There is a whole industry at work attempting to simplify investing to a simple set of rules which, if followed, can lead to reliably good investment outcomes.

The narrative goes like this –

- If someone had bought XYZ stock 20 years ago, the return would have been 100X

- The 25-year return of a well-known equity mutual fund is in excess of 20%

- If one invests when the NIFTY 50 trailing PE < 16, the probability of making a return of 15%+ p.a. over the next 5 years is in excess of 70% (or some other high number)

- All you have to do is to stay disciplined and there is a good chance that the return over the next 20 years can be as good

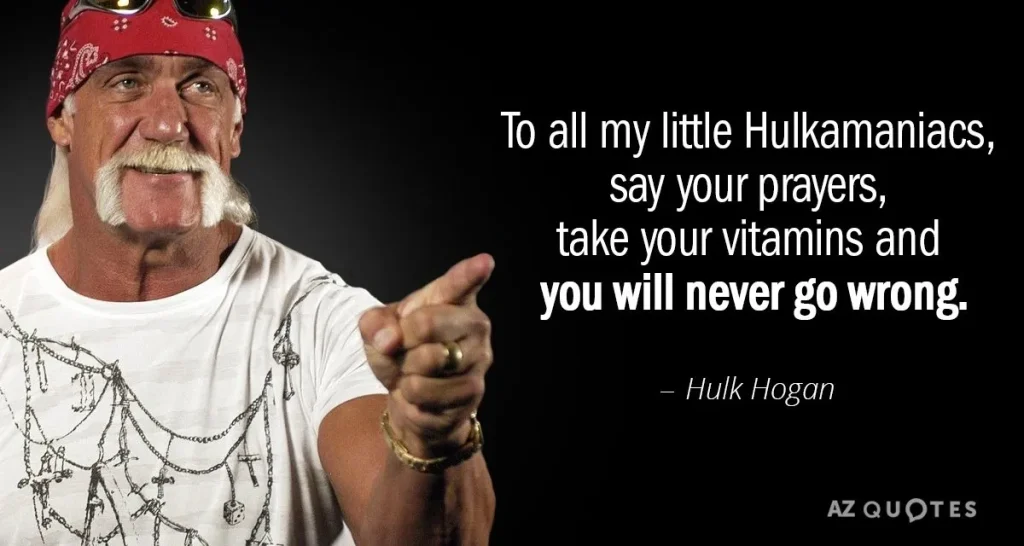

Reminds me of this campaign in the US.

Except that the average gym rat who followed this advice to a T over 10 years looked nowhere close to impressive. Very few people can look like Hulk by staying completely natural, even if they work their ass off for it.

What this campaign said was not harmful at all but it did skew expectations to a level where disappointment rather than satisfaction was likely. Who ate lunch? The supplements industry.

Mutual fund investors in India are waking up to this possibility. They’ve been disciplined at their SIP’s for more than 5 years now, they have seen a 15% p.a. return in their equity mutual fund portfolios only for a fleeting moment or two. Their actual annualized return is far likely to be much lower.

Why is the future likely to be different from the past for the average mutual fund investor?

Multiple funding avenues for good businesses

In the 90’s entrepreneurs had very few doors to knock on to raise capital. A lot of good businesses listed on the exchanges to raise capital at prices that were favorable to investors. Today we have private capital ready and eager to fund good businesses, they squeeze out a good part of the value creation and then pass the business to retail investors. When was the last time we saw a good business list at an attractive valuation? The 50X return people made by buying into the IPO of a good business in the 90’s is not likely anymore.

Liberalization leading to a one-time up-fronting of consumption patterns

Liberalization happened in the early 90’s. What liberalization did was to convince a generation of Indians to upfront their consumption decisions due to easier availability of capital. One no longer had to work for 20 years to buy a house and a car, one could buy today and pay off the debt over the next 20 years. Plain and simple up-fronting behavior created the base for the 2003-08 bull run which saw companies grow earnings at 20%+ p.a. How many companies do we find that have grown earnings at 20% since 2010? The 2003-08 bull run was an anomaly in that both the domestic and export economies were firing at the same time.

Lower interest rates

In the 90’s the interest rates were at levels which we cannot relate to anymore. People were parking money in FD’s with leading banks at a double digit return p.a. When one was able to earn that kind of return in an FD, only those who wanted returns of more than 25% p.a. dabbled in the equity markets. No wonder the stock market known as the adda of the street-smart trading community. Our previous generations weren’t idiots, they just took the safer method of growing their savings. Today a 1-year FD returns around 5%. There is a good chance that the much-touted wisdom of investing when the NIFTY 50 PE is less than 16 may never present itself as an opportunity in real life anytime soon. I am not talking of the NIFTY 50 touching 16 PE for a grand 30 mins during a 35% correction, I am speaking of a situation where the PE stays in that vicinity for a period that allows the average retail investor to put in some capital. As if the average retail investor has the stomach to invest when all seems lost!

Easier availability of information

The ubiquity of technology has ensured that financial information is available at your fingertips. Accessing annual reports, company filings, quarterly releases and equity research reports is way easier for investors than it was two decades ago, investors in the 90’s had to put in work to get access to the data that we take for granted today. Chances are that if you have figured out that something is a good business, many others have too and it is already priced accordingly. Information asymmetry continues to lose it’s importance as an edge in itself, though analytical edge and behavioral edge continue to hold into their importance.

The combination of lower interest rates and easier availability of information ensures that most good businesses are priced to the brim most of the time. A less than ideal growth environment means that 15%+ earnings growth over the long term is unlikely for most businesses. If the average retail investor stays disciplined over the long run (10 years) and invests through the equity mutual fund route, expectations should not exceed a compounded return of 12% p.a. assuming you do things right.

I’ve seen the wealth management industry from as close quarters as one can, I have advised and tracked more than 100 HNI portfolios over a period of almost 8 years. Every month we would send them portfolio summaries that would calculate the return on their equity portfolio. The only time I saw a compounded return of 20% p.a. hold for a respectable period of time was during the years of 2014 and 2017 when the markets were on a tear. This was also limited only to those customers who had the wisdom to make the bulk of their investments during years like 2012, 2013 and 2016. Keeping aside such exceptions to the rule, the rolling return for most customers lies in the range of 9-12% p.a.

The only way one can make a compounded return of 18% and above p.a. from here in the Indian markets is to find those limited set of businesses that can grow their earnings at a rate of 12-15% p.a. over the next 10 years and to buy them when the valuation is in favor. This way you get a kicker from the re-rating that plays out and the overall return gets you closer to the 18% p.a. mark.

By definition the number of such businesses at any point of time is limited thus making it a low probability event.

Investing is simple but not easy. Investing is in fact extremely difficult; it is just that the best investors make it sound easy.