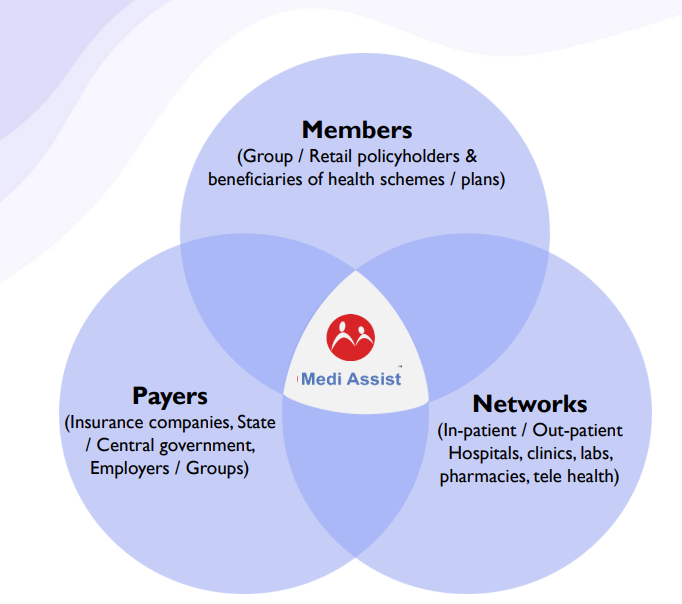

Medi Assist Healthcare Services Limited is into providing Third Party Administration (TPA) services in India to insurance companies. Medi Assist Healthcare Services Limited acts as a facilitator between (a) insurance companies and their policyholders, (b) insurance companies and healthcare providers (such as hospitals), and (c) the Government and beneficiaries of public health schemes. Through its subsidiary, Mayfair We Care UK acquired in 2022, Mediassist provides benefits administration services to Indian corporates in global markets as well.

Proxy Play for the Health Insurance Sector – Medi Assist Healthcare Services Ltd is a pivotal player in India’s growing health insurance ecosystem, offering a strong proxy to participate in the sector’s structural growth (expected CAGR: 18–19% over the next 2–3 years). As the largest and most profitable TPA, Medi Assist Healthcare Services Ltd benefits from industry consolidation, increasing health insurance penetration, and its leadership in scale, technology, and client relationships. With a track record of successful acquisitions., Medi Assist Healthcare Services Ltd is emerging as a key consolidator in a maturing market. A robust balance sheet, sticky insurer relationships, and global expansion through Mayfair We Care Ltd further add to its appeal.

Medi Assist Healthcare Services Ltd Company Summary

IRDAI introduced TPA regulations in 2001 to offer impartial and efficient health benefits administration. Medi Assist India TPA Pvt. Ltd was established in 2002 is one of the earliest IRDAI-licensed TPAs in India

Medi Assist Healthcare Services Ltd provides third-party administration services to insurance companies and corporations. As a third-party administrator (TPA), it acts as a facilitator between insurance companies, policyholders, and healthcare providers (hospitals) as well as the government and beneficiaries of public health schemes. The services include processing health insurance claims, handling customer grievances, customer relations, contract management, billing, and other services.

Medi Assist was initially mentored and seed funded by Infosys co-founder NS Raghavan, through his private investment firm, Nadathur Investments. During 2006, Reliance Health (Anil Dhirubhai Ambani Group) acquired Medi Assist. In 2011, the Medi Assist Management team with the help of Private Equity Firm – Bessemer Venture Partners, bought out both Reliance and Nadathur Group’s stake. Post the deal, Dr. Vikram Chhatwal, who was CEO of Reliance Health, quit his job to head Medi Assist.

Since then Medi Assist Healthcare Services Ltd has transformed into India largest TPA and is currently managing over ₹ 19050 Cr in health insurance premiums across retail and group policies, amounting to around 20% of the total health insurance premiums in the country (across Group & Retail segment). With a pan-India presence across 1,066 cities and towns, they have built trusted relationships with 35 insurance companies and over 19,305 hospitals.

Medi Assist Healthcare Services Ltd Company Structure

Medi Assist Healthcare Services Ltd (the holding company) operates through 7 subsidiaries, of which 4 are direct subsidiaries and 3 are indirect. Going forward Medi Assist Healthcare Services Ltd aims to simplify its business structure. It has already consolidated all TPA business under Medi Assist Insurance TPA Pvt Ltd and is planning to consolidate international operations under one subsidiary.

On August 26, 2024 Medi Assist Healthcare Services Ltd announced acquisition of 100% stake in Paramount TPA from Fairfax Asia and the Shah family through Medi Assist Insurance TPA Pvt Ltd. which is expected to reflect into consolidated financials soon. As on 21 March 2025, acquisition-related approvals are pending IRDAI.

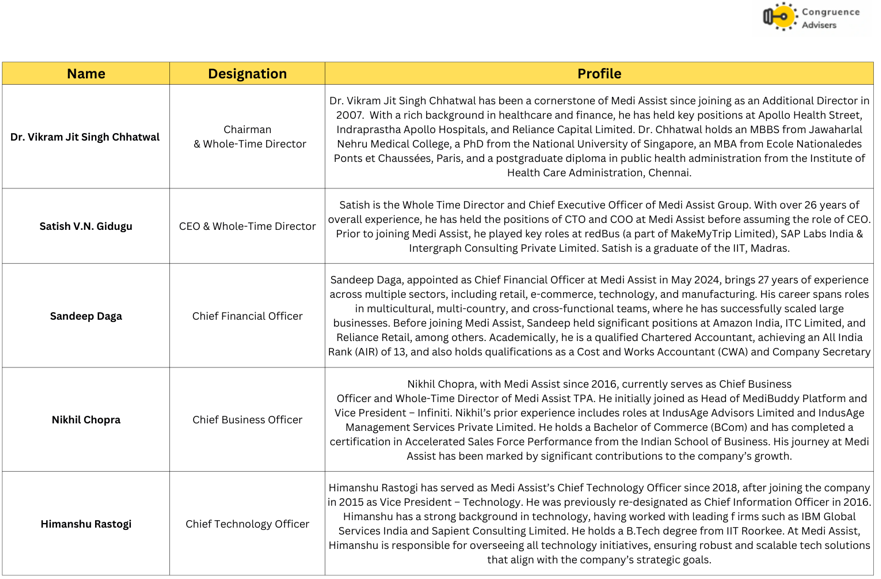

Medi Assist Healthcare Services Ltd Management Details

Medi Assist Healthcare Services Ltd is promoted by Bessemer Venture Partners American venture capital and private equity firm with assets under management (AUM) of over USD 20 billion as on March 31, 2024

Post the investment of Bessemer Venture Partners, Dr. Vikram jit Singh Chhatwal, who was the CEO of Reliance Health, quit his job to head Medi Assist Healthcare Services Ltd.

Dr. Vikram Jit Singh Chhatwal studied medicine in both India and Singapore. At Reliance Health, he had been involved in setting up the Kokilaben Dhirubhai Ambani Hospital and Medical Research Institute. Prior to that, he was the CEO of Apollo Health Street and had a concurrent position as the CIO for the Apollo Group. Satish V. N. Gidugu, currently CEO & Whole-Time Director, has over 20 years of experience in information technology. He joined Medi Assist Healthcare Services Ltd in 2013 as Chief Technology Officer and was elevated to the role of Chief Operating Officer in 2015. They are supported by a team of qualified professionals with expertise in their respective fields.

Medi Assist Healthcare Services Ltd – Industry Landscape

India Insurance Sector

As of March 31, 2024, India has 73 registered insurance companies, including three new entrants added in FY24—one in the life insurance segment and two standalone health insurers.

Historically, the Indian insurance sector was dominated by government-owned entities—LIC in the life insurance space, and National Insurance, United India Insurance, Oriental Insurance, and New India Assurance in the non-life segment. However, the liberalization of the sector in 2000 marked a turning point, allowing private companies to enter the market and making the industry more competitive. Today, the sector comprises of 26 life insurers, 25 general insurers, 8 standalone health insurers, 12 Reinsurance & FRBs and 2 specialized insurers

In FY24, the Indian insurance industry issued approximately 36.5 crore policies, generating a total premium income of ₹11.2 Lakh Cr of which Life insurance accounts for 75% of the premiums, while general insurance and health insurance accounted for 15% and 10%, respectively. The industry paid out ₹7.66 Lakh Cr in claims during FY24, translating to an overall claim settlement ratio of 68%. Segment-wise, the settlement ratios stood at 70% for life insurance, 58% for general insurance, and 75.4% for health insurance.

India’s insurance sector manages assets under management (AUM) of ₹67.57 Lakh Cr, with life insurance companies holding 91% of the total AUM. This is largely due to the long-term nature of life insurance products, in contrast to the typically short- to medium-term horizon of general and health insurance offerings.

In 2023-24, India’s insurance penetration (as the percentage of insurance premiums to GDP) was at 3.7 per cent as compared to 4 per cent in 2022-23. The insurance penetration for Life Insurance industry marginally declined from 3 per cent in the previous year to 2.8 per cent during 2023- 24. The penetration with respect to Non-Life Insurance Industry remained same at 1 per cent during 2023-24 as in 2022-23.

India’s insurance distribution network is powered by a vast and diverse force of over 75 lakh intermediaries led by individual agents (49 lakh) and POSPs (21 lakh). Alongside them, a network of brokers, corporate agents, Insurance Marketing Firms (IMF), Motor Insurance Service Provider (MISP), and web aggregators ensure last-mile coverage. Even niche players like micro insurance agents (1 lakh) play a critical role in rural outreach.

Health Insurance Sector

In the Indian health insurance segment, multiple growth levers are at play. While pandemic has significantly increased awareness of the need for health insurance cover, a higher number of patients, rising medical inflation, government initiatives, and increased affordability, have together boosted demand for health insurance policies.

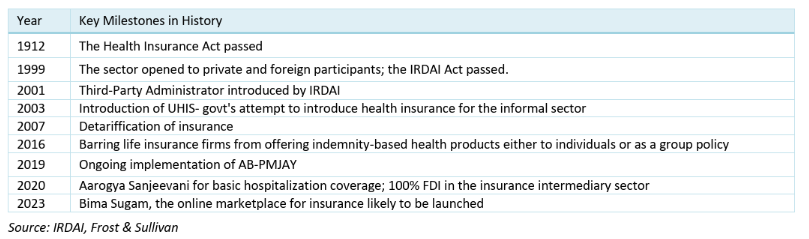

India’s insurance sector has evolved significantly over the last century, beginning with the Health Insurance Act in 1912. Liberalization in 1999 opened the doors to private and foreign players, followed by structural reforms like TPA introduction (2001) and de-tariffication (2007). Recent milestones include the launch of Aarogya Sanjeevani (2020), Proposed rollout of Bima Sugam, a digital insurance marketplace, in 2023 and the most recent one is Union Budget 2025 increasing the sectoral cap of insurance sector for FDI investments to 100% from 74%. This is expected to lead to deeper capital participation, higher global interest and deeper integration with global best practices. Along with the above, the recent proposal to provide healthcare coverage to gig workers as part of the PM Jan Arogya Yojana is also a positive development.

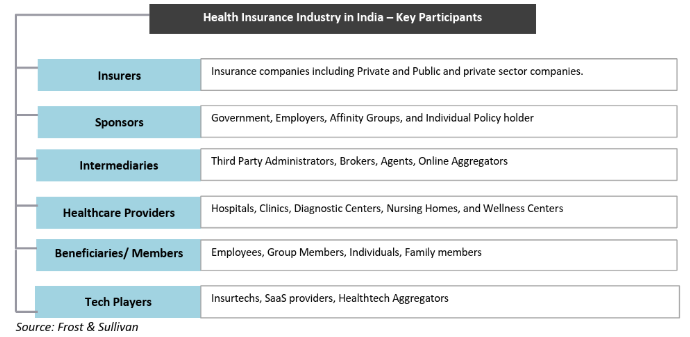

Key Participants in Health Insurance Industry

Health insurance players in India are broadly classified into three categories:

- A. Public sector insurers (Government Owned) and B. Private insurers offering multi-line products, where health insurance is sold alongside other segments like motor, fire, etc

Public sector insurers are New India Assurance, National Insurance, Oriental Insurance, and United India Insurance.

Private insurers are ICICI Lombard General Insurance, TATA AIG General Insurance, HDFC ERGO General Insurance, Bajaj Allianz General Insurance, SBI life insurance, Go Digit General Insurance, ACKO General Insurance.

- Specialized health insurance companies (SAHIs), which are monoline insurers focused exclusively on health insurance, offering products tailored specifically for health coverage needs.

Examples: Care Health Insurance, Star Health and Allied Insurance, Niva Bupa Health Insurance (formerly Max Bupa), and Aditya Birla Health Insurance.

Health Insurance Premium Growth

An estimated 40% of the population is covered by a health insurance policy (retail + group + government scheme policies excluding schemes run by the government directly). From a retail policy coverage standpoint, only 4% of the population is covered under health insurance.

Health Insurance premiums in India have grown from 20000 Cr in FY15 to 1.07 Lakh Cr in FY24 with 20% CAGR. (22% CAGR during FY15–FY19 & 20.7% CAGR during FY15–FY24). Total lives covered reached 57.9 crore in FY24, up from 28.8 crore in FY15.

Interesting thing to note here is that the growth in industry premiums during FY15-FY19 is split between both premium inflation and growth in no. of lives covered. While, during FY20-FY24, the 20%+ CAGR in total premium growth has largely been driven by premium inflation as lives covered have grown at only a measly CAGR of 3.5%.

Going forward, health Insurance Premiums are expected to grow at 18-19% over the next 2-3 Years

Group health premiums grew at a 20.37% CAGR (FY19 – FY24), while lives covered expanded at a faster pace of 28.6% CAGR, showing strong volume-led growth. The number of lives covered under group insurance tripled from 7.3 Cr in FY19 to 25.6 Cr in FY24, as post-COVID awareness led to even small and medium enterprises extending health insurance benefits to employees.

While, Govt-sponsored health schemes witnessed a decline in lives covered (-7.8% CAGR) over the same period, this could be due to policy realignments, tighter targeting, or rationalization of existing programs. Retail segment growth was driven by pricing, Premium CAGR (20%) significantly outpaced growth in lives covered CAGR (~6.6%). One reason for this can be higher per-policy ticket sizes, possibly due to greater demand for comprehensive or high-sum insured products in the post-pandemic environment.

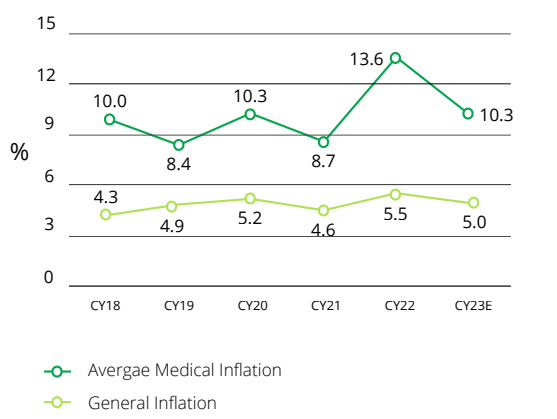

Indian Medical Inflation rate double of general inflation (CPI)

The Indian healthcare sector, while witnessing substantial growth, is also grappling with the rising costs of healthcare services. This surge in costs is driven by several factors, including medical inflation, technological advancements, and increased demand for healthcare services.

Health Insurance Premium Share State/UT Wise

Top 3 states account for 50% of health insurance premiums and Top 7 accounts for 70%. This concentration can be due to the fact that most large corporations have their headquarters or major operations in these urbanized and economically active hubs, resulting in higher group insurance uptake.

Maharashtra continues to dominate India’s health insurance market at 29% of the total premium in FY24 which reflects its strong corporate base. Southern states like Karnataka, Tamil Nadu, and Telangana have contributed around 26% of premium while Gujarat, Delhi and Haryana contribute around 7.85%, 6.57% and 5.24%.

Health Insurance Players Market Share & Claims Ratio

Both Standalone Health Insurance (SAHIs) and Private sector general insurers have posted very strong growth of 25% in the health insurance segment in FY24. Both SAHIs and Private sector general insurers have been gaining market share at the expense of Public sector general insurance companies since FY20. The market share of SAHIs has been on an upward trend, reaching 30% of the overall health insurance premium and 56% for retail health insurance premium in FY24.

Public Sector Insurers continue to struggle with high incurred claims ratios (ICRs) across business lines, mainly due to higher proportion of govt business, weaker underwriting controls and higher legacy claims.

Private Sector General Insurers, while showing relatively better ICRs than their Public Sector Insurers counterparts, still lag behind Standalone Health Insurers (SAHIs). Private Sector General Insurers focus more on group business (contributing 60%), their business model benefits from scale and business diversification.

SAHIs showcase better underwriting performance due to their retail-focused approach (contributing 73% to SAHIs Gross Direct Premium Income – GDPI) as the retail segment generally exhibits lower claims ratios across all types of insurers. SAHIs exclusive focus on health enables them to offer a range of specialised products for different population cohorts, customer service and claims handling tailored to the healthcare market and their ability to analyse risks in the segment and manage the healthcare enterprises network and the management of claims is better than other types of insurers. ICRs of SAHIs are also likely low due to the high rate of new business growth. Many SAHIs have grown their new business significantly over the last few years. In the initial years, products have a minimum waiting period which leads to lower initial ICRs. The return metrics of SAHIs are yet to come on par with private multi-line general insurance companies, which benefit from scale and diversified lines of businesses.

TPA Industry

The origin of Third-Party Administrators (TPAs) goes back to the US market, where entrepreneurs entered the insurance business in the late 1960s and 70s to capitalize on its growth potential. These entrepreneurs reduced the insurers administrative and claims management tasks by offering these services for a fee, which led to the birth of the TPA industry. Companies like Sedgwick started as small regional claims administrators for large insurance companies and grew successfully thereafter by expansion like most others in the TPA industry globally.

The concept of Third-Party Administrators (TPAs) in India emerged in the late 1990s as part of the liberalization of the insurance sector. By 1995, 2 million people had enrolled in the health insurance plans offered by the four public sector insurers. The industry started expanding with increasing coverage from corporates, removal of sub-limits, and availability of custom insurance plans. So did the services offered by insurers, such as 24X7 call centers, to address policyholders’ queries and direct settlement with the hospitals.

IRDAI introduced Third-Party Administrators (TPAs) regulations in 2001 following the Insurance Regulatory and Development Authority’s (IRDA) recognition that processing health insurance claims internally was neither efficient nor sustainable for insurers. To address this, IRDA introduced Third-Party Administrators (TPAs) in 2001, so that TPA’s could lead to building trust in the health insurance ecosystem by ensuring timely and efficient claims processing. By outsourcing this function, insurers could enhance responsiveness without overextending internal resources, while TPAs, in turn, benefited from economies of scale by serving multiple insurers and corporate clients.

The first TPA in India- Medi Assist India TPA Pvt. Ltd was established in 2002. While TPAs in India were initially primarily involved in processing claims for health insurance policies, their role expanded to include other functions such as policy administration, customer service, and provider network management.

The Indian healthcare insurance sector is experiencing a significant boom, driven by rising healthcare costs, increasing awareness, and supportive Government policies. As this sector expands, Third-Party Administrators (TPAs) are becoming increasingly crucial in managing the complexities of health insurance

Core Functions of TPAs

The core functions encompass several key areas:

Healthcare Provider Management – Streamlines patient interactions by coordinating communication, processing claims, verifying eligibility, and managing submissions. It also handles denials, appeals, and offers cashless treatment support with pre-authorisation arrangements.

Member and Beneficiary Services – Helps Members to navigate the complexities of health insurance. They assist with understanding coverage, processing reimbursements, and accessing healthcare providers. These services also include educating members about treatment options, coordinating appointments and transport, and resolving billing disputes—ensuring a smoother and more informed healthcare experience.

Insurer Support – focuses on managing provider networks, offering 24/7 customer service, preventing fraud, and enabling data-driven policy design through digital tools and analytics.

In addition to their core functions, TPAs in India also contribute significantly to public health insurance schemes by conducting outreach and verifying beneficiaries.

With the evolving insurance landscape, some TPAs are transitioning into Health Benefits Administrators (HBAs), expanding their roles to include enrolling members, managing eligibility, facilitating access to healthcare networks, educating beneficiaries, and implementing technology-driven efficiencies. They are also focusing on areas like medical inflation management, value-based care, analytics, and fraud prevention to improve overall healthcare delivery and cost efficiency.

Global TPA’s Vs INDIAN TPA’S

The Indian TPA industry remains healthcare-focused and is still evolving compared to global peers, which offer broader insurance services and operate independently. However, with rising digital adoption and a shift towards platforms, Indian TPAs are poised for a significant transformation over the next five years, led by players like Medi Assist Healthcare Services Ltd.

Benefits of TPAs To Stakeholders

Types of Claims Administered by TPAs

TPA Players & Their Hospital Network

As of 31st March 2024, there were 19 active TPAs in India. Two new players i.e. AKNA Health Insurance TPA Pvt. Ltd and Link-K Insurance TPA Pvt. Ltd. were registered during FY24. These TPAs significantly expanded hospital access by adding 69,334 health service agreements to their network. After accounting for withdrawals/removals of 10,782 agreements, the total network stood at 2.44 lakh agreements as of March 2024.

Currently there are 16 TPA’s, Raksha & Medvantage has been merged with Medi Assist Healthcare Services Ltd. For Paramount TPA’s acquisition by Medi Assist, the final approval is pending with the regulator.

Data on Claims Paid under Health Insurance Businesses of General and Health Insurers (FY23)

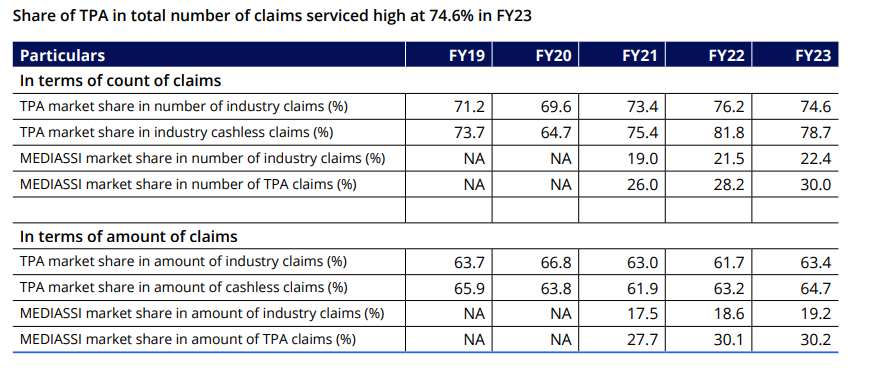

During FY23, General and Health Insurers have settled 2.36 crore number of health insurance claims and paid 70,930 crore towards settlement of health insurance claims. The average amount paid per claim was 30,087. In terms of the number of claims settled, 75% of the claims were settled through TPAs and the balance 25% of the claims were settled through in-house mechanisms. In terms of mode of settlement of claims, 56% of the total number of claims were settled through cashless mode and another 42% through reimbursement mode. In terms of value TPA settled 64% of health insurance claims

With the increase in the volume of claims and the complexity of products, TPAs have become indispensable to the healthcare ecosystem. TPA-serviced premium as a percentage of total industry premium was constant at 54.6% over FY18–22 but is expected to improve to 61.2% by FY28 as forecasted by Frost & Sullivan. The number of claims in the industry has increased at a CAGR of 7% in FY19–23, while TPA-serviced claims have grown faster at 8.3%, resulting in TPA market share improvement to 74.6% of the number of claims in FY23.

Medi Assist Healthcare Services Ltd has emerged as the market leader among TPAs, handling 30% of total TPA claim volumes and 30.2% of TPA claim amounts in FY23

Medi Assist Healthcare Services Ltd Business Details

Medi Assist Healthcare Services Ltd operates across three key verticals: Group Business, Retail Business, and Government Business. In the Group and Retail segments, Medi Assist Healthcare Services Ltd earns revenue as a yield on the premium, while in the Government segment, it charges a fixed fee per family per year. This revenue model has remained consistent over the past 25 years in the Indian market, and Medi Assist Healthcare Services Ltd does not anticipate any significant changes to it in the foreseeable future.

Group Business – Medi Assist Healthcare Services Ltd works with corporates in a diverse range of industries and sectors to help administer the insurance requirements of their employees. Medi Assist Healthcare Services Ltd facilitates seamless management of group health insurance policies, including enrolment & claims processing. Medi Assist leverages its advanced data analytics capabilities to provide corporate clients with customized reports and insights, helping them make informed decisions about their employee health benefits programs. Medi Assist Healthcare Services Ltd works with 28 Insurance companies in a group portfolio.

In addition to its strong domestic presence, Medi Assist Healthcare Services Ltd has extended its reach internationally through Mayfair Uk. This global platform allows the company to serve corporate clients with cross-border operations.

Medi Assist Healthcare Services Ltd entered the group business at a time when several large insurers began internalizing claims administration, reducing their reliance on TPAs. In response to this industry shift, Medi Assist Healthcare Services Ltd focused on building strong relationships with a robust portfolio of corporate clients, including marquee names like Infosys and TCS. This move enabled the company to retain a significant share of the group insurance market

TPAs Group PUM has increased from ₹10,000 Cr in FY18 to around ₹33,000 Cr in FY24, TPAs like Medi Assist Healthcare Services Ltd are particularly relevant in the group segment, where employers hold stronger bargaining power with the insurer. By mandating a specific TPA’s involvement, corporates can ensure timely, transparent, and independent claims processing, thereby reducing reliance on insurers and enhancing employee satisfaction.

Medi Assist Healthcare Services Ltd serves a broad base of over 10,500 corporate clients across India. The TPA Regulations allow the policyholder to choose a TPA of their choice from the TPAs engaged by the insurer. The insurer is required to provide the names of the TPAs amongst whom the policyholder may choose the TPA of their choice at the point of sale or at the time of renewal of the policy. The good part for Medi Assist Healthcare Services Ltd. is that it is able to retain ~94% of contracts in group policies (which account for 88% of its PUM) and its top 10 corporate clients have maintained relationships for an average of 8.3 years, which reflects Medi Assist Healthcare Services Ltd strong client satisfaction and long-standing relationships with group accounts.

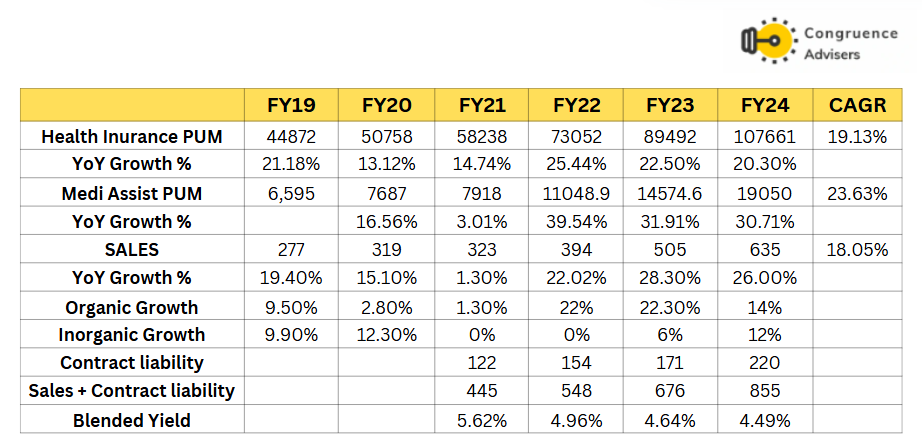

Medi Assist Healthcare Services Ltd Group PUM has grown at 23.6% CAGR, While Group sales have grown relatively slower at 19.9% CAGR over the last 5 years. Disparity indicates a compression in yield, likely due to intensified competition within the group insurance segment. Group accounts for 88% of PUM & 72% sales in FY24 for Medi Assist Healthcare Services Ltd.

Group Contract Liability is calculated based on the ratio of its group sales to the total sales*

Group products generally have take rates ranging from 2.5-4.5%, varying from contract to contract.

Retail Business – Medi Assist Healthcare Services Ltd provides TPA’s services to individual insurance policyholders and acts as the intermediary between the insurance companies, hospitals, and the insured members.

Medi Assist Healthcare Services Ltd has collaborations with 16 retail insurers including Public insurers , Private insurers and Standalone health insurance (SAHI) companies in its retail portfolio and is actively seeking to secure additional partnerships in this segment to further expand its market presence and increase its share of their business. To cater to insurance companies that have in-house claims processing, MEDI offers modular services including providing access to its comprehensive network and pricing, advanced claims processing capabilities, and state-of-the-art technology.

Medi Assist Healthcare Services Ltd has recently added 3 private insurance companies in the retail segment and in the majority of the new business contracts on Retail, Medi Assist Healthcare Services Ltd caters to nearly 100% at a product level or a portfolio level.

Medi Assist Healthcare Services Ltd Retail PUM has grown at 9.3% CAGR, While Retail sales have grown relatively slower at 7% CAGR over the last 5 years. Retail accounts for 12% of PUM & 11.5% sales in FY24 which indicates retail business is relatively high-margin business.

*Retail Contract Liability is calculated based on the ratio of its group sales to the total sales

Retails products generally have take rates ranging from 2.5%-3% up to 5.5%

TPAs have a lower share in the industry retail premium than group premiums, as insurers tend to retain claims processing in-house for retail business. The retail health segment is dominated by SAHIs, which prefer in-house claims processing. This restricts scope for TPA outsourcing in the retail segment.

Medi Assist Healthcare Services Ltd’s expanded its portfolio and added new services to both segments such as telemedicine, cashless hospitalisation and post-hospitalisation care, which enables Medi Assist Healthcare Services Ltd to meet the diverse needs of both insurers and policyholder

Medi Assist Healthcare Services Ltd engages in non-exclusive agreements with insurers, typically spanning one to three years, with provisions for early termination or renewal at the insurer’s discretion. Corporate contracts are generally annual. Renewal decisions are influenced by factors such as pricing negotiations, service quality, customer satisfaction, compliance with service level agreements (SLAs), and the breadth of Medi Assist Healthcare Services Ltd’s hospital network.

.

Government Business – Medi Assist Healthcare Services Ltd plays a crucial role in administering large-scale Government sponsored health schemes, ensuring that healthcare benefits reach the most vulnerable populations. Medi Assist Healthcare Services Ltd participates in this segment through two models:

1. Insurance model (B2B2C model) – Government uses insurance companies for underwriting public health schemes.

2. Assurance mode (B2G2C) – Government directly pays for healthcare expenditure and administration costs. Medi Assist Healthcare Services Ltd collaborates with Government entities to implement public health initiatives aimed at improving healthcare access and outcomes for underserved communities. Medi Assist Healthcare Services Ltd’s technological capabilities and experience in claims processing positions it well to support and benefit from the growing Government-led health insurance market.

In the Government segment, Medi Assist Healthcare Services Ltd charges a fixed fee per family per year and the government segment contributed 10.1% to sales in FY24.

As per recent exchange filings – ED has conducted search and seizure at certain offices of Medi Assist Insurance TPA Private Limited situated at Ranchi, Jharkhand on April 4, 2025 for alleged irregularities in certain Ayushman Bharat linked health schemes. At this stage, the officials have not shared any details with the Company in this regard.

Medi Assist Healthcare Services Ltd Healthcare Provider Network

Medi Assist Healthcare Services Ltd. has established a comprehensive healthcare provider network across India, comprising over 19,305 hospitals in 1,066 cities and towns across 31 states and union territories. This extensive network facilitates seamless cashless hospitalization services for policyholders.

Leveraging its market leadership, advanced technology platforms, and the substantial volume of claims it administers, Medi Assist Healthcare Services Ltd has negotiated discounted rates and preferential packages with many hospitals. As a result, 23 general and health insurance companies benefit from these negotiated discounts, with 14 insurers relying exclusively on Medi Assist Healthcare Services Ltd’s network. Additionally, Medi Assist Healthcare Services Ltd offers insurers pre-negotiated packages for common medical procedures, enhancing cost efficiency and streamlining the claims process.

Medical inflation in India is around 14-15%. Medi Assist Healthcare Services Ltd has reiterated its ability to reign it at 4-5 per cent continuously

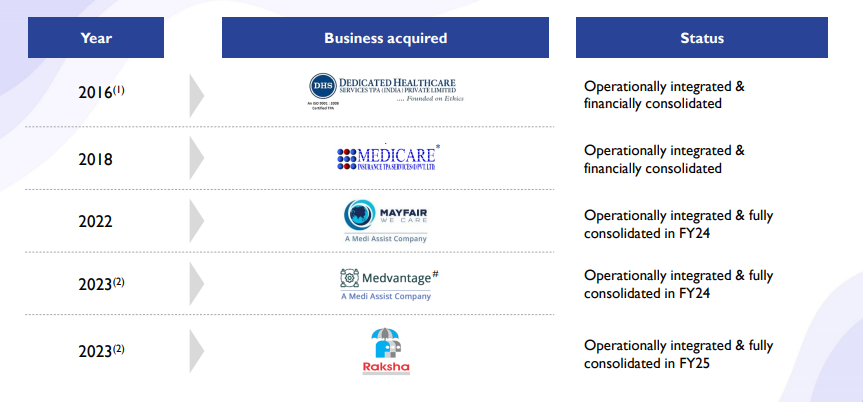

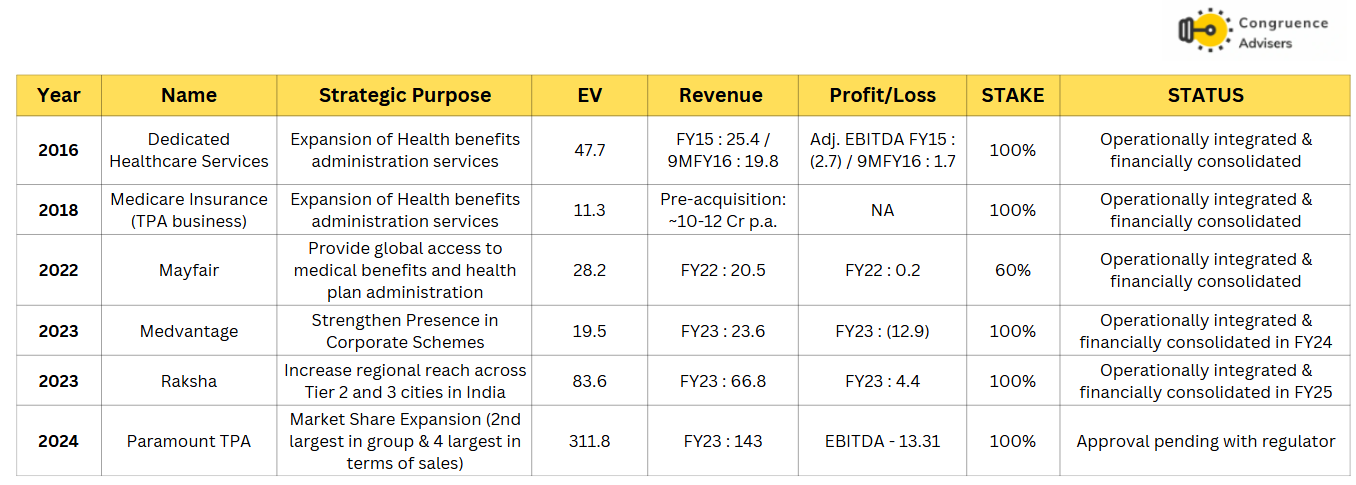

Medi Assist Healthcare Services Ltd Acquisitions History

Medi Assist Healthcare Services Ltd has completed 5 acquisitions in the past 8 years funded through internal accruals. Medi Assist Healthcare Services Ltd has demonstrated the ability to acquire companies in related businesses, successfully integrate them, and scale them up. For instance, the margins of acquired businesses (Raksha and Medvantage) have increased after integration. Also, the retention rate of the acquired entities has improved. All of them are operationally integrated and fully consolidated in Medi Assist Healthcare Services Ltd.

On August 26, 2024 Medi Assist Healthcare Services Ltd announced acquisition of 100% stake in Paramount TPA for EV of 312 Cr. This acquisition is significant as it represents one of the largest deals in the Third Party Administrator (TPA) space in India. It marks Medi Assist Healthcare Services Ltd third acquisition in the last three years and fifth overall in the Indian TPA sector.

Paramount TPA is the fourth largest TPA in India by total revenues and second largest TPA in group segment by premiums in India, on FY24 basis. In terms of market share, Paramount TPA had 6.2% in the group segment and 4% of the total health insurance industry by premiums, on FY24 basis.

Paramount TPA is expected to reflect in consolidated financials soon. As on 21 March 2025, acquisition-related approvals are pending with IRDAI.

As per the management, it will take 3-4 quarters to realise synergies from the acquisitions and for margins of acquired companies to improve. The ramp-up of these entities could act as a margin-kicker for the Medi Assist Healthcare Services Ltd going forward.

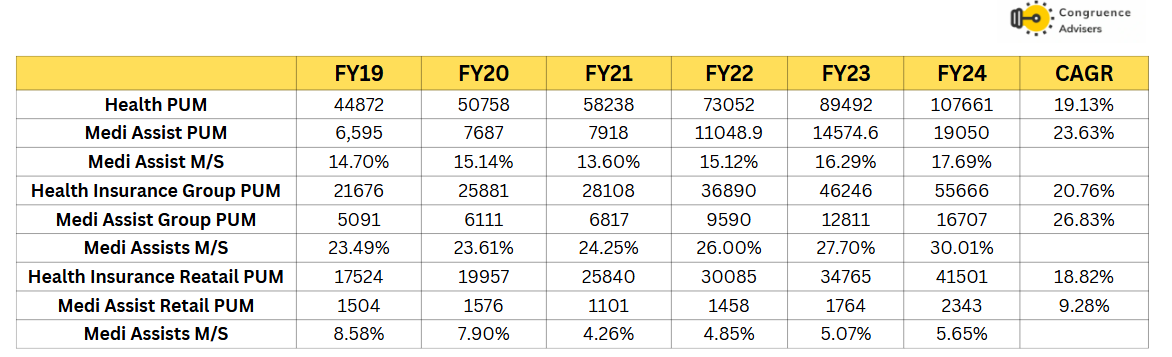

Medi Assist Healthcare Services Ltd Market share

Medi Assist Healthcare Services Ltd market share has increased from 14.7% in FY20 to 17.7% in FY24 in overall health insurance and market share in the group has increased from 23.5%in FY20 to 30% in FY24. The acquisition of Paramount Health Services & Insurance TPA Pvt. Ltd. is poised to further bolster Medi Assist’s market position. This strategic move is expected to enhance Medi Assist’s market share to 23.6% in the overall health insurance industry and to 36.6% in the group segment.

TPA services can be done in-house too. While group policies, which are low-margin products are largely outsourced (close to 70-75 per cent outsourced), retail health policies which are high-margin and have a lower frequency of claims are largely serviced inhouse (30-35 per cent outsourced).

Based on our estimates Medi Assist Healthcare Services Ltd market share in TPA market is estimated at 48-50% of in group premium managed (including Paramount)

Medi Assist’s Innovative Digital Ecosystem

By leveraging cutting-edge technology, Medi Assist Healthcare Services Ltd has created a comprehensive digital ecosystem that seamlessly integrates various aspects of health benefits management. From policy administration and claims processing to data analytics and fraud detection, Medi Assist Healthcare Services Ltd’s platforms are revolutionising how insurers, corporates, and individuals interact with the ecosystem.

Medi Assist Healthcare Services Ltd Corporate governance

We believe that corporate governance is unlikely to be a challenge for Medi Assist Healthcare Services Ltd. as, since its early days, it has secured the investment from reputed Indian VC funds and is currently promoted by Bessemer Venture Partners – an American venture capital and private equity firm which has guided Medi Assist Healthcare Services Ltd. on multiple things, including corporate governance.

Board Composition – Medi Assist Healthcare Services Ltd’s Board of Directors is composed of 9 members, including 5 independent directors and two women directors. They bring together a wealth of experience, diverse expertise, and visionary leadership With backgrounds spanning healthcare, technology, finance, and management

Related Party Transactions – There is no material related party transaction, However it has related party transactions of < 20 cr with Phasorz Technologies Private Limited (related due to common director) which owns Medibuddy, Docs App and Nutty Yogi. It is a Preferred network partner that provides healthcare & wellness services to the customers i.e Reimbursement for health check-ups to Medi Assist Healthcare Services Ltd customers.

Contingent Liabilities – According to the annual report of FY24, the total amount of contingent liabilities amounts to 57.5 Cr of which 46.5 Cr is towards income tax demand for payments made to various hospitals during the FY08 & FY09. This is ~12% of the company’s book value of equity and hence is significant. Potential realisation of these liabilities could be a negative outcome for the company.

KMP Remuneration – KMP Remuneration for FY24 is around INR 5.90 Cr which is around 8.6% of FY24 Net profit.

Audit Committee – Independent director chairs the audit committee and all members of committee are Independent directors. Having a fully independent audit committee is seen as a better corporate governance practice.

Medi Assist Healthcare Services Ltd Financial Performance

Medi Assist Healthcare Services Ltd has printed 18% sales CAGR between FY19-FY24 with FY24 sales having grown 26% YoY primarily driven by increased coverage in both group and retail health insurance portfolios. EBITDA has grown slower during this period, at a CAGR of only ~10%, which shows up in the decrease in EBITDA % from 30% in FY19 to 21% in FY24. The PBT% and PAT% has also reduced accordingly. This delta between sales and EBITDA growth is due to the absorption of several new acquisitions which have not reached full margin potential in FY24.

Medi Assist Healthcare Services Ltd PUM has grown at 23.6% CAGR over FY19–FY24, outpacing the health insurance industry’s PUM growth of 19.1% CAGR during the same period. However, Medi Assist Healthcare Services Ltd sales have grown at a relatively slower pace of 18.1% CAGR, due to compression in blended yield from 5.62% in FY21 to 4.49% in FY24 because of increasing pricing pressure and heightened competition in the TPA space, particularly in the group segment which dominates Medi Assist Healthcare Services Ltd portfolio.

Despite continuous compression in yield Medi Assist Healthcare Services Ltd maintains EBITDA% of 21%. However, as the scale of business expands, Medi Assist Healthcare Services Ltd is strategically trading off lower commission charges in exchange for higher volumes, enabling it to deepen insurer relationships and solidify its leadership position in the market.

* Blended Yield = Sales+ Contract Liability/ Premium Under Management

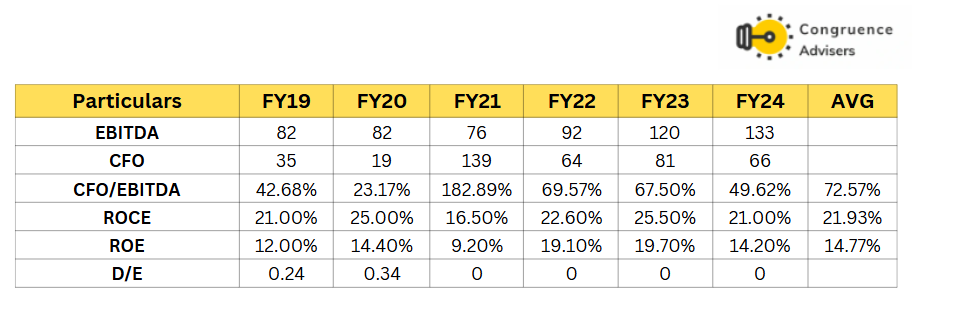

Medi Assist Healthcare Services Ltd Return Ratio, Cash Flow and Debt Analysis

Medi Assist Healthcare Services Ltd’s asset-light approach and negative working capital contributed to strong cash flows. Both ROE & ROCE have decreased YoY due to recent acquisitions, where synergies are yet to be realised

Medi Assist Healthcare Services Ltd maintains strong liquidity, with ₹296.5 crore in cash and liquid investments as on December 31, 2024.

Medi Assist Healthcare Services Ltd Comparative Analysis

To understand Medi Assist Healthcare Services Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Medi Assist Healthcare Services Ltd to its competitors (peer comparison) on various fundamental parameters and Medi Assist Healthcare Services Ltd share performance relative to relevant benchmark and sector indices.

Medi Assist Healthcare Services Ltd Peer Comparison

The TPA industry, which plays a critical role in managing health insurance claims and providing administrative services, has witnessed significant growth in recent years, largely driven by the increasing demand for health insurance. According to NextMile Consulting (NextMSc) the industry was valued at approximately Rs 10,000-12,000 crore ($1.2-1.5 billion) in 2023.

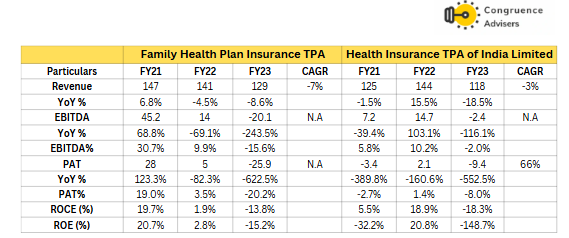

Based on our assessment of financials across unlisted third-party administrators (TPAs), we estimate the total TPA industry revenue pool to be approximately ₹1500-1600 Cr, with a profit pool of ₹100–120 Cr in FY23. Medi Assist Healthcare Services Ltd commands a dominant position in this market, with an estimated 31–34% revenue share and 60% share of the profit pool. When combined with Paramount TPA, the share increases to 40–43% of industry revenues and 70% of industry profits.

As there are no listed players we have compared Medi Assist Healthcare Services Ltd with its unlisted peers. Of the 16 peers, we have picked up the top 4 players for comparison

Vidal TPA has been bought out by Bajaj Health (subsidiary of Bajaj Finserv)

Medi Assist Healthcare Services Ltd is the clear leader in India’s TPA industry, commanding nearly 2x the revenue of the second-largest player. It also stands out on profitability, delivering EBITDA margins of over 22% and PAT margins of around 15% — more than double the margin profile of its peers, who struggle to cross even half these levels.

As the TPA Industry benefits from scale, consolidation is bound to happen. The number of active TPAs has shrunk from over 30 to 16. This presents a significant opportunity for well-capitalized players like Medi Assist Healthcare Services Ltd to lead further industry consolidation and expand their market dominance.

Medi Assist Healthcare Services Ltd

Medi Assist Healthcare Services Ltd share performance vs S&P BSE Small cap Index as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why you should consider investing in Medi Assist Healthcare Services Ltd?

Medi Assist Healthcare Services Ltd offers some compelling reasons to track closely and to consider investing if one is looking for good proxy play to higher growth health insurance sector

Beneficiary of Industry Consolidation – The Indian TPA industry is undergoing significant consolidation, with the top 4–5 players now controlling the majority of the market. Medi Assist Healthcare Services Ltd has been the clear Industry leader across parameters and has benefited from this Industry Consolidation, Medi Assist Healthcare Services Ltd has completed 5 acquisitions in the past 8 years and recently announced acquisition of Paramount TPA (approval pending with regulator). In this industry, scale begets scale. The larger a TPA is, the more corporate deal flow is likely to come its way because it will be empanelled with all the leading insurers and it will also have a large hospital network. Medi Assist Healthcare Services Ltd is thus likely to dominate this industry for several years to come.

Growth in Health Insurance Penetration – Health Insurance industry has been on structural expansion and has a long runway for growth (Posted 20%+ in the past decade and likely to grow 18-19% for the next few years) This industry tailwind bodes well for TPAs. as TPAs play a critical role in the insurance value chain, this expansion directly supports their business. Medi Assist Healthcare Services Ltd (Largest TPA) aims to outpace industry growth PUM

Strong balance sheet and healthy cash flows – Medi Assist Healthcare Services Ltd continues to remain net debt-free and had cash and liquid investments of ~₹296.5 Cr as of December 31, 2024. Medi Assist Healthcare Services Ltd generated a healthy cash flow from operations with 5 years Avg CFO/EBITDA conversion >75% along with negative working capital and minimal capex. Medi Assist Healthcare Services Ltd is expected to maintain a healthy balance sheet despite significant liquidity being utilised for the Paramount acquisition.

Leadership Anchored in Scale, Technology with Sticky Relationships – Medi Assist Healthcare Services Ltd is well-positioned to maintain its leadership among TPAs, backed by its scalable, tech-enabled infrastructure and cost leadership. Medi Assist Healthcare Services Ltd maintains sticky and long-standing relationships with 28 insurers in the group business and 16 in the retail business. With a diversified client base of ~10,500 group accounts (retention rate of 95%), PSU/private insurers have worked with MEDIASSI for an average of 20/9 years. Top 10 corporate groups have an average relationship of 8.3 years. Medi Assist Healthcare Services Ltd has a pan-India hospital network of 19,000+ healthcare providers.

Global Expansion Potential – With the acquisition of Mayfair We Care, UK, Medi Assist Healthcare Services Ltd has expanded its capabilities to serve Indian corporates with global operations. This strategic move positions Medi Assist Healthcare Services Ltd to tap into the growing international private medical insurance (IPMI) market and provides a platform for future global expansion.

Data Analytics and AI Capabilities – Medi Assist Healthcare Services Ltd being the market leader is the largest storehouse of digital health data in India. Its access to vast amounts of healthcare data, combined with its advanced analytics and AI capabilities, positions it uniquely in the market. These capabilities enable Medi Assist Healthcare Services Ltd to offer insights-driven services, improve fraud detection, and develop innovative products tailored to specific customer needs. Medi Assist Healthcare Services Ltd data driven approach also supports insurers and corporates in making informed decisions about policy design and healthcare management.

What are the Risks of Investing in Medi Assist Healthcare Services Ltd

Investors need to keep the following risks in mind if they choose to invest into this business. Risks needs to be weighed in combination with the advantages listed above to arrive at a decision that is optimal for your portfolio construct

Yield compression risk – Yield has been decreased from 5.62% in FY21 to 4.49% in FY24 because of increasing pricing pressure, heightened competition, tech advancements, rising healthcare costs and evolving consumer expectations and Also increase in premium due to increased cover/riders does not translate to equivalent revenue growth for TPAs, Higher-than-expected yield moderation may cause lower revenue growth

Medi Assist Healthcare Services Ltd is focusing on operational efficiency, innovation, and building strong relationships with insurers, healthcare providers, and policyholders.

Rising Trend of In-House Claims Processing – A key risk for Medi Assist Healthcare Services Ltd is the growing shift by insurers particularly from public sector ones toward in-house claims processing. The four PSU general insurers have formed a joint in-house TPA, Health Insurance TPA of India Ltd (HITPA), which handles a portion of their premiums and is expected to scale further. This trend could impact Medi Assist Healthcare Services Ltd, as a significant portion of its TPA fees comes from PSU insurers. So far, HITPA remains smaller in scale, focused primarily on the retail segment, while Medi Assist derives most of its revenues from corporate group policies, which continue to see strong growth.

Additionally, a few large private insurers have also adopted in-house TPA models. However, in-house TPAs remain limited to large players, given the high technology and operational expertise required as the smaller ones do not have the manpower, expertise or capacity and technology to process faster claims.

Client Concentration Risk – Medi Assist Healthcare Services Ltd drives large amounts of its revenue from top 5 clients contributing 71.6% of total revenue in FY24. This poses a concentration risk, where the loss or scale-down of business from any of these clients could materially impact financial performance.

To mitigate this, Medi Assist Healthcare Services Ltd is actively working to diversify its client base across industries and geographies. It also focuses on continuously monitoring client satisfaction and addressing concerns proactively. Additionally, Medi Assist Healthcare Services Ltd is developing new products and services to attract a broader range of clients and reduce dependency on a few large accounts.

PSU Insurers’ market share loss – Public Sector Insurers market share has been on continuous decline i.e. decreased from 50% to 38% in the last 5 years. Thai trend is expected to continue going forward which could impact Medi Assist Healthcare Services Ltd as a significant portion of its TPA fees comes from PSU insurers.

Economic and Corporate Hiring Slowdown – Medi Assist Healthcare Services Ltd derives 88% of its PUM and around 72% of its sales in FY24 from the group segment. Economic downturns tend to reduce healthcare spending and insurance coverage, which may lead to lower group policy volumes along with slowdown in corporate hiring could significantly impact Medi Assist Healthcare Services Ltd financial performance.

Acquisition and Integration Risk – Medi Assist Healthcare Services Ltd growth strategy includes inorganic expansion through acquisitions, which exposes it to potential risks around integration, cultural alignment and achieving expected synergies.

Although Medi Assist Healthcare Services Ltd has excellent track record i.e successfully completed 5 acquisitions in the past 8 years but there is always risk of failure to realise the anticipated benefits of new acquisitions

Technological Risks – Medi Assist Healthcare Services Ltd operations rely heavily on complex, interdependent IT systems, including various portals, applications, and third-party interfaces essential for services like claims processing and self-help requests. The complexity of these systems may make them vulnerable to breakdowns, potentially disrupting key services. Additionally, as many services are internet-based, there’s an increased exposure to cybersecurity threats such as viruses, ransomware, and spam attacks, which could compromise data integrity and system availability.

Furthermore, the TPA industry often depends on manual processes for claims management, leading to potential delays and customer dissatisfaction. While Medi Assist Healthcare Services Ltd has integrated AI and machine learning to automate claims processing and fraud detection, the adoption of new technologies also introduces risks related to system integration and the need for continuous technological advancements to maintain service quality and operational efficiency.

Regulation Risk – Given Medi Assist Healthcare Services Ltd is already 20%+ of the gross health insurance premiums of the country, with more acquisitions, is there a risk at some point in the near future of Competition commission of India stalling further acquisitions.

Additionally, the Insurance Regulatory and Development Authority of India (IRDAI) governs Third Party Administrators (TPAs) through specific regulations. Any adverse changes or stringent enforcement of these regulations could impact Medi Assist’s business operations and profitability.

Medi Assist Healthcare Services Ltd Future Outlook

Going forward, CareEdge Ratings expects the health segment growth to moderate (on account of base effect) in the range of 18-19% over the next 2-3 years as growth over the last four years has been on account of both pandemic-induced health insurance awareness and industry-wide price hikes. Medi Assist Healthcare Services Ltd aims to outperform industry PUM growth, However sales growth is likely to be lower than PUM growth due to continuous yield reduction as the scale of business expands.

Assuming Medi Assist Healthcare Services Ltd is able to log in PUM growth of 20-22%, it is likely to lead to sales growth of 15-18% on an organic basis for the next few years. Expected EBITDA impact from Paramount TPA acquisition is expected to be around negative 150 basis points in FY26, with a payback period of approximately four quarters. From FY27, according to management, EBITDA margins are expected to revert to 23-24% as synergies from acquisitions play out.

Medi Assist Healthcare Services Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Medi Assist Healthcare Services Ltd Price charts

Since the Medi Assist Healthcare Services Ltd stock has a trading history of only ~1 year, we will only be looking at the daily chart.

Not much to read or gleam from the chart, given the limited listing history. The only useful observations one can make are that the price has tested previous lows in the market carnage of April and is hence a weak stock at CMP. For any semblance of strength, the price needs to trade above the 50DMA backed by a volume spike.

We would rely more on our fundamental lens for such stocks where the technical trends do not reveal much. In our assessment, the business operates in a small industry where the profit pool is limited but growing. Given that the industry profit pool itself is limited to a few hundred crores, either the earnings growth profile will need to be very aggressive or the valuation multiple much lower for investors to be hopeful of market beating returns.

Medi Assist Healthcare Services Ltd Latest Latest Result, News and Updates

Medi Assist Healthcare Services Ltd Quarterly Results

Q2 to Q3 generally is sort of a flattish quarter for Medi Assist Health Services Ltd seasonally, which has led Medi Assist Health Services Ltd flattish growth. Despite consolidation and synergy yet to be fully reflected, the EBITDA % has improved to 21.5% expanded 50 bps QoQ and 100 bps YoY.

PUM administered was at 15,829 Cr as on 31st Dec ‘2024 up 16.6% YoY on a base adjusted for the premiums contributed by the acquired companies. Sales per average head count excluding the Government contacts is at 14.3 lakh annualize vs 10.6 lakhs YoY

Market share in terms of health insurance premium administered (Group + Retail), of the total health premium in India, was 19.8% as on 31st Dec 24, as against 19.2% as on 31st Dec 23

Medi Assist Healthcare Services Ltd has recently enabled resolution to raise 300 Cr from Equity. As per management right now it is more of an enabling resolution to plan for the next few years of growth and there are some deployments already announced in public disclosure

Final thoughts on Medi Assist Healthcare Services Ltd

Medi Assist Healthcare Services Ltd. is a direct play on increasing health insurance penetration and growth in India. By virtue of being the largest TPA by far in India, Medi Assist is in a commanding position in the industry and is likely to keep growing along with health insurance industry premiums for several years to come.

However, just as is the case with industries where smaller players service much larger clients (Think auto ancillaries and auto OEMs or any of the outsourcing plays such as ESM, pharma or FMCG outsourcing), here too Medi Assist has a concentrated customer base and deals with clients who are much larger than them, in insurance companies. This setup usually means that the concerned company has no pricing power and margins and return on capital metrics are capped beyond a limit. This is reflected in the falling yields of Medi Assist over the years where it is being given a larger share of business by insurance companies, but at lower yields.

This dynamic means that Medi Assist Healthcare Services Ltd. has to keep working on improving operating efficiency via technology and AI, otherwise it risks getting into a scenario where margins structurally erode over time. Medi Assist is already 60% of the TPA industry profit pool and hence any exponential growth can be reasonably ruled out. In fact there may be downward risks to healthcare insurance industry premium growth and hence Medi Assist’s topline growth if the insurance regulator takes a negative view of healthcare insurance premium inflation.

Hence, on balance, Medi Assist Healthcare Services Ltd. is a dominant player in a small industry catering to clients much larger than itself, where profits can perhaps be expected to grow sustainably at mid teen levels for several years. At the right valuations (Maybe 20-25x PE), this can become an interesting pick.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.