Only the optimists thrive. Only the paranoid eventually survive.

The true mark of intelligence is when one can hold conflicting ideas at the same time, yet continue to function rationally. The ability to appreciate varying shades of grey is one of the surest signs of maturity. In other words, black and white thinking can be the recipe for disaster over the long run, even if it can succeed brilliantly in the short run.

In investing, pessimists rarely create wealth. They can find twenty reasons to not trust the market at any point of time. However, pessimists are best placed to avoid large drawdowns, they are the ones to get the hell out at the first sign of trouble. You run away so that you can fight another day. An asset during tough times, a liability otherwise.

This works not just in investing but in evolution too. Dinosaurs got wiped out by some large event; rats, cockroaches and bacteria did not. Hell, we can never know if all of them existed at the same time but you get the drift. Species who are best placed to survive over a long period of time are usually small, resilient and reproduce in large numbers. Species that are best placed to thrive and dominate are large, but susceptible to changes in their environment and reproduce in small numbers.

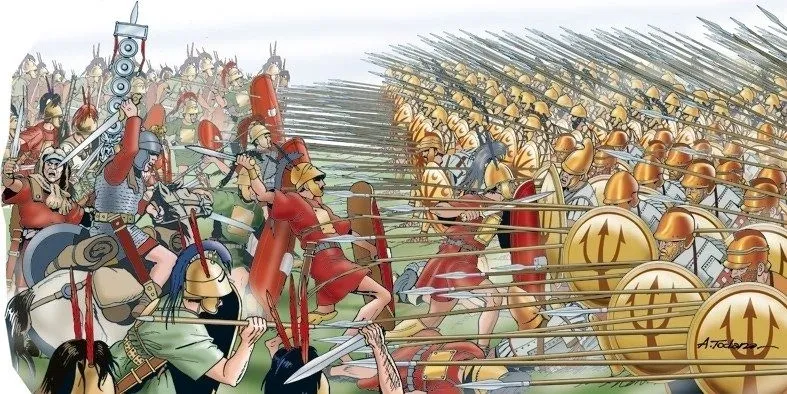

Look at military history. Greek military organized themselves into a Phalanx, a 16 by 16 structure of well-built men who held a shield in one hand and a long heavy spear in the other hand. The Phalanx formation enabled the Greek army to defeat the Persian army which was five times larger. This formation dominated the battlefield until it got defeated by the Roman legion, another unit of men with a large shield in one hand but a small sword optimized for close combat in the other. The problem was that once the Phalanx got outflanked it was toast.

Alexander believed in a decentralized army, if he fell/got injured it was just one Greek warrior out of the picture. The Persian army could not move an inch if their king got injured and could not direct action. Alexander personally led the cavalry charge and would place himself directly in the line of fire, this enabled him to read the battle as a participant and take decisive decisions. Darius would watch from far and would never fight, by the time he read the battle he had already lost since the Greek cavalry was within striking range of him. Darius’s strategy was based on numerical superiority and his ability to raise a large army through payments to allies and warrior tribes. Outflank/envelope the opposing army and overwhelm them with sheer numbers, even if his army was less skilled. Works well when things go as planned but the army becomes a slow and clumsy unit otherwise.

In investing scale works against you when it comes to performance. It is much easier to deliver healthy alpha on a 100 Cr portfolio than on a 10,000 Cr portfolio. Good retail investors in India should beat fund managers hands down across market cycles. Almost every good investor in my close amateur investing circle has compounded at 20%+ over the past decade. When large funds start underperforming, they rarely get back into the top Quartile again.

Good retail investors are expected to be more resilient, if one goes by nature’s laws. We can switch between being optimistic and being paranoid without caring too much about what other people think. Even if we are wrong over the immediate term, we can make up for it over the medium term.

Some amount of sub optimal positioning somehow creates resilience across domains, though it does have a cost over the short term.

Just in time inventory management works like a dream when all goes fine, but when there are disruptions in the supply chain you can be stocked out of critical parts for months. Any serious investor would have read about the China plus one approach post COVID. Globalization meant you source components/materials from where they are cheapest/best in the world, but if something disrupts life/economy in that source country you have the entire world suffering for a few months.

Mike Tyson would go for a 3-mile run every morning at 4 AM. He was a heavyweight boxer but he knew the importance of clubbing endurance with strength and technique.

Ali frustrated Foreman for 7 rounds and took the fight to a situation where Foreman (bigger, stronger, younger) was gassed out.

In Mixed martial arts, an elite Muay Thai fighter beats an elite boxer most of the time. The boxer is trained over years to load up his legs and torque his hips for a good strike, once the Muay Thai fighter lands 3-4 low kicks on the lead leg of the boxer the fight is over.

However, if you teach the boxer how to check kicks, he knocks out the Muay Thai fighter more often than not. His size and strength advantages matter only if he is resilient against the Muay Thai kicks.

Mature investors build redundancy into their portfolios to ensure they always survive. Sometimes it means leaving some gains on the table, sometimes it means taking cash calls.

I rode the 2017 small cap frenzy all the way to the top, when the eventual reversal came in 2018 it was painful. The only way I could have reduced the impact of the 2018 draw down was if I had started reducing exposure through the second half of 2017. Those who lived through the 2008 correction have a similar story to tell. The benchmark index rose almost 50% through the second half of 2007, leaving some gains on the table could have better prepared investors for what 2008 had in store. Of course, they had no idea what was coming in 2008 but that is the exact idea, always be prepared for a large correction.

Act like an optimist most of the time, but think like a pessimist at regular intervals.

Aim to be rich, but don’t aspire to become very rich. Too much money pushes you into dealing with a higher degree of complexity.

When strong leaders display a rare moment of vulnerability, it makes them more endearing to their followers.

Perfection is always short lived. Some amount of suboptimality makes things more enduring.