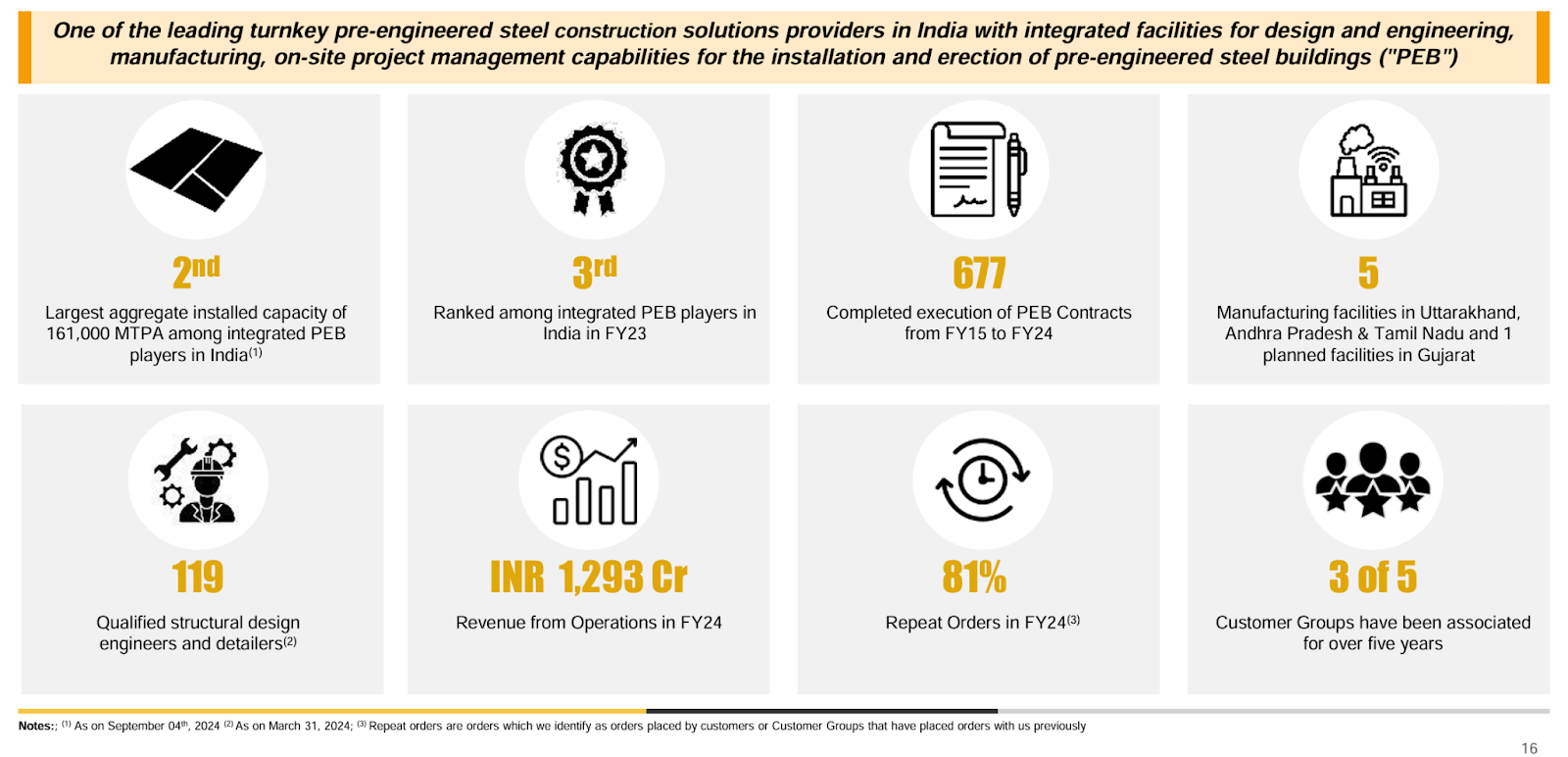

Interarch Building Products Ltd. is a micro-cap stock in the construction and infrastructure sector. Interarch is one of the leading turnkey pre-engineered steel construction solution providers in India with integrated facilities for design and engineering, manufacturing, and on-site project management capabilities for the installation and erection of pre-engineered steel buildings (“PEB”).

We Find Interarch Building Products Ltd an interesting play on private capex through pre-engineered steel buildings (PEBs). Interarch Building Products Ltd is well-positioned to achieve mid-double-digit revenue growth, supported by its planned capacity expansion and high asset turnover (capable of generating ₹450-500 crore in revenue with just ₹50-60 crore of capex) underscores its strong unit economics. Additionally, a robust balance sheet further strengthens its growth prospects

Interarch Building Products Ltd Company Summary

Interarch Building Products Ltd is one of the leading turnkey pre-engineered steel construction solution providers in India. It has integrated facilities for design and engineering, manufacturing, and on-site project management capabilities for the installation and erection of pre-engineered steel buildings (PEBs).

PEB offerings are designed, engineered, and fabricated by Interarch Building Products Ltd as per customer requirements, and find use in construction for industrial, infrastructure, and building (residential, commercial, and non-commercial) end-use applications. Interarch Building Products Ltd have delivered PEBs for projects ranging from multi-level warehouses for customers engaged in e-commerce to paint-product-moving consumer goods action lines for customers engaged in manufacturing paints and the FMCG sector for setting up manufacturing units for manufacturing their products. Interarch Building Products Ltd have also supplied large-span PEBs for indoor stadiums and customers engaged in the cement industry.

Interarch Building Products Ltd Management Details

The two promoter families, the Nandas and the Suri have extensive experience in the pre-engineered building industry. Arvind Nanda and Gautam Suri, the founders of Interarch Building Products Ltd, have nearly 30 years of experience in this industry. Viraj Nanda, Arvind Nanda’s son, and Ishaan Suri, Gautam Suri’s son, also have experience in the family business.

Interarch Building Products Ltd Industry Overview

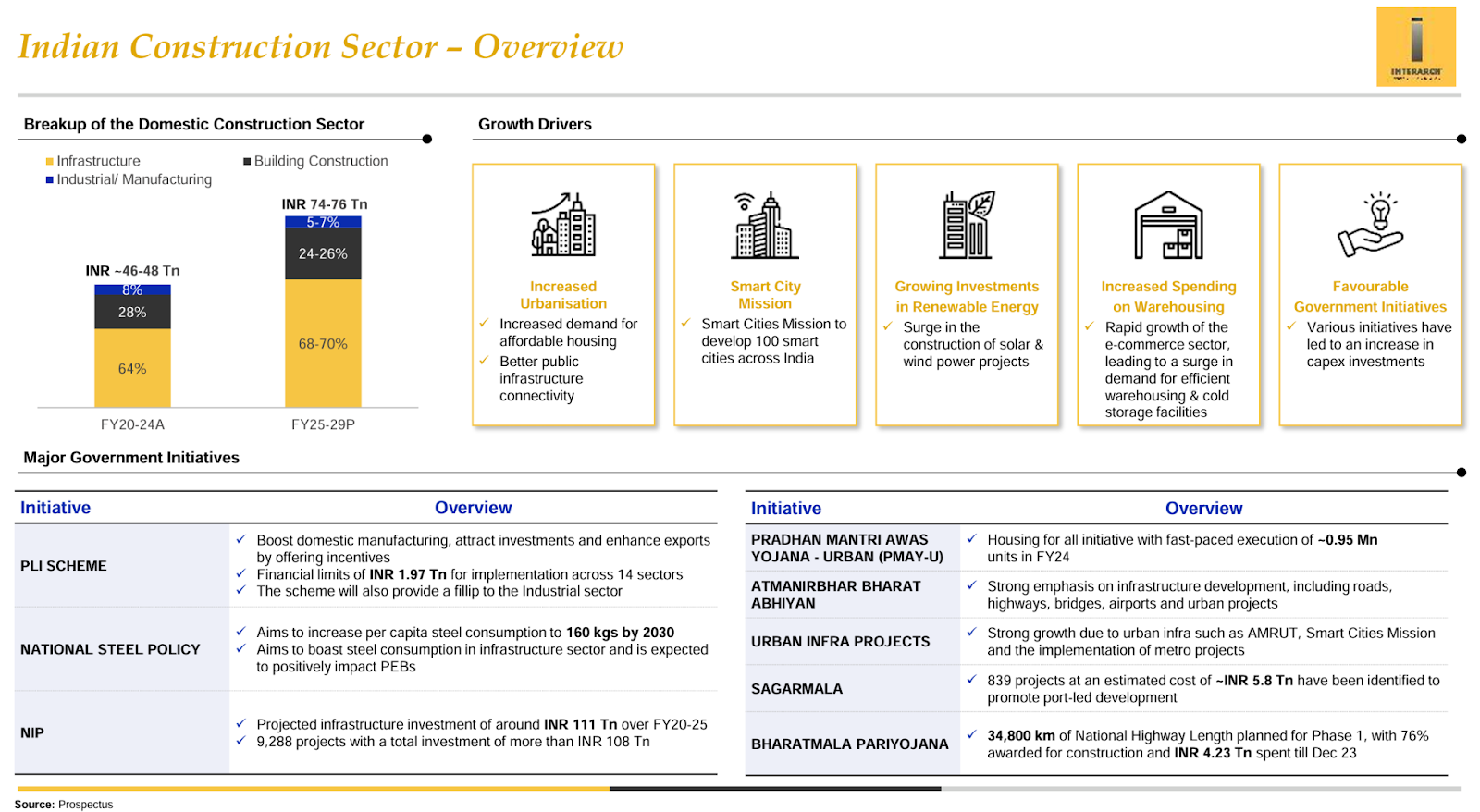

The construction sector in India can be broadly classified into Building Construction, Industrial/ Manufacturing construction, and Infrastructure construction. Industrial/manufacturing construction includes manufacturing plants, factories, power plants, and other highly specialized facilities. Infrastructure construction includes warehouses, bridges, dams, roads, airports, canals, etc., and building construction includes constructing buildings for residential uses such as houses, residential towers, etc., as well as non-commercial buildings like hospitals, educational institutions as well as buildings for commercial use such as offices, retail malls, etc.

The construction sector’s Gross Value Added (GVA) has shown substantial growth over the years. In FY23, it reached ₹13.1 trillion, a significant increase from ₹7.8 trillion in the Financial Year 2012, representing a Compound Annual Growth Rate (CAGR) of 4.8%. The sector’s GVA has grown at a CAGR of 5.2% between Financial Years 2012 and 2024. The construction sector’s share in overall GVA is estimated to have increased in FY24.

Construction Spending

- Total construction investment was estimated at ₹46-48 trillion between FY2020-2024 and is expected to increase to ₹74-76 trillion between FY 2025-2029.

- Construction capex is estimated to have increased by 13% in FY24, driven by the infrastructure sector.

- Infrastructure investments are expected to attract ₹51-53 trillion between FY2025-2029, up from ₹29-31 trillion between Financial Years 2020-2024.

- The building and construction sector is expected to grow to ₹18-19 trillion between FY 2025-2029, up from ₹12.5-13.5 trillion between Financial Years 2020-2024.

- Construction spending across industrial investments in the FY25 is projected to rise by 5-7%

Pre-Engineered Buildings (PEB)

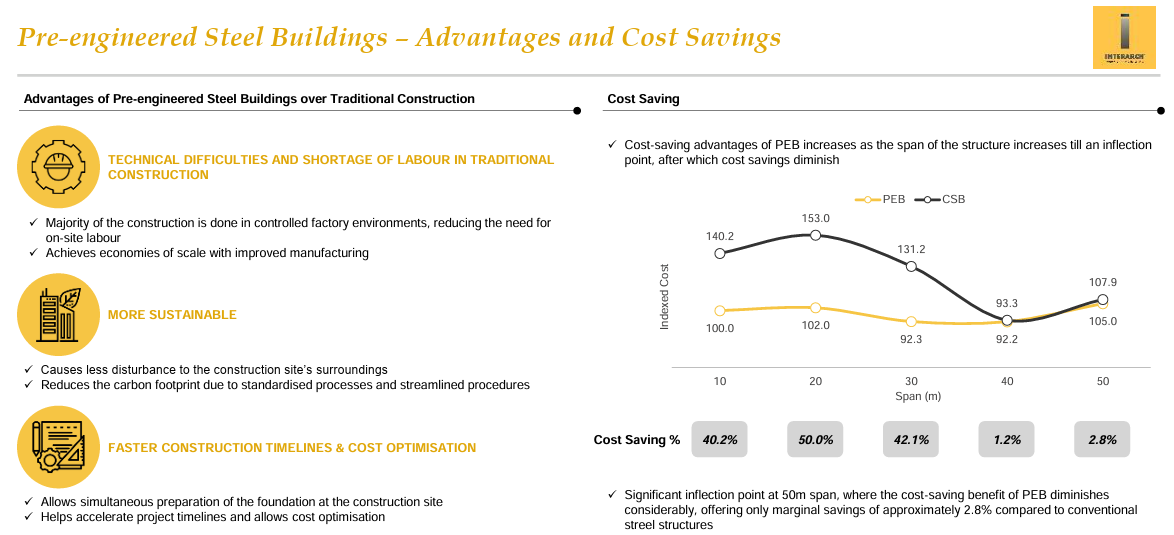

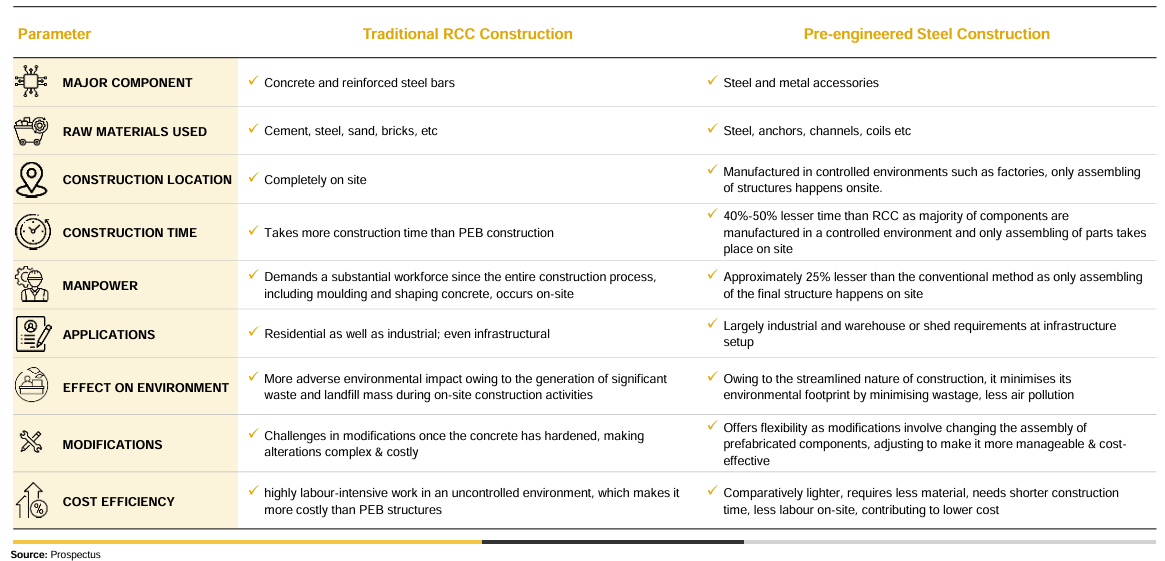

PEBs are steel structures fabricated in factories and then assembled on-site. They are gaining popularity due to their speed of construction and sustainability. The pre-engineered buildings market is expected to see good growth because of increasing awareness regarding modern off-site construction techniques

The global pre-engineered steel buildings market is estimated at $16-17 billion as of calendar year 2022 and is expected to grow at an 11-12% CAGR over the medium term till calendar year 2027..

The Indian PEB market is valued at approximately ₹195 billion in FY24 and is projected to grow to ₹340 billion by FY29.

India’s pre-engineered steel building (PESB) industry is valued at ~INR20,000cr, with organized/unorganized players contributing ~45%/~55%. In terms of revenue and capacity, Interarch Building Products Ltd ranks among the top two in India’s organized market, commanding a market share of 7–8% of total industry revenue.

Advantages and cost saving of Pre-Engineered Steel Buildings (PEB)

Low share of pre-engineered buildings in India combined with the increasing of awareness of benefits & cost savings in pre-engineered buildings over RCC, provides a substantial growth potential of pre-engineered buildings in India

Comparison Between RCC and Pre-engineered Steel Construction

Interarch Building Products Ltd Business Details

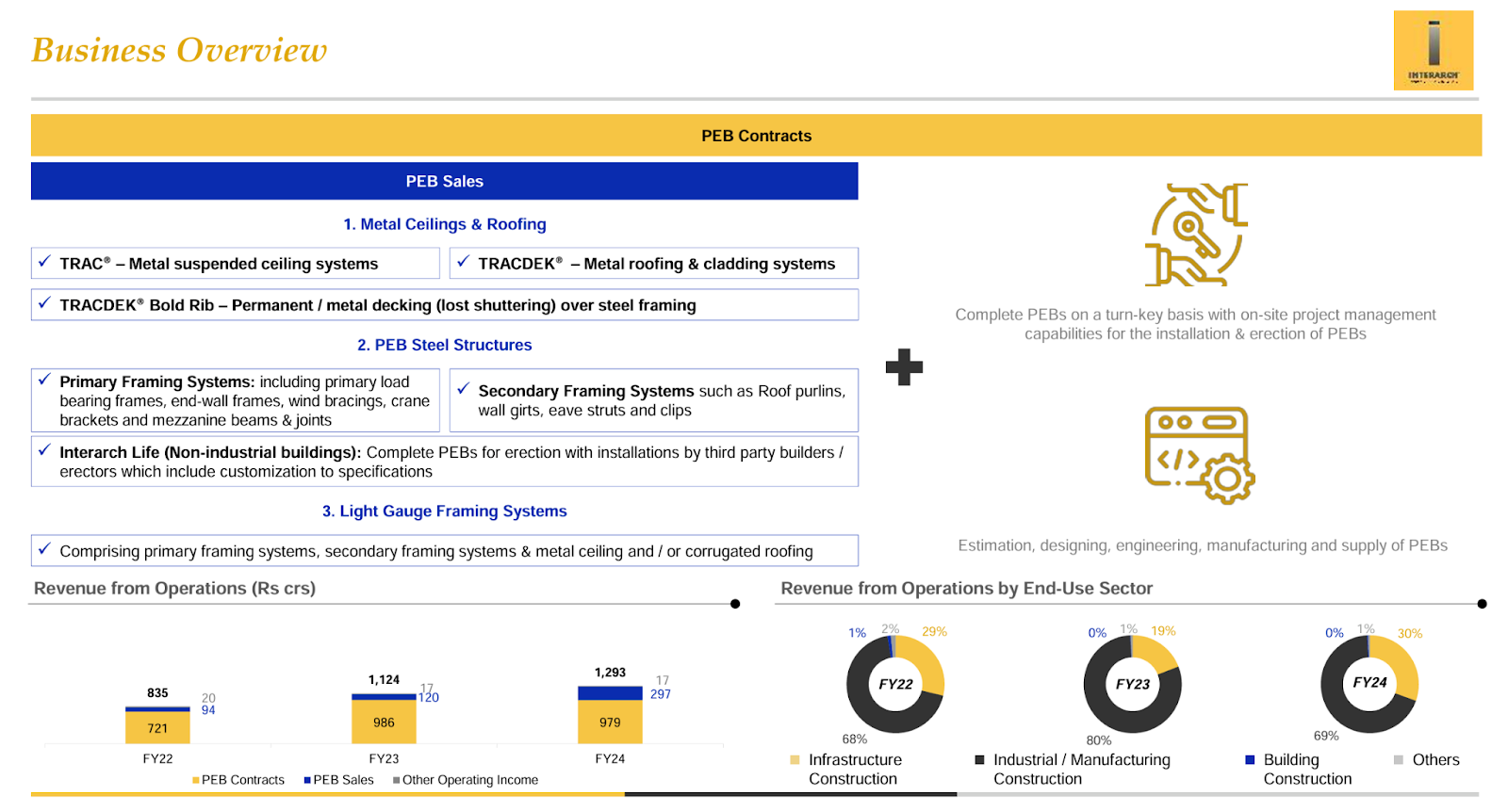

Interarch Building Products Ltd offers Pre-engineered steel buildings (PEBs) through

(a) PEB contracts where it provides complete PEBs on a turn-key basis to its customers, along with on-site project management expertise for the installation and erection of PEBs supplied to customers’ sites

(b) PEB Sales, which includes (i) sale of metal ceilings and corrugated roofing (comprising metal suspended ceiling systems (under the brand, “TRAC®”), metal roofing and cladding systems (under the brand, “TRACDEK®”) and permanent/metal decking (lost shuttering) over steel framing (under the brand, “TRACDEK® Bold-Rib”), (ii) supply of PEB steel structures (comprising, amongst other things, primary and secondary framing systems; as well as complete PEBs, such as non-industrial PEB buildings for non-industrial use, such as farmhouses and residential buildings.

Pre-engineered steel building offerings are customized, fabricated, and executed as per the requirements of the customers. All the components of the PEBs are engineered and fabricated at Interarch Building Products Ltd’s Manufacturing Facilities in a manner that there would be no requirement for any cutting or welding at the site of the customer.

Metal ceilings and corrugated roofing

- Metal suspended ceiling systems: Interarch Building Products Ltd’s TRAC® range of metal suspended ceiling systems are designed taking into account design, construction practices, and weather conditions. TRAC® metal suspended ceiling systems are manufactured out of pre-painted steel/aluminum/gypsum and are suitable for various interior and exterior spaces, including airports, offices, hospitals, schools, restaurants, shops, hotels, and power plants.

- Metal roofing and cladding systems: Interarch Building Products Ltd markets its metal roofing and cladding systems under the brand “TRACDEK®.” The Metal roofing and cladding systems consist of galvalume and galvanized steel substrates rolled-formed into corrugated sheets of various sheeting profiles and may feature coatings such as architectural polyester, siliconized polyester, or polyvinyl dinine.

- Permanent/metal decking (lost shuttering) over steel framing: Interarch Building Products Ltd offers permanent/metal decking (lost shuttering) over steel framing (under the brand, “TRACDEK® Bold-Rib”) consisting of cold-formed zinc-coated steel decking panels, designed for the construction of composite floor slabs which also act as permanent shuttering.

PEB steel structures

- Primary Framing Systems – The entire PEB depends on the load-bearing capacity of its primary framing system. Primary framing systems comprise all structural components that transfer the load of the PEB to the foundation, including primary load-bearing frames (also known as mainframes), end-wall frames, wind bracings, crane brackets, and mezzanine beams and joints.

- Secondary Framing Systems – Secondary framing systems consist of components that support the metal ceiling and corrugated roofing and transfer their load to the primary framing system. Secondary framing systems comprise built-up structural components and accessories such as (i) roof purlins, (ii) wall girts, (iii) eave struts, and (iv) clips, which are typically Z-shaped and C-shaped structures fabricated by cold rolling pre-galvanized sheets of varying thickness.

- Non-Industrial Buildings – Interarch Building Products Ltd also offers complete PEBs for erection and installation by third-party builders/erectors, including primarily PEB buildings for non-industrial use under the brand, “Interarch Life,” which feature customization to customer specifications, and include end-use applications in and as farmhouses and residential buildings, internal partitions and walls, rain screen facades and roof crowns of high-rise structures, resorts, low-cost housing projects, industrial office blocks, labor housing, and colonies, site offices and guest houses.

Pre-engineered steel building contracts: Interarch Building Products Ltd supplies complete PEBs on a turnkey basis to its customers pursuant to PEB Contracts, wherein Interarch Building Products Ltd provides complete PEBs which involve estimation, designing, engineering, manufacture, and supply of PEBs in completely knock-down condition from the Interarch Building Products Ltd’s Manufacturing Facilities for on-site assembly the installation and erection of PEBs.

On-Site Project Management

Interarch Buildings Products Ltd has dedicated a project planning and control team of 120 personnel, who are responsible for monitoring and overseeing the erection and installation of the PEBs at the customers’ sites across India. Upon receiving clearance for fabrication and subsequent shipment of the PEBs to the customers’ sites, the on-site project management team coordinates all aspects of the last-mile execution of erection and installation, including handling and storage of materials on-site to prevent any damage, supervising and inspecting the installation work of the impaneled builders/erectors, quality control checks at predefined milestones, meeting timelines, and troubleshooting and addressing errors on-site.

Design and Engineering

Interarch Buildings Products Ltd manufacturing facilities are supported by dedicated design and engineering centers in Noida, Uttar Pradesh, India; (b) Chennai, Tamil Nadu, India; and (c) Hyderabad, Telangana, India. Interarch Buildings Products Ltd has an in-house design and engineering team including 119 qualified structural design engineers and detailers with an average work experience of 7.66 years in Interarch Buildings Products Ltd.

Interarch Buildings Products Ltd’s design and engineering process involves analyzing, conceptualizing, and customizing PEB structures through design calculations, drawing approvals, fabrication sketches, and erection drawings. It also enhances PEB designs incrementally. A small portion of production is outsourced, accounting for 2.43%, 11.44%, and 6.27% of total production in FY 2022, 2023, and 2024, respectively.

Interarch Building Products Ltd Manufacturing Facilities

Interarch Buildings Products Ltd mainly manufactures its products in-house at its 4 Manufacturing Facilities, comprising 2 Manufacturing Facilities in Sriperumbudur, Tamil Nadu, India, and 1 each in Pantnagar and Kichha, Uttarakhand, India. Currently operating at 85% capacity, unable to accept new orders due to nearing full utilization.

Interarch Buildings Products Ltd has projected a 50% growth in North India for FY 25-26, with the majority of this growth coming from Uttar Pradesh. The North region is expected to contribute 30% to Interarch Buildings Products Ltd’s overall business volume during this period.

Planned manufacturing facilities in Andhra Pradesh and Gujarat

Interarch Buildings Products Ltd plans to set up such manufacturing units at Andhra Pradesh Manufacturing Facility. The facility will be set up in 2 phases and will have a capacity of 40,000 MTPA. The APIIC has allotted industrial land to Interarch Buildings Products Ltd for manufacturing PEBs. Further, the business also plans to set up a manufacturing facility in Kheda, Gujarat.

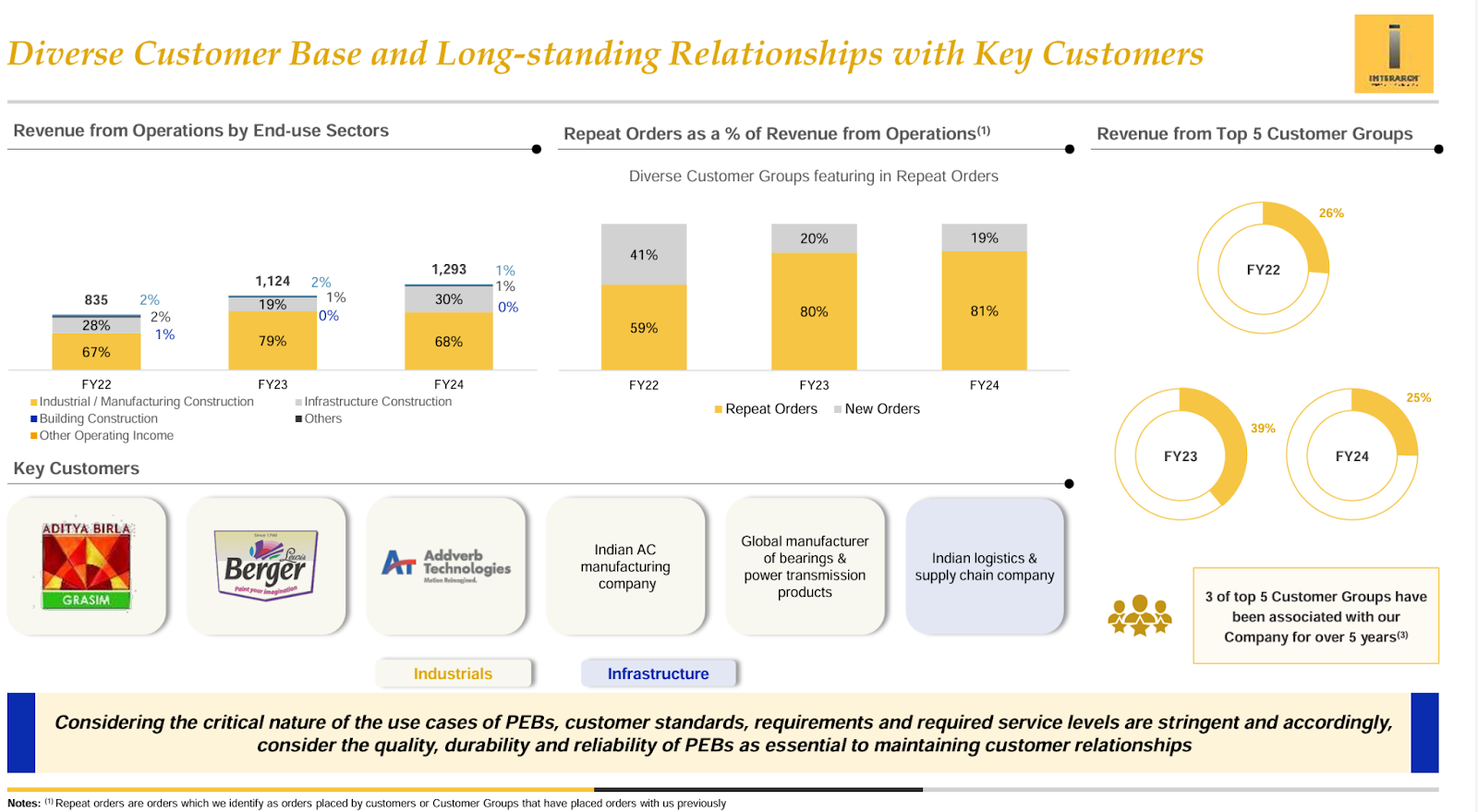

Interarch Building Products Ltd Clients

Interarch Building Products Ltd customers under the industrial/manufacturing construction category include Grasim Industries, Berger Paints India, an air conditioner manufacturer, Timken India, and Adverb Technologies, and the infrastructure construction category includes a warehousing and logistics service provider.

It has established long-standing relationships with a number of its customers, including various Customer Groups, which Interarch Building Products Ltd attributes in part to its emphasis on quality consciousness, cost efficiency, and timely execution. Interarch Building Products Ltd’s end-use customers for PEBs include three broad sectors viz, industrial/ manufacturing construction, infrastructure, and building (residential, commercial, and non-commercial).

Interarch Building Products Ltd primarily follows a B2B model, which is typically based on standalone purchase orders that contain the commercial terms of supply, including price, delivery location, payment terms, and warranty-related terms, which warrant conformity of products to specifications, drawings, or descriptions approved by the customers.

Top clients for Interarch Building Products Ltd are Emmvee Photovoltaic Power Pvt Ltd, Asian Paints Limited, Balkrishna Industries Limited, and Grasim Industries Limited.

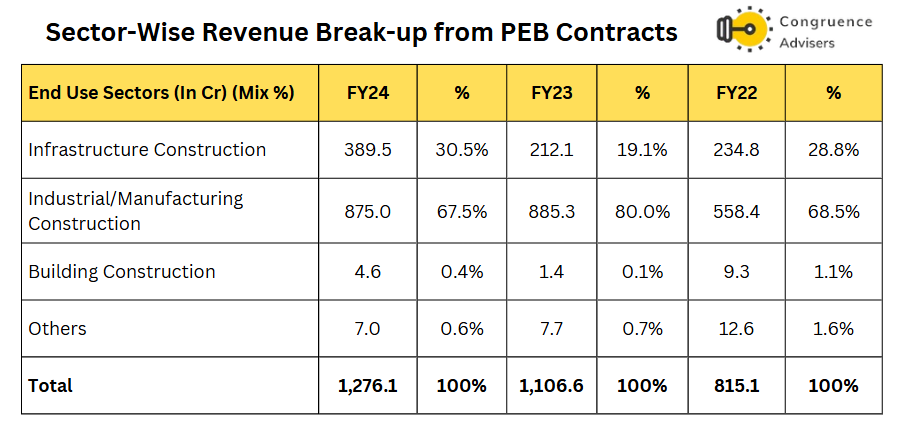

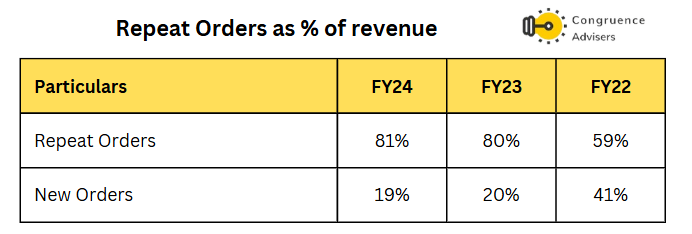

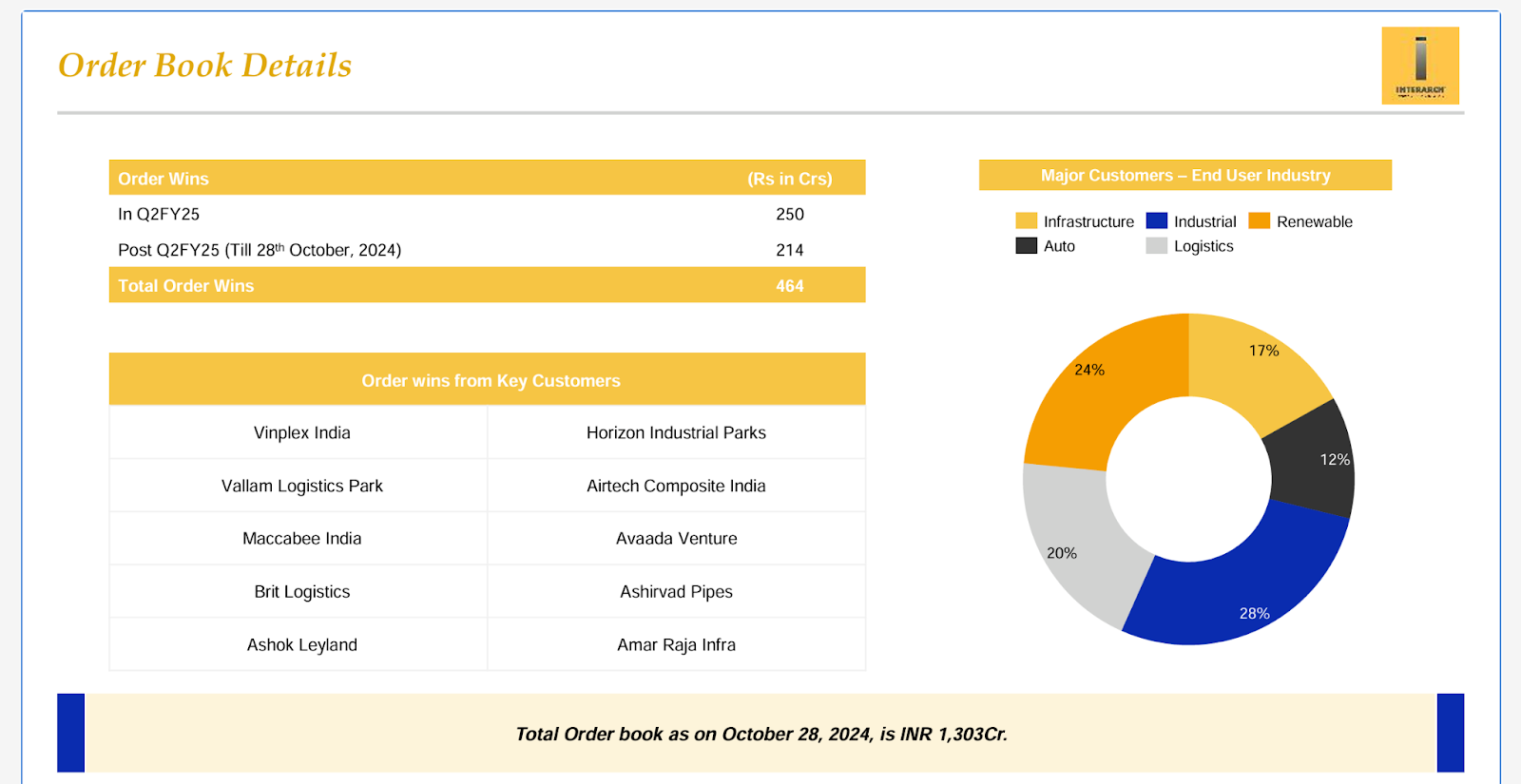

Order Book & Revenue from Repeat Orders

Over the years, revenue from the repeat orders has improved in repeat orders as % of revenue 59% in FY22 to 81% in FY24. and new orders has reduced 19% in FY24 when compared to 41% in FY22.

The average order size is about INR 12 crores. Order sizes can range from INR 1.5 crores to INR 120-150 crores. The average execution time is between 4 and 12 months. The current order book valued at INR 1,300+ crores represents about 9 to 10 months of work. The current pipeline of projects that have been bid for, also referred to as the qualified pipeline, stands at approximately INR 4,000 Cr as of September 16, 2024. It’s important to note that this figure represents projects that have been fully engineered and formally quoted, not just initial leads. The historical hit rate for these bids is between 20% and 27%.

Interarch Building Products Ltd is targeting a capacity that can handle an order book of over INR 2,000 crores. This goal is planned for FY25-26 onwards. With the current order book at INR 1,350 crores, representing roughly 9-10 months of work, the planned expansion aims to facilitate a significant increase in order intake.

Interarch Building Products Ltd executed 677 PEB contracts between FY15 – 24.

Raw material prices

Raw materials, mainly steel, could affect project costs, profitability, and project timelines. According to industry sources, the pre-engineered steel building industry relies heavily on a limited number of high-quality steel suppliers, including Tata Steel, Nippon Steel, ArcelorMittal Nippon Steel India, Steel Authority of India Limited, Jindal Steel & Power Ltd. and Jindal Steel for raw materials such as hot-rolled (HR) coils, high-grade, etc. The limited base gives these suppliers significant negotiating power, and the dependence on a small pool of suppliers makes the industry susceptible to supply chain issues.

Due to the high dependence on steel, the ability of players to tackle challenges related to input costs and working capital becomes crucial for the industry’s success. Additionally, steel prices are also susceptible to global geopolitical events, which further emphasizes the need for strategic resource planning. Domestic prices averaged ₹53,885 per tonne for long steel and ₹ 57,642 per tonne for flat steel in the Financial Year 2024.

Currently, Interarch Building Products Ltd order mix of 75% is fixed contract & 25% variable contract.

Fixed-price contracts: The steel price is locked in at the time of the agreement. Any subsequent fluctuations in steel prices will directly impact the company’s profit margins If steel prices decrease after a fixed-price contract is signed, the company benefits from higher margins. Conversely, the company’s margins will be squeezed if steel prices increase.

Interarch Building Products Ltd building manages this risk by holding steel inventory and securing orders from suppliers at fixed prices to cover short-term, fixed-price contracts.

Variable-price contracts: These contracts link the price of the building to the prevailing steel prices. This mechanism passes the risk of steel price fluctuations onto the customer, ensuring that the Interarch Building Products Ltd’s margins remain relatively stable regardless of steel price movements.

Interarch Building Products Ltd aims to balance fixed and variable price contracts, but the actual mix is primarily driven by customer preference.

Interarch Building Products Ltd Corporate governance

Board Composition – The Interarch Building Products Ltd. board of Directors has six members in total, with 4 independent Directors. The two promoter families, the Nandas and the Suris have extensive experience in the pre-engineered building industry. The two Non-Executive Director members of the Board are all promoter family members.

Promoter Remuneration – The total remuneration drawn by promoters in the form of salaries to ~INR 2.87Cr in FY24. This amounted to ~3.33% of the PAT of Interarch Building Products Ltd. for FY24. For FY23, the corresponding figures were INR 2.4 Cr and ~2.7% of PAT.

Related Party Transactions – There were no significant related party transactions for Interarch Building Products Ltd in FY24.

Contingent Liabilities – The total contingent liabilities for Interarch Building Products Ltd on account of service tax and Income tax amount to ~INR 109 Cr, which is 25 % of Interarch Building Products Ltd consolidated net worth.

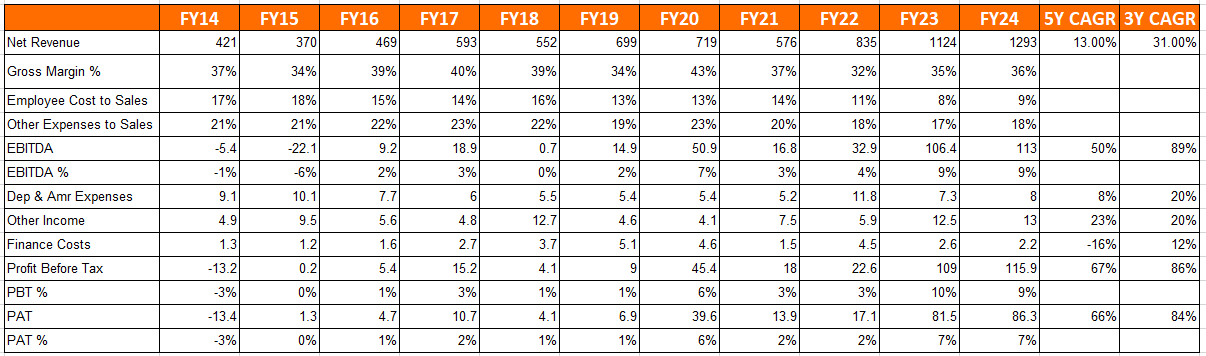

Interarch Building Products Ltd Financial Performance

Over the last 5 years, Interarch Building Products Ltd. has grown revenues at a CAGR of 13%, EBITDA at a CAGR of 50%, and PAT at a CAGR of 66%, During this period, EBITDA margin improved from 2% in FY19 to 9% in FY24, and PAT margin Improved from 1% in FY19 to 7% in FY24 led by operating leverage due to Employee Cost to Sales has reduced from 13% in FY19 to 9% in FY24. Interarch Building Products Ltd generated 60% of PAT in H2, driven by strong demand cycles.

Interarch Building Products Ltd Working Capital, Return ratios, Cash Conversion, and Debt ratios

Interarch Building Products Ltd working capital days have improved over the years which reduced to 69 days in FY24 v/s 88 days in FY18. Gross asset turnover has improved 8x in FY24 v/s 5x in FY20. Interarch Building Products Ltd has a strong balance sheet and debt free, and ROE & ROCE have improved in the last few years.

Interarch Building Products Ltd Comparative Analysis

To understand Interarch Building Products Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Interarch Building Products Ltd to its competitors (peer comparison) on various fundamental parameters and Interarch building products share performance relative to relevant benchmark and sector indices.

Interarch Building Products Ltd Peer Comparison

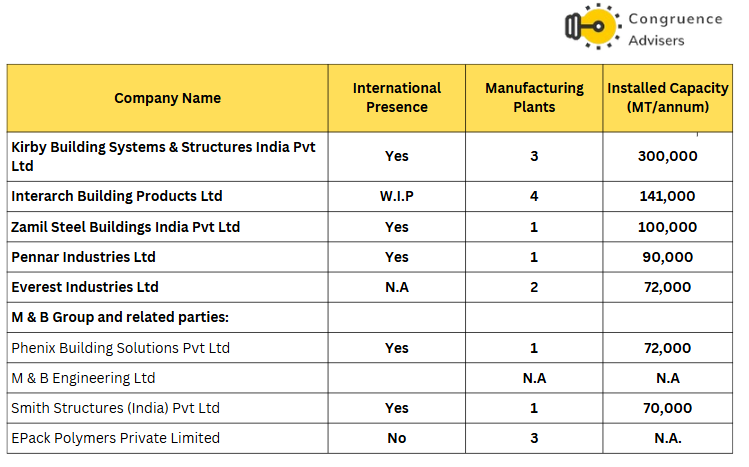

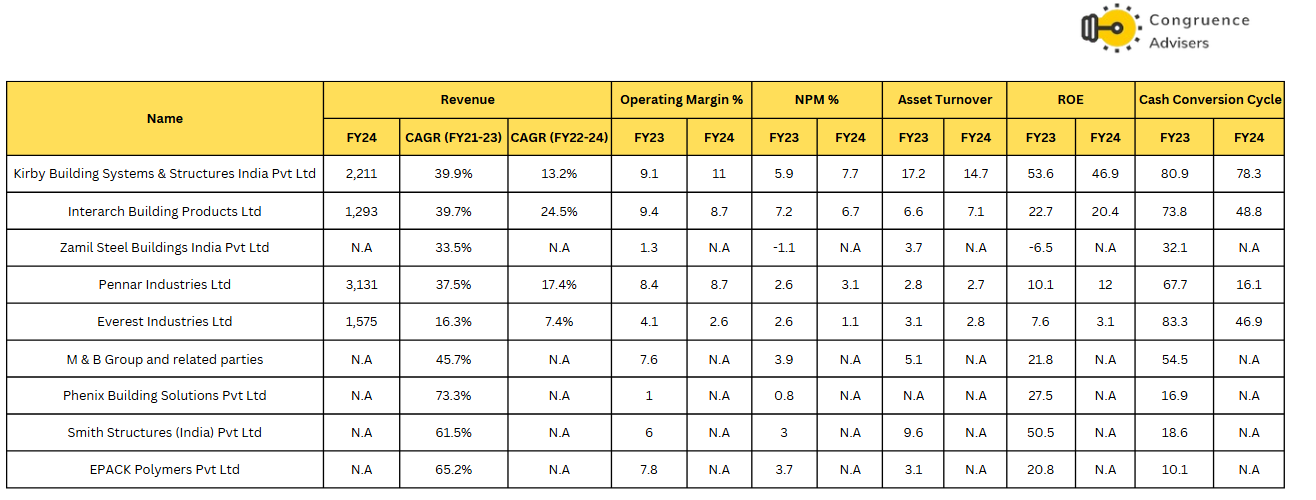

The top six players in terms of FY23 revenue are as follows: Kirby Building Systems & Structures India Pvt Ltd, Pennar Industries Ltd, Interarch Building Products Ltd, Zamil Steel Buildings India Pvt Ltd, Phenix Building Solutions/M&B Engineering, Everest Industries Ltd.

Interarch Building Products Ltd, Pennar Industries Ltd, and Everest Industries Ltd are listed public companies in the PEB Industry. As of FY24, Kirby Building Systems has the highest installed capacity, 300,000 Mt/Annum, followed by Interarch Building Products Ltd.

Interarch Building Products Ltd and Kirby Building Systems & Structures India Pvt Ltd scores much higher in terms of unit economics. Both companies have high asset turnover and return on equity. All players have delivered sales growth of around 30%+ CAGR (FY21-FY23), Both Interarch Building Products Ltd and Kirby Building Systems & Structures India Pvt Ltd have high operating margins and net profit margins as they are purely into PEB, while Pennar Industries Ltd and Everest Industries Ltd have other vertices also which is the reason for much lower profitability.

Interarch Building Products Ltd Index Comparison

Interarch Building Products Ltd share performance vs S&P BSE Small cap Index as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why you should Consider Investing in Interarch Building Products Ltd?

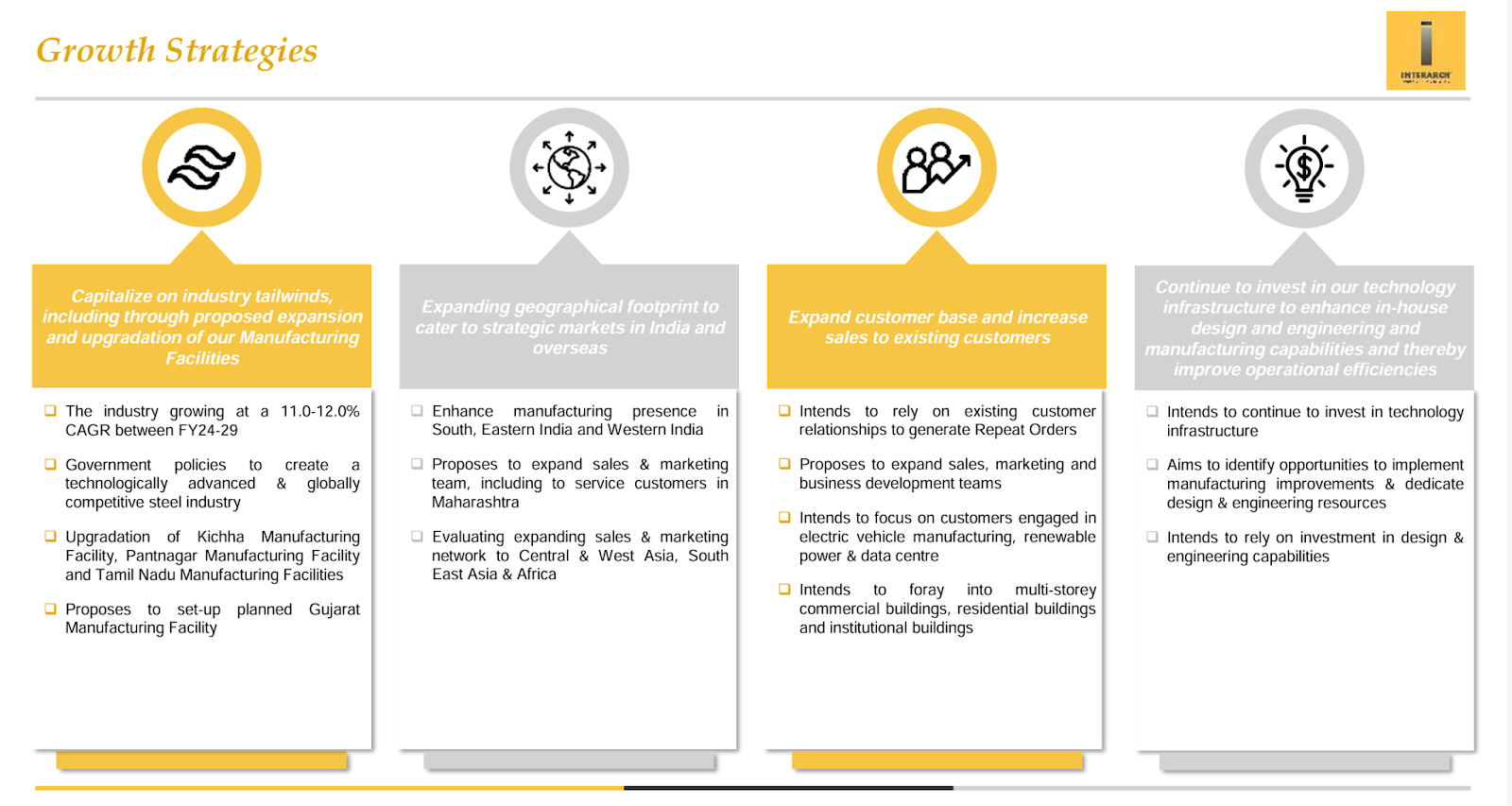

Strong Guidance – Interarch Building Products Ltd Management is guiding for doubling topline in 3-4 years with bottom-line growth outpacing topline growth. Management anticipated revenue growth of around 10% majorly driven by decent volume growth for FY25 and followed by 10-15% for the next FY26.

Health Order book – Interarch Building Products Ltd’s order book as of 28th Oct’24 stood at Rs 1,303 cr. Order win during Q2FY25 was Rs 250 cr. Interarch Building Products Ltd sometimes has to restrain the new orders on account of capacity constraints. Once the new capacity gets online in FY26, we expect the order restraints to be lower, and Interarch Building Products Ltd is targeting a capacity that can handle an order book of over INR 2,000 crores. This goal is planned for FY25-26 onwards. With the current order book at INR 1,350 crores, representing roughly 9-10 months of work, the planned expansion aims to facilitate a significant increase in order intake.

New Capex – Interarch Building Products Ltd has commissioned the Andhra Pradesh Phase 1 plant, which has added a capacity of 20,000 MTPA, totaling the manufacturing capacity to 1,61,000 million tonnes per annum (MTPA). The Andhra Pradesh Phase 2 plant is expected to be commissioned by Mar ’25 and will be fully operational by Q1FY26, having an additional capacity of 40,000 MTPA. (Total capacity of 2,00,000 MTPA). Upgradation of the Uttarakhand plant has also begun and will be fully operational from Jun’25. Recently Interarch Building Products Ltd acquired land in Gujarat, With each capacity having Rs 50-60 Cr capex plant can deliver 400-500 Cr topline.

Strong growth prospect for PEB Market – The PEB market in India is expected to grow at a CAGR of 11%-12% from Rs 19500 Cr to Rs 33000 – 34000 Cr between FY24 and FY29, driven by growth in industrial, infrastructure, and building sectors. The industrial sector is prominent in the PEB market, with high usage in the automobile, cement, and oil & gas industries. Infrastructure growth is attributed to the increased adoption of PEBs in warehouses, cold storage facilities, data centers, power plants, aircraft hangars, and railway yards.

Strong balance sheet and improvement in profitability – Interarch Building Products Ltd is a debt-free company, and profitability will improve due to operating leverage and higher capacity utilization; we could see an uptick in EBITDA margin in FY25 & FY26.

What are the Risks of Investing in Interarch Building Products Ltd?

Steel Price Fluctuations – Steel constitutes 87% of the raw material cost. Any volatility in steel prices could significantly affect profit margins.

Customer Concentration – Over 25% of revenue is derived from the top 5 customer groups. A loss of key customers could severely impact revenues. If the pace of corporate capex slows down for some reason, projects could become more competitive thereby decreasing operating margins for players in this segment. The profile & stature of customers is much higher compared to the leading PEB players, leading to an imbalance of power in the nature of the relationship that can come to the fore during bad periods.

Dependency on Largest Supplier – The largest supplier contributes 15.61% of total raw materials. Supply chain disruptions or failure to retain the supplier could hamper operations.

Reliance on Repeat Orders – A substantial 81.39% of revenues depend on repeat orders. A decline in customer retention or repeat business could affect financial stability.

Industry Cyclicality – The PEB industry is inherently cyclical. Demand downturns could significantly affect business performance. While Govt Capex has been the leading demand creator for capex in India since 2022, there is an implicit expectation that the baton will pass to corporate capex over the next few years. This message was subtly conveyed through the recent Union Budget of 2025 where the market was slightly disappointed with the capex outlay of the Govt for FY26. Any slow down in the overall capex environment can affect the prospects of players like Kirby & Interarch Building Products Ltd.

Geographical Concentration Risk – With facilities located in Tamil Nadu and Uttarakhand, regional disruptions such as political instability, natural disasters, or economic factors could impact operations.

Logistics Challenges – Reliance on third-party logistics partners introduces risks of delays or failures in transportation, affecting timely delivery and customer satisfaction.

Interarch Building Products Ltd Future Outlook

Interarch Building Products Ltd management aims to double its revenue in 3 to 4 years and aims to capitalize on the growing pre-engineered building (PEB) industry in India, which is projected to grow at a CAGR of 11-12% between FY24 and FY29. Management is expecting revenue growth of 10-15% for FY25 and 15% to 20% for FY26. This projected growth is linked to the anticipated increase in production capacity. As Interarch Building Products Ltd’s capacity grows, it can absorb more orders and expand its revenue base.

Interarch Building Products Ltd intends to expand its manufacturing capacity, including the establishment of a new manufacturing facility in Kheda, Gujarat. It has already secured land for this facility, each fully integrated plant has a revenue potential of around INR 550 Cr, and total installed capacity will reach 200,000 tons by the first quarter of the next financial year. This expansion is expected to increase the capacity to execute over ₹2,000 crore order from FY2025-26 onward.

Interarch Building Products Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Interarch Building Products Ltd Price charts

On a daily chart, Interarch Building Products Ltd. was listed on the stock exchanges on August 26, 2024. Since its debut, the price has been following an upward trendline. Interarch Building Products Ltd stock broke out at the ₹1,432 price level in October 2024, reaching a new high in November. It subsequently pulled back to the support level and experienced a false breakout around ₹1,800 in January 2024. In the medium term, the ₹1,432 level and the 50-day moving average (DMA) serve as strong support levels, while ₹1,800 acts as a significant resistance level.

With a shift in the focus of the Union Budget from Capex to consumption, there is every possibility that prices in the capex driven sectors of the economy will take a breather. The series of lower highs and since the false breakout is to be watched keenly. Any violation of the lower trend line might lead to price consolidation for a few quarters till the market starts seeing comfort in the sustainability of the order book and pace of execution. The positive for this business is that dependence on Govt capex is not high and the business is instead driven by private capex trends.

The price trend might take a conclusive turn once FY25 results are declared and investors have better visibility on the order book for FY26 and FY27.

Interarch Building Products Ltd Latest Latest Result, News and Updates

Interarch Building Products Ltd Quarterly results

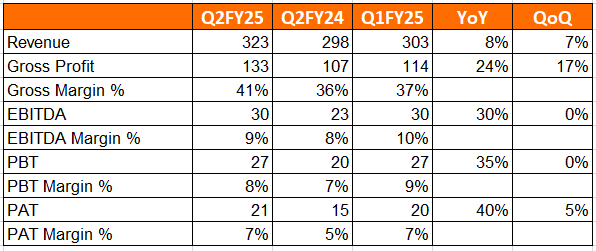

Interarch Building Products Ltd. reported good Q2FY25 earnings. Consolidated revenues grew by 8% YoY (Volume growth was higher at 16% YoY). EBITDA and PAT grew by 30% and 40% YoY, respectively. Even on a QoQ basis, Revenues, EBITDA, and PAT grew strongly by 7%, 0%, and 5%, respectively.

Business mix: Industrial and manufacturing contributed about 73%, The infrastructure industry contributed about 25%, and other industries contributed about 2% of total revenue.

Volume growth was significant at 16%, while value growth was lower due to softening steel prices, and the Current order book stands at ₹1,303 Cr, up from ₹1,100 Cr in the same period last year. Current capacity is around ₹1,700-1800 Cr, which will be increased to over ₹2,000 Cr post-expansion.

Margins are expected to remain stable despite fluctuations in steel prices; Interarch Building Products Ltd has a fixed pricing structure for a significant portion of its order book. Operating leverage is anticipated to improve margins as sales volumes increase.

Final thoughts on Interarch Building Products Ltd

As part of the qualitative analysis of this business, our team spoke to a small scale PEB player in the industrial belt of Karnataka who confirmed that the ROCE of even small players in this segment is > 25% so long as costs are under control and the profile of customers is good. Holding onto qualified professionals has been the biggest challenge facing businesses in this segment since 2022 as the demand side economics have been healthy. Project execution timelines have been good compared to the pre COVID times when order execution was relatively slow.

For this business to do well over the medium term, the baton of capex will need to conclusively pass from the Govt to the private sector through FY26. GDP growth will need to see an increase post the moderation of H2 FY25 and the major part of FY26, the projection for nominal GDP growth for FY26 has been revised downwards to 10.1% in the Union Budget. We believe that the market will take some time to calibrate to this downward revision and take a bottom up view on stocks going forward, rather than painting all economy facing stories with the same brush. The velocity of Govt capex has taken a conclusive breather after the highs of FY23 and FY24.

While the unit economics of the business are excellent, growth prospects will need to hold up in the face of lower than anticipated GDP growth for FY26 and a slowdown in the velocity of Govt capex. Sustained earnings growth for this business will need an increase in the pace of order book accretion through FY26.

Interarch Building Products Ltd is an early capex play since their products and services are needed in the earlier phase of capex compared to other components & services like building automation, air conditioning & moving equipment. In that sense, tracking this business should give a lead indication of how well capex execution is happening in the private sector. Investors should track this business keenly over the next few quarters.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.

Disclosure (Updated as of Dec 31, 2024) – No position in the stock in personal portfolio