A slew of bad developments have transpired through August. The much hyped Trump-Modi bonhomie came a cropper and the current US regime has been coming at India like a jilted lover. The geopolitical action has now shifted to the BRICS axis, countries who find themselves battling a common adversary in spite of obvious differences. Who needs movies when real life can get so entertaining?

Amongst all of these headlines news and theories, the recent Q1 GDP number in India has surprised many and disappointed a few at the same time. Nominal GDP growth of 8.8% is well under par and below the Budget math for FY26. Real GDP growth of 7.85% is propped up by benign inflation, while PFCE continues to struggle even on a low base. The GST rationalization announcement by the PM on August 15 may put a spanner in consumer spending till the rate finalization materializes. No Indian consumer will want to make big ticket purchases with the prospect of a pricing change looming, especially one for the better. We hope that the policy makers make up their mind soon, else we might see a dip in consumer spending brought about inadvertently.

Over the past 6 months, we have seen three massive policy moves in India –

- Income Tax change in the 2025 Budget that puts an annual salary of INR 12L outside the tax regime

- Front loaded rate cuts by the RBI when they weren’t under any great pressure to cut

- GST rationalization with the intent of giving indirect tax relief to consumers

We see these changes as an “all in” effort by the Govt and the central bank to spur domestic consumption out of the three year lull since 2022. While the rural economy buoyancy is starting to make the news and showing up in healthier 2W sales numbers, the urban market recovery has been very category and channel specific. FMCG players have spoken about better times ahead in the Q1 earnings commentary but the entire hope seems to be built on a good H2. Many discretionary categories are still ailing, while a few like travel & hotels are doing well. India is primarily a services economy that needs private consumption to fire for the GDP trend to print a healthy number.

With Govt capex spending projected to moderate to 10-12% YoY growth as per Budget math, GFCF alone may not be able to do the heavy lifting any more. Government fiscal math may get constrained by handout spending, with the GST & Income tax rationalization further imposing restrictions. One doesn’t need to do detailed macroeconomic math to realize that the Govt may need to bring back focus on divestments to make up for the shortfall in FY26 and FY27. The 10 year G-sec YTM has risen from 6.15% odd to 6.62% in almost no time after a rating upgrade for the country! When in doubt about fiscal math just look at the USD-INR and the 10 year G-sec yield, they usually tell the story much better than anything else. Throw in the sustained FPI selling of ~47k Cr a month over July and August and you’ll notice that all three classes in India – headline equity, government debt and the INR have had a tough couple of months. Resonance in all three classes has signaled pivot points in the past, we’ll see if this time will be different in a few months time.

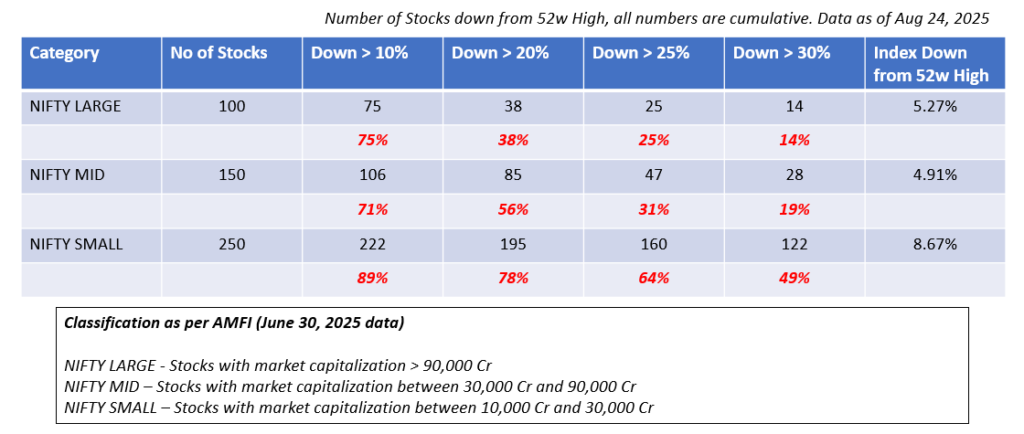

How has the broader market been faring in the meanwhile? This table should make this very clear

The headline indices are masking the pain in the broader market, unless you’ve been living under a rock you would have already felt this in your portfolio. This has been the trend in every reset/pivot year in India that has been occurring every 3-4 years, ever since the 2008 GFC reset. The longer this continues, the louder the passive investing voice will become. And rightly so, since passive investing looks like the best approach after every such STOP cycle in India (we’ve been writing about the START STOP nature of the Indian market for some years now). The natural outcome of this trend is that equity MF as a category does better than PMS and AIF on an average during such pivot periods. The same rules that make equity mutual funds appear inefficient during a bull run make capital preservation much easier during a falling/sideways market. From an allocation point of view, index funds & equity mutual funds have a place in the portfolio for this very reason. Anything that can provide a semblance of stability during volatile times enhances the staying power of investors, often underrated in the search for alpha.

The good news is that this tug of war between passive/active investing and MF/PMS performance tends to average out over a 4-5 year period. The bad news is that most investors will lose patience and end up chasing performance with a lag, only to end up with average outcomes over a 5 year cycle. The other notable fragility within the direct equity focused retail & affluent investor community right now is that the best narrative gets disproportionate eyeballs and flows. A few stocks that looked like a home run till February are struggling right now as investors realize that narrative is slave to macroeconomics, policy and more importantly, earnings.

The best performing stocks within our Emerging Business research offering right now are from pockets that had a lot of uncertainty going into Q3 earnings season, they surely didn’t look like they would be the portfolio leaders in a few months. Which is why we wanted to start on a conservative note (high cash allocation until June) with a balanced allocation rather than a concentrated one. We believe that a concentrated portfolio is usually the outcome and may not be the best starting point by itself. A balanced start makes allowance for a few macro shocks and judgement lapses which can set you back by a lot in a heavily concentrated portfolio. Very few investors can stay calm in the face of a 30% fall in a 10% allocation stock.

On the other hand, our recent additions to the Flexicap portfolio are doing far better than the legacy ones on an average. Which we see as an input from the market that we need to get more active on this front through this pivot year. We’ve had a larger market cap bias in the recent additions and this is clearly one tangible factor. The post COVID run has trained investors to disregard most larger stocks (market cap > 25,000 Cr) in favor of smaller ones, if we were to make a general observation. Who is to say that the next run won’t be led by the larger stocks? Especially if GDP growth turns in worse than anticipated? Any one who has invested through the 2018-21 period will know exactly what we are referring to. It is important to keep an open mind rather than be deterministic on how things can turn out from here.

H2 of this financial year is a very important milestone for India. We will hopefully see better growth and better earnings with a resurgence in consumption across the board. If we do not, the market will take more time to build conviction on current prices. Of course, lower rates in India and the developed world will help with valuation. With fixed income yields being low and the duration trade turning very volatile, growth assets like equity will continue to be in favor. SIP inflows have only been getting stronger which indicates that regular allocation to the equity market has become a habit for the younger folks today. This can set up the Indian equity market for good times in the coming years, if only the economy manages to deliver healthy numbers on the back of recent policy actions.

Equity investors will need to stay patient till the next bout of FPI inflows materialize. At the risk of being repetitive, the Indian equity market is most sensitive to a directional change in the FPI flows. The sixth positive month may not move the needle much but the first positive month usually moves the needle by 4-5%. One whole year of liquid fund returns can be delivered by the NIFTY 50 within one single month when things align. This non-linear nature of the equity market is what creates the window of opportunity for winners and losers, else every equity investor would go home with 12% p.a. over a 10 year period.

The bane of the investing profession is that fund inflows peak when the ability of the fund manager to deliver alpha is the least and vice versa. We don’t see this going away anytime soon. If one has signed up for this career, this is the ground reality that one needs to become better at managing.

Hopefully we will see better days in the equity market at some point in FY26. Better days tend to begin when least expected, we will see if this time will be any different.