Towards the beginning of CY2021, I’d written a note on the 2011-2020 decade titled “the decade that went by”

Hardly 17 months have elapsed since then, but the world is starting to look different already. No one knows if the current trend is here for good or will revert to the previous playbook, macro prediction is by construct a low probability endeavor.

In this post, we’ll revisit some of the key observations from this note and also see how some of the narratives in the domestic market have panned out so far.

The Crude Oil saga

Towards the end of the previous decade many were happily writing epitaphs for crude and other legacy forms of energy. “Crude to fall to USD 12 per bbl” was just one of the predictions that presupposed renewable energy will eat lunch at the expense of conventional energy. Of course, renewable energy continues to grow in stature, just that conventional energy has made a furious comeback.

Brent crude is well above even the 2010 levels today, suddenly the expectations are that it may rise to USD 140 per bbl and beyond ever since Mr. Putin made the world sit up and take notice of Russia’s ambitions. Gas price is up more than 2x and now threatens to stoke inflation higher.

All it took was 7-8 months for a well-entrenched narrative to get destroyed. Predictably India’s FX reserves are lower than they were 6 months ago and the INR a lot weaker than it was. Some cause and effect trends continue to work well across market cycles, arithmetic rarely lies if done correctly.

Low inflation in the US

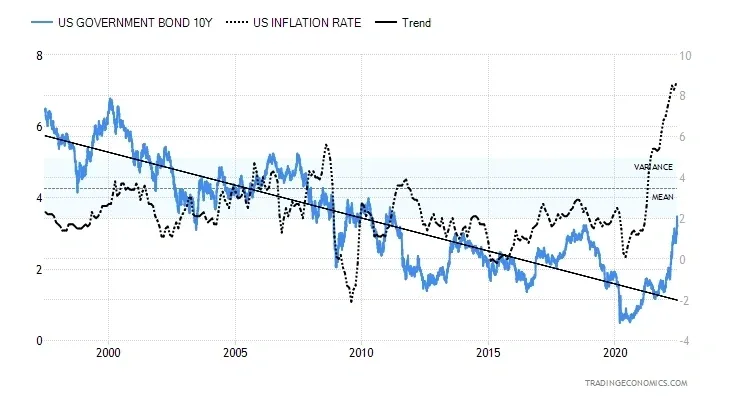

How things have changed! The US 10 year has easily breached the 3% level and continues to rise higher as the US grapples with the worst inflation it has seen for decades now. From being in denial with “inflation is transitory” to “inflation is a huge problem”, developed central banks scamper to raise rates as they come out of their ZIRP and negative interest rate policies. The amount of negative yielding debt across the world is now less than USD 3 Trillion from a peak of USD 20 Trillion a couple of years ago. This is serious MTM impact for bond portfolios which were starved of yield for a very long time.

“Digital asset classes” that were supposed to be inflation hedges and future currencies have fallen more than 75% from the peak, they are behaving like leveraged tech since the beginning of the year. We now have a few exchanges and other market intermediaries going under in this ecosystem with many investors wondering whether they have access rights to their digital assets in the first place.

All it took was 6 months of inflation and one crazy world leader to reverse a decade long trend. My sense is that inflation might stabilize at a much saner level next year, but then who knows for sure? The chart looks scary if inflation doesn’t show signs of abating through H2 CY2022, the situation looks very dicey for the US market and might eventually turn the corner for US real estate too. Obscenely priced pockets in the Bay area are likely see a ripple effect when investor portfolios are down by 30% (most folks there are loaded up on BTC and Tesla), the specter of tech layoffs looms and the mortgage rate climbs further.

If it weren’t for the very low interest rates across the world, would the Indian high-quality consumer stories be trading at price to earnings multiples in excess of 65?

High quality falling 30% from the peak is already the consequence of higher rates across the world. And we may not be done yet, under most normal conditions it is difficult to justify paying a PE of 70 for a business that grows profits at 15% and cash flows at 18%. I wouldn’t jump in just because prices are cheaper than they were 2 years ago. Run a reverse DCF, compare operating cash flow yield and free cash yield to what one can make by holding the Indian 10-year G-Sec today and come to your own conclusions.

If the market can ignore ITC’s 5% p.a. dividend yield for 3 years, why would it care too much for a 2% free cash yield when the 10-year G-Sec offers a YTM of 7.6%?

If it weren’t for the game changing crude oil price collapse in the mid of the decade, would the INR have stayed this resilient?

We already know the answer to some extent. Higher crude prices have never been good for India, so when you see Ambani, Adani, L&T and many other behemoths make a beeline for renewable energy capacity you know why. India needs energy independence to the highest extent possible over the next 5 years. The only other macro variable that is perhaps as important for India is job creation in semi urban and rural India.

If it weren’t for the more stable macro-economic environment for India post the US Fed taper tantrum, would the FII’s have continued to invest into India to this extent?

Observe the FPI sell numbers starting October 2021, enough said. Whenever money supply tightens in the developed world, FPI flows to this part of the world tend to dry up.

The macro environment matters big time, it sets the context in which investors take decisions on individual securities. This is a simple rule that gets forgotten very often, until it becomes such an important component of decision making that one cannot ignore it. Like it is today compared to the narrative of 12 months ago.

If free cash flow is what counts for most when one values a business on a longer time frame; and the risk-free rate spikes another 100 bps from here, won’t the valuation multiple that investors are willing to pay get affected?

From whatever experience I have as a money manager in India, I can tell you this –

At an annual pre tax return of 8.5% from fixed income, many investors will happily take that over the volatility of investing in the equity market.

The most likely outcome of buying and holding the headline benchmark index in India over a 5-year timeframe has been a CAGR of 10-12% p.a. Across the world, investing gurus and academicians agree that the equity risk premium is broadly in the range of 5-6%. From here one can do the math and see how a 12% p.a. return from equity isn’t very superior to a credit risk free 8% p.a. in fixed income on a risk adjusted basis.

Doesn’t mean one stays away from equity, it is still one of the only few asset classes that has been proven to beat inflation over longer time frames.

It just means that one should be more demanding of above average growth from businesses rather than happily pay up 50 PE for a 10% growth based purely on 5-year average multiples. Consider 10-year average multiples to demand a higher margin of safety from here, of course adjusted for changes in business quality over the timeframe.

For this very reason, valuation is an art and not just a science.