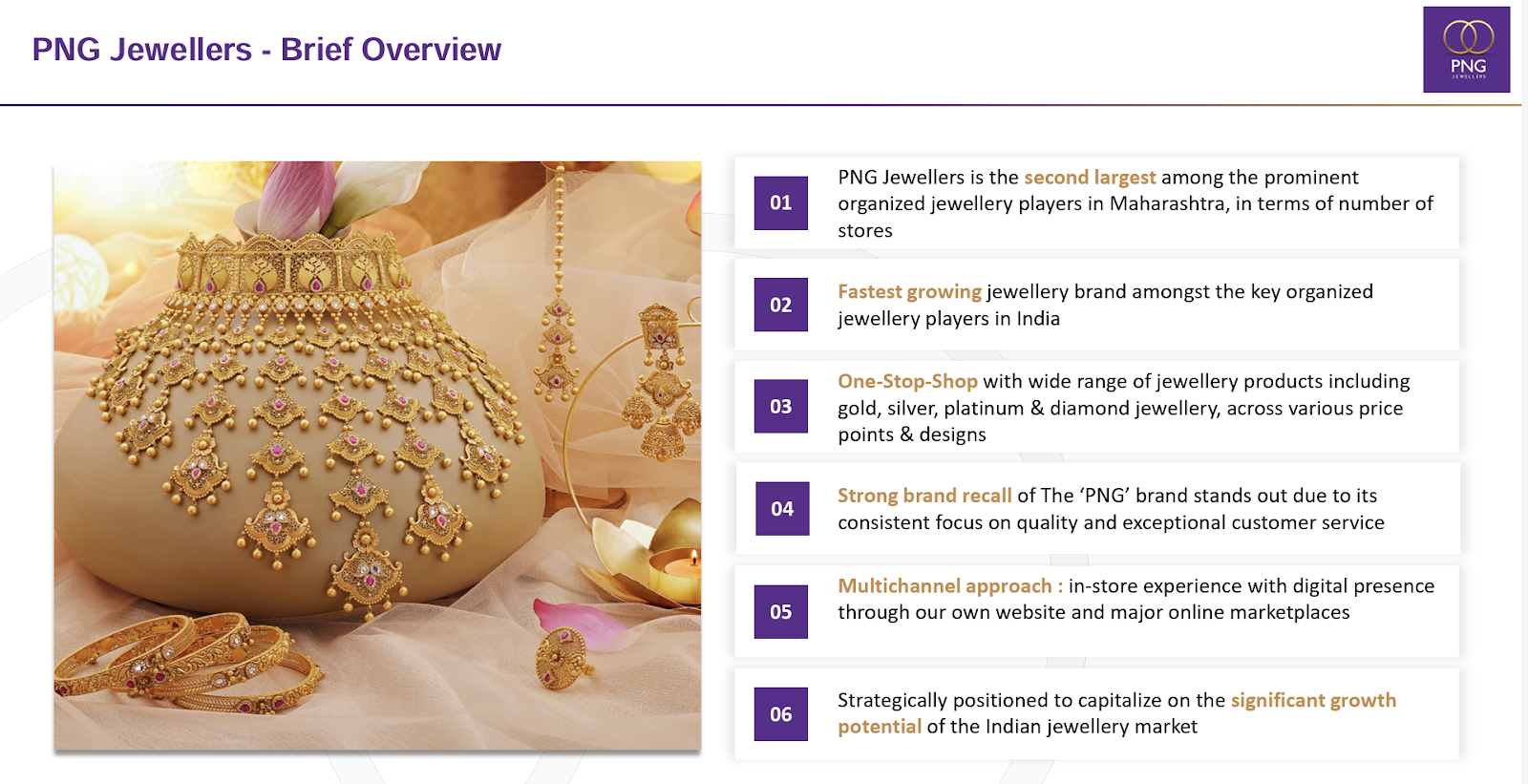

P N Gadgil Jewellers Ltd is one of the oldest Jewellers in Maharashtra. It is a part of the PNG group which is an established player in the gold, silver and diamond jewellery business, with a significant presence in Pune, Mumbai and other parts of Maharashtra. P N Gadgil Jewellers Ltd provides new jewellery trends in Maharashtra and has introduced Temple Motifs, Contemporary Jewellery designs, Light Weight, Daily Wear and Designer Collections, etc.

P N Gadgil Jewellers Ltd Company Summary

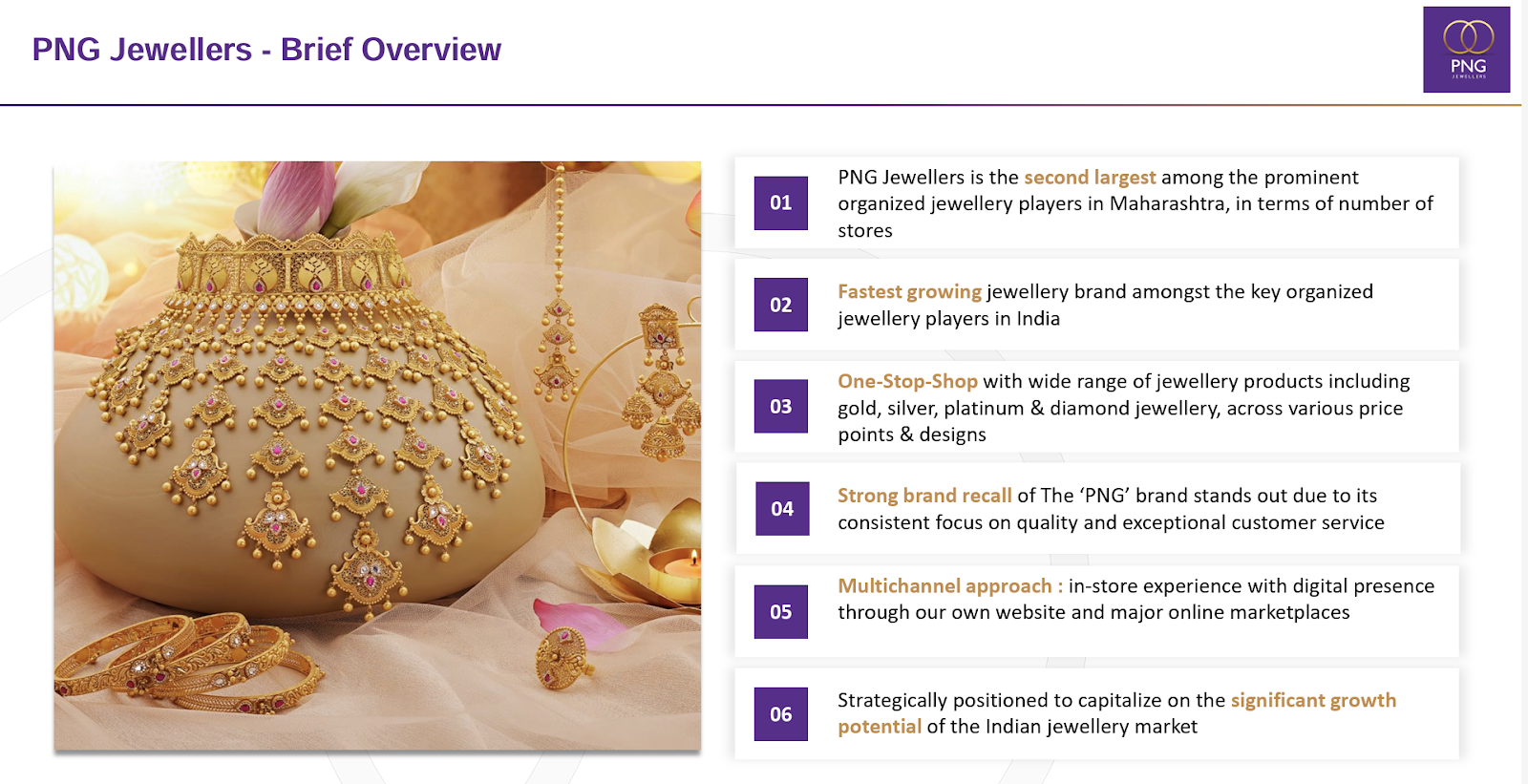

P N Gadgil Jewellers Ltd is the second largest among the prominent organised jewellery players in Maharashtra, in terms of the number of stores as of March 2024. Maharashtra is the largest market for BIS-registered outlets in India. P N Gadgil Jewellers Ltd is also the fastest growing jewellery brand amongst India’s key organised jewellery players, based on the revenue growth between Fiscal 2022 and Fiscal 2024. P N Gadgil Jewellers Ltd revenue grew 54.63%. Achieved an EBITDA growth of 39.78% between FY22 and FY24, which is the second highest in key organised jewellery players in India. P N Gadgil Jewellers Ltd also had the highest revenue per square feet in FY24 among the key organised jewellery players in India. Maharashtra leads the retail spending in India, accounting for approximately 15% of the overall retail spend on jewellery in India in FY23.

The ‘PNG’ brand derives its legacy from the ‘P N Gadgil’ brand, which has a rich heritage dating back to 1832 and a legacy of over a century. Leveraging the legacy and heritage of the ‘PNG’ brand, they have created a strong brand recall and presence in Maharashtra offering a wide range of precious metal/jewellery products including gold, silver, platinum and diamond jewellery, across various price points and designs which cover the need of customers and include collections that are specifically designed for special occasions, such as weddings, engagements, anniversaries and festivals, as well as everyday wear jewellery.

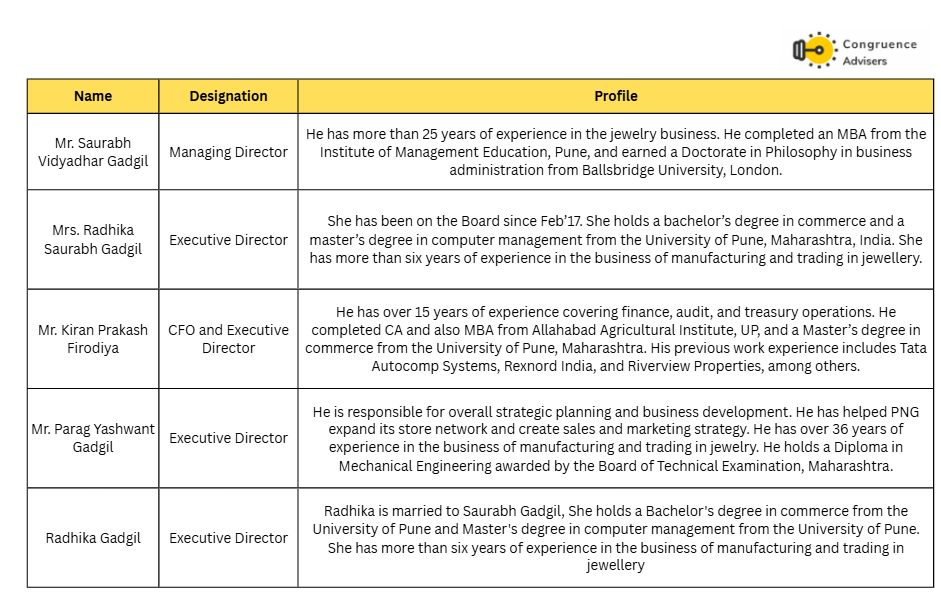

P N Gadgil Jewellers Ltd Management Details

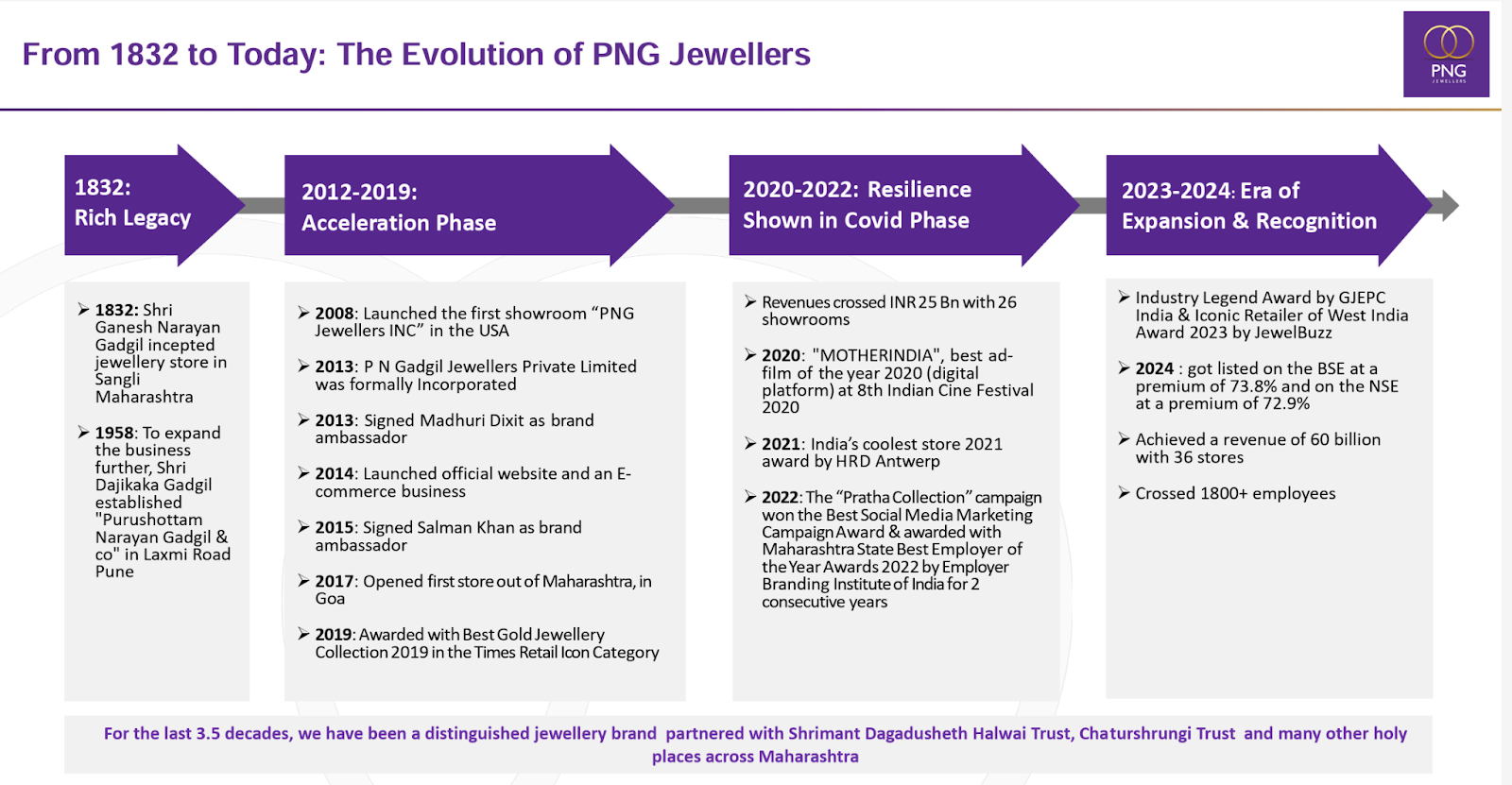

The P. N. Gadgil (PNG) Group has its roots in 1832 when Ganesh Gadgil started a jewellery business in Sangli, Maharashtra. Over the years, the family business became famous for its gold and silver jewellery, especially the traditional Maharashtrian designs. In 1958, the business expanded to Pune under Anant “Dajikaka” Gadgil, and the brand got wider recognition. For decades, the Sangli and Pune branches operated under the same family and brand name and built a reputation of trust and craftsmanship in western India.

In 2012, due to differences among family members and the complexity of operations, the business was formally split into two independent entities. One was led by Saurabh Gadgil (grandson of Dajikaka) and became PN Gadgil Jewellers Ltd. with headquarters in Pune. The other PN Gadgil & Sons Ltd. was led by Ajit Gadgil and his branch of the family and operated independently with its base in Sangli and Pune. Both retained the PN Gadgil name and hence there was some confusion among customers as they continued to operate in the same geographies.

PN Gadgil Jewellers Ltd., under Saurabh Gadgil, modernized aggressively after the split. The company opened dozens of stores across Maharashtra and went international with a store in the US. It positioned itself with celebrity endorsements (Salman Khan and Madhuri Dixit), did an IPO in 2023 and focused on blending tradition with contemporary retailing. As of 2024, it has around 50 stores and is one of the top jewellers in Maharashtra.

Meanwhile, PN Gadgil & Sons Ltd. also grew steadily and focused on company-owned outlets and launched its own sub-brand “Gargi by PNG & Sons” for fashion jewellery. With over 30 stores, it is a strong player in Maharashtra and nearby states. Although there haven’t been any major public legal disputes between the two entities, they do compete closely, especially in Pune and western Maharashtra, where both have a significant presence.

Despite the shared legacy and brand name, both companies have developed their own identity and strategy. While PNG Jewellers focuses on glamour and expansion through IPO funding, PNG & Sons emphasizes on craftsmanship and organic growth including new product verticals. The split while complex has allowed both to grow independently and build on the shared heritage in different ways.

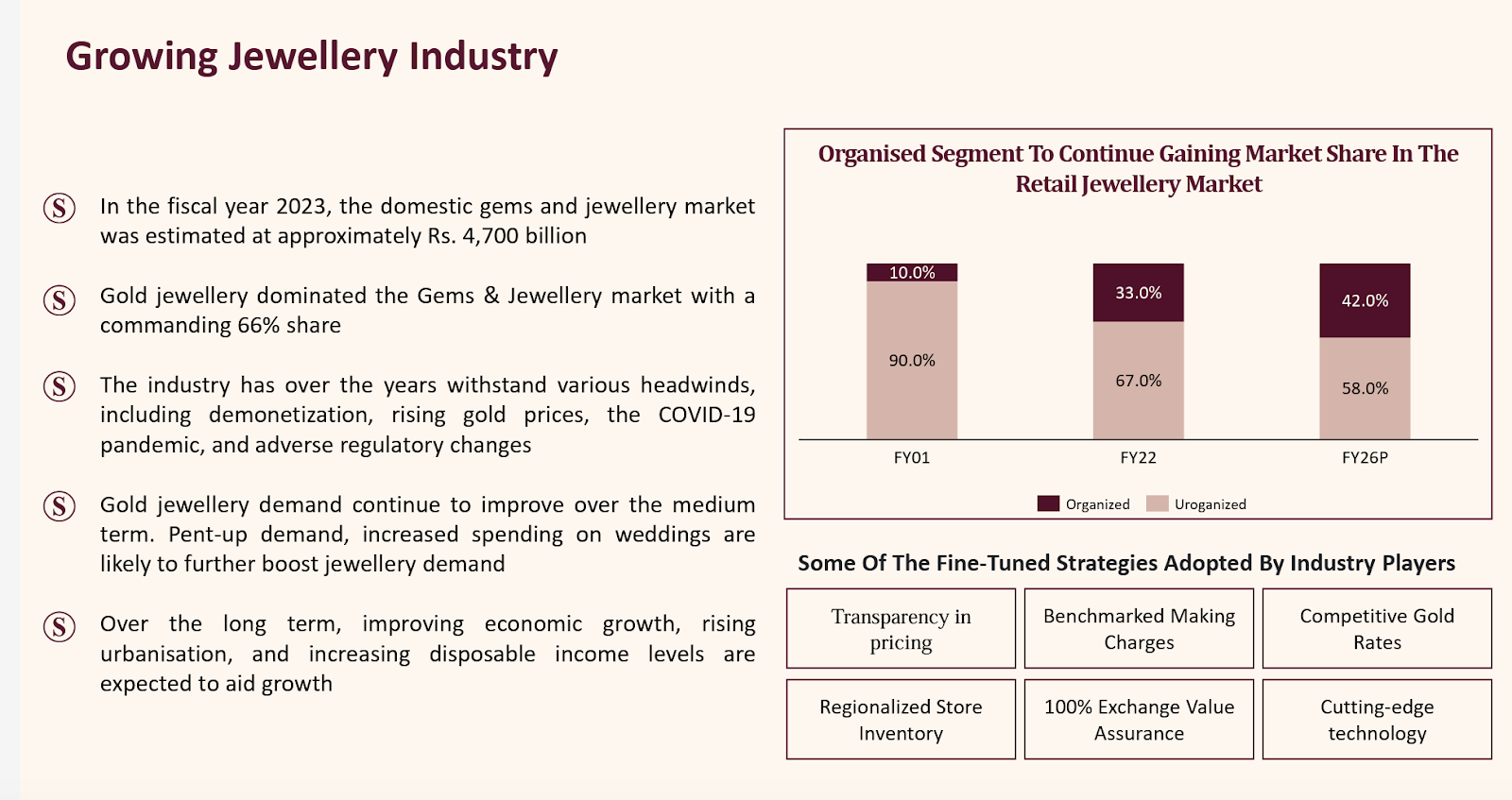

P N Gadgil Jewellers Ltd – Industry Overview

Gold and Jewellery Industry Overview

Measures that could lead to a shift to organized trade

- Better Enforcement – Widespread presence across cities and locations, & Price transparency and product quality.

- Better Compliance – Compulsory hallmarking of Gold Jewellery, Mandatory PAN Card for jewellery purchases over INR 200,000.

- Rising ticket prices, improved buying experiences, wider availability of choices through a variety of SKUs, etc, are driving this significant trend.

- In July 2024, the Indian government reduced the import duty on gold from 15% to 6% to curb smuggling and boost the domestic jewelry industry.

- Mandatory Hallmarking: The implementation of the Bureau of Indian Standards (BIS) hallmarking rule ensures quality assurance, which benefits organised players.

- The availability of gold loans, buyback options, and easy installment plans attracts buyers to organised channels.

- Digital wallets, UPI, and credit card transactions make purchases easier in the organized sector.

Gold Value Chain In India

Reduction in import duties lowers the overall cost of raw materials, making it more affordable for manufacturers to procure gold and have a positive impact on the market by making gold jewellery more accessible to a broader range of customers. Lower prices lead to a surge in demand, causing manufacturers to increase production.

Duty cuts also let companies to invest more in innovation, design, and advanced manufacturing techniques. This enhances the quality of jewellery and improves production efficiency.

Potential Margin Pressure for Retailers – Some jewelry retailers indicate that margins will be under pressure because of changes in import duties.

In India, the Reserve Bank of India (RBI) nominates specific banks and agencies to import gold bullion under strict guidelines, primarily to meet domestic demand from jewelers, traders, and investors. These “nominated agencies” include public sector banks like the State Bank of India (SBI), private banks like ICICI Bank, and government entities like the Minerals and Metals Trading Corporation (MMTC) and PEC Limited. The RBI authorizes these entities to import gold, often in forms like 1 kg bars or 100-gram bars, from international suppliers accredited by bodies like the London Bullion Market Association (LBMA).

Gold metal loan (GML) is a mechanism under which a jewelry manufacturer borrows gold instead of cash and settles the loan in terms of equivalent gold quantity (or INR equivalent of the gold quantity calculated based on gold prices on day of loan maturity) and an interest cost ranging from 3-5% per annum. GML can be availed for 180/270 days in the case of domestic sales/exports.

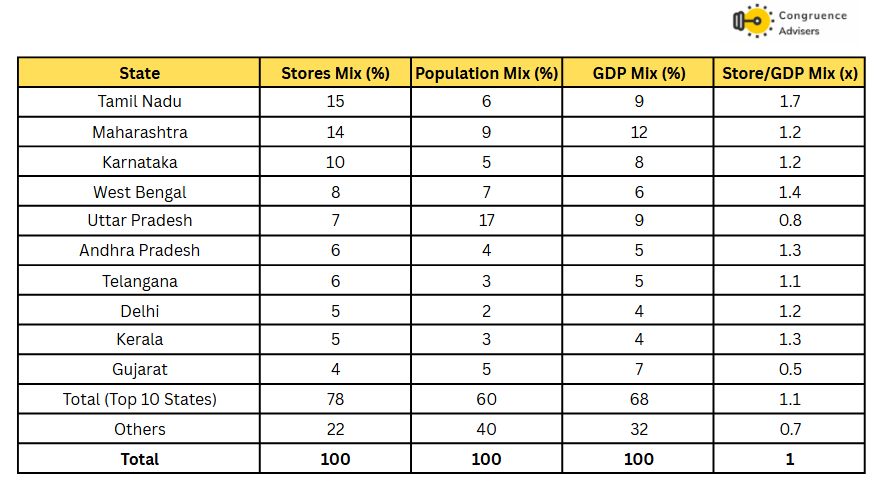

State-wise Organized Store Network vs. Population Mix and GDP Mix

Source: MOFSL, Company

The Indian gems and jewellery sector contributes 7% to India’s GDP. The domestic gems and jewellery market was valued at ~USD58bn, with gold jewellery being the leading segment in FY23. From USD38bn in FY23, India’s gems and jewellery exports are expected to touch USD145bn by 2028.

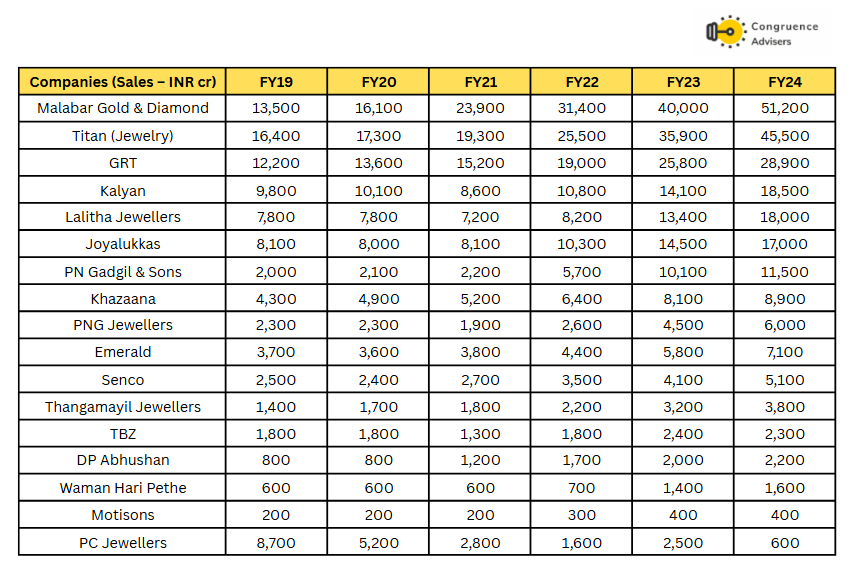

Top-10 organised players command more than 30% of the total jewellery demand:

A substantial portion of the industry is unorganised, particularly in rural and semi-urban areas. Around 36% of companies are branded national chains, while others are small regional players or independent retailers.

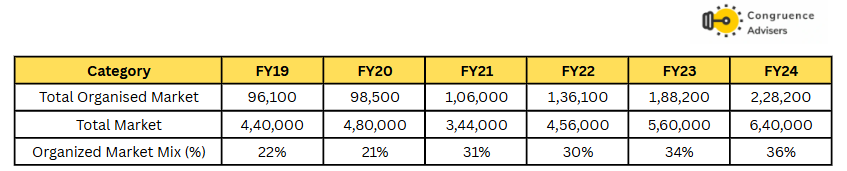

We expect the share of organised players to rise further to 44% by FY26. The total jewellery market reported ~8% revenue CAGR during FY19-24, reaching a market value of INR 6,40,000. The organised market clocked ~18-19% revenue CAGR while Titan, Kalyan, and Senco combined recorded ~20% revenue CAGR during FY19-24.

The total gold consumption in India was attributed to 66% of jewellery and the remaining 34% of bars & coins.

Source: MOFSL, Company

The jewelry market was close to USD 48-50 billion within the organized market in FY18, accounting for a share of 20-22%. The total market reported a CAGR of 9-10% during FY18- 24, while the organized market registered a CAGR of more than 17%. The last three years were golden years for the industry, which clocked a 20%/30% value growth for total/organized market segments.

First, the COVID-19 pandemic disrupted the unorganized sector more severely than organized players. Lockdowns and restrictions hit small, independent jewelers—often cash-based and lacking digital infrastructure—harder, as physical stores closed and consumer footfall plummeted. Organized retailers like Tanishq, Kalyan Jewellers, and Senco had the resources to pivot quickly to e-commerce and omnichannel strategies. For instance, Tanishq rolled out virtual try-on features and online booking systems across 200 stores by July 2020, capitalizing on a shift to online shopping when consumers couldn’t visit local goldsmiths. This adaptability allowed organized players to capture demands that unorganized jewelers couldn’t fulfill.

Second, consumer behavior shifted toward trust and transparency—areas where branded retailers excel. With economic uncertainty in FY21, buyers favored established chains offering certified products, transparent pricing, and buyback guarantees over informal sellers. Industry reports from later years note a growing preference for branded jewelry, a trend accelerated by the pandemic as people sought reliability amid chaos. Organized retailers’ use of karatometers, authenticity certificates, and exchange schemes further eroded the unorganized sector’s edge.

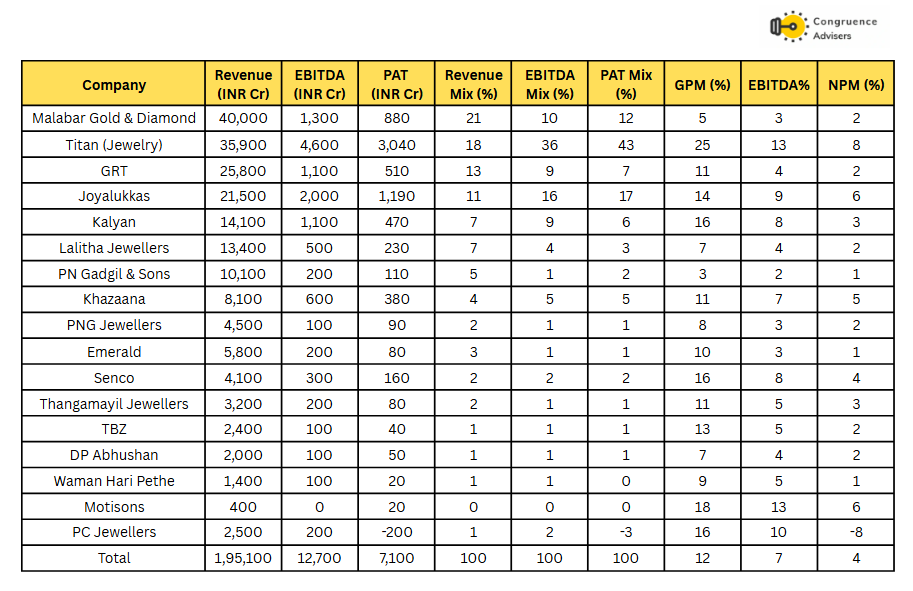

Industry revenue and profit pool

Industry revenue and profit pool. Although organized players have benefited from the change in consumer preferences, each player has a different business model within the industry. Jewellery is a highly localized market, and demand patterns vary significantly among regions. Therefore, the operating profit margin varies significantly among players despite using the same metal. The mix of bullion sales, stud ratio, and consumer preferences varies based on the financial profiles of the players. At the aggregate level, gross margins are close to 12%, with an EBITDA margin of 7% and PAT of 4%. Titan is a clear outlier with almost double the industry average gross margin (25%), EBITDA margin (13%) and PAT margin (8%). Titan is a clear outlier with almost double the industry average gross margin (25%), EBITDA margin (13%) and PAT margin (8%).

Source: MOFSL, Company

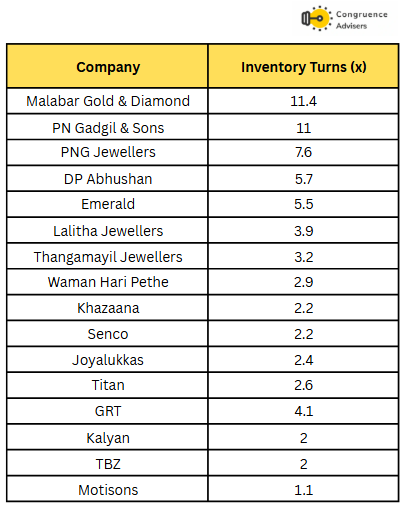

Inventory Turns (x) – As of FY23

Inventory turns are a very key metric for jewellery retailers. Unlike other retail formats such as apparel and QSR, inventory forms a bulk of the investment required for a jewellery retail store. In fact the amount spent towards capex and debtors are both negligible compared to the amount spent towards inventory for a jewellery retailer. The jewellery retailers who sell a higher proportion of bullion tend to have higher inventory turns (but lower gross margins). A retailer who can sell a higher proportion of value-added jewellery at higher than the industry average inventory turns, can truly hope to earn supernormal return on capital. But in in some cases inventory turns can be higher for a jeweller because of high proportion of bullion sales/gold refinement.

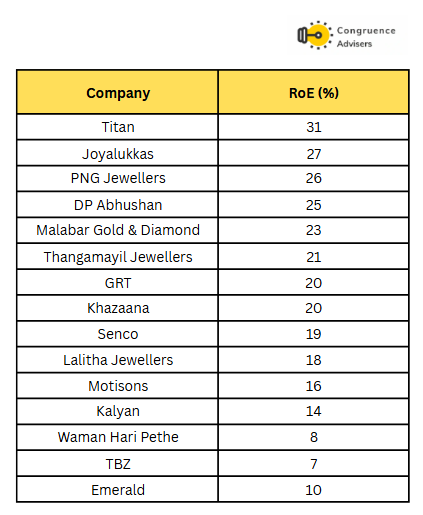

Top Players – ROE (%)

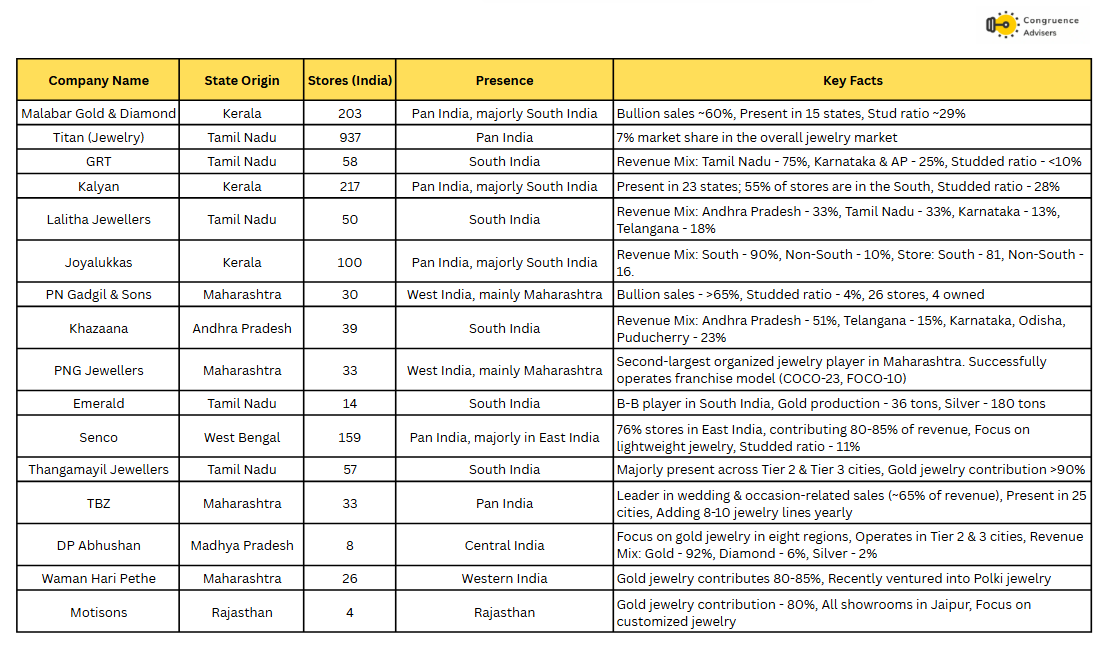

Top players – Background and key business Overview

Top players’ store mix: Organized retail store network at over 2,000 stores. Titan holds the lion’s share in the organized retail sector with ~45% share in a network of over 900 stores spanning Tanishq, Caratlane, Mia, and Zoya. Other major retail players include Malabar, Kalyan, and Senco. Several players, after experiencing success in their own region, have gradually become pan-India players.

Source: MOFSL, Company

Gold Consumption Patterns in India

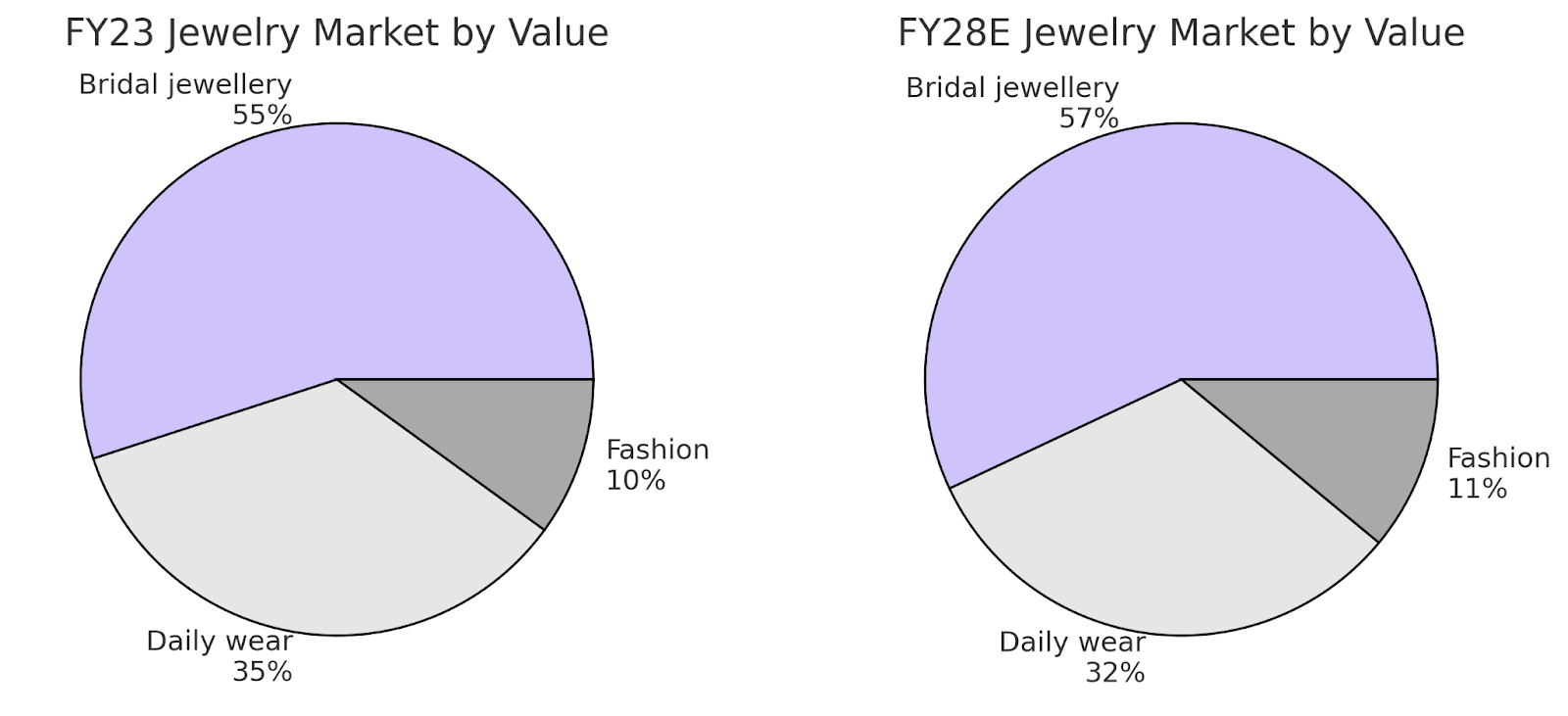

Jewelry consumption in India can be categorized into three segments: Bridal, Everyday wear, and Fashion jewelry. These segments have their unique attributes, offering various products, sizes, and designs. While companies like PC Jeweller and Kalyan Jewellers India are national chains catering mainly to the bridal segment, CaratLane and Tanishq cater to the daily wear segment, especially working women. Smaller independent retailers cater to their trusted client segment by focusing on specialization and customization.

Jewelry for occasions, weddings, and festivals is the primary reason for the purchase of jewelry in India. Bridal jewelry still accounts for a significant portion of demand, contributing 55% to the total jewelry demand. Daily wear jewelry accounts for 30-35% of the Indian jewelry market. Players are strategically focusing on manufacturing lightweight pieces to cater to the preferences of younger consumers, especially those who desire daily wear gold jewelry that complements Western-style attire.

Fashion jewelry, on the other hand, contributes nearly 10% to the Indian jewelry market Expectations indicate continued growth, especially among the youth seeking diverse and affordable products. Fashion jewelry, available across various value segments, materials, craftsmanship, and designs, caters to different preferences and purposes.

Source: MOFSL

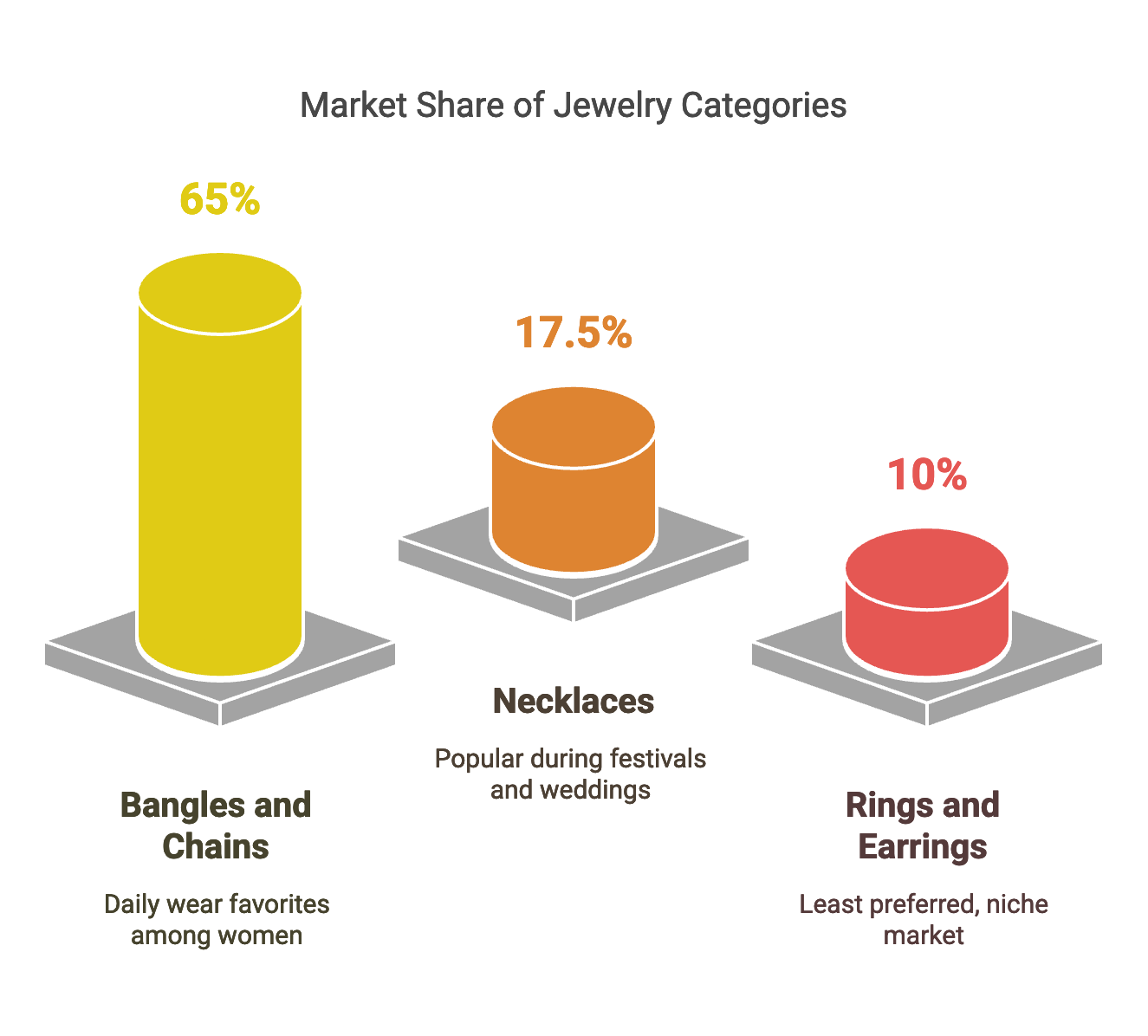

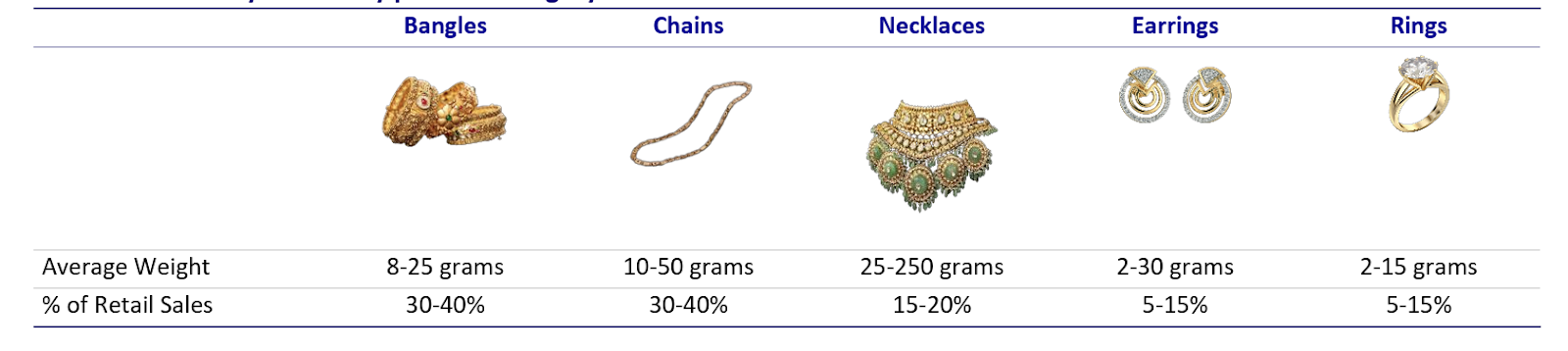

Jewelry by product category

Bangles and chains are the primary contributors to domestic jewelry consumption, accounting for 60-70% of total sales. These are preferred as daily wear by women.

Necklaces contribute around 15-20% to the sales volume, with their sales surging during special occasions, such as festivals and weddings. The remaining 5-15% of sales is attributed to rings and earrings.

Jewelry Demand Pattern

Global gold production is ~3,600 tonnes, while India imports ~900 tonnes, of which ~60-65% is consumed for jewelry. As per the industry, recycled gold contributes ~20% of India’s gold consumption for jewelry.

The last three years were golden years for the industry, which clocked a 20%/30% value growth for total/organized market segments.

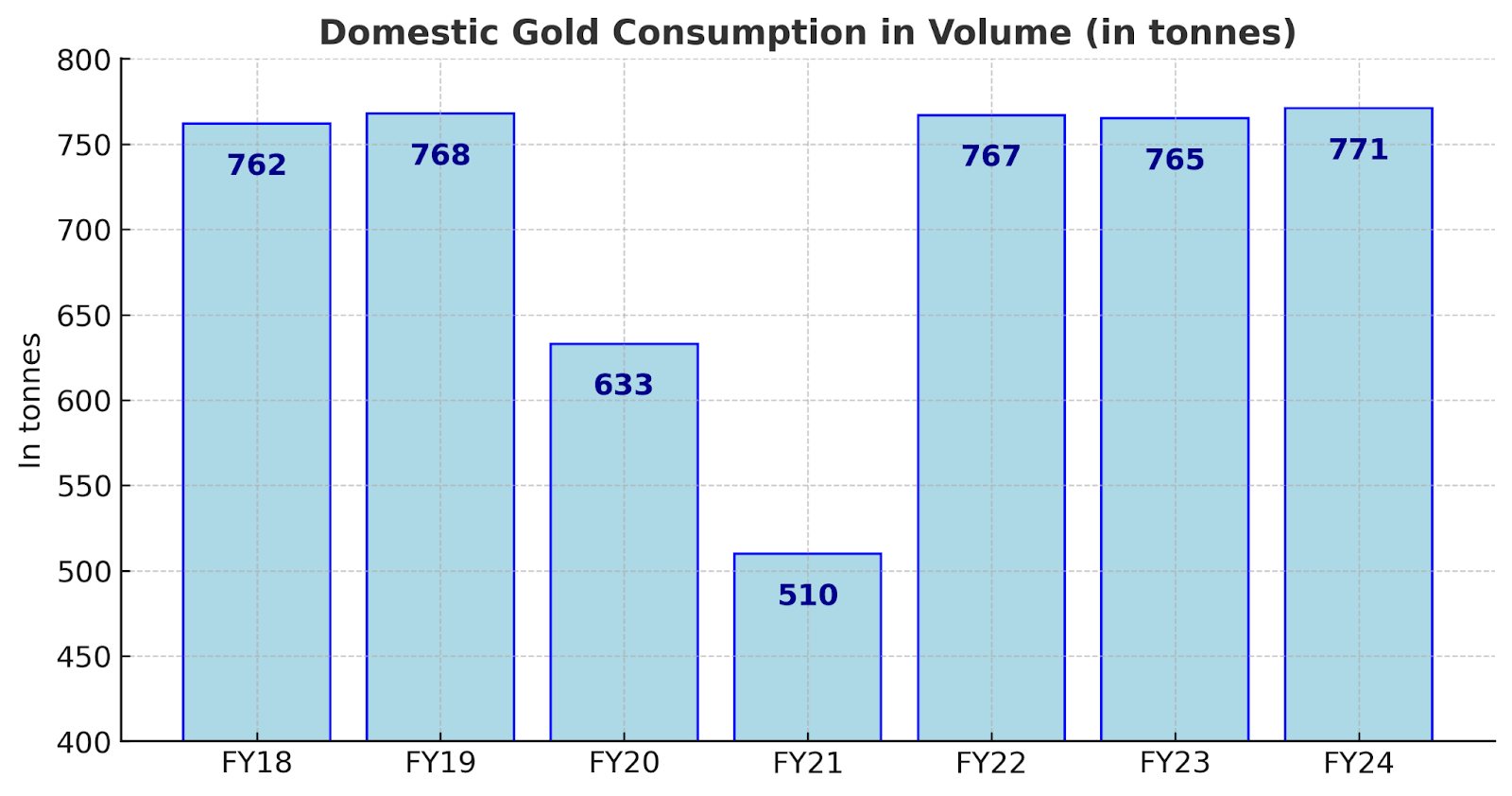

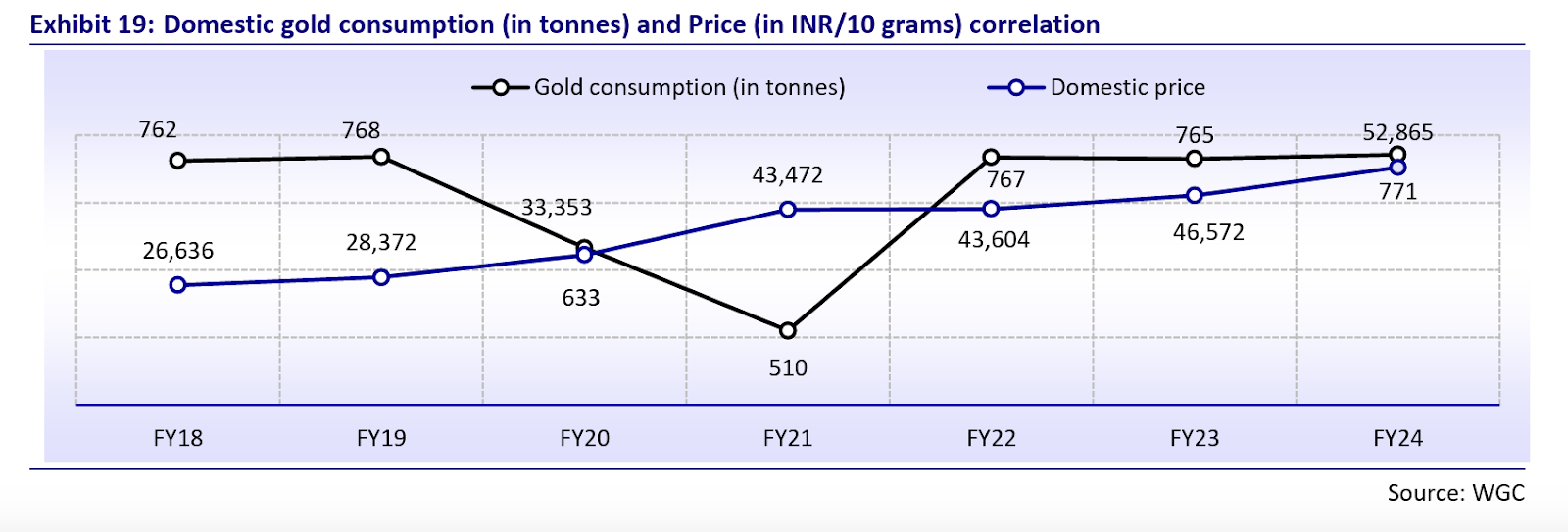

The closure of stores for a significant period and intermittent lockdowns in select states during that time further exacerbated the decline. Post-COVID, the revival trend persisted due to increased wedding-related purchases and an improvement in overall consumer sentiment.

In FY22, there was a notable improvement in the volume of gold to reach 767 tonnes from 510 tonnes in FY21. This surge was propelled by heightened discretionary spending and the gradual easing of the pandemic’s impact. The deferral of weddings due to the pandemic led to pent-up demand during FY22, contributing to a 50% surge in overall demand.

However, FY23 witnessed a marginal decline in domestic gold demand, attributed to the escalation of import duty from 7.5% to 12.5% starting 30th Jun. The first quarter of FY23 saw an improvement in gold demand, attributed to a low baseline and increased purchases for festivities and weddings. Nevertheless, the higher import duty prompted retailers to transfer the additional costs to customers, adversely impacting discretionary purchases.

Domestic gold consumption (in tonnes) and Price (in INR/10 grams) correlation

Source: MOFSL

Regional Insights

Regional variations in jewelry demand and their impact on profitability In the southern states of India, consumer purchasing behavior tends to favor traditional plain gold jewelry, which usually has lower margins.

Consumers in the northern and western regions of India are more receptive to studded jewelry and impulse-led, lighter-weight jewelry purchases (14k, 18k jewelry) vis-à-vis their southern counterparts.

Plain gold jewelry typically has a gross margin ranging from 10% to 14%, while diamond-studded jewelry has a gross margin ranging from 30% to 35%.

Consequently, as the studded ratio (studded jewelry/total revenue) goes up, profitability improves, thereby incentivizing South-focused retailers to expand towards the North, West, and East.

Regional jewelry demand and preferences

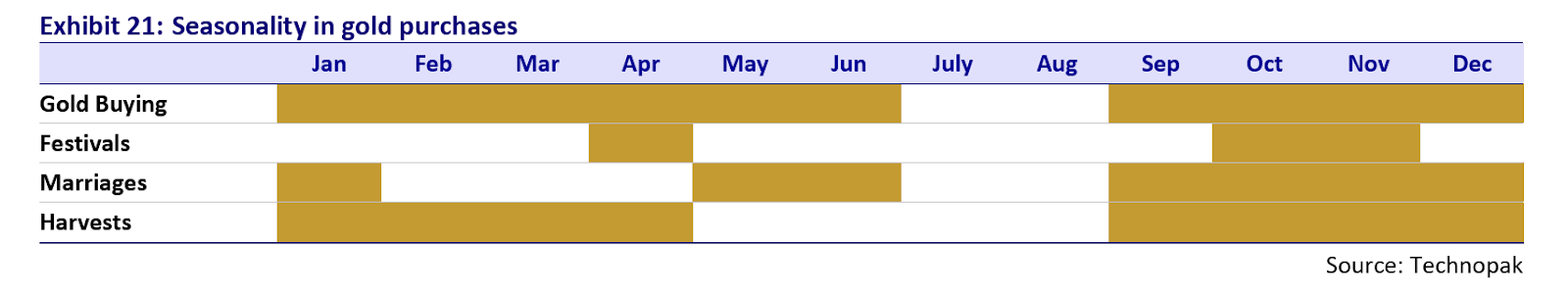

Seasonality in Gold Purchases

Seasonal and regional factors to drive Jewelry demand are also very seasonal in nature, with different seasonal patterns across regions in India. Jewelry demand peaks during the months leading up to popular wedding seasons, such as May-June, September-November, and January. Agricultural output and monsoon patterns influence gold demand in Tier II and Tier III towns. Rural households invest their proceeds from harvests in gold jewelry during the months of November and December.

Demand for gold and silver jewelry improves during auspicious religious events such as Diwali/Dhanteras in October and November and Akshaya Trithiya in April and May.

Source: MOFSL

India’s gold supply is dominated by imports

The gold market experienced notable fluctuations in imports from FY18 to FY20, reaching 980 tonnes in FY19 before declining to 720 tonnes in FY20.

Source: MOFSL

This volatility was led by various factors, including declines in global gold prices, buoyant economic conditions leading to heightened disposable incomes, and substantial demand for gold due to traditional celebrations and weddings. However, in FY20, a significant drop occurred due to escalating import duties and the initial stages of an economic slowdown.

Recovery signs emerged in FY22, marked by an increase in imports to 879 tonnes. Factors contributing to this rebound included gold’s appeal as an inflation hedge and the release of pent-up demand following the easing of pandemic restrictions.

However, in FY23, imports experienced a slight reduction to 678 tonnes, possibly influenced by government measures aimed at managing the current account deficit and promoting domestic gold recycling.

Procurement value chain for organized Jewelers in India

Source: MOFSL

Retail business comparison

P N Gadgil Jewellers Ltd Business Overview

P N Gadgil Jewellers Ltd is the second largest among the prominent organised jewellery players in Maharashtra, in terms of the number of stores as of March 2024, which is the largest market for BIS-registered outlets in India. P N Gadgil Jewellers Ltd is also the fastest growing jewellery brand amongst India’s key organised jewellery players, based on the revenue growth between Fiscal 2022 and Fiscal 2024. P N Gadgil Jewellers Ltd revenue grew 54.63%. Achieved an EBITDA growth of 39.78% between FY22 and FY24, which is the second highest in key organised jewellery players in India. P N Gadgil Jewellers Ltd also had the highest revenue per square feet in FY24 among the key organised jewellery players in India. Maharashtra leads the retail spending in India, accounting for approximately 15% of the overall retail spend on jewellery in India in FY23.

The ‘PNG’ brand derives its legacy from the ‘P N Gadgil’ brand, which has a rich heritage dating back to 1832 and a legacy of over a century. Leveraging the legacy and heritage of the ‘PNG’ brand, they have created a strong brand recall and presence in Maharashtra offering a wide range of precious metal/jewellery products including gold, silver, platinum and diamond jewellery, across various price points and designs which cover the need of customers and include collections that are specifically designed for special occasions, such as weddings, engagements, anniversaries and festivals, as well as everyday wear jewellery.

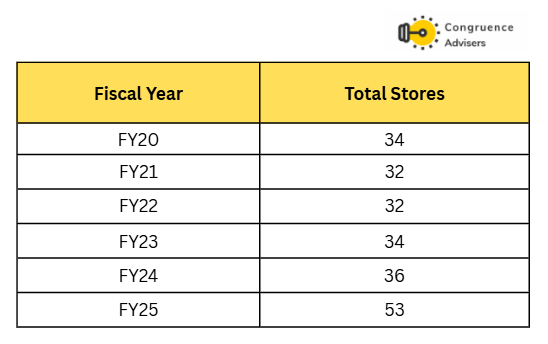

Note: The number of stores was 48 in Q3 FY25, company was stated in the investor presentation. The company released its Q4 FY25 quarterly update on April 8th, reporting a store count of 53.

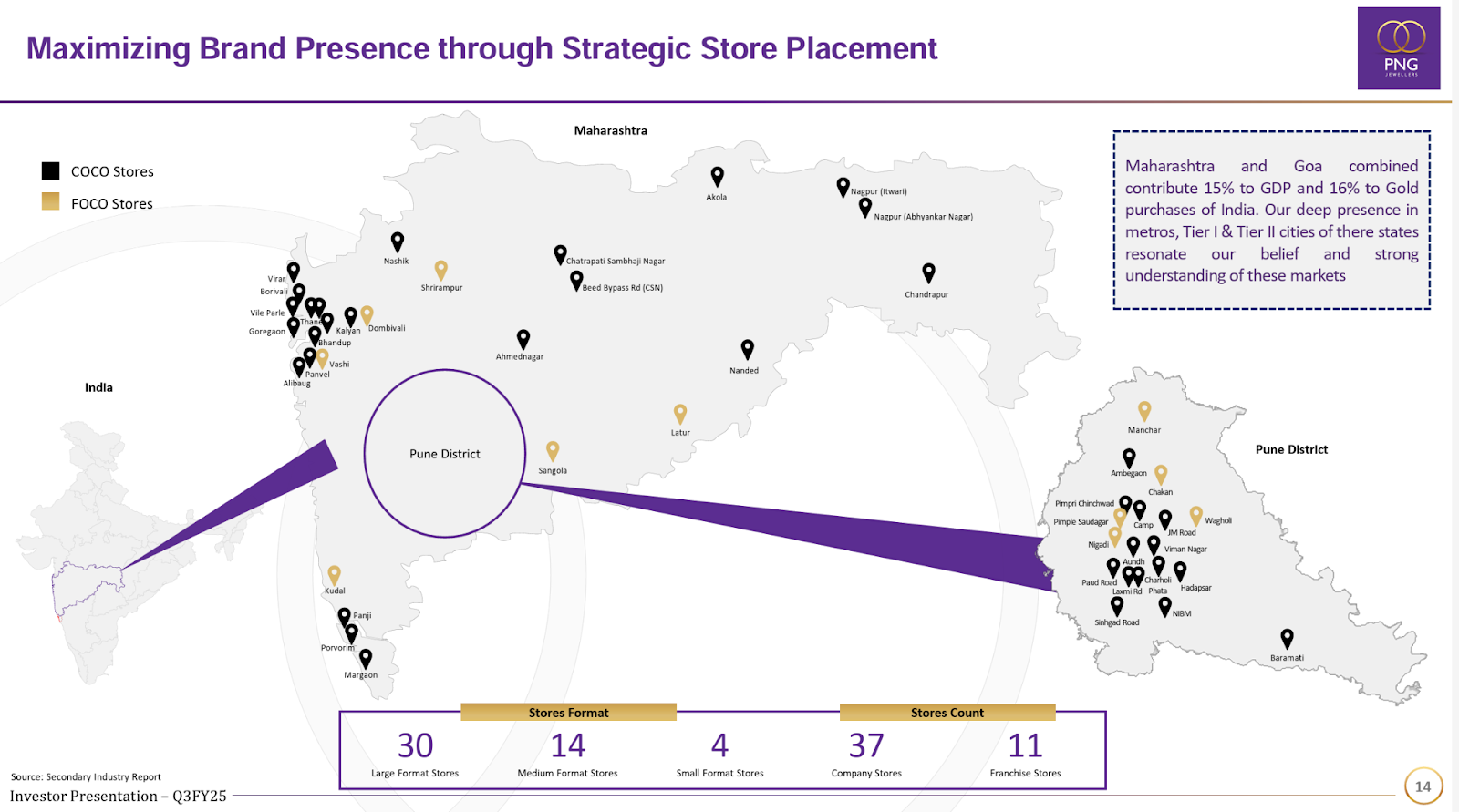

With a total store count of over 53 stores as of now (including two stores in Goa and one in the US). The company, during the last few years, has been focusing more on enhancing unit economics, increasing its mix of make-to-order offerings, and improving its product mix. However, following a consistent shift toward the formalised market, the company is now aiming to expand its store network, starting in Maharashtra before venturing into other states such as Madhya Pradesh, Chhattisgarh, Bihar, etc

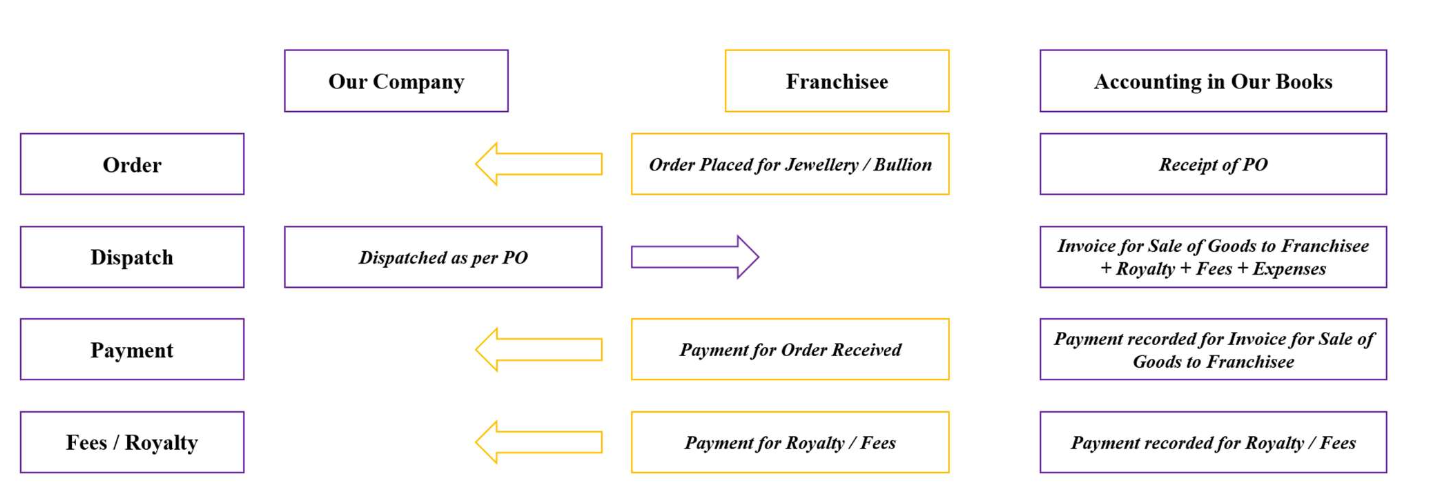

P N Gadgil Jewellers Ltd operates under two models FOCO and COCO

COCO Model: This stands for Company Owned, Company Operated In this model, the company, P N Gadgil Jewellers Ltd, owns the store premises (or holds the lease) and is entirely responsible for managing and operating the store. These stores typically have a larger format, with store sizes around 3,500 to 4,000 square feet.

FOCO Model: This stands for Franchise Owned, Company Operated. In this model, a franchisee owns the store, but P N Gadgil Jewellers Ltd is responsible for the operations, which means the company operates the store. PNG Jewellers introduced this franchise business model in 2018.

Some of the key terms and conditions of our FOCO agreements are set out below:

The Foco model focuses on Tier 2 & 3 cities and lower margin products, which carry less inventory risk.

Tenure: The tenure of the franchisee arrangement is usually five years, which can be extended for a further period as may be agreed mutually.

Consideration: The franchisee pays a management or license fee for operating the FOCO stores. In addition, the franchisee is required to pay royalties to the Company. The franchisee is also required to deposit a refundable security deposit for due observance and performance of the terms and conditions of the agreement.

Other covenants: P N Gadgil Jewellery Ltd requires consent from the franchisee for granting a franchise to any other person/entity within a specified distance of the relevant franchisee showroom. Further, P N Gadgil Jewellery Ltd is prohibited from establishing/opening/running/operating a FOCO store within a certain distance of the premises of the relevant Franchisee Showroom. The franchisees are obligated to obtain relevant government approvals and licenses for operating such FOCO stores.

Termination: The FOCO agreements can be terminated by P N Gadgil Jewellers Ltd or the franchisee by giving a six-month prior notice after the expiry of the lock-in period. The FOCO agreement shall be deemed to be terminated without notice on the happening of certain events specified in the relevant agreement.

In addition to the share of making charges, P N Gadgil Jewellers Ltd earns a royalty of 0.5% on annual sales from franchisees, along with an additional earns ₹50 lakhs per annum as a management fee from each franchisee.

The following flow chart represents the flow of transaction by and between P N Gadgil Jewellers Ltd and Franchisees

P N Gadgil Jewellers Ltd bills inventory directly to franchise, franchise is responsible for end sales to customers, P N Gadgil Jewellers Ltd appoints store manager while all other employees are on franchise rolls.

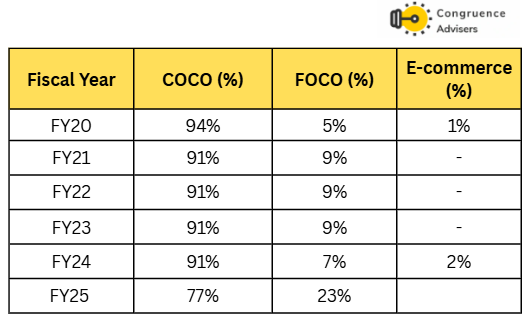

Store mix between COCO and FOCO.

Revenue contribution by COCO, FOCO, and E-commerce

COCO stores form the core of P N Gadgil Jewellers Ltd’s retail presence. These are larger-format outlets owned and operated entirely by P N Gadgil Jewellers Ltd.

- Store Size: Typically ranges from 3,500 to 4,000 sq. ft., with large-format stores averaging ~6,000 sq. ft. and medium ones between 2,200–3,500 sq. ft.

- Investment Per Store:

Inventory: Initial inventory ranges between ₹30–33 Cr, with a target of ~₹40 crore over time.

Capex: Store setup costs range from ₹1.5–1.75 Cr. - Revenue Per Store:

New Stores: Target 1.5x inventory turnover, implying ₹45–49.5 Cr in revenue with ₹30–33 crore inventory.

Mature Stores: After 2–2.5 years, aim for ~5x turnover, generating ₹120–130 crore in revenue. - EBITDA & Profitability:

EBITDA Margin: ~7% per store.

Mature Store EBITDA: ₹8.4–9.1 crore, with some estimates suggesting up to ₹10 crore EBITDA on a ₹30–35 crore investment. - ROCE:

Pre-IPO returns ranged around 28%.

Based on mature store performance, ROCE is estimated at 24%–33%, aligning with earlier figures.

In the FOCO model, franchisees invest in and own the store infrastructure and inventory, while PNG manages day-to-day operations. P N Gadgil Jewellers Ltd bills inventory directly to the franchises and the franchises are responsible for end sales to customers. P N Gadgil Jewellers Ltd earns a gross margin of 2-3% on franchise sales and earns a 0.5% royalty on top.

- Store Size: Smaller format — typically 1,500–2,000 sq. ft. (about one-third the size of a COCO store).

- Franchisee Investment:

Inventory: ₹11–12 Cr.

Capex: ₹0.5–0.75 Cr. - Revenue Per Store:

With 1.5 stock turns, stores are expected to generate revenue of ₹16.5–18 crore. - ROCE (Franchisee Return): Franchisees are reported to earn returns of 15%–18% on their investment.

3. Breakeven and Store Maturity Timeline

- Stock Turn Breakeven Target: 1.5x inventory turnover.

- Breakeven Timeframe: Typically 15–18 months. Stores opened ahead of festive seasons like Diwali or Navratri may break even faster (12–15 months).

- Maturity Period: Stores reach peak inventory and sales levels in about 2 to 2.5 years, after which they contribute significantly to overall profitability.

P N Gadgil Jewellers Ltd aims to become the leading jewellery retailer in Maharashtra within a few years (Tanishq leads in the store count at present). P N Gadgil Jewellers Ltd is focused on enhancing its product mix by increasing the proportion of studded jewellery. Over the last three years, the studded jewellery ratio has improved 250bp to 7%, and P N Gadgil Jewellers Ltd aims to take this ratio into double digits in the coming year. Studded gold jewellery has higher gross margins than non studded gold jewellery.

In FY22, the company wrote-off Rs 52 crore following the closure of loss-making subsidiaries in Dubai (PN Gadgil Jewellers DMCC and PNG Jewellers LLC). Before that, the group had sold off or discontinued operations in loss-making entities. P N Gadgil Jewellers Ltd sold Style Quotient Jewellery Pvt Ltd in FY18 and its joint venture, Anant Mauli Jewellers, in FY19. It also discontinued operations of GDPL in FY18. In FY23, it discontinued its operations in the Middle East. The US subsidiary is profitable.

P N Gadgil Jewellers Ltd outsources its jewellery manufacturing to a network of 75+ experienced and skilled Karigars (artisans) located in and around Maharashtra. These Karigars are engaged on a non-exclusive basis.

P N Gadgil Jewellers Ltd makes five-year agreements with Karigars and supplies necessary materials such as precious metals, diamonds, and semi-precious stones based on the approved designs. The Karigars are compensated by making charges. According to the terms of the agreements.

The stores are branded as ‘PNG’ stores, and in the store, there are several sub-brands to differentiate products. There are 53 retail stores as of October ’24, and P N Gadgil Jewellers Ltd also has an online presence through its website and various marketplaces.

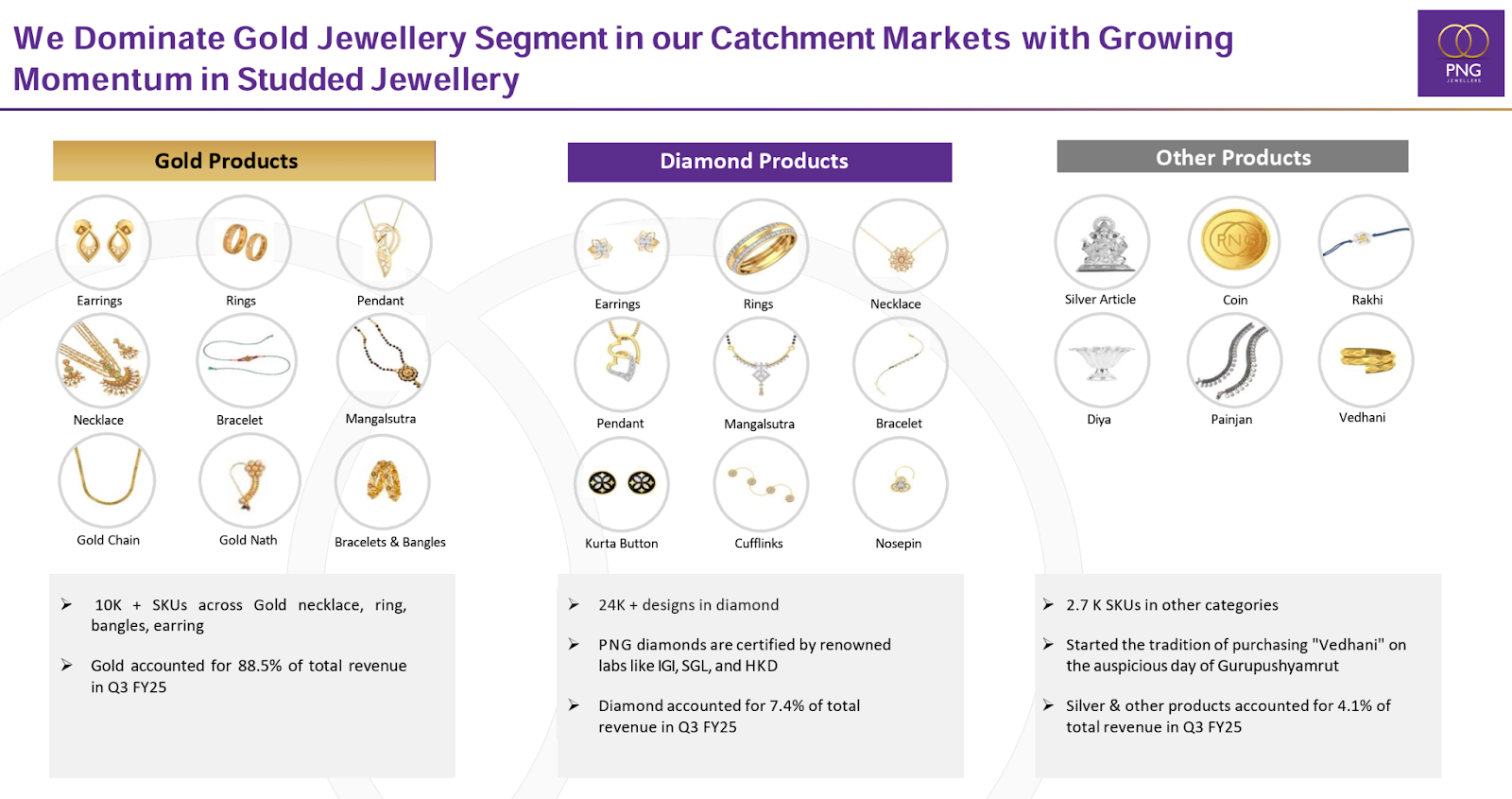

Product Portfolio

P N Gadgil Jewellers Ltd offers an extensive and diverse product portfolio that includes 10,000+ SKUS in gold, 1,200+ SKUS in silver, 2,700+ SKUs in platinum, and 24,000+ SKUs in diamond jewellery, spanning across price points and categories.

P N Gadgil Jewellers Ltd had eight sub-brands catering to gold jewellery, two sub-brands for diamonds, and two sub-brands for platinum collections. Key sub-brands include Saptam, Swarajya, Rings of Love, The Golden Katha of Craftsmanship, Flip, Lifestyle, Eiina, PNG Solitaire, Men of Platinum, Evergreen Love, Pratha, and Yoddha, each catering to specific customer niches and occasions.

P N Gadgil Jewellers Ltd leverages its heritage under the ‘PNG’ brand to curate products that meet the aesthetic and functional needs of consumers. Collections like Swarajya blend traditional Maharashtrian designs with modern styles, offering items such as mangalsutras, necklaces, earrings, rings, and bangles to cater to the region’s preferences.

The broad product range across precious metals, diamonds, and gemstones at multiple price points makes the company a “one-stop shop” for consumers across all income levels and age groups.

P N Gadgil Jewellers Ltd continuously develops and launches new designs to meet evolving consumer demands, leveraging its market knowledge, design expertise, and collaborations with Karigar teams. Signature collections include The Golden Katha of Craftsmanship, which uses 100-year-old dies, and the Saptam collection, featuring seven layers of wedding jewellery sets. P N Gadgil Jewellers Ltd launched 106, 159, and 291 new designs in FY22, FY23, and FY24, respectively.

Regional Insights

The size of India’s jewelry retail market was USD 80 billion in FY24, with organized Retail contributing about 37%, consisting of both national and regional players. The market is likely to surge ahead, reaching USD145b by FY28, fueled by increased disposable income, notable improvement in consumer demand for gold, gold price inflation, and rising interest in categories such as diamonds, other precious stones, and costume jewelry.

The western region accounts for 25% of India’s jewelry market, with states such as Maharashtra, Madhya Pradesh, Gujarat, and Goa being the four major contributors. Among these states, Maharashtra holds a dominant 46% share of the western market, making it one of the largest jewelry markets in India.

Maharashtra alone represents 17% of the country’s total jewelry outlets, boasting over 25,000 registered stores, which makes it the largest market for BIS-registered outlets in India. Further, Maharashtra is at the forefront of BIS hallmarking, hosting 239 hallmarking centers, more than any other state in the country.

Stores Insights

P N Gadgil Jewellers Ltd operates through multiple channels (COCO/FOCO) and continues to expand in Maharashtra. It has a strong digital presence, including its website and major online marketplaces. In Mar ’22, P N Gadgil Jewellers Ltd launched the “PNG Jewelers” mobile app, allowing customers to remain updated on new designs and collections while browsing the product portfolio. This ultimately enriches the in-store experience for customers.

P N Gadgil Jewellers Ltd aims to maintain this momentum by launching 20-25 new stores in FY26 while expanding its footprint in Madhya Pradesh, Chhattisgarh, Bihar, and Uttar Pradesh after establishing dominance in Maharashtra.

While P N Gadgil Jewellers Ltd has historically been heavily concentrated in Maharashtra, expanding their footprint to other states is explicitly part of their strategic plan, particularly targeting states with perceived connections to Maharashtra like MP, Chhattisgarh, Jharkhand, Bihar, and UP. As part of following the “Peshwa route” outside Maharashtra.P N Gadgil Jewellers Ltd also plans to expand with one store in the US, with Seattle identified for Q1FY26.

P N Gadgil Jewellers Ltd are conducting market surveys to understand competition, design preferences and brand perception. To establish early brand connect they will be organizing exhibitions and customer engagement activities before launching stores. The initial rollout will be company owned company operated (COCO) stores with select franchise stores in smaller towns. The pricing will be the same as existing stores, targeting middle and upper middle class customers. P N Gadgil Jewellers Ltd are also looking at Karnataka as a future market.

On scaling P N Gadgil Jewellers Ltd sees advantages: a proven scalable business model grown from 2 to 53 stores in FY24 since 2012, data driven store selection process, strong brand recognition in the target states due to cultural ties with Maharashtra. Their 200 year old heritage, handcrafted jewellery and strong customer service gives them an edge. Hiring local talent is part of their localization strategy. But they face significant challenges in this expansion out of Maharashtra, such as

1. Understanding the tastes of the local customer and being able to deliver products suiting those regional tastes through their current karigar network which is familiar with the Maharashtrian taste

2. Competing with established local players

3. Getting prime retail space

4. Regulatory hurdles by Obtaining Necessary Permits and Licenses

5. Longer breakeven period for new stores

6. Managing a larger operational footprint across multiple states

Going forward we need to track the performance of new stores outside Maharashtra closely.

New Store breakeven period: P N Gadgil Jewellers Ltd anticipates new stores will reach break even within 15-18 months. Stores opened before major festivals like Diwali or Navratri may break even sooner (12-15 months) due to higher consumer spending. P N Gadgil Jewellers Ltd targets a 1.5 stock turn in the second year of operation of a store. At 1.5x stock turns, a store is expected to generate INR 60-65 crores in revenue, suggesting per store inventory is around ~40 crores. A significant portion of sales come from made-to-order items.

Store openings during Navratri – nine stores in nine days

Following its IPO listing in September ’24, P N Gadgil Jewellers Ltd celebrated the auspicious occasion of Navratri in October ’24 by opening nine stores in nine days. This rapid expansion aligns with the P N Gadgil Jewellers Ltd’s strategy to strengthen its retail presence and capitalize on the festive season’s positive consumer sentiment.

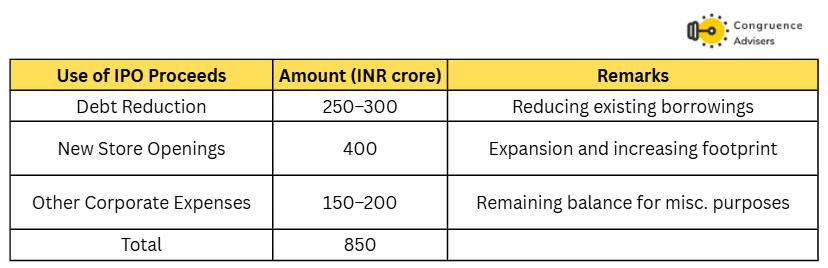

P N Gadgil Jewellers Ltd Raised 850 Crore in IPO

Debt has reduced to 50-70 Cr in Q3FY25

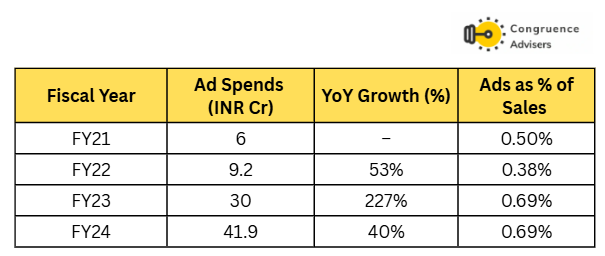

Advertising Spends

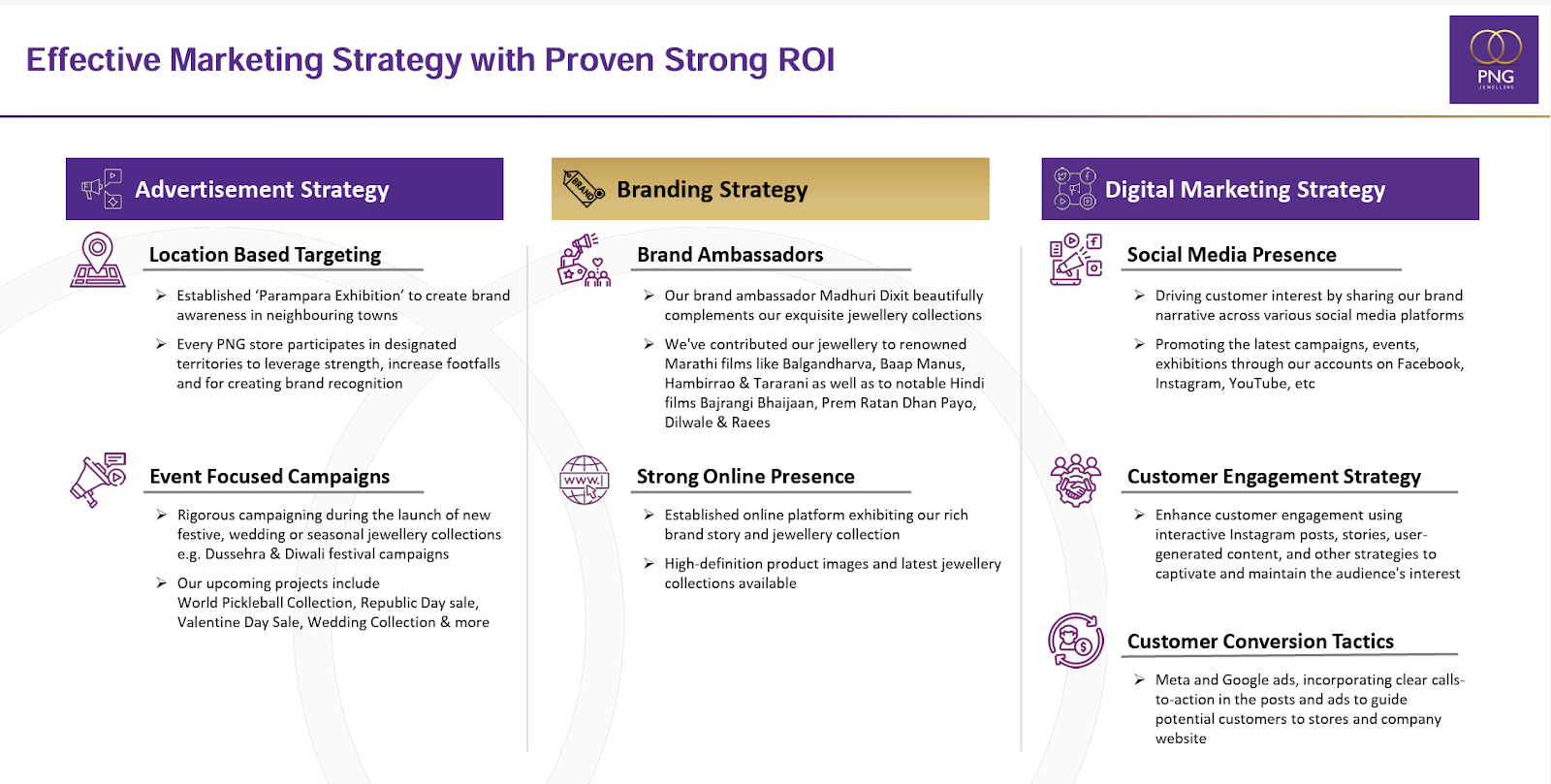

P N Gadgil Jewellers Ltd deploys multiple marketing strategies to boost brand awareness and brand recall. P N Gadgil Jewellers Ltd also conducts local marketing campaigns, such as participating in ‘Parampara Exhibitions’ and several event-based campaigns during festivals like Akshaya Tritiya, Diwali, and Dusshera.

Leveraging its strong presence in Maharashtra, P N Gadgil Jewellers Ltd focuses on local celebrations such as ‘Mangalsutra Mahotsav’. P N Gadgil Jewellers Ltd has enrolled celebrities like Madhuri Dixit as brand ambassadors and partners with movie producers to showcase its designs.

P N Gadgil Jewellers Ltd has significantly increased ad spends at a CAGR of ~90% over FY21- 24.

Various jewelry purchase schemes have emerged as one of the key marketing tools to attract a loyal base of customers. P N Gadgil Jewellers Ltd’s customer-first approach offers Loyalty programs and a future purchase plan (FPP) to help customers acquire jewelry gradually. FPP allows customers to pay in installments over 10 months and redeem the accumulated amount at the end of the period for jewelry purchases at a discounted rate.

Another option, the Dajikaka Promise Plan, enables customers to lock in current market rates by paying in advance and redeeming their purchase anytime within 12 months.

What are made-to-order items?

In the context of gold jewelry retail, “increasing its mix of make-to-order offerings” means the retailer is shifting more of its business toward customized or personalized jewelry that is produced only after a customer places an order, rather than selling only pre-made, off-the-shelf items.

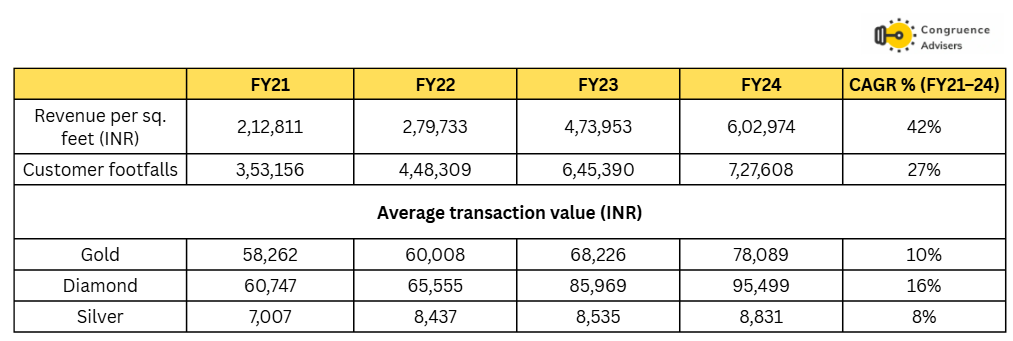

P N Gadgil Jewellers Ltd reported a robust 27% CAGR in footfall over FY21-24 across its stores, demonstrating its ability to attract and retain customers through its strong brand presence and customer engagement initiatives.

During the same period, the average transaction value (ATV) saw significant growth across key product categories. Gold jewelry recorded a CAGR of 10%, diamond jewelry grew at 16%, and silver jewelry saw an increase of 8%. These gains highlight the P N Gadgil Jewellers Ltd’s success in driving higher-value transactions and meeting evolving customer preferences.

P N Gadgil Jewellers Ltd believes that increasing same-store footfall and ATV will directly contribute to higher profitability per store. To capitalize on this, P N Gadgil Jewellers Ltd plans to enhance its marketing and outreach programs while also focusing on growing subscriptions for its customer loyalty and incentive schemes, further strengthening customer retention and revenue growth.

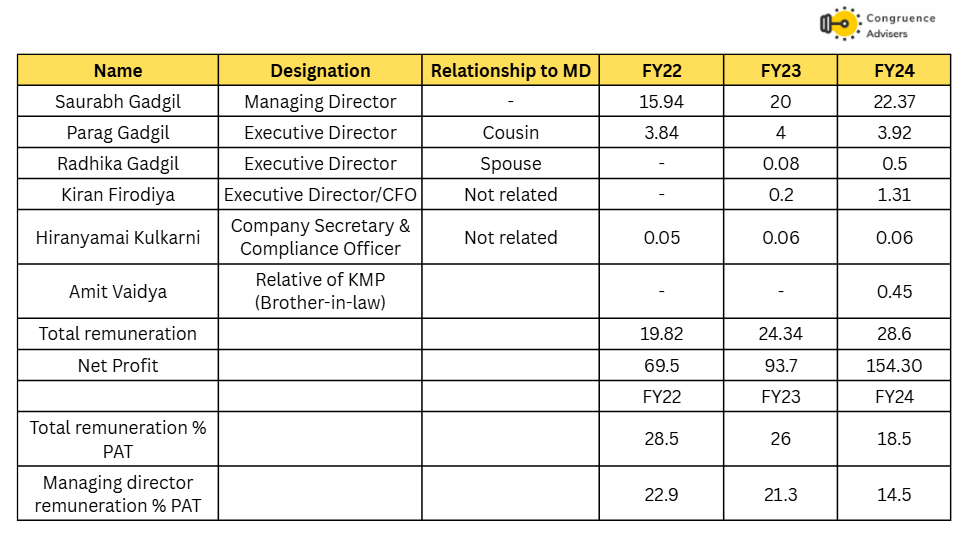

P N Gadgil Jewellers Ltd Corporate governance

Board Composition – P N Gadgil Jewellers Ltd Board of Directors is composed of 9 members, including 5 independent directors, three executive directors, and one managing director. Saurabh Gadgil is the Managing Director, & Two executive directors are from the promoter family. All board of directors bring together a wealth of experience, diverse expertise, and visionary leadership with backgrounds in gems and jewellery industry, technology, finance, and management.

Related Party Transactions – There are significant transactions with an entity called PN Gadgil Jewellers, a partnership firm controlled by the promoters. P N Gadgil Jewellers Ltd has purchased material worth ~INR 686 Cr from this related company in FY24 and has an outstanding recoverable balance of ~INR 78 Cr from the same firm. P N Gadgil Jewellers Ltd also gave an advance of ~INR 110Cr to this entity in FY24. P N Gadgil Jewellers Ltd also paid royalty charges to the entity amounting to INR 6 Cr.

Contingent Liabilities – According to the recent DRHP, the total amount of contingent liabilities amounts to 7.3 Cr of which a bulk is mainly related to income tax during the FY17 & FY18

Promoter Remuneration – The total remuneration to promoters for FY24 amounted to INR ~28.6 Cr. Total promoter remuneration as % of PAT amounted to ~18.5% in FY24.

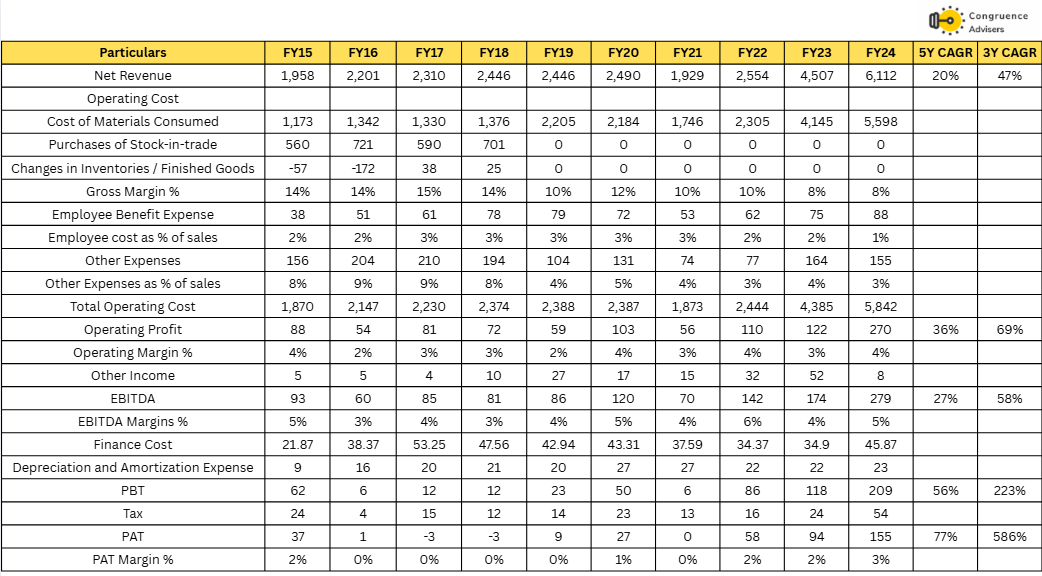

P N Gadgil Jewellers Ltd Financial Performance

Over the last 5 years, P N Gadgil Jewellers Ltd. has grown revenues at a CAGR of 20%, EBITDA at a CAGR of 36%, and PAT at a CAGR of 77%, demonstrating a steady growth trajectory. During this period, EBITDA and PAT margins have outperformed the revenue growth; EBITDA margins increased from 4% in FY20 to 5% in FY24, and PAT margins were around 1-3%, respectively. Over the 3 years, P N Gadgil Jewellers Ltd has grown revenues at a CAGR of 47%, EBITDA at a CAGR of 69%, and PAT at a CAGR of 586%. In FY24 sales Increased 36% to Rs 6,112 crore in fiscal 2024, supported by rise in jewellery and low-margin bullion sales, with healthy volume and higher realisations.

Gross margins have consistently decreased from 14% in FY15 to 8% in FY24 due to several reasons such as – product mix changes, higher proportion of low-margin bullion sales, increasing sales to franchises which are at low gross margins etc. Going forward, bullion sales are expected to reduce and an increase in the stud mix ratio to double digits is expected to improve the gross margin. P N Gadgil Jewellers Ltd has seen solid operating leverage play out in the employee cost and other expenses line items, leading EBITDA margins to be relatively stable between FY15-FY24 in spite of a severe decrease in gross margins.

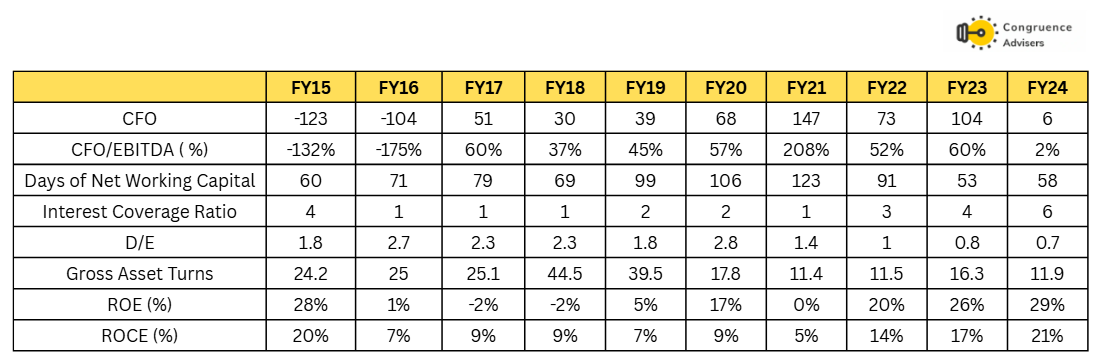

P N Gadgil Jewellers Ltd: Working capital, Return Ratios, Debt, and cash flow analysis.

P N Gadgil Jewellers Ltd debt-to-equity ratio improved to 0.7x in FY24 compared to FY20, which is expected to reduce P N Gadgil Jewellers Ltd’s debt paid back in Q3FY25 from the IPO proceedings. Net working capital days improved over the years, reducing to 58 days compared to 106 days in FY20. ROE and ROCE improved to 29% and 21% in FY24, respectively.

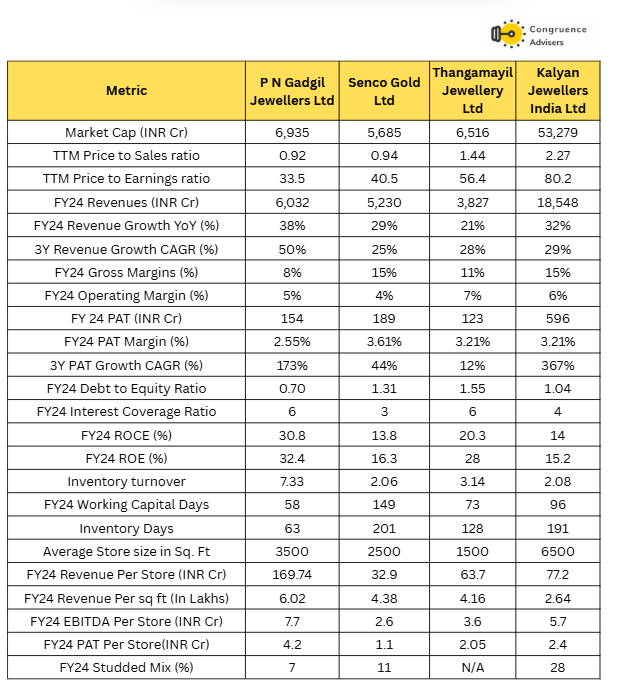

P N Gadgil Jewellers Ltd Comparative Analysis

To understand P N Gadgil Jewellers Ltd investment potential, We have conducted a comprehensive analysis. This analysis includes comparing P N Gadgil Jewellers Ltd to its competitors (peer comparison) on various fundamental parameters and P N Gadgil Jewellers Ltd share performance relative to relevant benchmark and sector indices.

P N Gadgil Jewellers Ltd Peer Comparison

We have compared P.N. Gadgil Jewellers Ltd against listed peers like Senco Gold Ltd, Kalyan Jewellery Ltd, Titan Ltd, and Thangamalyi Jewellery, and a few parameters of unlisted peers like Joyalukkas India and Malabar Gold.

The jewelry industry has a unique working capital structure characterized by high inventory & low payables. Retailers must maintain a wide variety of high-value jewelry designs, which leads to significant capital being tied up in inventory. Average inventory turnover in the industry is around 2.5-3x annually (or ~120 days), and it sometimes deteriorates during periods of store expansion.

Unlike other retail sectors, where inventory costs are often funded by payables, the jewelry sector has limited payables. Gold purchases are generally financed through bank loans, recorded as borrowings rather than payables, making inventory the key component of a jeweler’s working capital.

P N Gadgil Jewellers Ltd’s inventory management: P N Gadgil Jewellers Ltd has demonstrated efficient inventory management, achieving an impressive average inventory turns of 7.3 between FY19-FY24, outperforming peers. Higher make-to-order mix (25-30% revenue mix) and a lower studded mix provide the company with a superior inventory turnover.

Jewelry retailing is considered one of the most lucrative retail sectors. On average, the industry operates at RoE of 20% and RoIC of 15%. Jewelry companies operate at low EBITDA margins compared to other retail segments; However, it is compensated by a higher asset turnover and access to low-cost debt.

P N Gadgil Jewellers Ltd return ratios have been better than its peers’ as they operated at 34% RoE and 24% RoIC in FY24. Better inventory turns and higher through-put from stores resulted in such a superior return profile.

P N Gadgil Jewellers Ltd Index Comparison

P N Gadgil Jewellers Ltd share performance vs S&P BSE Small Cap Index, as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why You Should Consider Investing in P N Gadgil Jewellers Ltd

Inventory Days: P N Gadgil Jewellers Ltd distinguishes itself in the jewellery retail industry through a highly efficient and capital-light operating model. A significant portion of its revenue approximately 30–50% comes from made-to-order sales backed by customer advances. This approach drastically reduces the need for holding large inventory, allowing the company to operate with leaner capital and improve cash flow. As a result, it achieves significantly higher inventory turnover than peers, with historical stock turns reaching up to 10.6x—far ahead of industry averages (e.g., PC Jeweller at ~2.0x, Kalyan Jewellers at ~2.4x). P N Gadgil Jewellers Ltd further optimized its working capital during COVID by reducing inventory levels across stores by 25–30%, reinforcing its shift toward a more agile, customer-led supply chain.

In addition to its inventory efficiency, P. N. Gadgil Jewellers Ltd benefits from strong operational performance at the store level. P N Gadgil Jewellers Ltd operates medium-sized stores, enabling better cost control, while maintaining an exceptionally high footfall-to-conversion ratio of over 93%. These factors contribute to faster stock rotation and enhanced return on capital employed. Overall, the P N Gadgil Jewellers Ltd’s strategic focus on made-to-order sales, lean inventory practices, and efficient retail execution creates a scalable, resilient model that positions it well for sustainable and profitable growth in a highly competitive market.

Gross Margin Improvement By Increasing Stud Ratio: The stud ratio means, the percentage of diamonds used in gold jewellery, directly impacts profitability. P.N. Gadgil Jewellers Ltd currently has a stud ratio of around 7.4% in Q3FY25 and aims to increase it to double digits. The company is planning to reach an overall gross margin of 10% to 12% in the next 2 to 3 quarters, which they see as being in line with competitors. While titan and kalyan jewellers have double digits stud ratio which they have higher gross margin. Negotiating with existing Karigars (artisans) to reduce making charges and increasing the retail portion of sales, as the retail segment typically has a higher gross margin compared to the non-retail/bullion segment.

IPO Funds and New Store Expansion : As of December 2024, out of the total IPO proceeds of INR 850 Cr , INR 300 Cr had been utilised to repay the debt, resulting in significant debt reduction. Moreover, the store expansion in FY25 has also been largely funded through the IPO proceeds; P N Gadgil Jewellers Ltd utilised INR 351 Cr for opening nine stores during the year. In FY26, P N Gadgil Jewellers Ltd to open 25 new stores, out of which about 10 stores are likely to be in PN Gadgil lifestyle format, for which the average per store inventory requirement would be lower as compared to normal PNG stores. However, the overall debt levels are likely to increase in FY26 from the December 2024 levels of INR 50 Cr.

Reducing Finance Costs by Increasing GML share: P N Gadgil Jewellers Ltd is actively working to reduce its finance costs by transitioning from high-interest bank loans—previously around 9% pre-IPO—to lower-cost Gold Metal Loans (GMLs). It targets increasing the share of GMLs to 70% by March 2025. This financial restructuring strategy, which includes breaking the lender consortium and optimizing bank borrowings, is expected to bring down the overall cost of debt to 5–5.5%. Additionally, P N Gadgil Jewellers Ltd anticipates a 1–2% improvement in gross margins through cost efficiencies achieved via procurement through the India International Bullion Exchange (IIBX), operating leverage, and renegotiated terms with artisans. This trend is prevalent across the industry, with all major players in the previous note we discussed such as Skygold—adopting Gold Metal Loans (GML) to reduce financing costs.

Management Guidance for Revenue and EBITDA Margins: P N Gadgil Jewellers Ltd management has set an ambitious revenue target of INR 8,000 crores for FY25 and INR 9,500 for FY26. They also aim to achieve a gross margin of 10-12% in the next coming quarters, primarily driven by increasing their studded jewellery sales and optimising their sourcing and production costs.

What are the Risks of Investing in P N Gadgil Jewellers Ltd

Gold Price Volatility & Competition: Gold prices fluctuate due to global economic conditions, geopolitical events, and investor sentiment, impacting profitability. In addition, the highly competitive Indian jewelry market, with both organised and unorganized players, intensifies price wars and margin pressures, requiring businesses to hedge strategies and continuous innovation to stay competitive. Also, P N Gadgil Jewellers Ltd margins are susceptible to gold price movements. However, as informed by the management, the price risk will always be largely hedged with the use of gold metal loans and customer-exchanged gold. P N Gadgil Jewellers Ltd gold price hedging through gold metal loans increased to over 45% in 3QFY25 from 12% in 2QFY25.

Changing Consumer Preferences: P N Gadgil Jewellers Ltd operates in a fast paced industry where consumer preferences and market trends change rapidly and unpredictably. Demand patterns vary by region and there is no guarantee that past growth will continue. P N Gadgil Jewellers Ltd’s success is dependent on its ability to anticipate and react to these changes by developing relevant and appealing products on time. Any misread of market demand, failure to innovate or delays in adapting to changing consumer behavior could result in reduced sales and market share and materially impact financial performance.

New Geographic Expansion: Besides, organised players have also been expanding rapidly in select regions, posing stiff competition. As P N Gadgil Jewellers Ltd expands into newer geographies and cities, it will face severe competition from these local and organized players. P N Gadgil Jewellers Ltd planning expansion into neighboring states such as Madhya Pradesh, Chhattisgarh, Bihar, and Uttar Pradesh after establishing dominance in Maharashtra in FY26.

Intense Competition: P N Gadgil Jewellers Ltd faces competition from other large organised and unorganised local jewellers. Stagnant volume growth and aggressive expansion undertaken by several large jewellers have intensified the competition further, thereby constraining the margins.

Inherent Industry Risks: The gold jewellery industry has witnessed high regulatory oversight over the last decade, with several policy interventions. Gold imports amount to a significant burden for India, and any increase in the taxes/duties could adversely affect the demand and cost structure of gold jewellers. The industry has been subject to several compliances, including mandatory hallmarking along with restrictions on bullion purchase and gold saving schemes in the past. The introduction of any new regulation could increase compliance costs for the industry.

P N Gadgil Jewellers Ltd Future Outlook

P N Gadgil Jewellers is among the few jewelry companies that are rapidly expanding their store presence. With management guidance of revenue around 9500 Cr for FY26 with further improvement in gross margin by enhancing its studded mix (up 250bp in the last three years) and is actively seeking to further improve this mix in the coming years. Maharashtra is already a favorable market for studded products (~20% studded mix market); therefore, there is significant potential for further improvement in this mix. With a more favorable product mix and operating leverage With the IPO proceeding, the company has reduced its debt . P N Gadgil Jewellers Ltd is looking to add gold metal loans, which are likely to enhance its gold hedging strategy.

P N Gadgil Jewellers Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time, price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers, we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

P N Gadgil Jewellers Ltd Price charts

Since the P N Gadgil Jewellers Ltd stock has a trading history of only ~1 year, we will only be looking at the daily chart.

Tangible signs of bottom formation would be welcome, given that this stock listed only recently.

We would rely more on our fundamental lens for such stocks where the technical trends do not reveal much.

P N Gadgil Jewellers Ltd Latest Result, News and Updates

P N Gadgil Jewellers Ltd Quarterly Results

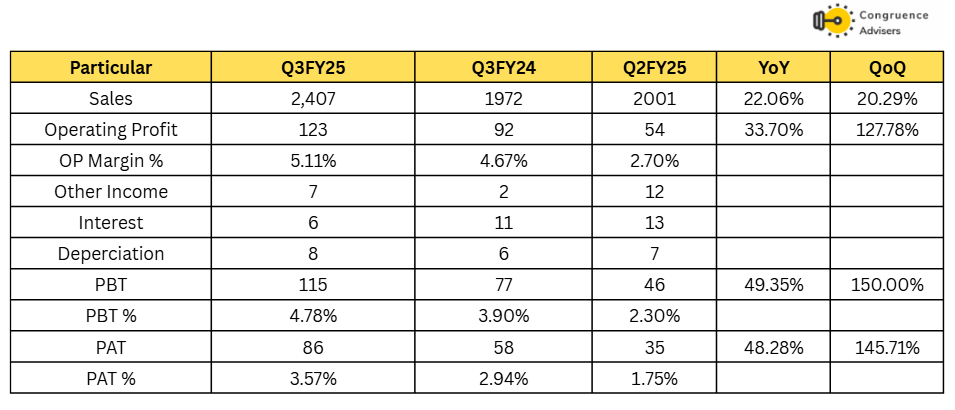

P N Gadgil Jewellers Ltd delivered a strong Q3 performance, with consolidated revenue surging 22% YoY to ₹2407 Cr driven by strong festive demand during Navratri and Diwali, and EBITDA growing 34% to ₹123 Cr. PAT rose to ₹86.5 Cr, improving margins to 3.57% from 2.94% last year.

Despite price increases, footfall remained stable in Q3. Rising gold prices led to an increase in old gold exchanges. P N Gadgil Jewellers Ltd had hedged 83.6% through GML by Dec ’24 and was fully hedged in Q4FY25. The transaction count grew by 21% and ATV increased by 22% to Rs 86000. Consumer footfalls increased by 36%, supported by a strong conversion rate of 94%. The company has repaid Rs 300 Cr in debt using IPO proceeds. In 3QFY25, gold volume growth stood at 14%, while value growth reached 44%.

Normal hedging expenses are included in COGS, but for gold programs hedged in advance, the mark-to-margin expenses are recorded under other expenses. P N Gadgil Jewellers Ltd sources its gold procurement as follows: 32-35% from GML, 30% from old gold exchanges, and the remaining from spot purchases through bullion vendors and IEBX. In FY26, P N Gadgil Jewellers Ltd plans to add 25 stores, including a mix of COCO, FOCO, and Litestyle by PNG formats. A new store typically takes 15-18 months to break even. However, the nine stores opened during Navratri are currently operating without cash infusion and are on track to achieve cash break even within a year.

Final thoughts on P N Gadgil Jewellers Ltd

PN Gadgil Jewellers Limited is the second largest organised jewellery store franchise in Maharashtra, only behind Titan. With the multi-decade long gold jewellery retailing legacy of the Gadgil family in Maharashtra, PNG is a very strong name in its own region.

However, it is already quite well penetrated in Maharashtra and from here on to grow fast, the brand will need to establish itself outside the state. The brand is not very well known outside of Maharashtra and therein lies its future challenge. If the company has to become a pan India jewellery player from a regional jewellery player, it will have to establish a brand and a viable business model across other parts of the country – not an easy task. Doing this would entail heavy investments on branding and store opening and sales traction in the initial years can be expected to be sluggish as customers assess the new brand before placing their trust in it. Therefore, if the company wants to grow fast outside of its home state, we expect it to do so by diluting its return on capital metrics for the medium term.

Separately, the organised gold jewellery retail industry has had a stellar run since Covid, playing on the twin growth engines of increased formalization and rapid gold price growth. However, gold prices can’t keep increasing forever and we feel that the yellow metal may take a breather in the short term while still being in a structurally bullish phase in the long term. Short term volatility in gold price can impact gold jewellery retail businesses negatively in terms of inventory losses. Current valuations across the industry range between fair to rich (leaning on the rich side) in our assessment. Hence for investors to make handsome returns from here on, everything has to go right for the industry, which is a tall ask.

P N Gadgil Jewellers Ltd is a solid business with a strong regional brand salience. At the right valuations and at the right stage of the gold price cycle, it can become a viable investment candidate.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this to a general audience. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will continue/be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.