June was a brute of a month on the upside, the average large cap mutual fund delivered of 7% in the period. All words of caution and restraint went for a walk as the market went into a party mode as if the incumbent Govt had come back to power with “400 paar”. Just goes to show how little the market cared about the actual political outcome, so long as it got what it wanted – political and policy continuity. The election result day saw a massive 20,000+ Cr being pumped in by retail in a single session, an unthinkable situation even 2-3 years ago. We see this single session alone as a confirmation of a few things that appear to be entrenched in the Indian market –

- The MF industry can finally rejoice that they have successfully sold the “mutual fund sahi hai” narrative

- Bulk of the retail investors today view every 5% dip as one to be bought into

- There are willing buyers ready at high prices, prices that many institutional investors aren’t willing to pay

- Our reliance on FPI’s has come down to a large extent compared to even 2021, leave alone 2014

- “Equity market ko to upar hi jaana hai” – this is cemented to such an extent that people aren’t aware of what can hit them

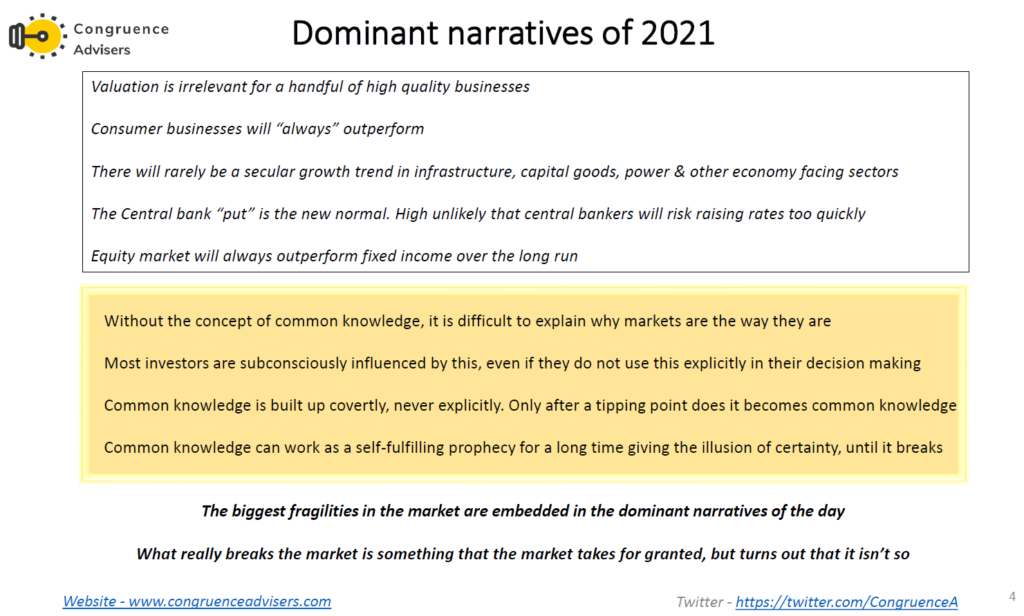

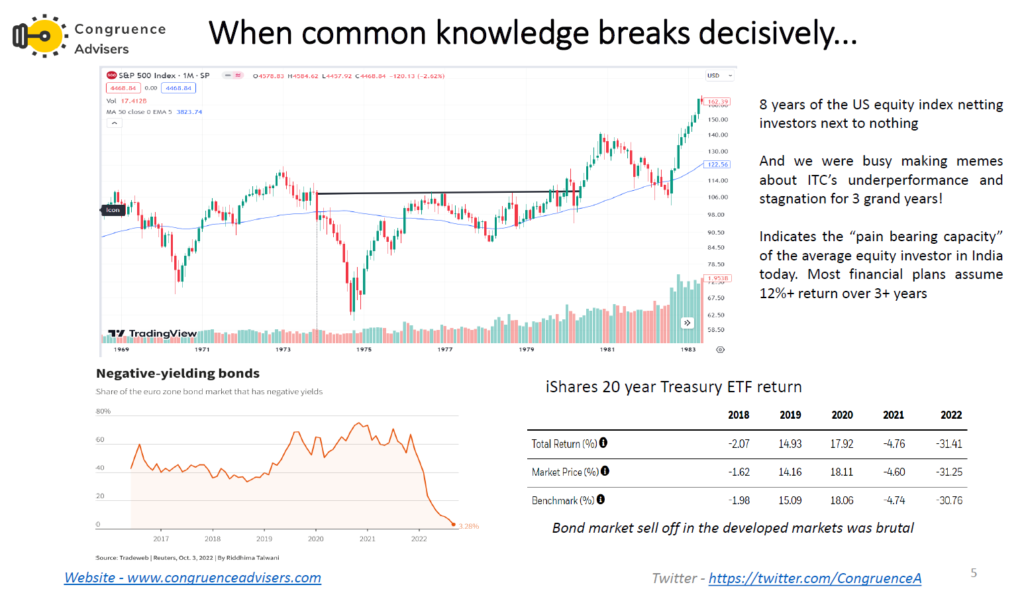

Fear mongering isn’t something we believe in; our career and survival depends on the equity market doing well over the long term. But that shouldn’t stop us from focusing on the fault lines and fragilities building up in our equity market. And we’ve been thinking about this for some time now, a snapshot our presentation at an investment summit in Aug 2023

These two slides should scare you if you are a rational investor. This 8 years of no return in the US market was after the narrative that no price was high enough for the best businesses in the US was cemented. While we aren’t yet there in India, we might well be on that track right now.

There is another recent trend that deserves a good amount of thought

The revival of many stocks from the IT Services & FMCG sectors since June 4. There is a clear divergence of views between the experience, institutional hands who manage large pools of capital and the retail segment where one doesn’t need to worry too much about agility and quick exits. Almost every institutional investor we’ve interacted with recently is nervously prancing around as the market heads higher in a few pockets almost every day. Concerns on valuation & a gush of liquidity prevent them from loading up on the hot stocks of the day; for they know that pulling out even 20 Cr from a stock once the trend reverses can get ugly. These are the folks taking early positions in IT Services and FMCG stocks, they are banking on a revival there within the next 12-24 months and don’t mind being early in the trade. They figure these are the pockets where large entries and exits can be taken seamlessly without having to worry about business quality, liquidity & earnings growth over the medium term.

While the non-institutional junta is happy deploying incremental capital into the same set of names – PSU, defence, Infra, power and associated sectors. They are also fine with loading up on sectors where the unit economics is yet to be proven, so far the market has rewarded them handsomely. What was a narrow market in the initial stages has now transformed into a broad based bull market across themes and sectors. When return is everywhere, it goes without saying that risks are being underweighted.

We would love for both of them to be proven right with their respective bets, but history and probability dictate that only one of them will be proven to be right. The real question to be asked is – “Who stands to lose more if proven wrong?“. The answer is pretty obvious. This is why experienced investors usually lag newer investors in a scorching bull run. They can think of more risks and are more focused on survival as a result. New investors have their foot on the accelerator and make the most of a bull run so long as it lasts, they lose the plot only after the trend reverses.

The implications for portfolio management over the next 6 months are clear. This is what we plan to do –

Insist on reasonable valuation in an absolute sense before adding any new names. Bull markets force us down the quality curve, so this focus by itself can lead to mistakes. Hence put your BQ MQ filters and weed out names before you look at valuation. If what remains is still expensive, be willing to stay in a liquid fund for a while.

Run your estimates for the next 5-6 quarters and base your conviction on expected earnings and numbers, not off market action. Just because a stock goes down 20% it doesn’t mean you sell out, if you believe earnings growth can justify current valuation. On the other hand, if a stock trades at 35 PE the expected earnings growth over the next 12 months better be 20%+

Stay diversified across market cap, investing styles, sectors & business models – if it means you buy a few more stocks than you usually do, so be it. Diversification when done well can be an alpha generator too, especially during a late stage bull market. You have a wide enough fishing net to evaluate what is being bid up and what is being sold off. Once a mini cycle ends, a newer set of winners emerge. The time to get back to concentration would be then.

The market will go bonkers on a few names till the upswing lasts. Have a clear approach for when you want to prune your winners and by how much. Leaving some money on the table shouldn’t matter too much if you have 15+ names in the portfolio. If you are early to book out somewhere, that opportunity loss will be made up somewhere else.

The default primary approach of the new direct equity investors appears to be TA, be prepared for self reinforcing loops of bullishness and bearishness in the hot names of the day. Lower price triggers more exits for some TA practitioners and vice versa. Stocks overextending both on the upside and downside is to be expected. It takes more hard work to understand the fundamentals of a business than to draw squiggly lines on a chart after a 1 week crash course.

Respect sector and stock limits, no matter what. Do remember that everything looks hunky dory at the peak of a bull run, that complacency is what sinks optimistic investors in a bull run.

Have an eye on the macros, the world is becoming more active politically in 2024. Policy decisions can be taken in a jiffy by leaders who have vote banks to answer to. Spend some time every week to get a sense of what is going on around the world, the 2024 US Election can get uglier than the 2020 one.

We are definitely in a more cautious mode on some pockets of the market, even if we aren’t convinced that the entire market is overvalued. Realistic expectations should drive decision making from here rather than potential growth and the India shining narrative.

We are still able to find some reasonably valued names, though price action is taking them away from reasonable valuation much faster today.