The Decade that went by

First up, some thoughts on the year that went by.

The biggest mistake that investors could have made during CY2020 was overthinking things. Any time one went “I am smarter than the markets, whatever is happening is madness”, one ended up getting clobbered.

When the COVID-19 crash started in late February, none of us could have predicted that the NIFTY 50 would fall from 12,000+ to a low of 7,500 within a month. Once the bounce back started in April, none of us could have foreseen a level of 13,600 on the same index before the CY ended. One had to keep the independent thinking hat on as a stock picker while constantly calibrating to what the markets across the world were telling us.

2020 was the year when novice, first time investors beat the pants off professional fund managers. Reason? They just trusted the age-old wisdom of buying during a bloodbath while the fund managers were busy thinking and not trusting their own experience.

We all know some smart and experienced investors who sold off in August and have been waiting for an entry point ever since. Twiddling your thumbs while the market runs up another 20% is never a pleasant experience. Especially if you went out on a limb and proclaimed that the market has lost its mind and is completely disconnected from the economic ground reality. Trailing stop losses exist for a reason, why be in a hurry to book out when the trend is in your favour?

The investors who were the most deterministic in their views were the ones that sat out of this rally. Those that were sane enough to keep an open mind are still the riding the trend and have made more money in 2020 than they did in 2014 and 2017. And those two were amazing years for Indian equity investors.

While 2020 is fresh in our minds, what we sometimes fail to take into account is how the operating environment has changed over the past decade. In investing, context is everything. Tracking geopolitics, FX markets, bond markets, commodity prices, central bank action, inflation et all and making sense of where the world appears to be headed is not easy. Neither is it a high accuracy endeavour.

With this context in mind, let us look back at some very important developments that played out through the decade of 2010 – 2020 and ask ourselves, did we see any of these coming?

I would want to wrap up 2020 on this note. For all the advances in technology, predictive analytics and the plethora of crystal ball gazers we have in the world, I would be very surprised if any of them saw any of these major changes coming.

If so, doesn’t excessive confidence/determinism have an impact price in investing?

Being right or wrong hardly matters by itself.

What matters is how much do you make when you are right and how much do you lose/leave on the table when you are wrong. Soros said this almost three decades ago.

The crude oil saga

At the beginning of the decade, brent crude traded at more than USD 100 per barrel. As of date it trades at less than USD 50 per barrel. Since 2015, it has traded below USD 50 for the most part, including a short tryst with a negative price in April 2020.

For a country like India where crude oil import is a big component of the trade deficit, this was such a huge boon that I believe this fundamentally changed the macro picture of the country for the better. If it weren’t for this event, things may well have been different today.

How many of us saw this coming at the beginning of the decade? None from what I can recollect. But we all knew in 2015 that this was potentially a massive trend change for India,

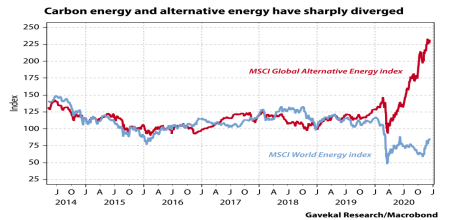

Now look at the following chart, make your own observations. 2020 might turn out to be pivotal too.

The USD-INR trend post the Aug 2013 mayhem

Once the carnage of the sharp INR depreciation had played out in August 2013, the fragility of the INR was the talk of the town given the twin deficits the country was grappling with. The RBI inadvertently sent the bond market into a tizzy in an effort to defend the INR from short term speculative attacks. So much, that fixed income funds with a duration of > 4 years were staring at a 6-7% MTM loss in a single session. This event did more to educate Indian investors about duration risk in fixed income than did all the courses and seminars put together.

The USD-INR pair went to 68+ in a matter of weeks, at that point of time almost everything was a problem going by the narrative. The stance of the RBI, their approach to communication, our FX reserves and our import cover. Almost everyone was sure that the INR would very soon depreciate more and that the FII’s would seriously reconsider their India stance.

What actually transpired? USD-INR has moved to the range of 74-75 over the 7-year period since then from a level of 66-68.

Watch the FX reserves of the RBI, over the past 5 years this has almost doubled to the current level of USD 570 Bn. The RBI has done this by absorbing USD over the years and by keeping the INR from appreciating. A weaker rupee is not a bad deal after all, just that the RBI wants it to move at its own natural pace in an orderly manner in response to market forces.

How many gurus foresaw this extent of stability in the USD-INR pair? Not many in 2013.

The decade of low inflation in the US

In the early part of the decade gold price ran up significantly up till 2012, peaking out at USD 1950 per ounce. The narrative was that all the money printing being done by the US Fed and the ECB would spike inflation sooner or later. Didn’t really pan out that way, did it?

What we have instead had is a decade where asset reflation has happened but inflation hasn’t reared its head at all. No better indicator of this than to track interest rates across the world and to watch bond yields in the developed markets.

To be fair, some of the better macroeconomic commentators got it right in 2014 that very low interest rates may well be the new normal for the next decade or so in the developed countries. But this call was next impossible to make at the beginning of the decade. Gold price in USD terms did not cross the 2012 peak until the COVID-19 crisis hit earlier this year. So much for QE stoking inflation.

Sovereign Bond Yields in the Eurozone

10 Year yields of all Eurozone issuers with a AAA rating (Govt Bonds and Corporate)

Watch the YTM of the AAA bonds after 2018, it was in negative territory even before COVID-19 hit. Almost USD 17 trillion of debt across investment grade issuers now trades in negative yield territory, that is almost 27% of the outstanding issuance within the category.

If we were to look at just the PIIGS nations (those that spooked the market during the 2012 sovereign debt crisis in the Eurozone), the picture is even more startling. Greece 10-year Govt bond yields 0.63% today, this was more than 10% when the decade started.

Today’s Eurozone periphery bond yields make the concerns of 2012 look borderline paranoid, but then that was the narrative back then.

Who could foresee this? Not many.

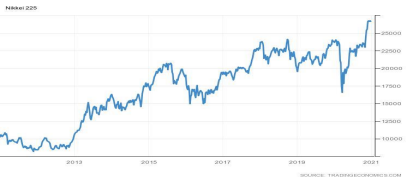

Japan’s quiet equity bull run

Japan has been a case study for equity market investors even since the 1990’s. The equity bull run peaked out during the latter part of the 1980-90 decade, leaving investors holding a bunch of overvalued stocks that just would not recover to their highs no matter what.

Japan was also touted as a country with a unique set of problems with no solutions in sight. Unfavourable demographics, minimal immigration, low bond yields, very high debt to GDP and an equity market that was a case study for all the wrong reasons.

Let’s see how the Japan equity market has done through the past decade.

bad eh? 2.5X in a decade in a country which is plagued by such problems is nothing to scoff at.

What does the return look like in USD terms if you keep aside financials?

Even better! In USD terms, even the Nikkei 225 is back to its all-time highs.

How many are talking about this right now? Not too many.

Enough charts and narratives.

What are we driving at here?

None of these big trends of the decade that went by (there are many more) could be foreseen by anyone. All one could do was to calibrate and keep updating the context in which one was making investment decisions. This has as much to do with game theory as it has to do with macroeconomic principles and business analysis.

When the best brains put together were not able to predict most of these, what edge does the average investor have when it comes to blue sky thinking? Our sincere suggestion is that investors keep aside their academic degrees and preconceived notions about how markets are supposed to be, keep their ego in check, get off their high horse and spend considerable time listening to what the markets are telling them.

- If it weren’t for the very low interest rates across the world, would the Indian high-quality consumer stories be trading at price to earnings multiples in excess of 65?

- If it weren’t for the game changing crude oil price collapse in the mid of the decade, would the INR have stayed this resilient?

- If it weren’t for the more stable macro-economic environment for India post the US Fed taper tantrum, would the FII’s have continued to invest into India to this extent?

- If it weren’t for Donald Trump and his anti-china rhetoric followed by the COVID-19, would we have seen the emergence of the China + 1 narrative in sectors like pharma and chemicals?

In a social science like investing, there are no boundaries that can be defined on what can impact the markets. It is not just the events that matter, the sequence of events matters too.

The best one can hope to do is to

- keep calibrating to the market movements

- have a good inferential reasoning framework that can assist one in understanding the investing context better than most others

- The last one is probably one of the most underrated aspects of investing.

Buffett is 90 years old, 99% of this net worth as of today was generated after he turned 50 years of age. Focusing on our health and endurance is as important as all of the investing skills.

take bets based on risk/reward mismatches as and when one perceives them – have a well-defined risk management framework that can limit losses when things go sour – stay humble and keep learning lessons while ensuring that the mistakes do not kill you – live long and hope for compounding to make a difference.

A good investor who lives to 70 years is likely to see more wealth than a great investor who lives to 55 years.

Disclaimer

The document expresses some views on specific business to better illustrate certain concepts. This does not constitute either investment advice or a recommendation to BUY/SELL/HOLD any of the businesses being discussed.

The purpose of this publication is not to express views on the valuation of the business or the sector being discussed. Most of the content here is an exercise in inferential reasoning and the mental models involved in thinking about businesses in general. Effective learning calls for specific examples to drive home the core concepts and that, precisely, is the endeavour here.

While utmost care has been exercised in preparing this document, www.congruenceadvisers.com does not warrant the completeness or accuracy of the information contained and disclaims all liabilities, losses damages arising out of the use of this information. Some statements and opinions contained in the document may include future expectations and forward-looking statements that are based on current views and involve assumptions and other risks which may cause actual results to be materially different from the views/expectations expressed. Readers shall be fully responsible for any decision taken based on this document.

We sincerely suggest that you view this as a learning exercise and nothing more. Please consult a qualified and registered investment professional before taking any investment decision.