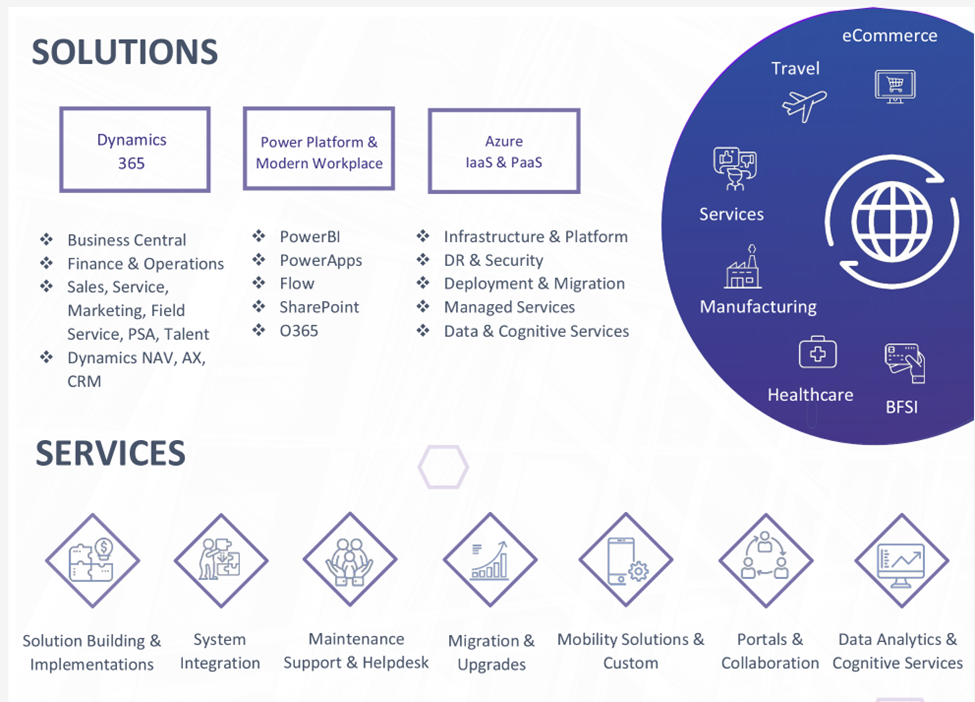

All E Technologies Ltd, a Microsoft-certified gold partner, is a business application and digital transformation services provider. All E Technologies Ltd is one stop digital solution shop for the entire suite of Microsoft stack to customers. It provides consulting services for solution assessments, provides product licences, carries out solution implementation and provides solution enhancements and on-going support. It also provides offshore technology services to some large Microsoft business applications partners from the US and Europe.

We find All E Technologies Ltd. interesting because it is a fast-growing company leveraging the Microsoft ecosystem whose growth momentum is likely to continue for many more years, given its scale and inorganic growth plans. All E Technologies Ltd is well-positioned to deliver 20%+ for a long period organically on the back of the Microsoft Azure platform and the business applications suite that are growing at 20%+ p.a. on an ARR of > USD 30bn. Increasing international market share along with a higher share of its own IP related solutions can further help All E Technologies Ltd enhance profitability.

All E Technologies Ltd Company Summary

Founded in 2000, All E Technologies Ltd has emerged as a respectable player in the Microsoft Business Applications and Digital Transformation space. In this age of digital transformation, Alletec helps clients stay ahead leveraging the suite of Microsoft Dynamics 365, Power Platform, Data & AI – powered by Microsoft Azure & Collaboration platforms industry solutions and services prepare clients to win in this volatile, uncertain, changing, and ambiguous business environment.

All E Technologies Ltd helps connect companies and customers, Factories and Field Services, Storefronts and supply Chains, Patients and providers, and People and governments by implementing integrated operational systems such as ERP, CRM, Collaboration Portals, and Mobile Apps and enabling businesses to draw actionable insights from data. It provides consulting services for solution assessments, product licenses, solution implementation, solution enhancements, and ongoing support. All E Technologies Ltd also offers offshore technology services to some large Microsoft Business Applications partners in the USA and Europe.

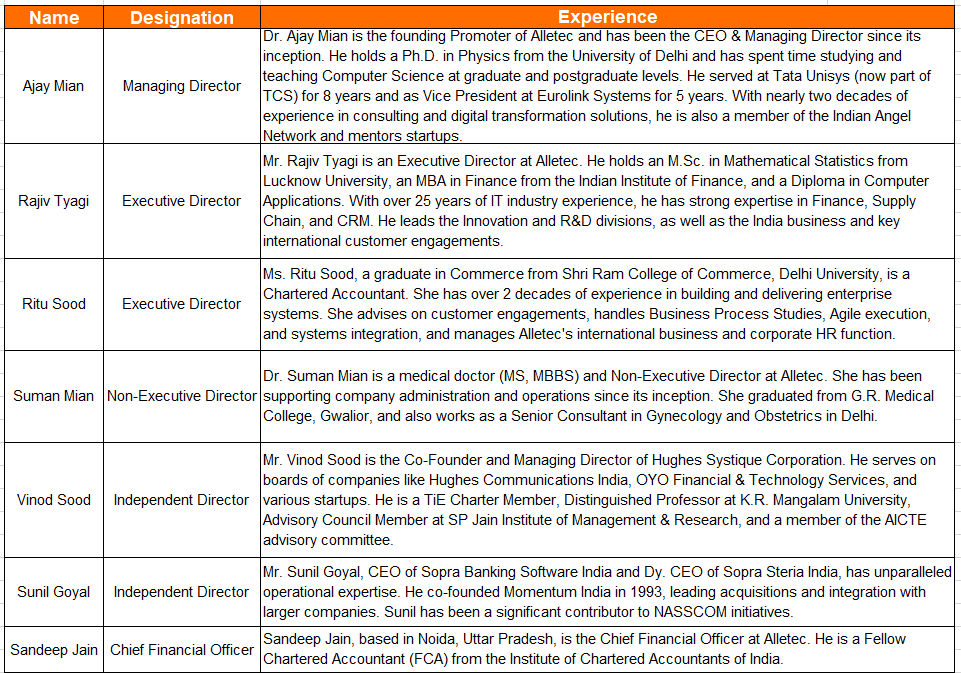

All E Technologies Ltd Management Details

Promoter Mr.Ajay Mian is a professor who transitioned into entrepreneurship, he founded All E Technologies Ltd in his 40s. He holds a Ph.D. in Physics from the University of Delhi and started his journey as a professor in Delhi University where Ajay taught Computer science courses at the graduate and postgraduate levels. Post that Ajay decided to quit teaching and joined the corporate world as a project manager in TATA Unisys Ltd (now part of TCS). Subsequently he worked with a start-up for 5 years and eventually started All E Technologies Ltd in 2000. Ajay brings a deep understanding of Tech requirements for a business throughout its entire lifecycle. Ajay is also the co-founder of Healnt Technologies Pvt Ltd (a health tech start-up) and a member of the Indian Angel Network and engages with startups in coaching and mentoring.

All E Technologies Ltd – Industry Overview

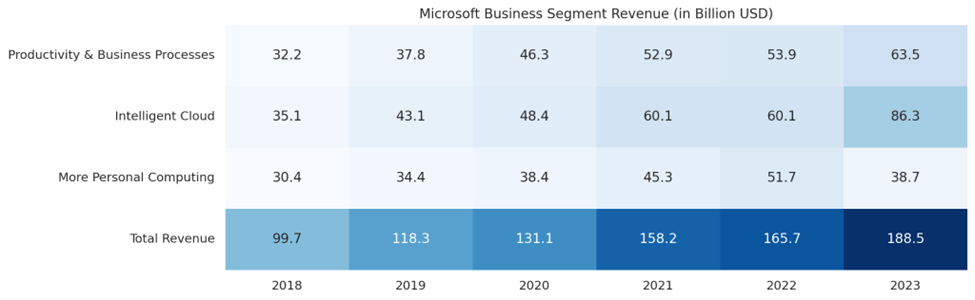

Global Microsoft Business Applications market

The global market for Microsoft Business Applications is substantial and continues to grow on the back of revenue contributions from software licenses, subscriptions, and associated services.

The global Microsoft Business Applications market, encompassing products and services, is currently valued at over USD 35 billion and is on track to exceed USD 50 billion within the next few years. Given its good positioning within the Microsoft ecosystem, this rapid growth of the base platform ecosystem provides implementation partners like All E Technologies Ltd a long runway for growth given the cost efficiencies of the Indian geography relative to developed markets like the US and Europe.

Microsoft Business Applications Suite is gaining much adoption among mid-sized companies due to its user-friendly interface, no-code capabilities, and integration with advanced AI features like Co-pilots, machine learning, and advanced data analytics. With users’ preferences shifting towards cloud-based solutions, Microsoft continues to lead digital transformation initiatives, and investments in advanced technologies which are enhancing value to the end user. Hence leading to sustained market expansion.

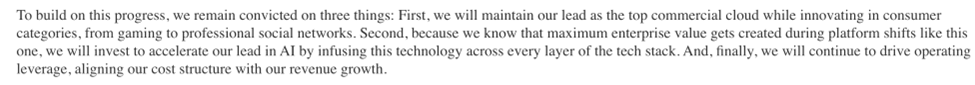

In the 2023 letter to shareholders, Microsoft CEO Satya Nadella highlighted their continued focus towards its clouds and tech stack

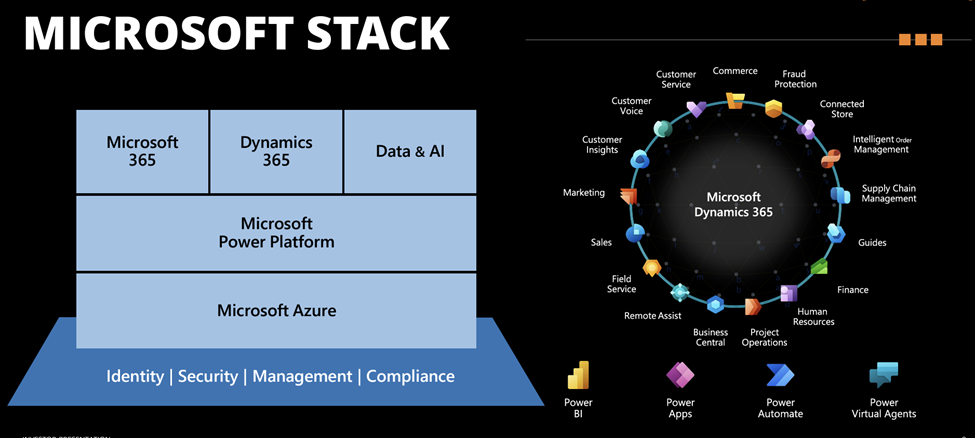

Microsoft Stack refers to the collection of Microsoft technologies, platforms, and tools used for developing, deploying, and managing software solutions. These technologies work seamlessly together to provide robust, scalable, and flexible solutions for businesses.

Microsoft Stack provides a unified ecosystem of tools and technologies that ensure seamless integration, scalability and flexibility for businesses. It supports efficient development, cloud integration, and advanced analytics while enabling customized solutions tailored to industry-specific needs.

Now, looking at how it creates business opportunities for IDCs which undertakes implementations for the Microsoft business application stack.

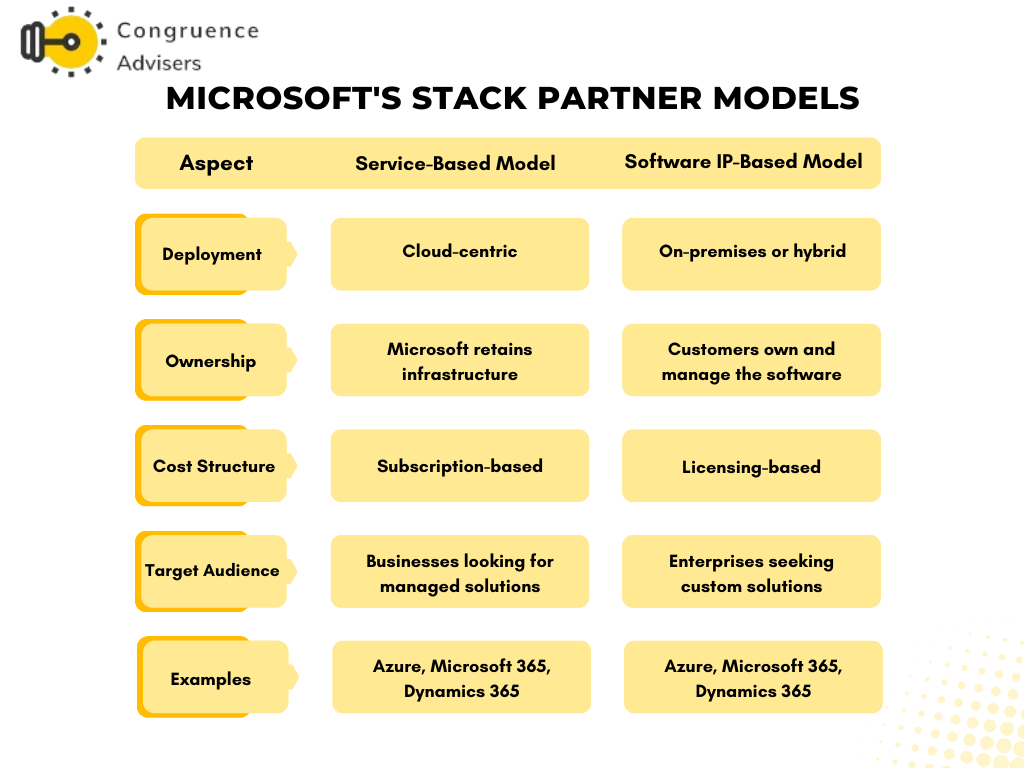

Microsoft business application stack model primarily revolves around two approaches: Service-Based Model and Software IP-Based Model.

Service-Based Model

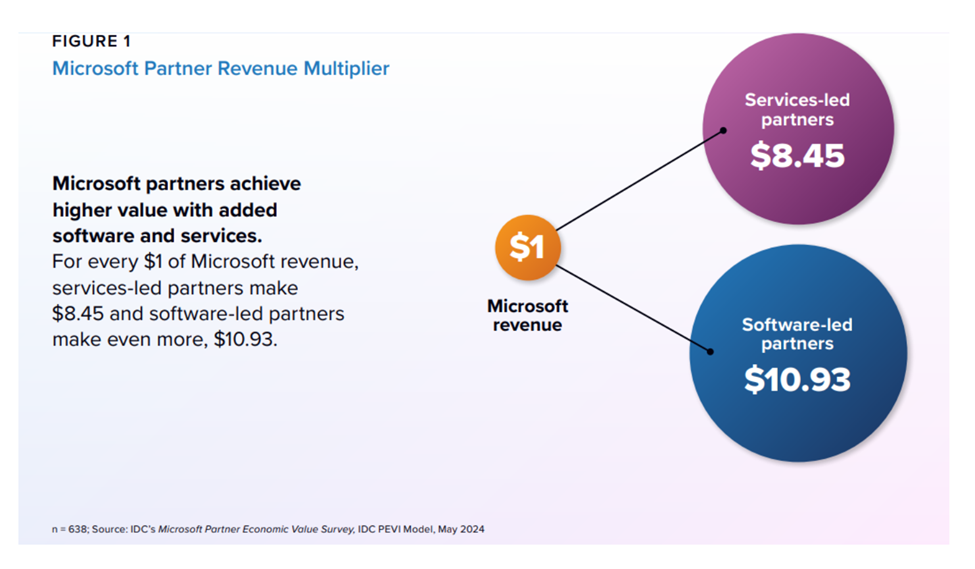

In a service-based model, partners generate revenue by offering services such as migration, implementation, managed support, and licensing to clients. For every $1 earned by Microsoft, the partner’s revenue multiplier over a customer’s lifetime is approximately $8.45. However, margins in this model are typically lower, as seen in companies like Sonata Software, where the contribution from services to overall revenue offers minimal impact on profitability. Despite this, advancements in AI and Copilot technologies are expanding service portfolios, presenting new growth opportunities.

Software-Based Model

In the software-based model, partners build and sell their software or IP on top of the Microsoft stack. This could include apps, add-ons, or tools integrated with Microsoft technologies. For such partners, the revenue multiplier is higher, at $10.45 for every $1 earned by Microsoft. This model allows partners to generate revenue from both the Microsoft stack and their IP sales or subscriptions. Margins in this model are significantly better, ranging from 15% to 20%, driven by the higher profitability of IP products, which greatly boosts overall margins.

Comparison of the Two Models

Microsoft often combines these approaches in its offerings. For example, Azure Stack enables hybrid cloud solutions by blending Azure’s service-based cloud model with an on-premises IP-based deployment. This dual approach ensures Microsoft can cater to a wide range of customer needs, from startups leveraging cloud services to large enterprises requiring customized, controlled environments.

Microsoft Partners are growing at 30%+

Key Players

The enterprise software & business applications market has many competitors like Oracle, SAP, Salesforce that provide a wide range of products and services that fulfil the technology needs of businesses across verticals like BFSI, Retail, Communication, Manufacturing and many others. Each one of these players is a large multi-billion dollar behemoth with its own ecosystem of value added distributors, System Integrators, Implementation Partners & sales partners.

While this larger market has a very large addressable market size, implementation partners like All E Technologies find value in specializing in a particular ecosystem to be able to optimize on selling & implementation costs. More the number of technology offerings, higher will be the sales & manpower investments needed. Small firms like All E technologies will have a tough time matching the organization complexity and manpower scaling that larger peers can bring to the table.

For this reason, it is difficult to find peers that are very similar to All E Technologies one can benchmark with. A better approach will be to understand the overall market opportunity of the Microsoft ecosystem and evaluate the market readiness of All E Technologies to ride this market opportunity. For academic purposes, a comparable (unlisted) peer in the SAP ecosystem would be Incture Technologies that is HQ’ed at Bangalore.

Market Positioning & Value addition

One will need a fair bit of context of the Enterprise Software Market to understand the market positioning and value addition that organizations like All E Technologies bring to the table.

I remember from the stint as a core banking IT salesman in India the many challenges we faced as an enterprise software provider. Every client wanted the best product at the lowest TCO, while the nature of requirements would be similar across clients, their IT budgets would vary a lot based on scale. For example, a large public sector bank, a regional rural bank, a co-operative bank would all want core banking software but at different complexity and price points. While the large clients would have the financial strength and IT budget needed to engage with a Tier 1 provider, smaller clients would often need the product strength and scalability but at much reduced cost and ongoing support.

One of the ways we would bring down the total cost of ownership as the market leading core banking vendor in India was to do the critical parts in house but bring in smaller implementation partners to do the pan India rollout. Our core team would take the first 25-50 branches live and stabilize the system but would hand over the pan India rollout across 1000+ branches to a smaller sized implementation partner who would work at less than 50% of our billing rates. Ongoing support costs would be optimized by staffing a couple of senior resources to manage the overall engagement but the bulk of the service would be delivered by resources from the smaller partner. Sometimes the margin for the smaller partner would be limited by the scale of the project, in which case we would route incremental license sales to the end client through the implementation partner so that their unit economics become better.

One of the other ways these implementation partners would add value is to meet the financial controllership needs of the large product owners. This is a very underappreciated aspect of this business model, since a large product company like Microsoft, Oracle or SAP would have standardized terms and conditions & payment terms that would never be accepted by the market. The implementation partner effectively takes the cash flow mismatch onto its books in exchange for higher margins. Sometimes the end client RFP has a payment terms of 90 days while the implementation partner/reseller pays the product owner within 30 days.

In terms of sales & geographical coverage too, the lower sales cost of the implementation partners enhances the revenue visibility of the product owner without having to commit salesmen to cover a particular region. It is for this reason that product companies develop large partner sales ecosystems. The best example would be an Asset Management Company (Mutual Fund) that empanels many IFA’s and distributors to enhance their market coverage and pay a commission in return for this. At a very high level, this is how distribution in IT products also works.

The final aspect is that SME clients are more comfortable dealing with organizations of their size and scale rather than dealing with multi billion dollar behemoths like Microsoft or Oracle. They get access to high quality products at reasonable cost, yet have the business comfort of dealing with organizations that will treat them like peers. This makes the partner ecosystem a win win proposition for all parties involved, this is why partner ecosystems flourish and thrive.

Businesses like All E Technologies start as small players (arguably commodity players) but can rise through the ranks over time as they execute projects reliably and win the confidence of the product owner. The balance of power will always be skewed in favour of the product owners but the implementation partners do add value and make growth & financial controllership much easier for the product owners over time.

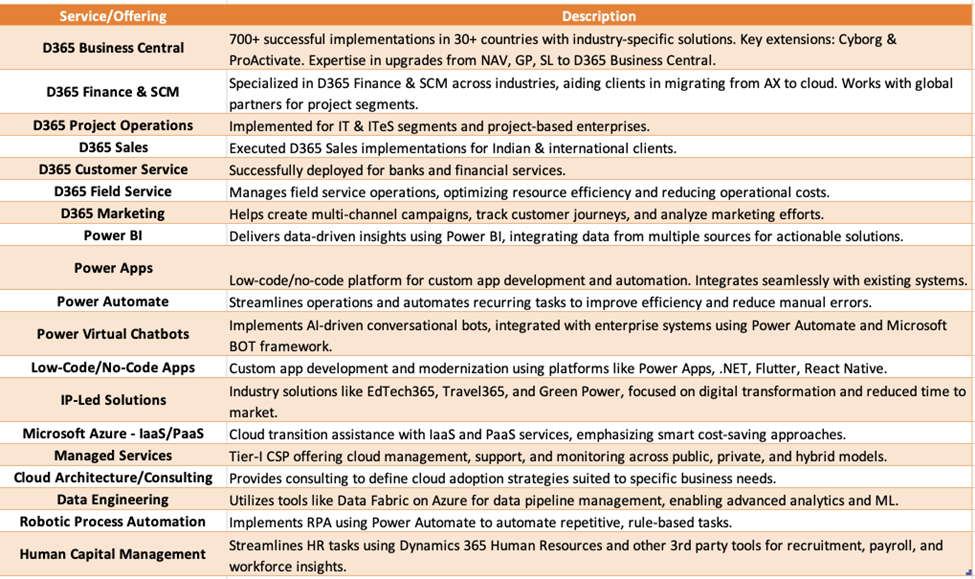

All E Technologies Ltd Services and Solutions Details

All E Technologies Ltd was earlier operated as a services company that would engage with potential clients to understand their tech adoption needs and suggest a suitable suite of Microsoft products that could help them achieve their goals. All E Technologies Ltd then handles the customized implementation of the relevant Microsoft software for the client while acting as a value added reseller of the underlying Microsoft products and licenses, wherever feasible. All E Technologies Ltd. has now started offering its own IP LED Solutions that they have been able to build over the many years of implementation experience they have accumulated. They have developed several applications for businesses that are listed on the global Microsoft App Store for Higher Education | BAFINS-CX | Green Energy | Travel

Microsoft suite implementation services

DIGITAL CORE MODERNIZATION – Transform operations and customer experiences and help businesses by modernizing the digital core with cloud computing, automation, applications modernization, collaboration, data engineering, and AI.

ENTERPRISE APPLICATIONS – ERP, CRM, HCM, and Commerce applications – Implement and customize to meet specific business needs.

PROCESS OPTIMIZATION – Optimize performance by streamlining business processes to improve efficiency and reduce costs through process assessments, bottlenecks identification, and redesigning workflows.

SYSTEM INTEGRATION – Integrate disparate systems and new technologies, ensuring robust IT architecture and seamless data flow across the organization.

DATA & AI – Harness the power of data and analytics to gain valuable insights, make data-driven decisions, and enable business growth with data management, advanced analytics, predictive modelling, and AI-driven insights.

CHANGE MANAGEMENT – Help manage organizational changes accompanying technology implementations – training, communication, and readiness assessments for smooth transitions and adoption.

Intellectual Property/ Solutions Listed on Microsoft App Store/ Partner Portal

All E Technology Ltd has developed Industry-specific, technology-specific, and platform-specific intellectual property assets that provide an edge in the market. These assets are available on Microsoft AppSource. Below is the list of Intellectual Property already approved and listed by Microsoft on their AppSource.

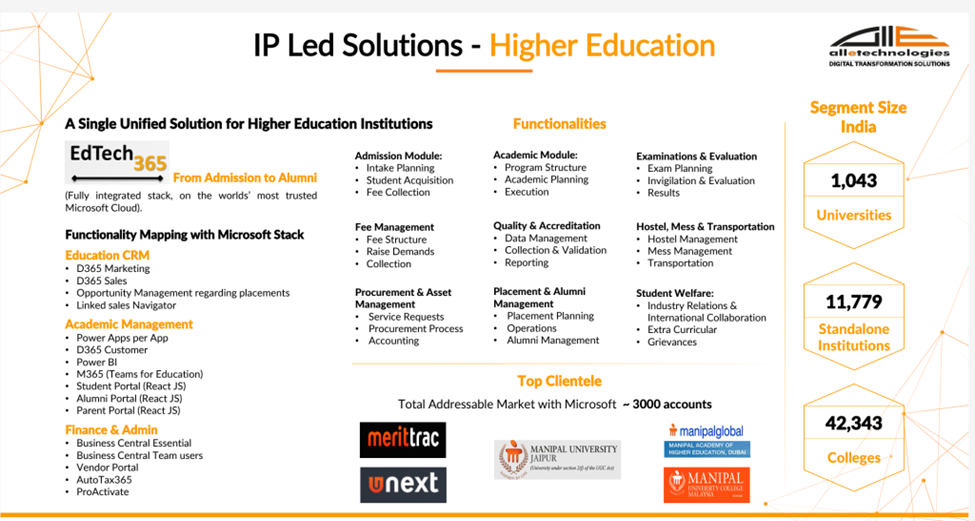

Edtech 365 – Edtech 365 is a proprietary solution developed by All E Technologies Ltd specifically for institutions of higher education. It offers a comprehensive suite of features, including a digital campus, education CRM, student lifecycle management, and a student information system. These components are seamlessly integrated with Dynamics 365 for financial accounting, providing a unified platform for academic and administrative excellence.

Travel 365 – For over 15 years, All E Technologies Ltd has been delivering innovative travel solutions to major players in the travel industry, including MakeMyTrip, Yatra, Agoda, EaseMyTrip, and others. Its comprehensive solution features two key components: a mid-office system and a back-office system for travel accounting. Customers can adopt either the complete solution or solely the back-office component, depending on their business requirements.

In the airline ticketing segment, the solution seamlessly integrates with leading GDS systems such as Amadeus, Galileo, and Sabre, as well as with the systems of low-cost airlines. The increasing complexities of travel businesses, driven by technological advancements and heightened customer expectations, have made systems indispensable. These systems manage bookings across various transportation modes, leisure activities, and hotels while also supporting the planning and execution of individual and group tour packages, customer requests, and financial accounting.

Green Energy & EPC – This solution, built on Microsoft Dynamics 365, caters to the unique needs of EPC and green energy companies. It enables real-time resource scheduling, inventory tracking, project progress monitoring, running bill adjustments, and settlements. By providing real-time insights into project execution, it empowers companies to manage large-scale, complex projects efficiently.

Digital Natives & E-commerce – Focused on a digital-first and tech-driven operating model, this service helps digital-native businesses and e-commerce enterprises thrive. By leveraging the Microsoft Business Application Suite, Dynamics 365, Power Platform, and Azure infrastructure services, it delivers innovative and scalable solutions to drive growth and operational efficiency in the digital economy.

IP Led component accounts for 25% of the revenue. Going forward, this share will only increase. IP component revenue is recurring every year, in addition to MS component revenue and then the services component

All E Technologies Business Cycle

On the business applications side, All E Technology Ltd two primary types of customer engagements are Implementations and Support.

Here is the typical cycle of new customer acquisition stages/ activities:

Lead Generation – Leads are sourced from digital campaigns, customer references, Inside Sales, Partner networks and Microsoft.

The current direct sales strength of the organization is limited since that is a high cost acquisition channel. Large direct sales teams are the default option for organizations that sell primarily into the Fortune 500 set of organizations where the deal size justifies the effort and the longer sales cycle. For organizations like All E technologies that operate at lower deal sizes and in the SME segment, the primary sales channel is likely to be references and the Microsoft partner ecosystem.

Lead Qualification – Inside Sales teams evaluate leads based on BANT criteria (Budget, Authority, Needs, and Timeline). Qualified leads are then handed over to the Sales Team for further qualification.

Pre-sales Engagement – Discussions are conducted with various stakeholders in the customer’s organization to better understand their business needs and goals.

Solution Demo – Based on engagement, Customers are provided with solution demonstrations tailored to their business requirements. Multiple demos may be required for large opportunities, with Microsoft teams often participating to clarify the scope.

Proposal – Project proposals are created and presented to the customer following demo discussions.

Licensing & License Fee – Licensing is managed via the CSP model (consumption-based) or through an Enterprise Agreement with a Microsoft LAR. Customers are billed periodically, and Microsoft pays margins or incentives for Enterprise Agreements.

Project Execution/Delivery – Solutions are implemented using a Hybrid Agile methodology. Support can be provided through a dedicated model or ticket-based system.

This process ensures streamlined customer engagement from lead acquisition to project delivery.

How All E Technology Ltd Pricing Works

All E Technology Ltd’s pricing strategy and margins depend on the geographic location and the specific components involved in the service offering.

All E Technology Ltd offers three main components in its engagements:

Consulting Services – This is entirely within All E Technology Ltd’s domain and involves the initial setup and engagement with the customer.

Solution Implementation – This includes both the solutions (divided into Microsoft’s part and All E Technology Ltd’s own intellectual property) and the implementation services. Margins vary depending on Geography. In India, margins are typically between 22-25%. In the US, margins are much higher, i.e., 50-55%, mainly due to higher service rates for implementation and maintenance support.

Product Margins – These are consistent globally but may be slightly lower in India due to the need for occasional discounting. Product margins generally fall between 16% and 18%, sometimes reaching lower.

All E Technology Ltd serves a diverse range of industries

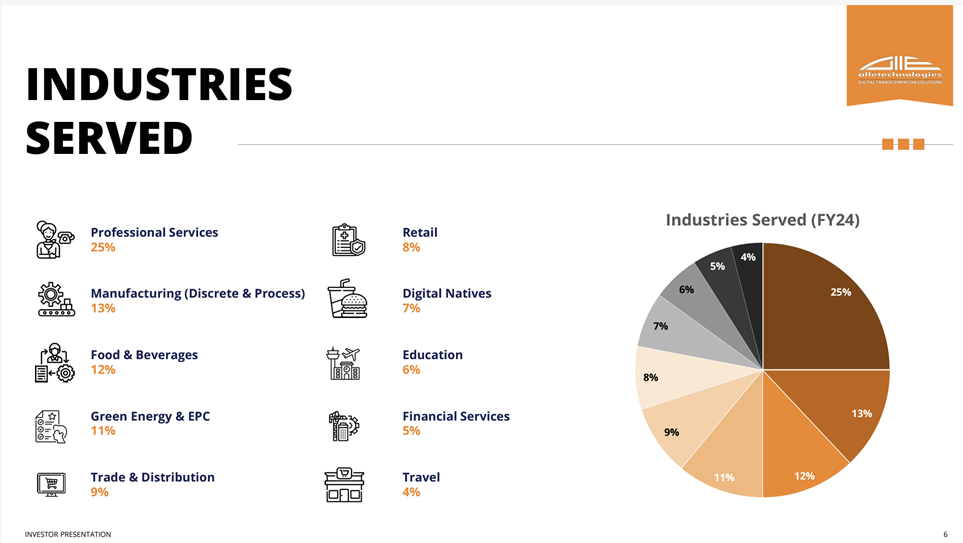

Alletec serves a wide range of industries, with Professional Services accounting for 25% of the total. Manufacturing (Discrete and processed) is the second largest at 13%, followed by food and beverages at 12%.

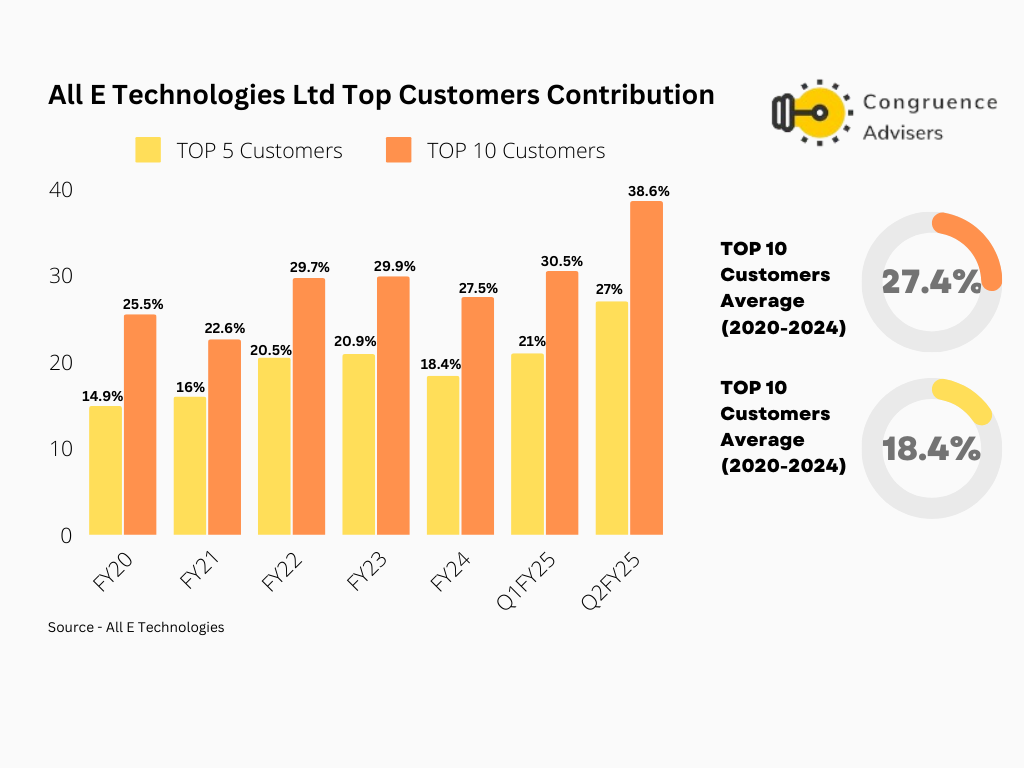

Revenue mix from top customers

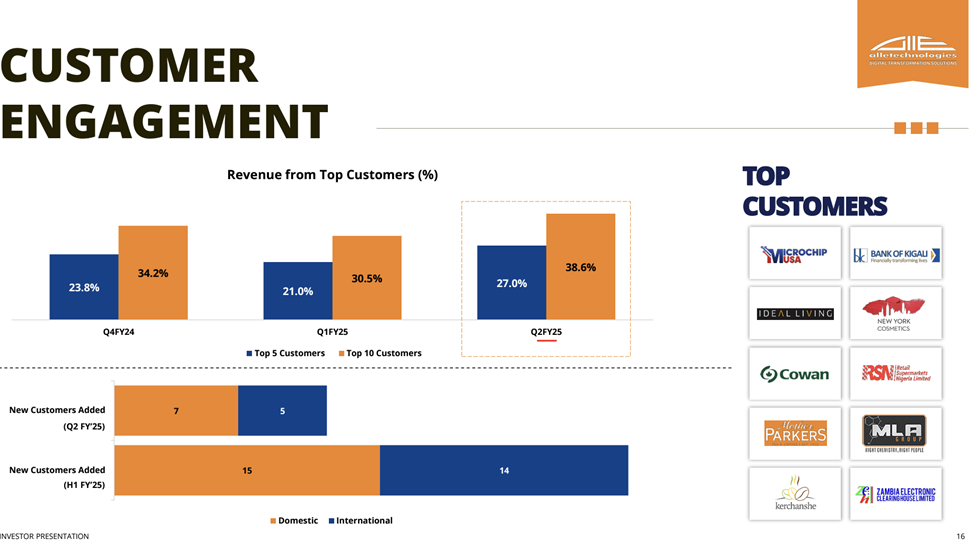

All E Technologies Ltd’s Top 5 & Top 10 customers as % of revenue has increased and are at highest in Q2FY25. Indicated high concentration risk; this needs to be monitored in terms of how fast management can reduce it over time.

All E Technologies Ltd has added 11 customers in Q1FY25 and 29 customers H1FY25 including both domestic and international

Its SaaS (Software as a Service) model increases wallet share by taking over data centre and IT maintenance costs for clients. Thus, it provides recurring revenue over a customer’s lifetime as the initial CAPEX transitions to OPEX, providing greater stickiness.

All E Technologies Ltd has a strong focus on maintaining long-term customer relationships and has 275+ active customers.

All E Technologies Ltd is a digital transformation partner for the top 20% of SMEs, focusing on deals between $100,000 and $1 million. Instead, All E Technologies Ltd’s sweet spot is the small ticket size where the deal size & sales cycles are relatively smaller. Given the lack of complexity of internal business processes as compared to larger clients, implementation needs are relatively simpler and quicker to achieve.

Sales and Marketing Team

All E Technologies Ltd has a sales and marketing team of about 16-20 people. They try to get leads via cold emails, industry events, digital marketing, round table hosting, and sponsorships. Other than this, Microsoft also shares leads with them. All E Technologies Ltd also participates in Request for Proposal (RFPs), which are issued by potential clients globally. Other than this, All E Technologies Ltd also upsells to its existing client base. More than 90% of their revenue comes from the existing client base. This is because the existing client’s requirements regarding technology keep changing as technology trends change.

All E Technologies Ltd has partners of its own, which pass on leads to them. For example, some company in North America that only sells Microsoft Office licenses (MS Word, MS Excel, etc) to businesses will recommend All E Technologies Ltd to their clients. Recently added a new Sales head in Toronto, having a sales office in Dallas – All E Technologies Ltd will continue to focus on sales as opportunities open up.

All E Technologies Ltd is now also looking at inorganic growth to get more clients as well as to get into adjacent lines of business. For example, they are trying to buy a data engineering and AI company that can give them the capability to be the AI partner of choice for their clients.

All E Technologies Ltd Corporate governance

Board Composition – As of FY24, the Board of All E Technologies Ltd. had 6 members: 2 Independent Directors, 1 non-executive & 2 Executive Directors. The Independent Directors bring relevant industry experience to the Board both directors served in technologies and startups. Independent Directors chair the Audit Committee and the Nomination and Remuneration Committee.

KMP Remuneration – All E Technologies Ltd KMP remuneration In FY24 was Rs. 2.6 Cr, which is 13% Net profit.

Related Party Transactions – All E Technologies Ltd does not have any material related party transactions that may potentially conflict with the interests of All E Technologies Ltd.

Contingent Liabilities – During FY 2022-23, Flamboyant Technologies Pvt. Ltd.’s cloud space was hacked, leading to the misuse of servers for money mining. The resulting cloud infrastructure consumption generated a significant bill, which was previously shown as a contingent liability. In FY24, Alletec resolved the issue by invoicing Flamboyant Technologies for ₹26.94 lakh and ₹1.32 Cr on 30th September and 4th October 2023, respectively. The company also agreed to pay Microsoft ₹1.48 Cr (including GST) in 12 equal monthly instalments starting from January 2024.

Dividend Policy – All E Technologies Ltd has consistently distributed dividends since FY22. For FY24, the total dividend payout will be ₹2 Cr.

All E Technologies Ltd Financial Performance

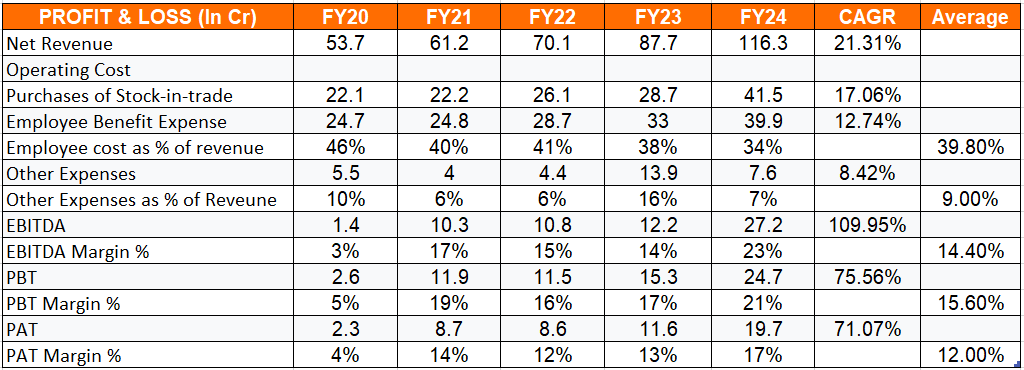

All E Technologies Ltd printed revenue growth around 20%+ CAGR in the last 5 years and 24% CAGR in the last 3 years. Employee costs have become more efficient as a percentage of revenue, dropping from 46% in FY20 to 34% in FY24. EBITDA%, PBT% & PAT% has growth much higher due to operating leverage and increasing international revenue mix and higher contribution of own IP Solutions.

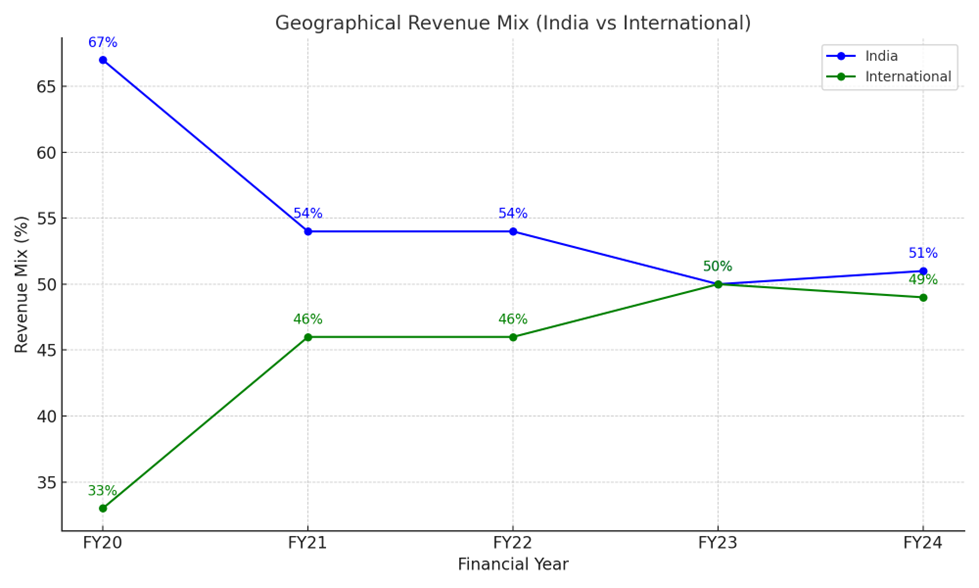

All E Technologies Ltd Region wise revenue mix

All E Technologies Ltd has increased its focus on international, specifically US, which has led to higher geographical mix from internal markets. The international market offers a higher margin profile as compared to the India market.

All E Technologies Ltd Service revenue mix

USA contribution has increased from 40.6% in Q3FY24 to 65% in Q2FY25, while India revenue has dropped from 36.20% to 24.50%. Going forward, All E Technologies Ltd aims to maintain 65% in the next couple of quarters. No Plan to explore EU or South African markets for now – APAC is a possibility.

The USA offers a relatively higher margin of 50-55% compared to 22-25% in India. All E Technologies Ltd leverages its India-based workforce while maintaining a dedicated team for international clients, enabling it to achieve better margins for comparable efforts. Thus consolidated EBITDA% has increased to 23% in FY24 due to a combination of services and geography mix. The key thing to note is that this pivot has been achieved without having to make large investments into manpower or sales teams.

All E Technologies Ltd Comparative Analysis

To understand All E Technologies Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparingAll E Technologies Ltd to its competitors (peer comparison) on various fundamental parameters and All E Technologies Ltd share performance relative to relevant benchmark and sector indices.

All E Technologies Ltd Competitive Overview

Competition In India – All E Technologies Ltd competition at 2 levels:

1. Competition from competing products from Salesforce, Oracle and SAP

2. Competition from the Consultants & System Integrators (large players being IBM, HP, PWC, KPMG and EY) who tend to have an inordinate say in the implementation partners that are finally chosen by the client.

In the USA and Canada markets – All E Technologies Ltd primarily faces competition from the well-established local mid-sized solution providers and Microsoft gold partners.

In Africa (other than South Africa) – where All E Technologies Ltd has started proactively building sales and marketing, Alletech is currently facing competition from local system integrators and Dynamics partners. This is also the case in most other geographies, such as Europe, the Middle East, and APAC.

While the market does have several other small and mid-sized solution providers, this market is usually not as competitive as the market for large IT projects where the deal sizes are > USD 5mn. Given the nature of this market, competition is usually limited to 4-5 players in each RFP where India based implementation players like All E Technologies have a clear cost advantage compared to larger peers in the developed markets.

All E Technologies Ltd management sees increased competition as a sign of an expanding market. Large players such as PwC and EY have entered the business applications ecosystem, intensifying competition but also validating market opportunities. All E Technologies Ltd has seen higher personnel costs due to competition but views this as a natural aspect of industry growth.

All E Technologies Ltd Ltd Index Comparison

All E Technologies Ltd share performance vs S&P BSE Small cap Index as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why You Should Consider Investing in All E Technologies Ltd?

All E Technologies Ltd offers some compelling reasons to track the business closely and to consider investing if one is looking build exposure to high growing business application software market

High base rate of growth in the Microsoft ecosystem – So long as the Microsoft ecosystem keeps growing at 20% p.a., there will always be downstream opportunities for implementation players like All E Technologies that can help bring down the Total Cost of Ownership (TCO). In the SME market in the US, reliability at hygienic cost is the right mix to win deals where All E Technologies has a global advantage by design.

Strong growth guidance by management – All E Technologies management is optimistic about growth prospects, targeting an organic growth rate of 20-25% p.a. All E Technologies is likely to exceed this target as they are in the advanced stages of finalizing deals with a few large organizations for their global operations and any Inorganic growth can further accelerate growth which they are actively looking for.

Margin expansion in play – All E Technologies Ltd is aiming for a higher share from both International Business and IP-led solutions for the next few years, which will lead to higher margins. Management is targeting a higher contribution of 65% from the US market in FY25

Higher focus on International Market – All E Technologies Ltd is putting greater emphasis on growing its revenue from international clients and markets, as these opportunities offer better margins for similar services and a more mature demand for its offerings. To support this focus, it has a dedicated team serving international clients, overseen by Ritu Sood and Ajay Mian. All E Technologies Ltd is actively exploring new territories, with a primary focus on the USA.

Inorganic growth – All E Technologies Ltd has more than Rs 100 Cr+ of cash on its balance sheet. It is actively looking for inorganic growth opportunities and exploring RPA, data engineering, and Al. All E Technologies Ltd has started an initial discussion with some companies for the same

IP-led products revenue share – All E Technologies Ltd has developed a range of IPs tailored for various industries, including Travel and Tourism, Banking and Financial Services, Green Energy and EPC, E-commerce, and Digital Initiatives. These IPs are built on the Microsoft technology stack and offered to clients either on a one-time fee basis or via subscription models. This approach not only ensures scalability and repeatability but also fosters strong customer loyalty to All E Technologies products.

Currently, 20-25% of All E Technologies Ltd products revenue comes from the sale of these IP products. In addition, All E Technologies products provide ongoing maintenance and upgrade services for its IPs, which generate higher margins. These solutions are highly customizable, drawing from All E Technologies’ deep industry expertise to meet the unique requirements of each client. This combination of low cost, quick execution & strong relationship with Microsoft positions the company as a reliable partner across multiple industries.

What are the Risks of Investing in All E Technologies Ltd?

Investors need to keep the following risks in mind if they choose to invest into this business. Risks needs to be weighed in combination with the advantages listed above to arrive at a decision that is optimal for your portfolio construct

Microsoft’s approach to the Partner ecosystem changing – This is the biggest risk in the business model, though a low probability one. If the relationship with Microsoft goes sour for whatever reason, there are many other equally capable partners that can fill into All E Technologies shoes within a short span of time without affecting the business prospects of Microsoft. Any bad development on this line can turn out to be an existential threat for the current business model.

Succession Planning and Keyman Risk – Since the inception, Promoter Ajay Mian has been running the show At 65 years old, he continues to lead and drive its operations, So succession planning becomes a thing to consider. Though All E Technologies Ltd is taking effective steps to address this issue by giving other senior members of the board to take up the responsibility and address the business issues.

Inorganic Growth Strategy – All E Technologies Ltd is actively looking for inorganic growth to enter adjacent solutions/products. One needs to track the valuation paid for it (as both private and listed markets are trading at higher valuations than in the last 3-4 years), and it involves a lot of due diligence and poses integration challenges with it. One of the recent inorganic target Where All E Technologies Ltd moved from the LOI stage to starting Due Diligence but is currently paused due to internal changes in the target organization

Talent Challenges in the IT Industry – Employee cost is something that is of prime relevance as it is their breadwinner. Also, in the current time when there is a shortage of skilled talent in this industry, they might face a shortage of hiring the right talent, which may hamper the business of All E Technologies Ltd.

Conservative Vision and Growth Strategy – All E Technologies Ltd Management’s vision is a bit conservative. They have an annuity model mindset, ensuring the surety of revenue but also not taking the risk of bidding for contracts of higher value, resulting in lower TAM.

All E Technologies Ltd Future Outlook

From the historical financials it is obvious that the growth prospects of All E Technologies look much better than the rest of the listed IT companies in India. The business has been printing > 20% YoY revenue growth rate for the last 8 quarters with no obvious signs of slowdown so far.

We would classify this as one of those businesses where the base rate of good revenue growth is very high, owing to its business model & small scale of operations. With the base technology platform growing revenue at > 20% YoY too (Microsoft Azure and Business applications verticals), there is bound to be a healthy pipeline of implementation services for all players in the partner ecosystem. In such a scenario, all a business needs to do is to replicate the template that has been working well so far without getting too ambitious. With a conservative management style and a growth veteran like Ajay at the helm, the business can squeeze out healthy growth and better PAT growth for years to come.

While the business outlook is healthy, valuation becomes the deciding factor when it comes to stock returns. Investors will need to do granular projections at a quarterly level to appreciate the pace at which earnings can grow and value the business accordingly.

All E Technologies Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

All E Technologies Ltd Price Charts

On daily charts, since All E Technologies Ltd listing in Dec 2022, the Price Action has been on a strong uptrend from listing, All E Technologies stock is in a consolidation phase between December 2023 – July 2024 between the price band of 220-300. Following that, All E Technologies Ltd stock broke out in late July, creating a bullish flag pattern again broke out in early November and a market-wide ongoing correction in October & November. All E Technologies Ltd stock looks relatively strong technically and created a new ATH in November. ~460 should act as strong support for All E Technologies Ltd stock in the near future.

On daily charts, one can see the two consolidation bands between Dec 2023 to July 2024 in the price range of 220-300 and between Aug, 2024 and Nov, 2024 in the price range of 400-480. One can see a strong breakout on extremely high volumes, followed by an ATH of 500, followed by a re-test of the ATH, and a pullback around 21 EMA.

In terms of moving averages, All E Technologies Ltd stock has consistently traded above its 200 EMA average in the last 1 year, All E Technologies Ltd stock has consistently traded above its 100 EMA and near 50 EMA averages. Even in the two brief marketwide corrections in August and Oct 2024, All E Technologies Ltd stock took support near its 50 EMA average.

The price trend on a weekly scale looks to be on a solid upswing.

All E Technologies Ltd Latest Latest Result, News and Updates

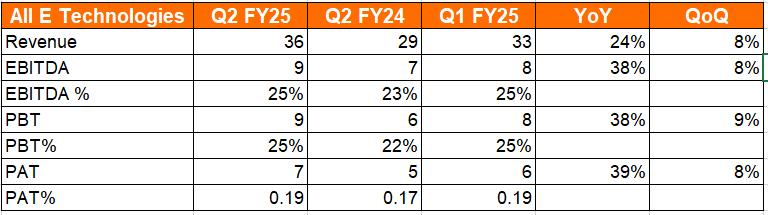

All E Technologies Ltd Quarterly results

All E Technologies Ltd, posted strong consolidated results in Q2 FY25, recording a revenue growth of 22% YoY from ₹ 29 Cr to ₹ 33 Cr. EBITDA grew by 38% from ₹ 9 Cr to ₹ 7 Cr and PAT grew by 39% from ₹7 Cr to ₹5 Cr.

Q2FY25 Industry Mix – Professional services at 26%, trade & distribution 13%, Manufacturing 13%, retail 13%, food & beverages 10%. Geo split for products & services at 48-49% India with the rest from International markets. Product & services split at 42% & 58%

13 new customers were added in Q2, including one large client. Additionally, the size of deals is also increased.

94% of revenue is recurring, driven by SaaS and ongoing service contracts. The Microsoft product line is growing faster than the market, with Microsoft Cloud at 22%, Azure at 30%, and Dynamics 365 at 20%.

All E Technologies Ltd Signed a letter of intent for an acquisition in Q1FY25 and initiated the due diligence process in Q2FY25. The process was paused due to an internal issue within the target organization, which may extend the pause for up to six months. Started discussions with another company, though no letter of intent has been signed for this new opportunity.

All E Technologies Ltd. is focusing on Africa and America for growth. Q3 will be a little challenging due to the holiday season in the US. Management is targeting an organic growth rate of 20-25% p.a., while margins will likely stay at a similar level going forward.

Final thoughts on All E Technologies Ltd

The positives are very obvious –

- Asset light and cash rich balance sheet

- Revenue growth > 20% YoY over the past 8 quarters

- No challenges on the cash flow front

- Good positioning in the Microsoft partner ecosystem

- A business development template that can be replicated for many more years

It all comes down to the investors view on valuation. Investors need to note that this stock is still on the SME board, hence low volumes and price limits will keep institutional investors at bay for some more time. One needs to see this as a retail & HNI counter where strong hands have already accumulated the stock at an attractive price and will continue to ride the price higher, till the business trend changes for the worse.

Since valuation is no longer cheap in an absolute sense, investors will need to do their own research if they intend to build positions here with a 3+ year view.

On an overall note, it is high time that investors start thinking beyond the usual large cap IT services names if one intends to be a good active investor. The plethora of options available in the listed space today weren’t there till 6-7 years ago. Differentiation in the portfolio construct with a nuanced view on valuation will be the name of the game for some more time in the Indian equity market.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.

Disclosure(Updated as of Nov 30, 2024) – The stock is part of the personal portfolio, please do not see this as an endorsement since the risk profile of the stock is much higher compared to the average small cap stock. The stock is still on the SME board, one single HNI exiting his/her position can bring the stock price down by more than 10% in a single session.