Transrail Lighting Ltd is a differentiated mid cap EPC play on the India & global power T&D capex cycle. Strong order visibility, disciplined bidding and best in class return ratios underscore its superior capital efficiency versus peers. With international exposure driving margin accretion and backward integration enhancing execution agility, Transrail Lighting Ltd appears well placed to deliver sustained earnings compounding in line with the structural grid upgrade cycle.

Transrail Lighting Ltd Company Summary

Transrail Lighting Ltd is a leading mid-sized EPC player in India’s power T&D and infrastructure space with an integrated manufacturing edge with over 4 decades of execution pedigree. Transrail Lighting Ltd has evolved from a small foundation contractor into a vertically integrated and multi vertical EPC powerhouse executing complex turnkey projects across 59 countries. Transrail Lighting Ltd is now on an accelerated growth path backed by sector tailwinds and a strong order book visibility.

The journey began in 1984 when a small partnership firm named Transrail Engineering Company laid its first 132kV transmission line for Gujarat Electricity Board. It was the era when India’s grid expansion was in early stages and Transrail Engineering Company positioned itself as a reliable partner for foundational infrastructure.

By 1987 the company graduated to handling direct 400kV transmission line contracts which was a key marker of capability in the T&D space. Sensing the need to control quality and supply timelines, the company soon backward integrated into manufacturing setting up its first tower factory in Baroda in 1993 under a new entity Associate Transrail Structures Ltd

Between 2004 and 2010, the company invested aggressively in manufacturing assets:

- 2004: Tower plant at Butibori (Nagpur)

- 2007: Conductor facility at Silvassa

- 2009: Tower manufacturing + testing station at Deoli, Maharashtra

- 2010: Pole manufacturing unit

This manufacturing buildout laid the foundation for what would later become Transrail Lighting Ltd’s competitive moat, an integrated value chain covering towers, poles, conductors, monopoles and even in house testing all critical for T&D execution and margin preservation. This phase of organic growth caught the attention of Gammon India Ltd, one of India’s largest infrastructure players at the time. By 2009 Transrail was fully merged into Gammon, transforming Transrail into a larger vehicle within the Gammon group for handling power T&D mandates. The defining pivot came in 2015-17. When Gammon India weighed down by debt and regulatory challenges exited the business. Its 75% stake in Transrail Lighting was sold to Ajanma Holdings (holding company of Transrail Lighting Ltd) and the entire EPC T&D business of Gammon India including assets, projects and manufacturing facilities was formally transferred to Transrail via an NCLT-approved scheme.

Fast forward to Today, Transrail Lighting Ltd positions itself as a fully integrated EPC solutions provider with a core focus on power transmission and distribution. Transrail Lighting Ltd has developed capabilities to execute end-to-end projects across voltage classes up to 1200 kV, encompassing transmission lines, AIS/GIS substations up to 765 kV, 800 kV HVDC corridors, underground cabling, and rural electrification.

A key differentiator lies in its backward-integrated manufacturing ecosystem, which supplies approximately 65-70% of project inputs including towers, conductors, poles and monopoles thereby ensuring execution efficiency, margin stability and control over delivery timelines. Transrail Lighting Ltd has also strategically expanded into adjacent verticals such as Railway electrification & infra, Poles & lighting infrastructure, Specialised Civil EPC. Most recently, Transrail Lighting Ltd has forayed into the renewable energy EPC space, securing its first international solar order.

Transrail Lighting Ltd has built a strong legacy over four decades evolving from a foundation level transmission player in 1984 to a fully integrated EPC firm today. Transrail Lighting Ltd has steadily expanded its capabilities setting up manufacturing units for towers, conductors, and poles, developing civil and underground cabling expertise and executing high voltage and turnkey international projects.

Transrail Lighting Ltd – IPO

Transrail Lighting Ltd is the latest listing story from the EPC T&D space having recently debuted on the bourses on June 27, 2024. The IPO received healthy investor interest and raised around ₹839 crore in total. This included a fresh issue of ₹400 crore (6.85% equity dilution) and an OFS of ₹439 crore by its promoter Ajanma Holdings Pvt Ltd.

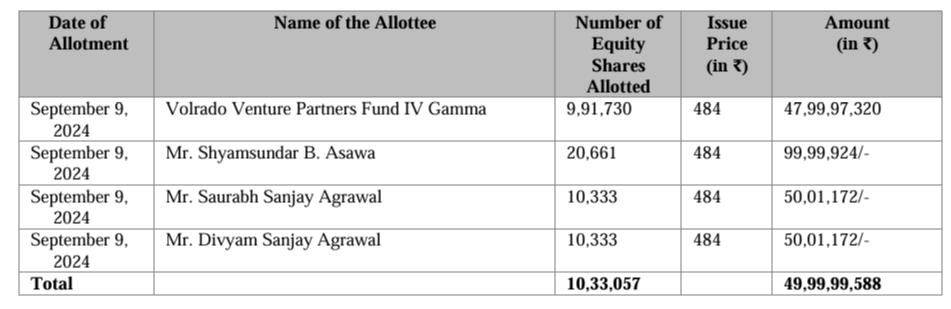

Before the IPO, Transrail Lighting Ltd raised ₹50 crore via a pre-IPO placement at ₹484 per share (i.e 20% premium to the IPO price of ₹432 per share). This placement saw participation from reputed investors such as Volrado Venture Partners Fund IV Gamma, Shyamsundar B. Asawa, Saurabh Sanjay Agrawal, and Divyam Sanjay Agrawal, etc.

The fresh issue proceeds are allocated to support business expansion and operational agility with ₹250 crore going towards working capital and around ₹90 crore for capex and the rest allocated for general corporate purposes.

Transrail Lighting Ltd Corporate structure

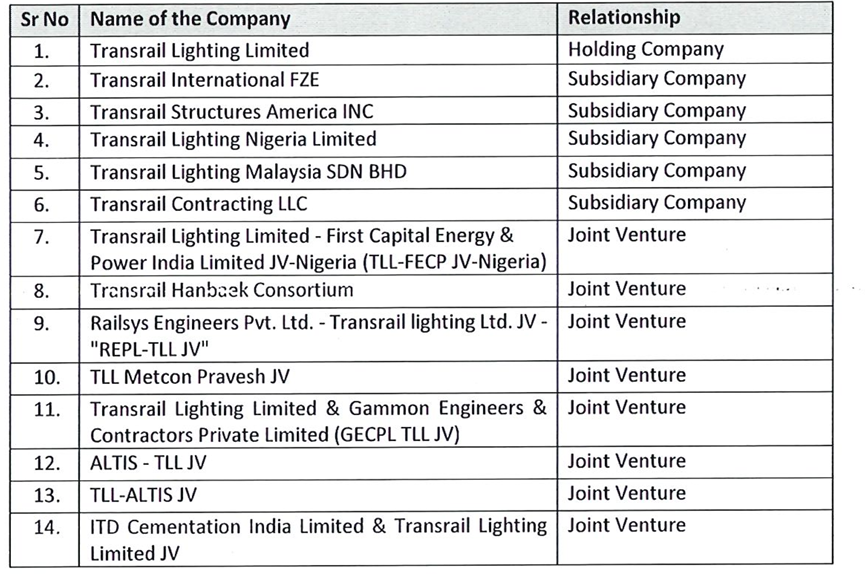

Transrail Lighting Ltd operates through a diversified corporate structure comprising 6 wholly owned subsidiaries and a network of 8 strategic joint ventures, supporting its global EPC operations. Transrail Lighting Ltd is involved in eight joint ventures and consortiums including partnerships with reputed industry players such as ITD Cementation, Altis and etc. with ownership stakes ranging from 25% to 100%. These alliances enable flexible bidding and execution models especially for international projects

However, from a financial standpoint most of the subsidiaries and JVs currently do not contribute meaningfully to the consolidated topline. The Nigerian subsidiary appears to be the only relevant one though it is presently loss-making. This suggests that while the broader structure provides optionality and execution flexibility its tangible financial impact remains marginal at present.

Transrail Lighting Ltd Holding Company – Ajanma Holdings Private Limited

As of June 30, 2025, Ajanma Holdings Private Limited held a 69.91% stake in Transrail Lighting Ltd representing 97.20% of the promoter shareholding.

Based on disclosures available as of March 31, 2024, Ajanma Holdings is owned by:

- The Freyssinet Pre Stressed Concrete Company Limited – 44.76%

- Global Axe Investment Firm (formerly Aviator Global Investment Funds) – 46.98%

- The Great International Tusker Fund – 8.26%

While the Freyssinet Pre Stressed Concrete Company Limited is majority-owned by Mr. Digambar Badge Venture LLP which shows strong promoter involvement and long-term commitment.

Both Global Axe Investment Firm and The Great International Tusker Fund are registered as Category II FPIs in Mauritius. These entities were also anchor investors in the 2023 FPO of Adani Enterprises. While certain global commentary (e.g. Hindenburg report) has drawn associations between these entities and Vinod Adani’s broader network, no official regulatory finding has established direct linkage.

Their presence in the shareholding structure may merit ongoing monitoring but does not pose any immediate governance overhang.

Transrail Lighting Ltd Management Details

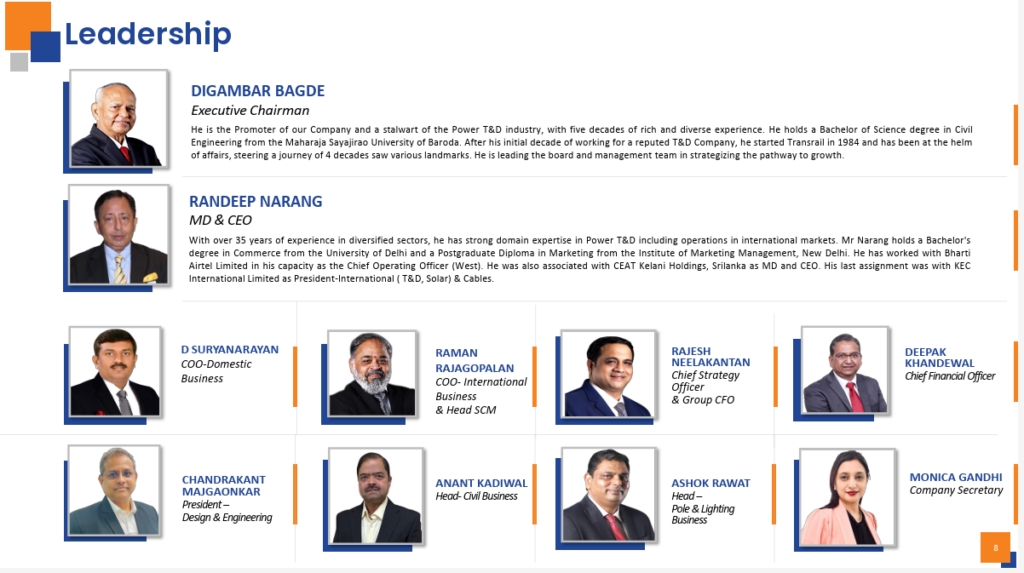

Transrail Lighting Ltd has a stable and seasoned leadership structure that combines a deep rooted promoter legacy with professional management depth. The team is led by Mr. Digambar Bagde who has remained consistent for decades; which provides comfort in terms of strategy and execution consistency. While its erstwhile parent, Gammon India, faced financial distress and underwent debt restructuring, Transrail’s T&D EPC business was always steered independently by Mr. Bagde, who continues to lead the company today.

Mr. Digambar Bagde (Executive Chairman & Promoter) has been the driving force behind Transrail Lighting Ltd since inception in 1984. A veteran of the power T&D sector, he served as Managing Director until 2020 and has led Transrail Lighting Ltd’s transformation from a domestic EPC player to a full-spectrum transmission and infrastructure solutions provider. Under his leadership, Transrail Lighting Ltd executed foundational milestones, built integrated manufacturing capabilities and developed a strong domestic order book. Today, in his role as Executive Chairman, he provides strategic oversight and continues to guide long-term vision, board governance and capital allocation. He actively engaged in key decision-making.

Mr. Randeep Narang (MD & CEO) Appointed in October 2020 as part of a planned professionalization of leadership, Mr. Narang brings over 35 years of cross sector experience with 15+ years in the T&D and infrastructure domain. His prior stints at KEC International (as President – International T&D, Solar & Cables), CEAT Sri Lanka (MD & CEO), and Bharti Airtel (COO – West). Which reflect his strong execution pedigree and global exposure. His induction marks a strategic inflection point for shifting focus toward international markets and EPC vertical expansion. Since his onboarding, the share of international revenues has scaled from ~20% (FY20) to 50%+ driven by stronger bidding capabilities, JV expansion and process upgrades. He is widely credited with institutionalizing systems and positioning Transrail Lighting Ltd for scalable and sustainable growth.

Transrail Lighting Ltd – Industry Landscape

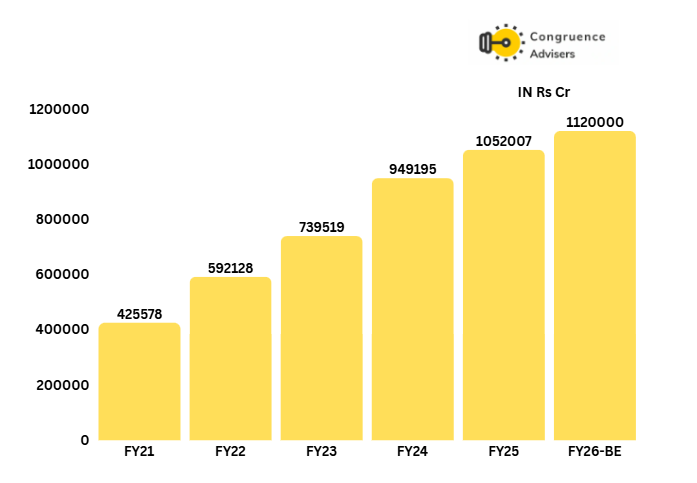

India Government Capex

India is currently in the midst of a multi-year infrastructure capex cycle, anchored by a sharp rise in the Government of India’s capital expenditure. The Union Budget for FY26 has increased the capex allocation to ₹11.2 lakh crore, up 10.9% over FY25RE and equivalent to 3.1% of GDP. While the allocation towards capex intensive sectors has seen only moderate YoY growth, the absolute figures remain substantial. This sustained thrust on capital expenditure reflects the government’s continued commitment to infrastructure led economic development and provides strong visibility for project execution across sectors like power, railways, urban & rural development.

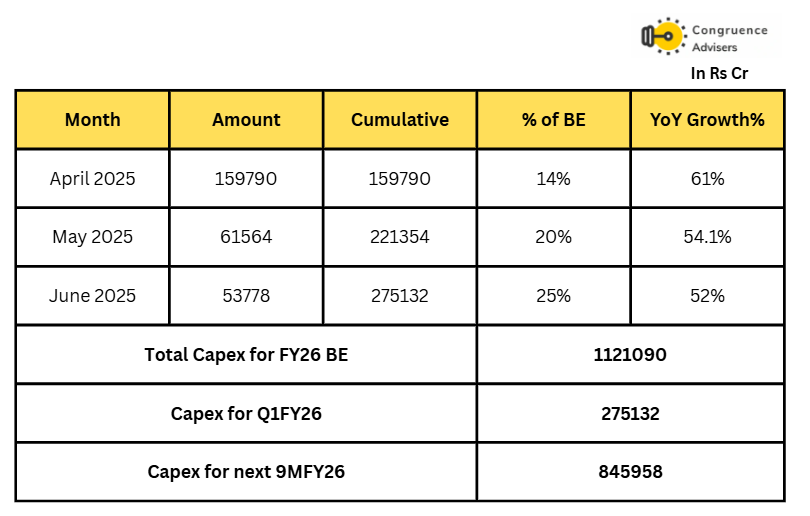

Capex Execution Picking Up Pace Early in FY26

India’s infrastructure capex cycle remains intact with execution off to a strong start in FY26. The central government has spent ₹2.75 lakh crore in capital expenditure during Q1FY26 accounting for 25% of the FY26 budget estimate (BE) of ₹11.21 lakh crore. This is not only a meaningful share of the full year target but also reflects a healthy YoY growth of over 50% across the first three months. While this growth is partly boosted by a lower base due to relatively subdued spends due to elections during the early part of FY25. it still suggests a continued front loading of investments with ₹8.46 lakh crore still to be deployed over the next nine months, the execution visibility remains robust and continues to offer a strong pipeline for EPC players

Power Transmission & Distribution

The power transmission & distribution segment forms the critical backbone of India’s electricity infrastructure which enables the efficient and reliable flow of power from generation sources to end consumers (both residential and industrial). This high-voltage conduit serves as the midstream layer of the power value chain, linking upstream generation assets to downstream distribution networks. A robust transmission system is essential to reduce technical losses, maintain grid stability and ensure last-mile supply especially as demand patterns grow more complex across geographies and seasons.

It covers two key components:

- Power transmission which involves the high-voltage transport of electricity over long distances

- Power distribution which deals with the final step of delivering electricity to end users through lower-voltage networks.

The T&D network operates across a wide voltage spectrum from extra high voltage (765kV, 400kV, 220kV) used for bulk power transfer, to high and medium voltages (132kV, 66kV, 33kV, 11kV) for regional and local distribution and low voltage (1.1kV and below) systems for household and small commercial use.

The transmission segment involves high voltage infrastructure such as transmission lines, substations, transformers and switchgear & circuit breakers which carry electricity from generating stations to substations. The distribution segment takes over from substations and includes distribution transformers, feeder lines, and metering & billing systems to deliver power to end consumers.

Need for Capex in Transmission

India’s growing energy demands, increasing renewable penetration and geographical consumption generation mismatch make a robust transmission network indispensable. A well developed transmission grid enables seamless power flow, reducing regional disparities in supply. It also enhances market efficiency by facilitating power trading and strengthens national energy security by improving redundancy and resilience.

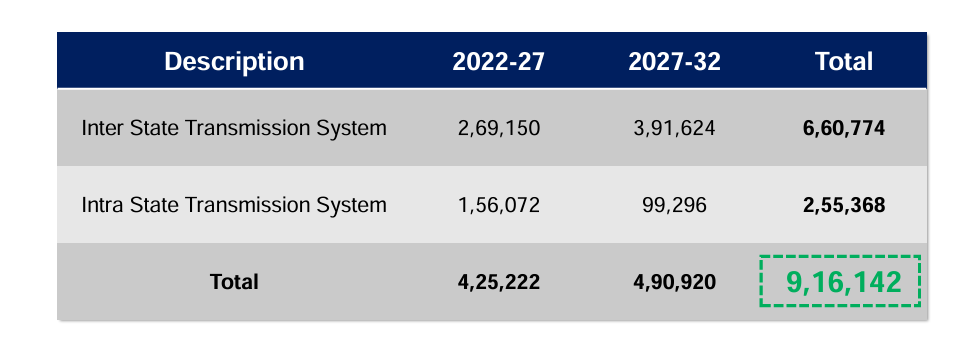

NEP Capex Summary

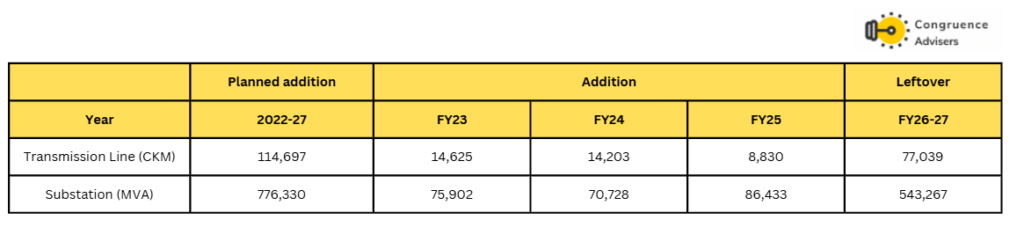

Between FY22-27 ₹4,25,222 crore is earmarked for adding 1,14,687 ckm of transmission lines and 7,76,330 MVA of substation capacity followed by ₹4,90,920 crore in FY27-32 for a further 76,787 ckm and 4,97,855 MVA. This sustained capex pipeline reflects the critical role of transmission infrastructure in meeting future power demand and energy transition goals.

Source – Power Grid Corporation of India Limited

The Indian Power T&D sector represents a ₹9 lakh crore capex opportunity, with transmission lines and substations each accounting for 30-35% of spend,and HVDC and other segments forming the rest.

As per NEP targets FY26 aims for 24,400 ckm of transmission line additions 3x the achievement of FY25 alongside 197,617 MVA of substation capacity, which is 2.2x higher than last year.

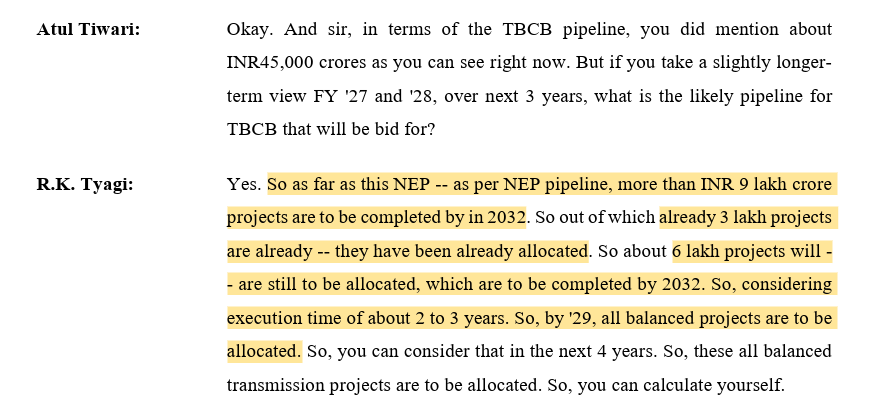

Power Grid Corporation of India Limited has signaled a significant capex over the next four years

NEP pipeline over ₹9 lakh crore worth of transmission projects are slated for completion by 2032 of which ₹3 lakh crore has already been allocated. This leaves a massive ₹6 lakh crore still up for grabs with the bulk of allocations expected by FY29 given the 2–3 year execution cycle.

We believe the next 3-4 years will see a significant acceleration in bidding activity, driving a robust capex cycle and creating a multi-year earnings visibility for players

Power Grid Corporation of India Capex Numbers

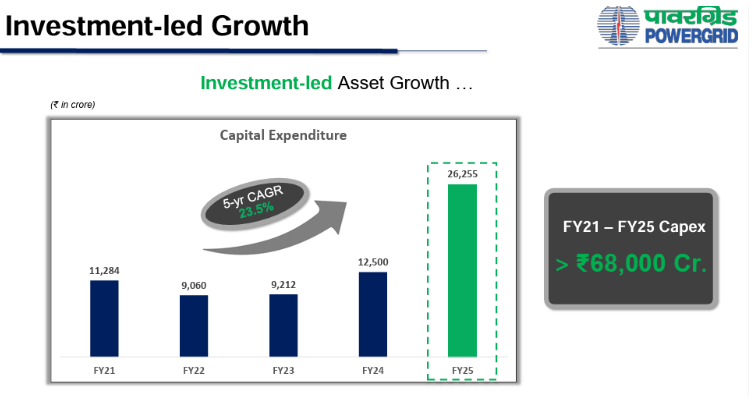

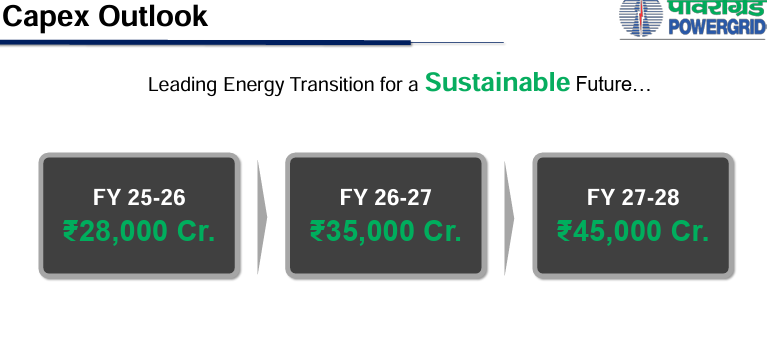

PowerGrid’s capex trajectory, the numbers scream growth visibility. FY21-FY24 capex has been steady in the ₹9,000-12,000 Cr range but FY25 is a breakout year with ₹26,255 Cr capex implying a 5 year CAGR of 23.5%.

Cumulatively, FY21-FY25 capex crosses ₹68,000 Cr and the forward guidance gets even more interesting. FY25-26 capex is pegged at ₹28,000 Cr, FY26-27 at ₹35,000 Cr and FY27-28 at ₹45,000 Cr. That’s a massive ₹1,08,000 Cr in just three years

Industry Structure (as per TBCB)

The Indian TBCB transmission sector is structurally dominated by a few large asset owners PowerGrid (50%), Adani Transmission (25%), and Sterlite Power (10%) with the remaining 15% spread across smaller players. These entities drive order flows to a concentrated pool of EPC majors such as KEC, Kalpataru, Skipper, Transrail and Techno-Electric, alongside global OEMs like Siemens, GE Vernova, and Hitachi Energy. The supply chain runs deep into transformer manufacturers (e.g., Bharat Bijlee, Voltamp, Supreme Power) and conductor/cable specialists (e.g., Apar Industries, KEI, Polycab, Finolex).

T&D EPC market

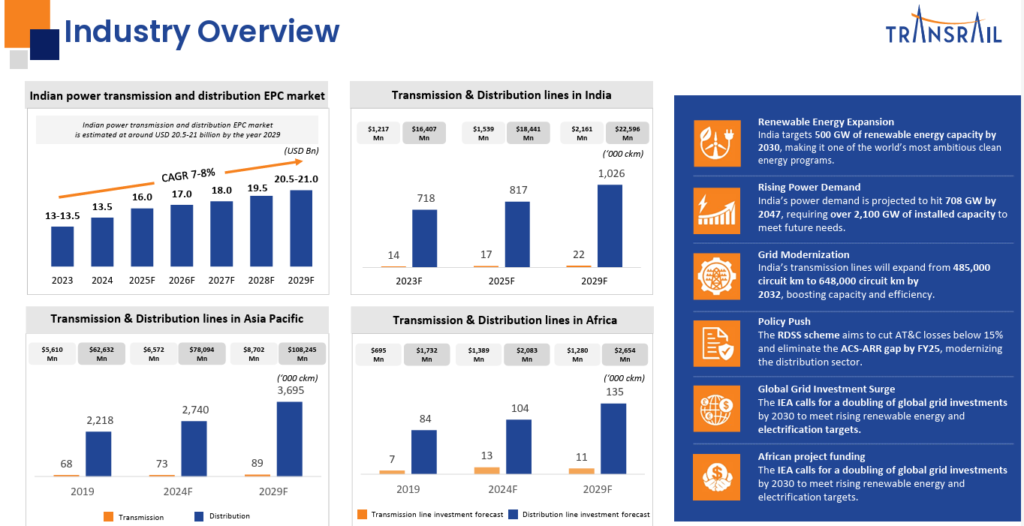

The Indian power transmission and distribution (T&D) EPC market is on a steady growth path expected to expand from roughly USD 13-13.5 billion in 2023 to USD 20.5-21 billion by 2029 implying a CAGR of 7-8%. This growth is driven by a combination of renewable energy ambitions, rising electricity demand and government backed grid modernization.

India’s renewable energy target is one of the most aggressive globally 500 GW by 2030 paired with a forecasted power demand of 708 GW by 2047. To meet this, over 2,100 GW of installed capacity will be required, which puts focus on growth in the T&D network to facilitate the integration of renewable energy sources into the grid. Power demand is expected to rise from 1,694 billion units in FY25 to over 2,170 billion units by FY29, further straining existing grid assets

Even Global trends are on a similar path. The IEA is calling for a doubling of global grid investments by 2030, a push mirrored in Africa and Asia Pacific where both transmission and distribution infrastructure are scaling rapidly.

Even the ongoing AI capex boom is unprecedented with hyperscalers projected to spend US$381bn in 2025 up 145% from 2023 levels. Meta alone has guided for over US$100bn capex in 2026 equivalent to more than half of its annual revenue. While the unit economics of AI remain highly uncertain, the real money being made today is by GPU manufacturers such as Nvidia. Yet the indirect but critical beneficiaries of this spending spree lie in the power sector and power T&D infrastructure.

As per the IEA, global data center electricity demand is set to more than double from ~460 TWh in 2024 to ~946 TWh by 2030, with US demand rising from 183 TWh to 426 TWh. This structural surge in energy intensity necessitates massive parallel investment in transmission networks, grid modernization, and high-voltage infrastructure. Thus, while AI’s commercial returns remain a long-term question, the power T&D sector stands as a tangible beneficiary of the current capex cycle.

From a cost structure perspective, the EPC T&D business is heavily weighted toward equipment (50–60% of cost), engineering & design at (5-10% of cost), Civil construction including labor, material and erection work accounts for around 15-20% of the total cost and other project-related expenses (land, approvals, management) make up the rest.

With substantial domestic demand, policy support and global momentum for grid expansion. The Indian T&D EPC players are positioned for sustained growth over the rest of the decade.

Our view on Power T&D Space

The highest valuation multiples have been given to the businesses that make critical components and are backed by MNC parentage. While the entire sector was in the doldrums for a decade, the post COVID resurgence of Govt spending has led to a steep rerating for the sector on the back of excellent order book and numbers. Businesses like Hitachi Energy, CG Power, BHEL, Siemens Energy, GE Vernova T&D, Schneider Electric all trade at hefty valuations and some have seen 6x+ moves over the past 3 years.

Our sense is that the components space is well discovered for the business quality on offer and that there are no great bargains there right now. The smart meter players like Genus Power & HPL Electric too don’t trade cheap anymore, after the steep run up since 2022. Differentiated transformer players like Shilchar Technologies and well known leaders like Voltamp transformers trade well above their 10 year mean multiples. Cables & Wires players which are proxies to the T&D and housing themes got rerated significantly over the past 2 years. Apar Industries is one story we were happy to play and exit once the story got fully priced in (although our exit was a tad early with the benefit of hindsight).

For this reason, we have chosen to focus on the EPC segment within the overall power sector. This is in line with our view in other EPC segments that led us towards businesses like L&T, ITD Cementation, Ahluwalia Contracts in the past. While execution risks in EPC can become high during periods of policy uncertainty, the current period has been a benign one since the central Govt is on a strong footing to be able to continue the capex spending on T&D.

Transrail Lighting Ltd Business Details

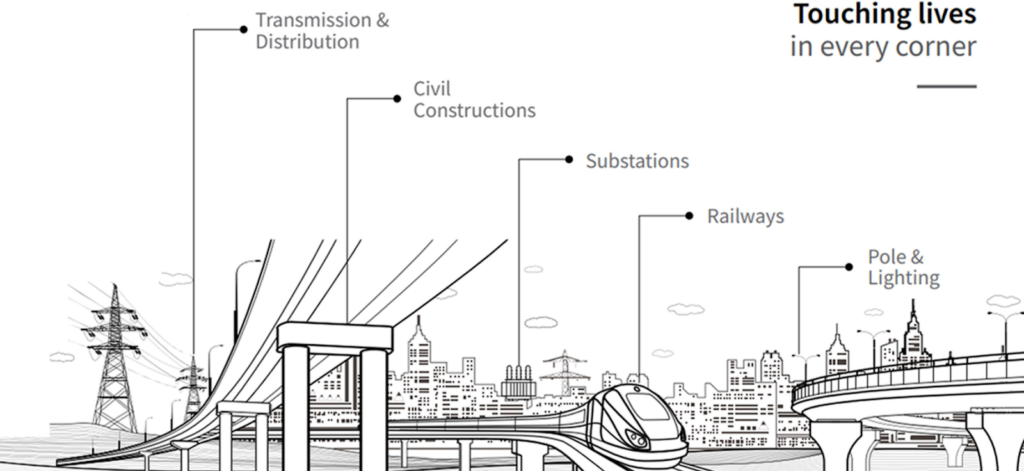

1. Power Transmission & Distribution (T&D) – Transrail Lighting Ltd’s core business lies in providing integrated EPC solutions in the power T&D space. Transrail Lighting Ltd boasts comprehensive in-house capabilities including design, manufacturing, testing and execution, supported by one of the largest galvanizing facilities in India.

Transrail Lighting Ltd has demonstrated technical competence across the value chain with project execution capabilities up to 1200 kV for transmission lines and up to 765 kV for both AIS and GIS substations. It also undertakes rural electrification, underground cabling, 800 kV HVDC lines and has experience in deploying HTLS conductors.

This vertical contributes the lion’s share of revenue and positions Transrail Lighting Ltd as a full-stack player in India’s growing power infrastructure space.

What differentiates Transrail Lighting Ltd is its backward integration i.e. self-manufactured products (such as towers, conductors and monopoles) contribute 65-70% of the typical contract value aiding both cost control and timely execution. This not only drives cost leadership and execution control but also insulates margins from supply chain volatility

Transrail Lighting Ltd’s singular focus on power T&D, robust backward integration and high exposure to international T&D are all key drivers of its industry-leading margin profile

Transrail Lighting Ltd enjoys an approved vendor status with key clients and maintains a strong presence across the EPC value chain, enabling it to participate in and execute high-value transmission projects. This positioning enhances its competitiveness in securing large-scale orders and reinforces its role as a trusted player in the sector.

In the power T&D space, Transrail Lighting Ltd’s portfolio is more skewed towards the transmission.

2. Civil Construction:

Transrail Lighting Ltd is gradually scaling its presence as a turnkey civil construction player, focused on high-complexity and niche segments. The company leverages its engineering bench strength and project management capabilities to deliver long-gestation, capital-intensive assets such as bridges, elevated roads, cooling towers, tunnels, and similar structures.

This vertical is still maturing, but the nature of projects under execution suggests potential for margin expansion and order book stickiness in the medium term.

3. Poles & Lighting Solutions:

Though a relatively smaller contributor to the top line, the Poles & Lighting division offers a diverse and technically rich product portfolio. The company caters to both traditional infrastructure (high masts, power T&D monopoles, and traffic gantries) as well as urban modernization themes like smart cities, decorative poles, solar streetlights, and stadium lighting.

With capabilities extending to luminaries, road signages, and even railway-specific portals and flag masts, this vertical enables Transrail to tap into the urban and semi-urban infrastructure upgrade cycles.

4. Railway Electrification & Infrastructure:

Aligned with India’s large-scale railway modernization push, Transrail has developed meaningful capabilities in this domain. It executes end-to-end solutions including Overhead Electrification (OHE), traction substations, signaling & telecommunication systems, and allied civil works like earthwork and track laying.

This vertical positions the company to benefit from Indian Railways’ capex cycle, especially as private and public investments ramp up in the coming decade.

5. Solar EPC (New Vertical – Foray in FY25):

In FY25, Transrail strategically entered the solar EPC space to diversify into clean energy and leverage its existing project execution DNA. The company is positioning itself as an end-to-end player in solar with offerings across utility-scale solar parks, mini-grids, rooftop solar for C&I clients and solar streetlight solutions.

While still in the early stages, the vertical provides potential long-term optionality for revenue diversification.

Transrail Lighting Ltd Orderbook

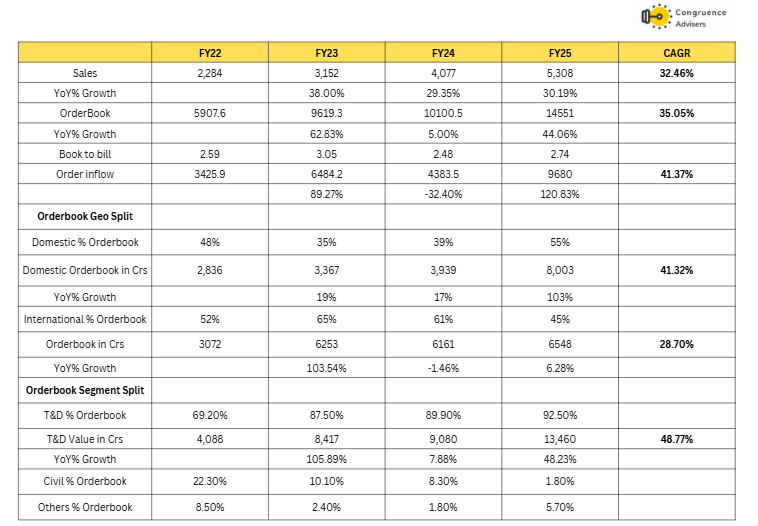

As of June, 2025, Transrail Lighting Ltd has a robust unexecuted order book + L1 pipeline of ₹15,637 Cr implying healthy revenue visibility of 3 years on FY25 revenues. The order inflow in FY25 surged 120.8% YoY to ₹9,680 Cr led by significant wins across both domestic and international markets, with the overall order book compounding at 35% CAGR over FY22-FY25.

Segmental Mix – Power T&D continues to be the backbone of operations forming ~92.5% of the order book in FY25 versus ~69% in FY22. Order book in T&D expanded at 48.8% CAGR during FY22–FY25, reinforcing Transrail Lighting Ltd’s positioning as a focused EPC player. Non-T&D contribution has moderated to <10%, reflecting Transrail Lighting Ltd’s strategy of selective bidding in high return EPC projects.

Geographical Mix – The order book is well diversified across geographies with a domestic:international split of 60:40 as of June, 2025.

Domestically, Transrail Lighting Ltd works with high-quality clients such as Power Grid Corporation and reputed private players like Adani, etc The company has reported no project losses or cancellations in the domestic market over the past decade. Like industry norms in the T&D segment 60% of execution is skewed towards H2 given the impact of monsoon in H1.

Internationally, Transrail Lighting Ltd has strong exposure to Africa (49%) and Bangladesh (40%) with balance coming from Americas and RoA markets. Transrail Lighting Ltd international order book is largely backed by multilateral funding agencies which ensure strong payment security through letters of credit which significantly reduces counterparty risk and ensures smooth cash flows. These international projects are funded by sovereign institutions and multilaterals such as World Bank, African Development Bank and Indian EXIM and are often priced in USD or INR linked terms with milestone based payments and commercial terms are materially better. Which minimises receivable risks. International T&D contracts typically offer superior pricing, better pass-through terms and smoother execution due to milestone based billing and pre-cleared sites. Transrail Lighting Ltd’s core international markets include Africa, SAARC and Southeast Asia where it maintains a consistent track record of zero project level losses. While occasional delays occur due to ROW issues or funding agency timelines execution remains stable.

Management aims to maintain a balanced mix (~50:50) between domestic and international projects over time with a focus on project quality, timely execution and margin profile. Execution timelines typically range from 24-30 months internationally and 18-24 months domestically. Margins in international projects are 1–2% higher than domestic projects, aided by favorable commercial terms under multilateral funding frameworks.

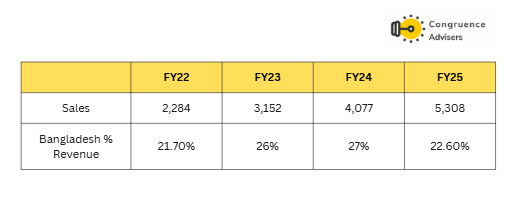

Exposure to Bangladesh

Transrail Lighting Ltd is doing 6 projects there 3 with EXIM and 1 is ADB and 2 with the Bangladesh government and Management sees no issue in terms of project execution or funding and things have normalized in Bangladesh. In fact, the client, Power Grid Company of Bangladesh (PGCB) has remained committed to timely execution and has actively supported funding flows.

However, as part of a deliberate geopolitical de-risking strategy, Transrail Lighting Ltd has reduced Bangladesh’s share in its order book from 20% in Dec 2024 to around 12% by May 2025 with further plans to taper at 5-6% by FY26 as key projects near completion. Transrail Ltd received over USD 70 million in payments in FY25, with zero write-offs.

Q1FY26 Management commentary on Bangladesh Transrail Lighting Ltd remains constructive. Bangladesh exposure to the order book has moderated to 12% currently. Execution progress has been smooth with timely milestone achievements and no funding delays. Importantly, cash flows are being received on schedule. Transrail Lighting Ltd expects Bangladesh exposure to taper further to ~6% of the order book by the end of FY26 and Management reiterated that the ongoing flagship project is on track to be fully executed by July 2026 with no execution or receivable concerns.

We see clear evidence of the management approach being risk driven and not just growth focused. There are clear safeguards and guardrails in place for the international business, payment & currency risks are hedged to a good extent.

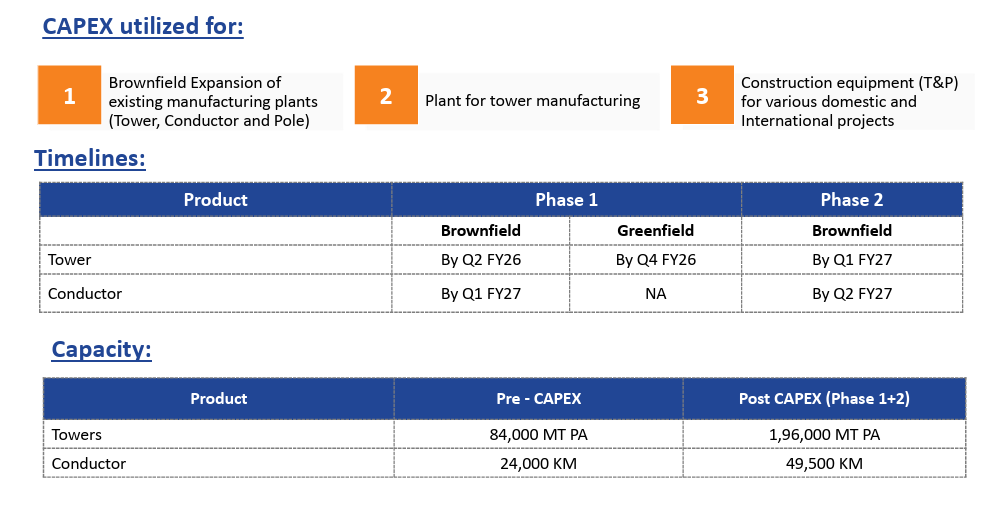

Transrail Lighting Ltd Capex

Transrail Lighting Ltd is undergoing a ₹520 Cr capacity expansion program, a timely and strategic investment to unlock the next phase of scalable and margin resilient growth.

The capex, spread across two tranches of ₹326 Cr and ₹198 Cr, is targeted at brownfield expansion of tower and conductor plants, a new greenfield tower manufacturing facility and tools & plants (T&P) to support execution of large-scale domestic and international projects. Funding is being structured prudently with ₹90 Cr from IPO proceeds, ₹300 through debt (sanctioned already in place) and the balance via internal accruals.

The management expects the entire capex to be executed in a staggered manner over the next 18 months (FY26–H1FY27) with work already underway. This ramp up will ensure readiness to deliver on Transrail Lighting Ltd’s ₹15000Cr+ order book, while creating headroom for the next wave of EPC mandates.

On completion, tower manufacturing capacity will expand from 84,000 MT to 173,000 MT in Phase I and further to 196,000 MT in Phase II. Similarly, conductor capacity will rise from 24,000 CKM to 40,800 CKM in Phase I and subsequently to 49,500 CKM. With utilization levels already approaching 90%+ in FY25, the additional throughput is essential for revenue scalability towards management’s long term target of 8000-10000 Cr revenue.

Conductor Division – The facility manufactures a wide range of conductors, including ACSR, AAAC and advanced HTLS variants and is qualified under both Indian and international standards. Nearly 90–95% of conductor output is consumed internally & 5% is sold to external customers post expansion and focus towards high performance conductors, management is targeting 10% external sales over the next 18–24 months.

The business has been able to fund its capex without stressing the balance sheet and impacting future cash flows. In house manufacturing of Towers & Conductors keeps the EBITDA margin profile healthy.

Transrail Lighting Ltd Corporate Governance

Board Composition – Transrail Lighting Ltd board comprises 11 members including 3 executive directors, 2 non-executive directors and 6 independent directors. indicating reasonable independence and oversight.

Related Party Transactions – About 10% of Transrail Lighting Ltd FY24 revenue is linked to related parties which indicates a high degree of group company dependence. Transrail Lighting Ltd has extended loans of ₹83 Cr to Burberry Infra Pvt Ltd (a group entity in the land business) with ₹8 Cr in interest receivable. One needs to monitor capital allocation towards group companies.

Contingent Liabilities – Transrail Lighting Ltd has ₹188 Cr worth of contingent liability, which is equivalent to ~10% of Transrail Lighting Ltd’s book equity. It poses a potential downside risk to net worth.

Promoter Remuneration – Promoter and CEO salaries stand at ₹4 Cr each. Which is < than 5% of FY24 profit.

Subsidiaries and JVs – Transrail Lighting Ltd has multiple subsidiaries and JVs, but most lack revenue contribution or meaningful net equity. The Nigerian subsidiary is the only relevant one currently though it is loss-making which may continue to weigh on consolidated performance.

Transrail Lighting Ltd Financial Performance

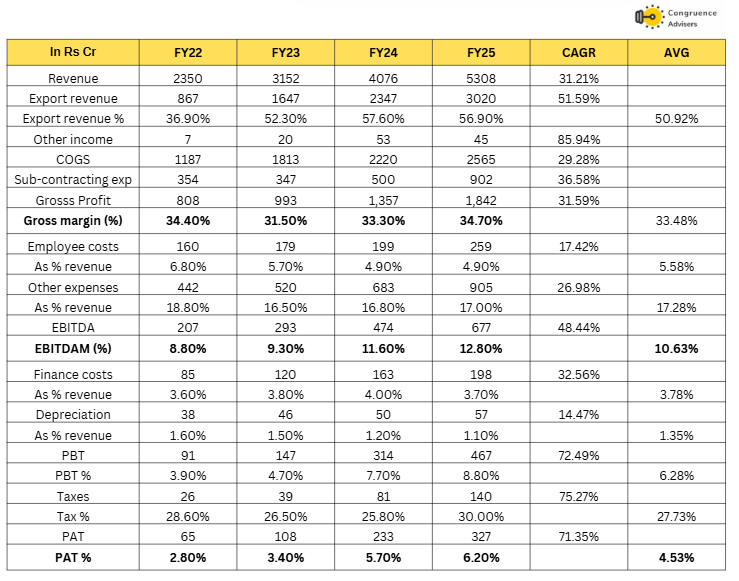

Transrail Lighting Ltd has demonstrated consistent operating and financial strength with printing revenue growth at 31.2% CAGR over FY22-FY25 supported by strong order inflows and execution scale up. Export revenues have outpaced the domestic revenue by printing 51.6% CAGR and now forms 57% of FY25 revenues in line with management’s articulated strategy of diversifying into international markets post covid.

On the profitability front, Transrail Lighting Ltd has printed sharp improvements over the last three years. Gross margins have remained broadly stable in the 33-35% range despite the inherent raw material and subcontracting intensity led by Transrail Lighting Ltd strong backward integration capabilities. EBITDA has printed a 48.4% CAGR over FY22-FY25 with margins expanding steadily from 8.8% to 12.8% in FY25. This margin uplift has been driven by disciplined cost control, better bidding discipline, benefits of international diversification, backward integration and operating leverage. PAT growth has been even more pronounced at 71.3% CAGR during FY22-FY25 led by the sharp flow through from higher EBITDA margins and some moderation in finance and depreciation expenses. Consequently, net profit margins improved significantly from 2.8% in FY22 to 6.2% in FY25.

Transrail Lighting Ltd delivered FY25 results largely in line with its stated guidance with revenues coming in at 4024 Cr broadly in line with management’s projection of 4000-4200 Cr. While the EBITDA margins at 12.7% touching the upper end of the guided 12-13% band, supported by cost discipline and a favorable project mix. Net profit has outpaced guidance by expanding to 6.1% vs the guided 5.5-6% range. Importantly, Transrail Lighting Ltd closed FY25 with a robust order book of ~₹14,551 Cr and 15915 including L1 (~2.9x book to bill) . Which positioned Transrail Lighting Ltd strongly for sustaining this growth momentum into FY26

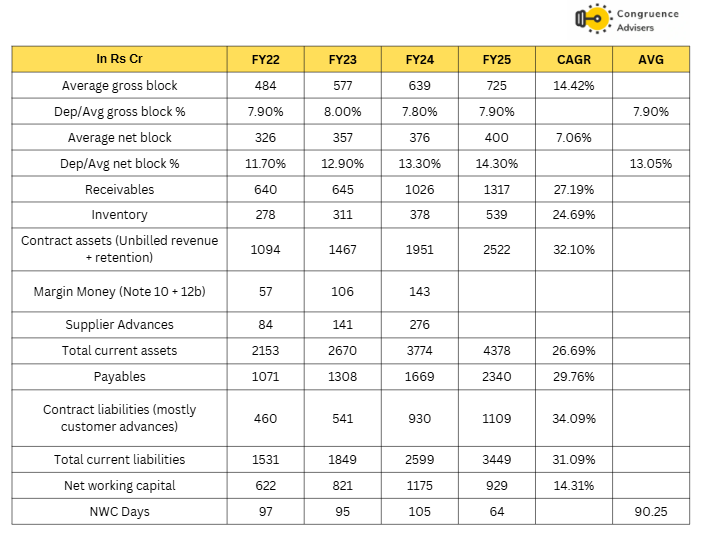

Transrail Lighting Ltd Working Capital

On the working capital side current assets have scaled in line with revenue growth at 27% CAGR respectively, driven by higher execution intensity. While current liabilities have scaled at 31% CAGR. This has allowed net working capital days to moderate to 64 in FY25. Gross block has expanded at a 14.4% CAGR over FY22-FY25 while depreciation levels have remained similar at ~8% of gross block. The net block has compounded at 7.1% CAGR.

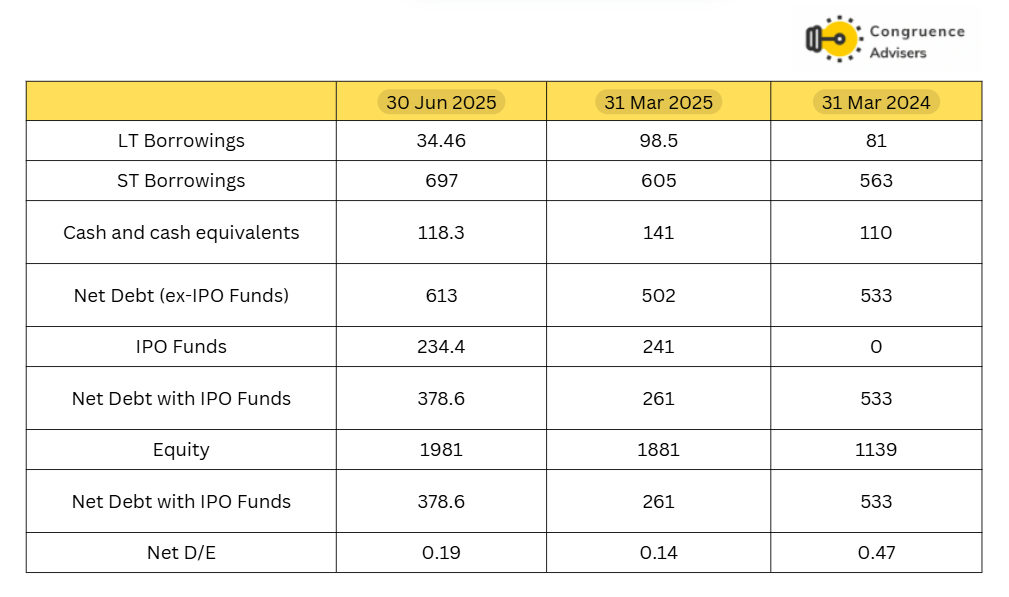

Transrail Lighting Ltd Debt

Leverage has eased meaningfully post-IPO. As of March 2025, net debt (ex-IPO funds) reduced to ₹502 crore from ₹533 crore in FY24, aided by stronger operating cash flows. Adjusting for IPO proceeds, reported net debt declined further to ₹261 crore, materially lowering gearing and finance costs. The IPO has also bolstered equity, reduced interest burden and enhanced prequalification eligibility for large-ticket EPC tenders.

Overall, the balance sheet remains well capitalized coupled with a lighter leverage profile, decent working capital and adequate cash flow cover to fund scale

To summarise the financial performance, Transrail Lighting Ltd has consistently delivered a healthy ROCE profile of 25%+ which highlights the strong unit economics of its EPC led franchise. Even in subdued industry years the business has enough margin buffer, EBITDA margins have remained comfortably above 10% and a working capital cycle contained within ~100 days unlike several peers in the broader power and capital goods ecosystem where elongated cycles often dilute return ratios. This discipline has translated into robust operating cash flows and should continue to sustain in future years as execution scales up.

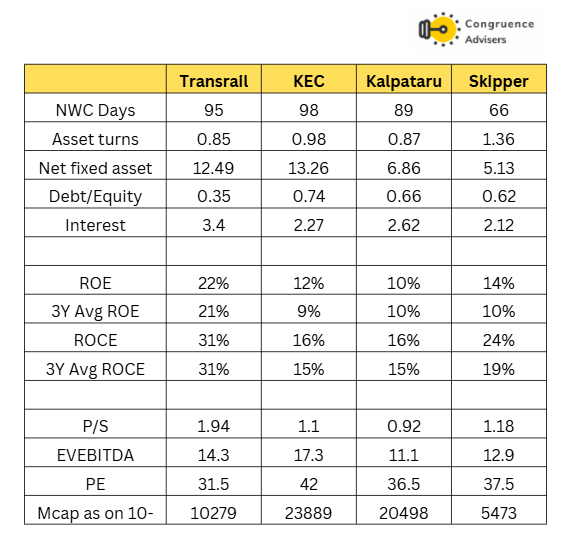

Transrail Lighting Ltd Comparative Analysis

To understand Transrail Lighting Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Transrail Lighting Ltd to its competitors (peer comparison) on various fundamental parameters and Transrail Lighting Ltd share performance relative to relevant benchmark and sector indices.

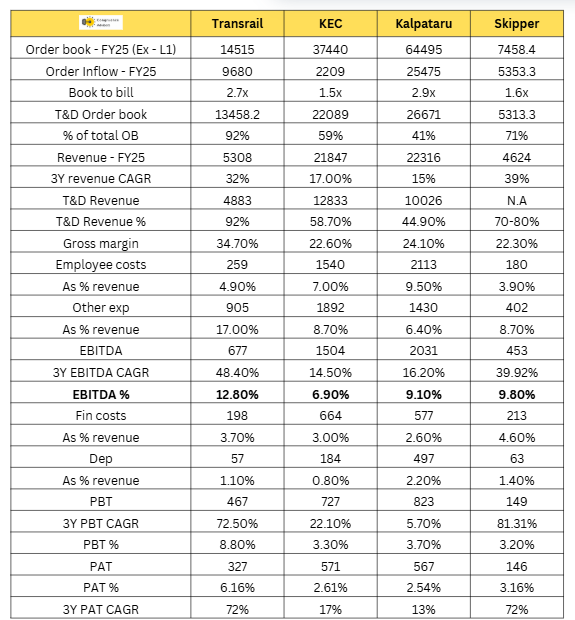

Transrail Lighting Ltd Peer Comparison

Within the listed EPC players in the T&D space, we compare Transrail Lighting Ltd with KEC International Ltd, Kalpataru Projects International Ltd and Skipper Ltd. While Tata Projects Limited also has a meaningful presence in the sector, it remains unlisted. Similarly, Bajel Projects Ltd, a wholly owned subsidiary of Bajaj Electricals Ltd was incorporated in January 2022 following the demerger of BEL’s EPC business and has been separately listed only recently. To maintain comparability and clarity, we have restricted our analysis to the four established listed players.

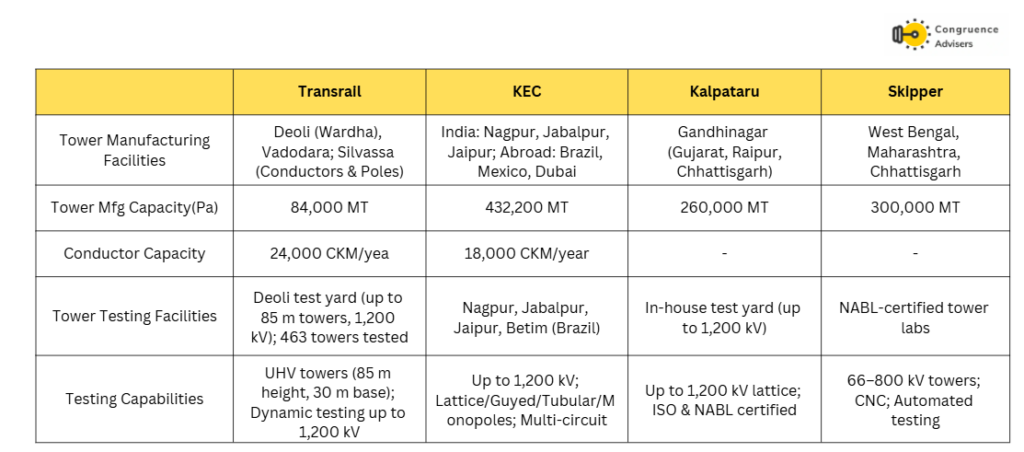

On the manufacturing front, Transrail Lighting Ltd currently operates three facilities with an annual tower manufacturing capacity of ~84,000 MT and conductor capacity of ~24,000 CKM. This is significantly smaller than KEC International Ltd (432,200 MT), , Kalpataru Projects International Ltd (260,000 MT) and Skipper Ltd (300,000 MT). Importantly, Transrail Lighting Limited has embarked on a brownfield capex program that will effectively double tower & conductor manufacturing capacity and will allow Transrail Lighting Ltd to scale and narrow the gap with peers. Transrail Lighting Ltd houses one of India’s largest ultra-high-voltage (UHV) test yards capable of testing towers up to 85 meters and 1,200 kV, which provides it with a technical edge, particularly in high-voltage transmission projects.

. Despite operating at a smaller scale than large peers like KEC International Ltd and Kalpataru Projects International Ltd. Transrail Lighting Ltd. stands out for its sharper focus on the Power T&D segment, where ~92% of its order book is concentrated versus 40-60% for larger competitors, while Skipper Ltd is more manufacturing-heavy.

Transrail Lighting Ltd runs a balanced EPC model with the right blend of domestic and international exposure, supported by a disciplined bidding strategy and differentiated testing infrastructure (Deoli yard capable of 1,200 kV dynamic testing). This focused approach combined with strong backward integration has translated into superior profitability metrics with EBITDA% at 12.8% (highest among peers) and a 3-year EBITDA CAGR of 48% versus low-teens for KEC and Kalpataru. Transrail Lighting Ltd’s international diversification has also gained traction, with exports compounding at 51.6% CAGR and now contributing a majority of revenues. This not only reflects successful de-risking from the domestic cycle but also cushions the business from seasonality in India, where H1 is typically slower for infra EPC players due to monsoon-related execution challenges.

Comparison with peer data establishes why Transrail Lighting Ltd stands out over FY22-FY25, Transrail Lighting Ltd has posted the highest Sales and PAT CAGR among peers while maintaining sector leading EBITDA margins. ROCE delivery has been structurally strong comparable only to Skipper Ltd with both being best indexed EPC plays to the Power T&D opportunity. However, Transrail Lighting Ltd has a structural edge over Skipper Ltd given its higher mix of international contracts which typically command superior margins and enjoy shorter working capital cycles. This international diversification not only de-risks the business from domestic infra cyclicality but also enhances its return ratios which position Transrail Lighting Ltd as one of the most efficient players in the mid-sized EPC T&D space.

Transrail Lighting Ltd Index Comparison

Transrail Lighting Ltd share performance vs S&P BSE Small Cap Index, as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why you should consider investing in Transrail Lighting Ltd ?

Transrail Lighting Ltd offers some compelling reasons to track closely and to consider investing in a proxy to both domestic & global power T&D capex

Multi Year Power T&D Capex Cycle as Structural Tailwind – India’s transmission segment is entering a golden capex cycle and now structurally better placed than ever with Integration of renewable energy into the grid is the key driver necessitating significant upgrades in transmission corridors, EHV lines and substations. India’s total ₹9.2 Lakh Cr of power capex program through FY32 creates a huge addressable for players like Transrail Lighting Ltd, KEC Ltd, Kalpataru and Skipper Ltd. Globally, the opportunity is even larger with $2 trillion in grid investments expected by 2030, enhancing Transrail Lighting Ltd’s ability to scale exports given its execution footprint across 59+ countries. Transrail Lighting Ltd’s integrated EPC model and backward linked manufacturing (towers, conductors, monopoles) provide a competitive edge ensuring both execution reliability and margin visibility.

Transrail Lighting Ltd sees a ₹1 lakh Cr bid pipeline over the next 12 months split evenly between domestic and international opportunities with an expected 8-10% hit rate translating to inflows of ₹9,500-10,000 Cr in FY26. Power Grid Corporation of India has announced over ₹3 lakh Cr capex through FY32 with annual tenders rising to ₹45,000 Cr offering strong multi-year visibility. For FY26 alone, Power Grid Corporation of India plans ₹35,000+ Cr capex, Where Transrail Lighting Ltd is targeting an 8-10% market.

Specialist EPC Franchise in Power T&D with Proven Execution – Transrail Lighting Ltd stands apart in the EPC universe with its singular focus on Power T&D, a segment with higher entry barriers versus roads or generic civil EPC where competition is cut-throat. With over 4 decades of experience and 200+ completed large-scale projects, Transrail Lighting Ltd has built a credible execution track record across 59 countries. Its integrated manufacturing ecosystem of plants spanning lattice structures, conductors and monopoles backed by CE certifications and NABL accredited in house testing reduces dependence on 3rd party suppliers and provides cost and margin visibility.

Robust Order Book Driving Multi-Year Revenue Visibility – Transrail Lighting Ltd has one of the most robust order books in the EPC universe providing clear visibility for the next 3 years. As of June 30, 2025, the unexecuted order book (including L1) stood at ₹15,637 Cr (3x of FY25 revenues), FY25 was a record year with ₹9,680 crore of new order inflows, representing 120% YoY growth and the highest ever in Transrail Lighting Ltd’s history. Management is expecting similar order inflow of 9500-10000 Cr in FY26 as well. Importantly, the order book remains well diversified with 92.5% is in T&D business (including substations) with a healthy geographic split of 55% international and 45% domestic projects. With strong order visibility, Transrail Lighting Ltd is well-positioned to clock 20%+ sales growth while maintaining resilient EBITDA margins in line with recent performance.

Backward Integration and Capacity Expansion – Transrail Lighting Ltd has steadily built one of the most integrated EPC platforms in India operating four CE-certified and NABL-accredited manufacturing facilities across Vadodara, Deoli and Silvassa. These plants manufacture towers, conductors, monopoles and poles, covering nearly 60–70% of EPC project value in-house. Such backward integration materially reduces reliance on third-party suppliers, enhances execution predictability and structurally supports superior margin delivery compared to peers.

To unlock the next leg of scalable growth,Transrail Lighting Ltd has approved a 520 Cr expansion program executed in two phases by September 2025. This will double tower manufacturing capacity from 84,000 MT to 1,96,000 MT and expand conductor output from 24,000 KM to ~50,000 KM annually.( FY25 utilization already near 90%),

This strong backed integration and future capex has enabled Transrail Lighting Ltd to build a structurally margin resilient business model. Management has guided to sustain EBITDA margins of 12 – 12.5% with backward integration being the key enabler.

Strong Management – Transrail Lighting Ltd has a stable and seasoned leadership structure that combines a deep rooted promoter legacy with professional management depth. The management team led by Mr. Digambar Bagde has remained consistent for decades; which provides comfort in terms of strategy and execution consistency. While its erstwhile parent, Gammon India, faced financial distress and underwent debt restructuring, Transrail’s T&D EPC business was always steered independently by Mr. Bagde, who continues to lead the company today. he leadership bench was further strengthened in 2020 with the induction of Mr. Randeep Narang (MD & CEO), a veteran with over 35 years of cross-sector experience, including senior roles at KEC International, CEAT, and Bharti Airtel.

Credit Rating Upgrade – CRISIL Ratings has recently upgraded Transrail Lighting Ltd’s long-term rating to AA‑ (Stable) (upgraded from A+ with Stable outlook) and its short‑term rating to A1+ (from A1). Which shows Transrail Lighting Ltd’s improving business and financial risk profile. Management highlighted in Q1FY26 earnings that the rating upgrade is expected not only to reduce borrowing costs but also to further enhance lender confidence.

What are the Risks of Investing in Transrail Lighting Ltd?

Investors need to keep the following risks in mind if they choose to invest into this business. Risks needs to be weighed in combination with the advantages listed above to arrive at a decision that is optimal for your portfolio construct

Execution Risk in Large EPC Projects – Transrail Lighting Ltd operates in milestone linked EPC projects where delays in land acquisition,RoW clearances, weather disruptions or community resistance can defer revenue recognition. This is especially pronounced in international geographies where institutional capacity is weaker and contract enforcement unpredictable.

Gammon Engineers Acquisition & Integration Risk – Transrail Lighting Ltd’s intent to acquire the Bridge and Hydropower business of Gammon India could be a double-edged sword. While the move aims to provide an entry point into solar EPC, a space with obvious long-term tailwinds, the lack of clarity around acquisition cost, integration strategy and synergy realization creates uncertainty. Poor integration could dilute focus on the core T&D franchise and strain capital allocation.

International Exposure & Geopolitical Volatility – Transrail Lighting Ltd derives 45% of its order book from overseas markets primarily Africa and Southeast Asia, Transrail Lighting Ltd remains exposed to execution delays from geopolitical disruptions, regulatory bottlenecks or local unrest. Although most contracts are backed by multilateral funding agencies, execution timelines could still face slippages and nothing can be taken for granted in the Trump II era.

Transrail Lighting Ltd carries concentrated exposure to a large river-crossing project in Bangladesh with ₹2,200 Cr of unexecuted orders as of March 31, 2025. The project has previously faced delays owing to slow appointment of engineering consultants, design approvals and 15-20 days of disruption due to political unrest in FY25. While execution has since stabilized and Transrail Lighting Ltd reported timely payments. Importantly, Bangladesh exposure has been steadily reducing from 35% of the order book in FY24 to 18% in FY25 and is expected to fall further to 6% by FY26 year-end as the project moves toward completion (targeted for July 2026).

Raw Material & Cost Inflation Risk – Domestic contracts often lack cost escalation clauses, leaving EPC players vulnerable to raw material price spikes in steel, aluminium, etc. Given that project cycles can stretch beyond 18 months any sustained commodity rally could compress margins particularly in fixed-price contracts.

Govt Linked Order Dependence – Material portion of the current order book comes from public-sector clients like PGCIL, Indian Railways and MEA funded overseas EPC projects. Any slowdown in infrastructure tendering, budgetary reallocation or payment delays from these entities could disrupt order inflows and cash flows.

Valuation & Discovery Risk – The power T&D theme has become increasingly well-discovered with multiples for quality EPC names already re-rated. Investors risk entering the cycle late, where even a small execution miss or sectoral policy setback could trigger sharp multiple compression and 20%+ MTM drawdowns.

Labour Risk – The industry continues to face structural labour shortages particularly in specialized EPC skillsets. Post IPO, Transrail’s order book has scaled sharply. The necessitating rapid mobilization of engineering teams, site managers and skilled labour across multiple geographies can be tough given the ongoing labour shortages. Any execution bandwidth mismatch or delays in labour onboarding could emerge as a serious risk and can potentially impact project timelines and delivery schedules.

Transrail Lighting Ltd Future Outlook

Transrail Lighting Ltd offers a compelling investment case anchored by its niche positioning as a T&D focused EPC player with proven execution pedigree. Unlike generic EPC peers exposed to cyclical civil or road projects. Transrail Lighting Ltd operates in a highly specialized and entry barrier heavy segment of erecting high voltage transmission lines and substations an area that requires deep technical know-how, prequalification credentials and long-term customer trust.

Transrail Lighting Ltd has entered FY26 with a strong operational and financial growth and has reaffirmed its guidance of 22-25% revenue growth with 11.5-12% EBITDA margins. The ₹15,637 crore unexecuted order book (including L1) provides 3 years revenue visibility even if order inflows moderate (which we believe is unlikely), The order book remains T&D-heavy (93%) with a healthy 60:40 domestic-international split and will continue to remain T&D heavy.

On the demand side, the T&D market remains robust. Transrail Lighting Ltd sees a ₹1 lakh crore bid pipeline over the next 12 months split evenly between domestic and international opportunities with an expected 8-10% hit rate translating to inflows in line with FY25’s numbers i.e. ₹9,500-10,000 crore. Powergrid alone plans ₹35,000 Cr+ capex in FY26 as Transrail Lighting Ltd expects an estimated 8-10% market share of Powergrid capex. Which stands to benefit meaningfully.

A key differentiator for Transrail Lighting Ltd is backward integration through in-house manufacturing facilities for towers, conductors and monopoles. i.e covering ~65–70% of EPC contract value. This not only ensures cost control, execution predictability and margin resilience but also strengthens competitive moats versus peers that rely on third-party sourcing. Further, the ongoing ₹520 crore capex program doubling tower and conductor capacity by FY27 lays the foundation for scaling revenues towards the management’s ambition of achieving ₹8,000-10,000 Cr annual revenues without margin dilution.

While Q1 FY26 delivered stellar YoY growth in revenue and PAT, management has resisted the temptation to up guidance, choosing instead to maintain a similar growth stance which we believe is a prudent move in a sector where execution schedules and revenue recognition can swing sharply between quarters. This is particularly relevant given Transrail Lighting Ltd’s meaningful international exposure, which could smoothen seasonality but still carries cross border execution risks.

Back of the hand calculations suggest 20% revenue growth and 12% EBITDA margins. Transrail Lighting Ltd can print ₹390-400 Cr PAT in FY26. The recent CRISIL rating upgrade to AA- (stable outlook) / A1+ validates its improving growth & credit metrics. From a valuation standpoint, Transrail Lighting Ltd stock trades at ~24-25x FY26E PAT, in line with the 22-26x forward PE band where most quality EPC names like trades.

Since its December 2024 listing, Transrail Lighting Ltd stock has consistently commanded a TTM PE multiple of 25-30x, Even through the market drawdowns of Feb-Apr 2025 which reflected investor confidence in the Transrail Lighting Ltd’s execution pedigree, sector tailwinds and management track record. With structural drivers in place, sectoral capex visibility and in-house manufacturing integration providing margin comfort, the next 2–3 years could be a phase of strong topline CAGR, steady margin delivery and healthy shareholder returns.

Transrail Lighting Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Transrail Lighting Ltd Price charts

Given that the trading history is limited is less than one year, we have just the daily chart to go by

Even if one has a rudimentary understanding of technical patterns, one should be able to quickly recognize the text book pattern at play here since listing. The current market mood does call for caution, but the trend so far has been interesting seen in context of the Q1 FY26 numbers.

Transrail Lighting Ltd Latest Latest Result, News and Updates

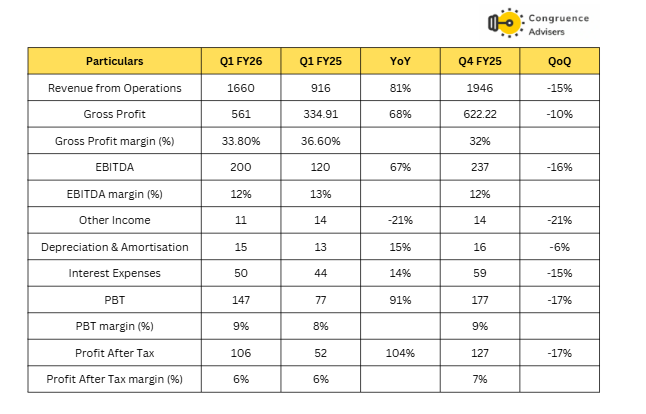

Transrail Lighting Ltd Quarterly Results

The management team held on to guidance of 25% revenue growth for FY26.

Transrail Lighting Ltd reported a strong YoY performance across all parameters with revenue rising 81% YoY to ₹1,660 crore driven by robust execution in the T&D segment (core focus area). Gross profit grew 68% YoY, while EBITDA grew 67% and PAT more than doubled to ₹106 crore i.e. 104% YoY increase. However, decline in sequential performance is primarily due to the seasonal nature of the EPC business where the H2 typically contributes over 60% of annual revenues. The overall execution momentum remains strong.

Transrail Lighting Ltd reported secured fresh orders worth ₹1,748 crore during the quarter (up 72% YoY) largely from domestic T&D projects, taking the unexecuted order book to ₹14,654 crore (+44% YoY) and ₹15,637 crore including L1 positions.

Transrail Lighting Ltd recently got an upgrade in credit ratings by CRISIL to Long-term: AA-/Stable; Short-term: A1+. Which further enhances the Transrail Lighting Ltd’s financial profile and likely to lower interest expenses going forward.

The business outlook, order book and execution all look good for FY26 going by the commentary. However one should keep in mind that this is an EPC business where lumpiness of execution, revenue and profit booking can happen anytime. This is not a linear, predictable business model though the order book gives comfort with significant international exposure to projects, the lumpiness and seasonality will hopefully get spread across regions.

Final Thoughts on Transrail Ltd

Transrail Ltd. seems to be a highly competent EPC player with a sharp focus on large, complex power T&D EPC projects in India, Africa, Middle East and South/South-East Asia. Even though its a smaller peer of established power EPC companies like Kalpataru and KEC International, on several financial indicators and metrics, it stands above its larger peers. Its backward integration into tower and conductor manufacturing and a large % of export order book, gives it an edge against its peers. A strong order book coupled with a strong bid pipeline and sustained global capex in power bodes well for the company for the next several years. Short of wide swings in raw material prices (steel/copper) or unexpected risks playing out in one or more of its International projects, the current order book and bid pipeline should enable Transrail Ltd. to deliver 25% growth in top and bottom line over the medium term.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this to a general audience. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will continue/be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.