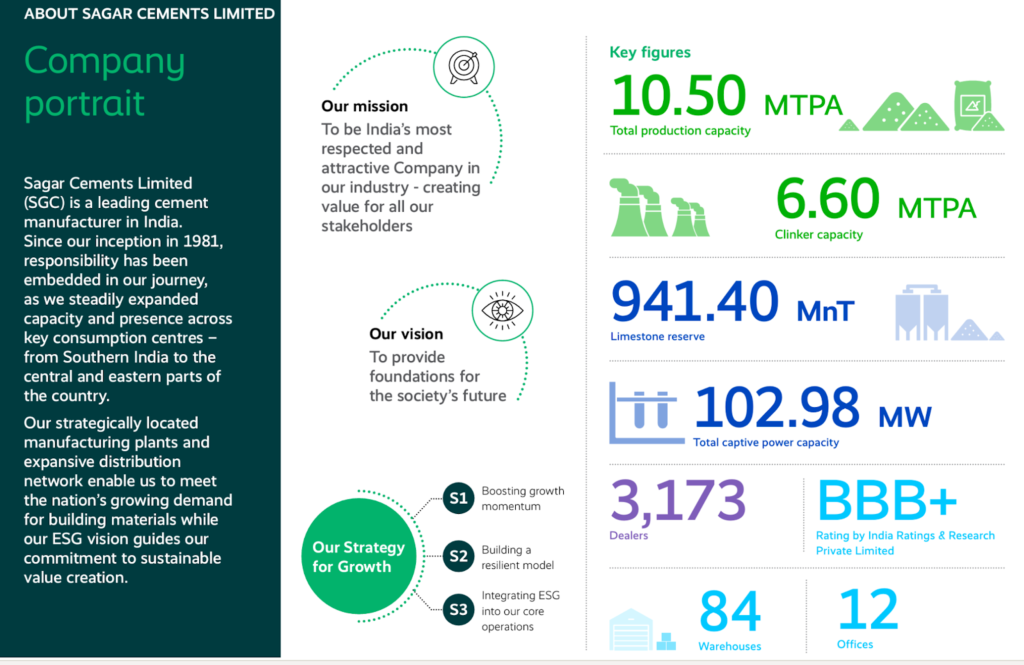

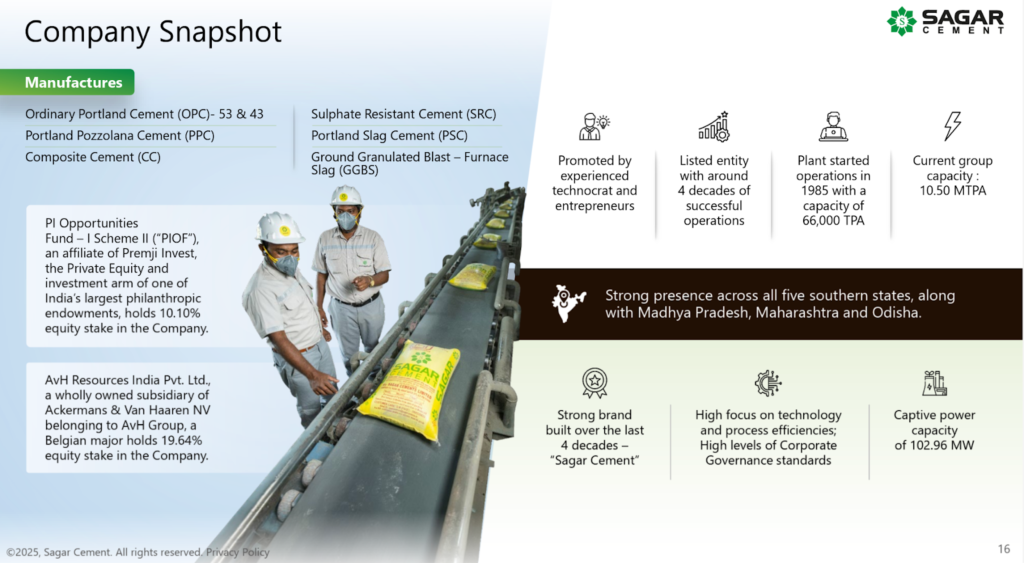

Sagar Cements Ltd is a leading Indian cement manufacturer with over 40 years of industry experience and a current installed production capacity of 10.5 million tonnes per annum (MTPA)

Sagar Cements Ltd in our opinion presents the possibility of a small player in the cement sector who can benefit disproportionately if the sector returns to better times over FY26 and FY27 at lower competitive intensity driven by the consolidation happening in the industry. If the management initiatives on reducing operating costs play out at increasing capacity utilization, the stock can look like an interesting tactical play. However, investors will need to have a good understanding of the cement sector to be able to play this theme given that there are many moving parts for a cement business.

Sagar Cements Ltd Company Summary

Sagar Cements Ltd is a leading Indian cement manufacturer with over 40 years of industry experience and a current installed production capacity of 10.5 million tonnes per annum (MTPA). Founded in 1985, the company operates plants in states such as Telangana and Andhra Pradesh and is known for its broad product portfolio, including Ordinary Portland Cement (OPC), Portland Pozzolana Cement, Portland Slag, Composite Cement, and specialty products like Ground Granulated Blast-furnace Slag and Sulphate Resistant Cement.

Sagar Cements Ltd Timeline

- 1985: Plant commissioned with a 200 TPD kiln using energy-efficient four-stage preheater technology.

- 1986-1989: Capacity enhancements, balancing equipment, and installation of diesel generators for a consistent power supply.

- 1998: Installed KIDS cooler and Variable Frequency Drives; improved fuel efficiency.

- 2008: Major brownfield expansion with a six-stage calciner preheater, upgraded kiln, and 2.5 MTPA cement grinding capacity added.

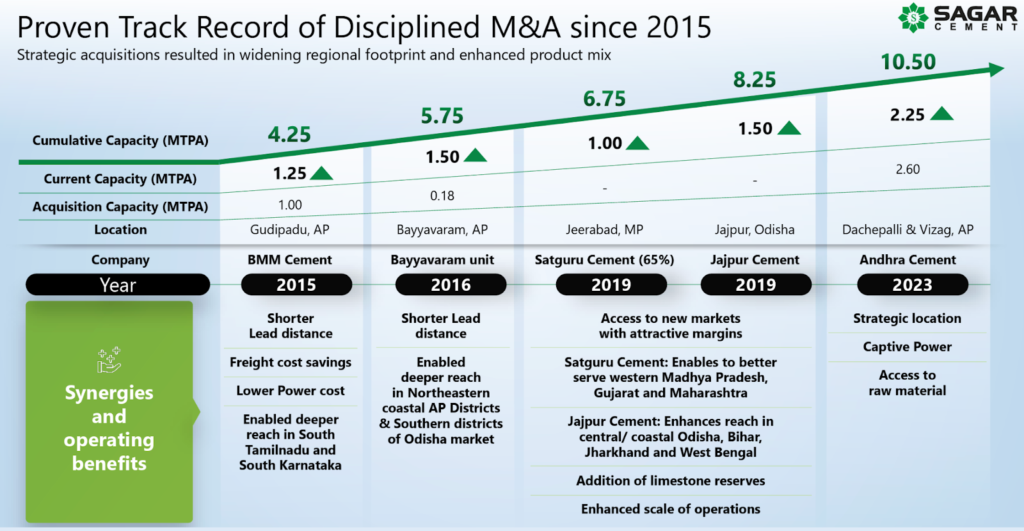

- 2015: Acquired a 1.0 MTPA plant from BMM Cement, funded from the sale of Vicat JV stake.

- 2016: Acquired Bayyavaram cement unit and began ramp-up of its capacity.

- 2017: Consolidated regional presence in the South and started expanding into Eastern markets, including capacity ramp-up in Bayyavaram and SCRL.

- 2018: Bayyavaram unit’s capacity increased to 1.5 MTPA; SCRL ramped up to 1.25 MTPA.

- 2021: Commissioned 1.0 MTPA integrated plant at Madhya Pradesh (Satguru Cement) and 1.5 MTPA grinding at Jajpur, Odisha (Jajpur Cement).

- 2022: Commissioned Indore (M.P.) and Jajpur (Odisha) units; received Best Management Award from the Telangana Govt.

- 2023: Acquired Andhra Cement Limited, adding 2.25 MTPA and expanding group total to 10.5 MTPA; amalgamated with Jajpur Cements Private Limited.

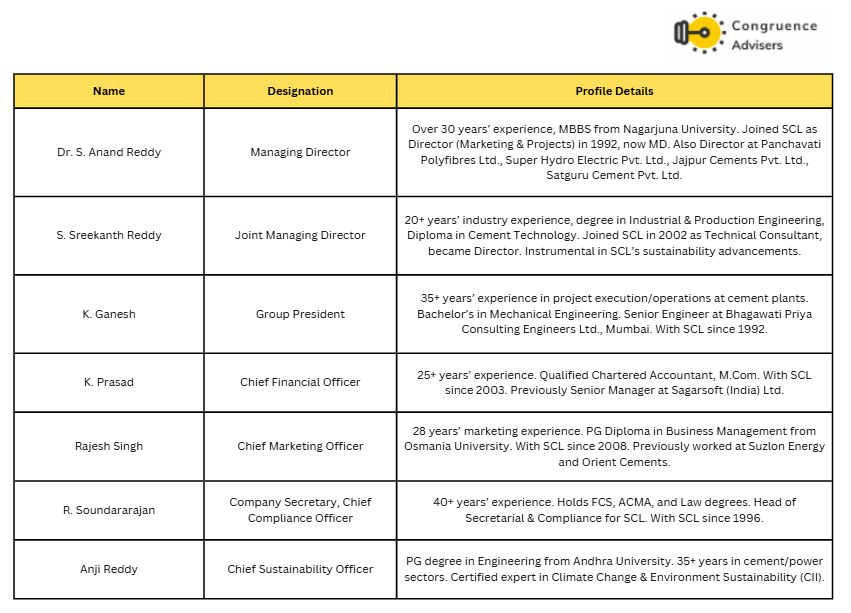

Sagar Cements Ltd Management Details

Sagar Cements Ltd is a leading Indian cement manufacturer with over 40 years of industry experience and a current installed production capacity of 10.5 million tonnes per annum (MTPA) promoter group consists primarily of Dr. S. Anand Reddy (Managing Director), Shri S. Sreekanth Reddy (Joint Managing Director), and Smt. S. Rachana (Non-Executive Director), who is a part of the promoter family group, is deeply involved in Sagar Cements Ltd, As of September 2025, the promoter and promoter group collectively hold 48.33% of the Sagar Cements Ltd’s shareholding, a level that has remained stable over the past several quarters.

Dr. S. Anand Reddy has played a key role in expanding Sagar Cements Ltd’s operational capacity and embracing technological advancements, while Shri S. Sreekanth Reddy brings expertise in engineering and cement technology to the promoter group.

Sagar Cements Ltd – Industry Overview

Global cement industry overview

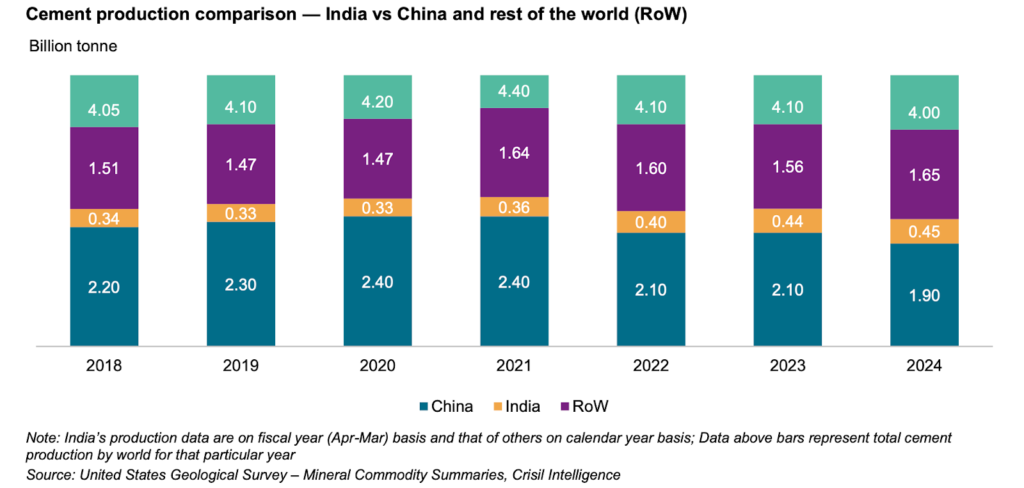

Global cement production in 2024 stood at ~4.0 billion metric tonne. The production had remained almost stagnant over the previous six years, with the highest production of 4.4 billion metric tonne recorded in 2021.

China is the largest producer of cement globally, accounting for almost half of the overall cement production. A major portion of the cement produced in the country is consumed domestically. India comes a distant second, accounting for 7-11% of the world’s production.

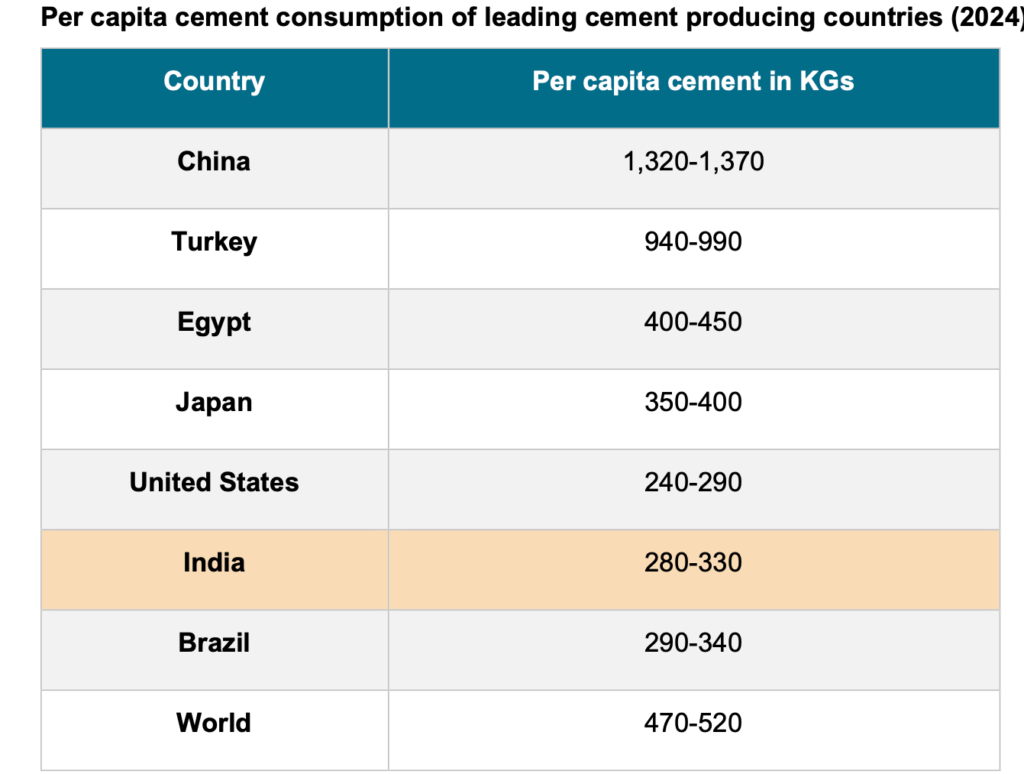

India’s per capita cement consumption stands at 290-340 kg, way below the world average of 470-520 Kg. China has the highest at 1,320-1,370 Kg.

Per capita cement consumption of some of the leading cement-producing countries is as follows:

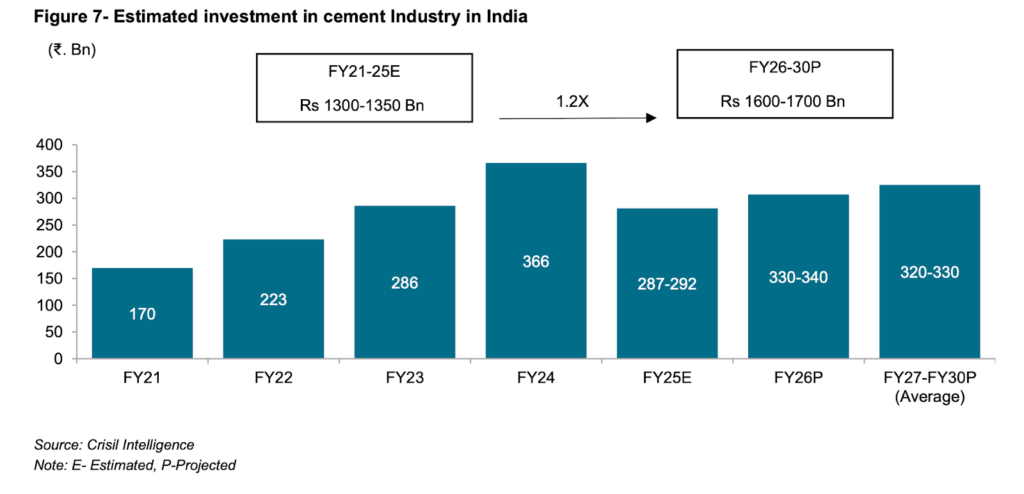

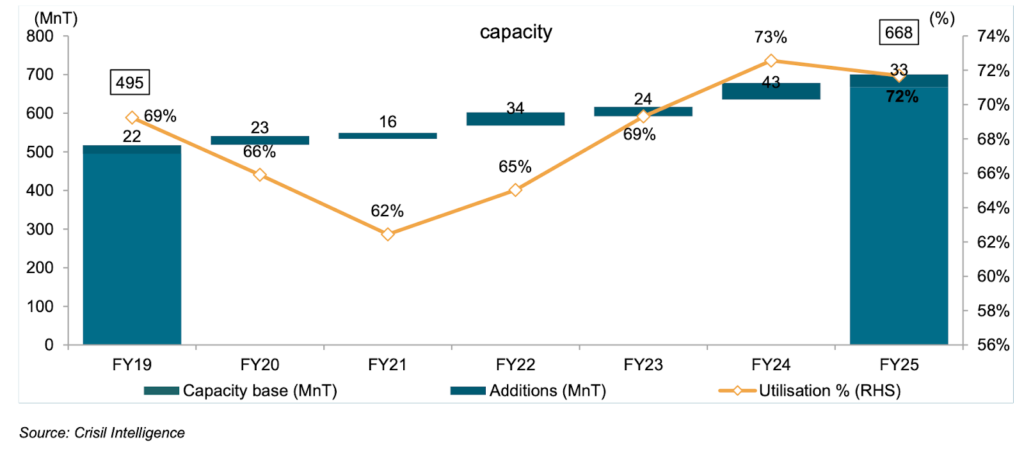

Expected capital expenditure in the cement sector

The Cement Industry in India is estimated to have witnessed an investment of Rs. 1300-1350 bn in the past five years (FY21-25E) with regards to adding new capacities, brownfield expansions, debottlenecking, and maintenance of existing plants. With a healthy demand outlook and increased competitive intensity, the players, especially the large ones, are implementing sizeable capex over the next five years with the aim of capturing the market share. Robust demand has bolstered the balance sheets of large players and mid-sized players with strong market presence, prompting them to expand capacity on the back of healthy cash accrual and credit profile.

Over the next five years (fiscal 2026-2030), it is anticipated that around 250-250 million tonnes per annum (MTPA) of grinding capacities will come online, necessitating an investment of around Rs. 1600-1700 billion. This represents a healthy increase, equivalent to about 1.2 times the capital expenditure incurred over the previous five-year period. Given With their strong balance sheets and high liquidity, a large part of this capex is expected to be incurred by the large players funded from their internal accruals.

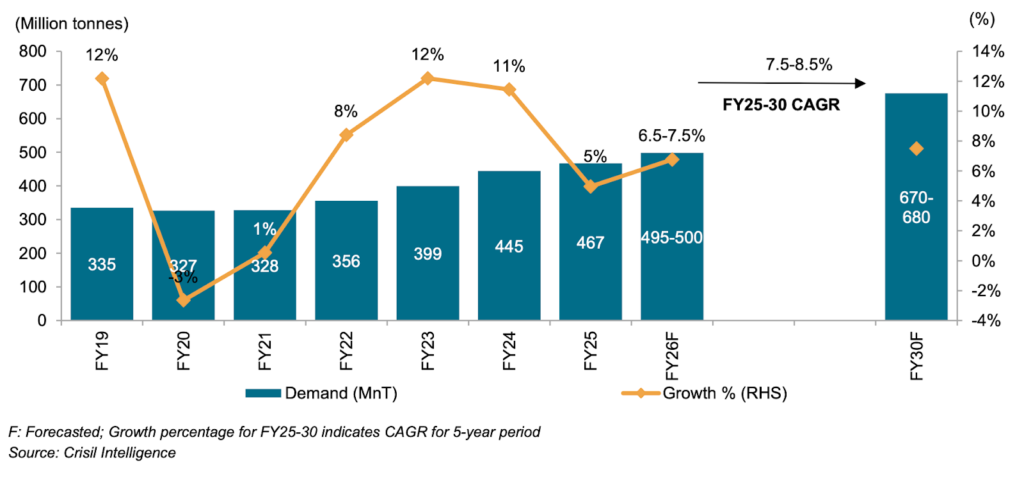

India cement demand review and outlook

Domestic cement demand grew at a healthy ~7% CAGR over fiscal 2020 to 2025, despite pandemic-induced slowdown, majorly led by sustained government thrust on infrastructure and affordable housing. In fact, a large part of the growth was due to a healthy uptick in FY22 and 23, while in FY20 and 21, demand was weak because of pandemic-induced lockdowns. On a low base, pan-India cement demand recovered by 8% in fiscal 2022 and accelerated further by ~12% in fiscal 2023, supported by strong demand for rural housing and infrastructure. A pre-election boost and healthy traction from the infrastructure segment led to a further 11% on-year growth in fiscal 2024. Although general elections and a slowdown in government spending moderated demand growth to ~5% in fiscal 2025.

Player-wise sales volume (Top 10 players)

Demand segmentation by end-user Industry

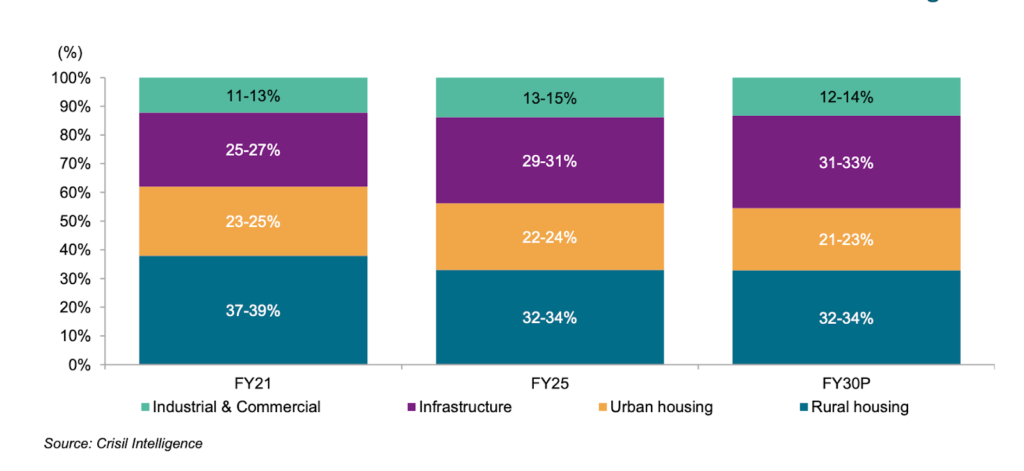

As of FY25, the end-user sector mix in cement demand share mainly comprised housing (55-57%), infrastructure (29-31%), and industrial/commercial (13-15%). Over the past five years, while the share of housing and industrial/commercial segments in overall cement demand declined, the share of the infrastructure segment increased. The decline in the share of the housing sector in the cement demand pie was because of the sector being buffeted by slow economic growth, weak demand, buyer unaffordability, and high Inventory.

Sectoral mix of cement demand

Segmentation by modes of sales

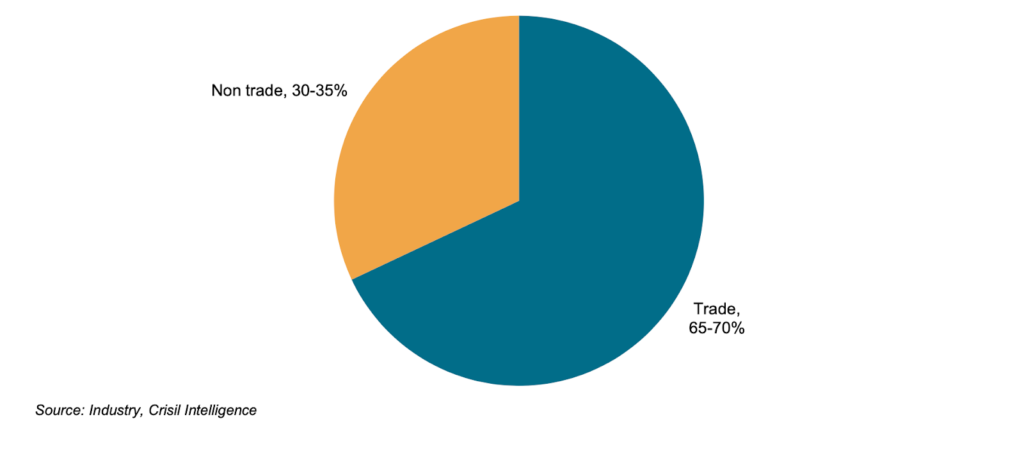

Cement is marketed under two mechanisms: trade and non-trade.

Trade: The manufacturer directly sells cement to dealers and retailers, who sell to the end consumers. It is a more common and stable method of vending cement since the manufacturer does not have to take the liability for making a sales pitch to the consumer directly. Also, it increases the manufacturers’ reach. The dealer gets incentives to sell the product. Segments that fall under this mode are individual housing, PMAY-G, and parts of infrastructure, industrial-commercial, as well as other housing segments.

Non-trade: Under this mechanism, the manufacturer directly sells to the consumer, like a construction company for use in a project. Here, the dealer is not involved.

Break-up of cement sales by mode of sales (As per FY25 estimates)

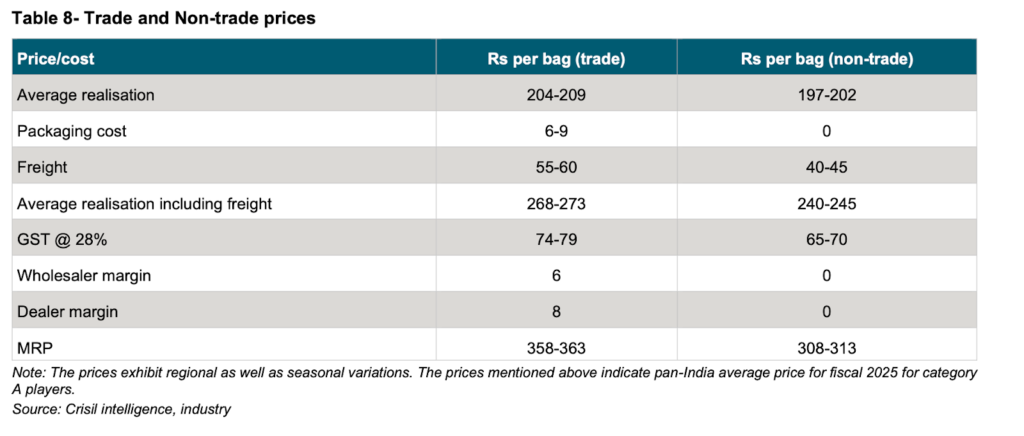

Higher profitability in the trade segment makes it more attractive

Trade is preferred by manufacturers as it fetches higher realizations. While the manufacturer has to invest in a distribution channel, the returns are relatively higher. The difference between trade and non-trade prices varies from Rs 30 to Rs 60 per bag for a manufacturer.

The difference in prices is based on factors such as:

• Region: the difference between trade and non-trade is highest in the southern region

• Volume: The Higher the volume, the higher the difference. For large-scale projects, buyers negotiate to get better prices

• Project type: For infra projects, prices are often fixed on an ex-FOR (freight on road) basis. Often, there is a pricing differential between trade and non-trade FOR prices to the tune of Rs 50-100 per bag.

• Relationship: The relationship between the construction company and the cement manufacturer plays a key role in determining the quantum of discount.

Trade and Non-trade prices

Cement supply analysis – India

Historical capacity additions and capacity utilization trend

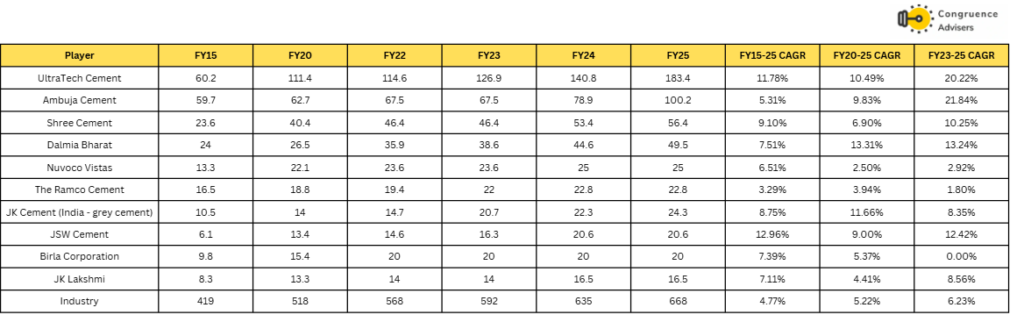

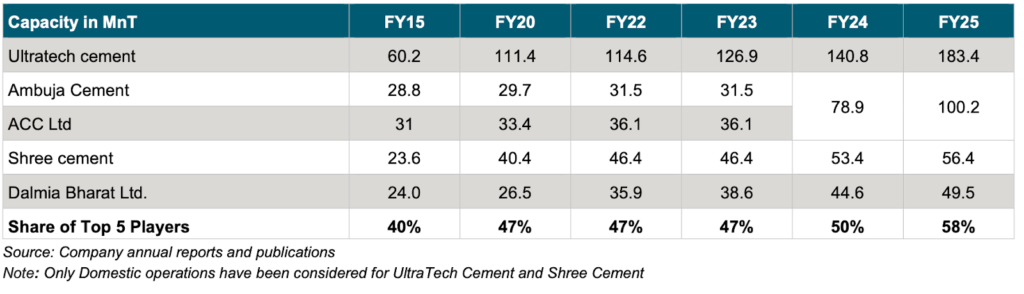

Player-wise capacity growth

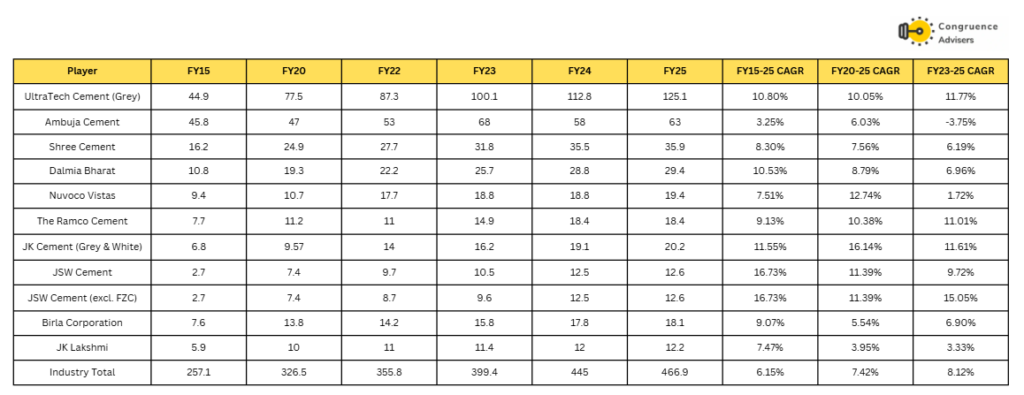

The Indian cement industry is highly fragmented and competitive, with the presence of a few large players and several medium and small players. Large and mid-sized players have used both organic and inorganic routes to grow. While UltraTech Cement has undertaken the maximum capacity additions in absolute terms, other large players such as Dalmia Bharat and Shree Cement have added capacity aggressively as well.

Among the mid-sized players, JK Cement, JK Lakshmi, JSW Cement, and Ramco Cements have undertaken healthy capacity growth, led by organic expansion to newer regions. JSW Cement has achieved the highest CAGR growth amongst the top 10 players in terms of installed capacity in the past 10 years, spanning from fiscal 2014 to fiscal 2024.

Trend in share of top 5 players

Sagar Cements Ltd Business Overview

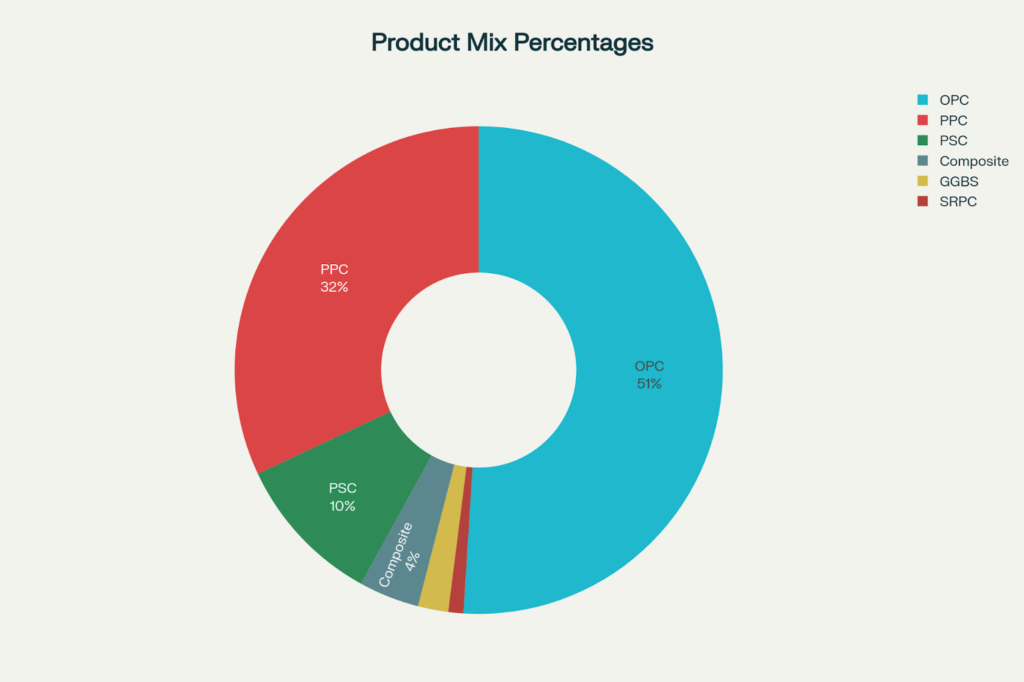

Sagar Cements Ltd Product Portfolio

Ordinary Portland Cement (OPC) – Ordinary Portland Cement (OPC), commonly known as grey cement, consists of 96% clinker and 4% gypsum. It is the most widely used type of cement. The company offers both 53 Grade and 43 Grade OPC. OPC is produced in line with sustainable practices, meeting the necessary environmental standards.

Applications – Construction of buildings, roads, pavements, and bridges. Precast concrete products, including blocks, tiles, and pipes. Foundations and structural works that require quick strength development.

Portland Pozzolana Cement (PPC) – Portland Pozzolana Cement (PPC) is a blended cement made up of 15-35% pozzolanic material with 61-81% clinker and 4% gypsum. Known for its improved durability, especially in aggressive environments, PPC also offers sustainable advantages by incorporating industrial byproducts such as fly-ash.

Applications – Mass concrete works such as for dams, foundations and water-retaining structures. RCC structures and high-strength concrete applications. Pavement and bridge construction where durability against sulphates is needed.

Portland Slag Cement (PSC) – Portland Slag Cement (PSC) is produced by blending 25-75% granulated blast furnace slag with 22-72% of clinker and 3% gypsum. It offers improved resistance to chemical attacks, particularly sulphates, and enhances the durability of concrete. PSC supports sustainable construction practices while offering superior strength and longevity.

Applications – Marine and coastal structures, such as jetties, harbors, and seawalls. Used in sewage systems and wastewater treatment plants due to its resistance to aggressive substances. Industrial flooring and heavy-duty concrete applications require superior durability

Composite Cement – Composite Cement is a blended cement made up of 15-35% pozzolanic material, 20-50% granulated slag, 3% gypsum, and the remaining clinker. It combines the benefits of both pozzolanic materials and slag, offering a well-rounded balance of strength and durability.

Applications – Mass concrete works such as dams, foundations and water-retaining structures. RCC structures and high-strength concrete applications. Construction of pavements and bridges where sulphate-resistance is necessary.

Other Products include Ground Granulated Blastfurnace Slag, Sulfate Resisting Cement (SRC).

Product Mix % For FY25

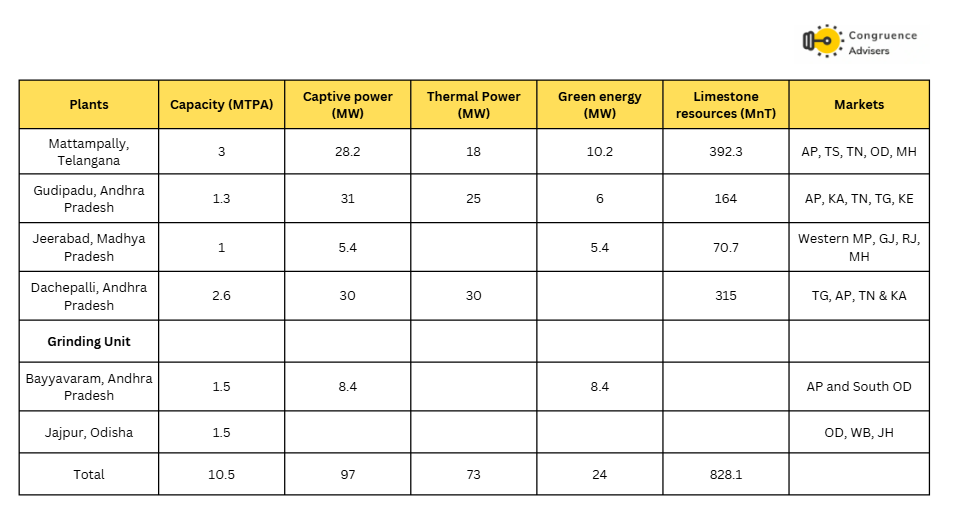

Manufacturing Facilities

Geographical Presence

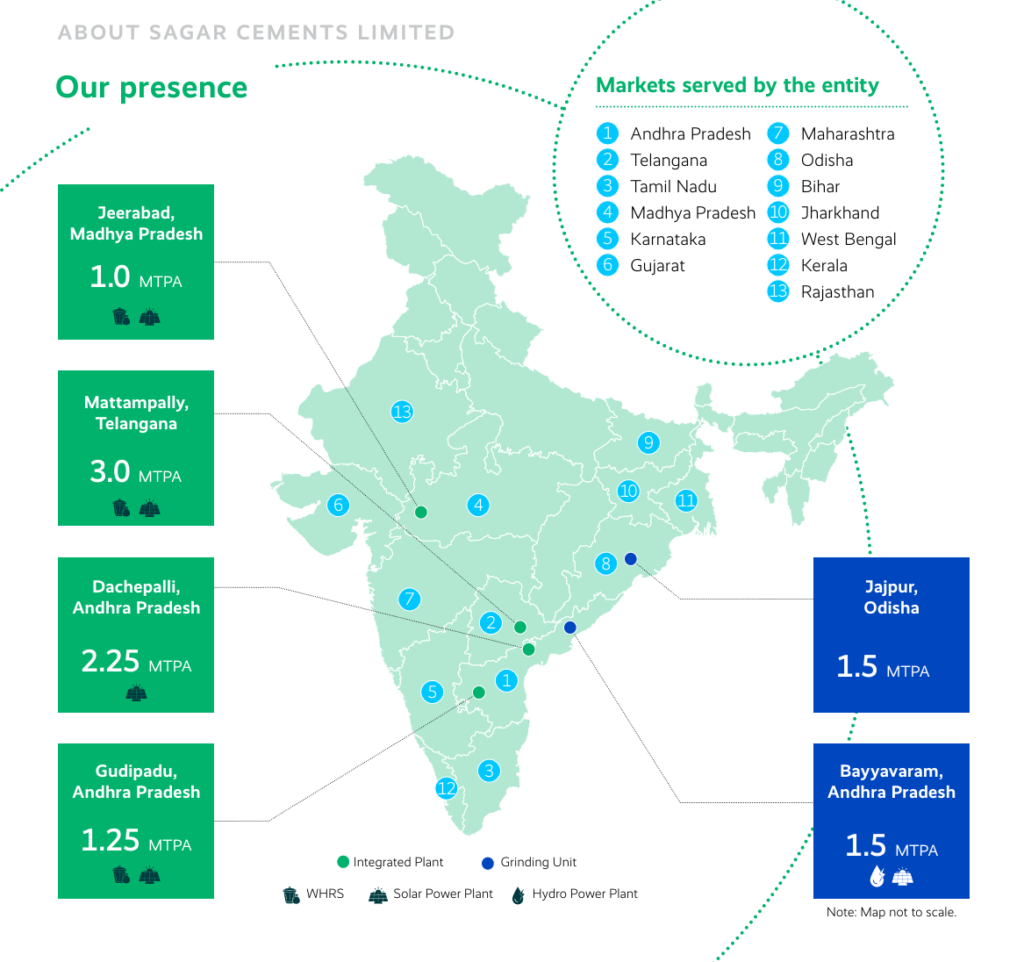

Sagar Cements Ltd, a South India-focused cement producer, has strategically expanded its market presence to Madhya Pradesh and Odisha, operating with a cumulative capacity of 10.85 MTPA (including Vizag). In 2023, Sagar Cements Ltd achieved its targeted 10 MTPA capacity ahead of the FY25 timeline through the acquisition of Andhra Cements Limited 2.6 MTPA. SGC continues to ramp up capacity by consistently upgrading and debottlenecking its plants, all located near key markets in South India as well as select regions in Maharashtra, Odisha, and Madhya Pradesh. With an expansion plan to reach 12 MTPA by FY27, adding 0.75 MTPA at the ACL plant, 0.25 MTPA at Gudipadu, and 0.5 MTPA at Jeerabad Sagar Cements Ltd aims to double its capacity every ten years.

Source: company

Geographical Revenue Split

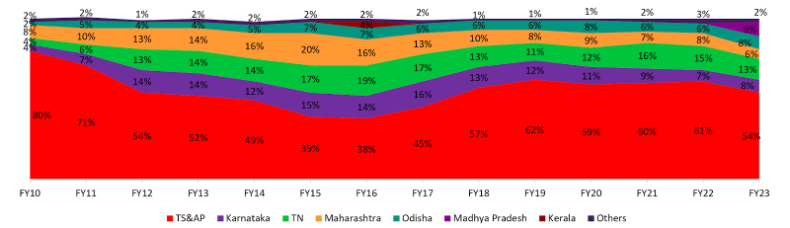

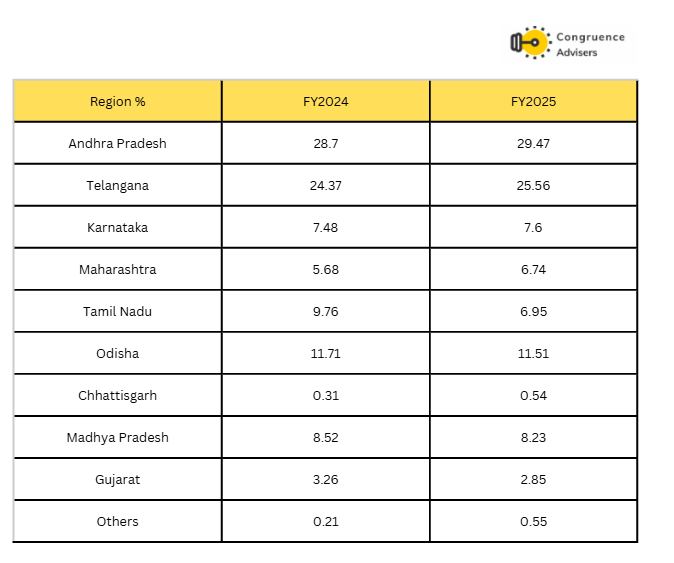

Sagar Cements Ltd geographical revenue mix has evolved significantly from FY10 to FY25, marking its shift from a South India-focused company to one with a wider national presence. In the early years (FY10–FY15), most of its sales came from Andhra Pradesh and Telangana, which together made up well over half of the company’s revenue. At that time, the company’s growth was closely tied to these home markets. Although it began selling in nearby states like Tamil Nadu and Karnataka, those markets contributed only modestly.

Over time, Sagar Cements Ltd changed its approach. Rather than relying solely on regional dominance, it started expanding capacity more strategically. This led to meaningful growth in newer territories such as Maharashtra, Odisha, and Madhya Pradesh, especially after the company’s plant acquisitions and ramp-ups around 2018.

By FY24 & FY25, the revenue split clearly reflects this successful diversification. Andhra Pradesh (29.47%) and Telangana (25.56%) are still Sagar Cement Ltd biggest markets, but their combined contribution has reduced to just over half of the total revenue. Karnataka, Maharashtra, and Tamil Nadu together now account for about 21%, while Odisha and Madhya Pradesh have grown into strong markets, collectively contributing nearly 20%. Newer regions like Chhattisgarh and Gujarat, though still smaller, are steadily expanding thanks to recent capacity additions.

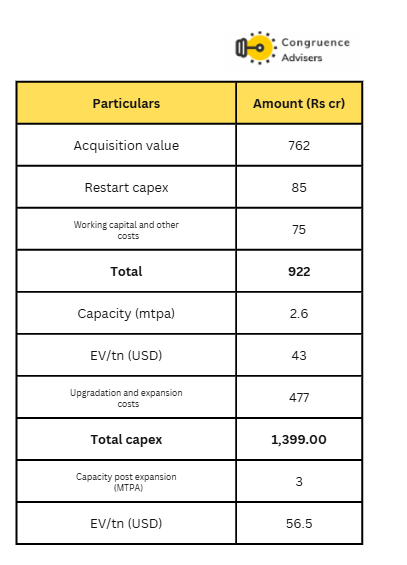

Acquisition

The acquisition of Andhra Cements added 25% to the company’s existing capacity. In 2023, SGC acquired ACL for Rs 920 Cr, which added 2.6MTPA capacity across two plants in AP – Durga Cement Works (1.8 MTPA) at Dachepalli and Vishakha Cement Works (0.8 MTPA) at Vishakhapatnam.

Vizag Cement Works – This unit has a grinding capacity of 0.8 MTPA. Sagar Cements has considered discontinuing operations at the Vizag plant due to constraints related to its proximity to the city and the antiquity of its assets.

ACL Acquisition Details

Funding the Acquisition

Equity: ₹322 Cr of the acquisition was financed through equity. Sagar Cements Ltd subscribed to 95% of ACL’s reconstituted paid-up share capital. Additionally, ₹350 Cr was raised in FY23 through a preferential issue of equity shares for this purpose.

Debt: ₹600 Cr was funded through debt. Sagar Cements Ltd had also raised a structured debt instrument of around ₹500 Cr in anticipation of this acquisition as early as July 2022, which was earmarked for the purpose. The existing debt liability of Andhra Cements, totaling ₹1,316 Cr, was settled for ₹725 Cr as part of the resolution plan.

For New Capex 470 Cr – ACL itself received new credit facilities of ₹315 Cr (₹195 Cr from Yes Bank Limited and ₹120 Cr from Union Bank of India) for its modernization, secured by Sagar Cements Ltd’s corporate guarantee and pledged shares in ACL.

Rationale Behind the Acquisition

Capacity Expansion: The acquisition helped Sagar Cements Ltd achieve its stated goal of reaching 10 million tonnes per annum (MTPA) capacity by 2025, well ahead of schedule. ACL added 2.6 MTPA capacity across its two plants (Durga Cement Works at Dachepalli and Vishakha Cement Works at Visakhapatnam, though Vizag operations are being discontinued).

Cost Efficiency and Modernization: Sagar Cements Ltd planned a significant capital outlay of ₹468 Cr for the enhancement of clinker capacity from 1.65 MTPA to 2.3 MTPA and cement capacity from 1.8 MTPA to 3 MTPA at ACL’s Durga Cement Works in Dachepalli. This investment is primarily for modernization and cost optimization rather than solely for volume increase, aiming to reduce costs through improved thermal efficiency and operational leverage.

Strategic Advantage: ACL’s Dachepalli unit offers integrated operations with a captive limestone mine, ensuring ample raw material availability. The overall acquisition cost of $56 per tonne (including upgradation) was considered competitive compared to greenfield project costs.

Andhra Cements Ltd Struggles in FY23

Andhra Cements Limited was in a state of financial distress, operating as a “Corporate Debtor” under an insolvency resolution process when Sagar Cements Ltd acquired it. This indicates significant struggles leading up to and during FY23.

The National Company Law Tribunal (NCLT) approved Sagar Cements Ltd’s resolution plan for ACL on February 16, 2023. Sagar Cements Ltd obtained control of ACL effective March 18, 2023, following the completion of the resolution process.

For over 3.5 years prior to the acquisition announcement in February 2023, the “Jaypee” brand, formerly associated with Andhra Cements, had not been seen in the market, implying a prolonged period of inactivity or severe underperformance.

As of May 2025, ACL had accumulated losses of approximately ₹1,200 Cr.

Andhra Cements’ performance was noted to contribute negatively to the group’s overall results during its ramp-up phase in FY25. Capacity utilization is around 30-40% for FY24 and FY25.

Modernization and Expansion at Dachepalli

Significant turnaround with its ongoing capacity and efficiency revamp at its Dachepalli integrated unit (IU). The expansion will elevate clinker and cement capacities from 1.85/2.25 mn MT to 2.3/3 mn MT by the end of FY26, leveraging limestone reserves (~315 mn MT) and a 30 MW captive power plant (CPP). A new six-stage preheater and a 6 MW solar plant are being commissioned, with the preheater successfully completed, and after trial runs, it got commissioned on 23 Oct ’25.

ACL has faced sustained operating losses since FY20 (notably, an EBITDA loss of INR 428/MT in FY25). As per Management, the Andhra Cement plant is expected to break even at 50% utilization (currently at 32%), targeting 60% next year with expected EBITDA/tn of Rs500–600, subject to realizations.

Additional raw material savings (~INR 100/MT) due to cheaper fly-ash supply from a neighboring thermal power plant. With plant utilization set to rise as expansions stabilize, operating leverage gains and ongoing cost optimizations are expected to further improve the margins.

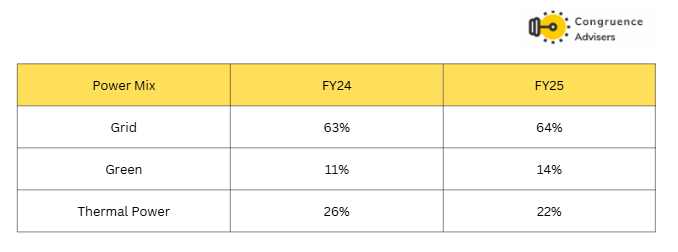

Power Mix

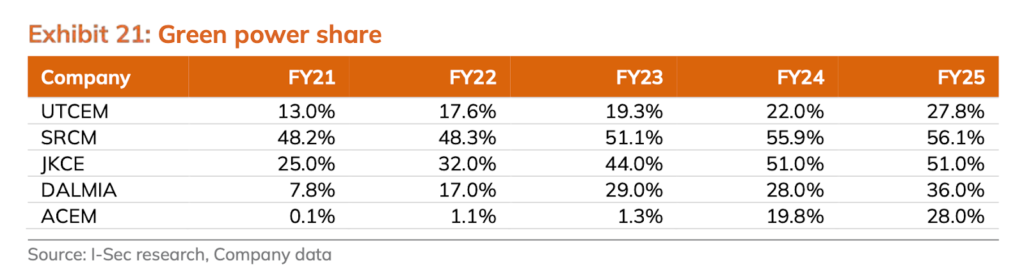

Peers Green Power Mix

Sagar Cements Ltd is behind leaders like UltraTech and some units of JK/Shree/Dalmia Cement in terms of green power share for FY25. Sagar Cements Ltd remains mid-tier on green energy usage today, but has plans to catch up with the sector targets over the next five years

Sagar Cements Ltd aims to achieve a significant increase in its green power share, reaching 50% by 2030 and 100% by 2050.

Power costs can be reduced in the coming years through several strategic initiatives focused on energy efficiency, the adoption of green and renewable energy sources, and the optimization of the fuel mix.

The planned installation of a new 6-stage preheater at the Dachepalli unit. This modernization is projected to substantially improve thermal efficiency, with thermal energy consumption expected to decline from approximately 770 kcal/kg to 710–720 kcal/kg of clinker, translating into a reduction of 50–60 kcal/kg.

In parallel, electrical energy consumption is anticipated to decrease from 28.50 kWh to 21.00 kWh per tonne of clinker, resulting in a savings of 7.50 kWh per tonne. Taken together, these reductions are estimated to yield overall cost savings in the range of ₹200–₹250 per tonne, primarily attributable to lower thermal fuel requirements.

The upgrade of preheaters at the Dachepalli plant commenced with construction in February 2024

The entire project is expected to be commissioned by the end of FY26 (likely it will be completed by the end of September to mid-October).

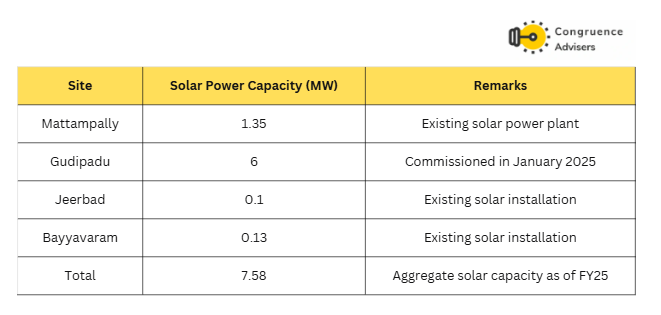

Increasing Green and Renewable Energy Share

Sagar Cements Ltd is increasing its usage of non-fossil fuel sources to meet energy needs as part of its net-zero pledge. This includes solar, hydro, and waste heat recovery systems.

Sagar Cements Ltd operates its own captive power plants, including thermal, waste heat recovery, solar, and hydro, which enable power security at reasonable prices.

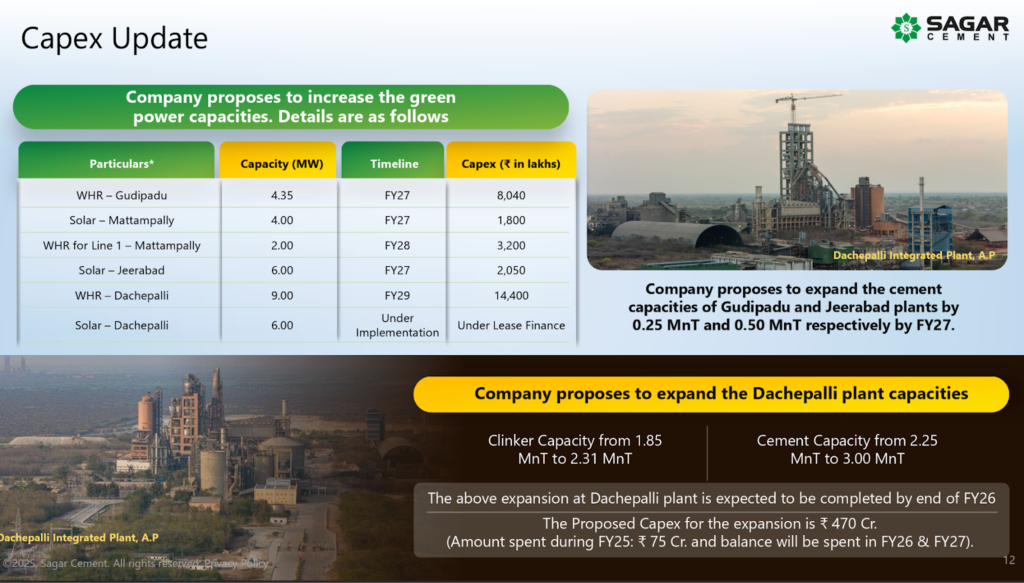

Waste Heat Recovery Systems (WHRS) – Current WHRS capacity includes 8.8 MW at Mattampally and 5.3 MW at Jeerabad.

Plans include a 4.35 MW WHRS at Gudipadu (FY27), 2.00 MW for Line 1 at Mattampally (FY28), and 9.00 MW at Dachepalli (FY29).

WHRS can significantly reduce electricity costs, as the generated electricity cost is very low compared to captive thermal or grid power. The WHRS at Gudipadu is expected to save anywhere between ₹50 to ₹75 per ton.

Solar Power Plants

Future solar plans include 4.00 MW at Mattampally (FY27) and 6.00 MW at Jeerabad (FY27).

Hydro Power Plants: The company has 8.3 MW of hydro power at GBC and LIS in Kurnool, with a total hydro power of 8.3 MW from GBC (4.3 MW) and LIS (4.0 MW).

Sagar Cement Capex Update

Sagar Cements Ltd Corporate Governance

Board Composition – As of FY25, the Board of Sagar Cements Ltd. had 9 members: 3 Independent Directors, 3 Nominee Directors, 1 Non-executive Director, and Dr. S. Anand Reddy, who is the Managing Director of Sagar Cements Ltd. S. Sreekanth Reddy is the Joint Managing Director, both are from the Promoter Group.

KMP Remuneration – The total compensation drawn by KMPs in FY25 is Rs 11.62 Cr, which is an increase of Rs 9.06 Cr from FY24.

Contingent Liabilities – The total contingent liabilities outstanding for Sagar Cements Ltd. as of FY25 amounted to ₹77.49 Cr, primarily about Income Tax and Service tax-related demands from the Government. The total contingent liabilities are ~5% of the book value of equity of Sagar Cements Ltd., and hence not very material.

Related Party Transactions – Sagar Cements Ltd RPT centers around regular operational linkages with its subsidiaries and associated entities. These transactions typically involve the sale/purchase of goods, services, rent, financing, and expense reimbursements across group companies such as Andhra Cements Ltd and Sagar Cements (M) Pvt Ltd.

Dividend Track Record – Sagar Cements Ltd has paid a dividend each year in the last ten years, apart from FY17 and FY25.

Sagar Cements Ltd Financial Performance

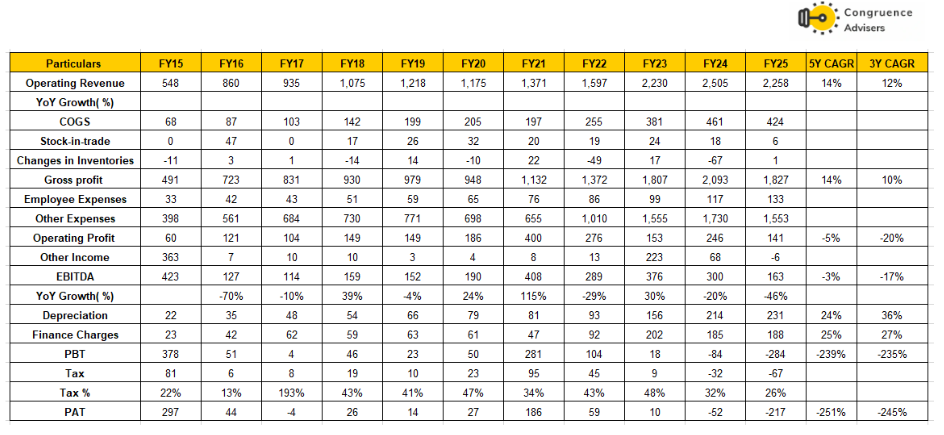

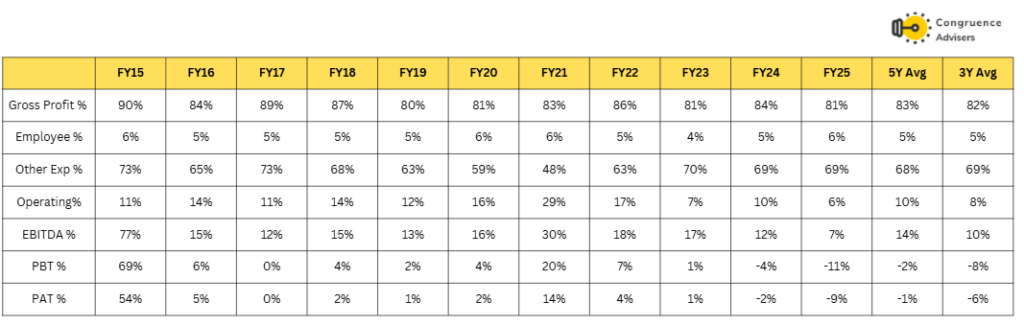

Sagar Cements Ltd financial performance over the past few years reflects a phase of significant capacity expansion and geographical diversification but also underscores operational challenges. Operating revenues have grown at a healthy CAGR of 14% over five years, reaching ₹2,258 Cr in FY25. However, profitability has come under pressure due to high material and fuel costs, competitive pricing, and ramp-up expenses from new and acquired plants.

EBITDA margins have steadily declined from 16% in FY20 to just 7% in FY25, while net profit turned negative in FY24 and FY25, impacted by the distress acquisition of Andhra Cements and underutilization at ramping units. Despite these setbacks, the company’s gross margin has remained relatively stable at 81–84% due to adequate raw material linkage and captive power, but operating and net margins are well below sector leaders.

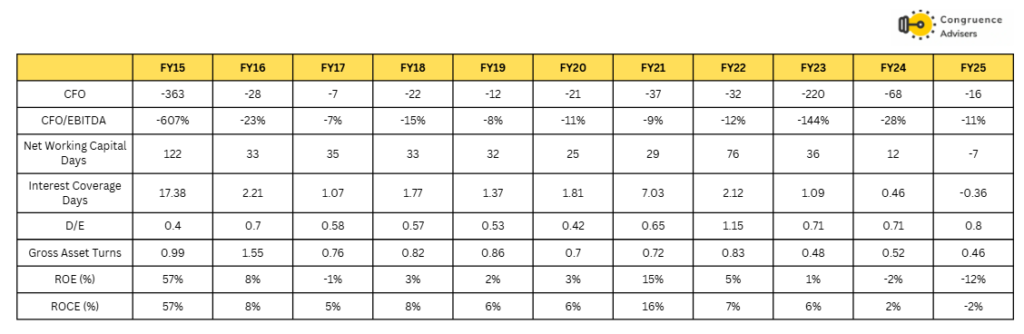

Sagar Cements Ltd: Working capital, Debt, and cash flow analysis

Debt levels have increased with the acquisition-driven growth strategy, pushing the debt/equity ratio to 0.8 in FY25, while interest coverage remains weak. Cash flow from operations has been negative in the last ten years, weighed down by swelling costs and working capital needs. Returns on capital (ROCE -2%, ROE -12% for FY25) have also slipped sharply. Sagar Cements Ltd management, however, is focused on turnaround measures including cost optimization, plant modernization, and expansion of green energy mix, aiming to improve margins and restore profitability. The path to recovery will depend on the successful ramp-up and integration of acquired assets and the realization of targeted efficiencies as utilization picks up in the coming years.

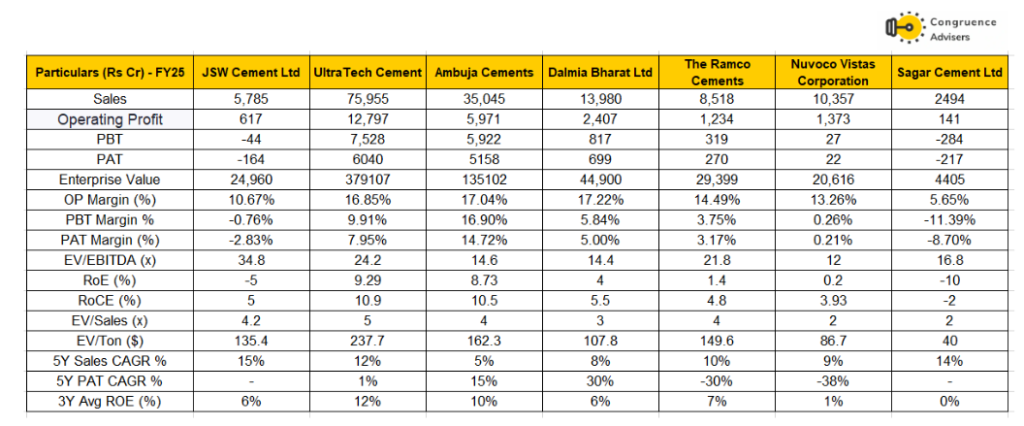

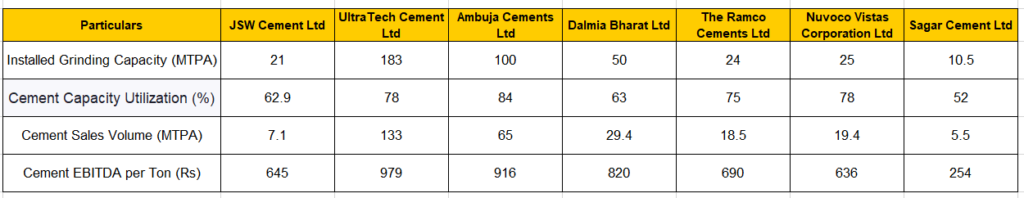

Sagar Cements Ltd Comparative Analysis

To understand Sagar Cements Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Sagar Cements Ltd to its competitors (peer comparison) on various fundamental parameters and Sagar Cements Ltd share performance relative to relevant benchmark and sector indices.

Sagar Cements Ltd Peer Comparison

We are comparing Sagar Cements Ltd with its peers in the Cement Sector. Hence, we have considered JSW Cement, UltraTech, Ambuja, Dalmia Bharat, Ramco Cement,s and Nuvoco Vistas Corporation for the peer comparison.

Sagar Cements Ltd, a mid-tier cement manufacturer, stands out for its aggressive growth, but it trails sector leaders like UltraTech, Ambuja, and Dalmia in scale, profitability, and operational metrics.

While industry giants maintain EBITDA margins above 15-17% and strong returns on equity, Sagar Cement Ltd margins are lower with negative net profit due to recent expansion and higher costs. Its valuation is attractive, trading at a much lower EV/Ton. Sagar Cements Ltd is actively investing in green energy and capacity upgrades, targeting a significant turnaround in margin and sustainability over the next few years, positioning it as a deep value bet among established players. The path to peer-like results depends on successful integration, margin expansion, and execution of its energy transition strategy, making it a higher-reward option compared to sector giants.

Sagar Cements Ltd Index Comparison

Sagar Cements Ltd share performance vs S&P BSE Small cap Index as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why You Should Consider Investing in Sagar Cements Ltd

Comfortable Market Position, Likely to Improve with Capex Completion and Utilisation – Sagar Cement Ltd capacity increased by over 80% to 10.5 million tonnes (mnt) over FY21-FY25 due to a combination of organic and inorganic growth. After completing greenfield projects in Odisha and Madhya Pradesh in 2HFY22, Sagar Cements Ltd acquired ACL in March 2023. This capacity expansion has strengthened Sagar Cement Ltd business profile by improving its market position and geographical presence. The management plans to further increase the capacity to 11.25mnt over the next couple of years, by improving efficiency and Utilisation with volume guidance of 6 MTPA for FY26 and 7 MTPA for FY27

Geographically Diversified with Presence in Three Regions – While Sagar Cements Ltd remained a south-focused entity until FY21, the company has expanded its manufacturing presence in central and eastern regions, which have high growth potential. SCL’s concentration in the southern region has been decreasing. The infrastructure spending remained weak in FY25, with the general elections leading to subdued demand. The development of Andhra Pradesh’s new capital, Amravati, along with increased budget allocations for essential infrastructure such as water, power, railways, and roads over the medium term, is likely to support cement demand in the southern region.

Adequate Raw Material Linkages and Captive Power: Following the ACL acquisition, Sagar Cements Ltd has consolidated limestone reserves of approximately 944mt, sufficient to meet the medium-to-long-term limestone needs of its existing plants. SCL is also developing feeders for alternative fuel consumption across all its plants, allowing flexibility in fuel choice based on availability and cost.

At the consolidated level, SCL has a 73MW captive thermal power generation capacity, a 14.1MW-waste heat recovery plant, and around 16MW of solar and hydro power plants, which are sufficient to meet the power requirements of the entities, including the new capacities being added.

Increasing Mix Green Power Mix and Improve Profitability – Sagar Cements Ltd aims to achieve a significant increase in its green power share, reaching 50% by 2030 and 100% by 2050. Increasing the green power mix is a key strategic focus area for achieving cost efficiency and improving margins. The company is targeting 600-650 EBITDA/Ton in FY26.

What are the Risks of Investing in Sagar Cements Ltd

Intense Competition and Price Volatility – The market is characterized by intense competition, which leads to cement pricing often not moving in tandem with inflation, resulting in lower margins for cement companies. The core South Indian markets (Telangana, Andhra Pradesh, Karnataka, Tamil Nadu, and Maharashtra) often witness heavy competition, resulting in wide fluctuations in pric,e impacting margins.

Regional Demand-Supply Imbalance – Cement supplies in Sagar Cements Ltd’s existing markets are currently in excess of the demand, which restricts the scope for increasing sales volume significantly in the near future. The regional demand/supply equation in the South is expected to remain skewed toward supply for the next few years.

Logistics and Freight Costs – Ineffective supply chain operations can lead to higher logistics costs and hamper profitability. Volatility in freight rates can offset benefits derived from lower fuel costs.

Market Slowdown – A market slowdown in the Southern region may significantly impact the company’s performance. Seasonal factors, such as the extended monsoon and severe flooding (e.g., in Tamil Nadu in Q3 FY24), have historically led to a significant tapering off of demand and volume loss. Furthermore, general elections and state elections can impact construction activity and labor availability, causing slowdowns

Sagar Cements Ltd Future Outlook

Sagar Cement Ltd is well on track to enhance its efficiency and profitability through various cost optimization initiatives. The company is actively ramping up its green power share, and the planned capex for upgrading the Dachepalli plant is expected to deliver substantial cost savings. With stable input prices and improving operating efficiency, Sagar Cement Ltd is well-positioned to benefit from higher utilization levels once the new plants are commissioned. Management Guidance: 6 MTPA volume in FY26 and 7 MTPA in FY27.

Sagar Cements Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time, price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Sagar Cements Ltd Price charts

On a weekly chart, Sagar Cements Ltd stock displays a broader multi-year price range between the horizontal support at ₹172 and resistance at ₹295. Sagar Cements Ltd stock recently faced resistance near ₹295 and pulled back. Despite intermittent rallies, the price repeatedly fails to sustain above ₹295 and finds support around ₹172. The current price at ₹226 is closer to mid-range, indicating that it is neither at a major support nor resistance and highlighting the stock’s tendency to oscillate within these boundaries over the past three years.

The trend on the day chart turned very negative once a level of 240 was broken post Q2 FY26. With this break, the trend also broker the short term pattern of higher lows and higher highs and is now hovering near the 200 DMA. In Q2 results declared so far cement sector has disappointed in terms of price action though many businesses showed a market improvement in EBITDA/MT. Some of the larger stocks like J K Cement have fallen > 15% in a short span of time indicating that the market had bid up prices a little too much on the back of FY26 expectations.

Given that Sagar Cements is one of the smaller listed businesses and suffers from high competition in the South zone, investors will need differentiated insights into the business to be able to make an investment decision.

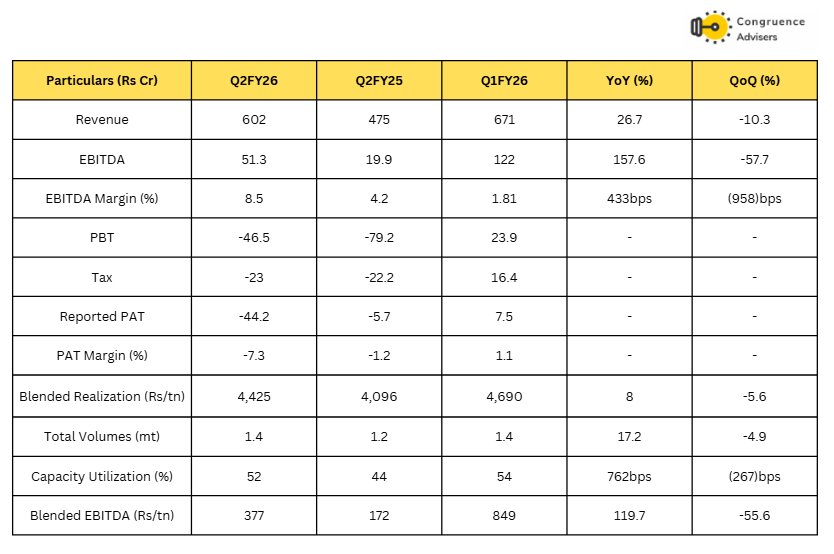

Sagar Cements Ltd Latest Result, News and Updates

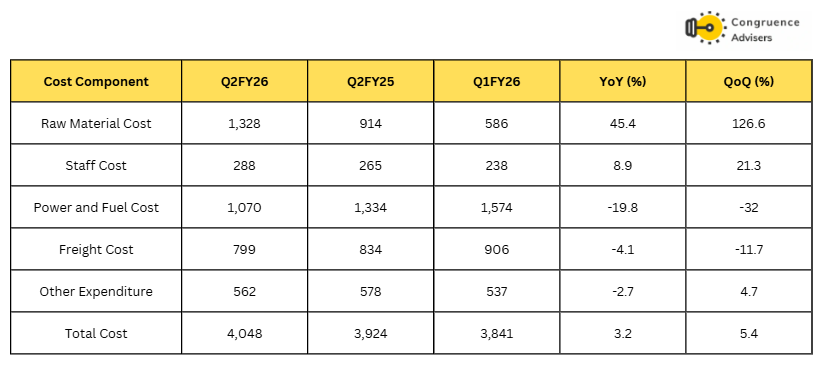

Sagar Cements Ltd Quarterly Results

Overall cement demand remained subdued during the quarter due to an extended monsoon, though the company achieved volume growth on a low base from last year. A demand recovery is expected post-monsoon, Q3 end with a visible rebound in 4QFY26.

Management reiterated its volume guidance of 6 MTPA for FY26 and 7 MTPA for FY27. With no major new capacity additions announced across the industry, a gradual ramp-up in utilization levels is anticipated. Pricing softened only marginally, declining 3–4% despite the GST cut, and is likely to remain stable through Q3. The company expects price hikes in early Q4, though minor corrections could occur toward the end of FY26 due to a year-end volume push. Non-trade prices are expected to improve in the coming quarters.

On the cost front, sequential EBITDA declined mainly due to a one-off incentive benefit, with incentives received at Rs 34 Cr in 1QFY26 versus Rs 11 Cr in 2QFY26. For FY27, incentives of at least Rs 25 Cr are anticipated, subject to state government discretion. Employee costs rose due to annual increments and are expected to remain around Rs 36.5 crore per quarter.

Capex guidance for FY26 has been revised upward to Rs 450 Cr (from Rs 360 Cr earlier), with Rs 180 Cr spent in H1 and Rs 250 Cr planned for H2. Capex for FY27, including maintenance, is estimated at Rs 250–270 Cr, targeting 12 MTPA of capacity by end-FY27 from the current 10.5 MTPA through ongoing expansion at Jeerabad (0.5 MTPA), Gudipadu (0.25 MTPA), and Dachepalli (0.75 MTPA).

Andhra Cements is currently operating at 32% utilization, impacted by a 40-day shutdown for plant upgradation. The plant’s break-even level is around 50% utilization, and management expects utilization to reach approximately 60% by the end of FY27. A new heater installation is expected to save 100 kcal and enhance efficiency. The company targets an EBITDA per ton of around Rs 600 in FY27, subject to improved realizations. Additionally, the Vizag land sale is expected to conclude by the end of FY26 and deliver better-than-anticipated realizations

Final thoughts on Sagar Cements Ltd

Sagar Cements Ltd. is a potential value play in the cement industry. Its valuation in terms of EV/Ton of installed capacity is half its peers. The market probably feels justified in giving it such a valuation due to its small scale, high cost structure, meager operating profits and levered balance sheet.

With the cement industry consolidating, if we see realizations remain stable or inch up and if Sagar Cements can continue to grow volumes year over year and reduce operating costs by optimising power and fuel costs in particular, then there could be significant margin and profit expansion for the company. In such an event, the market might re-rate Sagar Cements Ltd in line with its peers. However, such a turnaround won’t be easy and investors will have to track the story quarter on quarter to see how it unfolds.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this to a general audience. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will continue/be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.