Updater Services is an emerging business operating in the areas of Integrated facilities management and business support services. With a humble beginning, Updater Services Ltd has scaled up the value chain and established itself as a pan India player with presence across metro & major cities. Their clients include well known business across FMCG, manufacturing and engineering, banking, financial services, insurance (BFSI), healthcare, information technology/information technology-enabled services (IT / ITeS), automobiles, logistics and warehousing, airports, ports, infrastructure and retail, among others.

We believe Updater Services Ltd expected to grow leaps and bounds over the next decade as India urbanizes and industrializes at a rapid rate and stands as the unsung backbone behind corporate efficiency. Every square foot of new space entering the market represents a potential growth opportunity for Updater Services Ltd. Updater Services Ltd’s strong brand reputation, coupled with its ability to provide a wide range of boutique services under one roof, sets it apart from competitors.

Updater Services Ltd is well-positioned to deliver high double digit growth for a long period organically without needing much capital. (Even the end industry is growing in double digit) With a successful track record of value-accretive acquisitions, Updater Services Ltd continues to actively seek further opportunities to expand through acquisitions supported by healthy cash balance of 150 Cr

Updater Services Ltd Company Summary

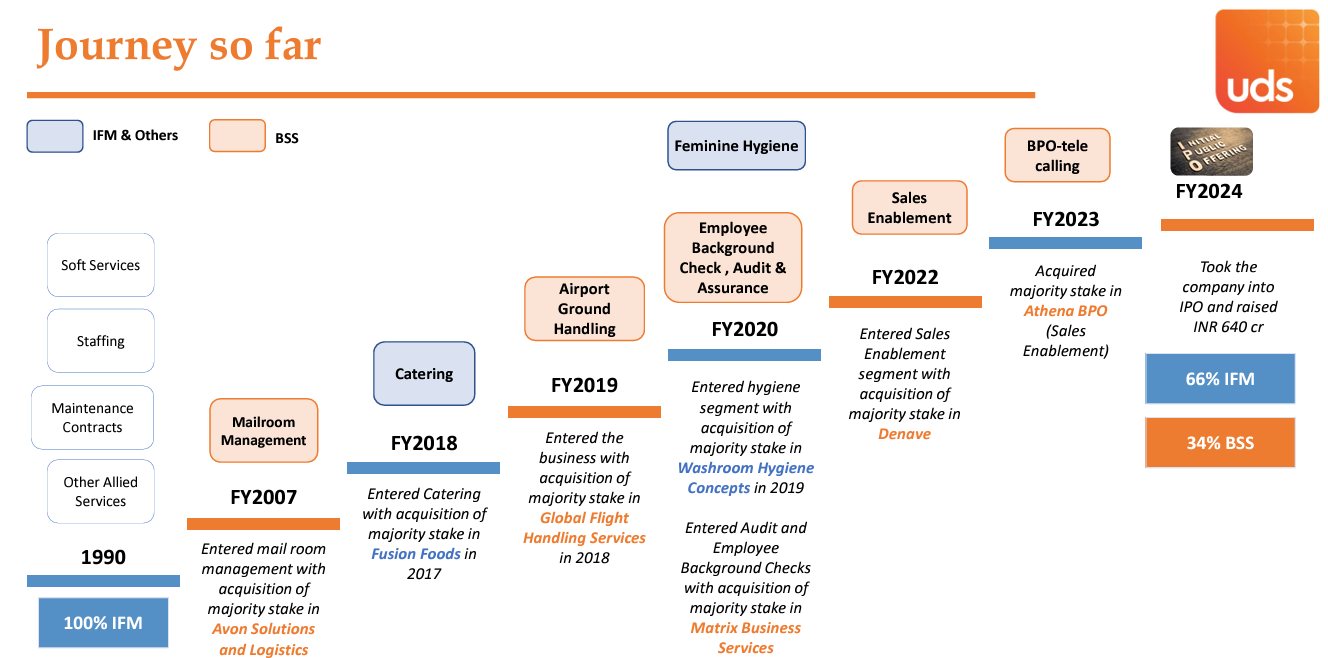

Updater Services Ltd has a very humble beginning; Updater Services Ltd started operations way back in 1990 in Chennai, Tamil Nadu, as a piecemeal service provider for soft services like housekeeping, plumbing, catering, electrical, etc. In the initial phase in 1990, the industry was not as recognised as it is today, and it was challenging to sell the concept of integrated facility management services to businesses. There were no organised players, and Updater Services Ltd is actually one of the pioneers in IFM space. The major turning point occurred in the late 1990s or early 2000s with the onset of the IT boom. When IT companies began establishing large campuses and offices, they started demanding support services along with high standards in facilities. Updater Services Ltd first started with CMC Limited, a Government of India (later sold to TCS in 2001) company. Their first IT campus contract came in 2000 at Chennai’s Tidel Park (one of the single largest buildings in Asia at that time) through a global RFP. Infosys took Updater Services Ltd beyond Chennai, and global majors Hyundai and Saint-Gobain established manufacturing units near Chennai. During that time, Updater Services Ltd took the opportunity to scale up the value chain to provide hard services like production support, catering, engineering services, etc and establish itself as a pan India player presence across metro & major cities. Post having a remarkable decade with high growth and high margins by 2010, the double-digit margins reduced significantly led by the entry of high competition mainly from international players, and low singles digit became the new normal for facility management services. This led Updater Services Ltd to enter into a business service platform with ground rule to be a B2B services business, scalable and with higher margin.

Source: Updater Services Ltd Investor Presentation

Over the years, Updater Services Ltd has evolved into an integrated business services platform with a Pan India presence that serves customers across industries and business service lines. Their clients include well known business across FMCG, manufacturing and engineering, banking, financial services, insurance (BFSI), healthcare, information technology/information technology-enabled services (IT / ITeS), automobiles, logistics and warehousing, airports, ports, infrastructure and retail, among others. Updater Services Ltd offers various services across its two key business segments: IFM services and BSS.

Funding History

Updater Services Ltd has historically attracted investments from several well-known private equity firms.

Private Equity Funding – Updater Services Ltd received its first private equity funding in 2006-07 from New Vernon Private Equity Limited for ₹40-50 Cr and invested in real estate. After that, in 2008, New Vernon’s entire stake of 40-42% in Updater Services Ltd was acquired by (India Advantage Fund III & IV) ICICI Venture Fund for ₹100 Cr.

As per VC-Circle, ICICI Venture Fund tried to exit its investment in 2011 but failed, and finally in 2016 the entire stake of ICICI Venture Fund was acquired by SPV, owned by a promoter at an undisclosed amount (SPV opted for long-term debt for acquisition), thereby making Updater Services Ltd entirely promoter owned. On 20 May 2016, Updater Services Ltd bought back shares worth ₹50 Cr from Tangi Facility Solutions Private (a promoter-owned entity). These shares were likely repurchased from the same SPV that had earlier acquired ICICI Venture’s stake. In 2017, Updater Services Ltd raised ₹100 Cr investment from (India business excellence Funds) Motilal Oswal Alternative Investment Advisors to scale up and expand to newer geographies.

These private equity players have helped Updater Services Ltd with various functions, such as enhancing operations, strengthening financial and internal controls, inorganic growth strategies, capital raising, strategic business advice, and implementing strong corporate governance standards.

Initial Public Offer – Updater Services Ltd launched its initial public offering (IPO) on 25 September 2023 and was listed on 9 October 2023. Updater Services Ltd has raised ₹640 Cr from the IPO. The issue consists of an offer for sale (OFS) of ₹240 Cr and a fresh issue of ₹400 Cr for repayment and prepayment of certain borrowings, funding the working capital requirements, pursuing inorganic initiatives, and general corporate purposes.

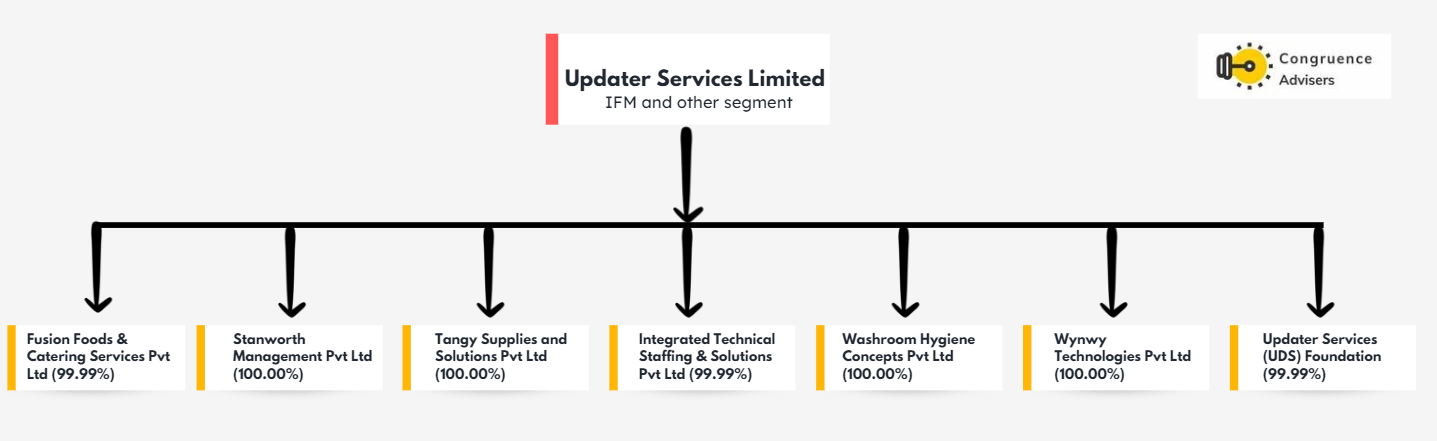

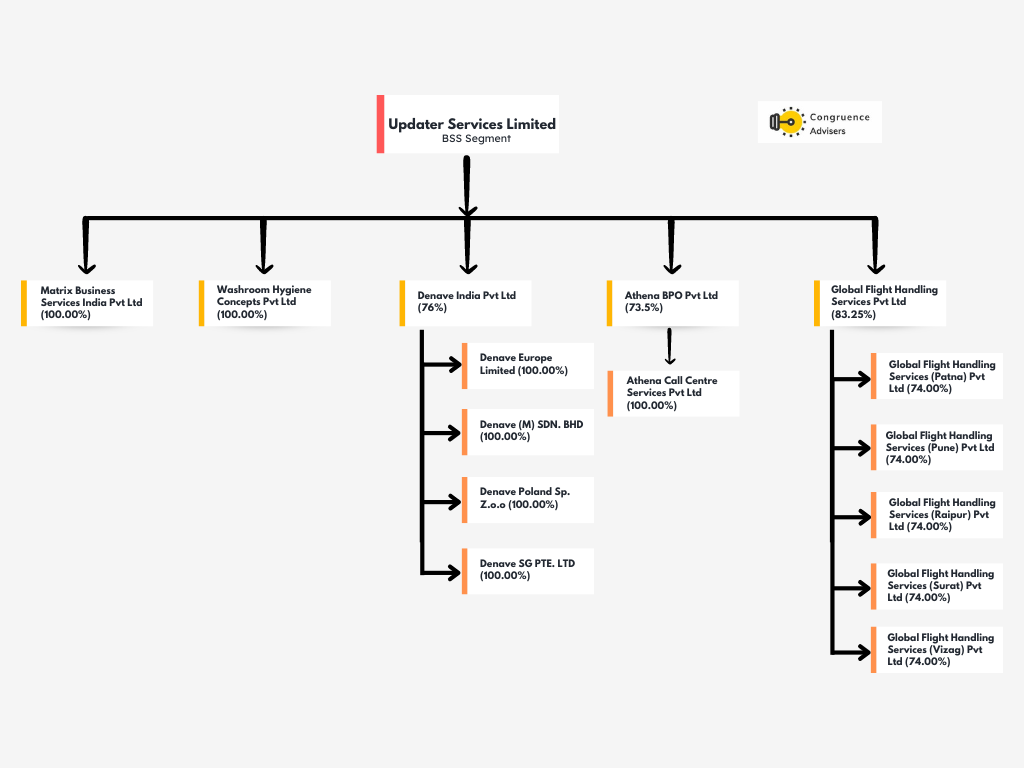

Updater Services Ltd Company Structure

Updater Services Ltd, in the last few years, has Acquired multiple companies and offers services through these subsidiaries

Organisation structure specific for IFM & Other services segment:

Source: Updater Services Ltd Investor Presentation and DHRP

Organisation structure specific for Business Support Services (BSS) segment:

Source: Updater Services Ltd Investor Presentation and DHRP

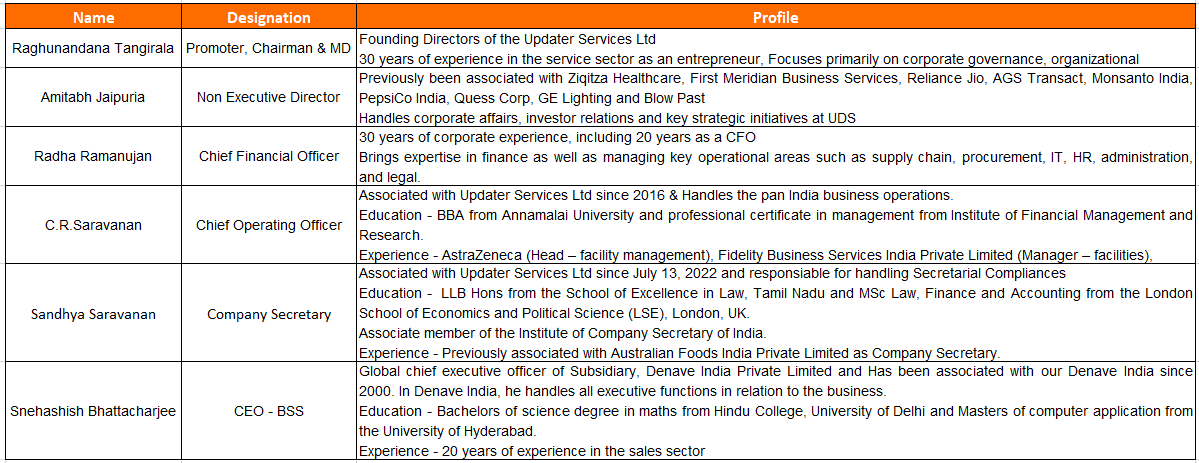

Updater Services Ltd Management Details

Founder and promoter Raghunandana Tangirala, son of an art director in the Telugu film industry, started his first venture of making and supplying mechanised bricks for the Indian Navy. He set up the base at INS Rajali (an Indian naval air station located near Arakkonam, Tamil Nadu) with the factory right next to INS Rajali that enabled him to save on transport cost and offer a better price vs. competitors. Post completion of INS Rajali Project, Raghunandana Tangirala realised that the business of mechanised bricks was not scalable. On a trip to Europe in early 1980, he discovered that facility management companies maintained airports and offices. A concept unheard of in India, Raghunandana Tangirala decided to foray into facility management, which is a more scalable and asset-light business, in 1985.

Raghunandana Tangirala, 64 years old, spent more than his life building Updater Services Ltd. Whenever Updater Services Ltd. acquires a business, the promoter of that business becomes part of the Updater Services Ltd. management family. For example, PC Balasubramanian, one of the key founding members of Matrix, who sold to Updater Services Ltd., is now a group advisor, and Snehashish Bhattacharjee, post the acquisition of Denave India, has been elevated to CEO of Updater Services Ltd’s BSS vertical.

A highly qualified and experienced team with extensive experience across the business lines in which Updater Services Ltd. operates supports the senior management team.

Among the recent management changes are an earlier chief financial officer, Company secretary, and Chief Culture Officer resigned during FY24, Radha Ramanujan was appointed as the new CFO on 30 Dec, 2023 (external candidate), and Sandhya Saravanan was appointed new Company secretary on 10 Feb 2024 (Internal candidate)

Updater Services Ltd – Industry Overview

Integrated Facility Management Overview

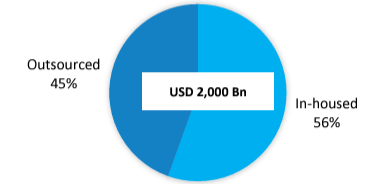

Global Facility Management Market: Global outsourcing is valued at USD 2 trillion, of which Global Facility management accounts for 45% and is valued at USD 890 billion.

Source: Frost & Sullivan Analysis

Outsourcing is evolving rapidly across the world. In the past decade, the main objective of outsourcing was cost optimization, but today, organisations want to outsource Facility management services to free up internal resources to deliver strategic value and focus on their core strengths.

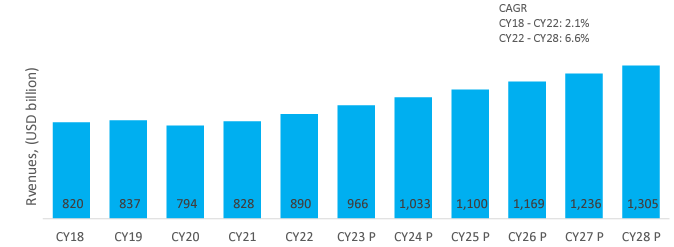

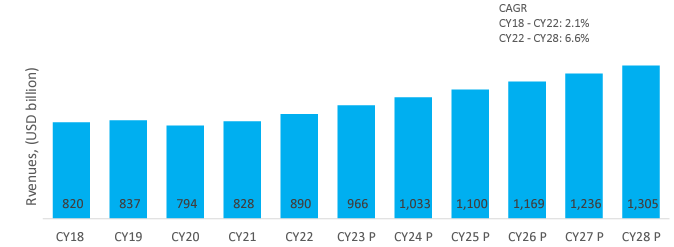

Global Facility management is expected to reach USD 1.3 trillion by CY28P, with an expected CAGR of 6.6%. Within Global Facility management, integrated Facility management services accounted for 11.7% in 2022, and Integrated Facility management is expected to reach a 13.8% penetration of the Global Facility management FM market.

Source: Frost & Sullivan Analysis

Asia is the largest region in global facility management. It is highly diverse, with a market share of 32.6%, followed by North America at 29.8%, Europe at 28%, and the Rest of the world at 9.6%. North America is the most mature market and leads the global standard for Integrated Facility management as it houses large contract management firms. The low penetration of Facility management services markets in many of Asia’s fast-growing economies indicates immense potential for market participants to grow and develop as outsourcing becomes more commonplace in the next 10 years.

Indian Integrated Facility Management (IFM) Market Overview

The Integrated facility management market in India has been growing steadily over the last few decades. Emergence for Indian facility management increased post-liberalization, which has opened opportunities for the private sector. This has attracted major MNCs to invest in India across sectors. The major breakthrough was in early 2000 when The IT and ITeS industry saw a surge in business opportunities, driving the industry to invest in construction operations to increase building stock. Over the years, India has developed a larger amount of infrastructure: Commercial buildings, retail malls, hospitals, airports, etc. This trend of infrastructure is expected to remain healthy going forward.

The total IFM market in India is valued at ₹1,00,387 Cr in FY23 & around 39.3% of this is outsourced to 3rd party companies. The outsourced IFM market was estimated to be worth ₹39,480 Cr. The overall IFM market is expected to grow at a healthy pace within the IFM market share of outsourcing, expected to increase to 45.30%. The value of the outsourced IFM market is expected to reach ₹86,442 Cr by FY28P.

Source – Updater Services Ltd investor presentation

While industrial and commercial offices account for the majority of the IFM market in terms of end-user segment, other sectors, such as hospitality, retail, healthcare, government infrastructure, education, and residential, are also starting to contribute significantly.

Regarding segmentation by service types, the IFM market is dominated by soft services, which include Housekeeping/ cleaning/ janitorial, Pest Control, Landscaping, and gardening. Soft services are expected to remain dominant going forward. This is followed by production support services (PSS), which are driven by increasing investments in the manufacturing segment and growing demand for qualified manpower. Hard Services are another significant contributor to the IFM market, driven by the need for preventive maintenance and energy efficiency.

The market is now shifting from a single-service contract model to an integrated services model, which consolidates many or all of the office/building’s services under one contract and management team. The intent is to streamline communication, make day-to-day operations easier to manage, and improve the building’s performance.

The split between government and private sector is 49.70% and 50.30%, respectively. Investments in smart cities and industrial parks are driving the growth of government-held properties, thus increasing the government sector’s share of FM market revenues. However, bureaucracy, lack of transparency, and payment delays are challenges in doing business with the government sector.

Real Estate Supply & absorption

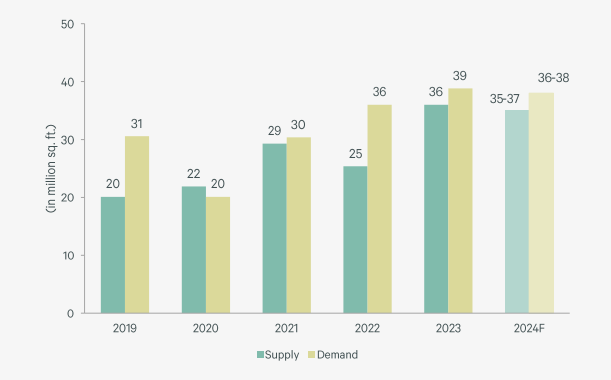

An increase in real estate stock has a direct impact on the growth of the IFM market. Regular investments in office, residential, and retail segments lead to the rapid addition to India’s real estate stock across commercial, residential, retail, industrial, and warehousing.

Office Market

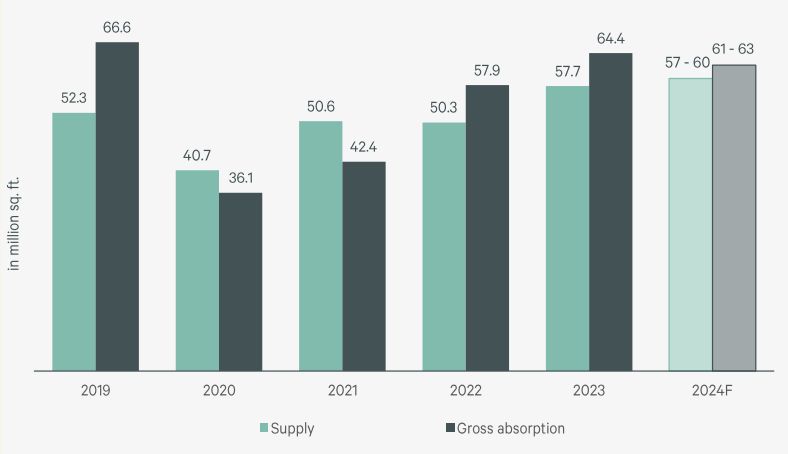

The office sector exceeded expectations in FY23, making it the second-highest absorption post-2019. Absorption is outpacing supply despite good supply growth. Out of 64.4 mn Sq ft gross absorption in FY23, domestic accounts for 46%, America 35%, EMEA 15%, and APAC 4%.

India’s average utilisation rate has increased from the low of 20-30% in FY21 to 50-60 in FY23; going forward, gross absorption is expected to remain high, led by a return to office witnessing a higher pace with many companies making a firmer stance on bringing back employees to the office. Some companies are making hybrid models more prevalent.

Source – CBRE

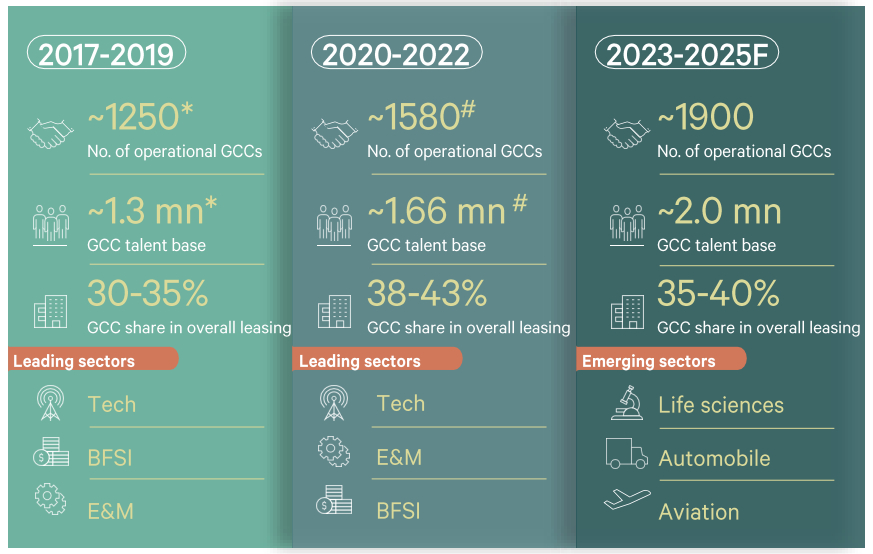

Over the years, global captive centres have emerged as a significant growth driver in India’s office market absorption, accounting for more than 1/3 share of gross absorption. Going forward, this trend is expected to be further led by India’s favourable investment policy and the availability of a cheaper and more skilled talent pool.

Source – CBRE

Flex leasing is also expected to remain strong, as a rise in hybrid work models and flexible lease options results in strong demand from various segments like startups, MSMEs, and even large corporates. Also, many listed companies & unlisted Flex space providers announced strong inventory additions across the country. Even smaller towns also

Source – CBRE

Industrial and Logistics Market

The Indian Industrial & Logistics market has been growing at a decent pace since the last few years and has mirrored the growth of the Indian economy since 2022, with demand not only sustaining but reaching record levels despite the volatile global economic environment. The leasing activity witnessed a standout performance in 2023, post a landmark absorption and this trend is expected to continue going forward.

Source – CBRE

Companies from the E&M sectors, including automotive, semiconductor, and energy, accounted for a significant portion of the total transacted volume; India has not only benefited from the ongoing trend of decentralising manufacturing capacity away from China but also from government’s initiatives, such as the Make in India campaign and the PLI scheme. These schemes have continued to enhance the prospects of the country’s E&M sectors.

Indian Industrial & Logistics has witnessed higher investment from many institutional players.

Source – CBRE

Retail Market

Changing lifestyles have led to increased organised retail developments in India.

2023 has witnessed the highest supply and absorption post-2019. Leasing activity was primarily driven by Bangalore, Delhi-NCR, and Mumbai, with the three cities accounting for a nearly 61% share in FY23. Close to 13 malls totaling about 6 million sq. ft. became operational across the country. The overall Demand and supply scenario is anticipated to remain steady. Even Tier-Il cities in India also witnessed sustained growth in 2023, with a total space take-up of 1.2 million sq. ft..

Source – CBRE

Luxury retail accounted for 50% of the transactions in FY23, led by many international brands foraying into the Indian market through strategic partnerships with domestic players.

Residential Real Estate

Residential Real Estate is witnessing significant demand post-COVID-19. We believe the current real estate cycle is expected to remain buoyant, as both sales and new launches will likely sustain positive momentum.

Source – CBRE

Some of the Key trends that are driving India IFM markets are the formalisation of the economy, Industrialization, Consolidation & Merger, and Acquisitions, Increase in Integrated Facility Management, Energy efficiency in Facility Management, Need for stringent quality standards and compliance

Value Chain & Key Stakeholders in IFM

Property Developers: They are the asset owners and the final decision-makers in the selection of IFM service providers. They work with FM consultants to procure FM services or directly work with FM service providers based on experience.

External FM Consultants: They are also called Managing Agents. The consultant assists the developer or the owner of a facility in choosing the right kind of IFM services and the IFM service provider. They help in the preparation of Request for Quotations, evaluate bids, and service provider capabilities. In some cases consultants sub-contract FM projects to companies to FM services providers

FM Service Providers: IFM Companies, in most cases, bundle the services based on the client’s need. Some IFM companies have all the resources and capabilities internally to provide these services. But widely, the IFM providers take the help of one or more single service providers who have expertise in the specific area of operation.

Sub-contractors/ Single Service Providers: The single service providers provide expert services in their area of focus. In most cases, they join hands with the IFM providers to provide services as a single package. In smaller contracts, single service providers directly serve the developer/owner.

End Users: They are the end users of the IFM services provided across commercial, residential, healthcare, and government segments.

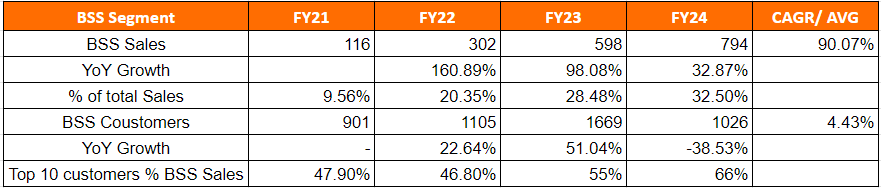

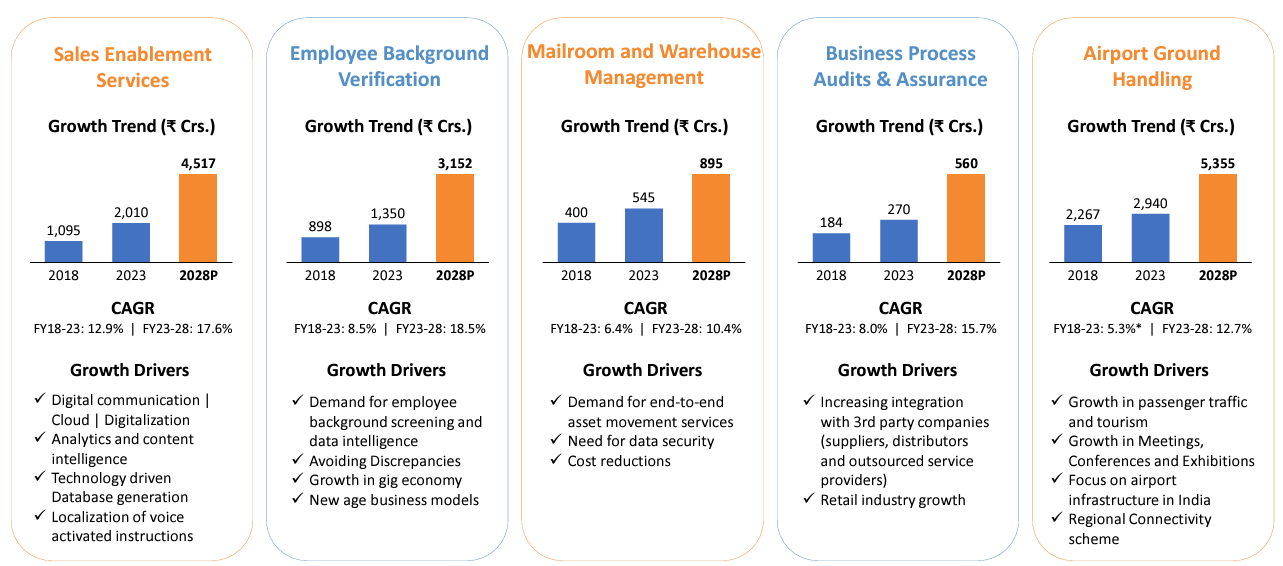

Business Support Services (BSS) Market Overview

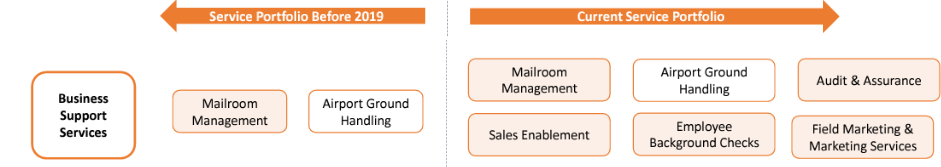

Business Support Services (BSS) is a set of ancillary services provided to companies to ensure the smooth conduct of business operations. There are several service segmentations within BSS, and we have only included which Updater Services Ltd operates in, i.e., Mailroom Management Services, Employee Background Verification Services, Audits & Assurance Services, Sales Enablement Services, and Airport Ground Handling Services.

In today’s globalised and complex business environment, companies outsource non-core tasks to third-party specialists to focus on their core operations. This helps them save time and resources, as managing support services in-house can be costly and inefficient without the right expertise.

Key benefits of outsourcing business support services are improved process optimization and efficiency, a focus on core business areas, cost benefits, and access to skilled resources.

Source: Updater Services Ltd Investor presentation

Business Support Services has grown at a hygienic rate of 8% CAGR from FY18-FY23, while the industry was impacted by COVID-19 and witnessed a decline of 27.1% in FY21. Post which industry has recovered sharply and even surpassed the previous high of FY20 in FY23. The industry is expected to grow at a healthy pace of 15% for the next five years. The increase in preference for outsourcing is expected to grow in the long term, and this will spike the demand for BSS.

Airport Ground Handling Services account for a major share at 41.3%, followed by Sales enablement at 28.3% and employee background verification at 19%. Mailroom Management Services & Audits & Assurance Services have a lower share at 7.7% and 3.8% in FY23.

Updater Services Ltd Business Segments

Updater Services Ltd offers its services through two main segments: Integrated Facility Management (IFM) & Other Services and Business Support Services (BSS). It works under different types of contracts, including cost-plus contracts, fixed-price contracts, and contracts tied to specific performance targets (SLA-linked contracts).

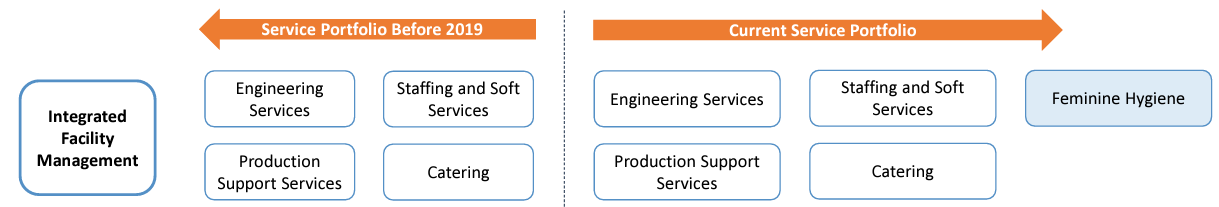

Integrated Facility Management (IFM) – IFM is basically an organically built business segment for Updater Services Ltd, as most IFM sub-vertices are built from scratch. The only acquisitions Updater Services Ltd has made in the IFM segment are Fusion Foods in 2017 for Catering services and Washroom Hygiene Concepts in 2019 for Feminine Hygiene services.

IFM is a highly fragmented industry growing at a high double-digit, Even the largest player has around 3-4% market share and Updater Services Ltd is the 2nd largest player with a market share of around 2.8%. IFM has a lot of scope for industry consolidation

IFM Updater Services Ltd basically handles backend maintenance like soft services, engineering, mailroom, and hygiene services to manage these facilities efficiently like IT parks, hotels, airports, retail malls, commercial buildings, hospitals, Manufacturing plants, etc

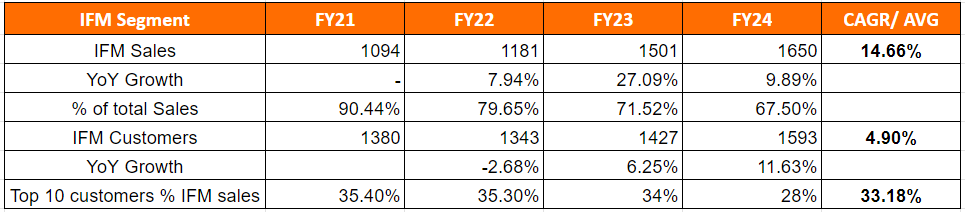

Updater Services Ltd IFM vertical delivered 3-year revenue CAGR of 14.66%, While FY24 revenue growth was lower at 9.9% (in line with industry growth of 10% in FY24) because of the portfolio rationalisation exercise and selectively exciting lower-margin contracts. At the same time, new customer additions remain healthy in FY24 despite portfolio rationalisation. IFM revenue contribution has reduced from 90% to 67.50% in FY24 as Updater Services Ltd focused more on higher-margin BSS verticals. EBITDA margin for IFM vertical was around 5.3% in FY24. Revenue contribution from the Top 10 customers is also trending lower as Updater Services Ltd is reducing dependency on the top 10 customers.

IFM Sub verticals

Soft Services – These include services such as housekeeping and cleaning services, disinfecting and sanitising services, pest control, horticulture, and facade cleaning.

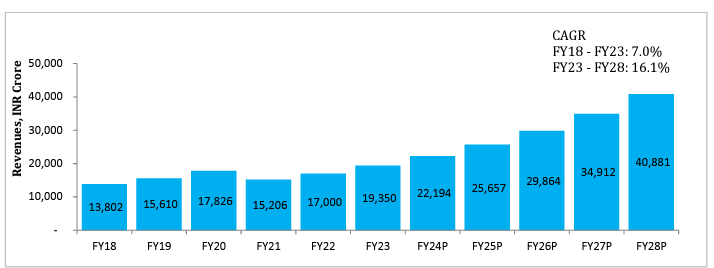

Indian Soft services market is estimated to be ₹19350 Cr as of FY23 and expected to reach ₹41,000 Cr in FY28P, growing at 16.1% CAGR

63% of the Soft Services segment market revenues are from Housekeeping/ Cleaning / Janitorial services, the rest from Disinfection & Sanitation services, Landscaping & Gardening and Pest Control Services. Going forward, Housekeeping continues to dominate the soft service segment

All the IFM companies provide Soft Services; the Soft Services segment is also highly fragmented, similar to the IFM market. BVG is the market leader in soft services, and UDS is the 2nd largest player. Other close competitors are SIS Ltd, Quess Corp, and Sadexo.

The top 5 players account for 22.5% of the total, which is a huge opportunity for industry consolidation.

While the margins in soft services are very thin, Updater Services Ltd is focusing on major end-user segments that require differentiated services and focus on quality rather than price. Updater Services Ltd has scaled up its business in the healthcare segment, where it provides hospital management services through Annual Maintenance Contracts (AMC). Updater Services Ltd is one of the leading companies providing services to the healthcare segment.

Some of Updater Services Ltd’s major customers in soft services are Hyundai, Saint-Gobain, TTK Healthcare, Shriram Transport, Honda Motorcycle, IIFL Finance, SBI Life Insurance, IIM Bangalore, John Deere India Private Limited, and Blue Star Limited.

Engineering Services – These mainly comprise services related to mechanical, electrical, and plumbing; these services, also referred to as hard services, include maintenance, repair, overhaul, and performance management of heating, ventilation, and air conditioning (“HVAC”) systems; power equipment such as generators and UPS systems; pumps, sewage treatment plants, fire safety systems, waste management systems as well as the management of annual maintenance contracts for elevators and other building related systems and equipment. In simple terms, engineering services basically is the back-end operations of the entire facility

Engineering services are expected to grow at a high double-digit from ₹9200 Cr to ₹20149 Cr in FY28P.

Historically, the Engineering services Segment has been dependent on the demand for Mechanical Electrical and Plumbing (MEP) services; however, Since 2012, the Engineering services Segment has evolved beyond traditional MEP services to include modern building technologies such as HVAC, fire safety systems, ELV/low voltage systems, security systems, CCTV, and lighting control.

BVG is the market leader in engineering services, with a share of 2.7%. The other 4 companies are Sodexo, Quess Corp, SIS Limited, and Updater Services Ltd. The hard services market is extremely fragmented, even more so than the soft services market in India.

Apart from providing engineering services to various IT parks, hotels, commercial buildings, hospitals, etc., Updater Services Ltd. provides engineering support services for auto manufacturers and a clutch of airports.

With new goals like resource efficiency and net-zero buildings, the developers are prioritising systems like water treatment and renewable energy solutions such as solar power. These trends add complexity to building upkeep, thus increasing the need for specialised Engineering services, which will require a highly skilled staff. This will present significant growth opportunities for IFM players as they can quickly bring in competencies.

Some of the major customers of Updater Services Ltd in engineering services are Blue Star, John Deere, IIFL Finance, and six major airports, including metro and non-metro airports (including Bengaluru T2, Mangaluru, Guwahati, Goa Mopa Airport, and Delhi International Airport)

Production support services – Solutions offered to manufacturing facilities, including material handling, material movement, on-site warehouse management, store and inventory management, production support activities, and equipment maintenance.

The production support services market is estimated at ₹10300 Cr and is expected to reach ₹24000 Cr by FY28P. The automotive industry is a key demand driver for PSS in India and accounts for 15% of the total market in FY2023.

Major IFM companies providing Production support services include Quess Corp, Updater Services Ltd, Krystal Integrated Services, and OCS Group. Staffing companies also provide these services, such as Team Lease, Randstad, Manpower, Adecco, etc. The market is fragmented, and more than 200 companies compete in this segment.

Updater Services Ltd is the market leader with a 2% market share and the leading production support services provider in the automotive industry.

Some of Updater Services Ltd’s major customers in Production support services are Hyundai, Eicher Motors Limited, Saint-Gobain, FLSmidth Private Limited, Mobis India Limited, and Salcomp Manufacturing India Private Limited.

Washroom and Female Hygiene

Historically, the market offered soaps, hair care products, face wash, air fresheners, sanitizers, and other washroom solutions but has undergone a transformation in terms of products sold for personal hygiene, particularly feminine hygiene.

The market for Hygiene Services is also highly fragmented and small in India. Key companies providing air fresheners in India are Dabur India, Godrej Consumer Products, Airance, and Procter & Gamble.

The feminine Hygiene Unit is a niche sub segment within Hygiene Services. Various products and solutions offered under this subsegment include Sanitary Napkins/Pads and solutions targeted towards proper disposal of sanitary waste. The common business model is to install the units in end-user locations, and the service provider would collect the waste on a periodic basis and dispose of it in an appropriate manner as per regulations. The bin liners are patented products, creating entry barriers for companies to enter this niche market.

The Feminine Hygiene market is estimated to be around ₹60 Cr in FY2023. Rentokil Initial is the market leader in Feminine Hygiene Units, with revenues of ₹41 Cr and a market share of 68.3%. Washroom Hygiene Concepts (which was acquired by Updater Services Ltd in September 2019) is the second largest player, with revenues of ₹13 Cr and a market share of 21.7%.

The existing system for sanitary waste disposal is poor and causes severe environmental issues; therefore, Feminine Hygiene Units are well poised to witness high growth opportunities in the coming years. Demand for feminine hygiene products and solutions is driven by Government Initiatives to Improve Menstrual Hygiene, Increase female Literacy rates, and increase the Female labour force.

Institutional Catering – Catering and food services to commercial offices, corporate cafes, educational institutions, corporate events such as meetings, training programs, exhibitions, conferences, and awards programs, and industrial facilities provided through Updater Services Ltd Subsidiary, Fusion Foods

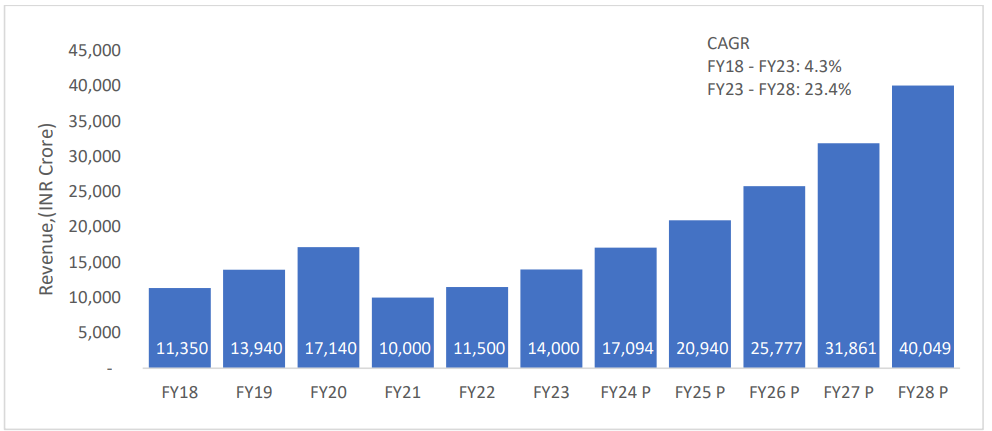

Catering and food services growth has posted lower growth in the last 5 years as it was the most impacted sub-segment within IFM, mainly due to COVID-19. However, it has recovered well, and Going forward, it’s expected to grow at 23.4% CAGR, the highest within IFM. Corporate Catering is the largest segment, with a market share of 60% of the total market, followed by Industrial Catering at 40%.

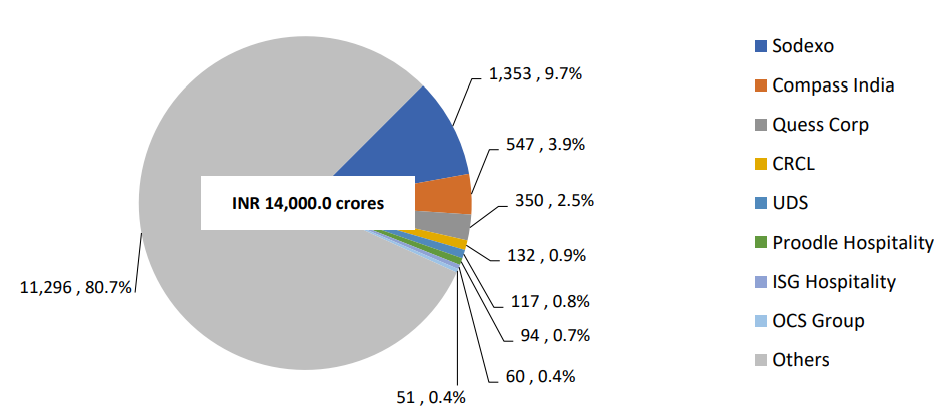

Catering and food services are also a fragmented market; organised players account for 30-40% of the market share, while unorganised players account for 60-70%. The regional players pose significant competition to organised players. Sodexo is the clear leader in this segment, with a 9.7% market share, mainly because its Sodexo meal cards are offered by employers to provide employees access to benefits like meal allowances, wellness programs, and more. Updater Services Ltd is within the top 5 players with a market share of 0.9% and has a very strong presence in South India. A few of their clients include Daimler, Vellore Institute of Technology, Eicher Motors, JK Tyre and Industries, Delphi TVS, and Sastra University.

Warehouse Management: Warehouse management services comprise the deployment of people, equipment, and processes to manage customer warehouses and operations within them. Under this category, Updater Services Ltd offers material handling, stock keeping, grading and sorting, breaking bulk, repacking, inward and outward dispatches, and return logistics.

Updater Services Ltd. provided warehouse management services to major logistics and manufacturing companies across the country, including Saint-Gobain.

Staffing Services – Staffing Services are defined as temporary staffing focused on the needs of IT/iTeS and the general staffing requirements of organisations encompassing all their functional requirements. This would include contract-based staffing only and the requirement is limited to specific projects and is short-term, i.e., 1 -2 years.

Companies in India tend to outsource non-core activities to their business function. Some of the key functions outsourced include recruitment, payroll, benefits management, HR compliance, Time and Attendance, etc. Staffing services are dominated by Quess Corp, Teamlease, FirstMeridian, Randstad, and ManpowerGroup, accounting for 50% of the total market in FY23.

Updater Services Ltd provides these services through its subsidiary, Integrated Technical Staffing and Solutions. These services generally comprise recruitment, payroll, and human resource services. However, they do not constitute a significant part of Updater Services Ltd’s portfolio, which focuses on specialty staffing in healthcare, payroll management, and field force management.

Other Services

Technology Services are offered through subsidiary Wynwy—Inconn. This integrated asset management software gives users visibility and control over their assets, allowing them to schedule, assign, and track both regular and breakdown maintenance tasks efficiently.

Procurement Services – offered through subsidiary Tangy, which specialises in procuring integrated facilities management machinery and supplies, including eco-friendly chemicals, paper products, cleaning supplies, engineering tools and tackles, cleaning machinery, and spare parts. Tangy also manufactures uniforms for internal as well as external customers

Business Support Services (BSS)

Updater Services Ltd offers multiple services through business support services, which are more specialised and value-added services. In simple terms, business support services are a revenue generation platform for companies, while IFM is a cost optimization platform. Business support services segment is an acquisition-led platform for Updater Services Ltd, with the goal of increasing profitability and offering a wider range of services to its customers.

Updater Services Ltd. forayed into mailroom management in 2007; the rest of the acquisitions were made in 2019 or after 2019.

BSS is a high-margin (compared to IFM) segment for Updater Services Ltd, both YoY and CAGR growth is high mainly because of the acquisitions. BSS customers decreased from 1669 to 1026 in FY24 mainly because customers who are contributing less than ₹5 lakhs in revenue and one-off projects have been eliminated, along with some rationalisation. The BSS segment can grow at 20% organically, While management is also actively looking for acquisitions in the BSS segment.

BSS Sub verticals

All BSS sub-vertices in which Updater Services Ltd is present are expected to deliver strong double-digit growth for the next few years

Sales Enablement Services –.This platform is mainly used to Serve global customers across multiple industries, including information technology/information technology-enabled services, telecom, and other industries, through global delivery centres located in India, Singapore, Malaysia, and the UK and also through partners in other parts of the world. BPO service includes inbound and outbound telecalling, focusing on Chatbots and Virtual assistant support. The whole purpose of a sales enablement platform is to assist a brand in reaching high-potential prospects, increasing conversions, and closing high-value deals.

Updater Services Ltd. provides sales enablement services through subsidiaries Denave and Athena.

Denave – Denave is the pioneer of B2B sales enablement strategy and works closely with industry-leading clients to implement a transformational approach aimed at enabling enterprises to grow sustainably, build a competitive edge, and drive positive impacts across the value chain. Over the years, Danave has specialised in B2B sales and lead generation for its clients. In some cases, they close deals on behalf of their clients, while in others, they pass along qualified leads. Their largest client is Microsoft. Additionally, they offer field marketing services, providing retail staff to support in-store promotions and activations.

Services offered include

- Revenue Development: Sales Intelligence, Intelligent Data Services, Digital Marketing, Telesales, Webinar Marketing, Field Sales Services SCAN To discover the growth of Denave

- Brand Activation: Digital Marketing, Merchandising & Audit, BTL Marketing & Events

- Revenue Enablement: Sales Training, Business Analytics, Tech & Platforms

Updater Services Ltd acquired Denave in FY22 with an initial stake of 54% and is currently holding 76% with a plan to increase to 100% by the end of FY25. Denave drives 50% of revenue from exports. Currently, EBITDA% is close to 8-9%, and Denave has a global delivery centre in Malaysia; it has recently opened a new global delivery centre in Korea and plans to enter some other markets also

Athena – Acts as a sales arm, mainly for the BFSI segment, where they make the B2C sales on the bank’s or client’s databases and then fulfil the sales lead. Athena is One of the oldest domestic BPOs in India and has grown rapidly over the last 16 years, with the current footprint spanning 2 cities – Mumbai and Bangalore with 3 operational centres. The company has over 3,000 billable seats in these locations and serves many reputed clients in diverse sectors like Banking, Telecom, Insurance, and FMCG. Athena is 2nd highest margin business for Updater Services Ltd with 23% EBITDA and 16% PAT as it focuses on niche segments such as the BFSI.

Major customers to whom Updater Services Ltd serves in sales enablement are Microsoft, Saint-Gobain, Hindustan Unilever Limited, Marg Business Transformation Private Limited, Vivo Mobile India Private Limited, Logitech, and Culturelytics Private Limited.

Major companies operating in Sales Enablement Services are Denave, Channelplay, Netambit, WebHelp, TeleDirect, Majorel, PPMS, eSearch Logix, Regalix, Ushur, Mindtickle, Athena and others. Updater Services Ltd (Denave & Athena) had a market share of 20.1% in FY23 and is the market leader in India, followed by WebHelp with a share of 9.8%

Updater Services Ltd acquired Athena in FY23 with an initial stake of 57% and is currently holding 73.5% with a plan to increase to 100% by the end of FY27

Mailroom Management and Niche Logistics and Transport Solutions – Updater Services Ltd, through its subsidiary Avon Solutions and Logistics (acquired in 2007), is a Leading service provider in India and a pioneer in the mailroom and asset movement business. Avon Solutions and Logistics has been the market leader since 2007, with a market share of 11.1% in FY23. It has also forayed into Niche Logistics and Transport Services.

The market is expected to move towards consolidation in the coming years. The industry average gross margins for organised companies are 15-20%. Mailit, Avon Solutions, Logistics, TGH, and Sodexo are major companies operating in this segment.

Matrix Business Services – Updater Services Ltd offers Audit & Assurances and Employee background verification services through Matrix Business Services (acquired in FY20)

Audit & Assurances – Services such as supply chain audit, including warehouse depot audit, distributor audit, and retail point audit, among others. Also, it provides back-office services related to marketing programs and channel partner claim processing to global customers with a specialised focus on FMCG and consumer durables companies. Major customers are P&G, ABFRL, Hershey, and More Retail, among others.

Apart from the four major audit companies, Matrix has reached the top spot in India, with a market share of 19.2% in FY23. ProTeam is the 2nd largest company, with a market share of 10.6% in FY23. It is followed by ChannelPlay, with a market share of 9% in FY23. The industry average gross margins are 12-15% among organised segment companies in India.

Employee background verification check services – Straight forward verification of employee’s background Services comprise address verification, identity verification, educational qualifications verification, employment history verification, and legal case history, among others.

Employee background Services is Updater Services Ltd’s highest-margin vertical and has a direct linkage to IT hiring. The company is currently facing a slowdown due to slow IT hiring, but management is planning to reduce its dependence on IT/ITeS by focusing on BFSI and other segments that are still hiring reasonably well. Major customers of Matrix Business Services are TCS and Persistent Systems Limited, among others.

The market is led by First Advantage, with a market share of 25.6% in FY23, followed by Authbridge, with a share of 11.3%, and Matrix Business Services is the 3rd largest in the segment, with a share of 5.4% in FY23. Other major companies are Pinkerton, Milliow, Arc Attest, Helloverify, Verifacts, cfirst, KPMG, and Idfy, among others. The industry average gross margins are in the range of 30-35%.

Airport ground handling services – Services include baggage and cargo handling, passenger movement, and aircraft turnaround, among others. It also provides meet-and-greet services at various airports around the country. Provided through Updater Services Ltd subsidiary Global Flight Handling Services (acquired in FY19), a JV with Bags Ground Services Ltd, and currently handling operations in 20 airports, 10 of which commenced in Q1FY25.

Once an aircraft lands and reaches the terminal, Everything that happens to that aircraft from that point on till the aircraft is ready to take off again is handled by Global Flight Handling.

Entering a new airport requires significant upfront investments in equipment like ground power units, air handling units, pushback tractors, luggage handling systems, and passenger buses. This business has a gestation period of 2.5 to 3 years. The gestation period is driven by three factors: 1) large initial investment in equipment, 2) time for passenger traffic to grow, and 3) immediate payments of minimum guarantees to the airport, while revenue takes time to build up. This is only a capex-intensive business for Updater Services Ltd.

Airport ground handling services had a turnaround EBITDA positive and PAT positive in Q1 FY25. Going forward, this division is expected to become a growth engine. Global Flight Handling Services has also launched the Aviation Training Academy, which is expected to pick up pace & start positive contributions by next year, i.e., FY26.

As per management, airport ground handling is a 10-year concession, which Global Flight Handling started in FY22. Because of this concession, this business is an absolute monopoly. The only competitor is Air India AIGSL, and the company doesn’t see it as a big competition.

Updater Services Ltd Acquisition Strategy

Updater Services Ltd preferred small acquisitions and followed a strategy of phased acquisitions. Updater Services Ltd typically acquires a majority stake, with the remaining stake acquired over a few years in multiple tranches. The promoter of the acquired company becomes part of the Updater Services Ltd family and helps to integrate and run the group efficiently.

Updater Services Ltd has developed and follows ‘PRASAD’ acquisition strategy

The initial acquisition price is based on business performance estimates, and the financial liability is accounted for at the time of the acquisition. If the acquired business performs better or worse than expected, any fair value adjustments are reflected in the profit and loss statement.

Updater Services Ltd Corporate governance

Expect some minor conflict of interest. We believe that corporate governance is unlikely to be a challenge for Updater Services Ltd. as, since its early days, this microcap has secured the investment and maintains strong relationships with reputed Private equity investors, which has guided Updater Services Ltd. on multiple things, including corporate governance.

Board Composition – The Board consists of 6 Directors, 4 of whom are Non-Executive Directors. Of the 4 Non-Executive Directors, 3 are Independent Directors, one of whom is a Woman Director. The Board comprises renowned professionals drawn from diverse fields.

Audit Committee – Although an independent director chairs the audit committee, it also includes Promoter Mr. Raghunandana Tangirala as a member; in general, having a fully independent audit committee is seen as a better corporate governance practice.

Promoter Remuneration – KMP Remuneration for FY24 is around ₹5 Cr, including ESOP; the Promoter is part of the remuneration and nomination committee, which is not a positive sign.

Related party – The related party with promoter-owned entity Best Security Services Private Limited (which provides security services) is around ₹5 Cr, which is not very large. However, it is engaged in a similar line of business, which may raise conflict of interest risk.

Lacks of internal control – The statutory auditors in the past have highlighted the lack of effective internal controls, which Updater Services Ltd has mended and appointed an external audit firm to check and monitor internal control measures periodically.

Statutory Auditors have also highlighted certain instances of irregularities in disbursement/payment of salary to fictitious and resigned employees in earlier years in relation to its subsidiary, Washroom Hygiene Concepts Pvt Ltd, in FY22.

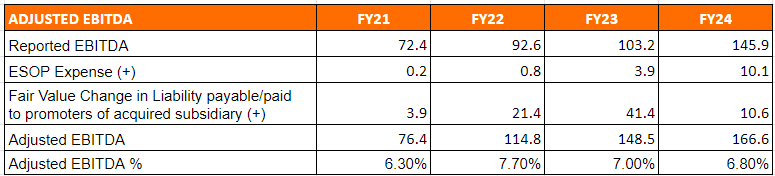

Updater Services Ltd Financial Performance

Updater Services Ltd. has printed healthy revenue growth of 26% CAGR on a 3-year basis while this growth is a mix of organic and acquisition led growth. The FY24 growth was slower than the guidance of 20% growth due to account rationalisation in the IFM segment. As a conscious strategy Updater Services Ltd. has exited the low-margin and government-related business). Gross profit margin was impacted due to higher headcount addition (mainly for sales enablement segment) and higher ESOP cost. The reported portability improved YoY but was lower the previous year due to Denave’s margin getting impacted by higher contributions from telecom customers (lower margin & higher upfront costs) and inconsistencies in tech clients for cost optimization. Even Matrix is also facing significant pressure due to a slowdown in IT hiring and losses reported by Global Flight Handling Services (turned EBITDA+ and PAT+ only in Q1FY25)

The reported profitability is also impacted by Fair value change (Higher payout due to better performance of acquired company) and higher ESOP costs (which are expected to decrease in FY25)

Unlike some other companies, which are mainly into staffing, Updater Services Ltd. has little exposure to staffing. Therefore, the adjustment to the tax rate because of the 80JJAA benefit is negligible.

Adjusting EBITDA & Net profit and excluding the impact of ESOP and Fair value change

The Reported and Adjusted PAT are at ₹66 Cr and ₹92 Cr, slightly lower than management’s earlier guidance of ₹70 Cr reported and ₹100 Cr for FY24. While the Adjusted Cash PAT for FY24 is healthier at ₹146 Cr.

Updater Services Ltd Return Ratios

FY24 ROE & ROCE have declined YoY mainly due to a higher equity base (due to the IPO) and Capex for Global Flight Handling Services (turned EBITDA+ and PAT+ in Q1FY25). While the decline from FY22 is due to lower profitability.

Updater Services Ltd Working capital, Debt and cash flow Analysis

The industry generally operates with a credit period of 60 days, and Updater Services Ltd. has a Days Sales Outstanding (DSO) of 75 days due to the time taken for invoice submission and processing. According to management, the ideal range should be under 70 days, which they are working towards. Approximately 60 days of credit is expected in almost every line of business, except Athena, where cycles are faster. Updater Services Ltd. has technically no writeoff; the writeoff of 0.2–0.3% in FY24 is due to disputes on calculations and reversals. Working capital to revenue for FY24 is 21%, i.e., 77 days. Updater Services Ltd. continues to remain debt-free since the last few years. Updater Services Ltd ₹150 Cr cash on its balance sheet and Updater Services Ltd maintains a healthy CFO/EBITDA conversion ratio

Updater Services Ltd Comparative Analysis

To understand Updater Services Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Updater Services Ltd to its competitors (peer comparison) on various fundamental parameters and Updater Services Ltd share performance relative to relevant benchmark and sector indices.

Competitive Overview

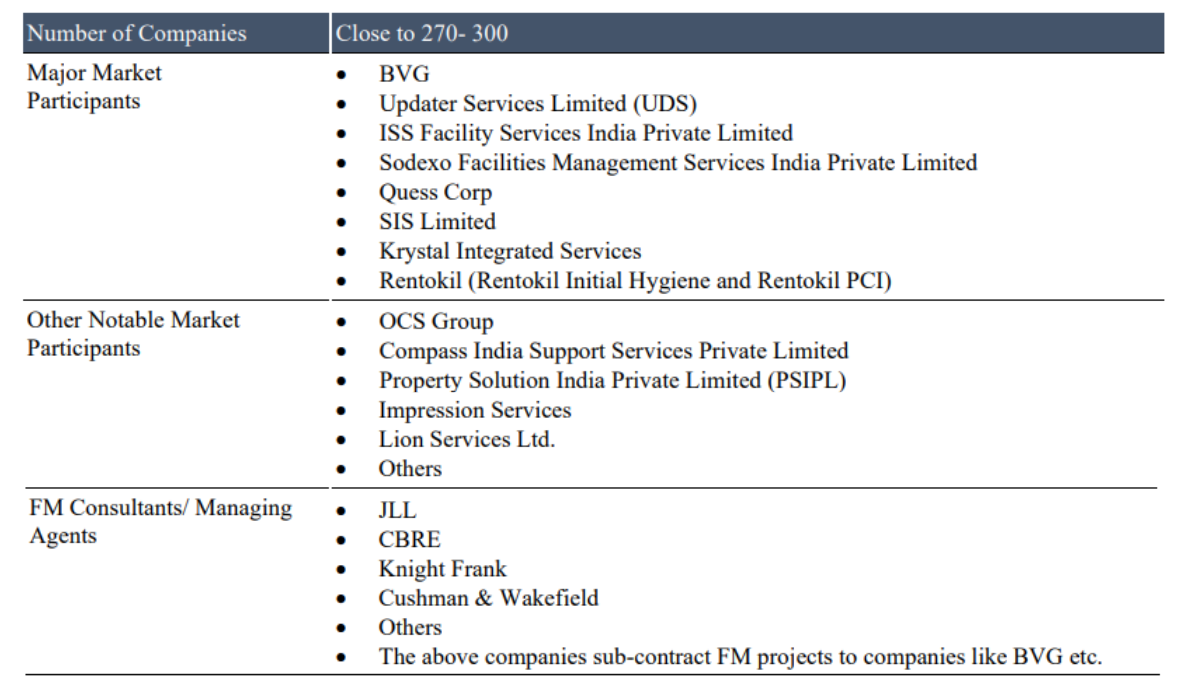

IFM Market Competitive Overview

The Indian Integrated Facilities Management (IFM) market is very fragmented, with about 270 to 300 companies operating nationwide.

There are 6-7 large IFM companies, known as Tier 1, that operate across the country, serving various industries and accounting for 19.2% of the market as of FY23. Tier 2 companies, about 60 to 70 in number, focus on specific regions. More than 200 companies fall under Tier 3, working in smaller geographic areas, such as a single city or town.

BSS Market Competitive Overview

The market has both multinational and local companies offering various services. Most of these Tier 1 FM companies have expanded their service portfolio to Business Support Services. For example, Quess Corp. offers compliance and payroll processing, and Sodexo is now providing mailroom management. Updater Services Ltd. stands out by offering a wide range of services, including audits, employee background checks, sales enablement, and airport ground handling.

IFM and BSS Market: Service Portfolio of Major Companies, India, FY2023

Updater Services Ltd broad service range gives it a unique position in India’s BSS market.

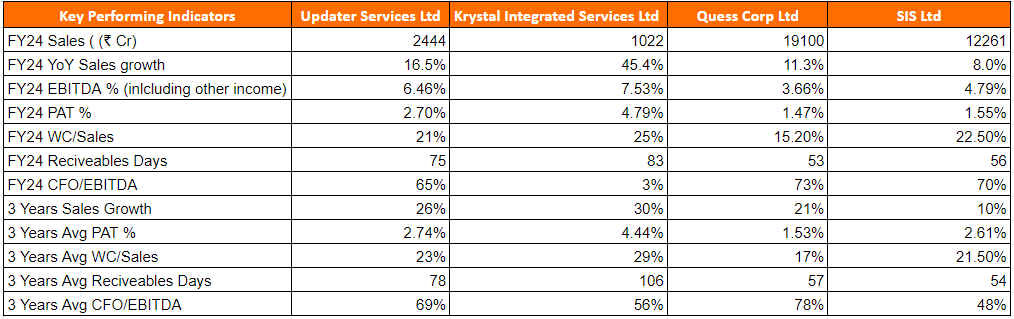

Updater Services Ltd Peer Comparison

While there are multiple listed and unlisted players in IFM segments, these players drive significant part of their revenue from other business verticals with differing unit economics. Which creates varied cost structures and profitability margins, making direct comparison consolidated comparison challenging. For example

Quess Corp has significant revenue streams from its staffing and products verticals.

SIS operates in the security services and cash logistics verticals.

Krystal generates over 70% of its revenues from government contracts.

BVG is diversified into waste management and emergency response services.

Updater Services Ltd offers a range of Business Support Services (BSS)

Krystal Integrated Services Ltd scores much better on growth rate and profitability and is the cheapest player among all, as the majority of its revenue (>70%) comes from government business. Krystal Integrated Services Ltd also carries huge political risk, i.e., promoter of Krystal Integrated Services Ltd is a politician and leader of the BJP Maharashtra. Quess Corp Ltd and SIS Ltd are the larger listed peers in the Indian market despite that Updater Services Ltd has showcased its ability to compete in the market and grow the market across regions and sectors.

We have fetched the IFM segment details of these companies to get better understanding.

For Quess Corp Ltd data includes for entire OAM segment (which includes telco service also)

Even unlisted players like BVG India Ltd and Sodexo have consolidated revenue of ₹2000 Cr+, showing how large and profitable the IFM market is. While Updater Services Ltd lagged in revenue growth on a 3-year CAGR basis, FY24 growth has been similar across players as the whole industry is doing portfolio rationalisation and existing low-margin business and government business. Expect Krystal Integrated Services Ltd, which recorded 30%+ growth as it focused more on the government sector. SIS is guiding for 5+% EBITDA% in the IFM segment for FY25. Updater Services Ltd has higher sales per employee compared to other peers.

Updater Services Ltd Index Comparison

Updater Services Ltd share performance vs S&P BSE Small cap Index as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why You Should Consider Investing in Updater Services Ltd?

High Runway for growth – Updater Services Ltd is one of the few businesses in India that offer the possibility of a 15%+ baseline growth rate potential for a reasonably long time (Even the end Industry is also growing at double-digit) without needing external capital. The larger players in the facilities management and business support services segments are likely to grow at a faster pace than the industry and capture a bigger share of the profit pool over the next 10 years

Strong Management – Updater Services Ltd. is led by a strong promoter and management team with 30+ years of experience in the industry. The promoter, a technocrat, has good relationships with stakeholders. Whenever Updater Services Ltd. acquires any business, the promoter of that business becomes part of the Updater Services Ltd. management family and drives the next leg of growth within a larger platform.

High customer retention rates – Updater Services Ltd. maintains high customer Retention rates of 95% in the IFM segment and 93% in the BSS segment over a 5-year window.. Clients are usually organisations that are much bigger than Updater Services who do not want to do the low value (but challenging) facilities management in house. Maintaining such high retention in a highly competitive and price-sensitive industry is commendable.

Strong track record of high-margin acquisitions – Updater Services Ltd has been acquiring capability in the BSS vertical while sticking to organic growth in the facilities management vertical. Updater Services Ltd. has successfully completed and executed multiple acquisitions in the past, which has led to higher margins and growth.

High Cross-sell opportunity – Updater Services Ltd now has multi-service offerings under one roof making and is now focusing on selling multiple services, including the BSS segment, to multiple clients (have around 2000 unique clients between 2 verticals)

Reasonable valuation & minimal hype – Updater Services Ltd trades at < ₹2,500 Cr valuation and there are very few voices talking about this business in the investment circles as of date.

What are the Risks of Investing in Updater Services Ltd?

High Competition – IFM is a highly fragmented industry with a large number of domestic and international players. Even big real estate players are entering this segment and in some industries top management teams can break away and try to poach customers and employees from the business. The BSS segment is also experiencing increased competition as many IFM companies are entering the high margin market like BSS and BSS also have some risk of technology disruption.

High Attrition Rate – Updater Services Ltd and the entire industry suffers from a high attrition rate ( 60-70%) because of unskilled/low skill and the temporary nature of the job. On the other hand, demand for quality manpower and competitive remuneration make it difficult to retain a skilled workforce, especially in the Hard services and even in the BSS segment.

High Employee Base – Updater Services Ltd. has a high employee base of 65,000+, making employee retention and compliance management challenging with regulatory risks involved. Even negligent acts by Updater Services Ltd. staff can expose the company to indemnification claims from customers, and wage increases could hurt margins.

Customer concentration risk – Most of their customers (if not all) are larger than Updater Services, thereby exposing the business to power imbalances in the supplier customer equation. Revenue from the top 10 customers in IFM is 28% ( trending lower), while for BSS, it is higher at 66%. Any cost-cutting initiatives and other slowdowns for these customers may lead to adverse impacts.

Lower Pricing Power – IFM is a highly competitive sector, and customers are very price-sensitive. Any price war initiated by competitors could prompt clients to switch providers.

Geographical concentration risk – Approximately 60% of Updater Services Ltd’s revenue comes from south India. Any disruption in South India may cause risk.

Updater Services Ltd Future Outlook

Updater Services Ltd stands out among the key players due to its comprehensive service offerings and ability to cater to various industries. Updater Services Ltd provides a holistic solution under one roof.

Management is Guiding for 20% revenue growth (3x GDP) in the medium term, while guidance for FY25 was lower at 15-16% (IFM 13-14% & 20% for BSS) as IFM segment growth for FY25 will be the impacted by portfolio rationalisation (which is largely over in Q1FY25). Overall margin is also expected to increase by 0.2-0.3% every year for the next few years, led by operating leverage, Technology leverage, and improving the business mix.

Updater Services Ltd is focusing on high-margin customers and value-added services by retaining existing customers (maintains 90%+ customer retention across all businesses), Adding new customers (75-80% of revenue growth comes from existing customers & 25-30% from new customers), Cross-selling its other services to existing customers and actively looking for acquisition on BSS (Mgt has hinted acquisition to happen in Sales Enablement and Audit and Assurance spaces as they are high margin, tech-oriented & more defensible due higher value addition to end user). Updater Services Ltd maintains a healthy Cash balance of 150 Cr

We believe both verticals have the ability to grow at 15%+ organically for a long period of time (BSS could deliver slightly higher growth) as the end industry is also growing in high double-digit growth. Therefore, BSS contributions will keep improving, but they will not dramatically increase. Unless Updater Services Ltd makes an acquisition on the BSS side. Based on a back-of-hand calculation we believe Updater Services Ltd. can print a consolidated PAT of ₹110+ Cr in FY25 and ₹150 Cr+ in FY26.

Updater Services Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Updater Services Ltd Price charts

Since the Updater Services Ltd stock has a trading history of only ~1 year, a look at the daily chart will suffice to understand the trend

It appears that Updater Services Ltd stock price formed a rounded bottom in the period through Jan 2024 to September 2024. Updater Services Ltd stock recently broke above the previous high of Jan 2024 and has been hovering around the same range since. Even if the price trend does break below the horizontal line around ₹370, there is a high possibility that the 50 DMA will act as a strong support for the Updater Services Ltd stock

We have enough confidence that FY25 numbers will be a significant improvement over FY24 numbers, hence any correction could be short lived until the next quarterly numbers are declared.

Updater Services Ltd Latest Latest Result, News and Updates

Updater Services Ltd. posted revenue growth of 13% YoY. The revenue growth within BSS was higher at 34% YoY, while the growth in IFM was lower at 5% YoY due to account rationalisation in the IFM segment. The management believes account rationalisation is largely over in the IFM segment in Q1FY25, which will lead to higher margin in future. Revenue contribution of IFM segments is at 65%, and BSS segments at 35% in Q1FY25 vs. 70% and 30% in Q1FY24. The new logos added in Q1FY25 in the IFM vertical are at 29, and the BSS vertical is at 15.

Management is guiding for 15-16% sales growth for FY25 (slightly lower than its earlier guidance of 20%+) with ETR Tax at 15-16% and ESOP Costs at 5-6 Cr. Updater Services Ltd planning strategic acquisition in the BSS space that will enhance the capabilities and it will be margin accretive in nature.

Final thoughts on Updater Services Ltd

Updater Services Ltd presents a good proxy for the India urbanisation and industrialization story with minimal balance sheet risk. The baseline industry growth rate is expected to be in double digits over the next decade and organised players like Updater should be able to capture a bigger share of this compared to the long tail of unorganised players. Every statistic we have seen over the past 6 months (Commercial real estate absorption, development of industrial parks and warehouses) indicates that the underlying industry growth is set to beat the nominal GDP growth rate by a healthy margin. We believe that the policy environment in India has already pivoted in favour of production and supply from an obsessive focus on demand side economics. With the Govt seeking to reduce dependence on imports and give incentives to large industrial parks dedicated to manufacturing, players like Updater Services can see their growth trajectory turn for the better in the coming years. The pace of new logo acquisition has been good for the business, once empanelled as a vendor for facilities management a player that executes well can get access to multiple facilities of the same customer across the country.

Once growth prospects are visible, the next set of variables to assess for investors are unit economics, competitive landscape, capital efficiency, balance sheet quality and management quality. Updater Services Ltd makes the cut in each one of these parameters in our assessment, even if the business quality isn’t exactly gold standard. Facilities management is a hyper competitive industry with low entry barriers to operating in the local markets, while the entry barrier is tougher if one wants to operate at scale across the country. The biggest challenge in our assessment is the large blue collar manpower requirement of the industry, it has traditionally not been easy to manage such a large workforce. In today’s era of Govt enabled freebies and handouts, the ability to hire and manage such a large workforce can become a key differentiator in this segment.

The business services vertical offers the highest potential for margin improvement and higher growth in our opinion. With the fixed investments made into newer business lines expected to pay off in the form of better scale in the next 1-2 years, operating margin printing in the double digit range should improve the unit economics from the current level. We will need to see if the business can deliver healthy growth at higher margins in this vertical through H2 FY25 and FY26.

Management depth will need to increase and scale in line with the business growth here, this will be a key variable to monitor if our growth assessment turns out to be accurate. Investors will need to assess the valuation one is willing to pay for a business like this where growth prospects are above average but the business quality and pricing power are nowhere close to some of the other listed services businesses in the country.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.

Disclosure (Updated as of Oct 30, 2024) – Updater Services Ltd is part of our advisory portfolio. Holding in personal portfolio and client portfolios under advice