Prince Pipes and Fittings Ltd incorporated in 1987, is among the leading domestic polymer pipes and fittings manufacturers and is currently India’s fifth largest player in terms of revenue with a market share of 5%.

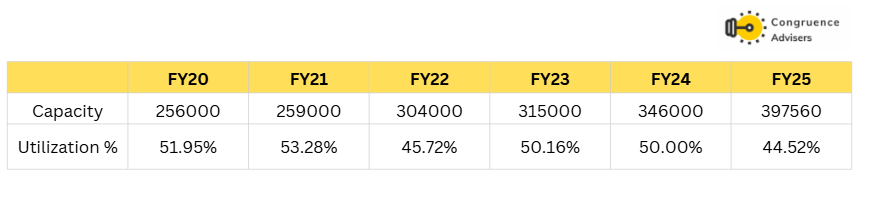

We believe Prince Pipes and Fittings Ltd is currently sitting on significant operating leverage with capacity of ~4.0 lakh+ MTPA but utilization below 45%. The weak FY25 and subdued Q1FY26 have reset the base creating scope for outsized earnings recovery once demand revives. With its diversified portfolio, strong distribution and focus on value added segments, Prince Pipes and Fittings Ltd is well positioned to benefit from cyclical recovery in agriculture, housing and infra. However, the key risk remains PVC resin price volatility which can swing margins sharply and continues to be the single most important determinant of near term profitability. We hope that the bottom in PVC resin prices is already in or is around the corner.

Prince Pipes and Fittings Ltd Company Summary

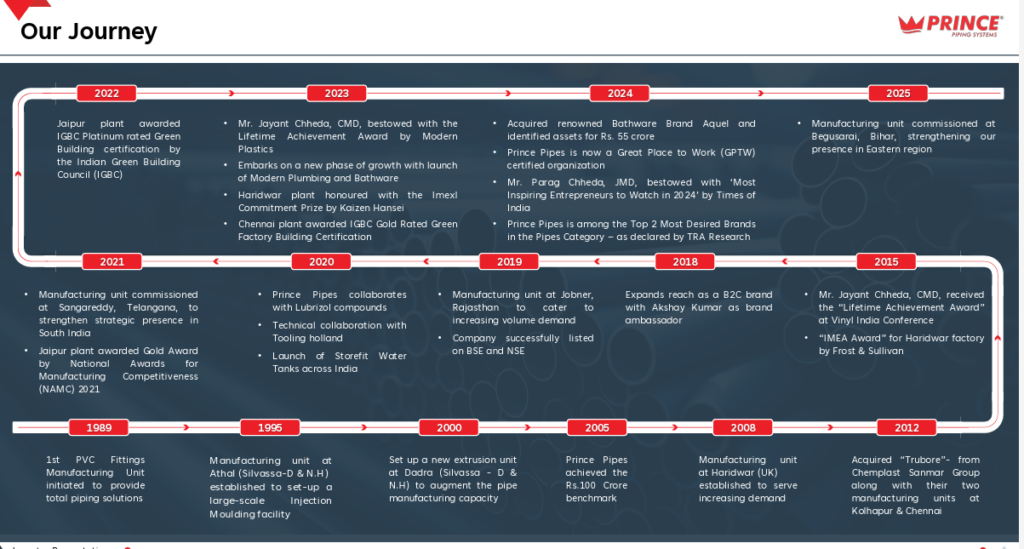

From modest entrepreneurial roots, Prince Pipes and Fittings Ltd has grown into one of India’s leading integrated piping solutions providers. The journey began with a small family kirana shop that diversified into plastics manufacturing in the 1970s, when five brothers began making household items like buckets and jugs.

A pivotal moment occurred when the family members chose to branch out. In 1980, seizing the opportunity in replacing traditional metal pipes with PVC, Mr. Jayant Shamji Chheda founded Prince Pipes by establishing a small facility in Mumbai under the “Prince Agri Fittings” name. The company’s early innovation lay in pioneering PVC pipes for agriculture, a product that was lighter, more hygienic and easier to use compared to conventional iron pipes.

By 1987, the demand momentum was so strong that Prince Pipes and Fittings Ltd scaled up with an 18 machine factory in Andheri. The 1990s brought industry challenges as the sector was fragmented, dominated by unorganised players and vulnerable to labour and supply disruptions.

Prince Pipes and Fittings Ltd faced labour unrest but strategically reset operations with the entry of his son Mr. Parag J. Chheda in 1994 who focused on inventory liquidation and stabilisation. That same year, Prince Pipes and Fittings Ltd took a bold bet on Silvassa (Gujarat) despite poor infrastructure, it was one of India’s emerging industrial hubs due to tax incentives and proximity to western markets. Within five years capacity quadrupled and by 1997, Prince Pipes and Fittings Ltd had become one of the early organised players positioned to benefit from India’s shift toward branded piping solutions and In the same year, Mr. Vipul J. Chheda, the second son, also joined the business.

The 2000s marked an inflection for the broader industry. Rapid urbanisation, the housing boom and rising use of plastics across infrastructure created tailwinds for organised players. Prince Pipes and Fittings Ltd expanded capacity with the Dadra plant (2000) and a Haridwar facility (2008) to serve the fast growing northern markets. By 2005, revenues had crossed ₹200Cr+ mirroring the sector’s scale-up as PVC consumption per capita in India surged.

A major milestone came in 2012, when Pipes and Fittings Ltd acquired Trubore Piping Systems from Chemplast Sanmar. The deal was timed with the rising consolidation trend in the industry and helped Pipes and Fittings Ltd gain scale in South India. With Kolhapur and Chennai plants, Prince Pipes and Fittings Ltd could now operate a dual-brand strategy (Prince + Trubore), addressing both premium and regional retail segments that remains central to its retail positioning today. Over the decade, Prince also entered the CPVC segment through partnerships with global leaders like Lubrizol, and added water storage tanks and modern bathware solutions to its portfolio.

The 2010s saw the organised pipes sector benefit from GST implementation, rising housing penetration and replacement demand. Prince’s public listing in December 2019 provided growth capital just as the industry entered a scale-up phase, with government spending on “Housing for All” and “Jal Jeevan Mission”.

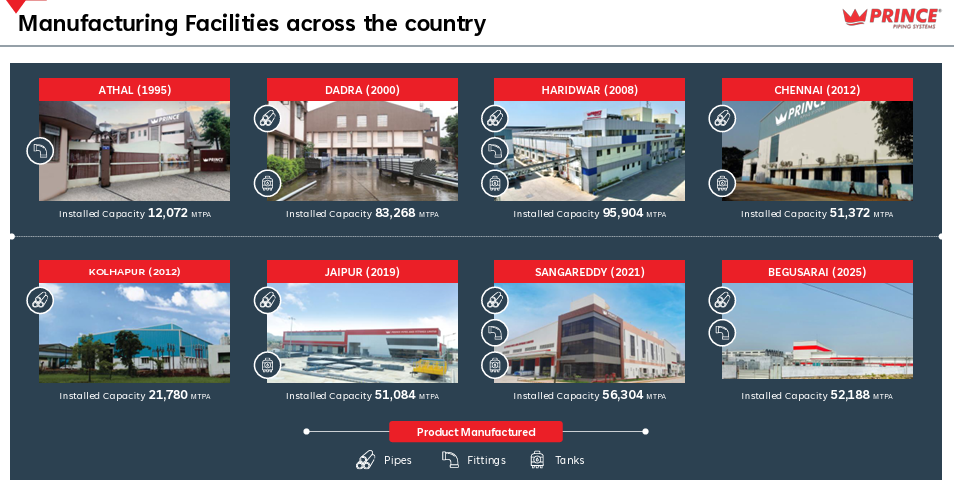

In the 2020s, Pipes and Fittings Ltd accelerated capacity expansion, commissioning plants at Jaipur (2019), Sangareddy (2021), and Begusarai (2025), expanding to eight strategically located facilities with ~4.2 lakh MTPA capacity. This matches the industry trend of pan-India coverage, as logistics efficiency and availability in Tier-2/3 markets have become critical differentiators.

Today, Pipes and Fittings Ltd commands a portfolio of 7,200+ SKUs, serving agriculture, plumbing, sewage, borewell, and modern bathware applications. With 1,500+ channel partners, nine warehouses, and pan-India distribution, the company has positioned itself amongst the top five processors in the Indian piping industry. Its strong brands — Prince in piping, Trubore in regional retail, Storefit in water tanks and Aquel in bathware make it a comprehensive solutions provider across the water management and building materials ecosystem.

Family Disputes and Resolution

Prince Pipes and Fittings Ltd’s journey has not only been defined by its entrepreneurial growth but also by internal family disputes that shaped its trajectory. In the early 1990s, the Chheda family divided the businesses among brothers with Prince Pipes and Fittings Ltd (PPF) under Mr. Jayant Shamji Chheda, while other entities such as Prince SWR Systems, Prince Realty, Prince Multiplast, and Prince Care went to his brothers. Despite no cross holdings, both PPF and Prince SWR marketed products under the same “Prince” brand name and nearly identical logos, sowing confusion in the marketplace.

The situation escalated in 2008 when Prince Pipes and Fittings entered SWR pipes (Prince SWR Systems’s core product) and Prince SWR Systems entered agricultural/plumbing pipes (Pipes and Fittings Ltd’s forte). This direct rivalry led both to dilute quality standards (excessive use of calcium carbonate), price wars, extend liberal credit policies and engage in aggressive market share wars. The result was a significant erosion of brand equity between 2009-2013, weakening balance sheets and damaging trust with channel partners.

Recognising the need to break free from this destructive cycle, Prince Pipes and fittings Ltd embarked on a corrective journey from 2013 onwards –

- Rebranding & Differentiation – Traditionally, Prince Pipes and fittings Ltd used to operate under the brand name ‘Prince’ but with a different logo. It used to have a similar logo which is currently used by PSWR. Both the companies PSWR and Prince Pipes and fittings Ltd marketed their products under the same brand name and similar logo which created a lot of confusion in differentiating their products and creating a mind recall for each of them.

In 2014, PPF unveiled a new three-point crown logo with the descriptor “Piping Systems”, creating a distinct identity versus PSWR’s five-point crown. This helped resolve years of brand confusion in the trade.

- Quality Restoration – Prince Pipes and fittings Ltd brought manufacturing back in line with BIS norms. Started reducing filler content and regaining credibility on product quality.

- Governance Clean-Up: Related-party raw material sourcing (via Ace Polyplast) and legacy promoter transactions (e.g., Prince Marketing) were unwound post-IPO, which has eased long standing investor concerns.

- Professionalisation – Prince Pipes and fittings Ltd moved beyond promoter only management by inducting seasoned professionals from blue-chip firms (ex-Asian Paints, HUL, ACC, UPL).

- Brand Monetisation – By appointing Akshay Kumar as brand ambassador in 2018 and launching the “Prince Udaan” loyalty programme, Prince Pipes and fittings Ltd built strong pull among plumbers and distributors, effectively addressing PSWR’s retail-level overlap.

These steps not only mitigated the family rivalry impact but also allowed Prince Pipes and Fittings Ltd to position itself as one of the top five organised players in India’s piping industry. The 2019 IPO further reinforced this transition which enabled promoter deleveraging and institutionalising governance practices.

In effect, what began as a family split that once threatened the brand’s survival, has now been transformed into a distinct, professionally managed and institutionally owned franchise with Pipes and Fittings Ltd clearly separating itself from its legacy competitors.

Prince Pipes and Fittings Ltd Management Details

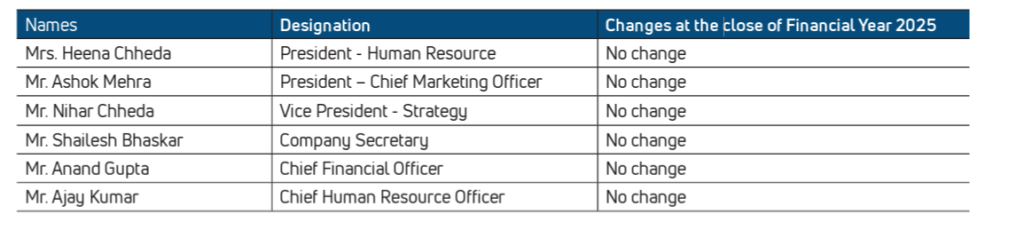

Prince Pipes and Fittings Ltd continues to be a promoter driven company, with the Chheda family retaining leadership at the top level. Mr. Jayant S. Chheda, the Founder, Chairman & Managing Director has been the guiding force since inception with over four decades of industry experience. His two sons, Mr. Parag J. Chheda (Joint Managing Director) and Mr. Vipul J. Chheda (Executive Director) joined in the mid 1990s and late 1990s respectively, driving expansion, professionalisation and operations. The next generation is also active: Mr. Nihar Chheda (Vice President – Strategy) focuses on corporate strategy, branding and global partnerships, while Mrs. Heena Chheda (President – Human Resources) looks after the HR department. Promoter family members Mrs. Tarla J. Chheda (spouse of Mr. Jayant Chheda) and Mrs. Ashwini V. Chheda (spouse of Mr. Vipul Chheda) are listed as shareholders but are not directly involved in operations.

The promoter family anchors vision, long term growth strategy and key operational areas such as production, procurement and institutional sales.

At the same time, Prince Pipes and Fittings Ltd has progressively strengthened its second line of leadership through a professional management layer. Over the last decade, executives from established consumer and industrial companies have been inducted in critical functions such as finance, HR, marketing, and operations. Notable professional leaders today include Ashok Mehra (Chief Marketing Officer, ex-Jaquar/Pidilite), Anand Gupta (CFO), Ajay Kumar (CHRO), and Shailesh Bhaskar (Company Secretary), alongside functional presidents across HR and strategy.

The governance clean up post 2014 and the 2019 IPO accelerated this transition with the promoters increasingly delegating day to day execution to professionals while focusing on strategy and expansion.

Prince Pipes and Fittings Ltd – Industry Analysis

In our previous month’s Microcap Series we did research on the broader building products sector in India, highlighting its evolution across different phases from traditional materials like steel, wood, and cement, to modern solutions such as engineered wood, tiles, and sanitaryware. We also underlined the close correlation between real estate and home improvement demand, as well as the typical time lag between a real estate cycle recovery and the subsequent pick-up in building material consumption, as illustrated in our earlier work on Shankara Building Products Ltd and also covered detailed analysis of real estate sector in our Capacite Infraprojects Ltd.

Building on that framework, In this section shifts focus to the PVC pipe industry, a critical subset of building materials that has gained structural importance in India’s housing, water management, and infrastructure ecosystem. Unlike many traditional building materials, PVC pipes straddle both core real estate demand (plumbing, sanitation, drainage, bathware) and non-real estate applications (agriculture irrigation, water supply, and industrial usage), making it a unique proxy for multiple end-markets.

Phases in the Evolution of India’s Plastic Pipes Industry

1. Initial Phase (Late 1960s – 1980s)

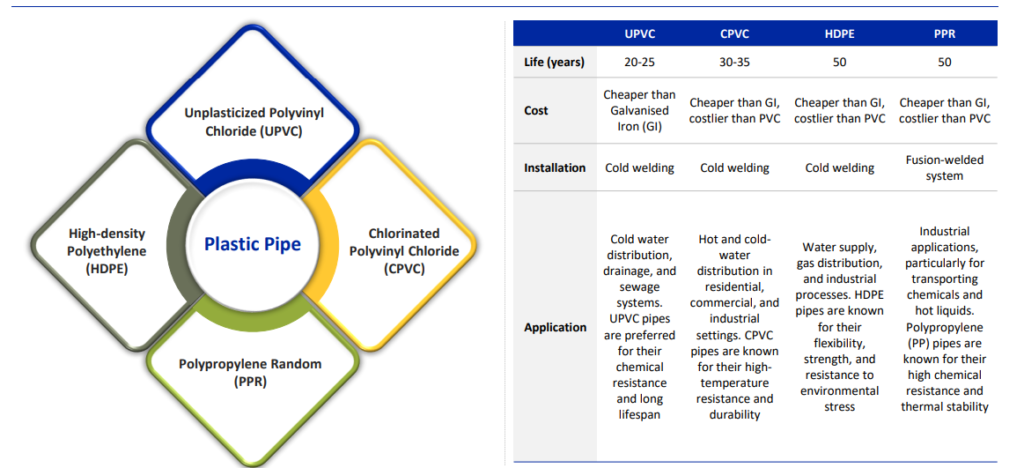

The Indian plastic piping sector began to take shape in the late 1960s when HDPE and PVC pipes were first introduced as alternatives to Galvanised Iron (GI) and Cast Iron pipelines. Adoption was initially limited as GI Pipes remained the industry standard for irrigation, plumbing and municipal water supply.

A key catalyst was the World Bank funded water and sanitation programs in the 1980s which demonstrated the cost and efficiency benefits of PVC in large scale municipal and agricultural applications. Despite this, penetration was low and the sector was highly fragmented with minimal organised presence as demand was largely project driven and dominated by government schemes rather than retail adoption.

2. Agri-Led PVC Take Off (1990s – mid-2000s)

The 1990s marked the first true growth phase as India’s push for rural electrification and irrigation created a surge in demand for plastic piping systems. PVC pipes started gradually replacing GI Pipes in pressure lines, driven by lower cost, easier installation and superior longevity. The agriculture sector accounted for 70-75% of PVC pipe demand during this phase. This was also the era when organised brands started emerging with companies setting up extrusion capacities in Athal, Dadra and later Haridwar. Many of today’s listed players built their initial reputations on agri focused products.

During this phase the growth was volume led with thin margins; distribution networks in Tier-2/3 India became the competitive differentiator.

3. Urban Plumbing & CPVC Premiumisation (Late 2000s – 2010s)

From the mid-2000s, demand drivers shifted decisively towards urban housing and real estate. The housing boom and expansion of high rise construction created a need for piping solutions that could handle hot/cold water and fire safety systems. This led to the introduction and rapid adoption of CPVC as it offers superior high temperature resistance, durability and safety versus PVC. Which is supported by global technology tie-ups (e.g., Astral-Lubrizol, Prince-Lubrizol). Simultaneously, replacement demand accelerated, as legacy GI pipes from the 1980s reached end of life (20–25 years). The organised sector began focusing on branding and retail channel education, moving the industry from pure commodity PVC to a multi-polymer, premiumised portfolio.

The Urbanisation + rising per capita incomes pushed CPVC/Plumbing as higher margin categories; agriculture fell to ~55–60% of demand.

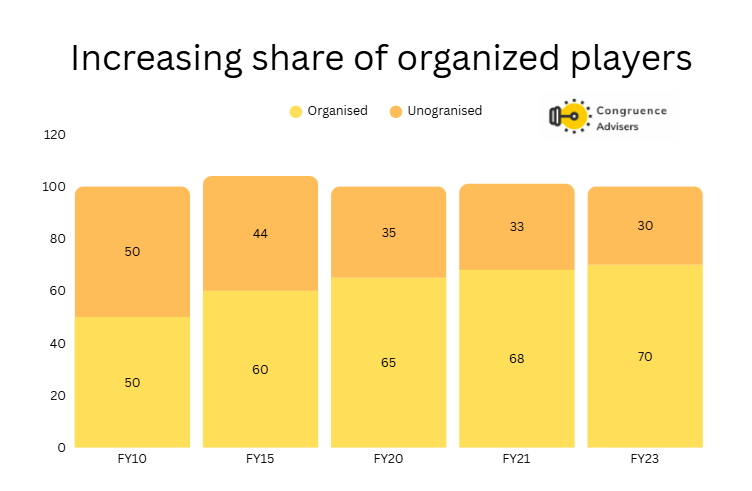

4. Consolidation & Formalisation (2016 – 2020)

The implementation of GST in 2017 was a watershed moment. Unorganised players who previously benefited from tax arbitrage, lost their cost advantage, leading to accelerated market share gains for listed and branded players. Companies invested aggressively in advertising, distribution and loyalty programs to build retail stickiness. The industry also saw M&A activity and contract manufacturing strategies emerge, as players sought pan India footprints (e.g., Prince’s acquisition of Trubore earlier, and capacity additions by peers like Astral). By FY20, the top 7-8 players controlled ~65% of the branded market, a sharp jump from <50% in FY15.

5. Cyclical Raw Material Volatility & Foray into adjacent categories (2020 – 2024)

Post covid 2022 in particular was an outlier year as demand surged across housing and infrastructure as post COVID pent up demand was released, government push for Jal Jeevan Mission accelerated and the real estate cycle entered recovery.

The pandemic period coincided with extreme PVC resin price volatility driven by supply shocks and crude linked input swings. Resin shortages squeezed margins but organised players with scale and diversified product portfolios fared better. This period also accelerated a strategic mix shift – leaders leaned into CPVC, underground drainage (DWC pipes) and water storage tanks i.e categories less exposed to commodity volatility and offering higher realisations.

By 2024, the industry entered a reset phase. Resin prices softened from their pandemic highs, easing input cost pressures and allowing margins to normalise. Demand stabilised after the 2022 spike and 2023 correction with government orders under Jal Jeevan Mission and PMAY Urban boosting volumes. Agricultural demand, which had been subdued, showed modest revival supported by rural infrastructure spending.

6. Subdued FY25 Performance

The Indian plastic pipes industry endured a challenging FY25, weighed down by multiple headwinds. Subdued infrastructure spending, tighter liquidity conditions in trade channels and continued PVC resin price volatility dampened overall demand. Core segments such as agriculture and mid tier real estate remained weak, while pockets of resilience came from premium housing and government led water supply initiatives under Jal Jeevan Mission, which cushioned what could have been a deeper contraction in industry volumes.

In response, industry leaders recalibrated their operations, focusing on supply-chain optimisation and digitalised inventory management to preserve efficiency and capital discipline. Distribution was rationalised to improve working capital turnover, while the strategic push toward premiumisation gained momentum.

7. Outlook 2026E – 2028E

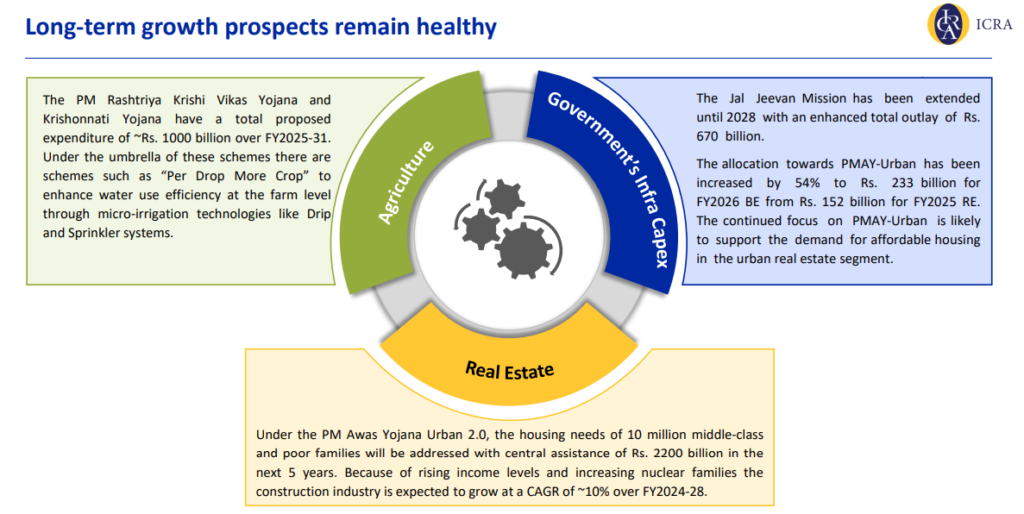

- Government spending on Jal Jeevan Mission, Housing for All (PMAY), and sanitation programs ensures steady base demand.

- Resin supply expansion – India’s PVC resin capacity is expected to nearly double, reducing import dependence (currently ~50%), stabilising raw material availability and costs.

- Industry growth outlook: Analysts project 9-12% CAGR over FY26–28E, supported by both rural/agri demand revival and continued premiumisation in urban plumbing and infrastructure segments.

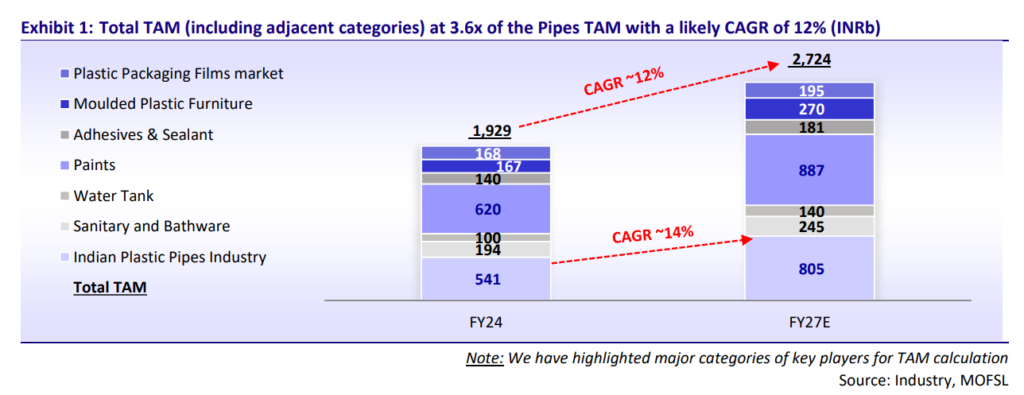

Total TAM of Pipes and Adjacent Categories

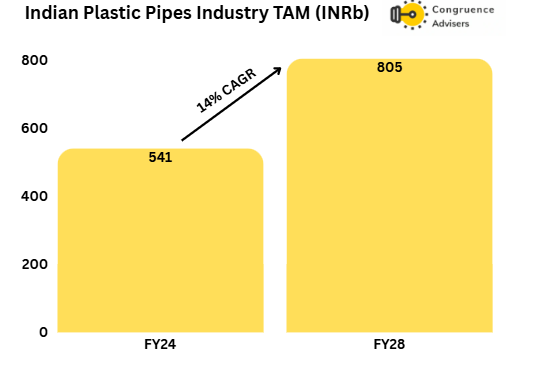

The Indian plastic pipes industry valued at ₹541bn in FY24 is expected to expand at a healthy ~14% CAGR to ₹805 bn by FY27 driven by rising demand from housing, irrigation, and infrastructure.

When including adjacencies such as water tanks, bathware, paints, adhesives, moulded plastic furniture and packaging films, the total addressable market (TAM) expands significantly to ₹1.9 tn in FY24 and is projected to reach ₹2.7 tn by FY27 implying ~12% CAGR.

Indian Plastic Pipes Growth Rate

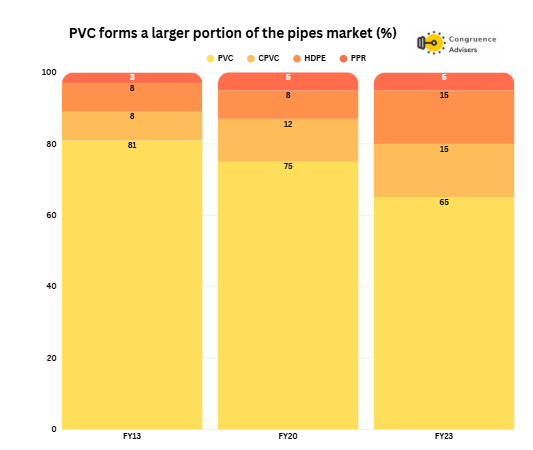

The Indian plastic pipes industry has witnessed steady growth over FY14-24, expanding at a 10-12% CAGR to reach a market size of ₹541 billion. This growth has been driven by strong demand from plumbing and irrigation, which together account for ~84% of total usage. Within this, CPVC, HDPE, UPVC, and PPR pipes have grown at higher than industry rates, supported by replacement demand for GI pipes and rising urbanisation.

Looking ahead, the industry is projected to accelerate at a ~14% CAGR, reaching ~₹805 billion by FY27. Key drivers include government programs such as Jal Jeevan Mission, Housing for All, Smart City Mission, river linking projects, and Pradhan Mantri Krishi Sinchayee Yojana, all of which support irrigation, real estate, and infrastructure demand. PVC remains the dominant raw material, but CPVC and HDPE continue to gain share due to their durability and application in premium plumbing and infra projects.

India has been predominantly a PVC/UPVC market. This dominance of UPVC as a piping material stems from it having better rigidity and higher-pressure tolerance as compared to other plastics besides being more cost effective.

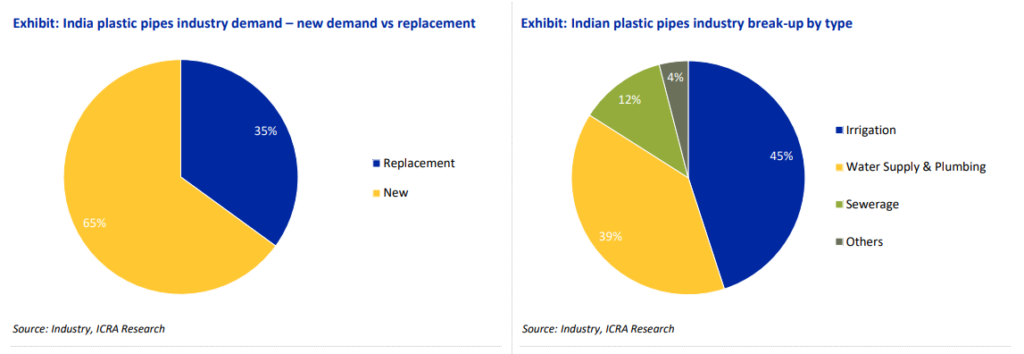

The Indian plastic pipes industry demand is driven by both new installations and replacement demand. Nearly 65% of demand comes from new projects, led by housing, plumbing, and government infrastructure schemes, while 35% arises from replacement, particularly substitution of older GI pipes (average life of 20–25 years, prone to corrosion) with PVC and CPVC systems. This replacement cycle has been a steady structural driver of growth. This is evident from the fact that real estate residential launches declined sharply over CY12–20 (down 38%), but CPVC/PVC pipe sales grew during this period.

By type of application, irrigation accounts for the largest share at ~45%, followed by water supply & plumbing at ~39%, sewerage at ~12% and others at ~4%. Irrigation demand is strongly linked to Central and State government initiatives like Jal Jeevan Mission, Nal Se Jal, and PMKSY, which focus on expanding irrigated land and improving water efficiency. Meanwhile, plumbing and water supply are gaining share with rapid urbanisation and real estate growth, making the demand profile more diversified and less cyclical over time.

The Indian plastic pipes industry has seen a steady shift in favour of organised players, whose share has increased from ~50% in FY10 to ~70% in FY23. This structural change has been driven by multiple factors, including GST implementation, which removed tax arbitrage that had long benefitted unorganised players. With GST, along with BIS quality mandates and stricter government procurement norms, many smaller players either had to formalise or exit, accelerating consolidation.

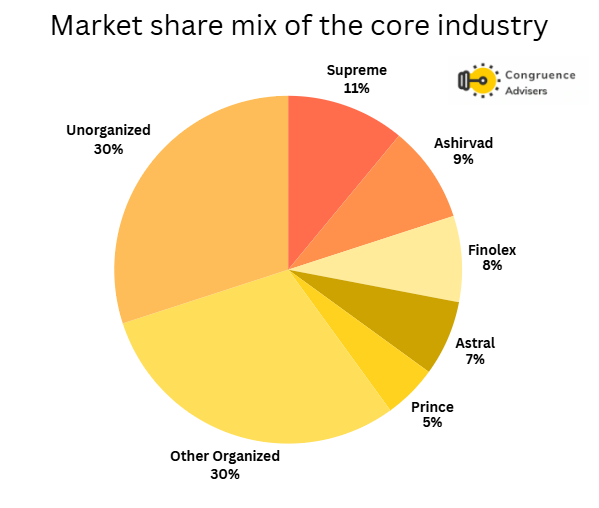

The Indian plastic pipes industry is moderately consolidated, with the top five players commanding nearly 40% market share. Supreme Industries leads with ~11%, followed by Ashirvad (9%), Finolex (8%), Astral (7%), and Prince Pipes (5%). The remaining market is split between other organized players (~30%) and the unorganized segment (~30%). Market leaders continue to gain share through innovation, wide SKU offerings, deeper penetration, and strong brand equity, while smaller and unorganized players are increasingly losing ground post-GST and due to rising consumer preference for branded products.

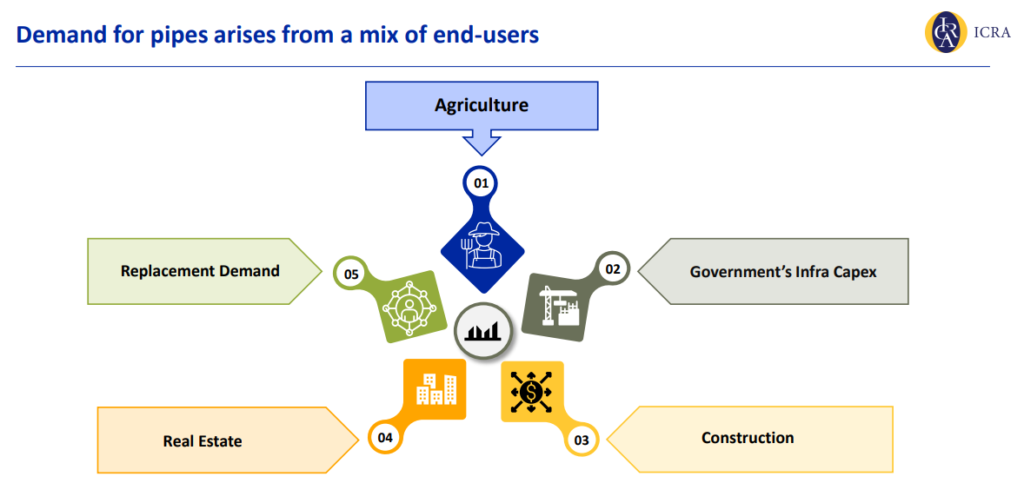

The demand for plastic pipes in India arises from a diverse mix of end user segments, which provides both cyclical and structural growth opportunities for organised players.

Agriculture is the single largest demand driver, accounting for a significant share of volumes. The sector’s dependence on monsoons and rural spending makes it cyclical, but long-term demand is supported by government irrigation programmes and subsidies. Schemes such as Pradhan Mantri Krishi Sinchayee Yojana and Nal Se Jal have created a steady push for efficient water management, making PVC and HDPE pipes critical for expanding irrigated acreage and improving water use efficiency.

Government infrastructure capex is another strong driver, with projects under Jal Jeevan Mission, AMRUT, Smart Cities, river linking and urban sewerage upgrades ensuring large-scale demand for CPVC, HDPE and DWC pipes. This provides high volume, long duration demand visibility beyond retail driven segments.

Construction and real estate together represent a fast-growing demand base, driven by urbanisation, rising housing starts, and increasing consumer preference for branded plumbing and SWR solutions.

Replacement demand is a structural growth lever, contributing almost a third of industry volumes. With the average life of GI pipes being 20-25 years and prone to corrosion, ongoing replacement with PVC/CPVC pipes ensures a steady flow of demand independent of new project launches.

Raw material prices & Its impact

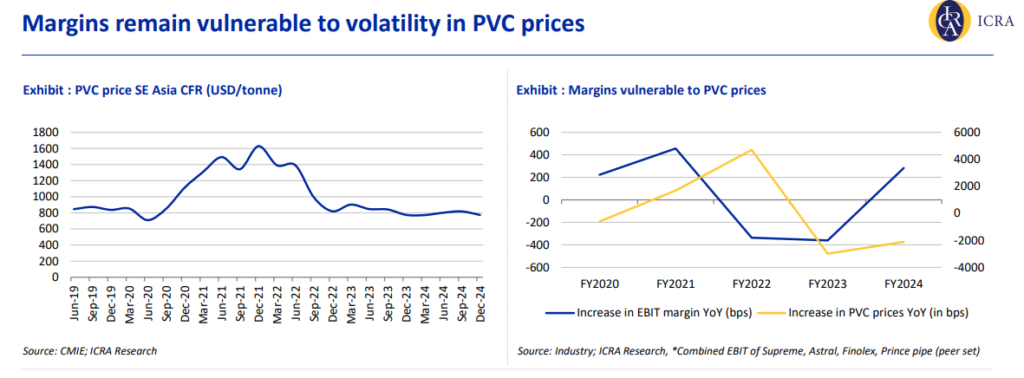

The pipes industry remains structurally attractive, but one of the biggest risks continues to be its dependence on PVC resin prices, which are closely tied to crude oil trends and global demand supply dynamics. Margins are highly vulnerable to volatility in PVC prices; sharp increases often cannot be fully passed on to customers due to price sensitivity, while steep declines lead to inventory losses and dealer destocking. This was evident during FY21–22, when PVC prices spiked to all time highs which boosted margins temporarily, followed by a sharp correction in FY23 that hurt profitability across the sector.

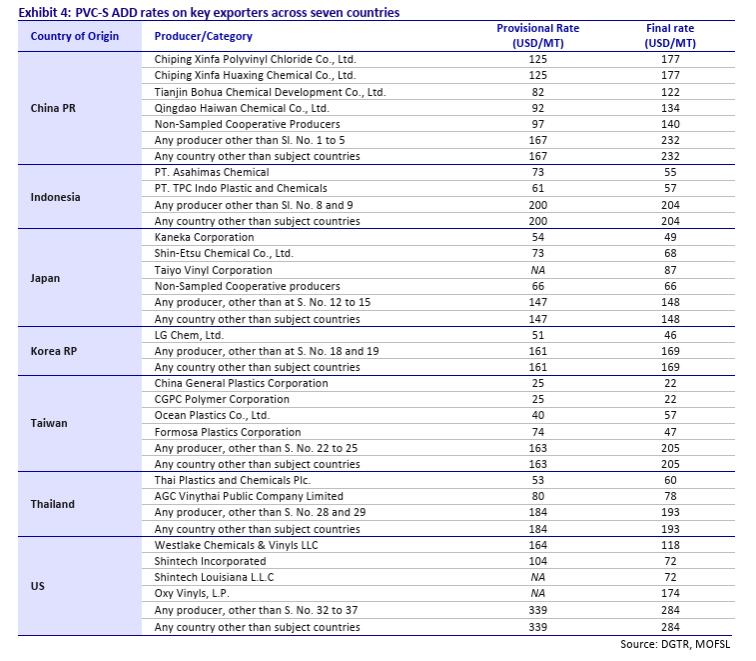

The slowdown in China’s real estate sector further aggravated the situation, leading to higher dumping of PVC in India from China. To counter this, the Directorate General of Trade Remedies (DGTR) in October 2024 recommended anti-dumping duties on PVC imports from seven countries (including China, Indonesia, Japan, South Korea, Taiwan, Thailand, and the US). The government had already imposed provisional duties in Nov ’24 following the preliminary findings.

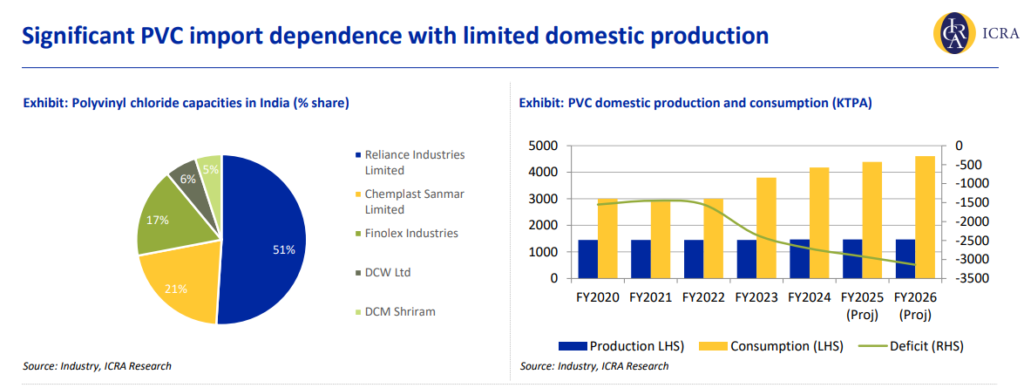

The Indian PVC industry continues to face significant import dependence due to limited domestic production capacity. As of now, Reliance Industries (51%), Chemplast Sanmar (21%) and Finolex Industries (17%) dominate domestic PVC capacity, but overall supply lags well behind consumption.

This structural deficit means India remains a large net importer of PVC. Demand for PVC has grown at ~5% CAGR over the past five years, while supply has not kept pace, widening the demand supply gap. By FY26, domestic production capacity is expected to nearly double to ~3,000 KTPA, supported by Reliance’s 1,500 KTPA expansion and a new 1,000 KTPA facility by Mundra Petrochem – Adani Group (commissioning in FY27). These additions should gradually reduce import dependence, though the near term will remain tight.

On the CPVC side, India’s demand is ~0.2 MMT, and local capacity remains limited to ~75,000 MTPA (Epigral being the major domestic manufacturer). Hence, the bulk of CPVC supply continues to depend on global majors such as Lubrizol, Kaneka, Sekisui, and Arkema, through tie-ups with Indian pipe manufacturers.

Recently DGTR has issued its final findings on the investigation into the dumping of PVCS in India. It concluded that dumping has adversely impacted the domestic industry and has recommended the imposition of ADD for five years on select exporters from seven countries: China PR, Indonesia, Japan, Korea, Taiwan, Thailand and the US.

These duties along with upcoming domestic capacity expansions by Reliance, Adani and others should help stabilise supply and reduce volatility over the medium term. However, until then, the sector’s earnings trajectory will remain closely linked to unpredictable swings in PVC prices.

Why We Like the Pipes Industry

The Indian plastic pipes industry offers a compelling long term growth story led by structural demand drivers and favourable policy support. Demand arises from a well-diversified mix of agriculture (~45%), water supply & plumbing (~39%), sewerage (~12%) and replacement (~35% of total demand) ensuring steady volumes across economic cycles.

Key reasons we like the sector include –

- Secular Growth Opportunity: The industry is expected to grow at ~12–14% CAGR over FY24–27, driven by government programmes (Jal Jeevan Mission, PMAY, Smart City Mission, irrigation push), rising real estate demand, and urbanisation.

- Shift from GI to PVC/CPVC: Structural replacement of GI pipes (life 20–25 years) with PVC/CPVC has kept volumes resilient even during periods of weak housing launches.

- Organised Players Gaining Share: Organised penetration has risen to ~70% (from ~50% a decade ago) post GST and rising brand preference, benefitting players like Supreme, Astral, Finolex and Prince.

- Diversification Across End Markets: Demand is not just linked to cyclical agriculture; urban plumbing, SWR, and infrastructure are emerging as higher-margin growth drivers.

- Operating Leverage Tailwind: With large installed capacities and relatively low utilisation, listed players sit on significant operating leverage, setting up for sharp earnings recovery as demand revives.

- Favourable Raw Material Dynamics: India remains structurally deficient in PVC, but with ~2.5m MT domestic capacity additions expected by CY27 (Reliance, Adani, etc.) and ADD duties imposed on key exporters, supply security and margin stability should improve.

Prince Pipes and Fittings Ltd Business Segments

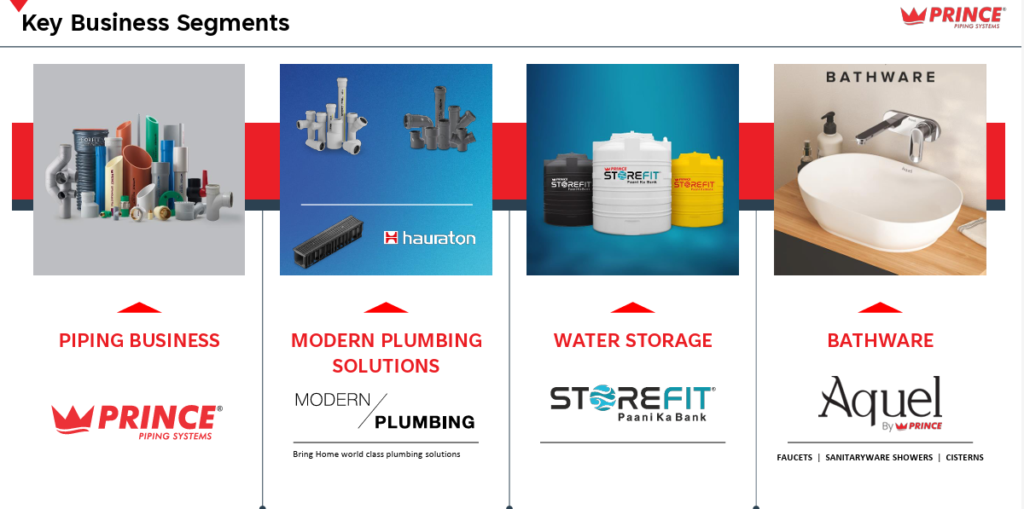

Prince Pipes and fittings Ltd has evolved into a multi category water management and building products company with a presence across four key verticals –

- Piping Systems

- Modern Plumbing Solutions

- Water Storage

- Bathware

Prince Pipes and fittings Ltd business is anchored by its Piping Systems division which contributes the majority of revenues (75-80%) and forms the Prince Pipes and fittings Ltd’s core franchise.

While the other verticals – Modern Plumbing Solutions, Water Storage (Storefit), and Bathware (Aquel) are relatively recent forays and are classified as strategic diversification bets rather than material revenue drivers.

1. Piping & Fittings Business

Prince Pipes and fittings Ltd has evolved into one of the most diversified polymer processors in the Indian piping space spanning PVC/uPVC, CPVC, SWR, HDPE, PPR and Fittings. which serve a wide range of industry applications like (1) plumbing, (2) sewage, (3) underground drainage, (4) surface drainage, (5) agriculture, (6) borewell, (7) industrial, (8) water storage, (9) modern plumbing, and (10) cable protection.

The piping division has been the cornerstone of Prince Pipes and fittings Ltd since inception accounting nearly 75-80% of consol revenues. Starting with agricultural PVC pipes in the 1980s, which drove its early growth, Prince Pipes and fittings Ltd expanded through the 1990s-2000s into uPVC and SWR systems which led to gaining presence in plumbing and drainage.

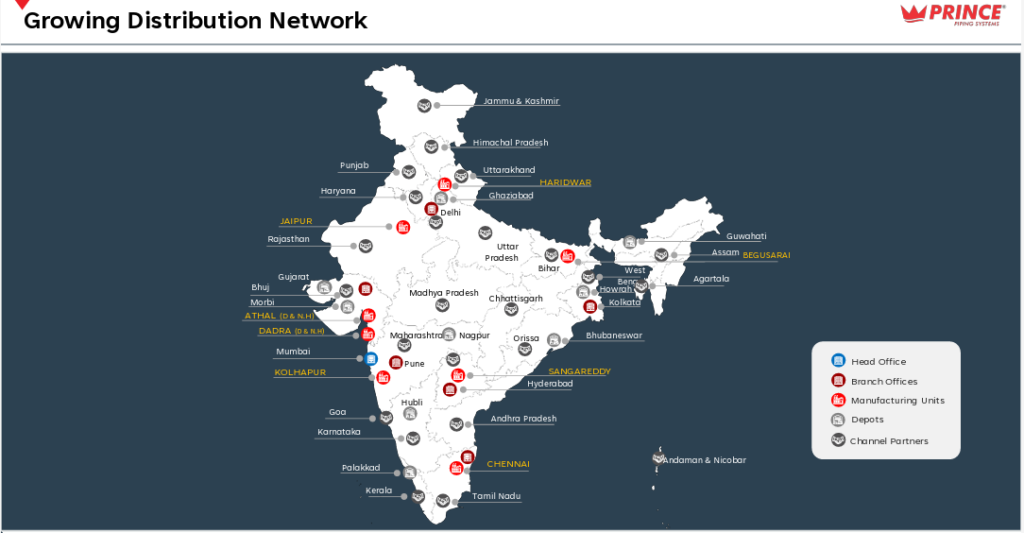

Today, Prince Pipes and fittings Ltd operates with a comprehensive portfolio of 7,200+ SKUs across uPVC, CPVC, HDPE, SWR and PPR pipes and fittings. This scale is supported by ~4.2 lakh MTPA installed capacity across eight plants and a strong network of 1,500+ channel partners, backed by nine warehouses which enables 48 hour delivery coverage across India.

From a profitability perspective, the segment remains volume led but with structural margin differentials across categories. Agriculture pipes, while still forming 30-35% are more price sensitive and cyclical which leads to structurally thinner spreads. Plumbing and SWR (65-70%) by contrast are brand driven and value accretive which typically generates relatively superior margins with more stable demand from housing and infrastructure. Working capital intensity is higher in agriculture due to longer dealer credit cycles, while urban plumbing is relatively more efficient with faster collection timelines.

Prince Pipes and fittings Ltd sells its products under two brands: Prince for pan India and Trubore, which focuses on South India particularly Tamil Nadu.

Each polymer and category plays a distinct role in shaping volumes, profitability and brand positioning.

CPVC (Chlorinated Polyvinyl Chloride) – CPVC has emerged as the most profitable and brand driven category. It is widely used in hot and cold plumbing and in industrial applications, where brand consciousness among end users is higher. CPVC currently forms a small but fast growing part of Prince Pipes and fittings Ltd’s mix (approx 10% market share & 25% revenue share) and has consistently delivered double digit growth in recent quarters. Margins are structurally superior to PVC, industrial CPVC (like Prince OneFit with Corzan technology) can yield almost double the gross margins of the traditional portfolio. The Lubrizol tie-up underpins credibility in this segment, making it a key margin lever for the company.

PVC/uPVC – UPVC by contrast remains the volume dominated product. It dominates agriculture pipes, cold water plumbing and drainage. While commoditised and price sensitive PVC pipes are crucial for market penetration, especially in rural irrigation. Margins here are thinner and subject to PVC resin volatility but this segment anchors utilisation, absorbs fixed costs and drives dealer throughput.

The Agri segment, primarily PVC based, contributes 30-35% of revenues. It is highly seasonal, tied to monsoons and government irrigation spending and margins are structurally lower than plumbing. Nevertheless, its strategic relevance is high: it builds rural penetration, strengthens channel relationships and allows cross selling of higher-margin products.

SWR (Soil, Waste & Rainwater) and Plumbing systems – They are the value added growth engines. Together with CPVC they form the bulk of the Prince Pipes and fittings Ltd’s building materials play. These categories are less price sensitive and supported by strong brand investments (Udaan loyalty program & Akshay Kumar brand campaign) and enjoy structurally better margins than agri. Demand is driven by housing sales, commercial real estate and government sanitation schemes like Swachh Bharat and Jal Jeevan Mission.

HDPE and DWC (Double Wall Corrugated) pipes (Infra play) – Prince Pipes and fittings Ltd foray into HDPE and DWC pipes marks its expansion beyond traditional PVC/uPVC markets into the infrastructure led water and drainage ecosystem.

HDPE pipes are widely used in water supply networks, irrigation systems, sewage and effluent disposal, borewell casing, gas distribution and telecom ducting. Their appeal lies in high flexibility, impact resistance, corrosion resistance and long service life. HDPE competes with PVC in many above ground and irrigation applications, but PVC often retains share in price sensitive rural markets due to cost advantages. While, HDPE pipes remain strategically relevant as they open up infrastructure projects and institutional orders that demand higher performance specifications.

Prince Pipes and fittings Ltd has also introduced PE-Fit Aqua Systems, an HDPE-based portfolio targeting water supply and infrastructure projects as well as retail markets. While margins in HDPE/DWC are generally moderate compared to CPVC or fittings, the segment enhances operating leverage by utilising existing extrusion capacities and contributes to cross-selling opportunities through the same distributor/dealer network.

PVC fittings – Fittings form one of the most important yet often underappreciated parts of Prince Pipes and fittings Ltd portfolio. Unlike pipes, which are more commoditised and volume driven, fittings are highly value-added which require precision moulding and offer superior realisations. This makes them structurally more profitable, with gross margins nearly 1.5-2x higher than pipes. Historically, fittings have contributed around 30-35% of overall revenues, a ratio Prince Pipes and fittings Ltd consciously maintains to sustain a healthy pipe to fitting balance.

Strategically, fittings play a dual role: they strengthen basket sales as distributors prefer to stock a full range of pipes and fittings together and they enhance channel stickiness, since plumbers and retailers view fittings as critical to installation quality. This makes fittings central to brand recall and loyalty programs such as Prince’s “Udaan” initiative. Importantly, as Prince Pipes and fittings Ltd expands into CPVC and premium plumbing systems, fittings become even more margin accretive given that CPVC joints and specialised SWR fittings command stronger pricing. With limited incremental capex required and strong demand pull from end users, fittings remain the silent profit driver of the business.

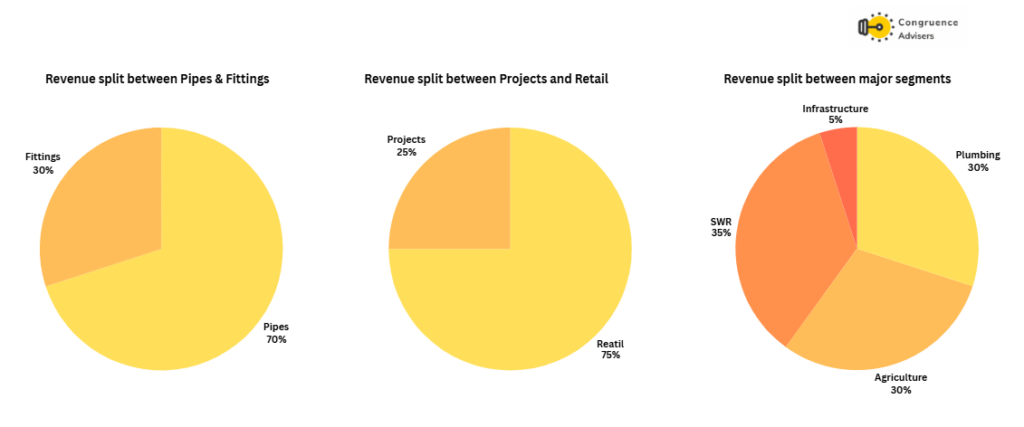

Prince Pipes and fittings Ltd derives its revenues from a well diversified product and channel portfolio, though the core remains its piping business. Within this, Prince Pipes and fittings Ltd maintains a healthy balance between pipes and fittings with pipes contributing ~70% and fittings ~30%.

Looking at end use applications, Prince Pipes and fittings Ltd’s revenue mix is broadly balanced across the three major segments i.e Plumbing (~30-35%), SWR (~30-35%) and Agriculture (~30-35%), While Infrastructure (HDPE/DWC, etc) contributing 3-4%. This balanced mix helps Prince Pipes and fittings Ltd avoid excessive reliance on any one vertical, though the cyclical agri segment still remains an important volume base. The Plumbing and SWR are relatively more value added and margin accretive which is supported by urban housing and government sanitation programs. Infrastructure, while currently a small share, offers a future growth lever as smart cities, drainage and underground projects scale up.

On the channel front, the business continues to be predominantly retail driven with 75-80% of revenues from the retail trade (distributors, dealers, and plumbers) and the remaining 20-25% from institutional projects. Which underscores the Prince Pipes and fittings Ltd’s strength in a fragmented market where distribution depth and brand equity drive volumes. Project sales however are gaining traction particularly in HDPE/DWC and CPVC categories and provide operating leverage by absorbing capacity outside the peak agri season. Prince Pipes and fittings Ltd aims to further expand into the projects segment and management intends to ensure tight control over debtors, even if it is at the expense of margin.

2. Modern Plumbing Solutions

Prince Pipes and fittings Ltd has diversified into the Modern Plumbing Solutions segment as part of its strategy to bring innovative and globally benchmarked products to the Indian market. This initiative is closely aligned with the Prince Pipes and fittings Ltd’s vision of strengthening India’s water infrastructure and broadening its product capabilities beyond conventional PVC pipes.

The segment has been built through collaborations with global leaders marking a clear step toward premiumisation and brand led differentiation in an otherwise commoditised industry.

Product Collaboration

Lubrizol (US) – FlowGuard Plus & Corzan CPVC

The most transformative partnership for Prince Pipes and fittings Ltd has been with Lubrizol the world’s largest manufacturer and inventor of CPVC compounds. Signed in 2020, the agreement gave Prince Pipes and fittings Ltd access to globally recognised CPVC technologies like FlowGuard Plus (residential and commercial hot/cold water systems) and Corzan (industrial piping solutions). Building on this, Prince Pipes and fittings Ltd launched Prince OneFit with Corzan CPVC technology in FY23, targeting high performance industrial segments, along with WireFit, a CPVC-based conduit system. These products mark Prince Pipes and fittings Ltd’s entry into industrial-grade CPVC, a category that delivers almost double the gross margins of its base PVC portfolio. Strategically Also, the Lubrizol tie up ensures supply security in CPVC (a segment where raw material dependence has historically been a barrier)

Ostendorf Kunststoffe (Germany) – Silent Drainage Systems

In FY23, Prince Pipes and fittings Ltd entered into a product collaboration with Ostendorf Kunststoffe a reputed German player in drainage solutions to introduce silent drainage systems in India.

Two flagship products were launched – Skolan Safe which is a polypropylene based premium silent drainage system rated at just 12 dB noise levels (certified by Fraunhofer, Germany) and HT Safe which is a low-noise PP drainage system designed to replace conventional piping challenges with superior acoustic, chemical, and mechanical performance. These products find applications in luxury homes, hotels, hospitals, commercial kitchens, libraries, and high rise apartments, aligning Prince Pipes and fittings Ltd with India’s expanding premium real estate and urban infrastructure markets.

Silent drainage is a niche but high value category with very few organised players currently active in India. By bringing globally certified solutions, Prince Pipes and fittings Ltd is positioning itself as a technology leader in this emerging space, adding a product vertical that is both margin accretive and brand enhancing.

Hauraton (Germany) – Surface Drainage Solutions

Another major addition to the Modern Plumbing portfolio came through a collaboration with Hauraton GmbH, one of Europe’s leading surface drainage solution providers. The joint offering branded as Prince Hauraton covers a wide range of applications in airports, car parks, container terminals, petrol stations, railway platforms, sports facilities and landscaped public areas.

By introducing these products, Prince Pipes and fittings Ltd has extended its reach beyond residential plumbing into infrastructure grade water management solutions, aligning closely with India’s Smart Cities and AMRUT programmes. This partnership allows Prince Pipes and fittings Ltd to capture a larger share of the project driven B2B market, diversifying away from its traditionally retail heavy model. With surface drainage systems typically offering better realisations and higher value per project than standard piping, this collaboration strengthens both Prince Pipes and fittings Ltd’s product breadth and its ability to participate in large, premium infra opportunities (a segment that is expected to see sustained growth over the next decade).

Management has described this vertical as the “next chapter” of growth, signalling a conscious effort to premiumise the portfolio, strengthen brand equity and build margin resilience Although its current contribution to revenues is modest, the long-term potential is significant especially as India’s urbanisation, real estate upgradation and infrastructure investments accelerate.

The Modern Plumbing vertical positions Prince Pipes and fittings Ltd as a technology led, premium solutions provider. These products are less commoditised, carry higher realisations and healthier margins than agriculture or commodity PVC and allow Prince Pipes and fittings Ltd to tap into premium housing, commercial complexes and smart infrastructure projects.

While adoption will require concept selling and may take 2–3 years to meaningfully scale, Prince Pipes and fittings Ltd is leveraging its strong pan India distribution network and dealer relationships to drive rollout. Importantly, Modern Plumbing complements its Bathware division together enabling Prince Pipes and fittings Ltd to provide end to end water management, storage and drainage solutions under one umbrella.

We believe Collectively these collaborations are more than product launches they form a deliberate strategy to premiumise Prince Pipes and fittings Ltd’s portfolio, hedge against cyclicality, and expand into institutional and project-driven demand pools

Apart from Product Collaboration Prince Pipes and fittings Ltd has technical Collaboration also.

Tooling Holland (Technical Collaboration)

Prince Pipes and fittings Ltd has long standing collaboration with Tooling Holland a global leader in plastic moulds manufacturing and has been critical in building its fittings franchise.

Fittings are highly precision dependent products that require advanced moulding capabilities, and this partnership ensures Prince Pipes and fittings Ltd consistently delivers durable, BIS compliant products across PVC, CPVC, SWR and HDPE lines. With fittings contributing nearly 30-35% of revenues and carrying 1.5-2x gross margins compared to pipes, Tooling Holland’s technical support has been instrumental in sustaining SKU depth (7,200+), enabling constant product innovation and maintaining brand credibility among distributors and plumbers. This collaboration strengthens Prince Pipes and fittings Ltd’s ability to differentiate itself in the commoditised pipes market through quality and reliability.

3. Water Storage

Prince Pipes and fittings Ltd entered the water storage solutions business in FY20 with the launch of its Storefit brand with tagline “Paani Ka Bank”, an extension of its piping franchise. The rationale was simple that tanks and plumbing systems are often purchased together and by offering both. Prince Pipes and fittings Ltd could enhance basket sales, strengthen dealer relationships and capture a greater share of the wallet from existing distributors and plumbers.

From a unit economics standpoint, the tank business differs significantly from pipes. Tanks are priced by litre capacity with realisation per unit much higher than commodity pipes, and carry EBITDA margins of ~12-16% owing to brand pull and fragmented competition. The working capital cycle is relatively light as tanks are fast moving products in retail. Moreover, capex intensity is lower compared to pipes, since tanks are manufactured via mould based production. This allows the segment to scale profitably with limited incremental investments.

Profitability drivers are anchored in three key aspects –

(1) the brand-led nature of the market where consumers prefer trusted names to avoid contamination issues associated with steel and cement tanks.

(2) the ability to cross leverage Prince Pipes and fittings Ltd’s 1,500+ distributor network which can ensure that the same dealer can sell both pipes and tanks which will improve throughput and distributor economics

(3) secular growth from both urban housing (premium storage solutions) and rural water storage supported by government water supply initiatives.

Since its launch, Storefit has scaled rapidly. In FY25, revenues reached ₹48 cr up ~20% YoY, despite an overall subdued building materials environment. Growth was supported by value migration away from cement and steel tanks as households and institutions increasingly adopt plastic tanks for hygiene and durability. To support this growth, Prince Pipes and fittings Ltd has expanded production to 5 in-house facilities i.e Dadra, Jaipur, Telangana, Haridwar (added in Q4FY24) and Chennai (added in Q2FY25) with additional capacity expected at Begusarai (Bihar) from H2FY26.

Prince Pipes and fittings Ltd estimates the Indian water tank market to be around ₹100 bn, providing a significant runway for growth as value migration from unbranded/steel tanks accelerates.

4. Bathware (Aquel)

Prince Pipes and fittings Ltd formally entered the bathware market in June 2023, launching faucets, showers, sanitaryware and accessories under Prince Bathware. The strategic rationale was clear that the Indian bathware market (~₹194 bn in FY24; ₹64 bn sanitaryware, ₹130 bn faucets) is growing at ~8–10% CAGR, and Prince Pipes and fittings Ltd aimed to leverage its strong distribution network to diversify beyond pipes and tanks.

In March 2024,Prince Pipes and fittings Ltd accelerated its entry by acquiring the Aquel brand and its Bhuj facility from Klaus Waren Fixtures. Aquel, with its established presence in faucets and bathroom accessories, provided Prince Pipes and fittings Ltd with brand equity, 250+ SKUs and manufacturing capability, positioning it in the mass premium segment (one notch below Jaquar). Management has explicitly benchmarked Aquel’s positioning to Jaquar in terms of product range, design and after sales service, while acknowledging that building consumer brand recall will take time.

From an operational standpoint, Aquel by Prince Pipes and fittings Ltd has already scaled to 200+ retail touchpoints with new showrooms added across Uttar Pradesh and Rajasthan in FY25 along with launches in Delhi, Haryana, Goa, Jaipur and Pune. The distribution strategy is heavily focused on Tier-2/3 cities where the mass premium segment is expanding rapidly.

Financially, the Bathware vertical remains in its investment phase. In FY25, revenues stood at ~₹30 Cr (Q4: ₹10.5 crore) but the business reported an EBITDA loss of ₹17-18 crore for the year (Q4: loss of ₹4.5 crore). Losses stem largely from aggressive branding, manpower build out (~₹5–6 cr annual cost) and distribution expansion. Management has guided for breakeven within 4-5 quarters (likely in Q1FY27 or Q2FY27) as scale improves.

Despite current losses, the segment is strategically important: bathware offers structurally higher value addition compared to pipes, aligns well with real estate growth and strengthens Prince Pipes and fittings Ltd’s “end-to-end water management and building products” positioning alongside pipes and Storefit tanks. Over the medium term, Bathware is expected to emerge as a high growth, margin accretive vertical, once scale benefits and brand equity kick in.

Prince Pipes and fittings Ltd Manufacturing Capabilities

Prince Pipes and fittings Ltd has built one of the most strategically distributed manufacturing footprints in the Indian piping industry with 8 operational facilities (Athal, Dadra, Haridwar, Chennai, Kolhapur, Jaipur, Sangareddy) and a newly added plan in Begusarai, Bihar. Prince Pipes and fittings Ltd has an installed capacity of ~4.2 lakh MTPA across pipes, fittings and tanks. Each plant is designed with product specialization in mind, ensuring economies of scale and product depth across its 7,200+ SKUs.

Unlike peers who rely heavily on a limited number of large plants Prince Pipes and fittings Ltd follows a multi plant model which allows it to place manufacturing units closer to demand centers. This strategy significantly reduces freight costs in a bulky product like pipes, where transportation plays a crucial role in competitiveness. For instance, fittings demand for South India was earlier serviced from Haridwar leading to higher logistics costs. With the Sangareddy (Telangana) plant becoming operational in FY21, Prince Pipes and fittings Ltd now services the South market locally thereby improving cost efficiency and delivery timelines. Similarly, the Begusarai unit is expected to strengthen Prince Pipes and fittings Ltd’s presence in the East, the region where it historically had the weakest distributor base.

Prince Pipes and fittings Ltd has freight expense of just 1.6% of sales vs 2.0% industry average. This 40 bps cost edge is material given the scale of the industry and highlights its ability to realign machinery and capacity across plants depending on SKU specific demand. Internal strategies such as shifting high-demand SKU machinery to the nearest plant further optimize net freight costs and ensure faster service to markets.

Prince Pipes and fittings Ltd expansion is tightly aligned with demand visibility and product mix strategy. For example, capacity was added at Jaipur (2019) to service North-West demand and Sangareddy (2021) to cater to Southern India. With demand in Eastern India rising due to government water supply schemes (Jal Jeevan Mission, AMRUT), the new Begusarai facility will not only meet supply needs but also enhance regional distribution which will reduce reliance on long-haul freight.

Prince Pipes and fittings Ltd has steadily expanded its installed capacity from 2.56 lakh MTPA in FY20 to nearly 3.98 lakh MTPA in FY25 which reflects its continued investments in scale. However, utilisation levels have remained modest and hovering between 45-53% and dipped to 44.5% in FY25 (industry operate with 60-65%) With the commissioning of the Begusarai (Bihar) facility, capacity is expected to cross ~4.5 lakh MTPA in FY26

Prince Pipes and fittings Ltd’s manufacturing network is supported by 11 depots/warehouses and a distribution network of 1,500+ channel partners (vs 766 in FY17). The South remains Prince Pipes and fittings Ltd’s strongest distribution region, while the East is the least penetrated, an imbalance the Begusarai plant is expected to address. Prince Pipes and fittings Ltd has deliberately shifted focus to improving the productivity of existing distributors while also expanding selectively in underrepresented regions.

Raw material

Prince Pipes and Fittings Ltd relies primarily on uPVC, CPVC, HDPE and PPR resins for its core piping portfolio, LLDPE for water storage tanks and polypropylene (PP) for modern plumbing and drainage products such as Skolan Safe and HT Safe.

Being petrochemical derivatives these resins are highly sensitive to crude oil cycles with price swings directly impacting input costs and near term margins. To manage this volatility, Prince Pipes and fittings Ltd has built a strategic procurement framework anchored on long term supplier partnerships, demand-linked sourcing and vendor qualification standards based on technical capability, clientele and proximity to plants.

Contracts with leading domestic producers like Reliance and Chemplast Sanmar ensure steady PVC supply, while the exclusive tie up with Lubrizol (US) provides premium quality CPVC compounds (FlowGuard Plus and Corzan), sourced locally from Dahej. Importantly, Prince Pipes and fittings Ltd has eliminated exposure to low quality Chinese imports which has mitigated the geopolitical and quality risks.

On the sourcing mix, PVC remains structurally deficient in India with demand of ~4.7 mMT vs domestic capacity of ~1.8 mMT, forcing the industry to rely on imports. Prince Pipes and fittings Ltd’s procurement typically balances between 40-60% domestic and imports, depending on price cycles. In CPVC, the company was historically import-dependent (Japan, Europe), but the Lubrizol contract has reduced volatility and improved margins. Other polymers like HDPE, PPR, and LLDPE are sourced through a mix of domestic and international suppliers.

Impact on profitability

Raw material pricing remains a key determinant of profitability. The pipes industry is largely a “pass-through” model where sharp resin price changes are eventually passed on to finished goods, but near term earnings can swing due to inventory gains/losses. For instance, sharp PVC price rallies have historically boosted gross margins, while corrections have compressed them. Product mix also plays a critical role as agri pipes being highly price-sensitive, dilute margins, whereas plumbing and SWR categories help cushion the impact.

From a regulatory perspective, the Government’s imposition of anti-dumping duty (ADD) on PVC imports in late 2024, confirmed for five years across seven countries (including China, Korea, Japan, US), is a structural positive. Alongside this, ~2.5 mMT of new domestic PVC capacity is expected by CY27 from large conglomerates, which should reduce import dependence, stabilize resin supply, and improve working capital efficiency. For Prince Pipes and fittings Ltd these changes combined with its strong supply contracts and decentralised procurement model are expected to enhance margin stability and support sustained volume led growth in the medium term.

Prince Pipes and Fittings Ltd Corporate Governance

Prince Pipes and Fittings Ltd has worked on strengthening corporate governance post its IPO and has actively addressed key investor concerns. Prince Pipes and Fittings Ltd has resolved issues around unsecured personal leverage, share pledges by promoters and related party transactions with promoter entities, all of which previously raised questions on transparency. Additionally, it has settled the matter of third party usage of the ‘Prince’ brand also. These steps mark a clear improvement in governance standards and reinforce alignment with minority shareholders’ interests.

Board Composition – Prince Pipes and Fittings Ltd maintains a balanced board structure comprising six directors, of which three are independent. Leadership remains promoter-led, with Mr. Jayant S. Chheda (Founder, Chairman & Managing Director), supported by Mr. Parag J. Chheda (Joint Managing Director) and Mr. Vipul J. Chheda (Executive Director). The independent directors are Mr. Rajendra Gogri (Aarti Group), Mrs. Amisha Vora, (CMD of Prabhudas Lilladher) and Mr. Ankur Bansal, (co-founder of BlackSoil) and a seasoned ex-investment banker.

Related Party – Prince Pipes and Fittings Ltd has taken notable steps in post post ipo and strengthened governance with legacy promoter linked related party transactions (Prince Marketing) fully reversed and resolved. In FY25 there were no material related party transactions.

Contingent Liabilities – Prince Pipes and Fittings Ltd contingent liabilities of 2.3 Cr hence not material

Remuneration of KMP – In FY25, the total remuneration to promoter family members was around ₹12 Cr which on an optical basis appears expensive given the subdued year for the industry

Dividend Track Record – Since its listing in December 2019,Prince Pipes and Fittings Ltd has maintained a consistent track record of dividend payouts barring FY23 when a dividend was skipped owing to the capex program.

Prince Pipes and Fittings Ltd Financial Performance

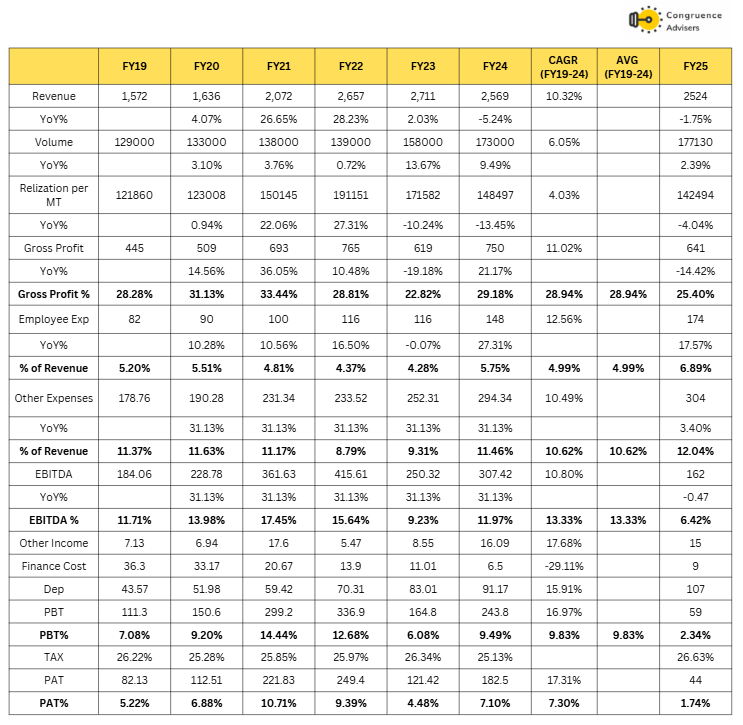

Prince Pipes and Fittings Ltd revenue grew from ₹1572 Cr in FY19 to ₹2569 Cr in FY24, translating into a 10% CAGR, driven by both volume expansion and rising realisations from premium categories such as CPVC and fittings. However, FY25 turned out to be a reset year, with revenues declining 1.75% YoY to ₹2120 Cr and volumes grew marginal at 2% as weak agriculture demand, muted tier-2/3 housing activity and sharp PVC price swings weighed on performance.

Realisations per MT nevertheless improved structurally over the years rising from ~₹1.22 lakh/MT in FY19 to ~₹1.42 lakh/MT in FY25, reflecting Prince Pipes and Fittings Ltd’s ability to move toward higher value categories and pass on raw material costs.

Profitability showed gains through FY19-24 with gross margins improving from 28.3% in FY19 to ~29% in FY24 and EBITDA margins averaging ~11–12%, aided by product mix shifts and scale efficiencies. However, FY25 margins contracted sharply with gross margins slipping to 26.4% and EBITDA margins plunging to 6.6% (the lowest in 6 years) mainly due to inventory losses on PVC volatility, adverse product mix (higher agri share) and elevated operating costs as Prince Pipes and Fittings Ltd expanded into water tanks and bathware. PAT fell drastically to just ₹37 crore in FY25 (1.7% margin) versus ₹182 crore in FY24.

Management reiterated in its concalls that FY25 was a year of margin reset due to raw material volatility, but emphasized that structural drivers remain intact and profitability should bounce back as CPVC and plumbing categories gain share and water tanks and bathware scale up over the next 12-18 months.

Prince Pipes and Fittings Ltd Debt, Return Ratios, Working capital and Cashflow analysis

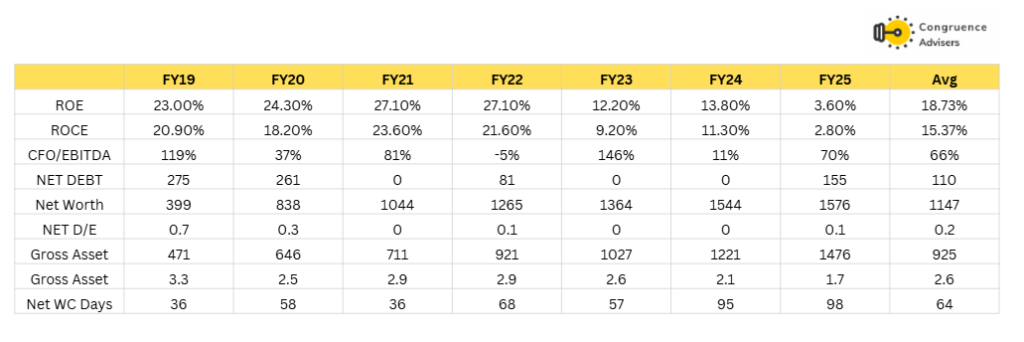

Prince Pipes and Fittings Ltd return ratios have seen sharp swings ROE/ROCE peaked above 27% in FY21-22 during the strong post-COVID demand recovery and PVC price-led inventory gains but subsequently contracted to 3.6%/2.8% in FY25 on account of weak volumes, subdued agri demand and PVC led inventory losses. Over FY19-25 average ROE and ROCE stand at ~18.7% and ~15.4%, respectively Despite cyclicality the business has delivered healthy cross cycle returns.

Prince Pipes and Fittings Ltd balance sheet has remained strong as post ipo Prince Pipes and Fittings Ltd has historically operated with a net debt free balance sheet, barring short periods of working capital drawdown (FY22 and FY25). Net debt stood at 155 Cr in FY25 which translated to a negligible 0.1x net D/E. Importantly, management reiterated in the concalls that the balance sheet is “growth-ready” with no structural leverage risks.

Prince Pipes and Fittings Ltd cash flow generation has been volatile in line with the commodity cycle. CFO/EBITDA averaged ~66% over FY19–25, with sharp outliers FY22 saw negative conversion due to PVC inventory stocking, while FY23 benefitted from high PVC spreads and working capital release. Net working capital days, which were under control at ~36 days in FY21, expanded to ~95–98 days in FY24–25 as demand slowed, particularly in the agri segment, stretching dealer credit cycles. Management highlighted in recent calls that normalisation of working capital remains a priority with focus on tighter credit discipline and inventory management.

On the asset side, gross block has more than tripled from 471 Cr in FY19 to 1476 Cr in FY25, led by large expansions in Haridwar, Telangana and now Begusarai. However, capacity utilisation remains modest at ~45% in FY25. Management has acknowledged this utilisation gap but emphasises that the long term strategy is to build ahead of demand to ensure market readiness and regional penetration (especially in East India).

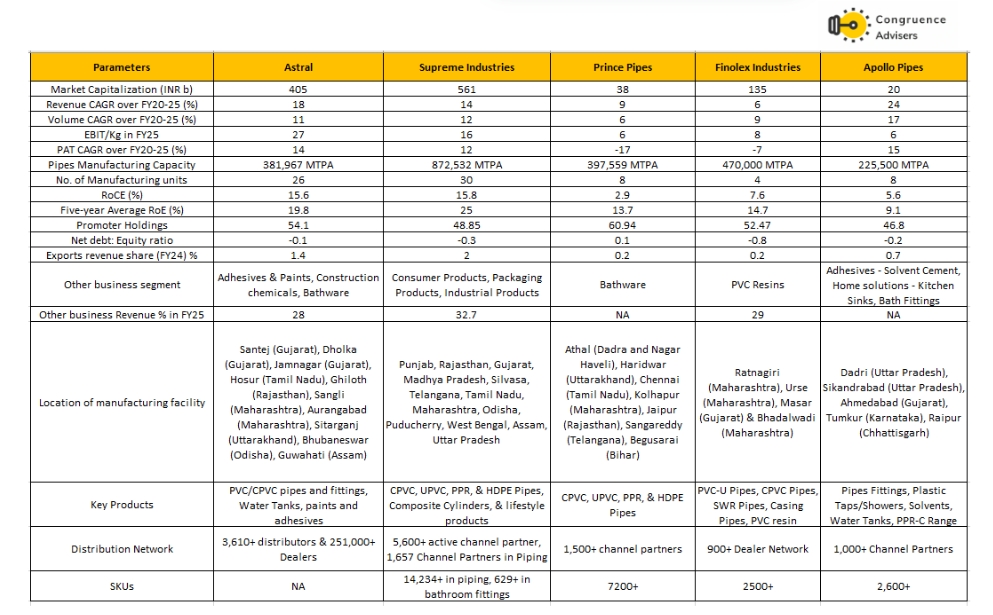

Prince Pipes and Fittings Ltd Comparative Analysis

To understand Prince Pipes and Fittings Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Prince Pipes and Fittings Ltd to its competitors (peer comparison) on various fundamental parameters and Prince Pipes and Fittings Ltd share performance relative to relevant benchmark and sector indices.

Prince Pipes and Fittings Ltd Peer Comparison

We have compared Prince Pipes and Fittings Ltd among its key listed peers Supreme Industries Ltd, Astra Ltd, Finolex Industries Limited and Apollo Pipes Ltd

Prince Pipes and Fittings Ltd with an installed capacity of 4.0 lakh MTPA in FY25 stands as the 3rd largest manufacturer in the listed pipes universe which positioned it behind Supreme Industries Ltd (873,000 MTPA) and Finolex Industries td (470,000 MTPA), while Astral td (382,000 MTPA) and Apollo Ltd (226,000 MTPA) operate at smaller scales.

From a growth perspective, Astral Ltd and Supreme Industries Ltd have clearly outperformed peers which is supported by their stronger presence in the project/institutional segment, diversified portfolios, deeper pan-India penetration and adjacent categories growth.

Prince Pipes and Fittings Limited and Finolex Industries Ltd, by contrast, have printed subdued numbers. Finolex Industries Ltd’s performance is tied closely to the agriculture cycle, given its higher agri-dependence and unique backward integration into PVC resin manufacturing, which provides raw material security but increases cyclicality.

For Prince Pipes and Fittings Ltd despite having scale, the key drag on growth has been its lower presence in project and institutional sales, where leaders like Astral and Supreme enjoy significant advantage. Its business remains largely retail driven, limiting operating leverage in large scale orders. On profitability too, Prince Pipes and Fittings Ltd lags peers. .

Peers have also built adjacent growth engines: Astral Ltd has diversified into adhesives, paints, and bathware. While Supreme Industries Ltd has created one of the widest plastic product portfolios spanning consumer and industrial segments. Prince Pipes and Fittings Ltd while has lagged historically but now appears to be at an inflection point expanding into adjacencies like water tanks (Storefit) and bathware (Aquel), supported by global partnerships (Lubrizol for CPVC, Ostendorf for drainage, Hauraton for surface drains).

At the smaller end, Apollo Pipes Ltd, though limited in scale, has been the fastest grower in the industry, leveraging brand visibility and aggressive expansion.

Overall, while Prince Pipes and Fittings Ltd has underperformed peers on growth and profitability, its under-utilised capacity base, retail-heavy orientation, and push into value-added categories suggest the possibility of significant operating leverage if/when demand picks up. A cyclical recovery in demand can disproportionately benefit Prince Pipes and Fittings Ltd

Prince Pipes and Fittings Ltd Index Comparison

Prince Pipes and Fittings Ltd share performance vs S&P BSE Small Cap Index, as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why you should consider investing in Prince Pipes and Fittings Ltd?

Prince Pipes and Fittings Ltd offers some compelling reasons to track closely and to consider investing in cyclical recovery of Plastic Pipes Industry

Huge Operating Leverage Play – With an installed capacity of ~4.0 lakh MTPA in FY25 and utilisation at just ~45%, Prince Pipes and Fittings Ltd is sitting on substantial latent capacity. FY25 was a low base year marked by muted volumes due to weak agri demand, PVC volatility and subdued infra spends. This creates a strong platform for outsized YoY recovery once demand normalises.

Management highlighted in its concall that agri demand is showing signs of revival, project ordering under Jal Jeevan Mission is accelerating and real estate momentum in Tier-2/3 cities is intact. Crucially, any volume pick up can translate disproportionately into EBITDA expansion, as fixed costs are largely absorbed. With no major capex needed in the near term (beyond the Bihar plant already under execution), Prince Pipes and Fittings Ltd has one of the cleanest operating leverage set ups in the sector.

Diversified Portfolio & Focus on Value Added Segments – Prince Pipes and Fittings Ltd has strategically diversified beyond its legacy agri pipes into plumbing, SWR, CPVC. These categories are more urban, brand driven, and margin accretive which will provide steadier demand visibility versus the cyclical agri segment. Within this Prince Pipes and Fittings Ltd has steadily shifted its mix toward value added products fittings (30–35% of revenues, carrying 1.5–2x gross margins of pipes), CPVC (via its exclusive Lubrizol partnership) and premium drainage solutions (Skolan Safe, HT Safe, Hauraton). The global tie ups not only strengthen technology depth but also position Prince Pipes and Fittings Ltd uniquely in higher value categories which will differentiate it from pure play commodity peers.

Optionality in New Segments – Water tanks (Storefit) are already scaling up at 20%+ growth, while bathware (Aquel) offers a long runway despite near term EBITDA drag.

Taken together, Storefit and Aquel are not just revenue diversifiers but also cross selling catalysts. Dealers selling pipes can now bundle tanks and bathware which will improve throughput per distributor and deepen channel stickiness. While near term earnings impact from bathware investments is visible, these adjacencies could meaningfully lift Prince Pipes and Fittings Ltd’s addressable market size and margin profile over the medium to long term, creating optionality that the market is yet to fully price in.

Strong Distribution & Pan-India Reach – Prince Pipes and Fittings Ltd has expanded its distributor base from 766 in FY17 to >1500 in FY25 with particular focus on underpenetrated East India. A decentralised multi plant model (8 operational plants) keeps freight costs among the lowest in the industry (~1.6% of sales vs 2–3% peers) which is a structural cost advantage. Prince Pipes and Fittings Ltd also leverages 9 strategically located warehouses to ensure 48 hour delivery across most markets, which strengthens dealer confidence and repeat business. Prince Pipes and Fittings Ltd’s Udaan loyalty program and plumber engagement initiatives further deepen channel stickiness which makes distribution one of its strongest competitive moats.

Favourable Industry Tailwinds – The PVC/CPVC pipe sector is in the midst of a secular growth phase driven by structural demand from government programmes (Jal Jeevan Mission, PMAY-Urban, infra push), urbanisation and housing activity and expected growth at health rate of 12% CAGR in medium term to long term. India remains structurally deficient in PVC but upcoming domestic resin capacities (Reliance, Adani, etc.) and the imposition of anti dumping duties (ADD) are expected to reduce import dependence, stabilise costs and improve supply security all of which favour organised players like Prince Pipes and Fittings Ltd.

The only near term industry headwind has been the sharp decline in PVC resin prices during FY25, which led to inventory losses and margin volatility across players. However, management commentary and sector data suggest that the bulk of this correction is now behind us making FY25 more of a reset year. With prices stabilising at lower levels, channel restocking and demand recovery should drive volume led growth, positioning players like Prince Pipes and Fittings Ltd for operating leverage benefits.

What are the Risks of Investing in Prince Pipes and Fittings Ltd?

Investors need to keep the following risks in mind if they choose to invest into this business. Risks needs to be weighed in combination with the advantages listed above to arrive at a decision that is optimal for your portfolio construct

Raw Material Price Volatility & Inventory Losses – Prince Pipes and Fittings Ltd is highly susceptible to volatility in the prices of its key raw materials which is a crude oil derivative. Any significant fluctuations in global crude oil prices or forex rates directly affect resin costs, making profitability vulnerable. The sharp drop in PVC costs in FY25 led to inventory losses, a risk that remains material if similar swings recur. While large organised players like Prince Pipes and Fittings Ltd can generally pass on raw material cost changes the lag effect often leads to quarterly margin swings. India’s structural import dependence (~55% of PVC consumed is imported) further exposes Prince Pipes and Fittings Ltd to global trade disruptions and duties. Over the past five fiscal years through FY25, Prince Pipes and Fittings Ltd’s operating margin has fluctuated widely between 6% and 18% which shows the inherent margin volatility arising from raw material cycles.

Subdued Demand Cycles (Especially in Agri Segment) – Demand in the agriculture segment remains highly cyclical driven by monsoon patterns, rural incomes and government irrigation spending. Weakness here was one of key factors behind the revenue decline in FY25, impacting industry wide performance. Although Prince Pipes and Fittings Ltd’s dependence on agri has moderated to 30-35% of revenues, it still represents nearly one-third of the topline making Prince Pipes and Fittings Ltd vulnerable to rural slowdowns. A prolonged weak cycle in agriculture could therefore offset the gains from higher margin plumbing and CPVC segments in the near term.

Uncertain Profitability in New Verticals – While diversification into adjacencies such as water tanks (Storefit) and bathware (Aquel) adds optionality, profitability remains uncertain The bathware division remains in investment mode posting a sizeable ₹17-18 Cr EBITDA loss in FY25 with management guiding breakeven only by FY26. These new verticals also require sustained brand building spends, distribution ramp up and category awareness. all of which could pressure near term margins. Execution risk is material if growth in bathware stalls or competition intensifies (from incumbents like Jaquar or Hindware) the drag could outweigh the diversification benefits in the medium term.

Exposure to Intense Competition – Prince Pipes and Fittings Ltd operates in a highly competitive industry characterised by low product differentiation and high price sensitivity particularly in the commoditised PVC and agri segments.Prince Pipes and Fittings Ltd faces competition from both large organised peers and a fragmented unorganised sector that often undercuts on price. This intensity of competition constrains pricing power and scalability in certain categories and overall profitability. While Prince Pipes and Fittings Ltd has sought to differentiate through fittings, CPVC tie-ups and premium modern plumbing solutions, the core business remains exposed to pricing-led rivalry.

High Dependence on Real Estate Cycles – Over 70% of Prince Pipes and Fittings Ltd revenue is indirectly linked to the real estate and construction ecosystem through plumbing, SWR, CPVC and modern plumbing solutions. This makes Prince Pipes and Fittings Ltd vulnerable to cyclical slowdowns in housing demand, project execution delays or regulatory disruptions in the sector. Any downturn in urban housing or infrastructure activity could materially impact sales momentum particularly as Prince Pipes and Fittings Ltd has consciously pivoted away from agriculture towards these higher margin but real estate dependent segments.

Dependence on Distributor-Led Model – Prince Pipes and Fittings Ltd entire sales model is routed through its network of 1,500+ distributors and dealers with minimal direct engagement with end customers. While this ensures wide reach and asset light scalability, it also creates dependency risks. Any disruption in key distributor relationships, regional demand weakness or competitive channel incentives could impact volumes. Moreover, limited direct consumer connect makes Prince Pipes and Fittings Ltd reliant on brand pull and channel loyalty programs to sustain market share particularly in premium and differentiated product categories.

Prince Pipes and Fittings Ltd Future Outlook

After a challenging FY25 and a muted start to FY26, the domestic pipes sector now appears to be at the cusp of recovery. For Prince Pipes and Fittings Ltd, FY25 was particularly subdued, with weak volumes and revenue contraction driven by muted agriculture demand, sluggish infrastructure investments and sharp volatility in PVC resin prices.

Prince Pipes and Fittings Ltd is consciously pivoting away from its historical dependence on the cyclical agriculture segment toward higher margin urban categories such as CPVC, SWR and modern plumbing. Collaborations with Lubrizol, Ostendorf, and Hauraton are helping Prince Pipes and Fittings Ltd bring differentiated global products like FlowGuard CPVC, Skolan Safe silent drainage and premium surface drainage solutions to India. Additionally, adjacencies such as Storefit water tanks and Aquel bathware add long term diversification, although the latter remains in investment phase with near term EBITDA drag.

Looking ahead, Prince Pipes and Fittings Ltd enters FY26 on a favourable base. With operating capacity of ~4.2 lakh MTPA but utilisation at just ~45%, Prince Pipes and Fittings Ltd sits on significant operating leverage. Revival in agricultural demand coupled with continued urban housing momentum and government led projects (Jal Jeevan Mission, PMAY-Urban) and stable RM prices can deliver outsized YoY growth in earnings.

Management has guided for double digit revenue growth in FY26 broadly in line with commentary from industry peers, While EBITDA recovery will be gradual Prince Pipes and Fittings Ltd expects margins to stabilise in the 12-13% range over the medium term, supported by mix improvement and operating leverage. Bathware is expected to breakeven within the next 4-5 quarters, while the water tanks segment continues to scale at 20%+ growth.

The broader building materials industry has been waiting for a pickup in housing starts and infra execution with income tax cuts effective April 2025 and RBI rate cut already in motion, consumer sentiment and housing demand are poised to improve. If this cycle materialises, Prince Pipes and Fittings Ltd with its strong distribution reach, diversified portfolio and under utilised capacity is well-positioned to benefit disproportionately.

Despite these positives, it is critical to note that Prince Pipes and Fittings Ltd’s profitability remains highly sensitive to RM prices, which in turn are influenced by global crude oil trends, Global capacity, duties and dumping practices. Over the last five years, operating margins have swung between 6% and 18%. This makes Prince Pipes and Fittings Ltd less of a secular compounder and more of a tactical re-rating candidate. With FY25 providing a low base, mean reversion could deliver sharp earnings recovery over the next few quarters if demand revives and pvc price stabilise

We see Prince Pipes and Fittings Ltd as a tactical bet rather than a secular compounder. Investors may look to ride the mean reversion upside as demand normalises, but should also remain mindful of the inherent volatility tied to resin pricing and agriculture dependence. Exit discipline will be key once prices reflect the cyclical recovery.

Prince Pipes and Fittings Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Prince Pipes and Fittings Ltd Price charts

The daily chart shows a clear Stage 4 stock with some potential of bottom formation right now. The price will need to cross the horizontal line for any semblance of strength coupled with a crossover of the 50DMA above the 200 DMA. While the possibilities are interesting, it is premature to call for a bottom right now given the weakness in the broader markets in India.

On the weekly timeframe the indications are the same. Crossing the horizontal line around 380 will make the trend spring back to life. This will need a bottoming out of PVC resin prices and an improvement in volume growth in fundamental terms, the focus now moves to H2 FY26.

If the long awaited revival of the building materials sector doesn’t materialize even by FY27, the cold winter may well continue for some more time.

Prince Pipes and Fittings Ltd Latest Latest Result, News and Updates

Prince Pipes and Fittings Ltd Quarterly Results

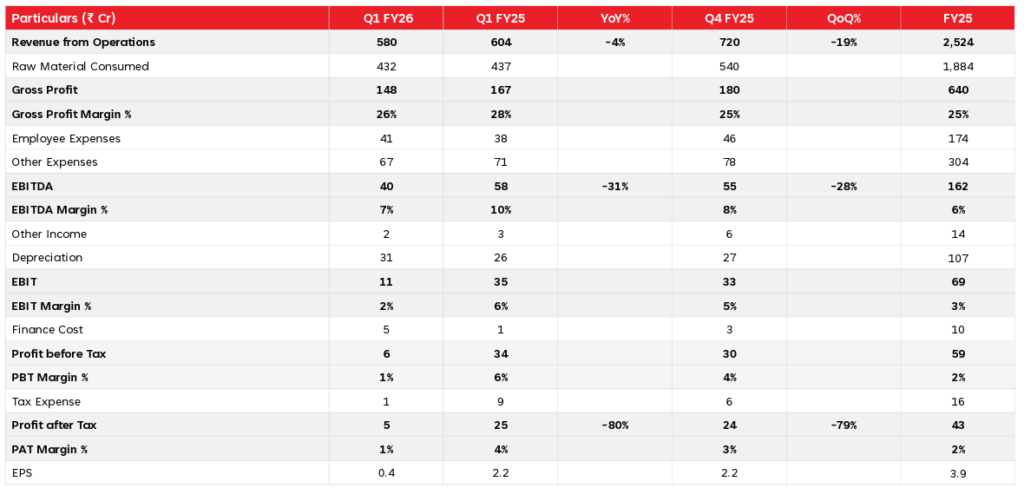

Prince Pipes and Fittings Ltd reported a subdued Q1FY26 with revenue numbers at ₹580 Cr down -4% YoY & -19% QoQ (vs ₹604 crore in Q1FY25 and ₹720 crore in Q4FY25). The weakness was largely driven by continued sluggishness in agriculture demand and softer real estate/infrastructure offtake.

Management highlighted that the quarter remained challenging due to weak agriculture demand and a slower pick-up in real estate/infrastructure. However, they expect recovery from H2 FY26 led by normal monsoon, housing demand and government infra push (Jal Jeevan Mission, PMAY-Urban).

Management maintained guidance of double digit revenue growth in FY26 and remain confident of margin recovery from H2FY26 as demand normalises and operating leverage kicks in.

Final Outlook on Prince Pipes Ltd

Prince Pipes and Fittings Ltd. is one of the largest players in the Indian pipes and fittings industry – an industry which is growing rapidly and has a long runway for growth. It has lagged behind larger peers on margins and growth but has added a lot of capacity since the IPO in 2019 and therefore presently sits on significant potential for operating leverage.

A general industry wide bounce back in demand and bottoming out of PVC resin prices should lift all pipes and fittings stocks in India. Prince is likely to benefit disproportionately in profitability if this happens due to the operating leverage possible. Beyond the cyclical turnaround, investors should closely monitor their ability to grow volumes in line with the industry averages, to gauge whether or not they can retain/gain market share in the years to come.

Prince Pipes will need to solve for one fundamental problem – below industry average volume growth for a few years now. This is more a function of how well the management can build distribution and push the channel to sell more without diluting unit economics. Quite some work to do before the business starts looking like a secular buy, until then it would be a tactical mean reversion play at best.