Global macro rumbles are finally here, though the effect of them on the trajectory of the Indian equity market is still unclear. We are seeing clear divergence on central bank action, for a change the US central bank is now following instead of leading rate action. The RBI is sitting comfortable playing a wait and watch game, they have no big concerns either on growth or inflation as of date. India’s regulators are trying to proactively prevent a few fault lines from developing in the financial markets and baking system. If not for their actions, maybe the financial conditions might have been more buoyant than they are today.

Not to offer a critique of policies, we are firmly in the camp that the Indian regulators have gotten more things right than wrong over the past decade. They also happen to know the ecosystem far better than we do. So onto what we are good at, investing for the medium term and calibrating to the changing texture of the equity market. The YTD return for the portfolio has been better than expected at ~25%, and the performance isn’t just driven by 1-2 stocks. Most of our bets have been working well, as it to be expected during a bull market.

It easy to sit back and attribute good return to skill during a bull market but history indicates otherwise. It takes greater skill to preserve profits once a bull run takes a breather; and to identify the next set of winners proactively. The portfolio tweaks we’ve been doing over the past few months are all in preparation of the eventual market pivot, whenever it occurs. At a philosophical level all we are doing is to prune exposure to pockets where good times are priced in and to increase exposure to pockets where we believe the market is underweighting the possibility of a return to good times. Sometimes that means leaving some money on the table, but proactively pruning exposure doesn’t hurt too much in a bull run if the pipeline of replacement ideas is good. We still haven’t reached a phase where we are struggling to find replacement ideas. Maybe that is a sign that our breadth of coverage is finally decent enough, though that won’t stop us from researching new ideas.

The great Indian SIP story has well and truly arrived. The monthly SIP gross inflow has moved from 8,000 odd Cr in 2018 to 20,000+ Cr today. While the MF industry has surely done it’s bit with the marketing campaigns on SIP, we should not discount the effort of the financial influencers in this regard. Some of them do spout a whole bunch of nonsense but their ability to connect with their audience is pretty good, they are able to funnel individual savings into the equity market at a rate the country has never seen before.

The July 2024 RBI bulletin has an interesting set of comments on this tsunami of household savings coming into the financial markets. Highlighting some of them

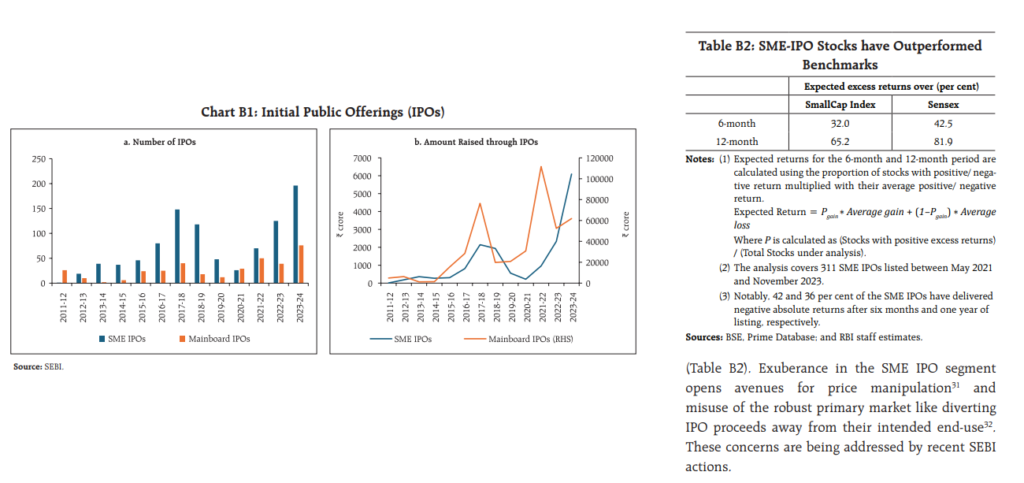

Without mincing any words, the RBI is telling retail investors to stay the hell away from SME IPO’s and SME stocks in general.

But when it comes to the investing culture the RBI appears to be optimistic, though being cautious is their natural state

Gross household financial savings being funneled into the equity market has almost become linear and predictable on a YoY basis. Such a trend usually indicates culture & habit rather than a logical, calculating decision of investing into the equity market. A quick interaction with any cross section of the educated population in India indicates that the interest level in investing has risen tangibly over the past few years, you have categories like students, young working professionals, retirees and housewives all investing into the equity market to a much greater extent today.

This statement from the “State of the economy” section of the report summarizes the view that most of us intuitively have today

The RBI Governor in FY21 had cautioned on the valuation of the Indian equity market, raising eyebrows then. From there to now where the RBI Bulletin acknowledges that the “current momentum may be sustained” is a considerable change. One of the best indicators of the market’s view on how well the market is expected to do is the share prices of listed capital markets businesses. Within this segment, one should focus more on the stocks that are well placed to benefit from the equity savings culture (rather than the broking segment that is driving revenue more off F&O activity). Just observe the price charts of listed AMC’s and wealth managers, any change in the price narrative of the Indian equity market should first reflect there. So long as these stocks keep heading higher, one shouldn’t worry excessively about an impending correction.

Our stance is still to continue to enthusiastically participate in the current rally, but in a much more judicious manner. If FY24 was a broad market bull run, we believe that FY25 is likely to get narrower on price action as the bull run matures. If an investor can broadly get the earnings trajectory right for a business over the next 12 months (easier said than done), markets have to reward the story if liquidity doesn’t shrink.

With every new macro shock (we expect a few to materialize over the next few months), one will observe that not all stocks will move with the previous level of momentum; and that some stocks will move with higher momentum following every small correction. In a counterintuitive way, we should welcome episodes of macro volatility because that will prevent a one sided market rally. A time correction along with periodic volatility can reduce the possibility of an eventual price correction in the broader markets. Periodic corrections also reveal the pockets of high relative strength, fundamental investors can then get a sense of where they need to direct their efforts on new stock coverage.

Anyone who is serious about becoming a full time investor or about managing money for others should find himself getting excited thinking about the various possibilities that can materialize the indicators one needs to focus on. Success is investing calls for a particular type of personality in addition to tangible skills. You will rarely see a good investor being the life of a party, it is just that they are excited about different things in life compared to the average bloke.

The Indian equity market appears to be in the mood to reward those who are willing to put in the hard work and stay the course over the next 5-10 years. Vibrant equity & entrepreneurial markets eventually lead to the wealth effect, beneficiaries of good market runs pass on this optimism to other pockets like real estate, lifestyle experiences, wining & dining and premium travel. Periodic hiccups cannot be avoided but the long term trend is very much in our favor as of date. It will take a large, prolonged fall in the equity market for the current equity savings culture to get punctured. What kills the interest level is not a 2008 or 2020 like correction but a sustained period of no returns like 2010-13. Like the one that materialized in the US for almost a decade after the NIFTY FIFTY crash of the 70’s.

Work hard (and party hard if you wish), but stay optimistic and continue to take calculated risks in India. Have a mechanism that allows you to calibrate to market changes, build strong investing networks and ensure that you have enough divergent view points before you put long term capital to work.