Incorporated in 2001, Windlas Biotech Ltd is a homegrown Generic Formulations Contract Development and Manufacturing Organisation (CDMO) player. Across the value chain, it provides a comprehensive range of CDMO products ranging from product development, licensing, and commercial manufacturing of generic products, including complex generics for its domestic customers, i.e., Generic Formulations CDMO vertical and consumers around the world, i.e., Exports vertical. Windlas Biotech Ltd’s foray into the Trade Generics and Institutional vertical delivers on the strategy of providing Accessible, Affordable, and Authentic medicine to the underserved geographical areas of India, situated in B & C class cities and small towns. Windlas Biotech Ltd derives its revenue from three main business segments: 77% from CDMO services and products, 19% from the domestic trade generics segment, and 4% from exports as of FY24.

We find Windlas Biotech Ltd interesting because it operates in the domestic pharmaceutical formulations industry, which has steady growth prospects. The trend of outsourcing pharma manufacturing is increasing among Indian pharma companies, which is in line with global trends. Additionally, the Government’s push for broader and more affordable healthcare for the masses is likely to support growth in the trade generics segment. Exports remain an optionality as Indian companies continue to strengthen their position as affordable providers of quality pharma products in the unregulated and semi-regulated geographies of Africa, Asia, and Latin America.

Windlas Biotech Ltd Fundamental Analysis

The Fundamental analysis of Windlass Biotech Ltd. aims to analyze parameters such as revenue, gross profit, EBITDA, net profit, and more.

Windlass Biotech Ltd. has demonstrated consistent growth. Revenue and gross profit have grown at a CAGR of 18% and 19%, while PBT and profit after tax tripled from FY20 to FY24 (33% and 38% CAGR). EBITDA margins improved from 11% in FY20 to a high of 14.53% in FY24. Windlass Biotech Ltd. delivered its highest-ever EPS in FY24 post-listing. In FY24, the EPS stood at Rs 27.97, a 42% YoY growth rate. We anticipate this strong growth trajectory will continue in the foreseeable future.

| Profit & Loss | FY20 | FY21 | FY22 | FY23 | FY24 | CAGR(FY19-23) |

| Revenue | 329 | 428 | 466 | 513 | 631 | 18% |

| Gross Profit | 117 | 153 | 163 | 188 | 235 | 19% |

| Gross Profit % | 36% | 36% | 35% | 37% | 37% | |

| Employee Cost | 13% | 14% | 14% | 14% | 14% | |

| EBITDA Margin | 11% | 8% | 13% | 14% | 15% | |

| Other Income | 2.5 | -18.5 | 6.7 | 10.0 | 13.5 | |

| Depreciation | 9 | 13 | 12 | 12 | 13 | |

| Interest | 9 | 13 | 12 | 12 | 13 | |

| Profit before tax (PBT) | 25 | 22 | 46 | 57 | 77 | 33% |

| PBT % | 8% | 5% | 10% | 11% | 12% | |

| Net profit (PAT) | 16 | 16 | 38 | 43 | 58 | 38% |

| Net Profit % | 5% | 4% | 8% | 8% | 9% | |

| No. of Equity Shares | 0.64 | 0.64 | 2.18 | 2.13 | 2.08 | |

| EPS | 25.3 | 24.3 | 17.5 | 20.0 | 28.0 |

Windlas Biotech Ltd Company Summary

Incorporated in 2001, the Windlas Group originally comprised two companies, Windlas Biotech Private Limited (WBPL) and Windlas Healthcare Private Limited (WHC). WHC was an erstwhile subsidiary of WBPL, which was amalgamated into WBPL, and the merged entity was renamed Windlas Biotech Limited

Windlas Biotech Limited Ltd is a primarily domestic pharmaceutical company that provides formulation CDMO services to generic pharmaceutical companies and sells generic medicines under its brand name in India. It is among the top five CDMO formulation companies in India. Windlas Biotech Ltd was founded in 2001 by Mr. Ashok Kumar Windlas, and over the next 2 decades, it has grown to a revenue of INR 600 Cr with 4 plants located in Dehradun. Windlas Biotech Ltd manufactures both solid and liquid dosage forms and has recently ventured into injectables by setting up a new facility. More than 95% of Windlas Biotech Ltd’s revenues are from India, and exports comprise less than 5% of the company’s current revenues. The target export market for Windlas Biotech Ltd is non-regulated and semi-regulated geographies. Windlas Biotech Ltd was listed on the stock exchanges in August 2021. From FY21 to TTM FY24 (Dec’ 2023), Windlas has grown revenues and profits at ~12% and ~50% CAGR, respectively.

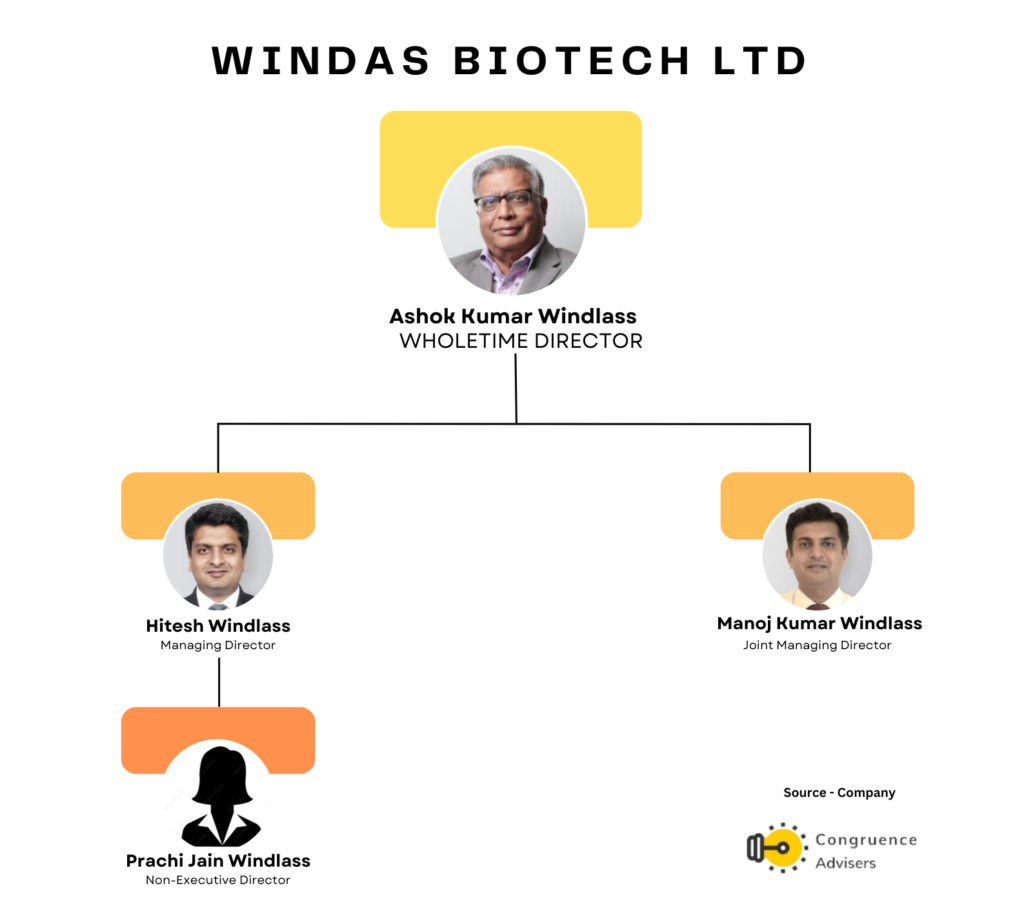

Windlas Biotech Ltd Company/ Promoter Structure

Windlas Family Structure

Windlas Biotech Ltd. has a traditional family business structure where leadership is passed down to the next generation. Ashok Kumar Windlass (70 years old) is the founder of Windlas Biotech and serves as a whole-time director. His sons, Hitesh Windlass (44 years old) and Manoj Windlass (42 years old) serve as Managing Director and Joint Managing Director, respectively. Hitesh’s wife, Prachi Jain Windlass, is a non-executive director.

Windlas Biotech Ltd Management Details

Management Details spotlight the significant role of the Windalas family and the profile of its management members in various functions.

| Name | Designation | Profile |

| Hitesh Windlass | Managing Director | 21+ years of experience in the field of management, bachelor’s degree from the IIT-BHU, MS in Material Science & Engr. from Georgia Institute of Technology, and MBA from the Booth School of Business, University of Chicago. Leads the company since 2008. |

| Vivek Dhariwal | Chairman and Independent Director | 22+ years of experience in manufacturing and supply operations. Previously associated with ICI India Ltd, Baxter India Private Ltd, and Pfizer Ltd. Bachelor’s degree from IIT-B & master’s degree in science from University of Kentucky |

| Ashok Windlass | Whole Time Director | Chairman of Confederation of Indian Industries, Uttarakhand State Council, Established Windlas Biotech in 2001. Led Windlas Biotech as MD till 2020 |

| Manoj Windlass | Jt. Managing Director | Co-founded Windlas Biotech in 2001. Deeply engaged in managing client relations and product portfolio expansion. Plays a significant role in driving product portfolio decisions and overall commercial operations, including business development, supply chain, and procurement. He is a BBA graduate from George State University Atlanta |

| Komal Gupta | CEO & CFO | Experience – 18+ Years; Educational Qualification – CA, CS & CWA Working with Windlas since 2015 Previously worked with DSM Group and Anand Automotives Systems Ltd. |

Windlas Biotech Ltd – Pharma Industry Landscape

We’ve never seen the pharma sector as a homogeneous segment; the flavor of the business might be the same, but the factors that affect business evaluation vary a lot. At a superficial level, all pharma businesses might look the same, but the differences and business drivers are significant. We see the sector with multiple sub-segments –

- Pure play API makers whose unit economics are in line with chemicals businesses (Gross asset turns < 2x, EBITDA margin 15-18%, limited pricing power)

- Domestic pharma-focused businesses (revenue from India > 65%, higher asset turns and more predictable EBITDA margin, distribution can be a moat, growth rate of 10-14% depending on which segment the business focuses on – acute or chronic therapies)

- Developed market-focused players (mostly formulation-heavy players with > 50% exposure to US and Europe, backward integration for key APIs, regulation risk heavy, legacy acquisition issues from the previous cycle which can prop up any time)

We prefer the second segment since it is easier to understand and does not have too many moving parts. Regulatory risks are minimal in India (NLEM pricing caps, WPI-linked price hikes) compared to the US FDA regime, which can go into overdrive mode and drastically increase regulatory costs almost overnight. Domestic pharma businesses also have an FMCG-like brand + distribution component to them, which we believe we understand to a good extent.

We don’t see this preference of ours changing drastically any time soon, especially since the developed markets are still grappling with supply chain, inventory, and pricing issues.

Formulations CDMO

The formulations CDMO industry manufactures outsourced formulations for domestic Indian pharma companies. It is more accurate to call this industry Formulation CMO rather than CDMO because the bulk of the operations involve contract manufacturing without much development. Formulations CDMO as an industry differs from the API CDMO industry, which has players like Syngene International Ltd, Divi’s Laboratories Ltd, Neuland Laboratories Ltd, Laurus Labs Ltd, etc. API CDMO players synthesize the API from scratch, which involves more complex chemical and biological processes. These companies usually have high gross margins (50-60%+) and high investments in fixed assets and human resources and work mainly with foreign pharma innovator companies.

On the other hand, domestic-focused formulations CDMO companies usually have domestic generics companies as their clients. They are generally provided with the API by their clients, or they procure it from the market and then synthesize the final formulation in the required dosage and form factor – oral solids, oral liquids, injectables – as per the client’s specifications. Some companies are also backward integrating into manufacturing generic APIs. Compared to API CDMO companies, formulations CDMO companies have much lower gross margins (20-30%) but much higher gross asset turns because the investments required in plants and human resources are considerably lower.

The Indian domestic formulations CDMO industry is estimated to be ~35000-40000 Cr INR in size as of FY23 [Source: DRHPs of Windlas Biotech and Innova Captab]. Including exports, the formulations CDMO industry size may be around 65000-70000 Cr INR. The domestic industry is expected to grow between 12-14% per annum for the foreseeable future, a few % points higher than the expected growth rate for domestic formulations at 9-10% CAGR. The formulations CDMO industry is highly fragmented, with few large, organised players. The industry is expected to consolidate gradually, and the larger players will gain more market share as outsourcing companies look for larger partners to work with and regulatory requirements become more stringent. The largest player in this industry is Akums Drugs and Pharmaceuticals Ltd, with a topline of ~3500Cr INR (10% domestic market share) in FY23. Windlas Biotech Ltd is among the top 5 companies by revenue.

Manufacturing facilities & product portfolio snapshot of key Industry Players

Trade Generics

The trade generics industry in India has only a 10% share by value of the total generic medicines sold in the country [Source: Kotak report]. 90% of generic medicines sold in India are sold as branded generics. The size of the trade generics industry in 2023 is estimated to be ~20000 Cr INR. The difference between a trade generic and a branded generic medicine is that for selling a branded generic, Medical Representatives are hired to influence doctors to push the particular brand via prescriptions. In contrast, trade generics are sold not directly via medical representatives but through a supply chain of stockists/distributors and pharmacies. Trade generics are much cheaper than branded generics. They are primarily sold in Tier 3/4 towns and villages and procured in bulk via Government healthcare programs such as Pradhan Mantri Jan Aushadhi Pariyojana.

The trade generics and Jan Aushadhi segment is expected to expand much faster than the branded generics, at a CAGR of 14-15% over 2023-28. The Govt aims to have 25000 Jan Aushadhi stores across India by 2026; the store count in 2023 was ~10000. The large formulations CDMO companies with established WHO-GMP regulation adherence, like Windlas Biotech Ltd, will likely garner an increasingly larger chunk of this demand.

Windlas Biotech Product Details

Windlas Biotech Ltd operates in three distinct product segments

1. Domestic formulations CDMO

2. Domestic trade generics and institutional business

3. Generic exports

For the 9M FY24, Windlas Biotech Ltd’s total revenue was 460 crore INR, with CDMO accounting for 77%, trade generics for 19%, and exports for 4%. The revenue mix has shifted significantly in favor of trade generics from FY21. In FY21, CDMO comprised 85% of the revenue mix, trade generics only 10%, and exports 5%.

| Segment Mix | FY19 | FY20 | FY21 | FY22 | FY23 | 9MFY23 | 9MFY24 | FY19-23 % Change |

| Generic Formulations CDMO | 84% | 87% | 85% | 81% | 78% | 78% | 77% | -6% |

| Trade Generics & Institutional | 9% | 9% | 10% | 13% | 18% | 18% | 19% | 9% |

| Exports | 6% | 3% | 4% | 4% | 4% | 3% | 4% | -2% |

Over the 3 Years from FY21 to FY24 (9M annualized), the trade generics segment has grown at a remarkable CAGR of 39%, while CDMO has grown at a CAGR of 9%, and exports have remained flat. This change in the mix is margin accretive for Windlas Biotech Ltd, as trade generics have 4-5% higher gross margins than formulations CDMO sales. Export gross margins, in turn, are 5-6% higher than trade generics gross margins.

Windlas Biotech Ltd Projected Segmental Revenue As Per Management Guidance

Windlas Biotech Ltd has set ambitious growth targets for FY26, aiming to double CDMO revenues, triple trade generics revenues, and quadruple export revenues compared to FY21, Translates to an expected total revenue of approximately ₹1000 crore, with a projected mix of 75% CDMO, 13% trade generics, and 7% exports.

| In Amount (Cr) | FY19 | FY20 | FY21 | FY22 | FY23 | FY24E | FY25E | FY26E |

| Generic Formulations CDMO | 258 | 286 | 362 | 380 | 398 | 484 | 539 | 750 |

| Trade Generics & Institutional | 28 | 30 | 44 | 61 | 91 | 118 | 135 | 150 |

| Exports | 18 | 10 | 19 | 21 | 20 | 29 | 50 | 100 |

However, Windlas Biotech Ltd is going to comfortably overshoot the trade generics revenue target of 130 Cr INR by FY26, as the FY24 run-rate itself has reached 115 Cr INR. Trade generics segment continues to grow at 25%+ CAGR on a yearly basis. Therefore, the trade generics mix in FY26 is likely to be 20% or higher.

Domestic formulations CDMO

The current annual revenue run rate for the CDMO formulation is INR 475 Cr. In order to achieve the target segmental revenue of 700 Cr INR by FY26, the CDMO segment needs to overcome the recent trend of sluggish high single-digit revenue growth and achieve a CAGR of 20%+, commercializing the injectables facility from Q4 FY24 should contribute to increasing the growth rate of this segment. The injectables facility has the potential to generate about 100 Cr INR in revenues at peak utilization with an EBITDA margin profile of 18-20%.

Source: FY23 Annual report

In its overall portfolio, Windlas Biotech Ltd has a 57% mix of chronic formulations vs a 43% mix of acute formulations. Chronic formulations address lifestyle diseases like hypertension, diabetes, or neurological disorders for which patients need to take medicines consistently. On the other hand, acute formulations address one-off ailments like pain or fever. Chronic formulations have a higher growth rate compared to acute formulations due to the increasing prevalence of lifestyle diseases in India. Additionally, Chronic formulations yield higher profit margins than acute formulations, positioning Windlas Biotech Ltd favorably from a portfolio perspective.

The mix of chronic vs acute revenues for Windlas Biotech Ltd over the years

| Segment | FY19 | FY20 | FY21 | FY22 | FY23 |

| Chronic & Sub-Chronic | 51% | 47% | 60% | 58% | 57% |

| Acute | 47% | 53% | 40% | 42% | 43% |

Source – Windlas Biotech Ltd

Windlas Biotech Ltd has a market share of approximately 1.5% in the domestic CDMO formulations industry. Its key clients include pharmaceutical companies such as Pfizer, Sanofi, Cadila, Zydus, Emcure, Eris Lifesciences, Intas, and Systopic. Windlas Biotech Ltd serves 7 of the top 10 formulation pharmaceutical companies in India. Windlas Biotech Ltd is highly competent in manufacturing multi-drug fixed-dose combinations, which are increasingly used to treat complex chronic ailments. For example, Windlas Biotech Ltd launched a fixed-dose combination of sustained-release metformin and immediate-release gliptins for metformin-resistant diabetic patients. Windlas Biotech Ltd also claims to have capabilities in manufacturing complex generic formulations, which require higher expertise and higher margins. In FY22 and FY23, Windlas Biotech Ltd allocated 1.4% and 1.75% of its revenue, respectively, to R&D expenses, which compares favorably with other peers in the industry.

R&D spends as % revenue for top players in the formulation CDMO industry

| Indian CDMO formulation players | Total Income (Rs. Cr) | R&D Expenditure (Rs. Cr) | R&D expenditure as % of total income |

| Akums Drug Pharmaceuticals Ltd | 3695 | 22 | 0.61% |

| Innova Captab Ltd.$ | 1187 | 11 | 0.93% |

| Synokem Pharmaceuticals Ltd’ | 691 | 8 | 1.09% |

| Theon Ltd. | 466 | 2 | 0.33% |

| Windlas Biotech Ltd. | 523 | 9 | 1.71% |

| Acme Private Ltd | 539 | 16 | 2.92% |

Domestic trade generics and institutional business

Windlas Biotech Ltd operates its generic trade business with the support of 700 stockists and distributors located across 29 states. In the trade generic segment, Windlas Biotech Ltd. has a portfolio of 278 pharmaceutical and over-the-counter (OTC) brands. Trade generic products are more affordable than branded generics, making them suitable for distribution to lower-income households in villages and semi-urban areas of India. Trade generics used to suffer from a bad reputation due to unorganized players with questionable regulatory adherence dominating this space. However, in recent decades, the emergence of large, organized, and regulatory-compliant players like Windlas Biotech Ltd, Akums Drugs and Pharmaceuticals Ltd, and Innova Captab Ltd has brought credibility to Trade generic manufacturing. In recent years, several branded pharmaceutical companies such as Abbott India Ltd, Cipla Ltd, Alkem Laboratories Ltd, and Dr Reddy’s Laboratories Ltd have also included Trade generics in their portfolios.

The Government has also made significant moves in this area to make cheap, good-quality generic medicines affordable for the masses. Under the Pradhan Mantri Bhartiya Jan Aushadhi Yojana (PMBJP) scheme, franchise-owned Jan Aushadhi Kendras have been opened across the country. The product basket of PMBJP includes 1800 drugs and 285 surgical equipment, which are sold at a discount of 50-90% compared to branded alternatives. The scale-up in the number of Jan Aushadhi outlets and the total sales through these outlets has been impressive over the last few years. Trade generics, as a segment, are expected to grow faster than branded generics. Even within this segment, the large and organised players with the necessary regulatory certifications, such as Windlas Biotech Ltd, are likely to experience the fastest growth. This is evident in the 35% CAGR growth rate of the Trade generics segment over the last 4 years for Windlas Biotech Ltd.

Generics exports

The export segment has been a laggard for Windlas Biotech Ltd so far. Export revenues have stagnated between FY21 and FY24. FY21 export revenues were 19 Cr INR, and 9M FY24 export revenues were 18.5 Cr INR. Windlas Biotech Ltd exports approximately 75 products to 10 countries in unregulated or semi-regulated markets. One of Windlas Biotech Ltd plants has EU GMP certification and is certified by the South African regulatory body. Management has stated that export growth will be concentrated towards the end of the projected period due to the time it takes for dossier filings to be approved. Hence, export growth is expected to be significantly high in FY26-FY27. The export segment is a key monitorable segment, as management has guided export revenues to reach ~75Cr INR (3.5x from current levels) by FY26 or FY27.

Windlas Biotech Ltd Manufacturing Plants

Windlas Biotech Ltd operates 4 manufacturing plants, all located in Dehradun. All of them are WHO GMP certified, and Plant IV is also EU GMP certified. A 5th injectables manufacturing plant has been commissioned as of Q2 FY24 and is expected to start commercial operations by the end of FY24. With its current capacities, Windlas Biotech Ltd can achieve a revenue of 700-750 Cr INR. By investing an additional 40 Cr INR in capex, the revenue potential can be expanded to 1000 Cr INR. All plants produce products for all 3 verticals for Windlas Biotech Ltd. Previously, the Dehradun Plant IV was US FDA-certified. Windlas Biotech Ltd collaborated with Cadila Healthcare to sell some products to the US market. However, after an import alert in 2020, Windlas decided to stop pursuing the US market. They chose to focus solely on the domestic pharmaceutical market and exports to non-regulated or semi-regulated markets. The management stated that the decision was made due to the steep erosion of oral solids realizations and margins in the US geography. In addition, for a company of their size, the additional regulatory compliance burden of US FDA inspections, regulations, and ANDA filings would also have been quite onerous. The US market would have diverted the limited management bandwidth away from its core competencies. We see this decision to move away from the US markets as a positive. It shows that management wants to focus its limited bandwidth in one direction rather than spreading it thin.

Management has indicated that they are evaluating inorganic growth options, too. They have cash balances and investments in excess of 150 Cr INR, which can be used for an acquisition if required. They have ruled out any backward integration into API CDMO, so any acquisition is likely to be horizontal or to add new capabilities in drug delivery mechanisms or complex generic formulations.

Windlas Biotech Ltd Financial Analysis

In this section, we present a detailed financial analysis of Windlas Biotech Ltd, Focusing on margins, cash flow generation, and return ratios. While historical margins have been stable, there are expectations of improvement due to capacity utilization and product mix shifts. Cash conversion has been moderate, and adjusted return on equity (ROE) reveals the underlying business strength of Windlas Biotech Ltd.

Since FY18, Windlas Biotech Ltd.’s Gross profit margins have remained in a narrow band of 33- 38%, and EBITDA margins have fluctuated between 10% and 13%. Following the Windlas Biotech Ltd listing in FY22, EBITDA margins have trended up from 11% to 13% as the business has scaled up, resulting in better utilization of fixed costs. Additionally, the higher-margin trade generics segment’s increased share of the overall revenues has contributed to the improvement in margins. With the growing utilization of capacity and faster growth of trade generics and exports compared to CDMO, it is anticipated that margins will continue to improve.

| Metrics | FY19 | FY20 | FY21 | FY22 | FY23 |

| Gross margin | 37% | 36% | 36% | 35% | 37% |

| EBITDA Margin % | 15% | 13% | 13% | 11% | 12% |

| EBIT Margin | 13% | 11% | 10% | 10% | 11% |

| PAT Margin | 8% | 5% | 4% | 8% | 8% |

| Gross Fixed Asset Turnover | 3.61 | 4.14 | 5.39 | 2.97 | 3.13 |

| Interest Coverage Ratio | 12.22 | 16.39 | 42.4 | 36.92 | 76.24 |

| Return on capital employed (ROCE) | 15% | 12% | 19% | 15% | 14% |

| Return on Equity (ROE) | 12% | 8% | 8% | 10% | 11% |

In terms of cash conversion, between FY18-FY23, Windlas Biotech Ltd converted 52% of its EBITDA into cash flow from operations. EBITDA/CFO is not a very high number for a pharma business, but it’s in the acceptable range. In spite of comparatively lower CFO generation, it’s good to see that Windlas Biotech Ltd has managed to generate modest free cash flows cumulatively between FY18-23 because the business does not need heavy fixed capital investments. In terms of Return on capital measurement, since the balance sheet does not carry any debt, Return on equity (ROE) rather than return on capital employed (ROCE) is the suitable metric. On an unadjusted basis, Windlas Biotech Ltd has reported a modest Return on equity (ROE) of 8%-11.5% between FY18-FY23.

However, Windlas Biotech Ltd has always held significant investments and bank balances on its balance sheet, which have bloated it and kept return ratios optically low. Calculating adjusted ROEs by considering PAT adjusted for other income in the numerator and equity employed by adjusting the idle cash and investments in the denominator, it is evident that the underlying business quality is much better. As the inorganic expansion is part of the management’s strategy going forward, these idle cash balances are likely to be utilized in the near future.

| FY19 | FY20 | FY21 | FY22 | FY23 | |

| Total Equity | 193 | 209 | 199 | 395 | 402 |

| Investments and Bank balances other than cash | 122 | 116 | 40 | 183 | 136 |

| Net equity employed in operating business | 71 | 93 | 159 | 212 | 266 |

| PAT adjusted for Other income | 19 | 15 | 30 | 33 | 35 |

| Adjusted ROE | 26.80% | 16.10% | 18.90% | 15.60% | 13.20% |

The adjusted ROEs tapered off from FY22 onwards as IPO cash came in but are likely to trend back up as the newly commissioned injectables facility starts being utilized from Q4 FY24 onwards and more of the existing capacity is utilized.

Windlas Biotech Ltd net working capital days ranged between 27 and 84 between FY19 and FY23. There has been a steady increase in working capital days over the years. An increase in the number of SKUs and clients has necessitated more complex inventory management and, therefore, higher inventory levels. Also, an increase in the mix of trade generics in overall revenues has perhaps led to slightly higher debtor days.

Working Capital Days

| Metrics | FY19 | FY20 | FY21 | FY22 | FY23 |

| Inventory Days | 24 | 55 | 35 | 46 | 53 |

| Receivable Days | 79 | 71 | 68 | 87 | 83 |

| Payable Days | 73 | 92 | 34 | 50 | 62 |

| WC Days | 37 | 49 | 85 | 109 | 95 |

Windlas Biotech Ltd Peer Comparison

One of Windlas Biotech’s direct peers is Innova Captab Ltd, which was recently listed in December 2023. Innova Captab Ltd appears to have a more significant focus on acute medicines in its product portfolio. Innova Captab Ltd is experiencing rapid growth, as it is currently constructing a new greenfield facility in Jammu. Additionally, it acquired Sharon Bio-Medicine through NCLT proceedings in FY23.

Below is the analysis of Windlas Biotech Ltd and its peer Innova Captab Ltd based on Gross margins, EBITDA margins, CFO/EBITDA conversion, working capital days (WC days), Return on Equity (ROE)

| Windlas Biotech | Innova Captab | |||||||

| Metrics | FY21 | FY22 | FY23 | Average 3Y | FY21 | FY22 | FY23 | Average 3Y |

| Gross margins | 36% | 35% | 37% | 36% | 24% | 23% | 25% | 24% |

| EBITDA Margins | 13% | 11% | 12% | 12% | 13% | 12% | 12% | 13% |

| CFO/EBITDA | 21% | 17% | 101% | 46% | 76% | 61% | 59% | 66% |

| WC days | 85 | 109 | 95 | 97 | 106 | 106 | 104 | 105 |

| ROE | 8% | 10% | 11% | 9% | 24% | 31% | 25% | 26% |

Windlas Biotech Ltd Index Comparison

Windlas Biotech Ltd share performance vs S&P BSE Small cap Index as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Windlas Biotech Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

On the weekly charts, Windlas Biotech Ltd stock broke out of its IPO levels at 438, with a big volume spike in the first week of January 2024. Since then, Windlas Biotech Ltd stock has steadily gone up, with good Q3 results supporting the stock price. On weekly chart levels, 464 and 475 should act as decent support levels.

On daily charts, over the last 1Y, Windlas Biotech Ltd stock has generally respected 50 EMA levels. Windlas Biotech Ltd stock has breached 50 EMA on a daily closing basis only thrice, once in Sep 2023, once in Oct 2023, and once in Mar 2024. On two of those occasions, it did not breach 100 EMA, and it took support at 200 EMA in October and reverted. In the near term, 485 (March lows) and 462 (has tested and bounced thrice from these levels in 2024) should act as strong support. A good Q4 performance can break through the resistance at 580 and create a new All-time High (ATH)

Why You Should Consider Investing in Windlas Biotech Ltd

We should consider investing in Windlas Biotech Ltd. due to its strong business fundamentals, exposure to growing pharmaceutical segments, favorable revenue mix shift towards higher-margin products, acquisition opportunity, and the likelihood of benefiting from industry consolidation.

- Windlas Biotech Ltd’s business quality seems sound, with stable margins and decent cash flow generation. The return on capital adjusted for idle cash and investments on the balance sheet is also decent.

- The domestic formulations business is a steadily growing market with a large addressable market size. India’s expenditure on healthcare is still relatively low compared to other developing nations, so there is room for growth for many more years. The CDMO space is likely to grow a few percentage points higher as more branded pharma companies outsource their manufacturing. The trade generics segment will also grow due to the government’s push to make affordable medicines available to the masses.

- Windlas Biotech Ltd’s revenue mix is shifting towards high gross margin segments such as trade generics, exports, and injectables. This shift, coupled with improved capacity utilization of existing facilities, is expected to drive faster bottom-line growth compared to the top-line.

- There is an optionality of an acquisition. If management chooses the right target, it can be value accretive and provide a further boost to medium-term growth.

- Regulatory strictures and customer preferences may lead to consolidation in the formulations of CDMO business, which will benefit companies like Windlas Biotech Ltd.

Overall this microcap stock looks good to invest.

What are the Risks of Investing in Windlas Biotech Ltd

We have outlined the significant risks associated with investing in Windlas Biotech Ltd, including slower-than-expected growth in the CDMO segment, increased competition in trade generics, inefficient cash utilization and potential missteps with diversification efforts outside its core competencies.

- Management’s inability to grow the CDMO business at a mid-teens CAGR will slow down the Windlas Biotech Ltd overall growth prospects, as 75% of the revenues come from the CDMO segment.

- Slowdown of growth in trade generics segment – Branded formulations companies like Cipla, DRL, and Alkem are increasingly entering this market. However, considering the size of Windlas’ business, the entry of larger players should not hinder growth in this segment. Establishing a robust distribution network and gaining brand acceptance will be crucial for maintaining rapid growth in this area.

- Non-deployment of idle cash on the balance sheet to productive use – If the cash is not deployed towards value-accretive growth, it will continue to drag on return metrics.

- Diversification outside of the circle of competence, such as re-entering the US generics business, may not be the best use of management’s limited bandwidth and competencies.

Windlas Biotech Ltd Results (Q4FY24)

Windlas Biotech Ltd’s latest Quarterly Results highlight excellent performance on parameters like Revenue, EBITDA, and Profit on both QoQ and YoY basis

FY24 revenue growth was 23%, compared to the IPM growth of 7.6%. Growth momentum is consistent across five quarters in a row, Q4FY24 Revenue is up 22% YoY; EBITDA is up 30% YoY & EBITDA Margin is at 12.8%, Segmental Breakup—Generic Formulations CDMO is at 78%, Trade Generics & Institutional is at 20%, and exports are at 5% of Q4FY24 revenue. Segmental performance: Generic Formulations CDMO is up 14% YoY; Trade Generics & Institutional is up 58%, and Exports are up 27% YoY.

Growth in the Generic Formulation CDMO business vertical is driven by our sustained efforts to attract new customers, increase wallet share with current customers, and launch new products. Trade Generics & Institutional verticals continue to be robust, propelled by a broader product portfolio as well as expansion in the distribution network across the target market. The government is targeting to increase the Jan Aushadhi store count by 2.5 times to 25,000 by the end of FY ’26. This will provide added impetus to Trade Generics & Institutional business. We expect this growth momentum to be sustained going ahead.

| Q4FY24 | Q4FY23 | Q3FY24 | QoQ | YoY | |

| Revenue | 171 | 141 | 162 | 6% | 21% |

| GPM | 37.40% | 36.80% | 37.30% | ||

| Operating Profit | 22 | 16 | 20 | 10% | 38% |

| Other Income | 4 | 2 | 3 | ||

| EBITDA % | 13% | 11% | 12% | ||

| Depreciation | 4 | 4 | 3 | ||

| Interest | 0 | 0 | 0 | ||

| Profit before tax (PBT) | 23 | 15 | 20 | 15% | 53% |

| PBT % | 13% | 11% | 12% | ||

| Net profit (PAT) | 17 | 11 | 15 | 13% | 55% |

| Net Profit % | 10% | 8% | 9% | ||

| EPS | 8.17 | 5.38 | 7.26 | 13% | 52% |

Windlass Biotech Ltd. had its highest-ever EPS in FY24 and Q4 post-listing. The earnings per share (EPS) experienced growth: In FY24, the EPS stood at Rs27.97, a 42% YoY growth, and in Q4, it stood at Rs 8.17, a 52% YoY growth.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.

Disclosure (updated as of Sep 30, 2024) – Stock is part of our advisory portfolio. This was added in Q1 FY25 in customer accounts, our estimate of the reasonable BUY price range at the time of inception into the portfolio was 675 – 800. The exact BUY call for paid subscribers was issued on June 14, 2024