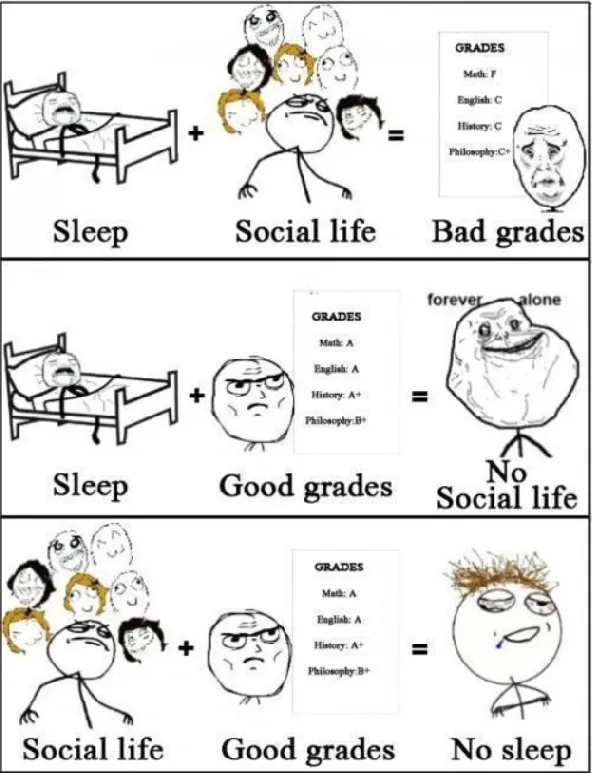

Trade off, happy medium, middle ground – all these terms all sound like a compromise, like you are grudgingly giving up on something to get to something else.

“Why should I compromise? I deserve the very best I can get” – sounds good in poetry and in theory, in real life this is exactly what keeps you frustrated even if things are fine on an average.

Young men foolishly strive for perfection, wise men build their lives around realism and sustainability. History tells us that war has been about wise men talking and young men dying.

Lesson in there.

In investing it is rarely the fastest growing company that creates the most wealth for investors. It is the business that endures decades of competition, the business that steadily increases earnings over time, delivers a return on capital higher than its cost of capital and minimizes negative surprises that creates the most wealth.

If you start with 100, see 50% growth in the first year and then a 10% fall in the subsequent year, you end up with 135. If you start with the same 100, see 20% growth in the first year and then an average 15% in the second year you end up with 138. Elementary math but hides an important lesson. No thrill or adrenaline rush in the second scenario; just cold blooded, ruthless efficiency.

In running there is always an optimal pace for each runner based on genetics and the level of training one is at. I can do a 5 Km run in 33 mins and maybe do another 5 Km if I want to. However, if I try to do the first 5 Km within 28 mins, doing the next 5 Km ends up being a real struggle.

Look at the best banks in the country, they all want to do a steady 15% p.a. growth in their loan book and keep NIM’s around 4% to ensure sustainability of growth for many years. They can as well target 25% p.a. growth at 5% NIM but that just increases the probability of an adverse credit event.

In weight training you have a rep range within which you can keep making progress for a long time. If you try to max out your big lifts too often, the chance of an injury goes up significantly. Higher rep ranges tend to overload the recovery system, those who do high volume workouts tend to work out every body part only once a week. Those who lift in the 6-10 rep range at 70-80% of their 1 RM (1 rep max) and stick to a decent amount of volume can hit each body part 2x a week and come back to the gym with enthusiasm in two days.

Timely rest is an important component of making progress in many contexts.

Observe how stock prices move, they rarely move in a straight line. The price makes a new high, spends a few days/weeks/months consolidating in a range and then a strong breakout follows to take it to a new high. Stocks that show exponential moves within a short period of time will tend to fizzle out at some point of time and follow it up with a painful period, as many of us have experienced.

As an employee at the lower levels of an organization, you are paid the most money when you make yourself irreplaceable operationally. However, as your rise through the ranks into middle management, you are paid the most money when you design processes that make your presence irrelevant. In senior management your goal is to make yourself irrelevant operationally but make yourself irreplaceable in strategic thinking. It is also a question of how many people can you groom to be like yourself. How well you manage this transition as you rise high determines how fast you rise higher.

Any business model that becomes stronger through iterations has most likely shaken off multiple small mistakes and learnt from them. A business model that raised a ton a capital too early and grew on steroids will usually have no frigging clue of how to optimize unit economics once it hits critical mass. It is possible in theory but rarely happens in practice due to a culture of misaligned incentives. You can have businesses that have made an impact on the world but have done zilch for investors and sucked all productivity out of their employees.

On the other hand, a few efficiently run me-too businesses have delivered value to all stakeholders over decades. Satisfied customers, happy investors, content employees and promoters with fat wallets. Many of these never cared about changing the world or about making the world a better place but they did make life better for all stakeholders.

The outcome follows the process in the real world, not the other way around.

Every time I am faced with a choice, I ask myself “What is the trade-off here?”

When you decide to invest into a structured product (market linked debenture), you are making a choice to trade market risk for credit risk. This can turn out to be a stupid choice since market risk is granular while credit risk is discrete. If you bought an MLD underwritten by an NBFC that went under, you can lose your entire principal. Return of capital becomes a challenge, leave alone return on capital. When market risk works against you, one can cut losses at 20% and live to fight another day.

When you buy a fully valued structural growth business over an undervalued cyclical, you are choosing to stick with the sure thing even at the risk of underperforming in the short term. And willing to accept a hygienic return rather than a 25% p.a. return in exchange for the ability to sleep in peace when market turbulence hits. Which it will, at some point of time.

If you decide to grow your business organically rather than raise capital to grow on steroids, you are choosing to retain a greater amount control over your business and have fewer people to answer to. Of course, this works only if your business can generate enough cash flows to grow organically in the first place. Without the presence (or the realistic possibility) of a network effect, no sane investor should want to fund a business that has bad unit economics. But then, I am just a poor listed market investor who does not really understand private market dynamics all that well.

Choosing between buying a house and renting one especially if you cannot afford it? The trade-off here is a simple one and it does not involve the expected return from the asset. The real trade-off is –

Would you want to get into a 20-year cash flow commitment rather than keeping your options open? You can always move back to a smaller place if life does not go as planned as a tenant, you do not have that easy option as the owner of an asset that is funded by leverage.

Would you rather live your life with a compromised sense of options or would you rather deal with the regular dose of nagging that your family throws at you? I know more men who have succumbed to constant, motivated nagging than to anything else.

Nothing else can explain the fact that bank credit to housing in India has shown positive YoY growth every year since 2009 when the price appreciation of the average apartment has not even beaten the fixed deposit return over the period.

In face of constant emotional pressure, data driven logical thinking rarely stands a chance.

Portfolio theory makes the central point of risk adjusted returns, just that it defines risk in an academic way and not necessarily in a practical way. In the real world, risk means the possibility of a bad outcome. In the academic world, risk means the possibility of an outcome that is different from the one envisaged. Risk adjusted return is a useful construct when used properly. Nobody gives a damn about risk and volatility when the outcome is 25% while the expectation was 15%.

Our previous generation always drilled home concepts of prudence and reasonable compromises to live a meaningful and fulfilling life. The YOLO generation however sees things differently, it does not like the term “compromise” and wants it all, yet plays the victim card when the bill for the choices made is presented to them.

It is always a good idea to start with a good understanding of the risks involved in each choice before you start salivating over the possible positive outcomes. Rationalism over emotionalism should be the motto. Emotionalism starts with “but that won’t leave me with a good feeling” and leads you astray while rationalism begins with the acceptance that any choice one makes might have sub optimal outcomes in a few aspects.

Understanding the nature of trade-offs is the essence of good judgement and effective decision making in the face of uncertainty. This is the only way one can sleep in peace and with no regrets when outcomes do not go in our favor.

In theory, one does not need a lengthy blog post to make this simple and rather obvious point. But in practice, the human mind does not internalize concepts that make logical sense but fail to personalize the learning.

Personalization is the cornerstone of good marketing.