Tarsons Products Ltd is an Indian labware company engaged in the designing, development, manufacturing, and marketing of ‘consumables’, ‘reusables’, and ‘others’, including benchtop equipment, used in various laboratories across research organizations, academia institutes, pharmaceutical companies, Contract Research Organizations, Diagnostic companies, and hospitals.

Tarsons products Ltd operates in an industry characterized by low gross asset turns but high operating margins. Players have embarked on a large capex prompted by the high demand environment of FY22 only to see demand normalize and high fixed costs impact the margins over the past couple of years. The industry operates at a low capacity utilization right now coupled with debt levels that are higher than warranted for organizations of this scale. Tarsons Products Ltd can look interesting if the business were to get back onto the growth track, operating leverage can spike profits non-linearly for a few years.

With the leading diagnostic firms in India starting to see a mean reversion of growth after a couple of average years, could Tarsons Products Ltd be a beneficiary some quarters down the line?

Tarsons Products Ltd Company Summary

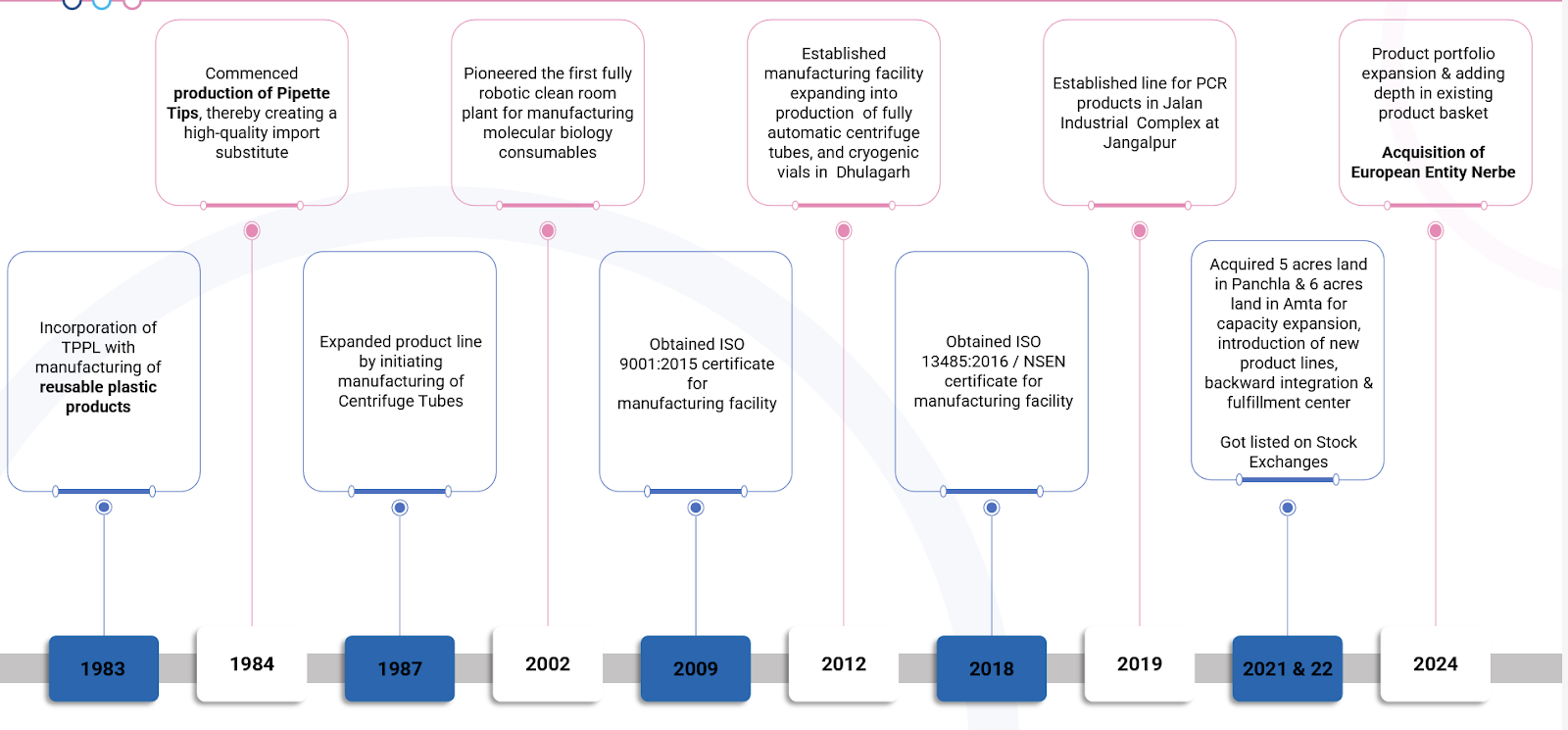

Tarsons Products Ltd was incorporated on Jul 5, 1983, and has since evolved into a leading Indian company in the plastic labware market, providing an alternative to high-cost imports in an industry historically dominated by global MNCs. Tarsons Products Ltd was founded by Sanjive Sehgal (promoter), who currently serves as the Chairman and the MD of the company. Rohan Sehgal (son of Sanjive Sehgal) is the Whole Time Director and has been working with Tarsons Products Ltd for over 9 years. In 2018, PE firm ADV Partners acquired a 49% stake in Tarsons Products Ltd from Sanjive Sehgal, and following the IPO, its shareholding stands at 26.9%.

Tarsons Products Ltd- Key Milestones

Tarsons Products Ltd Management Details

Tarsons Products Ltd is promoted by the Sehgal family of Kolkata with Mr. Sanjive Sehgal, the founder and current Chairman & Managing Director bringing over four decades of experience in the plastic labware industry. His son Aryan Sehgal (formerly Rohan Sehgal) serves as Whole-Time Director and has played a key role in modernizing the Tarsons Products Ltd’s operations and expanding its global footprint. In 2018, co-promoter Sachin Sehgal exited Tarsons Products Ltd by selling his stake to Clear Vision Investment Holding Pte Ltd (CVIHPL), a Singapore-based private equity investor backed by ADV Partners which currently holds 23.42% stake (stable since post ipo). Management control has remained with the Sehgal family.

Tarsons Products Ltd – Industry Overview

The Indian healthcare industry is poised for substantial growth with a projected Compound Annual Growth Rate (CAGR) of 23% between 2020 and 2025 compared to the expected 8.9% CAGR for the global healthcare industry. This growth is primarily driven by increased spending on medicines in the digital healthcare system, contributing to the overall expansion of the industry. A Frost & Sullivan report predicts that India will emerge as one of the top 10 countries in terms of medicine spending, with the growth rate projected to increase from 9% to 12% over the next five years. The aging global population and the rising prevalence of chronic diseases have led to an increased demand for high-quality therapies at affordable prices, prompting healthcare providers to invest in the sector and fueling the growth of the healthcare industry.

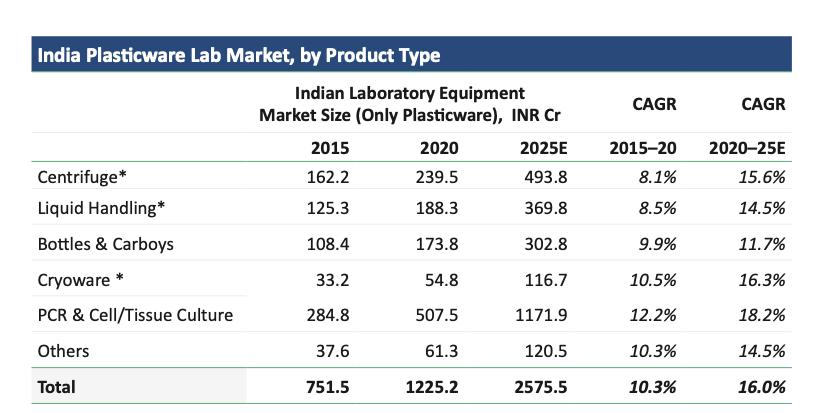

This significant growth in the healthcare industry, both globally and in India, has created a heightened demand for laboratory equipment used by lab technicians and scientists to perform a wide range of tasks, including analyzing patients’ biological samples, preparing cell culture mediums for research, and diagnosing various diseases through cell studies. The market for laboratory equipment can be broadly categorized into consumables (such as centrifuges, liquid handling, and cryoware products), reusables (including bottles, beakers, measuring cylinders, tube racks, flasks, and carboys), and other specialized equipment.

Technological advancements in chemical and biological research, the establishment of diagnostic centers, and the increased focus on biodegradability and reusability of laboratory products are driving the demand and continuous growth of the industry. Laboratories have evolved into multipurpose research facilities, hosting various testing mechanisms, novel developments, and research studies. Additionally, there is a growing emphasis on research-based studies, leading to the establishment of new laboratories in schools and universities, fostering early interest among students and further driving market demand.

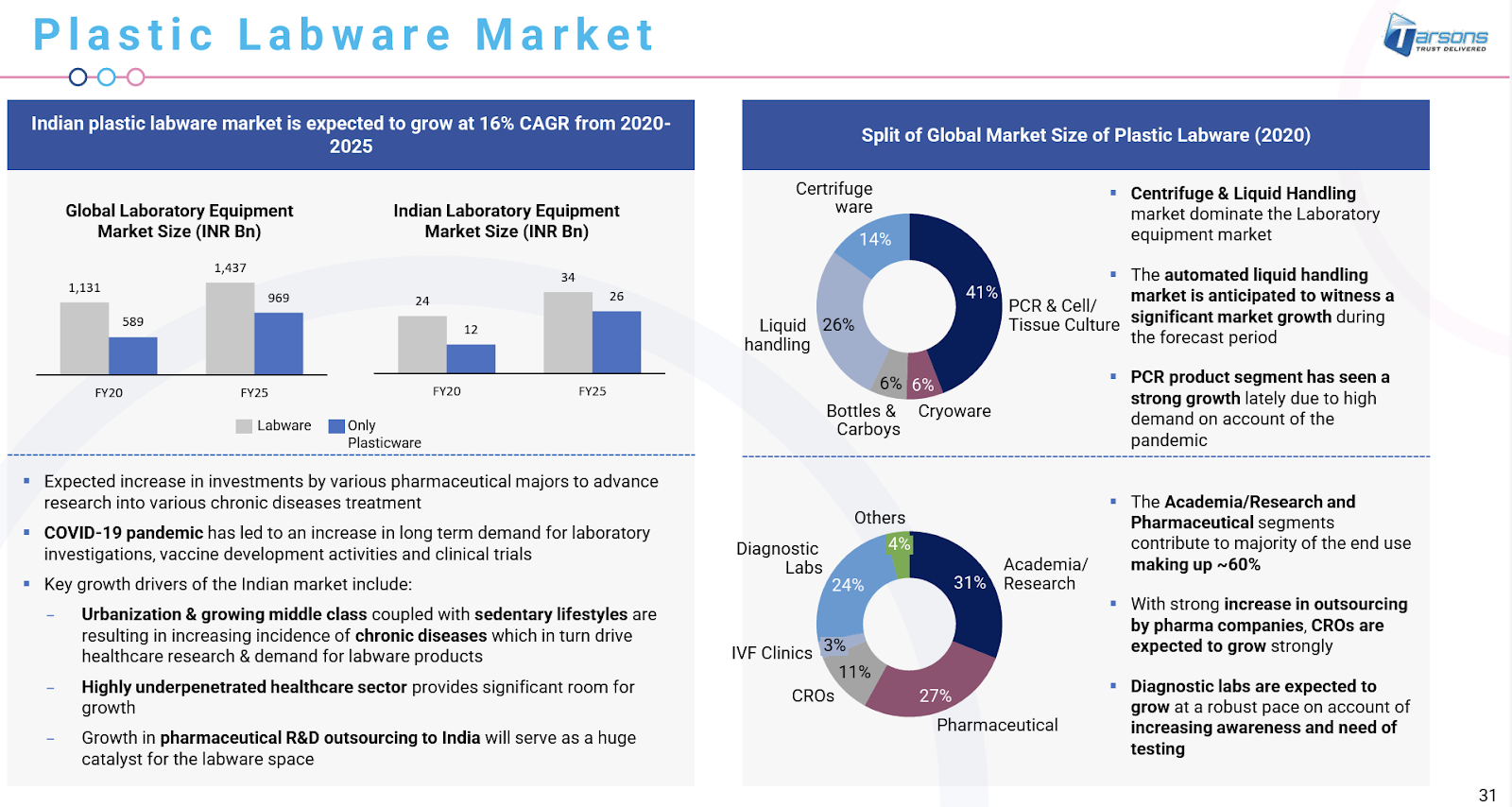

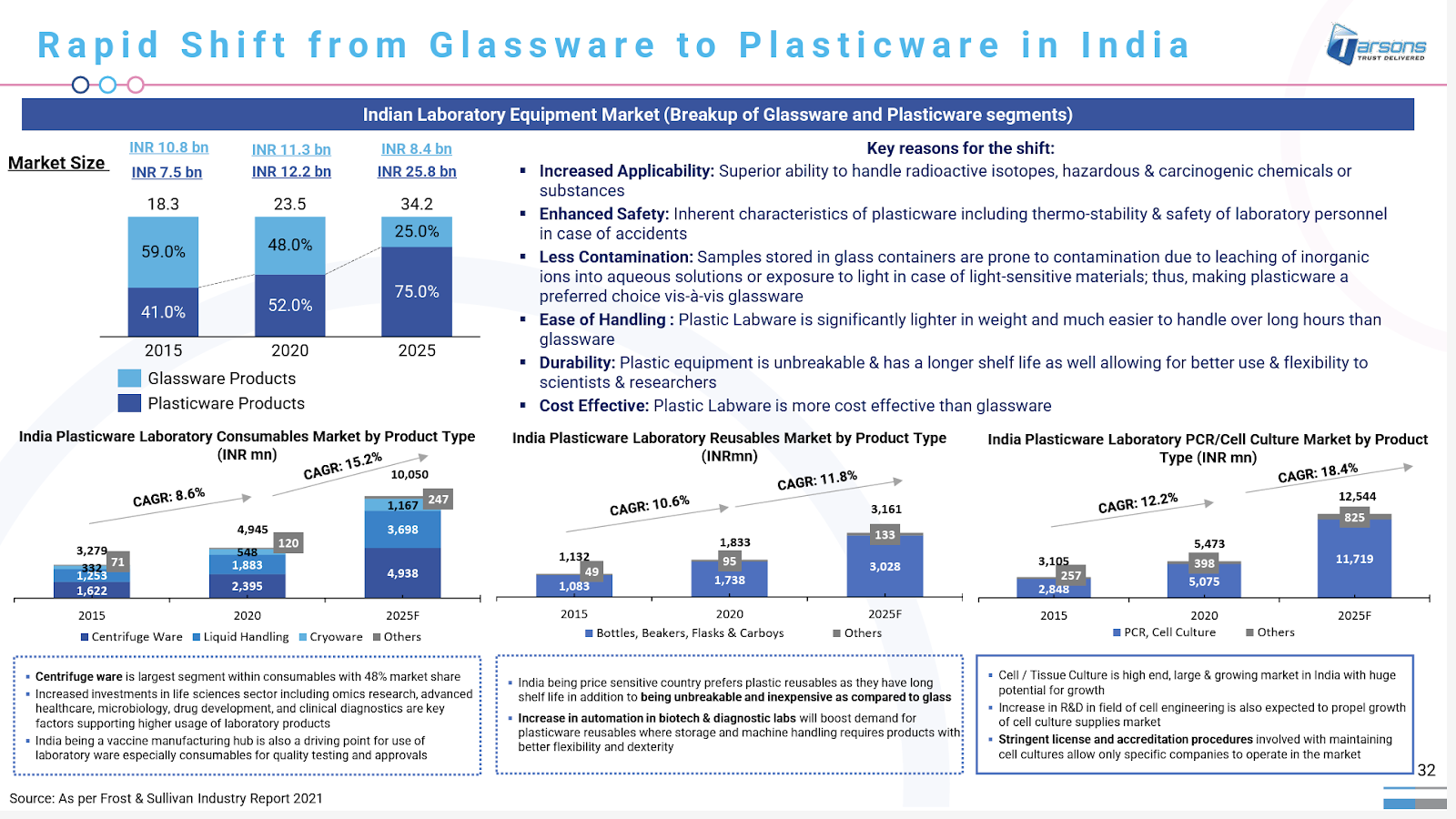

The global plasticware lab equipment market segment is expected to grow at a CAGR of 10.5%, expanding from $8.4 bn (₹612.5 bn) to $13.8 bn by FY25. Plasticware products currently constitute 52% of the total lab equipment market segment as of FY20, and this share is projected to rise to approximately 75% by FY25. The global labware market is witnessing an increased demand for plastic labware due to its advantages, such as lower breakage concerns, greater flexibility, and lower costs.

In FY20, the Indian laboratory equipment market (including both plastic and glassware) was valued at ₹24 bn and is expected to reach ₹34 bn by FY25, growing at a CAGR of 9.1%. However, the plasticware market alone is anticipated to grow at a CAGR of 16% during the same period, representing almost double the growth rate of the overall lab equipment market. This shift towards plasticware is driven by its favorable attributes, including ease of handling, flexibility, lower costs, and recyclability. In contrast, traditional glassware made from borosilicate glass, although heat-resistant, is non-recyclable, leading to increased preference for plastic lab containers. Overall, the healthcare industry’s growth, coupled with the increasing adoption of plastic labware, presents significant opportunities for the laboratory equipment market, both globally and in India.

The plasticware product is beneficial for the producers since raw material prices of high-grade plasticware resins (despite being a crude derivative) are not as volatile as crude prices and generally are passed on down the value chain, allowing the companies to benefit even while the crude oil prices fluctuate.

Tarsons Products Ltd Business Overview

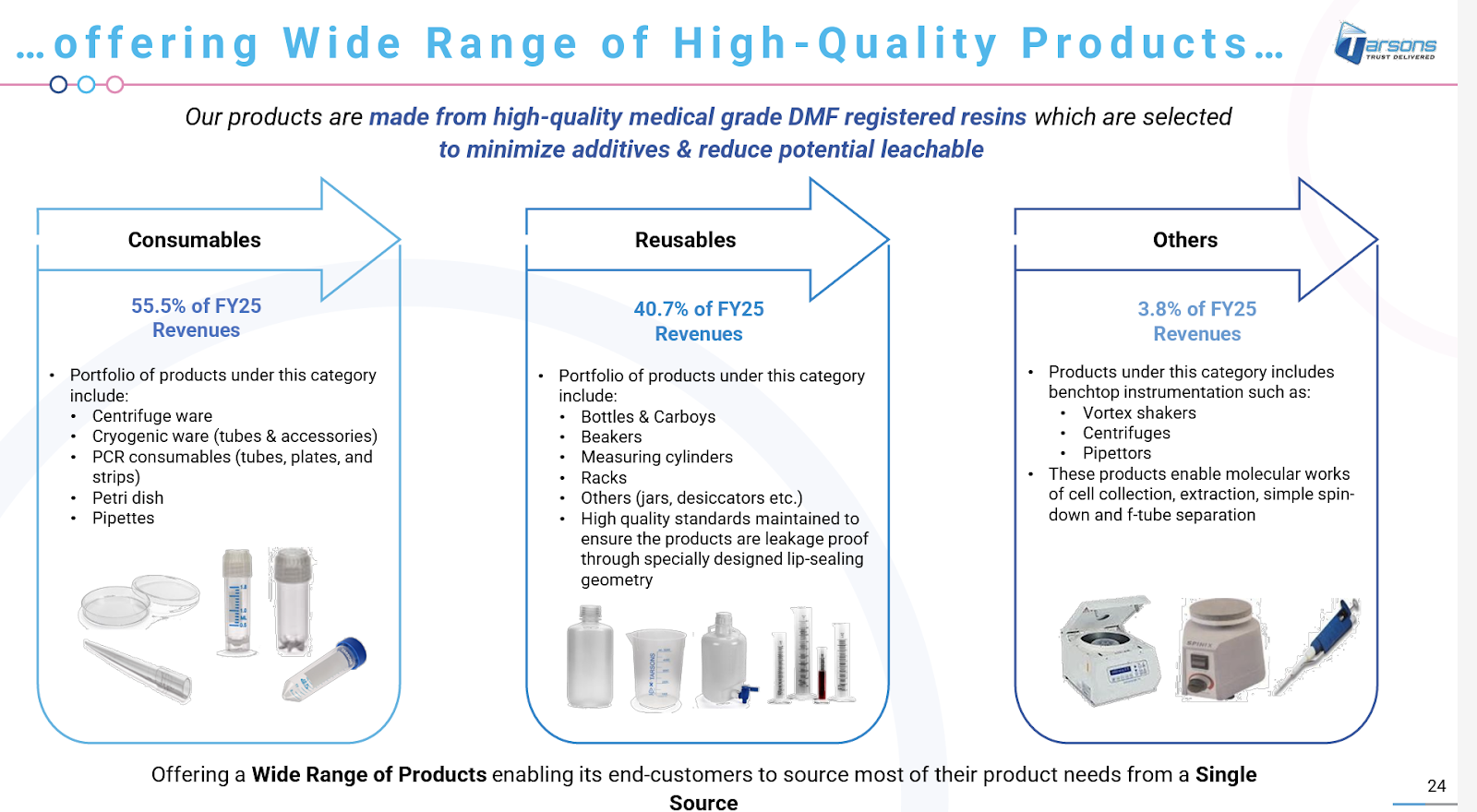

Tarsons Products Ltd is a leader in India in the production and supply of laboratory plasticware with more than three decades of experience. Tarsons Products Ltd is engaged in the design, development, manufacturing and marketing of consumables, reusables, and others (including benchtop equipment & instruments). Tarsons Products Ltd products are used by key end-user markets like Academic/Research Institutes, Pharmaceutical companies/CROs, Diagnostic players, etc. Tarsons Products Ltd has a diversified product portfolio with over 1,700 SKUs across 300 products. Tarsons Products Ltd’s products are made from high-quality medical-grade DMF-registered resins, which are heat resistant and specifically selected to minimize additives & reduce potential leachables.

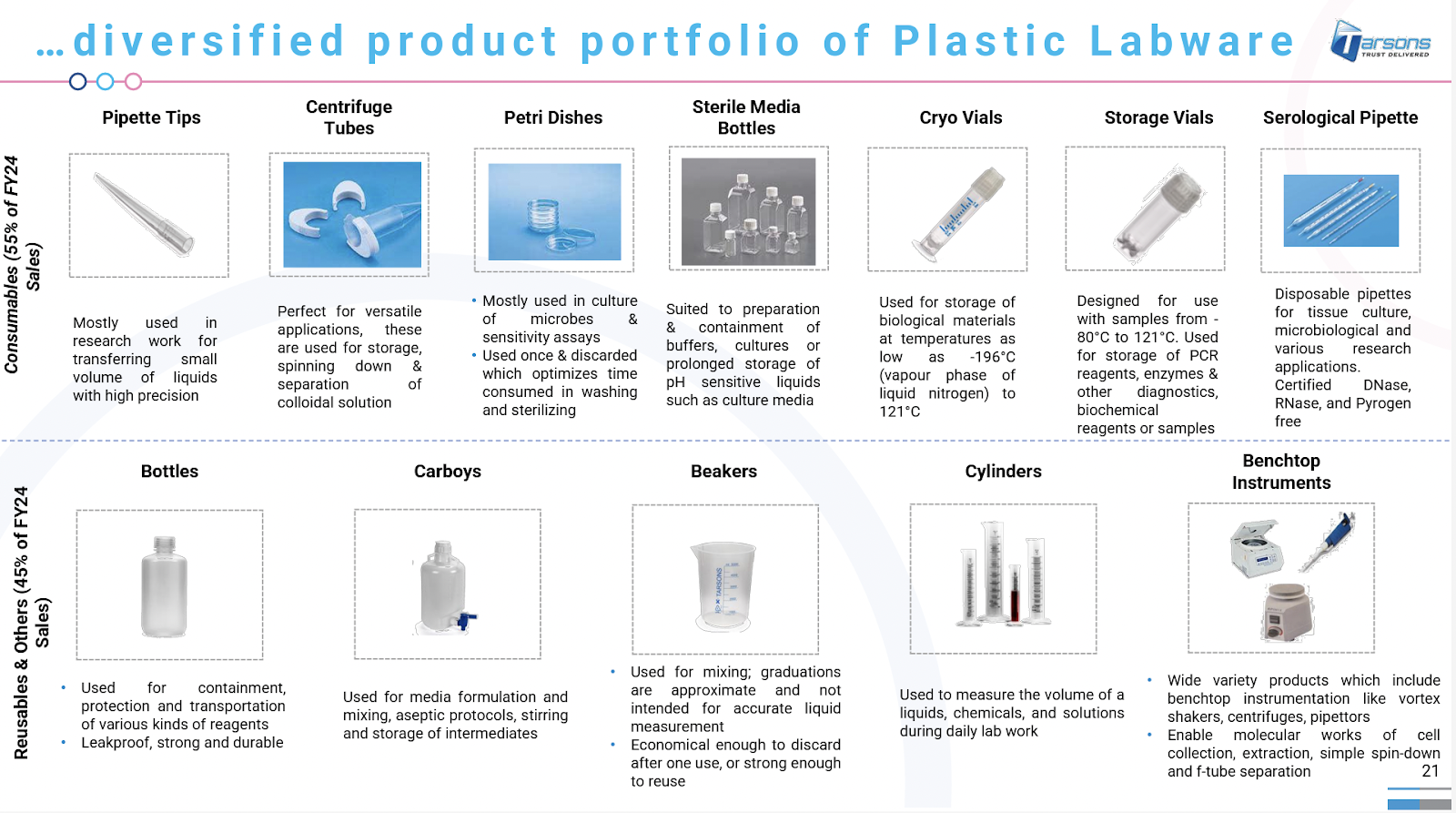

Tarsons Products Ltd’s product range includes disposable plastic labware, centrifuge ware, cryo labware, liquid handling systems, and instruments. Tarsons Products Ltd possesses expertise in plastic moulding and has sound knowledge of the latest and inventive laboratory techniques. Tarsons Products Ltd has a pan-India distribution network with long-standing relationships with its key distributors and is one of the few players in India to have a global reach in the labware market, with products being supplied to over 40 countries.

Tarsons Products Ltd primarily manufactures plastic labware, which contributed approximately 96% of its sales in FY22, while the remaining revenue came from lab equipment such as vortex shakers, centrifuges, and similar devices. Within plastic labware, the company divides its product portfolio into two categories: (a) consumables like pipettes, petri dishes, PCR consumables (tubes, plates, and strips), cryogenic and centrifuge ware (tubes and accessories), and (b) reusables like bottles, beakers, and measuring cylinders.

Tarsons Products Ltd is a good play in increasing R&D spending by pharma (CDMO included) and specialty chemical companies like SRF, PI, etc., in India.

Pharma and specialty chemical companies are making significant investments on the ground, and almost all of them are targeting contract manufacturing of patent-protected OEM products. This kind of business model requires significant investments in R&D.

Tarsons Products Ltd is the market leader in India in the plastic labware space with ~20% share of the overall market and ~40% share in addressable product segments, and hence would be the biggest beneficiary of this trend.

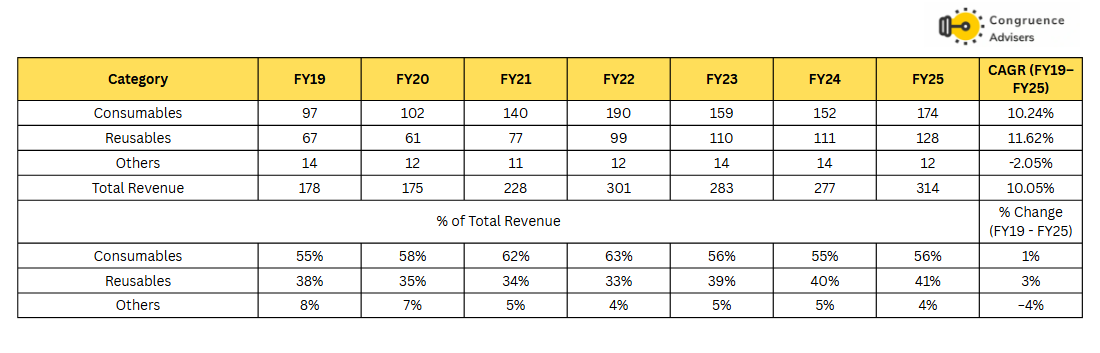

Tarsons Products Ltd product portfolio is classified into three categories:

1) Consumables range of products include pipette tips, centrifuge ware, petri dishes, cryoware, and storage vials, and contributed ~56% of FY25 revenue.

2) Resusable portfolio of the company includes bottles, carboys, beakers, measuring cylinders, and contributes ~41% of FY25 sales.

3) Others – apart from these, the company manufactures vortex shakers, centrifuges, and pipettors contribute 4% of sales.

Tarsons Products Ltd Segment

Tarsons Products Ltd Product Portfolio

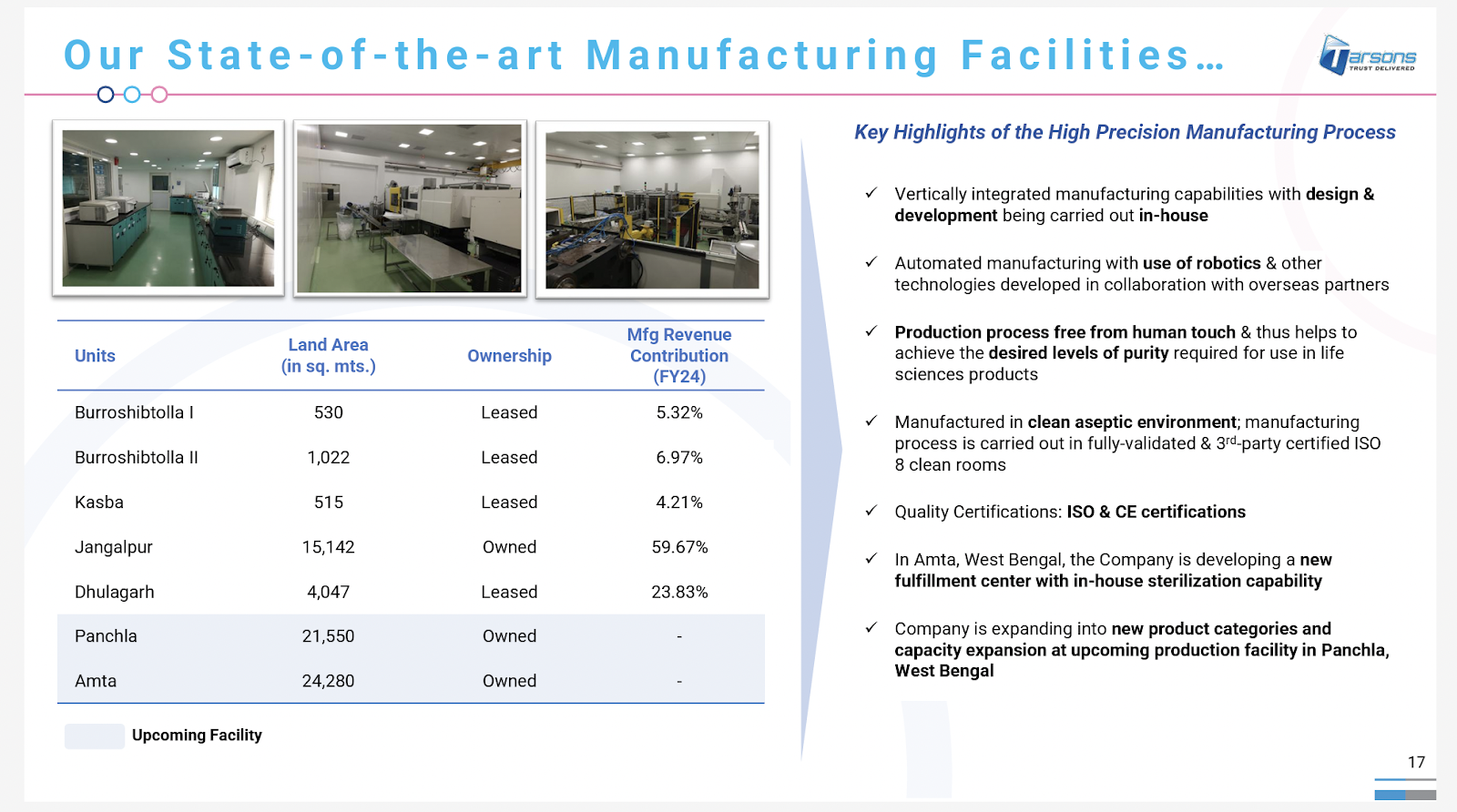

Tarsons Products Ltd Manufacturing Facilities and Capex

Tarsons Products Ltd currently operates five plants located in West Bengal, with four of them currently under lease. At present, the two facilities at Jangalpur (spread across ~15,142 sq mts) and Dhulagarh contribute to the bulk of revenues (~84% of revenue). Tarsons Products Ltd is currently undergoing capacity expansions at Panchla and Amta with a combined outlay of ~INR 550-650 Cr. The majority of capacity at the Panchla facility is likely to be focused on its foray into cell culture. At peak utilization levels, management expects revenue of ~INR 400 Cr at peak utilization.

Panchla Facility:

- Tarsons Products Ltd Panchla facility is progressing as planned, with commercial production commencing for certain products.

- Full ramp-up is anticipated in the first half of FY26, which will enhance capacity and cost efficiencies.

- The facility is expected to absorb fixed costs more quickly, leading to improved operating margins moving forward.

Capex mainly into Cell culture products is a specialized category of labware used for growing and maintaining biological cells outside their natural environment. They are major tools in cellular and molecular biology. and are used in fields such as drug development, tissue culture and engineering, gene therapy, drug screening, and the large-scale manufacturing of biological compounds.

Manufacturing Complexity: Cell culture products are generally described as more complex to manufacture than traditional plastic labware products. This complexity arises from the need for specific technical know-how, proprietary surface treatments, and chemical coating, which go beyond just machine output. Building high-quality, consistent cell culture products takes time and perseverance.

Tarsons Products Ltd Panchla facility at peak capacity can generate revenue of about INR 400 crores.. It is expected to take 3 to 5 years to reach this peak potential from commissioning. Tarsons Products Ltd Panchla Facility Phase 1 of commercial production is already underway, and Phase 2 is scheduled to commence operations in the second half of FY26.

The revenue contribution from the new Tarsons Products Ltd Panchla facility is expected to commence in H2FY26, and a full-scale revenue ramp-up from this is expected in FY27 and FY28 and Current annual expenditure at the Tarsons Products Ltd Panchla facility is approximately ₹7 crores to ₹8 Cr.

Tarsons Products Ltd Amta facility is a support center (warehouse, radiation plant) and will not add revenue, but may help improve gross margins.

The warehouse is expected to start operations by June end/the first week of July, and the radiation plant by July end/August. Tarsons Products Ltd Amta facility is expected to lead to cost savings by in-sourcing sterilization, which is currently outsourced.

Nerbe Acquisition Impact: The acquired Nerbe business (approximately a EUR 10 million company, FY25 revenue of INR 78 crores will contribute to consolidated revenue. Management’s strategy is to scale up and synergize the Nerbe business over the next 2 to 3 years.

Nerbe, acquired by Tarsons Products Ltd, is a Hamburg-based European company specializing in the distribution of plastic labware products, as well as medical and laboratory disposables. It operates with a trading-focused business model, which typically results in a lower margin profile compared to manufacturing entities.

Nerbe’s primary market is Germany and other key countries within the European Union, where it possesses an established distribution network. While it experienced a temporary surge in revenue and margins during the COVID-19 pandemic due to high demand for products like swabs for testing, its core business is now focused on supplying the life science industry, including products used by researchers for clinical trials and vaccine production. Tarsons Products Ltd aims to leverage Nerbe’s distribution capabilities to introduce its own manufactured products and expand its footprint across the European market

Tarsons Products Ltd Management stated the EBITDA margin for Nerbe was “about to be 9% to 10% with gross margin in the range of 45% to 55%. There is a possibility to increase the EBITDA margin to a 14-15% at better scale and higher utilization of capacity.

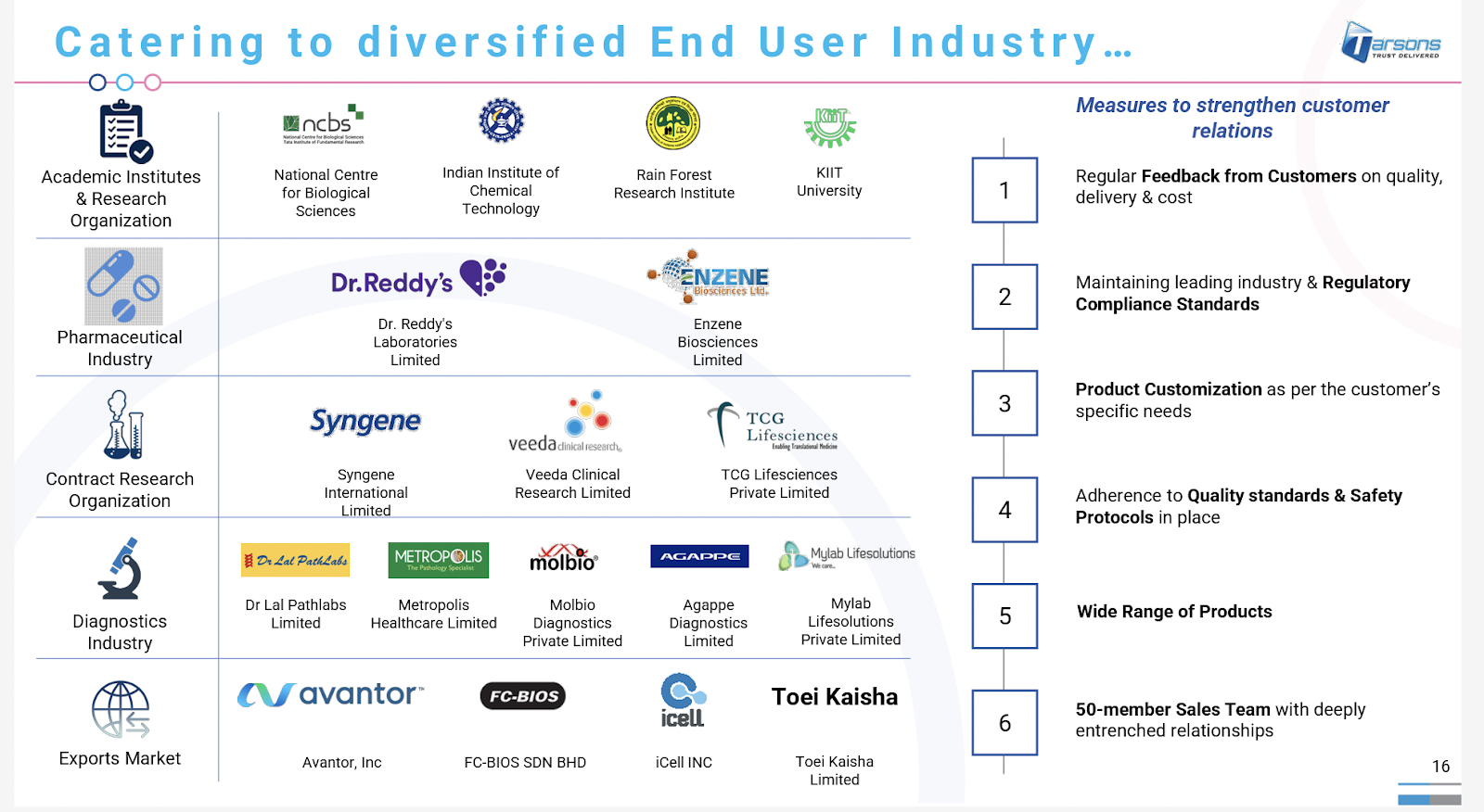

Tarsons Products Ltd Clientele

Tarsons Products Ltd products cater to a wide range of industries that include research organisations, academic institutions, pharmaceutical companies, CROs, diagnostic companies, and hospitals. The end-use industries of pharmaceuticals and diagnostics are set to grow ~10-11% and ~24% over FY22-FY27E (Source: IQVIA, Netscribes), which should help in sustaining healthy demand for the products in the coming years. Dr. Reddy’s, Syngene, Dr. Lal Pathlabs and Metropolis are a few notable clients of Tarsons Products Ltd. It also supplies its products to academia and research institutes such as the National Centre for Biological Sciences and the Indian Institute of Chemical Technology (IICT). Academia currently forms ~32% of the Indian plastic labware market by end use and is expected to maintain healthy demand with an increase in academia-industry collaboration.

Tarsons Products Ltd is the leading domestic player in an industry traditionally dominated by foreign MNCs and enjoys a healthy market share of ~9-12% in the overall labware market and ~25% in its covered markets. Over the years, Tarsons Products Ltd has been able to leverage its brand equity, high quality, and pricing (~10% lower than MNCs) to position itself as a cost-effective alternative to its MNC peers and garner market share.

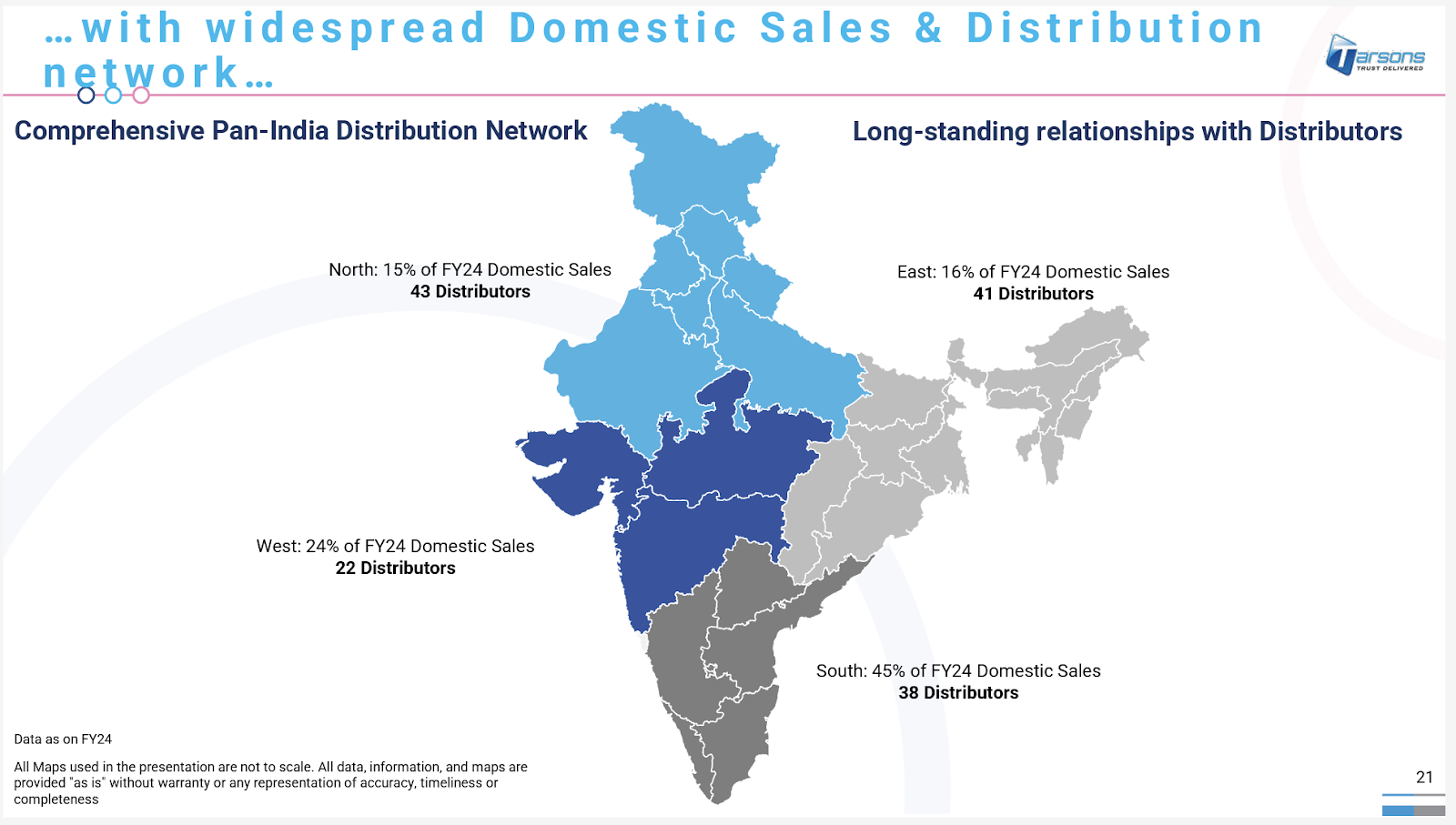

Tarsons Products Ltd follows a distribution-led model, where it has maintained long-standing relationships with its key partners. It currently distributes its products pan India through ~140 plus distributors, with South and West contributing ~69% of total sales. New product launches, foray into cell culture, and increased market share gains may drive domestic revenue going ahead.

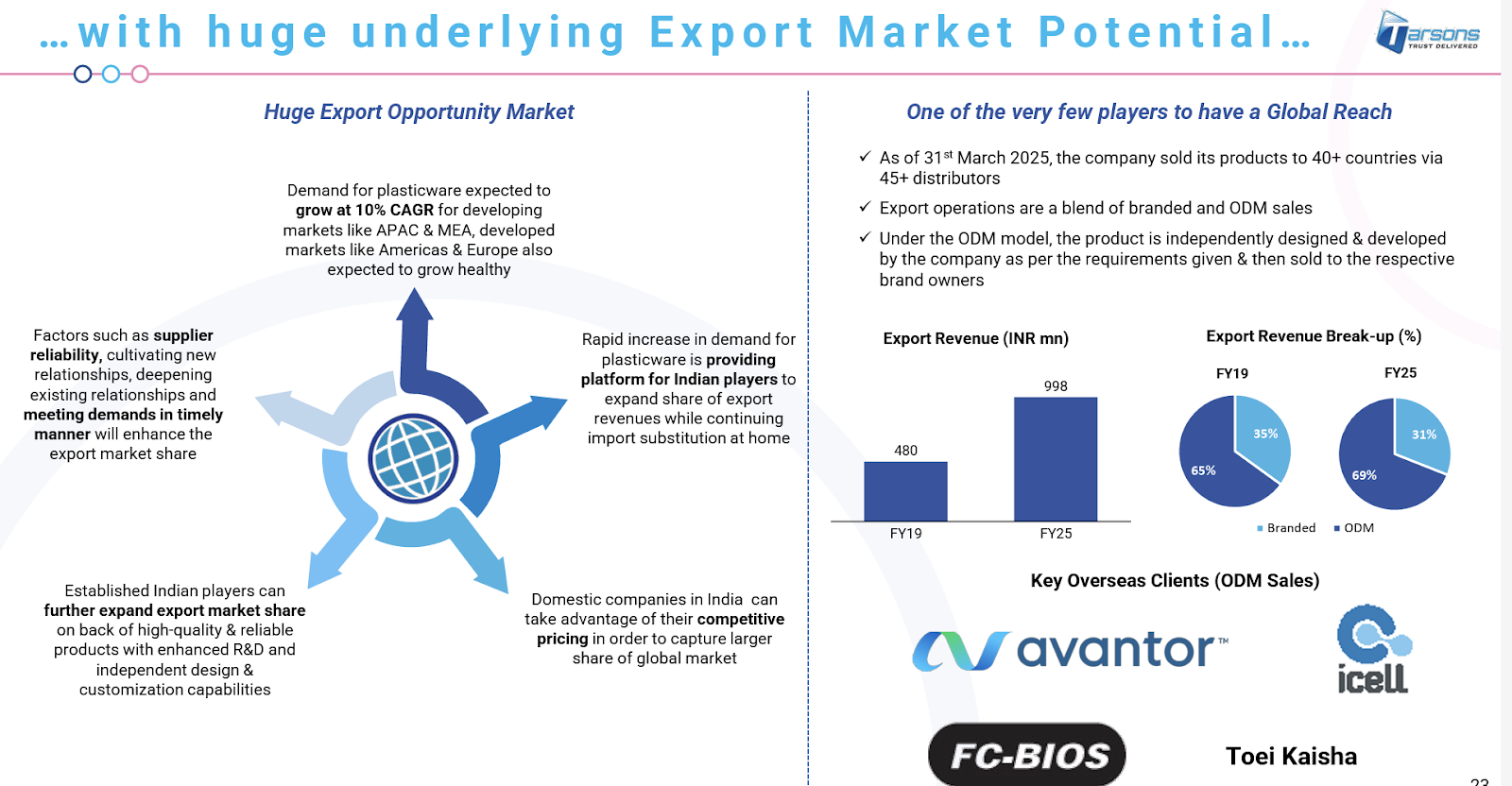

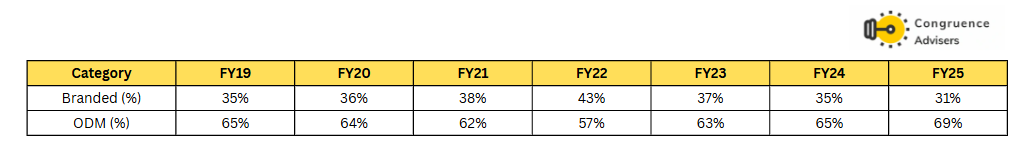

Exports

Tarsons Products Ltd has a healthy presence in export markets with products being sold across 40+ countries via 45+ distributors. The global plastic labware market stood at INR 50000 Cr currently. Tarsons Products Ltd sells its products through a mix of branded and ODM sales (also known as white label). Tarsons Products Ltd ODM model is undertaken in developed markets like the US and the EU, where the product is designed and sold to the respective brand owners. Avantor, iCell, and FC-BIOS are key overseas clients for its ODM sales. In emerging markets such as Asia-Pacific, the Middle East, and South America, Tarsons Products Ltd sells its products under its own brand name.

Avantor, iCell, FC-BIOS, and Toei Kaisha are global and regional players in the life sciences and laboratory consumables space. Avantor is a major multinational supplier of lab reagents and equipment; iCell and FC-BIOS focus on cell biology and biotech products, while Toei Kaisha is a Japanese firm involved in scientific instruments and chemical distribution.

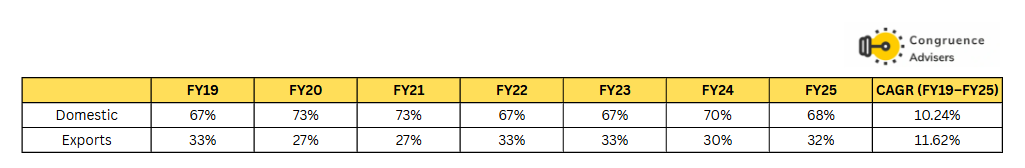

Tarsons Products Ltd Domestic & Exports Split

Tarsons Products Ltd Branded & ODM Split

Tarsons Products Ltd Corporate governance

Board Composition – Tarsons Products Ltd Board of Directors is composed of 7 members, including 3 independent directors and 1 woman director. Sanjive Sehgal acts as the Chairman and Managing Director, and Aryan Sehgal acts as a whole-time director. All board Members bring together a wealth of experience, diverse expertise, and visionary leadership with backgrounds spanning chemical, technology, finance, Law, and management

Related Party Transactions – Tarsons Products Ltd had no significant related party transactions in FY24. Some transactions have been done for subsidiaries, which have no impact.

Contingent Liabilities – According to the annual report of FY24, the total amount of contingent liabilities amounts to 2 Cr, which is less than 1% of net worth

KMP Remuneration – KMP Remuneration for FY24 is around INR 8.6 Cr vs 8.5 Cr YoY, which is 16% of FY24 net profit and thus on the higher side

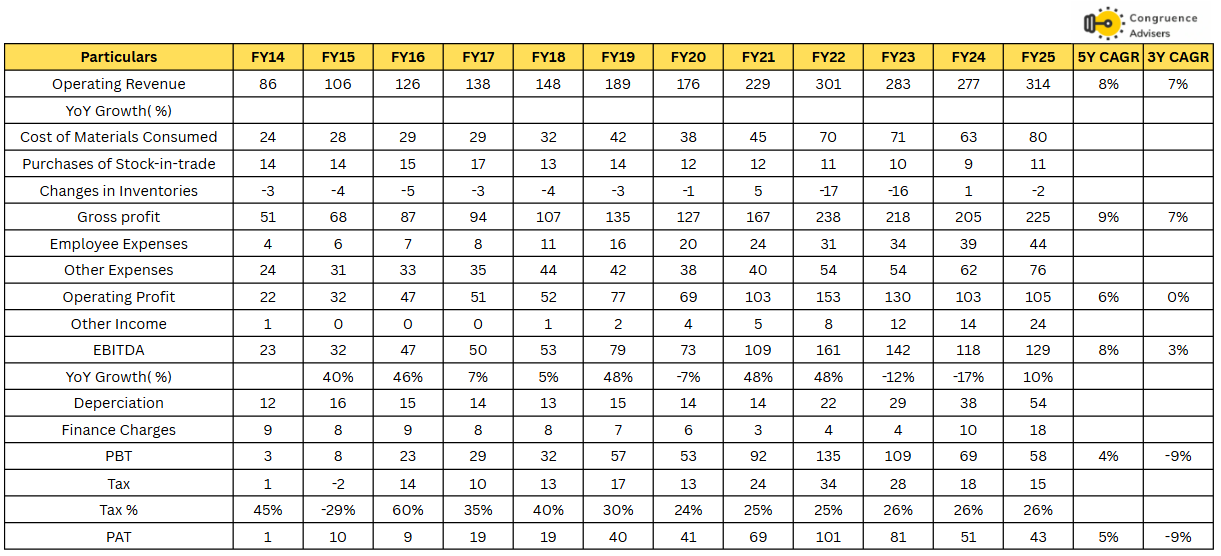

Tarsons Products Ltd Financial Performance

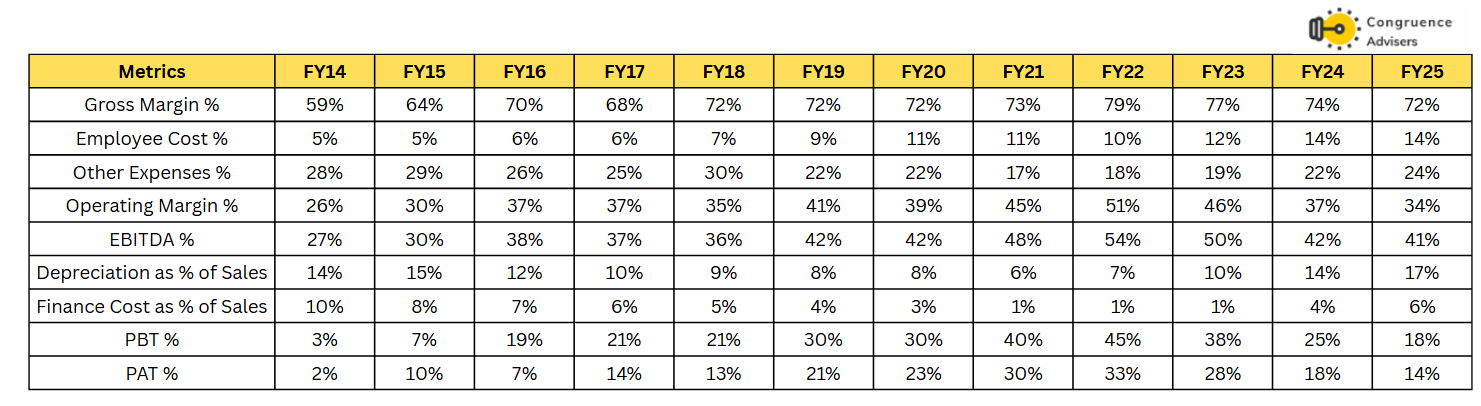

Over the last 5 years, Tarsons Products Ltd has grown revenues at a CAGR of 8%, EBITDA at a CAGR of 8% and PAT at a CAGR of 5% demonstrating a single-digit growth trajectory. During this period, EBITDA and PAT margins have been volatile, staying between 41–54% and 14%-33%, respectively. Over the 3 years Tarsons Products Ltd revenues have grown at a CAGR of 7%, EBITDA at a CAGR of 3%, and PAT at a CAGR of -9%.

Note: Standalone Nos

Tarsons Products Ltd Gross Margins have improved from 59% in FY14 to 72% in FY25, but they have dropped from FY22-FY23 levels of 79%-77%. During the COVID-19 pandemic, particularly in FY22, Tarsons Products Ltd benefited from a significant demand surge for high-end, value-added products and higher-margin items, such as those related to PCR testing and RT-PCR testing. These were often one-time products that contributed to exceptionally high gross margins. After that, the normalization of gross margins was primarily due to the waning of COVID-related demand and a shift in market dynamics.

EBITDA margins have improved from 27% in FY14 to 41% in FY25, but peaked at 54% in FY22. Post IPO, Tarsons Products Ltd revenue has declined in FY23 and FY24. The decline was primarily attributed to the industry’s slowdown and the negligible demand for COVID related products in FY23 and global recessionary trends, and inventory unwinding in FY24. Inventory stock-up had seen a substantial surge in FY22.

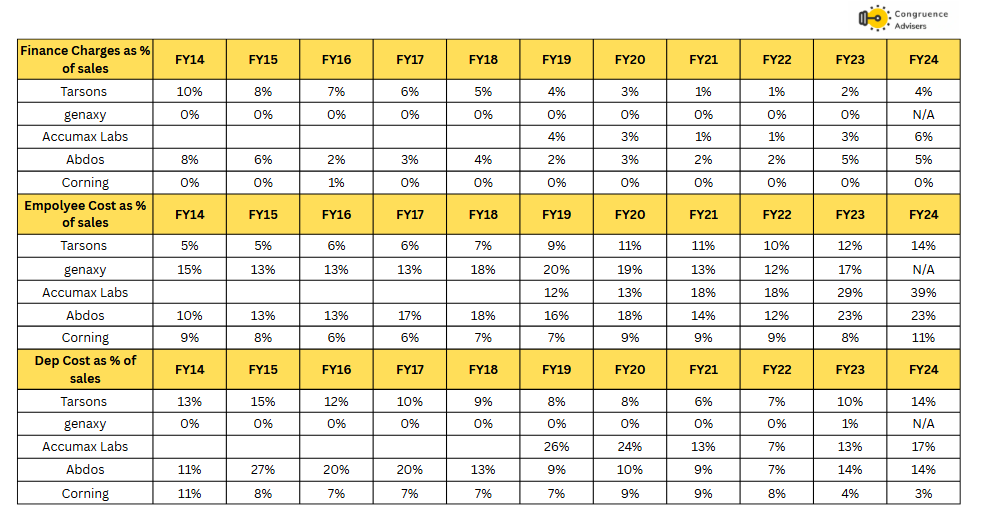

Employee Cost % of Sales has increased from 5% in FY14 to 14% in FY25. As growth resumes from H2FY26, operating leverage is anticipated to reduce the employee cost-to-sales ratio to 10-11%, which could benefit EBITDA margins by approximately 300 basis points in the next three years. Depreciation as % of Sales has increased from 6% in FY21 to 17% in FY25 due to higher depreciation charges especially from partially capitalized new facilities not yet generating full revenue, which have a direct negative impact on PAT margins. Management expects depreciation to peak around FY26. The total annual depreciation across all plants is expected to be in the range of ₹60-₹65 Cr and ₹80-₹80 Cr on a consolidated basis for FY26. From FY27-FY28 onwards, as new facilities ramp up revenue generation and the WDV method leads to lower depreciation charges for older assets, PAT margins are expected to recover to the 18%-20% range.

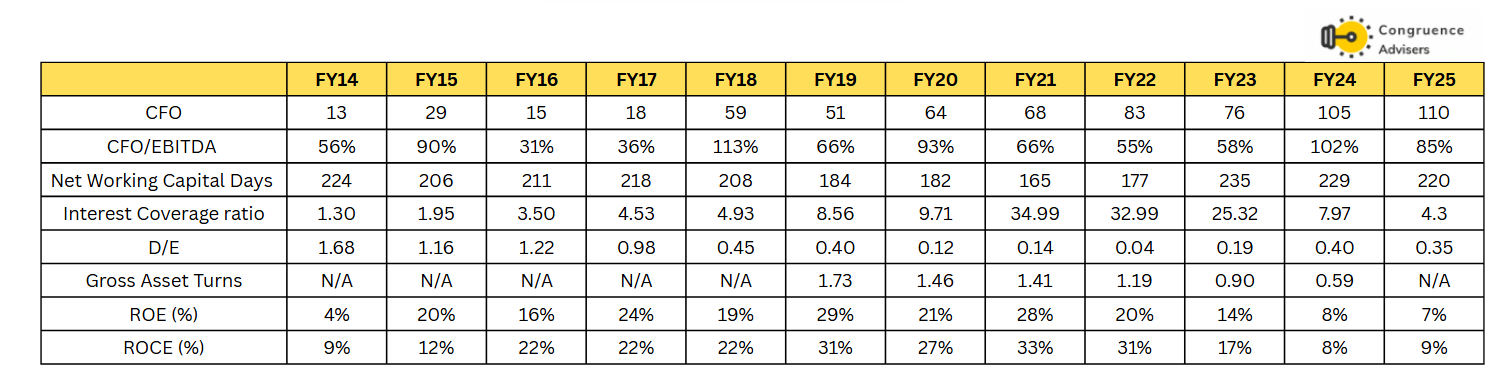

Tarsons Products Ltd – Working capital, Debt, cash flow, and Return Ratios analysis

Tarsons Products Ltd is currently in the midst of a strategic transformation driven by a large-scale capex program aimed at doubling its addressable market through entry into high-growth segments like cell culture and bioprocessing. While this has temporarily led to pressure on return ratios like ROE down to 7%, ROCE to 9% and asset turnover down to 0.59x in FY24, Tarsons Products Ltd continues to generate strong cash flows CFO/EBITDA at 85% in FY25 and maintains a conservative balance sheet with a debt-to-equity ratio of just 0.35x. Elevated working capital days and falling interest coverage reflect short-term strain from commissioning new capacity and muted demand, but are expected to normalize as utilization ramps up.

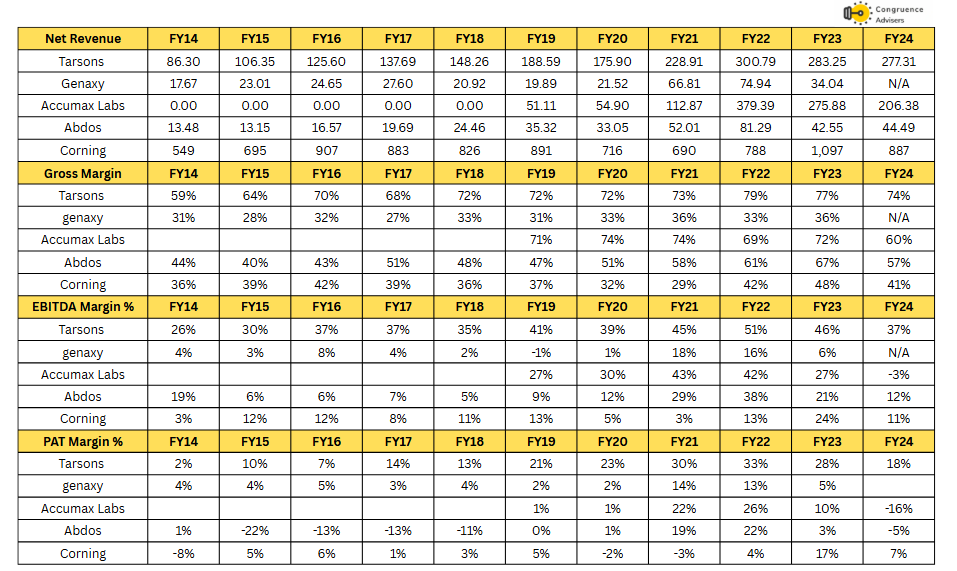

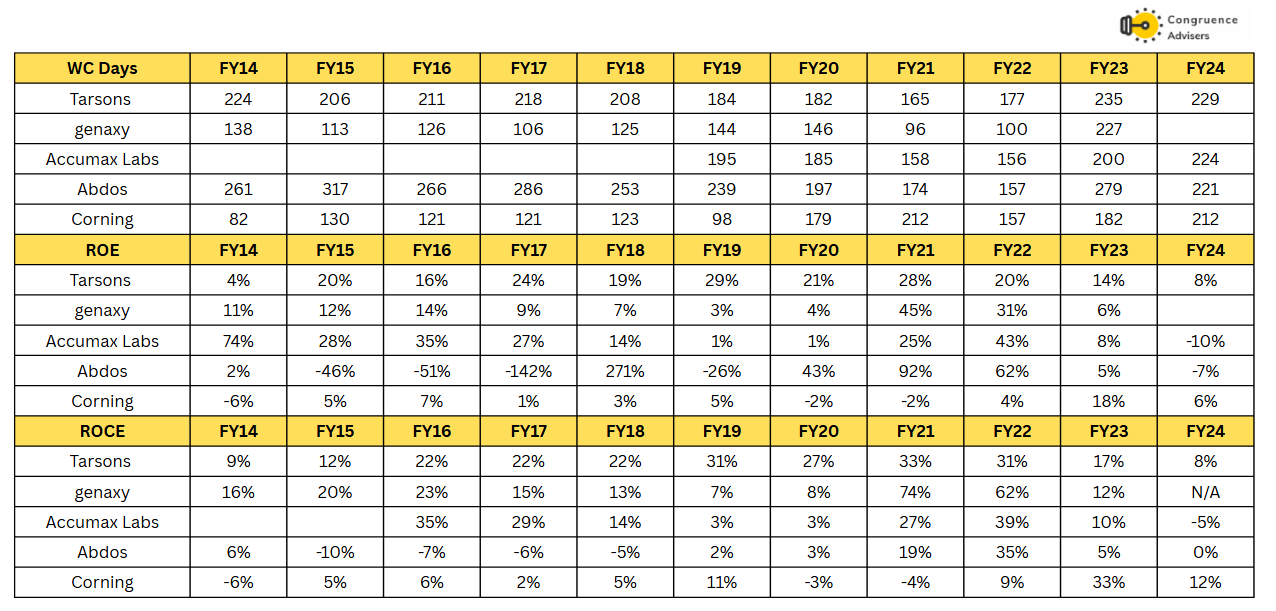

Tarsons Products Ltd Comparative Analysis

To understand Tarsons Products Ltd investment potential, We have conducted a comprehensive analysis. This analysis includes comparing Tarsons Products Ltd to its competitors (peer comparison) on various fundamental parameters and Tarsons Products Ltd share performance relative to relevant benchmark and sector indices.

Tarsons Products Ltd Peer Comparison

There are no like-for-like strong peer companies of Tarsons Products Ltd listed in India.

Key global players include Thermo Fisher Scientific, Corning, Eppendorf, Becton Dickinson, Mettler-Toledo, and Avantor. These companies historically dominate the labware market and often supply the Indian market through imports from their global facilities. Their products are generally priced at a premium and cater to customers involved in analytical research and requiring high-end products.

Domestic Players: Significant Indian competitors include Abdos Life Sciences, Accumax Lab Devices, Remi, Borosil (Scientific products division), and Genaxy Scientific. Some domestic players, like Abdos, are undertaking massive expansions, nearly doubling the capacity.

The market is competitive, and while Tarsons Products Ltd aims to maintain its margins, there can be competitive cost pressures, especially in new geographies or product launches whereTarsons Products Ltd might be aggressive to gain a foothold. However, some distributors value consistent quality and servicing over a slightly lower price. The overall life sciences industry has experienced a slowdown due to post-pandemic effects, recessionary trends, and inventory unwinding, impacting demand for labware products.

Increased Capacity Post-COVID, many manufacturers have increased capacity, and new players have entered the industry, leading to a global increase in competitive pressure. Tarsons Products Ltd is still doing comparatively well in terms of profitability vs most peers.

Tarsons Products Ltd Index Comparison

Tarsons Products Ltd share performance vs S&P BSE Small Cap Index, as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why You Should Consider Investing in Tarsons Products Ltd ?

Significant Capex done generating operating leverage potential – Tarsons Products Ltd. is nearing the completion of a transformative capital expenditure program that positions it for strong long-term growth and margin expansion. With nearly ₹525 Cr of its ₹600–650 crore capex already deployed, Tarsons Products Ltd is significantly enhancing its manufacturing capabilities through two state of the art facilities Panchla and Amta focused on scaling existing capacities, launching new product lines in high-growth areas such as cell culture and bioprocess products, and insourcing critical functions like sterilization to boost cost efficiency. These expansions are expected to nearly doubleTarsons Products Ltd’s addressable market enabling an incremental turnover potential of ₹350-400 Cr and lifting overall revenue capacity to ₹800 Cr annually by FY28-FY29. As commercial production ramps up from FY26 onward and utilization reaches optimal levels over the next 3-4 years, Tarsons Products Ltd expects significant operating leverage, improved margins and enhanced return on capital.

Despite near-term profitability pressures from higher depreciation and interest costs linked to ongoing investments, Tarsons Products Ltd fundamentals including prudent debt management (peak net debt capped at ₹400 Cr), internal accrual-based funding and strategic restraint in further capex. With capacity utilization at existing plants already at 70-75%, Tarsons Products Ltd anticipates reaching 50% to 60% utilization of the new facilities in about 2 years and 80% to 90% utilization in about 3.5 to 4 years and plans for automation and product diversification.

Strong Brand Recognition and High-Quality Products – Tarsons Products Ltd has built a trusted and reputable brand over the past four decades, known for delivering high-quality, reliable, and cost-effective labware solutions. Tarsons Products Ltd enforces stringent quality control protocols across all manufacturing processes, resulting in products that often rival those of global multinationals in quality, yet are offered at more competitive price points. This quality focus has earned it the confidence of India’s scientific community, particularly in sensitive domains like pharmaceuticals and R&D, creating a formidable barrier to entry for competitors.

Diversified Product Portfolio Supported by a Good Distribution Network – Tarsons Products Ltd offers a broad range of products with approximately 1,700 SKUs across 300 product lines. These include consumables, which contribute around 55% of total revenue; reusable products, accounting for about 40% and scientific instruments, which make up the remaining 5%. Tarsons Products Ltd serves a wide customer base, including scientific research organizations, contract research firms, hospitals, diagnostic centers, educational institutions, and R&D departments across various industries.

Tarsons Products Ltd sales are primarily driven through a well-established distribution network comprising around 144 active domestic distributors and 45 active international distributors, reaching customers in over 40 countries. Although direct sales through online channels are present they currently contribute a relatively smaller portion of the overall revenue. The recent acquisition of the Nerbe Group, a Germany-based trading company, is expected to significantly enhance Tarsons Products Ltd’s export revenue, particularly in Europe, where demand remains strong.

Tarsons Products Ltd is a good play on increasing R&D spending by pharma and specialty chemicals – We see pharma and specialty chemical companies making significant investments on the ground and almost all of them are targeting to get into contract manufacturing of products of OEMs, which are patent-protected. This kind of business model requires significant R&D investments.

Leadership in a Growing Market – Tarsons Products Ltd is the market leader in India in the plastic labware space with ~20% share of the overall market and ~40% share in addressable product segments, and hence would be the biggest beneficiary of this trend.

What are the Risks of Investing in Tarsons Products Ltd

Industry Downturn and Market Slowdown – The life sciences industry has recently faced headwinds due to global recessionary trends, geopolitical tensions, inventory destocking, and overall demand slowdown. These challenges have adversely impacted the demand for labware products. While Tarsons Products Ltd management believes this downturn is temporary and anticipates a recovery, the timeline and pace remain uncertain. Moreover, high inventory levels in the distribution network have also weighed on revenues. Tarsons Products Ltd performance is therefore vulnerable to unfavourable shifts in the evolving industry landscape.

Geographical Concentration of Manufacturing Facilities – All of Tarsons Products Ltd current and upcoming manufacturing units are located in West Bengal, India, exposing the business to significant geographical concentration risk. Any disruption be it due to political instability, civil unrest, natural disasters, or adverse local economic conditions could materially affect operations.

Raw Material Price Volatility and Import Dependence – Over 75% of Tarsons Products Ltd raw materials specialized medical-grade plastic resins are imported from countries such as the U.S, Germany, Singapore, Malaysia, and Taiwan. Fluctuations in raw material prices can impact profitability and margins especially due to potential lags in passing on cost increases. Moreover, Tarsons Products Ltd lacks binding advance purchase contracts with suppliers, making it susceptible to supply disruptions arising from geopolitical or logistical issues in sourcing countries.

Intensifying Competition – The labware industry is highly competitive, with global players like Thermo Fisher, Corning, and Eppendorf, as well as strong domestic companies such as Abdos Life Sciences, Accumax, Remi, and Borosil. Increased competition can result in pricing pressures and impact margins. Additionally, many competitors are expanding capacity aggressively (e.g., Abdos is scaling up production 2.5x), further intensifying the competitive landscape post-COVID for Tarsons Products Ltd

Operational and Project Execution Risks – Operational risks, including potential quality control failures, can harm Tarsons Products Ltd’s reputation and financials. While Tarsons Products Ltd has robust quality checks and automation in place, risks remain. Tarsons Products Ltd is currently undertaking capacity expansion projects (Panchla and Amta units), and any delays or execution issues could impact growth. Additionally, scaling newer, technically complex product lines such as cell culture products poses challenges, especially in regulated markets. These efforts require high technical expertise and strong market acceptance. Initial investments in automation and capacity expansion also lead to increased depreciation and interest costs, potentially affecting margins in the short term.

Working Capital-Intensive Business Model – Due to the wide range of products and reliance on imported raw materials with long lead times, Tarsons Products Ltd maintains high inventory levels. This makes the business inherently working capital-intensive.

Uncertain timelines for scale up of revenue – While the new capacity is expected to get fully commercialized in FY26, there is limited visibility on when revenue can ramp up. Management commentary indicates that healthy utilization may need 2-3 years which means that the interim period could continue to see higher fixed costs. While this means presence of operating leverage, it also implies a period of very muted earnings till the time revenue scales past a threshold.

Tarsons Products Ltd Future Outlook

Tarsons Products Ltd is entering a growth phase with capacity expansion and diversification. Tarsons Products Ltd Panchla facility is partially operational and will start contributing to commercial revenue in H2 FY26 and reach the full potential of INR 400 crores in 3-4 years. With Tarsons Products Ltd Amta facility (non-revenue support unit for sterilization and warehousing), the total capacity will be INR 800 Cr by FY28-FY29. Product expansion in high-potential categories like cell culture and robot-compatible consumables will further diversify revenue streams. A cell culture line alone can generate up to INR 100 crores at peak. Internationally, Nerbe’s acquisition gives Tarsons Products Ltd a foothold in Europe, and plans are to shift Nerbe’s sourcing to Indian manufacturing and unlock margin and scale benefits.

Tarsons Products Ltd Margins will be under pressure in the near term due to high depreciation and interest cost from capex. Standalone PAT margin is 13.6% in FY25. EBITDA is robust (36.5% standalone), and management expects meaningful margin expansion as fixed costs are absorbed with rising capacity utilization. EBITDA margin is guided to improve by 4-5% in 2-2.5 years and the long-term target is 40 %+. Nerbe has a lower margin structure (9-10%) but will support consolidated growth once Tarsons Products Ltd’ products replace third-party supplies. No formal guidance was given, but management and analysts expect a strong turnaround from FY27 with PAT margin normalizing to 18-20%.

Tarsons Products Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time, price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers, we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Tarsons Products Ltd Price charts

On the day chart there a signs of a bottom formation, though a clear trend may emerge only if the price crosses and sustains above the level of 460. At that price, one could also see the 50DMA cross above the 200DMA which would make the trend interesting poised, provided fundamentals support.

The weekly chart confirms what the day chart is telling us, that the price trend can spring to life only above the level of 450. We believe that a firm trend reversal is unlikely till numbers start getting better. One cannot just bank on the possibility of a bottom being in place since opportunity cost in the case of such stories can turn out to be high.

Tarsons Products Ltd Latest Result, News and Updates

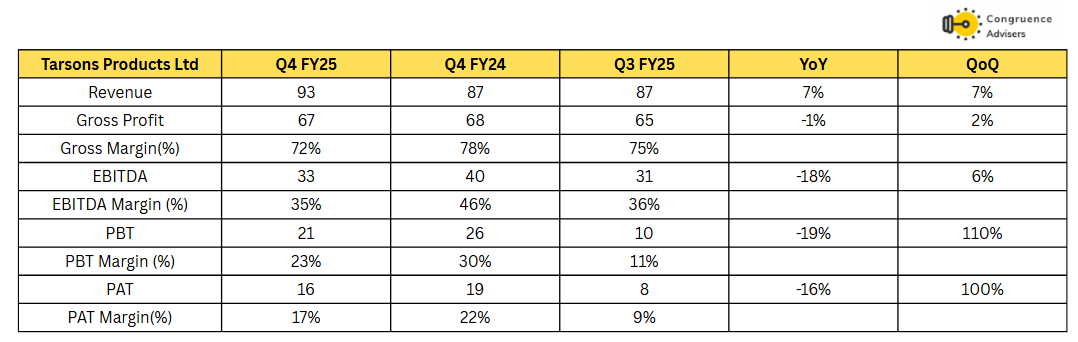

Tarsons Products Ltd Quarterly Results

Tarsons Products Ltd continues to navigate a subdued plastic labware industry, but early signs of recovery are emerging through increased RFQs and customer inquiries, especially in the OEM and CDMO segments. Tarsons Products Ltd remains a domestic market leader and is expanding globally despite macro headwinds notably in Europe.

Tarsons Products Ltd FY25 revenue growth was steady with standalone sales rising 13.3% YoY and consolidated revenue at INR 392 crores, boosted by the Nerbe acquisition. EBITDA margins remain robust domestically (36.5%) but are diluted at the consolidated level due to Nerbe’s low-margin, trading-heavy model. Tarsons Products Ltd standalone PAT dipped due to higher depreciation and interest costs from capex-related debt, though cash PAT rose 8% YoY to INR 97 crores. The business has significant headroom from the Panchla and Amta facilities which could support revenue of up to INR 800 crores in the future, however the timeline for the revenue scale up is uncertain right now.

Tarsons Products Ltd Management is focused on completing its capex cycle and leveraging the expanded Panchla facility to launch higher-margin cell culture and bioprocessing products, potentially doubling its addressable market. The Panchla facility will start contributing to revenue in H2FY26.

The transition of Nerbe from a distributor of third-party products to a channel for Tarsons Products Ltd own SKUs is expected to enhance capacity utilization and gradually improve margins. With no major new capex planned beyond maintenance, incremental growth will stem from sales ramp-up and operating leverage. Despite risks like uncertain US tariffs, European softness, and delayed recovery in government/research segments, Tarsons Products Ltd appears well-positioned for medium-term growth. Export momentum, improved domestic sentiment, and cost efficiencies from automation and in-house sterilization should support margin expansion and better cash flows by FY27.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this to a general audience. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will continue/be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.