Can Garware Hi-Tech Films Product Innovation Drive Company Growth Despite Corporate Governance Challenges – Garware Hi-Tech Films (GHFL) is an established Indian manufacturer with decades of experience in the polyester film industry. Garware Hi-Tech Films maintains a robust global presence, exporting products to over 90 countries (83% revenue in Q3FY24). Historically, Garware Hi-Tech Films has navigated industry-wide challenges such as product commoditization, regulatory hurdles, and intense competition. A strategic pivot initiated in FY15 led Garware Hi-Tech Films to focus on value-added specialty films and expand its reach in export markets. This transformation and a lucrative 2020 diversification into the automotive protective films sector have resulted in appreciable growth.

Garware Hi-Tech Films offers a unique investment proposition in the specialty film sector. Despite legacy corporate governance issues, its differentiated value-added products (sun control films and paint protection films), export success, rapid scaling of Paint protection films revenues, and recent market developments in the US present an interesting opportunity. Ambitious management targets (2500 Cr revenues by FY26-27) and steps towards unlocking value from their balance sheet add to the outlook.

Garware Hi-Tech Films Fundamental Analysis

The Fundamental analysis of Garware Hi-Tech Films aims to analyze parameters such as revenue, gross profit, EBITDA, net profit, and more.

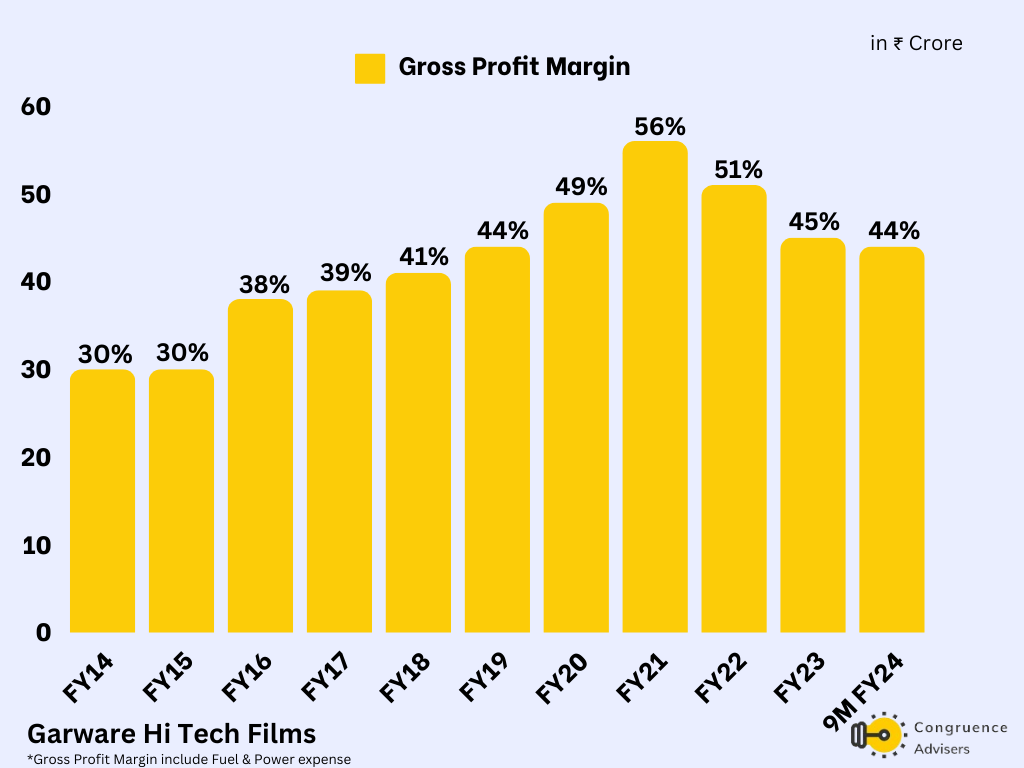

Revenue & Gross profit has grown at a CAGR of 11%, while PBT has grown at a CAGR of 16% & Profit After tax doubled from FY19 to FY23 (19% CAGR) due to value-added products & better product mix; gross profit margin has increased over the years, peaking at 56% in FY21 before dropping back to 45% in FY23 due to slowdown in IPD division, EBITDA margins have improved from 15% in FY19 to a high of 22% in FY21 but then moderated to 16% by FY23.

| Profit & Loss | FY19 | FY20 | FY21 | FY22 | FY23 | CAGR(FY19-23) |

| Revenue | 948 | 925 | 989 | 1,303 | 1,438 | 11% |

| Gross Profit | 419 | 457 | 554 | 667 | 646 | 11% |

| Gross Profit % | 44% | 49% | 56% | 51% | 45% | |

| Employee Cost | 8% | 10% | 11% | 9% | 8% | |

| EBITDA Margin | 15% | 17% | 22% | 18% | 16% | |

| Other Income | 9 | 12 | 15 | 39 | 42 | |

| Depreciation | 14 | 20 | 24 | 28 | 32 | |

| Interest | 19 | 18 | 20 | 18 | 17 | |

| Profit before tax (PBT) | 120 | 135 | 190 | 231 | 220 | 16% |

| PBT % | 13% | 15% | 19% | 18% | 15% | |

| Net profit (PAT) | 82 | 86 | 126 | 167 | 166 | 19% |

| Net Profit % | 9% | 9% | 13% | 13% | 12% | |

| No. of Equity Shares | 2.32 | 2.32 | 2.32 | 2.32 | 2.32 | |

| EPS | 35.1 | 37.0 | 54.2 | 72.0 | 71.5 |

Garware Hi-Tech Films Company Summary

Garware Hi-Tech Films is a niche player in India’s polyester film manufacturing industry. Garware Hi-Tech Films was founded in 1977 and is one of the industry’s pioneers. Its value-added products basket, which it developed over the past two decades, sets it apart from other domestic manufacturers of polyester film (which are much larger).

Garware Hi-Tech Films is the only Indian company that manufactures sun control films and paint protection films. These value-added products offer higher gross margins and are much less prone to cyclical fluctuations, unlike the more commoditized BOPP/BOPET film industry. Garware Hi-Tech Films is able to innovate due to decades of experience in plastics and polymers. Its backward integrated production capability allows it to produce crucial intermediate products from petrochemicals in-house, making it different from its Indian counterparts.

Garware Hi-Tech Films Family Structure

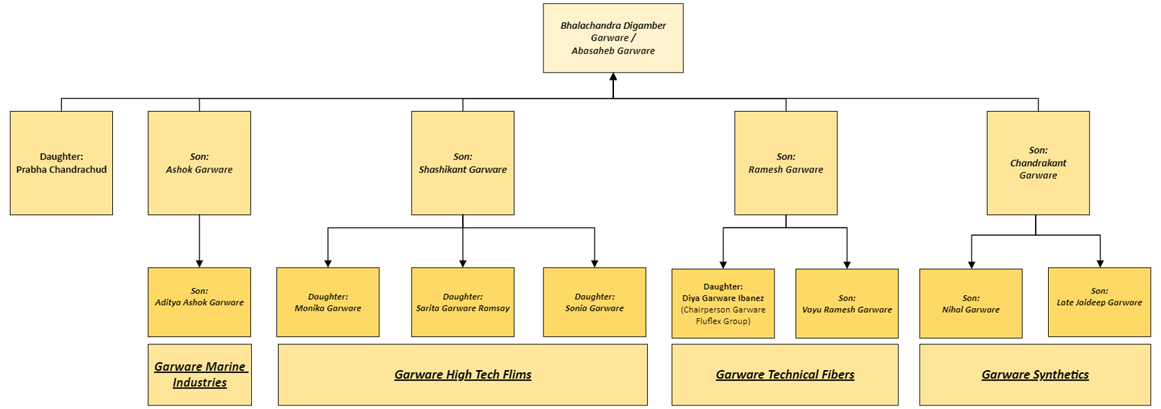

In this section of Garware Hi-Tech Films Family Structure, we will delve into the Garware Group Family structure, a diversified Indian conglomerate with a rich history. While the group has achieved significant financial success, particularly with Garware Technical Fibres, we will also examine corporate governance concerns that could impact investor confidence.

Garware Group is a Pune-based Indian conglomerate founded in 1933 with diverse business interests in Technical Textiles, Polyester Films, Fisheries, Aquaculture Wall Ropes, Oil exploration, etc.

The Garware Group, established by Dr. Bhalchandra Digamber Garware, comprises four companies, each operated by one of his sons: Ramesh Garware (Garware Technical Fibres), Shashikant Garware (Garware Hi-Tech Films), Chandrakant Garware (Garware Synthetics), and Ashok Garware (Garware Marine Ind). Of the four listed companies, Garware Technical and Garware Hi-Tech seem fully operational. However, Garware Group exhibits shortcomings in corporate governance. Key concerns include excessive promoter compensation, related-party transactions, and a track record that suggests minority shareholder interest hasn’t been given the priority it deserves.

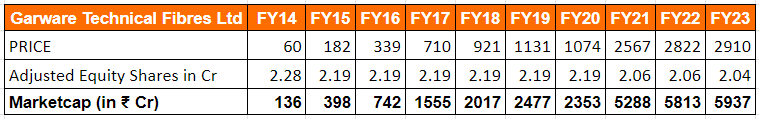

Despite these shortcomings in corporate governance, Garware Technical Fibres has created enormous wealth for shareholders, from a 136 Cr market cap in 2014 to 5937 Cr in FY23 (6,521 Cr As of 4th May 2024), delivering a CAGR of 52.12% FROM FY14 to FY23.

Garware Family Tree

Garware Hi-Tech Films is from the stables of the Garware Group of Industries, which is regarded as one of the pioneers of the thermoplastics industry in India. Garware Technical Fibres (MCap 6521Cr as of 4 May 2024) is its sister company. It is Chaired by Mr Vayu Garware, who holds familial ties as the nephew to Dr SB Garware and cousin to Ms Monika and Sarita Garware.

Along with its product innovation, Garware Hi-Tech Films has demonstrated remarkable skill and ambition in scaling its brands globally. In 2012, it showed impressive resilience in pivoting to international markets after India banned sun-control films on vehicles for safety reasons. While these qualities have served the company and its shareholders well over the years, the company has often suffered from a history of dubious corporate governance, which has led to its valuation being significantly lower than what its business quality would command.

This juxtaposition of excellent product quality and global reach with dubious corporate governance practices makes Garware Hi-Tech Films an Interesting case study in the context of investment.

Garware Hi-Tech Films Management Details

Garware, Hi-Tech Films Management Details spotlight the significant role of the Garware family and the experience of its management members in various functions. Garware High-tech Films is a promoter-run & Promoter-driven company; Dr. SB Garware (who is now 89 years old) chairs Garware Hi-Tech Films. His daughters, Ms Monika Garware and Ms. Sarita Garware, are co-managers. Each daughter takes care of different segments & they keep rotating these responsibilities among each other.

| Name | Designation | Experience |

| Dr. S. B. Garware (89 years old) |

Chairman & MD | Graduated from Dulwich College, England, and studied Senior Business Management course at the University of EdinburghHas held prestigious posts such as President of Maharashtra Chamber of Commerce, Director – LIC, Director – SBI, Honorary Counsel General of Turkey – Western India Office |

| Ms. Monika Garware | Vice Chairperson & Joint MD (Promoter) | Graduate from Vassar College, NY & MBA – Pace University – Lubin School of Business, NYLooks after production, R&D, innovation, finance, legal, corporate strategy, and business development |

| Mrs. Sarita Garware Ramsay | Joint MD (Promoter) | MBA degree from European University. She has vast experience in Marketing & Corporate AffairsHandles the company’s HR, production and operations management, R&D, domestic sales |

| Ms. Sonia Garware | Director (Promoter) | MBA degree from Boston College, USA.Handles international sales, marketing, finance, business development, and strategy. |

| Mr. Pradeep Mehta | CFO | CA28 years of experience, Ex- Grasim, Ex- Jspl, Ex – Essar |

| MR. M. S. ADSUL | DIRECTOR TECHNICAL | Alums of UDCT Mumbai40 years of experience in Plastics & Polymer Engineering |

| M R. DEEPAK JOSHI | DIRECTOR SALES AND MARKETING | MBA, BTECH (Man-Made Fiber Technology), 3 decades of experience in strategic procurement, supply chain, E-procurement & etc |

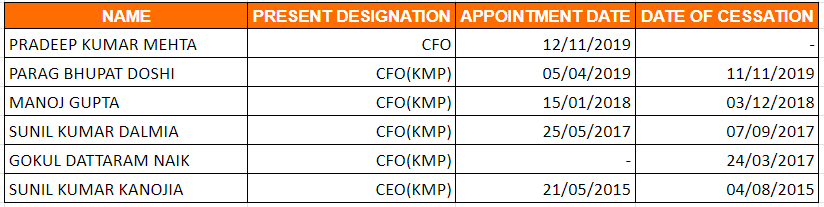

Garware Tech Films has suffered from CFO instability, but Mr Pardeep Joshi’s tenure since 2019 suggests a potential shift towards a more stable leadership structure.

Garware Hi-Tech Films Product Details

Garware Hi-Tech Films broadly manufactures 3 types of products.

- Paint Protection Films (PPF) are used in automobiles to shield car paint from chips and damage (Garware Hi-Tech Films is the only manufacturer in India). However, Paint Protection Films installation can be expensive, costing over 1 lakh INR to cover a whole vehicle; the USA and Europe account for the majority of the market. In India, Paint Protection Films is still in the early stages of adoption, but demand is expected to rise as the sale of premium cars increases; even in established markets like the US and Europe, there’s room for growth. While major players like XPEL, 3M, and Eastman dominate the US market, there’s still space for new entrants to grab a share.

- Sun control films (SCF) and safety films (Garware Hi-Tech Films is the only manufacturer in India) Sun control films are used in automobiles and architectural applications to modulate light intensity and block UV/IR radiation. Sun control films are quite an established product around the globe, with the US market dominated by 3M, Eastman, and Saint Gobain. Garware Hi-Tech Films brand Global is very well regarded in the US market for its product quality and value pricing. Sun control films have long been used in automobiles and architecture. The market is well-penetrated in the US and Europe. Safety films are high-impact resistant films installed on the glass to prevent it from splintering on impact. This product finds good traction in the USA, where gun violence is quite common.

- Various industrial and packaging films are used for electrical insulation, FMCG packaging, release liners, etc. This segment is more commoditized and has multiple competitors from India, such as Uflex, Jindal Polyfilms, Cosmo First, Polyplex, SRF, etc. This segment is currently going through headwinds, with all companies reporting significant pressure on margins as the industry suffers from overcapacity. It’s expected to take 12-18 months for demand to catch up with supply and for margins to normalize.

Garware Hi-Tech Films classifies these products into 2 categories.

- Consumer Products Division – Comprises Paint Protection Films, sun control films, and safety films.

- Industrial Products Division – Comprises shrink films, packaging films, release liners, thermal lamination, low oligomer films, etc.

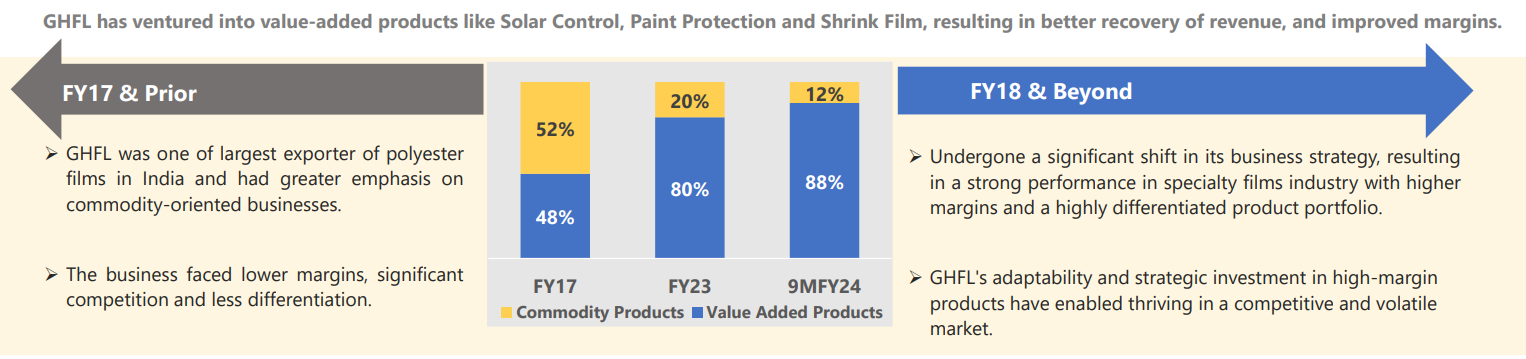

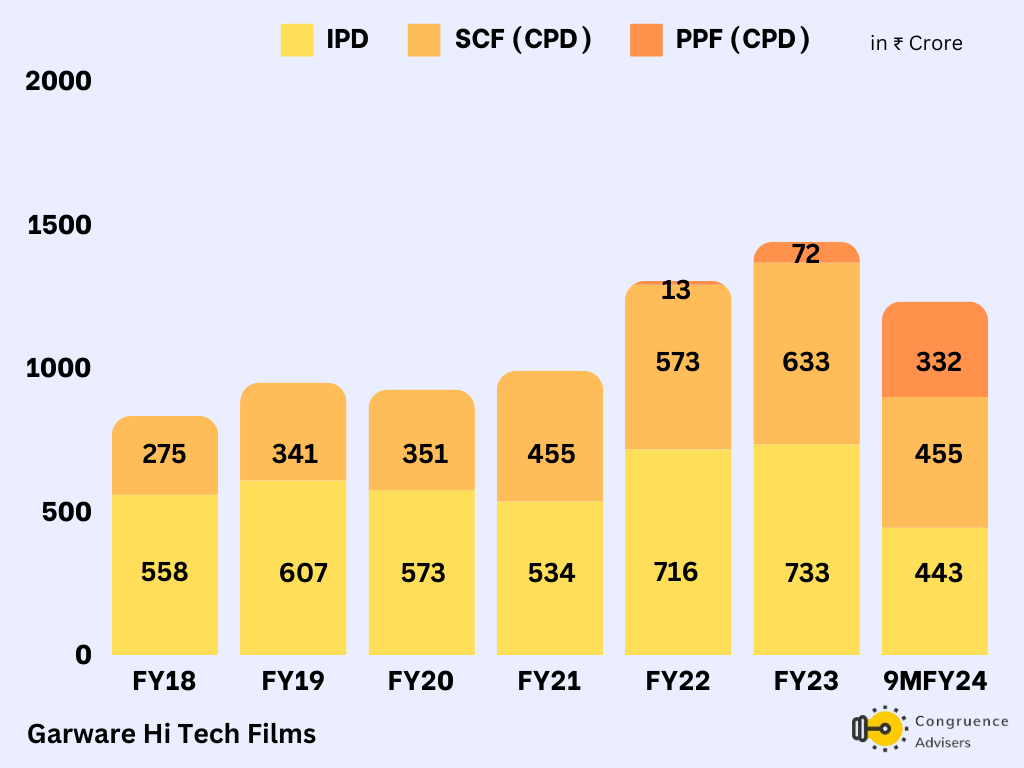

The Consumer Products Division comprises value-added products that have higher gross margins and better pricing power than the Industrial Products Division, which is more commoditized and prone to higher competition. Over the years, the proportion of value-added products has gone up for the company, resulting in improved margins and return on capital employed.

Source: Garware Hi-Tech Films Q3 FY24 Investor presentation

Garware Hi-Tech Film manufacturing process

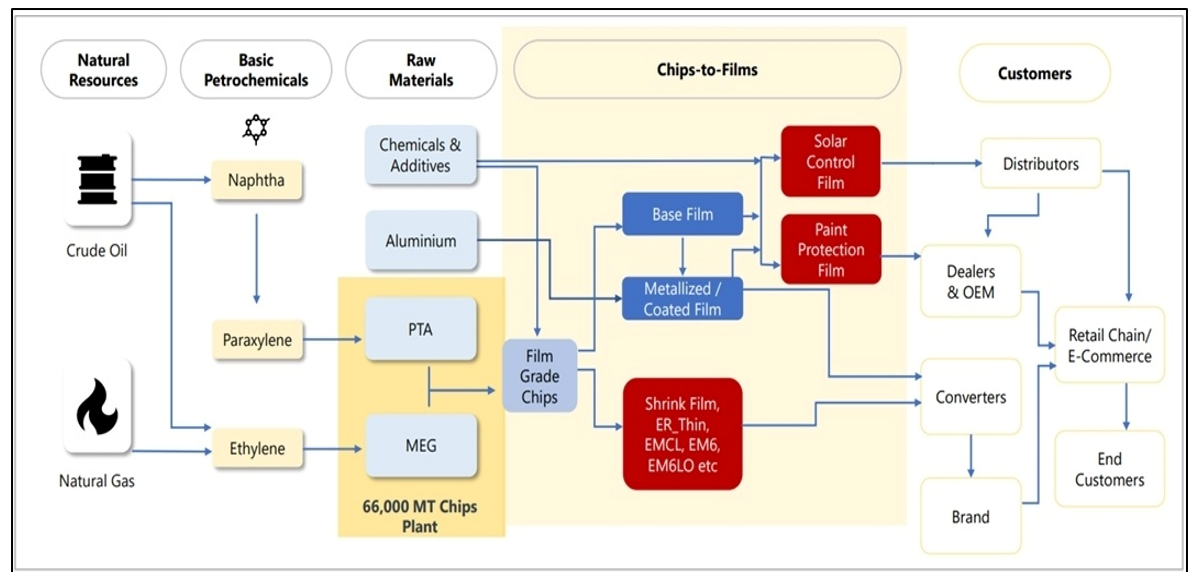

Garware Hi-Tech Film stands out as one of the select companies globally that operate a vertically integrated chips-to-films plant with multiple and flexible manufacturing lines, capable of producing a diverse and adaptable product mix.

Garware Hi-Tech Films enjoys a distinct advantage in Sun Control Films as it is backward integrated into the manufacturing of PET (polyethylene terephthalate) chips, which are converted into Sun Control Films. Most of its global competitors don’t make PET chips in-house; which gives Garware Hi-Tech Films a cost advantage and possibly a quality edge.

The primary raw materials used by Garware Hi-Tech Films in the manufacturing process are petrochemicals like Pure Terephthalic Acid, Mono-ethylene glycol, and polypropylene. Therefore, raw material prices fluctuate with changes in crude oil prices. The key suppliers are Indian refiners like Reliance Industries, and Garware Hi-Tech Films has an arrangement with them to procure RMs at import parity prices. Any increase in RM prices is passed on to the customers with a lag, especially in the value-added segment. [Source AR FY19]

Paint Protection Films are made from TPU films (thermoplastic polyurethane). Currently, Garware Hi-Tech Films does not produce the TPU films in-house but relies on imports. However, management has indicated in con calls that they expect to start producing TPU films in-house within the next 18-24 months, which should considerably improve the gross margins of the Paint Protection Films business, as the TPU film is a significant component of the final product.

Garware Hi-Tech Film manufacturing facilities are located at ChikalThana & Waluj in Aurangabad, Maharashtra

| Products | Capacities |

| Chips Plant | 66,000 MT |

| Consumer Product Division (CPD) | |

| Solar Control Films (SCF) | 4200 LSF |

| Paint Protection Films (PPF) | 300 LSF |

| Industrial Product Division (IPD) | |

| Plant | 42,000 MT |

| Thermal Lamination | 3600 MT |

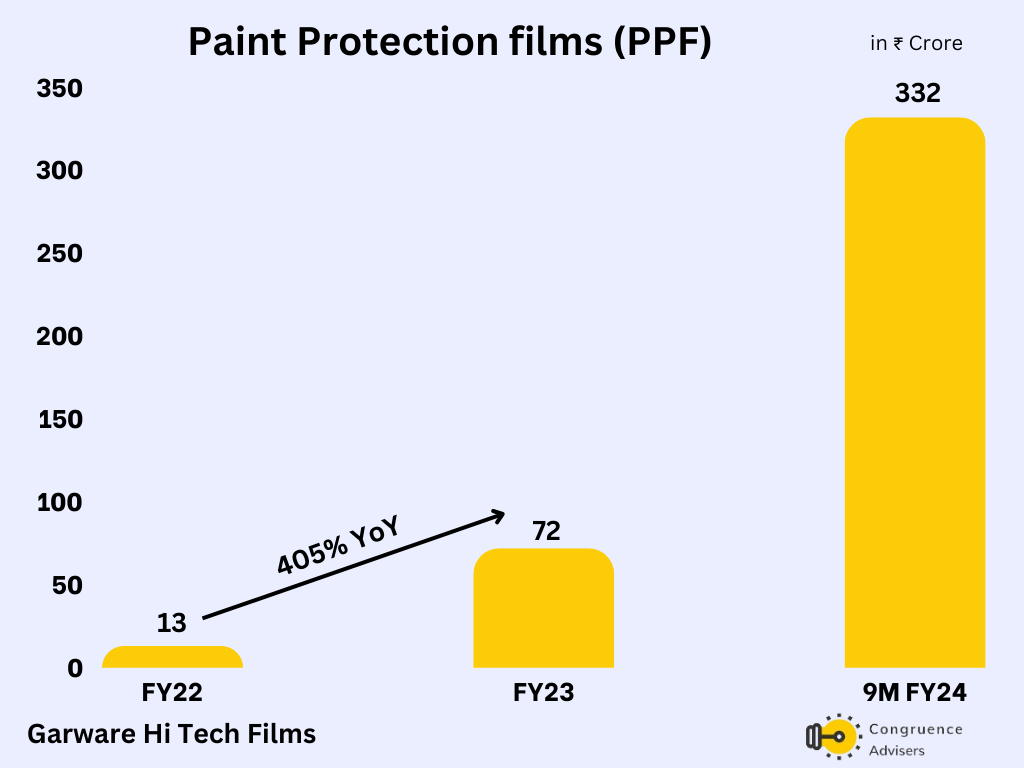

Garware Hi-Tech Films has aggressively expanded its capacity in the value-added segments over the last 3 years. The Solar Control Films (SCF) production capacity has increased from 2400 LSF (Lakh sq. feet) to 4200 LSF, while the Paint Protection Films (PPF) line was started in Dec 2020 and has scaled to a capacity of 300 LSF. More impressively, the Paint Protection Films line is already fully utilized as management has been able to generate enough demand for its product in export markets.

Garware Hi-Tech Films Industry Landscape of Sun Control Films & Paint Protection Films

Sun Control Films & Paint Protection Films Global Market Size

- The Global Sun Control Film (SCF) Market is expected to grow at a CAGR of 5.8% from 2022 to 2032; Garware Hi-Tech Films Market Share is ~8-10%, leaving ample headroom for growth

- Paint Protection Films market is expected to grow at a CAGR of 6.5% from 2022 to 2030

Source: Future Market Insights & Garware Hi-Tech Films Q3 FY24 Investor presentation

Garware Hi-Tech Films Financial Analysis

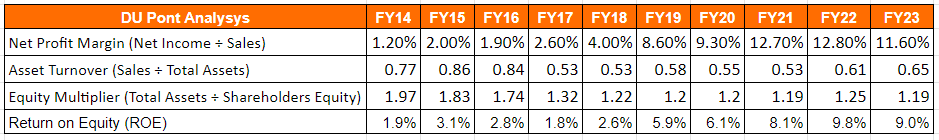

In this section, we present a detailed financial analysis of Garware Hi-Tech Films, focusing on key metrics such as ROE and ROCE. We highlight the significant improvement in profitability over the last decade, the impact of land revaluation on financial ratios, and Garware Hi-Tech Films’ lean working capital management.

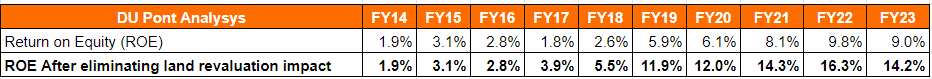

Return on Equity (ROE) of Garware Hi-Tech Films has consistently improved over the last 10 years from deficient levels of 2% in FY14 to still poor levels of 9% in FY23. The improvement in Return on Equity has almost solely come from a 10x PAT margin expansion over the last 10 years, reflecting the change in product mix. The Asset turnover ratio has remained range-bound while the equity multiplier has collapsed. Had the equity multiplier remained at FY14 levels, the current ROE would be ~15%, which would be respectable.

The equity multiplier collapsed from 1.97 to 1.19 because Garware Hi-Tech Films revalued its land holdings in FY17. The book value of land went up from 322Cr to 1007Cr due to the revaluation, and hence, 685 Cr was added to the book value, leading to depressing ROE figures. ROE, excluding the Land Revaluation impact as below

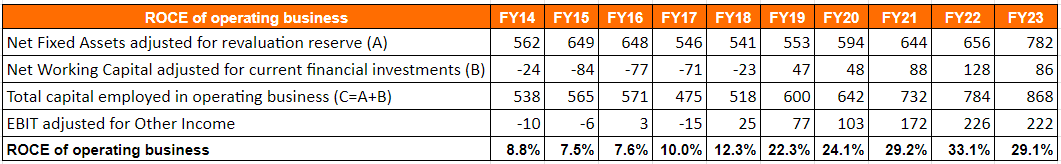

Return on Capital Employed (ROCE) of the operating business is also optically depressed due to the bloated balance sheet. After adjusting the capital employed for the revaluation reserve, the actual quality of the business emerges.

We have calculated ROCE as (EBIT – Other Income)/(Net Fixed Asset adjusted for revaluation of land + NWC – Current financial assets). Garware Hi-Tech Films has consistently delivered core operating ROCEs of > 25% for the last several years. Not many manufacturing businesses can consistently provide an ROCE of 25-30%. These ROCEs are not on the back of a cyclical tailwind, as we have already discussed.

Another remarkable feature of Garware Hi-Tech Films is the highly lean working capital days. As of FY23, the company had debtor days of 8, inventory days of 50, and payable days of 26. Such figures for a business with 75%+ revenues in exports are Phenomenal. Working capital discipline is the actual test of a distribution business quality, and the company passes this with flying colors. It demonstrates Garware Hi-Tech Films’ product quality and its hold over its distributors. In the USA, they operate with 5 distributors who hold inventory for them on a cash-and-carry basis and supply to dealers and applicators.

The business has also consistently generated healthy cash. The 5-year average CFO/EBITDA ratio is 75%, and the 10-year average is 82%, which is extremely good. Over the last 10 years, the business has also generated 788Cr of free cash flows.

Garware Hi-Tech Films Gross Profit Margin trend / Garware Hi-Tech Films Revenue/ Sales split

Garware Hi-Tech Films has an exciting Gross profit margin expansion trend. Gross margin increased from 30% in FY14 to 45% in FY23, and gross profit has grown at a CAGR of 11% from FY14 to FY23 as Garware Hi-Tech Films has pivoted towards value-added products (Sun control films and paint protection films). Although the gross profit margin has been down since FY21, as the Industrial Products Division division is facing a downturn, it is still the best among domestic peers. Garware Hi-Tech Films has scaled Value-added products (Sun control films & Paint protection) from 33% of revenue in FY18 to 49% of revenue in FY23 & 64% in 9MFY24.

Garware high-tech films Sun Control Films Revenue trend

- Sun Control Films revenue has grown at 18% CAGR from FY18-FY23

- As of Q3FY24, Sun Control Films Contributes 35% of Revenue & >90% Exported, Window film contributes 80% of Sun control film revenue, while the Architectural segment contributes 20%

- Garware high-tech films have 200 SKUs of Sun Control Films.

Garware high-tech films Paint Protection Films Revenue trend

- In Q3FY24, Paint Protection Films contributed 36% of Revenue & >90% Exported.

- White labeling accounts for 50% (+5-10%) of Paint Protection Films revenue & own brand account for 50%

- Garware high-tech films have 5000+ associations with Tinters Worldwide.

- Targeting to increase Garware Application studio and Paint protection films Distributors to 200 in the next 2 years (currently at 160) & OEM Brands Dealerships to 900 (currently at 600)

Garware Hi-Tech Films Corporate Governance

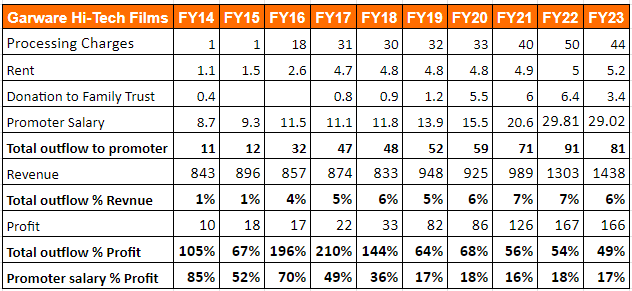

We believe the reason Garware Hi-Tech Films has never been valued proportionally to the underlying return on capital metrics is that it has had suboptimal corporate governance over the years, which has kept investors cautious. Key concerns regarding Garware Hi-Tech Films’ corporate governance include high payouts to promoters and related-party transactions, a board composition with limited independent oversight, a lack of promoter interaction with minority shareholders, and insufficient cash returns to shareholders.

High payout to promoters – Over the years, the promoter compensation as a % of PAT has been very high. Over the last 10Ys, on average, the total payout to promoters as % PAT has been 100%. That is an extremely high number, and any prudent investor should question the intention of the promoters. Apart from salaries to promoters and rent, the payout item that stands out is Processing charges. In FY23, this item was 27% of PAT. The processing charges are paid to a privately held company called Garware Industriees Ltd (Yes, it’s 2 Es in Industriees). Management claims that this private company had invested on behalf of Garware Hi-Tech Films in creating patents related to dyed polyester films, which Garware Hi-Tech Films uses in manufacturing the value-added products, and these payouts are therefore justified. The patent for the process of dyeing UV-stabilized polyester film exists but seems to have expired in 2020. Even if we assume that the private company continues to add value to Garware Hi-Tech Films at present, it begs the question of why it can’t be amalgamated with Garware Hi-Tech Films to benefit minority shareholders.

Management still needs to give a satisfactory answer to this question, and we have yet to see tangible, reliable steps in this regard that can provide assurance to minority investors.

Revaluation of land from time to time – Garware Hi-Tech Films, by virtue of its long history, has ended up holding large land in Mumbai, Nashik, and Aurangabad (where plants are located). Most of these land parcels are unutilized right now. Two or three times in the last 15 years, Garware Hi-Tech Films has ended up revaluing these land parcels to market rates. There is nothing wrong per se in revaluing land. Sometimes, companies do it for genuine reasons. For example, suppose a company is about to embark on much capex and needs bank loans. In that case, the company may need to revalue some of the land on its balance sheet to reflect current market value so that the debt/equity ratio improves and banks are willing to lend additional capital to them. However, in the case of Garware Hi-Tech Films, after revaluing land in 2013 and 2017, the company did not increase borrowings significantly. In fact, in 2013, the revaluation of land coincided with write-offs taken by the company w.r.t. Its associate company Garware Chemicals Ltd., which makes us suspicious about the intent behind the revaluations. Revaluations also hurt the optical ROE and ROCE of the business by bloating the balance sheet.

Board composition and promoter interaction with minority shareholders – Garware Hi-Tech Films doesn’t have a 50% representation of independent Directors on its Board, with only 6 out of 13 Directors being independent. Of the 7 non-independent Directors, 4 are from the Garware family. The CFO is not part of the Board, and Garware Hi-Tech Films does not have a CEO. The promoters don’t attend quarterly conference calls, and they have been known to skip AGMs as well. Which probably doesn’t speak highly of their commitment to minority shareholders. Only one member of the team that attends the quarterly conference interactions with investors is a member of the Board (Appointed in August 2023)

Not enough cash returned to shareholders – Despite generating healthy free cash flows to equity of 460Cr over the last 10 years, having enough cash balances available. No real need for intensive capital investment, the distribution of cash flows to shareholders in the form of dividends and buybacks has been low at around 140Cr over the last 10 years.

Garware Hi-Tech Films Peer Comparison

Garware Hi-tech Films does not have any direct domestic peers. However, a comparison can be made between domestic manufacturers of polyester film, such as Polyplex Corporation Ltd, Uflex Ltd, Jindal Poly Films Ltd, and Cosmo Films Ltd. The majority of the revenue of these peers comes from commoditized film products, compared to Garware Hi-tech Films, where revenue comes from value-added products. Below is the analysis of Garware Hi-tech Films’ peers based on various financial parameters Gross margins, EBITDA margins, CFO/EBITDA conversion, working capital days (WC days), Return on Equity (ROE) & other Financial parameters

Due to overcapacity and a cyclical downturn in the industry, TTM profits after tax for these players are currently depressed.

| Parameters | Polyplex | Uflex | Jindal Poly Films | Cosmo First |

| Gross Profit% | 34.04% | 41.35% | 20.55% | 27.34% |

| EBITDA% | 12.38% | 11.79% | 7.70% | 12.49% |

| D/E | 0.23 | 0.76 | 0.54 | 0.72 |

| ICR | 21.32 | 2.39 | 4 | 6.53 |

| CFO/EBITDA | ||||

| 5 Year Avg | 77% | 62% | 28% | 94% |

| 10 Year Avg | 93% | 70% | 47% | 86% |

| Working Capital Days | 95 | 104 | 126 | 37 |

| ROCE | ||||

| 5 Year Avg | 14% | 10% | 14% | 14% |

| 10 Year Avg | 9% | 9% | 11% | 11% |

| ROE | ||||

| 5 Year Avg | 22% | 11% | 15% | 28% |

| 10 Year Avg | 14% | 10% | 13% | 20% |

| P/E | 36 | N.A | N.A | 19 |

| P/S | 0.43 | 0.24 | 0.66 | 0.57 |

| M.CAP 18-4-23 | 2685 | 3160 | 2421 | 1505 |

| TTM PAT | 75 | -419 | -295 | 79 |

| TTM Sales | 6295 | 13317 | 3659 | 2661 |

Garware Hi-Tech Films Index Comparison

Garware Hi-Tech Films share performance vs. S&P BSE Small cap as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Garware Hi-Tech Films Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

On daily charts, post a steep run-up from 600 levels to 1600 levels between Apr-Oct 2023, Garware Hi-Tech Films stock consolidated between 1300-1600 levels for 3 months. On 08th Jan 2024, Garware Hi-Tech Films stock broke out of the consolidation zone with very high volumes. Since then, the 1600 level has acted as support, and the stock has generally respected the 100 DMA.

On weekly charts, Garware Hi-Tech Films stock took out the previous highs of 1150 in Aug 2023 and went on to almost double before consolidating in the 1600-1900 zone. As long as there is no adverse change in the current business trajectory or management guidance, 1600 levels should act as support.

Why consider Investing in Garware Hi-Tech Films?

Despite Garware Hi-Tech Films suboptimal corporate governance track record, we believe there are many reasons to consider investing in Garware Hi-Tech Films, including its unique product portfolio, growth potential in the paint protection films segment, promising management guidance, and potential value unlocking from its balance sheet.

A differentiated player in the polyester films industry – Garware Hi-Tech Films has a differentiated, value-added portfolio of products for the polyester films industry in India. They are a relatively small player by size in the polyester films industry, but they are the only Indian manufacturer of sun control films and paint protection films in India. Their gross margins vis-a-vis their peers demonstrate the quality of their product portfolio and the strength of R&D. Their products are well-regarded for their quality in the developed world, where they are exported. Such traits are rare among small-cap businesses in India.

A remarkable growth in Paint Protection Films – Garware Hi-Tech Films has delivered tremendous growth in paint protection films. Since commissioning the factory in FY21, they have scaled up Paint Protection Films revenues from 0 to 340Cr+ in 9M FY24 (28% of the overall revenue). Management has said in investor interactions that they expect the sales momentum to continue in Paint Protection Films in the coming quarters. There have been exciting developments in the US Paint Protection Film market that might benefit Garware Hi-Tech Films. The most significant player in the market is XPEL – a pure-play marketing and technology player in the Paint Protection Films market that outsources 100% of their manufacturing. Their largest supplier of Paint Protection Films – Entrotech – has announced a partnership with XPEL’s competitor, PPG, to launch a new paint film solution for automotive use. This move by Entrotech is likely to create urgency in XPEL to seek new Paint Protection Film suppliers, thus providing an opportunity for Garware Hi-Tech Films. The coming few quarters will give more clarity to investors on this front. Garware Hi-Tech Films has also taken significant steps to build the Indian Paint Protection Films market from the ground up by training applicators and opening Garware Application Studios (GAS) for Paint Protection Films applications. They have appointed Boston Consulting Group to help with India’s strategy and rollout for Paint Protection Films and safety glazing films.

Promising growth guidance – The management has said they have an internal target of reaching 2500 Cr revenues by FY26 or FY27. Current annual revenues range from 1500-1600 Cr, so if they achieve the guidance, Garware Hi-Tech Films can deliver 50-60% revenue growth in 2-3 years, leading to some operating leverage & resulting in improved EBITDA margins. Of course, there can be many slippings between the cup and the lip; Hence, Garware Hi-Tech Films management guidance should be taken with a pinch of salt.

Value unlock in the balance sheet – There are some early signs of value unlocking by management. In recent conference calls, management indicated they want to sell off the land parcel in Nashik. The estimated realization is estimated at 100Cr. It is a good sign and will address some of the concerns regarding the bloated balance sheet. If management can execute this by increasing payouts to shareholders, investor confidence in this microcap stock may increase further.

What are the Risks of Investing in Garware Hi-Tech Films?

We have outlined the significant risks associated with investing in Garware Hi-Tech Films, including concerns about corporate governance, potential slowdowns in key growth products, industry challenges, and broader economic factors.

Continued poor corporate governance – If there is no improvement in corporate governance parameters of Garware Hi-Tech Films, then it may not get the valuations that the underlying return metrics should command

Slow down in growth of Paint Protection Films – Right now, a large part of the growth thesis is Planned to come from the Paint Protection Films business. If there are some adverse developments in that area, the targeted growth may not pan out for Garware Hi-Tech Films. Potential adverse developments could be quality issues with the Paint Protection Films product (It’s still considerably new in the market), a new technology substituting Paint Protection Films demand (Entrotech-PPG’s new product) or Garware Hi-Tech Films inability to manufacture the critical TPU film layer in-house, thus preventing margin expansion in Paint Protection Films films. Any deterioration in the relationship with XPEL, one of their critical customers across solar control and paint protection films, can also be detrimental.

Continued overcapacity conditions in the Industrial Products Division (IPD)- The domestic-facing Industrial Products Division is going through a period of overcapacity, leading to depressed margins. Management expects the situation to improve over the next 12-18 months. However, the downturn here may elongate if demand doesn’t catch up with supply.

Sharp up move in crude prices – Since Garware Hi-Tech Films’ raw materials are petrochemical derivatives, any sustained increase in crude oil prices can hurt their gross margins. While cost increases can be passed on to a large extent in the Consumer Products Division, that may not be possible in the IPD segment.

Global slowdown in growth– A global slowdown in growth will adversely impact automotive sales and, in turn, affect the sales of the Garware Hi-Tech Films Consumer Products Division.

Garware Hi-Tech Films Results (Q3FY24)

Garware Hi-Tech Films’ latest Quarterly Results highlight excellent performance on parameters like Revenue, EBITDA, and Profit on both QoQ and YoY basis. This is driven by the Paint Protection Films business, which continues to deliver impressive growth and is strengthened by demand recovery in the Sun control films business. Meanwhile, the decline in the IPD commodity business continues.

| Q3FY24 | Q3FY24 | Q3FY23 | Q2FY24 | QoQ | YoY |

| Revenue | 454 | 324 | 397 | 14% | 40% |

| Gross Profit | 196 | 147 | 178 | 10% | 34% |

| Gross Profit % | 43% | 45% | 45% | ||

| Operating Profit | 75 | 45 | 65 | 15% | 67% |

| Other Income | 9 | 7 | 9 | ||

| EBITDA % | 19% | 16% | 19% | ||

| Depreciation | 10 | 8 | 10 | ||

| Interest | 2 | 4 | 4 | ||

| Profit before tax (PBT) | 73 | 40 | 61 | 20% | 83% |

| PBT % | 16% | 12% | 15% | ||

| Net profit (PAT) | 56 | 30 | 46 | 22% | 87% |

| Net Profit % | 12% | 9% | 12% |

- Q3FY24 Revenues stood at Rs 454 cr, up by 14.2% QoQ and up by 39.9% YoY

- Q3FY24 EBITDA was Rs 84.6 cr, up 14.3% QoQ and 61.2% YoY.

- EBITDA gains were driven by higher volumes in paint protection films and sun control films, which were marginally offset by the IPD business.

- Q3FY24 PAT stood at Rs 55.9 cr, up by 21.7% QoQ and up by 83.8% YoY.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.

Disclosure (updated as of Sep 30, 2024) – Stock is part of our advisory portfolio. This was added in Q1 FY25 in customer accounts, our estimate of the reasonable BUY price range at the time of inception into the portfolio was 2100 – 2300. The exact BUY call for paid subscribers was issued on June 26, 2024. After a stellar Q1 performance, we increase our estimate of reasonable BUY price to ~3200