Hindsight Bias. A well known, well documented and well understood behavioral bias.

Do I have something new to offer here? Yes, personalization. There is a difference between reading about a bias in a book and experiencing it real time. The former is something one can quote in debates to appear smart; the latter teaches you a lesson for life. Knowing is never the same as doing.

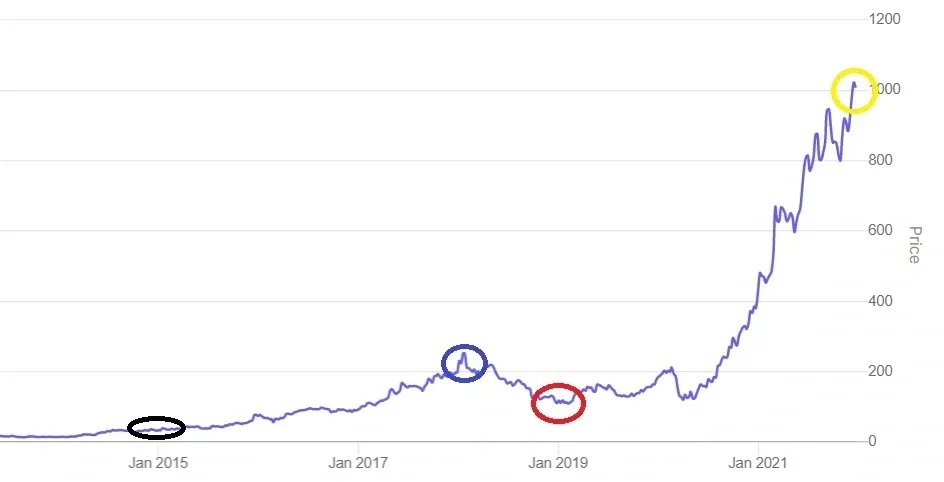

This is the chart of my biggest position till date, it is also the investment that has added the maximum value to me and my immediate family

What I will focus on is the actual, real-time commentary from my investment diary as the events were unfolding over the past seven years

Black

This is where the bulk of my position was built. Revenue growth was ~30% over the past 4 years, PAT was volatile. FY15 PAT was 64 Cr.

Actual note from my diary – “Are you kidding me? This is too good to be true, worth investing 7-8% of my net worth into this.”

Blue

The market had come around to my view and rerated this stock from 11 PE to 30+ PE. FY18 PAT was 158 Cr, though still volatile.

Note from my diary – “This was an easy one. I am making money for the right reasons”

Red

The small cap frenzy peaked out in Jan 2018 and the stock went into a 2-year downtrend, losing 60% from the peak at the lowest point.

Note from my diary – “Should have taken some money off the table at 30+ PE though I still believe in the story. Need to manage these mini cycles better from here on. However, this is still my highest conviction bet as of date.”

Yellow

This has been a 30x+ in 7 years. FY21 PAT was 360 Cr, likely to do 600+ Cr in FY22. I did not see this coming, the promoters of the business did not either. This is how optionality works when tailwinds emerge out of nowhere.

Note from my diary – “Could have executed better, my conviction made me buy more through FY19 and FY20 but the same conviction did not stop me from pruning the position”

If I had held onto every single share I had, I’d have been richer by ~20% today. But no regrets since the pruning was driven off risk mitigation which is as important if not more.

Look at the variety of emotions the same stock induced depending on when you peek into my diary. In hindsight, the dip of 2018 and 2019 looks like a small blip but it felt very different then.

When you look back at a chart, the outcome is already known. When you look forward, uncertainty always predominates.

In hindsight the human mind always mixes up possibility for probability and high probability for certainty.

Just because success was achieved does not mean it was deserved, planned for or was a given.

Mr. G is in his 60’s whose life changed significantly when Kotak Bank rose through the ranks to become one of India’s most successful private banks. Mr. G was invested in this and lived through the carnage of 2008 when the price fell almost 80% from the then peak. And then took five more years to make a new high.

Mr. G would always tell me that the one thing he is very proud of was his conviction in Kotak Bank and that he had always known it would turn out to be big. I started interacting with him in 2012, to his credit he had high conviction in the bank through the lull period of 2010-13. It is up ~7x since then, Mr. G still has 33% of his net worth parked here.

The same Mr. G also had tremendous conviction on Yes Bank and kept building a position through 2008–12. Till 2017 he always saw the next Warren Buffet when he looked at himself in the mirror.

Last I checked, he had booked out of Yes Bank at 90% loss on his invested principal. He kept buying through the fall 2018 and invested a large sum once he was convinced that the bottom was in place.

Now here is the real deal.

Mr. G is a bum who cannot read a balance sheet to save his life. He will also struggle to locate his own testicles if you ask him basic questions on accounting. He reads this blog by the way and is a good sport about me kicking his ass, so long as I do it in private or without naming him.

The same behavior that worked for him in Kotak Bank worked against him in Yes Bank. Turns out he was investing based on consensus narratives and not after doing his own ground up work. Big difference.

His first reaction after the Yes Bank stock burned him was that it was a once in a lifetime event. When it comes to Kotak bank, he somehow always knew it was a gem; when it comes to Yes Bank it was somehow a tail event. He did the same damn thing in both the instances, just that he ended up with different outcomes.

As Frank Costanza said to the “Assman” in Seinfeld

PS: I am not being a pervert; I am being literal. If in doubt, go watch the episode

Clouded hindsight can get to the best of us. The mind plays these tricks all the time, it contrives to ensure we don’t learn the right lessons from our own past behavior.

As is with war, your investing history is prone to being written by the winners. You have to go out of the damn way to ensure that this is not the case.

Which is why it is a good idea to keep an investment diary. When you write things down in black and white, you cannot bullshit yourself based on outcomes.

Do not be like Mr. G. He is worth more than 50 Cr, he could afford to lose his shirt, trouser and banian in the Yes Bank meltdown and still buy a BMW for his daughter on her birthday.

You and I do not have that luxury.

Mr. G knows that I am single, yet for some damn reason insists on calling me home only when his smart, independent (and also pretty) daughter isn’t around.

Life has never been fair to me.