Investment bankers focusing on public markets have their swagger back after a hiatus of three years.

They have an important role to play in the capital markets ecosystem, they are the folks who facilitate liquidity events for corporate India. Those who provide risk capital (PE, VC, other investors) to entrepreneurs when they need it the most usually have a good equation with investment bankers who help them unlock value through a liquidity event.

Stop right here. You should have already made the read by now.

They are friends to the promoters and capital providers, not to retail investors who participate in either primary or secondary sale of shares. They aren’t bad people, just that their incentive structure pushes them to give their customers a better deal than to the retail folks who are participating in the IPO process. Not always, but usually. Sometimes they list a business at a premium and the stock goes up 100% more in the next 12 months. But that is because of buoyant market conditions, not because they cared about giving retail investors a good deal. Good outcomes do not necessarily mean good intent, sometimes it’s just plain old luck or market momentum at work.

As a retail investor, I would not give them an inch because they want to take my money off my hands at terms that aren’t favorable to me. I don’t hate them but I am wary of them.

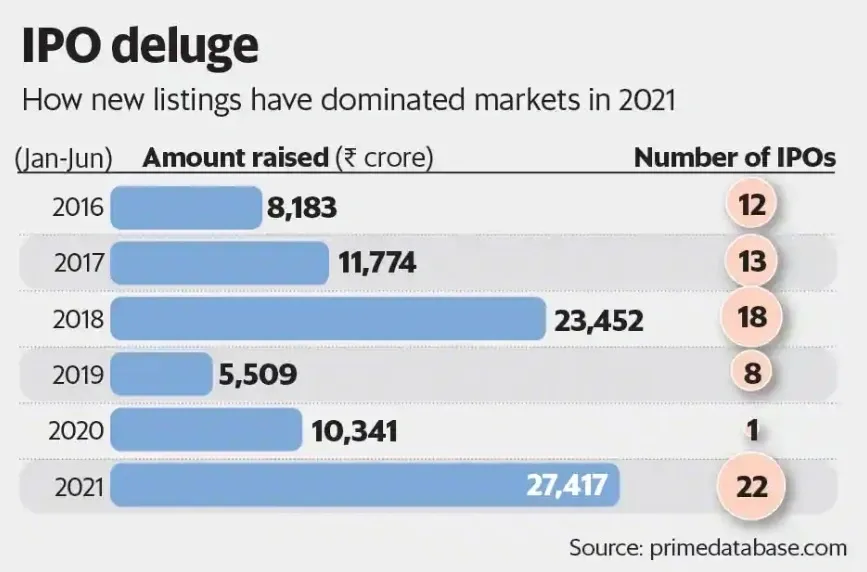

Look at CY 2021 numbers so far for IPOs.

Image Source: https://www.livemint.com/market/ipo/ipos-raise-27-417-crore-so-far-this-year-highest-in-10-years-11625077876075.html

Of the total amount raised through IPO, 62% went to those offering their shares for sale (OFS). Which means the promoter/PE is using good market conditions to sell their stake at elevated valuations to those buying in the IPO. Only 38% went as equity capital to the business that is getting listed. As a retail investor, your money is giving an exit to the existing investors. You aren’t necessarily giving risk capital to the business.

Once again, nothing wrong with this on the face of it. Until you ask a few basic questions…

- Who wields more power/influence in the IPO Process? You or the counterparty?

- Who knows more about the business? You or the counterparty?

- Who is paying fee to the lawyers and bankers managing the issue? You or the counterparty?

- Is the listing price determined by the market or by a group of folks who have a similar incentive structure?

- Why do IPOs see a rise in years like 2018 and 2021?

- Why did we have just one IPO through the whole of the first half of CY 2020?

As per the article, this was the story in 2018 and 2019 too where the OFS component was > 70% of the total money raised through the IPO.

As a retail investor who does not have any power or influence in what valuation a business lists at, the only choice I have is to vote with my money. Nobody cares about my words, thoughts or interests anyway. Because nobody needs to.

You cannot hate a snake for wanting to bite you.

You cannot hate a lion for wanting to kill it’s prey.

Similarly, you cannot hate someone who is just doing his job. It is my damn job to ensure that my interest does not get short changed because of someone else trying to do his job well.

So is a public offering good or bad for retail investors?

Respect everyone but don’t hesitate to politely tell them to fuck off if they aren’t operating in your best interests.

When the terms, conditions, incentive structure and probability are loaded against me, I choose to not engage and instead keep my money to myself. Unless I am convinced that there is going to be a bigger sucker who will pay me more a few months down the line. Which is not a smart game to play because the availability of suckers tends to diminish at exactly the time you need it the most.

Have I invested in any primary listing so far? No. And I will not, barring exceptional circumstances.

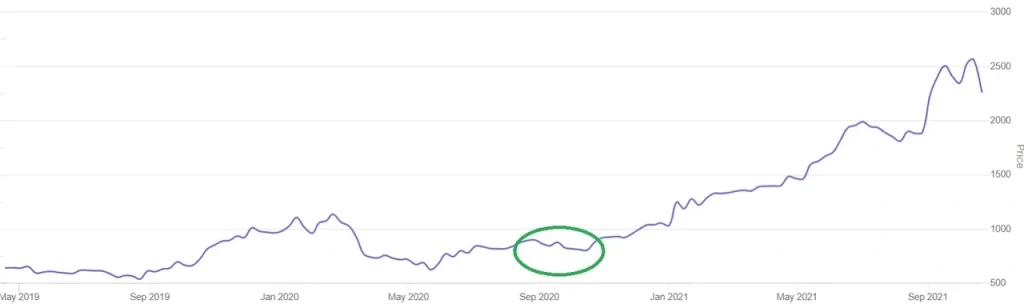

However, I have invested in some business that have listed in the past 5-6 years. And these have worked well so far because I was patient enough to wait for the right valuation, not necessarily the right price.

A few examples below, the green circle shows where I started taking a position in the stock.

As you can see, I don’t get it perfectly right. But I do manage to get it right more often than not. There are some stocks that listed at a premium and went on to do well from there. But I will be happy give these a skip if the category itself has a strike rate of < 30% over the long term.

I care about the return on my overall portfolio, I wouldn’t lose sleep over the 8-10 good opportunities I may have missed. If I am a good investor I will make my money one way or the other, unless I miss an Infosys or a HDFC Bank when it listed. But even with these, one could have bought at reasonable valuations years after they listed.

In investing you get many chances to buy into a good business. Investing is not a Yash Chopra movie where you get just one chance to be with the love of your life. Regret is for emotional suckers in investing, not for good investors.

Pick and choose your battles. Be numerate and operate on probabilities, not possibilities.

Probability is conscious, calculated and calibrated choice; it is a replicable process.

Possibility is mostly gut feel and a roll of the dice; it is not a replicable process.