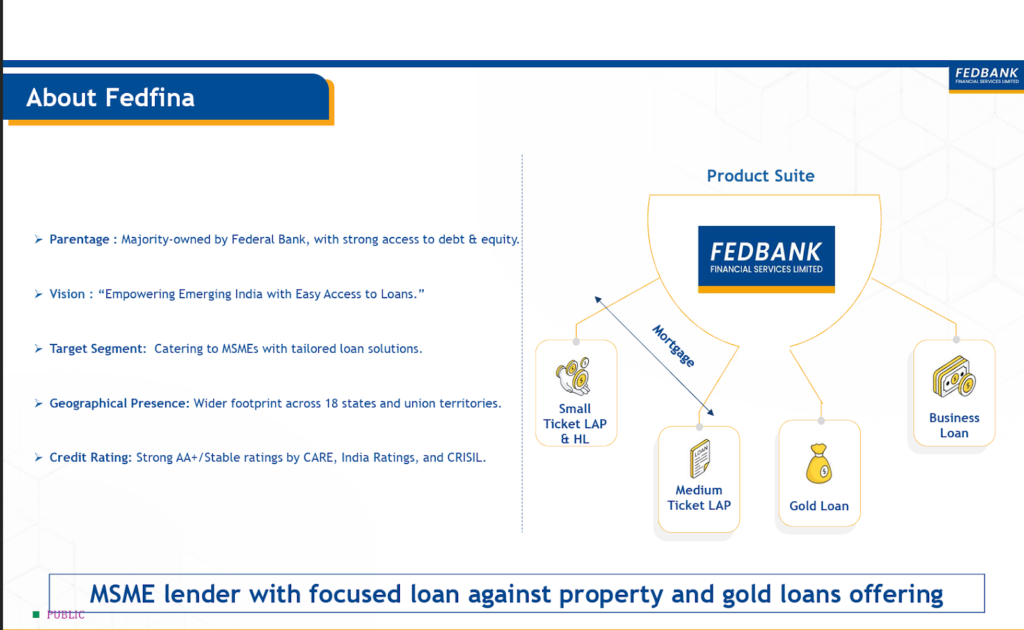

Fedbank Financial Services Ltd is a retail-focused NBFC promoted by Federal Bank Ltd & TrueNorth LLP. Fedbank Financial Services Ltd is primarily engaged in the lending business with a diversified portfolio of gold loans, LAP, and home loans

Fedbank Financial Services Ltd offers the prospect of a wholly secured lending portfolio in proven areas like home loans, mortgages & gold loans, backed by a strong banking parentage. With a proven management team in place that has experience in working at one of India’s largest private sector banks, Fedbank Financial Services is now expanding across the whole of India while optimizing on operating costs at the same time. This is one NBFC to watch out for over the next few quarters as credit growth in India is bouncing off a cyclical bottom.

Fedbank Financial Services Ltd Company Summary

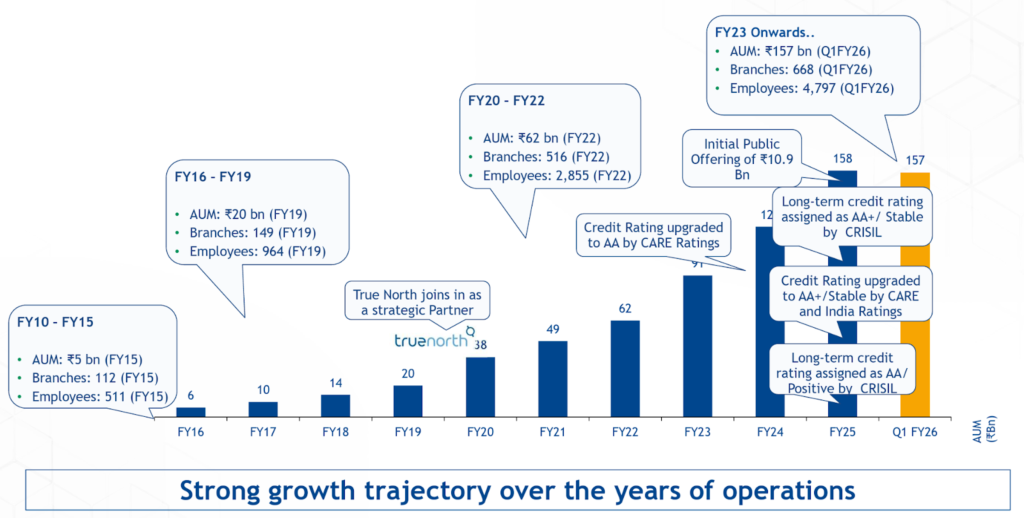

Fedbank Financial Services Ltd is registered with the RBI as a non-deposit-taking non-banking financial company, NBFC. It was incorporated in 1995 and received a license to operate as an NBFC in 2010. Fedbank Financial Services Ltd is a subsidiary of Federal Bank Ltd, which had held a 100% stake in the company until FY2018. In FY2019, TrueNorth LLP acquired a 17% stake in FFSL, and in FY2020, it acquired an additional 9% stake (totaling 26%). True North LLP is a homegrown private equity firm set up in 1999 with a focus on mid-sized profitable businesses in sectors including financial services.

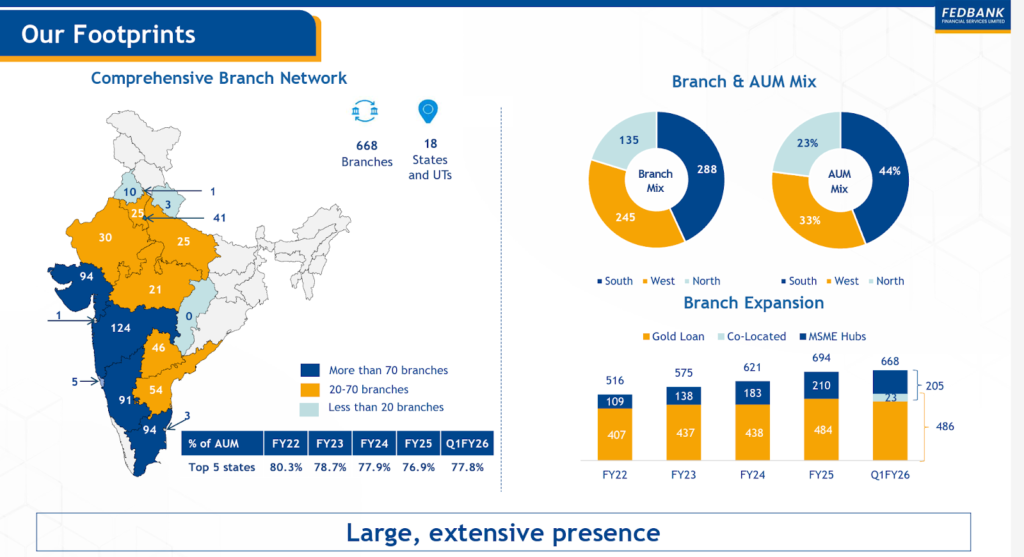

Fedbank Financial Services Ltd concluded its IPO and offer for sale in November 2023, resulting in a decline in FBL and TrueNorth LLP’s shareholdings to 61.7% and 8.8%, respectively, as of December 2023, and to 61% and 8.7%, respectively, as of June 2025. Fedbank Financial Services Ltd provides Gold Loans, Home Loans, Loan Against Property (LAP), and Business Loan Services. Fedbank Financial Services Ltd is present in 18 states and union territories across India, with a strong presence in the southern and western regions of the country, with 668 Branches and 2100+ channel partners.

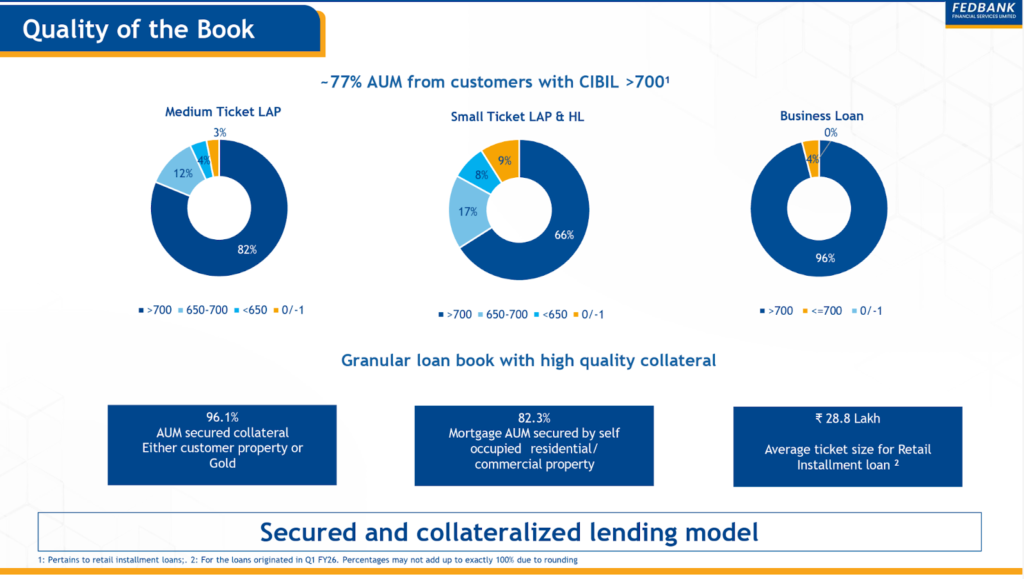

As of FY25 – 82.3% Mortgage AUM secured by self-occupied residential/ commercial property

₹ 30.6 Lakh Average ticket size for Retail Installment loan.

History of key events

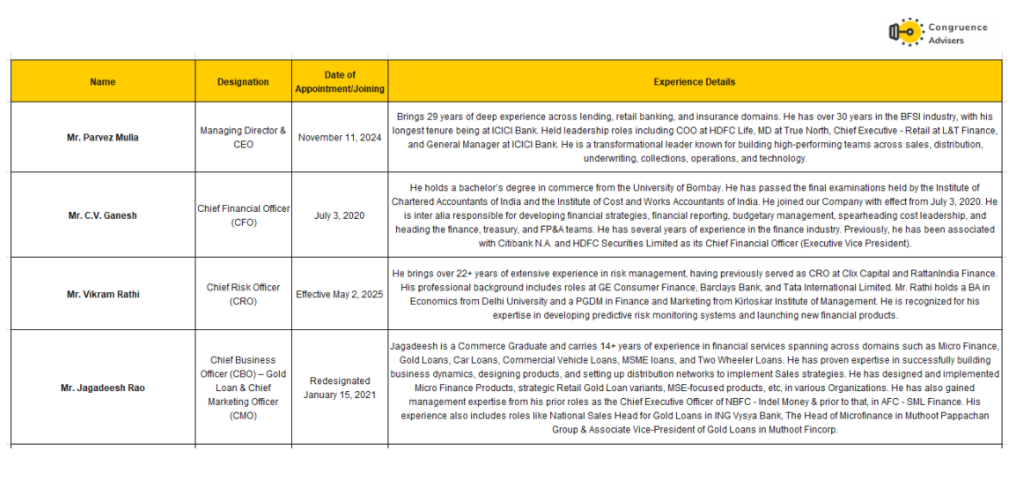

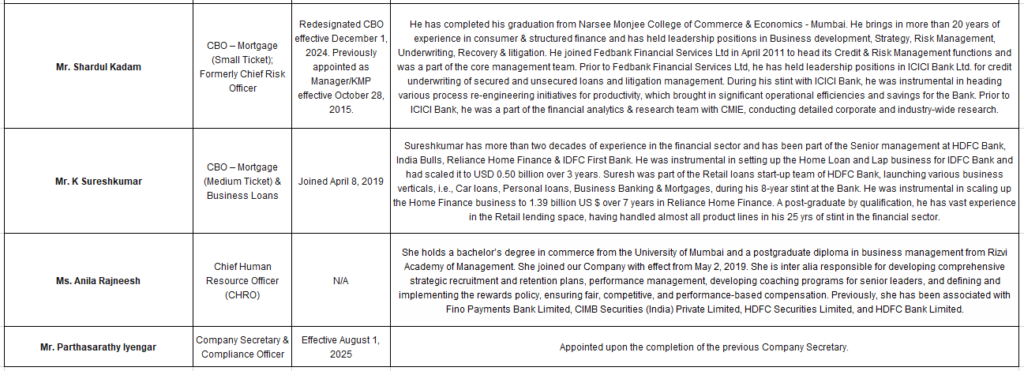

Fedbank Financial Services Ltd Management Details

Federal Bank is a prominent private sector bank in India, recognized for its robust asset quality and advanced technology adoption. It serves as the promoter of its NBFC subsidiary, Fedbank Financial Services Ltd. The bank has built a strong retail and SME banking franchise, complemented by an expanding footprint in digital banking and NRI remittances. With an emphasis on granular retail liabilities such as CASA and deposits, Federal Bank offers a well-diversified loan portfolio spanning retail, SME, and agriculture segments.

Fedbank Financial Services Ltd – Industry Overview

The Gold Loan Market Trend In India

India’s Gold Loan Revolution: What You Need to Know

The gold loan market in India has witnessed significant transformation over the past few decades, evolving from a largely unorganized sector to a formal, regulated, and digitally-enabled financial service. With India’s cultural affinity for gold, it has become a major asset for Business Expansions, Medical Emergencies, and any household requirements This report provides an in-depth analysis of the current landscape of the gold loan industry, covering various sectors, recent trends, and future opportunities.

Overview of the Gold Loan Market

A Gold Loan (GL) is a secured loan where borrowers pledge gold ornaments to access funds, typically for short-term financial needs. It is one of the fastest-growing segments in the lending industry, offering quick access to credit with minimal documentation.

Market overview

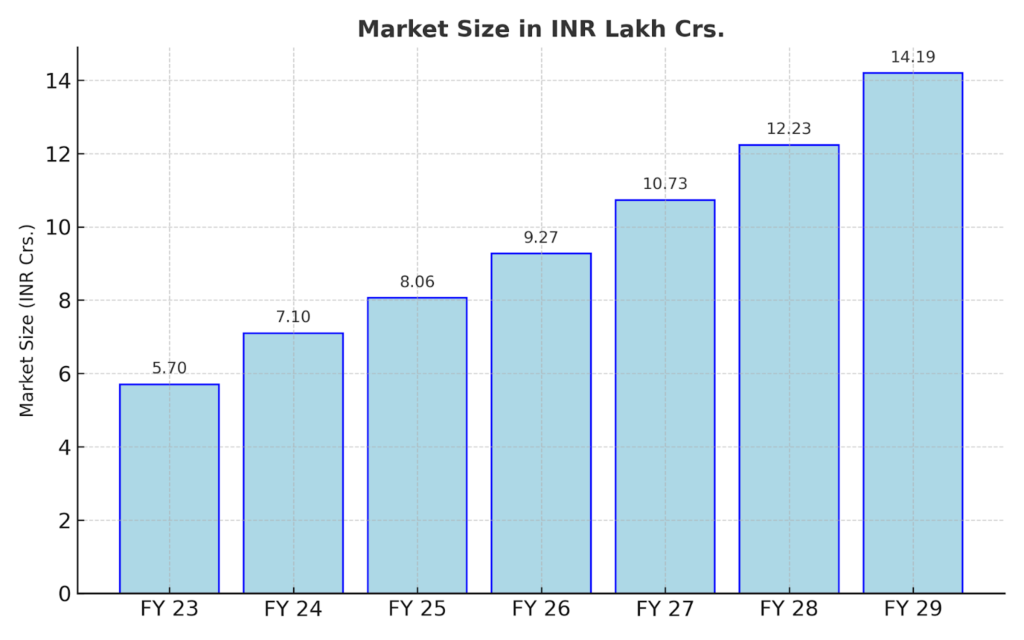

The gold loan market in India is currently valued at approximately ₹7.1 lakh crore (2024) and is expected to reach ₹14.19 lakh crore by 2028, driven by an increasing demand for credit and a growing reliance on gold as collateral.

Note: The gold loan market size projections have been developed using gold loan market trends, macroeconomic factors, customer behavioral trends, the shift in the market from unorganized to organized lenders, as well as insights from PwC Generative AI Technologies, the proprietary GenAI tool of PwC.

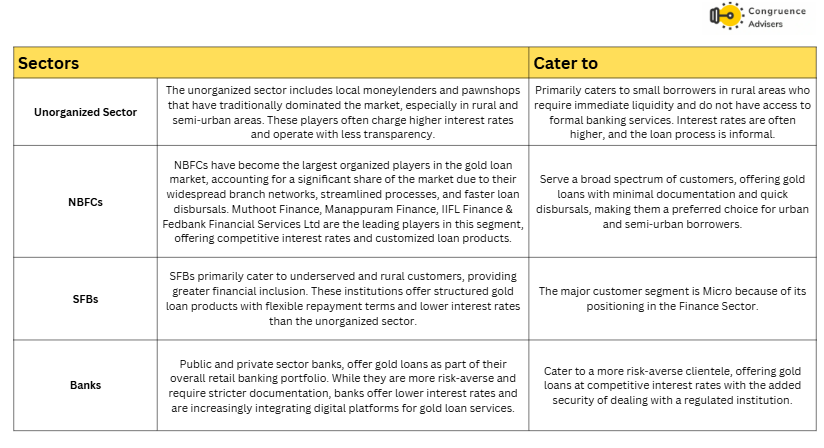

Key Sectors in the Gold Loan Industry

The gold loan industry operates through four primary sectors:

Target Audience Segments

Different sectors cater to a variety of needs, such as:

- Agricultural needs: Small farmers seeking credit for crop cultivation or farm equipment.

- Business expansion: Entrepreneurs and MSMEs (Micro, Small, and Medium Enterprises) requiring working capital.

- Education fees: Individuals seeking funding for higher studies or school fees.

- Personal and medical needs: Families facing medical emergencies or personal financial crises.

Evolution of the Gold Loan Industry: From Tradition to Technology

Historically, gold loans were limited to unorganized players, where individuals would pledge their gold with local pawnbrokers or moneylenders for immediate cash. Over the past two decades, the rise of NBFCs and formal financial institutions has revolutionized the sector, introducing transparency, regulatory oversight, and customer-centric services.

The industry’s growth has been further accelerated by the adoption of digital technology. Customers can now access loans through online platforms, receive instant approvals, and enjoy doorstep gold valuation services. This digital shift has not only increased the reach of gold loans but also enhanced customer experience through faster disbursals and more secure processes. This shift has made gold loans more accessible and convenient for a broader range of customers.

Renewal 24×7: Many institutions now offer the option to renew loans online, providing round-the-clock access for customers.

Digital/Online Gold Loans: Digital intervention brings convenience through the Customer APP & Self Service Portal. Customers can avail a limit of Gold Loans by appraising Gold at the Branch or at home, and avail the limit like an OD sitting at home through their Bank account. This saves a lot of money and time for the customer.

Doorstep Gold Loan Services(DSGL): One of the most recent innovations in the gold loan market is the introduction of doorstep gold loan services. This service allows borrowers to apply for and receive a gold loan from the comfort of their own homes.

Gold Loan Industry Trends (2019-2024)

The gold loan market has grown at a CAGR of 14.85%*over the last five years. Key factors contributing to this growth include:

• Economic Uncertainty: Gold loans gained popularity during the COVID-19 pandemic as households and businesses sought quick liquidity.

• Rising Gold Prices: As the value of gold increased, customers were able to leverage higher loan amounts against their gold holdings.

• Financial Inclusion: Expanding financial services into rural areas, led by NBFCs and SFBs, has further driven the adoption of gold loans.

The sector is projected to continue growing, with estimates suggesting that the market will double in size by 2028, reaching ₹14.19 lakh crore.

Regulatory Developments

The Reserve Bank of India (RBI) has introduced several regulatory measures to ensure the gold loan market operates with transparency and fairness. Key regulations include:

• Loan-to-Value (LTV) Ratio: The RBI mandates that the LTV ratio for gold loans must not exceed 75%. This ensures that borrowers do not take on excessive debt relative to the value of their pledged gold.

• Digital Push: To encourage digitization, the RBI has introduced norms that allow for the digital disbursal of loans, making the process faster and more secure for customers and institutions.

These regulations have played a pivotal role in standardizing the practices of NBFCs, SFBs, and banks, ensuring that the sector remains stable and well-regulated.

Benefits of Gold Loans to Customers

The gold loan industry offers several benefits, including:

• Quick and Easy Access to Credit: Minimal documentation and fast disbursals make gold loans an attractive option for individuals in urgent need of funds.

• No Credit Score Requirements: Borrowers do not need to maintain a high credit score, as the loan is secured against gold.

• Lower Interest Rates: Gold loans generally have lower interest rates compared to unsecured loans like personal loans or credit cards.

• Flexible Repayment Terms: Borrowers can choose from a variety of repayment options, including bullet payments or monthly EMIs.

Opportunities in the Gold Loan Market

As the gold loan industry continues to grow, there are several opportunities for expansion:

• Rural Market Expansion: The rural population remains underbanked, providing a significant opportunity for NBFCs and SFBs to extend their services.

• Digital Gold Loans: The growing adoption of digital platforms for loan applications, disbursals, and repayments is likely to drive future growth.

• MSME Financing: Micro, Small, and Medium Enterprises (MSMEs) increasingly rely on gold loans for short-term working capital needs, creating new opportunities for lenders to tap into the business segment.

Current Market Trends

• Digitalization: With the push towards a digital economy, the gold loan market is increasingly moving online, offering customers the ability to apply for loans, pledge gold, and receive disbursals through mobile applications.

• Competitive Pricing: Increased competition among banks, NBFCs, and SFBs is leading to more attractive interest rates and loan terms for customers.

• Sustained Growth: As gold continues to hold cultural and financial importance, the demand for gold loans remains robust, with growth expected to continue at a steady pace in the coming years.

Conclusion

The gold loan industry in India has evolved into a key component of the country’s financial ecosystem, offering diverse and customer-friendly credit options. As technology continues to advance and customer needs evolve, the sector is poised for further growth, particularly in rural markets and through digital platforms. Both organized and unorganized players will continue to adapt to changing market conditions, making gold loans an increasingly attractive financial solution for millions across the country.

Fedbank Financial Services Ltd Business Overview

Fedbank Financial Services Ltd is a retail-focused NBFC (RBI-registered, NBFC-ND-SI) promoted by Federal Bank, Fedbank Financial Services Ltd backed earlier by private equity player True North, has transitioned under the leadership of Mr. Anil Kothuri into a small business lending model catering mainly to MSMEs and self-employed borrowers. Its portfolio is concentrated in mortgage loans (housing + LAP), gold loans, and unsecured business loans, with gold loans acting as a counter-cyclical buffer. Fedbank Financial Services Ltd also supports Federal Bank through loan distribution and operates with a “Phygital” doorstep model that combines branch presence with digital reach.

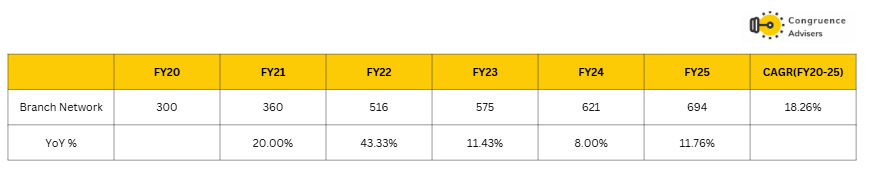

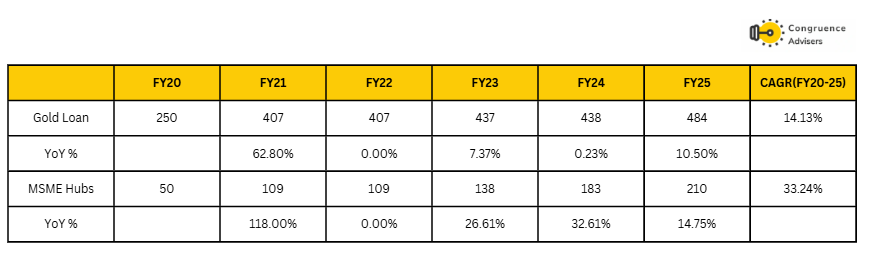

Branch Network

Fedbank Financial Services Ltd has separate gold finance branches in order to ensure collateral security and differentiated underwriting processes for gold and non-gold loans.

The gold loan branches are equipped with technology-led surveillance and security systems, integrated with an ERP application that enables smart security. These branches are primarily located in urban areas, including metro and semi-urban areas, with strategic presence in some metro and rural locations.

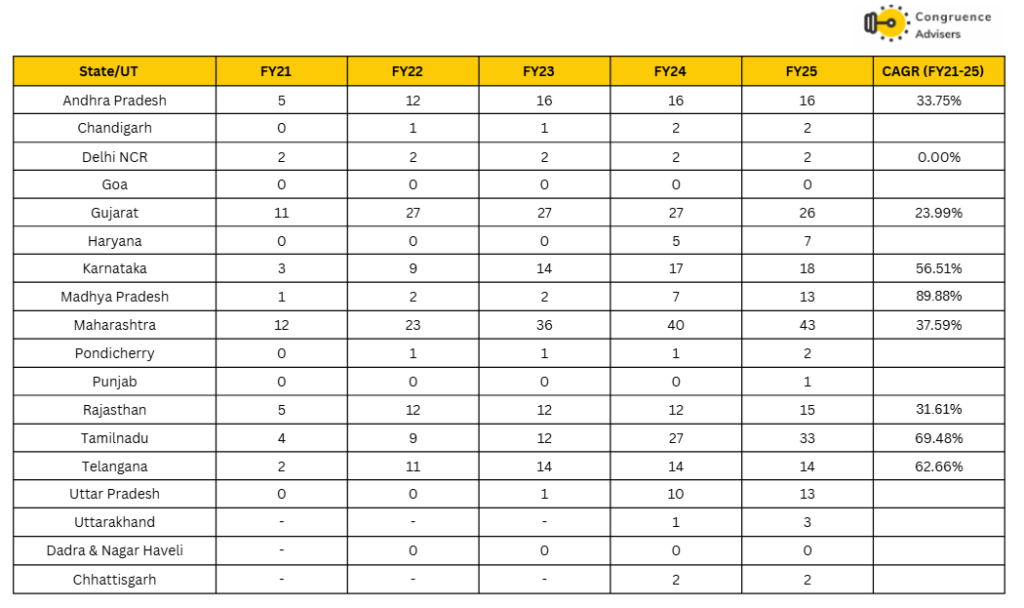

MSME hubs are low-cost branches spread across semi-urban, urban, and metro locations in 14 states and union territories. These MSME hubs give access to a large ESEI customer base and are cost-effective, with lean infrastructure.

As of FY25, Fedbank Financial Services Ltd has a total of 694 branches, out of which 484 are gold loan branches and 210 are MSME hubs.

In addition to branch-based sourcing, the company has 2000+ local channel partners, viz., direct selling agents (DSAs) and other local lead providers, to locally source potential customers at fixed commission costs. This allows the company to grow significantly at lower costs. The underwriting, however, is completely done by Fedbank Financial Services Ltd.

Fedbank Financial Services Ltd also offers doorstep gold loans whereby employees carry out appraisal and instant disbursal at customers’ premises, before transferring the pledged gold to a nearby branch with in-transit security that includes an electronic safe with GPS for tracking. The Collateral is further tracked via online portal and mobile applications in real time.

Specifically, there are plans to put across 100-plus gold branches in FY 2026. This is part of the strategy to expand the gold business through branch expansion.

The execution of opening gold loan branches is expected to see a substantial opening in Q2 FY26

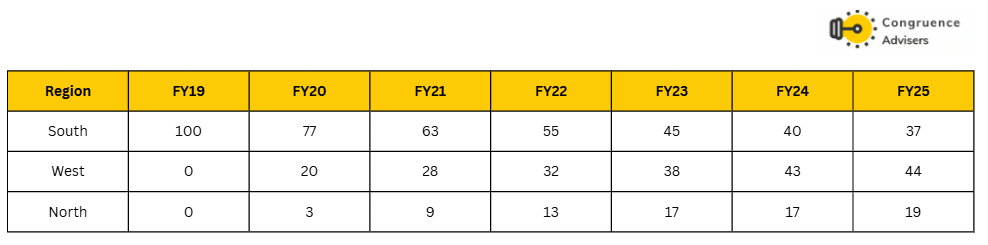

Going forward, more focus on the West and North. From Q1FY26, the company is focused on stabilizing and optimizing its current large network to extract operating leverage. Recent efforts include co-locating MSME hubs with gold branches to create synergies.

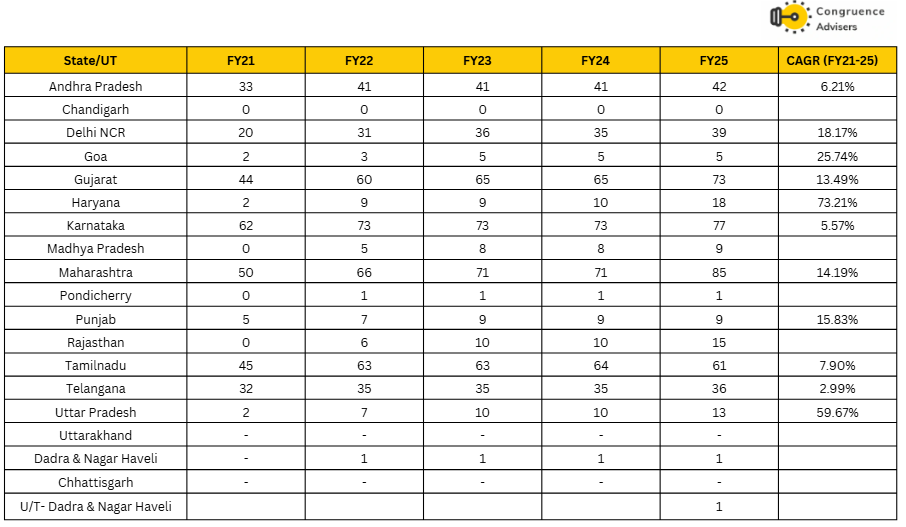

Total Branches State-wise

| State/UT | FY21 | FY22 | FY23 | FY24 | FY25 | CAGR (FY21-25) |

| Andhra Pradesh | 38 | 53 | 57 | 57 | 58 | 11.15% |

| Chandigarh | 1 | 1 | 1 | 2 | 2 | 18.92% |

| Delhi NCR | 22 | 33 | 38 | 37 | 41 | 16.84% |

| Goa | 2 | 3 | 5 | 5 | 5 | 25.74% |

| Gujarat | 57 | 87 | 92 | 92 | 99 | 14.80% |

| Haryana | 2 | 9 | 9 | 15 | 22 | 82.12% |

| Karnataka | 67 | 82 | 87 | 90 | 95 | 9.12% |

| Madhya Pradesh | 1 | 7 | 10 | 15 | 22 | 116.57% |

| Maharashtra | 64 | 89 | 107 | 111 | 128 | 18.92% |

| Pondicherry | 1 | 2 | 2 | 2 | 3 | 31.61% |

| Punjab | 5 | 7 | 9 | 9 | 10 | 18.92% |

| Rajasthan | 6 | 18 | 22 | 22 | 30 | 49.53% |

| Tamilnadu | 57 | 72 | 75 | 91 | 94 | 13.32% |

| Telangana | 35 | 46 | 49 | 49 | 50 | 9.33% |

| Uttar Pradesh | 2 | 7 | 11 | 20 | 26 | 89.88% |

| Uttarakhand | – | – | – | 1 | 3 | |

| Dadra & Nagar Haveli | – | 1 | 1 | 1 | 1 | |

| Chhattisgarh | – | – | – | 2 | 2 | |

| U/T- Dadra & Nagar Haveli | 1 |

Gold Loan Branches by State & Year

MSME Hubs by State & Year

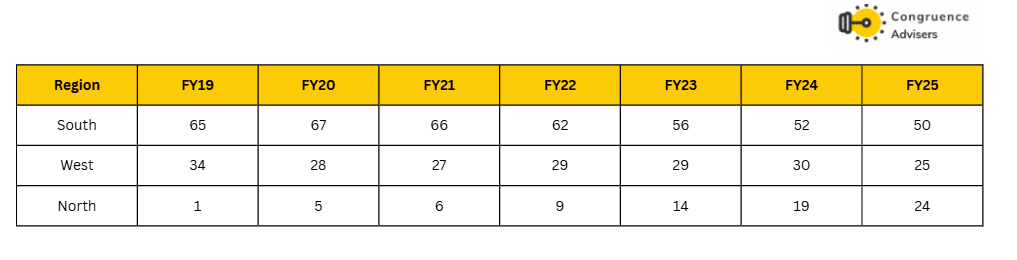

Mortgage Loan – AUM Share % by Region (FY19–FY25)

Gold Loan – % Share by Region (FY19–FY25)

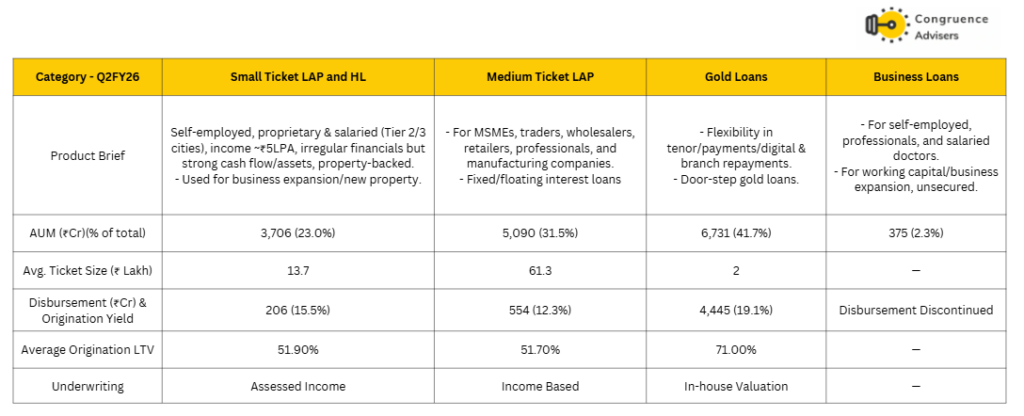

Fedbank Financial Services Ltd product suite

For small ticket Loans Against Property (LAP), the loans are secured by mortgaging the borrower’s property assets.

- Small ticket LAP is designed for self-employed individuals with working capital needs.

- The loans are typically secured against self-occupied residential and commercial properties.

- The customers often possess unencumbered properties that they can mortgage.

- As of June 30, 2023, for the overall LAP portfolio (medium and small ticket), 65.69% of the collateral was Self-Occupied Residential Property (SORP) and 11.68% was Self-Occupied Commercial Property (SOCP). Therefore, if the shop itself is a self-occupied commercial property, it would be included in the collateral.

Clientele for Gold Loans mainly comprises traders, owners of service and manufacturing units, their staff receiving informal cash wages, and individuals without regular income facing urgent financial needs (such as housewives).

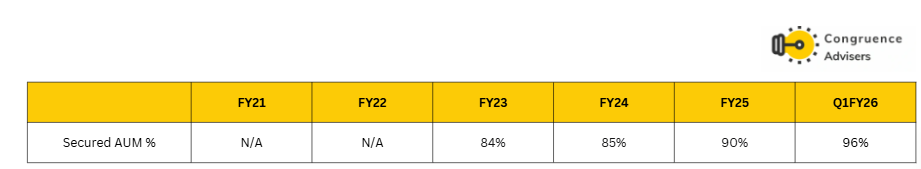

Fedbank Financial Services Ltd is primarily a secured asset lender focused on the MSME segment. It focuses on retail loan products with a collateralized lending model, targeting individuals and the emerging MSME sector, which ensures a granular portfolio and inherently lower risk. As of 1Q FY26, 96% of the asset book is backed by collateral property, as well as gold, making it a strong, secure, and diversified lender in the space.

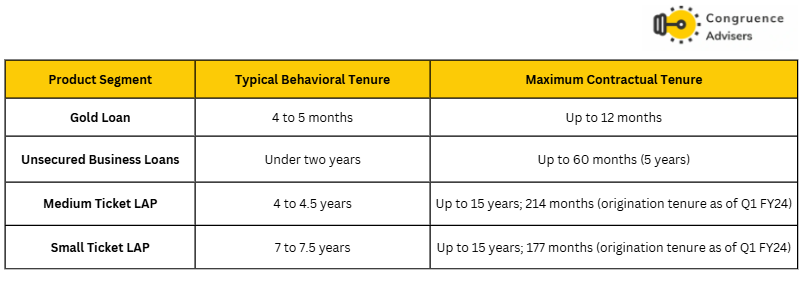

The typical loan tenures (behavioral and contractual) vary significantly by product segment:

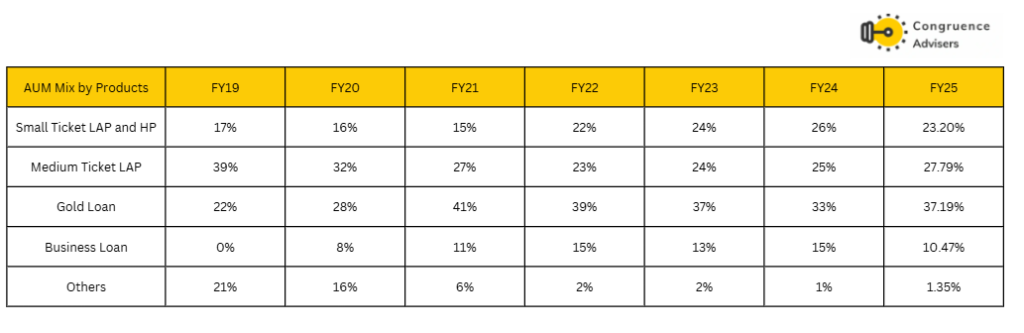

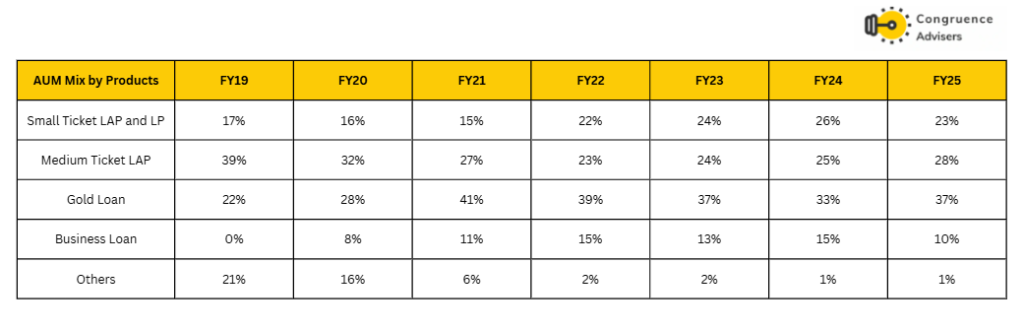

AUM Mix by Product Type

Gold loans: The gold loans market predominantly remains underpenetrated across the country, with more than 60% of outstanding gold loans originating from unorganized sources. Many NBFCs specializing in gold-based lending primarily focus their operations in the southern regions, leaving untapped opportunities in the northern markets where Fedbank Financial Services Ltd maintains a presence.

The ticket size under the segment starts from as low as INR 3k and ranges across large sizes, leading to an ATS of INR 100k. The gold loans offered by the company have tailor-made schemes with flexibility of tenor, interest payment choices, and digital and branch-based repayment options.

Mortgage loans: Fedbank Financial Services Ltd provides mortgage loans for working capital purposes with customized credit solutions depending on the customer’s needs and available documentation. Each of the products in the sub-segments has a unique value proposition:

a) Small ticket LAP and housing loans: This product caters to the requirements of both self-employed individuals with a proprietary setup and salaried customers with a median income of ~INR 5 lakh, accompanied by irregular or minimal financial transaction records. However, they maintain a healthy household cash flow, possess commensurate asset holdings, and own unencumbered properties. These are customers who typically reside in the outskirts of Tier-1 cities as well as Tier-2/3 cities.

b) Medium ticket LAP: This product addresses MSME requirements encompassing traders, wholesalers, distributors, retailers, self-employed professionals, and small manufacturing firms. It is a solution for diverse purposes such as capital injection, business expansion, working capital, asset procurement, and capital expenditure. The target customer base generally possesses well-established income channels, and loans are typically secured against completed and self-occupied residential and commercial properties.

Unsecured business loans: This product is designed to meet the credit requirements of self-employed professionals and non-professionals, as well as salaried doctors, among others. The target customer base consists of individuals with an annual turnover of INR 10 mn with a minimum of 5 years of business experience in their current field. This loan product primarily offers funds for bridging working capital needs and facilitating business expansion, without necessitating any collateral.

Fedbank Financial Services Ltd has made a conscious strategic decision to scale down the unsecured business loan (BL) division. While credit costs were a factor, the primary reasons are centered around strategic fit and profitability:

- Strategic Fit and Profitability (ROE/ROA): Management evaluated the business based on strategic fit, sourcing cost, operational cost, and the changing environment. The BL business was slowing down because it was not giving the expected Return on Equity (ROE).

- Shift to Secured Construct: The company decided to pivot to a 100% secured construct (Gold and LAP).

- Nature of Sourcing: The BL business was characterized as a “DSA-run business” and was not fit with the overall company strategy.

- Capital Release: The subsequent decision in H1FY26 to execute 100% direct assignment of the BL portfolio (₹886 Crores) was made to release capital for reinvestment in higher ROA businesses.

- Credit Cost Contribution: Credit costs were a material concern, as the BL segment accounted for almost 20% to 30% of total credit costs. Management noted that winding down the BL construct would help achieve a credit cost target below 1%.

During H1FY26, a 100% direct assignment of the business loan portfolio amounting to ₹886 crores was executed and de-recognized from AUM.

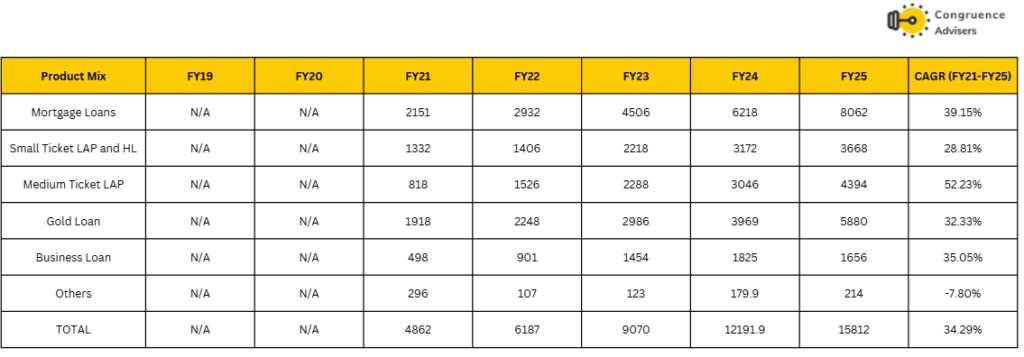

AUM Mix by Amount

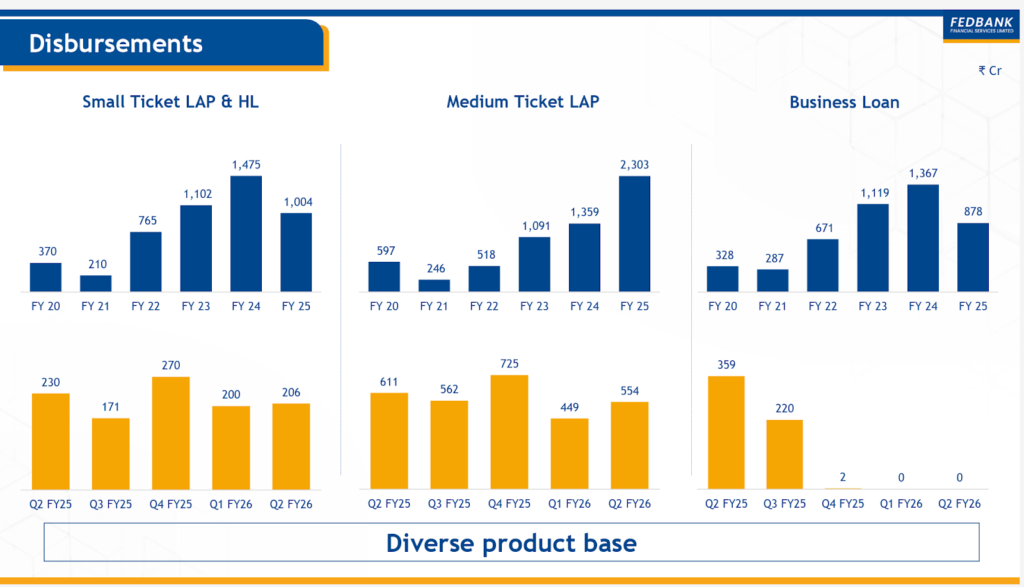

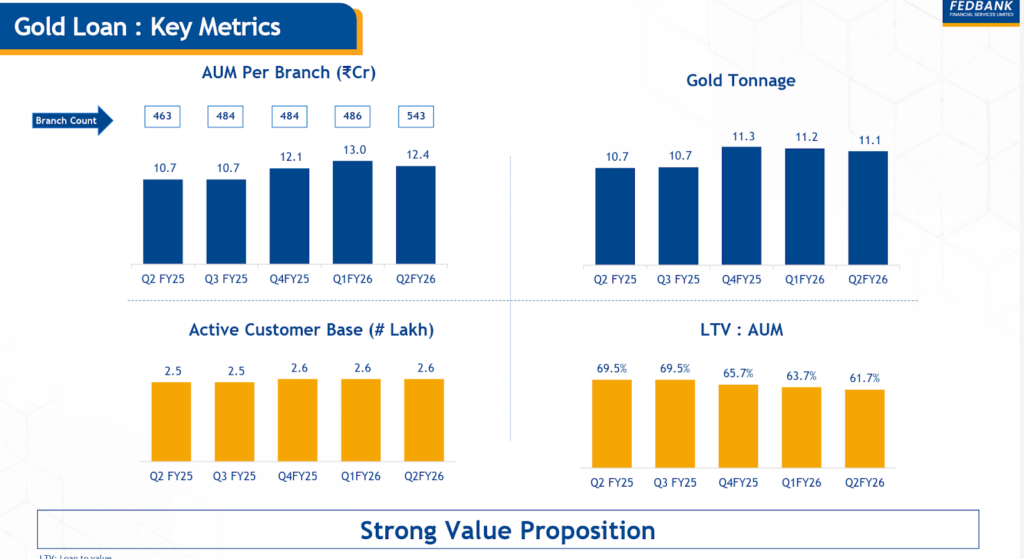

- Guided with a 25% YoY growth in gold with the current branches in place. And whatever new branches are going to come in, that will give the delta.

- MT LAP would continue to grow at a decent growth rate

- MT LAP business grew, while maintaining stable yields

- ST LAP would also grow at a similar pace to MT LAP going forward.

AUM Mix % by Products

The “Others” category is specified to include wholesale portfolio exposure and partnership business. This category is being wound down due to reduced focus on these businesses. The wholesale finance segment historically comprised construction finance to developers and loans to other NBFCs. The company limited its wholesale finance business before Fiscal 2021 and has not made any fresh sanctions since, focusing instead on servicing existing loans.

Fedbank Financial Services Limited % of fixed vs floating loans and liabilities

Assets (Loans)

- Overall Portfolio: As of Q1 FY26, a little under 89% of loans were linked to floating rate benchmarks.

- By Product (Behavioral/Reset Frequency):

- Gold Loans: Entirely fixed, but rates reset frequently due to short tenure.

- Small Ticket LAP: Almost entirely fixed in nature.

- Unsecured Lending: Entirely fixed-rate business.

- Medium Ticket LAP (MT LAP): Floating in nature, constituting about 30% to 31% of the AUM mix as of Q1 FY26.

Liabilities (Borrowings)

Fedbank Financial Services Ltd relies heavily on floating rate liabilities:

- In Q1FY26, 83% of borrowings are floating.

- As of June 30, 2023, Floating Rate Borrowings accounted for 83.06% of total borrowings, while Fixed Rate Borrowings were 16.94%.

- Out of the floating rate loans, 30% are linked to External Benchmark Lending Rates (EBLR) like the repo rate or T-bill rate, allowing for accelerated transmission of rate changes.

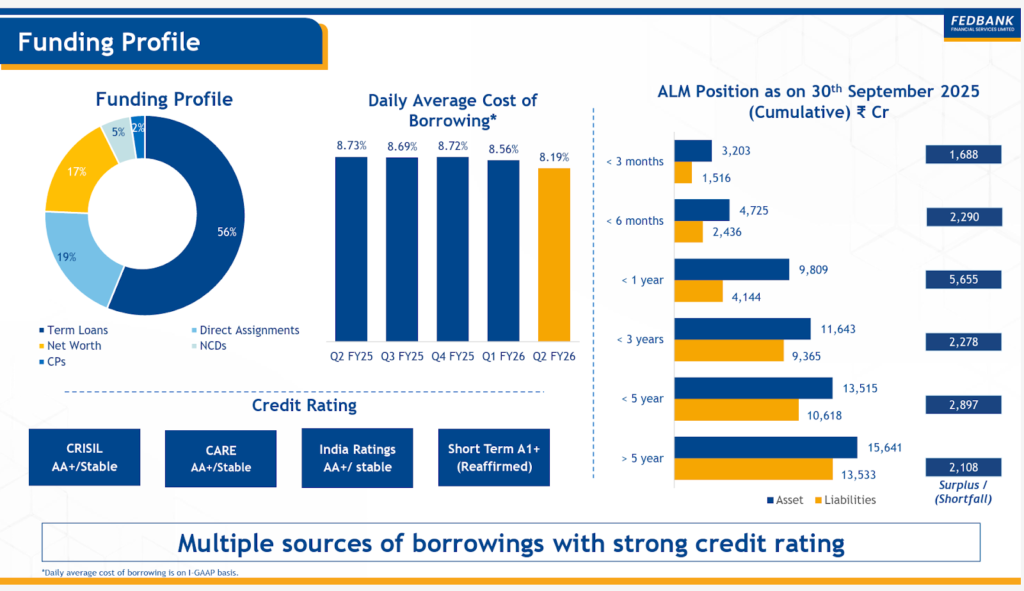

Funding Profile

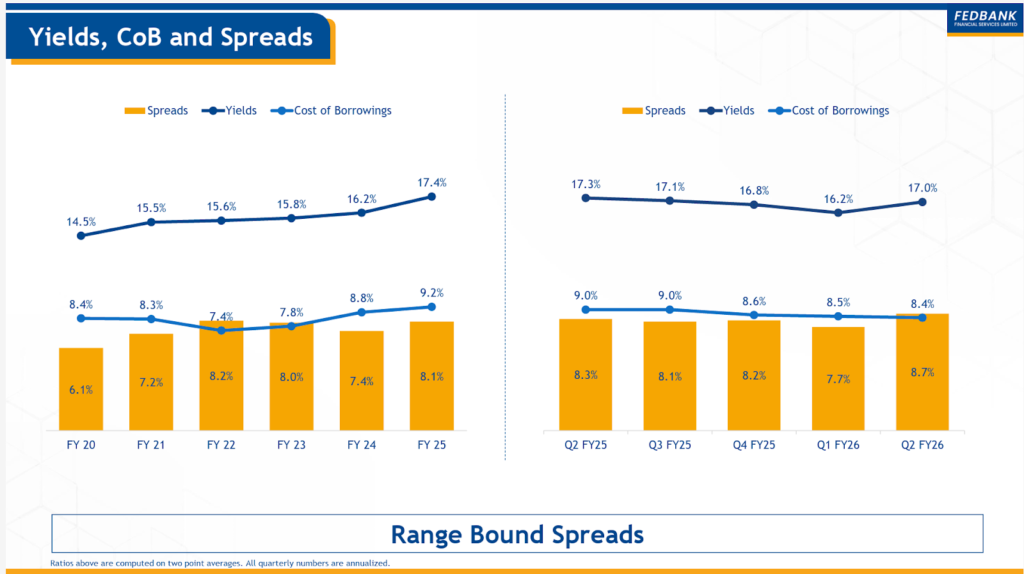

Yields, CoB, and Spreads

Disbursement

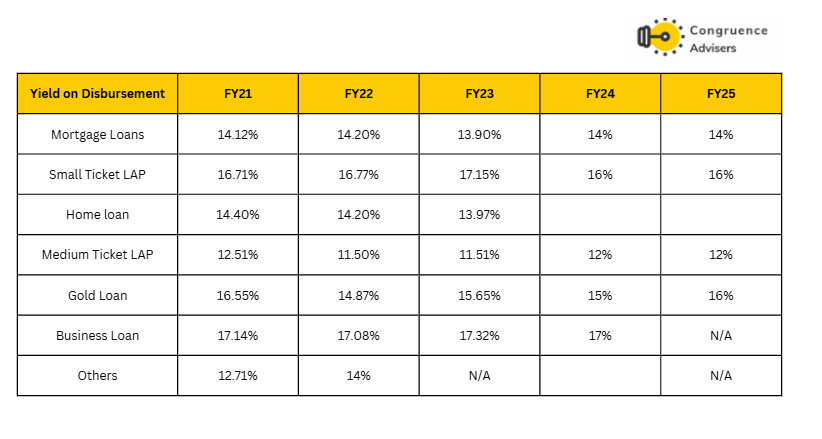

Yield on Disbursement

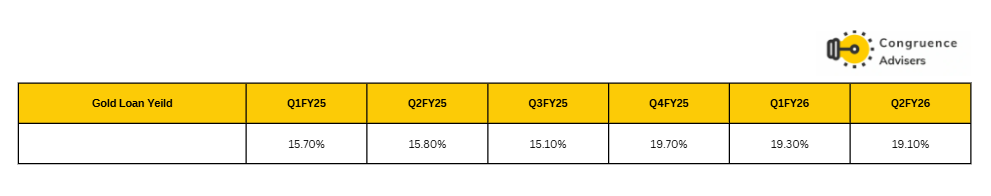

Till Q3 FY25, Fedbank Financial Services Ltd reported origination yields. It was in the range of 15-16% for 5 quarters. Q4 FY25 onwards, they have started reporting portfolio yields instead of origination yields. Portfolio yields jumped to 19.5%.

The reason is that only a customer making a monthly interest payment gets charged at the origination yield. For customers choosing quarterly/half-yearly interest payments, there is a significant tenure premium. Most customers go for bullet/high-tenure payment structures, pushing the PF yield 400 bps higher.

Fedbank Financial Services Ltd Quality of the Book & Recovery Framework with a risk-first approach

As of Q2FY26, over 77% of the AUM comprises customers with a CIBIL score >700

Gold loans

The gold loan appraisal involves two employees assessing pledged gold using the maker-checker concept. Loan amounts are determined based on a fixed rate per gram of gold content, irrespective of additional labour costs, using a standardized karat grading technique guided by centralized policies. Daily gold prices, influenced by recent average closing rates, are used to set the price per gram, generally lower than market rates, resulting in variable loan amounts based on jewellery type. The process starts with calibrated weighing, followed by valuation tests for gold quality and karat grading, including stone and acid tests. After successful evaluation, pertinent details are recorded in the loan origination system, enabling calculation of eligible loan amounts based on entered information and prevailing rates per gram.

At the branch level, the company has digitized the entire loan process from application to Disbursement and conducts real-time de-duplication against negative list customers using their credit history. Customer KYC is integrated into the loan origination system, and field verification is conducted before disbursement. The Fedbank Financial Services Ltd performs periodic and surprise audits of gold loan branches and implements OTP-based customer authentication for transactions. Bank account registration involves a penny drop check method, mobile number authentication via OTP, and capturing the customer’s photo for each transaction. At disbursement, customers e-sign the pledge card containing details such as branch information, gold collateral description with a photo, loan amount, interest rate, loan date, and terms.

Mortgage and unsecured business loans

For mortgage loans and unsecured business loans, Fedbank Financial Services Ltd meticulously gathers over 100 data points concerning each customer to comprehensively assess all aspects of the customer’s profile before making any credit decisions. Loan officers are mandated to dedicate a significant amount of time to understanding their customers and their financing requirements.

Leveraging the company’s localised knowledge of customers’ surroundings aids in making informed credit decisions. Each loan within these categories undergoes review and approval by distinct team members to ensure thorough checks and balances. Fedbank Financial Services Ltd diligently verifies all electronic or physical documentation provided by the customer and maintains an independent risk containment unit to oversee the entire process, guarding against fraudulent activities. Subsequently, post-disbursal verification is conducted to confirm adherence to all protocols and the accuracy of the information provided by the customer.

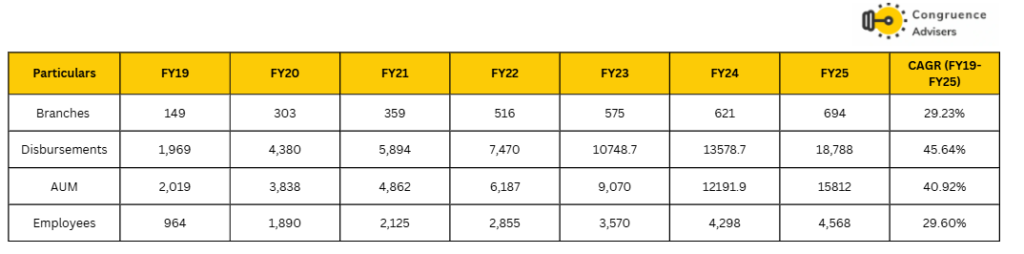

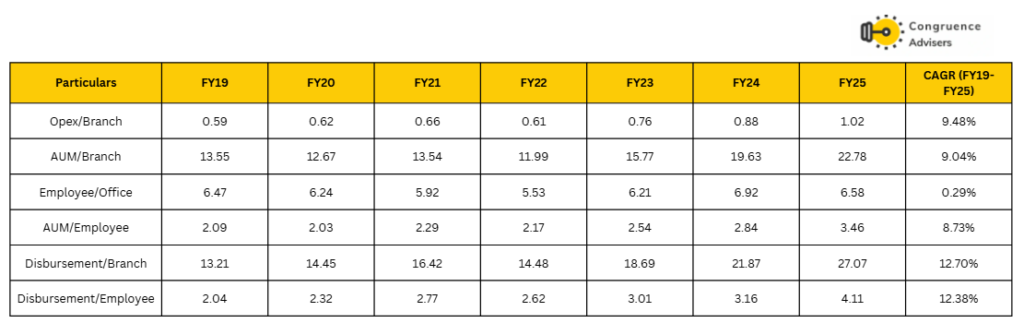

Fedbank Financial Services Ltd’s loan portfolio has grown at a robust 41% CAGR over the past 6 years (FY19-25) on the back of an increasing share of direct assignment (DA) on medium ticket LAP and unsecured BL, which offers higher earnings with lower funding costs due to leverage.

In addition, DA offers liquidity on the assets side, which can be reused for further lending. Fedbank Financial Services Ltd also has co-lending arrangements with banks to offer gold loans, which aid in a higher spread with credit risk spread between the company and the bank. With a continued increase in the share of off-book loans, which are also RoA and RoE accretive in nature.

In the last 2 years, there has been 10-15% tonnage growth.

Net Interest Margin

Management has indicated that they expect the Net Interest Margin (NIM) to be stable.

- This stability is underpinned by the fact that a large proportion of the company’s borrowings are on floating rates.

- Management also noted that increased growth in high-yielding segments like Gold Loans and Small Ticket LAP should generally have a positive impact on NIM.

- The strategy involves gradually reducing the reliance on Direct Assignment (DA) income and increasing focus on core earnings growth.

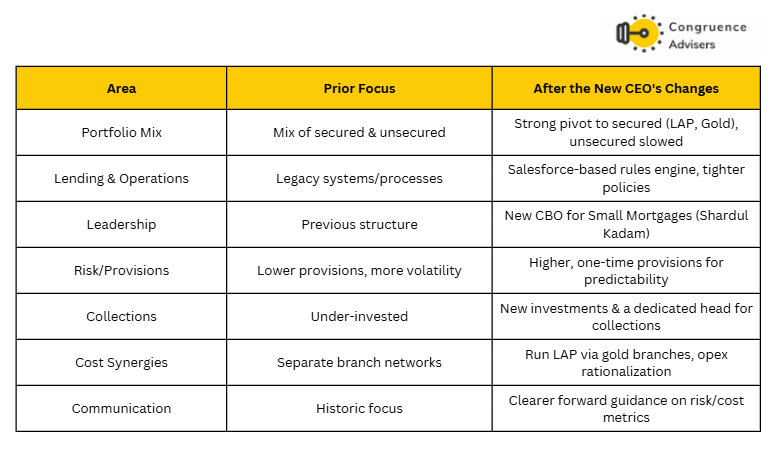

Fedbank Financial Services Ltd new CEO, Parvez Kasim Mulla, assumed leadership in November 2024 and initiated several organizational changes focused on operational streamlining, business growth, and digital-led innovations. Under his management, key initiatives included enhancement of digital transformation across sales and customer processes, added responsibilities for senior business heads (such as the LAP segment, also overseeing unsecured business loans), and a sharper focus on expanding the gold loan and LAP portfolios to strengthen profitability metrics.

New CEO priorities continue to be :

1. Conserve and allocate capital to businesses with high ROA and ROE

2. to move towards a fully secured lending portfolio.

3. Reinforce our twin strategy focusing on gold and LAP business

4. Expand the gold business through branch expansion and increased doorstep coverage. We expect to open gold loan branches in over 100 new markets this financial year.

5. Continue to foster synergies between gold and LAP operations.

6. Within LAP, Fedbank will concentrate on a combination of low-risk, high-yield ST LAP business and low-risk MT LAP business.

7. persist in enhancing collection infrastructure to effectively manage delinquencies.

8. Establish leadership in the ST LAP business and build a team for growth and quality.

9. Expand MT LAP with minimal capital allocation.

10. increase the core income while reducing reliance on DA income.

11. Use DA as a capital-conservation strategy.

12. Ensure that credit costs remain range-bound within the 1% plus or minus 10 bps.

Fedbank Financial Services Ltd Corporate Governance

Board Composition – As of FY25, the Board of Fedbank Financial Services Ltd. had 10 members: 5 Independent Directors, 4 non-executive Directors, and Parvez Mulla, who is the CEO and the Managing Director of Fedbank Financial Services Ltd. The Independent Directors bring relevant industry experience to the Board, having served in roles in financial services and banking in their professional careers.

KMP Remuneration – The total compensation drawn by KMPs in FY25 is Rs 10.65 Cr, which is approximately 48% of Fedbank Financial Services Ltd reported PAT.

Contingent Liabilities – The total contingent liabilities outstanding for Fedbank Financial Services Ltd as of FY25 amounted to ₹8.47 Cr, primarily of Income Tax and Service tax-related demands from the Government. The total contingent liabilities are less than 1% of the book value of equity of Fedbank Financial Services Ltd, and hence not material.

Related Party Transactions – Fedbank Financial Services Ltd has no contracts, arrangements, or transactions that were considered materially significant, which might have a potential conflict with the interests of the Company.

Dividend Track Record – Fedbank Financial Services Ltd has not paid a dividend in the last ten years, during which Fedbank Financial Services Ltd prioritized reinvesting funds into its own business.

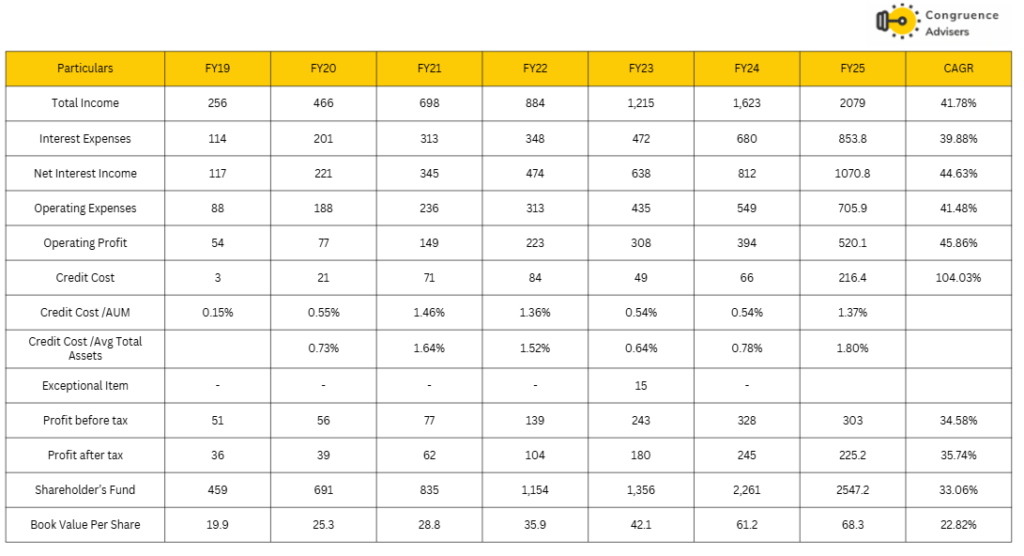

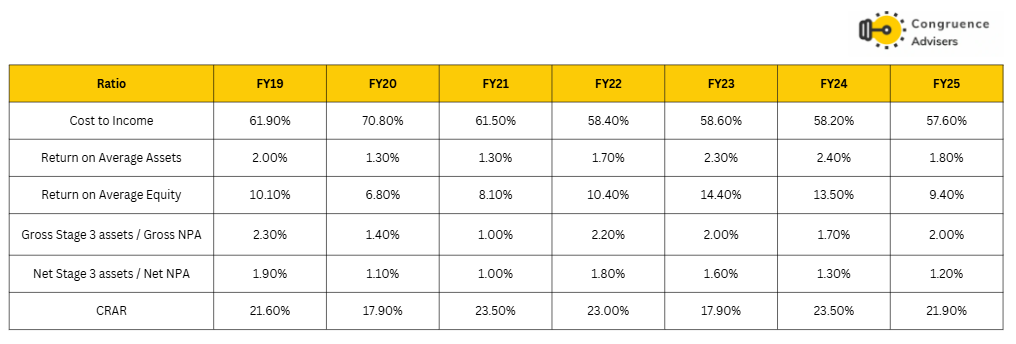

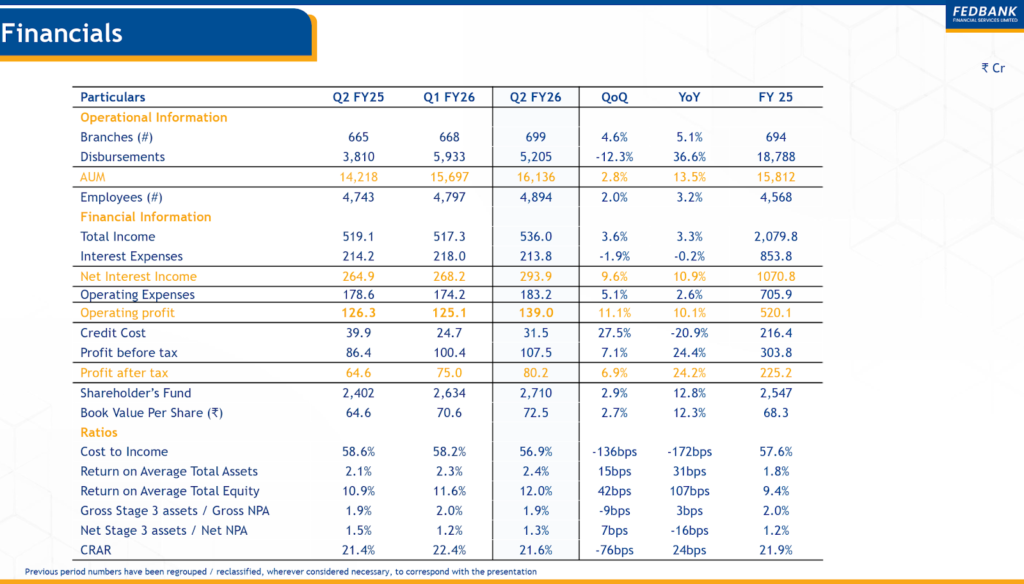

Fedbank Financial Services Ltd Financial Performance

Fedbank Financial Services Ltd has exhibited robust financial performance with total income rising from ₹256 Cr in FY19 to ₹2,079 Cr in FY25, marking a CAGR of 41.78%. Its net interest income reached ₹1,070.8 crore and profit after tax stood at ₹225.2 crore in FY25, supported by consistent growth in retail lending across gold loans, mortgage loans, and secured MSME products.

Loan book quality remains strong, with 96% of AUM backed by collateral and gold, and GNPA held at 2% overall but significantly lower at 0.32% for the resilient gold loan segment. Despite a spike in credit costs (1.8% for FY25) due to delinquencies in small-ticket LAP, the company has prioritized risk containment and provisioning.

Operational efficiency improved as the cost-to-income ratio declined to 57.6%. Return metrics remain attractive, with ROA at 1.8% and ROE at 9.4% for FY25, while strategic pivots like scaling down unsecured business loans are aimed at sustaining asset quality and profitability in a competitive environment.

Credit Cost

The spike in credit costs observed in FY25 (Credit Cost stood at 1.8% for FY25 up from 1.4% in Q1 FY25) was primarily driven by elevated delinquencies in the Small Ticket LAP (ST LAP) portfolio, requiring higher provisioning, rather than solely by the unsecured Business Loan (BL) segment.

- ST LAP Delinquencies: The small mortgages business faced elevated delinquencies in select pockets and delayed realization in deeper bucket NPAs. This was partly attributed to the collection infrastructure not keeping pace with business growth in certain outreach locations.

- Increased Provisioning: Management shored up provisions on the mortgage portfolio (which includes ST LAP) as a conservative measure to strengthen the balance sheet. In Q3 FY24 (leading into FY25), provisioning for Stage-3 mortgage loans was explicitly increased from 19.5% to 23%.

- BL Contribution (Mitigation/Factor): While the BL portfolio contributed significantly to overall credit cost historically (about 20-30% of credit cost at that time), the decision to slow down the BL division was a strategic choice to improve ROE and move to a secured construct. The subsequent removal of the BL book via 100% assignment in Q1 FY26 was expected to improve future credit costs.

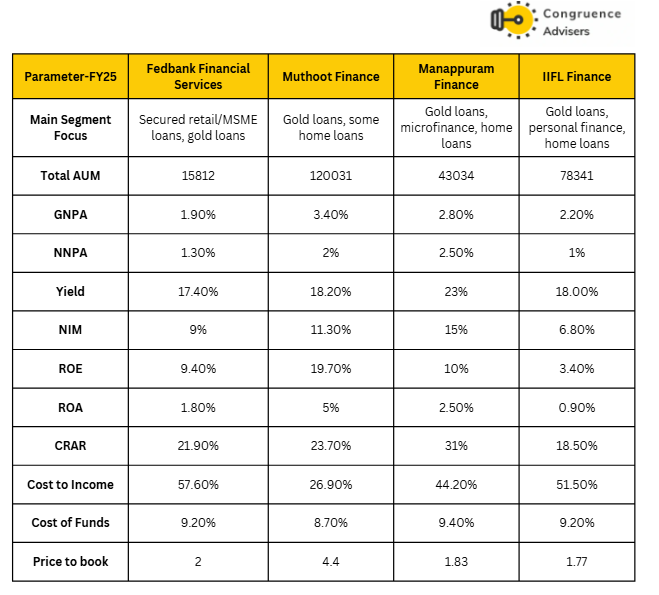

Fedbank Financial Services Ltd Comparative Analysis

To understand investment potential, Fedbank Financial Services Ltd we have conducted a comprehensive analysis. This analysis includes comparing Fedbank Financial Services Ltd to its competitors (peer comparison) on various fundamental parameters and Fedbank Financial Services Ltd share performance relative to relevant benchmark and sector indices.

Fedbank Financial Services Ltd Peer Comparison

Fedbank Financial Services Ltd stands out as a relatively smaller player demonstrating consistent improvement in profitability metrics and return ratios, which are expected to strengthen further over the next few years. Despite this progress, the stock continues to trade at a discount to established gold loan majors. Its valuation appears attractive, supported by a steady uptick in RoA and RoE alongside robust AUM growth. In comparison, Muthoot commands premium valuations owing to its superior return profile, though both its growth and profitability are showing signs of moderation. Manappuram and IIFL, meanwhile, trade at lower multiples, reflecting more stable but less differentiated business models. Against this backdrop, Fedbank Financial Services Ltd offers an appealing re-rating opportunity, underpinned by improving operational efficiency and scaling momentum.

Fedbank Financial Services Ltd Index Comparison

Fedbank Financial Services Ltd share performance vs the S&P BSE Small Cap Index, as the index benchmark comparison, is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why You Should Consider Investing in Fedbank Financial Services Ltd

Strong Promoter and Management – Fedbank Financial Services Ltd was established in 1995 and operates as a subsidiary of Federal Bank, which held a 60.97% stake as of June 2025. Federal Bank is expected to retain its majority ownership over the long run, ensuring strong institutional backing. The association provides Fedbank Financial Services Ltd with brand leverage, managerial oversight, and operational benefits from the parent bank. Additionally, the company distributes certain Federal Bank products and earns fee-based income from these activities. Over time, Federal Bank has consistently infused capital into Fedbank Financial Services Ltd while extending credit facilities such as working capital lines and term loans, reinforcing Fedbank Financial Services Ltd’s liquidity and business stability.

Optimized Distribution and Productivity Model – Fedbank Financial Services Ltd is implementing a co-location model for gold and mortgage branches to improve footprint efficiency and cost management. Its “phygital” strategy blends a physical presence important for building trust in semi-urban and rural markets with a digital infrastructure that ensures seamless onboarding and faster processing. Smaller spoke offices and co-located outlets now handle higher business volumes without proportionate cost increases, improving productivity per branch. This hybrid approach allows Fedbank Financial Services Ltd to scale and reach efficiently while maintaining close customer engagement.

Credit Costs Returning to Normal Levels – Historically elevated credit costs, driven by stress in business loans and small-ticket LAP segments, have begun to normalize. Management expects long-term credit costs around 1% (±10 bps), supported by a secured loan book, tighter underwriting in new vintages, and strong recovery visibility from collateral-backed lending such as LAP and gold loans. Fedbank Financial Services Ltd’s current portfolio structure and risk discipline suggest this level of credit cost should remain sustainable going forward.

Strategic Shift Toward Secured Retail Lending – Fedbank Financial Services Ltd has consciously pivoted away from unsecured and high-risk business loans to focus on more resilient, asset-backed segments like small property loans, affordable housing finance, and gold loans. These are secured by real collateral and cater primarily to small business operators, self-employed borrowers, and families in non-metro locations. Fedbank Financial Services Ltd’s familiarity with these markets, combined with a track record of navigating economic cycles, positions it well for steady, risk-adjusted growth. This shift improves portfolio quality, reduces default risk, and promotes sustainable expansion.

Reduction of Business Loan Exposure – Fedbank Financial Services Ltd.’s earlier growth strategy, emphasizing business loans and SME LAP, led to higher delinquencies, particularly during macroeconomic stress and the COVID-19 period. Recognizing this, the company has proactively wound down legacy exposures through portfolio run-offs, assignments, and stricter origination policies. These corrective steps have streamlined the balance sheet and materially improved asset quality and stability. Unlike the pre-2020 phase when NBFCs, including Fedbank Financial Services Ltd, emphasized rapid AUM expansion through a loosely underwritten SME portfolio, the current approach prioritizes prudence over pace, minimizing future volatility.

What are the Risks of Investing in Fedbank Financial Services Ltd

Asset Quality and Portfolio Concentration – Fedbank Financial Services Ltd’s loan portfolio has significant exposure to self-employed, ESFI, and MSME borrowers; these segments comprise a large share of the total book. A high concentration of borrowers in these segments means that defaults or economic slowdowns could disproportionately impact Fedbank Financial Services Ltd’s performance. Past increases in gross and net NPAs were driven by stress in home loans and business loans, with current levels still reflecting limited seasoning in newer products.

Regulatory & Compliance Risk – As an NBFC supervised by the Reserve Bank of India, Fedbank Financial Services Ltd faces risks associated with ever-evolving regulations and compliance requirements. Historic non-compliances have resulted in penalties, and future lapses may result in financial or operational setbacks. Changes in RBI policies or other regulations affecting NBFCs could alter Fedbank Financial Services Ltd’s profitability, business model, or liquidity.

Geographical Concentration – A majority of Fedbank Financial Services Ltd’s assets remain concentrated in southern India, especially in its gold loan portfolio, which heightens vulnerability to regional economic or policy shocks. While expansion is underway in western and northern regions, material risks from regional concentration persist.

Liquidity and Funding Risks – Like other NBFCs, Fedbank Financial Services Ltd depends on a mix of short-term borrowings and long-term lending, exposing it to liquidity risk during market disruptions or periods of credit squeeze. Sudden losses in investor confidence or tighter market liquidity could trigger funding challenges.

Market and Interest Rate Risk – Changes in market interest rates directly impact Fedbank Financial Services Ltd’s cost of funds and net interest margins. While Fedbank Financial Services Ltd has shifted its AUM towards more secured and fixed-rate assets, volatility in rates or spreads may impact profitability. The broader NBFC sector is also vulnerable to economic cycles, which can magnify risks in periods of credit tightening or stress.

Operational and Technology Risks – Fedbank Financial Services Ltd’s business model increasingly relies on digital onboarding, scorecard-based underwriting, and a “phygital” distribution network. Operational disruptions, cyber threats, or technology failures could impact productivity or risk management.

Fedbank Financial Services Ltd Future Outlook

Fedbank Financial Services Ltd is expected to post consistent growth supported by its business realignment efforts. The shift away from high-yield unsecured business loans could weigh slightly on portfolio yields in FY26, but this should be cushioned by lower funding costs and a rising proportion of gold loans and small-ticket LAP, both carrying higher yields. These strategic measures are expected to strengthen overall ROA.

Overall, in the next three years, the management expects the AUM to reach to INR 30,000crs, targeting ~25% CAGR. The new management is focused on building a high-quality (Secured) portfolio rather than pursuing aggressive growth. The focus would be on Quality, followed by Profitability and Growth.

Fedbank Financial Services Ltd expects ROA to rise to 2.2–2.5% in FY26 and targets around 3% by FY27, compared to a reported 1.8% in FY25. NIM is likely to remain stable, while credit costs are expected to hover in the range of 90–110 basis points in FY26.

Fedbank Financial Services Ltd is likely to consider an equity infusion around FY28 to fund its next phase of expansion. While several strategic measures are being implemented, the cost-to-income ratio is expected to remain above 55% in the near term, with a focus on achieving a gradual and sustainable improvement over time.

Fedbank Financial Services Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time, price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers, we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Fedbank Financial Services Ltd Price charts

On the weekly chart, the price is now closer to the IPO price and is looking to form a base before making a decisive move. The trend changed for the better once the price level of 130 was surpassed, indicating the worst of the correction since the IPO is over.

On the day chart the current pattern has a bearish undertone in our assessment. Especially after the price broke the short term trendline in the run up to the Q2 FY26 earnings announcement. While earnings by itself was on expected lines, it is tough to see how the market would give this stock a sustained rerating when some of the best HFC’s (also running 100% secured books) have been stuck in a time consolidation even after printing 20%+ earnings and book value growth for some quarters now.

The current consolidation & correction in the Fedbank Financial Services stock can be evaluated to see if it presents an accumulation opportunity with an investment horizon of around 3 years.

Fedbank Financial Services Ltd Latest Result, News and Updates

Fedbank Financial Services Ltd Quarterly Results

Gold Loan Business

The sequential moderation in gold loan disbursements was largely driven by customer withdrawals during August and September, coinciding with the festive season and elevated gold prices. This trend is typical for the gold loan business and does not indicate any structural issue. The management continues to maintain caution on credit quality, price movements, and LTV levels, operating under the guidelines introduced in December. During the quarter, 57 new gold loan branches were added, with plans to open another 90 branches in H2FY26. Additionally, 26 SLAP branches were merged and co-located with gold loan branches. The current AUM per branch stands at ₹12.4 crore versus ₹14 crore earlier, temporarily impacted by the addition of new branches, and is expected to normalize over the next one to two quarters.

LAP Business

Fedbank Financial Services Ltd had earlier reported collection challenges in its Small Ticket LAP (ST-LAP) segment during Q3 and Q4FY25. Initially, the same collection teams handled gold, MT&LAP, and ST-LAP portfolios. To enhance focus and efficiency, separate leadership and dedicated teams have now been deployed for ST-LAP, with headcount rising from 200 to 400 employees. The management is actively rebuilding this portfolio, and collection efficiencies have improved across several regions in recent months. Fedbank Financial Services Ltd also sold a stressed pool of ST-LAP and housing loan accounts worth ₹79 crore (including ₹41 crore of technically written-off principal) to an ARC for an upfront consideration of ₹32.6 crore.

Outlook

For FY26, Fedbank Financial Services Ltd’s key priority will be maintaining credit costs within guided levels. In FY27, focus will shift toward improving operational efficiency by tightening the cost-to-income ratio. The cost-to-income ratio for FY26 is expected to remain broadly in line with FY25 levels of 57–58 percent.

Final thoughts on Fedbank Financial Services Ltd

The pivot in favor of 100% secured loans is an interesting one and makes sense at the current scale of the business. While the business is mostly secured, the client profile is much riskier than those at well known banks and NBFC’s. Post the rolldown of one of the lines of business, the loan book is now indexed ~40% toward gold loans. While Gold prices have been on a tear through CY25, there are concerns that high gold prices are already leading to lower volume growth for leading jewellers in India. Gold price has seen a predictable consolidation in the last 15 days of October and it remains to be seen if the structural rise in gold prices will sustain or will peak out for some time. The market is wary of the fact that higher gold AUM over the past 1 year has been driven more by MTM gains rather than through increase in volume tonnage.

The market is also keenly watching on how the MSME segment will perform over the next few quarters on asset quality. While a good chunk of these loans are backed by loans against property which historically have low default rates, one cannot take things for granted in segments that are yet to be fully seasoned. The risk profile of LAP loans issued to the trader segment is very different from a housing loan issued to a Tier 1 salaried employee with a good CIBIL score. Property and gold are used as collateral by a client segment that has a tough time getting access to capital from the large banks and NBFC’s.

Over the medium term, the market will value lenders more on sticky criteria like operating expense optimization, geographical penetration, risk management and asset quality rather than on short term factors like where gold prices are headed. At a price to book of ~2x, Fedbank Financial Services is cheaper than most other secured lenders for sure and larger NBFC’s which are starting to trade at elevated valuation. However, compared to some of the mid-sized banks (which have better secular growth and risk management characteristics), the stock is not cheap.

Our suggestion is that investors should not reduce lenders to plain vanilla metrics like Price to Book, ROA and ROE; they should rather understand the intricacies of the client segment of each lender and get a qualitative sense of the risks involved in the business. Most lenders operating at a high yield on loans will print healthy ROA and ROE during good phases, it is the bad phases that really matter when it comes to medium term return across lending cycles.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this to a general audience. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will continue/be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.