Shankara Building Products Ltd is among India’s largest omni-channel marketplaces for building products, with an expansive portfolio spanning steel products, construction materials, plumbing and sanitaryware, flooring, roofing, electricals, and other allied home improvement solutions. The company’s retail operations are conducted under the well-recognized brand “Shankara Buildpro”, catering to a diverse customer base including homeowners, small contractors, fabricators, and institutional buyers.

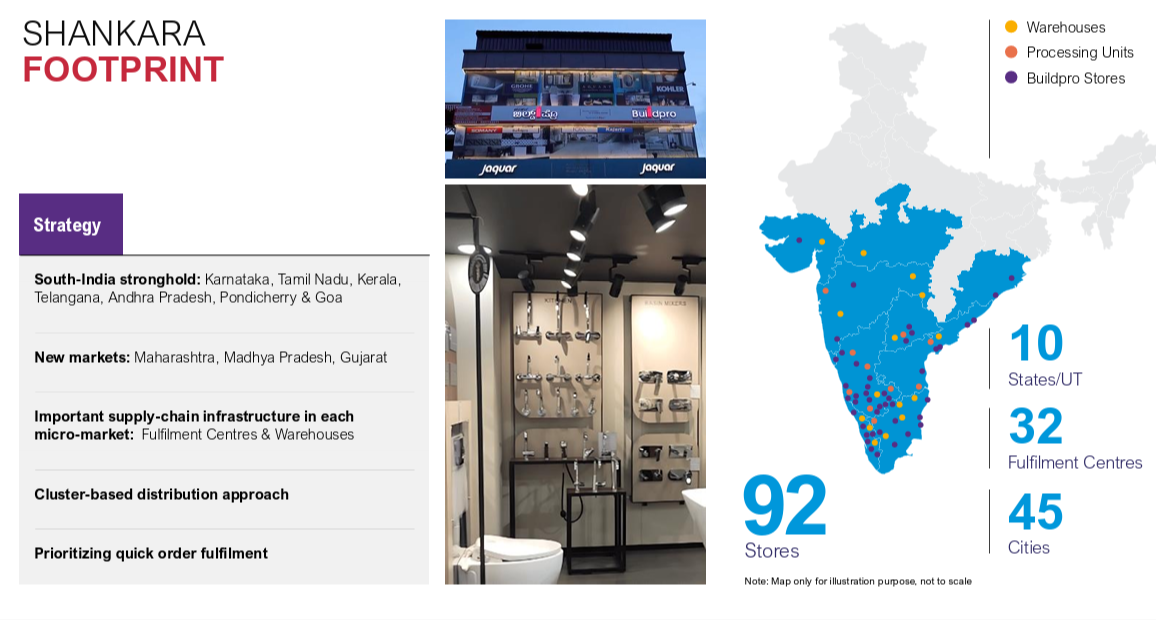

As of FY25, Shankara operates 138 fulfillment centers, comprising 92 retail outlets, 32 warehouses, and 14 processing units, primarily concentrated in South India (including Goa and Puducherry), with a growing presence in Maharashtra, Madhya Pradesh, Gujarat, and Odisha. The company’s integrated physical infrastructure is complemented by a strong digital presence via its proprietary e-commerce platform www.buildpro.store as well as listings on Amazon, Flipkart, and other third-party marketplaces.

Shankara Building Products Ltd Company Summary

Shankara Building Products Ltd started very humbly way back about 50 years ago when the promoter’s father started a small-scale business operating out of Chennai and Bangalore. The company took a more structured form in 1990 by becoming a private limited entity. However, it was in 1995 that the true identity of the business began to take shape with the formal establishment of Shankara Pipes marking the real inception of what is now known as Shankara Building Products Ltd.

At the time, the company had a modest topline of around ₹20 crore and operated primarily as a steel tube business. It built a strong association with Tata Steel and played a significant role as a business development partner in launching the “Tata Structura” brand, now a widely recognized name in the steel tubes segment. By 2000, Shankara Building Products Ltd’s revenues had grown to approximately ₹500 crore, which further reached ₹600 crore by 2005 and ₹800-900 crore by FY2010.

A major milestone came when Shankara Building Products Ltd acquired a small steel tube manufacturing unit in Bangalore enabling backward integration. In 2011 it raised ₹80 crore in private equity funding from Fairwinds PE to fuel expansion. Two years later, in 2013, Shankara Building Products Ltd acquired a roofing solutions company focused on profiling, further diversifying its offerings in the building materials value chain.

In 2015, Shankara Building Products Ltd ventured into private-label manufacturing, launching its own brands in pipes and roofing. This also marked a strategic shift Shankara Building Products Ltd began expanding beyond steel, gradually transitioning into a more comprehensive building materials company. By FY2016 Shankara Building Products Ltd had scaled its topline to approximately ₹2,000 crore driven by both organic growth and product diversification.

In 2017, Shankara Building Products Ltd took a significant leap by getting listed on the NSE and BSE enhancing its visibility and access to capital markets. The years that followed, particularly between 2018 and 2021 were characterized by continued efforts to reposition the company as a broader integrated building materials platform. During this phase, Shankara Building Products Ltd added several non-steel products to its portfolio, further strengthening its presence across the construction and housing ecosystem.

Retail expansion was a parallel growth engine. Shankara Building Products Ltd began its retail operations in 2009-10 and expanded steadily to reach over 134 stores by 2019. Starting in 2015, Shankara Building Products Ltd rapidly broadened its product offerings, introducing a wide range of SKUs across multiple categories to serve the growing demand for integrated building material solutions.

However,Shankara Building Products Ltd also took a pragmatic approach toward business consolidation. In the run-up to the COVID-19 pandemic Shankara Building Products Ltd initiated a store rationalization program closing down non-profitable outlets. Between 2019 and 2025, around 42 stores were shut bringing the total store count from around 92 to a more efficient footprint.

Over the last three to four years,Shankara Building Products Ltd undertook several balance sheet strengthening measures. These included improving working capital efficiency, reducing debtor days and entering a strategic partnership with APL Apollo. Which led to higher revenue growth but on the cost of profitability

Shankara Building Products Ltd today positions itself not just as a steel products company but as a comprehensive, one-stop platform for building materials. Through its retail network, it aims to deliver a “wholesome experience” to customers offering a complete range of products that meet the needs of both individual homeowners and institutional clients.

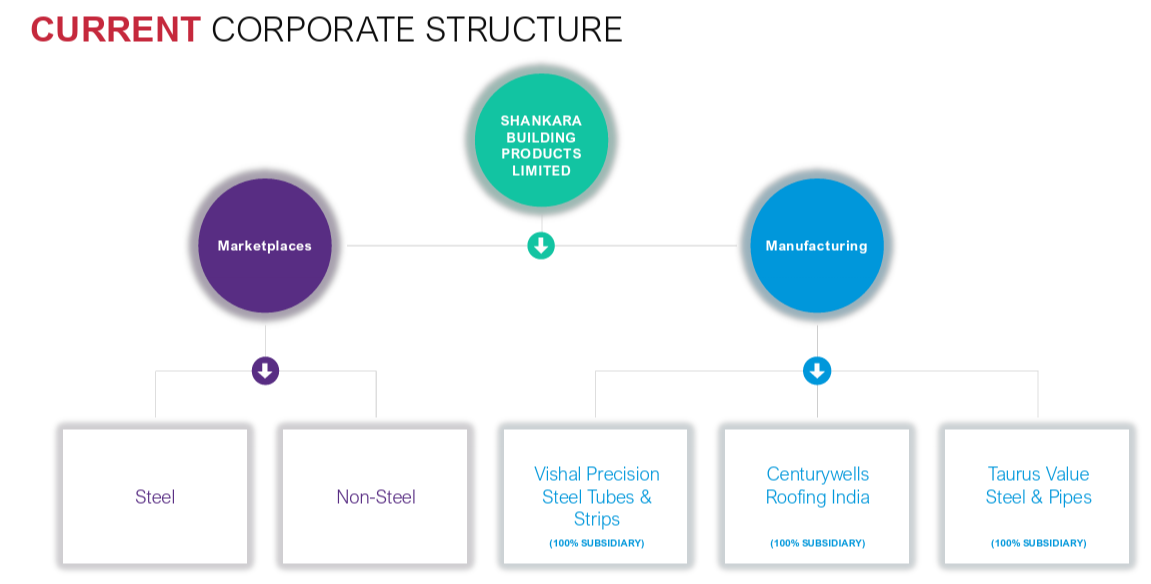

Shankara Building Products Ltd – Current Corporate Structure

Shankara Building Products Ltd’s operations are structured around two key verticals: Marketplaces and Manufacturing.

Marketplaces – These segments encompass the Shankara Building Products Ltd’s marketplace operations, offering a wide range of building materials to retail enterprise and channel customers.

Manufacturing – Under this vertical, Shankara operates through three wholly owned subsidiaries: Vishal Precision Steel Tubes & Strips (100% Subsidiary), Centurywells Roofing India (100% Subsidiary), Taurus Value Steel & Pipes (100% Subsidiary). These subsidiaries handle processing and manufacturing of value-added products such as precision tubes, roofing sheets and steel pipes.

Shankara Building Products Ltd has undertaken a strategic decision to demerge its business into two distinct verticals i.e Marketplace and Manufacturing. This move aimed at unlocking value and enhancing business focus. Further details regarding this demerger will be discussed in the later part of this notes

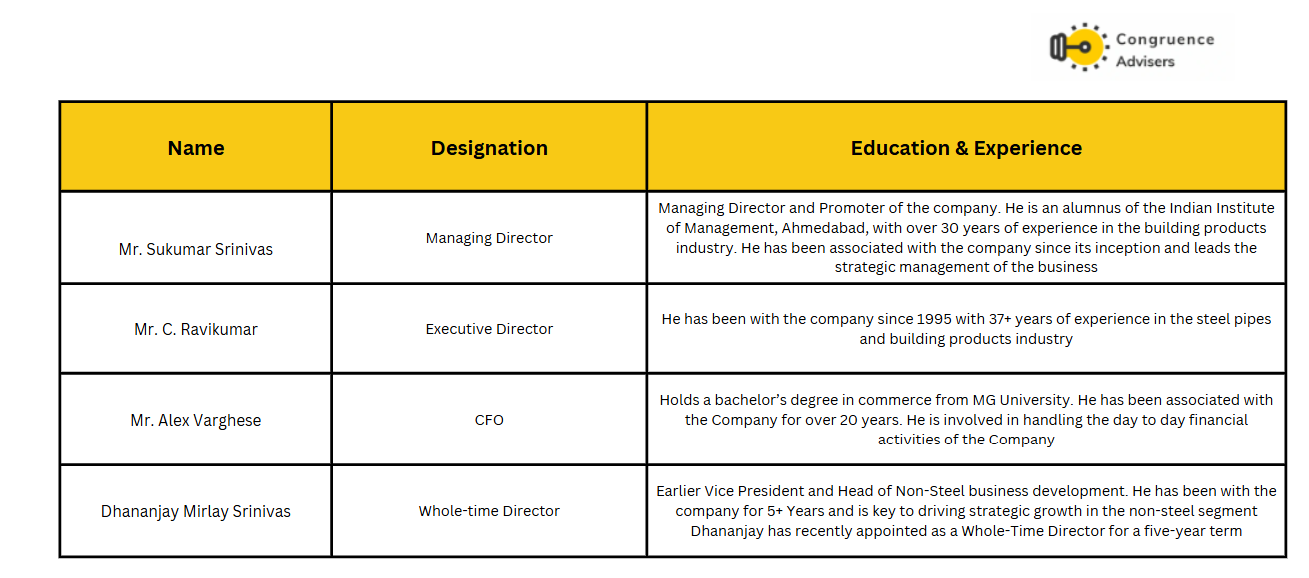

Shankara Building Products Ltd Management Details

Mr. Sukumar Srinivas is the Founder and Managing Director of Shankara Building Products Ltd and a first-generation entrepreneur with a deep-rooted legacy in the building products industry. He is an alumnus of the IIM, Ahmedabad and holds a bachelor’s degree in commerce from Loyola College, Chennai (University of Madras). With over four decades of experience Mr. Srinivas has been at the helm since the company’s formal inception in 1995, when it was incorporated as Shankara Pipes India Private Limited.

Before founding Shankara, Mr. Srinivas gained industry experience at Gemini Steel Tubes Limited and was also a partner in Shankara Agencies and Shankara Steel and Tubes. He has actively contributed to the industry ecosystem and is the immediate past President and a continuing office bearer of the Karnataka Pipe Dealers Association.

A pivotal moment came in FY2010. When he spearheaded the Shankara Building Products Ltd transition toward a retail-led & customer-centric model. His vision was to create a one-stop shop for home-building and improvement needs. Driving Shankara Building Products Ltd to expand into a wide range of product categories and establish a strong pan-South India retail footprint. Under Mr. Srinivas’s stewardship Shankara Building Products Ltd has transformed from a regional steel tube trading business into one of India’s leading organised retailers of home improvement and building materials under the Shankara Buildpro brand.

Mr. Dhananjay Mirlay Srinivas son of Mr. Sukumar Srinivas has been appointed as a Whole-Time Director of Shankara Building Products Ltd for a five-year term beginning May 16, 2025. Earlier served as Vice President at Shankara Building Products Ltd. He plays an instrumental role in driving strategic growth particularly in the non-steel segment which has become an important area of focus for Shankara Building Products Ltd’s future expansion. Mr. Sukumar Srinivas has publicly indicated Dhananjay as his successor.

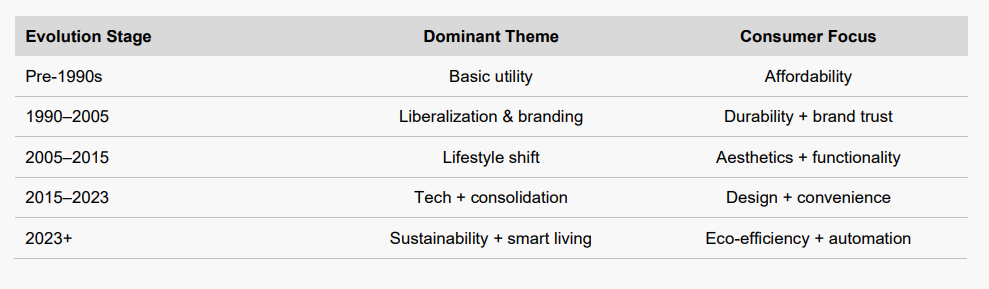

Shankara Building Products Ltd – Industry Landscape

India building products industry which is currently dominated by unorganized and small mom-&-pop retail stores. The building materials market is estimated at Rs. 10-12 lakh cr in FY23, of which 38% or roughly Rs. 3.8-4.5 lakh cr is through the organized retail network. This provides a massive growth opportunity for Shankara Building Products Ltd which enjoys a first mover advantage of establishing a retail chain in this industry.

The building products sector in India has gone through different phases in its journey so far

Source – Axis Securities

Phase 1: Foundation Phase –

- Dominated by basic construction needs- bricks, cement, traditional tiles

- Highly unorganised and fragmented markets

- Limited choices

- Large players – Hindware, Kajaria

Phase 2: Liberalisation –

- Economic liberalisation opened up to private and foreign players

- Rise in urban housing demand, start of retail penetration in tiles, sanitary ware and hardware

- Introduction of branded products in tiles – Kajaria, Somany

- Growth in real estate and organised manufacturing picks up pace.

Phase 3: Aspirational Growth –

- Rapid urbanisation and real estate boom

- Surge in retail formats like hardware and home improvement stores

- Rise of branded wooden panels and laminates (Greenply, Century Plyboard)

- Bathware became aspirational, and tiles evolved from utility to design-centric

- Emergence of modular kitchens and furniture, driving demand for MDF, plywood and particle boards

Phase 4: Innovation and Consolidation –

- Entry of private equity and IPOs (Prince Pipes, Cera, etc.)

- Growth of tier 2 and tier 3 as new consumption hubs

- Expansion of digital platforms and B2B aggregators

- Companies investing in automation and technology

Phase 5: Smart and Sustainable

- Omnichannel buying experience – Online and in-store/ digital ordering

- Shift towards value-added, modular and customizable products

- Government initiatives like PMAY, Jal Jeevan Mission, and Smart Cities are stimulating new product categories

- India is becoming a manufacturing and export hub for tiles, pipes, and laminates

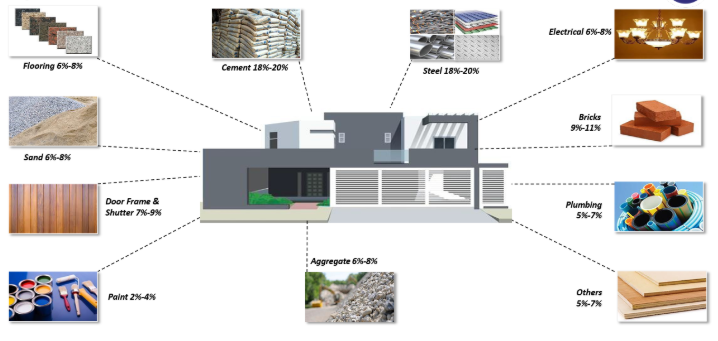

Overall building material market landscape – Traditional and modern building materials

Traditional building materials – such as mud, timber, clay bricks, slate and straw have been used for centuries and are among the oldest and most well-known substances in construction. These materials are typically sourced from nature and are often region-specific.

Modern building materials are innovative, engineered to offer enhanced durability, aesthetics and functionality. These include paints & coatings, wood products like laminates, metal-based materials, glass, plumbing fittings, HVAC systems, sanitary ware and industrial chemicals. They are increasingly preferred in contemporary construction for their performance, consistency, and adaptability to advanced architectural needs.

Building Material Cost Composition – Indicative Breakdown

In a typical building construction, cement and steel make up the largest share of material costs, each contributing around 18–20%. Other key components include bricks, doors, flooring, and electricals, each adding 6–11% to the total cost. Paint and plumbing are smaller cost heads but still essential. This cost split highlights the importance of tracking input prices when evaluating building material companies.

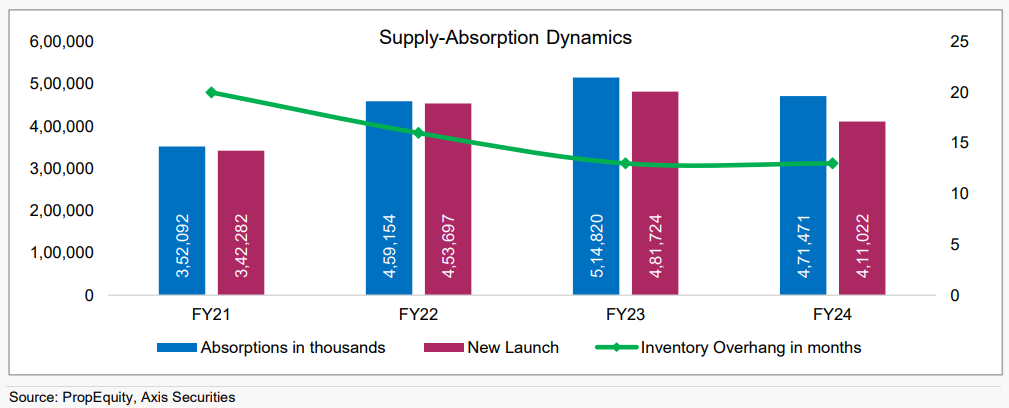

Real Estate and Home Improvement Product Demand Correlation

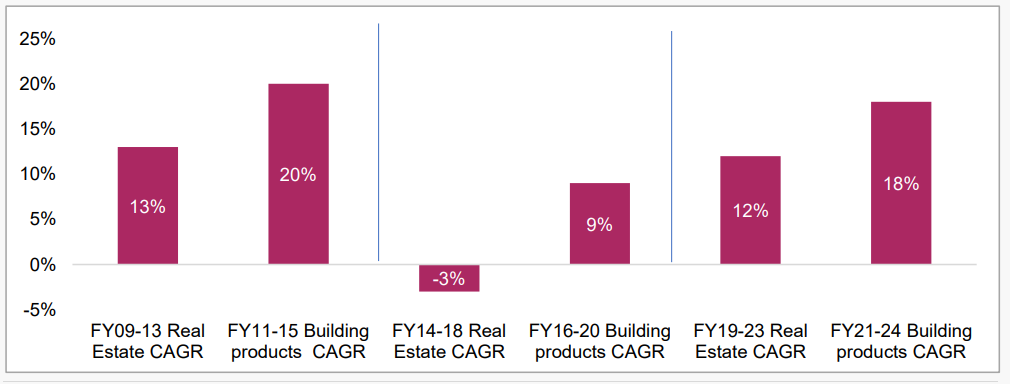

The building materials sector typically lags the real estate cycle by about two years, with demand picking up after peak home absorptions. Absorptions rose sharply in FY22 and FY23, pointing to a likely recovery in materials demand. However, the expected uptrend in FY25 has been slightly delayed due to election-related liquidity issues, lower government capex, and shifting consumer preferences like travel. Still, the overall cycle suggests a revival is on the horizon.

Time Lag Between Real Estate Cycle & Building Materials Pick-Up

As observed, the building material sector typically exhibits a time lag of ~2 years relative to the real estate cycle and tends to deliver a higher growth CAGR. In most scenarios, construction activity begins only after obtaining approvals, securing financing and completing planning stages. Products such as tiles, bathware and other finishes are among the final purchases in the construction timeline. These categories often demonstrate strong growth when real estate demand begins to plateau, reflecting their position at the tail end of the construction cycle

The Indian building products sector is set for strong demand recovery from FY26 following the real estate upcycle with its typical lag. Despite some softness in FY25 due to elections and liquidity issues, factors like 10-year low unsold inventory, rising housing absorption and large government schemes (PMAY, Jal Jeevan, Smart Cities) are driving broad-based demand across categories. Infrastructure spending continues to support early-cycle materials like cement and steel while finish material demand is steadily picking up.

The Indian building materials industry is undergoing a significant transformation with premiumization playing a pivotal role in shifting consumer preferences from unorganised to organised sectors. This trend is particularly evident in the plywood and sanitaryware segments, where consumers increasingly seek high-quality, durable, and aesthetically appealing products.

Shankara Building Products Ltd Business Details

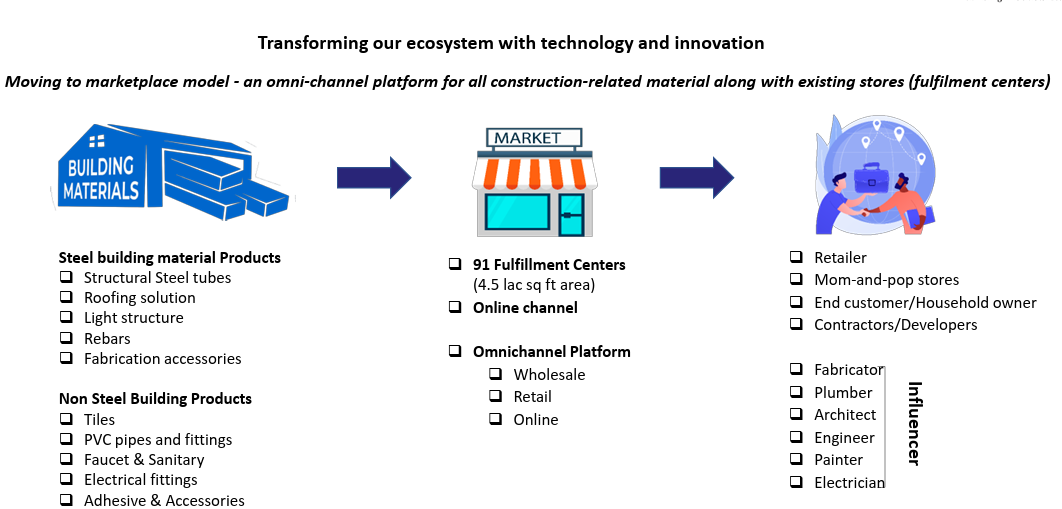

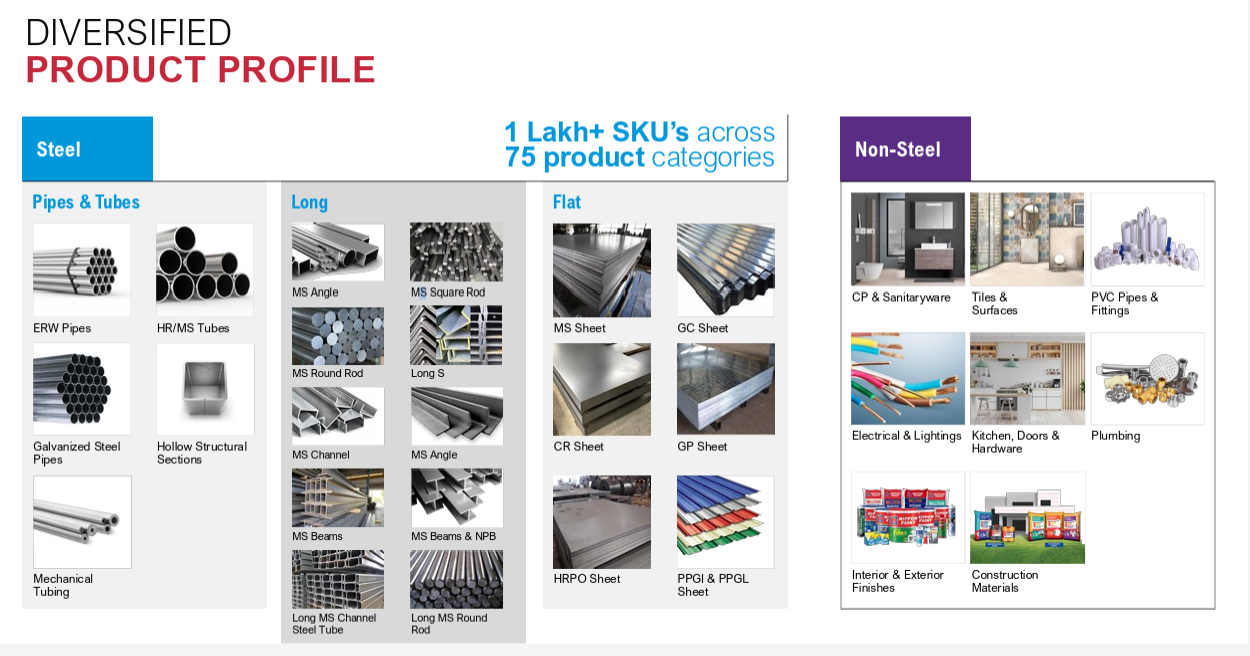

Shankara Building Products Ltd operates as a leading organised retailer of home improvement and building products in India under the “Shankara BuildPro” brand. Shankara Building Products Ltd business model is multi-channel, categorised into retail, enterprise, and channel segments offering a vast portfolio of over 1 Lakh+ SKUs including steel and non-steel products. They serve a diverse customer base from homeowners to industries through an omni-channel marketplace model that leverages both physical stores and an online presence

Shankara Building Products Ltd also has its manufacturing business primarily focused on processing steel products such as pipes, tubes, colour-coated roofing sheets, and bright rods, which are sold under their own brands. Historically, this segment has faced challenges due to steel price volatility and working capital impacts leading to a strategic scaling down of operations

Shankara Building Products Ltd operates under three primary business segments –

Retail Segment – Shankara Building Products Ltd is among India’s leading organized retailers in the Home Improvement and Building Products space operating under the well-recognized trade name “Shankara Buildpro”. The retail business continues to be the largest contributor to the Shankara Building Products Ltd’s overall revenues. In FY2025 Retail revenue stood at ₹2,943 Cr accounting for approximately 52% of total sales. The EBITDA margin for this segment was 5.72%.Shankara Building Products Ltd’s retail network spans approximately 5 lakh sq. ft., with an average store size of ~5,500 sq. ft., offering a wide assortment of steel and non-steel building materials to individual homeowners and small contractors.

Target Audience: Individual homeowners, professional customers, small contractors, architects, and home improvement seekers.

Product Offering: A vast assortment comprising over 1 Lakh SKUs across 100+ brands, including both in-house and third-party offerings.

Retail Model Strengths: One-stop solution for a wide range of building products, Strong backend capabilities via owned warehousing and logistics infrastructure, Trusted brand with efficient sourcing, Scalable operations with low-cost retail footprints

Enterprise Segment

This segment caters to large end-users like contractors and OEMs who require tailored solutions and stricter adherence to quality standards and specifications. In FY2025, sales from the enterprise segment amounted to ₹1,225.00 crore. Shankara Building Products Ltd supports this segment with its integrated processing facilities with customization and consistency in quality.

Channel Segment

The channel business serves dealers and other retailers through the Shankara Building Products Ltd’s branch network. In FY2025, the segment recorded revenues of ₹1,528.32 crore.

This segment provides the company with deep market intelligence and helps it stay aligned with evolving demand trends especially in tier-2 and tier-3 markets.

Operations and Infrastructure

Processing Capabilities – Shankara Building Products Ltd operates 14 processing units, primarily focused on:

- Profiling of roofing sheets and accessories

- Manufacturing of precision steel tubes (at two dedicated units)

These facilities help ensure product customization, value addition, and support for the enterprise segment’s quality-centric demands.

Supply Chain & Warehousing

- Shankara Building Products Ltd operates ~6.7 lakh sq. ft. of warehousing space, mostly owned.

- Warehouses serve as critical nodes for inventory storage and last-mile delivery.

- Shankara Building Products Ltd also owns a fleet of trucks, largely used for short-distance deliveries, enabling timely fulfillment and operational flexibility.

These numbers have been calculated by us by piecing together various data points shared by management across press releases and investor conference calls.

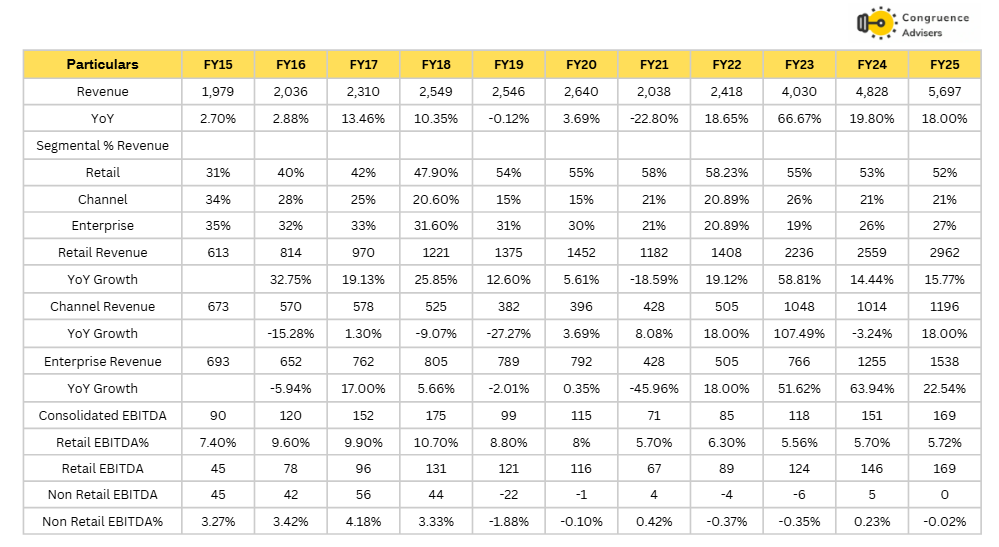

Retail Segment – Core Growth Engine with Superior Unit Economics

The retail segment has evolved into Shankara Building Products Ltd’s growth engine with its contribution to total revenue rising from 31% in FY15 to 52% in FY25. Shankara Building Products Ltd’s retail revenue has grown at a 10-year CAGR of ~17% supported by store expansion, increased SKU depth and a broader product mix including non-steel categories.

The retail EBITDA% has consistently stayed above 5%, while it has peaked at 10.7% in FY18 and currently is at 5.72% in FY25 post the Shankara Building Products Ltd’s transition to a low-price, cash-driven strategy. The segment continues to offer strong visibility, backed by product mix, in-house brands and working capital efficiencies.

Channel & Enterprise Segment – Low Margin, Volume-Driven Businesses

The channel and enterprise businesses together classified as non-retail contribute around 48% of FY25 sales, their EBITDA performance has remained sub-optimal often hovering around break-even levels. In FY25 non-retail EBITDA stood at just ₹0.5 crore, translating to a margin of -0.02% reflecting the inherently thin-margin, working capital-intensive nature of these B2B segments.

Within these, the enterprise segment has shown strong recovery post FY21, growing from ₹428 crore to ₹1,538 crore over four years, reflecting increased traction from large institutional buyers and OEMs. However, this growth has not meaningfully translated into improved profitability due to higher cost of fulfilment and processing complexity.

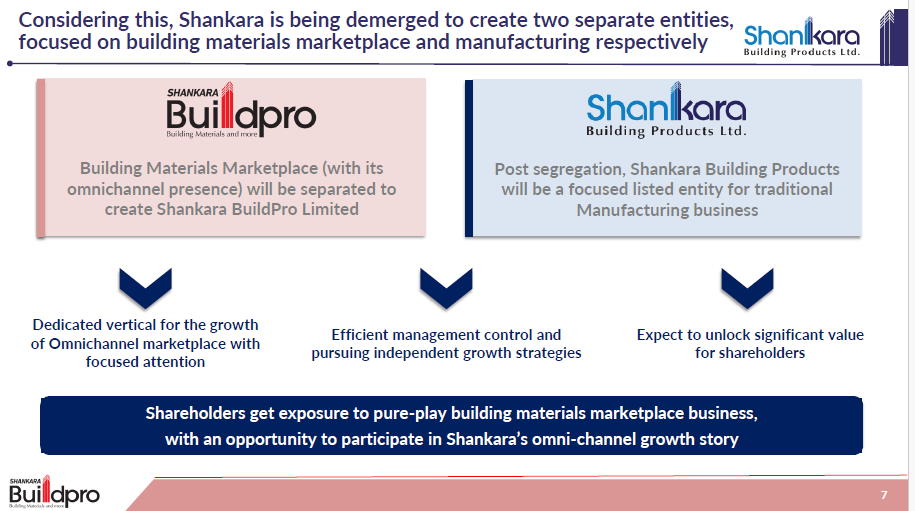

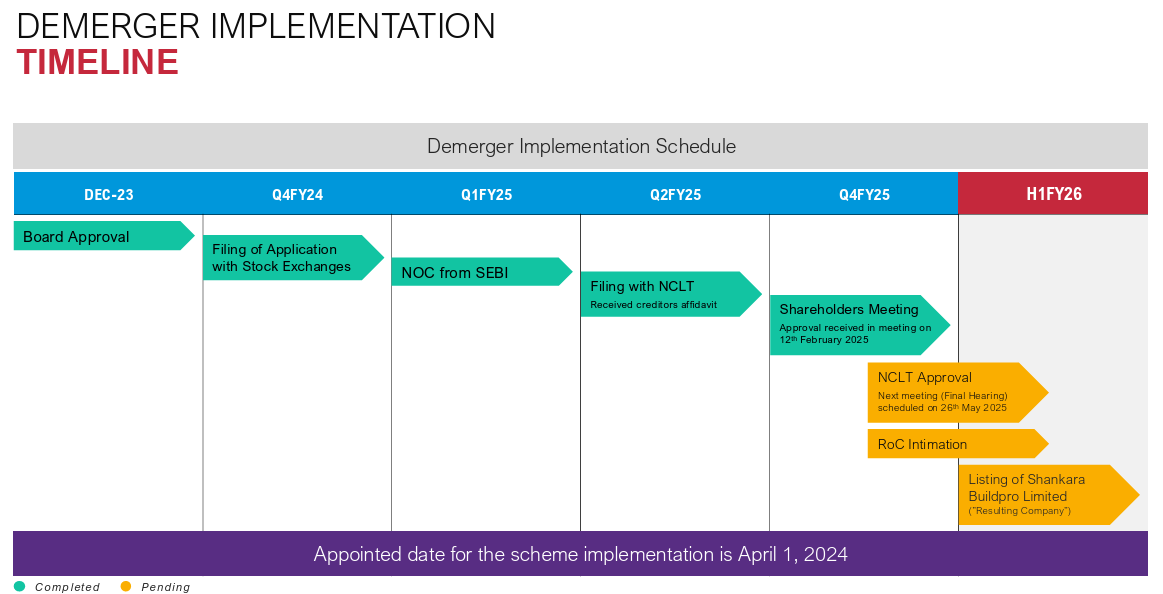

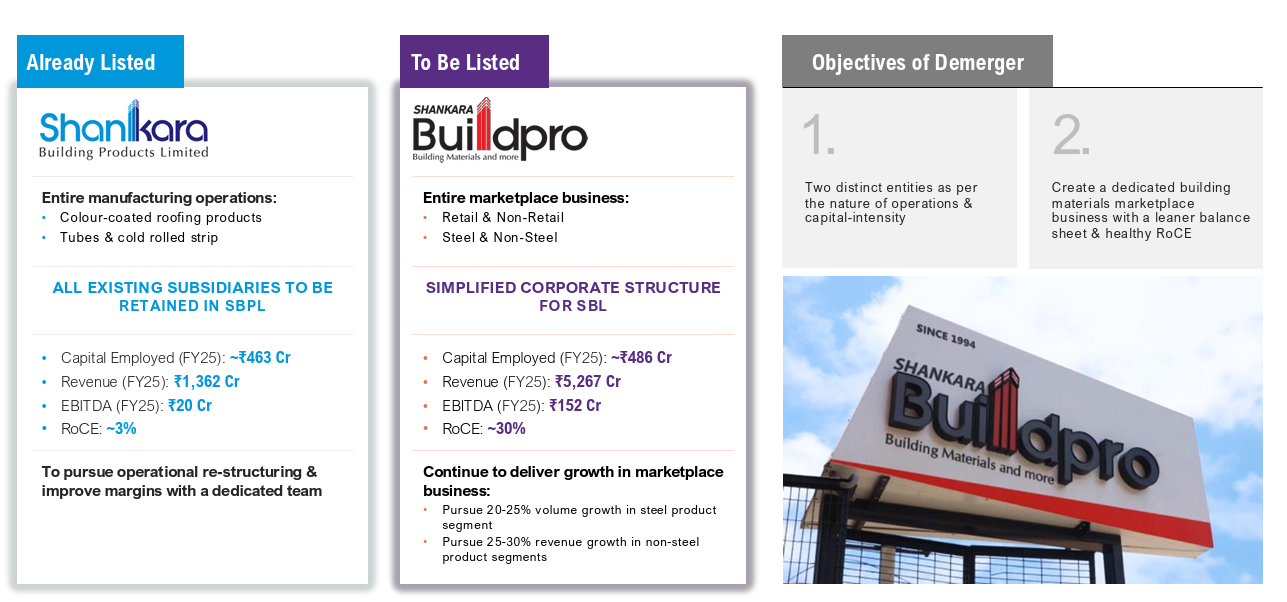

Demerger of Marketplace and Manufacturing Business

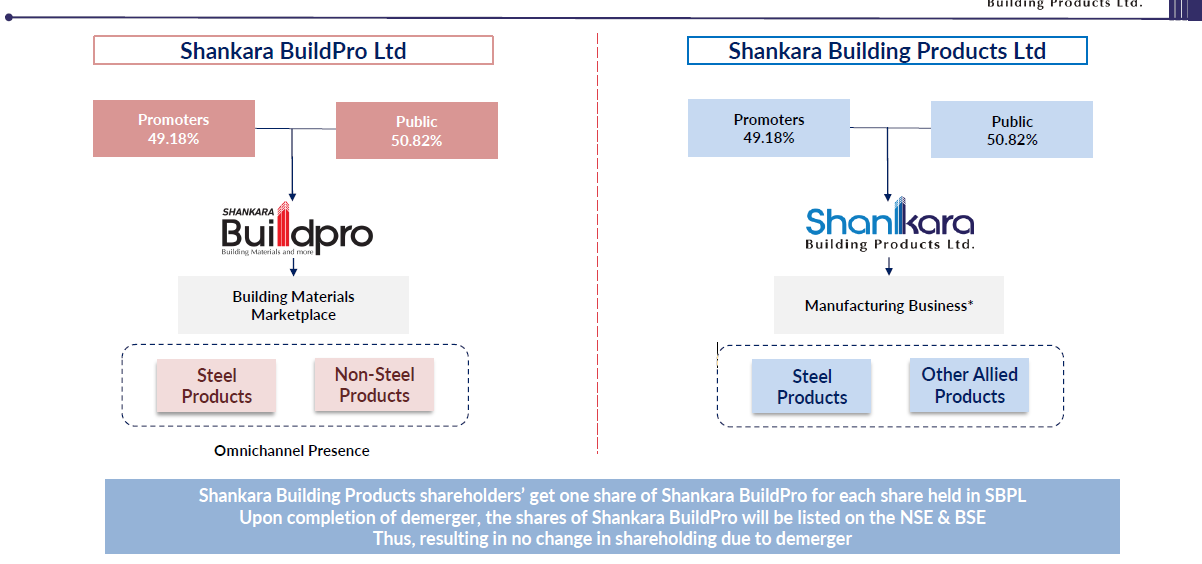

Shankara Building Products Ltd has proposed a strategic demerger of its operations into two distinct entities:

- Shankara Buildpro Ltd – To house the core retail and distribution (marketplace) business

- Shankara Building Products Ltd – To retain the manufacturing operations through its subsidiaries

The core rationale for the demerger lies in creating a simpler, more focused organisational structure that can independently unlock the value of each business vertical.

The retail business which has consistently demonstrated strong fundamentals, a robust omni-channel presence and a superior return on capital employed profile will benefit from greater visibility and focused resource allocation post-demerger. The new structure will allow for efficient capital allocation towards this high-ROCE segment enabling it to scale more rapidly in a structurally growing home improvement and building products market.

In parallel, the manufacturing business which includes steel tube and roofing profile manufacturing has underperformed in recent years. The separation is expected to provide dedicated management focus and operational autonomy to this vertical, improving its chances of a turnaround.

Additionally, the demerger is expected to:

- Simplify financial reporting and improve transparency for investors

- Allow both businesses to pursue distinct strategic goals aligned with their respective industry trends

- Optimize cost structures and capital deployment based on business-specific needs

- Enable better benchmarking with peers and clearer communication of performance metrics

The company has filed the scheme of arrangement with the stock exchanges. The approval process is continuing and is nearing final stages of approval.

As per the scheme of arrangement, it is proposed that the existing shareholders of Shankara Building Products Limited will be allotted 1:1 shares in the resultant entity as per the statutory norms.

The marketplace segment is the dominant value driver. With strong operating leverage, it generates high returns (~30% RoCE) and accounts for over 85% of group EBITDA. Management targets 20–25% volume growth in steel and 25–30% growth in non-steel products which indicate confidence in scaling the platform model.

The manufacturing segment is relatively capital-intensive and currently delivers modest returns. With only ~3% RoCE and EBITDA of just ₹20 crore on a revenue base of ₹1,362 crore, this unit is undergoing operational restructuring to improve margins. The presence of a dedicated team post-demerger is aimed at sharpening focus on cost control and asset productivity.

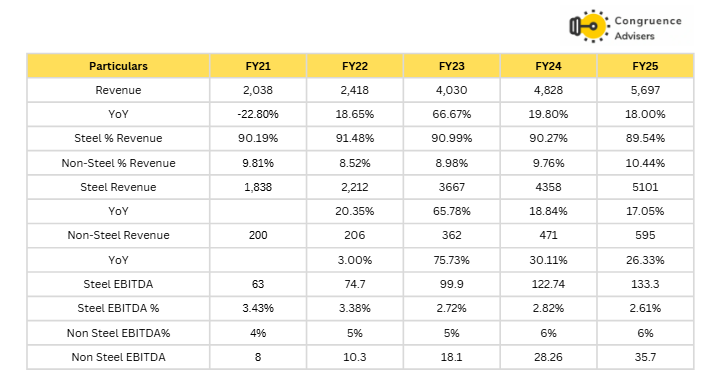

Steel vs Non Steel Segments

With the increasing scale of Shankara Building Products Ltd’s marketplace-led retail model, they have started to classify the company’s operations into two core business segments:

(i) Steel Products and (ii) Non-Steel Products.

- Steel Products: This segment comprises pipes, hot-rolled (HR), cold-rolled (CR), and galvanized plain (GP) sheets under flat products, as well as long products such as construction steel, angles, channels, beams, and roofing materials.

- Non-Steel Products: This segment includes sanitaryware, tiles, PVC pipes and fittings, electrical items, paints, and other building accessories.

Shankara Building Products Ltd has historically been a steel centric business with steel products accounting for over 90% of revenues across FY21 to FY25. However Shankara Building Products Ltd has made tangible efforts to diversify its product mix with non-steel revenues increasing from ₹200 crore in FY21 to ₹595 crore in FY25. While steel continues to dominate the top line contributing 89.56% of total revenues in FY25 the non-steel vertical’s contribution has gradually improved to 10.44%. More importantly, the non-steel segment has a stronger margin with EBITDA% at 6% in FY25 compared to the steel segment’s margin compression of 2.6% .

The steel segment clearly remains a low-margin and commoditized business and faces issues like increased competitive intensity, pricing volatility and cost pass-through limitations.

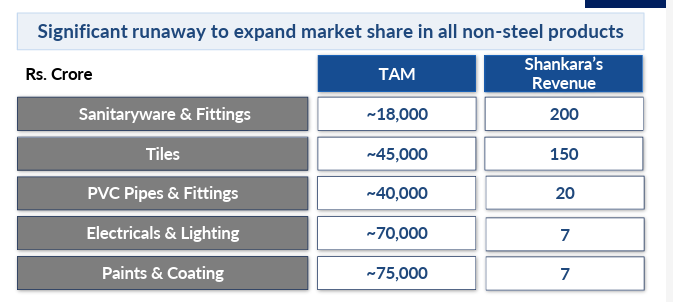

While non-steel products including tiles, sanitaryware, plumbing, electricals and paints offer higher value addition, brand stickiness and better gross margin structures relatively

Shankara Building Products Ltd’s non-steel EBITDA rose 4.5x from ₹8 crore in FY21 to ₹35.7 crore in FY25 demonstrating the superior unit economics and scalability of this portfolio. With a growing contribution from higher-margin categories the non-steel segment is expected to be a key driver of long-term margin expansion and retail differentiation.

Key Private Labels and In-House Brands

Shankara Building Products Ltd has developed a portfolio of private labels and in-house brands to enhance its control over product quality, customer experience and gross margins. These brands span across both steel and non-steel product categories.

Non Steel Brands

- Fotia Ceramica: For Ceramic & Adhesive, Launched in FY2023, The brand gained early traction with ₹116 crore in sales in FY2024 and has gross margin of 12% and EBITDA margin of 7%. The Fotia portfolio was expanded in FY2025 to include Quartz sinks and adhesives, aimed at increasing SKU depth in non-steel, high-value segments.

- Vaigai Sanitation: Focused on sanitaryware and fittings

Steel Brands

- Taurus: An early in-house brand focused on steel products, Taurus is positioned as a reliable supplier of construction materials. It was launched in FY2015 alongside Prince Galva Plus and Loha, as part of Shankara Building Products Ltd’s initial private label push in structural steel and pipes.

- Ganga and Centurywells: These are legacy brands in the roofing and construction accessories space and have strong recall in southern India markets.

- Vishal Tubes & Pipes: A brand associated with premium tubes and steel applications, backed by Shankara Building Products Ltd’s manufacturing capabilities via its wholly owned subsidiary Vishal Precision.

Shankara Building Products Ltd has a significant growth runway in the non-steel building materials segment with minimal current revenue contribution across large addressable markets. Categories like paints, electricals, pipes, tiles and sanitaryware together represent a TAM of over ₹2 lakh crore while Shankara Building Products Ltd’s presence remains nascent indicating ample headroom for market share gains and business expansion.

Shankara Building Products Ltd Corporate Governance

Board Composition – Shankara Building Products Ltd maintains a reasonably well-structured board with 6 directors of which 4 are independent. The Chairman is also an independent director. The board demonstrates a diverse skill set, spanning finance, private equity, marketing, taxation, production planning and retail management.

Related Party Transactions – Shankara Building Products Ltd has no material related party transactions. Most related party dealings are with its wholly-owned subsidiaries and are operational in nature.

Remuneration of KMP – The total compensation drawn by KMPs in FY25 is > ₹3 Cr, which is approx 4% of Shankara Building Products Ltd’s reported PAT.

Contingent Liabilities – Shankara reported contingent liabilities of approximately ₹2.9 crore which are immaterial relative to Shankara Building Products Ltd ’s balance sheet size and pose no significant risk to earnings visibility or solvency.

Dividend Track Record – Shankara Building Products Ltd has maintained a consistent dividend payout policy since listing, with the exception of FY21, which due to pandemic.

Audit Committee – The Audit Committee is chaired by an independent director and comprises a majority of independent members in line with governance norms. However, the promoter’s presence on the Audit Committee, while permitted, may raise questions on the independence of oversight mechanisms.

Shankara Building Products Ltd Financial Performance

Shankara Building Products Ltd delivered strong volume growth in FY25 despite a tough environment for the steel sector where falling steel prices hurt realizations and impacted overall revenue. Shankara Building Products Ltd recorded 29% YoY growth in steel volumes, crossing 8.43 lakh tons, aided by robust demand for structural steel tubes and pipes, an expanding distribution network and geographic growth in Western and Central India, while maintaining leadership in South India. However, due to an ~11% decline in steel HRC prices, revenue growth lagged volume growth revenue grew 17% for FY25.

The non-steel segment grew 26% YoY in FY25 and now contributes 10.6% of total revenues crossing 10% share for the first time. E-commerce sales also picked up sharply to ₹15 cr in FY25 (from ₹5 cr in FY24), showing early signs of traction. Shankara Building Products Ltd remains focused on achieving 1 million tons volume in FY26 and is committed to expanding both steel and non-steel businesses with a focus on new geographies, product categories, and brand tie-ups.

Full-year EBITDA margin at 3.02% was slightly down YoY due to inventory losses in the earlier quarters (~₹22 cr). With steel prices stabilizing Q4 saw no inventory loss/gain, giving a steady platform for FY26.

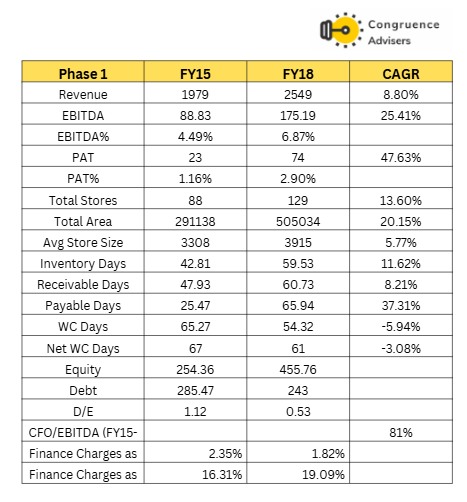

Over the last decade, Shankara Building Products has gone through two clearly defined business phases each driven by different strategies and market realities.

Phase 1 (FY15–FY18)- Fast Growth & Retail Expansion Post IPO

During this phase Shankara Building Products Ltd focused aggressively on expanding its retail presence across South and West India. It launched its IPO in FY17 at ₹460/share, raising ₹345 Cr primarily to give exit to its PE investor (Fairwinds) and fund expansion. Though a larger ₹250–300 Cr QIP was planned later for acquisitions and store growth it couldn’t go through due to weak market conditions.

Still, Shankara Building Products Ltd grew rapidly –

- Revenues grew from ₹1,979 Cr to ₹2,549 Cr.

- EBITDA nearly doubled from ₹89 Cr to ₹175 Cr.

- PAT grew more than 3x to ₹74 Cr.

- Profit margins improved from 1.2% to 2.9%.

- Store count rose from 88 to 129 in just 3 years.

Overall, this phase was all about gaining market share, increasing scale, and building a strong retail brand.

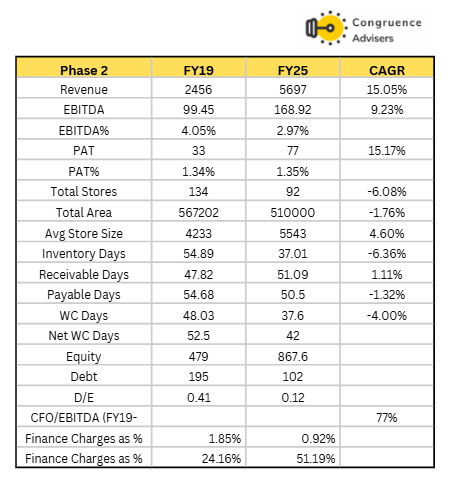

Phase 2 (FY19–FY25) – Focus on Cash, Efficiency & Balance Sheet Strength

Post FY18, Shankara Building Products Ltd shifted gears. With rising competitive pressure, especially from value-focused local players, Shankara Building Products Ltd reworked its strategy. Instead of chasing topline growth through new stores, it focused on increasing sales from existing stores by offering value pricing and reducing credit risk.

Key decisions included –

- Cutting down on credit sales and focusing on cash-based transactions.

- Offering more competitive prices to attract footfalls.

- Reducing store count from 134 (FY19) to 92 (FY25) to improve per store efficiency.

- Improving working capital and cash flow management.

During this phase Shankara Building Products Ltd divested a key non-core asset Taurus Value Steel & Pipes Pvt. Ltd. to APL Apollo for ~₹70 crore. Shankara Building Products Ltd has also raised ₹90 crore through a preferential allotment to APL Apollo Group. This not only unlocked working capital but also helped reduce overall debt.

Even with fewer stores, revenue growth picked up to 15% CAGR reaching ₹5,697 Cr by FY25. However, EBITDA margins dropped to below 3% due to more discounting and a focus on volumes over margins. Still, PAT growth held up well at 15% CAGR, mainly due to lower debt and better cost control. Working capital days came down and Shankara Building Products Ltd turned almost debt-free with D/E at just 0.12.

Despite having a relatively low level of long-term debt on its balance sheet, Shankara Building Products Ltd has been incurring elevated finance costs over the past few years primarily due to bill discounting for cash discounts. In FY25, Shankara Building Products Ltd discounted around ₹400 crore worth of receivables which added to its interest burden. Additionally, in Q1 FY25, Shankara faced a liquidity crunch due to a slowdown in government payments post the general elections an issue that lingered through Q2 and Q3. To manage operations. Shankara Building Products Ltd had to depend on high-cost short-term borrowings. Although the situation eased in Q4, the finance cost for the year had already spiked. Management is now focusing on improving the working capital cycle and is in advanced discussions with NBFCs to offload part of its receivables which could help reduce interest costs going ahead.

Shankara’s Phase 1 was about building scale and reaching more customers, a classic post-IPO growth story. Phase 2 on the other hand reflects maturity where the focus shifted to sweating existing assets, protecting balance sheet health and generating cash. While margins have compressed, revenue scale and cash flows have improved. Which has laid the foundation for a more stable and disciplined retail model going forward.

Shankara Building Products Ltd Comparative Analysis

To understand Shankara Building Products Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Mold-Tek Packaging Ltd to its competitors (peer comparison) on various fundamental parameters and Shankara Building Products Ltd share performance relative to relevant benchmark and sector indices.

Shankara Building Products Ltd Peer Comparison

Shankara Building Products Ltd operates in a highly fragmented building materials market where competition comes not only from small unorganised local players but also from emerging organised platforms. While there are no exact like for like competitors several vertical specific or region-focused players compete with Shankara across various product categories.

SG Mart – Backed by the APL Apollo Group, SG Mart is positioning itself as a super wholesaler. It operates largely in the wholesale space, unlike Shankara Building Products Ltd which follows a hybrid model of both retail and enterprise/channel sales. While SG Mart is still scaling up, its strong backing, pricing power, and focus on bulk volumes could cause pressure for Shankara’s wholesale vertical over time. While Shankara Building Products Ltd’s management has clarified that its engagement with SG Mart is more symbiotic than competitive. SG Mart occasionally acts as a super-distributor supplying products to Shankara in select regions when direct procurement is not immediately feasible. While Shankara primarily sources directly from manufacturers, it leverages SG Mart as a stop-gap supplier in certain territories.

Other Marketplace Players (e.g. Infra.Market, Industrybuying) – These are tech-first platforms that offer a wide range of building materials with integrated logistics, credit and procurement solutions for contractors and institutional buyers. While they don’t directly compete in retail they pose a growing threat in the B2B segment especially due to their use of data and tech to undercut traditional players on price and efficiency.

Shankara Building Products Ltd differentiates itself in the fragmented building materials market through its unique hybrid model combining a strong network of branded retail stores with a diversified B2B. This allows Shankara Building Products Ltd to control customer experience, build brand loyalty and mitigate demand fluctuations across segments. Its long-standing relationships with channel partners in the wholesale space ensure business stickiness even amid pricing pressures. Further its partial manufacturing integration, owned logistics and warehousing provide cost and margin advantages over smaller peers. Shankara Building Products Ltd’s growing digital footprint led by its e-commerce platform buildpro.store adds a scalable & tech enabled sales channel to supplement offline reach. Shankara Building Products Ltd has concentrated footprint across South India and a cluster-based expansion strategy.

Shankara Building Products Ltd Index Comparison

Shankara Building Products Ltd share performance vs S&P BSE Small Cap Index, as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why you should consider investing in Shankara Building Products Ltd ?

Experienced Leadership and Strong Market Position – Shankara Building Products Ltd benefits from the group’s longstanding presence of over three decades in the building materials industry and led by industry veteran Sukumar Srinivas who brings over decades of experience in the building materials space. Shankara Building Products Ltd has established itself as a leading organised retailer with a presence across 10 states and 1 union territory. Its strong ties with top-tier suppliers offer preferential product access and pricing advantages. Additionally Shankara Building Products Ltd’s customer first approach including loyalty programs for key influencers like contractors and plumbers helps drive repeat business and strengthens its market position. The presence of a well-laid succession plan and a capable second line of management further adds confidence in the Shankara Building Products Ltd’s long-term sustainability and execution strength.

Strategic Shift Towards Higher-Margin Non-Steel Products – Shankara Building Products Ltd is moving beyond its legacy steel trading business and shifting focus to higher-margin, non-steel categories. In FY25 Non-steel products contributed over 10% of total revenue and grew at higher growth rates. Shankara Building Products Ltd’s in-house brand Fotia Ceramica generates healthy gross margins of 12-15% with EBITDA% of 7%. This shift is expected to lift overall EBITDA margins, given non-steel segments enjoy margins compared to steel.

Strong Omni-Channel Presence – With a pan-South and West India network of 124 retail outlets and fulfilment centers Shankara Building Products Ltd enjoys strong brand visibility and customer access. Shankara Building Products Ltd is also investing in digital channels through its Buildpro website and mobile app. Online revenue grew threefold from ₹5 crore in FY24 to ₹15 crore in FY25. This omni-channel model allows it to tap both digital discovery and physical “touch-and-feel” preferences in building materials.

Upcoming Demerger Could Unlock Shareholder Value – Shankara Building Products Ltd is demerging its business into two focused verticals i.e Manufacturing business and Marketplace business (to be housed under Shankara Buildpro Ltd).

This move is aimed at sharper operational focus and better capital allocation. The marketplace business with its asset-light and tech-driven model is expected to generate a ROCE of over 30% which will make it a potentially high-return vertical.

What are the Risks of Investing in Shankara Building Products Ltd ?

Investors need to keep the following risks in mind if they choose to invest into this business. Risks needs to be weighed in combination with the advantages listed above to arrive at a decision that is optimal for your portfolio construct

Commodity Price Volatility and Margin Pressure – A significant part of Shankara Building Products Ltd’s revenue i.e. 90% comes from steel related products, making it vulnerable to fluctuations in steel prices. These price swings can squeeze margins and cause customers to delay purchases, hoping for better rates. For instance, Shankara Building Products Ltd saw a hit of profitability due to such volatility. It also had to take a one-time inventory write-down recently triggered by a sudden drop in steel prices. In a business that operates on thin margins of around 2-3% such sharp price movements pose a meaningful risk to both earnings stability and inventory management.

Geographic Concentration Risk – Shankara Building Products Ltd generates a large share of its revenue from South India particularly Karnataka. This regional dependence exposes Shankara Building Products Ltd to localized economic slowdowns or disruptions (e.g monsoon failure, political instability & regulatory changes). While management has started expanding across western part of India still around 80% of revenue is from Southern markets.

Market Fragmentation and Intense Competition – India’s building materials industry remains highly fragmented and dominated by unorganised players resulting in fierce competition especially from small & local businesses with low overheads and flexible pricing. This makes it difficult for players like Shankara Building Products Ltd to protect market share and sustain margins or build a strong brand moat. Additionally Shankara Building Products Ltd faces increasing competition from both emerging players and deep-pocketed corporates. For instance SG Mart (backed by APL Apollo) is aggressively expanding in the wholesale segment while large groups like Birla and Dalmia are also entering the online market place space. The entry of such well-funded players poses a strategic threat especially given Shankara Building Products Ltd blended retail-wholesale model and already-thin margins.

High Interest Cost – Although Shankara Building Products Ltd reports a relatively low borrowing figure of around 72 Cr the actual working capital requirement is much higher due to bill discounting. In FY25 Shankara Building Products Ltd discounted around ₹400 Cr worth of receivables taking the total borrowing + discounting to approximately ₹470 Cr. This heavy reliance on discounting pushes up interest costs which eats into margins. To address this management is working with NBFCs to directly discount receivables from end customers. However, until this structure is fully implemented, high finance costs will likely persist despite the low net debt on paper.

Susceptibility to Economic Cycles – Shankara Building Products Ltd’s business is closely tied to the real estate and home improvement sectors both of which are cyclical in nature. Any slowdown in construction activity or discretionary home renovation spends could impact the Shankara Building Products Ltd growth numbers.

High Dependency on APL Apollo Group – Shankara Building Products Ltd generated 42% of its revenue from sourcing products from the APL Apollo Group, primarily in its channel and enterprise segments. While the relationship has strengthened over the years with offtake growing nearly 3-4x since APL Apollo Group’s strategic investment in Shankara post-COVID. The recent sale of APL Apollo Group’s stake raises concerns about the long-term alignment of interests.

Management maintains that the core business relationship remains strong and that the original partnership objectives have been fulfilled. However, the risk of strategic drift cannot be ruled out especially with APL Apollo Group’s’s own foray into B2B marketplace business via its SG Mart which could potentially compete with Shankara Building Products Ltd institutional business.

Recent Promoter stake sale – Recently Shankara Building Products Ltd Promoter Mr. Sukumar Srinivas has divested a 7.8% stake (19 lakh shares) through open market transactions worth ₹176 crore at an average price of ₹926.1 per share. Post this sale, promoter holding declined from 49.25% to 41.41%. The stake was picked up by reputed investors including Sageone Investment Managers LLP (led by Samit Vartak), Singularity Equity Fund I (Madhusudan Kela), Ace Infracity Developers and Riti Foundation.

While the stake sale raised some concerns regarding promoter commitment, it may also signal a conscious effort to broaden the institutional investor base.

Shankara Building Products Ltd Future Outlook

FY25 was marked by a challenging operating environment particularly in the steel segment due significant headwinds and meaningfully declining realizations. which weighed heavily on top line growth and profitability. The broader building materials industry also remained muted with demand impacted by election-related slowdown, reduced government spending, softer retail sentiment, heavy monsoons and sluggish construction activity.

Looking ahead Shankara Building Products Ltd management is optimistic about a rebound in FY26 backed by improving macros, upcoming infrastructure push and internal growth drivers such as non-steel category expansion, retail footprint addition and growing contribution from the digital platform.

Steel Business – Shankara Building Products Ltd is targeting over 1 million tons of steel volumes in FY26 with flat steel products contributing 200,000 tons. The steel segment is expected to grow at a 20–25% volume CAGR. Management is guiding for EBITDA margins of 2-3% consistent with the trading nature of the business.

Non-Steel Segment – Shankara Building Products Ltd is guiding for 25-30% growth in FY26 for its non-steel portfolio led by categories like sanitaryware, tiles and private-label products such as Fotia Ceramica. Over the next 2–3 years, Shankara Building Products Ltd aims to scale non-steel revenues to ₹1,000+ crore which will be a key margin driver. Segment-level EBITDA margins are expected to remain healthy at 6-6.5% supported by strong gross margins (12-15%) in private-label products and increasing mix of value-added offerings.

Retail vertical which remains Shankara Building Products Ltd’s core strength, is expected to post 25% revenue growth from the existing store base. Shankara Building Products Ltd Plans are in place to add 4–5 new outlets in FY26 targeting underpenetrated growth corridors in Andhra Pradesh, Telangana, North Karnataka, Kerala and Tamil Nadu.

The BuildPro e-commerce platform including web and mobile app is witnessing growing traction with online revenues tripling from ₹5Cr in FY24 to ₹15Cr in FY25. Shankara Building Products Ltd is aiming to cap finance costs at ₹11 Cr per quarter and management is working with NBFCs to directly discount receivables from end customers.

We believe the proposed demerger of the high-growth and high-ROCE retail business into Shankara Buildpro Ltd marks a pivotal strategic shift. The move will sharpen business focus, enhance transparency and allow for more efficient capital allocation. Backed by stable profitability, a scalable digital platform and strong brand equity. Shankara Buildpro Ltd is well-positioned to emerge as a long-term value creator.

Importantly, the demerger also enables the management to independently scale the marketplace model which stands to benefit from strong industry tailwinds and has a significant runway for growth. We believe Shankara Buildpro Ltd holds meaningful strategic and valuation potential. Post-demerger, Shankara Buildpro Ltd (marketplace business) is likely to command premium valuations while the manufacturing entity may trade closer to ~1x book value given its commodity nature. One need to keep in mind that the demerged entity i.e. Shankara Buildpro Ltd will take some time to be relisted and management has indicated that the process is on track.

Overall, we view this separation as a value-unlocking catalyst and remain particularly constructive on Shankara Buildpro Ltd marketplace-led franchise.

Shankara Building Products Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Shankara Building Products Ltd Price charts

Shankara Building Products Ltd daily chart shows a solid uptrend followed by consolidation, where the price has developed a consolidation pattern after a strong uptrend. The price is ranging between converging trendlines, reflecting short-term uncertainty following a steep rally. Resistance is around Rs 1,120 and support is at 980.

On the longer-term weekly chart, the Shankara Building Products Ltd stock recently achieved a major breakout above a multi-year resistance zone near 820 backed by a strong upward move. The historical chart structure shows a prolonged consolidation zone between Rs 480 and Rs 820 followed by this breakout confirming a potentially significant shift in trend. The current price action is consolidating above the previous range indicating bulls are attempting to establish a new higher base. 925 should be a very strong support level for weekly price. The next key weekly support level would be at 806.

Shankara Building Products Ltd Latest Latest Result, News and Updates

Shankara Building Products Ltd Quarterly Results

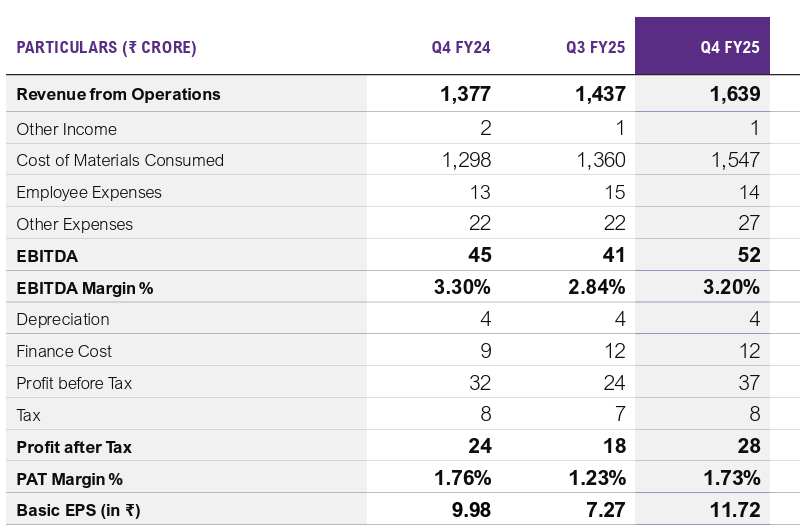

Shankara Building Products Ltd concluded Q4FY25 on a stronger footing. Shankara Building Products Ltd reported a net profit of ₹28 crores in the final quarter reflecting a 17% year-on-year growth driven by operational stability and improved cost control. A key positive in Q4FY25 was the stabilization in steel prices which helped avoid any inventory-related losses.

On the financing front despite an expanding scale of operations interest costs remained contained. Finance costs were highest in Q1FY25 but showed a consistent downward trend through the year. This also reflects early signs that Shankara Building Products Ltd’s efforts such as exploring partnerships with NBFCs to offload receivables.Going forward mgt expects finance cost of 11 Cr per Quarter.

Recently Shankara Building Products Ltd Promoter Mr. Sukumar Srinivas has divested a 7.8% stake (19 lakh shares) through open market transactions raising ₹176 crore at an average price of ₹926.1 per share. Post this sale, promoter holding declined from 49.25% to 41.41%. Which has led to reputed investors to the cap table including Sageone Investment Managers LLP (Samit Vartak), Singularity Equity Fund I (Madhusudan Kela), Ace Infracity Developers and Riti Foundation

Till previous Quarter APL Apollo Group held around an 8% stake in Shankara Building Products Ltd which it has since exited through open market sales. Which also raises some concerns. Management maintains that the core business relationship remains strong with the group.

While the promoter’s stake dilution raised some concerns initially it appears to be a strategic move to onboard reputed investors. This signals a shift towards a more market cap oriented mindset which indicates the promoter’s intent to improve market visibility and shareholder profile.

Final Thoughts on Shankara Building Products Ltd

Shankara Building Products Ltd. has built a robust building materials franchise over the years. With presence across building materials retail sales, channel sales and enterprise sales, it is addressing all kinds of customer cohorts. The company’s retail foray since 2010 has been very successful, driving higher EBITDA margins and ROCE for the company.

Recently, the company has started diversifying into non-steel products in the retail segment, which is giving it another leg of margin uplift. The entry into the non-steel building materials segment offers a large TAM but is not easy to capitalise on as several unsuccessful forays by building materials companies into non-core building material products have shown over the years. However, if Shankara Building Products Ltd. can push its captive retail customer base to buying all their building material products needs under roof as a one stop shop, then they can succeed in growing the non steel business quite well.

The demerger is obviously a very good value unlocking step by the management. The building materials market place company will be a high growth, asset light business and can command premium valuations. The stock price has moved sharply up since May 2025 and we believe it has covered most of the fair valuation gap that may have existed before that. However, the stock does not appear to be overvalued and we will be keenly waiting for the listing of the demerged company and find out about the true economics of the marketplace business.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this to a general audience. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will continue/be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.