Lemon Tree Hotels Ltd is India’s largest hotel chain in the midscale segment. Having established itself as a leader and a well known brand in the midscale segment, Lemon Tree Hotels is now embarking on an ambitious journey by making investments into the upper and luxury segment while expanding aggressively on an asset light in the midscale segment. Lemon Tree Hotels wants to aggressively capture the market opportunity in Tier 2 and below India where there is a paucity of branded hotels and local hotels still control the physical inventory.

Lemon Tree Hotels presents the prospect of a hotel business that has chosen a path that has historically led to higher valuation multiples in the global hotel industry. The business also presents the possibility of operating leverage once the Keys portfolio is refurbished and the room inventory starts to improve on some key parameters like ARR and RevPAR.

Lemon Tree Hotels Ltd Company Summary

Founded in 2002 by Patanjali Keswani, Lemon Tree Hotels Ltd began operations in 2004 with its first 49-room hotel. Today, it is the largest hotel chain in India’s mid-scale segment, with 100 hotels and a room inventory of 9,687 rooms. Having established leadership in the midscale category, Lemon Tree Hotels Ltd is now expanding into the upscale and luxury space with its brand Aurika. The recent launch of Aurika in Mumbai, featuring 669 rooms, strengthens its premium portfolio and is expected to enhance its average room rate (ARR).

Since going public in 2018, Lemon Tree Hotels Ltd has accelerated growth through strategic acquisitions, including Berggruen Hotels Pvt. Ltd., adding 936 owned rooms and 975 managed rooms under its economy brand Keys. Its entry into management contracts and, more recently, the franchise model has further fueled expansion by enabling a wider presence through an asset-light approach. Leveraging its strong brand equity, Lemon Tree Hotels Ltd now aims to deepen its network and simplify its corporate structure, reducing the current three entities to two.

In the early 2000s, 80% of the branded hotel supply in India was in the upscale/luxury segment. There was clearly enormous latent demand in the midscale and economy segments, which were then unmet needs. Lemon Tree Hotels Ltd was founded as the category creator for the branded mid-market hotel space in India.

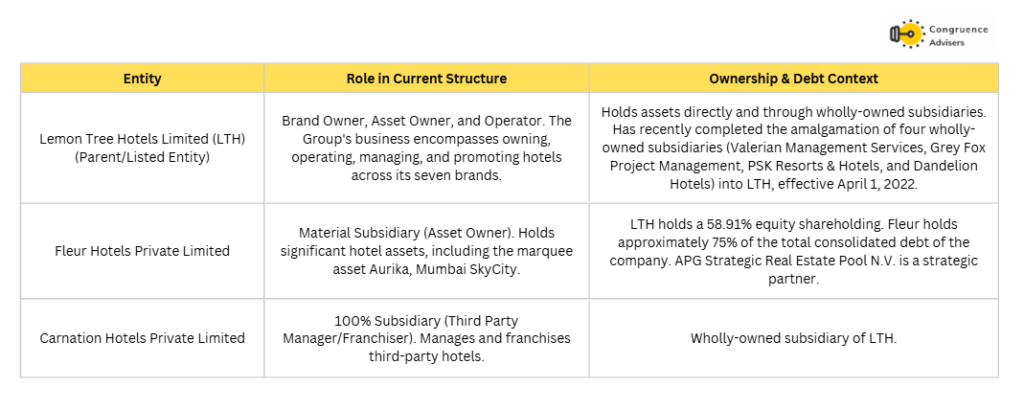

Lemon Tree Hotels Ltd Company Structure

The current structure is integrated, with Lemon Tree Hotel Ltd operating as the primary brand owner, asset owner (directly and via subsidiaries), and operator/manager.

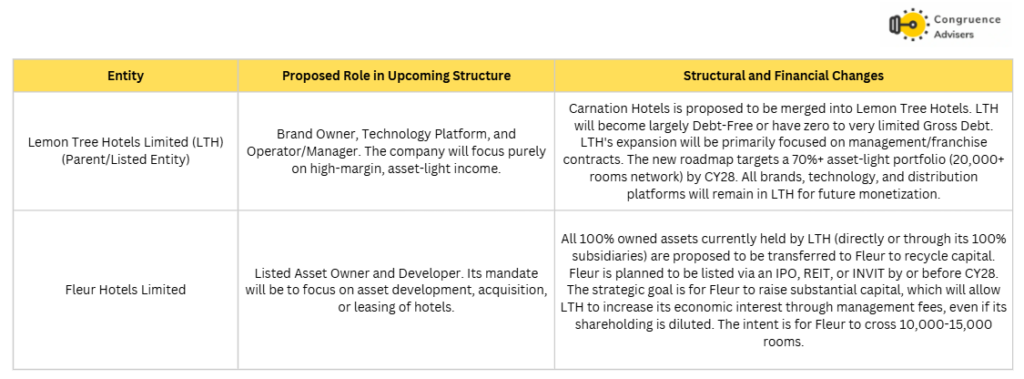

Upcoming/Proposed Group Structure (Targeted by/before CY28)

The strategic intent is to simplify the group structure to maximize valuation and accelerate expansion through an asset-light model for Lemon Tree Hotels Ltd and an asset-heavy growth vehicle (Fleur).

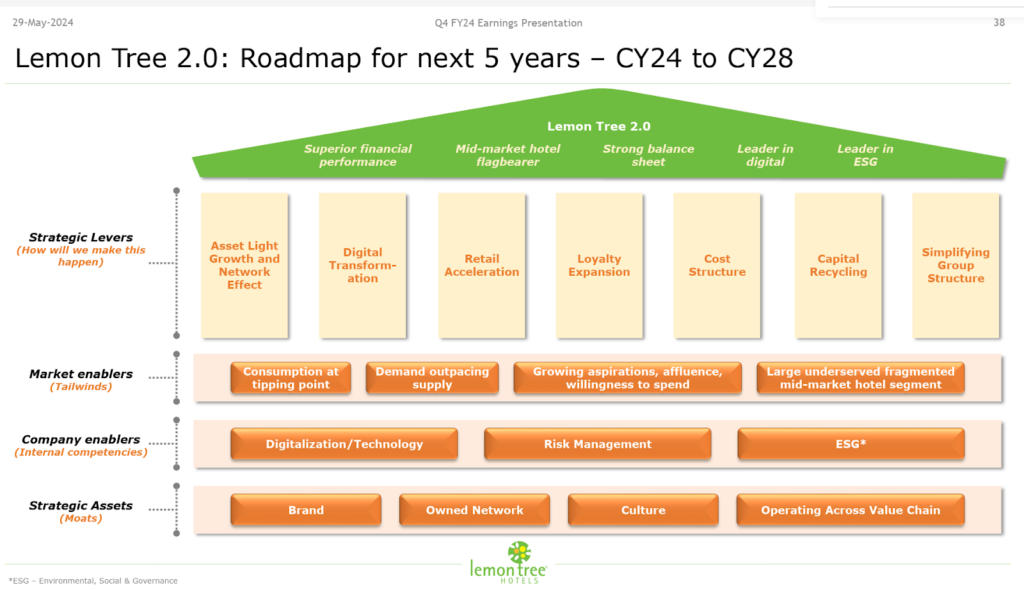

The structural changes reflect the Lemon Tree Hotels Ltd 2.0 strategy, aiming for:

- Asset-Light Growth: Moving the core Lemon Tree Hotels entity away from capital-intensive asset ownership to focus on management fee income, which generates high margins (80-85% flow through for management contracts).

- Asset Monetization: Creating Fleur as a standalone listed entity dedicated to capital recycling and asset growth, which allows Lemon Tree Hotels shareholders to hold two differentiated investment opportunities: one focused on brand and management, and one focused on real estate value.

- Debt Management: Separating the debt-heavy assets into Fleur will position Lemon Tree Hotels (the brand/management company) to become debt-free significantly faster than if the assets remained consolidated.

- Operational Consolidation: The amalgamation of various wholly-owned service and project subsidiaries and the future merger of Carnation will streamline the operating functions under the single Lemon Tree Hotels umbrella.

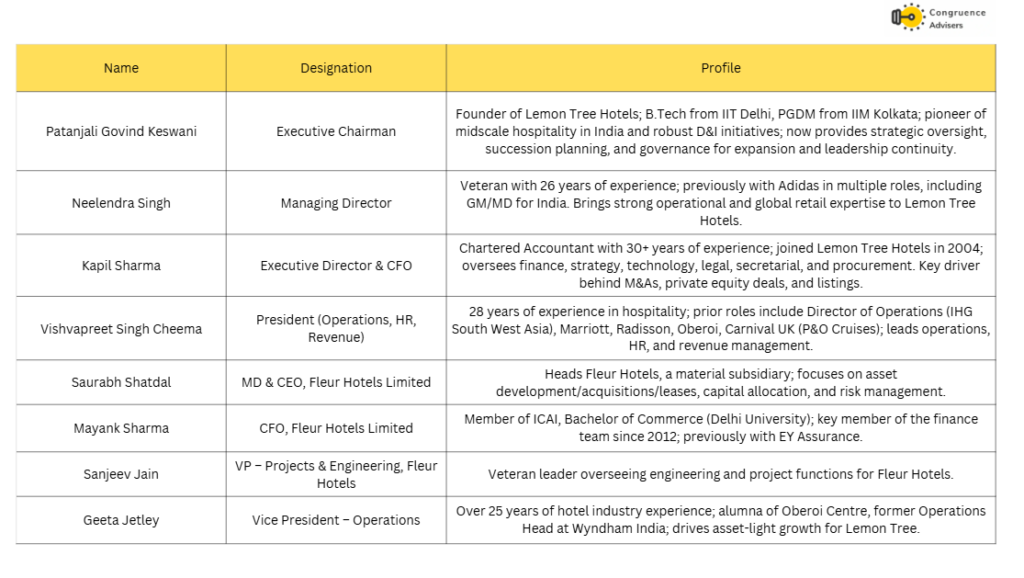

Leadership transition in Q1FY26: Two board committees formed for restructuring within Lemon Tree and Fluer. Neelendra Singh to become CEO of Lemon Tree Hotels Ltd from Oct 1, 2025; Patanjali Keswani to support as Executive Director for 18 months for transition and governance. Saurabh Shatdal to lead Fleur Hotels as MD & CEO; Mayank Sharma as Fleur CFO.

Lemon Tree Hotels Ltd Management Details

The promoter of Lemon Tree Hotels Ltd is primarily Patanjali (Patu) G. Keswani, who has played a transformative role in shaping Lemon Tree Hotels Ltd and the Indian mid-market hospitality sector.

Patanjali (Patu) G. Keswani is the founder, Chairman, and Managing Director of Lemon Tree Hotels Ltd. He holds a B.Tech in Electrical Engineering from IIT Delhi and a PGDM from IIM Calcutta. He started his career in the Tata Administrative Service and worked for over 15 years at the Taj Group, where he rose to the position of Senior Vice President and Chief Operating Officer. In 2002, he founded Lemon Tree Hotels, pioneering the mid-market hotel segment with the vision to provide high-quality yet affordable hospitality in India.

Keswani is recognized for his disruptive innovation, social responsibility initiatives, and strong advocacy for inclusive employment, with Lemon Tree being a leader in hiring from deprived and disabled segments. The Keswani family collectively holds around a 22-23% promoter stake in the company as of September 2025, giving considerable influence over the group’s strategic direction and operations. Keswani’s leadership is credited with not just commercial growth but also with making Lemon Tree Hotels a socially inclusive and innovative enterprise.

Lemon Tree Hotels Ltd – Industry Overview

Overview of the Indian Hospitality Industry

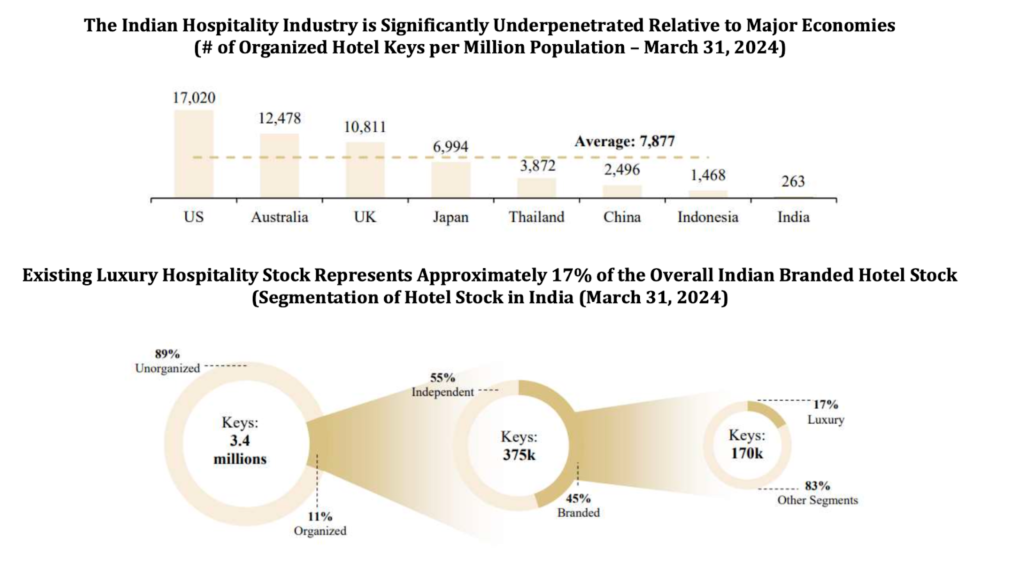

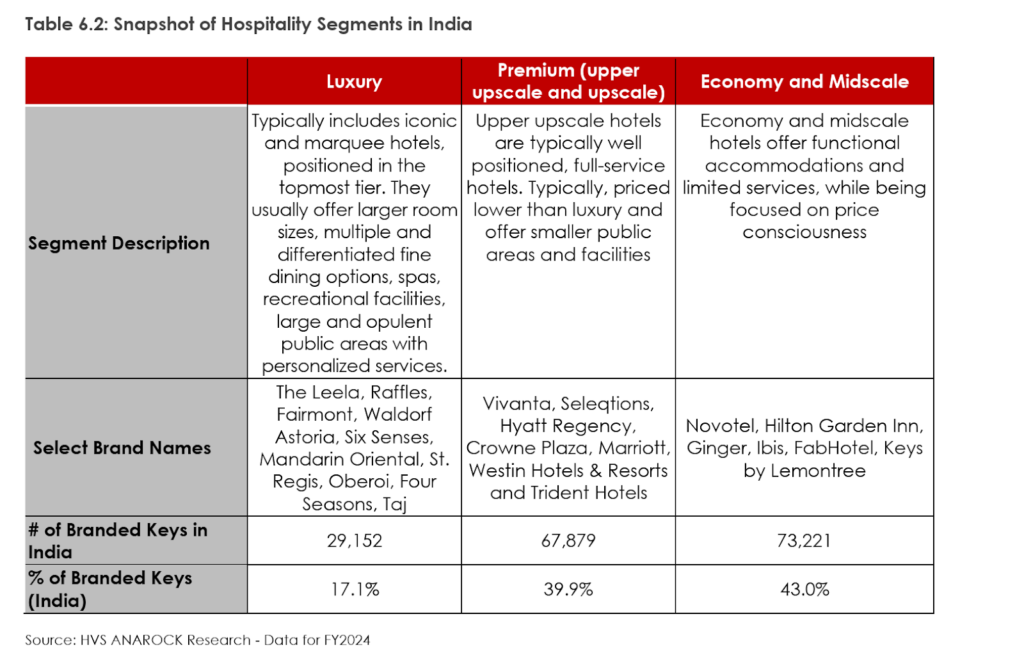

India’s hospitality industry has an inventory of approximately 3.4 million keys as of March 31, 2024, of which the organized sector, which includes branded, aggregators, and quality independent hotels, represents only approximately 11% or approximately 375,000 keys. The organized hotel stock is further segmented into branded and independent hotels, of which branded hotels constitute approximately 45% of the keys, i.e., approximately 170,000 keys. The stock of luxury hospitality remains constrained – constituting only 17% of the branded hotel market i.e., approximately 29,000 keys.

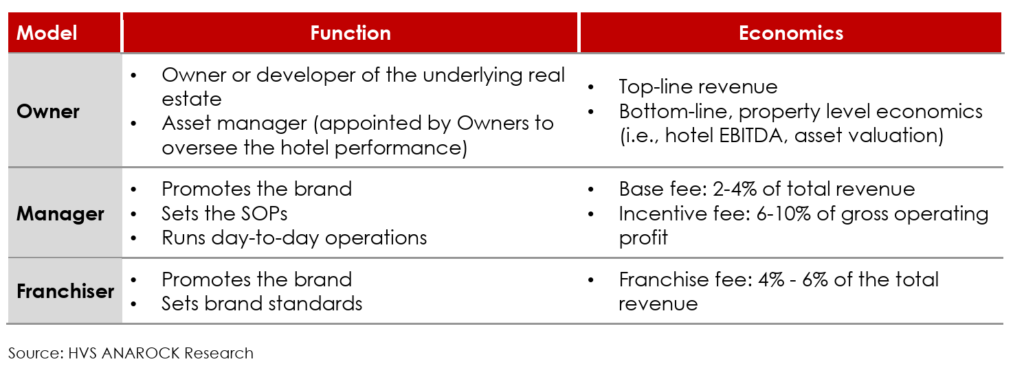

Hospitality in India is typically undertaken through Owner, Manager and Franchiser business models and any combination of these. The business model of an Owner-Manager combines asset ownership and management and provides alignment with an optimal focus on asset level profitability, brand progression and management fee growth. The hospitality industry comprises luxury, premium (upper upscale and upscale), economy and midscale segments, which provide a wide range of offerings, services, and experiences. Luxury hospitality segment has larger room sizes, high-quality amenities with best-in-class services and are typically characterized by multiple banquets, restaurants, and meeting rooms, depending on the target segment and thus are able to command higher ARRs compared to other segments.

Business Models in Hospitality

Hotel operating structures are stratified into layers, each performing a key role. This specialization of focus can create greater efficiency in the operation of the overall asset. While property owners are largely focused on maximizing asset value and underlying profitability, operators/managers are generally incentivized to drive revenues with a lesser focus on asset value growth. The business model of an owner-manager combines asset ownership and management and provides alignment with an optimal focus on asset-level profitability, brand progression, and management fee growth. The Leela is one of the few players with an owner-manager model and the only institutionally managed and owned pure-play luxury Hospitality Company in India.

Key Demand Drivers

Business Travel – Inbound and domestic visitation for business-related purposes, including travel on corporate account and by individual business travellers. Demand typically predominates between Monday and Thursday, slowing towards the weekend or public holidays; domestic business travellers at upscale and mid-priced hotels often stay through till Saturday. Business travel also slows during vacation periods. The services sector (IT, BFSI, professional services) and the manufacturing sector are significant drivers for business travel.

Tourism – India is known for its rich cultural heritage, historical sites (several of which are UNESCO heritage sites), diverse landscapes, and vibrant festivals. The growth of domestic and inbound tourism contributes significantly to the demand for hotels.

Leisure Travel – This is discretionary in nature and comprises long/short vacations, staycations at city hotels, weekend stays for recreation and entertainment, leisure attached to a business trip or to a trip for weddings and meetings. Greater affordability and spend propensity, changing lifestyle, and improved connectivity have materially benefitted hotels with good F&B, recreation and entertainment facilities.

MICE Travel – For corporate, government, institution, and association events (conventions, conferences, retreats, incentives, promotions, training programs, customer-facing events, staff events, etc). Corporate and government demand is mainly during the working week or on Saturday; institution and association demand can be on weekends. MICE demand occurs throughout the year, barring main holiday periods and the months from March through May. Cities with international convention centres are able to attract large international events.

Weddings and Social demand – This segment comprises destination weddings and other social/celebratory events, as well as substantial use of hotels for weddings and social events for local (non-residential) events. The trend for hosting weddings in city hotels or as destination weddings has grown materially and is gaining further momentum, as it percolates to the mid-market segment. Several city hotels attract large residential weddings, akin to destination weddings in leisure centres. Social travel also occurs for other social obligations and personal/family visits.

Diplomatic Travel – Government leaders and representatives of other countries, often accompanied by large trade delegations, and diplomats using upper-tier hotels during the transition period on postings to India.

Airline Crew – Helps create a core of demand at hotels, albeit at significantly discounted pricing. Airlines also generate limited demand for layovers when flights are significantly delayed.

Transit Demand – Comprises a person on an overnight stay during an air or road trip to a domestic or international destination. Each demand segment attracts domestic and inbound travel of varying measures, depending upon the hotel and destination characteristics. Demand quantum, profile, and rate paying capacity are also impacted by seasonality factors, which may apply differently to business and leisure hotels. The months from October through March of any Financial Year are materially busier than the summer and monsoon seasons.

Lemon Tree Hotels Ltd Business overview

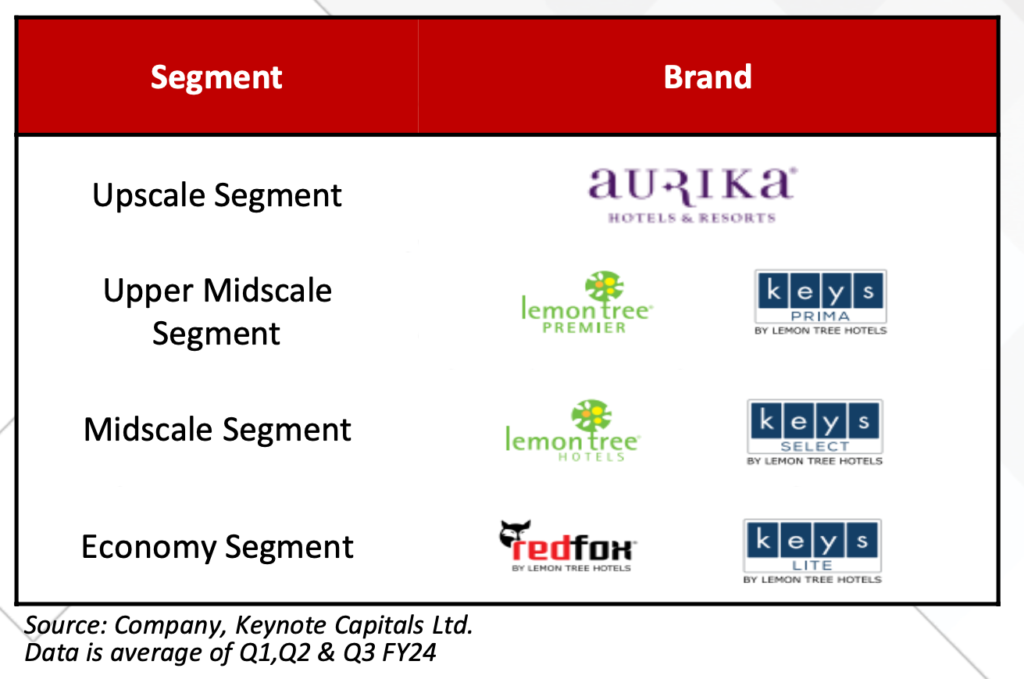

Lemon Tree Hotels Ltd is one of the largest hotel chains in India and owns/leases/operates/franchises hotels across the upscale, upper-midscale, midscale, and economy segments. Lemon Tree delivers differentiated yet superior service offerings, with a compelling value proposition. The group offers seven brands to meet guests’ needs across all levels, viz. Aurika Hotels & Resorts, Lemon Tree Premier, Lemon Tree Hotels, Red Fox Hotels by Lemon Tree Hotels, Keys Prima by Lemon Tree Hotels, Keys Select by Lemon Tree Hotels, and Keys Lite by Lemon Tree Hotels.

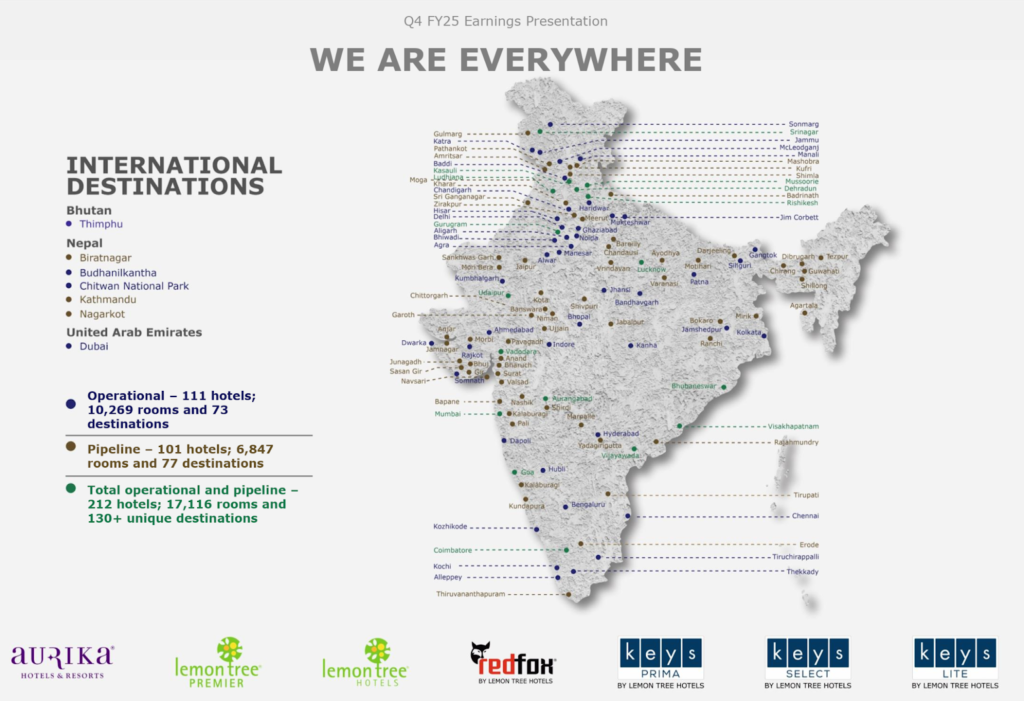

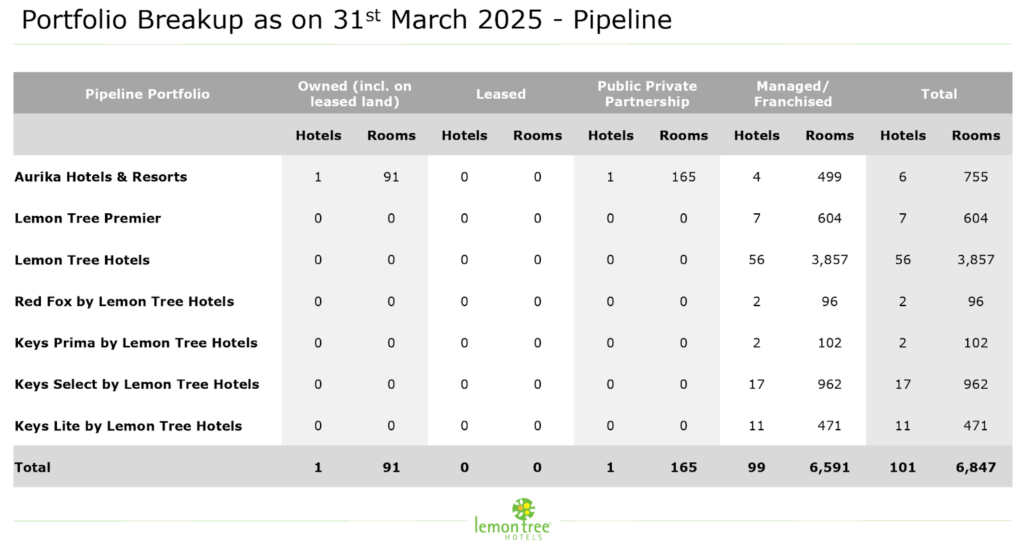

Lemon Tree Hotels Ltd has a portfolio of 111 operational hotels with a total operational inventory of ~10.3K keys. It has an additional 101 hotels in the pipeline with ~6.8K keys. Lemon Tree Hotels Ltd is present in more than 73 destinations, including international presence in Nepal, Bhutan, and the UAE. Lemon Tree Hotels Ltd has been a pioneer in the development of the organized and branded midscale and economy categories in India and has been the key driver of branded supply in the mid-market segment over the last two decades. Lemon Tree Hotels Ltd currently has a market share of ~13.2% in the midscale segment. It has expanded its addressable market by foraying into the upscale segment through its brand Aurika and has set up India’s largest hotel by number of rooms – Aurika, Mumbai Skycity, with 669 keys. Lemon Tree Hotels Ltd has aggressive expansion plans, targeting a 20,000-room portfolio, including a pipeline, by FY27, with over 300 hotels.

Hotel Presence across the country

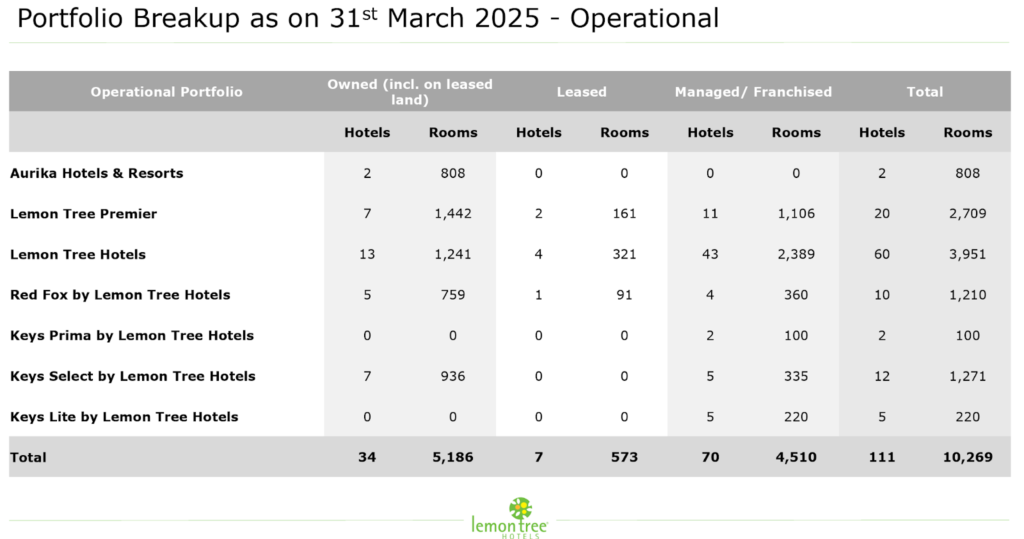

Portfolio Breakup as on 31st March 2025 – Operational

A hotel typically operates through Owner, Manager, and Franchiser business models and any combination of these structures.

Lemon Tree Business Model Mix

Managing and branding hotels is far more profitable compared to owning individual assets. Lemon Tree Hotels Ltd engages in management contracts, emphasising an asset-light model with third-party owners. This approach allows Lemon Tree Hotels Ltd to deliver quality management and branding services to asset owners, resulting in fee revenues.

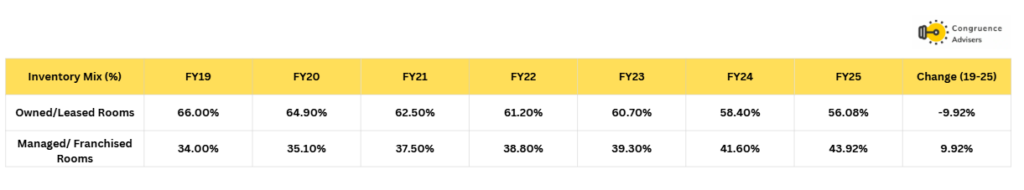

Lemon Tree Hotels Ltd is strategically planning an expansion, aiming to have ~70% of its hotels managed or franchised by FY28. Its long-term strategy focuses on managing and branding hotels due to their high return potential and core competencies

Additionally, the goal is to achieve a total operational inventory of 20,000 rooms across ~300 hotels by the end of FY28.

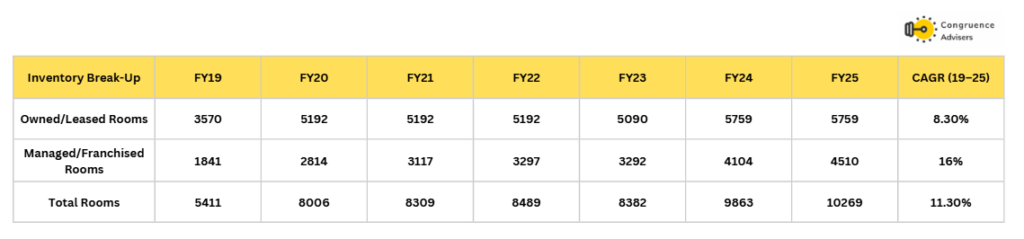

Annual Operational Metrics

Lemon Tree Hotels Ltd Segments

Lemon Tree Hotels Ltd is one of the few branded players that has successfully scaled up different niche brands for respective segments. Lemon Tree Hotels Ltd has set up the Aurika brand in the upscale segment, the Lemon Tree Premier and Keys Prima brands in the upper-midscale segment, Lemon Tree hotels and Keys Select brands in the midscale segment, while Redfox and Keys Lite represent the Economy segment for Lemon Tree Hotels Ltd. This diversified positioning allows Lemon Tree Hotels Ltd to capitalize on the broad-based demand growth across segments. Further, presence across segments allows Lemon Tree Hotels Ltd for faster scale-up through a managed route.

Lemon Tree Hotel Ltd Brand portfolio & distribution

Aurika

Lemon Tree Hotels Ltd diversified into the upscale segment in FY20, establishing Aurika. Aurika Hotels and Resorts emphasised design and is a true reflection of the destination they are located in. Stylishly elegant and featuring new-age dining and innovative entertainment options with fitness and wellness facilities, Aurika caters to customers willing to have a 5-star experience with LTH.

The decision to establish the Aurika brand was driven by a combination of strategic and opportunistic factors. With the increasing wallet share of loyal customers seeking upscale accommodations for their leisure or business travel needs, there was a clear gap in Lemon Tree Hotels Ltd’s offering that was yet to be adequately addressed.

Aurika MIAL started operations in October 2023 and is the largest hotel in India, with an inventory of 669 rooms. Located right around the Mumbai International Airport.

Currently, Aurika operates 2 properties with a combined 808 keys and has 6 hotels in the pipeline with 766 keys.

Lemon Tree Premier

Lemon Tree Hotels Ltd through Lemon Tree Premier, caters to the upper midscale segment with a total of 21 hotels and 2700-plus rooms; these hotels offer plush, spacious interiors with pools, fitness centres, and spas, along with meeting spaces and a business centre. These are entry-level 4-star hotels that provide premium and personalised services to customers. Effectively, at an ARR of ~Rs. 6,000-7,000, these hotels provide their customers with a 5-star experience.

The idea behind the operation of Lemon Tree Premier is to provide 90% of the services and amenities typically offered by a standard 5-star hotel at a 70% cost. The excluded 10% of offerings, which account for about 30% of the expenses, may not be essential for all customers. This strategic approach enables Lemon Tree Hotels Ltd aims to maintain a high standard of service without compromising on quality while simultaneously achieving cost reduction.

Lemon Tree Hotels

Lemon Tree Hotels, the flagship brand of the Lemon Tree Hotels Ltd, caters to the midscale segment. It is the main enabler for Lemon Tree Hotels, with a market share of ~20% of the branded midscale and economy segment. With an inventory of 4000 plus rooms in 60 hotels, the highest out of all brands, Lemon Tree Hotels is the core product offering of Lemon Tree Hotels Ltd. ‘Stylish Business Hotels’ at an ‘Unbeatable Price’ is the Focus of this Brand.

Keys (Prima, Select, Lite)

In 2019, Lemon Tree Hotels Ltd acquired Berggruen Hotels Pvt. Ltd., which has hotels in the Economy to Upper Midscale segment under the brand name Keys. While ‘Keys Prime’ is equivalent to the offering of Lemon Tree Premier, ‘Keys Select’ is considered at par with Lemon Tree Hotels.

Red Fox Hotels

This is another brand in the economy segment that offers all the basic facilities and mainly caters to price-conscious travellers.

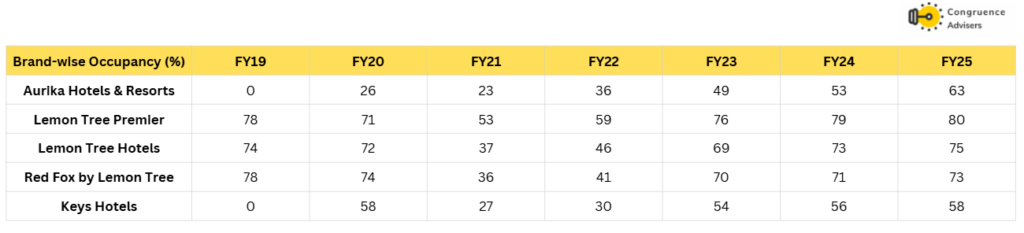

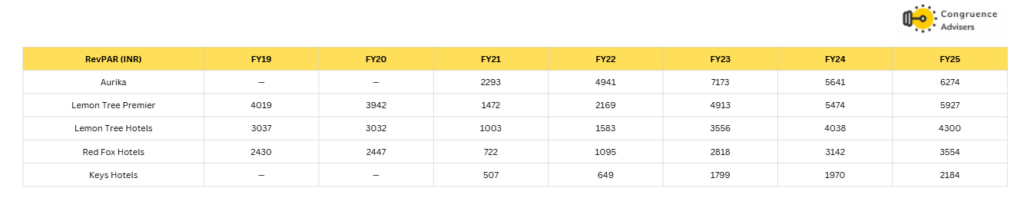

Brand-wise Occupancy (%) – Annual

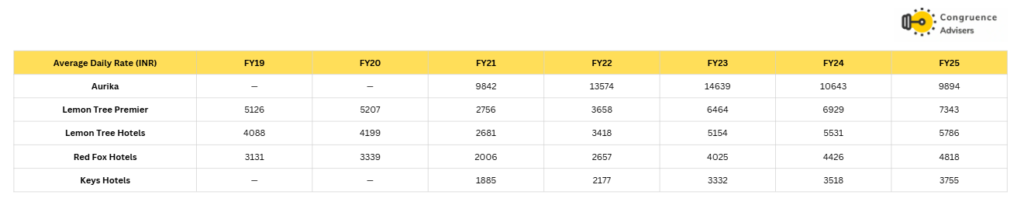

Average Daily Rate – Annual

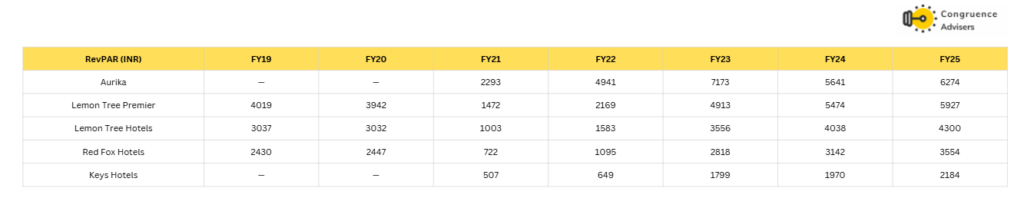

Revenue Per Available Room

Annual Hotel Level EBITDAR Margin (%)

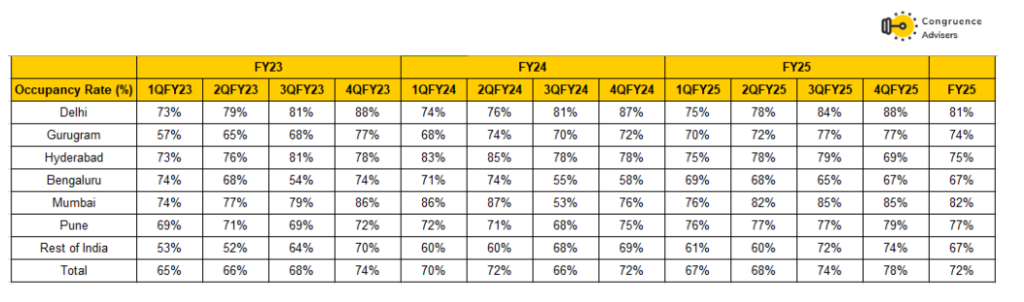

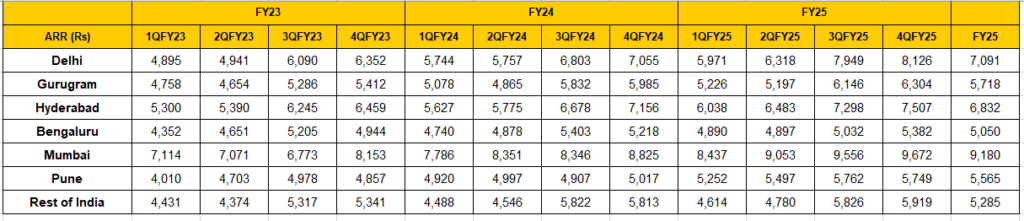

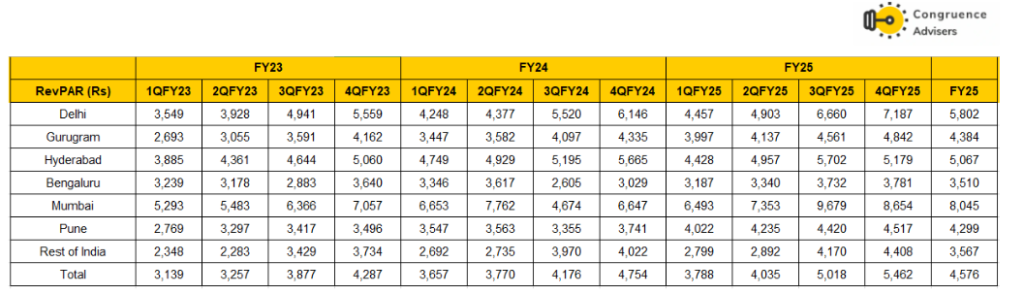

Region-Wise

In FY25, Delhi and Mumbai have a High Occupancy Rate, and Bengaluru and Hyderabad have the lowest rate.

Average Room Revenue: Delhi and Mumbai have a high ARR, and Bengaluru and Gurugram have the lowest rate.

In contrast, the RevPAR in Bengaluru is among the lowest in Lemon Tree Hotels Ltd’s portfolio due to the majority of the portfolio being in the economy and entry-level midscale segment, via their Keys brand. Further, renovations are in progress, due to which certain hotels are expected to remain shut. Post renovation of this portfolio, RevPAR is expected to inch upwards, aligning with the city’s growing market driven by its status as the IT hub of India.

Mumbai and Hyderabad have the highest EBITDAR margin, while Pune and Bengaluru have the lowest.

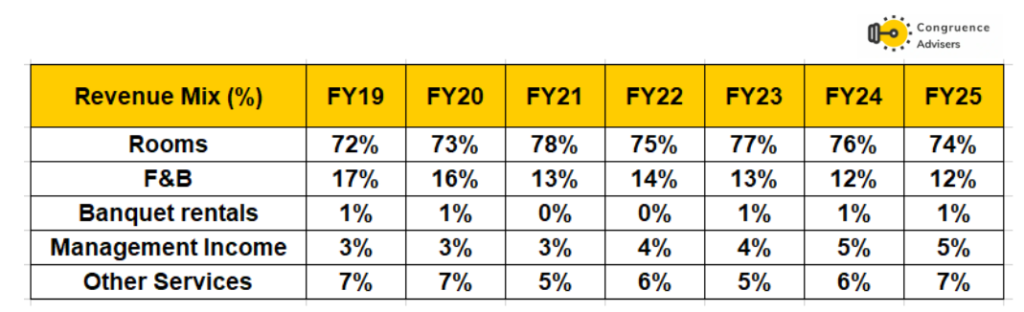

Lemon Tree Hotel Ltd Revenue Mix (%)

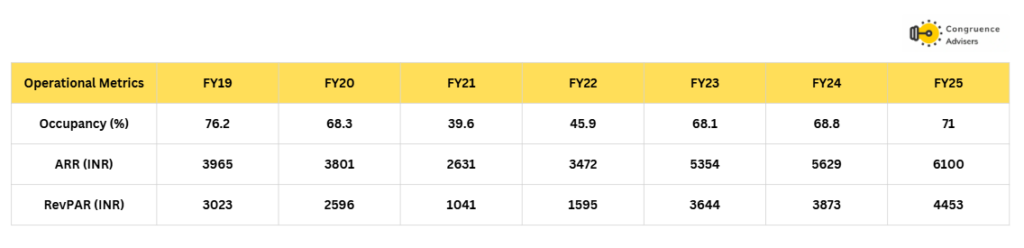

Lemon Tree Hotels Ltd strategically manages its Revenue per Available Room (RevPAR) by closely monitoring key performance indicators such as Occupancy, Average Room Rate (ARR), and room inventory. By maintaining a stable room inventory, Lemon Tree Hotels Ltd is well-positioned to drive revenue growth primarily through optimizing ARR and occupancy levels.

In FY22, Lemon Tree Hotels Ltd prioritized increasing ARR to selectively filter out price-sensitive customers. In FY23, the focus shifted to maximizing occupancy by recapturing customers lost during the previous repricing phase. This strategy is reflected in consistently high occupancies, exceeding 70% across all major markets. While the Company increased ARR slightly less aggressively than its competitors, it delivered RevPAR performance on par with the industry.

Additionally, Lemon Tree Hotels Ltd is gradually shifting its customer base from airline and corporate segments toward the retail segment, enhancing its ability to dynamically price rooms and reducing reliance on large corporate contracts.

The Retail Demand Share currently stands at 45% for FY24 and FY25 and is projected to rise to approximately 65% by CY28/CY29.

Food and Beverages

Lemon Tree Hotels Ltd has a notably lower share of non-room revenue compared to other major branded players, with non-room revenue constituting 26% of total revenue in FY25 and Food & Beverage (F&B) contributing only 12%. This contrasts sharply with premium and luxury players like IHCL and EIH, where non-room revenue accounts for approximately 50% of total revenue. A higher share of non-room revenue generally reduces earnings volatility tied to fluctuations in Average Room Rates (ARR) and occupancy, which are more directly influenced by industry demand cycles.

Despite the current lower F&B contribution, this presents a significant growth opportunity for LTH, particularly in its upscale, upper-midscale, and midscale segments where customers tend to spend more on F&B services. The success of IHCL’s Qmin restaurants within its Ginger hotels illustrates the potential upsell in these segments.

As part of its ongoing renovation of owned properties, Lemon Tree Hotels Ltd is expanding its F&B offerings by adding more restaurants and banquet facilities at select hotels. For example, at its upscale Aurika MIAL property, Lemon Tree Hotels Ltd has introduced several dining and event brands such as Mirasa (all-day dining), Ariva (bar), a Tea Lounge, a specialty restaurant, and extensive banquet spaces. These concepts could be adapted and rolled out to upper-midscale and midscale properties, thus enhancing the F&B revenue share over the medium term.

| FY19 | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 | |

| Avg F&B / Occupied room (INR) | 938 | 835 | 440 | 644 | 868 | 918 | 1019 |

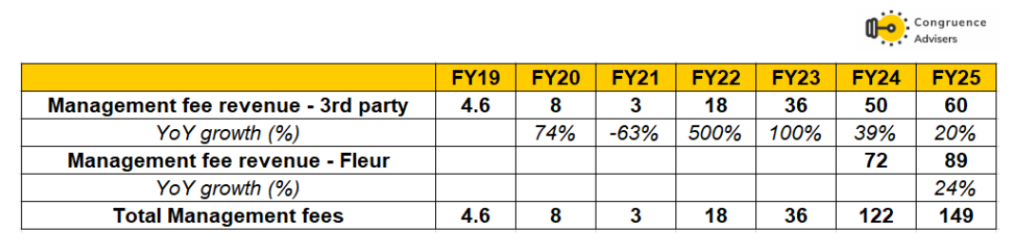

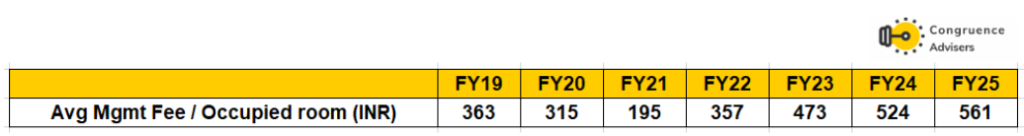

Lemon Tree Hotels Ltd Managed/ Franchised Rooms

The management of Lemon Tree Hotels Ltd places a key strategic focus on asset-light expansion through managed and franchised properties. This strategy is viewed as crucial for agile growth, leveraging the brand, and achieving a healthy balance sheet.

Management fees derive from both third-party owned hotels (Managed/Franchised) and its material subsidiary, Fleur Hotels Private Limited (Fleur), in which Lemon Tree Hotels Ltd holds a nearly 59% stake.

As of FY25, Lemon Tree Hotels Ltd has 70 hotels with 4510 managed/franchised rooms. The target for CY28/FY29 is to reach 20,000+ total rooms with 15,000+ managed and franchised rooms. This means managed/franchised properties will constitute 70%+ of the total inventory.

Modus Operandi and Fee Structure in Contracts

A. Fee Components for Managed and Franchised Hotels (General)

Revenue from management services generally comprises fixed and variable income. The fees earned by Lemon Tree Hotels Ltd are viewed as having a very high flow-through to EBITDA, estimated at around 80-85% flow-through for management contracts and 99% flow-through for pure franchise income.

1. Management Contracts: Typically involve Lemon Tree Hotels Ltd taking approximately 17% of the hotel’s EBITDA. Management contracts are primarily implemented under the Lemon Tree brand.

2. Franchise Contracts: Typically involve Lemon Tree Hotels Ltd taking approximately 10% to 12% of the hotel’s EBITDA. Franchise contracts are generally deployed under the Keys brand, particularly targeting smaller hotels (30-40 rooms), which are considered subscale for a full management contract. Lemon Tree Hotels Ltd recently announced the launch of a new franchise division.

B. Control and Quality Assurance

For both models, Lemon Tree Hotels Ltd focuses on network visibility and maintaining brand standards.

• Management Control: Lemon Tree Hotels Ltd retains significant control over managed hotels.

• Franchise Quality: Because the franchise model offers less control over service and customer experience, Lemon Tree Hotels Ltd enforces a three-step model:

- Before signing, Lemon Tree Hotels Ltd requires a minimum “improvement plan” covering training and product improvements.

- Lemon Tree Hotels Ltd tracks performance rigorously, especially the Net Promoter Score.

- Management ensures growth does not come at the cost of the brand and is vigilant against accepting poor or badly run hotels.

C. Fee Structure Example: Fleur Hotels (Related Party)

The management fee charged to Fleur Hotels (a subsidiary JV with APG) provides a clear example of the contract structure for Lemon Tree-operated assets within the Group. Lemon Tree Hotels Ltd’s fee structure with Fleur consists of:

1. Base Fees (Fixed Income): 3.5% of the Gross Income of the hotel(s) on a calendar monthly basis.

2. Incentive Fees (Variable Income): Based on the Gross Operating Profit (GOP) of the hotel(s) and the Adjusted Gross Operating Profit (AGOP) Margin:

◦ 4.0% of GOP if the AGOP Margin is 50% or less.

◦ 8.0% of GOP if the AGOP Margin is more than 50%,

Lemon Tree Hotels Ltd Management Contracts Tenure

The existing tenure of Hotel Operating Agreements for Lemon Tree Hotels Ltd is generally 12 years from the date of the start of operations. However, the specific management contracts can have varying durations. Examples of stated tenures include

10 years for some properties like Lemon Tree Premier, Bhubaneshwar, Lemon Tree Resort, Mussoorie, and Serviced Suites, Manesar.

12 years for hotels such as Lemon Tree Hotel, Thimpu, Lemon Tree Premier, Dwarka, Lemon Tree Hotel, Jhansi, Lemon Tree Premier, Vijaywada, Lemon Tree Hotel, Aligarh, and Red Fox Hotel, Neelkanth.

15 years for properties like Lemon Tree Hotel, Baga, Goa, Lemon Tree Hotel, BKC, Mumbai, and Keys Prima, Dehradun.

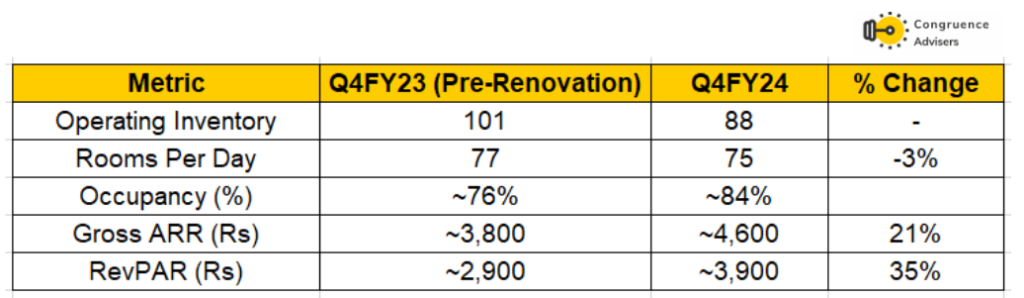

Lemon Tree Hotels Ltd Renovation Strategy

Lemon Tree Hotels Ltd plans to invest INR 250–300 Cr over FY24 to FY26 towards renovations, which equates to 5–6% of sales, significantly higher than the industry average of 1.6–1.8%. Of the approximately 5,800 owned and leased rooms, around 4,500 rooms are slated for renovation by the end of FY26. Within this portfolio, the Keys Hotels acquired in FY20 will undergo complete renovation on a rolling basis. Consequently, 20–25% of the Keys portfolio will remain non-operational until renovations are completed.

The rest of the portfolio will be renovated during the summer months, when occupancy is relatively low, ensuring full operational capacity during the high-demand winter season. Management has earmarked INR 100–110 Cr annually for this initiative, prioritizing properties with high repricing potential. Renovations began with a portion of the Keys portfolio in Delhi, Bengaluru, and Hyderabad.

In FY24, 250 to 300 rooms were renovated. For FY25 and FY26, approximately 1,800 to 2,000 rooms are expected to be upgraded each year. The renovation cycle per room is approximately 2.5 months. Management aims to complete the entire revamp by the beginning of FY27 and anticipates a significant uplift in ARRs post-renovation.

Management indicated that ~350 rooms were under renovation in Q1, with a focus on Delhi, Hyderabad, and Bangalore. Out of the 4,300 old rooms, 65-70% are rooms already renovated, and a full portfolio refresh is expected by October 2026 (H1FY27). Renovation opex is expected to be Rs. 80-90 Cr in FY26 (total Rs. 130 Cr including Capex), which is expected to drop to Rs. 20-30 crore post-cycle. As per the management, renovation is yielding tangible results, as the ARR of Keys Pimpri is up by Rs. 1,300–1,400, and occupancy is up 10%. Delhi/Hyderabad ARR has increased by 15%/19%, respectively, post-renovation. Once completed, management expects a huge expansion in EBITDA margins and a drop in annual repair/maintenance costs.

For FY27, revenue growth is expected to exceed 15%, driven by both ARR expansion and improved occupancy. The company targets a two-year breakeven for operational expenses (OPEX) invested, implying that incremental EBITDA should cover the renovation costs within that period. This is expected to substantially boost Return on Capital Employed (ROCE), with a target of over 20%, led by higher ARRs and improved utilization.

In the managed portfolio, Lemon Tree Hotels Ltd is also working with asset owners to initiate renovations, receiving positive responses with approximately 80% acceptance. Around 30–35% of the managed properties are in need of renovation, while the remainder is relatively new. Per the management contract, asset owners are obligated to maintain their properties to Lemon Tree’s brand standards for the full contract term (typically 15 years). Therefore, the managed portfolio is also expected to undergo significant upgrades over the coming quarters, with some renovations already in progress.

Lemon Tree Hotel Ltd earns a management fee of approximately 8% of revenue, which can increase to 10% if the hotel outperforms. Thus, renovating managed properties not only enhances brand consistency but also opens up potential for increased fee income.

The ongoing renovation program has temporarily impacted EBITDA margins due to higher expenses (5–6% of sales, compared to 1.8% earlier). However, this impact is expected to be short-term, with ARRs and occupancy recovering as renovated hotels return to full operations and spending normalizes. The company is also using this opportunity to add banquet halls, conference facilities, and boardrooms in key locations to tap into the sustained demand from MICE and wedding segments, potentially driving incremental revenue growth.

Specifically, the Keys portfolio is expected to witness a ~30% increase in ARRs post-renovation. As the properties had seen minimal investment since their acquisition in FY20, the uplift is anticipated to be strong. Post-renovation, the Keys portfolio is expected to generate annual EBITDA of INR 60 crore, with ARRs rising to approximately INR 4,500 per room per night, up from current levels of around INR 3,500.

The rest of the portfolio is also expected to benefit from similar trends. For instance, after renovating 120 rooms at Lemon Tree Premier, Delhi, ARRs surged to INR 10,500–11,000 per room per night, with 100% occupancy. In Q3 FY25, partial renovation benefits were already visible, with gross ARRs increasing by 15% quarter-on-quarter and 7% year-on-year, while occupancy improved by 580 basis points quarter-on-quarter and 830 basis points year-on-year.

Keys Select Hotel, Pimpri Pune | Re-pricing and RevPAR increase post renovation

Listing of Fleur Hotels

Fleur Hotels Pvt Ltd, a subsidiary of Lemon Tree Hotels Ltd, is majority-owned with a ~59% stake by LTH, while the remaining ~41% is held by strategic partner APG. Fleur owns 24 hotels with over 4,000 rooms, including its marquee asset, Aurika MIAL.

As part of its strategy to simplify the group structure, Lemon Tree Hotels Ltd plans to transfer its owned assets comprising 17 hotels with over 1,700 keys to Fleur, enabling capital recycling. Additionally, Carnation Hotels Pvt Ltd., a wholly owned subsidiary of Lemon Tree Hotels Ltd that currently serves as a third-party asset manager and franchiser, will be merged with the parent company.

Post-restructuring, Lemon Tree Hotels Ltd will function as the brand owner and operator, while Fleur will become the asset owner, with plans to be listed via an IPO or REIT by FY26/CY27..

This strategic restructuring will enable Lemon Tree Hotels Ltd to unlock and recycle capital through asset transfer to Fleur, generating significant cash inflows to support debt reduction and future expansion. Lemon Tree Hotels Ltd will continue to operate, manage, or franchise the entire portfolio, which is targeted to grow to over 300 hotels and 20,000+ rooms.

Investments in Digital Capabilities and Business Development

Lemon Tree Hotels Ltd has partnered with Boston Consulting Group to enhance its sales processes, revenue management systems, and loyalty program. As part of its digital transformation strategy, Lemon Tree Hotels Ltd has developed dynamic algorithms that will be deployed for new room inventory. It has also implemented an entirely new, digitally driven sales system that offers data-based recommendations to improve conversion and pricing decisions.

Additionally, Lemon Tree Hotels Ltd is reimagining its website and loyalty program to deliver large-scale personalized offers. The company currently has ~1.8 million members enrolled in its Infinity Rewards loyalty program, aligning with its goal of capturing two-thirds of retail demand over the next two years.

To unlock the full potential of its portfolio, Lemon Tree Hotels Ltd has also significantly strengthened its business development efforts, growing its business development capacity by 4x and expanding the sales team by 1.5x in a short span. Management trainees have also been added to the system. These initiatives, combined with enhanced digital capabilities and renovated hotel assets, are expected to improve operational performance and help Lemon Tree Hotels Ltd achieve its target of exceeding 20% RoCE by FY26.

Focus on Debt Reduction Through Free Cash Flow

Driven by its asset-light strategy focused primarily on expansion via management contracts and favorable industry tailwinds, Lemon Tree Hotels Ltd has generated strong free cash flows. These funds are being deployed toward hotel renovations and aggressive debt reduction.

In line with this approach, the debt to Lemon Tree Hotels Ltd decreased by about Rs. 190 crore during the year from Rs. 1,889 crore in FY24 to Rs. 1,699 crore in FY25. Management plans to continue allocating a portion of free cash flows to renovations, with the remainder directed toward reducing leverage. Based on current trends, Lemon Tree Hotels Ltd is expected to become debt-free within the next three years, supported by improving cash flows and declining renovation needs.

Furthermore, Lemon Tree Hotels Ltd plans to list its subsidiary, Fleur Hotels, which owns 24 hotels with over 4,000 keys, through an IPO or REIT by CY28. If this materializes, the potential stake sale could generate substantial cash inflows, allowing Lemon Tree Hotels Ltd to accelerate its debt repayment timeline even further.

Lemon Tree Hotels Ltd Corporate Governance

Board Composition – As of FY25, the Board of Lemon Tree Hotels Ltd. had 9 members: 5 Independent Directors, 2 non-executive Directors, and Mr.Patanjali Govind Keswani, who is the Chairman of the Board and the Managing Director of Lemon Tree Hotels Ltd. The Independent Directors bring relevant industry experience to the Board, having served in roles across commercial real estate, banking, and tourism in their professional careers.

KMP Remuneration – The total compensation drawn by KMPs in FY25 is Rs 6 Cr, which is approximately 2.3% of Lemon Tree Hotels Ltd reported PAT.

Contingent Liabilities – The total contingent liabilities outstanding for Lemon Tree Hotels Ltd. as of FY25 amounted to ₹24 Cr, primarily pertaining to Income Tax and Service tax-related demands from the Government and certain disputes with third parties. The total contingent liabilities are ~2% of the book value of equity of Lemon Tree Hotels Ltd., and hence not materially.

Related Party Transactions – Lemon Tree Hotel Ltd has had no material related party transactions in recent years. Major related party transactions include agreements and financial dealings with its subsidiaries, like Fleur Hotels and Iora Hotels, involving management fees, corporate guarantees, and equity share purchases. These transactions occur at arm’s length, with no significant conflicts, and loans to subsidiaries are interest-free and unsecured, supporting growth and consolidation efforts.

Dividend Track Record – Lemon Tree Hotel Ltd has not paid a dividend in the last ten years, during which Lemon Tree Hotel Ltd prioritized reinvesting funds into its own business and capex. Lemon Tree Hotels Ltd expects to become debt-free in the coming years. Post-listing of Fleur Hotels (the asset-heavy subsidiary), Lemon Tree Hotels Ltd would be an asset-light, expected better earnings, and a dividend-distributing company within the next 1-2 years.

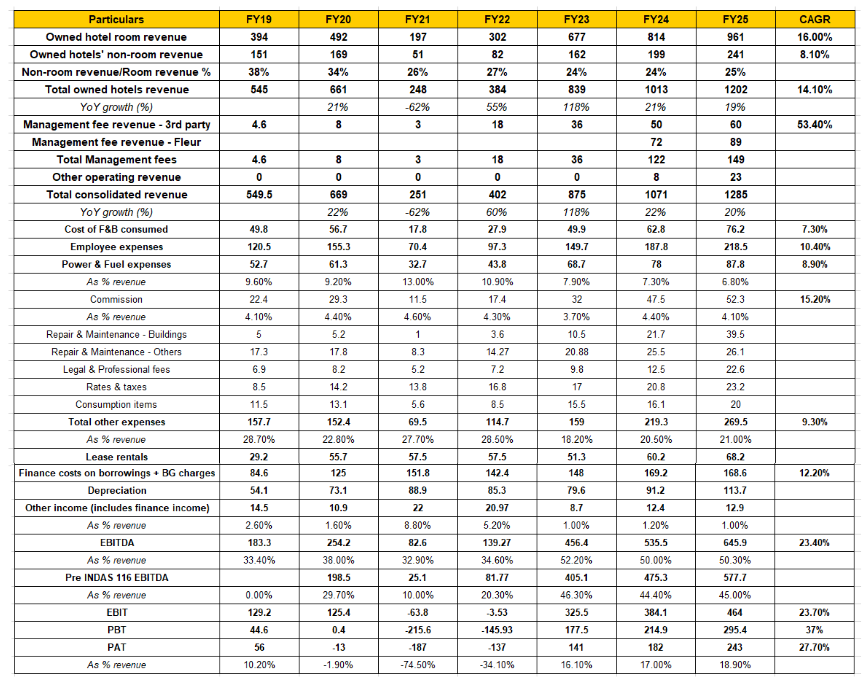

Lemon Tree Hotels Ltd Financial Performance

Lemon Tree Hotels Ltd financials tell a story of resilience and transformation. Pre-COVID (FY16-FY20), the company grew consistently with 20% revenue CAGR and EBITDA margins expanding from 27.9% to 36.9% driven by portfolio expansion and strong occupancy across its core brands. But COVID (FY21-FY22) hit hard, with revenue dropping by over 60% in FY21. Yet the company showed resilience by managing costs aggressively, driving structural savings and protecting margins, which laid the foundation for the recovery.

The recovery in FY23 and FY24 was phenomenal, and Lemon Tree Hotel Ltd is now poised for high growth. Revenue more than doubled in FY23 and grew 20% in FY24, with margins stabilizing above 49%. The RevPAR growth was largely driven by ARR increases and occupancy growth across key brands. Debt increased due to expansion projects like Aurika, Mumbai Skycity, but strong operational cash flow and disciplined deleveraging helped reduce the Debt-to-EBITDA ratio by FY25. The asset-light “Lemon Tree 2.0” strategy is also working well, with management fees growing over 20% annually and contributing to profitability with minimal capital expenditure.

Going forward, the Lemon Tree Hotels Ltd strategy of owning premium assets and managing/franchising a rapidly growing portfolio provides a balanced growth engine. With revenue expected to grow in double digits, margins stabilizing, and debt reduction on track, Lemon Tree Hotel Ltd is well placed to strengthen its leadership in the mid-market hotel space and create value through its scalable, asset-light model.

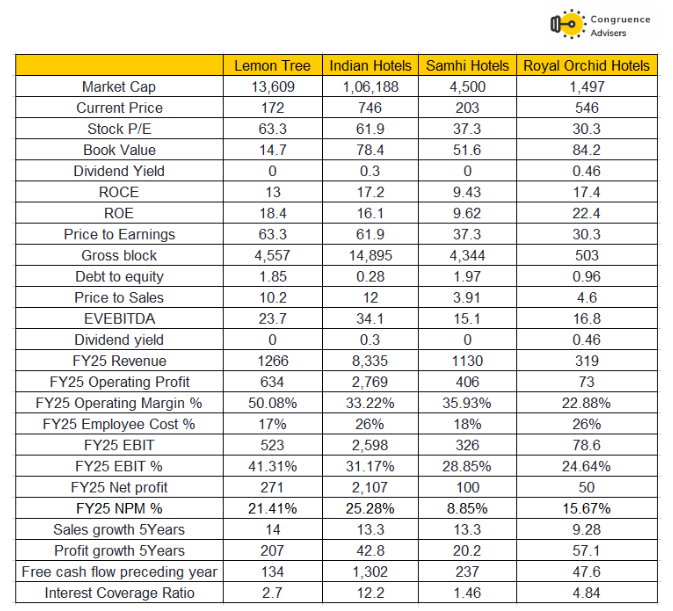

Lemon Tree Hotels Ltd Comparative Analysis

To understand Lemon Tree Hotels Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Lemon Tree Hotels Ltd to its competitors (peer comparison) on various fundamental parameters and Lemon Tree Hotels Ltd share performance relative to relevant benchmark and sector indices.

Lemon Tree Hotels Ltd Peer Comparison

We are comparing Lemon Tree Hotels Ltd with its peers in the Hotels Sector. Hence, we have considered Indian Hotels, Samhi Hotels & Royal Orchid for the peer comparison.

Lemon Tree Hotels Ltd has firmly established itself as the pioneer of India’s mid-market hotel segment, positioning itself as the “low-cost carrier” equivalent in hospitality. Its core differentiation lies in targeting the vast, underserved unbranded mid-market segment, unlike peers that remain heavily skewed toward luxury or premium offerings. Strategically, Lemon Tree Hotels Ltd has reshaped India’s “inverted pyramid” of hotel supply by building scalable brands spanning economy to upscale categories, offering value-for-money to both business and leisure travelers. This broad yet focused brand architecture, along with continuous emphasis on customer affordability and service efficiency, has allowed Lemon Tree Hotels Ltd to capture growing demand for organized mid-market rooms while structurally differentiating itself from competitors.

Operationally, Lemon Tree Hotel Ltd has demonstrated industry-leading efficiency, delivering some of the highest EBITDA margins, superior ROCE, and faster post-COVID recovery compared to peers. Its process innovations, digital transformation, lean staffing structures, and aggressively managed cost ratios have created a structurally profitable model even in an otherwise capital-heavy sector. Looking ahead, it’s “Lemon Tree 2.0” strategy driven by an asset-light pivot, structural separation of assets and operations, and aggressive franchising through Keys positions.

Lemon Tree Hotels Ltd Index Comparison

Lemon Tree Hotels Ltd share performance vs S&P BSE Small Cap Index, as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why You Should Consider Investing in Lemon Tree Hotels Ltd

Renovation drive to boost revenues and margins – Lemon Tree Hotels Ltd had ~350 rooms under renovation in 1QFY26 and will continue its renovation program through FY27. So far, 65–70% of its older rooms have been upgraded, and the entire owned portfolio is expected to be fully renovated by Oct ’26 (FY27). This initiative is expected to drive a meaningful increase in revenues from owned hotels supported by higher RevPAR and occupancy while also aiding margin expansion. For instance, at Keys Pimpri, ARR and occupancy rose by ₹1,300-1,400 and ~10%, respectively, post renovation.

Asset-Light Growth Model Through Carnation – Lemon Tree Hotels Ltd’s dual structure of owned/leased assets and managed/franchised hotels is a key differentiator. While owned and leased hotels provide stable cash flows, Carnation Hotels, its management arm, drives asset-light growth by signing third-party properties. In FY25, management fees contributed nearly ₹149 Cr, underscoring the scalability of this model. With more than 60 properties in the pipeline under management contracts, Carnation is expected to contribute a rising share of revenues and margins, reducing capital intensity and improving return ratios.

Path to debt-free status – Lemon Tree Hotels Ltd is transitioning into a pure-play asset-light, management, brand, and technology company. To this end, it plans to demerge Fleur Hotels (its material subsidiary) and list it separately by end FY26. Fleur Hotels, as an independent asset company, is expected to become debt-free within 1–1.5 years.

Lemon Tree 2.0 strategy – Lemon Tree Hotels Ltd’s long-term strategy emphasizes technology, asset-light growth, leadership in the mid-market hospitality segment, and debt reduction through strong cash flow generation. It is targeting an EBITDA margin of 50% plus (vs. 49% in FY25) and a total inventory of 20,000 rooms (operational + pipeline) by 2028. However, in its 1QFY26 update, management indicated that the 20,000-room milestone could be reached within the next six months.

Leadership in India’s Mid-Market Hospitality Segment – Lemon Tree Hotels Ltd is the largest player in India’s mid-market hotel category, a segment that is structurally underpenetrated yet poised for multi-year growth. With a portfolio spanning economy, midscale, upper midscale, and upscale hotels, the company caters to diverse demand pools including corporate, leisure, and MICE travel. Its market leadership is reinforced by a wide presence across more than 100 cities and a strong pipeline, positioning Lemon Tree Hotels Ltd to capture the next leg of growth in India’s fast-evolving travel and tourism industry.

What are the Risks of Investing in Lemon Tree Hotels Ltd ?

Investors need to keep the following risks in mind if they choose to invest into this business. Risks needs to be weighed in combination with the advantages listed above to arrive at a decision that is optimal for your portfolio construct

Lesser Autonomy in Management Contracts – With the target to have 70% of room inventory under Management contracts, it would be a challenge for Lemon Tree Hotels Ltd to maintain its quality and brand image. Further, management contracts are long-term agreements, which can limit Lemon Tree Hotels Ltd’s flexibility to adapt to changing market conditions or pursue alternative strategies.

Saturated levels in the midscale segment – Lemon Tree Hotel Ltd is a pioneer in the midscale segment, wherein the occupancies are at potentially maximum levels, or there is not much scope to benefit from an increase in occupancies. Thus, it puts the Lemon Tree Hotels Ltd’s ability to earn in jeopardy as it does not plan to increase the number of hotels owned; occupancies do not hold much scope for improvement; it then solely becomes dependent on increasing ARR to drive its revenue growth.

Susceptibility to cyclicality in the hospitality industry – The hospitality sector is susceptible to downturns in the domestic and international economies. Growth in revenue per available room (RevPAR) in business destinations is more sensitive to macroeconomic indicators, such as nominal growth in GDP. On the other hand, leisure destinations are more sensitive to non-economic factors such as terror attacks and health-related travel warnings, as seen during the pandemic. However, the RevPAR of mid-sized or economy hotels declines less sharply during downturns than for hotels in premium and luxury segments, as operating costs remain high for hotels in these segments. Thus, cash flow may remain vulnerable to economic downturns.

Key man risk – The founder and Executive Chairman of the company, Mr. Patanjali Keswani, has painstakingly built Lemon Tree Hotels Ltd up to become what it is today over several decades. He is 66 years old today and there is nobody from the next generation involved in the business. Therefore, over the next few years, inevitably Mr. Keswani has to step back and bring in senior professional level management to run the show at Lemon Tree Hotels Ltd. This process has already started as we have seen earlier in the article. Mr. Patanjali’s gradual dis-engagement from running the day to day business and his eventual stepping away are potential risk events for Lemon Tree Hotels Ltd. Investors need to make sure that the reigns of Lemon Tree Hotels Ltd are passed on to a capable set of hands.

Lemon Tree Hotels Ltd Future Outlook

Lemon Tree Hotels Ltd has aggressive expansion plans, primarily through managed additions. Approximately 99% of Lemon Tree Hotels Ltd’s pipeline during this period is via management contracts. This strategy enables faster scale-up by leveraging the Lemon Tree brand and operational expertise, while avoiding the capital-intensive process of property development. The asset-light model also eases the balance sheet burden, requiring lower capex and leading to improved return ratios.

Managed inventory is expected to grow at a 20% plus CAGR, more than doubling based on the current pipeline. Management aims to reach 20,000 keys by FY27, with a 30:70 owned-to-managed mix. This implies a portfolio of around 6,000 owned keys and 15,000 managed keys. Managed rooms thus have substantial headroom for growth and are expected to be a key driver post-FY27 as well.

Management contracts typically have higher EBITDA flow-through, in the range of ~80%, which should support margin expansion as the share of managed keys increases.

Lemon Tree Hotels Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time, price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers, we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Lemon Tree Hotels Ltd Price charts

On the daily timeframe, the Lemon Tree Hotels Ltd stock has recently completed a consolidation pattern breakout above ₹160, with price action retaining strength above the 50- and 200-day moving averages. After the breakout, Lemon Tree Hotels Ltd stock price rallied strongly towards the ₹174 mark, followed by a mild pullback that is holding above both moving averages, indicating the uptrend remains intact. Volume spikes around the breakout confirm robust buying interest, and the near-term support lies at ₹160, with the trend remaining bullish unless this level is decisively breached.

Lemon Tree Hotels Ltd is exhibiting a strong long-term uptrend, as seen in the weekly chart, supported by an ascending trendline that has provided consistent support since early 2022. Lemon Tree Hotels Ltd stock price recently broke above a significant resistance level near ₹159, turning it into support, and is trading near ₹172, indicating bullish momentum. Volume activity aligns with price advances, suggesting healthy participation in the rally. Key support levels are now at ₹159 and ₹113, while the next resistance targets would be historical highs.

Lemon Tree Hotels Ltd Latest Result, News and Updates

Lemon Tree Hotels Ltd Quarterly Results

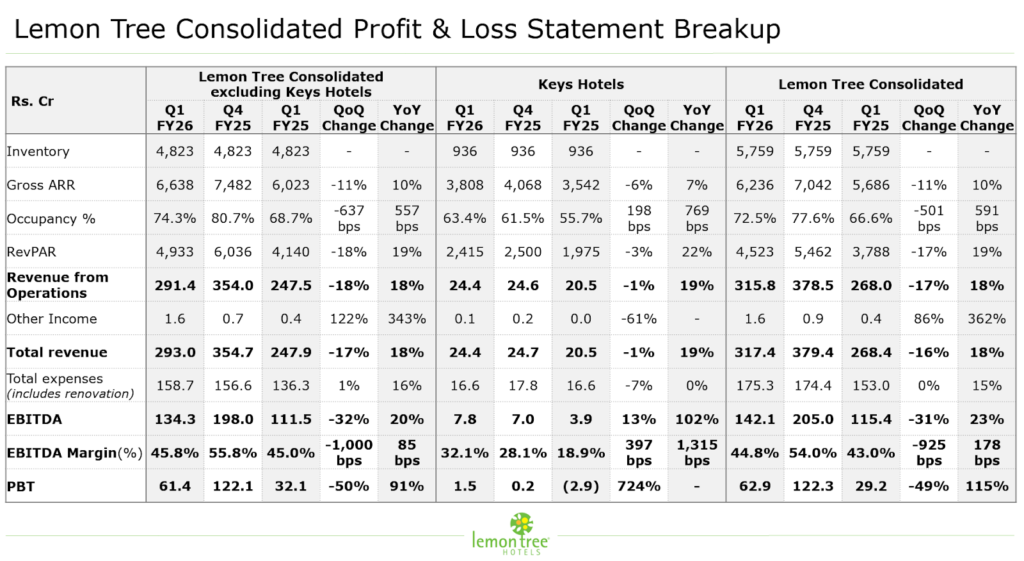

Lemon Tree Hotels Ltd recorded its highest ever Q1 revenue at Rs 316 Cr, growing 18% YoY. EBITDA Grew 22% YoY to Rs140 Cr. Gross Average Room Rate stood at Rs 6236, up 10% YoY. And the occupancy for the quarter stood at 72.5%. The management significantly reduced its debt to Rs 1658 Cr in Q1FY26, a 11% fall from Rs1864 Cr in Q1FY25.

Cost of borrowing decreased to 8.01% this quarter from 8.8% in the previous year. Fees from third-party management and franchise contracts totaled Rs 16 Cr, a 29% YoY increase. Fees from Fleur Hotels were Rs 21 Cr, also up 29% YoY, leading to a total of Rs 37 Cr in management fees for Lemon Tree.

Renovated rooms have shown notable improvements, with Keys Pimpri seeing its ARR increase by Rs1,300-1,400 and occupancy rise by 10%. Post-renovation, Delhi’s ARR increased by 15% and Hyderabad’s by 19%. Aurika Mumbai witnessed 76.6% occupancy in Q1FY26, up from 45.8% last year, representing a 30 percentage point increase. The EBITDA margin for Aurika Mumbai is approximately 60%. The increase in occupancy was primarily driven by negotiated corporate business and supported by non-negotiated business.

Lemon Tree Hotels Ltd loyalty program has over 2.1 million members, with a 43-44% repeat usage rate, targeting 3 million members next year by enrolling frequent repeating guests. In Q1FY26, the company signed 14 new contracts, adding 1,273 rooms to the pipeline, operationalized five hotels (about 400 rooms), and is developing two owned hotels in Shimla (100 rooms) and Shillong (160 rooms), both set to open within 2.5 years.

Management’s goal is to complete renovations for the entire portfolio of owned hotels by FY27, with about 65-70% of 4,300 rooms already completed in the last two and a half years. Renovation expenses are projected to be around Rs 80-90 Cr this year, decreasing to about 70% of that next year, and then dropping to approximately Rs 20 Cr annually. Total capex is expected to be around Rs 130 Cr.

Final thoughts on Lemon Tree Hotels Ltd

Lemon Tree Hotels Ltd is a one-of-a-kind mid to mid-premium segment branded hotels plays in India. Most of the other large listed hotel companies have premium or luxury portfolios such as IHCL, ITC Hotels, EIH etc. Lemon Tree Hotels Ltd has a pioneering jockey at the helm in Mr. Patanjali Keswani, who is very well respected across the industry. Lemon Tree Hotels Ltd, after having increased gross block 3x between FY17-FY25, is now accelerating inventory via an asset light managed and franchise model. Lemon Tree Hotels Ltd believes it now has a strong enough brand pull pan-India which will allow it to lend the brand and operational best practices to independent asset owners in Tier 1, Tier 2 and Tier 3 cities.

While this model has its own challenges – delay in asset construction, some contracts never materializing, certain hotels not being maintained to Lemon Tree Hotels Ltd standards – if Lemon Tree Hotels Ltd can sign up reasonable asset partners and enforce the required operational SOPs via its feet-on-ground, then it can generate a very lucrative and sustainable management fee revenue stream for the company. Such revenue would have very high flow-through rates to EBITDA, increasing the company’s ROCE. While Lemon Tree Hotels Ltd pursues this asset light strategy to grow its revenues in non-focus geographies, it plans to publicly list its asset owning subsidiary – Fleur Hotels Ltd. – to raise funds so that it could take up new hotel construction/acquisition in key focus micro-geographies. This dual strategy has the potential to deliver sustained 15-20% revenue growth with operating leverage.

While the hotel cycle is one to watch out for, adjusted for that, Lemon Tree Hotels Ltd is one of the better listed hotel plays to play the economic growth of India and the increasing spending power of its urban citizens.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this to a general audience. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will continue/be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.