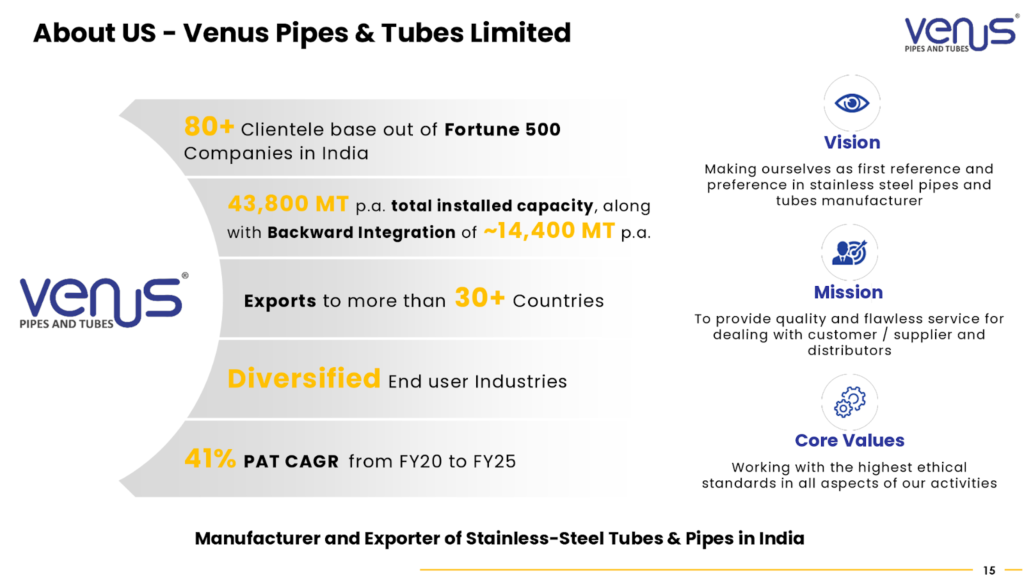

Incorporated in 2015, Venus Pipes and Tubes Ltd is a growing seamless and welded stainless steel pipes & tubes manufacturer. It manufactures high-precision heat exchanger tubes, hydraulic and instrumentation tubes, as well as seamless, welded, and box pipes.

Venus Pipes & Tubes is on the cusp of finishing a large capex by the end of FY26 and appears set to grow volumes and exports into the upcoming years of FY27 and FY28. With capacity utilization set to increase from FY27, there is the possibility of earnings growth exceeding revenue growth for many quarters before utilization hits the optimum level. With a reasonable starting valuation today thanks to the market correction, Venus Pipes & Tubes may present an interesting opportunity if the growth rate can sustain as guided over the next 2 years.

Venus Pipes & Tubes Ltd Company Summary

Venus Pipes and Tubes Ltd manufactures stainless-steel pipes and tubes. Its facilities are based in Kutch, Gujarat. It offers high-precision heat exchanger tubes, hydraulic and instrumentation tubes, as well as seamless, welded, and box pipes.

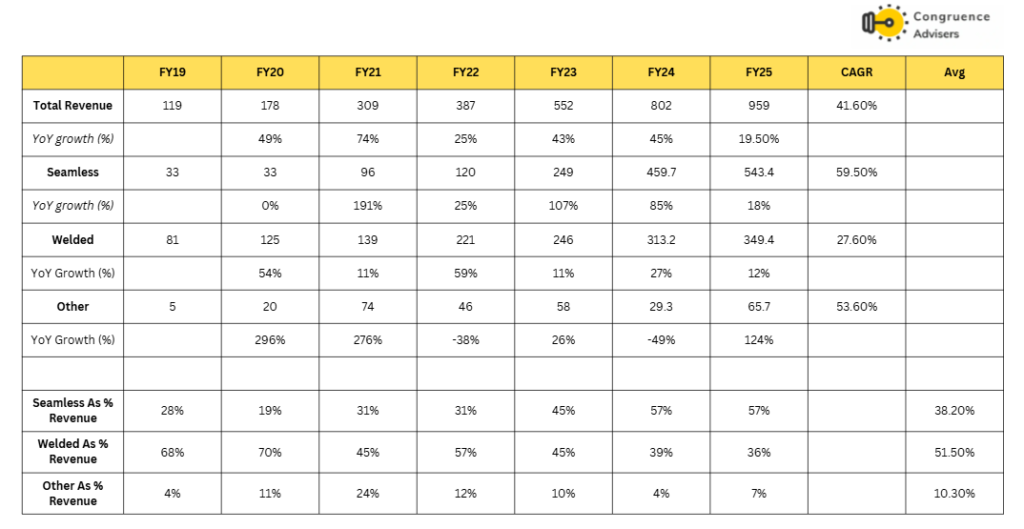

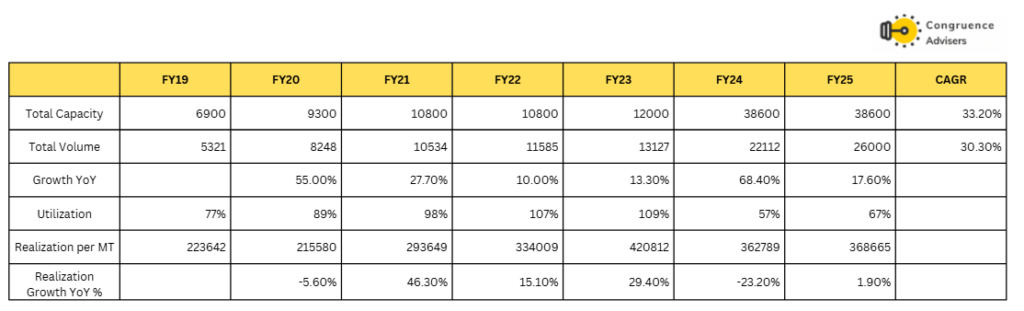

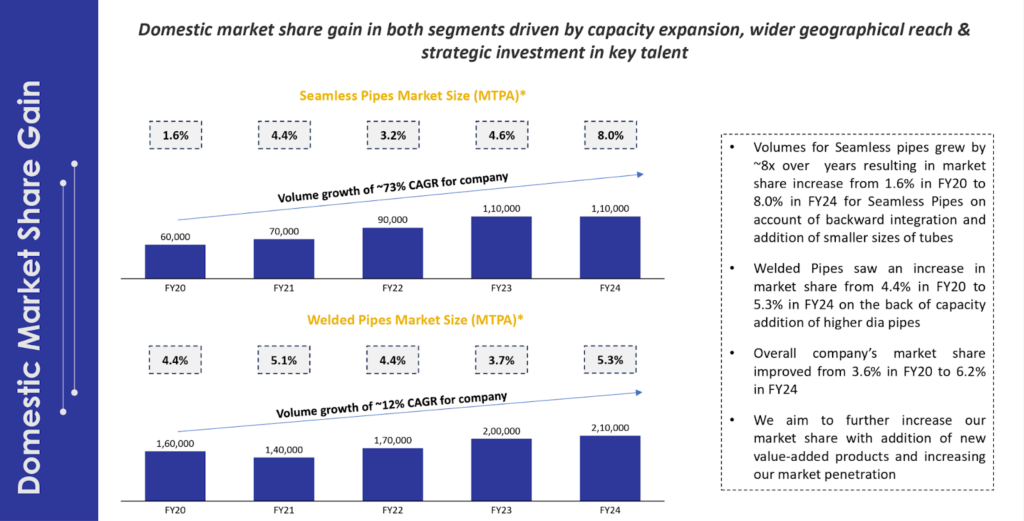

Venus Pipes and Tubes Ltd increased its stainless-steel pipes & tubes capacity three times over FY23-25, which helped the company increase its market share to 8-10% in FY25. Venus Pipes and Tubes Ltd outpaced every player in the industry, reporting 33% volume growth over FY19-24. For FY25, Revenue at Rs 959 Cr is up 19.49% Cr, and Volume growth is 17%.

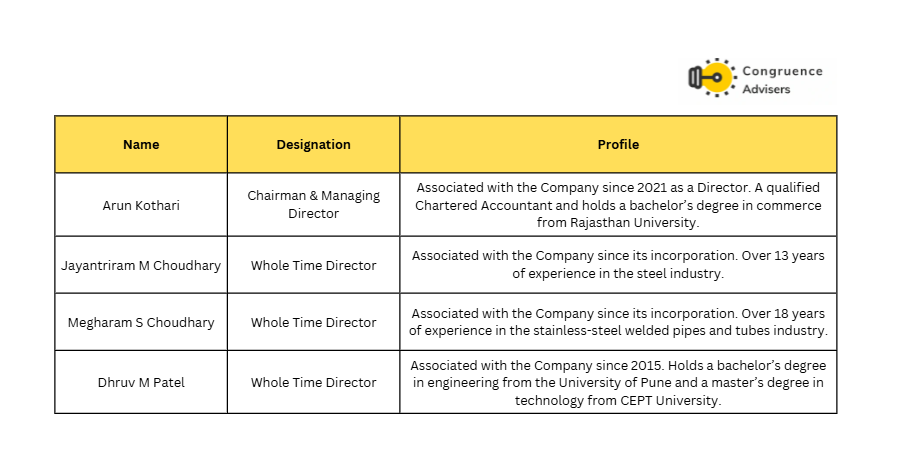

Venus Pipes & Tubes Ltd Management Details

The Directorial team at Venus Pipes and Tubes Ltd has over two decades of extensive experience in the Stainless Steel industry. These leaders have navigated various market cycles, technological advancements, and global economic shifts, demonstrating resilience and a forward-thinking approach to innovation and quality. Their tenure in the field spans critical roles and diverse challenges, equipping them with an acute understanding of the complexities inherent in stainless steel manufacturing and distribution.

The management team has demonstrated the right combination of hunger and risk management that reflects in its financial history. Venus Pipes & Tubes has delivered industry leading growth rate in its chosen sector at operating margin in line with the leader Ratnamani Metals & Tubes. The management has recently embarked on a capex for the fittings segment in addition to scaling up export revenue in an impressive manner over the past few years. With a diversified revenue base across multiple regions of the world being complemented by product category expansion, management moves instill a good degree of confidence in investors.

Venus Pipes & Tubes Ltd – Industry Overview

Global stainless-steel industry – Production

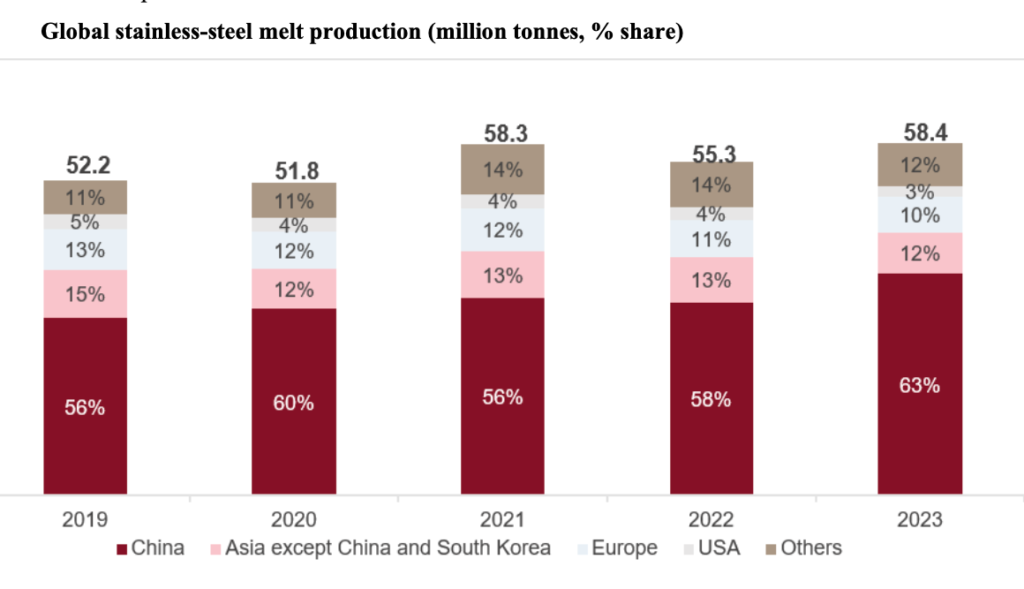

Global stainless-steel melt production increased to 58.4 million tonnes in 2023 from 52.2 million tonnes in 2019, logging a CAGR of approximately 3%.

Source: Scoda Tubes Ltd DHRP

Global stainless-steel melt production increased 13% YoY to 58.3 million tonnes in 2021, owing to a jump in production volume in key steel-producing countries such as India, Russia, and Brazil. The increase in production volume in these countries caused the share of China in global production volume to decrease from 60% in 2020 to 56% in 2021.

However, the production share of China increased to 58% in 2022 as global production normalized due to geopolitical uncertainties-led supply-chain bottlenecks. In 2023, global stainless-steel production increased 6% YoY. Meanwhile, China’s production surged 15% on-year, increasing the country’s share to 63% in global production volume, owing to the resolution of supply-chain issues and lifting of the country’s Covid-19 containment measures.

Demand

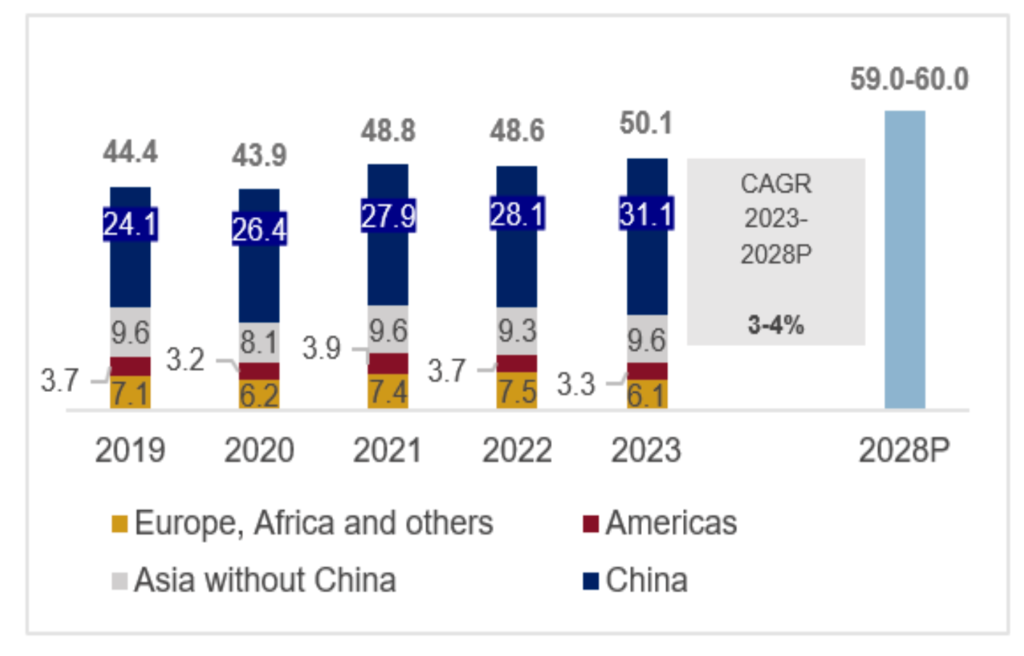

Global demand for stainless steel increased from 44.3 million tonnes in 2019 to 47.4 million tonnes in 2023, clocking a CAGR of about 2%.

Global stainless-steel demand (million tonnes)

Source: Scoda Tubes Ltd DHRP

The global demand for stainless steel is expected to grow at a CAGR of 3-4% over the next five years to 59-60 million tonnes in 2028. This growth in global stainless-steel demand will be supported by growth in consumption from key end-use sectors such as consumer goods, energy and chemicals, building and construction, and automobiles.

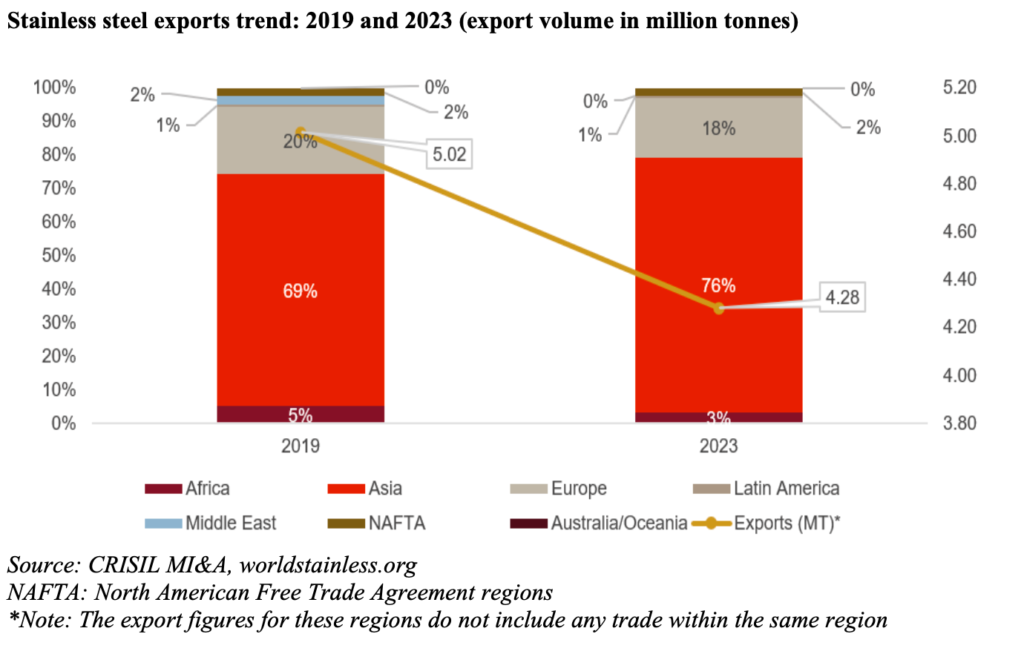

Global trade

The majority of stainless-steel exports during the period between 2019 and 2023 were from Asia, especially China, India, Korea and Indonesia, as a result of which the share of the Asian region in the overall global exports of stainless steel increased from 69% in 2019 to 76% in 2023.

This growth in the share of Asia in the global stainless-steel exports is on account of increased production capacities, capacity utilization rates, production of stainless steel at lower costs due to low labour and real estate-related expenses and resulting economies of scale in these regions.

Source: Scoda Tubes Ltd DHRP

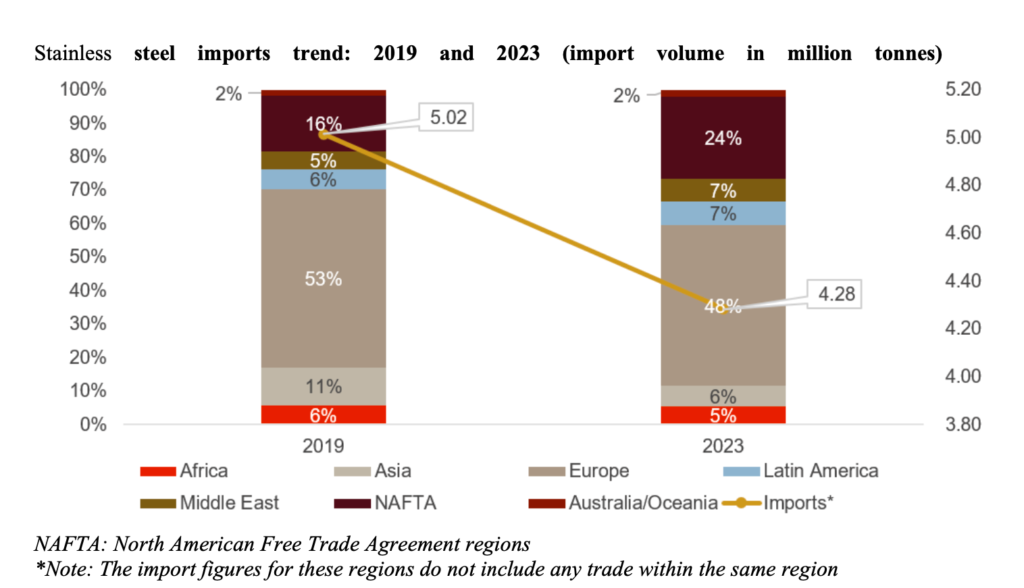

Share of Asia in global stainless-steel imports declined from 53% in 2019 to 48% in 2023, primarily due to higher domestic production capacity supported by a higher focus on self-sufficiency in these countries.

Further, the low-cost stainless steel being produced in Asian countries has resulted in their increased supply to the regions of Europe, Africa and NAFTA, wherein production volumes have decreased over time.

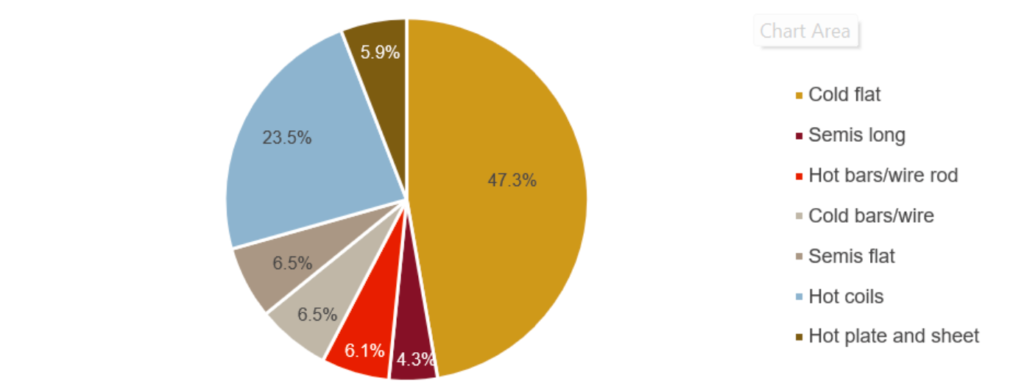

Global stainless-steel trade by product (% share) (2023)

Source: Scoda Tubes Ltd DHRP

Cold flat products continued to lead the volume in the global trade flow with a share of ~47% in the overall global stainless steel products trade flow in 2023. Stainless steel hot coils followed next, with a share of 23.5% in the overall global stainless steel products trade flow.

- Cold flat – Cold‑rolled coils/sheets. Used in kitchenware, appliances, building interiors, and auto body parts.

- Semis long – Billets/blooms. Input for making bars, wire, and structural shapes.

- Hot bars/wire rod – Hot‑rolled bars and rod. Used for fasteners, shafts, springs, and welding wire.

- Cold bars/wire – Drawn/peeled bars and wire. Used for precision parts, medical tools, high‑strength fasteners, and ropes.

- Semis flat – Slabs. Input for plate, hot coil, cold‑rolled sheet.

- Hot coils – Hot‑rolled flat coils. Used in pipes, structural parts, auto parts, and as input for cold‑rolling.

- Hot plate and sheet – Thick hot‑rolled flats. Used in ships, boilers, pressure vessels, and heavy construction.

Indian stainless-steel industry

Production and trade

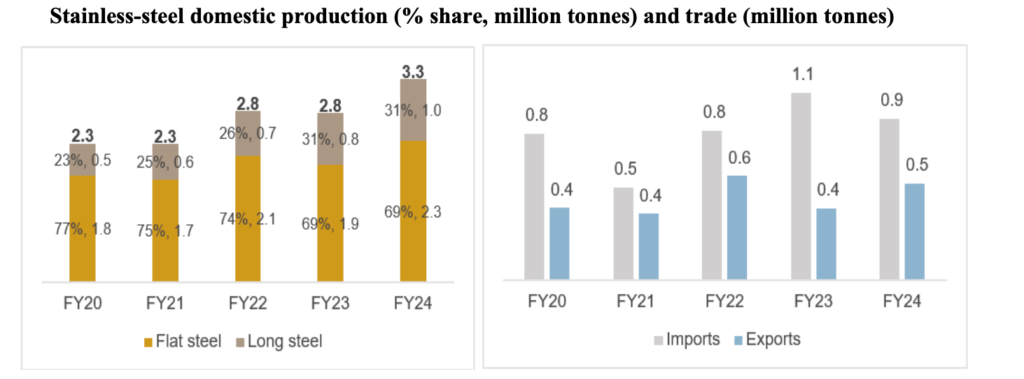

Domestic stainless-steel production grew from 2.3 million tonnes in FY20 to 3.3 million tonnes in FY24, clocking a CAGR of about 10%.

During this period, production of stainless-steel flat products logged a CAGR of about 7% and that of stainless-steel long products, a CAGR of about 18%.

Source: Scoda Tubes Ltd DHRP

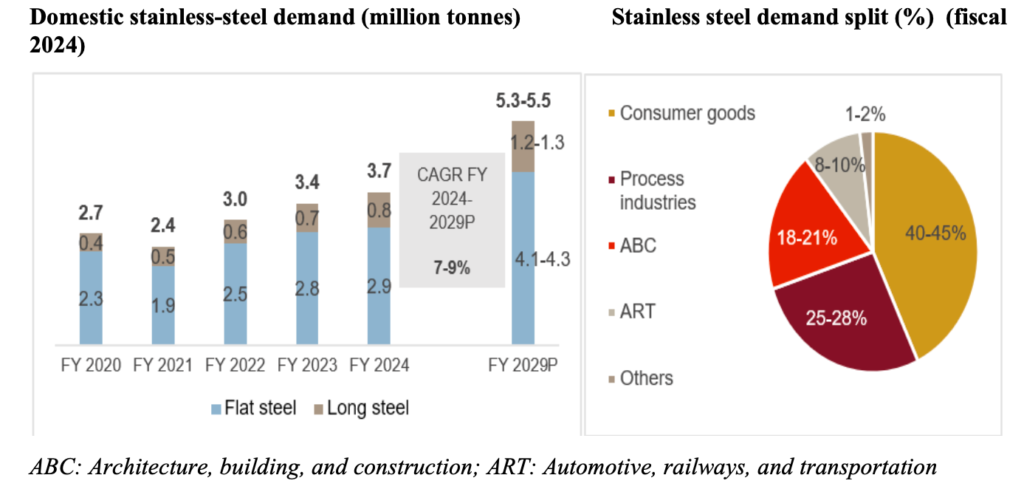

Demand

Domestic stainless-steel demand grew at a CAGR of approximately 8% between fiscals 2022 and 2024. FY21 which was hit by the pandemic witnessed an on-year demand decline of around 12% owing to subdued consumption from key end-use sectors like consumer goods and infrastructure. However, the demand for stainless steel increased robustly on-year by 27% in the following FY on account of a revival in consumer demand for white goods and durables and an increase in government-led Capex towards infrastructure development.

In FY23 and FY24, the demand increased on-year by 13% and 8%, respectively, primarily led by strong on-year demand growth of 19% and 25%, respectively, in FY23 and FY24, in the long segment of stainless steel on account of increased focus of the government towards infrastructure development in the run-up to the 2024 general elections.

This demand increase was also supported by the building and construction sector, which grew owing to rapid urbanization, government-led initiatives like “Housing for All”, improving consumer sentiments, and increasing industrialization on the back of the government’s push for local manufacturing.

Source: Scoda Tubes Ltd DHRP

Domestic stainless-steel demand is expected to grow at a CAGR of 7-9% during fiscal 2024-2029 to 5.3-5.5 million tonnes per annum in FY29. The major end-use industries that are expected to support this healthy domestic demand growth include consumer goods, process industries, infrastructure, building, construction, and automobile.

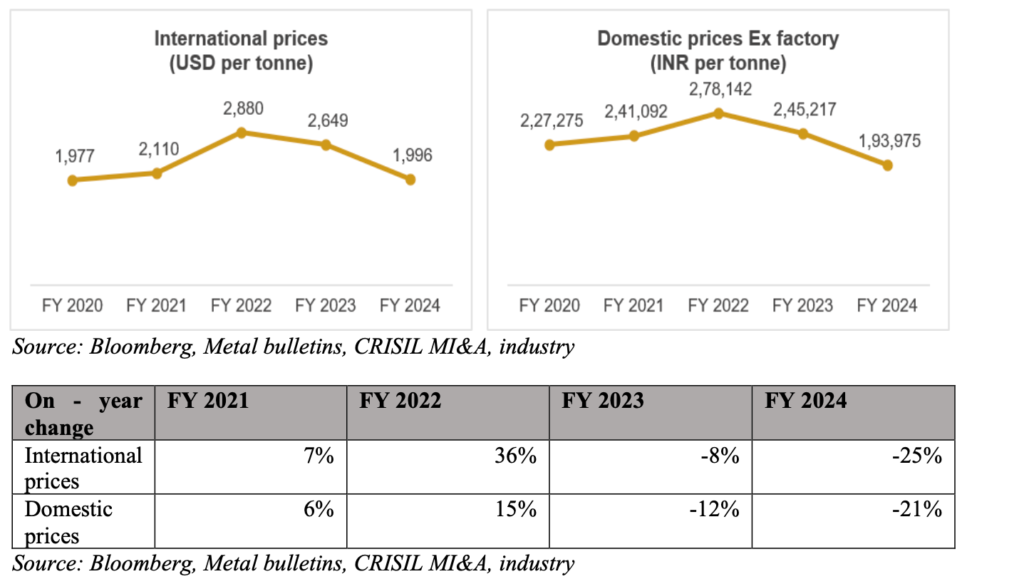

Price trend of stainless steel

Both international and domestic prices followed a similar growth trend over the last five fiscal. The prices increased in FY21 and FY22 owing to pandemic-led supply-side issues, leading to a demand-supply imbalance. In FY22, the Indian steel industry recovered from the supply-side issues and started production at near-optimum utilization levels, thereby cutting down the dependence on steel imports. Though the domestic stainless-steel prices increased on-year in FY22 but their magnitude remained lower than the on-year price increase in the international prices in the fiscal year as a result. The prices, however, cooled down in the next two fiscals due to the resolution of supply side issues, fall in demand in key countries of Europe and the Americas, and fall in prices of key raw materials used in steel production.

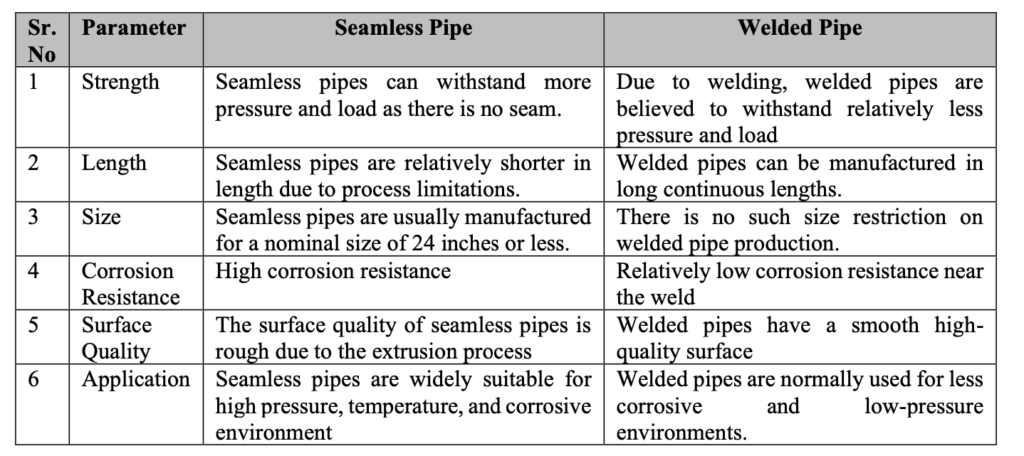

Seamless pipes and welded pipes

Seamless pipes are pipes without a seam(end joints) and are manufactured using billets, whereas welded pipes are manufactured by welding the flat steel strips into a round / circular shape. Some of the key differences between welded and seamless pipes are listed in the table below-

Source: Scoda Tubes Ltd DHRP

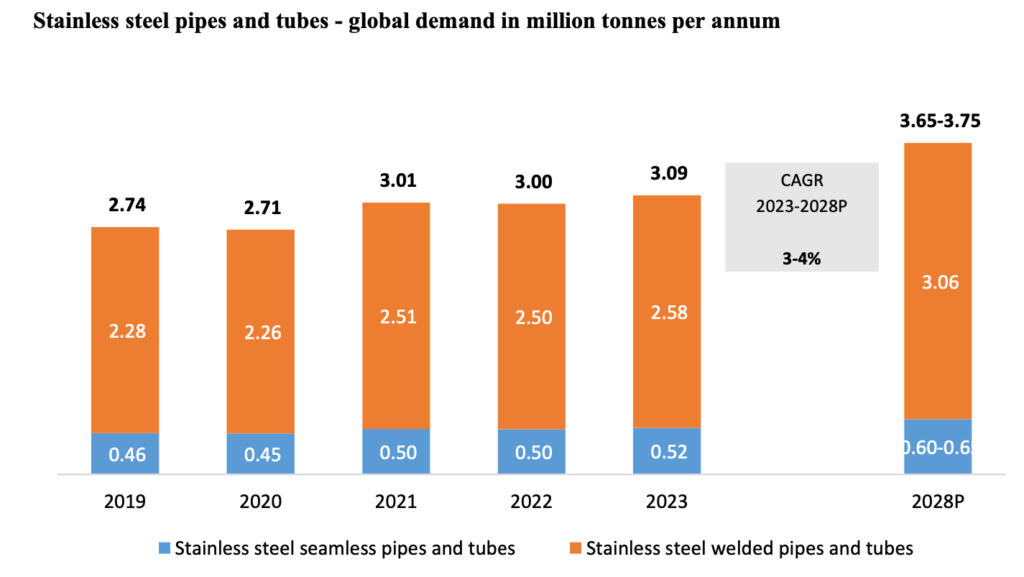

Demand

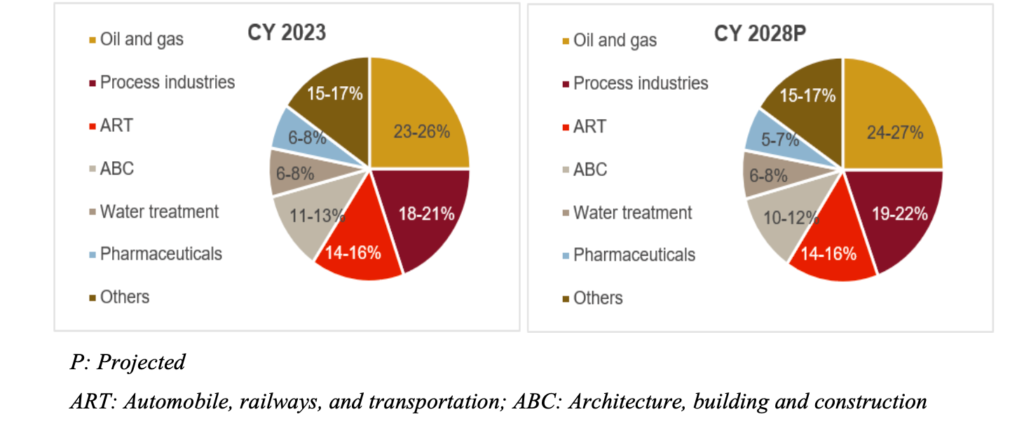

Global demand for stainless steel pipes and tubes increased from approximately 2.7 million tonnes per annum in 2019 to approximately 3.1 million tonnes per annum in 2023, clocking a CAGR of about 3%.

The share of stainless-steel welded pipes and tubes in the overall global demand falls in the 80-85% range, with the stainless-steel seamless pipes and tubes accounting for the rest 15-20% share in the demand.

Source: Scoda Tubes Ltd DHRP

Between 2023 and 2028, the demand for stainless steel pipes and tubes is expected to increase at a CAGR of 3-4% to approximately 3.65-3.75 million tonnes in 2028.

Stainless steel pipes and tubes – global demand split (CY2023 and CY2028)

Source: Scoda Tubes Ltd DHRP

Stainless steel pipes and tubes – global demand split by regions

China is the biggest consumer of stainless-steel pipes and tubes in the world, accounting for around

40% of its overall global demand.

Other Asian countries such as India, Indonesia, Malaysia and Middle East countries are also top consumers of stainless-steel pipes and tubes. Most of the countries in the region are developing at a high rate and as a result, are experiencing rapid urbanization and industrial growth, leading to an increased demand for stainless steel pipes and tubes.

Europe is also a leading consumer of stainless steel pipes and tubes. Turkiye, a highly earthquake-prone country, and Ukraine, which has been struggling for geopolitical stability, require massive infrastructure-related investments, which also include investments in stainless steel pipes and tubes installation for construction, water supply, oil and gas transport, etc

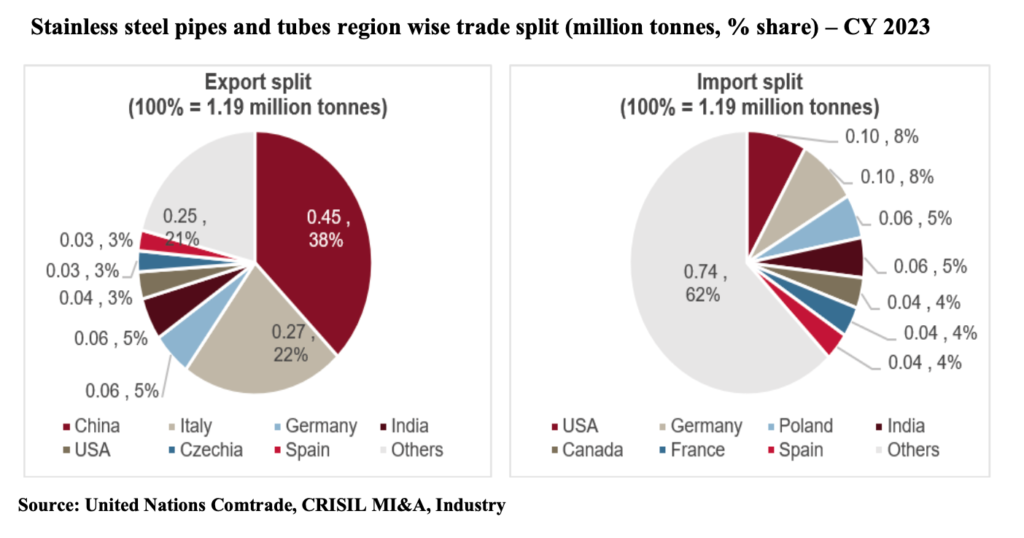

Global trade analysis

In 2023, the trade volume of stainless-steel pipes and tubes across countries amounted to approximately 1.19 million tonnes. During the year, most of the stainless-steel pipes and tubes were exported from China and Italy, which together accounted for ~60% of total exports globally. They were followed by Germany (5%), India (5%), and the USA (3%) in the total volume exported in the year.

On the import side, the USA, Germany, Poland, India, Canada, and France cumulatively accounted for approximately one-third of the global imports in 2023.

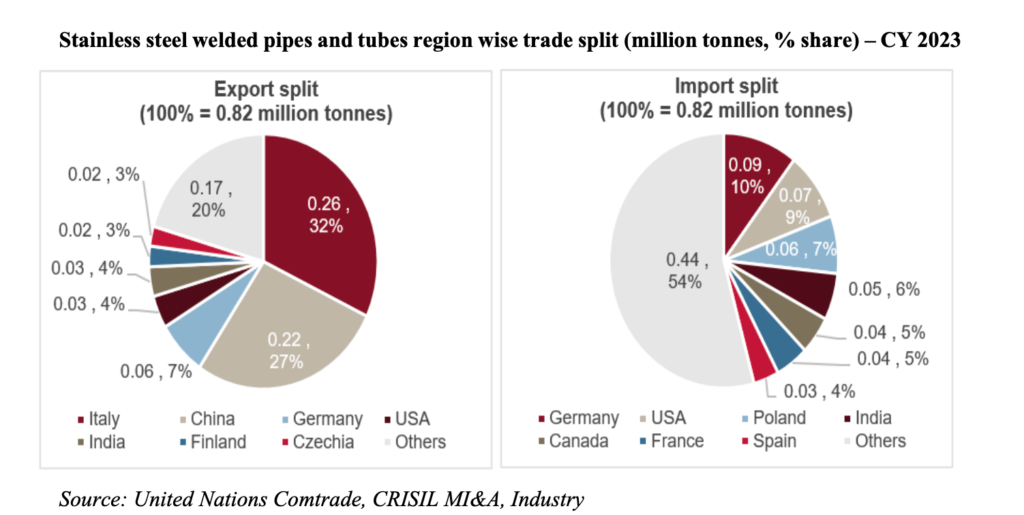

Stainless steel welded pipes and tubes

The overall traded volume of stainless-steel welded pipes and tubes amounted to approximately 0.82 million tonnes in 2023. During the year, Italy was the top exporter, accounting for a 32% share in the total global exported volume of stainless-steel welded pipes and tubes. China was the second largest exporter in the segment, accounting for a 27% share.

On the import side, Germany and the USA together accounted for around one-fifth of the imports of stainless-steel welded pipes and tubes (share of 10% and 9%, respectively). These were followed by Poland, India and Canada, which imported 7%, 6% and 5% of the total globally traded volume of stainless-steel welded pipes and tubes, respectively.

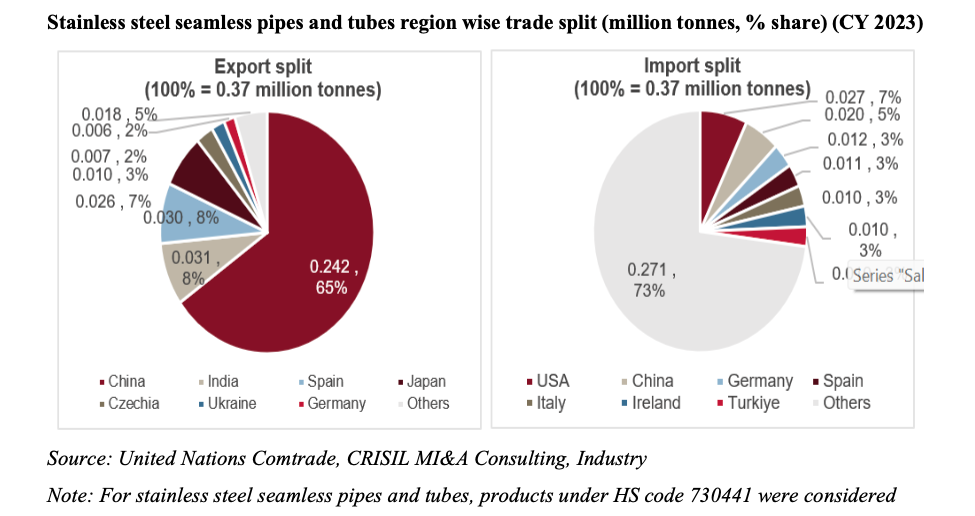

Stainless steel seamless pipes and tubes

In the stainless seamless pipes and tubes segment, China was the top exporter, accounting for 65% of the total traded volume in 2023. China was followed by India (8%) and Spain (8%).

On the import side, the USA, China, Germany, Spain and Italy, together accounted for around 20-21% of the overall global imports of stainless seamless pipes and tubes in 2023.

Indian stainless-steel pipes and tubes industry

Demand

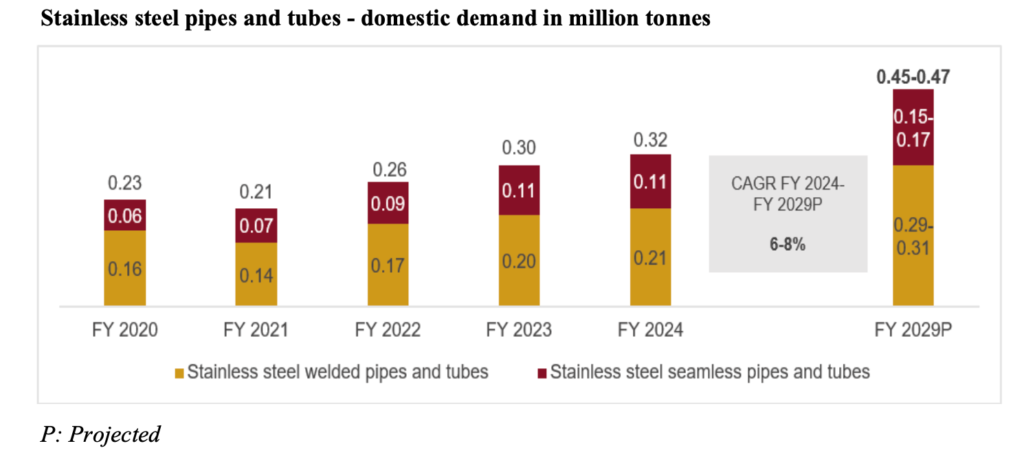

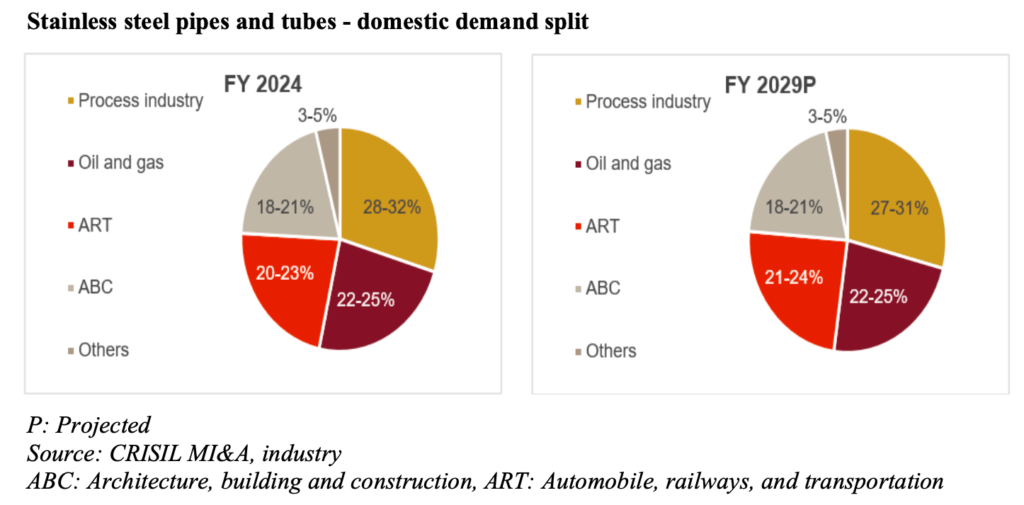

Domestic demand for stainless steel pipes and tubes increased from 0.23 million tonnes in FY20 to 0.32 million tonnes in FY24, clocking a CAGR of approximately 9% during the period.

The share of stainless-steel welded pipes and tubes in the overall domestic demand has largely remained at around 65% with the stainless-steel seamless pipes and tubes accounting for the rest 35% share throughout the period.

Between fiscals 2024 and 2029, the domestic demand for stainless steel pipes and tubes is expected to increase at a CAGR of 6-8% to 0.45-0.47 million tonnes in FY29.

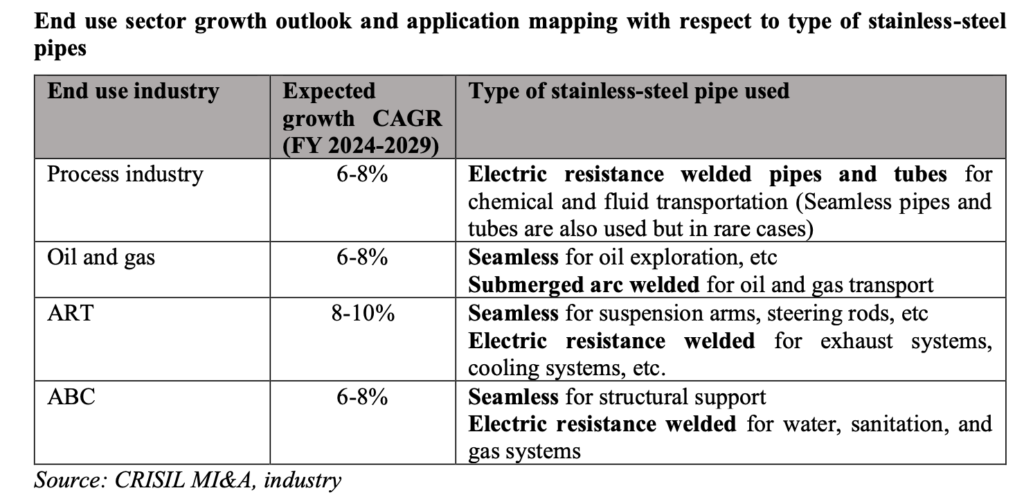

This healthy growth in demand will primarily be led by strong growth in major end-use industries of stainless-steel pipes and tubes, such as building and construction, automobile, oil and gas, chemical manufacturing, food and beverage, etc.

End-use sector growth outlook and application mapping with respect to the type of stainless-steel pipes

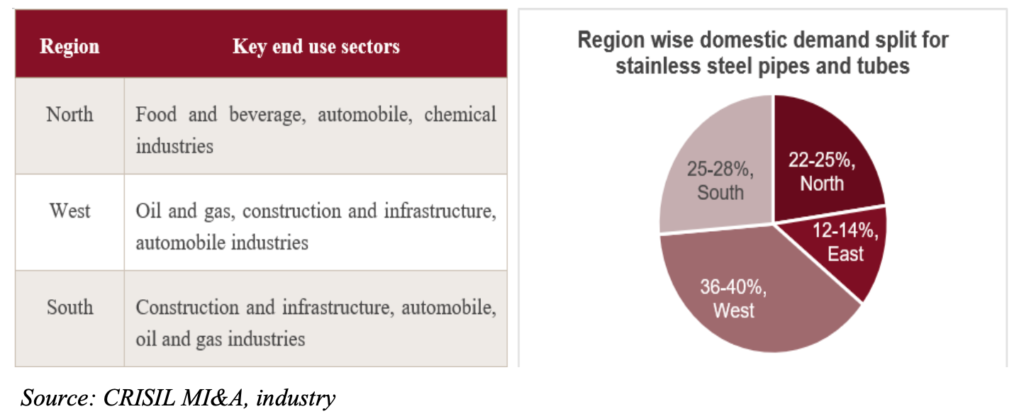

Stainless steel pipes and tubes – domestic demand split by regions

Source: Scoda Tubes Ltd DHRP

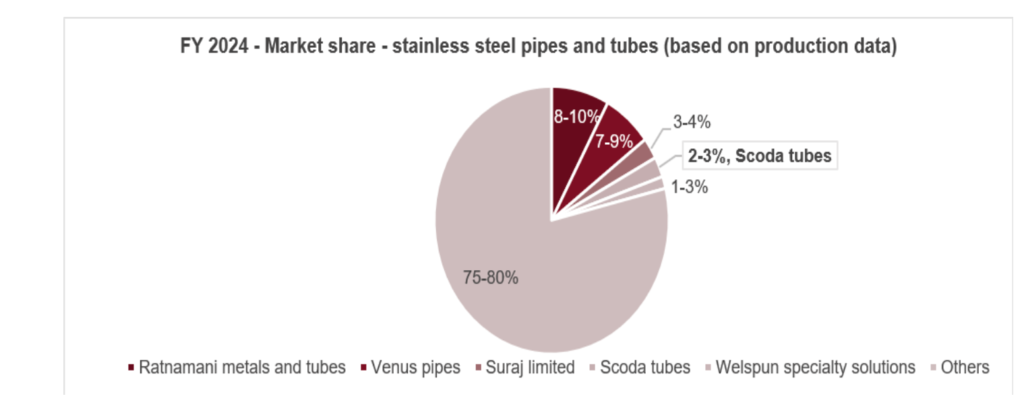

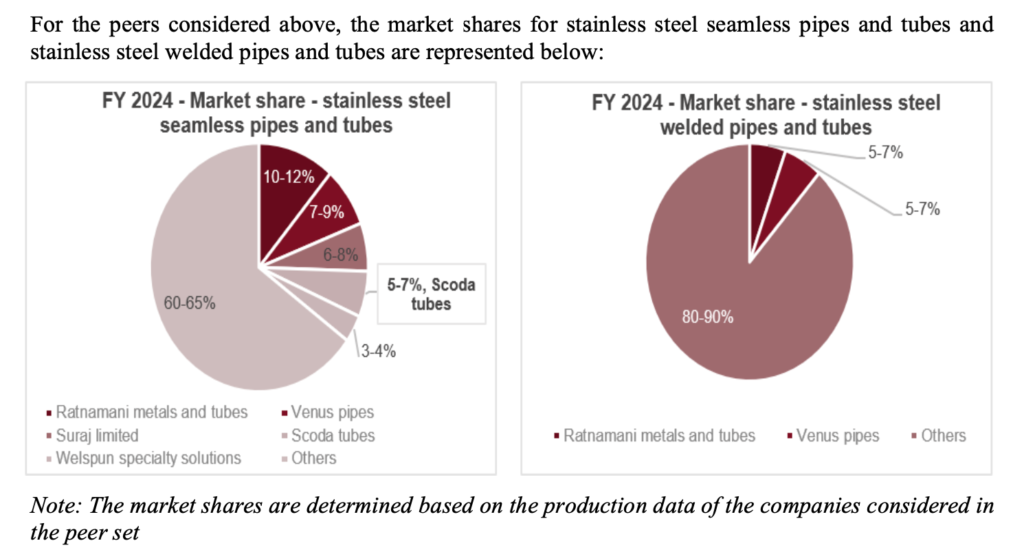

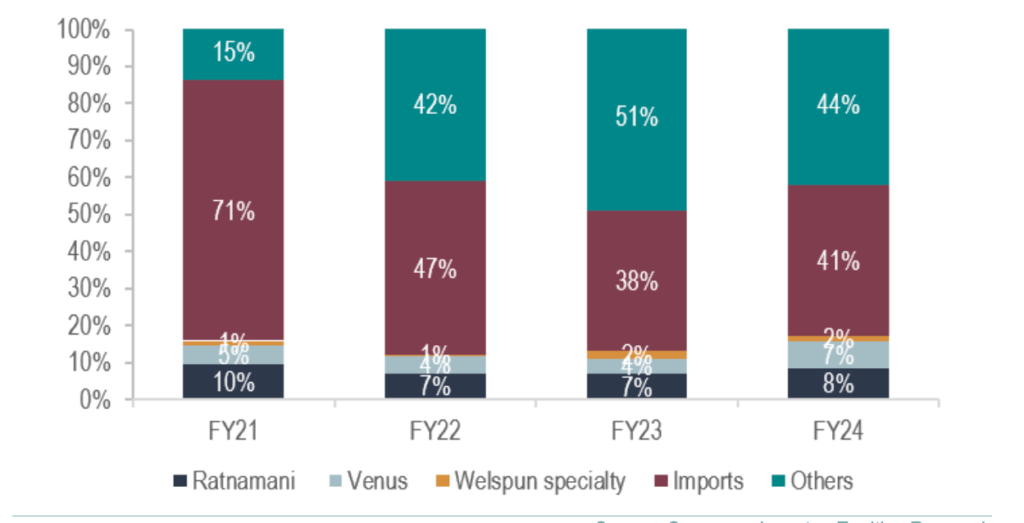

Stainless steel pipes and tubes – player-wise market share

The stainless steel pipes and tubes manufacturing industry is largely fragmented, with key leading players such as Venus pipes, Ratnamani metals and tubes, Suraj limited, Scoda tubes, and Welspun specialty solutions accounting for around 20-22% of the domestic market.

Source: Scoda Tubes Ltd DHRP

For the peers considered above, the market shares for stainless steel seamless pipes and tubes and stainless steel welded pipes and tubes are represented below:

Source: Scoda Tubes Ltd DHRP

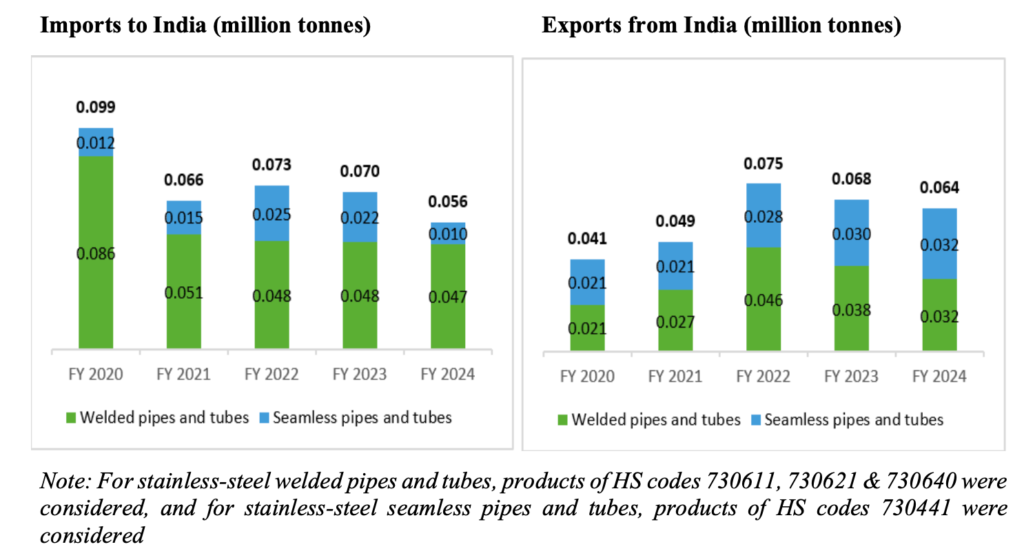

Trade analysis – India

Stainless pipes and tubes

Source: Scoda Tubes Ltd DHRP

The import volume of stainless-steel tubes and pipes by India declined YoY by 33% to 0.066 million tonnes in FY21, owing to reduced demand from key end-use sectors in the wake of the pandemic-induced lockdowns in the fiscal year. Between FY21 and FY24, the imported volume of stainless steel pipes and tubes decreased at a CAGR of (-5%) to 0.056 million tonnes, primarily because of an anti-dumping duty imposed by India on stainless steel seamless pipes and tubes from China to guard the interests of local producers.

As a result, the imported volume of stainless-steel seamless pipes and tubes, particularly, declined at a much higher negative CAGR of (-14%), during the FY21-24 period. This has led to a significant reduction in the import-export gap over the years, eventually making India a net exporter of stainless-steel pipes and tubes in FY22 and 24.

On the other hand, the exports from India increased at a CAGR of around 35% between FY20-22 to 0.075 million tonnes in FY22, on the back of the recovery of the economy and pent-up demand in key export destinations from the pandemic-induced slowdown in the previous fiscal.

However, the exports of stainless-steel pipes and tubes further declined at a CAGR of (-8%) between fiscals 2022 and 2024 to 0.064 million tonnes in FY24, primarily because of the inflationary environment of key export markets and geopolitical conflicts in FY23 and FY24.

Further, Indian steel produced faced high competition in the export market from the cheaper products made in other countries, resulting in a decline in demand for India-made stainless-steel pipes and tubes in the export market.

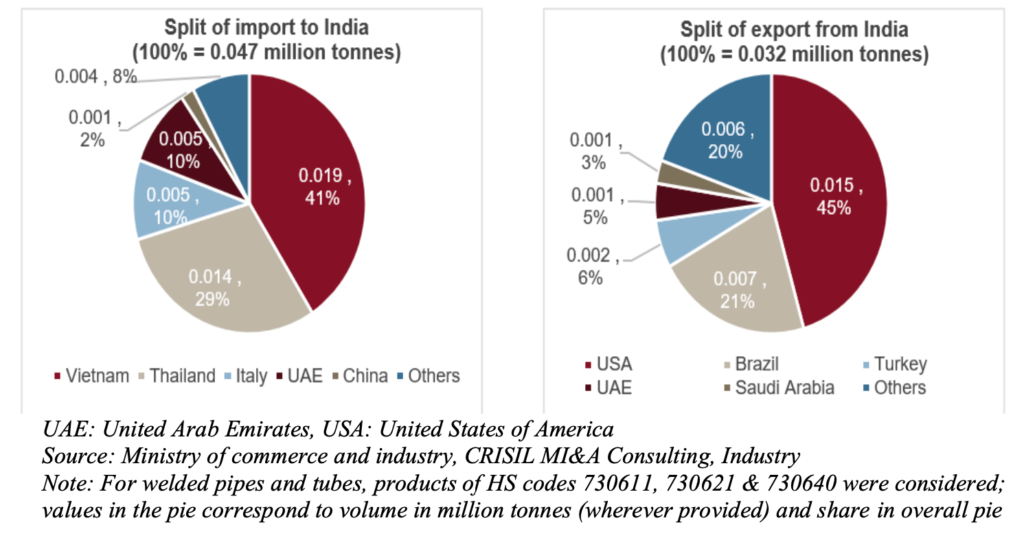

Welded pipes and tubes

In FY24, India imported the majority of stainless-steel welded pipes and tubes from Vietnam (share in total imports was ~41%), followed by Thailand (~30%) and Italy (~10%). The high import volume from Vietnam was on the account of its low cost and India’s free trade agreement with the country.

Source: Scoda Tubes Ltd DHRP

On the exports front, the USA accounted for ~45% of the total stainless-steel welded pipes and tubes export volume from India in FY24. It was followed by Brazil, which accounted for around 22% share in the overall exports from India in the fiscal year. The high share of exports to the USA and Brazil can be attributed to the rising demand for stainless steel pipes and tubes in various sectors such as construction, automotive, and oil & gas in both the US and Brazil.

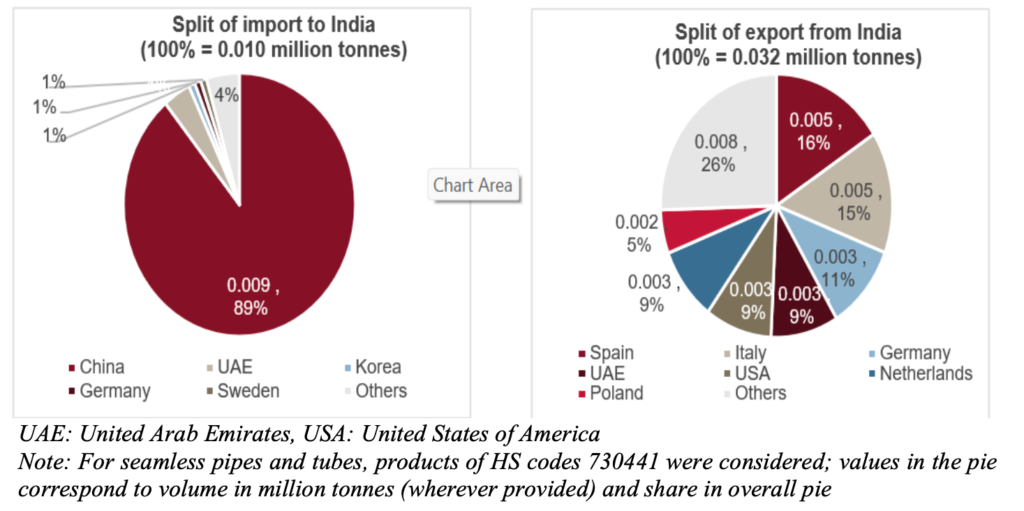

Seamless pipes and tubes

China accounted for approximately 89% share in the overall imported volume of stainless-steel seamless pipes and tubes to India in FY24, amounting to 8,692 metric tonnes. The high share of China-made stainless-steel pipes and tubes in India’s overall imports is due to the account of preference of end consumers in India towards low-cost Chinese steel products.

Source: Scoda Tubes Ltd DHRP

As far as exports are concerned, Italy, Canada, and Saudi Arabia cumulatively accounted for around one-third of India’s total exported volume of stainless-steel pipes and tubes in FY24.

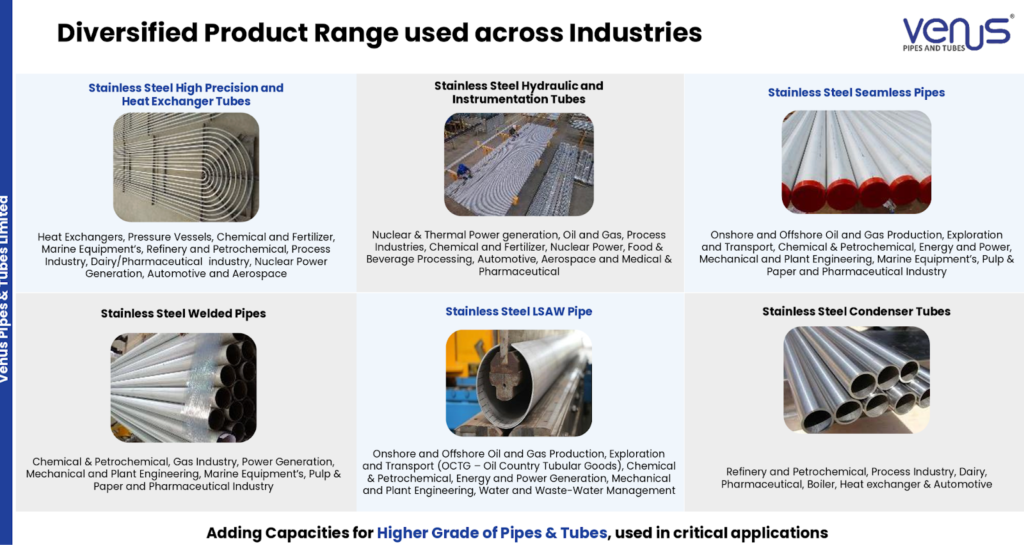

Venus Pipes & Tubes Ltd Business Overview

Venus Pipes and Tubes Ltd manufactures stainless-steel pipes and tubes. Its facilities are based in Kutch, Gujarat. It offers high-precision heat exchanger tubes, hydraulic and instrumentation tubes, as well as seamless, welded, and box pipes.

Product Portfolio

Summary of Portfolio Evolution

- FY15 – Entered the stainless steel pipes and tubes industry after conducting a thorough analysis of the sector.

- FY23-24 – Achieved a 3x capacity expansion and Backward integration into hollow pipes leads to cost savings and increased profitability.

- FY26 – Widening TAM (Total Addressable Market) by expanding into titanium tubes, Foray into fittings and ancillary products for the tubes and pipes segment, Aiming to increase the market share of seamless tubes for improved profitability.

Segments

Venues Pipes and Tubes Ltd operates mainly in two segments, which are Seamless Pipes and Welded Pipes.

1. Seamless Pipes & Tubes – this segment focuses on high-pressure, critical applications where precision and durability are paramount. These pipes are manufactured without any welding seams, offering superior strength and corrosion resistance. They are typically used in high-temperature and high-pressure environments. Venus Pipes and Tubes Ltd has implemented backward integration by installing a piercing line to manufacture Mother Hollow Pipes from stainless steel round bars.

Seamless pipes are currently the largest contributor to revenue, accounting for 57% of total revenue in FY25. Seamless segment revenue contribution, which improved from 28% in FY19 to 57% in FY25. This segment commands higher margins compared to welded pipes. Management has noted that EBITDA margins for seamless pipes are typically 40% to 50% higher than welded pipes. Seamless pipes Revenue has grown higher when compared to other segments from FY19-FY25, growing at a 59.5% CAGR, driven by anti-dumping duty by the government of India on imports and rapid expansion by the company.

Key Applications: Used in critical sectors such as Oil & Gas, Chemicals, Pharmaceuticals, Heat Exchangers, and Power Generation.

2. Welded Pipes & Tubes – This segment caters to bulk requirements and large-diameter applications, including the newly introduced value-added lines. These pipes are formed by rolling stainless steel strips/plates and welding the seam. Venus Pipes and Tubes Ltd manufactures various types, including LSAW pipes, which allow for larger diameters. The total installed capacity for welded pipes stands at 27,600 MTPA. This includes a recently operationalized 3,600 MTPA line in May 2025 specifically for value-added welded tubes (e.g., Titanium grade and hygienic stainless steel tubes).

Welded Pipes segment revenue contribution declined from 68% in FY19 to 36% in FY25. The segment is seeing rapid acceleration in recent quarters, with revenue growing by 48% YoY in Q2FY26. Management expects the volume mix to eventually tilt towards this segment due to the large tonnage of higher-diameter pipes. Revenue has grown 27.6% CAGR from FY19 to FY25.

Key Applications: Chemical, Gas, Power, Paper, Pharma, and infrastructural applications. The new Titanium range targets niche sectors like food processing and nuclear power.

3. Others – This segment for Venus Pipes and Tubes Ltd primarily comprises the two components:

- Scrap Sales: Revenue generated from the sale of manufacturing scrap.

- Trading (Fittings): Revenue from trading activities, primarily fittings. The company is currently setting up its own manufacturing capacity for fittings, so existing revenue from this product line has largely been through trading/stockists.

This Segment revenue grew 54% from FY19 to FY25. This segment contributed approximately 7% to the total revenue in FY25.

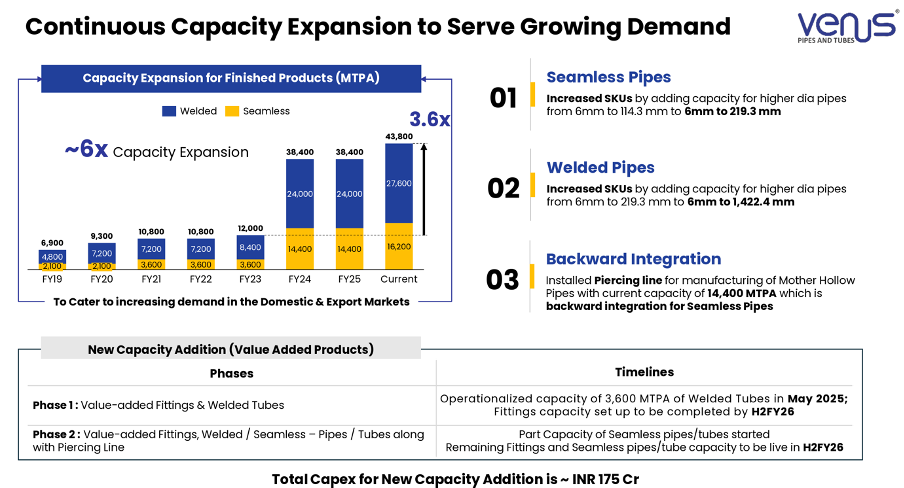

Capacity expansion

In 2022, Venus Pipes and Tubes Ltd announced a capital expenditure plan to triple its stainless-steel pipes and tubes capacity, funded through the ₹220 Cr raised via its IPO in May 2022. The expansion included backward integration into hollow pipe manufacturing, which enhanced operational efficiency and reduced production costs. By capitalizing early on favourable industry trends, Venus Pipes and Tubes Ltd significantly increased its production volumes, positioning itself well to meet rising market demand.

To sustain its growth momentum, Venus Pipes and Tubes Ltd subsequently announced additional expansion plans across seamless pipes (4,800 MT), welded tubes (3,600 MT), and fittings segments under Phase 1 and Phase 2, with an estimated capital outlay of approximately ₹175-180 Cr.

Venus Pipes and Tubes Ltd grew its total capacity at a 33% CAGR from FY19 to FY25, reaching 38,600 MT. These expansions facilitated product portfolio diversification and the introduction of larger sizes, bolstering Venus Pipes and Tubes Ltd ‘s competitive positioning in the stainless steel pipes and tubes market.

Fueled by capacity expansions, Venus Pipes and Tubes Ltd delivered a strong 30% volume CAGR over FY19–25, materially outpacing industry growth and key peers including Ratnamani Metals & Tubes Ltd and Scoda Tubes. This relative outperformance highlights the company’s effective market share gains in the stainless steel pipes and tubes segment.

The management anticipates that the Fittings segment has the potential to generate a peak revenue of approximately ₹180 Cr to ₹200 Cr. On a capex of approximately ₹60 to ₹70 Cr allocated specifically for the fittings project. Management expects an asset turnover ratio of more than 3x on this investment when the plant is fully operational.

Consequently, no significant revenue is expected from this new manufacturing facility in FY26 itself. Meaningful revenue contribution will begin from FY27 onwards as the capacity ramps up. Management anticipates that the fittings business will command higher margins compared to the existing piping business, as there are fewer manufacturers of fittings in the country and which allows Venus to offer a comprehensive solution (pipes + fittings) to clients.

Venus Pipes and Tubes Ltd effectively leveraged its expanded capacity to capitalize on strong domestic demand and declining import intensity, achieving over 50% utilization in the first operational year post-commissioning. This operational efficiency enabled market share expansion consistent with industry leaders like Ratnamani Metals & Tubes Ltd and Other Peers.

Venus Pipes and Tubes Ltd has successfully expanded its market share and simultaneously strengthened its presence in sectors that demand more value-added products. Venus Pipes and Tubes Ltd increased its production capacity and diversified its product offerings. This strategic move should enable Venus Pipes and Tubes Ltd to provide high-quality, industry-specific solutions to its clients. The introduction of Titanium tubes and Hygienic tubes, and fittings represents a significant shift beyond its traditional focus on stainless steel, aligning with industry advancements and a shift from unorganized share to organized players.

Source: Investec Equities

The Indian stainless steel pipes and tubes market was valued at US$2.40 bn in 2025. Organized players are gaining market share due to the following reasons:

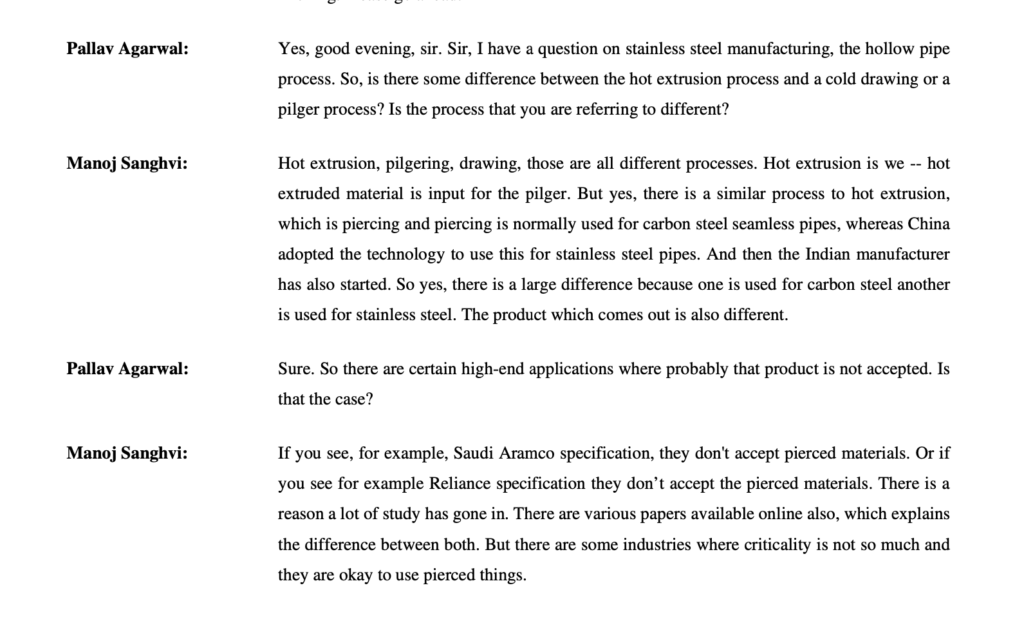

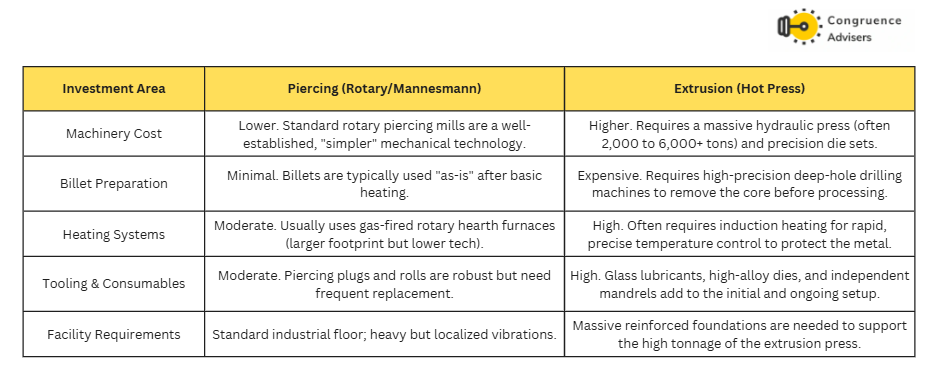

Technological Barriers and Manufacturing Process: The industry is bifurcated by manufacturing technology. High-end players like Ratnamani and recently listed players use “hot extrusion” technology, which is capital-intensive and produces higher-quality pipes required for critical applications.

In contrast, new entrants and smaller players often utilize the “hot piercing” method. Piercing is a lower CAPEX route, allowing more players to enter the market, though the resulting product is often not accepted for critical applications like those in the oil and gas or nuclear sectors.

Ratnamani – Concall Q4FY22

Capex Comparison Breakdown in Manufacturing Technology.

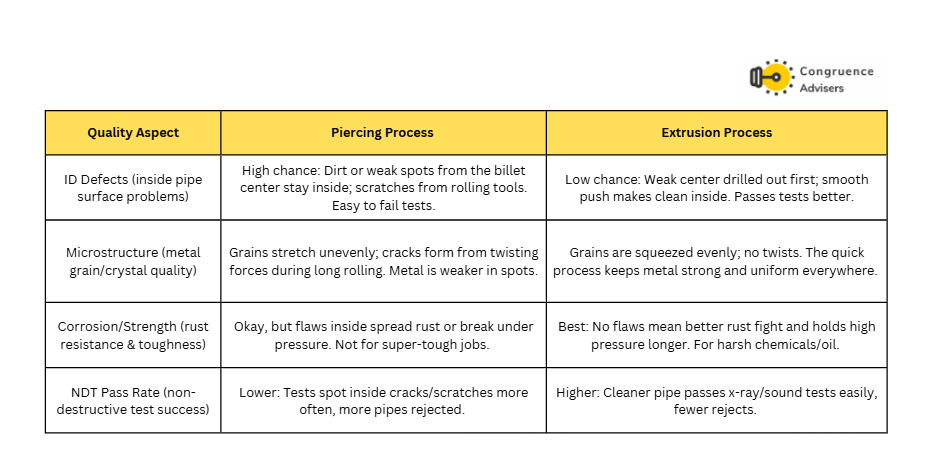

What is the difference in the quality of the end product made via piercing tech vs extrusion tech?

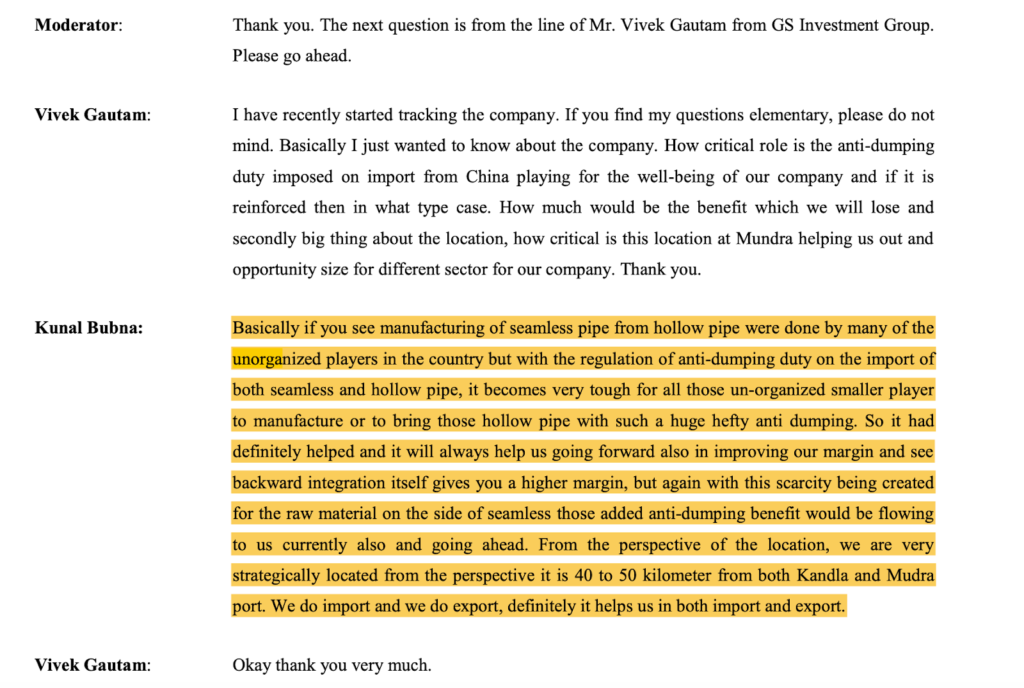

Necessity of Backward Integration: With ADD imposed on imported hollow pipes, manufacturers must integrate backward (set up piercing lines or hot extrusion) to remain competitive. Management notes that backward integration is a “costly affair” requiring significant capex, which unorganized or small players cannot afford. Consequently, no major capacity announcements have been seen from unorganized players in the seamless segment till FY24.

Concall Q2FY24 – Venus Pipes and Tubes Ltd

Segment Differentiation (Critical vs. Non-Critical): The “unorganized” or smaller players largely cater to non-critical sectors such as structural, architectural, or general engineering applications, where quality requirements are less stringent.

In contrast, critical sectors (Refineries, Nuclear, Defence, Aerospace) require stringent approvals and track records that take years to establish, effectively barring unorganized players from the high-value segment.

Drivers behind the change shift from unorganized to organized players.

- A primary driver is the implementation of the Quality Control Order by the Government of India, mandating Bureau of Indian Standards (BIS) certification. Any mill (domestic or foreign) supplying to India must have BIS registration. This has acted as a significant non-tariff barrier for Chinese and unorganized players who struggle to obtain or maintain these certifications, especially given travel restrictions that prevented audits during the pandemic. BIS certification became mandatory for stainless steel pipes and tubes in India on August 1, 2025. The Chinese government cancelled the 13% export rebates on stainless steel pipes, removing the cost advantage previously enjoyed by importers and traders in FY22.

- Government policies now mandate that for tenders up to ₹200 crores by Public Sector Undertakings (PSUs), procurement must be from local (domestic) manufacturers. This policy directly reduces the share of imports and strengthens domestic organized players.

- Organized players are aggressively expanding capacity specifically to replace imports. Ratnamani and other players, for instance, expanded their hot extrusion capacity to produce sizes and grades (up to 10 inches) that were previously imported, allowing domestic customers to switch from foreign suppliers to organized domestic ones.

- As end-user requirements become more stringent (e.g., critical applications in nuclear or high-temperature refineries), there is a shift away from “pierced” products toward “extruded” products. Since unorganized/smaller players largely rely on piercing technology, they are excluded from these high-value opportunities.

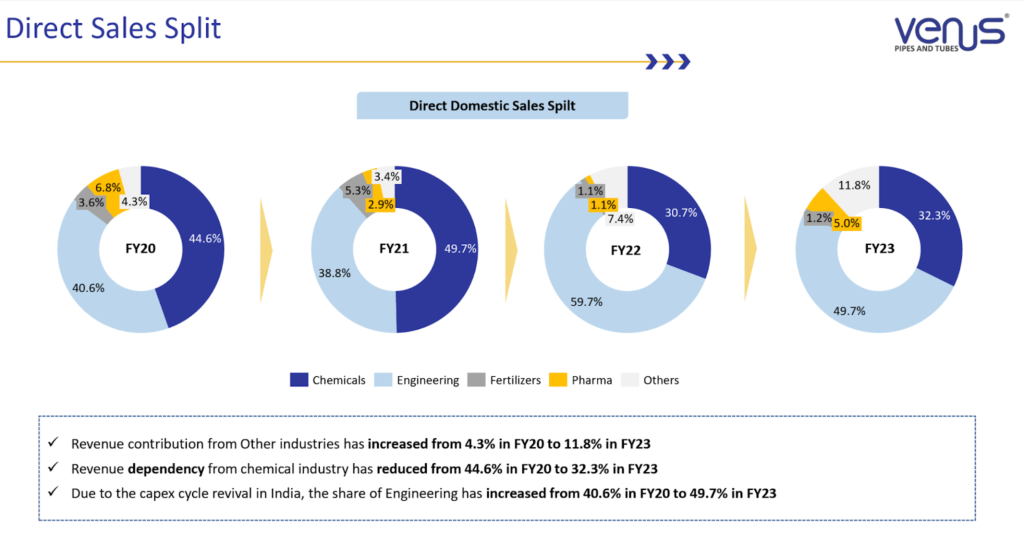

Venus Pipes and Tubes Ltd has a diversified B2B end‑user base across process, energy, engineering and high-spec industries.

Note – Recent data for FY24 & FY25 is not available

Venus Pipes & Tubes Ltd is witnessing significant demand across several key sectors, with a particular emphasis on the Power sector. Management noted “encouraging momentum” in this sector, providing clear visibility for sustained growth. Venus Pipes and Tubes Ltd recently secured a large order worth ₹190 Cr for stainless steel seamless boiler tubes from a leading integrated power plant equipment manufacturer for supercritical and subcritical thermal power projects.

While the Power and Oil & Gas sectors are the current heavyweights driving order inflows, the company is actively capitalizing on emerging opportunities in Railways, Defence, and Semiconductors.

Marquee Clientele

FY25 – Approximately 50% of revenue came from direct sales, 25% from exports, and the remaining 25% from traders/stockists.

FY23 – Direct domestic sales accounted for 60% of revenue, exports 5% and stockists/traders contributed 30%.

During the Q2 FY24 earnings call, the management stated that the top 10 customers contribute approximately 25% to 30% of total revenue.

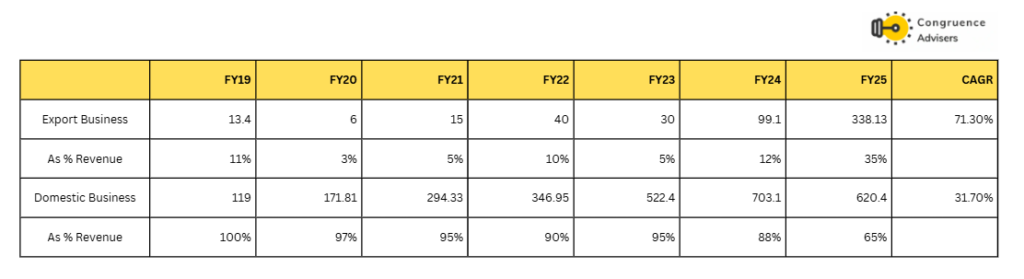

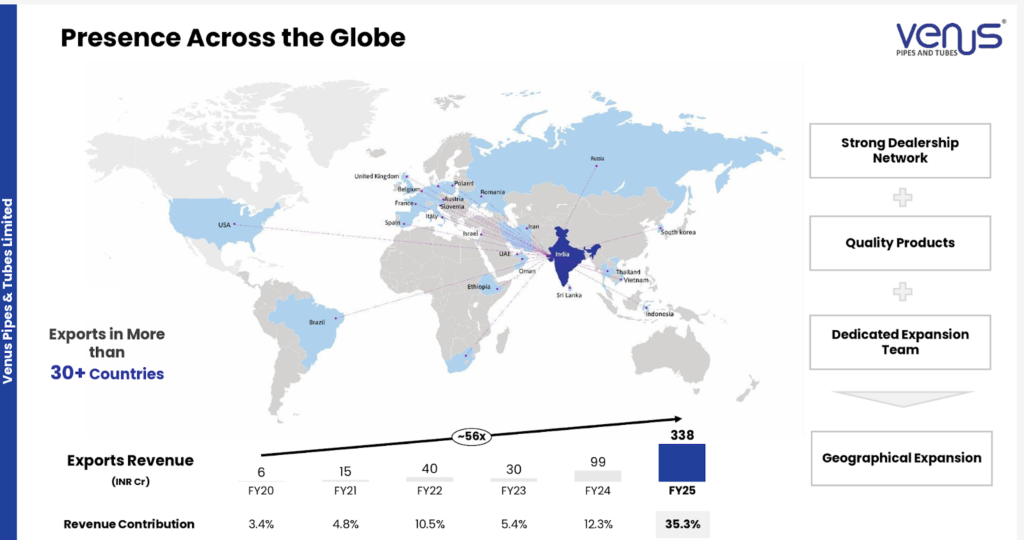

Export

Venus Pipes and Tubes Ltd exposure to exports has grown significantly on account of an increase in SKUs on the back of capacity expansion. Exports have surged at a 71% CAGR over FY19-25. The share of exports increased to 35% in FY25 (vs. 11% in FY19).

The company currently serves over 30+ countries, and with the expansion of its value-added product offerings.

Europe – This remains a stronghold, particularly for seamless pipes.Venus Pipes and Tubes Ltd hired a senior marketing representative specifically for the European market to drive penetration. Key countries include the UK, France, Italy, Germany, and Spain.

USA – Venus Pipes and Tubes Ltd successfully entered the US market, receiving its first orders in FY24. Demand in the US is primarily for welded pipes. Despite tariffs, Indian products remain competitive against Chinese imports, which face significantly higher anti-dumping duties.

Middle East – Venus Pipes and Tubes Ltd is actively securing approvals from oil and gas majors in this region. Approvals have been received from leading players, though specific names like Saudi Aramco are often still in process during the reporting periods.

Exports generally command 3% to 5% higher margins compared to domestic direct sales.

Product Segment Split in Exports

Seamless Pipes: Traditionally dominated the export mix (approx. 80% share at one point) due to strong demand in Europe, where local manufacturing is limited, and energy costs are high.

Welded Pipes: This segment has seen growth driven by the US and Middle East markets. In Q3 FY25, welded pipes contributed over 35% of the export value, a significant increase from previous periods.

The management has guided that export contribution is expected to be maintained at around 30% going forward.

On Price Hike

- Fixed EBITDA per kg Pricing Model – Venus Pipes and Tubes Ltd’s primary pricing strategy focuses on maintaining a fixed absolute margin per unit rather than a fixed percentage margin. When raw material prices fluctuate, the company adjusts the final selling price to ensure the EBITDA per kg remains protected.

- Pass-Through Mechanism (Specifically for Welded Pipes) -The management has explicitly described the welded pipe segment as having a “pass-through” nature regarding raw material prices. If stainless steel prices rise or fall, these changes are passed on to the customer.

- Back-to-Back Booking Strategy – To mitigate the risk of price volatility between the time of order and delivery, the company employs a “back-to-back” booking strategy. When an order is received from a customer, Venus Pipes and Tubes Ltd books the necessary raw material inventory simultaneously. This ensures that the cost of raw materials at that specific moment is locked in and factored into the customer’s price.

Venus Pipes & Tubes Ltd Corporate Governance

- Board Composition – The Board of Directors of Venus Pipes & Tubes Ltd. comprises 8 members, of whom 4 are Independent Directors. 3 whole-time directors and Mr Arun Kothari act as Chairman & Managing Director.

- Promoter Remuneration – The total remuneration paid to promoters via salaries and rents paid in FY25 was Rs 2.35 Cr, which is approximately 2.5% of Venus Pipes & Tubes Ltd reported PAT.

- Related Party Transactions – Other than the ones reported in promoter remuneration above, there are no significant reportable related party transactions in Venus Pipes & Tubes Ltd.

- Contingent Liabilities – The total contingent liabilities outstanding amount to INR 19 Cr, which is a 3.7 % of Venus Pipes and Tubes Ltd’s net worth of 511 Cr and hence immaterial.

- Dividend Policy – Venus Pipes & Tubes Ltd commenced dividend distributions at 10% of PAT from FY23, targeting a sustainable 5-10% payout range going forward. This disciplined approach balances shareholder returns with reinvestment needs in a high-growth environment.

Venus Pipes & Tubes Ltd Financial Performance

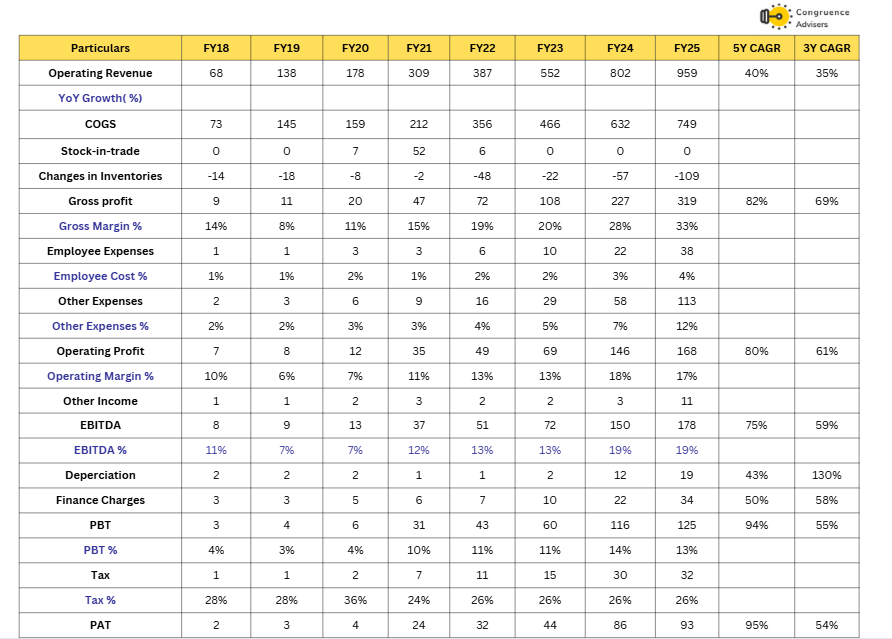

Over the last 5 years, Venus Pipes and Tubes Ltd has grown revenues at a CAGR of 40%, EBITDA at a CAGR of 75%, and PAT at a CAGR of 95%, with revenue growth above double-digit in the last 5 years. During this period, EBITDA margins have improved around 11-19% from FY18-FY25, and PAT has been volatile between 3–11%, respectively. Over the 3 years, Venus Pipes and Tubes Ltd revenues have grown at a CAGR of 35%, EBITDA at a CAGR of 61%, and PAT at a CAGR of 54%.

Gross Margin has improved from 14% in FY19 to 33% in FY25 due to the following reasons:

1. Backward Integration

The most significant contributor to margin expansion has been the backward integration in the Seamless Pipes segment.

- Mother Hollow Pipe Manufacturing: Previously, Venus Pipes and Tubes Ltd imported “mother hollow pipes” (the core raw material for seamless pipes). Venus Pipes and Tubes Ltd installed a piercing line to manufacture these hollow pipes in-house from stainless steel round bars.

- Cost Savings: This integration eliminated the margins previously paid to hollow pipe suppliers and reduced logistics costs and import dependencies. Management has indicated that approximately 80% to 85% of the margin expansion in the seamless segment is directly attributable to this backward integration.

- Full Utilization: By FY25, Venus Pipes and Tubes Ltd achieved full backward integration for a substantial portion of its seamless capacity, further boosting FY25 gross margins to 33.3%.

2. Shift in Product Mix (High-Value Focus)

- Seamless vs. Welded: Seamless pipes command significantly higher margins than welded pipes (a difference of roughly 40% to 50%). The revenue contribution from the seamless segment increased significantly over the years (e.g., from ~32% in Q3FY22 to ~57% in FY25).

- Higher Diameter & Precision: In the welded segment, Venus Pipes and Tubes Ltd began manufacturing higher diameter pipes (up to 48 and 56 inches) and LSAW pipes, where there is lower competition and better pricing power compared to routine sizes.

3. Optimization of Sales Channels (Direct Sales vs. Stockists)

Venus strategically reduced its dependence on intermediaries to capture higher margins.

- Direct Sales to Brands: Selling directly to EPC contractors and corporate brands yields higher margins (approx. 2% to 4% higher) compared to selling to stockists/traders. The share of direct domestic sales increased from 32% in Q1FY22 to 68% by Q1FY24.

- The revenue contribution from stockists/traders reduced from 56.3% in FY20 to 30% in FY23.

4. Export Growth

- Exports typically command margins that are 3% to 5% higher than domestic sales.

- Export revenue grew from a mere ₹6 crores in FY20 to ₹338 crores in FY25.

- Exports benefit from government incentives like the RoDTEP scheme (approx. 1.4%), which directly aids profitability.

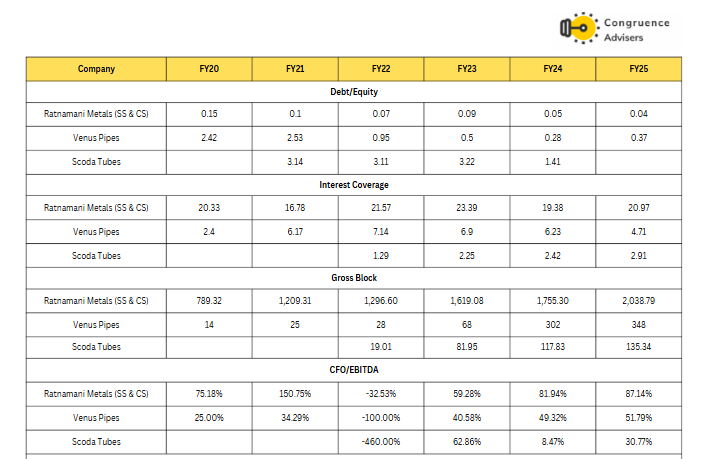

Venus Pipes & Tubes Ltd: Working capital, Debt, and Cash flow

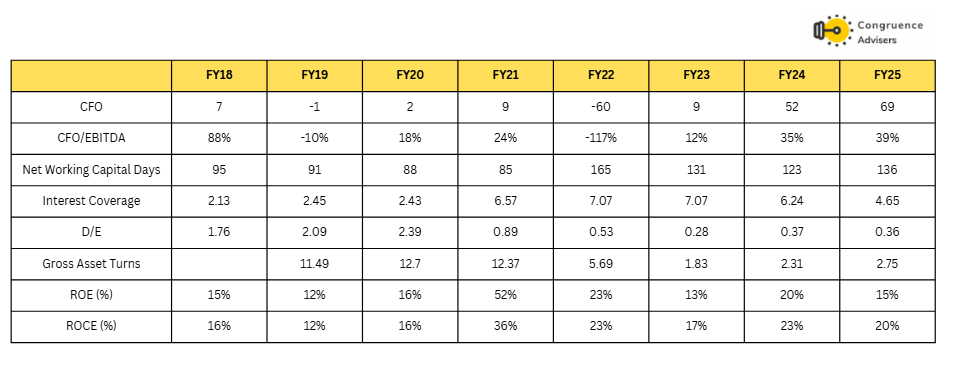

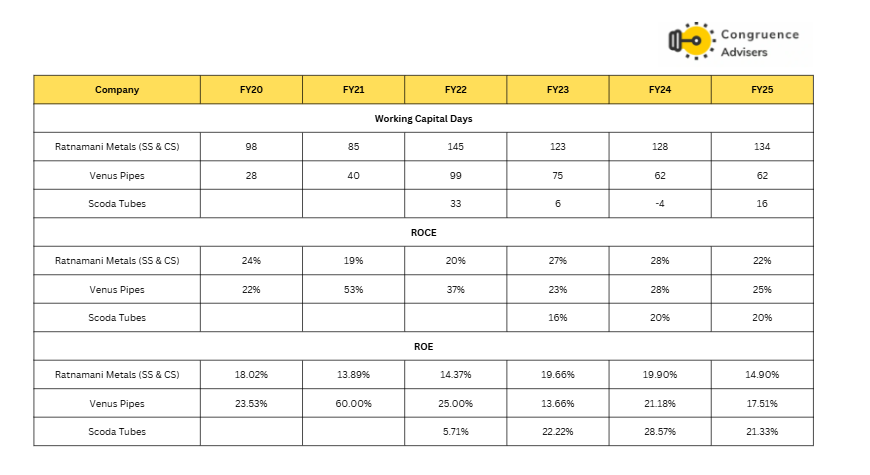

Venus Pipes & Tubes Ltd has seen a sharp improvement in operating cash flows, with the CFO turning consistently positive post FY22 and reaching 69 Cr in FY25, but conversion remains modest at 39% of EBITDA, reflecting structurally high working capital locked in 130–165 days through the last four years. Interest coverage has stayed healthy but is trending down from about 7x in FY22–23 to 4.65x in FY25 as absolute debt has risen, keeping D/E in a moderate 0.3–0.4x range versus above 2x in FY18–20. Asset turns have normalized from a very high 11–13x pre‑IPO to sub‑3x now as Venus Pipes and Tubes Ltd has front‑loaded capacity, while returns have also come off their peak, with ROE/ROCE moderating from over 50% and 35% earlier to about 18–20% and 20–30% respectively.

Venus Pipes & Tubes Ltd Comparative Analysis

To understand Venus Pipes & Tubes Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparing to Venus Pipes & Tubes Ltd to its competitors (peer comparison) on various fundamental parameters and Venus Pipes & Tubes Ltd share performance relative to relevant benchmark and sector indices.

Venus Pipes & Tubes Ltd Peer Comparison

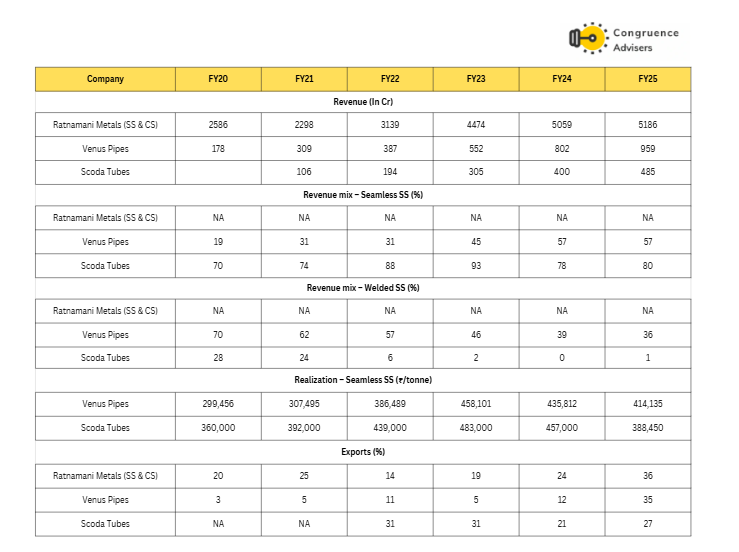

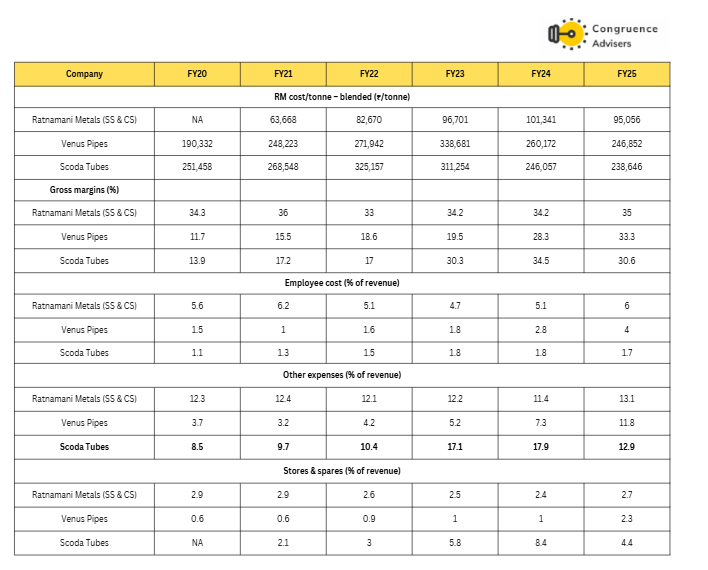

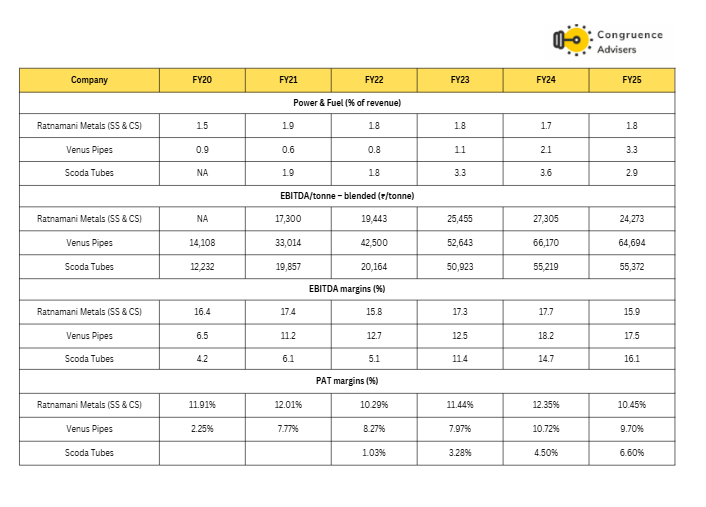

We are comparing Venus Pipes & Tubes Ltd to its closest peers in the listed space. Ratnamani Metals and Scoda Tubes are two players in stainless-steel pipes and tubes.

Venus Pipes & Tubes Ltd lagged its larger peers in FY25 with gross margins of 33.3%, improving from 28.3% in FY24 but still below Ratnamani Metals’ 35% and marginally above Scoda Tubes’ performance. At the EBITDA level, Venus Pipes achieved 17.5% margins, showing solid improvement from 18.2% in FY24, now closer to Venus Pipes & Tubes Ltd 15.9%. However, the critical weakness emerges in PAT margins, where Venus Pipes & Tubes Ltd delivered 9.70%, substantially trailing Ratnamani’s 10.45% and Scoda’s 6.60%, revealing continued challenges in debt servicing and working capital management. The revenue scale shows Venus Pipes & Tubes Ltd at ₹989 Cr (FY25) exceeding Scoda Tubes’ ₹485 Cr but significantly behind Ratnamani Metals’ ₹5,186 Cr, which includes carbon steel segment revenue, while the revenue mix remained consistent with 57% seamless SS and 36% welded SS for Venus, reflecting Venus Pipes & Tubes Ltd’s specialized product positioning.

Note: EBITDA margins do not include other income

Source: Investec Equities

Venus Pipes & Tubes Ltd Index Comparison

Venus Pipes & Tubes Ltd share performance vs S&P BSE Small Cap Index, as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why You Should Consider Investing in Venus Pipes & Tubes Ltd

Capitalizing on the Structural Shift from Unorganized to Organized Markets – Venus Pipes & Tubes Ltd presents a compelling investment opportunity as a primary beneficiary of the rapid structural consolidation in the Indian stainless steel pipes industry, where stringent regulatory norms like mandatory BIS certifications and Anti-Dumping Duties on Chinese imports are displacing unorganized players who lack compliance capabilities and scale. By aggressively investing in backward integration (manufacturing mother hollow pipes), Venus Pipes & Tubes Ltd has created significant entry barriers that smaller, unorganized competitors cannot surmount due to the capital-intensive nature of such facilities and the inability to source cheap raw materials following the ADD implementation.

Capacity Expansion – Venus Pipes & Tubes Ltd offers a compelling growth narrative anchored in its aggressive capacity expansion from ~12,000 MTPA to a projected ~46,800 MTPA by H2 FY26, designed to capture market share in both the high-demand domestic infrastructure sectors and lucrative export markets. This strategic scaling is fortified by a ₹175 Cr capex plan that not only increases volume but also enriches the product mix with higher-margin offerings like Titanium welded tubes and fittings. By evolving into a comprehensive PFF (Piping, Fittings & Flanges) provider with capabilities to manufacture large-diameter LSAW pipes (up to 56 inches), Venus Pipes & Tubes Ltd is effectively erecting entry barriers against unorganized competitors and positioning itself to capitalize on the multi-year capex upcycle in critical sectors such as Power and Oil & Gas.

Export Market – Export revenue has grown from just ₹6 Cr in FY20 to ₹338 Cr in FY25. Exports now contribute approximately 35-40% of total revenue. Venus Pipes & Tubes Ltd exports to over 30 countries, with a strong foothold in the European Union and increasing traction in the USA and the Middle East. The US share of exports was 20% in Q2FY26. Tariffs are getting passed on fully to customers. China has higher tariffs than India which is benefiting Indian companies.

Strategic Shift to Value-Added Products – Venus Pipes & Tubes Ltd is moving up the value chain to reduce commoditization risks and improve profitability. The portfolio now includes higher diameter welded pipes (LSAW up to 56 inches) and specialized Titanium grade tubes for critical applications. The company is entering the Fittings business (expected completion H2 FY26) to offer complete PFF (Piping, Fittings & Flanges) solutions. This is a high-margin segment with low competition, where Venus plans to use its own manufacturing scrap as raw material to optimize costs

What are the Risks of Investing in Venus Pipes & Tubes Ltd

Anti-Dumping Duty (ADD) Dependency – A significant portion of theVenus Pipes & Tubes Ltd’s competitive advantage in the domestic market stems from the Anti-Dumping Duty (ADD) imposed on Chinese seamless pipes and mother hollow pipes. While this is in place until December 2027, any premature removal or policy shift could lead to Chinese products flooding the market, intensifying competition.

Raw Material Price Volatility and Margin Pressure – Venus Pipes and Tubes Ltd faces margin pressure risks arising from multiple cost-side volatilities. Raw material prices, particularly stainless steel coils and round bars, are inherently cyclical and volatile, and any sharp adverse movements may compress margins if cost increases cannot be passed through to customers in a timely manner. Additionally, as the company expands into geographies such as the U.S. and the Middle East, especially within the welded pipes segment, it has adopted aggressive pricing strategies to gain market share, which has weighed on EBITDA margins in recent quarters. Further, export profitability remains exposed to fluctuations in ocean freight costs, with geopolitical disruptions such as the Red Sea crisis leading to sudden spikes in freight rates; while management endeavours to incorporate these costs into pricing, abrupt escalations may temporarily soften margins and overall profitability.

Operational and Execution Risks – Venus Pipes and Tubes Ltd is undergoing significant capital expenditure. The timeline for the Fittings project has already seen a shift, with commencement moving from the initial target of March 2025 to H2FY26. Delays in commissioning new capacities can defer revenue generation while fixed costs continue to accrue. To support future capacity, the company has aggressively hired senior management and technical professionals. This has led to a sharp increase in employee costs and other expenses, which impacts near-term margins before the new revenue streams fully kick in.

Foreign Exchange Risk – Venus Pipes & Tubes Ltd is exposed to foreign exchange fluctuations due to imports of raw materials and exports of finished goods. While they have a natural hedge and a hedging policy, volatility in currencies like the USD and Euro remains a risk factor

Dependence on sustained capex in key sectors – Demand centers for the company’s products need sustained capex by the Govt and the private sector. While the private sector appears to be on a strong footing due to strong balance sheets, the Govt sector is susceptible to muted capex depending on a host of macroeconomic factors. Govt capex has been lower than anticipated post the CY24 general election as the political reality of the country mandates higher handouts and social spending by local governments. Sustained weakness in the INR coupled with fiscal pressures may keep Govt capex from reaching desired levels.

Venus Pipes & Tubes Ltd Future Outlook

Venus Pipes & Tubes Ltd projects a robust growth trajectory for FY26 and FY27 with a targeted revenue CAGR of over 20-25%, underpinned by the operationalization of its significant capital expenditure projects, which are expected to expand total capacity to approximately 46,800 MTPA by the second half of FY26. Venus Pipes & Tubes Ltd anticipates that its new fittings segment, scheduled for commissioning in H2 FY26, will generate meaningful revenue from FY27 onwards with a peak potential of ₹180-200 Cr, while the completion of Phase 2 seamless pipe expansion and backward integration will further support margin stability in the 16-18% range. With a strategic objective to increase export contribution to over 30% and a focus on high-value sectors like power and oil & gas, Venus Pipes & Tubes Ltd is positioned to capitalize on its expanded capabilities and diversified product portfolio in the coming years.

Venus Pipes & Tubes Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time, price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers, we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Venus Pipes & Tubes Ltd Price charts

On a Weekly Chart Venues Pipes & Tubes Ltd, the long-term structure shows a strong multi-year uptrend that peaked near the 2,400 zone, followed by a prolonged corrective phase with lower highs and lower lows. Price has retraced back to a major horizontal demand area around 1,150-1,170, which earlier acted as a breakout base during the prior rally. The repeated tests of this zone suggest it is a critical make-or-break level. Sustained closes below it would confirm a deeper trend reversal, while stabilization here could still allow for a base-building phase. However, muted volumes and the absence of strong bullish candles indicate weak buying conviction so far, keeping the broader market cautious to bearish until a clear weekly reversal signal emerges. And we can see a bearish chart pattern of a head and shoulder.

On the Daily Timeframe, the stock is trending within a clear descending channel marked by a series of lower highs, with price currently hovering just above the key support band near 1,150–1,170. The recent bounce appears corrective rather than impulsive, as it stalled near the falling trendline, suggesting sellers remain in control on rallies. A decisive breakdown below this support could open the door toward the psychological 1,100 and possibly 1,050 levels, whereas a bullish reversal would require a strong close above the descending trendline and then a move past the 1,300-1,350 resistance zone. Until then, the structure favours range-to-bearish price action with high sensitivity around current levels.

Venus Pipes & Tubes Ltd Latest Result, News and Updates

Venus Pipes & Tubes Ltd Quarterly Results

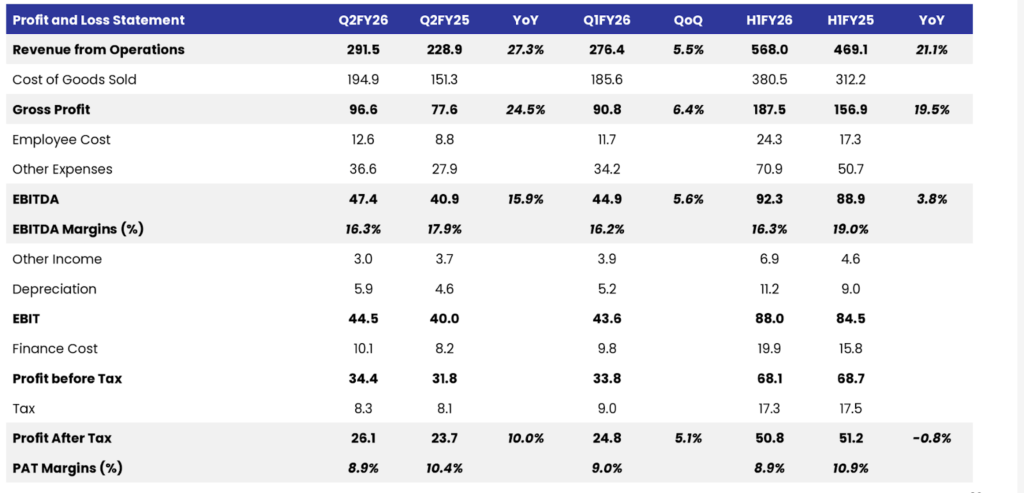

Venus Pipes & Tubes Ltd revenue grew 27% YoY, and Seamless up +25% YoY and Welded: +48% YoY, supported by a blended volume growth of 20%+ YoY in Q2FY26. The share of seamless/welded in Q2FY26 was 56%/39%.

Exports remain a key growth driver, contributing ~40% of Q2 revenue, with the order book at INR 490 Cr (70% domestic, 30% export). Management guides for 25% revenue growth, EBITDA margins of 16-18% by FY27 with incremental value-added capacity, and export contribution stabilizing at 25-30%, supported by robust inflows from the EU and the Middle East amid successful tariff pass-throughs and borrowings may rise modestly for remaining capex, peaking in FY27. The Q4FY26 fittings plant launch offers limited FY26 revenue during ramp-up but 3x potential on INR 60 Cr investment at peak.

Power sector execution stands at >15% complete (full by Jun-26), with new BHEL tenders eyed by H2FY26/Apr-26, fueled by chemical, power, and oil & gas sectors. Recent Saudi gains from Chinese pipe additions, full promoter warrant subscription, and ongoing Middle East/Southeast Asia approvals will enhance US/Middle East oil & gas access.

Final thoughts on Venus Pipes & Tubes Ltd

We see healthy possibilities of operating leverage playing out in Venus Pipes & Tubes once the current capex is completed by the end of FY26. What gives us comfort is the healthy balance sheet, steady margin and above average growth rate that the business has displayed since incorporation. The management team has displayed a clear focus on sticking to their strengths without embarking on value dilutive business forays.

With FY27 revenue expected to rise on the back of higher volumes from Titanium tubes & fittings expansion, PAT growth may show a healthy scale up in FY28 and beyond as higher volumes can absorb fixed costs in a better way and improve the per unit profitability. We will be keenly tracking the volume growth and the cash flow generation of the business starting H2 FY26.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this to a general audience. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will continue/be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.