A Multi asset and Multi Geo Perspective Making sense of macro movements and what is being priced in

January 2018

Disclaimer:

The points made here are inferences based on personal experiences, please do your due diligence before applying these to your unique investment scenario.

This is at best a study and does not constitute investment advice.

Scope of the Discussion

Scope of the Discussion

What is this not intended to be

- A macroeconomic discourse

- Detailed tutorial on Fixed Income, FX or other markets (one will need to do his own reading)

What is this intended to be – an attempt to

- Convey how doing this exercise can add value to investors and stock pickers • Establish a basic framework to connect what happens in different asset classes • Understand the prevalent common knowledge and dominant narratives in financial markets • Make sense of what the broader financial markets are expecting and are pricing in – and attempt to identify what can upset these calculations

What can one do to build his own framework

- My current objectives as an investor and what kind of reading I do to build on this • What data sources can one look at to evolve his own framework

Part I

Making sense of markets reactions – Inferring real world possibilities from market movements

Common Knowledge and dominant narratives today – Inferences from Global and India specific markets

Some Basic Concepts & Terminology

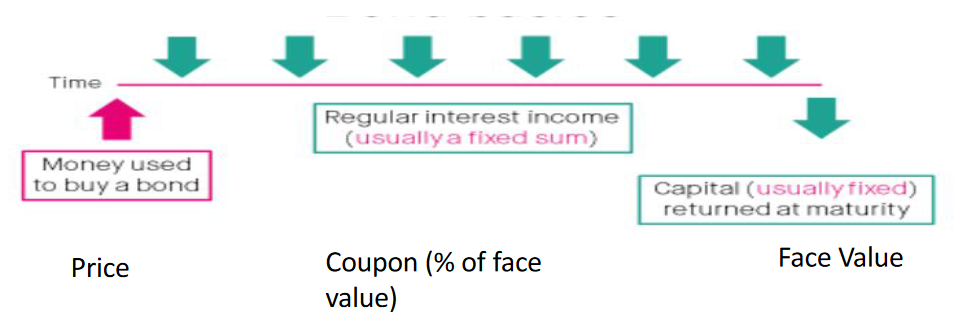

Yield to Maturity (%)– The discount rate in the NPV formula that makes the calculation equal to bond’s CMP

YTM and Bond Price move inversely, yield moving up means price goes down and vice versa

At CMP = Face Value, Coupon rate = YTM

Coupon rate is determined by credit rating and the spread it goes at over the risk free rate (T-Bill or G-Sec)

Lower than 1 year papers (no coupon, all are discounted securities) Certificate of Deposit (issued by banks)

Commercial Paper (issued by corporates)

Treasury Bills (issued by GoI)

Greater than 1 Year tenure papers

Government Securities (issued by GoI, sets the risk free rate for the particular tenure) Corporate Bonds (AAA, AA, A and unrated) – these trade at a higher yield than the corresponding G-Sec

Term Spreads – The additional yield (expressed in bps) that one demands to hold higher tenor paper

Credit Spread – The additional yield (expressed in bps) that one demands to hold a lower rated paper

Duration – measure of interest rate sensitivity of a bond, higher the remaining tenor of the bond, greater the sensitivity to interest rate movements

Low Duration – Less than 1 year, Short Duration – 1 to 3 years, Medium – 4 to 6 years, High – 6 years and above

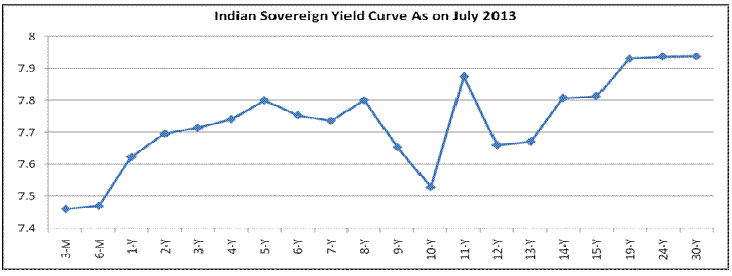

Yield Curve – One can draw this for G-Sec, AAA, AA and all other categories

Why are bond yields so important?

They set the base rates for any economy, borrowing costs are expressed in this terminology (LIBOR + 100 bps), G-Sec + 100 bps etc

Bond prices are determined by – Interest rate set by Central Bank, Demand (Banks, Investors) and Supply (Govt borrowing, Corporate Issuers), Expectations on inflation and interest rate action

2008 – Was a credit crisis (MBS)

2011 – Euro zone crisis was a sovereign debt crisis

Risk Free rate for any economy determines the discounting rate one uses to evaluate any security (including equities)

Common Knowledge – What everyone knows that everyone else knows. Some examples, not necessarily right but these were the dominant narratives

Whatever goes wrong, Central Banks have our backs (Ben Bernanke Put after US QE) ECB will do whatever it takes to save the Euro (the Mario Draghi way)

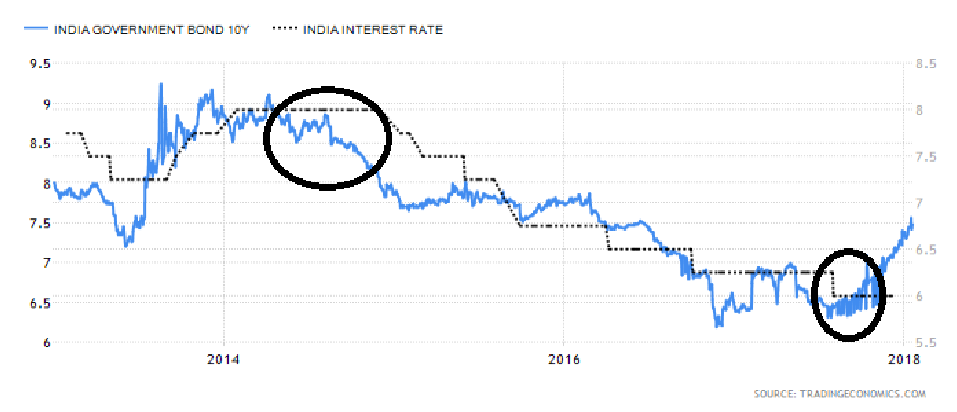

Interesting trends – Bond markets call policy actions before they materialize

Yield after mid 2014 falls way before the rate falls Yield spikes before the RBI even talks about a hike in end 2017

Till mid 2016 the yield kept falling though rates were raised After mid 2017, yields are now leading rate increases

Why this matters – Case Studies

Why this matters – Case Studies

Case Study 1 – Gujarat Election results on 18 December 2017

The 10 year G-Sec opened the day 14-15 bps higher on 18December (9 AM),USD INR – INR was lower almost by 0.7-0.9% when the FX markets opened (9 AM), Domestic equities fell almost 2.3% within the first 15 mins of trade (9:15 – 9:30 AM)

While election trends were too close to call the financial markets called the election well before the news channels did –

10 yr G-Sec rallied from the intra day low to trade 8-9 bps lower first, almost simultaneously the F&O market ran well ahead of the cash market with ITM Put premiums falling and OTM Call premiums rising (10300 Put fell from 87 to below 50, 10300 call went from 64 to 90) before the cash market caught up, equities rallied from intra day lows (only after 9:30 AM) and closed the day almost 50 points higher on NIFTY

What were the markets pricing in once the election became too close to call – 1) Dirtier politics. Fiscal spending up, possibility of rates hardening – Bond prices fall 2) Double whammy of higher crude & higher fiscal deficit – INR depreciates 3) 2019 win for Modi no longer a certainty? – equity markets have to price in this new found uncertainty

Note – Resonance across all three markets, all of them are concluding the same possibilities and pricing it in, markets were complacent going into results day (NITY went up 80 points on preceding Friday)

Case Study 2– Results of the Brexit Vote on 23 June, 2016

Financial markets across the world went into counting day with a sense of complacency going by the results of the opinion polls. Summary of how various markets reacted that day –

- GBP fell from 1.50 to 1.32 (at the lowest point) against the USD – biggest GBP fall in the era of free float FX

- US Equities fell by 3.8% led by banks, FTSE (UK Index) fell 9% intra day, Japan Indices (Nikkei and Topix) fell almost 7%, Crude down 6.4%

- Eurozone periphery bond yields up anywhere between 20 – 35 bps on their 10 year papers • US treasuries (10 year yield fell 30 bps intra day) and Gold soar (8% up), JPY appreciates 7%, UK Gilt yield fell 35 bps, German Bund 10 yr yield fell to -0.18%

Making sense of these movements –

- Bond yields – Eurozone breakup a real possibility, periphery bond prices fall while core economy papers like Germany and Swiss appreciate (flight to safety). Effect on trade agreements and flows – Crude falls

- UK Gilt appreciated since the bet was that BOE will come in with a liquidity line and additional measures to calm markets – this is why all equity markets ended way above the day’s lows 3. Safe havens – JPY, Swiss Franc, US Treasuries and Gold soar

Note – Once again all markets telling us the same thing, pricing in the same

Key takeaways (in my opinion and experience)

1) A view across asset classes helps one better gauge the overall mood of the markets (Risk ON or Risk OFF). Watching a single asset class or market is more likely to cause one to jump the gun UNLESS ONE IS A VERY GOOD TECHNICAL ANALYST (which most of us here are not)

Example – A 5% correction in Indian equity markets carries a different meaning today if that is accompanied by an appreciation of safe haven assets and currencies than it does otherwise

2) Resonance across all markets usually has been a very good indicator of pivotal points in trend reversals.

Example – In the Aug 2013 crisis, we had Indian equities, FX and Bonds all going into a tailspin for 10 days before the trend reversed. In Feb 2016 we had a similar run happening, the fall is usually the sharpest across all asset classes just before the trend reverses

Jan 2007 to Jan 2008 – India equities and FX kept appreciating almost every week, bond yields were at 1 year lows though we were in a rate hike cycle when the market peaked out. The ferocity of rally across asset classes is the fastest just before the eventual reversal

3) A reference class approach is more important today than it was 10 years ago

Rise of passive investing in developed markets (more than 60% of incremental money is going into ETF’s and Index funds in the US)

Rise of algorithmic investing and trading (marketstend to move in clusters and packs) Volatility is either too low or too high due to these clustering effects, diversity in financial markets will only come down before it goes up again

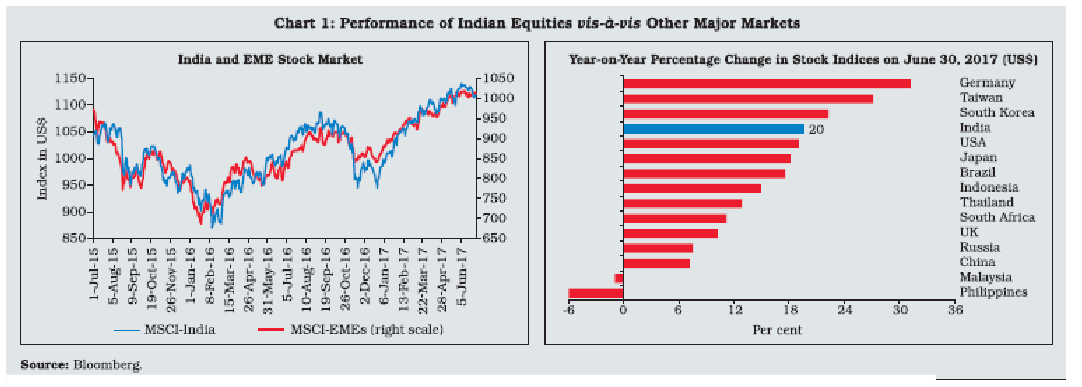

Example – If one sees performance of EM FX and EM equities through 2017, one will see that Indian market performance is well correlated to what MSCI EM index has been doing

4) Central Banks will continue to be important till economies and trade get better, interventionism that dominated from 2009-2016 will still lurk as an important variable

Examples of the Central Bank omnipotence narrative – The hype on US Fed raising rates, ECB reducing rate of monthly asset purchases, Chinese currency pegging to the USD still dominate most of what happens in the FX and bond markets (hence the anomaly of the yield on some PIIGS nations debt lower than the US 10 year yield, it is about Central Bank policy and not yet about fundamentals)

2009 to 2016 was all policy driven markets, 2017 is when we started pivoting to a fundamentals based market

Interesting Data Points – Equities & Commodities

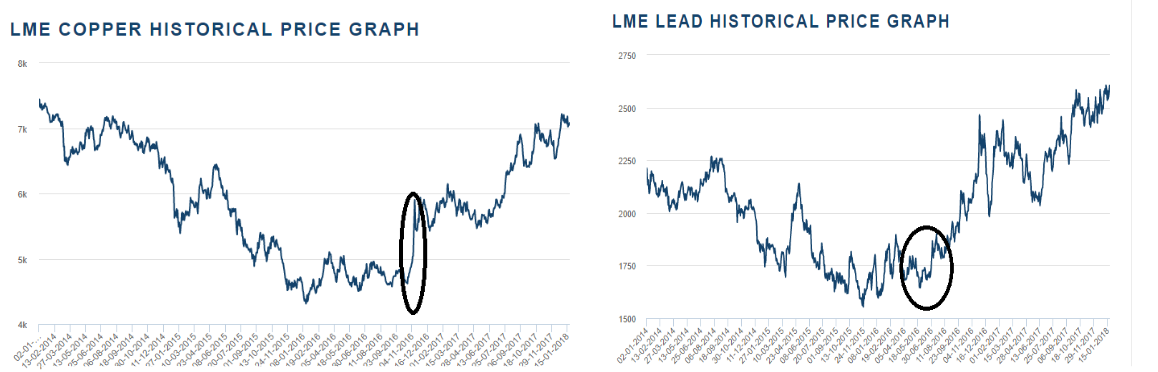

Most commodities (after minor adjustments for specifics) spike at the same time the US 10 yr bond yield started trending up, all equity markets show a similar trend from end of 2016 onward

Markets – Where are we today

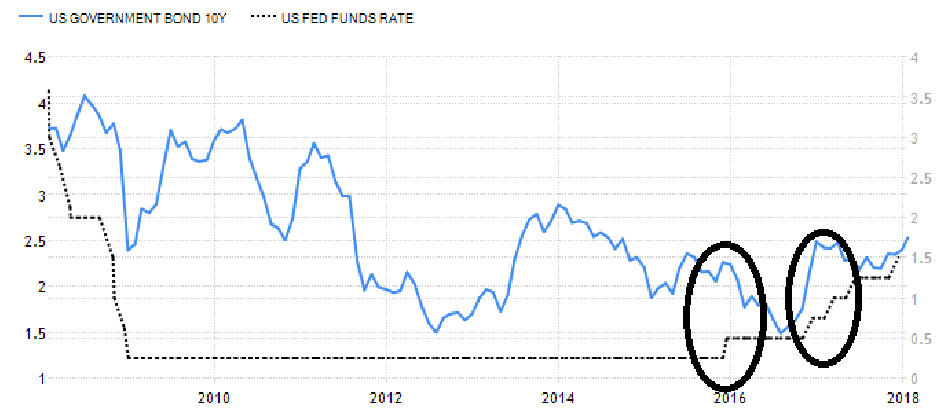

US Markets – Officially into the rate hike cycle, QE taper started August 2013 and ended in October 2014. Rate hike cycle started Dec 2015, funds rate currently at 1.25 – 1.50%, more rate hikes expected

What does a US Fed rate hike cycle imply?

- Greater confidence shown in the real economy by the Central Bank (inflation, unemployment)

- Higher bond yields (US 10 year at 2.6%+ now), higher borrowing cost for mortgages • Positive for growth assets (think equities and commodities) till inflation becomes a concern

Interesting snippet – US 10 year yield kept falling from mid 2015 till end of 2016 though Fed had already started the rate hike cycle. The spike in yield came only after Eurozone concerns were addressed in early 2017. Clear indications that bond yields now started reacting to fundamentals

Inferencesfrom this –

- Positive for equities till inflation becomes a concern

• Negative on US bonds unless another unanticipated negative event hits. Any reversal in the US bond yield trajectory needs to be watched carefully

Eurozone

- ECB QE continues, tapering expected in 2018

- After the Eurozone crisis of 2011-13, ECB taper has kept bond yields low for some countries that do not deserve to trade so low (Euro is a common currency, each nation runs its own fiscal policy)

- PIIGS nations bond yields continue to trade at levels below 2%, we had almost USD 10Bn worth papers trading at negative yields till end 2016

Inferences-

- EUR USD pair appreciating to 1.2+ from 1.06 after the Brexit vote indicates that political stability is good and unity issues are relegated to a low probability event now • Bond yields indicate that QE will continue for some more time and that inflation is not a concern

- Real economies in the Euro block will take more time to become healthier, say 3 year lag w.r.t the US

- Watch for reversal in EUR USD and strengthening of Swiss Franc – indication that some concerns arising

- Positive Eurozone bonds, neutral for equities from a fundamental view, positive from a liquidity and central bank support point of view (watch for country specific trends) • Negative yields trajectory revival in German and Swiss bonds is a strong reversal sign to watch for

India

- Appear to be in for an extended pause on rates or a reversal in rate cycle in 2018. 10 year bond yield has risen from a low of 6.4% to current level of 7.3% (increase of 90 bps while the RBI cut rates by 25 bps during the period!)

- INR has been showing an appreciating bias for the past 2 years, RBI intervention (FX reserves up from USD 260Bn to more than 400Bn since 2014) has kept INR to more than 63 to the USD

- Equity markets at all time highs driven by domestic liquidity flows (SIP inflows of > 6200 Cr a month) and MF equity cash position in excess of 30,000 Cr

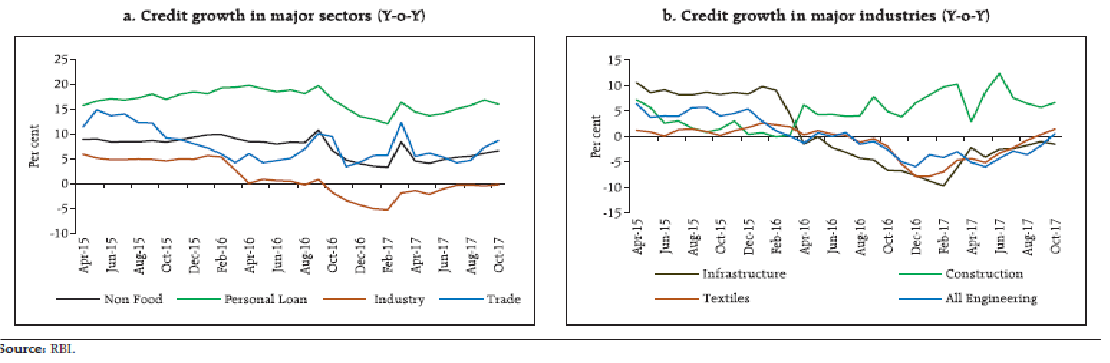

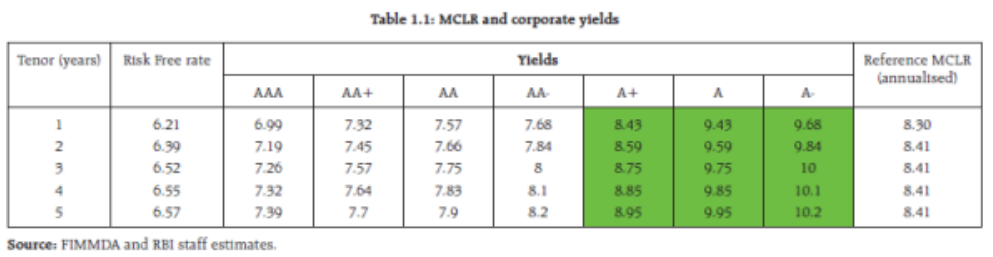

- Bank credit growth at sub 10% for more than 3 years now, however if you account for the growth in AUM of Corporate bond funds credit growth will be closer to 12-13% • Due to rise in bond yields, difference between bond market rates and bank lending rates coming down

- Bond yields have spiked in spite of banks investing large part of incremental funds into G-Sec due to lack of lending opportunities

- We are in a scenario where lending rates may fall without incremental rate cuts by RBI (this always happens with a lag), RBI cuts rates first, deposit rates fall and then lending rates

India Market Specifics – Let us try to triangulate

RBI Financial Stability Report – Dec 2017 Signs of Bank credit revival? Seen in combination with higher bond yields, banks may become more competitive going forward on lending rates Reducing AAA and AA bond spreads indicate that well rated corporates have been having an easier time borrowing money from the markets, while BBB has been having a tough time

India Market Specifics – Let us try to triangulate

In RBI’s own words – Difference between risk free rate and MCLR rate of banks expands scope for dis intermediation of bank financing by corporate bonds in case of quality corporates. Pervasive

domestic liquidity following demonetization has pushed down cost of borrowing for higher rates corporates

Inferences–

- We may have a scenario where G-Sec yields continue to rise while AA and above yields may rise at lower pace?

- If so may we have a scenario where the outlook for top rated corporates is better than the macro outlook for the country?

- With RBI managing INR levels well and India’s Sovereign rating being upgraded, corporates dollar borrowing cost is likely to remain benign as well?

- Lower credit spreads and bullishness in equity markets often go together! If so is the equity run really out of place?

- Both equity and credit markets are pointing to a good run for organized, well rated corporates

It would not be prudent to outright dismiss the equity market run going by what the credit markets are indicating

Implications for Investors

What does one do with the fixed income/cash portion? This is overlooked by most bottom up investors. The shorter end of the yield curve returned almost 6.8% over past 12M while the longer end of the yield curve returned -2%

- Earnings often is the last variable to turn and validate the hypothesis, borrowing cost for well rated corporates and credit spreads are excellent lead indicators of a better time for corporates. Of course credit markets can be wrong sometimes as well 🙂

- For small cap investors, the AA corporate yield +/- 100 bps is the discounting rate one needs to use in the DCF. Through 2014 and 2015 one should have gone with the Yield – 100 bps, right now Yield + 100 bps is a realistic estimate. This can swing intrinsic value calculations by a considerable range

- Inflation (especially WPI) trending up may well be viewed as a positive sign by the equity market in the early stages given the 65% weightage towards manufactured products. WPI is indicative of pricing power for industrials, this typically tends to happen as capacity utilization crosses the 85% mark (currently closer to 65%)

- G-Sec yields going up may be more of a call on Fiscal spending by the Govt, rather than a call on inflation trending up. If Inflation is the key variable one should expect AAA and AA yields to rise at the same rate

Implications for Investors

Reasonably good understanding of multi asset and multi geo macros can provide bottom up stock pickers the additional edge needed. A bottom up stock picking framework combined with a macro view is not an easy combination to find.

- Such a framework is valid especially in times like these where there is a lot of nervousness around equity market levels, a broad framework built on common sense and inferential reasoning can help us better navigate market gyrations

- A smart approach to fixed income can boost overall portfolio returns, a duration focused approach in 2014 and 2015 would have returned more than 11% on the fixed income portfolio while a conscious call to stay away from duration from 2016 onward would have protected capital and provided gross returns in the range of 7-8%

Word of Caution

Never try to be a macro economist and predict what will happen across asset classes and geographies. Our endeavour should be to infer what the various markets are indicating, evaluate the consistency of messaging, figure out the dominant narratives and adjust our probability models accordingly (similar to a reverse DCF approach)

Part II

Data Points to Track

Global

- Sovereign Bond Yields

- FX Currency pairs (Track USD, EUR, GBP, JPY, CHF pairs if not anything else) • MSCI EM trajectory (Morgan Stanley Composite Index – Emerging Markets) • Commodities

Domestic

- Yield curve (G-Sec, AAA, AA yields – calculate term and credit spreads) • Note the shape of the yield curve (normal, inverted, flat)

- Forex Reserves

- Credit and Deposit growth rates

- Historical returns of fixed income MF categories (Ultra Short term, short term Corporate Bond, Income Funds)

- YTM and Duration of these fixed income MF

- 10 year benchmark G-Sec yield

Spend 15-20 mins a day looking at all these data points

Global FX, Bond Yields – https://www.bloomberg.com/markets/

Read select articles on the markets page, good source to understand the dominant narratives in these asset classes

Spend 10-15 mins a day making mental notes of how these have moved overnight and link the narratives to these movements. Over a period of 18-24 months, once can straight away guess what the narratives would have been just by looking at the data

Commodities – Bloomberg page within the markets section, LME site

Charting – Basic functionality on the tradingeconomics.com site

Domestic Economy – Bloomberg terminal (if you have the access) for the yield curve RBI database for other data points (Forex Reserves, Credit and Deposit Growth) https://dbie.rbi.org.in/

Track real time bond yields here – https://www.ccilindia.com/OMHome.aspx Fixed Income MF returns – Valueresearch.com or moneycontrol.com should suffice

Once doing this regularly becomes a habit, one can start getting into inferential reasoning and build hypothesis on how X will react assuming Y changes while Z remains the same.

Suggested Reading to build the right mental models

Alchemy of Finance (Soros) – Suggest a reading of his diary in the second half of the book. I found the way he went about building narratives and hypothesis very fascinating, even more fascinating was his ability to accept that he was wrong and quickly reverse positions

Salient Partners, Epsilon Theory website (Ben Hunt) – His definition of the term common knowledge and how displacements from the common knowledge narratives shake the markets are very insightful

Zerohedge – Sometimes carry some very insightful articles on how macros across the world are severely under pricing risks and what those risks could be. You may need to discount the deep negativity 🙂

RBI Publications – Very under rated resource. Read their credit policy statements without exception, Annual Report, Financial Stability report can occasionally be a very good read

This calls for different mental model in my opinion since the signal to noise ratio is very low as compared to investing/speculating on individual businesses.

This mental model is mandatory if one wants to trade options at a later point of time