Orient Bell Ltd is a microcap company that manufactures 4000+ SKUs of tiles under the Orient Bell brand. Orient Bell Tiles are distributed through 2000+ Business Partners, and 61 Tile Boutiques (Experience Centre) across India. Orient Bell Ltd has 3 plants & 2 outsourced manufacturing facilities.

Orient Bell Limited: A Late stage Play for Indian booming real estate cycle?

We believe Orient Bell Ltd. could potentially be an interesting turnaround candidate in the tiles segment if it can grow volumes at a healthy rate from here. The tiles industry as a whole has gone through tough times in the recent past. Between FY18-FY24, the combined revenues of the top 5 organised tiles companies in India has grown at a measly CAGR of 6.3% while India’s real GDP during the same period has grown by 6.5%. With the spike in real estate sales since Covid and stronger GDP growth projected for the economy, building materials such as tiles are expected to do well in the coming 2-3 years. However, Orient Bell Ltd management’s execution in growing the business since 2018 has left a lot to be desired as we will see in detail below.

Orient Bell Ltd Company Overview

Orient Bell Ltd. is in the business of manufacturing, trading, and selling ceramic floor tiles in India and export markets. Orient Ceramics & Industries Ltd. (OCIL) was incorporated as a public limited company in 1977. The current promoter family, led by Mr. Mahendra Kumar Daga, took control of the company in 1993. OCIL decided to acquire Bell Ceramics Ltd. in 2010 to gain a foothold in South India. The merger was completed in 2012, and since then, the company has been known as Orient Bell Ltd. In 2018, Mr. Madhur Daga, son of Mr. Mahendra Kumar Daga, took over as the Managing Director of the company from his father.

Orient Bell Ltd has 3 plants located in Sikandrabad (Uttar Pradesh), Hoskote (Karnataka), and Dora (Gujarat), with a total manufacturing capacity of 27 million square metres (MSM). In addition, Orient Bell Ltd. has 2 outsourced manufacturing facilities in Morbi with a capacity of 10 MSM. Orient Bell Ltd. has 4000+ SKUs, 2000+ Business Partners, and 61 Tile Boutiques (Experience Centre) across India.

Orient Bell Ltd Management Details

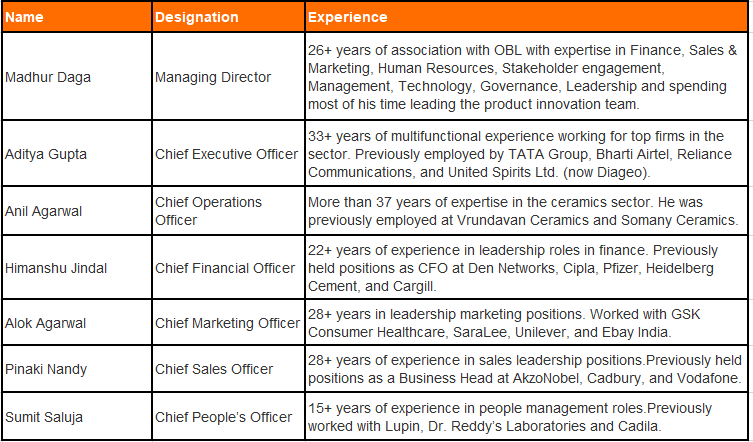

In 2018, Mr. Madhur Daga succeeded his father, Mr. Mahendra Kumar Daga, as the Managing Director of Orient Bell Ltd. Alongside this leadership transition, Orient Bell Ltd also saw a change in its management team, with the appointments of Mr. Aditya Gupta as CEO and Mr. Himanshu Jindal as CFO. This CEO/CFO duo team has since continued to the company. All of them bring multiple decades of experience across various businesses.

The MD, CEO & CFO are backed by a strong team that has vast experience across various departments like Operations, sales, marketing, finance, etc.

Orient Bell Ltd – Tiles Industry Overview

Ceramic tiles are among the largest industries in the building materials sector in India and one of the largest employers in the building materials sector. The total market size for ceramic tiles in India is estimated to be ₹59,500 Cr in CY23 and is estimated to reach ₹70,000 Cr in CY25, growing at ~13% CAGR. Since 2018, the overall ceramic tiles market in India has grown at an impressive CAGR of 17% (Source: Nirmal Bang Research)

Of this, around 30% amounting to ₹18,000 Cr, are exported. Exports have grown extremely well over the last few years, with India growing its share of global tile exports massively between CY12 and CY21, as illustrated in the chart below.

The abundant availability of cheap labour and raw materials has helped India carve out a significant place for itself in the global tiles export market. In recent years, the Indian tile industry has also taken advantage of import duties placed on Chinese exports by many countries to grow its share of exports. Morbi, in Gujarat, is the largest single-location hub of tiles manufacturing in the world. It is the prime centre for tile manufacturing and export in India.

The exports are well distributed across countries, with GCC countries and the USA contributing significant chunks of demand.

India is the second largest consumer and producer of ceramic tiles in the world after China, accounting for 11% and 14% respectively of global consumption and production, respectively. However in terms of per capita consumption of tiles, India is at 0.6sqm vs the global average of 1.4sqm. So, tile consumption per capita will go up as India’s per capita GDP keeps increasing. Govt push towards housing for all via initiatives such as PM Aawas Yojana – Grameen and Urban – are big demand drivers for the tiles industry.

Source: ICRA Research

A large part of the industry is unorganised. A handful of brands dominate the organised industry. The market leader is Kajaria Ceramics Ltd, followed by the likes of Somany Ceramics Ltd, Prism Johnson Ltd, Asian Granito ltd, Orient Bell ltd, Exxaro Tiles Ltd, Murudeshwar Ceramics Ltd, Simpolo, Qutone, Varmora, etc.

The key cost drivers for the industry are the cost of raw materials such as clay, feldspar, silica, calcium carbonate, etc., and the cost of power and fuel. Raw materials needed for manufacturing ceramic tiles are widely available in India. Power and fuel are major cost components for tile industries, as firing the tiles is a very energy-intensive affair. Apart from electricity, the process needs dense energy, which is usually obtained from compressed natural gas or propane. Thus, industry margins are quite susceptible to the movement of gas prices. The Russia-Ukraine war in 2022 and the resultant spike in natural gas prices caused tile margins to get squeezed significantly as all the price increases couldn’t be passed on to end consumers.

Source: ICRA Research

In terms of domestic consumption trends, incremental consumption is moving towards glazed vitrified tiles (GVT) as opposed to ceramic tiles. While ceramic tiles are made by firing natural clay, vitrified tiles have additives such as quartz and silica added to them before the firing process, which makes them less porous, more durable, and less likely to stain than ceramic tiles. Glazed vitrified tiles are vitrified tiles with a layer of glaze on top which can increase the aesthetic appeal of the tile. In addition to migration towards glazed vitrified tiles, consumption patterns are also shifting towards larger-sized tiles.

While vitrified and large-sized tiles are more expensive than smaller-sized ceramic tiles, the commoditized nature of the industry has meant that in spite of this value addition, the average realisations in the tiles industry haven’t been able to keep pace with inflation in the domestic market. As one can see in the chart below, average realisations per SQM have actually reduced between FY20-23.

With such unfavourable price dynamics in a largely commoditized industry, scale, distribution strength, and brand power become very important for a company to succeed. Thus, brands that have already achieved scale are likely to keep getting better and deliver better unit economics, whereas smaller companies would find it very hard to achieve scale. The challenging industry dynamics are reflected in the downward trajectory of industry margins and return ratios in the last few years.

For the end consumer, the bulk of the cost of installing tiles in their homes is not the cost of the actual tile itself but the cost of labour and material required to fix the tiles to the concrete floor. As can be seen below, the final installed cost of tiles can be anywhere between 2-2.5x the cost of the tiles themselves.

Orient Bell Ltd Products & Manufacturing details

Orient Bell Ltd has a total manufacturing capacity of 36.9 MSM, with 26.9 MSM of in-house capacity and 10 MSM of outsourced capacity via joint ventures. The 3 owned plants of Orient Bell Ltd. are located in Sikandrabad, Uttar Pradesh (14.8 MSM capacity), Hoskote, Karnataka (6.6 MSM capacity), and Dora Gujarat (5.5 MSM capacity). The two associated entities (JVs) are located in Morbi, Gujarat with a total capacity of 10 MSM.

Over FY 21-24, Orient Bell Ltd has increased its in-house manufacturing capacity by ~40% by adding ~7.6 MSM capacity for a total capital outlay of ₹131 Cr of the new capacity added, 3.3 MSM was added in the higher realisation GVT category, while 4.3 MSM was added in the ceramic segment. Apart from adding 3.3 MSM of fresh GVT capacity, the older 2.2 MSM line at Dora, Gujarat was also converted from ceramic to GVT, thus increasing overall GVT capacity by 5.5 MSM over these 4 years. Orient Bell Ltd overall capacity of vitrified tiles has increased from 5.5 MSM in FY18 to 14.6 MSM in FY24. Commendably, most of this ₹131 Cr capex has been done using internal accruals, with long-term debt only increasing by ₹14 Cr between FY18 and FY24. This has been the biggest success of the Orient Bell Ltd. management during this period.

In line with capacity, the proportion of vitrified sales has also gone up for Orient Bell Ltd, with 51% of the total revenue in FY24 coming from vitrified tiles vs 34% in FY18. Further, glazed vitrified tile (GVT) contribution as % of revenue has increased from 9% in FY18 to 30% in FY24. Now, Orient Bell Ltd is adequately benchmarked against the likes of Kajaria Ceramics Ltd, Somany Ceramics Ltd, Prism Johnson Ltd, etc., in terms of the total revenue contribution coming from vitrified and GVT tiles.

Orient Bell Ltd has 364 tile showrooms across the country called OBTBs. These are showrooms where dealers exclusively display Orient Bell products. Most of these exclusive showrooms came into existence between FY19-24 when ~240 such exclusive showrooms were created. The % sales coming from OBTBs have increased from ~20% in FY19 to 43% in FY24. Exclusive showrooms with extensive displays are the best way to showcase the Orient Bell Ltd brand to prospective customers. In multi-brand showrooms, Orient Bell Ltd is likely to have lower salience due to the higher brand recognition of Kajaria Ceramics Ltd, Somany Ceramics Ltd, Prism Johnson Ltd, etc. While these showrooms definitely give good exposure to the brand for customers, Orient Bell Ltd. doesn’t earn any extra margins via this channel compared to the multi-brand dealer channel.

The increase in the proportion of vitrified tiles and push on growing sales via the exclusive showroom channel during this period has helped Orient Bell in improving realisations per MSM from INR 237/MSM in FY18 to INR 279/MSM in FY24, showing a CAGR growth of 2.5% for the period. This is commendable because, in comparison, the average realisations of the other top 4 brands (Kajaria Ceramics Ltd, Somany Ceramics Ltd, Prism Johnson Ltd, Asian Granito India Ltd) during the same period have increased at a CAGR rate of 1.8%. While this is a positive development, it’s important to note that Orient Bell’s realisations are much lower than other branded peers, up to 15-20% lower than the likes of Kajaria Ceramics Ltd and Somany Ceramics Ltd; so, the scope for improvement was much higher in the case of Orient Bell Ltd.

In addition to increasing the number of exclusive showrooms, Orient Bell Ltd has also tried to focus on delivering an online sales experience to prospective customers through their website, adding features such as virtual visualisation, budget estimation, tile selection, and online ordering. These features are quite standard these days for consumer-facing brands, and we don’t think this will have any significant positive impact on their sales. These are good-to-have features, but almost all tile shopping by customers still happens in-store with the help of contractors, architects, or interior designers.

In December 2023, Orient Bell Ltd launched its first-ever pan India TV campaign to enhance brand visibility, strengthen customer engagement, and finally drive sales. The TV campaign ran with the tagline “100% tiles, 0% celebrity,” emphasising the no-frills, customer value-addition-focus of Orient Bell Ltd. As a result, the marketing cost as % of revenue for Orient Bell Ltd has spiked beyond 5% compared to 3-3.5% in the previous year. This investment is necessary as Orient Bell Ltd brand perception is clearly not as strong as the other large branded tiles manufacturers. Sustained brand visibility campaigns such as this will be needed for Orient Bell to make an impression in the minds of more customers.

Orient Bell Ltd Corporate governance Analysis

Board Composition – As of FY24, There are 6 directors on the board: 2 are executive directors (one is the executive chairman and whole-time director, and the other is the managing director). The remaining 4 are independent and non-executive directors, one of whom is a woman. Except for Mr. Mahendra K. Daga and his son, Mr. Madhur Daga, none of the Directors are in any way related. 3 out of the 4 non-executive directors are either CAs or graduates from IIT/IIM. The fourth director possesses expert knowledge in Corporate Social Responsibility (CSR). An Independent-Non Executive Director heads the Audit and Remuneration Committee.

Promoter Remuneration – The total remuneration drawn by promoters in FY24 was ₹3.46 Cr in the form of salary, which is 3.86 times of the FY24 Net Profit. An increment of 0.02% and 15.74% was seen in the salary of Promoter-Whole Time Director and MD, respectively.

Related Party Transactions – Orient Bell Ltd does not have any material related party transactions that may have potential conflict with the interests of the Orient Bell Ltd at large.

Contingent Liabilities – As of FY24, contingent liability amounts to ₹3.09 Cr. the same as FY23.

Dividend Policy – Orient Bell Ltd has consistently distributed dividends since FY19, with the exception of FY20. For FY24, the total dividend payout will be half (₹0.72 Cr.) of what has been paid over the past two annual years (₹1.45 Cr.)

Orient Bell Ltd Financial Performance

Orient Bell Ltd.’s performance since the new management came in 2018 has been dismal on the growth front. Revenue and volumes have been stagnant for 6 years, whereas the rest of the leading organised players have managed to grow volumes and revenues at 5% and 7% CAGR, respectively, over this time frame. EBITDA margins have fluctuated between 6-8% with a severe drop to 3.5% in FY24. PAT margins have also been in the 1.5-3% range. As a result, average ROE and ROCE over this period have averaged 7% and 13% respectively.

Orient Bell Ltd Profit & Loss Common Size Analysis

Analysis of the common-size profit and loss statement of Orient Bell Ltd reveals the Orient Bell Ltd problem over the last 6 years. Volumes have de-grown over the period, leading to flat revenues for 6 years.

Orient Bell Ltd has lost market share to other brands. EBITDA margins have collapsed in FY24 because gross margins have reverted to the mean after staying elevated for 2 years, and increased marketing spending and higher-than-normal power and fuel costs have impacted the margins by 1.5% and 2%, respectively. Fuel costs are market-determined and are not under management’s control. One hopes that fuel costs will revert to long-term average levels soon. Higher marketing spending is warranted because of Orient Bell Ltd lower customer mind-share. If they are to grow volumes at par or faster than the industry, they will need higher marketing spending at this point. On the other hand, higher marketing spending will put more pressure on their margins. So it’s a chicken and egg problem. But unless management makes efforts to increase sales volumes and revenues, Orient Bell will not be able to escape the subscale trap. Orient Bell Ltd. needs to expand revenues beyond ₹1000 Cr in the medium term to be able to consistently sustain ₹50 Cr marketing spending, which is necessary to maintain a pan India brand.

Orient Bell Ltd Ratios & Working capital Analysis

As a silver lining, Orient Bell Ltd has done well in keeping control over its working capital and in generating good cash flows. Orient Bell Ltd has effectively utilised cash flows to expand its capacity and reduce debt. Since FY20, Orient Bell Ltd.’s manufacturing capacity has expanded from ~19 MSM (Mn Sq metres) to ~27 MSM. Since FY18, Orient Bell Ltd.’s net working capital days have reduced from 76 to 40, and the debt to equity ratio has reduced from 0.35x to 0.13x.

Orient Bell Ltd Comparative Analysis

To understand Orient Bell Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Orient Bell Ltd to its competitors (peer comparison) on various fundamental parameters and Orient Bell Ltd Ltd share performance relative to relevant benchmark and sector indices.

Orient Bell Ltd Peer Comparison

The most relevant peers for Orient Bell Ltd are the large listed tile companies. We have compared Orient Bell Ltd with Kajaria Ceramics Ltd, Somany Ceramics Ltd, and Asian Granito Ltd. Apart from Prism Johnson, all other brands listed tile companies have been included in this comparison, so this should give us a rounded understanding of where Orient Bell ltd stands in the industry.

What’s clear is that Kajaria Ceramics Ltd stands head and shoulders above the other 3 and is a clear market leader. Its PAT, ROE, and ROCE% are far superior to that of the others. Somany Ceramics Ltd is a distant second, whereas Asian Granito Ltd and Orient Bell Ltd are the laggards in the branded segment. But Orient Bell Ltd. seems to have much better fundamentals than Asian Granito Ltd. Orient Bell Ltd gross profit margins are on par with Somany Ceramics Ltd, and its net working capital days are also quite optimised. But due to its sub-scale operations, fixed costs hit Orient Bell Ltd hard, resulting in below par margins and return ratios. As the FY18-FY24 volume growth CAGR parameter reveals, Orient Bell Ltd.’s sales volumes have decreased over 6 years while Kajaria Ceramics Ltd and Somany Ceramics Ltd have grown volumes at a 7% and 5% CAGR, respectively, over this period. So Orient Bell Ltd. has lost significant market share during this period.

As long as Orient Bell Ltd. is not able to grow volumes at least on par with industry volume growth, it will remain sub-scale, which will reduce its ability to spend on branding and marketing, thus reinforcing the negative cycle. If volumes increase, then operating leverage will play out, and its margins and return ratios will improve. It hopes to come close to Somany Ceramics Ltd.’s performance metrics over the medium to long term.

Orient Bell Ltd Index Comparison

Orient Bell Ltd share performance vs S&P BSE Small cap Index as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Orient Bell Ltd Valuation Ratios

| Metric | As on 30/08/24 |

| Price/Earnings | – |

| Price/Book | 1.77 |

| Price/Sales | 0.81 |

| EV/EBITDA | 23.03 |

Why You Should Consider Investing in Orient Bell Ltd ?

We believe that Orient Bell Ltd offers some compelling reasons to track the business closely and to consider investing if one is looking to build exposure to the building materials sector.

Real estate revival leading to tile demand – The real estate sector in urban areas has seen a large spike in sales post-Covid. The sector, which had been ailing throughout the 2010s decade, is seeing healthy demand, which is likely to persist for a few years. Tiles are used in the finishing stages of a building construction, just before it is handed over to the customer. Typically, it takes 3 years for builders to complete the construction of large apartment complexes. Thus the homes sold by builders starting 2021-22 will be reaching the finishing stages in 2024-25. This should lead to a large uptick in tile demand in urban areas. While the largest organised players, such as Kajaria Ceramics Ltd and Somany Ceramics Ltd, are likely to benefit most from this urban demand upsurge, even Orient Bell Ltd should see a significant uptick in its demand due to this.

Significant potential for operating leverage – Orient Bell Ltd sales for FY24 were 24 MSM, whereas it has a total capacity of ~37 MSM, including that of its associated entities. Thus, there is significant scope for operating leverage if Orient Bell Ltd is able to increase its sales volumes. There can be disproportionate growth in profits with double-digit volume growth.

Focus on brand building – Orient Bell Ltd has finally started getting aggressive on brand building. It commissioned a TVC in December 2023 for the first time and has ramped up its total marketing spending to > 5% as a % of revenue from the historical levels of 3-3.5%. This shows strong intent on the part of management to grow sales volumes. If the extra marketing investments are spent wisely they can help Orient Bell Ltd distribution network to grow and churn higher volumes from the existing setup by creating a customer pull.

Strong balance sheet and good cash flows – Orient Bell Ltd has a very robust balance sheet with very low debt and very solid interest coverage metrics. Its tight control of working capital means it generates enough free cash flows to be able to grow via internal accruals without resorting to debt. The strong balance sheet and healthy cash flows limit the possibility of any mishaps. Valuations are also relatively undemanding.

Risks of Investing in Orient Bell Ltd ?

Investors need to keep the following risks in mind if they choose to invest into this business. Risks needs to be weighed in combination with the advantages listed above to arrive at a decision that is optimal for your portfolio construct

Commoditized industry – The tiles industry is heavily commoditized, with very little to no difference in product quality between companies. India is a surplus capacity tiles market. Any slack in export demand can cause unorganised players to redirect their production towards projects in the domestic market, thus leading to pressure on tile realisations. Only strong tile brands are able to resist pricing pressure, and that too only to an extent. Kajaria Ceramics Ltd is the only such brand in India with Somany Ceramics Ltd a distant second.

Sub-scale operations – Due to the commoditized nature of the industry, pricing power, and sound unit economics are therefore gained via high spending on branding to gain customer share of mind and by increasing the scale of operations, respectively. Brand building at a national level requires a certain amount of absolute expenditure (₹ 50 Cr+ at least), which becomes prohibitive at a smaller scale. Kajaria Ceramics Ltd and Somany Ceramics Ltd, with 7x and 4x the size of Orient Bell Ltd., respectively, have much more scope to spend on branding and advertisement and thus attract more eyeballs. Large becomes larger in this industry. It’s all about scale.

Inability to grow volumes – The Orient Bell Ltd management has delivered zero volume growth between FY18 and FY24. This is a big red flag in management execution. The entire bet on Orient Bell Ltd is that it will be able to take advantage of real estate tailwinds and increased marketing spending to grow its volumes faster than the industry. If volume growth does not pan out over FY25 and FY26, then the investment case does not materialise.

Relatively lower presence in South and West – Most of the Orient Bell Ltd sales are in the North and East of the country, which are economically weaker regions compared to the West and South and are also prone to higher competition. The expanded Dora plant in Gujarat should address this issue to an extent by helping them sell GVTs in the South.

Industry’s susceptibility to energy cost fluctuations – Gas and power costs are more than 20% of revenue for tile companies. Thus, any large fluctuations in energy prices can have severe adverse impacts on tile margins.

Orient Bell Ltd Future Outlook

The tiles industry has gone through a few turbulent years now. On the back of higher real estate sales, tile demand is expected to see an uptick in H2 FY25 and FY26 as the constructed real estate projects reach the finishing stages. This, coupled with sustained government spending under urban and rural housing programs (PMAY-U and PMAY-R), should push tile demand higher in the coming quarters.

For Orient Bell Ltd as a company, this seems like a sink-or-swim moment. If management is able to capitalise on the demand spurt to grow volumes at par or faster than the industry over the next few years, then it could provide a significant upside from current valuation levels as significant operating leverage could play out. On the other hand, if management is unable to grow volumes despite significantly increasing marketing spends, then Orient Bell Ltd is likely to keep losing more market share to larger and more aggressive competitors like Kajaria Ceramics Ltd, Somany Ceramics Ltd on the one hand and canny, new operators like Simpolo Ceramics on the other hand. In such a case, Orient Bell Ltd would continue to deliver sub-par returns on capital, and Orient Bell Ltd stock would continue to languish.

Orient Bell Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Orient Bell Ltd Price Charts

On daily charts, Orient Bell Ltd stock is showing clear signs of bottoming out and forming a base. Through August 2023-March 2024 Orient Bell Ltd stock was in a clear downward trend with the 20 DMA and 50 DMA lines far below the 200 DMA line. Between March-May Orient Bell Ltd stock bottomed out and in June-July it has tried to move up beyond 420 levels but has been beaten back on the back of continuing tepid results. The 20-50-100-200 DMA lines are converging which is a classic sign of impending trend reversal. The market is probably factoring in that the worst is over for the tiles industry and better times may be around the corner thanks to a real estate led demand spurt.

On weekly charts, over the last 3 years, Orient Bell Ltd stock has gone up from the 320-390 range in H2 2021 all the way to 750 in mid 2022 and re-traced all the way back to 320 levels in March 2024. Orient Bell Ltd stock seems to have bottomed around 320 levels and is consolidating between the 320-410 levels. Once sales volume growth starts coming, Orient Bell Ltd should break through the 410-420 range and start moving upwards towards the 500 range. Thereafter, it’s likely to take support at 410-420 levels or move further upwards based on performance.

Orient Bell Ltd Latest Latest Result, News and Updates

Orient Bell Ltd Quarterly Results

Orient Bell Ltd. reported a flattish quarter in Q1FY25 with a 3% revenue growth, a 3% EBITDA margin, and a PAT loss of ~₹2 Cr. While volumes increased by 3.5% YoY, realisations dropped 0.8% YoY. The entire tiles industry reported a tough quarter, with Kajaria Ceramics Ltd growing ~5% YoY and Somany Ceramics Ltd de-growing ~1% YoY. Marketing spending continued to be high for the 3rd straight quarter. The higher marketing spending since Q3 has started reflecting in volume growth to an extent. For the last 3Qs, Orient Bell Ltd. has been able to match industry volume growth, whereas earlier, it was lagging behind. However, in order to really move the needle on earnings and deliver operating leverage, Orient Bell Ltd. has to deliver high single-digit or low double-digit revenue growth. That seems some way away still. Most companies have indicated that they are optimistic about tile sales volumes increasing significantly from Q3FY24 or Q4FY25 as real estate sales over FY21-24 start translating into sales of building products.

Final thoughts on Orient Bell Ltd

The building materials industry is interestingly poised in the sense that the best businesses are already pricing in good times over the next 2-3 years. Across segments like tiles, sanitaryware and pipes & fittings, the best businesses like Kajaria Ceramics, Cera Sanitaryware, Astral Poly & Supreme Industries are all trading slightly above their 5 year mean TTM multiples.

It appears to be a high probability event that the building materials segment will start seeing better volume growth towards the end of FY25 as the post COVID housing starts approaching their completion stage. Housing wires which derive demand from residential and commercial projects are already printing good numbers across the board, Polycab, KEI Industries, Havells & Finolex Cables have all benefited from the construction boom already. In such a situation, it is unlikely that investors will make above average returns by buying the best businesses that are already priced to perfection. In this context, one is better off betting on the second rung if one is confident that the management team can execute well.

At a market capitalization of less than 600 Cr, Orient Bell Ltd is a micro cap in every sense of the term. If the management team can ride the real estate cycle well and deliver volume growth, a lot of challenges will get addressed as higher scale will improve the numbers all around. The bigger risk will be if the management team continues on their aggressive brand building exercise only to realise that their execution has been sub par. At the current price, we believe that the downside could be limited to 20% since the replacement cost of the capacity the management has built is worth a good chunk of money.

Investors would do well to track the story closely and watch out for signs of better volume growth for a start. In such stories where the growth momentum has been missing for a few years, it is better to see evidence of things getting better; even if one has to pay a higher price for participation. The asymmetric payoff structure at CMP is what makes the story interesting.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.

Disclosure (Updated as of Sep 30, 2024) – Hold a tracking allocation that is less than 2% of the overall equity allocation in personal portfolio