Investing doesn’t just mean equity investing.

Many retail investors in India today believe that SIP into equity mutual funds and stocks is all there is to investing other than buying a house when they can. Over the past few years, I have seen many retail investors park all of their monthly savings into equity funds with no meaningful allocation to fixed income.

Investors intuitively understand equity and real estate as asset classes, yet demonstrate little understanding of how fixed income allocation adds value to a portfolio.

To appreciate the value of fixed income allocation, one needs to look no further than a few real examples from the Indian market over the past decade –

- In 2008, I parked money in a bank FD at 10.5% p.a. while the equity market kept falling every month

- Those who invested money into duration funds at the height of the 2013-14 INR crisis made 11% p.a. post tax over the next 3 years. Buying a simple 3-year FMP netted people 9.5% p.a. at minimal credit and duration risk while the equity market stayed volatile through 2015 and 2016

- Between Oct 2019 and Oct 2020, the NIFTY 50 was flat while some fixed income mutual funds returned 9%+ over the same period

- Tax free bonds issued in 2012 and 2013 at an annual tax free coupon of 7%+ p.a. have beaten returns from most asset classes (including real estate) for investors sitting in the highest tax bracket

- Over the past 12 months, NIFTY 50 return is hardly 1-2% while a plain old bank FD would have netted 5% gross

When fixed income investing is done well, it adds balance to the portfolio and ensures your net worth doesn’t see a steep drawdown even if the equity market stays volatile for a couple of years.

A meaningful allocation to fixed income gives one enough dry powder to participate in an equity market correction at lower levels, as the market moves back to a positive sentiment one can sweep profits off the equity market and park the proceeds back into safer avenues.

I do equity investing for a living and still have ~40% allocation to fixed income right now. For the first time in my life, I had a 25% allocation to bank deposits through the second half of 2021 and until recently.

For all the attention that equity investing attracts, fixed income as an asset class is treated with the same respect in India by retail investors. The 10-year rolling return from holding the 10-year G-sec in India is in the range of 7.5-8% p.a. while the return from NIFTY 50 is in the 11-12% p.a. range over the same period. Not a bad outcome if you go by the economic theory of the equity risk premium being 5-6% across the world. If anything, fixed income has done better than one would have expected.

Fixed income investing is all about NOT getting the rate cycle wrong.

So where are we on the rate cycle in India right now?

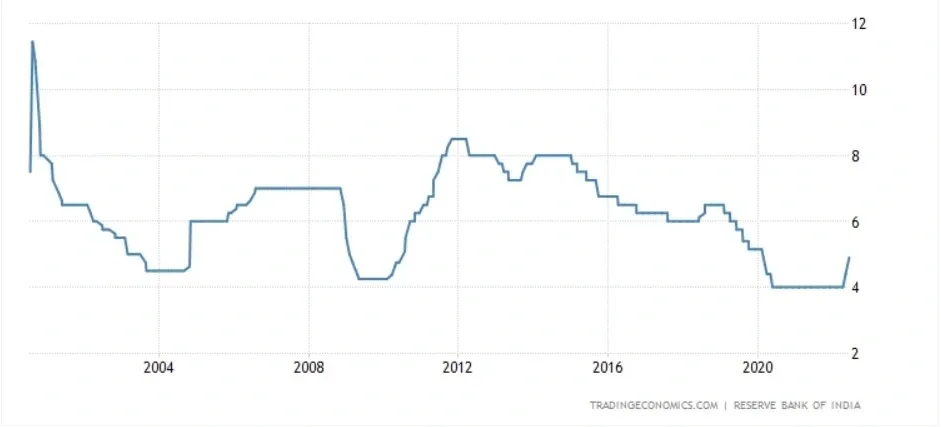

We are finally into a regime of rising interest rates after a trajectory that trended lower for many years. Long term interest rate trajectory below, pay specific attention to the trend from 2014 onward.

See how the 10 year yield bond yield has moved after the spike in 2014

As the RBI increases the benchmark interest rate in response to higher inflation, weaker rupee and many other factors, investors will see both deposit and borrowing rates increase with a lag. Unless you have been living under a rock, you would have noticed that deposit rates have gone up by ~0.5% over the past 12 months.

Fairly simple and common sense based so far.

So where does fixed income investing get tricky?

In the sense that as interest rates rise, the prices of bonds in the market fall and eat away into the return that one makes. Every bond has two components that determines the return – the annual coupon rate and the price. While the coupon rate is fixed (usually) and does not change in response to interest rates, the price of the bond changes inversely to the interest rate movement. If you bought a bond for INR 100 at a yield of 6.5% last year, today the bond price would be lower than INR 100 since interest rates have moved higher by 0.5%. So, the return from that bond today to the investor is the entry yield +/- % change in the bond price over the period. It would effectively lower than 6.5% since today’s price is lower than the price of one year ago.

It works this way only in traded securities and not in a bank FD. It is precisely for this reason that I parked my money in an FD and not in a debt mutual fund that has tradable securities whose prices rise or fall in response to changes in interest rates.

Over the past year, the average return for various categories within fixed income MF is –

- Short Duration Fund – 3.5%

- Medium Duration Fund – 3%

- High Duration Fund – 2%

Please see the returns for yourself here – https://www.moneycontrol.com/mutual-funds/performance-tracker/returns/short-duration-fund.html

What should one do here on?

This is what I plan to do for my fixed income allocation

- Keep rolling over bank FD for shorter tenures like 6 months for some more months

- Wait for the RBI to indicate in their policy communication that inflation is showing signs of cooling off

- Start redeeming from the bank FD and start investing into medium duration (modified duration of 2-4 years) and long duration (modified duration of 4-6 years) once the market starts speculating that the final rate hike might come in the next 1-2 months’ time.

The same interest rate cycle that works against bond prices in the upcycle works in favor of bond prices during the down cycle. As interest rates come down, the price of the traded fixed income securities will appreciate (based on a variety of factors). So going back to the return equation, investors can expect to make more than the yield at which they bought the security or the portfolio.

Since most retail investors invest through the mutual fund route, these are the key data points to note from the scheme information document –

- YTM (Yield to maturity of the portfolio). This is the return one can expect to make p.a. if there are no changes to bond prices during the tenure of the investment

- Modified Duration – A measure of the portfolio’s sensitivity to interest rate movements. The AMFI and SEBI classification of Low/Medium/High duration is driven off this measure, it is expressed in years

- Credit quality – What proportion is allocated to the AAA, AA and A credit rating categories? For retail investors, the sub-AAA exposure should ideally not exceed 30% of the overall fixed income portfolio

The AAA segment of the corporate bond market typically yields 100 bps (1%) more than a G-Sec of the same tenure. Since retail investors usually invest with a 3–5-year horizon, the gross YTM of a AAA portfolio today for that tenure is in the range of ~7.3-7.5%.

At some point of time over the next year, if rates were to rise 0.5% more and the yield curve further moves higher, investors might get the opportunity to lock in 8%+ p.a. yield at a gross level for the next 3-4 years. Post expenses and taxes (assuming long term capital gains taxation), investors might be able to pocket between 6.5-7% p.a. on a net basis even without taking aggressive long duration bets. A skilled investor who manages to time things right might even eke out closer to a double digit return over 2 years at a gross level.

However, please do note that fixed income market has its own volatility that is not very obvious to those who do not track the market. Fixed income only means that that return (coupon) is fixed, there is no implicit or explicit guarantee of return being made. If the issuer of a bond goes under, bond holders may not get paid at all (in simple terms, credit risk).

Investors should note that the fixed income market presents an attractive yield curve only once every 4-5 years as the rate cycle first pauses and then finds its next course. Such pivotal points in the interest rate regime tend to be a good time for experiences fixed investors to optimize the return on fixed income portfolios.

Now would be a good time for people to start building up knowledge about fixed income so that if an opportunity presents itself over the next 12 months, one will have a plan in place to play the rate cycle.