Man Industries Ltd is one of the largest Manufacturers and Exporters of LSAW and HSAW pipes in India with a total installed capacity of 1.18 million tonnes. Man Industries Ltd is among the leading manufacturers of large diameter pipes with 3 decades of presence in the steel pipe Industry.

Man Industries Ltd Company Summary

Man Industries Ltd was incorporated in 1988 and promoted by the Mansukhani family. Man Industries Ltd has a strong footprint in manufacturing and coating large-diameter LSAW, HSAW, and ERW pipes with the associated infrastructure. Man Industries Ltd is based in Mumbai, India. The Promoter group owns 48% of Man Industries Ltd. Man Industries Ltd specializes in producing longitudinal submerged arc welded line pipes for various applications, such as oil, gas, petrochemicals, and dredging, as well as helically submerged arc welded line pipes for oil and gas transportation, water supply, sewerage, agriculture, and construction, among others. Additionally, Man Industries Ltd offers a range of coating systems for its pipes. It serves both domestic and international clients like GAIL, HPCL, ONGC, Reliance, SHELL, IOCL, BPCL, Adani, Kuwait Oil Company, etc.

Man Industries Ltd has subsidiaries, namely Merino Shelters Private, Man Overseas Metals DMCC, and Man USA Inc. The company has a global presence, with offices in the UK and UAE, besides India. Man Industries Ltd has a track record of executing pipeline projects for onshore, offshore, and critical sour service applications. Man Industries Ltd has manufactured and supplied over 20000 km of pipes globally for various applications, meeting all international project standards.

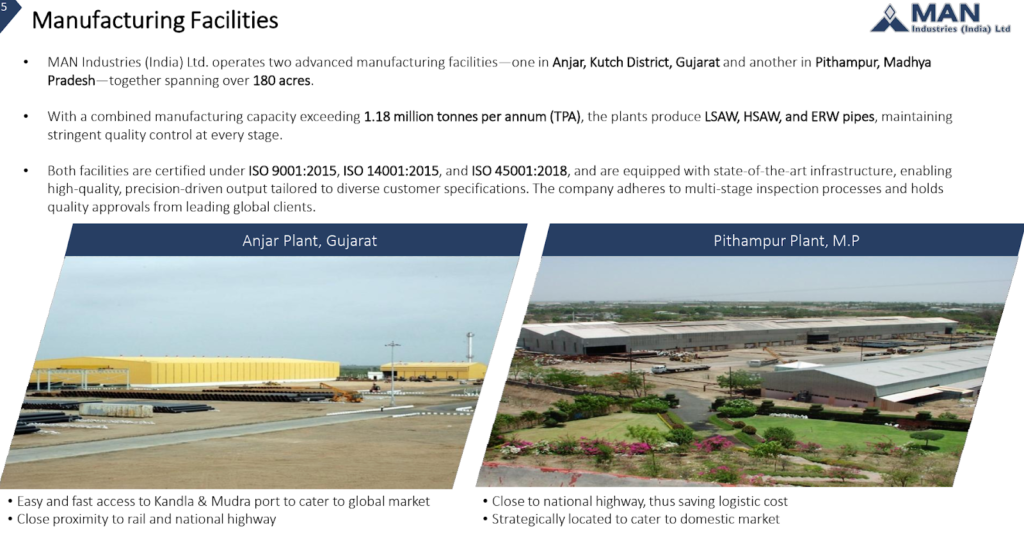

Man Industries Ltd has two manufacturing facilities: one located in Anjar, Gujarat, which is established to have fast access to the Kandla and Mundra ports, to cater to the global market. The other facility is in Pithampur, Madhya Pradesh, strategically placed near the national highway to save logistic costs and serve the domestic market. The Anjar plant has 2 LSAW and 2 HSAW line pipe units and 1 ERW unit and types of anticorrosion coating system, whereas it has 1 facility at Pithampur, Madhya Pradesh with total capacity (both plants) of over 1.16 MTPA of both the plants. Recently, Man has been investing further to widen its offering by entering the manufacture of stainless steel pipes.

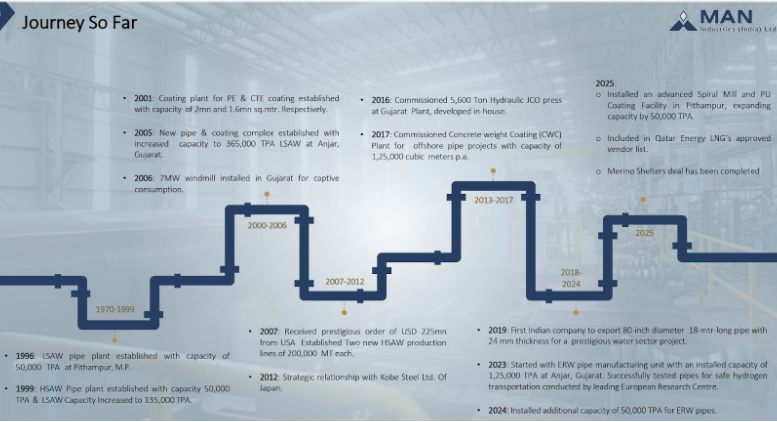

Man Industries Corporate Timeline

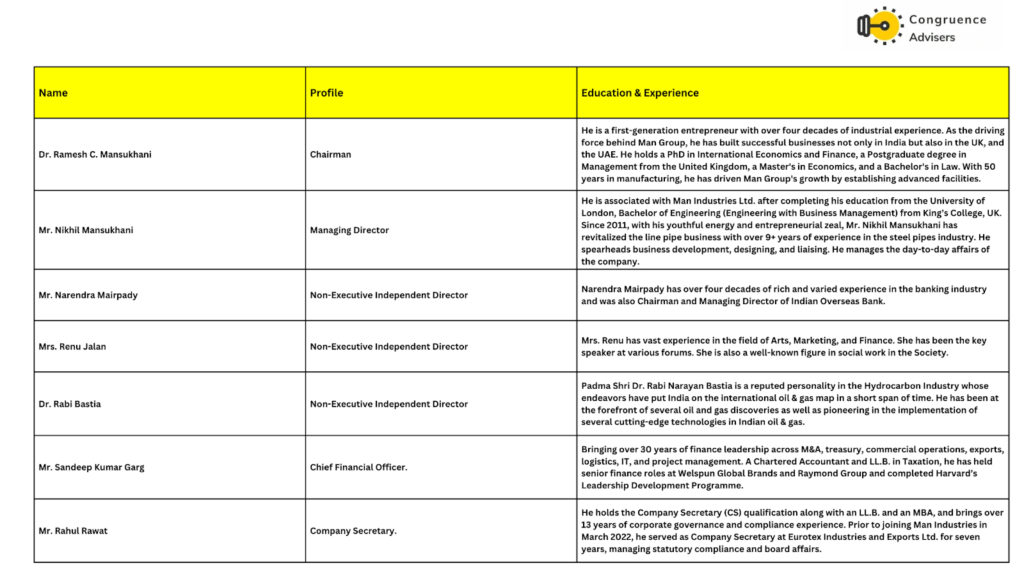

Man Industries Ltd Management Details

Man Industries Ltd was promoted and is controlled by the Mansukhani family, who remain deeply involved in Man Industries Ltd’s management and strategic direction. The group’s founder, the late J.M. Mansukhani, built Man Industries Ltd from humble beginnings. Today, the leadership is largely held by Mr. R.C. Mansukhani (Executive Chairman), son of Mr. Mansukhani and his family.

Mansukhani made a humble beginning at Jaora village in Madhya Pradesh as a chemist at a sugar mill after migrating from Pakistan in the post-independence era. He had successfully ventured into various businesses such as steel, cement and construction in Mumbai. He was instrumental in launching and growing the Man Group, of which Man Industries Ltd is the flagship company.

Mr. Nikhil Mansukhani, the son of Ramesh C. Mansukhani, has been appointed as the Managing Director of Man Industries Ltd for a five-year term beginning October 1, 2023. Earlier served as Executive Director at Man Industries Ltd.

Man Industries Ltd – Industry Overview

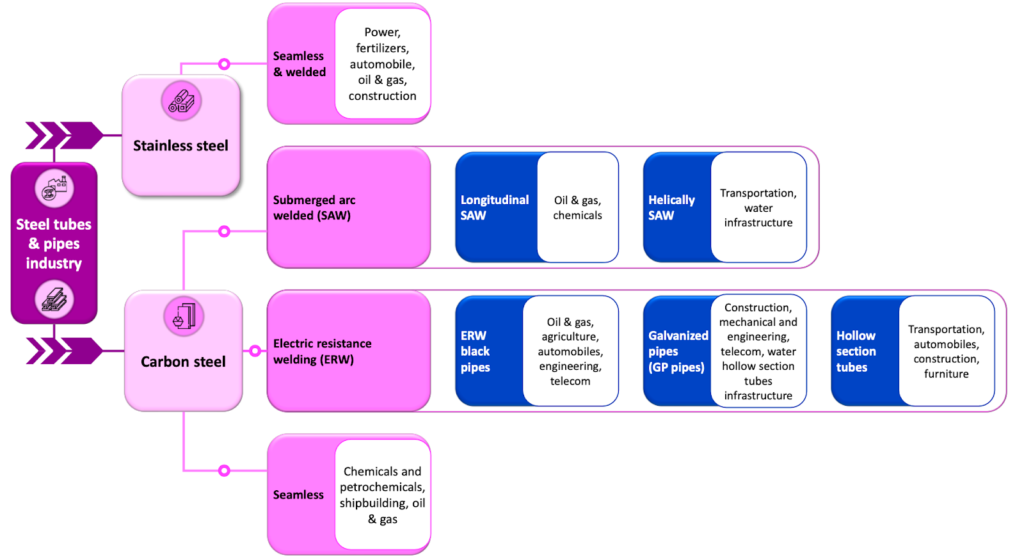

Overview of the steel pipes and tubes industry

Steel tubes and pipes, primarily manufactured from carbon steel, stainless steel, or alloy steel, are broadly classified into two categories: seamless and welded based on their industrial application. In a rapidly developing economy like India, these products are increasingly being used across diverse sectors such as oil and gas, infrastructure and construction, automotive, petrochemical and water transportation, food and beverage processing, energy and power, and medical devices. Steel pipes and tubes account for nearly 8% of the country’s total steel consumption, driven largely by accelerated infrastructure growth and construction activities.

Carbon steel line pipes, composed of an iron–carbon alloy, are widely used in the oil and gas industry for transporting hydrocarbons such as natural gas and petroleum. Known for their high tensile strength, these pipes can withstand significant pressure and stress during long-distance fluid transportation. They are broadly categorized into Seamless, Electric Resistance Welded (ERW), and Submerged Arc Welded (SAW) pipes, with the latter further divided into Longitudinal Submerged Arc Welded (LSAW) and Helical Submerged Arc Welded (HSAW) types. Beyond oil and gas, carbon steel line pipes also play a vital role in water infrastructure, serving applications such as tap water distribution, industrial water supply, and agricultural irrigation.

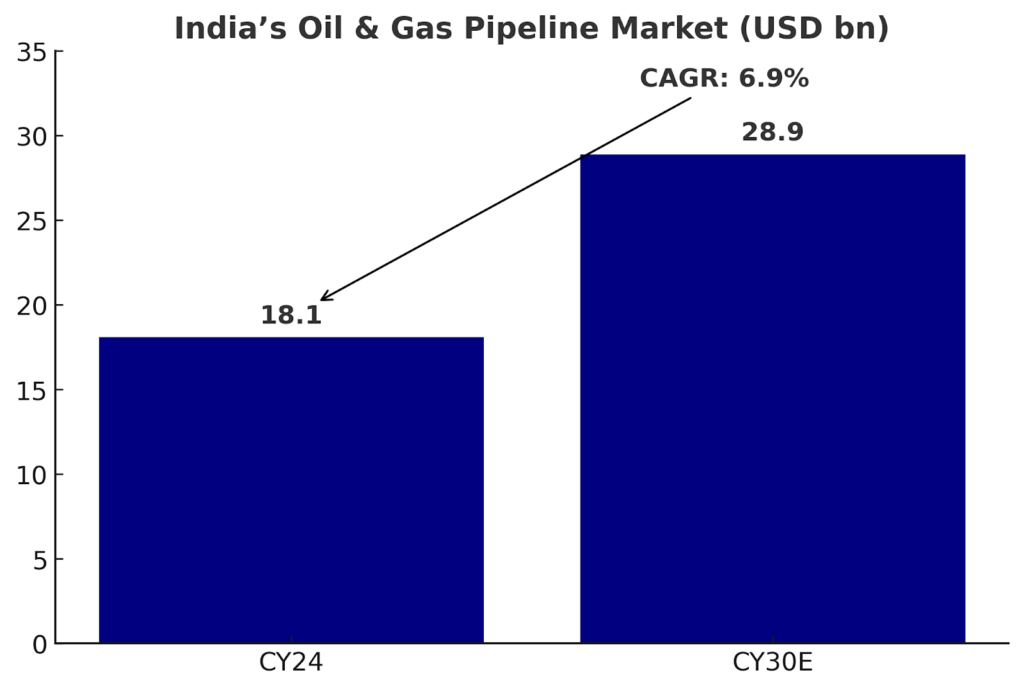

India’s Oil & Gas Pipeline Market

The Indian oil and gas pipeline market was valued at USD 18.1 billion in CY2024 and is projected to reach USD 28.9 billion by CY2031, reflecting a CAGR of 6.9% over the forecast period. This growth will be fueled by rising energy demand, accelerated infrastructure development, and government-led initiatives to expand the natural gas network. India’s natural gas demand is expected to increase by nearly 60% by CY2029, underscoring a significant transformation in the country’s energy landscape. Expanding the domestic pipeline network will be critical as India targets more than doubling the share of natural gas in its energy mix to around 15% by CY2030.

Pipeline network demand in the Water Sector

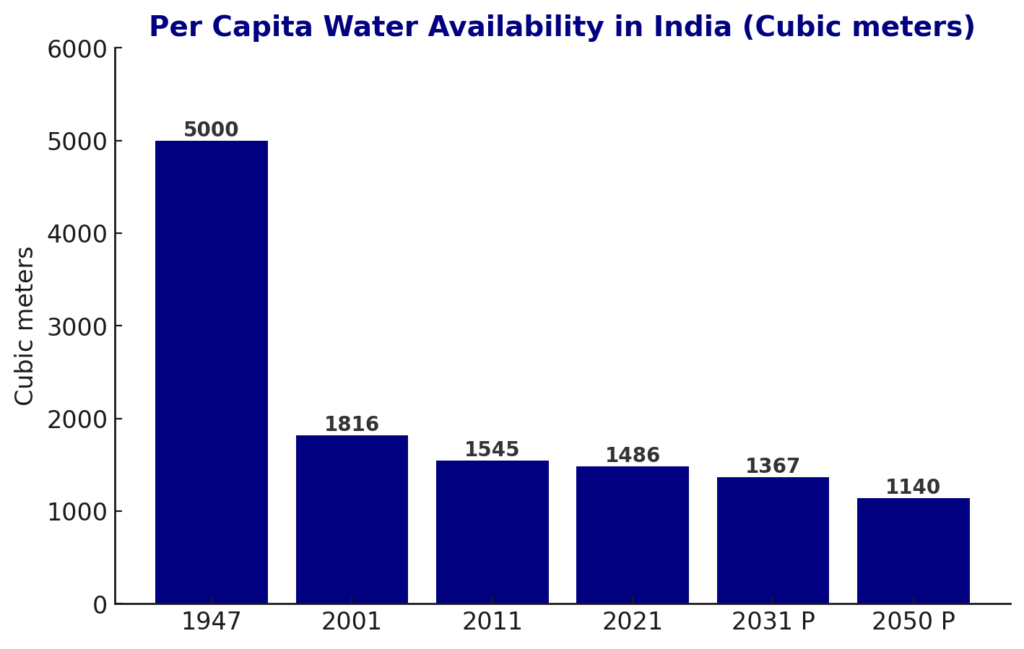

India, home to 18% of the world’s population but endowed with only 4% of its freshwater resources, is among the most water-stressed countries globally. A significant share of the population experiences high to extreme water stress, largely due to the nation’s dependence on an increasingly unpredictable monsoon. While India is not yet classified as ‘water scarce,’ it is already ‘water stressed,’ with annual per capita water availability falling below 1,700 cubic meters. Climate change—through the melting of Himalayan glaciers and increasingly erratic rainfall patterns—poses further risks, intensifying the country’s water challenges in the years ahead.

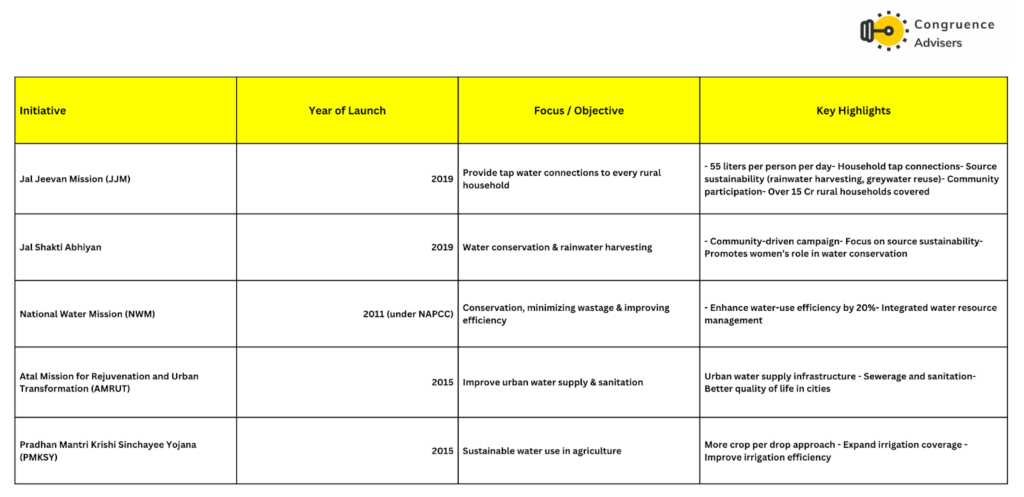

To address this pressing challenge, the Government of India, in partnership with state governments, has rolled out several flagship initiatives, including the Jal Jeevan Mission (JJM), Jal Shakti Abhiyan, National Water Mission (NWM), Atal Mission for Rejuvenation and Urban Transformation (AMRUT), and the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY). Together, these programs reflect a strong national commitment to strengthening water security and managing critical water-related challenges across the country.

Key government initiatives launched in India to tackle water-related issues

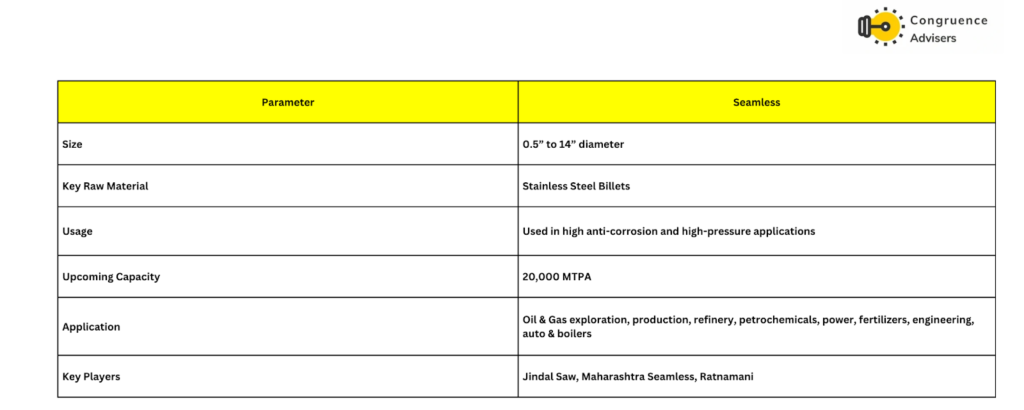

Stainless Steel Pipes & Tubes

Stainless steel (SS) pipes and tubes are categorized into two types: seamless and welded. Seamless pipes are manufactured from billets without any joints or seams, providing a uniform structure. Welded pipes, on the other hand, are produced by welding flat steel strips into a round or circular shape. Seamless pipes are preferred for applications involving high pressure, elevated temperatures, and corrosive environments due to their superior strength and durability. Welded pipes are typically used in low-pressure, less corrosive conditions.

Global

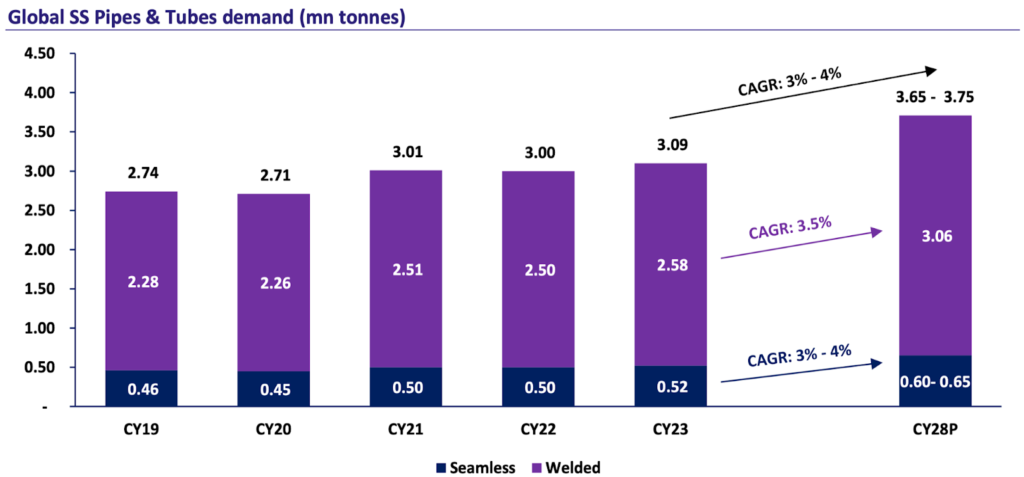

The global demand for stainless steel (SS) pipes and tubes reached 3.1 million tonnes (mnt) in CY2023, with welded pipes accounting for approximately 80% to 85% of this demand. Looking ahead, the market is projected to grow at a CAGR of around 3% to 4% during the CY2023–CY2028 period, reaching between 3.65 and 3.75 mnt by CY2028. This growth will be driven by rapid urbanization and industrial expansion in emerging economies such as India, Indonesia, Malaysia, and key consumers in the Middle East. Additionally, China’s emphasis on enhancing water transportation infrastructure and expanding its water supply network supports strong demand prospects, with China currently representing the largest single consumer, accounting for about 40% of the global SS pipes and tubes demand.

Source: Industry, SSL Research

Domestic

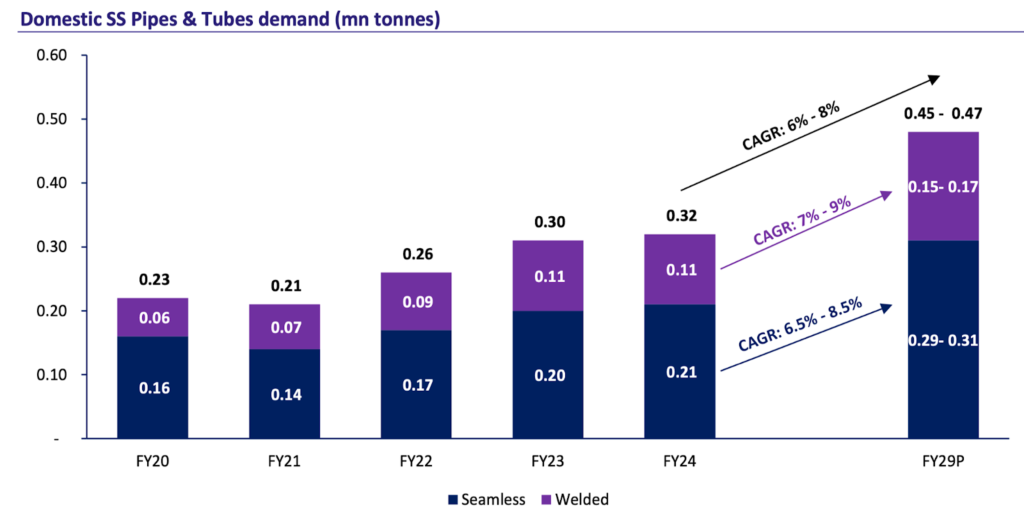

Domestic demand for stainless steel (SS) pipes and tubes is projected to rise from 0.32 million tonnes (mnt) in FY2024 to between 0.45 and 0.47 mnt by FY2029, reflecting a CAGR of 6% to 8% over the forecast period. This robust growth will be largely driven by strong expansion in key end-use sectors, including building and construction, automotive, oil and gas, chemical manufacturing, and food and beverage industries. As of FY2024, welded pipes accounted for 65% of the domestic market share, while seamless pipes comprised the remaining 35%.

Man Industries Ltd Business Overview

Man Industries India Ltd is one of the largest manufacturers and exporters of large diameter carbon steel line pipes (LSAW, HSAW, and ERW). These pipes are used for various high-pressure transmission applications in the Oil & Gas, Petrochemicals, Water, Dredging & Fertilisers, Hydrocarbons, and CGD sectors. With over 3 decades of presence in the pipe industry, Man Industries Ltd’s manufacturing capital boasts of 2 state-of-the-art manufacturing facilities located in Anjar, Gujarat, and Pithampur, Madhya Pradesh, having a total installed capacity of over 1.18 Million+ MTPA. Both these plants are strategically located and cover a total area of ~180 acres.

These facilities hold internationally accepted quality standards laid down by the American Petroleum Institute (API), which is a mandatory requirement to produce high pressure line pipes for hydrocarbon applications, owing to which Man Industries Ltd caters to a number of Oil & Gas majors domestically and internationally such as IOCL, HPCL, BPCL, SHELL, Kuwait Oil Company, etc. Man Industries Ltd has a strong global customer reach spread across 30+ nations.

Man Industries Ltd Product Portfolio

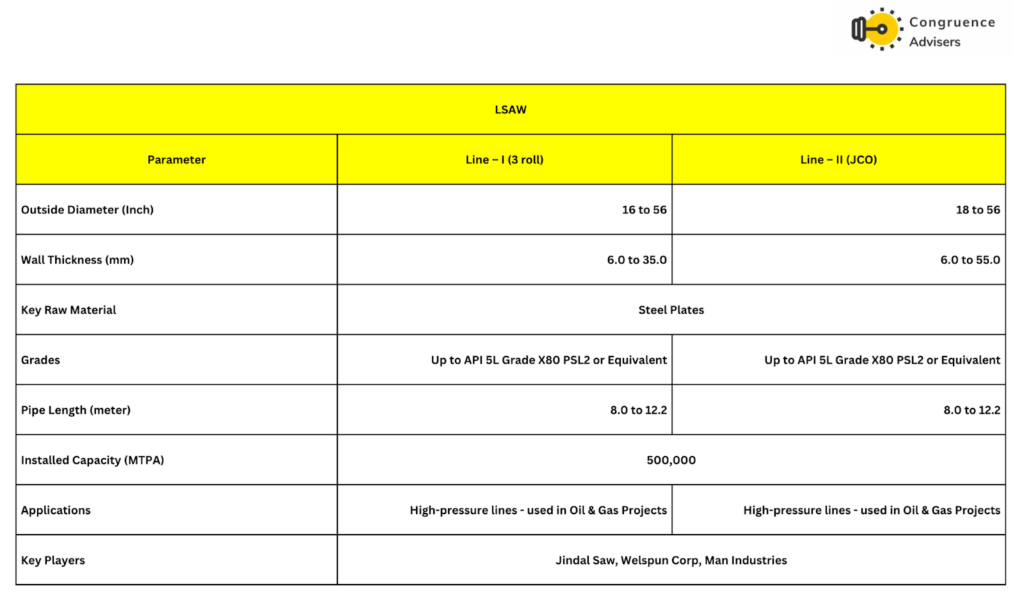

1. Longitudinal Submerged Arc Welded (LSAW) Pipes – Man Industries Ltd produces LSAW Line Pipes in a wide range of diameters, from 16 inches to 56 inches. These pipes are made to meet both general industry standards and the specific requirements of each client. They serve a variety of sectors, including oil and gas, petrochemicals, fertilizers, and dredging, where strong and reliable pipelines are essential for transporting materials over long distances and under high pressure.

The LSAW plant at Man Industries Ltd is equipped with cutting-edge production and testing technologies sourced from Europe and India. It features a state-of-the-art automated pipe manufacturing line, offering both 3-Roll Bending and JCO Forming press options within the same facility. The plant includes advanced Inside and Outside Submerged Arc Welding (SAW) lines.

LSAW Pipes – Man Industries Ltd Product Specifications and Production Capabilities

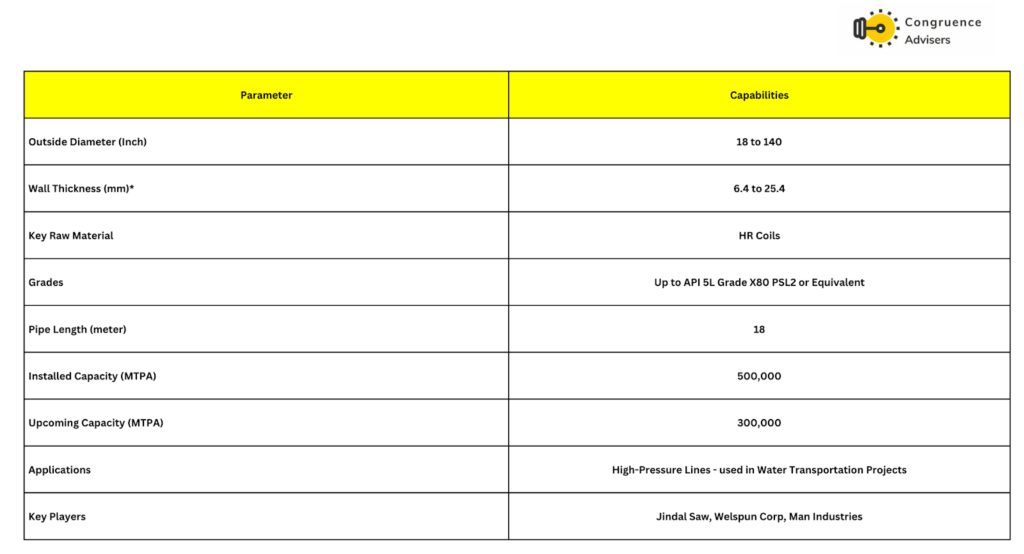

2. Helical Submerged Arc Welded (HSAW) Pipe – Man Industries Ltd’s HSAW Line Pipe facility in Anjar is fully equipped with advanced Non-Destructive Testing (NDT) systems and comprehensive laboratory capabilities to meet the stringent requirements of its global clientele, particularly in high-pressure and critical application segments. While HSAW Line Pipes continue to see steady demand in traditional sectors such as oil and gas transportation, water supply, sewerage, agriculture, and construction, there is a growing global trend toward their use in high-pressure onshore installations. In response to this evolving market, Man Industries Ltd. delivers high-quality HSAW Line Pipes that conform to internationally recognized standards, ensuring reliability and performance across diverse applications

To ensure the timely delivery of high-quality products, Man Industries Ltd has established a Two-Step HSAW Mill. This advanced setup allows for pipe forming and continuous GMAW (Gas Metal Arc Welding) in the first stage, followed by final inside and outside SAW (Submerged Arc Welding) at separate dedicated stations. The high-speed forming mill is supported by four SAW welding lines for both internal and external welds, along with an Automatic Coil Ultrasonic Testing Machine, Hydrotesting equipment, and an Automatic Weld Ultrasonic Testing system to maintain stringent quality standards throughout the production process.

HSAW Pipes – Man Industries Ltd Product Specifications and Production Capabilities

New Capex – Man Industries Ltd is setting up a greenfield project in Saudi Arabia. Capex of Rs 600 Cr is earmarked for this, with a planned capacity of 300kt. Price realizations are expected to improve relative to the pricing Man Industries Ltd gets in India with revenue potential from this plant around Rs 2000 Cr Plus.

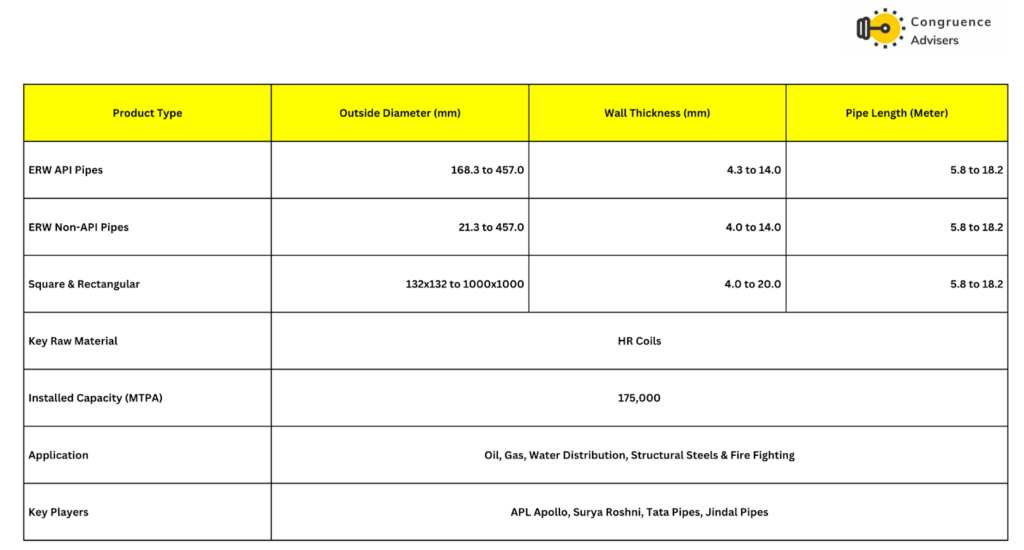

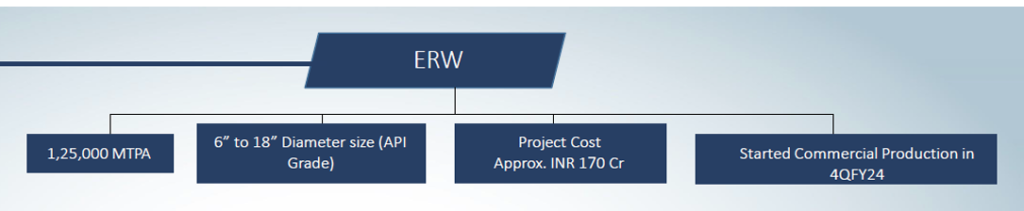

3. Electric Resistance Welded (ERW) pipes – Man Industries Ltd manufactures ERW pipes in a range of sizes and specifications to meet the growing global demand for pipeline solutions. Man Industries Ltd has established a dedicated unit in Anjar, Gujarat, for producing ERW steel pipes and tubes, available in various grades, diameters, lengths, and wall thicknesses. These pipes are produced using high-frequency induction welding technology, with nominal diameters ranging from 4 inch to 18 inch. These ERW pipes are manufactured in strict compliance with API standards and customized client specifications, serving key sectors such as oil, gas, fertilizers, and water supply. All line pipe manufacturing facilities at Man Industries Ltd hold valid licenses to use the API Monogram and have received numerous customized approvals from reputed clients across the globe.

ESAW Pipes – Man Industries Ltd Product Specifications and Production Capabilities

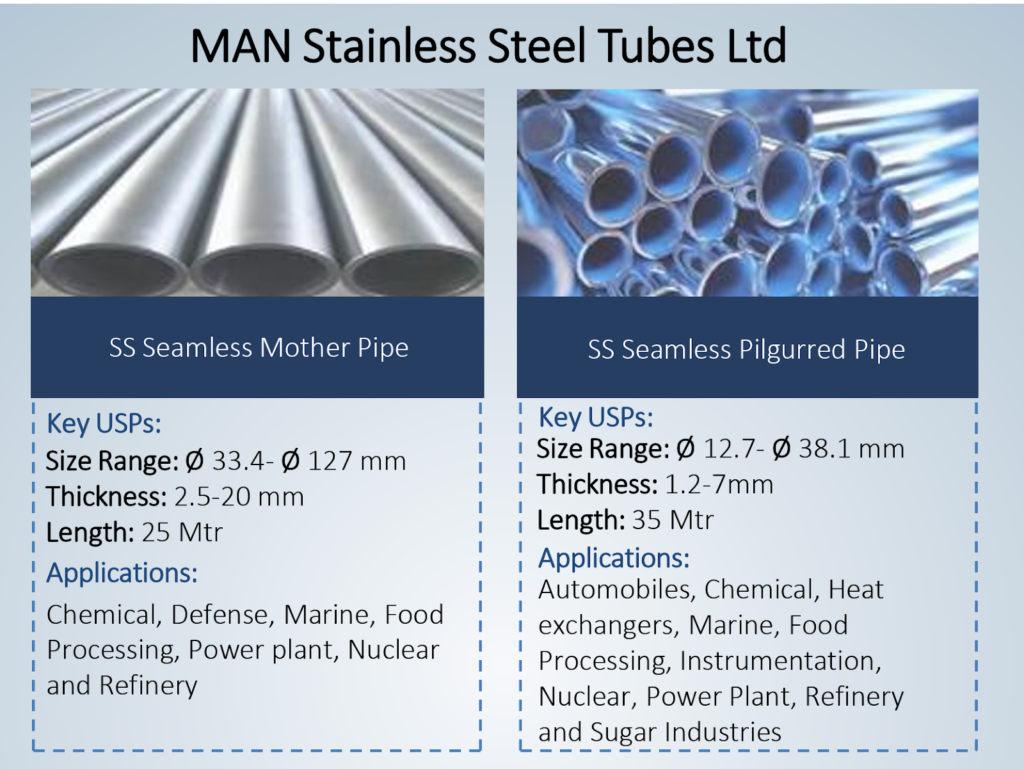

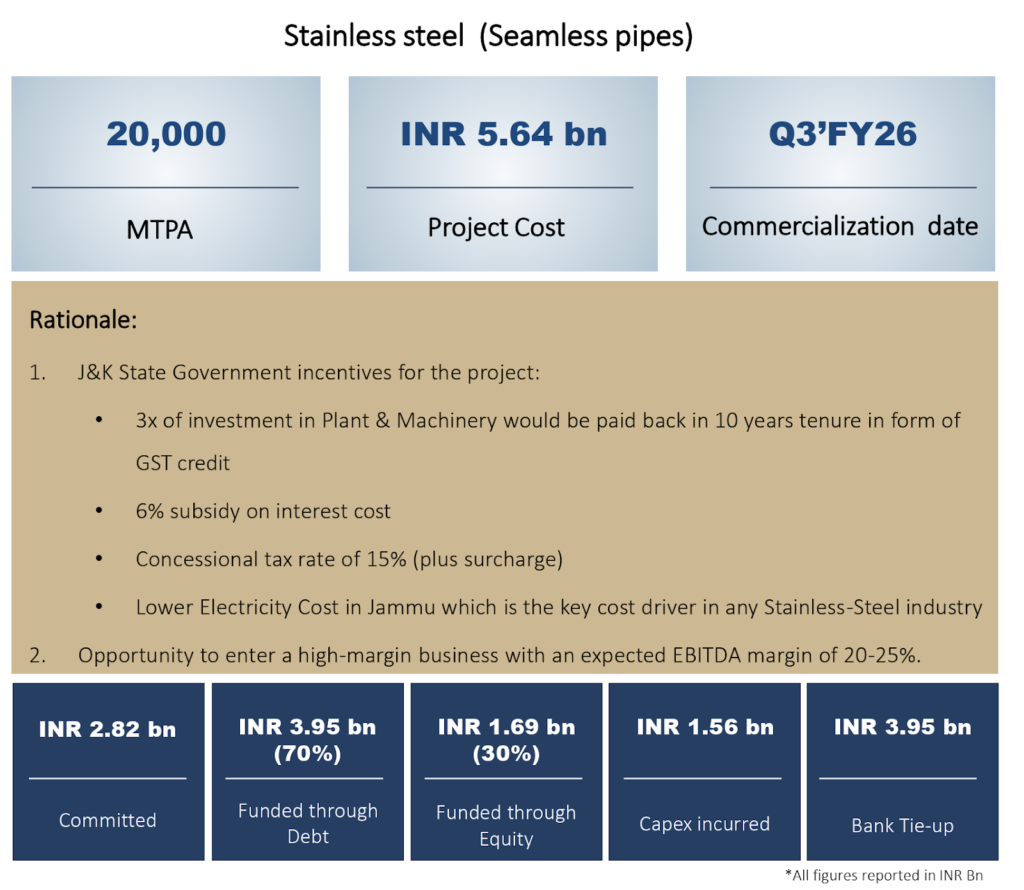

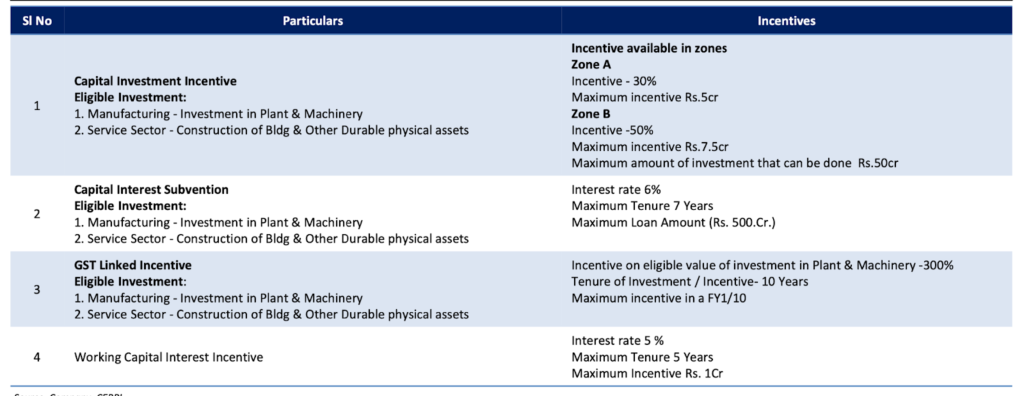

4. Stainless Steel Tubes – Man Industries Ltd, through its 100% subsidiary, MAN Stainless Steel Tubes Ltd, has undertaken a greenfield expansion at Jammu focusing on the production of Stainless Steel Seamless Pipes, with a planned annual capacity of 20,000 MT, with a total investment of Rs 564 Cr, with revenue potential from the new plant around 1000-1200 Cr. Commercial operations are expected to begin by 3QFY26. These pipes find applications across sectors such as chemical, defense, oil & gas, power generation, and food processing. The project is eligible for government incentives in the form of a 10 year GST credit payback, 6% interest subsidy, a 15% concessional tax rate, and lower electricity costs.

Stainless Steel Tubes – Man Industries Ltd Product Specifications and Production Capabilities

5. Other Segments – Man Industries Ltd offers various coating options to protect line pipes from corrosion and enhance their operational life. The available coating systems include single-layer Fusion Bonded Epoxy (FBE) coating, 3-layer Polyethylene (PE) coating, 3-layer Polypropylene (PP) coating, internal blasting and painting, and concrete Weight Coating (CWC). These coating systems are applied to the line pipes to safeguard against corrosion and extend their service life. This ensures reliable performance in diverse applications such as oil and gas transportation, water supply, and other critical infrastructure projects.

Man Industries Ltd is aggressively expanding its capacity in the ERW segment, a high-volume product category widely used in Oil & Gas (O&G) and construction-related projects. ERW pipes are preferred in these sectors due to their faster asset turnover (A/TO), which is 3–4 times higher than HSAW and LSAW pipes, resulting in a shorter working capital cycle. However, ERW margins are structurally lower compared to HSAW and LSAW, given the competitive intensity, higher automation, and lower labor dependency in the process.

Segment-Wise EBITDA Margins

- SAW Pipes: 9–10%

- Saudi Project: 12–13%

- Stainless Steel (SS) Seamless Tubes: 20-25%

- ERW Pipes: 6–8%

Oil & Gas v/s Water Segments

- Oil & Gas Projects: Typically yield 11–13% EBITDA margins, translating to USD 150–250 per ton depending on competition, geography, and project complexity. This segment generally delivers stronger profitability.

- Water Projects: Generate 7–8% EBITDA margins (INR 5,000–7,000 per ton, or USD 60–80 per ton in India). Margins are structurally lower due to reduced coating and testing requirements, lower steel grades, and higher competition.

ERW Pipes – Margins in the ERW API business are typically slightly higher margin comparable of LSAW/HSAW pipes. The company aims to enhance profitability by focusing on API-grade pipes and exports. Some ERW Non API orders, however, have delivered EBITDA margins in the 6–8% range.

Stainless Steel & Seamless Tubes – This segment is positioned as a high-margin business.

- Expected EBITDA margins: 18–22%, with potential to scale up to 20–25% for the new Jammu greenfield expansion.

- Mother pipes and pilgering each contribute 10–11% margins. Being a premium product, SS seamless tubes serve as a key margin driver for the company.

Exports – Exports typically command better pricing and face lower competitive intensity than the domestic market, leading to superior margins. The company’s export pipeline is largely concentrated in the MENA region and Southeast Asia.

Manufacturing Facilities

Following the successful completion of the 100kt ERW pipe expansion in FY24, management has established a track record of execution and is now pursuing a broader and more strategically significant expansion. The next phase includes entry into the stainless steel segment through a facility in Jammu, as well as capacity addition in the LSAW/HSAW pipe segment in Saudi Arabia. Both categories are expected to benefit from structural, long-term demand tailwinds. Moreover, the Jammu project is supported by fiscal incentives, including tax and interest subsidies, which enhance project viability and return potential.

Management has demonstrated superior execution capabilities

Man Industries Ltd constructed the ERW plant with a project capex of Rs 170 Cr, installing 100kt of capacity. In addition, the company installed 25kt of ERW capacity in Anjar as part of the proposed expansion in Jammu. The project construction took nine months and was completed in 2023. The company started commercial production in the fourth quarter of FY24.

In 2024, Man Industries Ltd installed an additional capacity of 50,000 TPA for ERW pipes. This addition was located at the Pithampur Plant, increasing the total ERW capacity to 1,75,000 MTPA

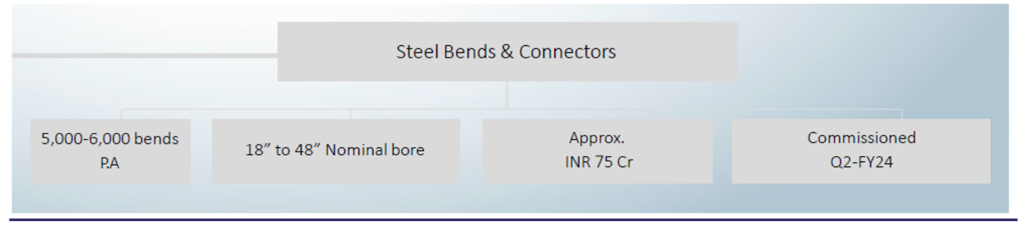

Man Industries Ltd also completed a project in 2023, for steel bends and connectors with a capex outlay of Rs 75 Cr.

Man Industries Ltd would invest ₹564 Cr to set up the unit in Jammu and ₹600 Cr in Saudi Arabia, for a total capex of ₹1,164 Cr. The management targets delivering such expansions in Q3 FY26 and fully ramping up operations by FY27.

Man Industries Ltd has set up a subsidiary company named Man Stainless Steel Tubes Limited for its Jammu expansion. The project is in Kathua, Jammu (Kathua is a small town located close to the Jammu & Kashmir and Punjab border). It is strategically located in Kathua, Jammu & Kashmir, which grants it subsidy and incentive benefits from the Central Government for catering to the domestic market.

Although a small ERW unit was initially planned for Jammu, this plan was later dropped.

Some of the key benefits of setting up plants in Jammu

The key draw for setting up a facility in the union territory of J&K is the tax subsidies and interest subvention available from the government. Man Industries Ltd invests in plant and equipment of around 450 Cr in Jammu. The government is expected to give 3 times the cost of the plant & equipment over 10 years. Rs 1000 Cr plus refund on sales that the company would be eligible to receive, which would be split over 10 years. The actual amount to be received each year would be dependent on the revenue generated in the preceding year.

New Initiative 2: Strategic Expansion In Saudi Arabia

Man Industries Ltd is setting up a greenfield project in Saudi Arabia. Capex of Rs 600 Cr is earmarked for this with a planned capacity of 300kt. Price realizations are expected to improve relative to the pricing Man Industries Ltd gets in India

Saudi Arabia, compared with the Indian pipes industry, has an orderbook that is more standardized with uniformity in product specifications. The uniformity comes largely from the kind of infrastructure the country is building, wherein there would be demand for pipes that connect the country in length from East to West and from North to South in areas involving water transportation. This would require pipes of similar sizes and diameters. Man Industries is targeting this opportunity.

Standardized orderbook specifications imply being able to produce large volumes of the same length and diameter of pipes. This would essentially augment the capacity utilization rates. For context, Man has been operating at 30-35% utilization in recent quarters; in contrast, it is looking to operate at 60-70% capacity upon full ramp-up of the Saudi project.

Utilization rates in Saudi Arabia are expected to be higher than those plants in India.

Man Industries Ltd current capacity is 1.18 MTPA with manufacturing facilities established in Anjar, Gujarat, and Pithampur, Madhya Pradesh. The expansion in Jammu and Saudi Arabia would raise the group’s capacity to 1.64 MTPA.

Saudi plant revenue potential at full capacity at Rs. 2,000 Cr p.a & Jammu at Rs. 1,000–1,200 Cr p.a. Full ramp-up expected over 2 years post commissioning.

Order Book & Exports

Order Book: The order book remains at ~ INR 3200 Cr, with expected execution over the next 6 to 12 months. Additionally, Man Industries Ltd has a healthy bid pipeline of ~INR 15000 Cr. Export now accounts for around 75% to 80% of consolidation revenue and 80% of the company’s current order book. Major exports to MENA (North Africa, Gulf, Saudi Arabia), Far East, Canada, and Europe. The export mix depends on the project flow.

Tariffs: No exposure to the US currently; management sees potential benefit if US tariffs on other countries create an opportunity for Indian manufacturers.

Clientele & Raw material

Man Industries Ltd has historically derived the majority of the revenue from the oil and gas segment and the remaining from the water and irrigation segment. A slowdown in the oil and gas industry because of a significant decline in crude prices impacted operations in the past. Strong demand from new projects in the oil and gas segment in key markets of India and the Middle East is critical for improvement in overall operations. Any major and continued slowdown in end-user industries will weaken demand for line pipes and impact performance.

Furthermore, operations remain exposed to government policies and preferences with respect to factors such as local supply and trade duties. Consequently, the group’s order inflow and operating performance are highly linked to the demand prospects from these sectors. Moreover, there is a lead time of 2-4 months between the application and the final award of a tender. Because these contracts are of a fixed-priced nature, Man Industries Ltd cannot pass on increases in input costs to customers after applying for the tender.

Man Industries Ltd is also exposed to foreign exchange fluctuations, as reflected by the foreign exchange losses incurred by the company during FY23. In case Man Industries Ltd becomes a net importer in any given fiscal year, the forex rate will adversely impact the company.

Management states raw material (steel) prices are hedged at the time of order confirmation.

Monetization of Non-Core Asset

During 4QFY25, Man Industries Ltd successfully completed the monetization of a substantial non-core asset (a 6-acre land parcel located in Navi Mumbai) lying in its wholly owned subsidiary, Merino Shelters Pvt Ltd. As a part of the transaction, Man Industries Ltd executed a Deed of Assignment and granted development rights for the land parcel to Paradise Green Spaces LLP (part of the Paradise Group) and received an upfront consideration of Rs 70 Cr. Additionally, the company will be entitled to 30% of the total developed area, equivalent to ~4,50,000 square feet of the RERA carpet, both commercial and residential. The management expects the value of their share in the developed property to be in the range of Rs 650 Cr – Rs 700 Cr over a period of 5-6 years. This will help Man Industries Ltd to unlock additional capital and back its core business, future expansion plans, and working capital requirements.

Man Industries Ltd Corporate Governance

Board Composition – Man Industries Ltd maintains a reasonably well-structured board with 5 directors, of which 3 are independent. The Executive Chairman is Mr. Ramesh C Mansukhani. Mr. Nikhil Mansukhani is the Managing Director. Overall, the board has retained a core of long-standing members, while adding new independent directors and governance roles in the last few years to strengthen oversight and strategic focus.

Related Party Transactions – Man Industries Ltd has no material related party transactions in recent years. In the past, there were instances of related party transactions and borrowing by promoters from subsidiaries, but such amounts have been returned. This has been part of the governance concerns addressed in the past, including SEBI forensic audits that reviewed related-party transactions and other issues. Man Industries Ltd has taken steps to improve transparency and disclosures.

Remuneration of KMP – The total compensation drawn by KMPs in FY24 is Rs 12 Cr, which is approximately 8% of Man Industries reported PAT.

Contingent Liabilities – Man Industries Ltd reported contingent liabilities of approximately ₹145 Cr, which are related to VAT, customs duty, and legal cases. This amounts to ~9% of the Man Industries Ltd’s consolidated net worth as of FY25

Dividend Track Record – Man Industries Ltd has maintained a consistent dividend payout policy, except in FY22 and FY25, during which Man Industries Ltd prioritized reinvesting funds into new business ventures and capex.

Audit Committee – The Audit Committee is chaired by an independent director and comprises a majority of independent members in line with governance norms. The promoter’s presence on the Audit Committee, while permitted, may raise questions on the independence of oversight mechanisms.

Promoter Shares Pledging – As of June 2025, Man Industries Ltd has approximately 20% of its promoter shares pledged. In addition to the share pledges, Personal guarantees by the promoters, Mr. Rameshchandra Mansukhani and Mr. Nikhil Mansukhani, are also provided as security for these loans.

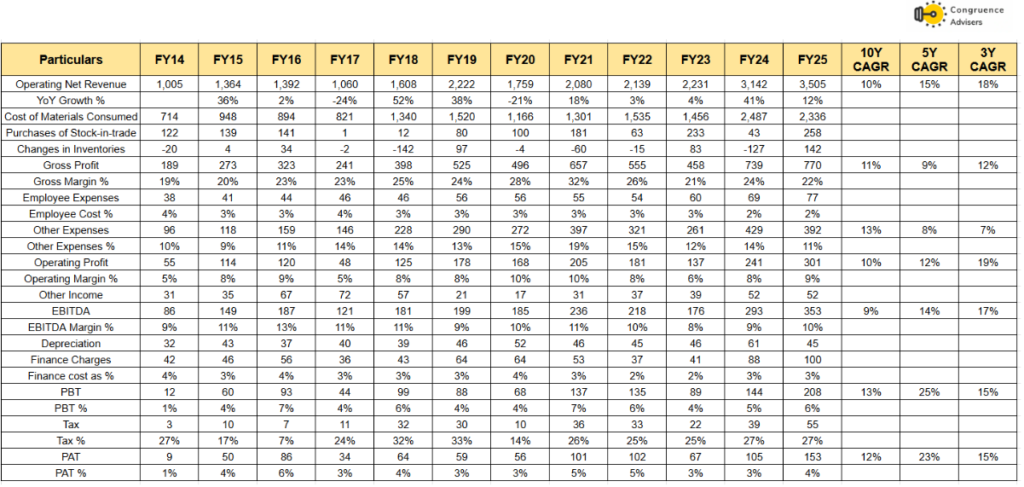

Man Industries Ltd Financial Performance

Man Industries Ltd delivered strong revenue growth in FY24, up 41% YoY, backed by improved order execution supported by an increase in the order book. In FY25, Man Industries Ltd revenue grew 12%, aided by its strategic entry into the ERW API product line, which contributed ~10% of revenue. This expansion, with a strong focus on international markets, allowed the company to tap rising global demand while diversifying its portfolio.

Man Industries Ltd currently has healthy revenue visibility for FY26 and FY27 with an order book of Rs 3200 Cr to be executed in the next 6-12 months. Additionally, EBITDA Margins during FY25 improved to 10% from 9% in FY24 and 8% in FY23, due to higher margin orders executed during 2024 and FY25, along with better product mix.

Man Industries Ltd Comparative Analysis

To understand Man Industries Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Man Industries Ltd to its competitors (peer comparison) on various fundamental parameters and Man Industries Ltd share performance relative to relevant benchmark and sector indices.

Man Industries Ltd Peer Comparison

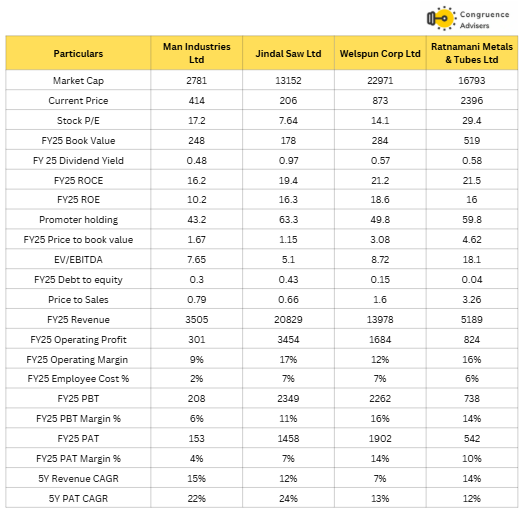

We are comparing Man Industries Ltd with its peers in the Steel Pipes and Tubes Sector. Hence, we have considered Jindal Saw Ltd, Welspun Corp Ltd, and Ratnmani Metals & Tubes Ltd for the peer comparison.

Jindal Saw Ltd manufactures LSAW pipes, HSAW pipes, DI pipes, seamless pipes, and pellets.

WCL is one of the largest manufacturers of large-diameter pipes globally. The company also manufactures BIS-certified Steel Billets, TMT (Thermo-Mechanically Treated) Rebars, Ductile Iron (DI) Pipes, Stainless Steel Pipes, and Tubes & Bars.

Ratnamani Metals & Tubes Ltd is engaged in the manufacturing of stainless steel pipes and tubes, and carbon steel pipes.

Man Industries Ltd is a small cap player in the pipe manufacturing sector, when compared to much larger peers like Welspun and Jindal Saw. Man Industries Ltd stands out for its fastest 5Y Revenue CAGR of 15% and PAT CAGR of 22% in the peer group.

Compared to its peers, Man Industries Ltd. reports significantly lower profitability, EBITDA margins, ROCE, and ROE. This underperformance is largely attributable to its low-margin product mix relative to the industry. Now, with the huge capex of Rs 1100 Cr plus, the capex, being towards value-added products, is expected to boost the profitability of the company upon commissioning.

Man Industries Ltd Index Comparison

Man Industries Ltd share performance vs S&P BSE Small Cap Index, as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why You Should Consider Investing in Man Industries Ltd

Steps into Stainless Steel Seamless Pipes with new plant in Jammu – Man Industries Ltd, through its wholly-owned subsidiary Man Stainless Steel Tubes Ltd, is setting up a greenfield facility in Jammu to enter the Stainless Steel (SS) Seamless Pipes segment. The project involves an investment of ₹564 Cr (70% debt and 30% equity) and will have a capacity of 20,000 MTPA. The project is eligible for substantial incentives under J&K government’s industrial policy, including reimbursement of 3x the investment in Plant & Machinery over 10 years through GST credits (full 18% GST rebate), subject to a maximum of ₹90 Cr per annum, 6% interest subsidy, subsidized power at ₹4.5/unit and 15% tax. Commercial operations to start by Q3FY26.

Capitalizing on Saudi Arabia’s infrastructure growth with a 3 lakh MTPA greenfield facility – Man Industries Ltd is expanding its global footprint by setting up a 3,00,000 MTPA HSAW pipe manufacturing and coating facility in Dammam, Saudi Arabia. The project involves an investment of ₹600 Cr (70% debt and 30% equity) and is poised to benefit from the region’s infrastructure growth, particularly in water and oil & gas sectors. The facility will produce high-spec HSAW pipes for high-pressure applications and will have the advantage of local economic conditions, including tax holidays. Commercial operations are expected to start in Q3FY26, and the project is expected to have higher margins of 12–14% as compared to 9–11% from domestic operations.

Strong Order Book and Global Competence Driven by API-Certified Facilities – As of Jun’25, Man Industries Ltd has a strong order book of Rs 3,200+ Cr, with an execution period over the next 6 to 12 months. Bid pipeline stands at ~Rs 15,000 cr, which indicates strong revenue visibility. Additionally, Man Industries Ltd’s inclusion in QatarEnergy LNG’s approved vendor list marks a major milestone for Man Industries Ltd, allowing it to access high-value LNG infrastructure projects. A key differentiator for Man Industries Ltd is its status as an API-certified manufacturer of LSAW, HSAW, ERW pipes and Coating products, which enable it to meet the stringent International standards mandatory for oil & gas, water, hydrocarbon, and CGD applications. API certifications are Internationally accepted quality standards laid down by the American Petroleum Institute (API), which are mandatorily required to produce high-pressure line pipes for hydrocarbon applications.

Experienced and Qualified Management – Man Industries Ltd benefits from a strong leadership team, including Dr. Rameshchandra Mansukhani, the Chairman, a first-generation entrepreneur with around 40 years of extensive experience and a Ph.D. in International Economics and Finance. Mr. Nikhil Mansukhani, the Managing Director, is a second-generation entrepreneur with over 8 years of experience in the steel pipes industry, spearheading business development and capex plans

What are the Risks of Investing in Man Industries Ltd

Susceptibility to cyclicality in end-user industries and to volatility in raw material prices and forex rates – Man Industries Ltd remains susceptible to cyclicality in end-user industries, volatility in raw material prices, and forex fluctuations. With a significant revenue share from the oil & gas segment, past slowdowns due to falling crude prices have impacted operations. Sustained demand from oil & gas projects in India and the Middle East is therefore critical. Man Industries Ltd’s performance is also influenced by government policies, trade duties, and tender-based contracts with a 2-4 months lead time, which are fixed-price in nature and limit the ability to pass on cost escalations. Additionally, exposure to currency movements poses risks, as reflected in forex losses during FY23, particularly if Man Industries Ltd becomes a net importer.

Delay in commercialization & ramp-up of Jammu and Saudi plants – The Jammu stainless steel plant, originally scheduled for commissioning in Q3/Q4FY24 and later deferred to Q3/Q4 FY25, is now expected to commence operations by Q3FY26. The delay primarily stemmed from land acquisition challenges in Jammu, which extended the timeline by nearly a year. Any further delay will affect the profitability

Promoter Disputes & Regulatory Issues – Man Industries Ltd promoter groups, primarily from the Mansukhani family, have been involved in protracted legal and regulatory disputes. The conflict revolves around two promoter factions: the RCM Group (led by Mr. R. C. Mansukhani and Mr. Nikhil Mansukhani) and the JCM Group (represented by Mrs. Anita Mansukhani and M/s JPA Holdings Pvt. Ltd.).

The dispute centers on the ownership and title of shares, as well as entitlement to dividends. This has resulted in a significant amount of dividends being held in abeyance in unpaid dividend accounts, which raises concerns about potential dilution of shareholder returns and governance issues.

On December 21, 2018, SEBI imposed a ₹10 Cr penalty jointly and severally on Mr. Nikhil Mansukhani (RCM Group), Mrs. Anita Mansukhani, and M/s JPA Holdings Pvt. Ltd. (JCM Group) for alleged violations of the SAST Regulations, 1997. The penalty relates to share acquisitions and warrant conversions in 2010 that caused the promoters’ shareholding to exceed the 55% threshold without required regulatory compliance. This matter remains sub judice before the Supreme Court, contributing to ongoing legal overhang risks for the company.

Competition –Man Industries Ltd faces significant competition from other players in both domestic and international markets, including Indian, Chinese, Korean, and Japanese manufacturers. The industry has also seen consolidation, with larger players gaining dominance, particularly in the Electric Resistance Welded (ERW) segment.

Man Industries Ltd Future Outlook

We believe that Man Industries Ltd has stellar growth potential on the back of its foray into the high-margin Stainless Steel Seamless Pipe segment with a 20,000 MTPA facility, Strategic expansion in Saudi Arabia with a 3,00,000 MTPA HSAW Pipe plant. Healthy business relations with marquee clients across the public and private domains through API-certified operations, and EBITDA to improve with a change in product mix.

Both new plants are expected to contribute Rs 3000 Cr plus in revenue at full capacity, with an improved margin than the existing products, along with benefits from subsidiaries from the Jammu government, and cash flow from the monetization of non-Core assets of Merino Shelters Pvt Ltd.

Man Industries Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time, price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers, we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Man Industries Ltd Price Charts

On a Daily Chart, the bounce off the March lows was impressive with further follow through seen in May on the back of high volumes that took the price above the 200 DMA. The shaded range is crucial to hold in the face of the current correction. This is a business that has a high exposure to the export market which is not the market’s preference right now. Q1 results were disappointing and not up to the market expectations. While the March 2025 bottom may hold up, the short term trend isn’t showing any great strength right now given the broader market conditions.

The weekly chart indicates a clear consolidation pattern post the sharp up move once the Nov 2021 high was taken out. The market is waiting for the capex to get commissioned and for the earnings to show a spike for the price to take out the previous high. On a fundamental basis, the business traded above 20x TTM earnings multiple for a short period of time before the 2025 market correction brought it down to the current range of 16-18x. Intuitively, this correlates well with the delay in plant commissioning which set back the earnings upgrade by 3-4 quarters.

Given that this business has rarely traded at a multiple above 20x TTM earnings, capex commissioning and quick ramp up are the key variables to monitor rather than obsess over the technical chart.

Man Industries Ltd Latest Result, News and Updates

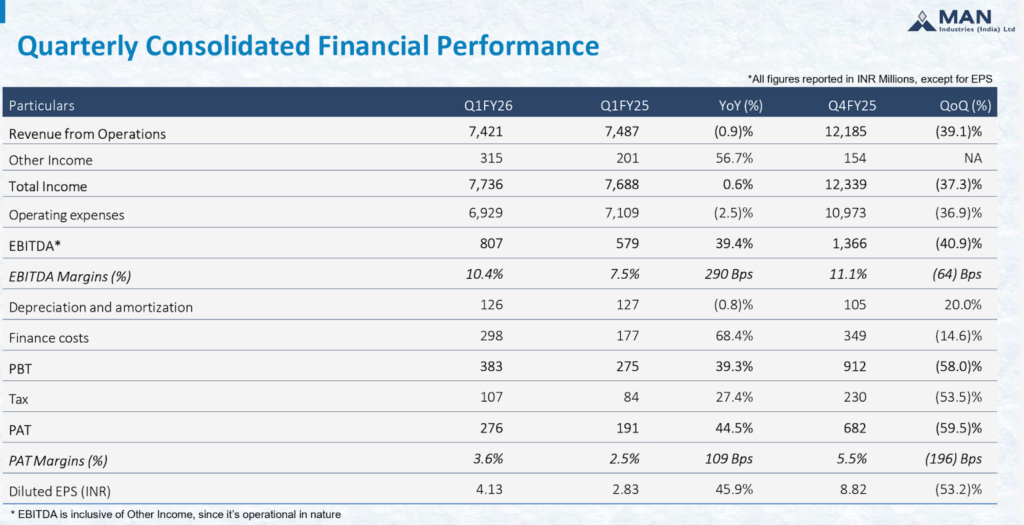

Man Industries Ltd Quarterly Results

Man Industries Ltd revenue at INR 772 Cr, a marginal YoY decline of 0.9%, attributed to the deferment of export shipments worth INR 150 Cr due to geopolitical disruptions. EBITDA surged 39% YoY to INR 80.6 Cr. EBITDA margin expanded by 290 bps to 10.86% from 7.73% YoY. PAT increased 45% YoY to INR 27.6 Cr, PAT margin improved by 110 bps to 3.6% from 2.59%.

Order book stands at Rs 3,200 cr (~80% exports) with an execution span over the next 6-12 months. Bid pipeline remains robust at Rs 15,000 cr. The management expects incremental inflows of ~Rs 2,000 – 2,500 Cr during the year.

Merino Shelter asset monetization – The project in which the company is entitled to 30% of the total developed property (~4,50,000 square feet of RERA carpet) is expected to be launched in 2QFY26/3QFY26, following which the company expects to receive ~Rs 70-80 cr in FY26. Post-FY26, the inflows shall average to about Rs 80-100 cr for a period of 5 years.

Project update -The Jammu & Saudi plants are expected to be commissioned by 3QFY26/4QFY26.

Project specifications for the Jammu have been revised, as the company plans to install a capacity of 22,000 metric tonnes (vs 20,000 MT earlier). This shall command an incremental capex of ~Rs 30 cr.

The management expects a peak revenue contribution of ~Rs 3,000 Cr (Increased Guidance from 2000 Cr) from the Saudi plant. At present, there is a demand-supply mismatch in the Saudi market, which is expected to continue for another 3-5 years. The management anticipates ~15-20% topline growth for FY26, with expectations of 2HFY26 spanning out much better than 1QFY26.

Final thoughts on Man Industries Ltd

The entire SAW pipes industry in India has seen a significant uptick over the last few years thanks to a revival in global oil and gas capex and strong capital expenditures by India on water transmission projects. Man Industries Ltd has benefitted from the same trends. It currently has a healthy order book mainly from the O&G segment and is embarking on two large capex projects which should improve its EBITDA margins. The monetization of the land held under their subsidiary Merino Shelters Pvt. Ltd. should aid the capex initiatives and debt paybacks.

Once the two projects start ramping up, the profitability of Man Industries Ltd should significantly improve in FY27 and FY28. Man Industries Ltd has a reasonably healthy balance sheet. However, investors should always keep an eye on end industry demand in oil & gas and the water sector. Any slowdown in these sectors will impact the whole SAW pipes industry, including Man Industries Ltd.

Our view is that multiple rerating is not a high probability in such old economy businesses where narratives cannot be built, given that the stock has been listed for a long time. The right lens would be earnings breakout and all of our efforts should be focused there. Once the capex gets commissioned, there could be 1-2 quarters where the effects of depreciation, finance cost & other expenses may depress earnings on a YoY basis before the earnings uptick materializes due to higher revenue. Q3 and Q4 of FY26 thus becomes important milestones for this business.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this to a general audience. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will continue/be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.