Take a good, hard look at your portfolio and your own mood & behavior since this bout of volatility began.

If you find yourself having doubts about the businesses and stocks you were really excited by till they fell 15%, you have some introspection to do. It is easy to BS yourself that you are passionate about investing so long as the going is good, periods of correction will reveal who you really are. Any newfound love or appreciation you had for a new investing skill that appeared to work very reliably till July 2024 would have been tested to some degree. Good marketing doesn’t amount to good investing, keep that in mind before you subscribe to some investing gyan guru who proclaims to have found a sure shot way. I’ve been looking for a “sure shot” way to invest for more than 15 years now but the market continues to teach me lessons in every pivot.

Mike Tyson very eloquently said “everyone got a plan for me till I punch them in the face”. Ronnie Coleman said something very profound too – “everyone wanna be a bodybuilder but nobody wanna lift no heavy ass weight”. There is no walking away from some fundamental truths of life, no matter how accomplished or experienced you are at your craft. When it comes to investing success, you will have to live through many drawdowns, some of which will be short lived while some others can extend for years.

If your portfolio has fallen < 10% from the peak while outperforming the BSE 500 YTD, you can give yourself a pat on the back for the time being. But such victories can be short lived, the next down leg of 5% on the NIFTY 50 (if and when it happens) can turn out to be very different for small & micro caps compared to the recent past. The need of the hour is to focus on the basics and have execution clarity when the opportunity presents itself on your set of chosen stocks. Do remember that the next set of winners will be different from the ones that have led for the past 12-18 months.

Q2 FY25 earnings season so far has been a horror show for some businesses. Some of the most widely acknowledged high quality businesses in India have been taken to the cleaners by the market post Q2 results. This is what happens when the cloak of invincibility goes, both the numbers and the valuation multiple fall making a mega cap behave like a micro cap in a market correction. Reminds me of the ending of the movie Black Death; a group of knights is sent by the Church to investigate why a particular village has been immune to the effect of plague so far. Eventually it turns out that there was no secret or necromancer at work, the village was just far and hence was spared till the arrival of the knights. Eventually the disease takes its toll on the village too. Kind of sums up the situation for many high quality stocks right now – the operating environment eventually got to them, pricking the bubble of certainty of earnings that investors had built up in their minds.

With the US Election clarity now in place, one can assume that many aspects of policy will be questioned by Mr. Trump in his second term. Some of these decisions will affect the operating environment for businesses across the globe, depending on how exposed they are to the export market, their sector of operation and who they compete with. Right now is not an easy time for medium term decision making, with the domestic environment taking a turn for the worse in Q2 (even if short lived) and policy volatility anticipated in the US, where do investors allocate capital?

We are at an interesting juncture where there is divergence between the Q2 numbers for the listed universe and the RBI expectations for GDP growth for FY25. The RBI continues to hold it’s stance of 7%+ GDP growth through FY25

Can we have a situation where the real GDP grows by 7% for FY25 but the largest listed businesses in India lament about muted growth across the board?

How can the rise in rental yields and property prices across metro cities be accompanied by one of the worst urban hiring markets we have experienced in recent years? Fresh hiring and healthy wage growth are the best indicators for real estate growth over the medium term, if one keeps aside the luxury segments.

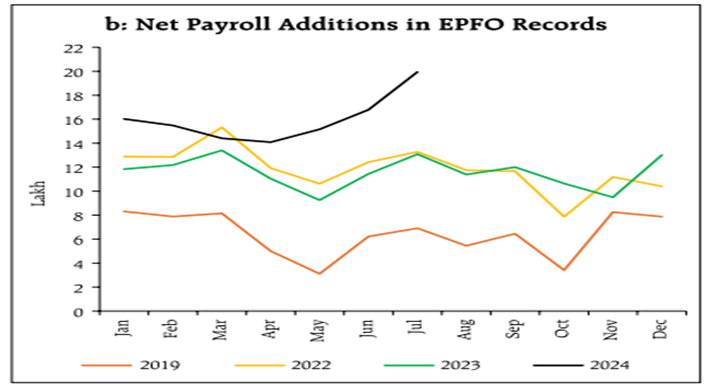

How does one reconcile this chart from the RBI Monthly Bulletin of October to what one is experiencing on a daily basis as an employee? Is this spike of payroll additions driven by higher compliance or by better hiring numbers?

With the microfinance sector running into rough weather and credit disbursal there set to see a steep fall through H2 FY25, to what extent can the expected rural revival get dented? 2W sales through the festive season don’t inspire any cheer yet

With the RBI further tightening the lending environment for NBFCs, HFCs and unsecured, low ticket retail lending for banks, what exactly are they banking on when they expect private consumption spending (PFCE) to revive in H2 FY25?

Given where we are, one of the few good probability bets one can make is that Govt capex spending is likely to come back in a big way in H2 FY25 and FY26. One should expect to see a constant barrage of order inflows for the largest PSU & EPC businesses operating across the Infra, Power, Defense & Capital Goods sectors soon. We will be tracking this keenly at Congruence Advisers, given our current portfolio construct and the operating environment.

Over the past few years, we would have observed that the primary approach for the new crop of direct equity investors is trend following and technical analysis, it is no longer fundamentals based investing. While the SIP inflows increasing through October is a very healthy sign, there is a pocket of hot money within retail investing that will all want to exit at the same time. This pocket isn’t big enough to move the needle on a HDFC Bank or HUL but it can surely move the needle on a 1500 Cr micro cap stock where they have all piled on looking at the same trend line. If that trend line were to break for whatever reason, sell triggers will go off across this pocket at the same time. For this reason, we aren’t yet trusting the “relative strength” of the small cap and micro cap indices so far. Beyond a threshold, they can fall steeply for frivolous reasons in no time.

All we can do right now is to have clarity on the investment timeframe and the price we are comfortable with for the businesses where we think earnings growth will be healthy over the next 1-3 years. This becomes very important once the “buy high, sell higher” phase of the market takes a pause or gets broken, as we have experienced recently.

More equity research and less investment philosophy for us over the next few months, irrespective of what happens to prices. Even through this bout of volatility there are businesses that have delivered 20%+ growth and have visibility of healthy growth into the medium term future. The index is not the market and the market is not the index, if you are an active investor.