It is easy to get lost in the din of what is happening in individual stocks and specific portfolios, especially when the going has been good. But every once in a while, it is good to take a step back and see the overall picture. We have a simple rule at work – data first and foremost, interpretations and gyan later. Excessive focus on the specific business or stock can keep us from appreciating the steady, impactful change happening around us.

In this edition we want to focus on the bigger picture of what is happening to the operating environment in India and if things are indeed different compared to the previous decade. Anyone operating today with a post 2016 lens is underperforming big time, like an enthusiastic student who is writing the “correct” answers but ends up getting a below par grade in the evaluation. No better place to start than the regular RBI publications. This is the one institution that had the guts to stick it’s neck out and call for a high growth rate in India when all other economists were predicting a slowdown.

Most of the charts and data points here are from the RBI Bulletin of January 2024

Observe how the baton of growth has been decisively handed over to GFCF (capex formation) from private consumption that was the bigger contributor till 2021. PFCE is not just lower in contribution but also slowing down YoY. At some point of time, the base year will become favorable and growth will become healthy again; but it may not be worth 60 PE in the eyes of the market. In terms of relative attractiveness, a 25 PE capex story growing at 20% may look better than 60 PE consumer story growing at 15% for many investors. Valuation multiples aren’t just about absolute growth rates & interest rates, they are also about relative attractiveness in a specific market.

The Red sea disruption has the potential to be a serious problem if not addressed in the near future. Many sectors have been speaking of inventory rationalization through CY23, what if the channel is forced to stock up again given that container movement is taking longer and becoming more expensive since December?

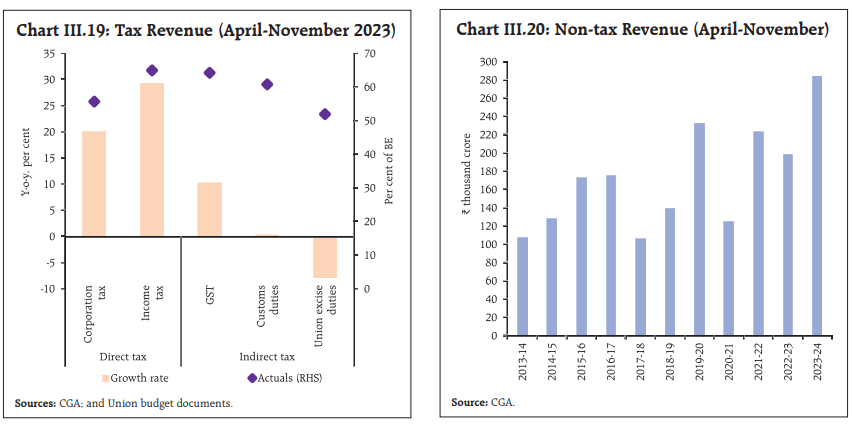

The higher capital expenditure by the Indian Govt since FY22 is not associated with a corresponding rise in deficits. This is by far the biggest positive for India’s infra sector, all these years the central Govt had to worry about deficits and that stopped them from doing the capex that our economy needs. Think of the implications for bond markets due to this, is it really a coincidence that the Indian bonds are finally getting included in the global bond indices?

Corporation tax and Income tax collections have grown at > 20% for 9M FY24. Once we take into account that < 2.5 Cr individuals in India actually pay income tax, it becomes evident that only a few of us are participating in the vibrant asset markets as of now. No wonder flights & restaurants are full, SUV’s are selling like hot cakes and premium real estate is witnessing buoyancy. GST collections might see a slowdown YoY to the 9-10% range since inflation is trending down, but there are enough other avenues firing to keep Govt spending going for some more time. We don’t see any news on Govt divestment these days, do we?

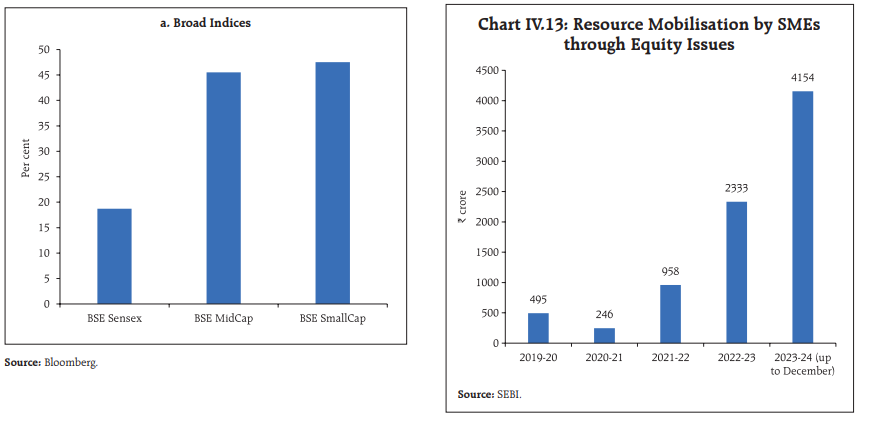

The market buoyancy outside of the NIFTY 100 is evident across segments, this SME listing boom cannot end well. So if you are a subscriber who is slightly frustrated with our reluctance to add too many new names from these pockets, now you know why. Valuation multiples have risen significantly in the mid & small cap segments, paying 40 PE for a business needs an investor to have a lot of confidence in the medium term earnings trajectory. Very few small cap businesses offer that kind of predictability.

Wonder why the RBI is sounding a note of caution on retail unsecured lending? One of the under appreciated aspects of the current capex revival (both Govt & Private) is the reduced reliance on debt. If the largest companies in India can fund a good chunk of their capex through internal accruals, banks will have no other option than to chase retail & SME credit to keep credit growth at 15%+. The competition for assets will eventually lead to lax underwriting standards over time as sales teams are forced to chase growth. The RBI is just being proactive here in ensuring the bubble doesn’t get built up too soon, especially in vulnerable retail sections. Junta taking sub INR 50,000 loans to fund their consumption aspirations is fraught with risks.

There are enough trends in these charts to make us think hard about portfolio positioning for the rest of CY24. And we need to consider the impact of global macro and valuation in addition to these. Exactly the reason why we aren’t fans of a pure momentum driven investing approach, we refuse to get sucked into steep rallies without building an understanding of the fundamentals involved. Our sense is that the market is shaping itself for a pivot in the upcoming months. We are proactively preparing for this without coming to any rigid conclusions yet.

Sector limits will become very crucial going forward, when the air fizzles out of a hot sector/segment, prices can fall 15% in no time. In small, micro & SME segments liquidity just goes out all of a sudden after a few lurches and false starts. Please don’t get stuck in these segments without an exit plan. The worst outcome is reserved for those who hop onto a late stage trend, you get hit with a price correction first and are then forced to become a long term investor.

Incremental equity deployment (at least in our case) will need both of these to be in place – confidence of better earnings and reasonable valuation. And it is time to be market cap agnostic right now, not the time to shy away from bets in the large cap segment when one can make 15% p.a. over the next 2-3 years.

Investors need to be ahead of the trend after understanding the current trends well, this is the essence of prudent investing. Sometimes we are wrong, at other times we may be too early; but the guessing game is a permanent fixture of investing and we cannot wish this away.