Sharda Motor Industries Ltd, Incorporated in 1986, is a leading auto ancillary company which is into manufacturing of various auto components, mainly exhaust and emission control systems for passenger vehicles and commercial vehicles. Sharda Motor Industries Ltd is India’s largest manufacturer of exhausts for automotive players. Sharda Motor Industries Ltd. has 8 manufacturing facilities located across India and one R&D centre in Chennai.

We believe that Sharda Motor Industries Ltd offers an exciting opportunity to participate in the niche auto ancillary segment of exhaust and emission control systems. Sharda Motor Industries Ltd’s strong financial position, coupled with multiple growth triggers, positions it well for continued growth. The recent initiation of share buybacks and increased dividend payouts indicate a commitment to enhancing shareholder value.

Sharda Motor Industries Ltd Company Overview

Sharda Motor Industries Ltd. is a small-cap company that is into the manufacturing of various auto components, mainly exhaust and emission control systems for passenger vehicles and commercial vehicles.

Sharda Motor Industries Ltd. was founded in 1986 by Mr. Narinder Dev Relan and listed in the stock markets as early as 1987. Presently, Sharda Motor Industries Ltd. is run by Mr. Ajay Relan, who is the Managing Director, and Mr. Aashim Relan, his son, who is the Chief Executive Officer. Sharda Motor Industries Ltd. forayed into exhaust systems in 1998 with an agreement with Hyundai Motors. In 2002, Sharda Motor Industries Ltd. ventured into the suspension assembly business and also set up an R&D unit for exhaust systems. Later, in 2010, Sharda Motor Industries Ltd. set up an R&D facility for emission control systems in Chennai. In 2018 Sharda Motor Industries Ltd. entered into a technical collaboration with Bestop Inc. USA for soft-top canopies for vehicles. In 2019, Sharda Motor Industries Ltd entered into a joint venture with Eberspaecher (now known as Purem) to develop exhaust systems for medium and heavy commercial vehicles (MHCV). In 2021, Sharda Motor Industries Ltd formed a joint venture with Kinetic Green for the assembly of Lithium-ion battery packs for two-wheelers. In 2023, Sharda Motor Industries Ltd. set up another exhaust systems plant in Chakan, Pune, and followed it up by setting up a new facility for suspension systems in Chakan, Pune, in 2024. Through its journey, Sharda Motor Industries Ltd. has placed much importance on developing indigenous R&D systems in its areas of operations, primarily in exhaust and emission control systems. It has also started collaborating with a number of foreign companies recently to enhance its scope of operations and absorb new technologies, with a special thrust on entering powertrain-neutral auto components. Powertrain neutral auto components are those that are used in both internal combustion engines (ICE) and battery powered electric vehicles (BEV).

In 2020, the seating business of Sharda Motor Industries Ltd. was demerged and listed separately on the exchanges as NDR Auto Components. NDR Auto Components is into the manufacturing of seat frames and seat trims for 4W passenger vehicles and 2Ws. Mr. Rohit Relan and his family led it. Mr. Rohit Relan is the younger brother of Mr. Ajay Relan. The demerger was borne out of disputes between the two brothers. Post the demerger, however, there is a clean break between the two brothers, with each of them managing separately listed companies, and this is no longer an overhang on the company.

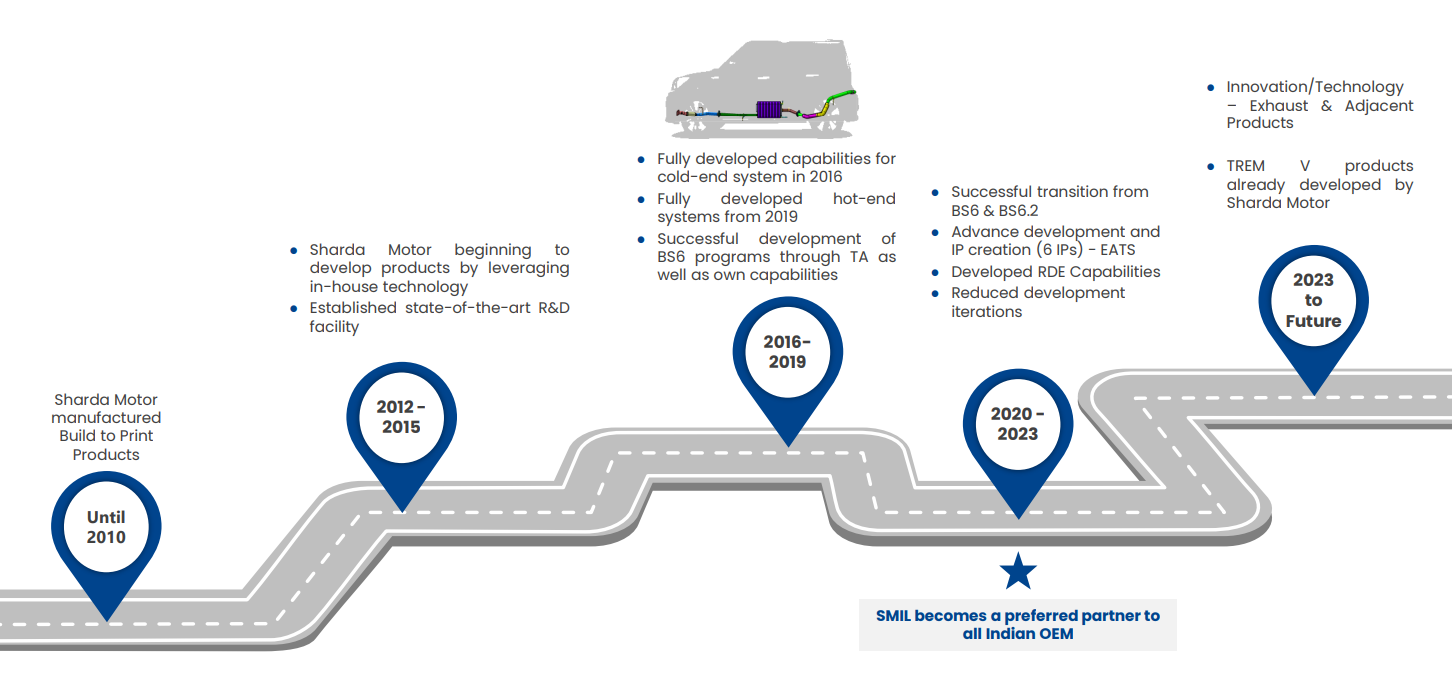

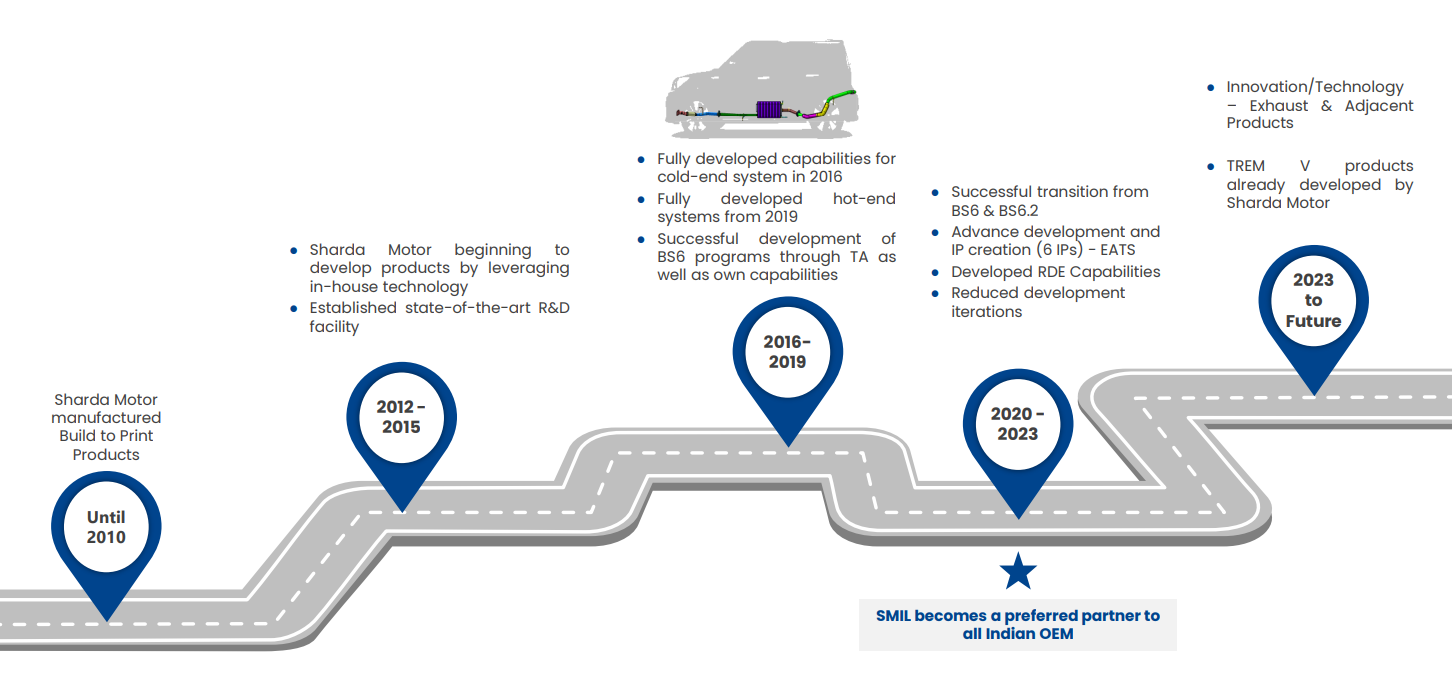

Sharda Motor Industries Ltd Journey

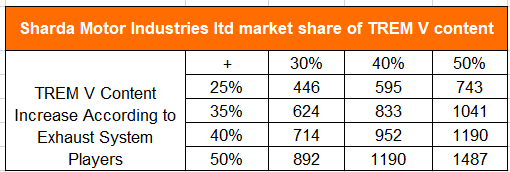

Over the last decade, Sharda Motor Industries Ltd has really transformed from a build-to-print manufacturer of exhaust systems to the leading company in India for providing exhaust systems and emission control systems for the leading auto OEMs of the country. Sharda Motor Industries Ltd. enjoys a 30% market share in the PV vertical in India in emission systems and a 10% market share in control arms for Passenger vehicles in the lightweighting vertical.

In the last decade, there have been significant changes and new implementations in Indian vehicle emission norms. The 4th iteration of BS IV norms was mandated nationwide in 2017. India decided to skip BS V norms altogether and implemented BS VI norms directly in April 2020. In April 2023, India implemented BS VI RDE or BS-VI Phase 2 for real-time emissions. Throughout these increasing regulations, Sharda Motor Industries Ltd consistently managed to upgrade its technology and iterate its design and manufacturing to meet every new norm and become a reliable emissions control partner for almost all major auto OEMs in India. Today, Sharda Motor Industries Ltd is the only Indian technology provider for emission control systems.

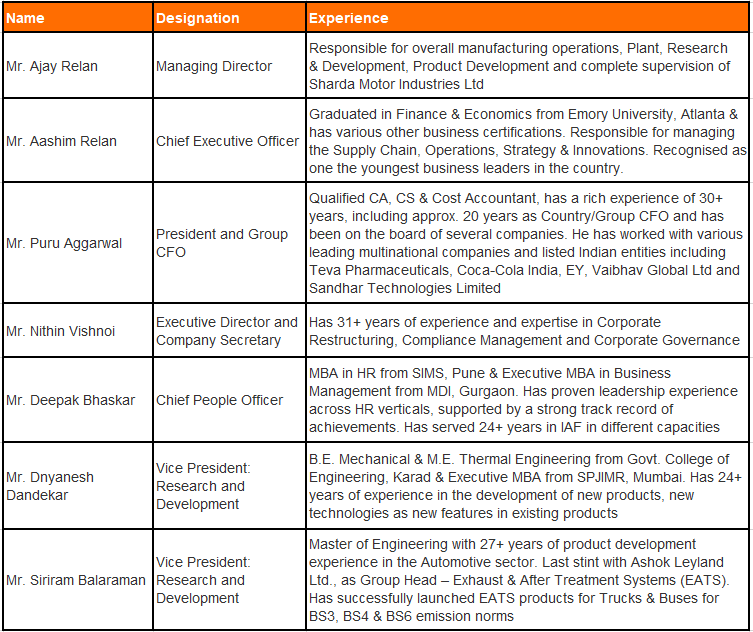

Sharda Motor Industries Ltd Management Details

The late Narinder Dev Relan founded Sharda Motor Industries Ltd and named it after his wife, Sharda Relan. He had two sons, Ajay Relan and Rohit Relan. In 2020, the brothers decided to split the business, leading to the demerger of the seat business into NDR Auto Components, which Rohit Relan now manages. Ajay Relan and his family continue to manage Sharda Motor Industries. In recent years, Ajay’s son, Aashim Relan, has taken on the role of CEO and appears to be the central executive at Sharda Motor Industries Ltd. At the same time, Ajay Relan holds the position of Managing Director. Ajay Relan and Aashim Relan are backed by a strong management team with vast experience

Sharda Motor Industries Ltd Industry Overview

Exhaust systems and emissions control industry size

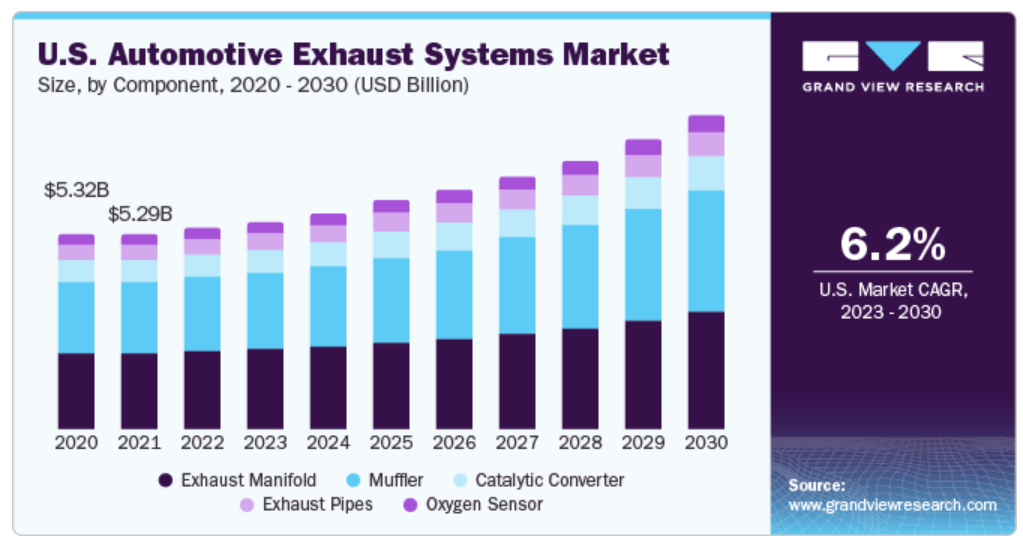

The global automotive exhaust systems market is estimated to be about 46bn USD in size as of 2022. The market is estimated to grow robustly at a CAGR of 7%+ between 2023-2030, reaching a size of ~80bn USD in 2030 [Source: Grand View Research]. A very high global focus on reducing automotive-led air pollution has put the spotlight on the emissions control industry, with emission norms globally becoming more and more stringent by the year.

The US market is estimated to be ~12% in size, whereas the largest geography by far is Asia Pacific, with a 61% share of the total market.

Source – Grand View Research

The passenger car segment accounts for about 70% of the market, with the commercial vehicle segment accounting for the rest.

Source – Grand View Research

Global Emission Control norms

Globally, the latest emission norms in major geographies are as follows:

- Europe – Euro 6d/6e norms: The first Euro 6 norms came into force in 2014 and have since been regularly upgraded. The latest Euro 6e norms are to come in during H2 CY24. Euro 7 norms are likely to be introduced in 2027. Europe has the leading emission control norms in the world, well ahead of the USA.

- United States of America – EPA Tier 3 and Phase II emission norms for light-duty vehicles and heavy-duty vehicles, respectively

- China – National Emission Standard 6A/6B

- India – BS Stage 6 and BS Stage 6 RDE – In terms of emission norms, India has caught up with the rest of the world, and its emission standards are as strict as those of Europe, for example. While Euro 6 standards were introduced in Europe as early as 2014, India introduced nationwide Bharat Stage 6 norms (BS-VI) only in April 2020. The earlier BS IV norms were introduced in 2010 but were mandated nationwide as late as 2017. Subsequently, in order to catch up with global standards, India decided to skip the BS V norms altogether and directly implemented BS VI in 2020, which was a commendable achievement. In April 2023, India implemented BS VI RDE norms (real driving emissions) or BS-VI Stage 2 norms. BS VI RDE mandated that the effluent norms be followed on the road under real driving conditions as opposed to the requirements under BS-VI, which mandated that vehicles clear emissions norms only in laboratory conditions. With the implementation of BS VI RDE, India’s emission norms are currently on par with those of Europe.

Exhaust systems and emissions control systems technology

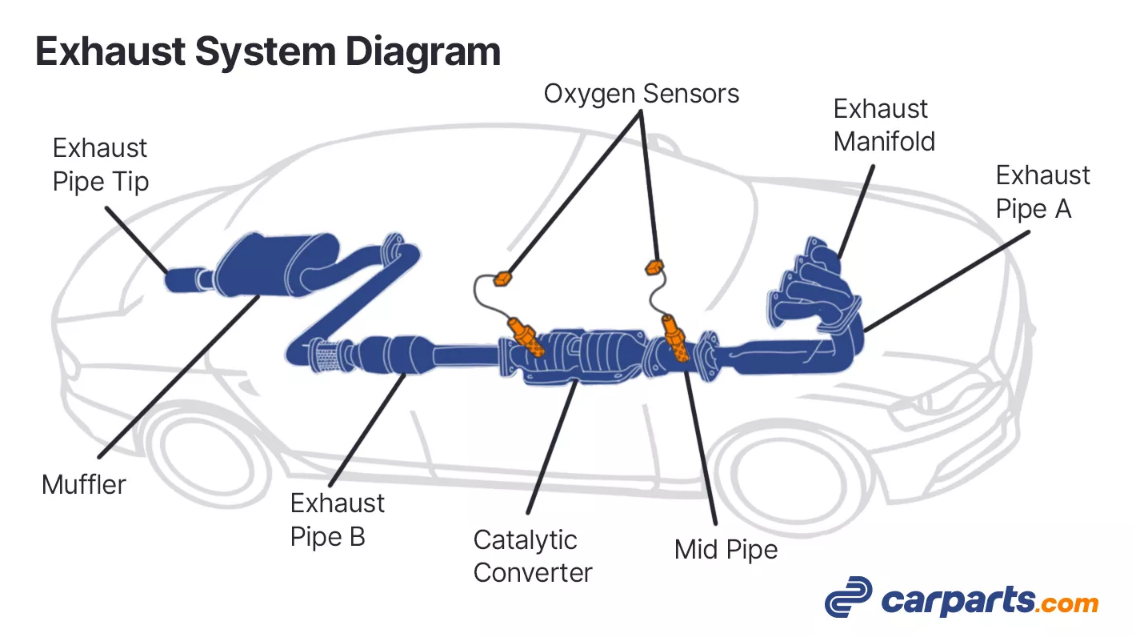

Let us understand the structural components of an exhaust system in further detail. As you can see in the below diagram, the main components of an exhaust system are:

Source: Carparts.com

- Exhaust manifold – The manifold connects to the various engine cylinders and is responsible for collecting the exhaust gases and redirecting them towards the exhaust system for further processing.

- Mid pipe or downpipe – The mid pipe moves the gases from the manifold toward the catalytic converter.

- Catalytic converter or brick – The catalytic converter uses a catalyst (platinum, palladium, rhodium) to convert harmful pollutants in the exhaust gases into less harmful substances. It transforms carbon monoxide (CO) into carbon dioxide (CO2), nitrogen oxides (NOx) into nitrogen (N2) and oxygen (O2), and hydrocarbons (HC) into carbon dioxide (CO2) and water (H2O).

- Muffler – The muffler reduces the noise generated by the engine and exhaust gases. It uses various chambers and perforated tubes to dampen sound waves.

- Tailpipe or cold end – The tailpipe is the final outlet through which the exhaust gases exit the vehicle

Within the structural components of the exhaust system lie various emission control components such as oxygen sensors, NOx sensors, selective catalytic reduction components, diesel particulate filters, exhaust gas recirculation systems, etc. Let’s also take a brief look at them.

Source: Bosch

- Oxygen sensors – Oxygen sensors measure the level of oxygen in exhaust gases and send a signal to the Engine control unit to regulate the amount of oxygen in fuel injection to optimise engine performance

- NOx sensors – NOx sensors measure the quantity of harmful NO and NO2 gases at various points in the exhaust system and accordingly send signals to the engine control unit, which regulates the performance of catalytic converters that convert the harmful NO and NO2 gases into safe gases. NOx sensors are placed upstream and downstream of the catalytic converter to measure before and after quantities of NOx.

- Selective Catalytic Reduction (SCR) – SCR is an advanced system used in diesel engines to reduce NOx emissions significantly. The SCR system regulates the injection of Adblue (urea) into the exhaust gases to break down NOx into nitrogen and water.

- Diesel particulate filters (DPF) – DPF is responsible for removing particulate matter from the exhaust gases

- Exhaust gas recirculation systems (EGR) – The EGR redirects a part of the exhaust gases back into the combustion chamber to mix with the fresh air-fuel mixture in the engine. This is done to reduce the combustion temperature of the air-fuel mixture, which in turn reduces the amount of NOx produced

Key Global Players

The largest global companies in the emissions control and exhaust systems industry are – Tenneco (USA), Faurecia (France), Bosch (Germany), Continental AG (Germany), Magna International (Canada)

Companies such as Bosch, Continental, Faurecia, and Tenneco are involved across most elements of exhaust systems as well as emission control systems such as Adblue injectors, NOx and oxygen sensors, DPF, EGR, etc. Sharda Motor Industries Ltd, on the other hand, is present mainly in the structural parts of the exhaust systems, such as the exhaust manifold, downpipe, mufflers, resonators, and tailpipes. Sharda Motor Industries Ltd is not involved in making the electronic and chemical elements of emissions control systems and, hence, is less sophisticated in its capabilities compared to its global peers. However, in the structural exhaust system components, Sharda Motor Industries Ltd is as capable as its global peers and is the lowest-cost producer by some distance.

Sharda Motor Industries Ltd Product Details

Sharda Motor Industries Ltd operates across three verticals

- Emissions systems vertical – This vertical contributed 92% of the company’s revenues in FY24. In this vertical, Sharda Motors has a 30% market share of India’s total passenger vehicle market. Apart from Maruti, all other PV OEMs are Sharda’s customers. While Sharda Motor Industries Ltd. pursues PV and LCV business under the standalone entity, it has a JV with Eberspaecher (now Purem) for developing emission control systems for heavy commercial vehicles.

- Suspensions or Lightweighting vertical – This vertical contributed 8% of the company’s revenues in FY24. Under this vertical, the company manufactures upper and lower control arms and front axle and suspension assemblies.

- Soft top roof systems for cars – This vertical is pursued under a joint venture with Bestop Inc. of the USA and contributes a minuscule portion of the company’s revenues.

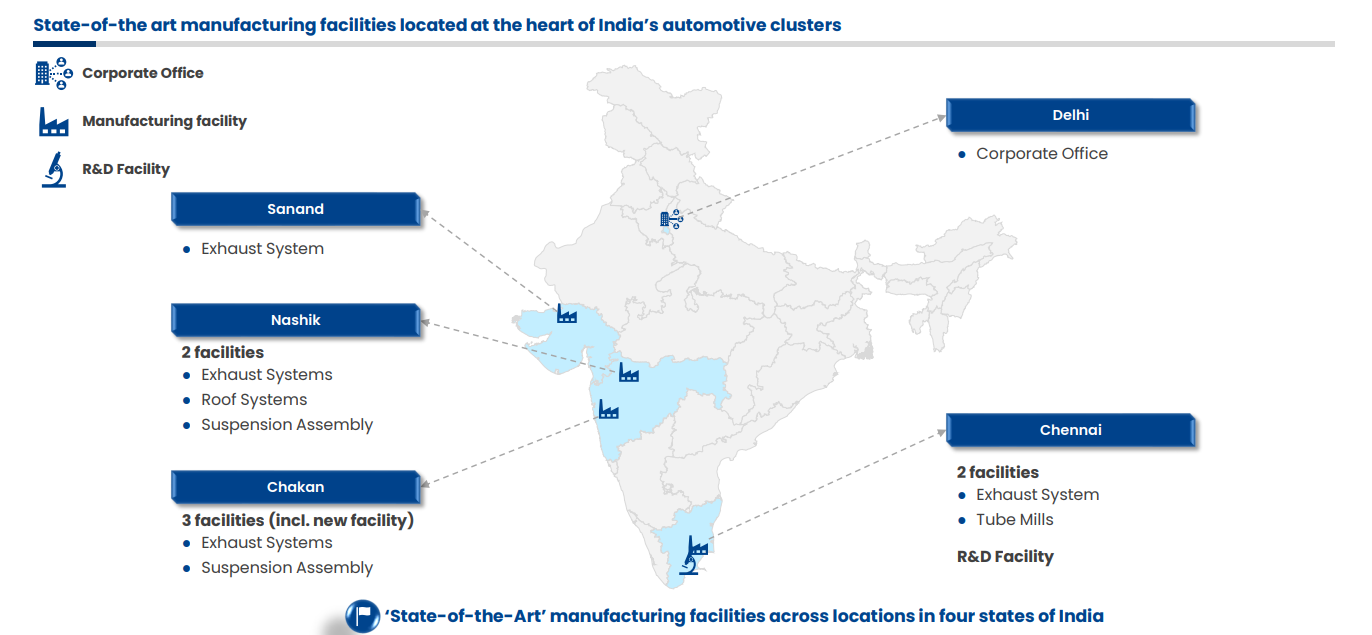

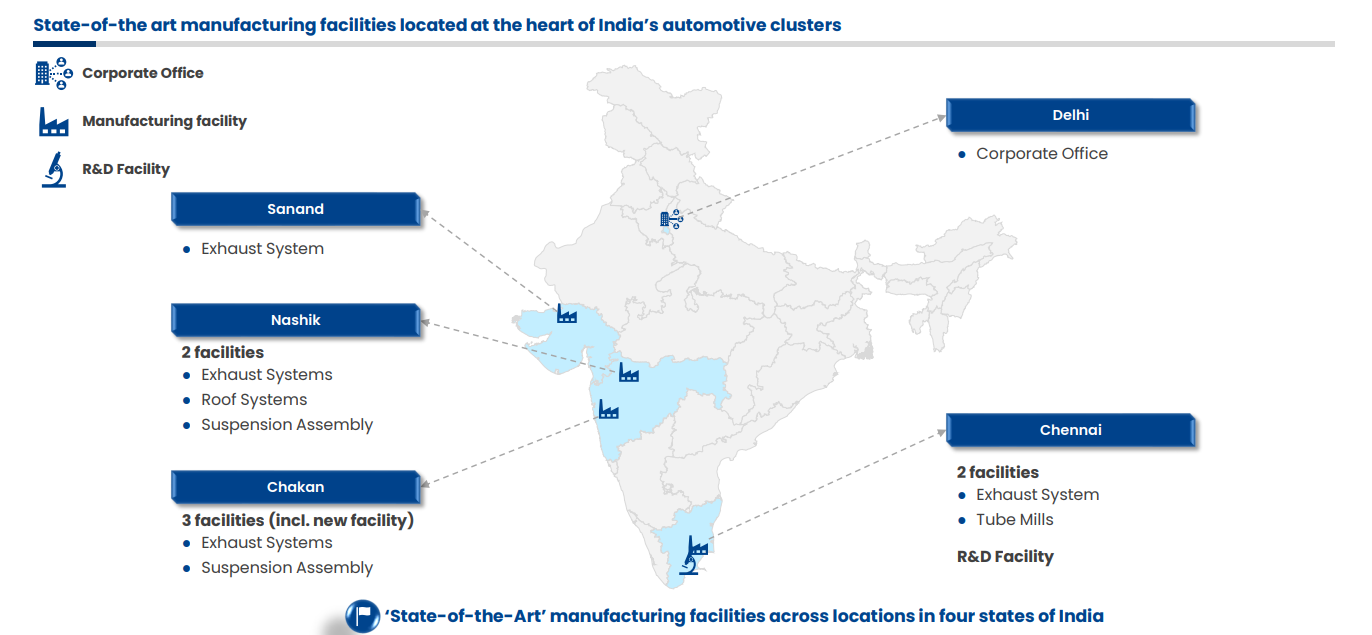

Sharda Motor Industries Ltd Manufacturing Facility

Sharda Motor Industries Ltd. has 8 manufacturing facilities located across Sanand (Gujarat), Nashik & Chakan (Maharashtra), and Chennai (Tamil Nadu). Chakan Plant II came up in 2023 for exhaust systems, and Chakan Plant III is currently under construction for the lightweighting vertical.

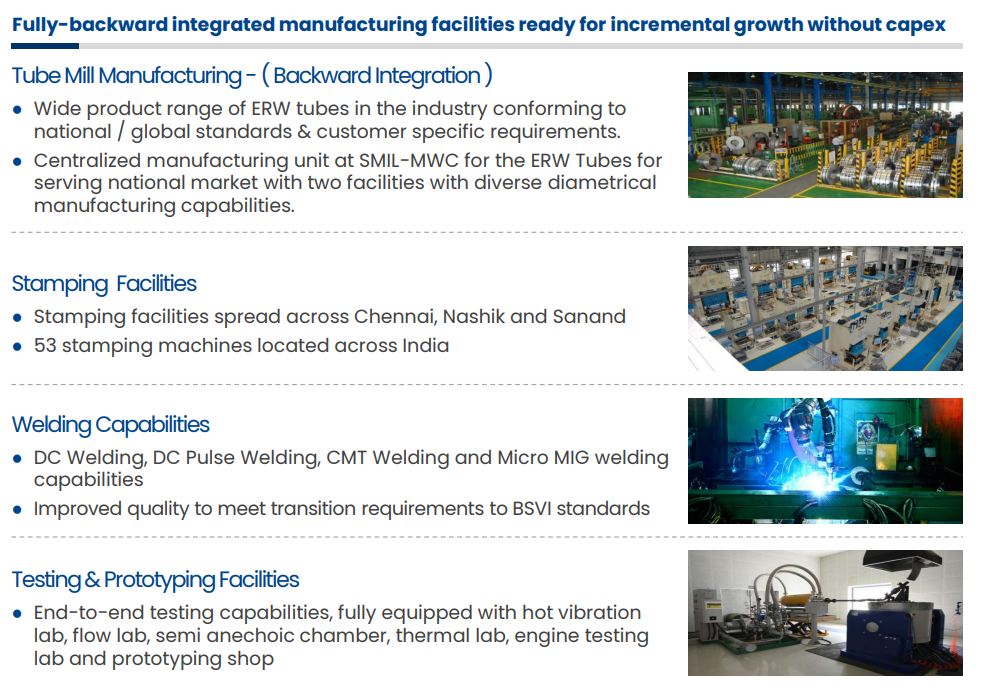

Sharda Motor Industries Ltd’s backward integrated manufacturing operations provide a significant advantage in terms of lower costs and self-reliance. Sharda Motor Industries Ltd. has its own ERW (electric resistance welding) tube mill manufacturing facilities of various diameters, welding facilities and stamping facilities.

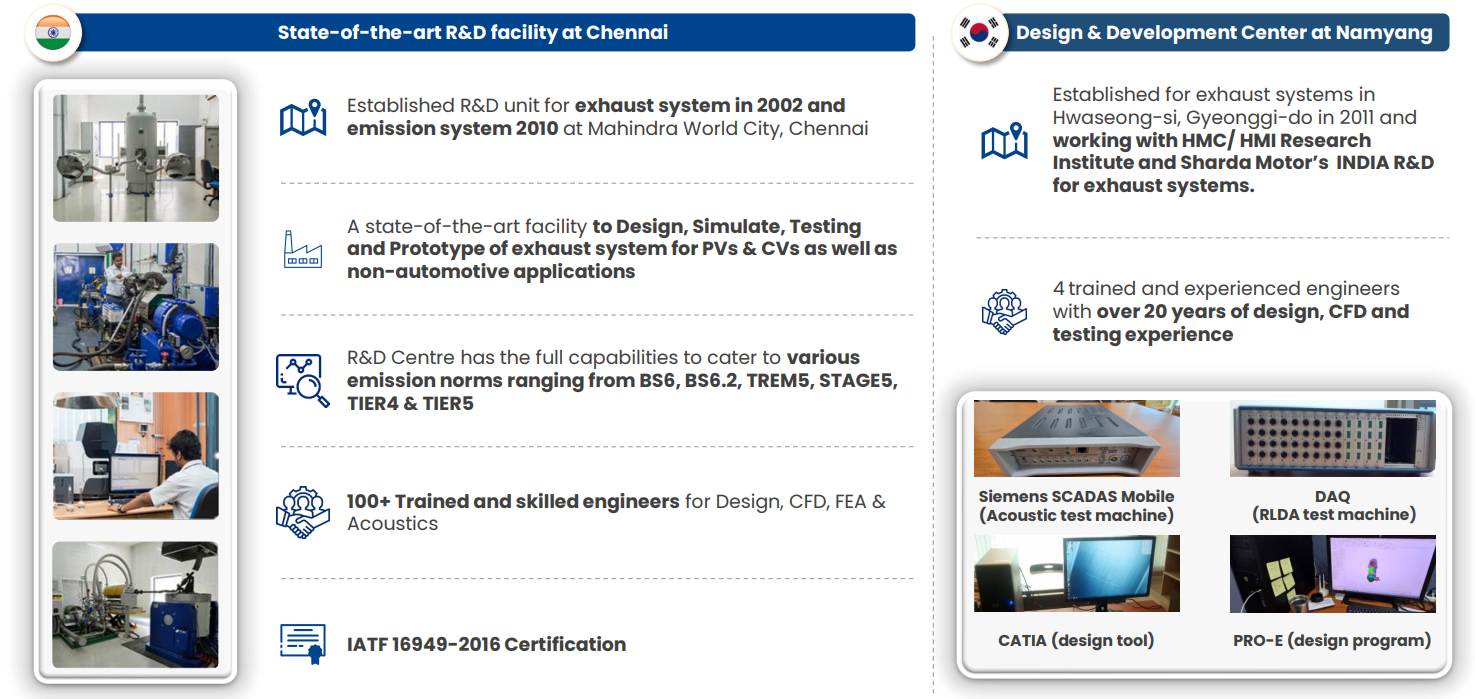

Another key advantage for Sharda Motor Industries Ltd. is its state-of-the-art R&D centre for exhaust and emission control systems in Chennai, established in 2002 and 2010, respectively. The R&D Center enabled the company to progress from a build-to-print supplier to a full-stack designer and manufacturer of exhaust and emission control systems. The facility allows for the design, simulation, testing, and prototyping of exhaust systems for automotive and stationary applications. In addition, Sharda Motor Industries Ltd. also has a design and development centre in Namyang, South Korea.

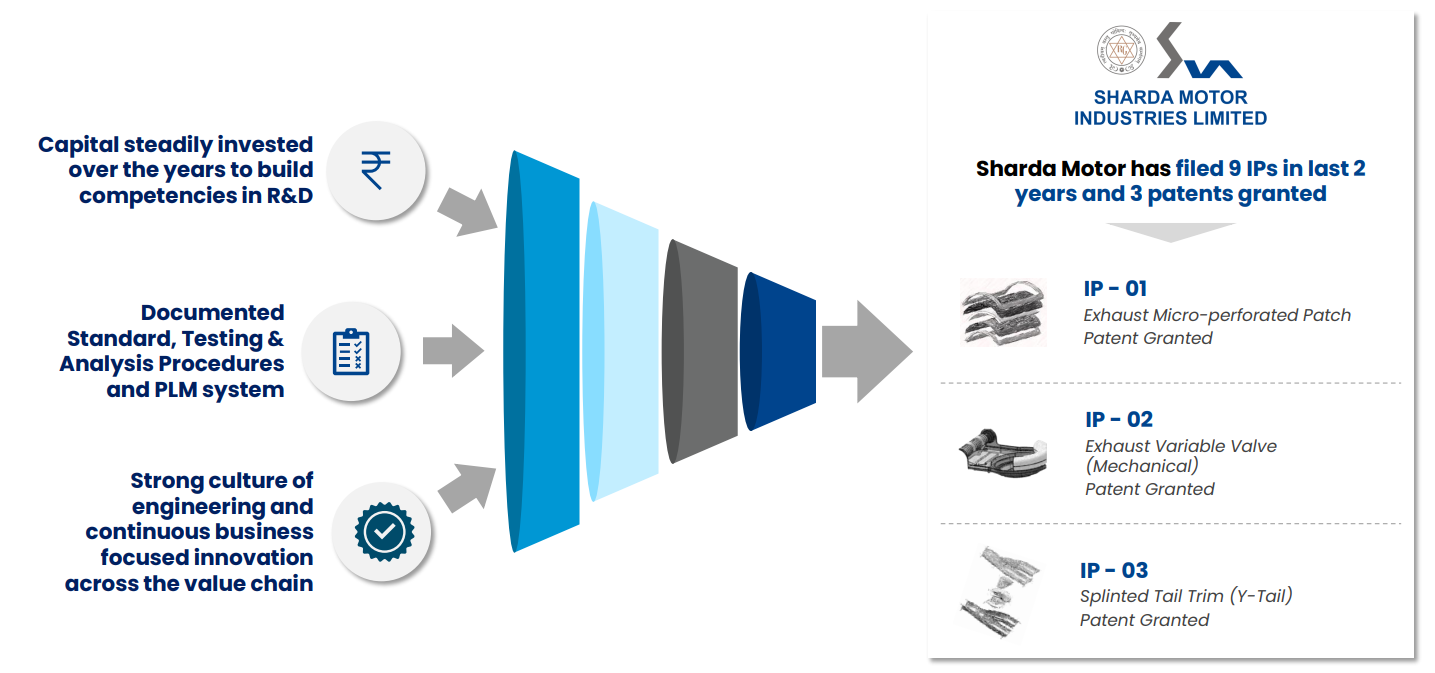

Investments in R&D have resulted in Sharda Motor Industries Ltd. filing for 9 patents and being granted 3 patents in the last 2 years.

Sharda Motor Industries Ltd Future Growth levers

There are several growth levers for Sharda Motor Industries Ltd to capitalise on. Let’s take a look at them in some detail.

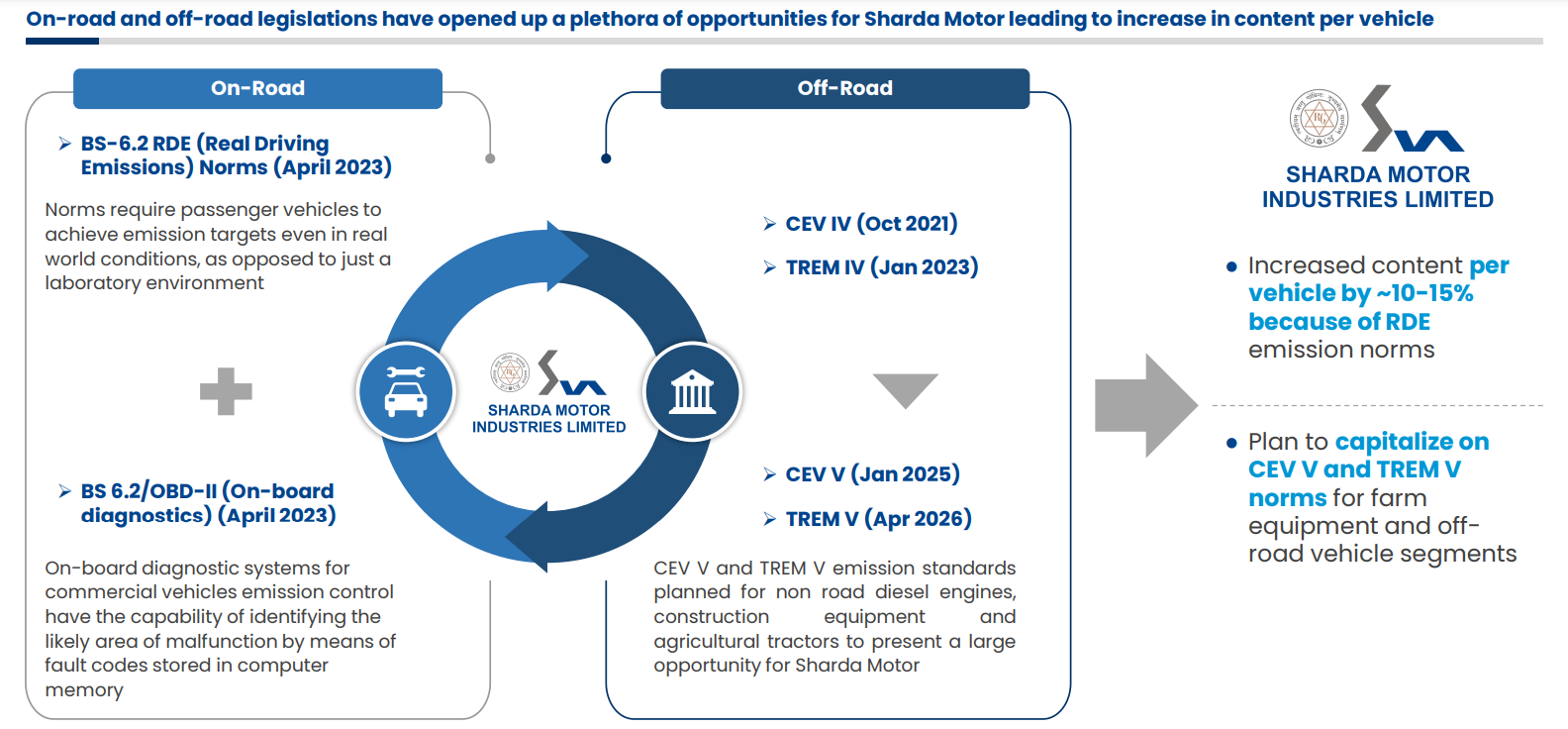

- Emission norms for tractors and off-highway vehicles (TREM and CEV) – Until recently, off-highway vehicles such as construction equipment and tractors were under the purview of very lenient emission norms in India. Recently, the government has introduced regulations to bring these vehicle types under stricter emissions norms. The regulations are called TREM for tractors and CEV for off-highway vehicles. While the emissionizing of off-highway vehicles is not a very big opportunity for Sharda Motor Industries Ltd, the emissionizing of tractors is a big opportunity for Sharda Motor Industries Ltd.

The first phase of the regulations – CEV IV and TREM IV – have already been implemented in FY21 and FY23, respectively. However, these address smaller sections of the overall market. The next phase of the regulations – CEV V and TREM V – which are slated to be implemented in Jan 2025 and Apr 2026, respectively, will emissionize the entire off-highway vehicles and tractors markets.

TREM V has the potential to significantly move the needle for Sharda Motor Industries Ltd. in terms of additional addressable market size. Let us analyse the potential revenues Sharda can gain from TREM V in more detail.

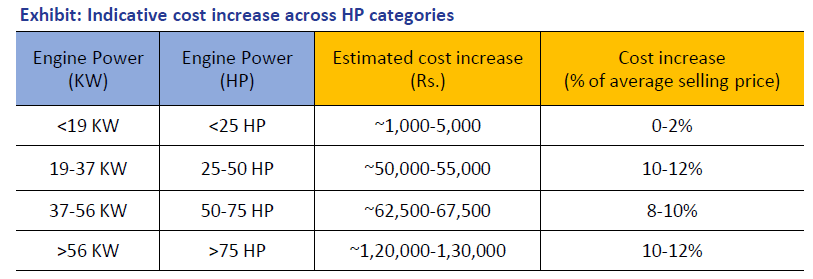

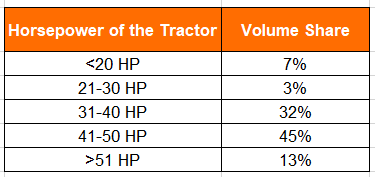

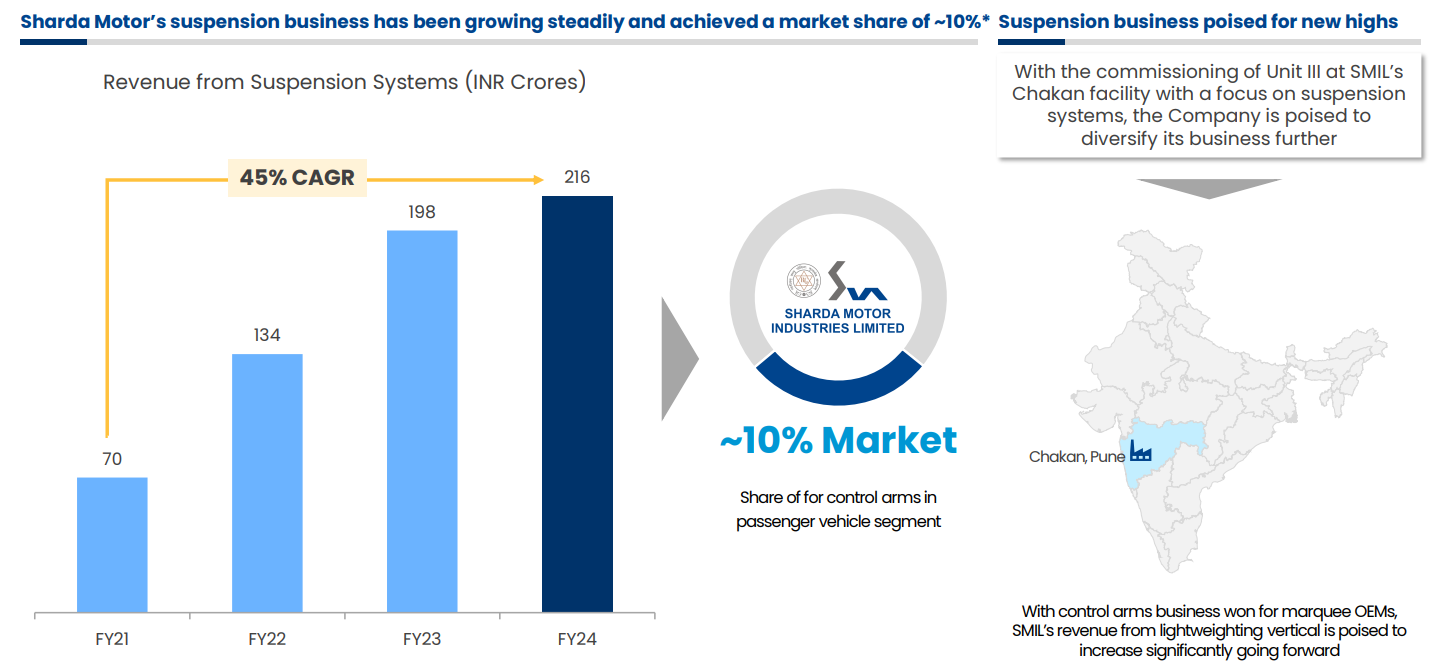

According to an ICRA report, below are the indicative cost increases expected for tractors once TREM V is implemented in India.

Domestic tractor sales in FY24 were 8.75L units, and in FY23, it was 9.4L units. Discounting cyclical demand ups and downs, one can assume that domestic tractor sales in India in 2-3 years would be near 10L units.

The rough split of tractor volumes by horsepower in India is as follows.

Combining this data with the price increase data as per the ICRA table above, we can estimate the total increase in sales value of domestic tractors due to this regulation coming into force. It seems from the data that the total rise in the content value of tractors sold in India could increase by ₹ 6000 Cr due to TREM V coming into force.

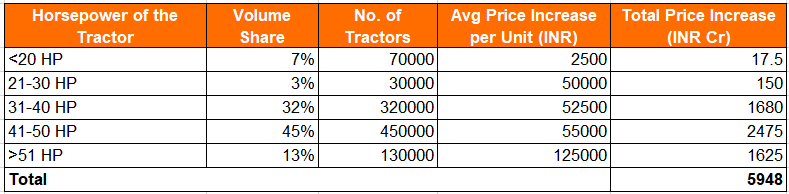

Of this ₹ 6000 Cr content increase, only a part of it will accrue to exhaust systems players like Sharda Motor Industries because other tractor parts, such as the engine, will also require modifications, the content increase for which will not accrue to the likes of Sharda Motor Industries Ltd. Even with the content increase for Exhaust system players, Sharda Motor Industries Ltd will not get 100% market share as there are 2 other credible competitors in the space.

Running a scenario analysis for various scenarios of market share win by Sharda Motor Industries Ltd. and content share accrual to exhaust system players, one can arrive at a range of potential revenue increases from TREM V for Sharda Motor Industries Ltd.

Depending on which scenario plays out, the revenue increase for Sharda Motor Industries Ltd. due to TREM V could range between ₹ 450 Cr to ₹ 1500 Cr. Assuming a 13% EBITDA margin on these revenues, Sharda Motor Industries Ltd’s EBITDA could increase by ₹ 60 Cr to ₹ 195 Cr, which is an increase of 17-54% on the company’s FY24 absolute EBITDA.

- Increase in exports – Management has been speaking of capitalising on export growth opportunities for several quarters now. As per management, there is a huge scope to increase exports in exhaust system sub-components, stationary power exhaust systems (mostly generator sets), and even commercial vehicle exhaust systems. According to management, they are seeing China + 1 playing out in this segment. Usually, in auto component supplies to OEMs, qualification and testing of supplies by potential new suppliers is a time-consuming process spanning multiple years. Therefore, Sharda Motor Industries is likely in the qualification phase with potential export customers, and once qualification is done, export sales can show a step jump. Sharda Motor Industries has created a dedicated export sales team for this purpose. We continue to monitor developments on this front.

- Expansion of the lightweighting vertical – The lightweighting vertical has grown at a robust CAGR of 45% between FY21 and FY24.

Recently, a new unit for this vertical has been commissioned in Chakan at a capex cost of ₹ 50 Cr. Management sees large demand coming up in lightweighting and calls it a megatrend. Electric vehicles are much heavier than ICE vehicles, hence lightweighting is an imperative for EVs to maximise battery mileage. Presently, Sharda Motor Industries Ltd. is making control arms and suspension assemblies for passenger vehicles in this vertical. In future it plans to expand to other lightweighting categories.

- Potential for inorganic growth – Sharda Motor Industries Ltd. has indicated that it is open to doing an M&A transaction if the right opportunity presents itself. Sharda Motors has significant cash on the balance sheet, which can be used for an acquisition if needed.

Sharda Motor Industries Ltd Corporate governance Analysis

Board Composition – As of FY23, Sharda Motor Industries Ltd board consists of 7 directors, with 4 of them being independent. The chairperson of the board is also an independent individual. The founder’s son, Mr. Ajay Relan, holds the position of Managing Director, while the founder’s mother, Mrs. Sharda Relan, serves as the Co-Chairperson. However, it seems odd that one of the independent directors is a doctor by profession, which raises questions about their role on the board. The subject expertise of Mrs. Sharda Relan is not mentioned, but she holds a Bachelor’s degree and has been associated with the business since its inception. Overall, the Sharda Motor Industries Ltd board doesn’t seem to be very high quality, and it appears that the promoter family maintains tight control over the Sharda Motor Industries Ltd Board.

Promoter Remuneration – Mr. Ajay Relan, who’s serving as the Managing Director of Sharda Motor Industries Ltd, received around ₹7.92 Cr as salary in FY23, which is an increment of 37.9% YoY. Mr Aashim Relan, who’s serving as the CEO, received ₹1.44 Cr as salary, which was the same as FY22. Mrs. Sharda Relan’s remuneration is not explicitly mentioned, but she receives ₹1.45 lacs as a sitting fee.

Related Party Transactions – As of FY23, there were no material-related party transactions of concern in the company

Contingent Liabilities – There are contingent liabilities in the form of disputed tax matters, GST matters, excise matters, disputes with vendors, etc., to the extent of ₹17 Cr, which amounted to ~2% of the company’s book value of equity

Dividend Policy – Sharda Motor Industries Ltd has come up with a dividend policy of paying between 10-30% of PAT as dividends each year. The dividend payout in FY23 was 25% of FY23 PAT, the highest proportion paid out since FY14.

Sharda Motor Industries Ltd Financial Performance

Sharda Motor Industries Ltd. has displayed robust performance between FY19-FY24 across most parameters. Sharda Motor Industries Ltd has grown revenues at a CAGR of 20% between FY19-24. The gross profit margin has varied significantly between FY19-FY21 and FY22-24 because since FY21, after the nationwide implementation of BSVI norms, under new agreements with automotive OEMs, Sharda Motor Industries Ltd was required to purchase and supply catalysts on a no-profit basis. This distorted the revenue and gross profit margin figures – it artificially increased revenues, whereas it depressed gross margins. Hence, a more accurate way of tracking value-added growth delivered by Sharda Motor Industries Ltd between FY19-24 is by tracking the growth in absolute gross profits and absolute EBITDA delivered by Sharda Motor Industries Ltd. it has delivered a gross profit CAGR of 13% and an EBITDA CAGR of 20% between FY19-FY24. In the same period, PAT has grown at a CAGR of 26%.

Sharda Motor Industries Ltd Ratios & Working capital Analysis

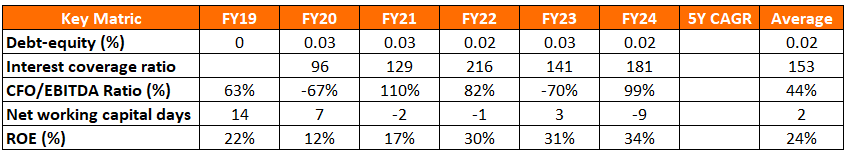

Sharda Motor Industries Ltd. has always had a solid balance sheet throughout its history with almost non-existent debt, as reflected in the average debt-equity ratio of 0.02 and interest coverage ratio of 153x during the FY19-FY24 period. Sharda Motor Industries Ltd. also had robust working capital control, with 3 out of the 6 years having negative net working capital days. Strong profitability and a lean balance sheet have resulted in a very robust return on equity ratios for the company, with average ROE clocking in at 24% over the FY19-FY24 period.

Sharda Motor Industries Ltd Comparative Analysis

To understand Sharda Motor Industries Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Sharda Motor Industries Ltd to its competitors (peer comparison) on various fundamental parameters and Sharda Motor Industries Ltd share performance relative to relevant benchmark and sector indices.

Sharda Motor Industries Ltd Peer Comparison

Sharda Motor Industries Ltd. is the only domestic manufacturer of exhaust and emission control systems in India. Apart from them, Tenneco and Faurecia are two MNC competitors of Sharda Motor Industries Ltd in India. While Tenneco has an Indian subsidiary, Faurecia operates in India via a joint venture with a local company. Thus, it’s a 3 player market in India. Other automotive suppliers such as Bosch and Continental AG provide components of emission control systems such as Adblue injectors, NOx and Oxygen sensors, SCR and EGR systems, etc., but Sharda Motor Industries Ltd. is not present in these components of emission control systems.

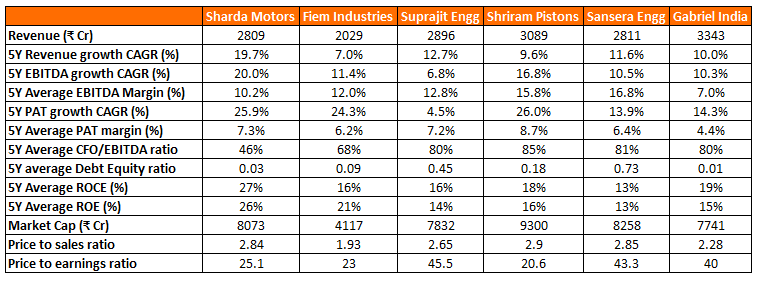

As, there is no domestic peer of Sharda Motor Industries Ltd. in the exhaust systems and emission controls systems segment. Hence, we have compared Sharda Motor Industries Ltd to other domestic-facing auto ancillaries that have revenues in a similar range as Sharda Motor Industries Ltd. We choose the following well-reputed companies in the auto ancillary space for a peer comparison with Sharda Motor Industries Ltd. – Fiem Industries ltd, Sansera Engineering ltd, Suprajit Engineering ltd, Shriram Pistons ltd, and Gabriel India ltd.

Sharda Motor Industries Ltd. performed very strongly with the set of 5 reputed peers chosen on almost all metrics concerned. It has the most substantial return on capital profile and has enjoyed the fastest bottom-line growth over the last 5 years. While their cash conversion has significantly lagged behind peers in the last 5 years, it is not a big concern as Sharda Motor Industries Ltd’s balance sheet is hugely net cash positive, and incremental growth in exhaust systems (e.g., TREM V) requires very little capital expenditure.

Sharda Motor Industries Ltd Index Comparison

Sharda Motor Industries Ltd share performance vs S&P BSE Small cap Index as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Sharda Motor Industries Ltd Sector Comparison

Sharda Motor Industries Ltd performance vs BSE Auto as We believe sector comparison helps to differentiate between industry-wide trends and company-specific factors & also helps in executing sector rotation and stock rotation strategies.

Sharda Motor Industries Ltd Valuation Ratios

| Metric | As on 30/08/24 |

| Price/Earnings | 25.5 |

| Price/Book | 7.86 |

| Price/Sales | 2.84 |

| EV/EBITDA | 16.36 |

Why You Should Consider Investing in Sharda Motor Industries Ltd ?

We believe that Sharda Motor Industries Ltd offers some compelling reasons to track the business closely and to consider investing if one is looking to build exposure to the auto ancillary sector.

Robust track record of profitable growth – Sharda Motor Industries Ltd has an excellent track record of consistently growing topline and gross profits while maintaining healthy profitability and very good return ratios. The balance sheet of Sharda Motor Industries Ltd has also never been under stress and, in fact, has a lot of surplus cash.

Conservative nature of management – The management of Sharda Motor Industries Ltd. is quite conservative in nature. They have consistently refrained from providing forward guidance on revenues and profitability but have always maintained that they will grow faster than the automotive industry. They also don’t want to hurry into new ventures such as exports or an M&A transaction without tying up all ends. They have not scaled up the battery assembly joint venture with Kinetic Green due to the frequent regulatory changes and high on-road risk in that business. These are signs of prudent and risk-aware management.

Presence of several growth triggers – There are multiple triggers for Sharda Motor Industries Ltd., such as TREM V and CEV V regulations, export sales, growth of the lightweighting vertical, and potential for inorganic growth.

No incremental capex is needed for TREM V – Sharda Motor Industries Ltd. already has the technology and manufacturing capability to meet TREM V norms. In fact, Sharda Motor Industries Ltd already supplies TREM V exhaust systems to tractor OEMs for exports. Technology and capacity already being there, management has confirmed that no extra capital expenditure is needed to generate TREM V revenues.

Improved capital return to shareholders – As highlighted earlier, Sharda Motor Industries Ltd. has started returning more cash to shareholders by way of a higher dividend payout and by initiating the first share buyback transaction in the company’s history in Q1 FY25. This is a very progressive move and is a sign of improving capital allocation. The management has also transparently declared that land holdings are available with Sharda Motor Industries Ltd which can be liquidated if more cash is needed for the operations.

Risks of Investing in Sharda Motor Industries Ltd?

Investors need to keep the following risks in mind if they choose to invest into this business. Risks needs to be weighed in combination with the advantages listed above to arrive at a decision that is optimal for your portfolio construct

A downcycle in the auto industry – FY23 and FY24 were strong years for the domestic PV and CV industry. FY25 is expected to have weaker growth owing to a high base effect. Any significant weakness in PV and CV demand will affect Sharda Motor Industries Ltd.’s performance negatively.

Further Delay in the rollout of TREM V regulations – TREM V regulations were set to be rolled out in April 2024. However, they were postponed to April 2026, presumably because of pushback from the tractor industry and farmers. TREM V regulations will increase the prices of tractors, which will impact farmers. Any negative impact on farmers is a sensitive issue in India for Governments. Hence, any further delay in TREM V implementation due to resistance from farmers can have negative implications for Sharda Motor Industries Ltd.

Delay in pursuing growth opportunities such as exports or M&A – The management has been talking about potential growth opportunities via exports and M&A for a few quarters now. Still, there is so far no sign of anything materialising. While it’s good for management to be cautious and prudent before deploying significant chunks of capital, one hopes this does not become a case of pondering over options for long enough to see the possibilities or opportunities disappearing.

Valuations are no longer cheap – At 25x trailing PE multiples, the stock is no longer as cheap as it was even a few months back. While the stock is not overvalued, from here on, returns will depend on earnings growth.

Income Tax raid in FY24 – The Income Tax Department raided the premises of Sharda Motor Industries in May 2023. There has been no further communication from the IT Dept on the results of the raids since then. While IT raids are increasingly common these days and may not be a cause of concern necessarily, this is still worth keeping in mind for investors.

Sharda Motor Industries Ltd Future Outlook

In FY24, Sharda Motor Industries Ltd. gained from the implementation of BS VI RDE norms, which increased their content per vehicle by 10-15%. This regulation helped drive Sharda’s robust YoY gross profit increase of 25%. The revenue increase was much slower at 4% because, for the new supplies under BS-VI RDE, Sharda Motor Industries Ltd stopped doing pass-through sales of catalytic converters to OEMs, which it was doing under the earlier BS-VI regime. This also resulted in a 300 bps EBITDA margin expansion from 10% to 13% in FY24.

In FY25, the base effect of RDE sales will start coming into play from Q2 onwards. Thus, Sharda Motor Industries Ltd may not show as strong gross profit and EBITDA growth as it was able to show in FY24. PV and CV industry growth in India is expected to be in the high single digits in FY25. Growth for Sharda Motor Industries Ltd should be a few % points higher than industry growth, as has historically been the case. However, if export sales start getting traction in FY25, then it could be another year of robust growth for Sharda Motor Industries Ltd. TREM V is expected to be rolled out by April 2026; thus, a sales jump from TREM V can be expected in FY27.

Sharda Motor Industries Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Sharda Motor Industries Ltd Price charts

On the daily charts, over the last one year, Sharda Motor Industries Ltd stock had moved strongly upwards in an inclined channel from 800 levels in August 2023 to 2000-2100 levels in June 2024. In late June 2024, the stock broke out of the channel on the upside on very significant volumes. This happened due to news breaking regarding the entry of domestic institutional investors following a bulk deal where promoters sold ~8% stake to these DIIs. Post a steep rise in June and July, Sharda Motor Industries Ltd stock consolidated again to reach 2250-2300 levels and bounced again from the edge of the channel. FY25 YoY earnings growth from Q2FY25 onwards has to face a strong base effect. We feel, depending on the results, Sharda Motor Industries Ltd stock should continue to stay above 50 DMA or 100 DMA till further triggers come into play.

On weekly charts over the last 3 years, the story is one of two parallel channels. The first parallel channel between 600-900 lasted for two years, from Aug 2021 to Aug 2023. Sharda Motor Industries Ltd stock broke out of that channel with strong volumes in early September as the value-added revenues due to BS 6 RDE norms started showing up in higher EBITDA margins and strong YoY earnings growth from Q1 FY25 onwards. Subsequent strong YoY results throughout FY25 took Sharda Motor Industries Ltd stock on the inclined channel from 900 levels all the way up to 2000 levels in June 2024. Following the news of domestic institutional entry, Sharda Motor Industries Ltd stock broke out of that inclined channel and has continued to stay above it. Sharda Motor Industries Ltd stock may fall back into the channel if FY25 YoY earnings growth from Q2 onwards slows down, but it should stay within the channel. Exports, M&A and TREM V, could provide the next upward trigger for Sharda Motor Industries Ltd stock.

Sharda Motor Industries Ltd Latest Latest Result, News and Updates

Sharda Motor Industries Ltd Limited Quarterly Results

Sharda Motor Industries Ltd. reported another strong quarter in Q1 FY25. Revenues grew only 5% YoY, but gross profits grew 30% YoY, EBITDA grew 41% YoY and PAT grew 40% YoY. As discussed above, absolute gross profit growth is the accurate way to track growth in Sharda Motor Industries Ltd because of the difference between pass-through catalyst revenues in Q1 FY25 and Q1 FY24. In Q1 FY25, Sharda Motor Industries Ltd executed a buyback of 10.28 lakh shares via a tender offer at ₹1800/share. This was the first-ever buyback in Sharda Motor Industries Ltd history. Along with an increase in dividends, this is a very good sign for investors. Sharda Motor Industries Ltd has been accumulating a lot of cash on the balance sheet. Returning some of it to shareholders without hampering growth opportunities is a good capital allocation strategy.

Final thoughts on Sharda Motor Industries Ltd

We have always believed that category expansion is the key to an auto ancillary business delivering a secular growth over the medium term. The auto components industry has a plethora of components with each segment having 2-3 strong players with limited pricing power. Auto OEM’s continue to be the big daddies who exert a tremendous amount of control over auto ancillaries, resulting in hygienic unit economics for most auto ancillary players.

Any auto ancillary that can deliver a steady state EBITDA margin of > 12% deserves a closer look, hence Sharda Motor Industries Ltd deserves a deeper look. This is what quipped our interest initially. A debt free balance sheet and good cash flows further provide comfort on the long term execution of the management. Over the next 5-10 years, we believe that many more auto ancillaries can cross the threshold of moving into the midcap category through a combination of well executed category expansion and growing the addressable market through R&D investments. The tractor opportunity (if it materialises as expected) can move the needle on revenue growth for the business over the medium term. This can provide the much needed counter cyclicality to the PV and CV segments that the business relies on for growth.

The business is within the Top 20 auto ancillaries in India on parameters like 5 year sales growth, balance sheet quality and absolute profit. Good execution over the next 5 years can take the business to the next orbit without stressing the balance sheet, not many auto ancillaries offer this kind of comfort. Higher localization should also work in favour of the business, as the local manufacturing drive further picks up pace in India.

At CMP the stock looks reasonably valued in spite of the steep run up from 1600 to 2500 recently. In a roaring bull market stocks tend to get repriced rather quickly, precisely the situation here. If not for this recent run up, this business would have been a very interesting bet. Investors will need to build an independent view on how the CV and PV cycles will play out from here before considering investing at CMP.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.

Disclosure (Updated as of Sep 30, 2024) – No position in the stock in personal portfolio