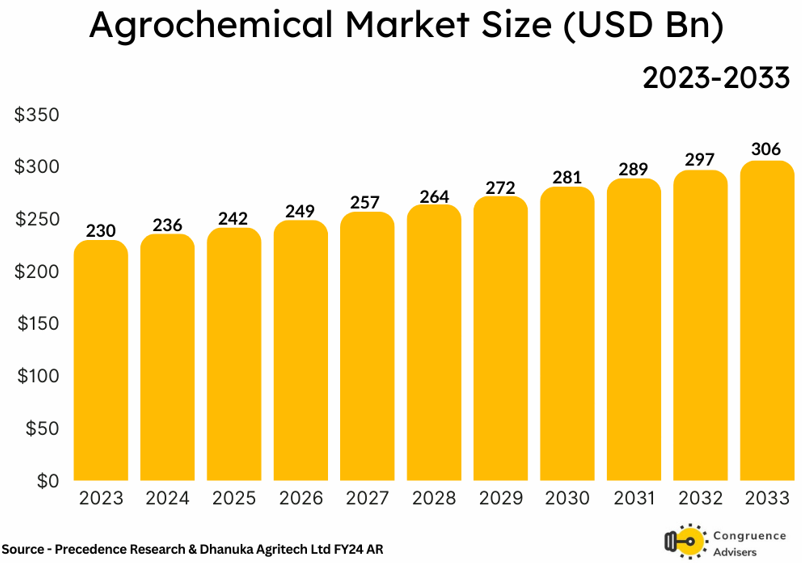

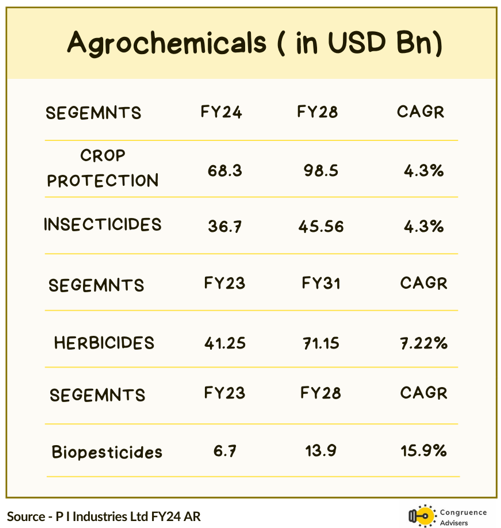

Global Agrochemical Industry

The global agrochemicals market size, valued at US$ 229.53 billion in 2023, is poised to grow to US$ 305.63 billion by 2033, growing by a CAGR of 2.92% during the forecast period of 2024-2033, as per a report by Precedence Research, a global market research firm.

Indian agrochemical market

The market size of India’s agrochemical industry is expected to grow from US$ 7.90 billion in 2023 to US$ 12.58 billion by 2028, a CAGR of 9.75%.

India is predominantly an agrarian economy, and most of its regions are dependent upon monsoons for irrigation. On an average, pests and diseases eat away around 20-25% of the total food produced in India. Overall, food crops compete with around 30,000 species of weeds, 3,000 species of nematodes, and 10,000 species of planteating insects. Hence, agrochemicals play a significant role in enhancing agricultural productivity. They help reduce crop losses and thereby increase food safety and revenues for farmers. The prospects for the domestic agrochemicals industry depend on a multitude of factors like monsoons, crop yield, incidence of pest attack, etc.

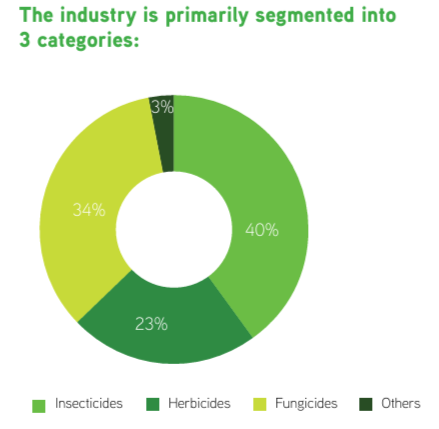

Agrochemicals can be manufactured and sold mainly in two stages.

Technical: Technical is the first stage of manufacturing where the chemical is concentrated and unsuitable for direct use.

Formulation: Technicals are then processed with formulants to develop the finished pesticide, known as formulation.

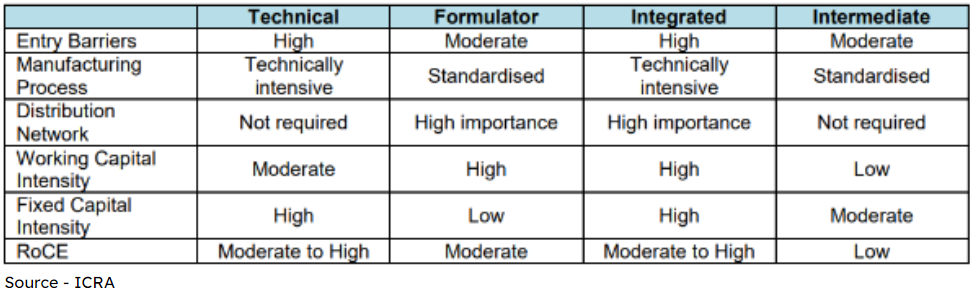

While MNCs often concentrate on high-end specialty products, the majority of Indian agrochemical organizations manufacture and market generic and off-patent agrochemicals, which make up about 80% of the Indian market. Since generic items have no added value, brand image, a robust distribution network, and reasonable pricing serve as differentiators.

Characteristics -Agrochemical Industry Players

Agrochemicals Industry suffers from multiple factors like higher working capital requirements, poor CFO/EBITDA conversion, climatic risks, RM volatility risk, Regulatory risk and Seasonality risk

Dharmaj Crop Guard Limited Product Details

Formulation Products

Dharmaj Crop Guard Limited has grown into a multi-product manufacturer of agrochemicals such as insecticides, fungicides, herbicides, plant growth regulators and micro fertilisers. This diversification across products and categories has allowed it to-de risk its business operations.

Dharmaj Crop Guard Limited sells its agrochemical products in granules, powder and liquid forms to its customers. Additionally, Dharmaj Crop Guard Limited manufactures and sells general insect and pest control chemicals for Public Health and Animal Health protection.

- Insecticides – Insecticides enable the protection of crops from insects by either preventing their attack or destroying them. They help in controlling the pest population below a desired threshold level. There are two types of Insecticides.

- Contact insecticides: Insects get killed in direct contact with these insecticides, and they leave marginal residual activity, which affects the environment minimally.

- Systemic insecticides: Plant tissues absorb these insecticides and destroy insects when the insects feed on plants. These are generally related to long-term residual activity.

- Fungicides: Fungicides find their application in fruits, vegetables and rice, and they are vital to contract postharvest losses in vegetables and fruits. Fungicides are used to prevent fungi attacks on crops and to handle diseases on crops. Protectants and eradicants are two types of fungicides. Protectants protect or hinder fungal growth, and eradicants destroy the diseases on usage. This thus results in better productivity, contraction in crop blemishes and raises storage life.

- Herbicides: Herbicides, also known as weedicides, are used to destroy unwanted plants. The unavailability of cheap labour leads to the significant usage of herbicides in rice and wheat crops. The demand for herbicides is seasonal as they develop in damp, warm climates and perish in cold spells. They are of two types depending on the way of action: selective and non-selective. Selective herbicides destroy specific plants, not harming the desired crop, and non-selective herbicides are used for widespread ground clearance to handle weeds pre-crop planting. Based on the usage, there are three types of herbicides.

- Application prior to sowing of the crop (pre-emergence)

- Application post-development of weeds (post-emergence)

- Application right away subsequent to sowing (early post-emergence)

- Plant growth regulator : Plant growth regulators are substances applied to crops to enhance nutrition efficiency, abiotic stress tolerance, and crop quality traits.

- Micro fertilisers : also known as micronutrient fertilisers, are fertilisers that provide plants with essential micronutrients in small quantities for proper growth. These nutrients are crucial for various plant growth and development processes, such as flowering, fruiting, and protein synthesis. Micronutrients can help overcome soil deficiencies and promote optimal plant nutrition, yield, and quality

Dharmaj Crop Guard Limited Business Verticals

Branded formulations (B2C) – In the Branded formulations vertical, Dharmaj Crop Guard Limited directly markets the products to end customers with a robust brand portfolio of 121+ products, 350+ SKUs, and sales through its distribution network of 15,000+ retail touchpoints (13,500 in FY23), 5,000+ dealers (4,500 in FY23), & distributors across 24 states (20 in FY23), with 20 stock depots (16 in FY23) connecting more than 10 lakh farmers.

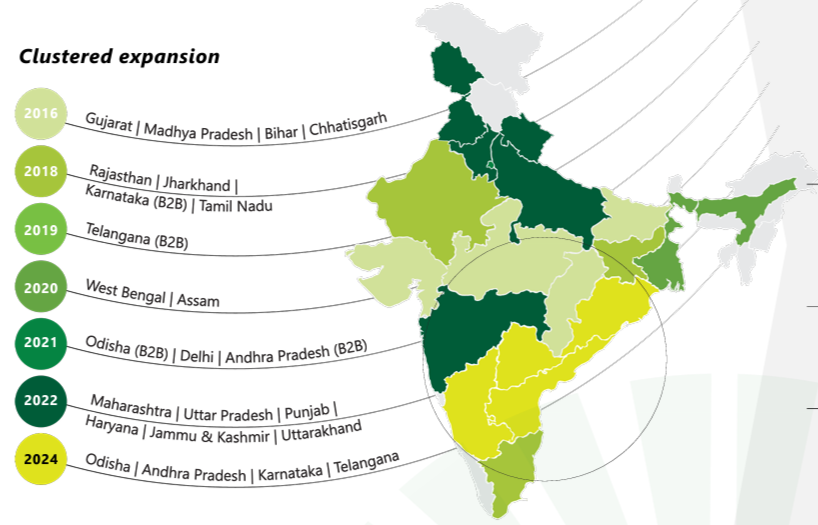

Dharmaj Crop Guard Limited follows a cluster approach in setting up business and it takes about 2 years for proper establishment.

In FY2024, Dharmaj Crop Guard Limited expanded into 4 new states, marking its entry into South India (Odisha, Andhra Pradesh, Karnataka, and Telangana). With this expansion, Dharmaj Crop Guard Limited’s presence increased to 24 states, up from 20 states in FY23 and 15 states in FY21.

Given that Dharmaj Crop Guard Limited has now established a strong presence across almost all of India, the management does not plan to add more markets in the near future. Instead, the focus will be on growing the business in the markets that have been added in the last 2 years.

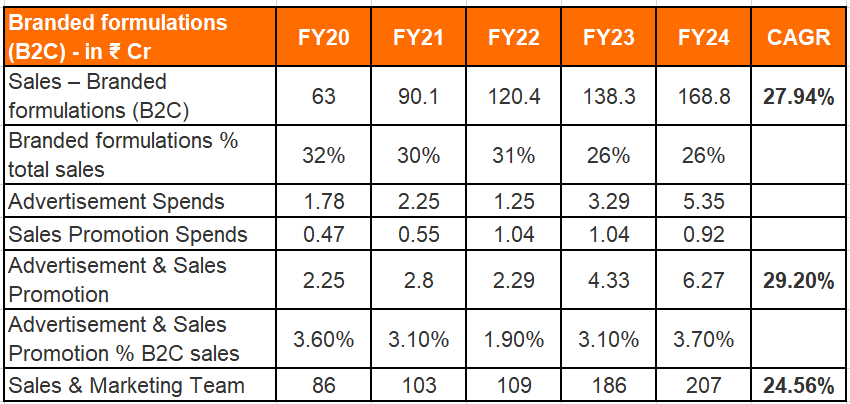

Dharmaj Crop Guard Limited has grown its Branded formulations (B2C) business at 28% CAGR & delivered 22% growth YoY in FY24 despite the industry headwinds. The contribution of branded formulation sales % total sales has come due to the Institutional formulations business growing much faster; while the Institutional formulations business has higher growth rates, the Branded formulation has a higher profitability profile with a Gross profit margin of 30-35% & EBITDA% of 14-16%.

Dharmaj Crop Guard Limited aims to increase Branded formulations contribution to 32-35% over the medium term vs 26% as of FY24

Gujarat accounts for 47% (80 Cr) of Dharmaj Crop Guard Limited’s Branded formulation sales; the Gujarat market is around approximately ₹ 2000 Cr, So there is still room for growth in existing as well as new markets. Dharmaj Crop Guard Limited has been very aggressive in the hiring of in Sales & Marketing Team and allocating higher spending towards Advertisement & Sales Promotion, which is expected to yield results in the future

The reason for such strong growth in brand formulation is that Dharmaj Crop Guard Limited has fixed field-level demand generation. Basically, Dharmaj Crop Guard Limited goes to the farmer’s fields and does demonstrations and farmer meetings, which helps in publicity. Secondly, Dharmaj Crop Guard Limited has more than 400 CIB licences (Central Insecticides Board), So Dharmaj Crop Guard Limited does an analysis on which molecule the farmer’s cost will be less or will be competitive and chooses the product according to the margin of the channel and the margin of the company.

Interestingly, the Branded formulations (B2C) portfolio is well-diversified, with the top 15 products contributing just 17%.

Every year, Dharmaj Crop Guard Limited keeps on adding new product molecules to existing product portfolios by identifying the market’s needs by conducting market analysis and surveys. Over the last 5 years, Dharmaj Crop Guard Limited launched 79 new products, with 7 debuting in FY24 alone. These launches not only contribute to expanding operational scale but also invigorate & refresh the overall portfolio, ensuring sustained profitability margins.

For any new product, 1st year is for field-level demonstrations for demand generation, and 2nd year is for selling volumes.

Dharmaj Crop Guard Limited generally follows two strategies while launching new products. High volume strategy working on high volumes for gaining market share with low gross margins & launching some different products that have higher realisation contribution and promote it through demand generation activity. Dharmaj Crop Guard Limited’s margins average out over these two categories.

Branded formulations (B2C) business & Dharmaj Crop Guard Limited also create future opportunities for partnerships. If a company seeks to introduce a monopoly molecule in India, having a PAN-India customer base is essential. Dharmaj Crop Guard Limited’s aggressive expansion ensures they are well-positioned for such strategic tie-ups with R&D companies.

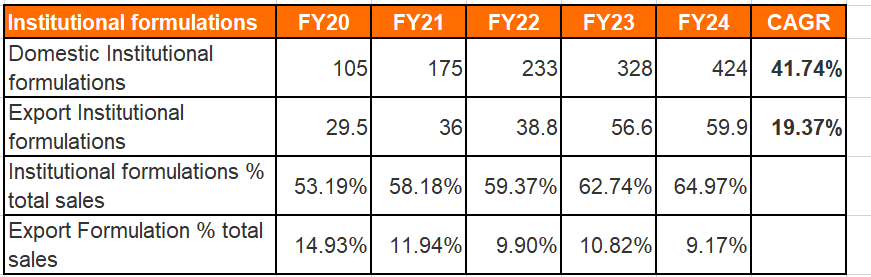

Institutional formulations (B2B) – The institutional formulations business has been the biggest revenue & fastest-growing vertical for the Dharmaj Crop Guard Limited since its incorporation. Formulations are marketed in all kinds of packaging to B2B customers in India and abroad. Offering 250+ products to 700+ customers of all sizes: MNCs, domestic majors, and smaller firms. Institutional formulation’s Profitability is lower vs. branded formulation’s gross profit margin of 15-20% & EBITDA% of 10-11% but offers higher growth with low costs.

Dharmaj Crop Guard Limited’s key differentiator of the Institutional Formulation vertical is their dedicated focus on small formulators & regional players having <10 Cr sales(which is a big underserved category); Dharmaj Crop Guard Limited is expanding this segment across Pan-India and offering services nationwide, something that no major company has done to date. These Players account for the majority of Dharmaj Crop Guard Limited Institutional formulations sales.

Dharmaj Crop Guard Limited entered the corporate level in FY22 and achieved some breakthroughs with large agrochemical majors like Rallis, Coromandel International Ltd, etc. Corporate-level business is linked with their QC (Quality Control) department approval. For example, the procurement process of Rallis is such that it does not purchase goods from everyone in the market. They purchase from a QC department-approved vendor; its system is such that if a material needs 50 tons, it will not buy 50 tons from a new vendor. First, it will buy 5 tons, then 10 tons, then 50 tons, even if it is in L1. In FY24, Dharmaj Crop Guard Limited got the approval for 6-7 products from Rallis QC and started supplying & from next year, growth will be more impressive.

Some of the marquee clines in institutional formulation vertical are Sumitomo Chemical India Ltd, Nichino, Coromandel International Ltd, Rallis India Ltd, Atul Ltd, Meghmani Organics Ltd, Heranba Industries Ltd, Crystal Crop Protection Ltd, Hemani Industries Ltd & Krishi Rasayan Group.

Export Institutional Formulations – Dharmaj Crop Guard Limited exports to 90+ institutional customers across 29 countries. With a robust portfolio of 85 export market product registrations and an additional 202 products in the registration pipeline, this segment contributes 9.20% of FY24 sales.

Dharmaj Crop Guard Limited is focusing on expanding export product registrations, with several new approvals expected soon in existing markets, and also exploring opportunities to enter new markets like Brazil, the USA, and Europe &, etc. As more product registrations are finalised, the Export business is set to grow significantly.

Domestic Institutional formulations are the fastest & biggest growing vertical for the Dharmaj Crop Guard Limited, delivering 42% CAGR, while exports delivered 20% CAGR in the last 5 years. Dharmaj Crop Guard Limited is targeting a 10-15% contribution from export formulation in the next 2-3 years vs. 9.20% in FY24.

Dharmaj Crop Guard Limited has a high level of diversification, with the top 5 customers contributing approx 15% of sales & top 10 customers contributing approx 22% of sales in Institutional Formulations

Active Ingredients and Intermediates vertical – Dharmaj Crop Guard Limited recently started its new Active Ingredients and Intermediates manufacturing operations on January 22, 2024 (after a slight delay vs initial guidance of Nov23); initially focused on Synthetic Pyrethroids, Dharmaj Crop Guard Limited expanded its scope to include non-synthetic Pyrethroids due to market opportunities. Dharmaj Crop Guard Limited will use active Ingredients and Intermediates for both captive consumption (25-30%) as well as external sales (70-75%).

Synthetic pyrethroid has diverse use in agriculture, household as well as veterinary. India is the largest exporter of synthetic pyrethroids & exports 70% of production. Initially, the main focus for Dharmaj Crop Guard Limited will be exports. Dharmaj Crop Guard Limited has already started exporting to the Asian market, with initial shipments dispatched between April and May. Looking ahead, Dharmaj Crop Guard Limited plans to expand exports to regulated markets such as America, Europe, and Australia within the next two years.

For the Domestic market, Dharmaj Crop Guard Limited is targeting B2B in PAN India, aiming to engage with over 1,500 small formulators nationwide, ensuring no business opportunity is missed and for the corporate level. Dharmaj Crop Guard Limited wants to leverage its existing relationships with big corporations like Coromandel International Ltd, UPL Ltd, Hemani Industries Ltd, Hemani Industries Ltd, Rallis India Ltd, Nagarjuna. They are already in discussion with Rallis India Ltd and Coromandel.

As per management, Dharmaj Crop Guard Limited has to initially compromise on prices in older molecules, While newer molecules (such as CTPR) don’t expect lower pricing

It is interesting to note that Gharda is the largest manufacturer of Synthetic Pyrethroid in this industry, but Gharda’s plant has been shut for the last 6 – 8 months. As Gharda is shifting the whole plant from Dombivli to Sayakha, and it will become operational after 2 years, this will provide a great opportunity for Dharmaj Crop Guard Limited & other manufacturers of Synthetic Pyrethroid to fill the entire gap

Overall, Dharmaj Crop Guard Limited is guiding for ₹ 450-500 Cr sales ( without captive consumption) with 2-2.5x assets turns and gross profit margin of 30% & EBITDA margin of 15-18% at optimum capacity utilisation for this division vs. (Q4FY23 Guidance of GPM at 35-37% & EBITDA% 20%), we think they have reduced it due to pricing erosion in the agrochemical industry.

In Q1 FY25, Dharmaj Crop Guard Limited saw commercial scaling with external sales reaching ₹5.56 crore, with the Saykha plant producing 9 molecules, including 1 intermediate.

Although this division is new for Dharmaj Crop Guard Limited, we believe this will be the future growth & profitability driver for Dharmaj Crop Guard Limited

Dharmaj Crop Guard Limited Manufacturing Facility

Dharmaj Crop Guard Limited has made a majority investment in the Active ingredients manufacturing facility & increased the capacity of its formulation facility between FY22-24, Any significant investment for the next few years is unlikely from Heron.

Formulation Manufacturing Facility

Dharmaj Crop Guard Limited Formulation facility is Located in Kerala GIDC, Ahmedabad, and is equipped with modern plant and machinery capable of producing quality agrochemical products and has received quality control certifications such as ISO 9001:2015, ISO 14001:2015, ISO 17025:2017, and ISO 45001:2018 for development and manufacturing of agrochemical formulations

Dharmaj Crop Guard Limited’s Formulation design prioritises operational flexibility and efficiency. Equipment is capable of being used interchangeably across segments with minimal modifications. Dharmaj Crop Guard Limited Formulation has (an R&D) centre at its manufacturing facility. A NABL-accredited quality control laboratory on-site enables rigorous quality checks at every stage, from raw material intake to finished product dispatch.

Dharmaj Crop Guard Limited has also installed a soil bio-reactor at its manufacturing facility which is used to treat waste/ sewage water and to remove pollutants. It has also installed solar power panels at its manufacturing facility to generate green power in order to optimally use the electricity that is sourced from third parties during the manufacturing process.

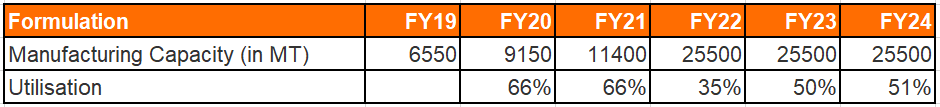

Dharmaj Crop Guard Limited had gone through 2.25x capacity Expansion to 25,500MT between 2022-24 and running at 51% capacity utilisation in FY24. As per Dharmaj Crop Guard Limited management formulation manufacturing capacity has a sales potential of 1000-1100 Cr at optimum utilisation

Active ingredients manufacturing facility

Dharmaj Crop Guard Limited’s Active ingredients & Intermediates manufacturing facility is Spread across ~37,000 Sq. Mt. in the Saykha Industrial Estate, Bharuch, Gujarat (Acquired land parcel on 99-year lease) commissioned on Jan 22, 2024. Aligned with both Indian and international regulatory standards to cater to both domestic and global markets, the facility has also incorporated a dedicated DSIR-certified R&D unit, QC laboratory, and state-of-the-art equipment. It has a Manufacturing Capacity of 8,000 TPA (5,500 TPA multipurpose technical capacity & 2,500 TPA dedicated intermediates capacity)

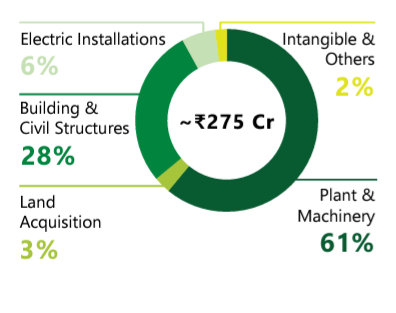

Total total capex for the project amounted to 275 Cr vs. (vs. 200 Cr guided in Q3FY23 vs. initial Projected cost at 173 Cr), Dharmaj Crop Guard Limited Guiding for 2-2.5X Fixed Asset Turns at optimum Capacity Utilisation & Product-Mix (reduced from 3x initially guided in Q3FY24)

Project Financing is Partially from IPO Proceeds: ₹105 Cr, Partly financed from Term Loans (Cost for Term Loans is 9% & subsidy from Gujarat govt is 6%, Net cost of debt is 3.5%) & Balance funded from internal accruals. Short-term borrowings & internal accruals will be used to finance additional working capital requirements.

Cost breakup of capex

The cost of CAPEX has scientifically increased due to cost overrun led by i) cost escalations in material, labour, and equipment costs. ii) Dharmaj Crop Guard Limited has installed some additional plants and equipment that will be used for higher product mix flexibility with better purity; iii) Dharmaj Crop Guard Limited has shifted their boiler plant to an adjacent site, which they acquired recently and moved the boiler from a safety and risk management perspective. Although this cost overrun will not lead to increased incapacity, it will enhance Dharmaj Crop Guard Limited’s ability to move beyond synthetic pyrethroids.

Dharmaj Crop Guard Limited is targeting average monthly production of 200 metric tons per month (2400 MT p.a), implying 30% capacity utilisation in FY25. As per management, 40% capacity utilisation is required for a breakeven 3000 MT p.a (220 Cr sales at current prices)

Dharmaj Crop Guard Limited is confident of reaching optimum utilisation, i.e., 75-80% in FY27.

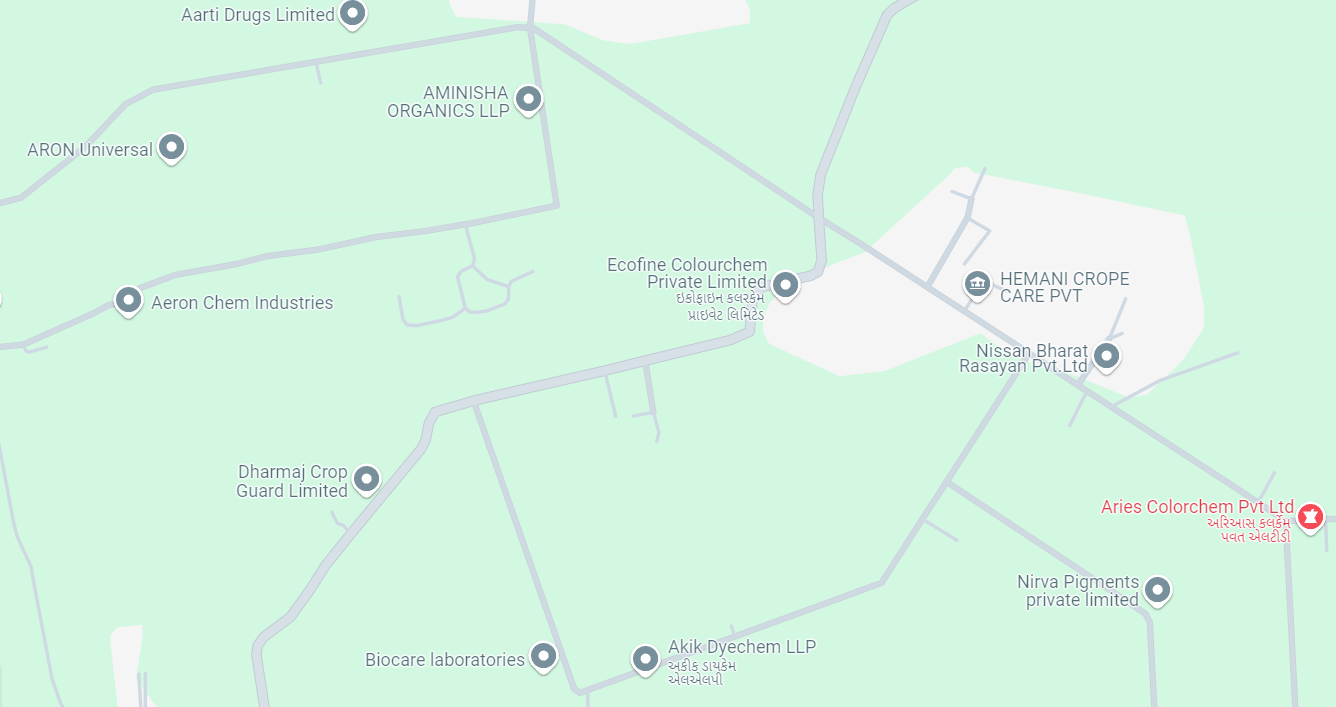

Dharmaj Crop Guard Limited’s Saykha facility is strategically located near several established and upcoming agrochemical companies, providing easy access to transportation and material sourcing

Dharmaj Crop Guard Limited Corporate governance

Board Composition – As of FY24, Dharmaj Crop Guard Limited’s Board consists of 6 directors, including 3 executive directors who are also promoters & 3 are independent directors. Interestingly, all independent directors are from Gujarat (the home state of the promoters). It appears that the promoter family maintains tight control over the Board.

Audit Committee – Although an independent director chairs the audit committee, it also includes Promoter & MD Rameshbhai Ravjibhai Talavia as a member, which is not a positive sign for governance.

Promoter Remuneration – The total remuneration (including perquisites & incentives) drawn by KMP in FY24 was at ₹1.96 Cr, which is 4.43% of FY24 Net Profit. The annual increment of promoters is between 14-17%. Notably, Malvika Bhadresh Kapasi (Company Secretary) drew only ₹5.9 lakh in salary in FY24 vs ₹4.6 lakh in FY23.

Related party transaction – Dharmaj Crop Guard Limited does not have any material related party transactions that may have potential conflict with the interests of the Company at large.

Auditor remuneration – Dharmaj Crop Guard Limited Auditor remuneration has increased to ₹15.80 lakhs in FY24 vs ₹4.5 lakhs in FY23

Dividend Policy – Dharmaj Crop Guard Limited don’t have any dividend policy

Dharmaj Crop Guard Limited Financial Performance

Dharmaj Crop Guard Limited has grown its sales at 36% CAGR, making it one of the fastest-growing agrochemical companies in India, although on a small base. While gross profit has grown in line with sales, EBITDA, PBT & PAT have grown much higher at 43%/52%/55% CAGR on an absolute basis, led by scale & operating leverage. The compression in profitability ratios post FY22 is mainly on account of higher institutional sales where margins are lower, business expansion activity like higher advertising spends, higher on-ground marketing team additions, & agrochemical industry headwinds

Interestingly, despite all the industry headwinds, Dharmaj Crop Guard Limited posted 35% & 25% sales growth in FY23 & FY24. Volume growth for FY25 was 50%, while value growth was 25% in all vertices.

Profitability for Q4FY24 was mainly impacted on account of higher depreciation, finance costs, operational expenditures & other fixed overheads on account of new capex, which was commissioned on 22 Jan 24, so that impact was for 68 days.

Dharmaj Crop Guard Limited Working Capital Analysis

Dharmaj Crop Guard Limited has a very efficient inventory management system, and one of their competitive advantages, Dharmaj Crop Guard Limited procure RM such that the cheapest thing in RM basket is purchased first. The most expensive thing in the RM basket, i.e. technical ingredient, is purchased last, post that Dharmaj Crop Guard Limited processes it immediately, packs it and sells it out. Dharmaj Crop Guard Limited has a self-policy of Net Cash Rate (NCR). They operate more business in cash, and in B2B, they give credit facilities only to the customers who work in the discipline of 90 days to 120 days.

Receivables have grown higher than sales due to higher contributions from institutional business vertices (B2B). Also, Working capital increased due to creditors being reduced substantially, As management smartly used the opportunity of industry downturn of inventory destocking to procure maximum raw materials at lower prices by paying upfront at a very bargain rate.

Working capital cycles have also been stressed over the last 2 years due to entry into new states as a part of the strategy; Dharmaj Crop Guard Limited management is now working on bringing this under control. As per management formulation, businesses usually have 90-day credit periods, while technical plant credit periods are generally higher than the formulation, i.e. 120 days. So, going forward, Dharmaj Crop Guard Limited is guiding for 85 to 90 days of normal working capital cycle

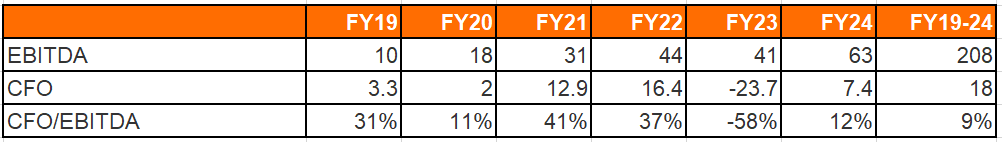

Dharmaj Crop Guard Limited Cash Flow Analysis

While Dharmaj Crop Guard Limited has ticked every box of a strong microcap story, they have lacked in cash flow conversion. Management alluded that this is due to working capital extension & higher reinvestment towards expansion (higher operating costs like human resources hiring, advertisement & marketing, higher other operating costs, and costs associated with new capex), 6-year cumulative CFO/EBITDA conversion is very poor at 9%. Going forward, Cash flow conversion will be key monitorable

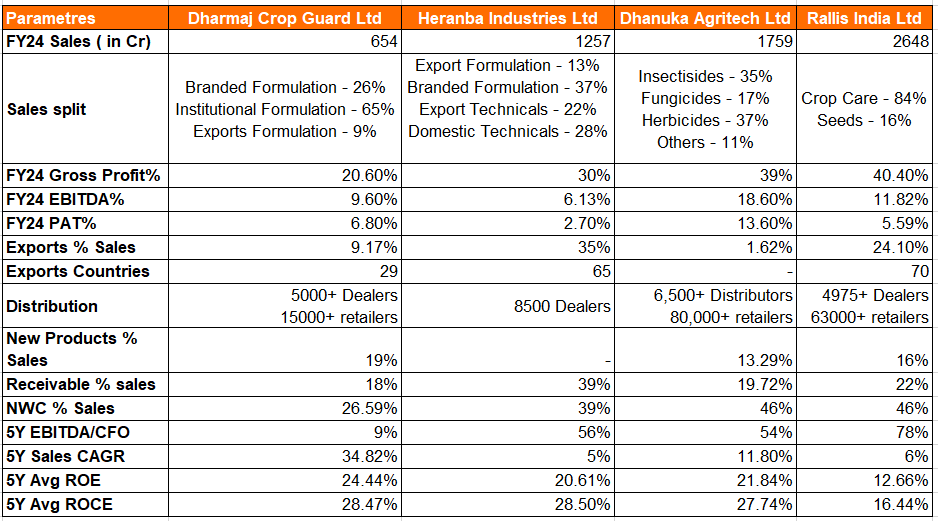

Dharmaj Crop Guard Limited Comparative Analysis

To understand Dharmaj Crop Guard Limited investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Dharmaj Crop Guard Limited to its competitors (peer comparison) on various fundamental parameters and Dharmaj Crop Guard Limited share performance relative to relevant benchmark and sector indices.

Dharmaj Crop Guard Limited Peer Comparison

We have compared Dharmaj Crop Guard Limited with agrochemical players like Heranba Industries Ltd, Dhanuka Agritech Ltd & Rallis India Ltd. However, they are much larger on scale & have a differentiated product mix.

Dharmaj Crop Guard Limited has delivered very high growth rates. However, on a small base, the profitability of Dhanuka Agritech Ltd & Rallis India Ltd is much stronger as they have superior consumer franchises with a well-penetrated distribution network; interestingly, Dharmaj Crop Guard Limited has very efficient net working capital management. Dharmaj Crop Guard Limited has very poor EBITDA/CFO conversion, an area that requires management attention for improvement.

Dharmaj Crop Guard Limited Index Comparison

Dharmaj Crop Guard Limited share performance vs S&P BSE Small cap Index as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Dharmaj Crop Guard Limited Valuation Ratios

| Metric | As on 30/08/24 |

| Price/Earnings | 29.9 |

| Price/Book | 3.53 |

| Price/Sales | 1.7 |

| EV/EBITDA | 19.72 |

Why You Should Consider Investing in Dharmaj Crop Guard Limited?

We believe that Dharmaj Crop Guard Limited offers some compelling reasons to track the business closely and to consider investing if one is looking to build exposure to the Agrochemical sector.

Strong promoter – Dharmaj Crop Guard Limited has very strong promoters with 2.5 decades of experience in the agrochemical industry; their deep understanding of the sector and established relationships with customers and suppliers provide a solid foundation for growth.

Diversified customer base – Dharmaj Crop Guard Limited caters to a broad range of customers in B2C & B2B vertices; within the B2B sector, Dharmaj Crop Guard Limited caters to MNCs, domestic majors, regional players, smaller firms and exports.

High growth – Dharmaj Crop Guard Limited delivered high growth rates in the past, and momentum is likely to continue as management is guiding to double sales every 3 years; also, investment has already been made in capex, and the focus now is on increasing capacity utilisation. Very few businesses in India offer the potential for 25%+ growth rates over the medium term

Forayed into technical & intermediate – Dharmaj Crop Guard Limited has recently entered the technicals and intermediates division. Which will be used for both captive consumption as well as external sales. This will provide Dharmaj Crop Guard Limited higher competitive edge & going forward, this division is expected to enhance overall profitability & growth

Diversified Product Portfolio & Continuous New Product Launches – Dharmaj Crop Guard Limited has a portfolio of 121+ products & 350 SKUs in branded formulation, 250+ products in the institutional formulation vertical, and Dharmaj Crop Guard Limited keeps adding a high number of new products, contributing 9.20% of FY24 sales

Establish pan India network – Dharmaj Crop Guard Limited has a presence across 24 states, 16000+ retail touch points & 5000+ distributors, making it eligible for tie-ups with global innovators & in-licensed marketing model.

What are the Risks of Investing in Dharmaj Crop Guard Limited?

Investors need to keep the following risks in mind if they choose to invest into this business. Risks needs to be weighed in combination with the advantages listed above to arrive at a decision that is optimal for your portfolio construct

High Competition & Low Pricing Power – The Agrochemical industry is a highly fragmented industry with intense competition as end consumers are very price sensitive and agrochemical companies find it difficult to pass on the increase in costs to their customers because of pricing power.

Poor cash flow conversion – Dharmaj Crop Guard Limited has very poor CFO/EBITDA conversion, given the higher working capital requirements for the new plan. Dharmaj Crop Guard Limited needs to borrow short-term debt to fund working capital.

Execution risk – Dharmaj Crop Guard Limited may face some execution risks for scaling the new technicals and intermediates division.

Regulatory Risk – Every pesticide needs to be registered with the govt authorities before launching into a new country. Registrations are country-specific, and a company needs to register its product in every target country.

Volatile raw material prices – Most of the raw materials used as inputs for the production of technical products and formulations are derivatives of crude oil. As a result, raw material costs witness much fluctuation as crude oil prices are very volatile. Volatile prices cause risk for MTM losses as agrochemicals are a working capital-intensive industry.

Seasonality – The consumption of agrochemicals depends on the sowing of specific crops, which is seasonal in nature. Therefore, the demand for these agrochemicals peaks during a couple of months of a particular crop season and declines sharply after the crop season. Q2 & Q3 are major consumptions at ground level for the agrochemical industry, while Q1 is total preparation for Q2.

Dharmaj Crop Guard Limited Future Outlook

Dharmaj Crop Guard Limited is guiding for 900 Cr sales in FY25 with similar margins, out of which 750-800 Cr sales from formulation vertices where Dharmaj Crop Guard Limited is expecting volume growth of 20-25%, While value growth to be around 15% due to price erosion and 150 cr sales from the new technical plant (excluding captive consumption) implying 30% utilisation with 15-20cr Ebitda loss (at current pricing), and Also guiding 25-30% overall sales growth for FY26 along with 1-1.5% improvement in margins.

The profitability in FY25 is expected to remain subdued, with some improvement in FY26 due to the rebasing of operational expenses, depreciation & finance costs associated with the new technical plant.

We believe real growth is expected to emerge in FY27, where margins will improve by 3-4% on a consolidated level, Driven by higher contribution & optimum utilisation of technical plant.

FY25 looks to be good for agrochem as rainfall forecasting is good, and the cropping patterns are also improving. Dharmaj Crop Guard Limited is now fully prepared to create a space for itself in this market. Dharmaj Crop Guard Limited has made a majority investment and doesn’t foresee anything significant in the coming 2-3 years; while Working capital cycles have been stressed over the last 2 years due to entry into new states as a part of the strategy, Management is now working on bringing this under control

Dharmaj Crop Guard Limited is also aiming for 2000 Cr sales by 2030

Dharmaj Crop Guard Limited Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Dharmaj Crop Guard Limited Price Charts

On daily charts, Dharmaj Crop Guard Limited has broken out from resistance in July 2024 with strong volume, confirming a trend reversal; it is currently trading within an upward-sloping channel, with higher highs and higher lows, indicating a strong uptrend. The overall trend remains bullish as long as it stays within the current upward channel and above key support levels.

On weekly charts, Dharmaj Crop Guard Limited displays a classic Cup and Handle pattern, which is a bullish continuation pattern, & stock broke out from the cup’s resistance level at ₹276 with strong volume crossing the IPO price level, confirming the pattern. A breakout indicates the potential for a significant upward move, with no major resistance in the visible range. Dharmaj Crop Guard Limited is in a strong uptrend, with the current price well above the key moving averages.

Dharmaj Crop Guard Limited Latest Latest Result, News and Updates

The domestic agrochemical industry has started the season on a positive note. Although rainfall has not entirely met initial expectations, it has been adequate, and the India Meteorological Department (IMD) forecasts improved rainfall between August and September 2024, which is promising for the agricultural sector.

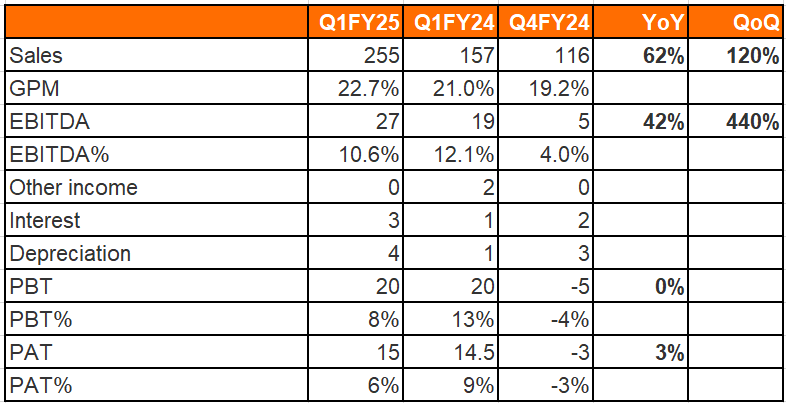

Dharmaj Crop Guard Limited Quarterly Results

Dharmaj Crop Guard Limited has delivered 62% YoY growth, led by the solid performance of the Formulation vertical & successful introduction of the new Active Ingredients vertical, which contributed to revenue for the first time in Q1FY25. Gross Profit margins have improved on both YoY and sequential basis. At the same time, the profitability was impacted by higher fixed operating costs along with higher depreciation & finance costs due to the plant commissioning.

These costs will continue to impact short-term profitability but are expected to normalise as utilisation increases.

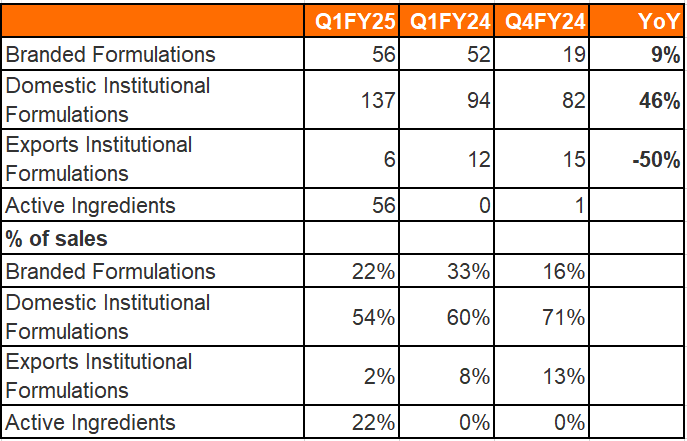

Dharmaj Crop Guard Limited Business Verticals Performance

The institutional Formulations business continues to strengthen and drive our overall performance; Branded Formulations vertical growth has been partially offset by lower realisations in the generic portfolio (resulting in a lower growth rate ). Dharmaj Crop Guard Limited strategically discontinued certain low-price products and focused on high-value products. Within the Branded Formulations vertical, Focus Portfolio has performed better, anticipating improved results in the future. While Institutional Formulation Exports performance was sluggish in April and May, affected by delayed orders from certain customers & unexpected lumpiness. However, a positive shift in demand from July onward has been observed.

Dharmaj Crop Guard Limited launched 7 new products in Q1FY25, including 3 in the new Plant Health vertical, which focuses on micronutrient products, while the other 4 products in the existing B2C portfolio, Retail touchpoints increased to 16K+ in Q1FY25 vs. 15K+ in Q4FY24; additionally, the workforce has also expanded with the addition of 10 sales & marketing personnel and cumulative 88 new hires at the company level, primarily for Unit-2 at Saykha.

Final thoughts on Dharmaj Crop Guard Limited

Dharmaj Crop Guard presents the rare prospect of an agrochemical business that can deliver aggressive growth over the next 3-5 years. The agrochemical segment in India has been plagued by cyclicality and unpredictability in the domestic market and volatile pricing in the export market.

We are seeing a trend of domestic agrochemical businesses putting up capacity to manufacture Technical ingredients and intermediates with the expectation of being able to sell them in the global market. Bharat Rasayan, Dhanuka Agritech and Dharmaj Crop Guard are all going down this route; though the marketing capability of Dharmaj Crop Guard coupled with reasonable valuation makes it the more interesting prospect.

We will be keenly tracking the pace at which export sales will grow for Dharmaj through FY25. While FY25 is unlikely to deliver earnings growth on a YoY basis, getting past the 40% utilisation mark by the beginning of FY26 can make the upcoming FY a breakout year. The market obviously knows this too, hence the uptrending stock price over the past few weeks. At the right price, this business can be an exciting addition to the portfolio, given the high possibility of strong revenue and earnings growth over FY26 and FY27.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.

Disclosure (Updated as of Sep 30, 2024) – No position in the stock in personal portfolio