Established in 1986, Mold-Tek Packaging Limited (MTPL) is the leader in rigid plastic packaging in India. Mold-Tek Packaging Limited is involved in the manufacturing of injection molded containers for lubes, paints, food and other products.

Mold-Tek Packaging is on the cusp of becoming a truly diversified business within the rigid plastic packaging space, with the reliance on paints & lubes segment set to come down from here. As the revenue proportion of newer verticals increases, one can expect to see higher EBITDA/Kg and better earnings profile from here. Though the business is much smaller than the largest player in the sector, the margin profile and competitive position continues to remain strong even in the face of raw material price volatility and pricing pressure imposed by large buying centers. At a market capitalization of < 2,500 Cr as of date (June 2025), the business offers a business quality and diversification typically seen in much larger businesses. At the right price, this business can become an interesting addition to the portfolio since it derives demand from paints, consumer & pharma sectors which are proven to be secular sectors with a long growth runway.

Mold-Tek Packaging Ltd Company Summary

Founded in 1986 by industry technocrats Mr. Lakshmana Rao and A. Subramanyam, Mold-Tek Packaging Ltd is a leading manufacturer of rigid plastic packaging in India.

Mold-Tek Packaging Ltd was originally incorporated on February 28, 1997, at Hyderabad, as Tresure Paks Private Limited, The name of the Company was subsequently changed to Moldtek Plastics Limited effective from August 20, 2007. The Company adopted its present name, Mold-Tek Packaging Ltd, with effect from March 12, 2010.

Mold-Tek Packaging Ltd Story goes back to early 1990s, When Mold-Tek Packaging Ltd started developing plastic pails for the paint industry at a time when the entire industry was using traditional tin containers due to its higher durability and chemical resistance and at that time packaging was focused on functionality rather than branding or user experience. Post the introduction of plastics pails paints companies started using plastic pails for distempers and decorative paints segments. Due to cost efficiency, easy logistics and handling, customization & branding and end user convenience, Mold-Tek Packaging Ltd was able to secure a lot of orders and major clients like Asian Paints, Kansai Nerolac and Berger Paints.

The surge in orders called for further investment and expansion, which led Mold-Tek Packaging Ltd to launch an IPO of 4 crore in 1993 mainly to fund the expansion plan of 6-7 Cr

After establishing a strong presence in the paints industry, Mold-Tek Packaging Ltd started entering into another lucrative market, lubricants, in 1998. Mold-Tek Packaging Ltd started supplying plastic pails to companies such as Castrol, Valvoline, Shell and Exxon Mobil which were also using metal containers till then. Mold-Tek Packaging Ltd came up with innovative features such as the “pull up spout”, locking system and tamper-proof seals. These product innovations were granted a patent in 2007.

During 2001 Mold-Tek Packaging Ltd also started a new division Mold-Tek Technologies Ltd for offering Engineering services to clients in Europe and the USA. which got demerged and got independent listing in 2008

In 2011, Mold-Tek Packaging Ltd pioneered IML (in-mold labelling) in India, integrating pre-printed labels into plastic containers to enhance durability and brand visibility. This advancement allowed MTPL to diversify into the food and FMCG sectors, where high-quality packaging is essential. In 2014 Additionally,Mold-Tek Packaging Ltd started developing in- house robotics and label printing, Mold-Tek Packaging Ltd gained a significant cost advantage, distinguishing itself from competitors.

Most recently Mold-Tek Packaging Ltd has expanded into high value pharma packaging and recently break even in Q4FY25

Currently Mold-Tek Packaging Ltd has 10 Manufacturing Units, 2 stock points PAN India. Current installed Injection molding capacity of over 55,000 MT

Mold-Tek Packaging Ltd commands strong presence across all major customers like Asian Paints, Castrol, Shell, Mondelez, Hindustan Unilever, etc. Mold-Tek Packaging Ltd has Superior margins in the packaging industry due to to the cost advantage emanating from backward integration

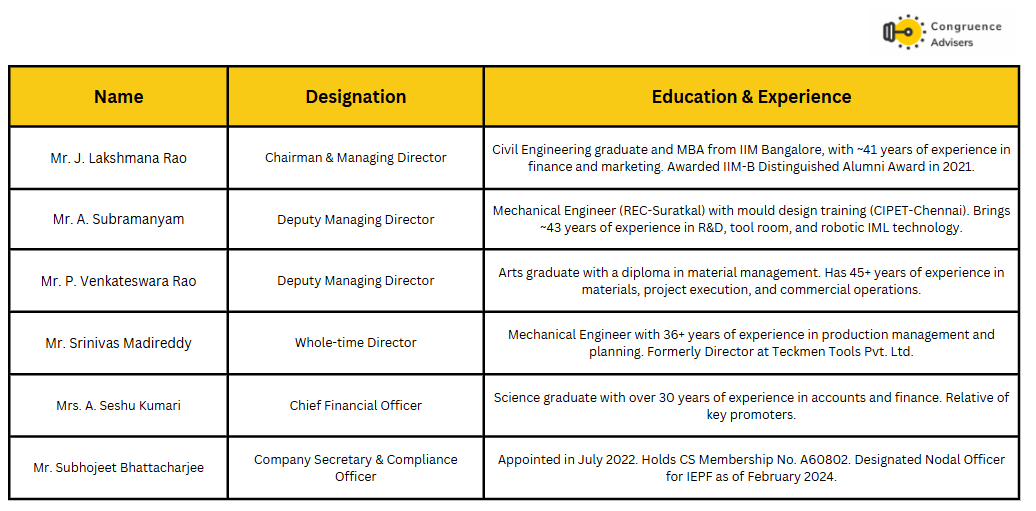

Mold-Tek Packaging Ltd Management Details

Mold-Tek Group is a 3,000Cr market cap Group (as on 09 may 2025), It is broadly diversified into Mold-Tek Packaging Ltd, which is the leader in rigid plastic packaging in India and Mold-Tek Technologies, which is into Engineering and Technology Solutions partner to many key players in various Engineering services across the globe.

Mr. Lakshmana Rao Janumahanti is the founder and driving force behind the Mold-Tek Group, which he established in 1986. A Gold Medalist in Civil Engineering and an MBA graduate from IIM Bangalore (class of 1982), Under his stewardship, the company evolved from a small-scale business to become one of India’s largest injection moulding players with multiple manufacturing facilities and a diversified client base.Mr. Lakshmana Rao Janumahanti is widely credited for pioneering several innovations in the packaging sector and revolutionizing the Indian rigid packaging landscape.

Mr. A. Subramanyam is Deputy M&D & Co- Promoter. He holds a degree in Mechanical Engineering from REC Suratkal and has completed a specialized course in mould design and manufacturing from CIPET Chennai. With over 40 years of experience, he heads the in-house tool room and R&D function which is critical to Mold-Tek Packaging Ltd’s product development and innovation capabilities. He played a key role in developing in-house robots and was instrumental in introducing IML (In-Mould Labelling) with robotic technology in India. He is responsible for overseeing plant operations and the tool room across facilities.

Mold-Tek Packaging Ltd Industry Details

Global Packaging Market

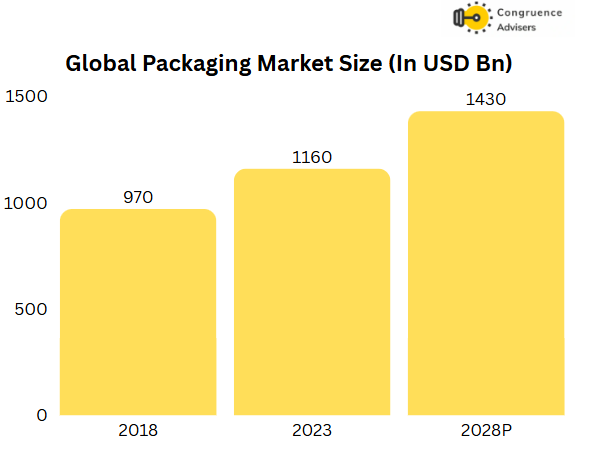

The Global packaging industry serves as a cornerstone of the global economy, supporting a wide array of materials and applications that facilitate the safe transport, storage, and presentation of products across sectors.

Source: Secondary Research, Technopak Analysis

In the calendar year 2023, the global packaging market was valued at approximately USD 1,160 billion. Despite challenges such as rising input costs and macroeconomic uncertainties, the industry is expected to maintain steady growth, with projections indicating a compound annual growth rate (CAGR) of 4.3%, reaching an estimated USD 1,430 billion by 2028.

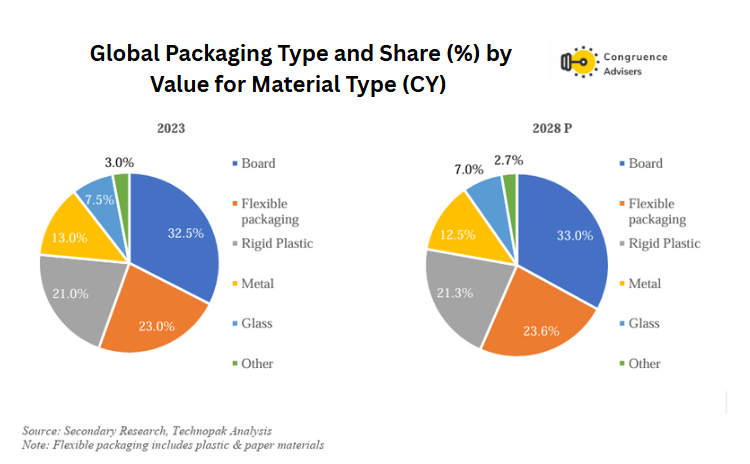

The global packaging industry is segmented based on two types, one is by material type and the other is by product type.

In the global packaging industry, board has the highest share of ~32.5% in CY 2023 (USD 377.0 billion) and is expected to see an upward growth to reach ~33% by CY 2028 (USD 471.9 billion) growing at a CAGR of ~4.6%. This is primarily due to the growing e-commerce industry which uses cardboard boxes as tertiary packaging. This is followed by flexible packaging as the second largest with a share of ~23% in the market in CY 2023 (USD 266.8 billion) and is expected to reach at ~23.6% by CY 2028 (USD 337.7 billion) growing at a CAGR of ~4.8%. Flexible packaging includes flexible plastic and paper packaging. Flexible plastic was 75% of the total flexible packaging market in CY 2023 (USD 200 billion) and it is growing faster as compared to paper packaging, which is relatively a smaller market (USD 66.7 billion). This is followed by rigid plastic packaging with a share of ~21% in CY 2023 (USD 243.6 billion), growing at a CAGR of ~ 4.5% by CY 2028 (USD 304.2 billion). In plastic packaging out of the two Rigid and Flexible plastic packaging, rigid plastic packaging is more recyclable as compared to the flexible plastic packaging. The share of glass is expected to decrease by CY 2028 (USD 100.1 billion) to reach 7% from 7.5% in CY 2023 (USD 87.0 billion) due to the heavy weight and inert nature of glass, the rigid plastic market share stands to benefit from this as an alternative material to glass.

India Plastic Packaging Market

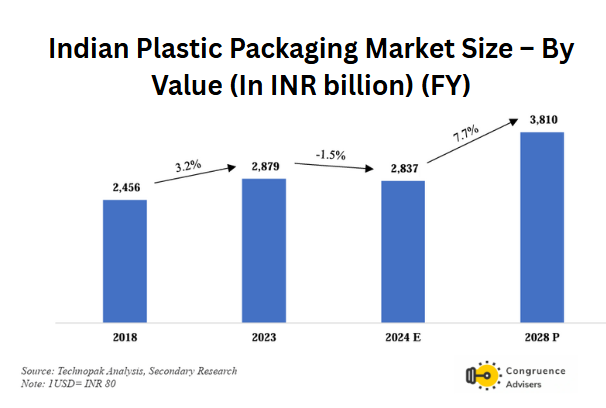

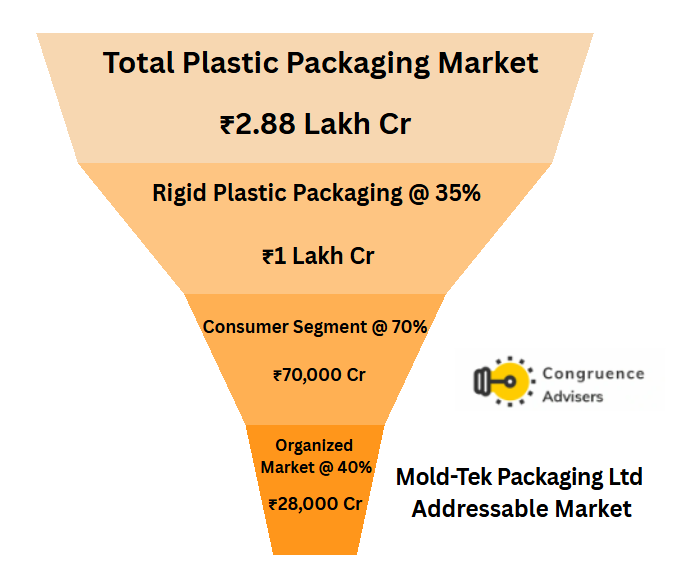

India’s plastic packaging market stood at ₹2.88 lakh crore in FY23, growing steadily from ₹2.46 lakh crore in FY18. A marginal dip in FY24 to ₹2.84 lakh crore is mainly due to raw material price volatility and lightweighting trends. Despite this volume growth continues. Over the next four years the market is projected to grow at a 7.7% CAGR, reaching ₹3.81 lakh crore by FY28. Growth will be fueled by rising urbanization, shifting consumer preferences, and strong demand from food & beverages, pharma, and personal care segments supported by India’s growing middle class and higher disposable incomes.

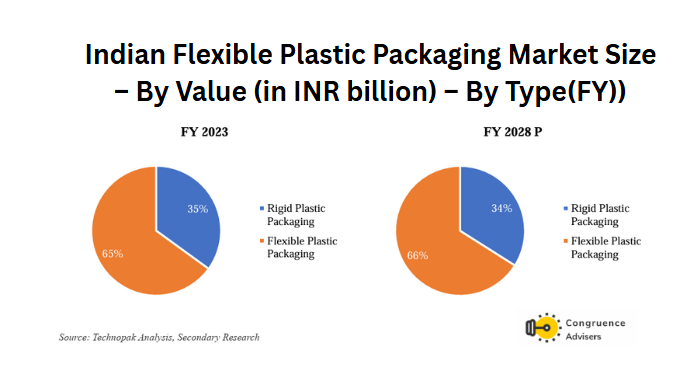

Based on product type, the Indian plastic packaging market is segmented into two categories, Rigid Plastic Packaging and Flexible Plastic Packaging.

Mold-Tek Packaging Ltd Addressable Market

India’s plastic packaging market stood at ₹2.88 lakh crore in FY23. Of this, rigid plastic packaging accounts for roughly 35%, or ₹1 lakh crore. Within the rigid segment, consumer-facing applications contribute about 70% translating to a ₹70,000 crore opportunity. However, only around 40% of this consumer segment is organised i.e ₹28,000 crore which represents the realistic addressable market for players like Mold-Tek Packaging Ltd. This offers Mold-Tek Packaging Ltd a substantial and growing opportunity, especially as demand shifts toward more hygienic, sustainable, and branded rigid packaging solutions.

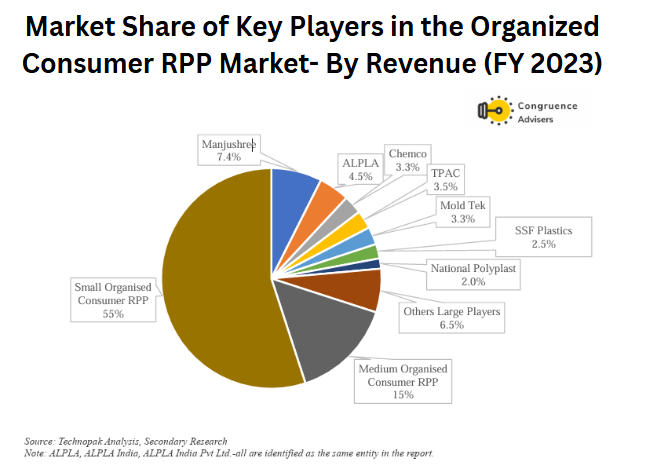

Within the Organized Indian consumer RPP market, the large players accounted for ~30% of the market share in FY 2023 and the remaining 70% is accounted for by the medium & smaller organised consumer RPP players.

Manjushree Technopack Ltd. having the highest market share in terms of revenue of 7.4% in FY2023 in the organised consumer RPP industry in India, which was 1.7 times the market share in terms of revenue of the second largest player in India. Mold-Tek Packaging Ltd is the 5th largest player with 3.3% market share.

The Indian rigid plastic packaging (RPP) market, though currently fragmented, is expected to undergo significant consolidation over the coming years. Industry experts foresee organized players expanding their market share through strategic mergers and acquisitions, absorbing smaller unorganized entities. This shift will be driven by the pursuit of economies of scale, access to advanced technology, regulatory compliance, and growing demand for sustainable packaging solutions. As a result, the share of the organized segment in the consumer RPP market is projected to rise from 40% in FY24 to over 48% by FY28. The unorganized segment, constrained by outdated infrastructure and limited capital, will find it increasingly difficult to compete, accelerating the pace of consolidation. This transition positions financially and technologically stronger players like Mold-Tek Packaging Ltd to capitalize on emerging growth opportunities and lead the sector’s structural transformation.

Regulatory Landscape – Extended Producer Responsibility

In India mandatory recycled plastic content in packaging is being phased in across different fiscal years starting with 30% for rigid plastics (like PET bottles) from April 2025, increasing annually by 10% to reach 60% by 2028-29. Beyond rigid plastics other categories of plastic packaging also have targets with some reaching 80% recycling by 2028.

- The Ministry of Environment, Forest and Climate Change has mandated these recycled plastic content targets.

- The goal is to promote a circular economy and reduce plastic waste.

- These regulations apply to rigid plastic packaging, including PET bottles.

- There are also recycling targets for other categories of plastic packaging, with some reaching 80% by 2028.

- The enforcement of these rules involves penalties for non-compliance.

Specific Targets by Fiscal Year:

- 2024-25: 30% recycled content for rigid plastics (like PET bottles), increasing annually by 10%.

- 2025-26: 40% recycled content for rigid plastics.

- 2026-27: 50% recycled content for rigid plastics.

- 2027-28 onwards: 60% recycled content for rigid plastics.

Extended Producer Responsibility (EPR) and Mold-Tek Packaging Ltd

As a Producer/Importer/Brand Owner Mold-Tek Packaging Ltd is mandated under the Plastic Waste Management Rules, 2016, to manage post-consumer plastic waste.

Mold-Tek Packaging Ltd has partnered with recycling organizations to ensure proper waste collection and uses digital platforms to track compliance. It has steadily increased the use of recycled plastic (RCP) in production from 9.38% in FY23 to 15.36% in FY24 and 20% in FY25 without compromising product quality or mold life.Mold-Tek Packaging Ltd works with top paint, lube, and FMCG clients to adopt RCP

Mold-Tek Packaging Ltd designs fully recyclable products using 100% polypropylene (jar, lid, handle, label) and emphasizes durability and brand retention through IML. It also focuses on water neutrality, energy efficiency, and sustainable sourcing, with all facilities certified as “Green Zones” by the PCB.

While EPR compliance presents operational challenges including higher trial work and rejection rates when using Recycled Plastic (RCP) it also gives organized players like Mold-Tek Packaging Ltd a chance to differentiate on sustainability. Unlike many unorganized players who lack the scale or technology to adapt

Mold-Tek Packaging Ltd Business Details

Mold-Tek Packaging Ltd is one of India’s leading players in rigid plastic packaging, primarily serving sectors like paints, lubricants, FMCG, and pharmaceuticals. Let’s understand the two key aspects of Mold-Tek Packaging Ltd’s business – (1) Manufacturing Process & Printing Technologies and (2) End Products.

Mold-Tek Packaging Ltd Manufacturing Methods

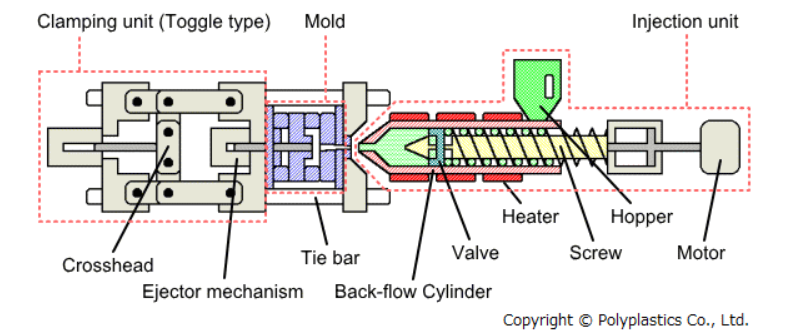

Injection Molding – Mold-Tek Packaging Ltd primarily uses injection molding to manufacture rigid plastic containers without necks such as paint buckets, lubricant packs and FMCG tubs. This process involves injecting molten plastic under high pressure into a custom-designed mold, which shapes the container. These containers are used across diverse sectors including paints, lubricants, oils, food, FMCG, cosmetics, and pharmaceuticals. Injection molding offers excellent accuracy, durability, and surface finish making it ideal for high volume production.

It involves high upfront costs; each mold can cost several lakhs to crores, For instance, a single mold for a 20-litre jar and cap can cost over ₹1 crore. And design changes require entirely new molds as each mold can produce only one specific shape. This makes it uneconomical for low-volume or frequently changing products. While it requires high capital investment in molds and machinery, it delivers very low per-unit costs at scale. Multi-cavity tooling enables high throughput, and the process is highly scalable, with multiple machines operating in parallel. From a sustainability perspective, the process has a relatively low material waste footprint and supports recyclability.

Advantages –

- Highly efficient for mass production

- Low cost per unit once the mold is made can benefit from economies of scale.

- Precision and repeatability – parts are consistent, which reduces waste and quality issues.

- Initial setup (mold-making) is capital-intensive, so companies with large volumes have a competitive edge.

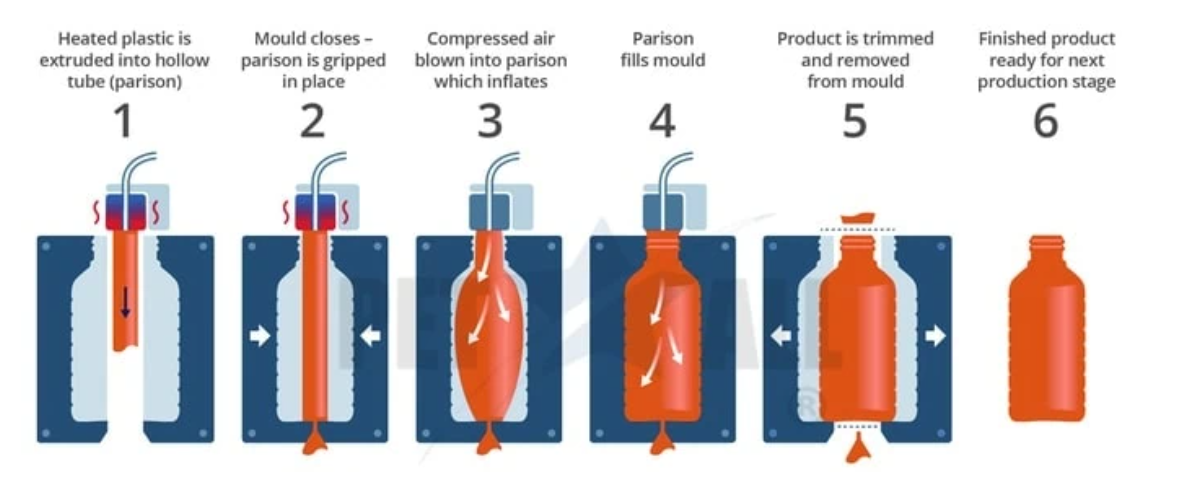

Extrusion Blow Molding (EBM) – Mold-Tek Packaging also uses extrusion blow molding (EBM) to manufacture hollow containers with handles and small necks, typically seen in products like shampoo bottles, edible oil packs, and household liquid packaging. The process involves extruding a molten plastic tube (parison), capturing it in a mold, and blowing air to form the final container shape.

EBM is cost-effective with low mold costs, usually ranging between ₹5–10 lakhs, making it suitable for products where cost and volume matter more than precision. Although dimensional accuracy is relatively low, the process allows for greater design flexibility, enabling a wide variety of shapes and sizes.

Though its use has declined for premium applications due to lower finish quality, EBM remains essential for larger containers especially those above 0.8–1 litre, where IBM technology isn’t viable yet. This makes it particularly relevant in sectors like FMCG, edible oils, and industrial packaging. where economic viability takes precedence over high-end finish or fine detailing.

While EBM generates more waste compared to injection molding and offers moderate surface finish, it remains a practical solution for large-scale, cost-sensitive applications. Most of the trim waste is recyclable.

Injection Blow Molding (IBM)

Injection Blow Molding (IBM) is a hybrid process positioned between Injection Molding and Extrusion Blow Molding (EBM). It combines the dimensional accuracy of injection molding especially at the neck with the lightweight structure of blow-molded bodies. The result is a seamless, high-quality container suitable for applications where both form and function are essential.

IBM is primarily used for containers under 1 litre, such as cosmetic jars, pharmaceutical bottles, ointments, pastes, powders, and food-grade packs. The process delivers excellent finish quality, accurate capping, and aesthetic appeal, making it ideal for FMCG, pharma, and personal care segments.

While IBM offers superior performance for smaller SKUs, it is not suitable for larger containers; anything above 0.8 – 1 litre still relies on EBM due to technical limitations. With EBM gradually being phased out from premium categories, IBM is emerging as the preferred solution where finish and precision matter.

Mold-Tek Packaging Ltd, historically a leader in injection molding, is now entering the IBM space to tap into these high-margin product segments.

Mold-Tek Packaging Ltd Decorative Techniques

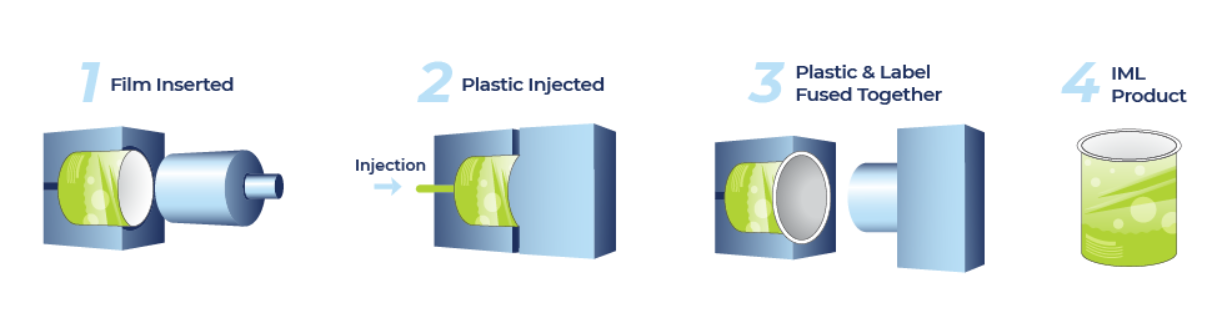

In-Mold Labelling (IML)

In-Mold Labelling (IML) is a modern and premium decoration technique used in plastic packaging. In this process, a robot places a pre-printed label inside the mould before plastic is injected. The molten plastic fuses with the label during moulding, so the container comes out fully decorated, with no need for any stickering or printing after production.

IML provides a high-quality, photographic finish and covers almost the entire surface of the container (95–98%), which is better than other methods like Heat Transfer Labelling (HTL). Since the process is hands-free and automated, it is more hygienic—making it suitable for food, personal care, and other sensitive products.

Mold-Tek Packaging Ltd was one of the first companies to bring IML technology to India. It also developed the ability to make IML labels and robotic systems in-house, which helps reduce cost and lead time. Recently, Mold-Tek Packaging Ltd has also started using QR codes on IML labels for better traceability and anti-counterfeiting, adding more value for clients

Backed by early investment, automation, and vertical integration, IML remains a strategic differentiator for Mold-Tek Packaging Ltd as it expands across Paints, FMCG & Foods, lubricants, personal care and pharma segments.

Heat Transfer Labelling (HTL)

Heat Transfer Labelling is a decoration method where a pre-printed design is transferred onto the plastic container using heat and pressure. A special printed sheet is wrapped around the container, and the ink is pressed onto the surface. The backing paper is then peeled away, leaving the design on the product.

The method provides around 80% surface coverage, making it suitable for medium to large containers such as paint buckets, chemical drums, and edible oil tins, especially where IML is not feasible due to size or shape. It works well even on curved surfaces.

The process offers vibrant, full-color graphics and is more cost-effective than IML for shorter runs or when frequent design changes are needed. It also works on already-molded items, offering flexibility across shapes.

However, HTL is less durable than IML. HTL labels may fade or scratch over time. It also involves adhesives and plastic layers, which can make recycling difficult. Production speed is slower since each item must be decorated individually, and while equipment cost is moderate, scalability is lower than fully automated IML setups.

Automatic Screen Printing

Automatic screen printing is a process where ink is transferred directly onto the container surface using squeeze pressure through a stencil, based on the customer’s design. Mold-Tek Packaging Ltd uses automatic screen printing machines which help achieve better alignment of multiple colors and consistent print quality across large volumes. This method is primarily used for decorating paint and lubricant pails, and is suitable for both flat and cylindrical surfaces. It delivers vivid, durable prints and is a cost-effective solution for medium to large production runs.

While screen printing does not require labels or adhesives making it more environmentally friendly it has some limitations. Each color requires a separate screen, so setup time and cost increase with design complexity. It is less suited for small batches or frequent design changes, and is typically limited to 4-6 colors.

Overall, automatic screen printing remains a scalable and cost-effective solution for high-volume standard designs, especially in industrial and consumer packaging segments.

Other decoration options mentioned used by Mold-Tek Packaging Ltd include Offset Printing and Shrink Sleeving.

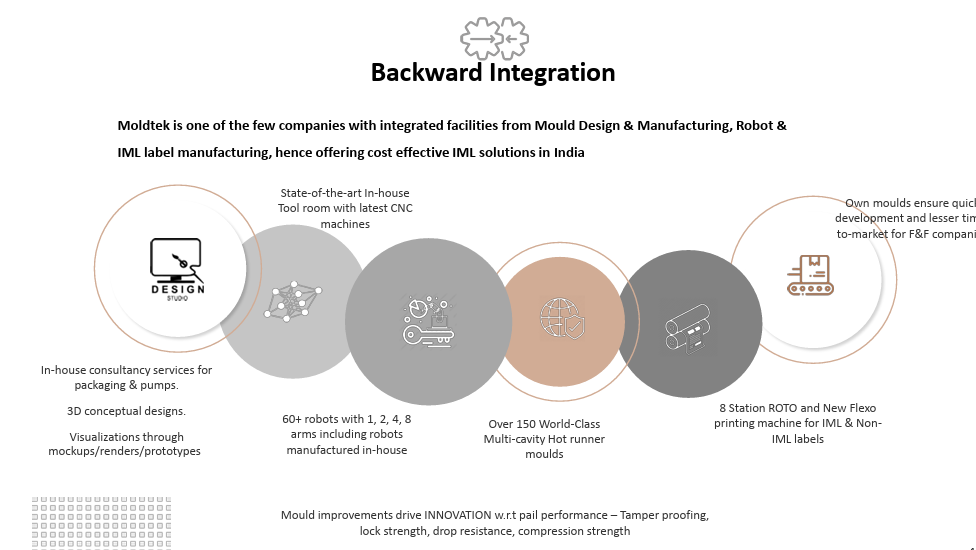

Mold-Tek Packaging Ltd Backward Integration

This deep integration allows the company to control quality, reduce costs, and accelerate product development, giving it a strong competitive edge.

Mold-Tek Packaging Ltd is uniquely positioned as the only rigid packaging company globally with full backward integration. Mold-Tek Packaging Ltd’s backward integration journey is virtually end-to-end. Since the 1980s, the company has systematically added upstream capabilities starting with in-house mold design, followed by label manufacturing, and eventually robotics and automation. Which is helping Mold-Tek Packaging Ltd with strong cost control, faster go-to-market, and consistent margins despite raw material volatility.

Source – Mold-Tek Packaging Ltd 22 presentation

Tool & Mold Manufacturing – Mold-Tek Packaging Ltd established its in-house tool room early on, and by FY2012 was producing 8 cavity molds, significantly accelerating product development. Today, in-house mold design is a core strength, enabling rapid customization and high-precision packaging solutions.

IML Label Production – To support its IML strategy, Mold-Tek Packaging Ltd set up an in-house IML label printing facility in FY2011. This eliminated import dependence and helped win large clients like Amul and Vadilal. Mold-Tek Packaging Ltd now operates both analog (gravure) and digital (UV inkjet) label printing, offering high-quality, variable-data IML.

Robot Manufacturing – In FY2014, Mold-Tek Packaging Ltd began manufacturing its own robotic arms used in IML operations, reducing costs by 40–65% compared to imports and drastically improving maintenance turnaround. This gives the company greater control over quality, innovation, and cost efficiency which is a big differentiator in the IML space.

R&D and Innovation – Mold-Tek Packaging Ltd runs an R&D centre in Hyderabad, credited with multiple granted patents and pending patents. The team focuses on tooling innovation, energy management, packaging design (e.g. square packs, tamper-proof lids), and newer formats like IBM+IML containers for pharma and cosmetics. Though R&D spending is modest (~0.8% of revenue), it has delivered tangible product and process innovations.

Other Integrations – Over time, Mold-Tek Packaging Ltd has added in-house capabilities for spouts, pump dispensers, and now injection-blow molding (IBM) further reducing dependency on third-party vendors and enabling entry into newer, high-margin segments.

Strategic Partnerships

- Durst Group (via Newgen): In 2024, Mold-Tek partnered with Durst to install a 510 mm UV inkjet press for IML labels. This partnership brought advanced digital printing in-house, allowing on-demand, high-speed, low-waste IML production, strengthening its position in high-quality FMCG and food packaging.

- Technology & Training Partners: The company collaborates with automation hardware suppliers (CNCs, injection presses), enterprise software providers (e.g. Salesforce), and training institutes like CIPET for workforce development.

Mold-Tek Packaging Ltd invests in new packaging technologies to stay ahead. Its in-house design studio develops advanced concepts such as square-pack containers, QR code track-and-trace labels, anti-counterfeit features, etc. Each of these innovations leverages the internal tooling/automation base.

Mold-Tek Packaging Ltd Raw Materials

Mold-Tek Packaging Ltd primarily uses polymers as its key raw material for manufacturing rigid plastic packaging containers. The specific types of polymers used include Poly Propylene Co polymer (PPCP), Polypropylene (PP), High Density Polyethylene (HDPE), Low Density Polyethylene (LDPE), and Linear Low Density Polyethylene (LLDPE). Polypropylene copolymer is the major raw material, constituting about 95% of the material used. Beyond the main polymers, other materials consumed include pigments, handles, printing materials, packing materials, and other consumables.

Raw materials are primarily procured from the domestic market. Reliance is the major supplier around 75-80% followed by Indian Oil.

The price of polymers is affected by fluctuations in the international price of crude oil and changes in the demand and/or supply of polymers. Mold-Tek Packaging Ltd generally has the flexibility to pass on raw material cost fluctuations to most customers through periodical pricing arrangements ranging from quarterly to monthly basis

Mold-Tek Packaging Ltd Products

Paint & lubricant

Since its inception in 1986, Mold-Tek Packaging Ltd has emerged as a pioneer in India’s rigid plastic packaging space, especially in decorative paint pails. It was among the first to replace traditional metal tins with injection-molded plastic pails in the paint industry which helped paint companies to reduce logistics costs while maintaining durability. This innovation helped Mold-Tek secure Asian Paints Ltd as an anchor client early on and since then it has maintained a strong relationship with Asian paints Ltd.

Mold-Tek Packaging Ltd offers a variety of pails for paints with 1-20 liter pails with flat or tamper-proof lids, mainly used for emulsions and distempers.

Mold-Tek Packaging Ltd has set up dedicated plants near Asian Paints facilities in Satara, Mysore and Vizag. Mold-Tek Packaging Ltd is consistently serving as its second-largest packaging supplier. After Hitech Corporation Ltd which is promoted by Mr. Ashwin Dani, one of the three promoters of Asian Paints Ltd which functions almost like an in-house packaging arm for Asian Paints Ltd.Mold-Tek Packaging Ltd as a preferred supplier and enjoys a “green channel acceptance” status with Asian Paints Ltd due to its high-quality products and consistent supply. All of Mold-Tek’s manufacturing plants are “green channel accepted” by Asian Paints signifying a high level of operational approval and trust.

The paint segment remains Mold-Tek Packaging Ltd’s largest revenue contributor at 44% with Asian Paints accounting for 30–35% of total sales. Other key paint clients include Kansai Nerolac, Berger Paints and newer clients like Pidilite and Birla Opus (Aditya Birla Group). Grasim (Birla Opus) has selected Mold-Tek Packaging Ltd as a preferred supplier at its three plant locations out of six plants and regular deliveries began in April 2024. I.e Panipat, Haryana, Cheyyar, Tamil Nadu, Mahad, Maharashtra.

Mold-Tek Packaging Ltd operates eight manufacturing facilities across India, several of which are dedicated units for large clients. These facilities are designed with multi-purpose flexibility, enabling quick transitions between packaging for paints, lubricants, and other products like square containers used in the Food & FMCG segment.

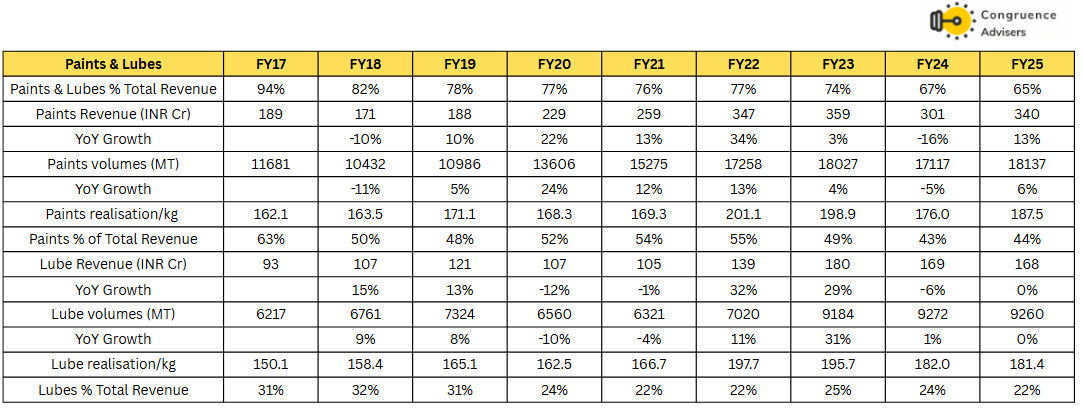

Paints realisation is around 190/KG and it prints EBITDA/KG of around 30-35. The share of IML Labels (higher margin) is 20% at present and management has highlighted that both Asian Paint Ltd & Birla Opus (ABG) have started moving further towards IML, which will lead to better profitability in the segment going forward.

In FY25, Mold-Tek Packaging Ltd’s paint packaging revenue & volume segment grew by 13% & 6.79%, driven by higher demand from ABG (Grasim Paints) and wider IML adoption by Asian Paints. To meet this rising demand, Mold-Tek Packaging Ltd doubled capacities at its Cheyyar and Panipat plants for ABG and also expanded capacity at the Satara unit by over 50%. (which became operational in April 2025). Additionally, both ABG and Asian Paints began in-house adoption of HTL labels. Mold-Tek Packaging Ltd is also focusing on sustainability, preparing for increased use of recycled polypropylene (PP) in its products.

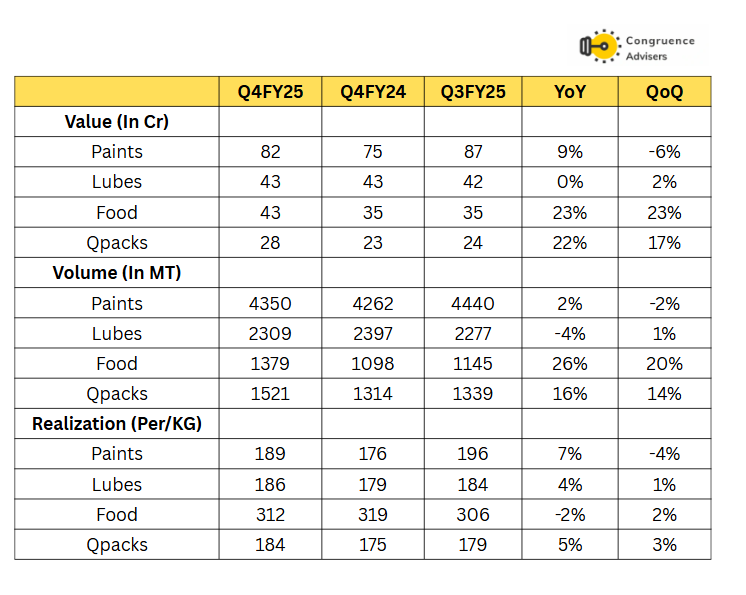

Segmental Performance of Paints & Lubes Division

Lubes – Mold-Tek Packaging Ltd’s lubes division primarily supplies rigid plastic containers to oil and lubricant companies. In lubricants, it supplies 5-25 liter pails with flat or spout lids.

Mold-Tek Packaging Ltd is a leading player in the lube and grease packaging segment in India, known for offering high-quality, tamper-proof, and leak-proof containers. Mold-Tek Packaging Ltd provides advanced decoration technologies such as In-Mould Labelling (IML), Heat Transfer Labeling (HTL), and Silk Screen Printing, enhancing the shelf appeal of its products. Its patented locking systems and tamper-evident designs help prevent oil adulteration, a major concern for lube brands. Mold-Tek Packaging Ltd ’s innovative packaging with features like flexi spouts and anti-counterfeit elements has helped resolve duplication issues for many top lubricant players, strengthening its value proposition in the segment.

Mold-Tek Packaging Ltd serves a wide range of clients in the lubricant sector both from the private and public domains. In the private space, its key clients include Castrol, Shell, Gulf, Valvoline, Mobil, Benzol, Chevron, and Total Lubricants. On the public sector side, it has PSU giants such as BPCL, HPCL, and IOCL.

The lubes segment for Mold-Tek Packaging Ltd operates at similar realizations and margins as the paints segment, with average realizations of around ₹180/kg and EBITDA of ₹30–35/kg. However, growth in this segment remains muted. This is primarily because lube demand is closely linked to automobile sales, and improvements in lubricant quality have led to longer usage cycles and lower consumption over time, resulting in subdued volume growth. The increasing penetration of electric vehicles has also been a drag on lubes volume growth.

The lubricants segment saw a slight de-growth of 2.0% in FY25, mainly due to economic slowdown and a general decline in lubricant sales. Despite weak demand, margins held steady, supported by improved adoption of IML and HTL (relatively higher margins). Mold-Tek Packaging Ltd has also secured long-term contracts with major lubricant brands such as Gulf, Shell, and Castrol helping safeguard its market share in this segment.

Food & FMCG (F&F) –

Mold-Tek Packaging Ltd.has steadily strengthened its presence in the Food & FMCG (F&F) segment offering rigid plastic containers for a wide range of products such as edible oil, ice cream and dairy. Mold-Tek Packaging Ltd leverages its proprietary in-house IML robotic systems to deliver hygienic, tamper-evident, and leak-proof packaging.

India’s Food & Beverage (F&B) sector remains one of the largest and fastest-growing markets globally, driven by rising per capita income, urbanization, the growing working women population, and an accelerated shift towards safer, more hygienic packaging formats. The industry is witnessing a structural transition from traditional formats like tin, glass, and pouches to IML-based rigid plastic containers.

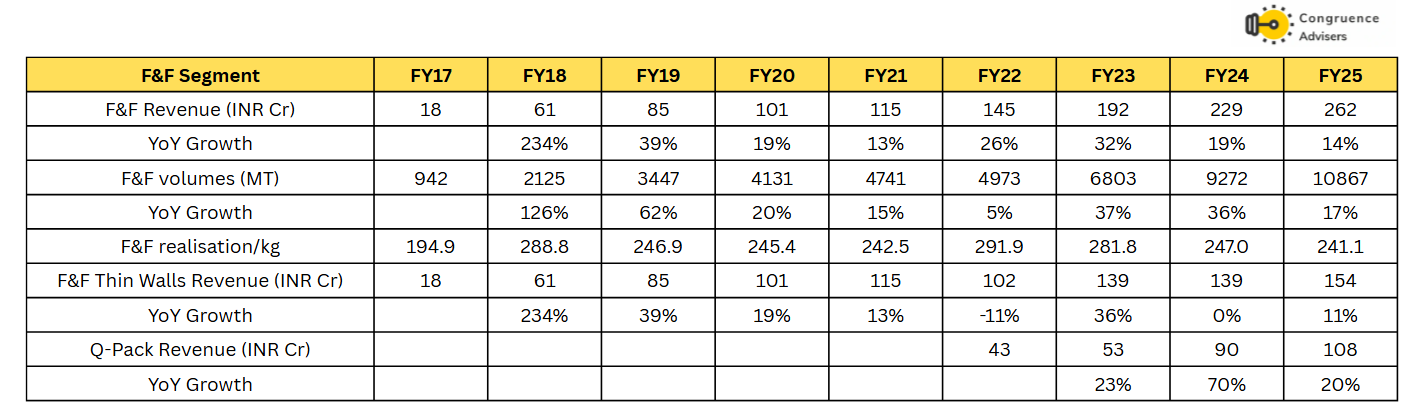

Mold-Tek Packaging Ltd’s F&F (Food & FMCG) segment is divided into two product categories i.e Thin-Wall Containers and Qpacks each with distinct use cases and margin profiles.

Food & FMCG Packs (Thin-Wall) i.e (F&F without Qpacks) are smaller high-margin packs used for ice creams, yogurt, chocolates (like Cadbury Lickables), ready meals, protein powders, and nutraceuticals. They offer superior aesthetics, leak-proof and tamper-evident features and are often microwaveable. These packs enjoy strong demand due to rising awareness of hygiene and the regulatory push against thin non-recyclable plastics. Realization & Margins are high, at 270/kg & 70-75/kg approximately.

Mold-Tek Packaging Ltd printed 11.8% growth in its Thin-Wall F&F segment in FY25 supported by improved printing capacities. Growth was further aided by the launch of beverage packs for cafes and restaurants, a new line of nutritional powder containers for a major MNC and strong traction in the Ready-to-Eat space with clients such as Marico and MOM. The Thin-Wall portfolio is becoming the preferred packaging format in the RTE industry which is growing at 28.2% in India.

Segmental Performance of F&F Segment

Note: The management does not explicitly give a bifurcation of Q-pack and thin-wall volumes, revenues and realisations in its investor communication. These numbers have been calculated by us by piecing together various data points shared by management across press releases and investor conference calls. Hence, they may not be 100% accurate, but we are quite confident that the revenue nos for each sub-segment are quite close to accurate.

Square Packs (Qpacks): on the other hand are large square containers used for edible oil, ghee, Vanaspati, fertilizers, cashews, and aqua foods. They are increasingly replacing tins due to better design and transport durability. Though volumes are strong and growing fast (20%+ expected), Realization is around 215/kg and margins (₹40–₹45/kg) are much less than the F&F thin pack segment but quite superior to margins in paint and lube segments.

The patented Square Pack segment grew by 17.34% YoY in FY25, driven by robust demand from the detergent and cashew segments. Mold-Tek Packaging Ltd enhanced capacity at its Daman and Panipat facilities and localized 10L Qpack molds across three plants to reduce freight costs. It also began marketing smaller 2L and 6.3L variants targeted at the retail and confectionery markets.

To summarise, Thin-Wall F&F brings premium margins and brand-focused utility, while Q-packs drive scale and industrial replacement demand at better than industrial segment margins.

Pharma

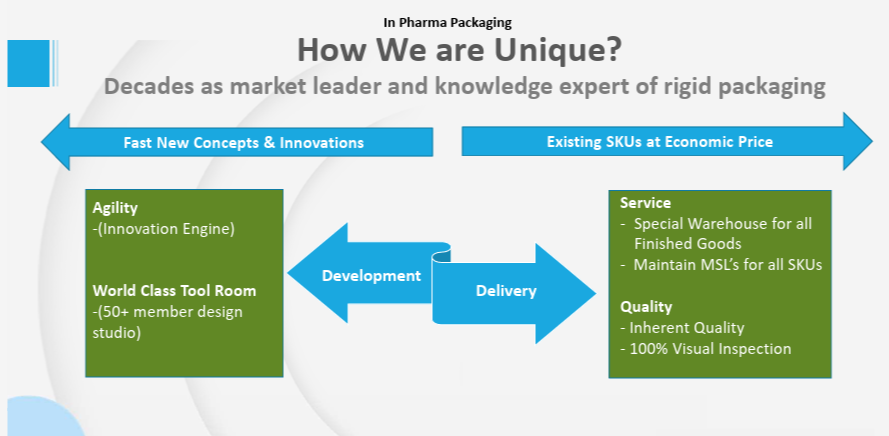

As per Mold-Tek Packaging Ltd management the pharmaceutical packaging market in India including exports to the US and Europe is estimated to be valued at ₹4,000–5,000 Cr with bottles and caps alone accounting for a significant share. Mold-Tek Packaging Ltd’s entry into the pharma packaging segment is backed by strong industry tailwinds, including increasing regulatory scrutiny, a shift towards high-quality packaging, and the expansion of India’s pharmaceutical manufacturing base.

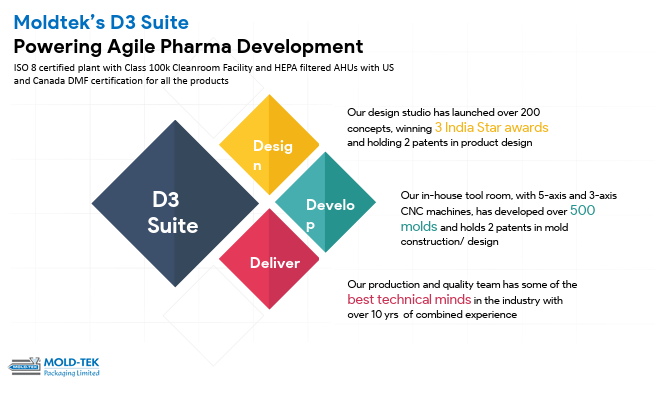

Mold-Tek Packaging Ltd had initially experimented with IBM-IML in FY21, targeting OTC pharma due to fewer regulatory constraints. However, challenges like high capex and audit hesitancy among clients led to a temporary pivot. Mold-Tek Packaging Ltd has since realigned its focus and the successful commission and commercialized its pharma facility in Q4FY24 with total investment of 90Cr and capacity of 1,500 MTPA at Sultanpur, Telangana, located strategically near Hyderabad, India’s pharma hub. This facility marks a technological milestone as the country’s first to integrate Injection Blow Molding (IBM) with In-Mold Labeling (IML), offering lightweight, high-precision packaging with enhanced branding capabilities

Mold-Tek Packaging Ltd initially targeted lower-barrier OTC products like sanitizers and hand washes but has since expanded its product suite to include 12 tablet container variants, 4 effervescent (EV) tube sizes, 3 canister variants, and specialized CT and CR caps.

In Q4FY25, the Pharma segment posted revenues of ₹6.67 Cr (~3.35% of Q4 sales) and achieved operating-level break-even ahead of schedule. The product mix and fast commercialization enabled by in-house mold development have led to approvals from 18–20 clients with commercial supplies underway to 4-5 of them. Pharma segment’s EBITDA/kg stands highest at ₹90-100. with five new IML machines being commissioned by June 2025.

and management is guiding for 30-35 Cr revenue in FY26 and ₹50 Cr in FY27.

Capacity is expected to double to 3,000 MTPA by FY26-end to support the expansion Mold-Tek Packaging Ltd has applied for an additional 2.5 acres adjacent to its current facility at an estimated investment of ₹10 Cr. Moreover, Mold-Tek Packaging Ltd is tapping into global markets having initiated exports to the US and receiving interest from clients in Germany and Bangladesh. Key differentiators include the first-time use of IML for EV tubes in India one-piece canister construction, laser-engraved desiccant canisters for enhanced sustainability, and superior agility compared to legacy players like Gerresheimer, Shriji Polymers, Parekhplast, and others.

Mold-Tek Packaging Ltd pharma segment is well-positioned to scale with full capacity utilization offering a potential topline of 90-100 Cr annually. This will be a major profitability driver for Mold-Tek Packaging Ltd going ahead as pharma segment has realisation of 300/Kg & EBITDA of 90-100/Kg i.e highest among all divisions

Mold-Tek Packaging Ltd Corporate Governance

Board Composition – Mold-Tek Packaging Ltd’s Board of Directors comprises 10 members, including 6 independent directors and 1 woman director ensuring a well-diversified and compliant board structure.

Related Party Transactions – Mold-Tek Packaging Ltd reported related party transactions amounting to ₹16 crore in FY24 with KMP related companies primarily related to purchases and services received which is 2.3% of total revenue.

Dividend Payout – Mold-Tek Packaging Ltd has maintained a consistent track record of dividend payments over the years which shows its commitment to shareholder returns.

Contingent Liabilities – Mold-Tek Packaging Ltd’s contingent liabilities is > ₹1 crore, hence not material.

Audit & NRC Committees – Both the Audit Committee and Nomination and Remuneration Committee are chaired and run by independent directors

Remuneration Payout – Key Managerial Personnel drew total compensation of ~₹10 crore in FY24 i.e. including salaries and performance-linked bonuses. While this represents ~14% of PAT, it appears elevated due to depressed profitability arising from higher depreciation linked to recent capex.

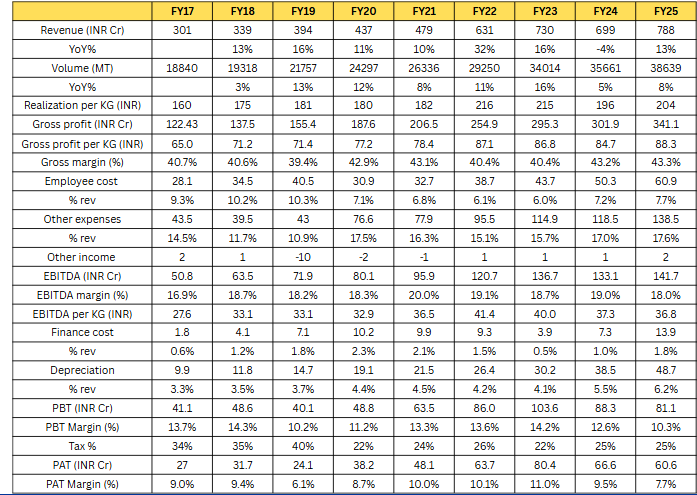

Mold-Tek Packaging Ltd Financial Performance

Mold-Tek Packaging Ltd has printed good numbers in FY25 with 13% YoY revenue growth and volume growth of 8%. While FY22 was clearly an outlier year mainly due to higher crude prices which led to higher realisation, similarly FY24 posted negative revenue growth due to lower crude prices. What we like about Mold-Tek Packaging Ltd is its ability to defend and maintain its margin despite operating in a raw-material-intensive and cyclical industry and it deals with big corporations in both sourcing and selling. EBITDA margins largely stable around 18–20%, which speaks highly of a packaging company with large-scale B2B clients and vendors.

Bottom line number has been impacted by the higher front loading cost of new capex and investments in new product lines division which has led to higher Employee costs & other expenses. Depreciation has grown sharply (22% CAGR) due to continuous capex over the years, but it is expected to peak in FY26 after which it should stabilize as Mold-Tek Packaging Ltd moves to maintenance capex mode.

We believe Mold-Tek Packaging Ltd’s ability to sustain high EBITDA%, Grow volumes, and improve per kg profitability speaks of its cost efficiency, and differentiated value proposition in the rigid packaging space.

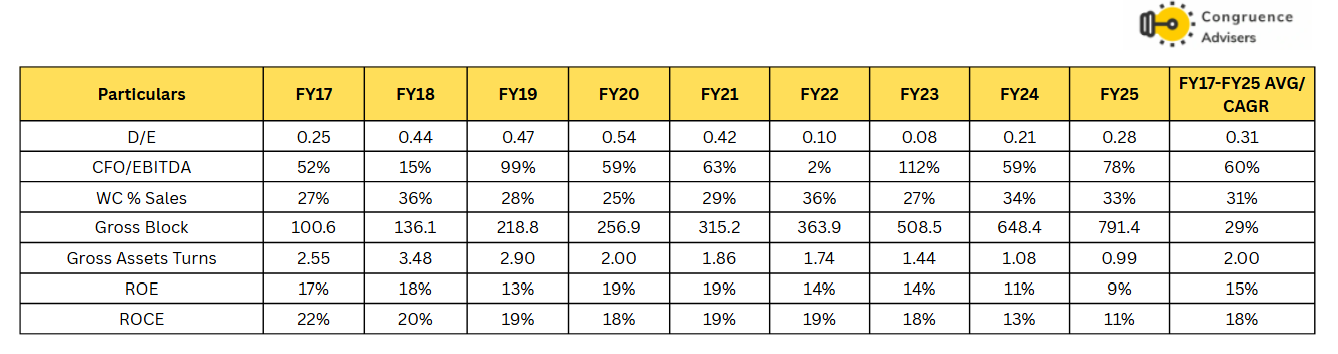

Mold-Tek Packaging Ltd Return Ratio, Cash Flow, Working Capital and Debt Analysis

Mold-Tek Packaging Ltd has managed its balance sheet prudently while continuing to invest aggressively in capacity expansion. Despite a consistent capex cycle with gross block growth at a 29% CAGR over FY17–FY25 the debt-to-equity ratio remained modest, averaging just 0.31x. With CFO/EBITDA averaging 60% from FY17-25 & Working capital % of sales has hovered around 31% Which is a good metric for the company’s operating in B2B model and deals with large clients.

As per cash flow statement Capex out flow for last 3 years is 400+ Cr vs 363 Cr invested in Gross block since the inception of Mold-Tek Packaging Ltd

As capacity addition outpaced revenue growth and incremental capex came at higher costs, gross asset turns have declined sharply from 2.5x in FY17 to ~1x in FY25. However, this is expected to improve going forward as most of the large capex is behind and Mold-Tek Packaging Ltd will start printing volume growth and better utilization from FY26 onward.

Return ratios have moderated in recent years due to front-loaded costs and under-utilization of newly added assets with capex and depreciation expected to peak in FY26 which will lead to profitability improving through higher-margin pharma and F&F segments a gradual recovery in return ratios looks likely in the coming years.

Mold-Tek Packaging Ltd Comparative Analysis

To understand Mold-Tek Packaging Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Mold-Tek Packaging Ltd to its competitors (peer comparison) on various fundamental parameters and Mold-Tek Packaging Ltd share performance relative to relevant benchmark and sector indices.

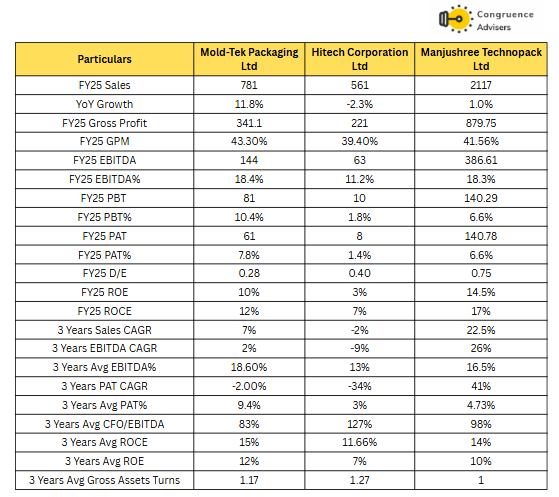

Mold-Tek Packaging Ltd Peer Comparison

We have compared Mold-Tek Packaging Ltd with two key players in the rigid packaging space: Hitech Corporation Ltd and Manjushree Technopack Ltd.

- Hitech Corporation Ltd is a listed company promoted by Mr. Ashwin Dani, one of the three promoters of Asian Paints Ltd. Asian Paints is also the largest customer of Hitech Corporation and the company functions almost like an in-house packaging arm for Asian Paints.

- Manjushree Technopack Ltd has been unlisted since 2015 and is currently majority-owned by Advent International, a global private equity investor. It is the largest player in the rigid packaging industry by scale and serves a wide range of clients across sectors.

*FY24 data for Manjushree Technopack Ltd used for comparison in table

One of the most interesting takeaways is that Manjushree Technopack Ltd being almost 3x the size of Mold-Tek Packaging Ltd in terms of revenue. The Gross profit margin & EBITDA margins of both companies operate at similar levels. Which means that scale alone does not confer margin superiority in the rigid packaging business. Mold-Tek Packaging Ltd’s ability to defend its margins despite being significantly smaller is a strong reflection of its operational discipline, cost efficiency, backward integration, and value-added mix (IML). While Hitech Corporation Ltd, on the other hand lags behind despite being backed by Asian Paints co-promoter. With EBITDA margins of just 11.2% and weak profitability, it highlights how scale or anchor clients don’t always translate to performance.

Mold-Tek Packaging Ltd also maintains a lean balance sheet (D/E of 0.28). It continues to invest in growth through strategic capex without overextending its balance sheet unlike some peers. All three players have strong EBITDA to Cash Flow conversion, Mold-Tek Packaging Ltd holds its ground well against peers like Manjushree Technopack Ltd and Hitech Corporation Ltd, both in terms of operational strength and financial quality.

Why you should consider investing in Mold-Tek Packaging Ltd

Mold-Tek Packaging Ltd offers some compelling reasons to track closely and to consider investing in a proxy to paint industry and packaging Industry.

Stable Margin – Mold-Tek Packaging Ltd has maintained stable EBITDA margins of 18–20% over the past eight years, which speaks very highly for a packaging company operating in a raw-material-intensive and competitive industry. Mold-Tek Packaging Ltd has demonstrated the ability to pass on raw material cost increases to clients. Recently, EBITDA per kg has also improved, with further upside expected as volumes grow from newer segments like pharma and FMCG.

Technocrat Promoters – Mold-Tek Packaging Ltd is led by technocrat promoters whose strong technical backgrounds and industry experience have been central to the Mold-Tek Packaging Ltd’s innovation-led growth. Their deep understanding of manufacturing processes has enabled. Mold-Tek Packaging Ltd to pioneer technologies like in-house robotics and In-Mold Labeling (IML), giving it a distinct edge in the Indian packaging industry.

Established Player and reputed customer base – Mold-Tek Packaging Ltd has nearly three decades of experience in the rigid plastic pail packaging industry, making it a well-established player in the segment. Over the years, Mold-Tek Packaging Ltd has built strong relationships with marquee clients across the paints, lubricants, food, and FMCG industries, ensuring consistent repeat business. Mold-Tek Packaging Ltd is also expanding its reach by engaging with major pharmaceutical players, which is expected to support more profitable growth in the coming years.

Diversification in newer products and customers – Mold-Tek Packaging Ltd is actively diversifying its revenue base beyond its traditional strongholds of paints and lubricants, with increasing presence in FMCG and a recent entry into the pharma packaging space. Within paints, it has added key customers like Birla Opus and Pidilite Industries to reduce dependence on Asian Paints. The growing adoption of In-Mold Labeling (IML) across segments, rising volumes from Grasim, ramp-up in the pharma division, and new client additions in the Food & FMCG space are expected to drive long-term growth and create a more balanced mix

Vertical Integration – Mold-Tek Packaging Ltd has achieved strong backward integration by building in-house capabilities across key processes like mold design, robot development, and various labelling technologies including IML, HTL, screen printing, and shrink sleeves. Its consistent investment in R&D and innovations like QR code-based solutions has helped Mold-Tek Packaging Ltd stay ahead of packaging trends, reduce production costs, and respond quickly to customer needs. This integration, both backward and forward, gives Mold-Tek Packaging Ltd a competitive edge and supports Mold-Tek Packaging Ltd ability to win and retain clients.

What are the Risks of Investing in Mold-Tek Packaging Ltd

Investors need to keep the following risks in mind if they choose to invest into this business. Risks needs to be weighed in combination with the advantages listed above to arrive at a decision that is optimal for your portfolio construct

Raw Material Fluctuations Risks – One key risk for Mold-Tek Packaging Ltd is its dependence on crude oil-based derivatives which make up about 95% of its input costs. When crude prices fluctuate the cost of raw materials fluctuate too. While Mold-Tek Packaging Ltd usually passes on these higher costs to customers, it doesn’t happen immediately; it can take a month or even a full quarter depending on client agreements. This delay can temporarily impact profitability.

Customer Concentration risk – Mold-Tek Packaging Ltd faces a Customer concentration risk, as its business is heavily dependent on a few large clients. In FY24, the top 10 customers contributed around 65% of total revenue, with Asian Paints alone accounting for 30–35%. This means that any slowdown or change in buying patterns from these key customers can have a big impact on the Mold-Tek Packaging Ltd’s growth.

For example, when Asian Paints saw lower volume growth in the past due to increased competition, it led to underutilization of Mold-Tek Packaging Ltd’s dedicated plant a, as there were no other major clients in that region to absorb the excess capacity which led to lower growth

Higher Competition Risk – The rigid packaging industry is highly competitive, and Mold-Tek Packaging Ltd must constantly adapt to changing customer needs and preferences. This is especially true in the Food and FMCG segment, where competition has been increasing steadily.

To maintain its edge, Mold-Tek Packaging Ltd is focusing more on high-quality packaging using modern technologies like IML. Mold-Tek Packaging Ltd purposely avoids low-margin clients who still use older, cheaper decoration methods like screen printing. While this strategy protects profitability, it also means Mold-Tek Packaging Ltd may lose out on volume-based opportunities in the lower price segments.

Execution Risk in New Capex – A big part of Mold-Tek Packaging Ltd’s future growth relies on the success of its recent expansions, especially the doubled capacity for Aditya Birla Group’s dedicated plants and its pharma packaging foray, where the planned capacity is also being doubled. Any delay in volume ramp-up from Aditya Birla Group could affect growth, even though the machinery is fungible. There’s also a risk if Mold-Tek Packaging Ltd is unable to attract other nearby customers, leading to underutilized facilities as seen earlier at its RAK plant, where low demand forced a shift of equipment to India.

Supplier Concentration Risk – Mold-Tek Packaging Ltd sources around 90% of its raw materials from Reliance Industries, which creates a supplier concentration risk. However, the risk is partially mitigated as the company has the option to import materials or buy from alternate suppliers to keep operations running smoothly

Environmental & Regulatory Risk – Mold-Tek Packaging Ltd faces moderate environmental risks due to regulations around pollution, hazardous waste, and plastic use. Since many of its products, like food and rigid plastic packaging, are single-use, there’s growing pressure to improve recyclability and adopt eco-friendly materials. While Mold-Tek Packaging Ltd recycles all process waste, it must continue adapting to stricter environmental norms.

Under the Extended Producer Responsibility (EPR) policy, Mold-Tek Packaging Ltd must increase use of post-consumer recycled plastic from 30% by 2025 to 60% by 2028. Although it reached 20% PCR use in FY25, meeting future targets could raise raw material and maintenance costs, and higher rejection rates may further have an impact on Mold-Tek Packaging Ltd ability to manage these costs and pass them on to customers will be key as regulations tighten.

Mold-Tek Packaging Ltd Future Outlook

Mold-Tek Packaging Ltd is set for a steady growth trajectory in FY26 driven by multiple segments. The paint segment is expected to see 10% volume growth, largely supported by the newly expanded capacity for Aditya Birla Group which became operational in April 2025. Additionally, interest in IML is rising among key clients like Birla opus and Asian Paints, which should aid margins and realisations as IML offers better profitability (IML has 20% penetration in paints segments), While the lubes segment remains subdued due to reduced replacement cycles, it is expected to stay largely stable.

In the Food & FMCG (F&F) segment Mold-Tek Packaging Ltd is guiding for 15–20% volume growth in FY26. Within this, Q-packs are expected to grow at the higher end (around 20%) while the F&F thin-wall segment is likely to grow at ~15%.(Q-packs operate at a lower EBITDA/kg of Rs 40–45, while F&F thin-wall yields higher EBITDA/kg of around Rs 70). The newly operational Panipat plant which commenced thin-wall F&F production in Q1FY26 is expected to aid this growth and help Mold-Tek Packaging Ltd maintain segment profitability.

The pharma division, a relatively new vertical for Mold-Tek Packaging Ltd, is expected to print revenue of Rs 30-35 Cr in FY26 and Rs 50 Cr in FY27. Given its highest EBITDA/kg of Rs 90–100, successful execution in pharma could become a key profitability driver in the coming years.

Capex for FY26 is pegged at Rs 70-80 Cr ( of which 20-25 Cr for pharma, 20 Cr for molds & machinery and printing and 14-15 Cr for the Mahad facility) From FY27 onward, only maintenance capex is expected and depreciation costs are likely to peak in FY26.

Overall, Mold-Tek Packaging Ltd management is confident about delivering growth across segments and improving profitability. EBITDA per kg is expected to reach Rs 42/kg over the next couple of years, with potential upside as capacity utilisation improves and the pharma segment scales.

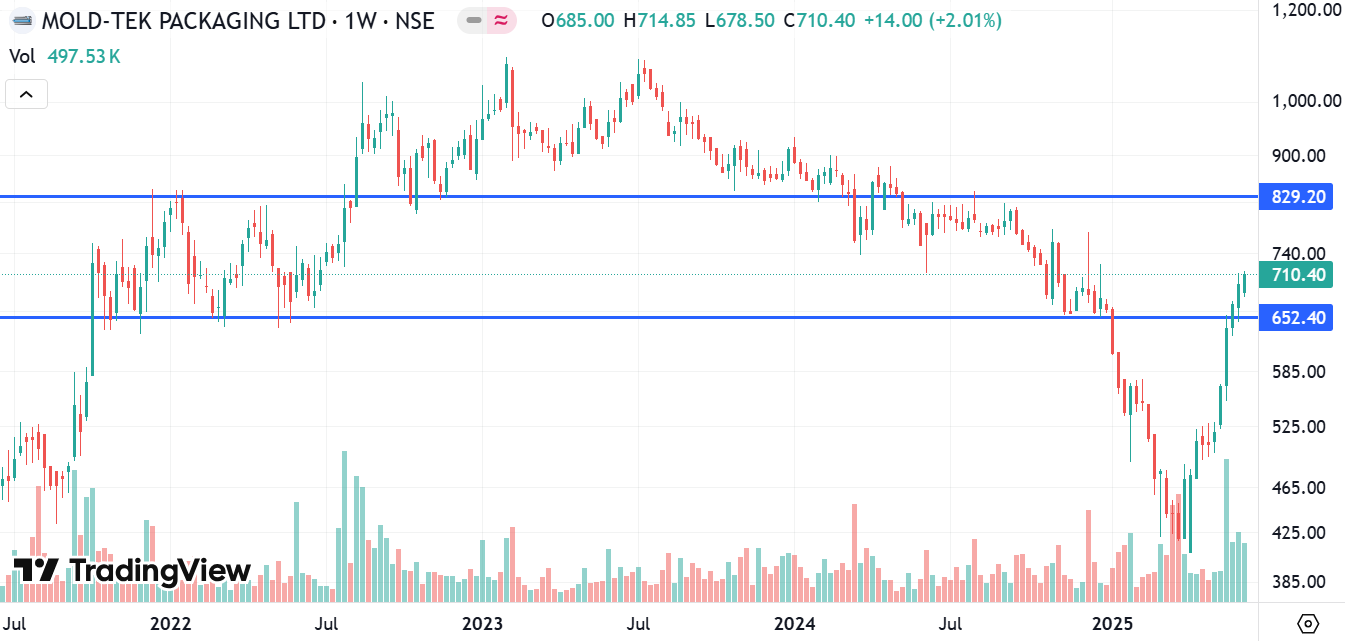

Mold-Tek Packaging Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Mold-Tek Packaging Ltd Ltd Price charts

Let’s look at the weekly chart of Moldtek Packaging Ltd. over the last 4 years, from mid 2021 to now. The stock consolidated in a horizontal range between 650 and 830 for a year between 2021 and 2022. Then it broke out of the 830 resistance level with high volumes in Aug 2022. For the next 1.5 years, 830 acted as a strong support level and the stock barely breached it. In March 2024, the level broke as the market digested that profitability in FY24 was going to be lower YoY due to tepid demand in the important paints segment. Through the rest of CY24, the stock continued to trend lower and finally broke the second key support level of 650 in Jan 2025. Successive market events in Q4 FY25 (Indian market correction due to tepid GDP growth and Trump tariff tantrums) took the stock way down to 425 levels, levels not seen in 4 years. Since then, the stock has made a sharp V-shaped recovery on the back of more upbeat commentary by management around paints and pharma and a general return to bullishness in Indian markets after the shocks of Trump tariffs and the Indo-Pak skirmish got digested. The stock crossed the first key resistance level of 650 on the back of large volumes. In the near term, this level should act as support for the stock. The next key resistance level is 830.

On the daily chart, over the last 1Y, we can see 3 distinct phases. The leftmost phase between Jun-Sep 2024 when the stock tried to hold above the support level of 767. The support cracked in late Sep 2024 and then, the stock consolidated in a rectangular channel between 652 and 767 during Oct 2024 to Dec 2024. During this 3 month period, the stock tried to rally beyond the 767 level twice, but was brutally beaten down both times. Eventually in Jan 2025, the stock broke the 652 support level and went into a tailspin, bottoming out around 420 levels in Mar-Apr 2025. The stock probably bottomed out due to seller exhaustion as some buyers started finding value at levels near 400. After consolidating between 500 and 520 for a month between April and May (Tariff + Indo-Pak volatility), the stock went on a tear-away rally like much of the small and micro-cap market as soon as the worst of the Indo-Pak war seemed to be over. The momentum took it easily past the key resistance level of 652. Going forward, the key near term support and resistance level for the stock is 652 and 767 respectively. We expect the stock might consolidate for a while in this range till a breakaway quarter helps print a significant YoY PAT growth (most likely led by a big quarter for pharma and revival in paints).

Mold-Tek Packaging Ltd Latest Latest Result, News and Updates

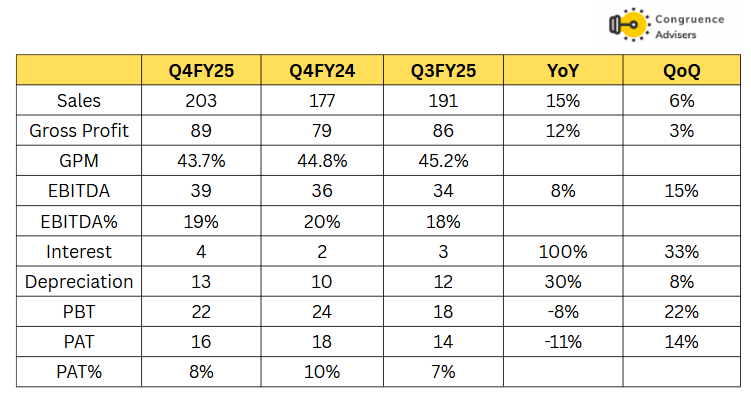

Mold-Tek Packaging Ltd Quarterly Results

Mold-Tek Packaging Ltd Printed revenue growth 15% YoY & 6% QoQ, with sales crossing 200 Cr mark, Volume growth stood at 7.3% YoY. EBITDA rose 8% YoY & 15% QoQ, While PAT down by 9% due to higher interest and depreciation costs. Mold-Tek Packaging Ltd EBITDA per kg grew by 8% QoQ to nearly Rs.40/kg in Q4FY25 vs Rs.37/kg in Q3 FY25. driven by strong performance in the Pharma and F&F segments. Looking ahead, Mold-Tek Packaging Ltd is targeting an EBITDA of Rs. 42–43/kg for FY26.

Q4FY25, IML & HTL contributed increased to 75.5% vs 64.4% YoY, In terms of volumes and In terms of value, IML accounted for 77.4% (vs 74.4% in FY25 & 68% in FY24), As Top paints customers are preferring for higher-value IML offerings. Mold-Tek Packaging Ltd has added Marico and Mankind to its list of blue chip clients.

Paints segment posted a tepid volume growth of 2.1% YoY, while the Lubricants segment volume declined by -4% on a YoY, Growth was driven by Food segment which posted strong volume growth of 26% YoY & QPacks posted 15.8% YoY. Pharma division contributed 3.3% of the total revenue in Q4FY25 and achieved break-even with a revenue of 6.67 Cr

Final Thoughts on Mold-Tek Packaging Ltd

Mold-Tek Packaging is a compelling proxy to Indian consumption with presence across industrial segments like paints and lubes, FMCG segments such as food and also pharmaceuticals. The technocrat management has demonstrated their forward thinking mindset over the last many years by investing in IML technology ahead of the pack and backward integrating significantly in its injection molding processes. The fact that their EBITDA margins have stayed rangebound at 17-20% over the many years and EBITDA/kg has improved from ~INR 28/kg in FY17 to ~INR 40/kg post Covid, is a testament to the value addition they bring in rigid plastic packaging. Their margins and return on capital ratios are on-par or better than the industry leader. This becomes even more impressive when one takes into account the fact that on one side they buy raw material from a giant like Reliance Industries and on the other side they sell their finished goods to giants like Asian Paints, Aditya Birla Group, HUL etc.

This is one business that should have very high terminal value given their presence across key consumption sectors that are not disappearing anywhere. One hopes that the technocrat management will keep finding ways to increase contribution from more exciting and forward looking business segments such as pharmaceuticals while gradually replacing sluggish segments like lubricants, in the process continuously increasing their EBITDA/kg. If they can crack an exciting industry like pharmaceuticals which somehow allows them to grow yearly revenues at 15-20% instead of the historical 10-12% that they’ve been doing, this business may get premium valuations from the market.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this to a general audience. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will continue/be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice